The Home Price Benchmark Index is down 14% from peak in March 2022, Toronto down 15%, after wild and woolly sucker rally over the spring.

By Wolf Richter for WOLF STREET.

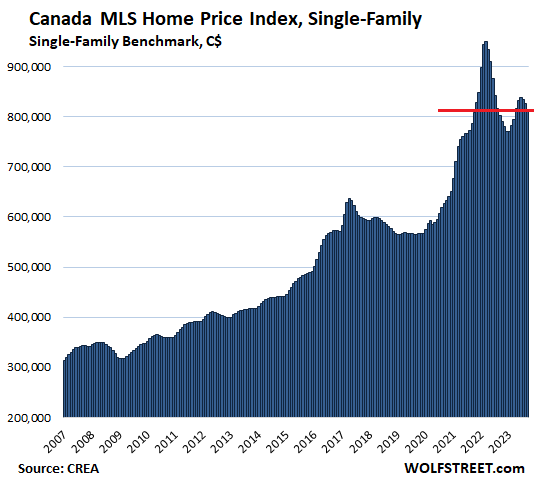

The Canada Home Price Benchmark Index for single family houses in fell for the third month in a row, in September by 1.3% from August, after having dropped by 1.1% and by 0.5% in the prior two months, to $815,300 (all prices in Canadian dollars).

The three months in a row of declines came after a wild and woolly sucker rally in the spring, fueled by the spring buying season and fake hopes about rate cuts. But the Bank of Canada instead went on to hike rates further to 5.0%, and at the last meeting added a further tightening bias, while inflation has begun to resurge across the board, topped off with Canada’s worst rent inflation since 1983.

The breathtaking price plunge last year forms the base for this year’s year-over-year comparison; and after the wild and woolly sucker rally this spring, the benchmark price is up 1.6% year-over-year. Since the peak in March 2022, the benchmark price has now dropped by 14.2%, or by $135,300, according to data from the Canadian Real Estate Association (CREA) on Friday.

Sales dropped, supply rose. Home sales fell 1.9% in September from August, the third month in a row of declines. New listings “jumped” by 6.3% month over month, according to CREA. Since the low in March, new listings have surged by 35%. Supply rose to 3.7 months, over double the level of the pandemic low. “The recent trend of slowing sales and rising new listings continued in September,” CREA said.

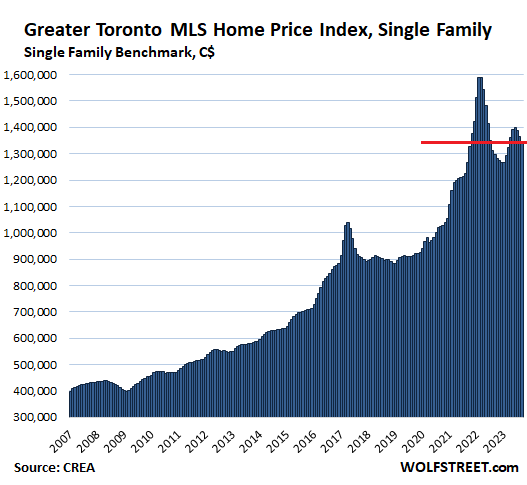

Greater Toronto Area (GTA): The MLS Home Price Benchmark Index for single-family houses fell by 1.5% in September from August, after having fallen by 1.7% and by 0.8% in the prior two months, to $1.345 million.

From peak in February 2022, the index has dropped 15.4% or by $245,600. Due to the plunges last year during this time frame – the base for the year-over-year comparison – and the effects of said wild and woolly rally in the spring, the benchmark price was up 3.7% year-over-year.

These kinds of free-money-spike-and-end-of-free-money plunge would be hilarious, if they weren’t so serious.

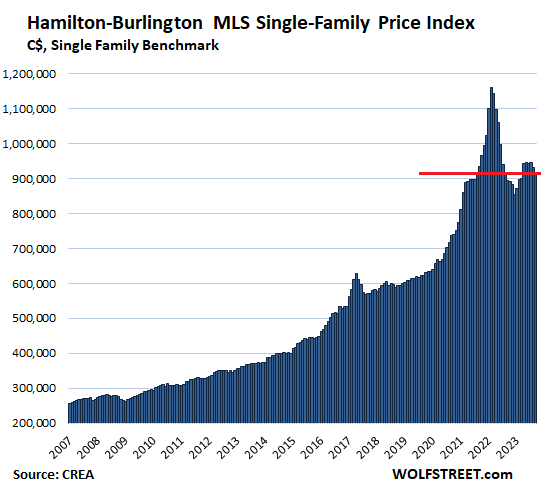

In the Hamilton-Burlington metro (part of the “Greater Toronto and Hamilton Area” or GTHA), the single-family benchmark price fell by 1.3% in September from August, to $918,000.

From peak in February 2022, the price has dropped by 20.8%, or by $240,900. Given the plunge last year at this time that had followed the spike in the spring, the price in September was up 2.7% year-over-year.

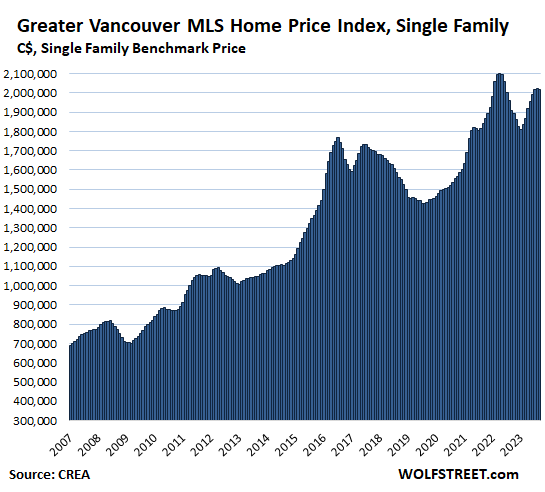

Greater Vancouver: The MLS Home Price Benchmark Price for single-family houses dipped 0.1% in September from August, to $2.018 million:

- From peak in April 2022: -4.0% or -$83,900

- Year-over-year: +5.3%

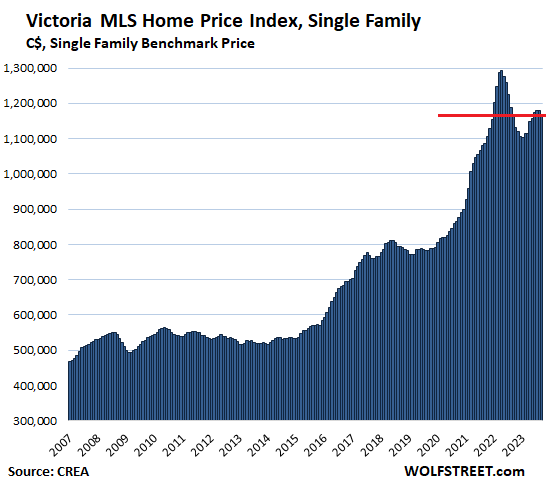

Victoria: The single-family benchmark price fell 0.8% in September to $1.169 million:

- From peak in April 2022: -9.7% or -$125,000

- Year-over-year: +0.5%

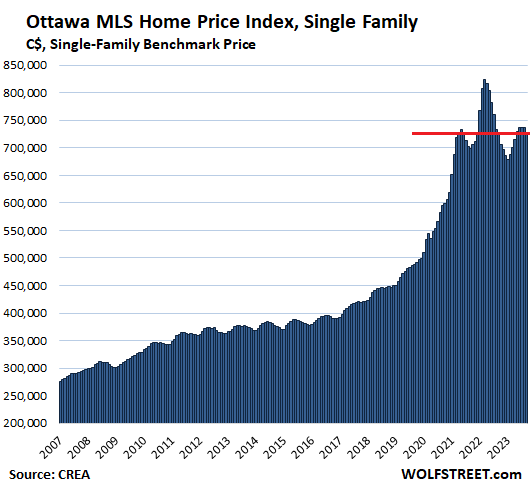

Ottawa: The benchmark price of single-family houses fell by 1.3% in September, to $727,500:

- From peak in March 2022: -11.6% or -$95,700

- Year-over-year: +0.6%.

