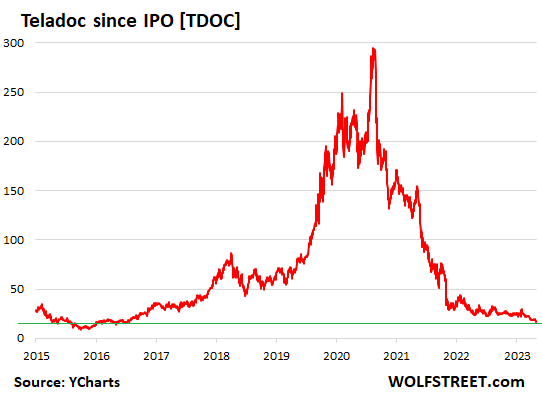

Down 94% from the infamous February 2021. These kinds of goofball charts are stunning — and now totally common.

By Wolf Richter for WOLF STREET.

Teladoc, which provides virtual healthcare services, including through AI, under various brands over the internet and via mobile devices, and which became a huge pandemic spike-boom darling, reported another big net loss today, $57 million in Q3. Revenues grew a lame 8% year-over-year to $660 million.

This brought its cumulative net loss since its IPO in 2015 to a fabulous $15.2 billion, exceeding its cumulative revenues of $8.9 billion by a wide margin. This kind of stuff – losses nearly twice as large as revenues over a span of nine years – takes some doing!

The stock [TDOC] tanked another 6.7% to $16.90 a share in after-hours trading today, below its IPO price in 2015 of $19, and down by 94% from the intraday peak of $308 in February 2021. Obviously, after that 94% collapse, today’s 6.7% drop can barely be seen (data via YCharts):

These kinds of charts are just stunning, in a goofball sort of way. But they’re now totally common, and my pantheon of Imploded Stocks is full of them.

It’s another one of those hype-and-hoopla outfits that just keep losing money every single year, and periodically unspeakably huge amounts of money, which was one of the essential preconditions for becoming a spike-boom darling during the pandemic in the first place.

But folks are now gradually coming out of consensual hallucination, as I have come to call it, and then they’re smelling the bad breath.

At that peak in February 2021, the company had a market cap of $44 billion; now down to $2.8 billion. The remaining $41 billion of consensual-hallucination money have evaporated.

That February 2021 became infamous here because that’s when we noted that stuff started coming unglued, after the breathtaking spike-boom, to the point that it caused us to muse here on March 3, 2021: “Was That the IPO Stocks Bubble that Just Popped?,” in which Teladoc also appeared as a top holding of the ARK Innovation ETF [ARKK], which had already begun its long and hard collapse, and which is now down 77% from its peak in said February 2021. These outfits are in my vast pantheon of Imploded Stocks.

For Q4, the company projected another big loss on revenues of $658-$683 million.

Like so many of these outfits, the company hands executives and employees big-fat stock-based compensation packages. In Q3, stock-based compensation expenses amounted to $53 million. Stock-based compensation dilutes the bejesus out of existing stockholders.

But the dilution doesn’t really show up in a painful way when the company keeps losing money every quarter, and what gets diluted are effectively the losses per share, and so the losses per share could theoretically decline over the years due to dilution even if the net losses, expressed in tens of millions of dollars every quarter, stay the same.

In other words, dilution doesn’t make any difference if the company keeps losing money. Dilution only matters when the company makes money.

And that’s a game that permanently money-losing companies play. They’re just ripping their investors off. It’s a good thing that investors have now thrown this stock out the window onto the huge and growing pile of similar stocks.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I really hope one day, far in the future, when they discuss tulip mania and all these last years… you get claim to fame on “consensual hallucination.”

Wonder if SEC’s purpose included preventing fraudulent pump and dump schemes and why these companies didn’t make the cut?

Also, do we know of a major short on Cathy Woods ETF? Why Hinderberg has to go all the way across the world to India when there is such good shorts here :).

Brought to you by Cathy Woodshed.. seriously why is msm still taking her seriously like she is some genius investor..jesus..

