Services are big, and that one-month outlier was massive, and it drove down Core CPI and overall CPI.

By Wolf Richter for WOLF STREET.

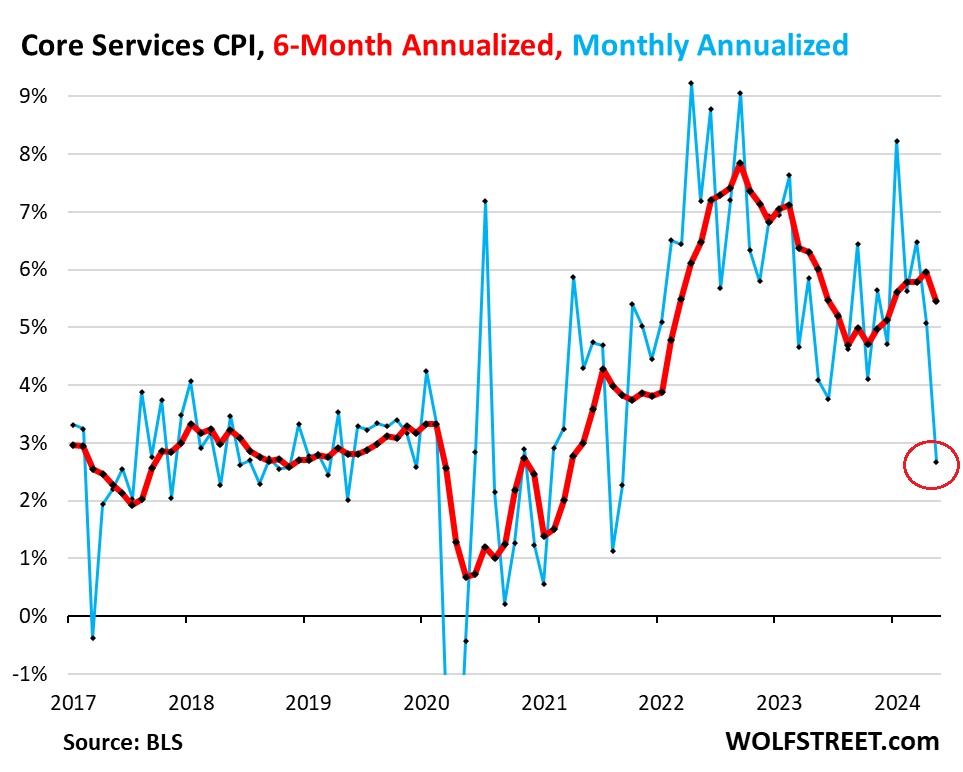

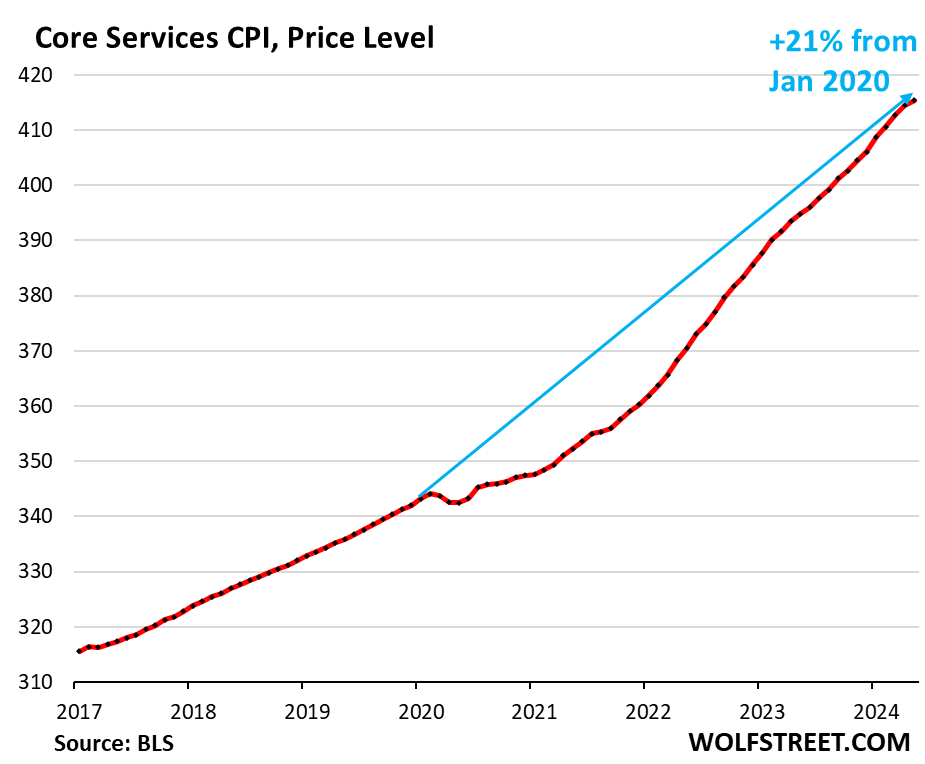

The Consumer Price Index for May, on a month-to-month basis, was pushed down by the continued sharp drop in durable goods prices, a drop in energy prices, flat food prices, and “core services” prices that rose at the smallest pace since late 2021 in a stunning whiplash-inducing outlier move, according to data from the Bureau of Labor Statistics today. So, we’ll start with that outlier because it’s so big, and because core services are so big — they account for 65% of total CPI — and because that outlier drove everything else.

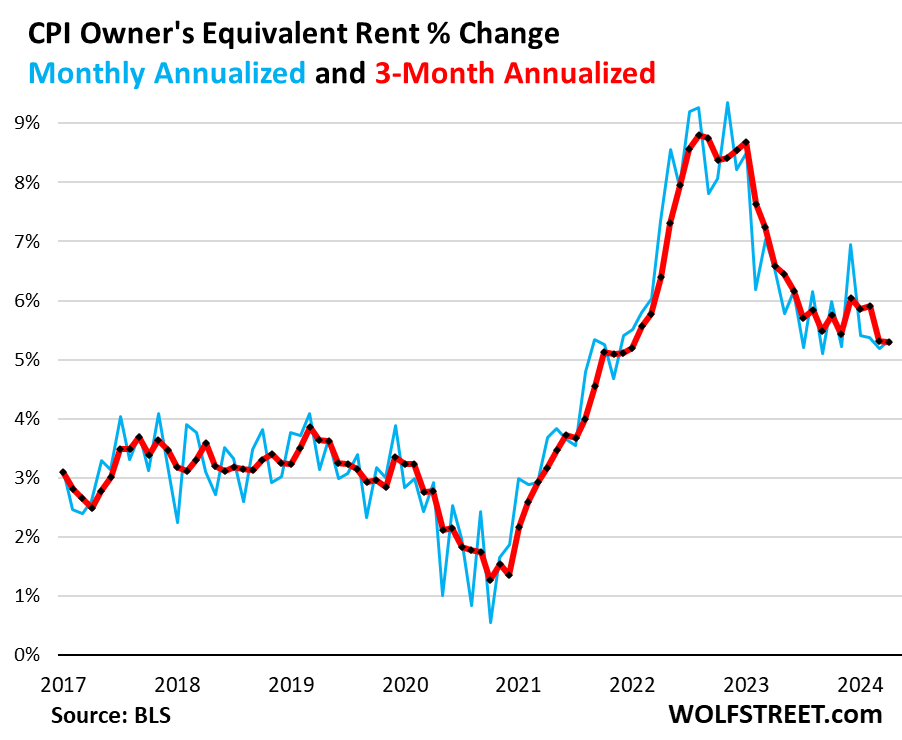

Stunning outlier: Core services CPI increased by 2.7% annualized in May from April (0.22% not annualized), the smallest increase since October 2021 (blue line). These kinds of outliers don’t make a trend; they’re soon reversed, as all other outliers in core services have shown. This massive one-month outlier drove down the six-month reading.

The six-month core services CPI rose by 5.5% annualized, the first deceleration since October 2023 (red).

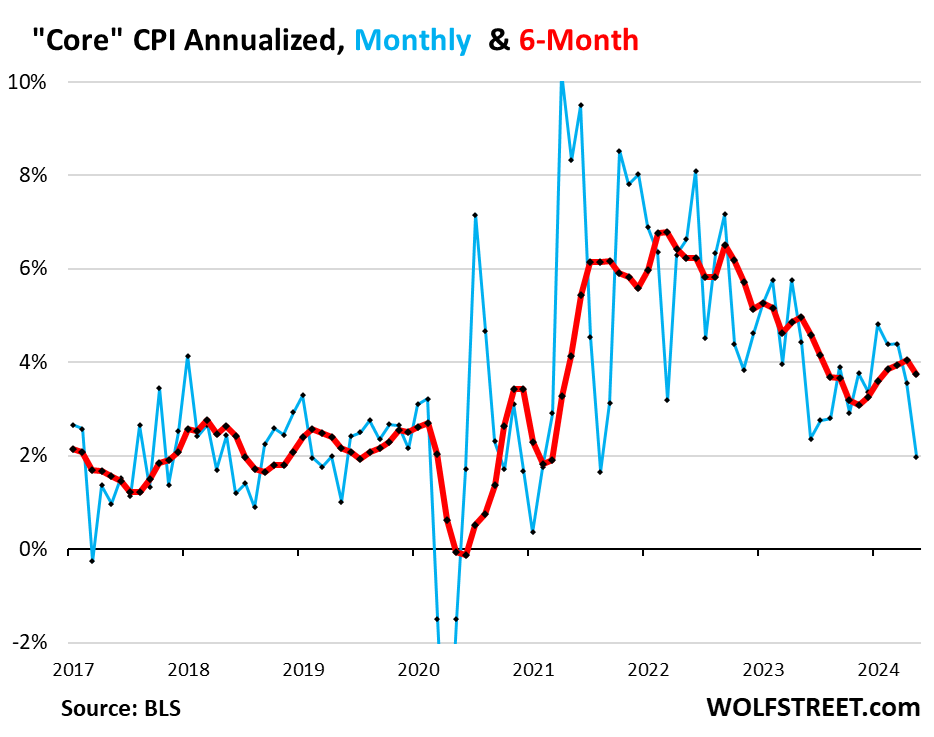

Month-to-month core CPI driven down by outlier in services.

Core CPI rose by 2.0% annualized (0.163% not annualized) in May from April, the smallest increase since August 2021 (blue line in the chart below). The month-to-month squiggles can be wild, and this one was driven by the whiplash-inducing outlier in core services CPI.

The six-month core CPI, which irons out most of the month-to-month zigzags, rose by 3.7% annualized, the first deceleration, after five months of accelerations in a row.