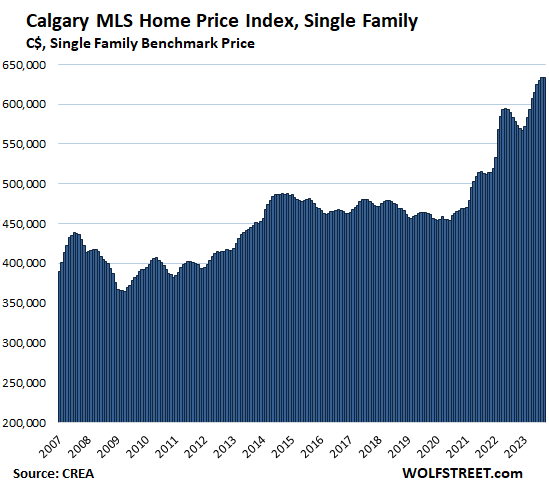

Calgary: The single-family benchmark price edged down by 0.1% from the record in the prior month, to $633,300, and was up by 9.6% year-over-year:

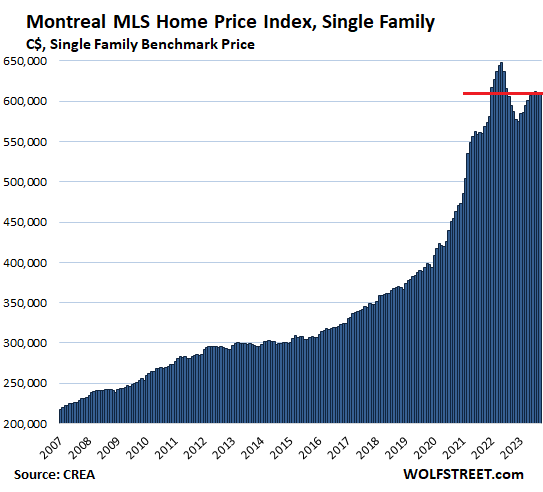

Montreal: The single-family benchmark price was unchanged for the month at $610,800:

- From peak in May 2022: -5.7% or -$36,800

- Year-over-year: +2.6%

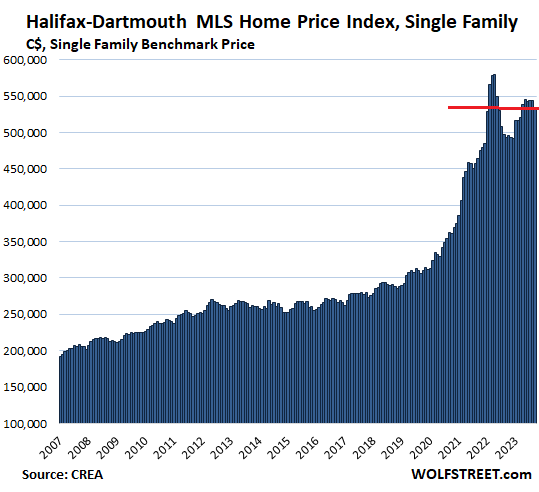

Halifax-Dartmouth: The single-family benchmark price fell by 1.9%, to $534,300:

- From peak in April 2022: -7.8% or -$45,200

- Year-over-year: +8.3%.

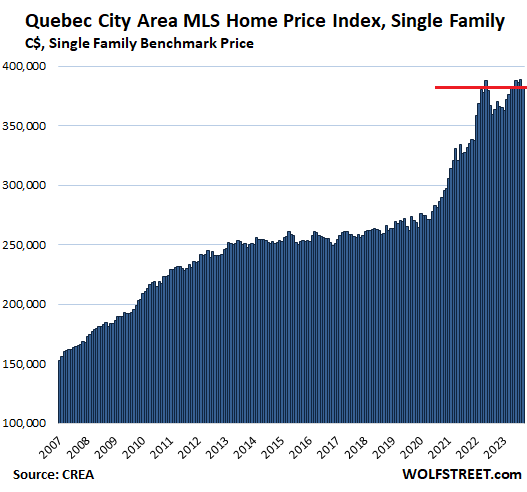

Quebec City Area: The single-family benchmark price fell by 1.6% from the record in the prior month, to $383,300, and was up by 5.4% year-over-year:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Starting to see more price drops here in flyover land, with more supply and overpriced houses staying on market for a long time.

I second your anecdote.

Wealthy American suburbs in the Northwest are now a collection of 40 year old houses with walls filled of mold and degraded structure painted over multiple times to hide the rot.

With good overlays to improve looks, these pest infested, maintenance intensive and moisture damaged structures are still worth $2.5 million each.

Sometimes a builder comes by and buys one of these for their huge lot size and posh neighborhood and then rebuilds a bigger house and tries to sell it at $5 million.

God bless our soon to be homeless children

> God bless our soon to be homeless children

They’ll move to Mexico or Costa Rica, where life is cheaper and more fun while working remotely.

I guess we take better care of our homes here in the SE than folks in the NW. My 40 year old home is in perfect condition and worth 7 times what I paid for it on 2000.

You said Wealthy American Suburbs, in Canada Vancouver or Toronto to be exact all the homes up for sale for a million and up are average 3 bed 1.5 bath optional, and the surrounding neighborhoods not as nice, trees and basic landscape is optional as well. I don’t see how so many people miss this obvious criteria to a million dollar home? 😄

CCCB,

Moisture (rain and snow) inevitably erodes a home over years and decades…it wears away foundations and does a number on the wood that almost always makes up the skeleton (“bones”) of a house.

The SE has rain…but nothing like the NW. And desert sited homes can be pretty weakly planned/constructed…but will last much longer due to the absence of rain/snow.

Hi Leo, I’ve worked in lots of 100 year old houses up in Vancouver Canada with no sign of rot or mold! As long as roof is fixed ever 25 to 30 years you have no problem with rain. Where the problem came is when they started super sealing houses 40 years ago and the moisture from inside the house can’t escape so it builds up in the house envelope. Sun is far more destructive of building materials than rain.

Reply to Cas127:

Depends on how you measure it.

Number of days of drizzle or amount ?

Eugene to Bellingham get lots of drizzly, rainy days, yes. Chilly rain not pleasant.

But amounts, annual inches:

Seattle 37,

Atlanta 49,

Olympia (WA) 49,

Tennessee cities 45 to 50,

Bellingham (WA) 36

Spokane 17

Tri Cities (WA) 8 (NOT a typo)

Most anything east of Indiana whether north or south or in between will get 40 to yes, 60 inches… 60 near north Mississippi).

West of Cascades (Oregon, Washington) 36 to 50, on the coast itself much more (Aberdeen Hoquium 83), but east of Cascades much less typically anywhere from 10 to 25.

Too wet, too dry they each present problems.

It’s not a good idea to live in an overpriced home, with extra footage, if you are living on a budget and need retirement income. You can sell the overpriced home for a nice price, put the money in a long-term CD and earn 5%. A home worth $800,000 could generate extra interest income of $40,000 per year, plus remove the burden of increasing RE tax and insurance rates. Good time to downsize, and make sure your legacy isn’t a house full of junk for heirs to deal with, especially if family isn’t local.

I think lots of late stagers are heading this direction and starting to list their homes.

The other large segment of new listers are people who bought in 2020 to 2022 and are nervous watching their home equity dissipate, especially when they bought something relying on a WFH arrangement that didn’t pan out. The huge jump in RE taxes is likely unnerving these folks as well, as well as a prospective higher reset of variable mortgage loans.

Downsizing is one thing but to sell a paid off house to become a renter at the mercy of a landlord who is free to raise the rent every year? No thanks.

If you sell a paid off house, just buy a smaller one. No renting needed.

That’s a one-sided view of the rent/own scenario. Homeowners’ expenses rise, too. Major repairs, property taxes and insurance, and other bills are always increasing.

Roddy, yes, but many landlords have taken advantage in the past few years, especially in places like Denver, Nashville, Miami, and other “hot” cities.

Don’t forget the huge jumps in cost of insurance due to a combo of inflation, increased valuations, and, in some cases, reduced competition.

Your “$40,000 in interest income” is also reduced by taxes. If you put it in an “at risk” account (aka stocks or munis), it could suffer a worse loss. Plus, your assumption is that the house is owned outright – which many are not.

Some of the $40K you tout also gets consumed by rent. If you have “stuff”, you still need renters insurance. You don’t escape unless you want that to go poof in the event of a natural disaster, fire, or burglary. You still have utilities. Moving isn’t cheap… even with a POD and doing the packing yourself. There is such a thing as false savings.

These “one size fits all” rants are naive. The key to anything is balance. With stagnant (at least in the U.S.) costs of servicing a mortgage, the increases in property taxes in certain areas are marginal (mine went up <$600 in the 6 years I've lived here), insurance increases (also marginal by taking advantage of discounts for alarm, multiple vehicles, adjusting coverage through buying an umbrella liability policy and reducing liability coverage on the vehicles and home, etc.) in OUR case work out to be about $2,000-$3,000 a month CHEAPER than renting a comparable home. If I factor in the loss of the 5% return on what we paid (we have no mortgage), our cost is $46,000 a year for housing…. 2700 square feet on a golf course with full mountain views vs. a cardboard cliff. That's less than $4K a month and still less than renting a comparable home in this community (which has increased based on current private rental listings to $4,500-5,000 a month). Two years ago, when interest was 2%, it was a huge win. Don't forget your interest rates can adjust downward as well as a house.

