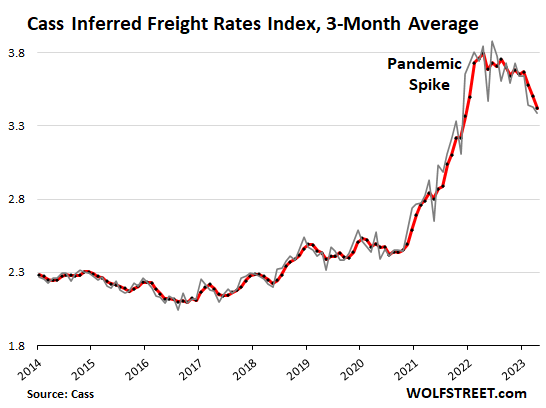

But freight rates only unwound one-third of their Pandemic Spike.

By Wolf Richter for WOLF STREET.

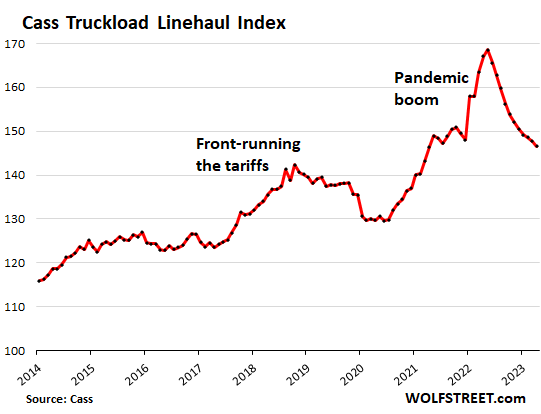

The Cass Truckload Linehaul Index, which tracks per-mile linehaul spot and contract rates and does not include fuel and other charges, fell for the 11th month in a row in April on a seasonally adjusted basis, and was down 12.3% from a year ago.

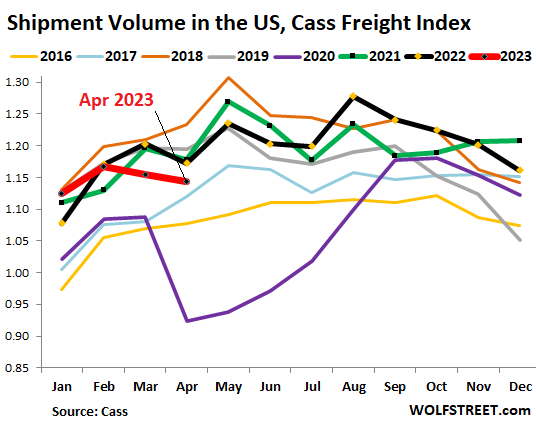

Everyone has long predicted that the enormous boom in goods during the pandemic would fade and return to trend as consumers shifted spending back to services, and that shipment volume would decline and return to trend. This has been happening, but later than expected – it started in mid-2022 – and much more slowly than expected, and hasn’t yet returned to trend.

Note the boom in 2017 and 2018, when companies were trying to front-run the tariffs that the Trump administration was putting in place. The pre-tariffs boom reverted to trend in 2019. And then came the pandemic boom that is now reverting. But April’s level remains above the peak of the boom during tariffs-front-run bonanza:

Trucking is now skidding down the other side of the pandemic boom that had been triggered by an explosion of demand for goods that caused all kinds of havoc – including price spikes – in the transportation industry and the goods-based sector of the economy.

The broader Cass Freight Index – which is concentrated on trucking but includes rail and other modes of transportation – also fell again in April (fat red line in the chart below) and is down 2.4% year-over-year. The index has now fallen below the Aprils of 2022, 2021, 2019, and 2018 (record April). But it’s above April 2017 and 2016.

Truckload shipments represent over half of the dollar amounts in the Cass Freight Index, rail is in second place, followed by less-than-truckload shipments, parcel services (such as UPS and FedEx), and others. But it does not include bulk commodities.

Cass derives this data from the 36 million invoices and $44 billion in freight spending it processes annually for its client base of hundreds of large shippers.

Shipment volume includes goods that retailers sell and all kinds of other goods, equipment, components, and supplies that manufacturers, construction companies, other industrial companies, and services providers buy.

Freight rates have also come down.

Part of the decline of freight rates is due to trucking mileage rates that have come down, as we have seen above. They do not include fuel charges.

