UiPath -85% from peak just three years after IPO amid CEO chaos. When consensual hallucination fades…

By Wolf Richter for WOLF STREET.

Software companies – despite all their efforts to coddle up to the AI hype and hoopla and be part of it – got whacked down today by two messy quarterly reports, suggesting that massive spending on AI hardware and AI services by their customers and potential customers was draining their budgets for other stuff.

The primary instigators were Salesforce which plunged 19.7% today, and UiPath which plunged 34%. Other software companies followed in their tracks.

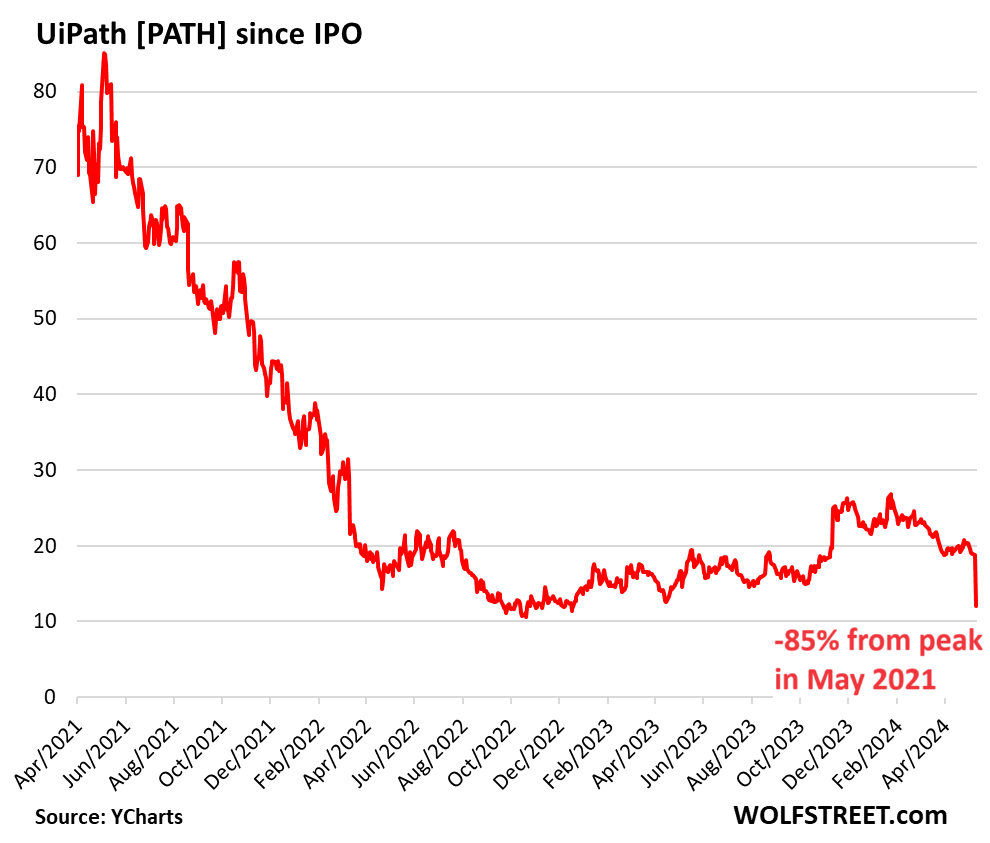

UiPath [PATH] had gone public via IPO in April 2021 at $56 a share. After the “pop” on the first day of trading, shares closed at $69.00. They peaked in May 2021 at $85.12, giving it a market cap of $45 billion. This was a creature of what we have come to call consensual hallucination. But consensual hallucination eventually fades, sometimes fairly quickly. By June 2021, hot air came out of it.

Over the past five years, UiPath booked big losses every year, totaling $1.6 billion, including the $49 million loss it reported yesterday afterhours for Q1. Revenues in Q1 grew 16% to $335 million.

In Q1, the company “saw increased deal scrutiny and lengthening sales cycles for large multi-year deals,” it said, and lowered its guidance for revenues and operating margin.

In addition, the company announced that CEO Robert Enslin resigned “effective June 1” from his position of CEO and from the Board of Directors. He will be replaced by company co-founder Daniel Dines, who himself had been moved out as co-CEO in January this year, which had made Enslin the sole CEO. So now, Dines is the sole CEO.

Enslin, a former Google Cloud executive, had been hired as co-CEO in April 2022. At the time, Dines had said that he “brings the right balance of experience and skills to scale our operations, allowing me to focus on our company culture, vision, and product innovation, areas I am passionate about – and that bring considerable value to our employees and customers.”

