Listing prices in June flat YoY and below June 2022. Mortgage rates still at 7%. Prices way too high. Something has to give.

By Wolf Richter for WOLF STREET.

New listings of homes for sale have been rising, in June by 6.3% year-over-year, but that’s not huge; what’s huge is that sales have plunged in a historic way because buyers remain on strike as prices are way too high, and the new listings pile on top of the active listings still on the market before they get pulled, and so active listings across the US jumped by 36.7% year-over-year in June, to 840,000 listings, the highest since and just a hair below June 2020.

But it’s not spread evenly across the country.

In some metros active listings have exploded, while in other metros, well, in one metro of the top 50 metros, active listings declined.

Of the 50 largest metropolitan areas, the Tampa metro came out on top with active listings in June nearly doubling year-over-year (+93.1%), on an 18% year-over-year increase in new listings. It was followed by the Orlando and Denver metros.

The San Diego metro was #4, with a 72% surge in active listings, and a 20.6% increase in new listings, according to data from Realtor.com today. These are magnificent increases in inventory for sale, even as sales have fizzled compared to pre-pandemic years.

Of the top six metros, in terms of increase in active listings, four are in Florida. California has two in the top 10: the metros of San Diego and San Jose.

These are listings of existing homes of all types – single-family houses, condos, co-ops, and townhouses. But new homes that builders are selling are excluded unless they’re also listed on the MLS.