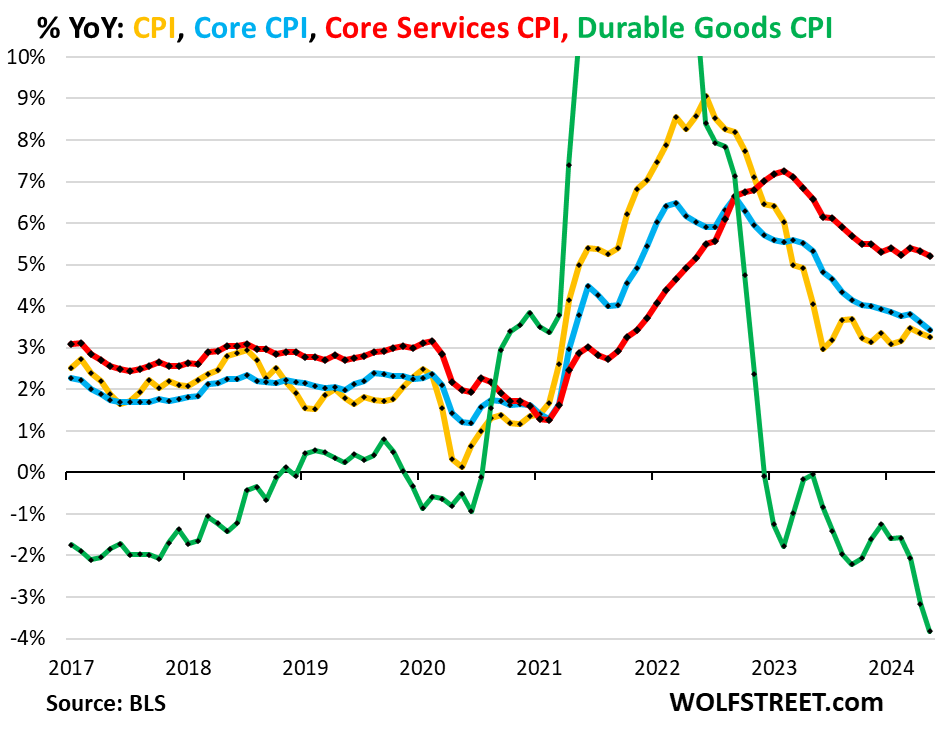

Year-over-year CPI measures, summary:

Core services CPI increased by 5.2% year-over-year in May, roughly the same hot pace for the eighth month in a row (red line).

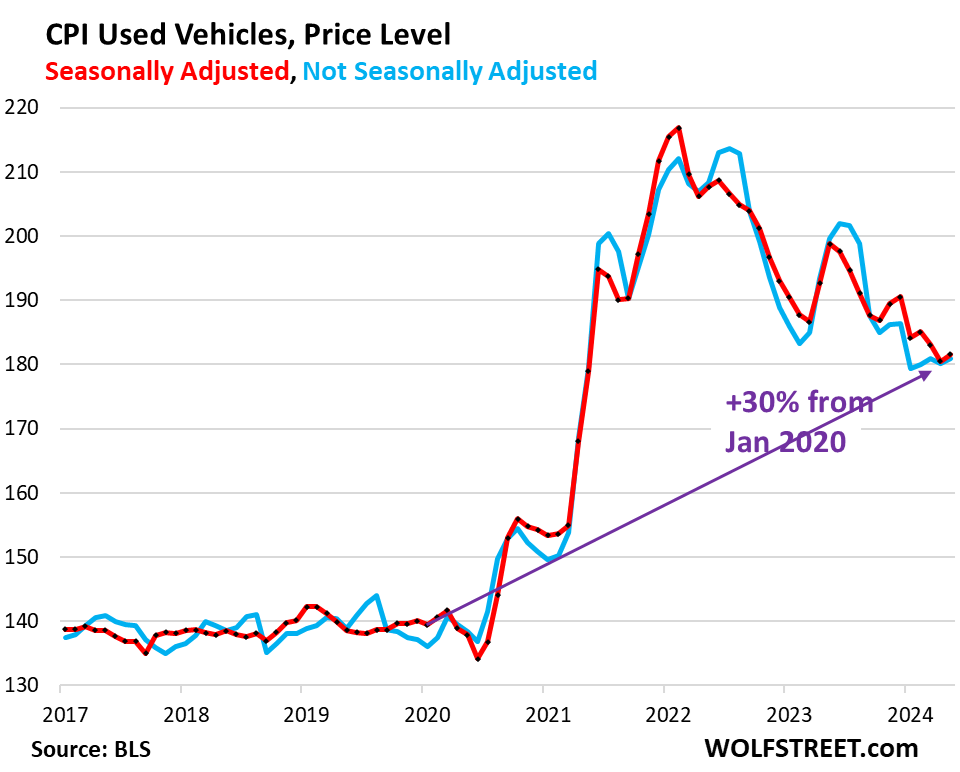

Durable goods CPI – after the spike during the pandemic – has been falling across the board since mid-2022, led by the plunge in used-vehicle prices. In May, durable goods CPI was down 3.8% year-over-year, the biggest drop in 20 years (green).

Core CPI, which excludes food and energy, rose by 3.4% year-over-year, continuing its deceleration, slowed by the sharp drop in durable goods (blue).

Overall CPI rose by 3.3% year-over-year. It has been in essentially the same narrow range since June 2023 when it hit the cycle-low of 3.0% (yellow):

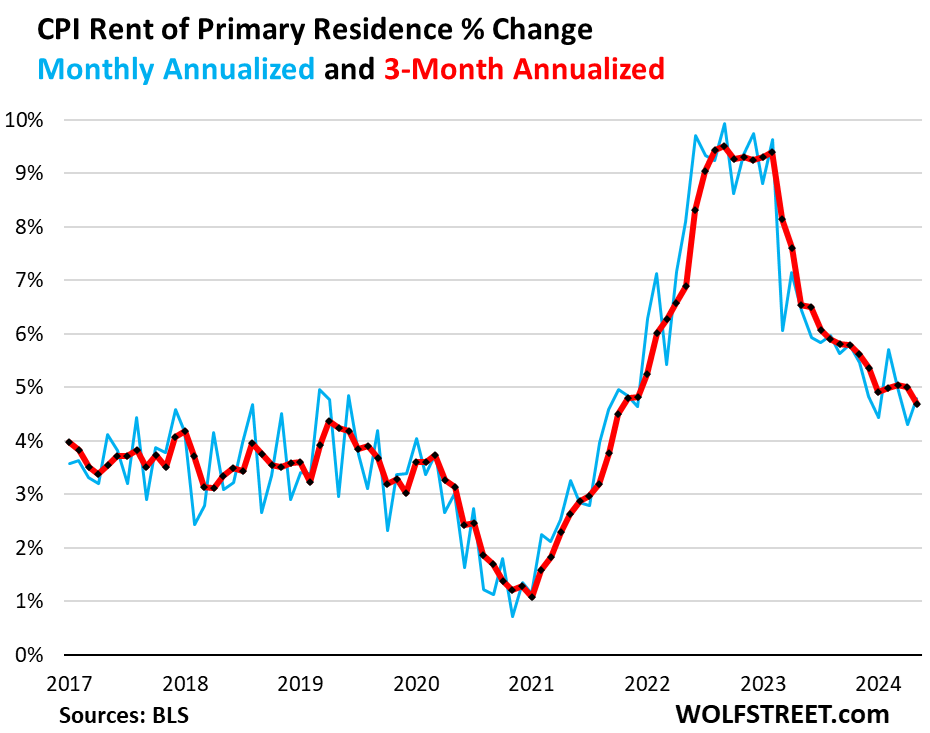

The housing components of core services CPI.

Rent of Primary Residence CPI rose by 4.8% annualized in May from April, an acceleration from the prior month (blue).

The three-month reading rose by 4.7%, the smallest increase since October 2021.

The Rent CPI accounts for 7.6% of overall CPI. It is based on rents that tenants actually paid, not on asking rents of advertised units for rent. The survey follows the same large group of rental houses and apartments over time and tracks the rents that the current tenants actually paid in these units.

The Owners’ Equivalent of Rent CPI rose by 5.3% annualized in May from April, an acceleration from the prior month. It remains in the range of which August 2023 had been the low point (+5.1%).

The three-month OER CPI also rose by 5.3% annualized, roughly the same as in the prior month.

The OER index accounts for 26.6% of overall CPI. It is designed to estimate inflation of “shelter” as a service for homeowners – as a stand-in for the services that homeowners pay for, such as interest, homeowner’s insurance, HOA fees, maintenance, and property taxes. As an approximation, it is based on what a large group of homeowners estimates their home would rent for, the assumption being that a homeowner would want to recoup cost increases by raising the rent.

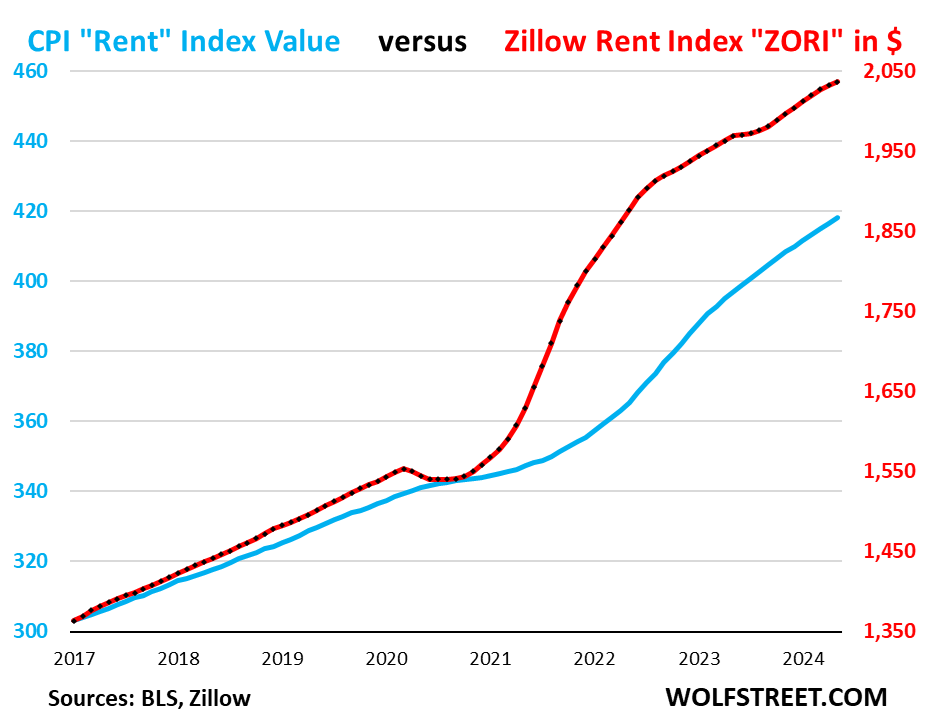

“Asking rents…” The Zillow Observed Rent Index (ZORI) and other private-sector rent indices track “asking rents,” which are advertised rents of vacant units on the market. Because rentals don’t turn over that much, the ZORI’s spike in 2021 through mid-2022 never fully translated into the CPI indices because not many people actually ended up paying those asking rents.

