FDIC Board Member McKernan laments “our country’s bailout culture that privatizes gains while socializing losses.”

By Wolf Richter for WOLF STREET.

First Republic Bank, after disclosing last week that it’s a zombie, was shut down early today by the California banking regulator and handed to the FDIC as receiver, which then dismembered it and handed the pieces, after “a highly competitive bidding process,” to JP Morgan Chase Bank. These pieces are “substantially” all of its assets — including $173 billion in loans and $30 billion in securities. And JP Morgan assumes all its remaining $92 billion in deposits.

Another bailout of uninsured depositors, including the big banks: All depositors, including uninsured depositors – including the $30 billion that 11 big banks, led by JP Morgan Chase, deposited at First Republic in March to prop it up – have access to their money today during regular business hours. All 84 branches reopen today as branches of JP Morgan Chase.

JP Morgan, in its press release, said that it will pay for it in part with a $50 billion five-year fixed-rate loan from the FDIC. I sorted through the details of what JP Morgan got and what it paid here.

And it said it would “recognize an upfront, one-time, post-tax gain of approximately $2.6 billion,” and incur post-tax restructuring costs over the next 18 months of “approximately $2.0 billion.”

The FDIC also entered into a loss-share agreement with JP Morgan under which the FDIC will share in the losses and potential recoveries on the single family, residential, and commercial loans that JP Morgan purchased from the FDIC’s pile that was First Republic Bank.

Total cost to the FDIC insurance fund will be about $13 billion, including the costs of bailing out the insured depositors, according to FDIC estimates.

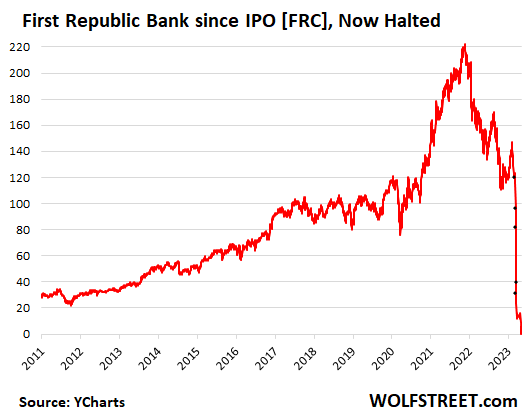

Stockholders got bailed in and wiped out. They’d already been mostly wiped out by Friday evening in one of the most spectacular stock plunges ever.

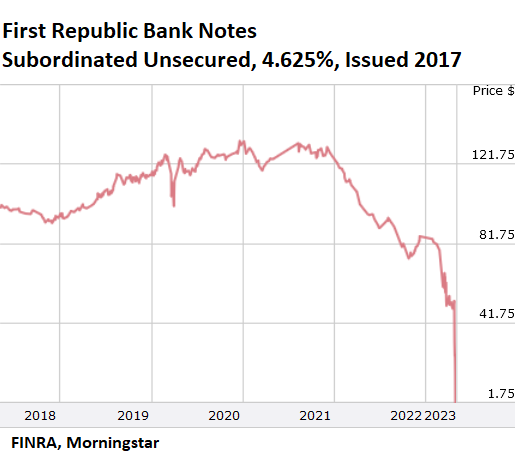

Holders of the unsecured subordinated bank notes got bailed in and wiped out just about entirely. This is a form of preferred stock. There were two issues, totaling $800 million. For example, the 4.625% bank notes, issued in 2017, traded at less than 2 cents on the dollar this morning, another spectacular plunge.

This was a bank resolution over a weekend with a minimum amount of drama and disruptions for bank customers that leaves all deposits and substantially all assets in the private sector – unlike the messy receiverships of Silicon Valley Bank and Signature Bank that involved a huge amount of drama over the deposits that was deemed to require the FDIC’s emergency powers; and this mess is still dragging on with the FDIC still trying to sell the remaining assets.

“Our country’s bailout culture that privatizes gains while socializing losses.”

Very interestingly, in a separate statement about the First Republic resolution, FDIC Board Member Jonathan McKernan rebuked bank regulators, bank regulations, and the “bailout culture”:

“I am pleased we were able to deal with First Republic’s failure without using the FDIC’s emergency powers. It is a grave and unfortunate event when the FDIC uses these emergency powers. Any decision to use the FDIC’s emergency powers should be approached skeptically, taking into account the unique facts and circumstances of the time, and with careful attention to the implications for the future.