| To 50 Metro Areas | Active Listings, YoY | New Listings, YoY | |

| 1 | Tampa-St. Petersburg-Clearwater, Fla. | 93.1% | 18.1% |

| 2 | Orlando-Kissimmee-Sanford, Fla. | 81.5% | 14.7% |

| 3 | Denver-Aurora-Lakewood, Colo. | 77.9% | 7.6% |

| 4 | San Diego-Chula Vista-Carlsbad, Calif. | 72.5% | 20.6% |

| 5 | Jacksonville, Fla. | 69.6% | 21.8% |

| 6 | Miami-Fort Lauderdale-Pompano Beach, Fla. | 67.7% | 12.7% |

| 7 | Seattle-Tacoma-Bellevue, Wash. | 61.9% | 30.5% |

| 8 | Atlanta-Sandy Springs-Alpharetta, Ga. | 58.6% | 13.5% |

| 9 | Phoenix-Mesa-Chandler, Ariz. | 56.4% | 5.6% |

| 10 | San Jose-Sunnyvale-Santa Clara, Calif. | 53.5% | 26.5% |

| 11 | Memphis, Tenn.-Miss.-Ark. | 53.3% | 8.7% |

| 12 | Dallas-Fort Worth-Arlington, Texas | 52.3% | 10.4% |

| 13 | Charlotte-Concord-Gastonia, N.C.-S.C. | 49.3% | 13.9% |

| 14 | San Antonio-New Braunfels, Texas | 48.6% | 21.8% |

| 15 | Sacramento-Roseville-Folsom, Calif. | 45.9% | 8.7% |

| 16 | Riverside-San Bernardino-Ontario, Calif. | 43.9% | 10.4% |

| 17 | Raleigh-Cary, N.C. | 40.4% | 16.6% |

| 18 | Birmingham-Hoover, Ala. | 40.2% | 2.1% |

| 19 | Houston-The Woodlands-Sugar Land, Texas | 39.7% | 17.4% |

| 20 | Richmond, Va. | 39.5% | 5.7% |

| 21 | San Francisco-Oakland-Berkeley, Calif. | 39.5% | 11.3% |

| 22 | Oklahoma City, Okla. | 38.7% | 11.4% |

| 23 | Los Angeles-Long Beach-Anaheim, Calif. | 36.9% | 11.2% |

| 24 | Portland-Vancouver-Hillsboro, Ore.-Wash. | 34.6% | -0.9% |

| 25 | Columbus, Ohio | 32.3% | 3.9% |

| 26 | Austin-Round Rock-Georgetown, Texas | 31.8% | 1.5% |

| 27 | Cincinnati, Ohio-Ky.-Ind. | 30.4% | 9.5% |

| 28 | Baltimore-Columbia-Towson, Md. | 29.4% | 2.1% |

| 29 | Indianapolis-Carmel-Anderson, Ind. | 28.8% | -6.2% |

| 30 | Louisville/Jefferson County, Ky.-Ind. | 28.7% | 6.3% |

| 31 | New Orleans-Metairie, La. | 28.6% | -0.4% |

| 32 | Virginia Beach-Norfolk-Newport News, Va.-N.C. | 27.9% | 1.3% |

| 33 | Washington-Arlington-Alexandria, DC-Va.-Md.-W. Va. | 27.2% | 8.3% |

| 34 | Kansas City, Mo.-Kan. | 23.9% | 5.1% |

| 35 | Boston-Cambridge-Newton, Mass.-N.H. | 23.1% | 6.9% |

| 36 | Providence-Warwick, R.I.-Mass. | 22.9% | 9.3% |

| 37 | Minneapolis-St. Paul-Bloomington, Minn.-Wis. | 21.8% | -6.3% |

| 38 | Milwaukee-Waukesha, Wis. | 20.6% | -3.5% |

| 39 | St. Louis, Mo.-Ill. | 20.6% | 0.7% |

| 40 | Nashville-Davidson-Murfreesboro-Franklin, Tenn. | 20.0% | 6.0% |

| 41 | Pittsburgh, Pa. | 14.1% | 4.8% |

| 42 | Philadelphia-Camden-Wilmington, Pa.-N.J.-Del.-Md. | 10.8% | 1.6% |

| 43 | Detroit-Warren-Dearborn, Mich. | 10.3% | -2.7% |

| 44 | Buffalo-Cheektowaga, N.Y. | 10.0% | 8.7% |

| 45 | Hartford-East Hartford-Middletown, Conn. | 6.4% | -1.7% |

| 46 | Chicago-Naperville-Elgin, Ill.-Ind.-Wis. | 5.8% | 0.3% |

| 47 | Cleveland-Elyria, Ohio | 5.6% | 1.3% |

| 48 | New York-Newark-Jersey City, N.Y.-N.J.-Pa. | 3.1% | -1.5% |

| 49 | Rochester, N.Y. | 3.1% | -2.1% |

| 50 | Las Vegas-Henderson-Paradise, Nev. | -29.5% | 15.5% |

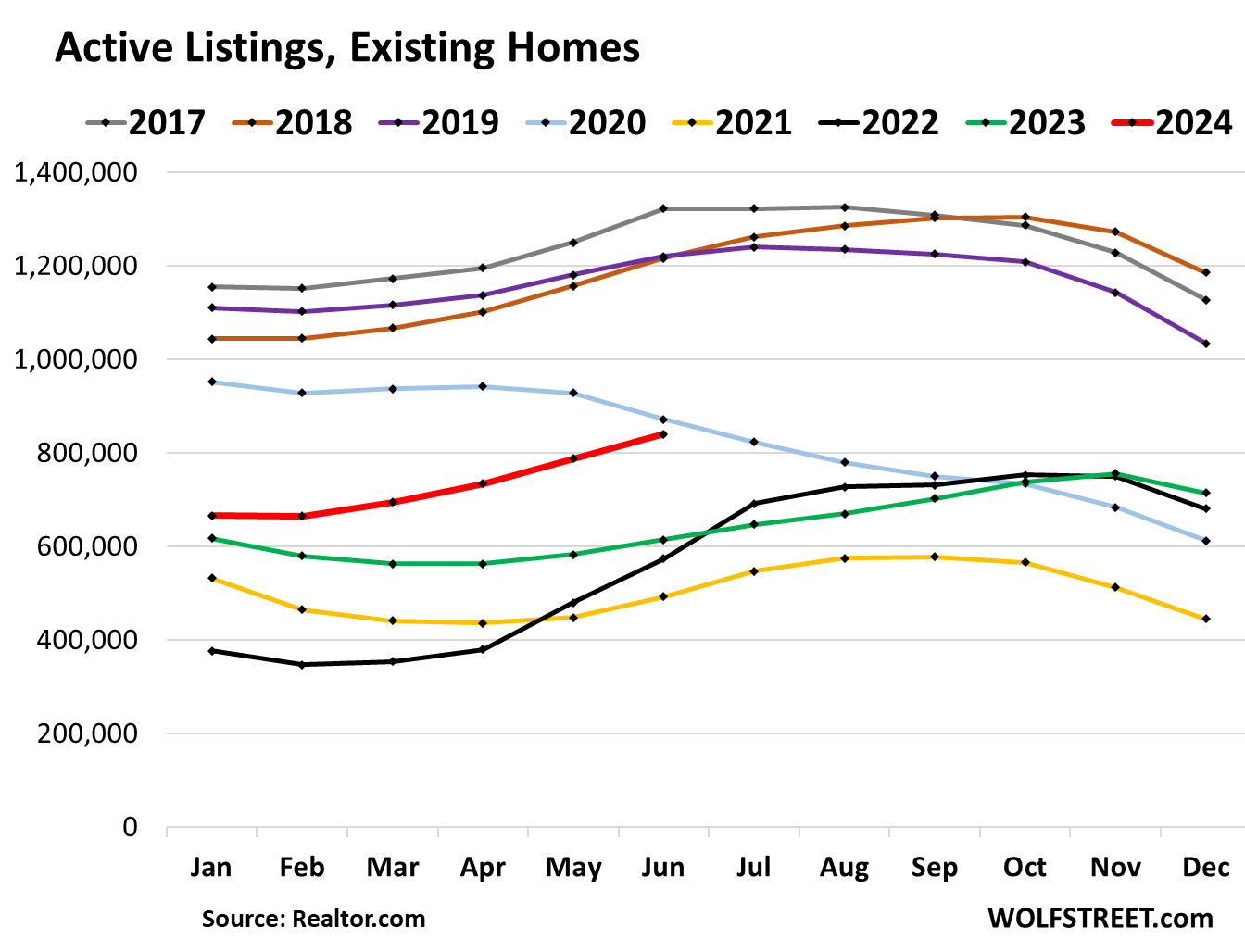

Active listings nationwide.

In the country overall, active listings rose 36.7% year-over-year to 840,000 in June, just a hair below June 2020, according to data from Realtor.com today.

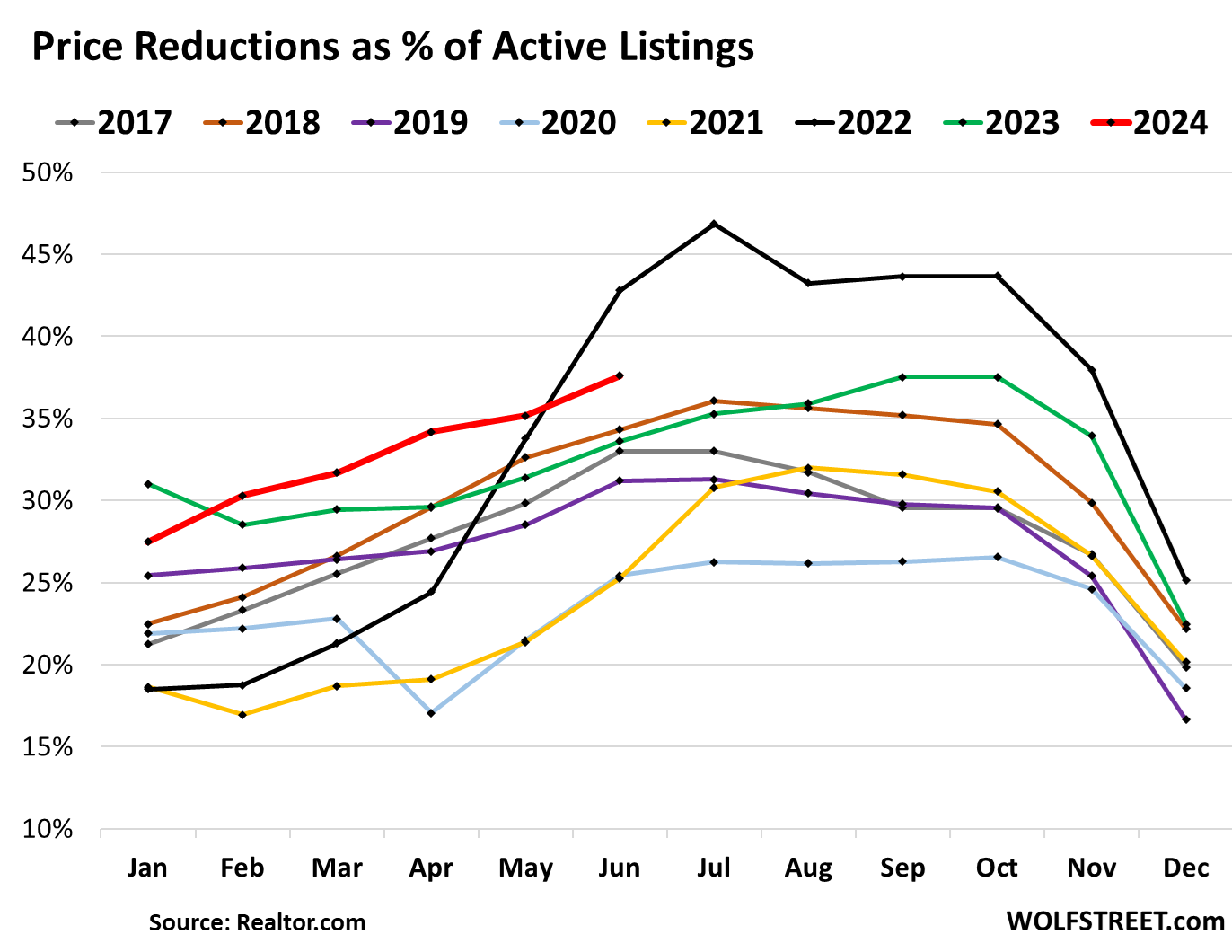

Price Reductions.

Of the active listings, 37.6% had reduced prices in June. There were some months in 2022 with a higher share of reduced prices, and beyond that, there were none in the data of Realtor.com going back to 2016:

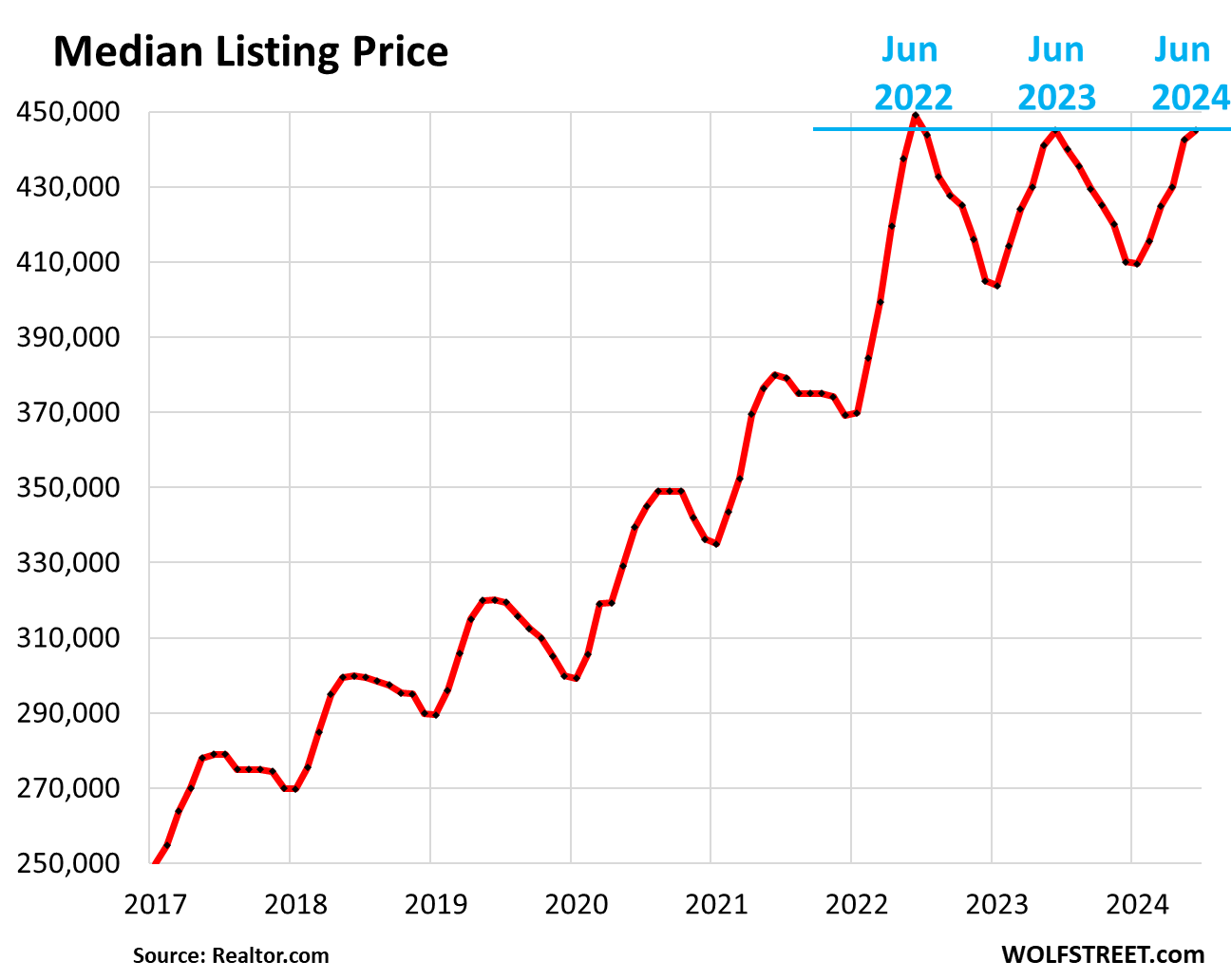

Listing Prices.

Every year around June, the median listing price peaks seasonally and then falls off through January. In June 2024, listing prices were flat with June 2023 and a hair below June 2022. This is forming a beautiful triple top, with the first top having been the highest, and now the active listings are piling up too and the (tiny?) price reductions off those still too high listing prices can’t move the inventory.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf,

If you adjust the last chart for CPI inflation, then we are already on a downtrend.

Purists might object to that, but if we are doing technical analysis, then it means the downtrend has already started and is likely picking up steam.

How do you think about CPI adjusted asset price charts?

I’m a “purist” then. I also don’t adjust the S&P 500 to CPI. Assets are not consumables, but CPI tracks price changes of consumables that Consumers consume, which is their only job. Assets have their own inflation, such as house price inflation, and it dances to its own drummer.

Wolf,

The reason I think it make sense to look at CPI adjusted charts is to help guide investment decisions.

For example, if during the 1970s you were invested in a broad based stock portfolio, you had returns almost as bad as during the Great Depression (on an inflation adjusted basis, especially considering the deflation during the Great Depression).

How many investors think of things that way?

What has happened in the 40 years since then? You’re crushing inflation by 7 or 8 percent invested in VOO. Most (almost all) people’s investing timeframes are far longer than a decade.

20% of VOO is in 3 stocks ( Microsoft, Apple, Nvidia).

Technically house is a consumable, most of us consume just one. So, higher price = starvation for one with zero house, moving from pizza to cavior or vice versa for one moving from one house to another, jubilation for one ready to give up not just the house but all.

I noticed Tucson — 60% more listings in June Vs May, according to Realtor dot com. Where did you get this comprehensive data, is that only for 50 metros or do they have for other smaller cities too in one place. — like S&P 500 Vs Russel 2000. TIA.

1. In terms of consumables, I’ve never consumed a house or a condo. I’ve only lived in them, and after I moved out, they continued to exist, and after I’m outa here, they’ll probably still be around.

2. You can download the data from Realtor.com, I linked the page. You can choose the data by zip code, by county, by metro, and by state. The data mostly goes back to 2016, and you can build a chart of your county, if you wish.

Technically, a house is not a consumable. No portion of it disappears when it is used overnight. You refill yr gas tank, yr food and yr toilet roll, as you consume them. Not yr house.

Here’s some thoughts from a 65 year continuous house owner. They are not a consumable in the same vein as a cheeseburger.

In the short run, they could be a good way to make some money or even a lot of money. In the long run, they are a money pit.

The taxman and insurance man never go away. they take a bigger bite every year.

After 65 years, the only part of the house still original are the stud walls and drywall. The rest has been replaced. By the rest I mean, roofs,siding, gutters, downspouts, all mechanicals, i.e. airconditoners, furnaces, hot water heat, windows, outside doors, landscaping, kitchen and bathroom upgrades, etc. numerous paint jobs inside and out.

As an investment, not good at all. And, inflation played a good role in it all.

Like Wolf I’ve never “consumed a house or a condo” and unlike with cars even if you are super hard on a house or condo it will not drop in value to near zero like an old worn out car that won’t run anymore.

Not technically true, ApartmentInvestor, a house value can go to zero. The land has value.

@AC when most people talk about “home prices” they are talking about the “home and land” just like when people talk about “car prices” they are talking about the “car and wheels”.

@Louie it costs some money to pay the property tax and maintain a paid off 65 year old home, but it almost always costs a LOT less than the cost to rent a similar home so I would not call it a “money pit”. With rare exceptions anyone that wants to live somewhere else can rent out a paid off home they are living in for far more than it costs to own the home.

This is a great point and spot on. CPI adjusted metrics are still rarely used because most participants in the financial markets aren’t old enough to have experienced meaningful inflation.

While a house isn’t a consumable in the sense that it’s destroyed in its usage, housing costs still are a part of the CPI because an increase in prices has real impact on our financial expenditures… whether because we have to invest more and therefore lose out on other income we could be earning or because we borrow more to finance our purchase of our housing.

Everyone pays the consumable parts of home ownership…insurance, maint, taxes etc…..even renters. Especially renters. I rent a home out to a young couple. We could charge $1000 more per month to mimic the local market, but choose not to as they are family friends. Plus, I built the place myself and it has been paid for for years. However, the big however, the rent charged is still predicated on expenses. It covers taxes, insurance, materials etc on that place, and the expenses of the home that we live in. If it was built for just income and return we would charge more. The rental home added an assessed value of roughly $300K to the property it sits on compared to the sister lot next to it. It cost me $50K to build without pricing out my sweat equity. (I enjoyed the build.) Housing is an extremely good investment if bought low, or self built. A paid for house is the same as receiving an after tax income boost of a high percentage of whatever the rent would be for a comparable property in your market. Everyone has to live somewhere, and home ownership, be it a condo, single family, duplex, is more than a dwelling in any event. It usually defines one’s life and lifestyle.

Furthermore, property taxes, materials, upkeep of a rental is all tax deductible on our joint family income.

Another issue is security. I built the rental because an elderly friend was being evicted. He had a mobile on a property down the road from us. He had been told he could remain there for his entire life in payment for past work performed and a 65 year family friendship. His buddy died, the widow was nasty and sold the property to her daughter for peanuts, and she was/is a nightmare and decided to play with this guy’s life and evict him. When she sold the property she realized a 900% profit, but lost any reputation she once had. I have seen many older folks evicted in their later years as property was bought for redevelopment. It isn’t fun to have to pack up and move on in your later years, in fact we later found out our friend had made plans to kill himself. If you own your home you can remain in place until you croak or can no longer function. And you can even defer your property taxes in many jurisdictions which is later reclaimed from the estate. Choice and security, priceless.

Thanks for the well-written commentary. It’s comforting to read things from humane, decent human beings.

You built a home for $50k? Can I ask how long ago?

Wolf, thanks for the great data and charts.

Real Estate Pumpers Meet Windshield.

Aaaaaaaany day now….

Several articles over the last month have discussed record low affordability. Perhaps, the tables are finally going to turn on the corporate buyers and AirBnB crowd?

Way down we go guys!

Just the beginning

Everything takes longer than expected

The bad news is that home prices are almost back to the long term trendline, as seen by drawing a line through the peaks of 2017, 2018, and 2019. The floor in housing prices may be near, at least until AI advances to the point where it can start legitimately pushing people out of routine jobs.

