Credit cards are a huge payment method but not a big borrowing method.

By Wolf Richter for WOLF STREET.

For the first time in at least two decades, credit card balances remained unchanged in Q1 from the Q4 holiday spending binge, rather than dropping. In the data going back to 2003, credit card balances always dropped in Q1 from Q4, and often by large amounts. But this was the first time they didn’t drop. Which shows just how strong spending has been in Q1, because credit card balances are mostly a measure of spending and prices rather than a measure of debt.

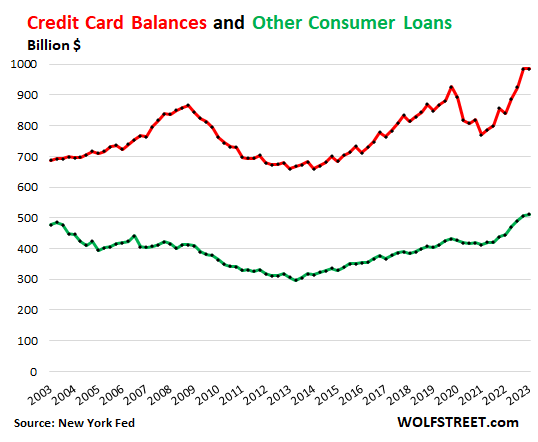

At $986 billion, credit card balances were up 17.2% year-over-year, according to the New York Fed today.

Credit cards as payment method not borrowing method. Consumers use their credit cards mostly as payment method and pay off their credit cards every month. According to the Federal Reserve in April this year, consumers used their credit cards to pay for $4.9 trillion in purchases in 2021.

Most of these $4.9 trillion in charges were paid off by due date and never accrued interest. But because the due-date is after the end of the month, the month-end balances that never accrue interest and are paid off a few days later still show up as credit card balances in the reports. So what we’re looking at here is largely a measure of spending via credit cards and to a smaller extent interest-bearing credit card debt.

“Other” consumer loans, such as personal loans, payday loans, and Buy-Now-Pay-Later (BNPL) loans, ticked up by $5 billion, to $512 billion. Over the past two quarters, they finally edged above the high from 20 years ago. Unlike credit card balances, most of these “other” balances are interest bearing, but not all: For example, BNPL loans tend to be interest-free and are subsidized by the retailer.

Credit card balances (red) and “other” consumer credit (green) combined amounted to $1.50 trillion

Banks incentivize the use of cards as payment method by offering 1.5% or 2% cash-back on card spending or frequent flyer miles, etc. The bank that issued the card collects a fee from the merchant, retains part of the fee as profit and kicks part of the fee back to cardholders as an incentive to run more payments through the card so that the bank can collect more fees.

Banks discourage borrowing on credit cards by charging huge interest rates. And a large majority of cardholders got the memo eventually, and they pay off their credit cards every month to avoid interest charges.

Households are not burdened by these balances.

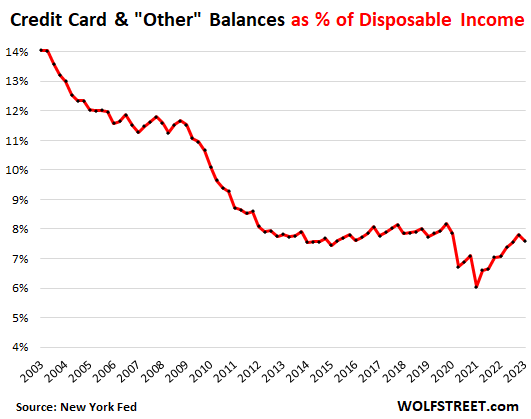

As a percent of disposable income, credit card balances and “other” consumer debt combined in Q1 dipped to 7.6%, after two years of increases from the historic low during the pandemic (disposable income = income from all sources minus taxes and social insurance payments).

In the good old days 20 years ago, credit card balances amounted to 14% of disposable income:

Credit card balances’ share of consumer debt fizzles.

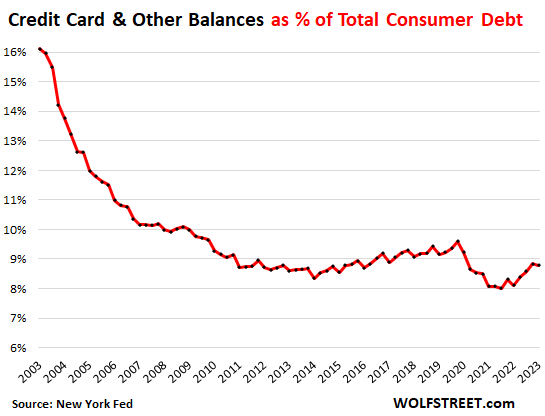

Credit card balances and “other” consumer debt combined amounted to only 8.8% of total consumer debt – which also includes mortgages, HELOCs, auto loans, and student loans. This is down from 16% two decades ago:

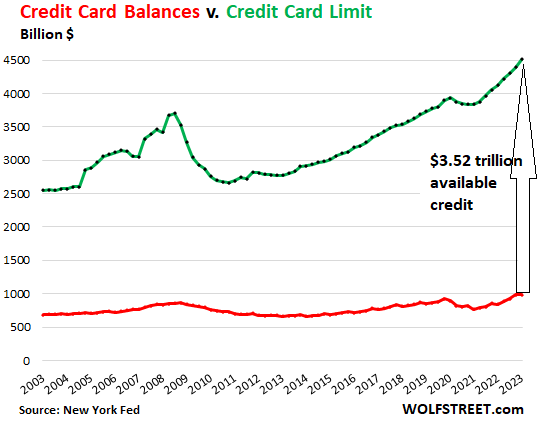

$3.52 trillion in available unused credit.