It's balance. There's no absolutely perfect one-size-fits-all solution.

And, by the way, why do most wealthy people own property and strive to own more? Because it's a "loser"? Geez. The key is don't let your eyes be bigger than your ability to support any purchase – car, house, truck, camper, fishing cabin, girlfriend…..

“car, house, truck, camper, fishing cabin, girlfriend…..”

A man with a plan. Love it. Gonna look up fishing cabins now.

Howdy El Katz Debt Free is the only way to be. That s real freedom….

A paid off $800,000 house in my area will have property taxes in the $6,000-$8,000 per year range. You still have to carry homeowners insurance which is no cheaper than renter’s insurance so that’s a wash. I pay $150 per YEAR in renter’s insurance.

Further, an $800k house is nothing to write home about, pretty much starter home territory. We’re talking 3/1 or 3/2 with 1,500 square feet or less, generally speaking. The rents on those are $2,500 to $2,800 max. Anything in the $3,000 and up rent range has to be nice. You have to pay utilities whether renting or owning, so that’s a wash.

So, selling the $800k house, sticking it into a 5% interest bearing product and renting the same house for $2,800 per month would yield you $6,400 net per year, or more than $500 per month. Keeping the paid-off house and paying property taxes would lead to a deficit of $12,000+ per year. ($6k property taxes, loss of $6,400 net interest income).

This does not even factor in maintenance and repair. I have worked on houses my whole life. They are money pits. The people who say “my house hardly ever needs anything” are riding a vehicle of delusion called “deferred maintenance” which threatens the structural integrity of a building over time.

When you factor in the service life of things like roofing, HVAC, paint, plumbing, septic, well pump, fridge, etc. you would likely come up with an average yearly maintenance/repair cost of somewhere in the neighborhood of $3k-$5k per year. So, the paid off “homeowner” is in the red by about $15k versus selling it and renting. The downside is the renter gets no chance at asset price appreciation, but those days look to be over.

Conclusion: Sell the overpriced POS, ALL DAY LONG.

I hope renting works out for Depth Charge, but for most people with a paid off house they like staying in the house is the best option (next best is selling a home and buying a cheaper one for all cash) P.S. To anyone looking for a fishing cabin make sure it is high above the river or lake. Our little on the cabin on the Yellowstone in MT has flooded twice since 2008 and I laughed when I read last year when it flooded “The devastating flooding that occurred along the Yellowstone River this week constitutes a 1 in 500-year event”. P.P.S I cut the drywall at exactly 4′ up the first time I had to cut it all the wet moldy stuff out so the last time it flooded it was easier to replace the wet moldy drywall).

El Katz,

You come from the South if I recall. Your logic may hold in the South and Midwest, but it surely doesn’t hold on the Coasts, where housing prices have gone up 200% to 300% while rents have gone up no more than 40% over the same time period.

On the Coasts and other high priced areas, the best play is to sell near the top, that is, for anybody who is financially minded and wants to build wealth and security. Renting in the short term can or downsizing can make you a lot of money at this stage of the RE cycle.

Anybody who doesn’t factor in opportunity cost of various options is financially naive. Buying an overpriced house and hoping to break even in 15 years is a financial disaster from a finance perspective. You’ve earned nothing on your biggest financial investment.

An $800K house with property taxes of $6000-8000. What a bargain. Here in San Antonio, that house would have $21,000 in property taxes and an additional $8,000 in homeowners insurance.

Depth charge, you wrote…..The downside is the renter gets no chance at asset price appreciation, but those days look to be over.

‘Over’, for how long………long term we debase our currencies, always…..

And the ‘we’ is universal

“These “one size fits all” rants are naive.”

Yes, everyone needs to assess their own situation. Projecting your situation onto everyone else doesn’t make sense.

Bobber a big reason “property” tax is higher in TX is that you don’t have the high “income” tax we have in CA (and we also have high “sales” tax, but thanks to Prop 13 long time property owners will pay less than 1/10th of 1% of the value of a home in “property” tax every year).

Depth Charge,

Interesting numbers. They don’t lie.

In my area the comparison is even more astounding. The only house for sale in my immediate neighborhood has a $1.9M price tag. It’s a nice but small 3/2 rambler with 1800 feet, two car garage.

A much bigger 3/2 home down the block with 2800 ft., more common area, and a nicer lot rents for $3800/month, so I have a great view of the buy v. rent situation in my area. Most people would say the rental home is superior to the listed home, but I’ll be generous and say they are comparable.

If the home seller were to sell his home for only $1.7M (a $200k concession), he could put that money to work and make guaranteed $85,000/year in interest, avoid $12,000 in RE tax, maintenance cost, and eliminate all risk of quick RE price drops, which is a major concern with mortgage rates rising, prices starting to drop, and the potential quick reversal of a quick 100% price gain in five years.

He can then move his junk to the bigger house down the block and rent it for $46,000/yr, rather than pay the > $97,000/yr ownership cost, which is largely opportunity cost (something many RE diehards fail to understand and appreciate).

Unless you think RE prices are going to magically shoot higher from here, with affordability levels at all-time lows, an obvious price bubble on the charts, and stock prices waiting to tank after major increases to discount rates, it’s a NO-BRAINER!

The guy who sells his house and rents a better home down the block saves over $50k per year.

Bobber,

I don’t know where you live, but if a person can sell a home for $1.7M and rent a better home for less than $4K per month, that does seem like a local anomaly. A rent to price ratio of over 400 is astounding. It costs nearly $4K to rent a 3 bedroom apartment by me and homes that expensive will rent for well over $6K, which is still a very high rent to price ratio. I guess these anomalies are why everyone needs to assess their own situation. I don’t think you can extrapolate your local situation, which sounds very extreme, to other markets.

Similar thing here in South Florida, although not as extreme.

Houses that rent for $3,500-$5,000 are still selling for $600k-$900k.

Bobber-

The $800k houses around here are sh!boxes. 3/1 in a working class neighborhood that need work. Starter homes. We are in the biggest real estate bubble in the history of the world. Anything nice is over a million. It is so absurd as to be comical. Wages don’t support this nonsense by a long shot. A 50% crash won’t even get back to affordability.

Bobber:

I am originally from Chicago…. left in 1984. Lived in Western PA, Philly, Connecticut, Oregon, Coastal CA (Seal Beach – Orange County). Now live in the SW (Scottsdale). Seal Beach is about as “Coastal” and about as expensive as just about anywhere for an average schlub. We lived 15 minutes by bicycle from the sand. 10 in a car because traffic lights. In the current market, it’s *worth* about $2M. Sold it to a young Asian couple with a couple of kids. Early 30’s – she a public school teacher and he was/is an investment advisor.

Opportunity cost? The house I presently live in is a *free* house. The profits from moving over the past X number of years (in both recessions and positive markets) paid for it even after satisfying the mortgages (if any). The purchase price on this barn plus upgrades would earn me @$25K a year in taxable interest @5%. Rent on a comparable house is $4-5K in this hood. Current *market* value is up 40% in the current market. If it falls 40%, I’m out less than the price of a 15 year old Civic. Try that with your rent receipts. We live here for @$2K a month – all in (taxes, HOA, trash, cable, broadband, insurance, electric, water, sewer). $2,500 if you include the sinking fund. We *pay* ourselves a monthly amount for *rent*. Silly, but it keeps spending in perspective. Oh… and the rest of the equity we had remaining from the other house? It’s pumping out more than the *lost opportunity* the other poster flaunted of $40K. The key is to never spend equity. Never borrow against your home. Never spend bonuses (we invested them every year). It’s a bonus. Treat it as such.

To the poster that said experience from the 80’s and 90’s isn’t valid. My response to you is “hahahaha”. My parents paid their retirement with their home sale profits which their timing and 17% interest on CD’s they took for 7 years – and left me a small grubsteak – which I gave to my kids as I didn’t need it. My parents bought their first house in the late 1940’s. Worked for them. My grandparents? Bought theirs in the early 40’s and could have been the source of funds for their retirement. They were able to live off of Social Security and a small pension (he was a machinist) and left the house to their kids who split the proceeds. Before that, I don’t know as they came through Ellis Island from Germany… my wife’s great great grandparents rural homestead in the Czech Republic is still there. The family still owns it. Great place to bug out if the SHTF. So, in looking back a over a hundred years, owning real estate worked…. Think long term, not short term. Serves you far better than tripping over $10 bills to pick up nickels.