Or a recession casuing job losses.

Have a friend in San Diego who bought a 1.5 mil home last year and lost his job.

Job market is tough and he may need to sell his home .

Sucks for your friend, but a 1.5m house in SD is probably a 50 year old shack. Price in no way reflects value in an insane asylum like CA. Was he in biotech?

Thanks, Wolf! Great info, very timely as to the pulse of the existing housing market. I note that two metro areas, Seattle and San Jose had very high month increases in listings over comparable prior year month. Such large jumps suggest something unique may be happening to those already high priced housing markets. The four Florida metro areas in the top ten of increased YOY listings are also… unusual. Another few months will provide some clues and news for those two groups.

Florida is California’s dumb little brother (I can say that as somone who was born in Florida and lived here most of his life). We had a million mask haters move down during COVID. They sold their $600k house in Jersey and paid $550k of that for a $250k house in Orlando. Prices went through the roof. Property taxes went through the roof. And now insurance is through the roof. They’re predicting the worst hurricane season in history. It’s 99 degrees outside everyday with 99% humidity. This started in May and will run through October.

When prices went up, every yahoo came out to become a house flipper like their Cali brothers. Native Floridians can’t pay $300k for a house much less $500k. Folks are trying to move out. The house flippers can’t carry the costs. Panic is setting in.

it’s always going to be the worst hurricane season in history !

And it has been like this since 2004, when Florida had four hurricanes.

Good thing for you two there is a savior who can very easily right ALL the bad and troublesome changes since the “beautiful” times, then, huh?

Actually there is two of them…….the way I understand your “thinking”, yes?

What’s looking bleak in FL?

1) Insurance companies are NOT paying people what they owe them (ex. Ft. Myers, Hurricane Ian).

2) State of FL took away property owner’s right to recover attorneys fees from insurance companies if they win.

3) FL changed how insurance company’s fiscal health is measured. What is a “C” ranked co. in Ohio is an “A” in FL.

4) Hottest water ever =powers hurricanes.

5) Look up “rapid intensification” (ex. Hurricane Otis increased 100 mph in wind speed in less than 12 hours.

Yes, the sky IS falling!……sorry to second that.

On a lighter note checked out my very first Tesla “truck” in parking lot today……other than lack of ground clearance, it “looks” good to me….don’t know if it is.

Kind of just a racy looking SUV….but I like that king of styling better than the everywhere “inverted bathtub” look FN Ford started.

Think Can Am style impressed me and just stuck.

Florida condo owners are being hit with massive condo assessments due to recent changes in the law.

My Brother-In-Law who has a very nice house in the Tampa area for sale ($579K) has had it listed for over a year now with few lookers. He has reduced the price about $100K within the last year, too.

He’s getting desperate.

Reminds me of my friend in San Diego

He listed for 760k but after 2 years sold for 460k in 2012.

Classic chasing down the market .

@Jon, don’t tell that to majority of the people in SD or SoCal now. They will bet their first born this won’t ever happen again and now this time is different and market is crash proof and who knows they might be right..

Personally I would love love love to see this again, to see that hubris and over optimism get completely wipe out, to me that’s priceless

Wolf, what do you think will happen to housing once the Feds cut rates? Prices go back up? How will the election effect housing? Interested in your thoughts.

What if the Fed cuts once or twice or even three times, and then inflation takes off again, and the Fed has to hike again, and higher than before? That’s what happened last time. And Powell has mentioned that scenario. They’re acutely aware of it.

Sales have plunged because everyone is waiting for lower prices and lower rates. If the Fed cuts a couple of times, that’s not going to change anything for homebuyers.

If the bond market things that the Fed is relaxed about inflation and will let it run hot, long-term interest rates are going to be higher, no matter what the Fed’s short-term rates are, and the yield curve will be back to normal, and mortgage rates will be higher.

Lots of different scenarios out there.

I stand by my opinion that the Fed will not cut rates at all in 2024 and possibly not until well into 2025 or beyond. They can’t raise any more now but everything is just waiting for that first “twitch” lower and then prices and markets explode higher in an inflation fueled frenzy. Right now the market is waiting to see if the Fed blinks. “Do you mean 2.0% or 3.5% Jerome?”

As long as the Fed sits still and pretends to be ready to cut rates, inflation *should* keep ticking down tenth by tenth for a while. But it could be January 2026 before it actually hits 2.0%.

As it stands, even the mere rumor of rate cuts causes the markets to explode higher. It doesn’t even take an actual rate cut to continue the mania.

Any chance the market is just banking on a repeat of Trump getting elected and “keelhauling Powell on a daily basis” to lower rates and print money? I’d imagine that would backfire pretty badly this time around but that won’t necessarily stop them from trying it.

Agree; U.S. has been all over the road trying to SELL debt. It would kill foreign demand if interest rates were cut. USD has nothing going for it other than being an inflation symbol.

1. There is a huge amount of demand for longer-term Treasuries, which is why the yield is so low. Long-term yields are going to where the market is. If there is lots of demand for this stuff, yields fall (prices rise), as right now. If there is less demand, yields rise (prices fall) until enough demand emerges, foreign or otherwise. Last time the 10-year yield hit 5% for a few hours, if that long (Oct 2023), demand exploded because everyone wanted to get some 10-year maturities with a 5% yield. This demand crushed yields again.

2. The Fed would only cut short-term rates. So short-term yields would be directly impacted by it. But the Fed doesn’t control longer-term yields, the market does that, and the Fed is also unloading its long-term bonds. So longer-term Treasuries are on their own, and for now, there is huge demand.

“Wolf, what do you think will happen to housing once the Feds cut rates?”

If this bubble bust is anything like last time (and there’s no reason to think it isn’t), it won’t matter what the Fed does for quite a while.

The very rapid rate cuts the Fed did just before the GFC got far worse were made in large part because they saw how badly and quickly the economy was deteriorating. Those cuts of course did nothing, because it was far too late, and home prices continued to fall for years even after the Fed had ZIRP’d rates.

Some may say this is just the Fed being bad at its job. I now think, after having seen these bubble/bust cycles far too many times in the last couple decades, that the Fed is just evil, especially given the amount of data and modeling they have to look at.

Per my limited knowledge:

Fed directly controls short term rates via FFR. They have no control over long term 10Y rate unless they do QE/QT.

FED is not doing QE but doing QT. This should increase long term rates thus mortgage rates generally.

On top of this, govt deficit spending would act as a floor to 10Y yield.

Bottomline: Per my limited understanding, FED cutting rates should not impact 10Y yield and thus mortgage rates.

Counter-argument:

Lowering short term rates causes a selloff in long bonds due to loss of confidence in the Fed’s inflation fight.

The Fed can let housing crash. They might not want it to, but it’s also not the end of the world. But the Fed absolutely cannot let Treasury prices crash, because the latter is vital to the existence of the whole gov’t apparatus.

Cool, small step in the right direction. Great to see San Diego on the list, although so far it’s doing not much for the decline of price. Disappointing to see LA didn’t even crack rop 20 and OC is nowhere to been seen and RE agents and housing cheerleaders are still full of hubris in OC for sure…for now

All bets might be off though if that mythical rate cute do happen in Sept, the expectation it will unleash on the FOMO crowds might reenergize some demand and embolden sellers to hold out longer in this mexican standoff

My advice to everyone is to avoid living at sea level, or close to it….own beach front property at your own peril.

Doesn’t seem to be worrying folks in the Hamptons or Martha’s Vineyard.

Despite their professed lather about climate change.

Definitely a thing in the TPA bay area Mark, probably because it ain’t the rich and richer folks who don’t care as in the Hamptons, etc., but rather the middle classes being affected by the higher high tides and surges from little storms, etc., hereabouts.