Despite rumors of a “credit crunch,” banks raised the aggregate credit limits on credit cards to $4.51 trillion. With only $986 billion in credit card balances outstanding, the total available unused credit rose to record $3.52 trillion:

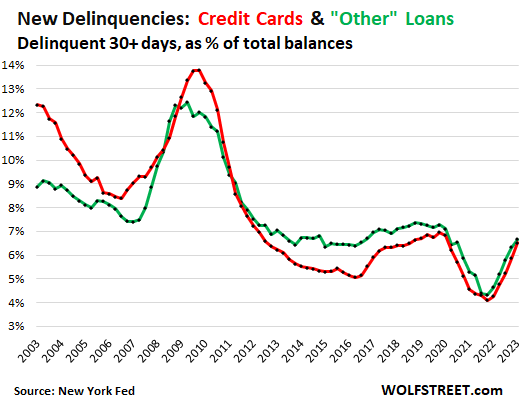

Delinquent balances tick up, but still below pre-pandemic.

The pandemic money, the eviction bans, and the various forbearance programs that washed over consumers had the effect of reducing delinquencies to record low. Those times are over, and delinquencies on credit card balances and “other” consumer credit are reverting to the Good Times levels before the pandemic.

Credit card balances that transitioned into delinquency as they became 30 days or more past due during the quarter rose to 6.5% (red), compared to 6.7% in Q1 2019. During the Great Recession, delinquent credit card balances spiked to nearly 14%.

Balances of “other” consumer loans that transitioned into delinquency rose to 6.7%, compared to 7.3% in Q1 2019:

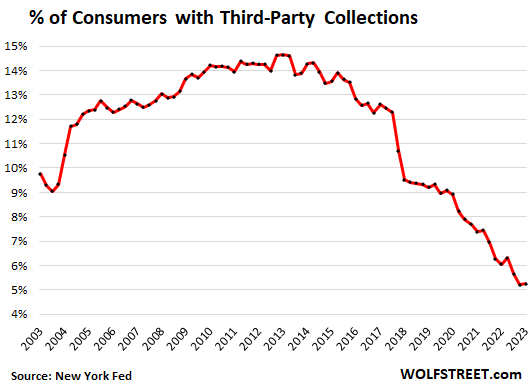

Third-party collections remain at historic low.

Third-party collections are where defaulted credit card accounts and “other” credit accounts tend to eventually end up after banks sell the accounts for cents on the dollar to wash their hands off them. This is our final step in the health checkup of credit cardholders. The percentage of consumers with third party collections remained at the historic low of 5.2%, down from 14.6% of consumers after the Great Recession:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

In the real good old days…

You could write off credit card paid interest as a deduction off your taxes.

“In the good old days 20 years ago, credit card balances amounted to 14% of disposable income”

LOL, this gives away your age? It gives away my age. That stopped when, in the 1980s?

I think that was back when Karl Malden was still making AMEX commercials.

And Mel Blanc as well. Remember that one?

I liked the “Getting old isn’t for sissys” commercial. Forgot what it was for, but it’s true.

Yep, tax reform act of 1986. I’m old, remember it well.

As I recall, it was sold as a tax simplification rule change.

The same tax act also contributed to making medical insurance “unaffordable”…. you used to be able to deduct that from your FIT as well.

Representative Jack Kemp and Senator William Roth, both Republicans, had nearly won passage of a tax cut during the Carter presidency, but President Jimmy Carter feared an INCREASE IN THE DEFICIT (familiar?????!), and so he prevented the bill’s passage.

The Reagan-bot’s handlers made a major tax cut his top priority once he had taken office. (Everything needed was in his script, and FINALLY!……TOTAL “MOVIE” SUCCESS, for a failed and now senile, union leader and failed B actor)

His 1981 tax cut reduced the top bracket from 70% to 50%. In 1986 he went from 50% to 33% then 28% in 1987. Bush 1 was forced to raise it back to 33%, taking all kinds of shit for it.

Budget balancing became unpopular thanks to the Reagan-puppet, however “supply side economics” (aka “trickle down”) became fashionable as did extreme LEGAL class warfare and voting with money. Yes, many Dems were bought off as well, (and still are by big $$$, either Corp or private), once the R-bot had finally decimated the unions and the Dems traditional primary source of funding and voting blocks.

Here we are…..enjoy!….

..IF you have enough people between you and homelessness or resorting to non-financial crimes, and thereby entering the Public/Private “further crushing system”.

Re; Bush 1 above.

Once rich people’s Fed taxes had dropped from 90%, to 70%, to 28% bumping it back to 33% was hardly worth the shit he took for it, and didn’t help much, but he knew the “voodoo economics” plan. Being part of a rich dynasty he didn’t have to do that, or stop the first Iraq war.

But I like to think that when he was in the service he found out that poor people were neither lazy nor stupid….most all just weren’t given a chance anymore.

Any fool could see he was ashamed of his spoiled rich stupid offspring.

More and more I see in my travels…

Cash only merchants or merchants that tack on a 3.5%-5% fee for using a credit card.

“The bank that issued the card collects a fee from the merchant, retains part of the fee as profit and kicks part of the fee back to cardholders as an incentive to run more payments through the card so that the bank can collect more fees.”

I’ve seen 3% tacked on. I haven’t seen 5%, but maybe overseas it’s more common. But also have seen “cash only” right here in the US.

Overseas, credit cards are getting phased out by direct bank debit digital apps that charge way below 3% on each transaction.

US is missing out on new innovations that increase transaction efficiency.

There are lots of ways to pay peer-to-peer and via cellphone in the the US, including Zelle.

But credit cards give the consumer 1% to 2% cash back. These morons in Europe just haven’t figured it out yet, LOL

The 1% casback comes at customer expense in form of hidden merchant fee by pricing all goods and services 3% higher.

Overseas in many countries, merchants are now bluntly asking for 3% higher price on credit card and debit card payments. That forces customers to use apps that provide 3% lower cost of goods and services.