As far as “deferred maintenance”, it doesn’t happen here. We have a sinking fund to pay for such events. We put $500 a month into it. It’s now about $35K and earning 5% (it’s sequestered – just like our medical funds). Smart people insure against failures. We have a homeowners (HO-5) policy along with a major systems endorsement (covers A/C, hot water heater – which is solar, built in appliances for somewhere about $60 a year – so far it’s paid me out $5K and I’ve put in maybe $400 in premiums). We also have a supply line endorsement which covers the water line from the street to the house, the sewer main, and the buried electrical lines. Probably $30ish a year (too lazy to look). So, those big scary expenses you tout are, for the most part, nothingburgers. Paint? I bought a commercial airless spray system several houses ago. This rambling house took a week of 4 hour days – including pressure washing. Paint costs were $1,500-ish, masking plastic, multiple rolls of tape, two battered t-shirts, and a pair of Costco shorts. Didn’t even require a step ladder (bought the gun extension). Roof? Had it replaced from our sinking fund two years ago. Has a 10 year renewable warranty if I have them maintain it at 5 year intervals. The average schmuck that claims housing maintenance costs are onerous didn’t spend enough time figuring out how to mitigate them.

We didn’t start out with jack. Our net worth when we returned from our hornymoon was -$3,300 USD, not counting my wife’s student debt. By our first anniversary we bought our first house. I made $9,100 a year and my wife $4,000 (part time teacher). $75K in today’s inflated $. It was just more important to us than a Corvette or a vacation at Club Med (when that was a thing).

I dont see either late stagers or recent buyers selling here (Florida) Mostly lots of folks waiting to buy… and waiting… and waiting.

Most are waiting for either interest rates or prices or both to drop and it’s just not happening.

I agree that is happening in areas of the country with low and mid-level price points, say $500k or less. I wouldn’t be concerned about buying in those areas as potential downside is fairly limited and the pool of potential will always be large. The rent v. buy comparison may even support buying in many of those areas.

Once you get into price points above $1.5M and above, which is typical in the mountain, coastal, or other high demand areas, most rent v buy comparisons clearly favor renting by a wide margin. In fact, I know that many of the folks living in my area couldn’t buy their own houses at today’s price, based on their income level.

Florida will crash. It always does. Everything has gotten worse: crime, traffic, cost of living, insurance, weather (hurricane). It’s gonna crash hard with an inventory increase.

CCCB, I don’t know where in Florida you are, but down here in Palm Beach/Broward Counties, I’m seeing a TON of listings of people who bought in 2021-2022, and sometimes even in 2023.

“You can sell the overpriced home for a nice price, put the money in a long-term CD and earn 5%. ”

LOL. In the last 15 years, how many have been >2% yields? Like, two? That 5% is hardly reliable.

Well, right, that’s the crux of this right? The asset markets are priced as though the current 5% yields are a blip, and we’ll be back to ZIRP/QE in a year or two.

If that is true, then the assets are likely priced correctly. If it’s not true, and those 0-2% yields were an anomaly, and 4-6% (or higher) is the foreseeable future, then assets are obscenely overpriced.

Whether or not you’re holding assets or cash at this point is based on where you think yields will be next year and beyond.

You need to check the facts on the ground.

I did check before posting, and you can lock into a 10-year or 30-year treasury return at 4.8% right now. That’s guaranteed. Throw in a small mix of ultra-safe Grade AAA corporate or Grade AAA municipal, and you are easily over 5% ultra-safe interest over a long 30-year time span.

Here’s the thing though, am guessing you’re American, Here’s the shocker, in Vancouver or Toronto, majority of average homes do not contain this extra footage you mentioned ie an acreage size big lot, nooo these are your average tiny homes in average neighborhoods most are townhouses and borderline hood or Ghettos as it known south of the border, believe me I am Canadian lol

I’m shocked the global housing markets have held up so well as the US bond market implodes. Per Bloomberg, worst total bond loss in the last 150 years for the USA, in which the world tends to not ignore when setting rates globally…

“Bondegeddon” is real in relative terms (not absolute levels), per Bloomberg:

In terms of total returns, this is the biggest bond market rout in 150 years. Last year was in fact US bond investors’ worst year since 1871, with a total return of minus 15.7%, even worse than the annus horribilis of 2009. For 2023, the year-to-date return has been almost minus 10%; annualized, that’s minus 17.3% — even worse than 2022. We are looking at bond investors’ two worst years in a century and a half.

We all know the reason for the bond rout. The Fed is monkeying with the money supply, and it has no respect for consequences.

It’s no coincidence the greatest bond losses in 150 years occurred shortly after the Fed embarked on its radical QE money printing program.

The 20% inflation we’ve seen since 2020, and insane RE prices are other consequences.

To be frank, the Fed has been completely short-sighted and out of control.

The Fed needs to continue raising rates and start selling its asset portfolio at a quicker pace, including the MBS, before the consequences deepen.

Well it is what it is, people paying a premium over what the price should be.

It goes back to whether the home prices will collapse when the excess of monetary stimulus is mopped up.

Personally, a couple of pct decline in the price of an asset that I consider 40 – 50 % overpriced doesn’t seem to be anything that sellers should be concerned about.

Still nosebleed territory. Cheaper to rent for canucks?

It’s *way* cheaper to rent.

Prices will fall further or CAD will if they cut before the Fed.

BoC talking about another raise this week because they have to raise if the Fed raise, so they are preparing the ground to make it look like their decision.

Absolute clown show.

Some fool in the other thread was saying that the rent and sale price disparity means rents have to come up. No one can ever realize that sale prices can come down.

Rate spike will be required to deflate prices and allow for lower rates in future that make U.S. debt service manageable. Be ready, the deals will be amazing!

It does not suit him that house prices fall, but he dreams of rising rents. He must be a rentier – a dreamer, lol

I want everything, the entire financial system, to crash and burn just to have the schadenfreude when the speculators, investors, and other parasites lose their shirts.

IMHO the idea that rent prices have to rise to match the mortgage costs is precisely what current Canadian government aims to achieve. This government is firmly on the side of home owners, and props them up with various actions (like extending amortization periods for distressed homeowners, or flooding the country with hundreds of thousands immigrants annually, etc.)

Government is the one who insured all these insane mortgages, and may well go broke should all these over-leveraged home owners start to default on their recently bought homes. Squeezing extra cash from renters (perhaps all their cash) in order to prop up housing market is seen by the government as an additional defense against housing crash.

They said that because rents only go up, which is why owning rental property is a great long term investment. Notice I said long term investment, not short term trading vehicle.

“…rents only go up…”

This is a classic misconception. You’re confusing the national rent indices with local rents where tenants and landlords actually operate, and where rents can actually plunge and stay down for years or decades.

This happened in Tulsa — know from personal experience. Rents collapsed in the mid-1980s, and didn’t recover to 1985 levels until maybe 30 years later.

And it happened in San Francisco, where rents plunged during the dotcom bust and didn’t recover back to 1999 levels until 2012.

There are lots of local examples of plunging rents that stay down for a long time. And tenants/landlords are local, not national. If your property was in Tulsa, it didn’t matter what the national rent index said. You had to rent to local tenants, and you got what the local market allowed you to get, or you sat on your vacant rentals forever.

Agree. You can buy an overpriced home, then watch the rents and home price plummet. Uncertain times and monetary experiments bring serious risks to the table that didn’t exist the past 30 years. The platitudes and beliefs that developed during times of extreme stimulus can be very dangerous.

Bobber, the new meme among real estate apologists is that prices can’t drop because lending standards are higher than they were in 2006-2008 (in other words, no subprime loans, NINJAs, and so on).

They forget two main points. First, most people don’t have enough cash saved up that they can pay their mortgages indefinitely if they lose their jobs. The Fed has publicly committed to getting inflation under control. I, and many others, don’t believe they can do that without a recession.

Second, prices are set at the margins, and psychology plays a larger part than anyone is willing to admit. As people start listing houses, realizing that the “good old days” of 3-4% mortgages are gone for good, psychology can change very quickly.

Wolf: I remember reading about OK and TX apartment developers getting killed in the 80’s but it seems like most rents were back to pre crash levels within a decade (I don’t remember hearing of any well maintained apartment that was still getting 80’s rents when Obama was elected). In the 90’s I was working for a company that bought a portfolio of AZ apartments and I had lots of data going back to the 70’s that I graphed with Quattro Pro that showed when vacancy went down rents went up with values and building permits. When the thousands of new apartment units were built vacancy went up and rents rents, values and building permits dropped like a rock…

ApartmentInvestor,

You didn’t get the message. You don’t rent in “OK and TX.” You rent in a specific LOCAL market. Dallas was very different from Tulsa. All the oil companies moved from Tulsa to Houston. Houston started doing pretty good, while it was a depression in Tulsa. That’s why I said LOCAL.

You’re fooling yourself if you think “OK and TX.” You need to think TULSA. You need to think SAN FRANCISCO. You need to think in terms of a local market. And in local markets rents DO go down a lot and stay down for a long time, while rents may be booming in a city a few hundred miles away.