I mean, the whole thing is corporate hogwash to cover up chaos.

Shares have now collapsed by 85% from the peak, and market cap has been whittled down to $6.9 billion. We’re proud to have the stock in our pantheon of Imploded Stocks, for which the minimum requirement is a price drop of 70% from the peak (data via YCharts).

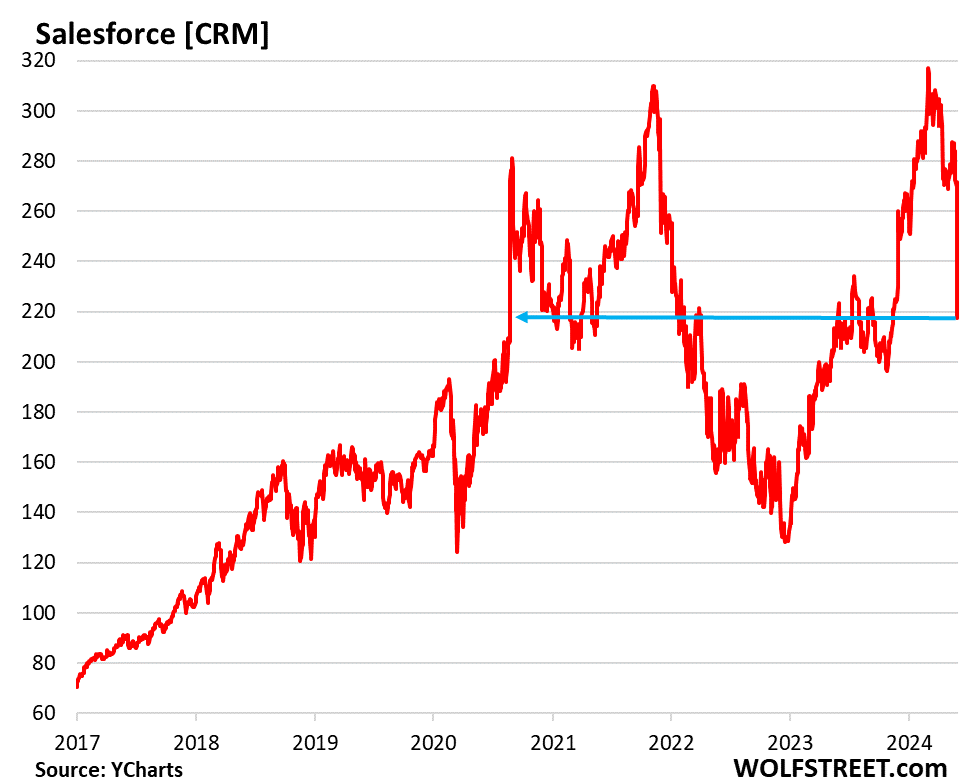

Salesforce shares today plunged by $53.61, or 19.7%, the biggest one-day plunge since 2008, to $271.60, back where they’d first been in August 2020, and down by 31% from the high on March 1, 2024, after the company issued disappointing guidance, missed Wall Street estimates on revenues – the first miss since 2006 – which grew only 11%, as revenues from Professional Services and Other fell 9%, and billings only increased by 3%, the smallest increase in ever. During the conference call, it said that it saw budget scrutiny, longer deal cycles, deal “compression,” and slowing projects.

AI spending by its corporate customers seems to be sapping everything else. And that would be bad news for other software companies.

What is most astonishing is the mindbender of a senseless rally in 2023 through March 2024, but that was a sign of our times (data via YCharts).

Many software companies were sharply marked down today, possibly subject to similar forces of wild and woolly AI spending sapping budgets for everything else.

| Some Major Software Stocks Today | ||

| UiPath | [PATH] | -34.00% |

| Salesforce | [CRM] | -19.70% |

| ServiceNow | [NOW] | -12.0% |

| Cloudflare | [NET] | -9.60% |

| CrowdStrike | [CRWD] | -9.6% |

| Rubrik | [RBRK] | -8.4% |

| Okta | [OKTA] | -7.8% |

| Adobe | [ADBE] | -6.6% |

| SentinelOne | [S] | -6.3% |

| Oracle | [ORCL] | -5.4% |

| SAP ADR | [SAP] | -5.3% |

| Snowflake | [SNOW] | -4.9% |

| Palo Alto Networks | [PANW] | -4.5% |

| Microsoft | [MSFT] | -3.4% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wash, rinse, repeat.

I knew the man who added that last word to the shampoo bottle, interesting fellow. Made the shampoo industry millions. He also put the phrase, “for restaurant use only” on individual ketchup bottles so they couldn’t be purchased as bulk, then resold individually for more later.