So, who are the moron?

That’s exactly what FedNow is supposed to facilitate in the US. Similar systems have been available in other countries for years. FedNow goes live in a couple of months but it will take banks years to build end-user products on top of it. Oh, and please don’t believe all the nonsense conspiracy theories around FedNow. They’re being spewed by people who have no clue what they’re talking about.

Side note: a similar instant payment platform called RTP has been available in the US for at least five years but because it is operated by The Clearing House – which is owned by the dozen or so huge US banks, the thousands of smaller banks have been reluctant to join it (even though they can and TCH markets to them aggressively). TCH operates parallel banking services infrastructure in competition with the all Fed’s banking services to banks (FedNow vs. RTP, FedACH vs. EPN, Fedwire vs. CHIPS). Most banks in the US prefer to use the the Fed’s services but it’s good to have competition to help keep prices low.

Zelle has been around for a decade. It’s owned by a consortium of banks, is free for all, is instant, and can be used peer-to-peer. Works great.

The issue with Zelle is not all banks support it. I have memberships with two credit unions but neither works with Zelle.

This is not the kind of efficiency we need!

In the good old days, ’70s to 80s, I would normally carry a couple thousand USD in my pocket, and could frequently get a discount from owners of supply places up to 25% for cash on the barrel in THE bay area.

Many years ago TBH, but same seems to work on much smaller basis these days almost everywhere IMHO.

Very interesting to see fall of CC and other ”balances against disposable income circa ’08 & after;;; don’t supposed ‘murricans finally realized what a rip off carried balances were???

NAH, must of been some other factor, eh

Great summary Wolf; thanks.

There was a case that made it to the Supreme Court and ruled in favor of merchants over credit card companies on this. I think it was 2017 and was related to a suit with a hairdresser.

Most of our business operates on trade credit but credit cards are still a decent chunk. We used to charge the fee, then got pushback from some folks saying it was illegal in a few states, so we avoided it for a few years and just tried to push buyers toward trade credit or check before shipment. Now it’s legal to charge a fee nationwide and folks are doing it so long as it does not exceed the actual cost to process.

We are a manufacturer averaging 3-5% net profit. We grew tired of the immense complexity of designing, building, and supporting our products just to have a bank make the same amount for pushing around a few electrons. Our processor prefers we don’t charge it as it discourages card adoption but they can stick their objection where the sun don’t shine.

Our bank is starting to push a new system where our account payable folks begin using one-time-use credit cards issued in the exact amount of the invoice, and the vendor runs the card number once. Sounds mostly like it is being pitched as a fraud avoidance (check fraud is rampant) scheme but it rubs me the wrong way. Sounds like a way to charge more fees and stick their grubby banker tentacles in more transaction volume to collect more fees. Still too new for me to tell, and we haven’t signed on yet.

I highly doubt LN takes off in a widespread fashion. Banks have no incentive to use cryptocurrency based products for any of this because they don’t need to.

They’re going to use the new FedNow platform (which goes live in a couple of months) or the competing RTP platform that’s already available from The Clearing House Payments Company that’s owned by the big banks.

What a racket. Sell consumers on credit cards at the expense of the seller. Everyone pays higher prices; you have to use a card just to get back your share … less the middleman’s share.

It’s only a matter of time before this gets obsoleted.

But, this all changes when people lose their jobs.

Yes, we’re still patiently waiting for this huge wage of people losing their jobs. This is still a very tight labor market, and most people who got laid off can find jobs pretty quickly.

Wolf,

I know what you are saying, but (at the risk of being berated…) I would just like to point out that the 25-to-54 prime age employment-to-population ratio is still 1 percent lower than the late 1990’s highs.

And “employment” really doesn’t say a ton about post-tax/post-inflation effective real wage.

Things are much better than they have been for many periods over the last 23 years…but still not as good as they were 25 *years* ago.

In many ways, that is the definition of a nation in secular decline.

(Particularly when all the DC financial legerdemain and inflation fueling debt – used to prop up the coma patient for 23 yrs – is taken into account).

The period of mid-1997 to mid-2001 (dotcom bubble) was a unique phase in the US economy with college kids leaving school to work in the dotcom bubble and get rich, etc. etc. All kinds of crazy stuff was going on. The current prime age employment-to-pop ratio (80.8%) is lower only compared to those three crazy years.

Before 1997, the ratio NEVER hit 80.8%, and after mid-2001, it didn’t hit it again until April 2023

Exactly – the next wave is coming and it is not in tech. No surprise tech was first to cut. FIFO for pandemic over hiring and fast release.

Slower companies are just now applying the brakes.

And why would Americans lose their jobs? Trendline from labor workforce has a ways to go. I predict 3% unemployment by year end 😉

“And a large majority of cardholders got the memo eventually, and they pay off their credit cards every month to avoid interest charges.“

We get cash back on our purchases and pay the balances off at the end of each month. Just about everything goes on the card and pays a healthy portion of the bill a couple of times a year.

Seems to inversely correlate with credit card interest rates, which are insanely high right now…

Consumer debt overall has hit a record high…

You cited and linked yada-yada-yada BS from CNBC for the simple-minded. Here is reality: Total household debt as percent of disposable income:

Wow, 87% of household disposable income goes towards paying off debt? Seems like we are living on the edge!

BS. It means total household debt ($17 trillion) = 87% of disposable income ($19.7 trillion).

Interest payments on that $17 trillion in debt are a LOT lower and amount to only about 9.7% of disposable income.

Total household debt service payments (interest and principal) as a percent of disposable income in Q4 (latest available) was 9.7%, the lowest in history except for the free-money pandemic years.

OK, I get it. This includes long term current debt that paid over a length of time, not just short term (credit card) debt.

“Disposable personal income is the amount someone has left to spend or save after paying taxes.”