The ZORI rose by 0.2% in May from April, seasonally adjusted, and by 3.4% year-over-year.

The chart shows the CPI Rent of Primary Residence (blue, left scale) as index value, not percentage change; and the ZORI in dollars (red, right scale). The left and right axes are set so that they both increase each by 55% from January 2017. The ZORI was up by 49% from January 2017, and the CPI Rent was up by 38% over the same period.

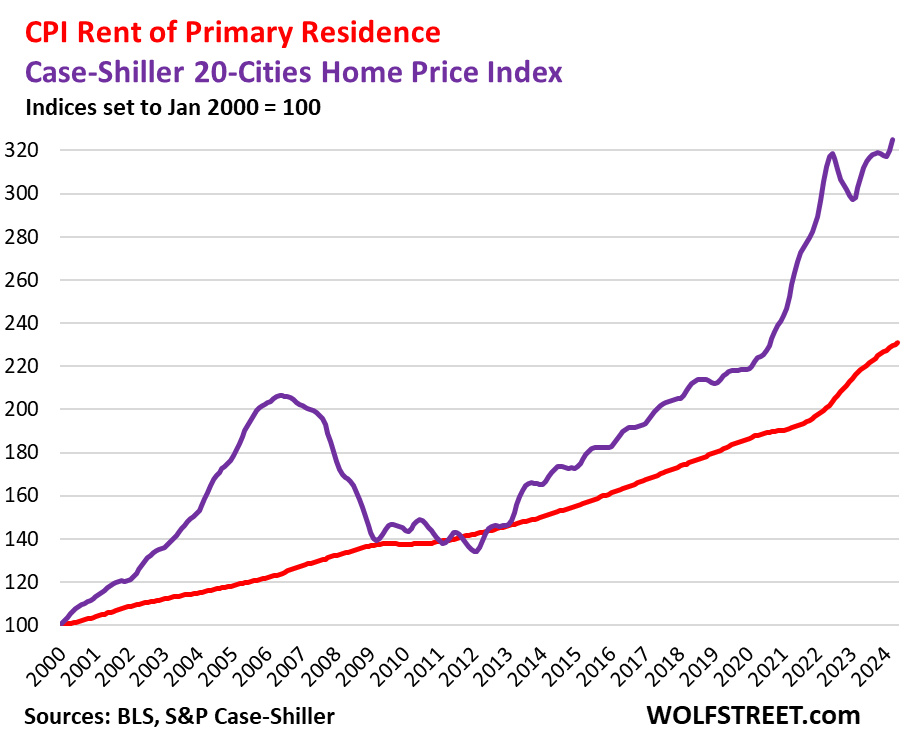

Rent inflation vs. home-price inflation: The red line in the chart below represents the CPI for Rent of Primary Residence (actual rents paid by tenants) as index value. The purple line represents the Case-Shiller 20-Cities Home Price Index (see our “Most Splendid Housing Bubbles in America”). Both indexes are set to 100 for January 2000:

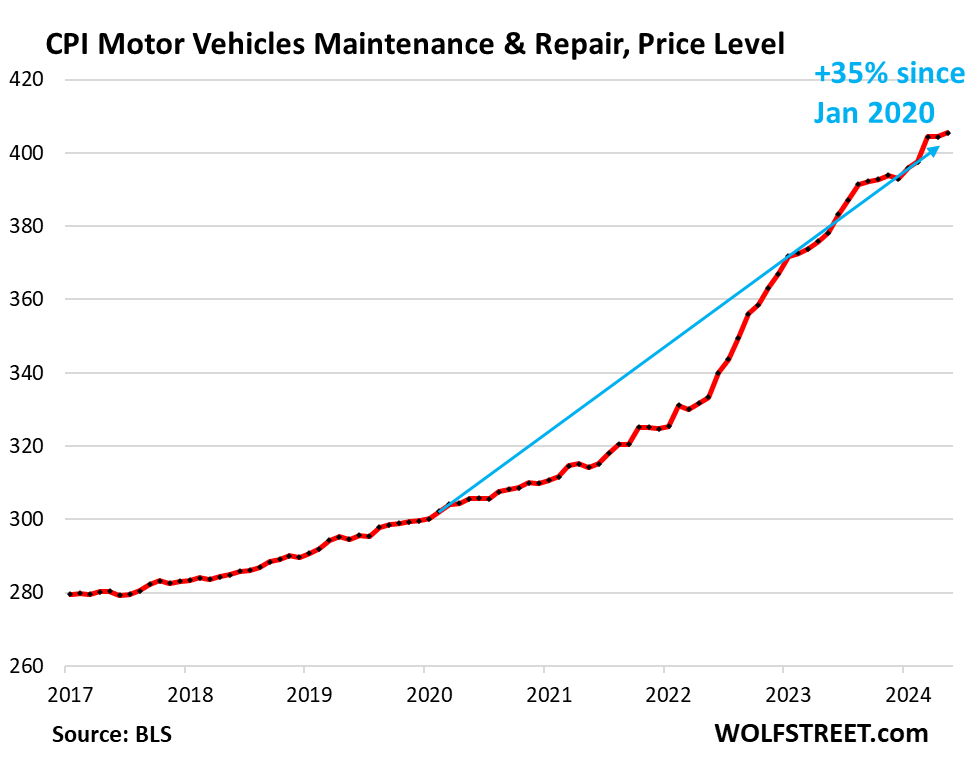

Services related to motor vehicles.

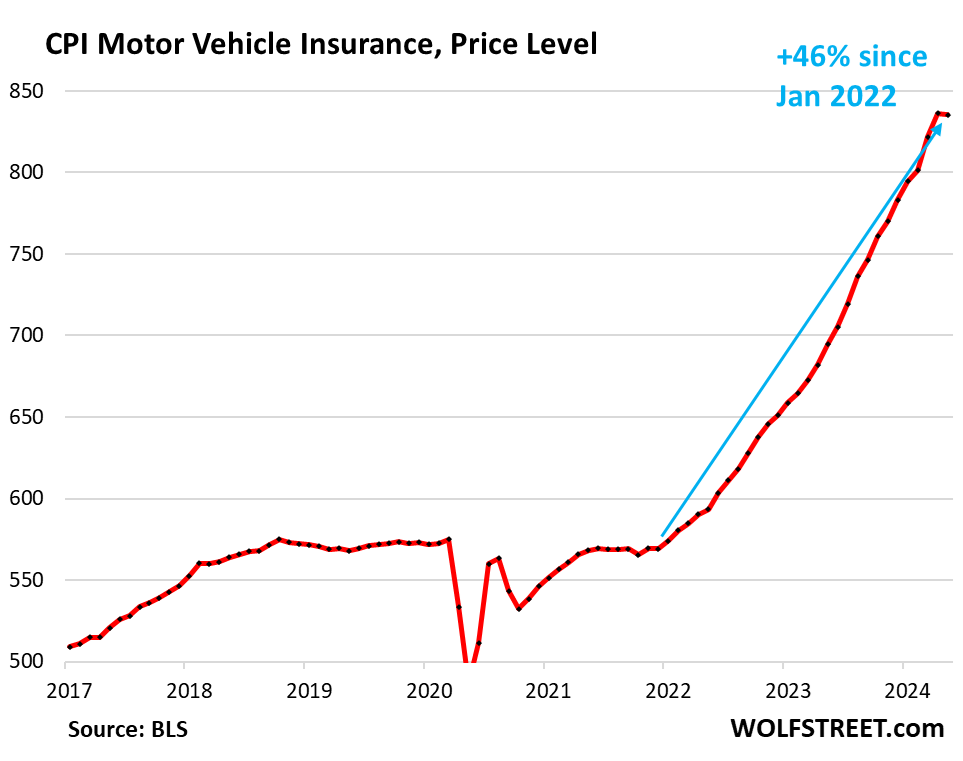

Motor-vehicle insurance costs have soared during the pandemic largely because used-vehicle prices have spiked, which translates into higher replacement costs. And motor-vehicle maintenance costs have surged because wages of auto-repair technicians have surged, and because prices of replacement parts have surged.

But that spike during the pandemic seems to be backing off at the moment.

Motor-vehicle insurance CPI:

- In May from April annualized: -1.4%

- Three-month annualized: +18.3%

- Year-over-year: +20.3%

- Since January 2022: +46%

Motor-vehicle maintenance CPI

- In May from April annualized: +3.3%

- Three-month annualized: +8.3%

- Year-over-year: +7.2%

- Since January 2020: +35%

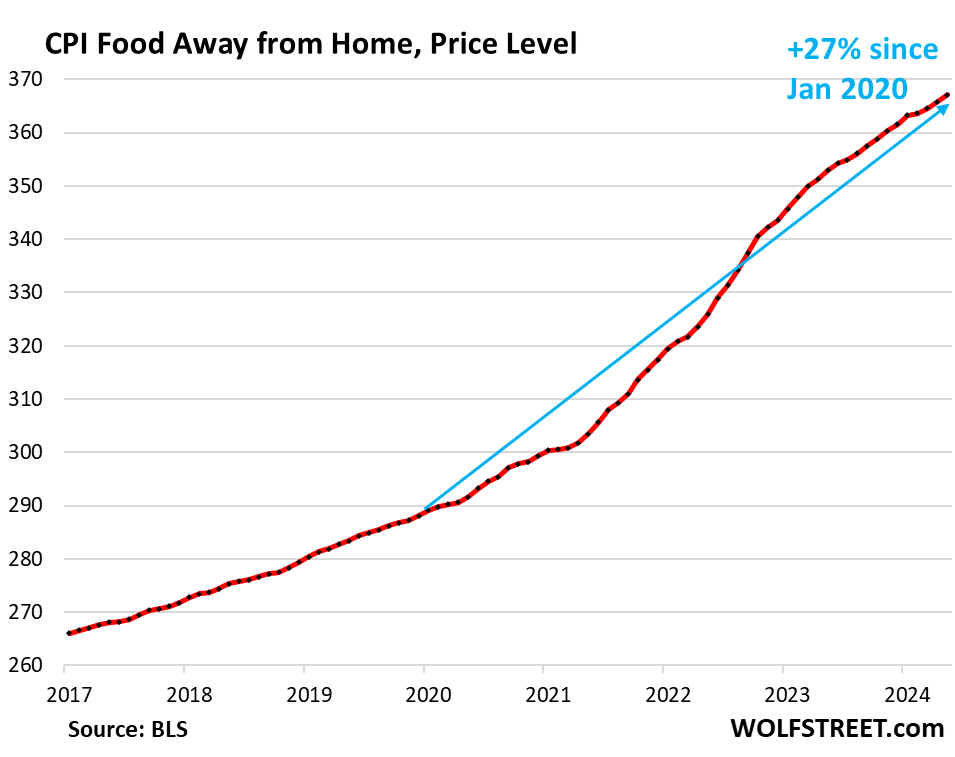

Food away from Home CPI – often called food services – includes full-service and limited-service meals and snacks served away from home, food at cafeterias in schools and work sites, food served at stalls, etc.