This comment isn’t really anything against you or what you said or your observations. I just want to elaborate and say that Cathy Woods is part of this controlled media’s degeneracy and and public well being have nothing to do with what the people who control the major media want to see happen to this country. She’s just a prop in an evil game. This country is as corrupt as any other, it just is much more sophisticated about it’s manipulation and corruptions so it’s harder to point it out. This country is ran by traitors and dual-citizen war instigators.

Cramer was also portraying himself as a medical expert 2 years ago.

Cramer should be a living meme of that one Seinfeld episode when Constanza decided to go opposite of his instinct and everything seems to work perfect.

Anything Cramer push or recommends, do the opposite and the track record will probably be much better. Put clown make up on that guy and he would fit right in..

There is an Inverse Cramer Tracker ETF called SJIM.

‘This country is as corrupt as any other…’

In China and Russia you would be looking at arrest for posting those words. That’s why they are false. The apparent paranoia is another issue.

I agree that the US is not as corrupt as Russia (definitely) or China (probably…definitely in the realm of aggressive info repression) but…the US is a lot more corrupt *than a lot in the US think it is*…they are just pretty damn used to “that’s the way things are” (at least for last 50-100 years in the US).

The US G has failed to remotely balance its budget for essentially over 50 years – largely to ensure that incompetent/corrupt institutions receive perpetually increasing shares of the national wealth.

That is pretty damn corrupt.

And we know this about China and Russia because our MSM told us so. Its probably true don’t get me wrong, but surely there’s more nuance to be discussed that’s lost in sensationalism.

The US has more freedom of press than, say, the UK. And Canada is also trying its damndest to censor as much as possible this side of shoving predeceased dissentors out windows. But its coming in the US and already here in devious ways. The MSM is quickly losing ground and its only grasp is censoring internet and social media. Turning each against the other is working to a large degree.

Until something like Wolf’s blog gets thrown under the bus, the transition will continue to be subtle, window dressed in the guise of safety, security and the forced acceptance of the WHO, pandering to identity and lifestyle politics and cancel culture. But stuff like the Trusted News Initiative stinks to high hell.

Yeah, I can’t see US being more corrupt than Russia, not even close honestly. I’ve lived nowhere near China so it’s hard to say for sure but I did grow up in a communist controlled country and I would bet a large sum they’re more corrupt. I mean corruption ran so deep in our country that regular every day people were well versed in bribery, was part of daily life, corruption and bribery is how I got to leave the damned place with my parents. There’s levels to corruption, the US seems to have found one that works well for it, I do admire the passion of US citizens to fight the amount that is there though.

Seba – nailed it. (…though willful ignorance and entropy rarely seem to sleep…).

may we all find a better day.

I wonder if the normal corruption by the lobbyists who play in (GOP team for sure, because of shooting, don’t know about the Dems*) the Congressional baseball games (it being our wholesome national pastime for over a hundred years….even fit for children), OR, there is a lot of “Say it ain’t so, Joe”, between the second baseman and the runner, etc, throughout the whole game? (Fans no longer matter, have teeny-tiny say…. that is still shrinking)

*(would be interesting info….to me, anyway….maybe I’ll ad checking it out to my cluttered desktop)

Good article…SO, all one needs is an idea (and BE a SOCIOPATHIC “entrepreneur”), good at sales/marketing or have one or more interested, and count on enough ignorant people with greed and money. Which is, so far, no problemo. But poverty trickles up…..and not linear on the time axis.

Guess selling “services” IS the future…..till the potatoes are all gone, all the water and air are too toxic…..or whichever happens first.

Well that notion on corruption theme here sure became a complete verbal mess. Not my first, though, that’s for sure.

But I did find out Congress Critters, their staff, lobbyists, and others close enough do get on the teams, even as coaches and advisors. We have around 13K registered lobbyists and a lot that aren’t. Plus all the infamous “dark money”.

Very little team composition info, it’s mostly their charity thing….changes a lot, I suspect….they try to balance ringers.

They have a HockeyTeam, too.

That’s a bloodsport…….in NHL, anyway.

As with all media, we only see what sells to enough eyeballs.

YEP!

re msm stocks _ Isn’t it time for Moderna to be looked at by Wolf ?

Previous high 484.47 Aug. 09, 2021

Today 79.00

Some day. I’d like to see a much lower price before I direct a broadside at it. Something in the $15-range would be fun. But it’s already in the Imploded Stocks.