Einhal, I agree.

Unfortunately, 30 years of interest rate drops and easy money policies have weakened the minds of of RE investors, particularly those who lack knowledge of finance, macroeconomics, alternative investments, opportunity costs and asset price discounting. If a person doesn’t have a handle on these things, and they just monitor current price levels to get a feel for what is happening, they’ll never gain any insight as to what is GOING TO HAPPEN. They’ll make decisions based on the past.

The fast-moving bond trading professionals quickly realized the changing macro and were first to react. That’s why long-bonds have lost 30-50% in value in a few short years. Commercial RE is well informed, and that is dropping too. This same turn in macro and long rate picture is going to attack residential RE as well, but many Ma & Pa RE diehards will need more jabs to the head before they understand the financial dynamics in play.

It goes without saying, results vary by location, but the sheering has clearly started in the Coastal and high-end property arena.

The party will come if interest rates stay at these levels. The mass refinance in Canada is at 5 years

If I understand correctly, the Canadian mortgage industry structures rates to reset periodically.

Are there stats that indicate:

~ what proportion reset in the next 1, 2, or 3 years?

~ what proportion of homes are 100% equity?

Also, has the current mortgage regime (using adjustable 5 year rate) been in existence for many decades? Specifically, it would be interesting to see home prices held in past rate-hike cycles (e.g. 1987).

(Apologies if these are questions covered in past articles or posts that I missed…)

The 2008 crisis did not affect Canada the way it affected the US and the rest of the world.

The bubble continued to inflate in Canada.

Therefore, today the Canadian real estate bubble is the largest in the world.

There is no way Canada can get away with the problems of other countries again.

I must challenge that claim: we have the biggest bubbles in the USA. The crypto crap bubble had its equivalent only in the tulipmania of centuries past. Our commercial real estate would collapse in value if certain people were not too afraid of how obviously insolvent their entities would be shown to be if the losses were realized; ditto for residential rral estate and auto loans now going into default. Once a big recession hits, we will be revealed to have the biggest and best of the collapses, bubble bursts, massive bankruptcies, biggest fraudsters, etc. USA is number 1 now! USA, USA, USA! LOL

What we will see in the USA by the way it, is what happens when the crooks do the regulating and have the power to bail out their cronies with generated dollars— for many decades now. Read “The Quiet Coup” by Simon Johnson.

RH,

I think it was a year ago when Wolf wrote:

Home prices in downtown Toronto are 5 percent higher than in Manhattan.

Prices in the suburbs of Toronto are FOUR TIMES higher than in the suburbs of New York.

The GDP of all of Canada is the same as that of New York State.

PS: the res RE in Canada is at least 50% worse than US. This is not my number, you just have to surf a bit to find it.

Some reasons: 1 the pop has always been less into stocks, and the Can stocks have in fact given lower returns than US. There is no type of Nasdaq.

2 The extreme concentration of the pop. About half the pop of BC is in metro Van. Here a beef of my own: about ninety % of BC is not available for habitation. It is Crown land. As soon as u look over the border in Wash, small parcels of a 1 to 5 acres drop in price by 30 to 50 %.

3 There are no 30 yr mortgages. About 20+ % are variable, they fluctuate month to month. These are the ones feeling the pain, but when they are forced to sell, they will affect the rest of the market.

“Are there stats that indicate:

~ what proportion reset in the next 1, 2, or 3 years?”

I don’t think there’s a publicly available stat for it, probably the banks have info like this on their customers. Since 5yrs is by far the most popular term and homes get bought every year I would assume the number of refinances happening every year won’t be vastly different though.

What’d be more interesting to visualize is the number of homeowners who bought in at various price points. There’s a ton of people who are nowhere near those peaks. So dramatic falls in price are affecting a very small number of homeowners. Interest rates will affect everyone in time but many people should be able to handle the cost outside of the most recent buyers.

Having said that, RE and Construction combined are like 21% of Canada’s GDP. So if sales stay down it will have an effect on the economy. All the projects that started will continue but when they’re completed I think that’s when the slowdown shows up in other stats.

Thing is though, we trade something like 70% with the US, if US economy keeps chugging along it might not be a catastrophic recession here. In reality we are still short labour in trades, in our company we are still understaffed on large city projects across various provinces, other sectors of the economy might hold up better. It’s not yet clear that we are going to have a 2008 type scenario played out, it depends on US economy as well

As far as I could gather, total residential mortgage debt in Canada hovers around C$ 2T, with circa C$ 320B refinancing in 2023 and C$ 370B refinancing in 2024.

The smaller refinancing (since 20% of C$ 2T is C$ 400BI is probably due to early refinancing to take advantage of lower rates in 2020 and 2021.

‘Popularity of fixed versus variable mortgage rates

Moreover, according to a report published by the Bank of Canada, variable-rate mortgages accounted for roughly a third of Canadian mortgage debt by the end of 2022, as compared to just 20% in 2019.’

So a third have no term, they go up as soon as the rates go up. This is the crux of the crisis, it’s happening now. Folks who were at 3% have seen it bumped every month until now at eight.

The auto plunge for 5 year was popular before rates went lower and lower, frustrating folks who went 5 yr.

My bro-in-law has had a variable mortgage since the GFC. He’s been a self proclaimed genius of the family. But amazingly he never refinanced into a fixed rate during the pandemic. He’s very quiet about it now, what a colossal mistake.

Canadian government officials will try everything in their power to keep the bubble blown. They are allowing massive influx of immigrants, with minimal new housing. They are allowing banks to refinance people into longer mortgages to reduce monthly payments in order to keep them paying on their ridiculously overpriced homes.

This is the opposite of what government should be doing. The more egregious example I can think of is how people in Hong Kong are stuffed into deplorable housing conditions, while the bureaucrats and land owners make sure that the supply of good housing is never increased to the point where it balances the supply-demand equation.

When you fly over Canada or the United States you realize there is abundant real estate that can be developed and that the scarcity of housing is a mere function of government policies and corruption.

If you want affordable housing, reform the government regulations on housing and reduce the flood of illegal immigrants. Or here is an idea – let’s tax undeveloped land at a higher tax rate so that people who have no intention of actually building on it are forced to sell and thereby provide an abundance of low priced land for developers to increase home building. I read online that government fees and delays and regulations add $100K to the price of a home. Not sure if that is true, but I do think that if the federal housing agency were to focus on incentives to reduce building costs and maybe also helping the industry to become more cost efficient with new building techniques (current building techniques are hundreds of years old), that could also provide affordable housing for all.

Nearly all of the problems government creates is by trying to fund the demand side of the equation to help out businesses, thereby distorting the prices paid, instead of creating an environment that increases the supply to help out consumers. Greater supply, and competition, always leads to more prosperity for a greater number of people and less billionaires. Insurance, education, healthcare and housing are some of the industries that enjoy the greatest amount of government support and also have had the highest inflation as a result.

It isnt rocket science, it is simply the greed of the rich, again, with government serving the interests of the rich.

You really need better sources of information. Turn off nutty TV. It is rotting your brain and taking advantage of you.

Seriously, why let them take advantage of you like that. Educate yourself si you cab up to the nuttiness.

A lot of Canadians had variable-rate mortgages, so they’re already getting hosed, though some are arranged such that the payments stay fixed and the mortgage total rises accordingly — until the term is up and then it must be financed again. Those people will face a reckoning as the terms expire, but I don’t know either the percentage that such “homeowners” represent, nor the number of years it will take before all of them are forced to refinance. A rough guess might be 20% of variable rate mortgage holders each year?

Others (like me) are getting dinged as our fixed-rate terms expire. I took a 3 year fixed, the payments for which are significantly higher than the 4 year fixed that expired last month. I didn’t break my mortgage when the rates bottomed during Covid because the penalties for doing so here are painful. Turns out I was going to get burned regardless. I don’t know how many “homeowners” face this annually, but again I would guess about 20% of fixed-rate mortgage holders?

So maybe within 3 years or so everyone will have been forced into the higher rate environment.

What I’ve done several times is to extend my existing mortgage balance to ten years. No penalty with Scotiabank.

In October 1987 the Dow Industrials dropped 30%. That was a rout! And it happened as/because US Treasury rates were rising. Rates had risen from about 6.5% to just under 10%, and it finally broke the US stock market (at least temporarily).

Anyone here have records or a recollection of how the real estate market (Canada or US) acted in the preceding and following 2 years?

It’s something like 20% of mortgages that have to reset their rate per year. Because almost all are on 5 year terms. That will possibly not hold on the future, but it doesn’t matter for what we are looking towards. The drop off in Canada real estate starts I’m 2025, 2026 if rates remain 5% or higher.