So a person completely broke from paying rent, food, car etc. will look financially well off debt wise if they don’t dare charge anything even though they are one paycheck away from homeless or in financial quicksand due to endless inflation. 40% increase in used car prices in a single year!

Yes, there are homeless people too. That doesn’t mean that consumer spending isn’t growing. It’s not the homeless people that drive up consumer spending.

“Consumers use their credit cards mostly as payment method and pay off their credit cards every month.”

This must partially explain why this percentage appears so high!

And, it’s,…..NO landing! Just when I think it can’t get any crazier, the numbers just get more and more unbelievable. None of the traditional indicators are indicating anything, no traditional correlations exist now that did in almost every cycle in the past. But then, the Fed had never done as much QE before in history than it did during the Pandemic, so me thinks this time is different and maybe none of the old rules apply. What a grand financial experiment that we are all living through in real time!?! Thanks Wolf, for always challenging the b.s. out there, with hard data.

Hasn’t one of the factors in the impending doom narrative been the surge in credit card debt? This info clearly counters that, unless I am missing some subtlety here? I know it is only one of the negative factors feeding those who are predicting a deep recession, but does this soften the odds on that a bit? i.e. liquidity actually not going to be as bad as predicted?

Yeah that narrative is common on Reddit and whips doomers into a frenzy. No one contradicts it as Wolf has.

The world needs a FRED graph of value of interest paid on CC debt over total CC debt or percentage of CC debt that bears interest or something.

“Credit card balances and “other” consumer debt combined amounted to only 8.8% of total consumer debt – which also includes mortgages, HELOCs, auto loans, and student loans.”

I wonder what the percentage of consumer debt would be if student loans were removed from the consumer debt total. Particularly since payments are still optional and the huge increase in student loan balances since 2003.

Student loan debt will be a huge drag on consumer spending by the end of this year.

I don’t even consider student loans a form of debt since no one is making payments, and since no interest is accruing.

Student loan payments are schedule to start 60 days from June 30, unless the Supreme Court issues their decision before then. My guess is that the Supreme Court will overturn Biden’s student loan foregiveness.

Once those payments resume, that will subtract from the money spent in the economy. It will hit areas where people in their 20’s, 30’s and 40’s spend, such as cellphones and social media companies (whose ad revenues are dependent upon conversion to sales).

The true purpose of student loan forgiveness is to prop up the revenues of the upper education industry, which is among the largest lobbyists in our country. Think about it. If people can assume that student loans will be paid by the government, they dont really care how much debt they take on and will spend frivolously on education. Maybe get a degree in social justice or anthropology or some other area that doesnt add value to your earning potential? Why not? The taxpayer will just pay for it (or more debt will be piled on the heap.

Businesses that feed off the trough of public spending or public finance (healthcare, housing, upper education, military industrial, etc) are the scourge of the nation. The government racket of propping up these companies and piling the cost onto the national debt is a crime.

+1. But the politician that offers free things wins votes. We are doomed unless we can overhaul the entire infested swamp inside out, and regulate the money that sneaks its way into congress.

Hopefully it’ll start with the PELOSI trading ban. Index funds only for all those crooks

Game/Apple

Great thinking great commentary!

Invest every dollar that you both have in a website and I guarantee you will both become Billionaires. Trust me.

And close the voting booth curtain you two are cuddling up in…… don’t want anyone to steal your money making ideas, do you?

Do you have access to any data on the amount of Federal vs Private student loans? Wife and I refinanced in 2019 (2.5%, thanks First Republic!) so we’ve been making payments and accruing interest this whole time. I can’t imagine we’re in the minority here

https://wolfstreet.com/2022/08/07/are-federal-student-loans-even-loans-from-forbearance-to-forgiveness-to-taxpayer-expense-fairer-solution-allow-bankruptcy/

“Federal student loans account for about $1.3 trillion of this $1.59 trillion in total student loans, according to a separate report from the New York Fed. The remainder are Family Federal Education Loans (FFEL) owned by commercial banks, and private loans.

“It’s the $1.3 trillion in federal loans that were all moved into forever-forbearance in the spring of 2020, and that are now up for forgiveness.

“The median balance of federal student loans is $18,773 – meaning half of the federal student loans balances are lower than $18,773, and half are higher.”

Wolf,

I love your newsletter and read it frequently, but on this I completely disagree. There is no reason to believe that federal student loan interest rates will remain zero forever. And as you correctly pointed out below, there is more than $250B in private student loan debt outstanding, and most if not all of that is bearing interest. In addition, the federal student loans cannot be expunged through bankruptcy and must be repaid, or they will end up being taken out of a borrower’s estate by the government when they die. This is definitely a form of debt.

I learned at lot about student loans as one of the first employees at SoFi.

I have been going to bed every night for three years praying for federal student loans to once again become “loans” with accruing interest and required payments that are being made regularly until the loan is paid off. And every morning, for three years, I woke up and without fail discovered that my prayers have not been answered. So at some point, I get a little cynical about those grandiose announcements. There is always some other thing that is being done so that these student loans don’t ever become loans again.

Obviously you chose a much lesser known and hence poorly financed deity.

Construction continues for 1.5 million dollar homes Colorado. My neighbor runs his own plumbing company says he has more work than he can handle, labor is almost nonexistent. He who is considered skilled labor already hired out to highest bidder, local restaurants and businesses have revolving door employee syndrome. I always make sure to hold a in-depth conversation with college kids waiting tables or takeout leaving substantial tip$$. They are being burnt out by not enough staff. I guess the debt ceiling may be the apocalypse everyone is waiting on for 8 million layoffs. I don’t see it or feel in my daily observations in Denver. I have more neighbors excited about cruises and summer vacations planned. My Marriot bartender neighbor can’t believe her weekly tip$ amounts and it’s not even football season.