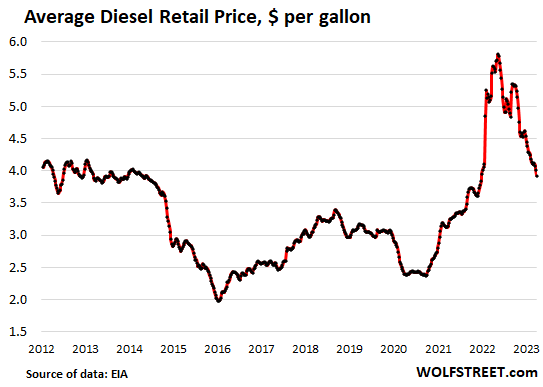

And the cost of fuel has plunged from the peak of the spike in 2022. The average price of diesel in the US is down 30% year-over-year and 33% from the peak in June last year, according to EIA data:

The Cass Inferred Freight Rates Index fell again in April “due to modal mix shifts, lower fuel prices, and market pressure,” Cass said. “While fuel is a big factor, there’s clearly also still market pressure on rates,” Cass said.

The index includes fuel costs and is based on Cass’s measures of freight volume and freight expenditures.

The index is now down 11.9% from April 2022, which was the peak of the Pandemic Spike. Even though freight rates have come down substantially, they have unwound only one-third of the spike during the Pandemic.

The red line represents the three-month moving average that irons out some of the dramatic month-to-month zigzags.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It should line up with the trade deficit, no ?

Credit card data from KeyBanc shows 18% drop in apple sales in April versus prior year. Consumer demand is finally going to plummet over the coming six months, as credit card balances will shoot higher for next 4-5 months, but then level out as credit card companies stop increasing limits. Bank balances are also falling to pre-pandemic levels.

All of the things pushing demand higher – wealth effect from higher real estate and stock prices, wage increases, increasing credit balances, declining bank balances, government stimulus programs, etc – are all reversing now. It is about the trend direction.

It is very typical for bubbles that get blown to reverse and plunge below the prior balances of the period before the bubble.

Dont listen to any financial talking heads that predict a new bull market. That talk will end by mid-summer at the latest.

Amen brother. The reset is coming; and it’s not a question of if, but when. I still can’t wrap my head around equity investors thinking the never-ending bull market is still alive.

“equity investors thinking…”

It is an info availability bias…the greaseballs of CNBC have a huge share of mkt coverage, are enormously biased towards selling shares/churning commissions, and the informed short-side can’t compete in terms of public awareness.

so where is all that democratic slush money going??

Inflation Production Act

duranged chips act

bloated 2023 budget with $88B for ARMED IRS agents

Some cowardly politicians have been excreting a lot of political BS about increased IRS spending in the so-called Inflation Reduction Act. In fact, most of that money will be spent on hiring revenue agents to audit tax returns and collection officers to collect taxes that are due. In addition, the IRS will hire people to answer telephone calls and process tax returns timely. Yes, some money will be spent to hire new armed agents because we have a lot of dangerous tax evaders in this country (that is, drug dealers, money launderers, organized crime, etc.). Al Capone went to prison for income tax evasion.

There is no plummet in consumer spending.

I was reading an article and it says travel and related service industry is preparing for record travelers this summer.

All around me, I see people itching to spend.

I said that consumer spending would plummet in coming six months. There are some areas, like Apple products, that are highly discretionary and will get cut first. Americans are still burning off their bank balances and tapping their credit limits to keep spending., but the cliff is very close now. One of the biggest reasons consumer spending is still hanging in there is that many Americans feel rich in home equity (which is the middle class largest asset).

But credit card balances can only increase so much before the banks stop issuing more credit, bank balances drop to pre-pandemic levels and once the debt ceiling is raised, the Treasury issues alot more debt, which drives long term rates much higher and kills off the real estate market.

Once the stock market turns lower in the coming months, companies will really start to pull back on hiring and wages will drop as well.

The poor and young are probably cutting expenses first. Apple products skew more toward younger people who may not have alot of money, but will spend everything on a new phone, so my guess is that gets hit before travel, which might skew older and richer.

The democrats are trying to make sure that they are not forced to give back unspent pandemic stimulus because they are trying to goose the economy through the next election cycle. This is a truly horrible move because noone can pretend that we are still suffering from the pandemic. But the Republicans have done it in the past, so you cant say they are much better.