- In May from April annualized: +4.3%

- Year-over-year: +4.0%

- Since January 2020: +27%

| Major Services ex. Energy Services | Weight in CPI | MoM | YoY |

| Core Services | 64% | 0.2% | 5.2% |

| Owner’s equivalent of rent | 26.6% | 0.4% | 5.7% |

| Rent of primary residence | 7.6% | 0.4% | 5.3% |

| Medical care services & insurance | 6.5% | 0.3% | 3.1% |

| Food services (food away from home) | 5.3% | 0.4% | 4.0% |

| Education and communication services | 5.0% | 0.4% | 2.9% |

| Motor vehicle insurance | 2.9% | -0.1% | 20.3% |

| Admission, movies, concerts, sports events, club memberships | 1.8% | 0.3% | 4.7% |

| Other personal services (dry-cleaning, haircuts, legal services…) | 1.5% | -0.3% | 4.1% |

| Lodging away from home, incl Hotels, motels | 1.5% | -0.1% | -1.4% |

| Motor vehicle maintenance & repair | 1.2% | 0.3% | 7.2% |

| Public transportation (airline fares, etc.) | 1.1% | -3.1% | -4.7% |

| Water, sewer, trash collection services | 1.1% | 0.1% | 4.8% |

| Video and audio services, cable, streaming | 0.9% | -1.3% | 2.8% |

| Pet services, including veterinary | 0.4% | 0.4% | 5.9% |

| Tenants’ & Household insurance | 0.4% | 0.5% | 4.3% |

| Car and truck rental | 0.1% | -1.2% | -8.8% |

| Postage & delivery services | 0.1% | 0.3% | 3.8% |

Core services price level. Since January 2020, the core services CPI has increased by 21%. The steepness of the curve indicates the rate of inflation.

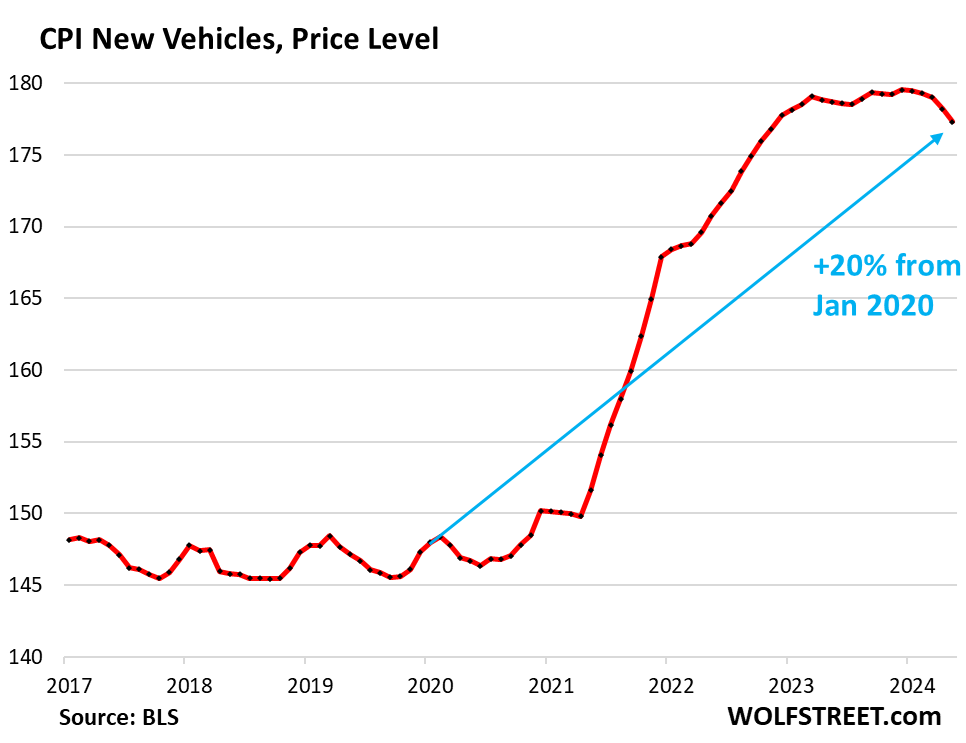

Durable goods CPI.

The durable goods CPI fell by 5.6% annualized (-0.48% not annualized) in May from April, and by 3.8% year-over-year, as overall price declines accelerated, except in used vehicles.

New and used vehicles dominate this index, which also includes information technology products (computers, smartphones, home network equipment, etc.), appliances, furniture, fixtures, etc. All categories have been experiencing price declines starting in late 2022, after the ridiculous price spike during the pandemic.

From January 2020 to the peak in August 2022, durable goods prices spiked by 23%. Since then, they have dropped by 5%, having unwound only one-quarter of the pandemic spike. Compared to January 2020, the index is still up 18%.

| Major durable goods categories | MoM | YoY |

| Durable goods overall | -0.5% | -3.8% |

| New vehicles | -0.5% | -0.8% |

| Used vehicles | 0.6% | -9.3% |

| Information technology (computers, smartphones, etc.) | -1.9% | -8.1% |

| Sporting goods (bicycles, equipment, etc.) | -0.3% | -0.3% |

| Household furnishings (furniture, appliances, floor coverings, tools) | 0.0% | -2.5% |

New vehicles CPI fell 5.8% annualized in May from April (-0.49% not annualized), the fifth month-to-month decline in a row, and the steepest yet. Year-over-year, the index fell by 0.8%.

After a long plateau, prices are now finally heading south, as inventories of new vehicles have built up into what amounts to a glut at many dealers, and automakers are having to offer big incentives and discounts to sell the vehicles.

In the years before the pandemic, the new vehicle CPI zigzagged along a flat line, though vehicles were getting more expensive. This is the effect of “hedonic quality adjustments” applied to the CPIs for new and used vehicles and other products (detailed explanation of hedonic quality adjustments in the CPI).

Used vehicle CPI rose by 7.5% annualized in May from April (+0.60% not annualized), seasonally adjusted (red); not seasonally adjusted (blue), the index rose by 5.8% annualized (+0.47% no annualized).

These price increases in May diverge from wholesale prices that continued to drop in May.

Used vehicle CPI has now given up a big portion of the 53% spike from January 2020 through January 2022, but is still 30% higher than in January 2020.

Food Inflation.

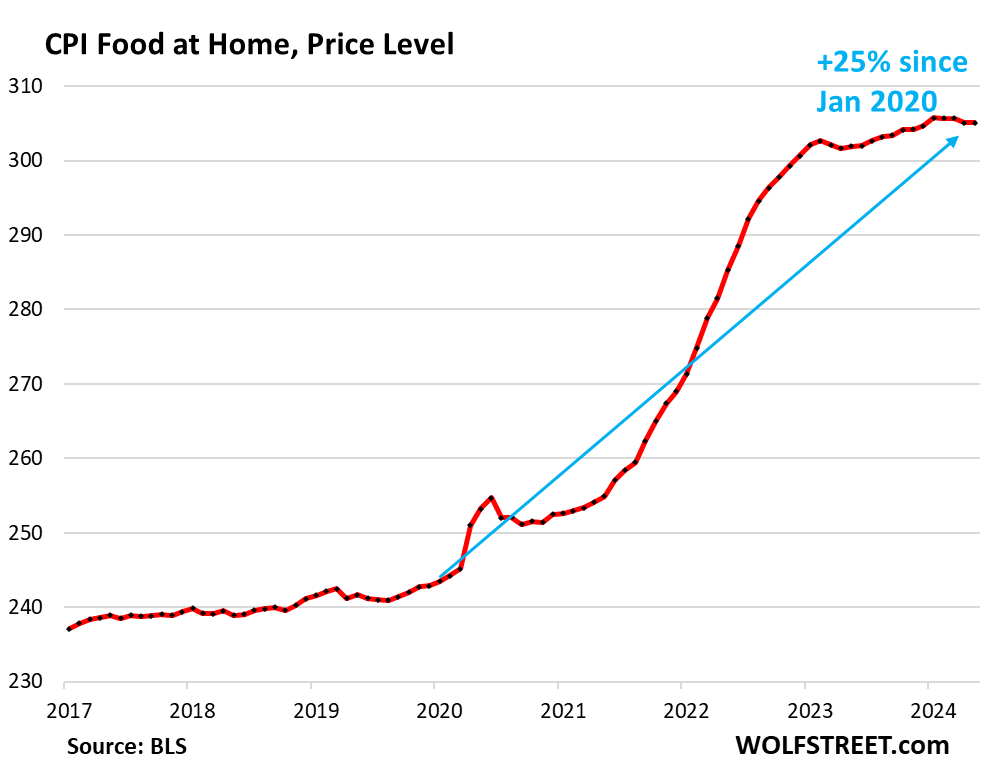

Inflation of “Food at home” – food purchased at stores and markets and eaten off premises – has cooled, with no increase in May from April, and a 1.0% increase year-over-year, after the massive spike during the pandemic.

| MoM | YoY | |

| Food at home | 0.0% | 1.0% |

| Cereals, breads, bakery products | 0.2% | 0.7% |

| Beef and veal | -0.3% | 5.7% |

| Pork | 0.9% | 2.6% |

| Poultry | 0.4% | 1.2% |

| Fish and seafood | -0.5% | -1.0% |

| Eggs | -0.4% | 3.0% |

| Dairy and related products | -0.5% | -1.0% |

| Fresh fruits | 0.4% | -0.2% |

| Fresh vegetables | -0.4% | 0.8% |

| Juices and nonalcoholic drinks | -0.5% | 2.0% |

| Coffee, tea, etc. | -0.6% | -2.5% |

| Fats and oils | -0.3% | 2.2% |

| Baby food & formula | -1.3% | 2.5% |

| Alcoholic beverages at home | 0.2% | 1.4% |

The CPI for food at home, after the pandemic spike, is up 25% from January 2020. Prices have flattened out, but have not come down.