Physical chemists no longer teach Biochemists…

..other Biochemists do……enjoy.

In Biochem AI is called “In silico”….from the old in vivo, in vitro Bio.

Same purpose as AI elsewhere…..cut labor, save material from supply chains, spin more impressive and confusing “scientific” advertising campaigns, (for professionals and patients) and in this case market more drugs faster.

People should check the timeline of the GROWTH of WHO’s list of “Essential Medicines” to have a well stocked clinic, hospital, etc.

Each country is about the same.

Pill popping is good biz, for you investor types that don’t quite have enough for your “bucket lists”.

Somewhat related, I thought it was odd that Pentalon Corp. received a lot of high-profile coverage over the year I began paying attention and while it was still considered a viable yet small company with a niche product.

Pentalon*

Peloton

Or a marathon Satanic Worship party……lasts till everyone disappears underground in flames, including some virgins and others from the nearby villages.

We used to just burn ’em, way before that crap could even get started.

America and Europe were “Great” back then….sigh.

Anyone have spare member berries?… I could use a few……

Who wouldn’t want to invest in French trousers? ;-)

…no loon like a pantaloon..

may we all find a better day.

Do a search on “Elaine Garzarelli”; she was the prior generation’s Cathy Wood. Garzarelli was made famous for a bearish call in September 1987 (shortly before the October 1987 crash). That call made her career (right place, right time, right call) and she was treated as an market oracle for years. Per Wiki, her fund avoided the crash, but went on to lose half it’s value.

I think that Wood is/was in much the same role today: right broadly once and then treated as an oracle thereafter (maybe lighting does strike in the same place 2/3/4 times?)

I think that there’s a great deal more luck and randomness in the market that is admitted. Taleb talks about a thought experiment where 1000 analysts flip a coin as to whether the market is up or down the next month for 10 months (head is up, tails is down); at least one out of the 1000 will be right all 10 months. Just random luck.

Fast Ed – …as we used to say in moto racing: “…if forced to choose between being fast or being lucky, choose lucky…”.

may we all find a better day.

Always. Luck is where the strongest power is in this universe……(cheating or being sociopathic is probably second?…kinda similar)

“The most successful people are not the most talented, just the luckiest, and the luckiest will eventually run out of luck.”

“When things go our way we reject the lack of certainty.”

Taleb

r12 – perhaps a prime directive of evolution is that one must steadily work at improving tomorrow’s odds of survival, (no guarantees implied)…

may we all find a better day.

Walter, any idea how much ‘allusination’ money has been lost in total (from peak ?)(that’s not real money) and how much total real money (from IPOs) ? and wat the weight is compared to the market ? Tks Guy

So ETFs can be crooked too?

Doesn’t anyone vet these people?

Gonna have to do an in person drop by and see if 11 executives are living together.

Let me not forget our overleveraged, zombie, US companies! With our Enron-SBF accounting practices now, who knows which nonbanker-crony company will munch dirt any time now. The bankers’ Fed only loans (directly or indirectly) and so rescues CRONY insolvent companies! LOL The pretend rating agencies will never tell you if they knew!

Wolf,

Wow! All that pandemic money had to go somewhere. Volatility was all trading back then and don’t hold anything. Just make sure there was money to cover the settlements. That vol was definitely hallucinating and profitable to some. Thanks for sharing your smarts.

Wolf,

I’m really trying to grasp the absurd and hallucinating articles that the fed will have to cut rates because the money supply will shrink! It makes no sense to me and if they do cut I believe things will be far worse than raising them. Your thoughts please?

Yes, some of this pivot stuff out there is bizarre, and has been for 18 months. For amusement only.

I think the pivot trope is necessary to keep selling various assets. Just today I got a newsletter saying I should invest in REITs because the office RE space has been undervalued due to “high” interest rates. Obviously if you’re trying to sell that it’s helpful to have supporting documentation saying that rates have to come down and stuff.

At least how I’m reading the tea leaves, I don’t know, I only know some things because wolf spits serious data 😆

Does this mean Miss Woods is going to back up the truck and buy more now its a “value” Stock ?