As one who used to spend the summers in old shacks directly on the gulf, I see those locations with at least a couple of feet of water at the low tides these days; while some of that is certainly due to erosion, some of it is clearly NOT. There are also places where there are platted lots under water at low tide these days, but high and dry 100 years ago…

While there is obviously a lot of malarky going on to ensure funding for ”research,” there is little doubt global warming IS an actually happening thing these days, eh

…simple self-research one can do ref: global temps/sea level rise: look at historic photos of famous glaciers/high-mountain snow coverage, lowlying littoral areas circa-1900. Then examine (or, if you like/can afford to travel go and ‘ground-truth’ those locations against the old photos, in same season/between low&high tides, natch…) current photos of same, cross-checked against historic map info of ice/land extent and now…(easy-access bonus points: check out SF Bay level records over the same period…).

(One might consider doing this as a building inspection of the only house you’ll ever have-it does have a lot of rooms, but it’s the only house…as Miriam’s character said in the Python’s ‘Life of Brian’: “…it’s HAPPENING, Reg, it’s HAPPENING!…”).

may we all find a better day.

I live on a former glacial lake bed.

To my north, south, and east I can view glacial moraines. My west view is of the drift less region.

When change stops…the least of man’s worries will be if it’s to hot or cold.

Tom15 – good point, but the crux is our seeming lack of belief that reasoned restraint and, often tragically inconvenient adaptation, with the spacecraft’s basic life-support systems to improve the odds of a functioning future will ALWAYS be necessary, somewhere, among our planet’s many interconnected rooms…best.

may we all find a better day.

Au contraire, mon ami. Beachfront houses in Nantucket have been sold for peanuts comparatively speaking due to beachfront erosion. The chickens are coming home to roost!

Rich people don’t have the same problems we do.

If their vacation home goes under water, they just get another.

You don’t even have to be at sea level, close to the beach will do in some circumstances. Every year we have a few fools who move to the Oregon coast from California or Florida and build a new house next to the beach. They think they are safe because they are 30 feet up from the high tide mark. That is until a few winter storms scoop out the cliff under them and their new house falls in to the surf.

I would think the Cascadia Subduction Zone would hang over your little patch of blue like a Damocles sword. That said, I worked a bit in/around Lincoln City in my youth and found the area to be incredibly beautiful, so I understand the appeal.

My sister lives on Camano Island in WA. She lives across an alley/lane from the beach properties. Big storms push logs up into the beach yards and tear out their retaining walls. It is getting worse every year. Anyway, some guy with too much money bought the cottage across the way, tore it down and is now having built a monstrosity that he thinks the extended family will come and visit many times per year. (hah ha) But here is the rub, FEMA was involved in approving the design, setbacks, and structure elevation before the first machine arrived on site. A federal agency is now being used preemptively in addition to local building inspection. I don’t know if they can even get house insurance? Maybe the insurance company is involved as well?

@Paul: Since FEMA is involved with flood insurance, it might be (speculating) that because FEMA signed off, an insurer will write it.

I’ve noticed the uptick in new listings in Utah over the last 4-6 weeks. I’m working in a large number of markets, all over the state, and I’ve seen a recent increase in new listings over the last 4-7 weeks. Maybe people are realizing rates aren’t going down and so it’s time to do something?

In the Park City Resort area, I’m starting to see a rapid pile up of luxury, new construction homes starting at $2.5 MM. Some spec but some that started as custom and the owners are now listing them.

Wonder if many disappointed sellers will withdraw their listings if their homes don’t sell by end of summer and then rent them out as STRs? Maybe this fall and winter we see a glut of withdrawn listings turned STRs?

“Maybe this fall and winter we see a glut of withdrawn listings turned STRs?”

Hopefully, I’ll be ready to vacation

If you are motivated to sell, then let the buyer assume your low rate mortgage if it is assumable such as Veteran Affairs (VA) or FHA.

Also offer to buy up to 4 discount points for the buyer, which will lower the buyer’s 30 year mortgage rate by 1%.

That is what my wife and I plan to do if we sell next year with our 30 year VA mortgage rate of 3%. We may have to move to live closer to family.

If the Federal Reserve lowers the Fed Funds rate from 5.5% to 4.5% then I would reasonably expect the 30 year mortgage rate would drop to 5.5% to 6%.

Seems like there is enough safety margin to set it to 4.5% if PCE remains below 3% for at least 14 consecutive months.

We would buy then and buy 4 discount points so our mortgage rate is 4.5% or 5%. And then we would refinance in the future if the mortgage rate drops to 3.5%.

Wolf – any idea how much supply is being added due to localities increasingly regulating short term rentals like ABNB/VRBO? Case in point – Lake Tahoe. I track that market out of (morbid?) curiosity and see that there a lot more vacation homes hitting the market (you can generally tell they’re STRs based on photos which include signs posted around the house)

@hreardon I have owned a North Shore home in Tahoe for more than 20 years and I have been following the market for almost 50 years since I tried (unsuccessfully) to get my parents to buy a fixer upper A frame on the West Shore down the street from a friend’s family cabin for $35K. Even a decade ago (when Tahoe home prices were ~50% lower) you could not buy a cabin in Tahoe (unlike other markets with cheaper real estate) and make money renting it without a massive down payment, so most of the new cabins added to the STR (Short Term Rental) pool in the last ten years were cabins owned by other people like me, the “working rich” who want their own place in Tahoe where they can leave all their ski stuff and are just looking for some STR money to help with (the ever increasing) expenses. Unlike some STR markets where people bought up multiple properties (with low interest IO loans) to get into the “STR Business” this did not happen much in Tahoe and most people will be fine with the market cooling (like my sister with the place in Aspen who has been complaining that her STR income is about half of what it was just two years ago).

Great response, thank you for that. My wife and I spend a fair amount of time in SLT (don’t laugh….), and the impression I’ve gained over the years is that a lot of these properties are second homes moreso than purpose bought to be STRs.

I mentioned this inventory buildup situation happening in my Southeast housing market (one of the ones featured in this article) on a post I made on another article a few days ago. However, despite the enormous inventory buildup, this has not adversely affected house prices. On the contrary. In my market, prices (both median sales price and median sales price per square foot) are up about 3% YoY.

So far this situation seemingly continues to defy the laws of physics. Not sure how much longer this can persist but certainly the more it does, the more it makes you scratch your head.

Median sales prices are really not a great indicator of the market actually. It’s being inflated by an abundance of upper end sales compared to medium or lower end sales. This is occurring in most areas of the country at the moment ….. especially in Florida.

That’s why I also referenced median price per square foot as that helps to cancel out the effects you mentioned.

Follows roc’s in M*Vt, long-term money flows, the volume and velocity of money.

N-gDp to fall below targeting levels after July. Buy TLT

Anecotally in my stubborn SoNH neighborhood, there are now 3 for sale signs I pass on my way out, and I bet there are more I haven’t seen.

When I was buying in 2020, my house was the only listing in the entire neighborhood, which has ~100 small homes (mostly ranch & split level).

But, prices are still what I call ridiculous. Something’s gotta give.

You MM-ers are confusing me and everyone else. There are two different MMs here – not the same commenter. One or both of you, please add something to MM, such as MM1 or MMtoo, or something, PLEASE

Wolf you’re right; it’s much too simple of a handle, and easy for someone else to have the same idea.

From here on I’ll be using ShortTLT as my handle.

Thanks!

I’ve posted this several times already in other articles on this blog, but there are price reductions on almost all properties in metro Denver with exceptions only in the most in demand areas (suburbs with the highest quality schools). My daughter is looking at condos north and west of downtown and every single listing more than 30 days old has cut prices. Every one. There appears to be a building trend toward lower prices here. It is long overdue.

The mountain towns are seeing more listing, but still showing increasing prices for now at all price ranges.

In Jeffco lots of price cuts, but the initial listing prices are ridiculous so prices are still appear up from the year prior. Also people are listing their super outdated house (think hideous wooden paneling) at close to the same price as their neighbors updated move in ready house. Everyone seems attached to their Zillow value. I still see people buying, most are just buying down their interest rates for 1-2 years thinking that mortgages will be back in the 5’s before their first rate adjustment because the media pushing rate cuts as coming soon – this is being marketed by realtors as get in now before the rate cuts and prices skyrocket. Nice move in ready properties still seem to move in a weekend. I think though as more and more people hit their rate adjustments on their arms and buy downs it will take money out of the economy and as travel returns to more normal levels a lot of Airbnbs will go on the market. From the dynamics I’ve seen in the market the last 10+ years IF prices start to decline in a noticeable way (probably 7% or more) I think it will pick up speed fast. A lot of people here max out their budget to buy and put down as little as possible with the idea it doesn’t matter because the house is going to go up 50% and make them rich. Then they cash out refi and buy an Airbnb that they can’t afford the second mortgage of but it doesn’t matter because it’s going to always be rented. That or people buy a house they can’t afford without roommates or airbnbing a room.