To repeat:

‘Popularity of fixed versus variable mortgage rates

Moreover, according to a report published by the Bank of Canada, variable-rate mortgages accounted for roughly a third of Canadian mortgage debt by the end of 2022, as compared to just 20% in 2019.’

The five year term, once the norm, went out of favor as rates went lower and lower. As with SV Bank etc. etc. there was no expectation of them rising. So like SV Bank. about a third of Canadian mortgagors are trapped.

Correction:

It would be interesting to see how home prices held up in past rate-hike cycles.

Yes, your exasperation is palpable. Some of the population hope the whole thing collapses, which I don’t.

Unfortunately, I suspect that housing prices will decline suddenly toward the market clearing price which currently lies 40 pct or more below the price that the buyers are paying.

If the market was a free, competitive market, rather than a child of QE. The price of housing has been manipulated by the federal reserve policy.

Assuming that housing prices are free to fall is a fools bet. The Central bank created and controls the excessive price of housing. They are likely too intervene were the price of housing equilibrate.

Wolf …Everyone needs a Holiday. I am poor but I Take one for two months every year!

It is clear, that as a result of Zero or near zero interest rates the USA Fed is juggling huge balls of its own making.

You have been clear, it is slowly unfolding until it crashes into a heap of bank defaults and job losses… come back and enjoy everything New York maybe toast but it is not the World.. Sri Lanka showed me that life is short, live it, every day.

But I forget, you are driven….. That is a fools errand. Please take a break ! but thank you for your service to many . Take a break please.

Howdy Thunder If you worked those 2 months, you might not be poor anymore?

Lol!!!

I think Wolf took some time off to motorcycle thru 4 continents. Or maybe it was 40 countries. Found his better half in Japan. Then rode motorcycle back to San Francisco. I could be off on geography, but pretty cool holiday.

3 years, 100 countries, without motorcycle.

Omg, I did not know we had 100 countries. And I’m even counting Canada. That is quite an adventure.

Got you mixed up with Sadghuru “Save the Soil” tour :)

@andy,

You’re thinking of Jim Rogers. He rode through a bunch of countries on a motorcycle. He even wrote a book about it, “Investment Biker”.

Fantastic start to the weekend.

Let’s remember what Canadians believed a few months ago:

– they won’t raise rates – wrong!

– prices will stay high “because of demand from immigrants”. Wrong!

– If prices did fall the government would prop them up “because people need high prices for their retirement ” – wrong!

40% of Canadians don’t understand who sets rates, erroneously thinking the government sets them.

What have they learned this far into the crisis?

NOTHING.

georgist

Glad to see you happy again

Caveat emptor.

“Let the buyer beware”

Canada has adjustable rates so totally different story vs the USA. No doubt their socialist govt will step in with “fairness” programs to fix the rates, etc. As a current home buyer here in the USA, sale/comp home prices (not wish-list prices) remain at/near their record highs due to 30 year fixed rate-lock, and there is record low resale inventory. Unemployment also near record lows and FED refuses to sell MBS. Decent homes sell within hours/days. There is simply no “price-crash” coming under these conditions.

Quebec anyone?

Quebec is weird. So much of it is a complete mess, yet nearly everyone is driving a leased newish SUV.

The roads are just so bad.

Wages are not high.

Taxes are high.

Healthcare is non-existent.

The province guaranteed an “adult” (not a teacher) in every classroom.

Generally it just looks pretty run-down.

Immigration is just *huge*. Traffic jams at all hours of the day, every one in two people looks Indian or Chinese. The government are lying about immigration levels.

In my job in tech it’s been flooded with cheap Indian/Chinese “developers” on work visas, who are nearly all ten-a-penny in terms of skillset and should 100% not have been granted any kind of “specialist” visa as any Canadian graduate would be at least as good.

So why is the government letting average developers in?

1. they force down wages

2. they force up housing prices

2% increase in population (and the rest as the govt are lying) and GDP is flat, plus they lie about inflation so the deflator used on GDP overstating “real” GDP, therefore real GDP is negative despite a 2% increase in population.

Nobody is having kids domestically, all the population gain comes from immigration.

Forget zombie ZIRP companies. We have a zombie ZIRP country.

Sounds as though you should become an immigrant yourself and move to another country.

Although I’m a firm believer in the old adage ” No matter where you go, there you are.” And therein lies your dilemma.

I keep hearing this dumb trope, and it’s really annoying. Western countries have had enormous amounts of immigration, largely imposed upon the people by the elites, political class and intelligentsia. Why should people be forced to absorb huge numbers of people from alien cultures, when the housing market, job market, and infrastructure clearly can’t handle it?

Careful…that slope is slippery and there’s a nasty wall at the end (and I don’t mean *that* wall).

I might zoom out another magnitude: one of the most dire issues facing humankind is that there are eight billion of us, and all vying for first world amenities — it’s too much.

I am constantly amazed at how few people realize immigration is a net positive for a given country.

“every one in two people looks Indian or Chinese”.

LOL

Ignorance on parade……

Suckers Rally Indeed, I think anyone who gets in to any aspect of the housing market ( other than foreclosure operations) as an investment over the next few years is a Sucker. It can still be an ok time to buy a house to live in if you are willing to put down the Zillow ” Crack” and just live your life and ignore the value of your house. But anyone who thinks dabbling in it is a substitute for a real job will be taken to the woodshed by Mr. Market.

People buying overpriced homes to live in will suffer as well. A lot of their future earnings will be spent on the home that is declining or stagnant in value. They’ll have no money left over for savings in a high yielding environment. There’s a huge opportunity cost to buying that overpriced home.

The buy v. rent equation is dramatically skewed in favor of renting in nearly all locations. A few years of renting could greatly accelerate your wealth buildup. Even if you think your rents would be high, it surely beats the alternative of losing 5x that in equity and watching RE tax and insurance increases bleed you to death. RE tax increases in my area were 20-25% last year.

I would be interested in knowing how many people that criticize home ownership, rental properties, second homes etc. actually own or have any direct experience in that regard.

I ask only because as someone that does, I see so much inaccurate speculation on these subjects. Quite similar to those that make statements regarding finance or ecomonic issues that Wolf blows apart with the actual facts

Agree. We have been debt free on housing and rental property for many many years having made home ownership a priority from the age of 23. Now that I am in my late sixties, I worry about some friends who are facing the reality of renting in their senior years….in a rental market that is simply not affordable unless you are making big bucks. One couple I know just keeps moving to crappier places every few years. They take what they can get.

People forget these issues work in cycles, like a pendulum swings. As someone who once suffered a mortgage increase to 18% in the early eighties when my 5 year term was up, I have been amazed listening to current hopeful folks saying they could ‘handle’ a 7% mortgage. Well, that was our first mortgage rate on our first house. Oh yeah, got laid off at the same time and had to work away on 3 month contracts. Had a big garden. Did cash jobs under the table. Whatever it took to get by. I also remember my Dad saying interest rates would most likely never go below 12% in our lifetime. Well? He didn’t live long enough to see this free money cycle. Lately people have said rates will never rise very high because the economy will collapse and the Govt won’t let it. Nuts. It’ll do what market forces dictate and the only way individuals can weather the swings is to be debt free or at least be low in total debts.

Pretty soon the toys will come up for sale. Meanwhile, in our corner of Vancouver Island RE sales are non existent, but the prices have not yet begun to drop, at least not here. The last downturn, around 2010?, my neighbours across the river wanted a million for their place. It sat and sat on the market, and finally they sold it for $450K to people fleeing Victoria.

If folks manage their debts these swings are just interesting. But that means when times are roaring along and flush people need to remain on budget with a plan for an eventual downturn. And in a downturn people should also have faith it won’t last forever, because it won’t. It can get a while lot worse before it gets better. I grew up on stories about The Great Depression. My folks and in laws had a terrible time. We’re a long ways from that.

regards

Shooting the messenger is weak. Try disputing the message instead.

Paul-

Thanks for the wisdom concerning debt, cycles, human nature, and hope!

Doug, Glad to see Im not the only one recognizing a lot of folks parroting bullshit they know nothing about.

When Wolf writes about things I’m not familiar with, I read and learn and keep my mouth shut rather than spouting off a bunch of idiotic crap and showing my complete ignorance.

More people here would do well to do the same. I know real estate from a lot of different aspects and experience and most of what is commented here about the subject is unadulterated ignorant horse sh**

Paul S, I see this line of reasoning from your generation a lot. The fallacy is believing that, since buying assets (housing, stocks, bonds, etc.) over time since the early 1980s has been a good investment, it will continue to be.

The 1980s and the 30-40 years that followed saw a boom that was based on a series of factors unlikely to ever be seen again. I agree that making homeownership a priority since the age of 23 for you and remaining debt free has served you very well. I’m not convinced that someone 23 today who buys a house is going to see things the same way (assuming he can afford to buy in the first place).