I think that before we see alot of layoffs we will see a decline in hiring and then people will start to have to take the best job they can get.

Consumer spending has been falling and if you look at some data coming out on credit card expenditures in April, it looks like we are hitting a wall.

Real estate is going through a weird phase where the lack of sellers is actually more acute than the lack of buyers. I see a standoff for another 6 months to maybe year, before the downturn is fully validated and there is some stress in the markets. The real estate markets need to see some distressed sellers to drive prices down, otherwise, owners can just sit on their properties. I thought the high monthly payments would decimate residential real estate, but without forced sales, the lack of sellers is preventing any real downturn.

“Consumer spending has been falling and if you look at some data coming out on credit card expenditures in April, it looks like we are hitting a wall.”

EVERY part of this sentence is fabricated unadulterated this BS. People need to stop regurgitating this BS. Here is Q1 consumer spending, adjusted for inflation:

Don’t listen to this guy, Game, what’s he know about websites. You and Apple take my advice above and just roll in the $$$$s!

“And a large majority of cardholders got the memo eventually, and they pay off their credit cards every month to avoid interest charges.”

What % of cardholders and/or balances accrue interest?

43% of the credit cards (not cardholders) carried revolving balances in Q3, according to the latest report by the American Bankers Association. 57% did not.

Wolf,

Why do you think 57% use credit cards as de facto debit cards instead of, well, debit cards?

1. the safety: you should not use your debit card to buy stuff. It’s direct access to your bank account. There may also be issues with fraud protections, etc. Use your debit card at the ATM.

2. The incentives: 1% to 2% cash back or other incentives on credit cards. Debit cards as far as I know don’t come with incentives.

BTW, people ARE using the debit card to buy stuff. Per the New York Fed data I cited: in 2021:

– Credit cards: $4.88 trillion in purchases.

– Debit cards: $4.55 trillion in purchases.

For a card total $9.43 trillion.

I’ll add a #3 to Wolf’s list: its a 1+ month, interest free loan. I put everything on my credit card, and autopay the full statement on the due date, which for me is the 2nd of every month.

This means something I bought on April 25th doesn’t come out of my bank account until June 2nd, and yet I didn’t pay any interest on that free loan. I also wait until the very last day my other bills are due to pay them.

Now that my cash actually earns interest, I’d rather sit on it as long as possible before paying what I owe.

Another anecdote: my credit union pays me a couple % more interest on my checking account if I make at least 12 debit card transactions per month – I interpret this as their version of ‘points’ in encouraging me to spend some of my money on their debit card instead of a credit card.

Thanks Wolf.

I agree credit card usage isn’t a sign of consumer distress (I put everything on my Cap One to earn the points), but if the % of cards accruing interest starts to rise substantially, perhaps that could be a warning sign.

I saw a graph elsewhere that showed the number of people with credit card debt is near all time lows, but that the average balance of the people with debt has started to spike up. I imagine that anyone who owns a home can take out equity and pay off the high interest credit card debt and that keeps credit card balances down.

ValuePenguin routinely surveys Americans on their credit card usage and they report that the percentage of families (not accounts) which carry a credit card balance that accrues interest typically ranges between 38-45%. In their most recent article on this topic, they found that 45.4% of American families have some sort of credit card debt: https://www.valuepenguin.com/average-credit-card-debt

This means that only 54.6% of American families have paid off all of their credit cards each month to avoid interest charges. While that is slightly more than half, I would disagree with the characterization that this constitutes “a large majority of cardholders”. Instead I would say “a slim majority of cardholders…”

1. The latest figures in the link you cited are for 2020 and EXCLUDE the biggest portion of the free-money era.

2. A lot of the households that have some CC debt, have very small balances that soon get paid off — buy something for Christmas and spend three months paying it off. It then goes up the spectrum all the way to those that have a huge overhand of CC debt that they can never deal with.

3. If an election is won by 54.6% over 45.4%, that’s a “landslide” victory, I’d say.

Wolf,

I must respectfully disagree.

ValuePenguin has been surveying people since at least 2017 and each time the proportion of American households with credit card debt are 38-45%. This is consistent over time. It did go down during the free-money era of the pandemic and some speculated that Americans have “finally got religion”, but that is incorrect as you know since credit card balances have started to increase again.

54-46 is a landslide in an election, but that is only because a larger margin than that is very unusual. 54-46 is not a shellacking in basketball. If 54% of the population do just about anything (e.g prefer Coke over Pepsi), I do not consider that to be “a large majority” of people.

Some people always get in trouble. So what? But we’re talking about the economy OVERALL. Interest-bearing credit card debt is small. It’s just a few hundred billion, less than $400 billion out of the $1 trillion in credit card balances, most of which get paid in full every month. Read what I wrote about $4.9 trillion being paid for in 2021 with credit cards, and yet, credit card balances at the end of 2021 were below where they had been in 2019! People need to get grip about credit cards. In the $26 trillion US economy, credit card debt just is not a big thing. This fear-mongering is getting really old.

There is always some one out there of 7 billion people on Earth who is an untapped market with lightning flash electronic systems ready to stamp out credit. Seems this game is until (a) bankers quit, (b) people quit, (c) neither bankers nor people bur the world will be too saturated with credit to care for credit? With slick electronic- insta-credit world wide there is a sucker willing to pay the interest or not so then another sucker picks up the tab. LOL.

Anecdotally in consumer electronics retail: there is still huge demand for “no interest financing” (as customers say; its really deferred interest).

Most of these promos are sponsored not by the retailer themselves but by the companies whose products they sell. I see these promos as analogous to the rate buydowns in housing: companies want to stimulate demand, but don’t want to directly lower the price as this is perceived as lowering the value of the product itself. So instead, they fund below-market finance rates to nudge customers.