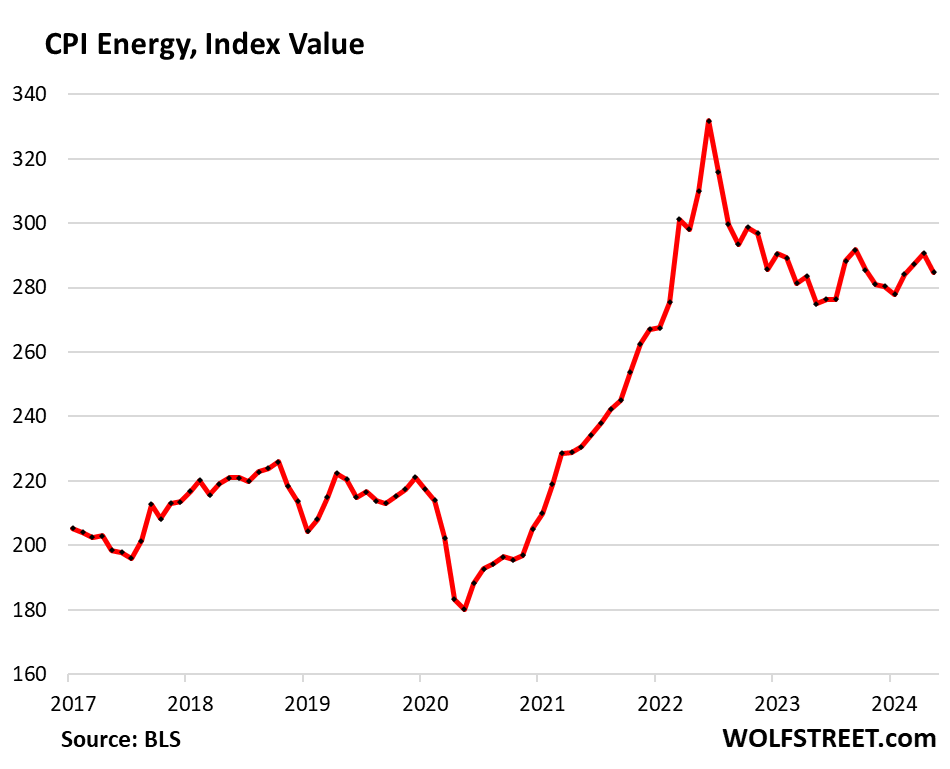

Energy.

The CPI for energy covers energy products and services that consumers buy and pay for directly:

| CPI for Energy, by Category | MoM | YoY |

| Overall Energy CPI | -2.0% | 3.7% |

| Gasoline | -3.6% | 2.2% |

| Electricity service | -0.2% | 4.7% |

| Utility natural gas to home | -0.8% | 0.2% |

| Heating oil, propane, kerosene, firewood | -1.0% | 2.8% |

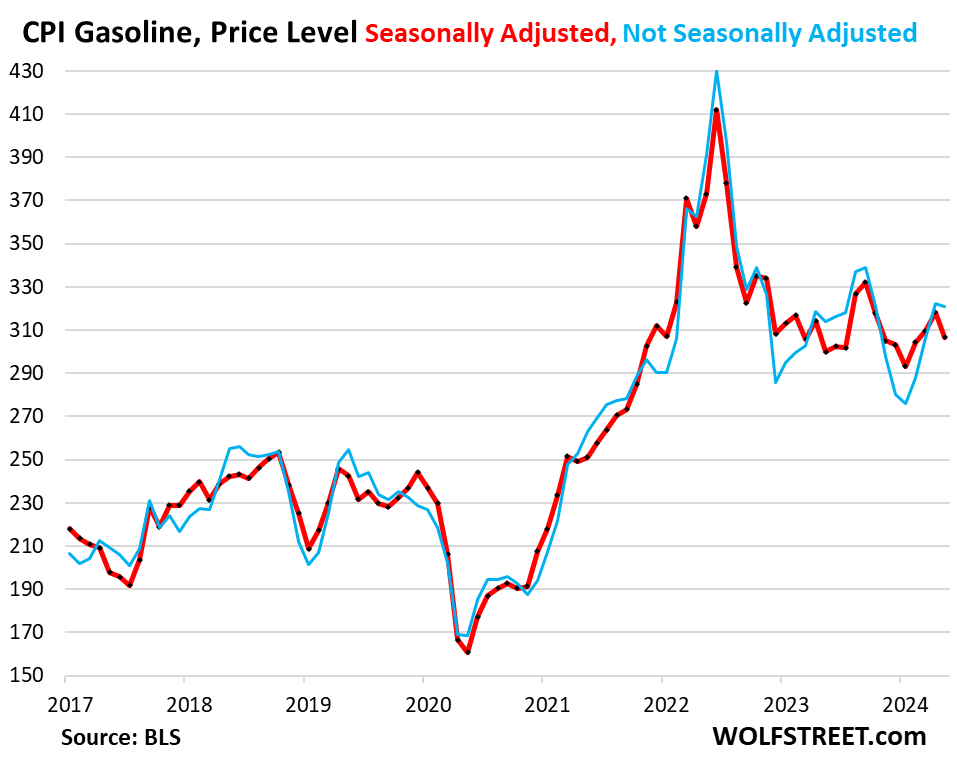

Gasoline prices (account for about half of the energy price index) are very seasonal, with the lowest prices in December or January and the highest prices during driving-season in the summer. Seasonally adjusted prices (red) and not seasonally adjusted prices (blue) declined in May from April:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Great read as always!

One point that comes to mind though is that the outlier is still considerably smaller than the increase that occurred in January 2024 isn’t it? Back then you said “Powell’s Gonna Have a Cow when he Sees the Spike in Core Services Inflation”.

I’m not sure what the equivalent is in this situation but it looks like good news. Lets hope it is the start of a trend.

A point well & politely made – of course, you won’t find the words “outlier” or “volatile” anywhere in the January CPI article :)

What you DO find about CPI in January (Feb 13 article) is this right near the top, third paragraph, above the first chart, impossible to miss:

“The three-month moving average, which irons out the month-to-month squiggles, jumped by 0.50%, or by 6.2% annualized (red), the worst since March 2023.”

Yes, good to see I don’t use most of these things and that meat went up.

This is also “Beneath the skin of CPI”

In 2016, the American Heart Association, Verily Life Sciences, and AstraZeneca invested $75 million in the One Brave Idea program. The money was awarded to institutions researching new biomarkers, such as genetic and molecular factors, that put individuals at risk for atherosclerosis.[25][26] It was hoped that the research would help the AHA reach its goals of increasing cardiovascular health by 20% and reducing cardiovascular mortality by 20% by 2020.[26]

In 2017, the American Heart Association, the American College of Cardiology, and nine other groups redefined high blood pressure for the first time in fourteen years.[27] Under the new guidelines, the high blood pressure reading is 130 over 80, a change from the old 140 over 80. The change was made in recognition of the risk of heart disease, disability, and death faced by those with blood pressures at 130 over 80.[27] The organization said that they hoped by identifying cardiovascular risks earlier, more people would be able to address the health risks by lifestyle changes instead of medication.[27]

In 2018, the American Heart Association and American College of Cardiology issued new guidelines for clinicians on the management of cholesterol as a way to reduce risk for heart attack and stroke. Newly included in the guidelines is a recommendation to use coronary artery calcium score if healthcare providers are having difficulty deciding if a patient could benefit from statin medications or should focus solely on lifestyle modifications. The cholesterol guidelines were last updated in 2013.[28]

Change of lifestyle are lies, the just lowered levels where drug “intervention/indication” are REQUIRED. Anyone can go to ClinCalc learn a lot…it IS YOUR BODY they are FN with for profit.

It is also worth your time to look up “Learned Intermediary” legal doctrine. Our food, healthcare, and Rx drug corporations are getting rich being extremely evil……by any god or religion’s standards, and also people like me that don’t need an “answer” to the whole universe right this second, so they can proceed to think in black and white, or otherwise fear unknowns in their life…and pursue truth, not swallow it.

Forgot store OTC and TV non Rx wasteland.

The aim of science is not to open the door to infinite wisdom, but to set a limit to infinite error.

Re; Those noble goals above.

Especially with an old person, a doctor can pick any of a dozen “causes of death”, as everything is quite worn out or FD up even worse by all the drugs they have been given or “procedures” done.

Sure, they can really help sometimes like car wrecks, etc, and a few other things, like just simple palliative care…REST…(which their MANAGERS want to cut down on as hospital sleeping and associated labor is damned EXPENSIVE…..sending you home with a bunch of pills is much cheaper…FOR THEM….but the BIG $$$ BS far exceeds the real help….they don’t know 20% of what they claim to, and the managers strip them of using half of that.

I did notice that you chose to show 3-month averages in that article, and 6-month averages in this one :)

The three-month CPI is still very volatile. I posted both with the PCE article (May 31), 3 and 6 months. But there are a lot more charts in the CPI article (17!!) than in the PCE article. And I have to choose the one that shows the trend better, instead of posting both, because there are a lot of metrics, and I end up with 30 charts, instead of 17. As you know, I also posted the YOY. So: month-to-month, 6-month, and year-over-year, on each of several metrics!!! If that’s not enough for you, go somewhere else.

CPI experience is personal:

If one’s COL, is mostly food, rent, & gas, then that 20%+ cummulative increase is financially crushing.

Alternatively, if one can command large salary/fee increases, then party on.

Excellent point, Frank. Inflation is yet another curse that hurts the poor, who have few assets, far more than the rich. The wealthy’s assets keep increasing in price, and as you pointed out, they have more options to cut back expenses without affecting their core lifestyle. Meanwhile, the poor can hardly afford to eat and pay their rent. It is ironic how “progressive” economic logic inevitably hurts the people they are supposedly helping. It also increases the wealth divide. The massive interest that the federal govt is now paying on their enormous debt is going into the pockets of the rich who own T-bills.

I wonder if this bit of good news is just “transitory”. Either way I think it’s rate cut party time at least till next data release.

The irony is that historically speaking when the Fed does the first rate cut that’s when new bear markets begin (plus or minus a few months) especially when you have nosebleed valuations like we do now (Shiller P/E, Buffett Indicator, etc)

If the Fed does get inflation down to 2%, expect equity prices to fall significantly. Gains of the past several years were driven by inflation. Without the inflation, look out below.

Is this why progress against inflation has stalled? 2% inflation is a third rail at these asset price levels, prompting many well-known economists to promote a 3% inflation target.

Good point, Bobber. After having caused this crushing cumulative inflation load onto the public, they now want to move the goalposts to 3% inflation. That would cut the value of our purchasing power in half in roughly 20 years. Great idea, huh?

Longer View,

We know the Fed would never go down that slippery slope of USD collapse, but I think the Fed would accept 3% inflation for 10 years, possibly more, to avoid recession, while claiming the target is 2%. They might successful hoodwink treasury bond holders for a while, until they can’t.

There are lots things out of whack today. If anything reverts, it could set off a chain reaction. It think that is why the Fed is pussyfooting the “tightening”.

Don’t forget in the 1970’s the second wave of inflation was much bigger than the first. Rate cuts almost assure a large second wave of inflation.