You MM-ers are confusing me and everyone else. There are two different MMs here – not the same commenter. One or both of you, please add something to MM, such as MM1 or MMtoo, or something, PLEASE

Where the heck is Jeffco? Is that a new state I am not aware of? If you are referring to Jefferson County there are dozens of those sprinkled around the US.

West Denver Suburb that everyone wants too live in

Thank you for the 1!

@Hubberts Curve, Jeffco is Jefferson County which is west of Denver, CO proper. I live in SE Aurora, CO, (Arapahoe County) in the Cherry Creek School District (best in CO)j. Lots of home coming onto market include 10 just in my townhouse neighborhood (Pioneer Hills – 80015 zip code). I am renting and my rent is still cheaper (like $700/month less) than dealing with mortgage, property taxes and HOA fees with buying a house.

I remember now, that’s the place the Wags used to call Coors County.

This very recent economic summation from NZ, below, seems spot on for global consumers and dynamics which are causing resilient exuberance to moderate — as consumers go into retrenchment mode.

Greater hesitation in purchasing anything from cookies to homes will be an amplified factor going forward.

In addition, the unique stimulus from immigration and fiscal policies is a fading tailwind, as is ai tech mania — and overall there’s an increasing number of pins and needles flying around the Everything Bubbles — easily seen in housing inventory and price cuts.

“ The household sector has gone into hibernation. The housing market is in the doldrums. Consumers remain extremely cautious and are unwilling to extend themselves financially. Cost increases facing households are waning, but the sources of pressures are rotating. Firms have likely held on to labour in anticipation of a lift in demand but hiring plans are being reassessed as economic prospects sour and pressures on profitability grow,” Smith said.”

Do we have any idea what the heck is happening in Vegas? Seems like an extreme outlier.

There was a note on Realtor.com that part of the Las Vegas data is under review. It didn’t say which part. Maybe a data problem.

Yeah, that data can’t possibly be correct.

Movoto also shows something very odd with inventory (look at the Homes For Sale 5yr graph) in June of last year that continues to this day.

https://www.movoto.com/las-vegas-nv/market-trends/

I have no doubt Las Vegas is going to get rocked just like they did last time. If I remember correctly, L.V. home prices dropped over 60% from 2006 to 2012.

With its ingrained bubble/bust gambling mentality, that town is such a good indicator of bubbles and busts

As a recent (6 months ago) purchaser of a home in Vegas who had closely watched the market for 3 years before that, it all comes down to the fact that real estate is a local phenomenon. Yes, there are national trends, but ultimately local circumstances drive the market.

In the case of Vegas, one of the biggest drivers if real estate prices is it’s proximity to southern California, Arizona, and Utah.

On one hand, businesses are finding out that Nevada is a cheap place to live compared to surrounding states. Cost of living is cheap, taxes are low (thank you casinos), flights in and out are cheap as well. So companies looking to set up southwest U.S. offices or distribution centers, Vegas is a great place. The pace of warehouse construction in Vegas (and North Las Vegas) is crazy. So there some demand from that.

A big driver of housing demand in Vegas is also the fact that it is generally cheaper than surrounding states. In Utah the cost to live in SLC or St George is far higher than in Vegas. In California it is even worse. People coming from California can get twice the house for 1/2 the price. That is huge. If a person works from home and has to go into the office occasionally (every couple of weeks) why not live in Vegas compared to South California? It is only hours away.

Finally, it should be noted that 2 or 3 years ago, Vegas cracked down on short term rentals (airbnbs). Casinos rule in Vegas and they didn’t appreciate the competition from Airbnb. As a result, renting out properties short term was cracked down upon (basically a license was required and spots were limited) as a result, some short term rental properties went on the market. So two and 3 years ago sales numbers were slightly inflated making current comparisons look even lower.

As Wolf mentioned, there probably is a problem with the data. A 30% drop doesn’t seem right. That said, I would bet that after it is revised the numbers will still be pretty close to flat. Housing prices are still slightly below their peak, but just barely.

My experience is that when dwellings go on the market, as long as they are priced just under peak pricing, they will sell fairly quickly. Furthermore there isn’t a lot of dwellings for sale. No one is selling unless forced to.

Vegas is an interesting market, lots of forces at play (both up and down). It just goes to show that real estate is local.

I’d expect a surge of new listings in Vegas. Isn’t there a ton of room to build out there?

New houses for sale by builders are not included in this data – only homes listed in the MLS.

As Wolf mentions, this is for existing houses, not new. That said, yes and no to not having a lot of room to build. Within the existing population area there isn’t large tracts of empty space where thousands of homes can be built. That said, there are lots of small tracts where a few dozen can be built. It is hard to drive more than a mile in Vegas without seeing at least one such empty lot.

Also, while it is true that there isn’t a lot of empty private land left on which to build, it is only because most of the areas around Vegas are federal public lands. However every decade or so, the federal government will make a deal with local government and release a large chunk of land to be developed in exchange for assurances that certain natural points of interest are kept open for public access.

That said, most of these tracts that can be released by the federal government are at the far edges of Vegas. None of them are within a 1/2 hour drive of the strip or downtown (or the airport).

I think the price reduction metric is not terribly useful, at least in some locations. I decided to look through local house listings and saw several houses with list prices 50% above what the paid 2 years ago (without improvements) and double what it would have sold for 5 years ago. If these houses drop their price by 25% they would still be looking at a significant increase in value in just 2 years. Also active listings is bit miss leading since it seems no house stays on the market more then month before it gets delisted and relisted again a few weeks later. I would not be surprised if the actual active listings is not at least 10% higher and who knows what the actual days on market number really is.

Not surprised to see so many Florida cities, if you know anything about the state it has seen as many housing booms and busts as it has swamps.

^^This regarding days on market. Removing things after 35-45 days and just re-listing them seems to be common practice.

I have to add my anecdotal experience from this spring, after watching my old house go on the market, two years after I sold it.

The person that bought my house for $435k, June 2022, listed it for sale at $580k around April this year.

He apparently received very few offers, no foot traffic and after too many “lowball” offers, cancelled contract with agent, after about 7 weeks.

Now, the fascinating thing about this, is his agent seems to have worked very hard to completely scrub that failed effort, from any internet observation.

The deal was scrubbed from all MLS connections, every site that had the listing, took it down, and the only thing I can find now, is my sale from 2022.

I think this is an example of shadow inventory that isn’t included in current data. I don’t know how common that scrubbing process is, but I think it’s dishonest, because it distorts price discovery for public buyers.

It seems like there must be alternative ways to examine sales history?

Did you check on Zillow? (you probably did, I just want to confirm).

Zillow and every internet housing search engine purged any info on the cancelled sales contract.

Apparently withdrawn and canceled contracts do erase active marketing status provided by places like Zillow.

I think my case is rare, but I’m wondering if there’s a greater percentage of cancelled contracts — but in the aggregate this is probably not distorting the increase in overall inventory.

It seems odd, primarily because my old house is still available on Zillow for the 2022 sale price.

Oh well, I’ll move on.

Last I checked, Realtor.com and Trulia still show the price histories that have been bowdlerized from Zillow and Redfin.

Last I checked was a few months ago, though.

I’ve noticed this also, at least on Zillow/Redfin/other public real estate sites. I haven’t researched it as thoroughly though, just an observation that left me confused. A couple of properties in my area were listed and then removed after sitting 35-45 days. When they came back on the market all evidence of the previous listing was gone. One house near me did this 3 times since late last fall. However, for the majority that get relisted, the history stays so I’m not sure what to make of it, bad data? Or it intentionally being scrubbed?