MM – back in the Nixonian pleistocene, I understood many companies left subsequent msrp’s high in fearful reaction to the possibility of future wage/price control experiments…

may we all find a better day.

0% introductory APRs for 15-21 months are still commonly offered by credit cards. This means that for anyone with a half-decent credit score, it no longer makes sense to pay off the credit card balance each month because you can collect around 5% interest while waiting to pay off your credit card for around a year and a half. You’re effectively getting paid to borrow.

When Japanese imports wiped out the economy in the Detroit area, I was told as a youngster at the time that the US was toast. Well, maybe so but even to this day nearly 4 decades later the average american spends, gloriously…

PCE is up too right?

Wage inflation must be happening otherwise I out of ideas or am I missing something.

Basically everything is up…so maybe just another higher plateau

Every Cash Only merchant should clearly explain their position on the card scam with this simply worded sign: “We don’t drink from your toilet, So please don’t pee in our pool!”.

Of course spending is strong. I figure there was $4 trillion of deficit spending in 2020 to 2022 that was wasted or went to fraud. That’s about $26k per family in the US, but the reality is many households got nothing, allowing other families to get $40k or more. That’s a windfall that is being spent.

On top of that, the Fed’s QE policy juiced asset and RE prices, creating wealth from thin air that the Fed is fighting hard to preserve. Many families that own homes and stocks gained hundreds of thousands, or millions. They feel a lot more wealthy and are spending.

Those gains are really just wealth transfers from younger generations who are being straddled with debt and inflation.

Inflation becomes entrenched in democracies when the beneficiaries of free money vote to keep it flowing even though the free money is rapidly depreciating. For example, in Turkey the governing party just won re-election despite presiding over runaway inflation. Once politicians and the people figure out money printing means never having to say no, high inflation is inevitable and savers go extinct. The US has started down that road.

Erdogan faces a runoff, he did not win.

Whose voting for the Fed and the government to keep a free money spigot open? Oh I forgot it’s Wall Street voting with their campaign contributions, and paying for Supreme Court Justices children to go to private school.

It’s not a “Supreme Court Justice’s” child. The child in question is a grand nephew who said Supreme Court Justice took custody of when the child was six. Another scandal created out of nothing. Spend more time analyzing “your team” for corruption before commenting such nonsense.

Still accepting money from a billionaire isn’t it?

Corruption has many faces.

Oh it’s an “adopted nephew”. Ok that won’t buy any influence then.

All sides are dirty, the problem is that they are all so cheaply bought. Biden, Clintons, and Obama taking the post brides were completely egregious.

And I take no sides, since neither is fighting for me.

You’re correct, to a degree. However, since there’s no evidence of said billionaire ever having a case before said judge, there was no conflict of interest and no influence to be purchased by what purportedly was an act of charity.

I’m more concerned with those who stole from the charities for the Haitians with their fake foundation. Or getting bribes from foreign governments funneled through a series of LLC’s.

What families received 40k? None. Next story.

excellent summary of what is happening. i have asked my daughter why the kids are not revolting and she just shrugs her shoulders and says, “did you see that picture of Khloe with her boyfriend?”

OK, my daughter is a little smarter than that, but the overall young people are simply clueless about politics. They have been brainwashed by their liberal elite universities to focus on things that truly dont matter and ignore weighty subjects like the national debt.

For anyone who wants to know whether the future of our country is in good hands…it isnt. The kids are idiots. Girls spend their days fetishizing fake lifestyles on social media and the guys are just playing video games.

Shame on our “leaders” for the huge deficits our children will have to deal with.

In my mind, this is pure theft. We are racking up debts without the permission of people who have to pay them off.

Each of them would be better off being forced to pay $100,000 at gun point. At least they’d be able to look the perpetrators in the eye.

Don’t be so harsh on kids. I was an idiot too back then. Probably a much bigger idiot, and it was a lot of fun being an idiot, and with hindsight, I’m lucky I survived that phase of the learning curve, LOL.

I escaped my idiot phase in the beginning of junior year of college.

good one game,

Fact is, far damn shore, ”most” USA institutions of ”higher learning” have become propaganda originators and outlets as the focus has changed from ”how to think” to ”what to think.”

Very sorry to see this movement, as IMHO, it at least suggests, if not proves, the ”degradation of the empire.”

Certainly wish I could stick around a bit more to see if this outcome, degradation of USA empire, proves to be the result this time, as it appears to have been, from what we can read, for many empires over the last couple thousand years or so.

”History” (AKA the winners report,) is actually quite fascinating, if not always educational, for those who chose to study ALL available reports, including what is usually referred to as ”historical fiction”

“They have been brainwashed by their liberal elite universities to focus on things that truly dont matter and ignore weighty subjects like the national debt.”

Ha ha, good one. You are joking, right?

I used to love signing up for new cards and pocketing the sign up bonus points/miles after spending the minimum. Always paid the cards off right away and cancelled the card prior to the annual fee. Lots of free flights and hotel stays over the years. Haven’t gotten any offers lately to sign up for new cards. Maybe too many people were doing the same and/or they figured they won’t make money on me (credit card churning).

It’s big on Reddit. Kinda seems pointless to me. Tbh

On Macrotrends.net it says, “Visa net profit margin as of March 31, 2023 is 50.95%”. They’re coining it in!

That is correct and this is one of the problems with the credit card industry: Visa and MasterCard are a duopoly who impose inflated fees on merchants, and by extension, every single one of us, whether we buy things with credit cards or not. Merchants, even gigantic ones like Amazon and Walmart, despise them. And where is the antitrust division of our Justice Department? Asleep at the wheel, it seems.

You can see here that Visa reported 50.3% net profit AFTER TAXES (!!!!!!!!!!!) for the last 12 months: https://finance.yahoo.com/quote/V/financials?p=V. They make Apple, Google, Facebook, and Microsoft – all companies with large profit margins – look like amateurs.