Excellent point. As Wolf has repeatedly pointed out, this narrow short-term focus on monthly jiggles in economic indicators makes for great news articles, but does not indicate a trend. And, as Wolf has also pointed out, quite often these outliers end up being revised to the mean eventually. Better for us investors to focus on the long-term trends. Inflation is a tricky beast. Once it shows up at your door, it can act in unpredictable ways, as it did in the 70’s. Just like you astutely pointed out.

Great review of inflation since 2020. Does the Fed need to raise the FF rate over 6% to reverse these excessive price increases. It seems like the lack of a recession has enabled the inflation to remain in contrast to previous economic cycles. Trying to engineer a Goldilocks soft landing may prove to be inconsistent with removing these excessive price increases.

Raising taxes instead of funding the gov’t with deficit spending would do a good job of putting the brakes on inflation, imo.

Who doesn’t want a good tax rate rise on themselves. At least one good tax raise every couple years to help in the inflation fight.

Then in the good times, lower the taxes.

Now I’m going to go jump in the lake.

Sadly, if the government has more income they will just spend even more. A better solution is legally mandated balanced budgets with debt pay down and penalties to politicians if they fail to reduce the debt.

I’m not advocating that the gov’t should “spend more money”. When you fund 40% of all government spending with borrowed money, it is inflationary. People tend to blow borrowed money.

Raise taxes and cut the deficit spending is what I’m saying. Or – don’t raise taxes and cut spending by 40%.

Stop the gov’t borrowing and you will see inflation go down.

Time for Congress to put their big boy pants on and govern responsibly.

HahahahahahahahahahahahahahahahahahahahahahajahahahahahajHajahjJaajjjajJajAjhahahahahahahah!!!!!!!!!!

Cutting spending would have a more direct effect since those who pay the most taxes tend to also be the biggest savers and may not cut consumption in the way you expect.

Seriously? How about cutting spending and by a lot.

Yes. How about back to the 2019 budget.

Hard cut spending. Buying votes is so expensive now.

Raise taxes on who????

Don’t know about you but I already pay a good chunk…

Maybe we should go after the bottom 50% of tax payers that don’t pay any income taxes…

That’s a one-sided soundbite.

Sorry about chunk, Gun-top, but I’m too busy living it up to bother with taxes.

Will an apology with a big kiss (xoxoxox) and lots of credential-less health and other advice and observations do it for ya? Also I only have a breaker bar (hardly used) from Harbor Freight here….no gun.

Agree 100% dtj…..but most all of the money is in private hands now, so they can easily buy and sell the elected (and those chosen by the elected) gov’t, and they DON’T LIKE taxes AT ALL.

I think the basis for our society will soon become one big Vagrancy Law, with strict enforcement and very harsh penalties for not having enough money.

The only question is how violent it will get as we do the switch over.

Climate change effects, which I am banned from posting here as this is a financial site, may not matter, so the ban is a wash.

Make that money or a place to BE (physically)….or both.

OOPS, make that 50% dtg, raise taxes ONLY, especially “Death Taxes” (love that phrase)…and may some pre-death “Obscene Wealth” taxes, too…..till things are more evened out…..kind of a capitalism re-set…..like the old Biblical Jubilee……sans Priests running things.

No, they won’t. This time doesn’t seem to be much different. Like in the ’80s, we’ll just have this sticky inflation for a few years. Unemployment is rising a bit, but I’m pretty sure they’ll lower the rates before the unemployment rate goes much higher than it is now. They’ll lower the rate before the election. That’s my bet. Then, we will have a new inflation wave.

“That’s my bet.”

I’ll take the other side of that bet. Unemployment stays low and there are no rate cuts all year,

This is an excellent question, Jack. Investors are already whining that the federal funds rate is “too high”, but that is only if you compare it to recent history. From 1971 to 2024, the average federal funds rate was 5.42%. That is over 50 years of data. From 1960 to 2022, the average inflation rate has been 3.8%. Note that the average fed funds rate has been OVER the average inflation rate by about 1.5%. So, your question about whether the fed funds rate is high enough to kill the inflation beast is a good one. That being said, one suspects that all of the whining about “high interest rates” is so that investors can go back to speculating and leveraging up on debt once the Fed pivots to lower rates. The last 20 years have been quite unusual, with low inflation and extremely low interest rates. But things can change. Especially when you have federal debt projected to be 130% of GDP in the not-too-distant future. Debtors love low interest rates, and our government is the world’s largest debtor.

Data analysis has increasingly become infotainment, with greater ambiguity and bifurcation, providing greater uncertainty and confusion, which makes most of the CPI circus and Powell prognostics inconclusive and contradictory.

Then, toss in data revisions and assorted lags and bias distortions and maybe it’s not far fetched to ponder why stocks like Nividia aren’t based in reality.

I was confused as to why stocks went higher on the one rate cut projection, after being so jubilant about seven cuts less than four months ago?

This game is increasingly stupid

Go ask a 12 year old kid in a ghetto or on a reservation why he doesn’t give a shit about his life or anyone else’s.

Then pick another word for this game besides “stupid”, OK?

NBay – that’s the great thing about VR goggles, they only let the players and situations you desire and agree to acknowledge into the game, with none of those other pesky distractions of the physical-reality world…

may we all find a better day.

Curious where chocolate would be counted. Cocoa beans have gone from $3000 tonne to $9000 tonne. This increase is just now hitting to retail market. All my suppliers have raised prices for finished product 10 to 20%. Also as we basically place orders 6 months in advance for imported goods, I can tell you my wholesale costs are going up 20 to 40%!!! Retail chocolate prices for the 4th quarter are going to be shocking for consumers!

I’m curious as to where this fits in the cycle of CPI. it most likely is a small fraction, but it will surely be noticeable to many chocolate lovers.

User name most definitely checks out ;)

Sounds like you could use a sugar daddy. I know an uncle that has no problem funding people, especially failures.

“Curious where chocolate would be counted.”

Depends what chocolate is in. If it’s in ice cream, it’s under “Dairy.” If it’s in sweets, is under “Sugar and sweets.” If it’s a drinkable format, it may be in “Other beverage materials including tea.” “Snacks” is another good one. Plus, “Other miscellaneous food.”

Thank you, much obliged.

Think chocolate has theobromine in it (maybe it was coffee) and we made cast theobromine suppositories in Pharmacy School. Think it was for asthma….not sure. But it could also be under drugs/health.

I picked raspberry flavor off the shelf and flavored mine. Only a couple guys found that humorous.

I was just at the hardware store where a single (normal size) KitKat bar costs $3.50 (they were $0.25 each in the 70’s – my peak candy bar buying years in Junior High)

So those chocolate bars in my “Go To Hell” kit were a good investment?

Do they still work like they did in France in WW 2?

Howdy Folks. 2024 CPI. 3.1 3.2 3.5 3.4 3.3

There is a 2 in one of the numbers. Guess thats the 2 everyone is talking about????? HEE HEE.

They will “manipulate it down” to 2 in the third quarter, no matter what, because that’s the quarter they use to calculate the cpi increase for social security.

The 3.3 number is so absurd to me, I don’t have the words anymore to describe the corruption. My rent is up 25% in three years, more than twice the cpi of the last three years. Their data is just pure propaganda to me.

Rent of primary residence CPI is in fact up about 27% over three years, just eyeballing the chart.

Petunia,

In terms of your second paragraph: Try to read this CPI report. It gives you the rent CPI. The rent CPI is up is up 24% since Jan 2020 and it’s up 40% from 2017, and you can see all that in this CPI report. Please try to learn something here and contain your BS.

BTW, overall CPI is up 21% since Jan 2020, not 3.3%. Also check out the chart for Food CPI, services CPI, and all the others, including auto insurance CPI which is up 46% from Jan 2020.

Blue line is Rent CPI. I’ll just repost the chart here because you refuse to read the article:

I don’t see a single chart which shows any indication of ever returning to even close to price level before the pandemic and 5.5% fed funds rate and huge government deficits.

I suppose since we’re comparing YOY numbers for all measures of inflation, eventually prices will level out at significantly higher numbers relative to the decade before COVID and 5.5% or we would have parabolic charts.

My question is this, if we have 5.5% (and in most cases 7-10%) interest expenses baked into the entire economy, along with big pay raises and interest income) how can we expect inflation to come down, other than just letting the prior year comparisons get easier over time?

Well, there’s always the old fashioned, but wildly unpopular solution – A BIG BAD RECESSION!

I think that Petunia’s point remains intact. I did not interpret her “3.3” comment to be about the cumulative increase in prices, but instead was referring to the current inflation rate. Her point appears to be that these massive cumulative increases in prices are very painful, and they are here to stay. As Lyn Alden astutely points out, from a policy perspective, nobody ever talks about prices actually going DOWN. Heaven forbid we have that dreaded deflation beast! Deflation would make all of the debt addicts in this country very poor. Better to pay off your low-interest debt with worthless dollars via inflation. In other words, Wall Street speculators and government debt addicts want lower interest rates and higher inflation. That way they can finance their debt with low interest, and pay it back in worthless dollars. And the U.S. government is the biggest debt addict of all. Meanwhile, ordinary folks are struggling to pay the rent and to afford their grocery bill.

The Longer View,

Her bullshit lie was this: “My rent is up 25% in three years, more than twice the cpi of the last three years.”

The bold is the BS lie. Her rent may be up 25% over the last three years, but CPI is up 21% over the same period, and the rent CPI is up 24%.. So if her rent is up 25% over this period, and CPI is up 21% and rent CPI is up 24%; then it is a lie to say that her rent is up “twice the CPI of the last three years.”

She used this BS lie to say that CPI lies, when in fact SHE lied about CPI.

When in fact, the Rent CPI totally nailed her rent increases!!!

ALL this data is in the article above.

You do not get away with spreading these lies on this site (to make political hay), especially when the article provides all the data, and Petunia didn’t read the article because she just came here to spread BS lies.

About your second point — “prices ever going down”: RTGDFA. Read what the article says about durable goods, including new cars and used cars. Their prices have been GOING DOWN.

Before you comment about inflation here, you have to read the inflation articles or else I will block and delete these dumb comments.

The last time we had real deflation was the Great Depression.

Half the country was ready to go communist. FDR wisely spotted this and sought a middle ground. The rich took note of BOTH and won’t let EITHER ever happen again.

Rich and greedy people may be mentally ill in their own way, but they know it’s alway’s best to screw someone else for a living, and always the easiest ones first.

That’s why what trickles up is poverty….nothing but BS trickles down.

It will catch up with many or most here….they will even vote for it.

Thought you quit that old man with both hands on his cane “HEE HEE” shit.

Plenty of people here real close to your age or much older.

Good article. Skilled staticians know when outliers should be ignored.