I agree both parties are to be blamed and would do anything to win over votes.

The asset market so far has been proven resilient.

I mostly agree that spending will decrease, but will play devils’ advocate… Lots of people refinanced their house at lows rates. In addition to increased equity, they now spend less pay on the their house payment. Even if their house value drops, they have more cash in hand to spend and they may want to spend it before inflation eats it. I would guess spending is driven by homeowners, much more than by renters. As we get closer to having slums and castles, like other third world countries, spending of the bottom half or so would seem to matter less and less.

Plus a large portion of the money that renters spend is given to homeowners, who in turn have that much more to spend.

Issue is that all things pushing rates higher (hint: same things) are also unwinding. Equity prices are set with longer-term expectations, not 18 months of earnings. So stagflation risk killed NASDAQ. That is a no show – there is no persistent stagflation risk mainly because there is no energy crisis type supply shock. So long rates will continue to come down.

So we have a regular cyclical slowdown that will reset the high inflation that drives short rates higher. Recession is mostly priced in.

Anyone not thinking the bubble was burst already need look only at the pockets of high fliers down 70% from peak. Including 90% by type of crypto.

The recession will hit some segments, sure. But it is a long-run equity market positive. Prudent to be somewhat defensive today as some of those segments that will be hit harder will be ripe for dry powder deployment. But doom and gloom… BS.

Diversified intelligently is where it’s at.

Hmmm… I had commented that I didn’t think 2022 truck milage was being properly considered in the previous EV article which compared gasoline usage vs. total vehicle miles driven (including diesel) to support the assertion that EVs are making a noticable dent.

Wolf, you said that I, “Got the wrong year. The big year for trucking was in 2021.”

Yet this graph of the CAS linehaul index clearly shows that 2022 was, by far, the heaviest hitting year for trucking overall. The first half of 2022 was characterized by a giant spike, and even the index’s 2022 lows on the downslope of that spike were right around 2021’s highs.

Per this index, 2022 was the big year for trucking, especially the crazy first half.

Nah.

The linehaul index reflects $-per-mile rates that truckers charge, not miles driven. READ THE ARTICLE!

The linehaul index $-per-mile rates (spot and contract rates combined) slowed their increase in April 2022, peaked in May, and then spent the remaining 7 months of the year dropping. Which means that truckers were charging less per mile.

Spot rates started dropping in January 2022 (DAT Dry Van Linehaul Rates), and contract rates followed gradually with a delay. The reason rates were dropping was dropping demand for trucks starting in Jan 2022 — hence fewer miles driven starting in Jan 2022. Dec 2021 was peak of the DAT spot rates.

Why charge less, if you don’t have to?

There’s lots of evidence this inflation is sticky in the up position, despite the supply chain crisis becoming unwound.

There seems to be an ongoing pushing of the envelope to discover the maximum headroom of this current price-no-object mania. It’s not like temporarily suspending your gag reflex when paying 8 dollars for a bottle of water and some salted peanuts in the airport; no, people are voting with their wallets and establishing a new permanently high normal.

Just because you can, doesn’t mean you should…just because you can…

Related: During that time, I really enjoyed Republicans attempts to describe tariffs without using the word ‘tax’, or something similar.

And pretending that the tariffs are paid by the other countries.

Similar to Dems explains health care mandate, as a fee not a tax. Either way, in the end , we pay, whether a tariff or mandate!

When it comes to health care, you’re going to pay through the nose no matter what. That’s never going to change. Except for the one-third of Californians on Medicaid. They don’t pay a dime, while I’m paying Kaiser 5 grand a year

5k is a bargain. Had no idea healthcare was cheaper in California.

Have you noticed that the Biden administration has retained the tariffs on China? One has to search for this information, as it’s not often or widely reported.

I guess spending shift from goods to service. BTW, I am still waiting for the airfares and rentals to go down. My wife has been waiting for US passport renewals since March 2023 (her passport book expired last year). We want to look at international trip next year when prices come down a bit… still waiting.

I picked up my wife from the San Francisco airport yesterday, coming in from Japan. The drive lanes at the arrivals section of the International Terminal were utter mayhem. I have never seen such a crowd there. Revenge Travel is a thing.