She seems to do that a lot with other peoples money.

“I know I’m going to get rich with this scheme! And quick!” – Homer Simpson (patron saint of investors?)

Saw an ad flash on my FB feed (yes, I’m Facebook old) for an e-stim workout system called Katalyst. Since I’m in a slow cycle at work, I followed the ad down the rabbit hole because it was one of those “seems too good to be true” types of things that I absolutely love debunking in my own head. I read quite a bit about the system from reviews, articles about using e-stim in exercise in general, reddit forums and the like, as well as read quite a bit about the company itself. It’s private and relies on private investors, but if this thing ever comes out and tries to go public, it should go on the Wolf List as soon as possible.

In short; over $2k for the system + over $500/year just to use it, mixed reviews in terms of the viability of the equipment long-term, with *mostly* positive reviews on how it works but little underlying scientific support on the benefits…but there’s NO WAY this will ever be anything but a niche-market product like Pelaton at those price points.

41 States Attorney General’s are suing Meta over poisoning the Youth’s minds on Instagram.

Facebook is Instagram on speed.

here’s to your health! Cheers

The only reason behind this stupidity is that the FED flooded the market by printing insane amounts of money. Some of my friends, who had no idea about how financial markets work, used to buy stocks and told how their “investments” has shot up.

Even if you bought rocks, they would go up. None of the assets was really heading up actually. The U.S Dollar was going down, because the FED flooded the market with $4T almost instantly, doubling its balance sheet and seriously devaluing the dollar. It was most felt for the speculative assets.

Hype companies like this have been around forever. They are nothing new.

Remember the dotcom era 20+ years ago? Remember Drkoop.com? Cofounded by former Surgeon General C Everett Koop? It was No. 1 health care content site on the Internet until it went bust and shutdown.

Don’t these folks feel ripped off when this “compensation” loses 94% of its value by the time you get to sell it?

As in…You just got played to work for “peanuts?”

“Like so many of these outfits, the company hands executives and employees big-fat stock-based compensation packages.”

Zoom did “re-up” grants to employees whos original grants were based on the bubble price. Only further increasing the amount of stock buybacks they had to do to keep the shares from being diluted. It makes no sense.

2019…Disruption companies!

2023…Boring companies that actually have profits!

I guess that makes me a contrarian. I bought boring companies that actually have profits (mainly Scandinavian banks) in 2019. One is +23%, the other +52%, with yearly dividends of 7-10% based on my original purchase price.

I speculate that the enormous losses show that the company (shareholders) is being looted from within. They must be over-paying for the services and infrastructure and whoever should be controlling those costs must me in cahoots.

Yet another “Imploded Stocks” whose profits are in another galaxy far, far, away. Consentual Hallucination should become a standard definition within the financial industry. Best description I’ve seen.

I’m dumbfounded by these money fueled blast furnaces. Do the various “institutional investors” that hold tons of this poop, (82%) actully have analysts on staff that recommend these losers?

Out of curiosity, would you happen to know what these “Special Income Charges” represent as shown in a summary report from Yahoo Finance’s TDOC income statement? Figures are current period, last year and 3 years past.

“Special Income Charges -3,815,105 -13,425,848 -70,391 -97,313 -6,620”

The consensual hallucination has migrated to AI stocks. Every AI gain will lead to incredible job losses in the overall economy. That’s not a great plan for societal health and stability, at a time when wealth concentration and societal strife are already topping the charts.

Also, is AI really increasing productivity, or does it just rehash the same old knowledge base that is already out there, in an error-prone manner?

I work in tech and I question whether AI will live up to the current hype and hallucination.

I predict within 2 years, companies with AI in their names will join Wolf’s infamous list.

With all of this free money, Wall Street has been doing a great job of Hoovering it in leaving a few billionaires and many foolish without a retirement.

Gaming, crypto, EV, health/drug stocks. All have gone to spectacular highs before cratering and winning a spot on Wolf’s list. Now it is AI. Wall Street has gotten much better at finding the next hype compared to the DotCom days of the early 2000’s.

Cynically Yours,

I forgot to add that even the conservative investors got hooked with the hype for commercial RE, airBnB rentals, and even safe long term treasuries.