To be honest. You did an excellent job of presenting the inflation picture. The problem is the current structure of the industry, and the distribution of income is messed up. Many restaurants are forced into lease payments at the same customer demand has fallen, and food costs have already risen. For most new families, rent or the cost of buying a good house is out of reach. Tech firms view the world from a point of view of 100 miles in space. When workers use technology, this increases their productivity. The rational thing to do would be to pay them more. But, the managers do not because they do not face a union. Mixed in all of this is a high percentage of industries that are actually oligopolies, and they are colluding. We need a recession where everyone gets mad enough to break up these oligopolies and to restore competition. Competition and price discovery are good things. We tell people to start a business. But the result is concentration. Concentration is an extremism. It is way past the time to enforce the antitrust laws as originally stated. The next generation deserves a fair system and to prosper.

In the tech space, you would also have a hard time dealing with “blank cheques” venture funds financing anything fashionable today. That creates hordes of startups that are unviable and crowd the markets. Recession is that breath of fresh air that give a chance for new businesses planted in a fertile soil. Otherwise, indeed, concentration to oligopolies, with economy stagnation.

Real story on how inflation has changed decisions: The services inflation has driven me back to doing my own vehicle maintenance and repair. I used to do all the work on my old pickup before marriage and a kid. Sold that truck 10 years ago with 300k miles.

Fast forward: The belt went on the Mazda a few weeks ago (90k on the button) and after thinking about the cost of my mechanic (who is great and reasonably priced), I bought a new floor jack and jack stands and fixed it myself. Then I changed the oil in both vehicles and inspected suspensions, etc. I expect the new equipment has already paid for itself. I forgot how satisfying it is. Thanks inflation!

But I discovered I should replace most of the suspension on the Element after 180k (90k of my abuse). I knew it was coming and just confirmed it. Winter project.

Howdy Eider. Good Job,,,, Keep at it yourself and in time, even after breaking something and making it worse and costing you more $$$$.

You will still come out ahead…….

The Bubba way is the only way…..

Luckily, the previous generation Mazda 3 has two belts running off the crankshaft, one to the water pump and one to the A/C and alternator. The alternator belt went, so no harm done, just the wife coming home saying a battery light is on.

While I was in there, I replaced the other belt.

After thinking about your comment on breaking things, you mean breaking something while trying to fix it… I had a couple of those with the truck. It’s called a breaker bar for a couple reasons…

Excited to get back at it. Its an interesting realization that my time isn’t as valuable as my money, in this case. And the kid may learn from Dad working on the car — hopefully more than new 4 letter words.

Scooting about ander your vehicle, and knowing what your looking at. Kind of a personal thing.

Doing your brakes, pounding on the pickle fork, dropping the fuel tank and then the radiator up front….Wopeee

Keeping the filthy paws of the mechanic off your money as well.

I have literally saved 10’s of thousand$ doing my own repairs. So much good info on the web today for beginners.

“Overall CPI rose by 3.3% year-over-year. It has been in essentially the same narrow range since June 2021 when it hit the cycle-low of 3.0% (yellow):”

I think you meant to write June 2023 in that sentence. The x-axis on the corresponding chart also needs to be adjusted two years forward (2017 to 2024 as you have in your other charts).

Otherwise great article! Thanks for another thorough analysis.

Yes, thanks.

The rising cost of auto insurance is likely to be at least partly self-perpetuating. As the price rises, people drop their car insurance coverage while they continue to drive. Their risk/liability gets shifted on to the remaining policyholders who then pay higher premiums, causing yet more people to drop coverage.

Probably the best reason for lower speed (max 35) around town SMALL and LIGHT simple cars…I used to see them fairly often, usually lead-acid EVs, but have a hunch the big auto companies killed them off.

And not much public transit is being built/updated….we will need it.

The big corps who run most of our farms will make sure workers get way out there……just another tax write-off consumers pay for.

Hmm kind of like that monthly outliar in mid-2021 right before core svcs CPI rocketed higher…

Exactly. As stated in the article, “These kinds of outliers don’t make a trend; they’re soon reversed.”

That’s why this recent data point is an outLIAR – don’t listen to it!

Since the main exterior human brain game is better resolution for better situational awareness, such things are generally referred to as “artifacts” of one’s resolving methodology.

But the null hypothesis must always be kept in mind.

Which is an academic way to say your pun stinks.

Greyscale is a good B/W resolution improvement trick (just an algorithm) that needs no human intervention…guess it is AI?

Curious if the Biden Govt is still selling off the oil reserves?? If so does it effect the price of gas.???

No, on the contrary, the Biden Govt has been buying at these prices and they’ve been refilling the SPR since the summer of 2023. In the latest week, the SPR was up to 370.5 million barrels again, the highest since March 2023.

When Biden took office the SPR was at 600 million barrels; it is now 364 million barrels.

Yes, buy low, sell high. The US no longer needs the SPR for strategic reasons, being the largest crude oil producer in the world with declining gasoline consumption. So the government used the stock to help push down prices. This was done globally in a concerted effort in Europe, China, and other countries. People were pissed off about high gasoline prices, and Biden-haters are now pissed off that people are no longer pissed off about high gasoline prices. And so they blame Biden for bringing down gasoline prices because they can no longer put their Biden-did-this stickers on the gas pumps to make political hay. Kinda funny.

What’s wrong with saving Americans a whole bunch of money on gasoline, at the expense of oil companies and their investors?

The SPR is pointless now that we’re the largest oil producer in the world.

The whole point of the “Strategic Oil Reserve” is the word “strategic”. Despite the U.S. being the world’s largest producer, it is quite possible that in the short run there could be a geopolitical crisis where oil prices could spike to the moon. That is what the SPR is for, and it is foolish to draw it down for political reasons so that certain politicians can look good. And isn’t the current administration doing their best to KILL fossil fuels? So, let’s follow the logic here: We draw down the SPR for political reasons, and we do our best to kill domestic oil production. Sounds like a genius strategy, huh?

1. The SPR was designed when the US was desperately dependent on the Middle East for oil, a time when Saudi Arabia could shut down the US economy. We had two of those incidents in the 1970s, and that triggered the creation of the SPR. That’s no longer the case, and hasn’t been the case in years. So the SPR has served its purpose, and it’s no longer needed.

2. “it is foolish to draw it down for political reasons so that certain politicians can look good.”

So you want Americans to get ripped off by the oil companies???? You want Americans to pay out of their nose for gasoline to fatten up the profits of the oil companies??? And you want the oil companies and their investors to rake in huge profits by ripping off American consumers at will, so that your Trump can get elected??? What kind of bullshit is this? Biden stepped on these goddamn oil companies and ended their rip-off of Americans by deploying the SPR. And Americans benefited from that every time they went to the gas station. High gasoline prices are a scourge for Americans. And Biden did something to bring them down (though they’re still fairly high).

“…it is quite possible that in the short run there could be a geopolitical crisis where oil prices could spike to the moon. ”

I disagree for two reasons.

1. The whole point of domestic oil production is we’re insullated from e.g. the middle east tensions, which caused the oil spikes of the 70s.

2. Cheap natty gas is putting a ceiling on oil prices. Right now at just over $2/mmbtu its priced like $15bbl oil.

The second point is underappreciated imo. Oil and natty gas will never be too far appart in price due to the inherent fungibility of the two. Natty gas can be converted to a gasoline-equivalent, and gasoline engines can be redesigned to burn gas.

“And isn’t the current administration doing their best to KILL fossil fuels? ”

Ironiclly, the oil&gas industry makes more $$ when the president is blue. The industry has no self-control, and will oversupply the market & crash prices if allowed. By pushing back against e.g. new drilling leases, dems (generally) create scarcity, push up prices, and increase oil companies’ profits.

MM,

Re-read that garbled word salad PLEASE, and go VOTE any damned way you THINK you have chosen to.

Are you planning to live forever?

Just curious….it’s a survey I get NO answers on here….which is odd…what is to be ashamed of?

I think there are likely aliens….somewhere…..and not a bit ashamed of it.

Why are the FED and market participants so fixated on lowering interest rates when the CPI has been in the 3%+ range for a year with no indication whatsoever that it’s moving down to 2% at all?

I could understand the motivation if CPI was even close to 2%, but it’s not.

Also, the current very elevated prices we are all seeing just can’t be allowed to continue because already Americans are being forced to cut spending to cope.

If interest rates are lowered, prices will certainly take off again.

> Why are the FED and market participants so fixated on lowering interest rates

The everything bubble must go on.

If the Fed does achieve 2% inflation for a significant period, how could asset prices and RE maintain their lofty price levels? It’s the inflation that drove outsized corporate profits the past four years. Take the inflation out of profits and what do you have left?

Stock and RE prices would plummet, which would surely cause the Fed and government to spray the world with excess inflation again to avoid financial crisis and/or unemployment. I’m betting the excess inflation will come in spurts, usually after bouts of stimulus, and inflation will never be allowed to go below 2% with recession avoidance being the primary goal.

Exactly, Bobber. And keep in mind that, due to the federal government’s extreme reliance on the wealthy for the majority of their tax receipts, the party must go on so that the wealthy keep getting richer and keep paying taxes to finance the government’s endless largess and magical thinking that they can promise anything to anyone and pay for it all by printing more money.

No thanks. You and MM keep your word salads in your own heads.

BTW, will YOU participate in my “I Plan to live Forever” survey?

Wider, you are being taught lessons. There are 3 words to describe happy motoring, Lexus, Toyota and Honda. Mazda, Nissan and Hyundai/Kia are the next level down. Everything else? Keep your workshop and tools in very good order.

Ah yes, I’ve heard that the new Toyota turbo V6s are very reliable indeed (snicker….)

Toyota finally made something with factory-installed forced induction?? Never thought I’d see the day.

It’s a sad time. They’ll have to rip my NA engines from my cold, dead fingers. Turbos are just something else to leak and break.

My wife and I own two Subaru Crosstreks and we have had great success with them. We just bought a new one for about $30K including a maintenance package. And they were built in Japan, not the U.S.

Wow. Are you fellow off-roader owner? 4 wheel drive?

Spent much time in the forested hills and dirt….trekking across stuff?

Every Mazda owner I’ve ever known has kept theirs running forever without many repairs, they’re great value. I was going to trade my Subaru in when I decided it was time to “grow up” and “be responsible” by getting something “modest and dependable” but inflation got in the way, so we’ll see how that works out in the long run

Nissan VQ…..as legendary as Toyota 22R-E……but the newer they are…..who knows what they are up to as the clock ticks down to….?????

How about a 2012 cut-off since that’s what I have, and I want to be happy and certain, OK?

Except Green New Deal compatible stuff.