The question for people is whether an asset is a good hold TODAY. Not whether it was a good hold over the past 40 years.

Yes, your peers who never purchased got screwed in a lot of ways, and it will make life more difficult for them. But that doesn’t mean that someone who is in their 20s or early 30s today should always buy, because “over time, housing only goes up!”

Owned rentals for 40 years. Thought I knew my tenants pretty well. Long story short. House tested positive for meth. Disaster. Good Luck Doug.

Thanks Gomp, but I don’t ever rely on luck. I do screen very strictly and in over 20 years of being a landlord have had none of the issues that other people have had by not paying attention to their business.

Never had to use any deposits to repair, never evicted, never had any bad endings. In fact, many past tenants are now friends.

Maybe I’m just lucky, or maybe I actually know the business and pay attention to the important details that others ignore. I try to learn by other’s mistakes so I don’t make them myself.

Thanks for your contribution!

Doug, Paul, lets catch up in a couple years and compare RE notes. It’s about the future, not what happened in the distant past.

Well Bobber, I will be in even a better position in a couple years.

Properties paid off, rents increasing. Property values don’t matter at all as they will ALWAYS be worth more than I paid for them years ago. And even if they go to zero, which ain’t going to happen, it still doesn’t matter because they are a hard asset storage of wealth that I got for free.

Yes, I got them for free, after many years, because my tenants paid for them for me.

People that don’t own rentals don’t seem to understand that the property value of the house means nothing, as they continue to pay a great dividend every month. And they also do not understand the many tax benefits that they allow.

Those wishing for a crash that wipes out all evil investors and homeowners that were so “foolish to buy now” are crying because they are not in that club. Instead of wishing for disaster, why not do what you can to join, it really isn’t that difficult to learn folks.

Doug glad you did well, but my focus has been on predicting future price movements. I’ve never said RE investing is a bad idea in general. To the contrary, it can be a great investment at times. But, like everything in life, timing is everything.

I’ve said that, right now, it’s a bad time to buy and a great time to sell in overpriced areas that have seen abnormal price appreciation, and I haven’t heard much on this message board to counter that contention, aside from arguments saying prices haven’t moved yet or gains were amazing in the past. That’s not analysis. That’s a weak stool to sit on.

I’m in Burlington, but we bought in 1997. I think we’ll be OK.

Once that price drops get really serious, it’s hard to imagine that they’ll let them fall to the levels that they should be at. I predict some really asinine government intervention to “stabilize” prices. Some politician will appear with an UMC family that had to give up one of the Mercedes because of the drop in their overpriced dwelling. I can posit some really malignantly evil financial machinations on the part of government to rescue these folks from their patently bad buying decisions.

Canada has a tiny currency. Any govt bailout will be punished by lower CAD, which will then feed through into inflation, so back to square one.

There is no way out of this when the Fed are not also conducting loose monetary policy.

Well, no way out other than the one way that Canadians hate: working hard and adding value to create wealth. They prefer mortgaging their kids’ future for free consumption.

Google “investing com yield curve canada”, look at how inverted the Canadian yield curve is compared to the USA one or even the UK. This suggests that bond investors expect BoC to lower rates and for Canada to have one whack of a recession.

They’ve created a real mess here and it just didn’t need to happen. Adding millions of people with dubious value addition, putting pressure on housing so that property speculation paid more than starting a business, the results of these crazy policies have destroyed quality of life for most.

Agree, bailouts at this point would be very risky, with long-term rates breaking out. Central banks say they are going to tackle inflation, but more and more people are now saying “show me”.

Ask a long-bond holder how they feel about governmental stimulus and experiments with the money supply.

Not sure why you limit that to Canadians hating it. Americans hate it too. Americans think that an ever increasing standard of living and ability to sell debt and print currency is a birthright.

USD is the reserve ccy, cad is totally different. Canada is not the USA.

USA: rule maker

Canada: rule taker

Saw and heard a few ladies complaining that the price of a dozen eggs increased from $3 a dozen to $5 a dozen, with the 18 egg tray from $4 to $7 a tray.

Glad I stocked up on canned beans and rice. The 71 cent Loonie isn’t helping with groceries either, because that California cauliflower will cost more.

Loonie 73 as u write. While back I put about 100K into 1 yr GIC at 71 so in addition to the 4.7 % guaranteed, have over 2% bump.

For sure Can finances dubious but compared to US, which is about double in debt per person, I see more upside than down to loonie. Canada Feds cracking down on spending, telling most depts to cut 10%, US adds another T every 2 months.

Btw: I disagree with Lib gov telling defense to cut a billion.

The US knows we’re free loaders. ‘you bring booze, we’ll bring ice’. This is not how u get respect.

Canada gov per capita is about half as indebted as US. Canada Fed debt about 1.5 T vs US 33 T and rising faster than Canada’s.

Vancouver what an amazing home price environment must not be many sellers with prices still so high and enough buyers to keep prices up.

Enough buyers for sure. Like one or two billion at least

“I was in Canada once, but that doesn’t count ’cause it’s like attached.”

Definitely seeing some cracks show up in the housing market in Canada, but it is still early days.

Crazy high immigration/rents probably does put a floor on prices, but given the dependence of the economy on residential construction / housing, a prolonged price decline could start to generate a lot of downward momentum and get out of hand for a while before investors come in to buy stuff up on the cheap.

Not much to do right now but sit and watch, another rate hike would be a mistake in my opinion.

I would be so angry about these home prices, but it’s Canada, not Texas.

Don’t worry. Texas will catch up. The median home price in Austin is $US 480,000 which is equivalent to $CAN 656,000. Give it a little time.

I sure hope so, then my $250K 1,500 sq. ft. home will be worth $500K? That would certainly help my longevity as an old retiree as I can sell it and move into a rental.

Off topic but I wonder if anyone made a student loan payment this month.

No one is making any student loan payment. The govt is hell bent and working furiously to make sure no one starts paying student loan.

Sold my paid off, and very nice suburban home of 36 years, and bought a rural ranch on 10 acres on a lake, nearly surrounded by 2,000+ acres of state lands. For a roughly similar valuation, I pay about 40% of what I used to pay in proprerty taxes here.

No debt, and living within my fixed income. For what I don’t spend on a mortgage or rent, and the lower taxes, I can easily repair or replace a lot of major stuff and still be money ahead. So far in 3 years, a new roof, a new furnace and AC, a 14Kw whole house generator, about $32,,000 spent so far These larger expenses may occur every 20 to 30 years or more so their costs spread over time are really very small.

Sitting on my deck, with no noise whatsoever, overlooking the fall leaves, electric blue sky, the lake, and the hills of the state park acreage on the far side of the lake is simply priceless. If this property value goes to zero, I’ll still be here enjoying the heck out of it. Being debt free lets you do some real living. It is a truly liberating experience. Highly recommended for peace of mind and a life style on an entirely different plane.

New build permits are down, on average, around 50% year over year. Peterborough, Oshawa, etc. – Kingston, Ontario I believe is (negative) -150% year over year. Well, so much for the CMHC’s push for over supplying the market in order for prices to become affordable (it was a pipe dream to start with – no credibility). In the next 2 years – 2024 and 2025, roughly two thirds of all outstanding mortgages expire – right now 17% to 20% have extended terms – will they revert back? Will the government (OSFI, CMHC) back stop many over leveraged owners? The next election is now scheduled for 2025 – a federal government seeking reelection with a bunch of homeless, foreclosed Canadians? Oh, things are yet to get even more interesting.

Interesting indeed. There never was an end game in sight for government plans to stimulate housing. Government can reduce interest rates and subsidize borrowers for a long period, but then asset prices adjust upwards, affordability drops, and you have to do the same thing over again, creating a long-term cycle of ever-increasing asset prices.

The problem starts when the zero rate bound is hit and inflation kicks in. Governments then lose control over matters, unless they are willing to look directly at the sun, bring hyper-inflationary scenarios into play, and deal with much higher degrees of wealth concentration and societal strife.

Kicking the proverbial can down the road – that’s the government’s strategy. An ever increasing number of Canadians are also relying on or planning on their primary residence helping fund retirement with very little in the way of savings. Throw in the potential of the government and BOC’s hope of massive generational wealth transfer and I don’t believe affordability is happening anytime soon.

Everybody is still gambling on lower mortgage rates and a return to the artificially low rates in general. This entire economic system was destroyed by the FED and their shenanigans.

Sadly, yes. A couple days ago was the first release/quote by big bank (BMO) economists here in Canada, predicting and gearing back to low rates. I think he was calling for a benchmark of 2.25% by Q4 2025 to Q1 2026. I know outlooks are consistently revised; but it’s pretty obvious what they’re gunning for.