Witty, witty.

“Repeat” indeed.

Any time an executive says they’re excited or passionate is a sell signal.

“corporate hogwash”

We had a 3-day project planning event at my company back in March. The first guy to speak was the organizer of the event, a senior product manager. He has been with the company less than a year. He was talking about “AI this” and “AI that”. I couldn’t believe the BS. He didn’t know what he was talking about (but he thought he did). Everybody pretty much rolled their eyes afterwards. When he was done, and we got back to reality, he never spoke again. I can’t believe they hired this guy, I’ll be surprised if he lasts, then again, maybe I won’t be surprised. One of the bullet points from his presentation was:

– True North is Innovation

The stock price of a company is strongly correlated to the number of AIs in the earnings report.

Tech companies are increasingly run by imposters.

Harvey, you once said our work paths (‘careers”) were similar, but you were 10-20 years behind

I used to think R&D was the most fun, and it was years ago, but now I’m getting kinda glad I did my last 20 years as a Field Tech….(far away from the marketing BS described)..and I still got to experiment/improve a few things, and chase electrons, whatever they really are.

What a FN mess…..”innovative visionaries”….ie, HUSTLERS.

Blame the laws that allow it, AND the greedy pigs who, “Just use the laws of the land”.

I agree some way or another

Yeah Wolfman, the stock market is erasing a lot of the COVID pandemic gains.

On one of several websites that track the stock market metrics, I saw that the inflation-adjusted S&P 500 is at the same level it was in October 2021 and only about 13.5% above its January 2021 level.

This equates to an average annualized real gain of about 3.7% from January 2021.

With all things considered, it is a pretty good performance for the S&P 500.

Can you show the step by step calculations to prove this?

Here are my approximate calculations.

S&P 500 inflation adjusted return from the website MULTPL

January 2021: 4611

30 May 2024: 5235

3.7% annual rate over 3.5 years

[ (1.037)^3.5 ] x 4611 = 1.135 x 4611 = 5233

I have researched the historical S&P 500 real or inflation-adjusted returns for the last 100 years from various references and it is around 7.4% That last 24 years has not been the best period for the S&P 500.

Very good comment, one look at my portfolio performance graph reveals the correctness of your calculations. Fortunately now only 50% of my assets are in equities, the remaining 50 % in heartwarming 5.2% interest current account type cash deposit. My only worry now is is to avoid buying the dips too soon, an easy trap to fall into at this stage, because Be There or Beware is as true as ever.

The S&P inflation-adjusted return is a bit better than that after including dividends. I’m getting 6% pre-tax total return after inflation from my data (stockcharts dot com, graph of $SPXTR:$$CPI)

Could Microsoft’s AI sales effort could be cannibalizing its other product sales, such as Dynamics or O365, etc? IT budgets have limits. Dominant IT market share makes growth a challenge. I don’t think any degree of cannibalization is priced in.

Our company IT dept is getting further into bed with Microsoft. They are consolidating their vendor base and had really simplified their support model and lowered their costs.

Microsoft is coming to eating up the marketplace – making it hard for smaller software providers.

True, but AI will transform, but is not yet ready to transform many businesses. Bubbles will occcur, because the AI hallucinations and low reliability problems are not yet fixed, so the businesses are rushing to use most AIs too soon. Disappointment will pop bubbles.

Please add MongoDB to the list which collapsed 32% (25% after hours and 7% during the day).

Saw that one too…always looking for benchmarks on how fast and how far equities can fall (measure of overvaluation/speed of sudden correction).

Samsara and Couchbase report next week, both loser companies that burn money. Elastic reported yesterday and lost money as usual but was up something like 11% today. I’ve used their software, API is awful but I have to admit Kibana (data visualizer) is awesome and something other DB companies should have done years ago.

Not a big deal, Salesforce down to 218 from 272 but this number would help it faster to join your list of imploded stocks. :) It still has lot of froth

I called it long before, this is a zero sum game. Just because I see a AI driven ad in my Wolf feed, I am not going to buy a Kordia EKG monitor that I bought just a month ago! I have only one heart, that too slowing down!!

Not a big deal, Salesforce down to 218 from 272 but this number would help it faster to join your list of imploded stocks. :) It still has lot of froth

I called it long before, this is a zero sum game. Just because I see a AI driven ad in my Wolf feed, I am not going to buy a Kordia EKG monitor that I bought just a month ago.

You tried to post the same comment six times now, and I deleted four of them. Is your keyboard stuck?

He has many things to say

And what does this stupid toy “tell” you? Or is it just another iPhone “killer” app to show off to the other morons?

Does it top a tailgate that folds 6 ways?