With the price of new cars and maintenance exploding higher due to an overabundance of unused “features” on the cars, the automobile manufacturers are going to put themselves out of business. My wife and I rented a car for a week long trip instead of driving our own, in preparation of phasing out our car ownership altogether. Let the car rental companies and Uber drivers worry about all these costs. Now that I’m retired and don’t need the daily commute, the numbers have stopped adding up for ownership.

Never forget – the Fed created the problems that it is now trying to solve.

Yup, no consequences for them whatsoever.

“In the past, corporate profit growth accounted for maybe a third of inflation. But a report from the Kansas City Fed found that nearly 60% of inflation in 2021 was because of corporate profits.”

That continued into 2022 as they tried to front run producer costs apparently but am curious if it’s still a factor?

As mentioned above, inflation is personal and a lot of the plebes I know are very b*tthurt about it on the cumulative basis over the last few years. I assume their wage pricing power isn’t keeping up.

in my opinion, corporate profits are inflation, they’re not a consequence of it. that’s where his argument fails.

Don’t know much econ, but that sure sounds right to me. Corps inflated my uncle and all his pal’s and their offspring’s net worth REAL damned good!

I’m wondering if there’s some psychological effect/media propaganda driving inflation at this point. Media promotes rate cut mania and soft landing and inflation comes back. Media turns bearish, talks of recession, no rate cuts, higher for longer rates and inflation – inflation drops. So now they’re celebrating the dip in inflation again and finding whatever dovish statements they can from the feds statement to turn into headlines – so I wonder if this will drive more inflation/synthetically loosen policy in anticipation of rate cuts.

The only thing that is dramatically different between this and the last real rate hiking cycle is the constant availability of mass media at the click of a button on our phones, laptops, everywhere.

I’ve noticed friends perceptions of the economy vacillating with whatever the media is printing. Don’t get me wrong they’re all pissed about prices and inflation but the should we be worried about a recession and whether rate cuts are coming soon attitudes seem to shift with the media

If this is the case, we may get stuck in this period of vacillation until something breaks.

for some reason, the media wants the average person to think the stock market going up and up is good, so they can justify pressuring government actions to support it.

Per other commenter here, I have gone back to doing a lot of my own maintenance on my car and home. I fully expect that to have anyone come to my house to do anything, expect a de-facto rate of $100-120/hr. Same for car repairs.

I bought the shop manual and buy parts from Rockauto and do the work myself. Maybe I should start fixing cars, I’m pretty sure they make more per hour than I do.

Wolf can you elaborate on what would cause the data outlier to reverse? Or was that more of a general observation from the chart?

For instance you’ve previously covered base effect, where a lower base in a prior period causes the increase to appear larger. Coincidentally Powell mentioned as much when explaining why the FED’s estimate for inflation by year end 2024 is higher than they had previously forecast. Is there some similar logical explanation for the outlier in the CPI print ?

Thanks!

That’s just the nature of volatile month-to-month data. You’ll see that in the services CPI chart (first chart, blue line). All outliers were reversed within a month or two. Nothing is going to change that.

Any way you slice it, inflation is still much too high. Doesn’t matter that it is at a slower rate only one month. Glad Powell poured cold water on rate cut euphoria.

All the media drama about rate cuts, comes from those who profit from them.

What would one or two tiny cuts even mean to the average person?

I would venture inflation is a far begger issue.

All this crap about home prices is exactly that. Want a lower effective interest rate, then pay an extra hundred bucks a month. Can ‘t afford it, then you can’t afford a home!

My home would easily sell for much more than it cost me. So what! It is where I live. It’s value will only matter when I am dead.

Way too many people believe, that owning a home is a pathway to wealth. I guess they also believe that Social Security will support them when they get old.

“So what! It is where I live.”

Love it and feel the same. Its walls and a roof that keep me warm and dry. I can’t put a price on that.

Who cares what it’s theoretically worth if it’s not for sale?

Dear Bear Hunter: It would appear that you are a responsible person who understands that inflation is very BAD when you own a home, because all of your expenses are going up. Property taxes when your home is reassessed at a higher value. Repairs when the plumber comes to visit. Home insurance. However, you are missing one key point: Since you are a responsible person, you are not treating your home like a piggy bank and taking out home equity lines so that you can go to Disney World or Las Vegas. Then, your neighbors will think you are rich until the music stops. But will the music ever stop? Do you know that the federal government backs up over 70% of home mortgages either directly or through government entities such as Fannie Mae, VA, FHA, Freddie Mac, etc? Do you know that the U.S. is the only country in the world where the majority of primary home mortgages are 30 fixed rate loans? Many countries have variable rate mortgages, which encourages responsible borrowing. Not gonna happen here. Do you know that recently policymakers have proposed extending government protection to home equity loans? Bear Hunter, I am with you, buddy. I own my home free and clear and have no interest in using it as a piggy bank. So, like you, I am suffering from inflated expenses on my home.

I guess I have grown skeptical, perhaps even doubtful, about bureaucratic figures of all kinds. Also do not trust the commentary that comes with those announced figures. Wolf, like a lamp in the coal mine, is trying to help us make sense out of all this, but I get this nagging feeling in my gut that the gov “data” is a bit “goal seek’d” as they say.

All I can say is my fixed income, including the SS increases, is being impacted at the far, high end of the “inflation figures”, maybe more.

Meantime, thanks Wolf for all your work, it is an obvious passion for you and it is highly appreciated.

Lets pretend that inflation evens out at the FED 2% target. The general price level is still 20% higher. But we are told that everything is fine. Go along for 3 or 4 or 5 years at 2% and enjoy another 20% stair step.

It’s nothing more that a steady (but stealthy) debasement of the currency.

On Zero Hedge, the articles tend “bigly” toward the “sky is falling”. With Mr. Wolf the keel is a little (or a lot ?) more even, but with some a bias toward “everything is wonderful”. Time will tell.

With that said, Wolf will catch my attention when his articles start saying “watch out below”. So if information is “surprise” that catches our attention, Wolf provides more signal to noise.

“Wolf will catch my attention when his articles start saying “watch out below”.”

Wolf said that about CRE two articles below:

https://wolfstreet.com/2024/06/11/fitch-doesnt-see-bottom-of-office-cre-mess-sees-cmbs-delinquency-rates-spike-way-past-financial-crisis-peak-in-2025/

Hi Dan: One of Wolf Richter’s most admirable qualities is that he doesn’t have a particular slant, but presents the data as it is. His politics are not an issue for me. Besides, we all need to pull together from all sides and try our best to respect different points of view. As an investor, I LOVE to read negative takes on a stock that I own. Or a different macro view than mine. Too many people live in echo chambers these days. That is not a good way to learn or to invest your money. Getting a variety of perspectives provides more value and understanding of complex issues. As a statistician with an economics and accounting degree who does his own investing, what galls me the most is the hubris of many so-called “experts” who claim to know exactly what the future holds, and smugly assume that their preferred narrative is the only correct one. Economics has always been, and always will be, a social science. It is far too complicated to truly predict the exact consequences of certain policies until after the fact. And even then, it is rarely certain what decisions have brought about what outcomes. That being said, it helps to have a historical perspective like Lyn Alden and others. The Fed’s PhD economists have a miserable track record of predicting the future path of anything. And so do most other “experts”. The only thing I am she-it sure about is this: Never in the history of modern civilization has a fiat currency ever survived in the long run. It inevitably gets debased to zero, usually due to those in power trying to pay for all of the promises they have made to themselves or to the citizenry. So, I don’t expect a happy ending in the long run for our current regime of fiat currencies. “Inflation” is ultimately an inevitable consequence of currency debasement.

…gotta perform that SWOT-recon in the everpresent, swirling smoke and gas of burning paper and imperfectly-digested thought …

may we all find a better day.

I sure hear that one dustoff!……it’s what I do also. Plus am here adding to it.

Later.

Appreciation vs Inflation. Appreciation is where your house doubles in value but the money is worth half as much. Inflation is where the money halves in purchasing power but your house doubles in value. See the difference?

Asset bubble vs inflation. An asset bubble is where housing goes up 40%, stocks go up 60%, cryptocurrency goes up 1000%, but your currency devalues 20%.

See the difference?

The value of your house hasn’t changed, its’s only the price.

Value is what you get (in terms of useful attributes),

Price is what you pay.

Price is also what you earn so that’s gotta keep up to speed too.

Not really, but then I never claimed to understand many words as they are used in econ circles. See recon in smoke difficulty above,

As mentioned, this outlier anomaly in CPI will be modified or revised, amended, somewhat along the lines of incongruent employment data, but, we still have sticky CPI around 4.00231 — which is far higher than the Fed comfort zone. As with employment revisions, it doesn’t seem likely that in the next few months, CPI drifts lower.

I assume the Fed is just playing a game of chicken, buying time and essentially hoping the economy doesn’t go into super nova mode, even though, running the economy hot, with overheated bubbles, seems politically possible — especially with the bifurcated combination of rich getting richer and poorer folk being ground into dust. That’s a very weird environment for election stability.

If anything, between Biden, trump and Powell, someone has to land a huge plane that’s out of fuel. I don’t think we have anyone with Scully skills.

The Federal Reserve is TOTALLY IRRELEVANT these days and has been for many, many years.

I know who could land a plane, Gregory Peck, I bet he could do it. Once I saw him jump on a whale. If not him, my second choice is Earnest Borgnine, he had his pilots license.

Another magnificent report from Wolf Richter. His attention to detail is incredible. And his breadth of coverage is remarkable. Sometimes I think he must have a hidden army of workers assisting him, because it is amazing how much data he posts up, along with his expert interpretation. Thanks again, Wolf!

Sure are a lot of sharply sloping lines in these charts. I also read a lot of sycophantic cringe pieces that say that We the People are too dumb to understand how great the economy is.

Is it not true, that a smaller percentage increase, on top of a huge percentage increase, still means a bigger number? And while it’s encouraging to see used car prices dropping, it’s less encouraging to see that costs for used car loans and insurance are shooting up.

Seems we’re stuck.

Are certain items removed from the inflation reports? Discontinued items. Example: ground coffee, Series ID: 717312. If so, doesn’t that change the method in which they calculate inflation?

Stupid internet bullshit. Don’t ever go back to the site where you saw that. They’re lying to you.

That item “ground coffee, Series ID: 717312” refers only to the “13.1–20 oz. can” measure.

What is included is the all-sizes measure, priced per pound: ID 717311: “Coffee, 100 percent, ground roast, all sizes, per lb. (453.6 gm)”; “Ground, regular caffeine content coffee sold in a can or plastic container, regardless of size.” it’s included as price per pound.

Coffee now weighs 0.186% of overall CPI, up from 0.169% in Oct 2021.

I find it interesting that the Case-Shiller index continues to rise while the housing market as a whole is stuck in a quagmire.

I know Wolf will have a report on this in the future, so I expect to see certain markets weighted a little heavier that’s somehow pushing the index up.

I’m a fan of your work.