Because:

1) All real estate ALWAYS goes up. Up 30% last year?? We need to leap into this gravy train!

2) As you approach retirement, your bond holdings should rise to 60%! Rates will go negative soon. Invest in the safest investment ever to lock in 0.8% for 30 years!

I tried Teleldoc and another tele-medicine company when I was bicycle touring. These services are not at all like having a doctor whom you have rapport with.

I suspect these companies will be for the poor and for those in medical care deserts. I even tried a phone appointment once with my GP and that too is inferior.

I don’t think the poor will ever have access.

My health plan waves copays for teledoc sessions.

Sadly consensual hallucination is not completely dead, glad to see these worthless hype stock go to zero but we still got a long way to go…this hallucination is still thick in the air…Bitcoin anyone? We’re now back to $34K….what a show..

As I am reading this….one thing came to mind, the amount of money that went to money heaven…$44B and just from one freaking company…imagine using this money for things that matters or benefit the public like good infrastructure investment, schools, health care…etc but oh no we as a society can’t afford that…

These bubbly assets (IPO stocks, crypto, etc.) are doing a great job draining liquidity from the system as their prices deflate.

Draining liquidity from greedy fools, more like it.

I saw a good description of what created these imploding companies Wolf highlights which was hypoglycemic companies addicted to the ZIRP free money addiction like sugar. The Fed takes away the sugar because of raging inflation and the addicted companies want the sugar high back

Pelaton 🤡🤡

Take a look at the Management Team.

Who is the CEO.

Who is responsible for the Supply Chain.

Nuff said. Look out below. Dive, dive, dive

💸🤑💸🤑💸🤑

Thanks to modern tele technology you can see the patient has flat-lined from 1000 miles away. Now what do you do about it?

I hope the employees didn’t take 100K in RSUs vesting over 3 years in lieu of salary back in 2021.

Use machine learning on the data to predict the patient is going down the pan, then use a normal web-API to quickly take out a life insurance on him/her/other?

I believe US equities are in the very early stage of the next leg down in the bear market, which is the direct result of the massive liquidity excesses and asset bubbles created by the Fed. If correct, Wolf’s Imploded Stock list will be much longer before this is over. We should know one way or the other sometime next year, perhaps Q2 or Q3.

I’m still astonished that these types of tech companies have continued on as well as they have now that money costs something again. Sure there have been lots of collapses in market cap and a few BKs here or there, but I would have expected nearly all of them to have run out of “runway” by now. Tech should be a total bloodbath of layoffs and BKs. I guess we just printed enough that many of them will still be able to hang on and burn some more cash for just a tiny bit longer.

How much longer will be interesting to find out. There’s clearly a lot of unneccessary waste spent on do-nothing jobs in tech. Multiple sources say Musk has cut over 80% of the workforce at Twitter, and to the surprise of nobody who works a real job, the platform seems to be doing just fine. Work-from-home types will be OK when employed by profitable companies that developed sufficient digital leashes to keep the former call-center or phone customer service tasks going smoothly, until their jobs are shipped off to other English speaking countries. All kinds of self employed WFH people will probably be OK. But overpaid and laughably unproductive WFH tech employees are doomed if higher-for-longer interest rates hold steady. I don’t care what elaborate argument was cooked up to support the claim that a covid-era WFH employee became super productive vs. their office days… If a company can cut 80-90% of the people in a position and barely notice, then that position was a BS job.

As investors increasingly demand profitability and dividends to compete with safe interest income, I suspect there is a lot more doom and gloom coming for companies in the pantheon of imploded stocks and the Woodshed ETF.

I’m always shocked that these stocks aren’t trading at $.00- $.01

Looks like, in spite of huge drop, a lot of folks made plenty of money – especially VC money and early investors/stockholders

I’m sorry if I’m repeating a comment made prior to mine but:

These people are thieves. I believe they know that their product is not viable let alone profitable but thanks to the free money environment, go ahead and create a fantasy company, do an IPO (or another iteration), and sail on with other people’s money.

Yes, those who thought they “invested” in a viable, soon-to-be profitable company are culpable too. If we don’t learn from our mistakes, we remain as stupid as we were when we made the first one!

$15.2 billion! That is impressive.