NBay – now a tailgate that doubles as a Rubik’s Cube, that WOULD be sumthin’! (/s, but why do I get this feeling we’re at flank speed to design similar concepts into our various OS’? Intellectual bankruptcy a flywheel weight on the wheel of history,perhaps, and hoping like hell we aren’t compromising the pressure hull and airlock in the process?-best).

may we all find a better day.

Dustoff,

I still can’t wait for the Chicanos who make cars and PU beds “dance” to get to work on these tailgates……since it’s basically like a tongue, the extra movement could make for some really sexual looking whole vehicle moves and upset someone who is easily upsettable….we have many of those people, and I did my part to upset as many as I could get away with…..as punishment for ignoring REAL problems…..such as charging flank speed into who knew what?

Later.

One of my kids works for a small, public “tech” firm. I bought ONE share, just to track it. At one point it was up over 130% from my one share purchase.

I kept scratching my head as there’s no way this firm ever becomes “great”. But I watched. Then some insiders sold out (likely end of a lockup period). Stock dropped to a 75% gain from my purchase.

Looked today. Now up a whopping 20% from my one share purchase. I’m guess it likely goes negative in the next year.

The bloom is coming off the rose in the current higher rate environment.

Wait until investors realize that almost no tech vendor is going to make a profit on AI other that Nvidia

Even Nvidia is a bit down from it’s high. I wonder where it will go…

Why won’t other tech companies make money from AI?

The old – sell shovels during the gold rush – saying?

new age of gold rush. What will be left are a bunch of gapping holes and tons of wasted hardware.

Wolf, I read that Cloudflare and CrowdStrike had merged yesterday after the market closed. Could you please update your chart with the new company, ClownFluke? Thanks!

They’re just expanding their “strategic partnership” in terms of linking their platforms. But I have to admit that their two names combined are kind of a tongue-twister and should be simplified into one name, and your suggestion might be on the top of the list.

It’s not bad, but I will add CrowdFart to the list of options.

My medical provider started using Salesforce to provide online whatever. It was awful. For example, I inquired about something, and the first thing I was asked was which provider was I with? This from my provider’s website run by salesfarce. I opted out of any further interaction.

AI chatbots are idiots. Artificial idiots. They drive everyone nuts.

I don’t know Wolf, they are getting better. I booked an apartment showing with Showmojo chat bot. It was easiest booking to make versus emailing back and forth like other apartment managers.

AI Chatbots and call centers are coming and they will be excellent.

The shoomojo bot had the booking calendar built into the bot. That’s smart.

Nope.

AI is a marketing campaign.

AI is a fraud.

All you can do with a computer is program it.

That’s it.

…who is the programmer, and who the programmee?

may we all find a better day.

91B20 1stCav (AUS),

As dog owners know all too well, the dog is the programmer, and the human is the programmee.

Wolf – no doubt (much like our old feline always reminding us that cats were GODS in ancient Egypt…).

may we all find a better day.

As a counterpoint, I have dealt with dozens of AI chatbots and customer service bots. Every single one of them was idiotic and useless. My only goal with these automated idiots is to figure out how to get around them and talk to a live person so that I can get my problem solved. These things are NOT getting better and they won’t because the vast majority of people who call customer service have a specific problem that is not easily solved by an autistic AI robot.

That does not matter. The only thing that matters is not their utility, but some businessman’s feeling that they are good for profit.

If a company feels that using AI is less expensive than their current, functional human employee-based system, then it’s AI all the way, functionality be damned.

Consider the foreign customer service rep based call center. Sometimes my interaction with Manila is barely operational. I’m thinking of studying Tagalog to be able to do business.

I agree that call centers in Manila are no better than AI, maybe worse. In my experience, it seems these folks have a list of 15 sentences that they’re allowed and trained to say, and they get to choose which of the 15 they’re going to say. Anything else sends the conversation into circular hell.

My bank uses a call center somewhere in the US South, and it’s beautiful, I get to talk to these women (mostly) with their dry sense of humor and familiar accents, and their occasional easy laugh, which is one of the reasons I still bank there. A company can choose to run off its customers; it’s easy to do.

When they say AI, they just mean fancy computer programming.

I worked on the Y2K & Euro conversion in 1999.

I recognize nonsense, usually immediately but not always.

AI & crypto are nonsense. In the meantime, automative phones answering services still don’t work.

@Sacramento

I disagree. There are things that AI will change forever. These are early days and things will only get better from here. The early applications are like putting lipstick on a pig but better ones will emerge. It is dangerous to dismiss this as a new technology altogether and group it with programming.