I have a house near me that was flipped and supposedly sold over a year ago. Except there was no recording of the sale and it was back on the market for sale 6 months ago. It “sold” recently, for full price which is absurd as nothing is selling for full price now and even after the Reno it’s a dump of a place.

Fraud everywhere, nothing new. When I sold a house in the last bubble whoever recorded the sale knocked 20% off the sales price that gets broadcast by Zillow et al. It was sold to a flipper so there may have been an attempt to hide the true purchase price. Fraud was everywhere back then too.

I have seen this also for Zillow and Redfin. However, I have found that Realtor.com still has the information of the failed listing.

Redfin and Zillow seem very friendly to listing agents, allowing them to hide previous list prices and such.

When that happens, I go to Realtor.com to see the price history and so far, I tend to find it there.

Redundant writes about “shadow inventory”. 100% correct.

In the Chicago area it seems that Realtors™️ have their own list of properties not on Zillow or Redfin. Not sure about MLS.

Anecdotally – for us – the condo we bought was never listed publicly. Also anecdotally when we sold our single family detached dwelling it never was on Zillow or Redfin.

It appears that Realtors™️ have their own internal network of dwellings the ‘public’ never sees.

They’re called “pocket listings”. They don’t go on the MLS at first, because all these slimeball realtors figure they can get the whole deal done in-house or whatever. Sellers may be amenable because of privacy concerns, less stress, or whatever.

Sometimes the realtor then goes and puts a sign in the yard and/or sticks it on the MLS to show how many houses they are moving.

I watched houses turn over in my (now-) neighborhood for years without any chance to buy. It was incredibly frustrating. Here, my wife and I had been keeping ourselves as free agents thinking we could go to the selling realtor and buy using one of their buddies to keep all the commission “in the family”, thus gaining an edge. Eventually, we somehow got stuck with an agent, and pulled off our own great stunt to steal one of the best houses in town out from under everyone else. Man…still proud of that. If you can’t beat ‘em, join ‘em, I guess.

Want to add, that realtor did great for us. Can’t say he did it for us altruistically or that he wasn’t a slimeball…but he did what needed to be done.

MussSyke,

Have you been looking over my shoulder? 🤪

What you wrote was 100% accurate. The Realtor™️ behaved – and did – exactly as you said.

I’ll add that I thought my Reactor™️ put our house on the ‘market’ for way more than we would have if we did the ‘sold by owner’ thing. The first offer we received (after 2 days) and which we accepted, was for the ‘offered’ price. Even accounting for commissions and ‘other’ marketing costs we ended up way ahead.

anon,

It’s just like any other business where most people are shysters: you learn your tricks from each other. I guess you have to be good at making shallow friends and keeping your real feelings to yourself. My realtor was young, but learned quick, and put in some real effort.

To Wolf’s point, I had a neighbor say on Facebook (definitely NOT encouraging its use) she wanted to sell her house, and suddenly she had a bunch of offers and chose a massive pile of cash most of us would not have suspected the house to fetch.

On the other hand, to your point, I’ve seen plenty of FSBO properties sit a long time. I think buyers are half afraid of that, for whatever reason.

Some sellers really like to do a pocket listing. You don’t have to prep your house and host a bunch of open houses. Random people walking through etc. Pocket sale in a hot market can be a smart move.

I was also wondering about this – there’s a house with a for sale sign down the street from me, but no corresponding listing on Zillow.

When I sold my condo back in the day, I didn’t hire a broker, and it wasn’t listed. I just worked the people I knew and who knew my place (unique, big, and gorgeous bachelor/couple pad), and word got around that it was for sale, and within two weeks, I got one offer from a retired couple (former Conoco executive, when Conoco was still headquartered in Ponca City, OK), and it was reasonable, and I took it. The unit never made it into the inventory figures nor the sales figures. But the sale was of course entered into the public records. Zillow uses public record data among other sources, and it would have picked up the sale, and the price, but Zillow didn’t exist at the time.

ShortTLT,

In the past, I swear that houses in “coming soon” status did not hit Zillow, etc. until they went “active”. This seems different now – maybe it is, or maybe the seller/realtor can choose? But that was a common problem for my wife and I before we had a realtor: not knowing when some places were going live and then being too late.

You’re not allowed to be shown a place in “coming soon”, but you are allowed to buy…

“… I think it’s dishonest, because it distorts price discovery for public buyers.”

If the home wasn’t actually sold then it doesn’t really matter what it was listed at. You could list it at any other insane amount and it still wouldn’t really make any difference regarding price discovery.

Really the only thing that listed/removed data would show is that both the seller and the agent were smoking a lot of crack.

I have noticed a variety of things similar to what you describe. From personal observation, it seems like the internet listing websites for real estate are a major player in the things I have noticed just as much, if not more so, than just the real estate listing agents and sellers. I would have to think for a bit to try to remember all the odd changes and strange activities I have noticed but I will try to think of some of the things I noticed.

Here is one……..

On Trulia (I use for casual searching because it’s format is better than it’s associated Zillow website) the “Recently Sold” listings now only go back about three months instead of a few years.

Another thing I have noticed on some of the listing websites is that their sale / transaction history does not go back as far as it did not too long ago, like a two or more years ago.

A little less than a year ago, I noticed a 50% drop in listings when searching various places that I have been following around the country. There was no news articles or discussions of this that I saw and such a big drop in specific locations was too large to correlate with interest rate expectations and other financial variables going on that could contribute to a drop. I can understand maybe even a 25% drop in listings, but not a 50% drop in listings from a diverse selection of places around the country………All in the same exact week, serious in 1 single week. I never saw any discussion of this.

I am conspiratorial and suspect that the government manipulates it’s financial standing now through collusion with these tech-real estate companies to manipulate data to the benefit of the financial system. I suspect that real estate is purposely being used to prop up the value of the dollar as the world diversifies away from the petro-dollar hierarchy.

I think enough people would agree, at the least, that tech-real estate companies purposely manipulate the overall data to benefit their associated (publicly known or secret affiliations) with real estate investment. Zillow was known to be major real estate investors right? And they have a huge sway on publicly presented data that manipulations people’s valuations and FOMO. Connect the dots right, at least the obvious ones.

I have also seen the option to view foreclosures on some of these websites disappear and then reappear. I see a lot of inconsistency in the presentation of foreclosure properties among the real estate websites. I do understand some of the technical details related to foreclosures can explain away a significant amount of these differences in what is displayed for those that are not skeptics, but it the patterns over the last few years in how those properties are shown seems to not be based simply on the foreclosure process variations and technicalities.

These are some things I have noticed that I can think of at the moment off the top of my head, for the sake of making this comment, but there are probably other significant things I am not thinking of at the moment that I have noticed over the last 5 or so years.

Here is a simple synopsis. When the data favors the FED and the asset holders positions and their storyline, the data and it’s presentation are more readily available. When the data doesn’t fit their narrative, they suppress it, delay it, manipulate the statistics behind it, and pull investment inventory en mass from the market to drive the data back to where they want it to be for their benefit.

How is Zillow not busted in some type of investigation for things like this. How can you be a major real estate investor (or at least they were, according to articles) and be the ones giving valuations and presenting data.

When capitalism is allowed to run it’s course long enough, it seems like monopolies always form. And when monopolies form, they control entire industries. When they control entire industries, they gain major influence over government policies. When things evolve and come together in such a way, it sounds like a form of communism that has far less accountability than in simple communism. It is like a form of communism entirely in private hands with no oversight and nobody you can name as being responsible.

I am not advocating communism, or anything really. I don’t believe any system is great enough to worship as infallible. It is only the morals of the constituent population and their specific culture that can really keep a system / government / nation from turning into garbage, not it’s fundamental ideological economic systems.

About 20 years ago, I remember telling someone much older than me that going into a huge Walmart makes me visually see that this system we have is devolving into some retarded version of communism. I won’t try to elaborate on the variety of reasons to make such a simple statement like that, but I will point out at least one thing about that, which is that the things in Walmart are for the most part not even made in this country, and at the time were coming from the ‘big bad communist entity of China.’ At least the so-called communist countries of the past supplied their own garbage. Our capitalist system that devolves into a shadow form of unaccountable form of communism evolves in such a way as to supply us from communist sources, to simplify quite a bit. (I don’t view China as being purely communist or know enough of communism to know if there was ever truly any nation that actually implemented a true theoretical version of communism.)