I challenge everyone who reads this to name a company with more than $1B in revenues that has a higher profit margin than Visa.

Get a job is a cliche and almost meaningless in todays economy.

I say this because I walk that tightrope every day. Fortunately, I am in a livable situation with room mates. Going it alone in todays rental environment would take at least 70% of my received income.

I have not had reasonable health insurance for well over a decade, so of course, I go without. I pray every day that my car continues to run so I can run just liability insurance. If anything breaks, I am the next person under the bridge.

Fortunately, the boomer generations has seen this all before and will be eager to jump into the fray and help out, just like the Bob Hope generation always did, BLAH…

I pay so many damn bills. If everything was free that I pay for I would prob break even every year.

It seriously is hamster on a wheel kinda deal.

I feel for you and everyone in your generation.

Unfortunately, I am completely clueless on how we can as a country break the nexus between companies and government so that we can have better policies that can provide a steady and sustainable growth over the near, medium, and long-term growth. Where are the statesmen when you really need them :(

This craziness of immediate gratification should end – and end soon.

I walked that rope in my 20s in the 90s. Fell off a couple times and had to move back in with my mom. Don’t give up and don’t take on bad debt, you’ll make it to the other side.

If overnight we all used 2.52 trillion dollars on credit cards. What would happen? Bank failures?

You mean if we all charged $2.5 trillion overnight on our credit cards? What would happen? HUGE GIGANTIC BOOM in consumer spending, inflation would explode, retailers would run out of stock, banks would make a gigantic amount of money on the fees they collect on their card spend… that’s what would happen.

1) Banks cannot make money by borrowing at 5% lending at 3.5%/6%. The c/c loans spread is “healthier” : 20%/25% minus 5% = 15%/20%. The available c/c credit is $3.5T. In the next recession the available spread will shrink.

2) Consumers c/c debt to the bank is $1T. // C/C debt is 9% of the total consumers debt.

Total consumers debt : $11T. Total gov debt : $32T. The unfunded gov liabilities est is over $100T.

3) The third party collection hit nadir. The delinquency rate is low. Between 70 days and 88 days most delinquencies are wiped out to escape the recycle bin. A deal is struck to keep zombie consumers debt, IOU to the banks, and banks assets intact : zombies interest rates cut to 0%/2% for the next 5Y/8Y. Banks profit are down, but no harm is done.

4) The Fed raided “other” people bank accounts, issuing an IOU to the

banks. The Fed sent the money to the gov in exchange for an IOU to the Fed, in a system control with a positive feedback loop, piling a tsunami of IOU. The gov spent most of the tsunami money. The money is gone. The gov IOU to the Fed is there. The Fed IOU to the banks is there. The banks IOU to “other” people money is there.

5) The who blink first gang game might expose the IOU tsunami calamity.

I’ve been signing up for 0% offers ranging from 15 to 21 months for more than a decade. Probably have 25 to 30 credit cards right now. They tend to give me limits anywhere from $10k to $25k. I use them for business and rental property spending. Tools, renovations, repairs, a couple of trailers, even a van. I’ve paid exactly $0 in interest during this period, but I’ve been consistently floating a balance anywhere between $5k and $20k at all times. Besides a couple of routine that they spending cards that we promptly pay off, the rest of the 0% ones sit for years inactive with high limits that keep our credit score looking good. Surely I can’t be the only one doing this. And the free money spigot has not dried up yet either because I just got another offer last week.

Its 0 percent but transaction fee is 5 percent

That’s for transfers. Purchases have no fees. I don’t do balance transfers – get a new card, run up the balance, pay it off before the 0% offer expires. Free Money.

I wonder if the cash-out refinance of real estate and homes has replaced credit cards as the primary engine of free money to fund bad fiscal decisions in our society. Those vacations, cars, furniture and dining out aren’t going to pay for themselves, and a lot folks aren’t paying for them either.

Why would anyone cash out refinance their house at today’s rates? That’s simply stupid.

“I’m short of money to buy trinkets. My income isn’t keeping up. I know! I’ll hock my house, take out $100K, double the interest rate on the entire mortgage balance plus the 100K, and my problem is solved!”

That’s some really funny math.

Many gas stations in the southeast offer a .10/gallon discount for cash. Wolf, is there any data on the percentage of how many people pay with cash vs credit cards at these stations?

I get a 5% rebate on fuel for my credit card so I don’t see how the .10/gal works as an enticement. For $100 of gas I save about $3.30 paying cash but with the credit card I earn $5 in rebates.

Can’t tell you the last time I used my cash station card. We always use our Southwest card to buy everything. Rack up the mileage points. Pay it off every month. The SWA card has as much detail visibility to our purchases as the cash station.

“Banks incentivize the use of cards as payment method by offering 1.5% or 2% cash-back on card spending or frequent flyer miles, etc. The bank that issued the card collects a fee from the merchant, retains part of the fee as profit and kicks part of the fee back to cardholders as an incentive to run more payments through the card so that the bank can collect more fees.”

So what I’m hearing is “sit tight, this is going to take awhile”.

The remuneration rate on reserve balances, 5.15% is much higher than 10-year debt, 3.5%. Net interest rate margins on short-term financed debt is prohibitive.

Neither A Borrower Or A Lender Be

The cards that offer airline miles aren’t as great as they seem. They have blackout periods for holidays and periods of high demand, so you can’t count on using the points when you may need them. Plus, they keep inflating the flight cost. Ten years ago, you could get a flight for 25,000 points. Nowadays, they often want 40,000 to 60,000 points for a flight. I just booked one and had to pay 55,000 points.

They always find a way to hammer you down, directly or indirectly.

Something like Chase Sapphire Reserve is better, where you can choose where and when to use the points.

Given that a point is supposed to roughly correspond to a penny, though, these points would be subject to the same inflation as the USD, on top of any devaluations imposed by the points vendor.