“Revenge travel” (at spiked prices).

Yep, nothing “shows ’em” more than increasing one’s financial exposure (and stress).

More stressful work for more fleeting “experiences”

Screw ’em…I’m going to Disneyland (at $250 pp per day…).

I was hoping to “revenge travel” to Canon Beach in OR this weekend but everyone else had the same idea and there’s no more rooms, the few available ones are about 2x more and not as good as what you normally get. So I checked flights to SD and LA, almost 3x what I paid late last year. I give up, not enough revenge in my bank account for that ☹️

We went to Sicily for Revenge Travel, but that was before it became a thing.

Who/what are you revenging by traveling on a cramped fart tube for 17 hours to fight through lag & scrums of other annoying tourists?

bul – if you aren’t familiar with Coppola’s ‘Godfather’ trilogy, XC’s jest might be a bit obscure…

may we all find a better day.

1) Tucking cost in the south is almost half than diesel and labor in the west.

2) Commercial real estate in Mobile and Huntsville AL is flourishing. SF and NYC office vacancies rates hit a new all time high.

3) Aerodynamics engineers rarely buy fine jewelry. If they do they will inspect the shank, ask about the structure. Hollywood and SF executives pay for glitter.

4) Analysts and econ 101 prof are bearish. CFO’s and CEO’s became conservative. They don’t know what to do next. If the Dow popup after a summer lull CASS might takeoff > the 2023 chart.

5) Old horses recover from the long trip since 2002 low. They regain some strength, eating grass west of Lake Tahoe, but they are old, over 20 years old. Old. The market rotate to new stuff.

not to be a topper Wolf, but re airports: IIRC was in couple dozen in USA this century, including SFO at six am when it was still so provincial that they could not serve Irish Coffee at 6am.

ALL of them could be bedlam at times, boring other times.

My questions re trucking/freight are:

1. At avg about $1222 per invoice, this index must include many low cost loads; won’t this average go way up with declining consumer consumption? And is amazing one and others similar now — Kroger, WM, etc., included?

2. Are marine freights included at all?

3. Are bulk loads such as dump truck loads of dirt or gravel delivered to construction or consumer sites included?

Charts appear to show direction we headed, eh?

It cost me $900 to get my pallet of beer mugs shipped in August last year, from the mug printer in Ohio, to my media mogul headquarters in San Francisco, at peak rip-off freight rates, LOL.

The index also includes the parcel carriers. So that brings the averages down quickly.

I’ve seen it in a tangential trucking service. Specialized freight. We’re a major company and our smaller competitors have closed down service areas that are farther away. We’ve taken the accounts. We have had positions open for a couple years with no applicants. We’ve had 5 apply but not follow through, mostly because it is trucking with back breaking dirty manual labor involved and the pay is still low compared to other labor involved trucking sectors like P&D and food service. And woefully lower than union line haul and fuel haul divisions.

Interesting to see the shift in just a matter of months. But I’m still drowning in hours and working every legal hour between 10hr resets and 34hr resets. I’m looking forward to having a single free minute outside of work and living by the elogs. Even if it means layoffs lol.

Consumers spending : from the millions –> to the thousands –> to the crumbs. If the debt ceiling rise –> new gov spending in the trillions, mostly in the mid-west and the south, on road works, mfg facilities, defense… Cass will love it. The regional banks might takeoff.

Ilan, for fun and entertainment, tomorrow on CNBC at 6pm with David

Faber…not with what his name.

Wolf,

I wonder how this will affect the autonomous trucking startups. At least the few that are left. Will their profit margin projections to investors change or were they very, very rosy,

Truly autonomous trucks (or even cars) are many years away. Those startups better have lots of cash to burn over those years.

Well, is there a doubt that ICE propulsion system is being replaced by the electric vehicle. The world has committed too a Mexican standoff in the sense that we have come too a branch in the road.

One path is moral, the other, not.

“…when you come to a fork in the road, take it…”

-Master Berra

may we all find a better day

Reminds me that I was once a lumper carrying 200+ lbs of beef quarters up to 45 feet to hook the the hind or the front on the meat warehouse receiving meat hook.

To this day, the smell of a big rig idling is liberating. Other than that, what is the relevance of the freight rate data. Is it a reliable indicator of the current economic construction, let alone the future.

I don’t think so. It is fickle, like the weather.