I’m curious if most housing transactions are 1:1, someone sells a house and buys new house, how is there such a significant increase in listings and decrease in buyers? Are these second homes? Airbnbs? Large scale investors unloading rental properties?

We’ve been talking about this for a while, back when it was happening a lot. These are vacant homes the owners put on the market. Lots of reasons for vacant homes, and there are about 11 million housing units that are year-round vacant. Of them, about 3.5 million are “held off the market” for some reason. Census Bureau tracks this and lists the reasons, such as owner does not want to sell, which we discussed here, for example. One reason is that people bought a new home and moved in, but didn’t sell the home they’d moved out of because they wanted to ride up the price spike all the way. I know people like that. We saw quite a bit of that during the pandemic. These are vacant homes that are now coming on the market without associated purchase.

I have recently seen a flood of price reductions in the area we are trying to retire to. I have about 75 houses saved on Zillow and have received notices of price reductions on about 1/3 of them. Many of these have been $100k to $250k reductions. Our favorite house has dropped 4 times in the last 10 weeks for a total of $350k reduction. They are all still overpriced but the trend is very encouraging!

@TerraHawk: Can you share where you are planning to retire? Just curious because these are huge price reductions.

Howdy TerraHawk. Hopefully what you posted happens coast to coast. A new bubble will be created but not in my lifetime…. Always found great RE deals in any market. You just have to know what you are doing. Most have no idea about buying or selling RE.

Howdy Folks Is that more hissing we hear???? Will The Lone Wolf charts have shown their final housing peak??? Will millions of 3 % ers be able to move if needed??? Fun Stuff, stay turned to Wolf Street to find out.

CPI tomorrow……..What a world……

MW: Lumber prices are at record lows — what that means for buyers and homebuilders

“Record Low”?

I see $147/1000 board feet on the chart (feb. 2009) vs today’s $437.

A far cry from the “war premium” of $1500, and maybe an “inflation adjusted” low-ish price (still 2X the Feb ‘09 price).

My source is trading economics .com with data back to the ’80s.

I had to comment because just last week I was talking with a friend (former builder) who said he just about left the lumber at the yard because of the price (again, he remembers 6-8 years ago prices).

“Record low since Jan 2023” would nail it 🤣

I follow such data in commodities and pseudo commodities on Trading Economics as well. The patterns I an deduce from those graphs have been more insightful than anything else I have found. Sorry wolf, but they just simply have a massive amount of data. I understand you’re just one guy. They are not a good source for articles though, they are very basic and limited. They also don’t have a comments section to sift through for insightful anecdotal or informative nuanced details from a variety of people. I end up forgetting to check that website as much as I check this one. Attracting high quality commenters with insightful tidbits of information or observation is my greatest cheese-to-mouse attraction for repeatedly viewing a website, healthy or not, wise or not, just saying how it goes.

Remember the old saying/adage that “those that sell first, sell best”, even if they have to take a haircut and aggressively price the home, its best to sell first. This logic should have been applied six to twelve months ago for most home sellers (if they could have) as the time to sell, when inventory was lower, was a while back. Now, the sellers are all beginning to run to the exits at the same time which as most people know, never ends well.

I don’t believe its a stampede yet as just like holding on to a stock for too long, to eek out that final smidge of a gain, greed and denial often displace logic and acceptance. But if this does turn into a stampede, which could be driven by continued softness in the economy and job market instability (which is just beginning to creep into the equation), then look out below as the rush for the exits could be epic. Not that this isn’t needed as pointed out numerous times by WR, prices need to correct lower, and in some cases, significantly lower.

For those home owners that took a reasonable approach and applied by the logic of “pigs get fat and hogs get slaughtered”, well done. And to those home owners that became hogs, best of luck.

Howdy Tracy. Don t forget there are wolves out there looking for pigs and hogs and no matter what the pig or hog did, some will get eaten alive……

Best to live a squirrels life……..

Thanks DFB. And to quote Jack Torrance played by Jack Nicholson in the Shining “Words of wisdom, Lloyd my man, words of wisdom”.

I think RE price reductions will accelerate if the stock market faces some trouble. Equities and RE are clearly correlated, with a lag.

In Seattle, employee stock ownership has clearly made people feel a lot wealthier and willing to spend on big ticket items. Lots of Microsoft, Amazon, Google, and Facebook employees here.

The Boeing employees probably don’t feel as secure or spendthrift.

I think Wolfstreet provides excellent data and analysis, but I do distrust data a lot more lately, especially with revisions, seasonality and various ways to shape narrative.

Data has always had sampling noise and error corrections but tweaking values in a market that seems broken is really adding to overall uncertainty .

From about a month ago:

“The proportion of inventory lingering on the market for at least 30 days is growing rapidly in Dallas. In May, more than 60% of homes on the market in the city had been listed for longer than 30 days, up from 53% a year ago.”

That’s super old and useless, but that rate of change trend is your friend.

This data is NOT BASED ON SAMPLES. It’s actual listings on the MLS. There’s no sampling error. Don’t make those comments if you don’t know what you’re talking about, just to promote some silly narrative.

Why don’t all these people just go to real offer .com?

I see this (ironically?) advertised on this article on Wolf Street.

I wonder about these “cash next week” buying outfits: where does the cash come from, and what happens if prices crash?

I get “cash offers” all the time in the mail for my house.

I figure they work like some of those mail order electronics retailers that offer to trade-in your old equipment for credit. They offer some amount on their website up-front, but when you send the item in, they find this, this, and this wrong with it, and lowball you on their actual offer.

@The Struggler almost all the “cash next week” people make super low ball offers and prey on people that are desperate for “cash next week” (if you don’t believe me contact one of them and see what they offer for your house.

Yes, I have always assumed that is the case. When you see tagged on: “we buy any home” it reeks of predatory behavior.

I have also wondered if the amount of this activity is any “sign of the top.” Obviously flipping drove the last bubble. Vacation rental seems to have fueled this one (along with a pandemic induced exodus from urban/ overpriced/ overcrowded areas… resulting in more overpriced/ overcrowded areas).

Once the fire has jumped out of the pit, it’s anyone’s guess what’s going to catch next.

Why is the Salt Lake City Metro area not making this list? The houses that were listed at $200K back in 2021 are now listed at over a million dollars. Listings appear for a short time, get pulled, and are relisted as no one is willing to pay the insane prices being asked. Townhouses and apartments are being built like crazy out here, but there’s only so much land available in the narrow SLC corridor. We’ve been here since 2021, and we’re definitely on a buyer’s strike as we can’t afford these insane prices.

“Why is the Salt Lake City Metro area not making this list?”

These are the largest 50 metros in the US by population count.

Ok. Fair point.

Do you have any interest in correlating the fastest growing metro areas with the explosion in their home prices?

The largest metro areas can better handle an influx of new residents than a smaller metro area less capable of handling a large influx. In this case, there would be an outsized effect on home prices that exceeds that of larger metro areas more capable of handling a population surge.

Buyers have an easier time of finding a home in NYC or San Fransisco where populations are fleeing from than in the places these populations are fleeing to such as SLC and Coeur d’Alene, ID.

The housing market is nuanced, and these nuances aren’t being captured by looking only at the largest areas. There is a huge buyer’s strike in the SLC metro area that no one bothers to cover. The SLC metro neatly captures the fact that buyers can’t afford the high prices and high interest rates, and the corresponding fact that sellers can’t afford to sell and become buyers.

Thesis; COVID tripled the mortality among the elderly (Presumably the highest concentration home-owner demo)… The kids are settling debts + opting for liquidity. If I’m right – the demo’s of those locations should skew older + higher population density. Watcha think? Home owners died and the kids don’t need two? – Armchair Econ

Thanks for the data. Just wondering how much of the real estate is owned by public and private REITs, Zillow etc. There carrying costs must be expensive.