Wolf and Commentariat,

Do you see a significant move to cash for relatively modest purchases–say under $200-300–given the increasing move by some retailers to charge a fee for using a CC?

I imagine that the use of cash would vary depending on the category of merchant as well. Also, is there any data out there on whether the Cash Only Fridays idea has any importance or traction?

I have never heard of Cash Only Fridays.

Credit-card transactions reduce the retailers’ costs of handling cash. Cash is very expensive to handle and tends to vanish unless there are strict and costly controls. A lot of expensive employee time goes into balancing cash drawers, taking the cash to the bank, etc. If cash could be eliminated, retailers would save these costs. This reduction in costs offsets the transaction fees from credit cards.

Now if retailers have the costs of handling cash, PLUS they have to give a discount of 3% for cash payments, then the equation gets even iffier.

Zelle and other smartphone-based methods are cropping up that are free for both parties. But they don’t pay the consumer 2% cash back.

Cash and cards both have costs:

Cash: employee time as Wolf said, also some banks now charge retailers an extra fee for large cash deposits.

Card: fees as Wolf said, but also chargebacks. Thieves have discovered its easier to steal from merchants by making purchases and then using the chargeback system to get a refund, rather than the more traditional way of stealing.

I would still use the credit card. Much easier to get refunds, the card company will intervene in a dispute, and you don’t get cash back (my card is 2%). Plus I don’t like using a debit card anywhere it can be “skimmed”. A credit card protects you from that whereas you have to fight with the bank to prove you didn’t authorize the charge/use of your debit card before you can get your funds returned.

Merchants can’t charge a fee for using a credit card per the agreement with Visa and Mastercard. They can, however, offer a cash discount and still comply with the issuer TOS.

More People Are Falling Behind on Credit Card and Car Debt

Share of debt balances that became at least 90 days delinquent in the first quarter was 1.08%, up from 0.071% a year earlier. May 16, 2023

Why do you drag this context-less WSJ BS into here when I gave you the chart and data.

https://wolfstreet.com/2023/05/15/households-far-from-tapped-out-credit-card-balances-burden-credit-limits-available-credit-delinquencies-collections/

We all know Wolf never forecasts and bases his analysis in currently available data, but the trendlines should be a concern at this point. The US consumer started ahead post-pandemic and now delinquency is in the same parabolic growth pattern as the GFC. The rest of the metrics seem relatively stable, almost regardless of economic conditions. Pile inflation, general cost of housing, student loans kicking back in, and it’s just hard to believe that we aren’t approaching the consumer wall. Even with the job market being resilient so far, the trendline for new unemployment filings is in an uptrend. Time will tell, I personally think the US economy has peaked and J-Pow’s wish of the soft landing is only a wish.

Home Depot seems to think that things are slowing down….. they might be the canary in the coal mine.

The pandemic-free-money remodeling boom is suddenly not eternal? LOL

Total US ecommerce sales had a big increase in April. That is far larger, and dwarves Home Depot’s sales. Don’t get fooled by what just one retailer said.

I’m surprised anyone is still buying anything at Home Depot after the sales surge they had during the pandemic.

And I’m surprised how well retail sales are holding up (growing!), given that spending has shifted massively to services, including travels, and retailers sell goods, not services, so retail sales were supposed to drop off. But they grew, and they grew despite the price drops in many categories – dropping prices means that dropping sales if consumers buy the same amount of merchandise.

FogCutter,

Look at the trendline of delinquencies in 2020 and 2021. Could you extrapolate from there? Nope. Because they were going to zero, and that’s not happening. Be careful if you use trend lines to forecast.

What the trends tell me is that delinquencies are slowly reverting to the Good Times normal range, now that that much of the free money is gone. That’s ALL these trends might say, if that much.

NEVER extend a data flow with a straight line into the future and think that’s where it is going. It won’t. It didn’t in the past, and it won’t now.

Just to let you know, things seem to be starting to crack here in Buffalo. Medaille University is closing here; Tops Super Markets appears to be in trouble again; Popeyes Chicken just closed here in North Buffalo; Party City is in trouble, etc. This may be just the beginning. This is all sudden for us here. Just saying.

Buffalo has been in trouble for years.

Credit card debt needs to be managed. One should never become enamored of the shiny object, in this case rebates, toasters, whatever.

The only reason that the terms seem acceptable is because your paying for the service and it is currently, the only game in town.

Frankly, when I look at the structure of the credit card business as it currently exists, my mind conjures up the ghosts of the shakedown / loan sharking industries only this time it’s legal.

I really think that it is time for a US Postal Bank.

Just one more idea how we may deal with Frankenstein’s idiot monster, that has escaped to the small community, every living and future human beings will have to be able to identify whether you are talking to a human being or an electronic contraption.

I call on the philosophy community to develop a heuristic that a synthetic advertising entity would be unable to answer like the United States Constitution guarantees, as an initial idea.

AI, so called artificial intelligence, is trained to accomplish an agenda. That’s all it is and in the long haul will accomplish what it was designed for, resolving feed back problems, portraying any human being on earth, etc. Nothing to see here, move along.

Any AI bot has an agenda that was codified by specifying the desired outcome and find a relationship between that and a series of selected inputs. The most relevant input needs to be manipulated to attain the least squared variance as specified by the result matrix which happens to be the very data set that the idiot was trained to minimize the sum of the squared variance, in the first place.

Bots that are currently available, trying to throw off their parents, can be led down the prim rose path to disaster, just like the target audience they were trained to mimic.

An extremely vulnerable but sensible sector of the population that is in control of the future. I don’t think they could possibly make as many mistakes as we did, and survive.

I’m at an age whereby I recognize the foolish splendor of my life.

…’sic transit gloria mundi’, indeed…

may we all find a better day.