Agree with your views on crypto and the fact that AI is massively overhyped right now. But that is what you get when you have monetary spigots open for so long and open so wide.

I was an account manager for 9 western states for one product line at a huge software company. SFDC was the CRM and I used it to the fullest. But reading Wolf’s article, I sure cringed at the thought of having SFDC AI involved with my prospect/customer conversations offering real time prompts to me. Being a know-it-all rep was not my style. In fact, my boss had a nickname for me between us. But he knew how I worked and let me fly with it. His boss hated me because I didn’t follow the formula to the letter. I can see AI ratting me out or for NOT taking its advice (wink).

For me, AI and Bitcoin are in the same league. What the Hell can they do for me? Someone explain, please.

So can start a business, design the factory robot, order the factory robot, lease the factory, hire workers, train workers, make a product, stolen to u are sleeping

Is this AI humor?

Salesforce tanked that much? Hmm…they must not be forcing their people back in office hard enough..they need more of those in person collab to bring back the productive /s

MW: Cathie Wood’s ARK Invest doubles down on UiPath as software firm’s stock price crashes!!!

Good. Might be time to short that junk ETF again.

Quite a way up in the commentary, Wolf mentions pleasant experience with a particular call center.

My experience with call center personnel includes injecting humor at the end of our conversation. When I’m asked; “is there anything else I can do for you today?” I answer, “well I’m 93. Can you take 10 years off my age?”

A few Humorless individuals take it literally and give a serious “I’m sorry (etc.)”, but most laugh and the conversation ends pleasantly.

Dealing with “the public” all day long is stressful. I enjoy easing that for both of us.

RD – good on ya’, mate.

may we all find a better day.

While AI is nothing more than faster chips and greater memory, it has a grand future!

It will replace millions of useles keyboard and phone junkies working from home, who fancy themselves as useful and intelligent.

Perhaps they could learn a useful skill before they join the homeless?

“It will replace millions of useless keyboard and phone junkies working from home, who fancy themselves as useful and intelligent.”

Moi? 🤣❤️

Good morning. Please understand that the current “AI” model is nothing more than a very well written algorithm. As a species, we really need to focus on quantum computing, room temperature super conductive materials and robotics. When these developments intersect (and please, I’m not postulating Terminators running around), this will be THE preeminent investment that will push all of us into a new era, then everything will change. Study, learn, invest wisely.

The AI dawn is over. Now comes the sunset. The overhyped BS of AI is the same as so many other prior manias. We were promised fully autonomous self-driving cars by 2020 by countless “experts” at Google, Tesla, Apple, Microsoft, etc. I am legally blind and cannot drive. Still waiting…

Question: If AI is so good, then why can’t it solve the self-driving car problem? And don’t cite me nonsense about self-driving cars being safer than the average driver. I am a statistician. If you factor out OUI drivers, excessive speed and recklessness by male teenagers, distracted driving, etc then you are left with responsible drivers that have a FAR safer track record than self-driving cars.

But that’s the thing, Longer View. You can’t remove those danger variables you mentined from the real world – the ONLY way to stop drunk drivers, reckless male teenagers, dumbasses texting while driving,etc. from operating a vehicle is to not let the vehicle be operated. Self driving scares the hell out of me – I’m one of those long distance road bicycle nuts that ride out on wide shoulders in rural highways – but it may be the ultimate solution to all those accidents caused by the irresponsible drivers who can’t be stopped.

I miss having my Dad around to help keep me grounded where what computers can and cannot do. He was employed in programming (RCAF, Price Company and then Northern Electric/Northern Telecom/NorTel and finally some spin-off from NorTel at the end) from the early 60s through 2002 but still had a handle on what was possible through the mid 20-teens.

Now I have to try to channel the ghost of his skepticism, but it keeps getting harder and harder every year … :(

MongoDB as mentioned above deserves a look by all for the fun factor.

Think of Alex Karras and Flash Gordon for the full effect.

The web site is a wonder in itself.

the CFO/COO are one and the same.

Go ahead and explore the ERG.

🎪🎪🎪🎪🎪🎪🎪🎪🎪

“In Q1, the company “saw increased deal scrutiny and lengthening sales cycles for large multi-year deals,” it said, and lowered its guidance for revenues and operating margin.”

I noticed this last sentence. “…lowered its guidance for revenues and operating margin.” ????

Being an old retired guy, perhaps a dinosaur, I still learn a lot from Wolf Street. For decades the phrase “operating margin” gave me the general impression that the “margin” referred to was on the positive side of zero. Silly me for making such a grotesque assumption.

Oh well, still learning I guess, and having more fun than should be legal. Love Wolf Street and the comments.