Google the Canada yield curve then compare it to the USA one, if an inverted curve is said to predict a recession then Canada is at higher risk than the USA.

Young men will see no futrure in Canada if jobs, housing and the “American Dream” isn’t provided to them.

It’s the white picket fence, spouse and two kids which many young men had in the developed countries.

Now, developed countries like Canada is entering a feudal system if real estate prices don’t match with incomes. Those who own the land will rent it to the working class who will own little assets to gain wealth.

I don’t think a single woman would be comfortable living in a rooming house with strangers, and paying C$1,000 or more a month for the privilege. This is where Canada is heading towards.

Those who already own land become richer, and those who don’t can’t own, and those who have mortgages will become mortgage serfs for life, hoping to own the property outright a few years before they croak or are forced into medically induced death.

Want a good laugh- look up what former BOC governor Stephen Poloz did after finishing his term in 2020. Well, you might not laugh, maybe shake your head.

“Key” is the key – ha.

If this isn’t insider trading or misuse of public office, then what is?

(Reuters) – Key, a Toronto-based real-estate technology company advised by former Bank of Canada governor Stephen Poloz, said it was launching a digital platform to make home-buying easier by lowering down-payment requirements and removing the need to qualify for a mortgage.

Key said buyers can co-own a house by paying 2.5% of a property’s value, lower than the typical 20% requirement, and then make monthly payments that would partly be rent and partly go into increasing the buyer’s stake in the property.

The company, which counts Plazacorp and Luge Capital as investors, said it would pay the rest of the cost of a house under what it calls a co-ownership model.

Housing prices in Canada have sky-rocketed during the pandemic. In the past year, Canadian Real Estate Association’s home price index has gone up 23.4%.

Google this: “google maps 2300 Angrignon Road Montreal” then go to the street view link.

You will see “big box” stores. You will see they are one storey high and cover a massive area. The stores are generic, have no competition in each sphere of business and are generally depressing.

Then look in the distance and you will see condos. This is where the immigrants are shovelled into.

The condos have to be 20 storeys high “because of energy efficiency, but the big box stores and their massive tarmac car parks only have to be ground level. They cover *way* more ground space than thousands of people do.

Why are they forcing people to live like this, in depressing identikit expensive apartments with “company store” big box monoculture?

No outside space for kids without a parent taking them out, huge area devoted to pointless commerce?

These condos are going up everywhere in the name of “energy efficiency” but it’s really about huge profits per square foot.

Why are you dissing condos? Lots of people do not want to live in a single-family house. I don’t either. We want to live up high with a view, have zero yardwork, and lots of amenities in the building, including a place where the delivery people can safely drop off packages. Lots of condos are far more expensive than houses.

It’s a side effect that energy bills are a lot smaller in a condo.

Off topic – but what about Mark Carney’s stint as Brookefield Asset Manager/director while spear heading a UN climate change organization? Where do they find these people?

It is sometimes referred to as the gamblers fallacy. Since childhood, I’ve discovered that they are absolutely and without question correct, 50% of the time.

It appears as though RE is heading south but that a tired refrain. I’ll believe it when I see it and for now, this is just a gulley…

That’s not a firefly in the tunnel headed our way. It is a freight train doing 70+ mph. Hold on to your hats, wallets, homes, etc. The Postman comes.

I know it when people are lying when they say “prices are going down in my area”, “my neighborhood”, “my city”, “over here”.

Why not post the city or zip code? This way we can verify.

In my area (Windermere, FL/Bay Hill Orlando) the same homes are selling quickly for about 50% more than they were sold for in 2021 with no renovations. These are $1-3 million range and typically lakefront (not canal, although some of those sell 50% more), golf front, and/or guard-gated community with pool and 3 car garage. Over $3m and under $1m sit for longer and get price cuts, but still priced way above 2021.

Not for long! Do you like to try to catch falling knives?

Nimesh Patel,

So then, on your basis, people are also lying when they say “prices are going up in my area”, “my neighborhood”, “my city”, “over here” without posting a zip code?

Wow! You can ask the same of the people who say their prices are going up

Everyone needs to read this over and over again until they understand.

“By our first anniversary we bought our first house. I made $9,100 a year and my wife $4,000 (part time teacher). $75K in today’s inflated $.”

It basically tells that american dream is dead because of the greed and over financialization of all things.

Any family earning 75K today can’t even dream to afford a home.

That family earning $75k can buy a nice home in Tulsa.

Sweet. If both parents have remote jobs they can move there and force out some other family that makes a lot less (Tulsa median income ~55k). That family can move somewhere else and do the same until one family ends up homeless. Oh well, as long as we can maintain exclusionary zoning, downzoned cities, and AirBnB rental empires.

But what if they don’t have remote jobs? I suppose they can both quit, uproot their family, and move for a pay cut?

Something doesn’t add up.

Where I live in Markham, Ontario Canada the average new house costs about 3 million dollars about seven times more than the U.S. average. A new townhouse with no basement and no backyard costs about 2 million dollars. These are unaffordable for the locals that aren’t of the Chinese race.

Why? It’s apples to oranges. The differences between young upwardly mobile white DINKs in 1974 (just a guess) and being DINKs on ~ the same financial rung today are not delimited by inflation alone…to suggest so is specious at best; delusional at second best.

Young people from one generation being able to afford housing while young people from another generation can’t.

Age-adjusted purchasing power is about as apples-to-apples as you can get.

What I’m saying: just because Bobby Bootstraps from 50 years earlier could enjoy the myriad spoils of a working class income does not then mean that his modern day contemporary—making the same income adjusted for inflation—has the same opportunities or enjoys a share a similar landscape. Just look at tuition and/or medical expenses/ insurance premiums

Oil is up; going higher if war in middle east. Grain is also up…. Canada will be just fine. The stock market is fine. Cheap CAD$ is good for exports and inward investment. No crash.

Canada doesn’t rig and manipulate their stock market like what we’ve seen in America for the last thirty years. Good luck you’ll need it.

I heard an interesting comment today from a big home builder CEO, who said 50% of their new home purchasers are not new buyers, but owners of existing homes. So it appears some folks are closing out their low cost mortgages and deciding to move to new digs, despite the mortgage rate increases. The builders might facilitating those moves by buying down the rate.

If you can control for design, build specs & finish-out quality, I vote buy new. Who wants what amounts to a walk-in human crucible chock-a-block with decades worth of old toenail clippings, sneeze stipplings & other bodily secretions, all thinly veiled beneath a hasty coat if Kilz or gray laminate?

And then again, there’s the walls of the fresh build filled with Monster energy drink empties, vape cartridges & urine filled Gatorade bottles.

Living the cdn dream….we’re fine, I think…..if, 30% give or take, fall in res. real estate, from insane high…..The mtgs are hurting, happens much more quickly here than the U.S………cdn ‘normal’ residential mtgs are shorter term, typically 2 to 5 yr term, so interest changes affect 700% higher percentage of mortgage payers per year, for 4 years or so, by which time all mtg holders have been affected, than in the 30 year term U.S……..where notionally, only 7.5% of mtg holders have been affected after 4 years.

I understand the Brits have even shorter term mortgages……so again affect of higher interests affects more, quickly..

People think the price of housing has been rising the past several years. Nope, the currencies are being devalued and it takes more dollars to buy the same house. I have lived in my current house over 20 years. The value of this roof over my head and this living space for me has not changed in those 20 years. It is still holds the same value I seek. The price has gone up but the value to me has not. The house is not bigger, more comfortable, or more pretty. It actually is more worn out, not as straight, and has a few cracks.

What has change is someone will have to offer me 200% more dollars to me to get the same value as i do for this home when i move.

So should i sell and rent and hope for a price crash. With the Federal debt projected to be 50 trillion in 10 to 12 years, it will probably take at 300% more dollars than I paid to buy my house from me.

Honestly, over the long term I would be more worried about rent inflation than housing deflation.

One thing we know for certain is the government likes to spend money.

“ People think the price of housing has been rising the past several years. Nope, the currencies are being devalued and it takes more dollars to buy the same house.”

And by this logic house prices won’t fall as much as some think they should. Inflation is a counteracting force to mean reversion. Two steps upward, one step downward. The greater the inflation, the shallower that downward step will be.

The Bank of Canada tightening bias just ended today as they opted to save the housing industry and worry about inflaiton later maybe much later. Bogus CPI and core CPI figures came down the pipe today. Like I expected the Bank of Canada is there to save the housing market and any possible banking fallout. That’s their apriority concern.

I’m going to whack your theory over the head later today with Canada’s rent CPI, which spiked again to a new multi-decade high, and which is what the BOC is very much concerned about, and has said so. The housing CPIs are not cooling, and the BoC is trying to get them to cool.