“The March 12 rescue of SVB and Signature’s uninsured depositors was an admission that 15 years of reform efforts have not been a success. Many of the Dodd-Frank Act regulations were prescriptive, burdensome, and expensive. Yet still a failed bank’s investors do not always bear the consequences of the bank’s poor risk management. And yet still the banking system is not resilient to failures of bank supervision.

“More work remains to be done. We should avoid the temptation to pile on yet more prescriptive regulation or otherwise push responsible risk taking out of the banking system. Instead, we should acknowledge that bank failures are inevitable in a dynamic and innovative financial system.

“We should plan for those bank failures by focusing on strong capital requirements and an effective resolution framework as our best hope for eventually ending our country’s bailout culture that privatizes gains while socializing losses.”

Well said. But good luck.

Here is one of the two issues of the bailed-in subordinated unsecured notes, trading at less than 2 cents this morning, going to heck in a straight line, thereby violating the Wolf Street dictum that nothing goes to heck in a straight line (chart via Finra/Moringstar):

And here are the misbegotten shares [FRC] that also violated the Wolf Street dictum. The stock is halted and will be delisted. It may eventually trade over the counter for a while for a few cents. On Friday, after hours, it plunged to $1.90. Dip buyers who helped other investors unload this stuff should be thanked for their services. The shares don’t represent anything anymore. Their fate is zero. And this fate is already included in the chart. And thereby another spectacular hero in my pantheon of Imploded Stocks bites the dust (data via YCharts):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

There are so many zombies when you think of what ZIRP created. In all industries. No one wants to take the pain so we all suffer as a society.

I think there is more to come. Almost everything bought since pandemic response is going to be a loss if 5% plus rates stick around.

There are something like close to 2000 zombie companies, by my quick Google searching, primarily focused in Real Estate. Not to mention all of the wildly over-leveraged banks that cannot cover all of their risky debts.

Once the Covid welfare is gone, it’ll really hit

What are you searching for, exactly? Just curious.

I worry about underwater non-recourse Jumbo loans in cities like Seattle and San-Francisco. Many of these loans are held by banks in their books instead of being resold as RMBS.

Despite having underwater loans, and despite many layoffs in big tech in good paying jobs, these banks are still offering Jumbo loans at rates lower than conforming loans to use their deposits.

It’s already cheaper for laid-off borrowers that took loan a year ago to handover their houses to the bank rather than sell these houses or service the loans, and this number will just keep increasing.

Looks like it will be a lot worse before it gets better. Fed QT keeps failing as banks are still not acting responsibly and Fed is unable hold them accountable.

Nah. I mean, obviously, you can “worry” about whatever you want. But this won’t be a problem until home prices fall a WHOLE LOT more.

1. There are VERY FEW underwater mortgages, period. Jumbo or conforming. Only the mortgages that were taking out during the very peak of the bubble are underwater now. That’s a small number of mortgages because the peak was steep and short. On the West Coast, mortgages taken out in mid-2021 and before are ABOVE water even with no down payment. Mortgages with down payment are even further above water. Home prices spiked so fast that only a relatively small number of buyers bought during the very brief top.

2. Wealthy people may eventually walk away from a non-recourse mortgage, but they won’t do it for just a few percentage points. That’s financial idiocy. The price of the home would have to plunge 40% or 50% below the outstanding mortgage balance. If they perceive this to be a relatively brief decline, they will just sit it out and wait because they can afford it.

3. The actual layoffs have been very small in the Bay Area. I have documented them in my articles about the WARN filings. The layoff announcements you’re citing are global, and just announcements.

4. Right now, most laid-off tech workers can find jobs quickly (older tech workers cannot, but that’s age discrimination, and that’s always the case).

5. First Republic was heavily exposed to those loans, but the problem wasn’t that they’re underwater and borrowers defaulted on them. The problem was their low interest rate and not being able to SELL those loans when deposit flight set in. The loans themselves have very high credit quality. No one is going to quickly default on those super-low-interest-rate loans. They’re now incredible deals for the borrowers!!!

6. Those big mortgages to the wealthy were a First Republic specialty. No other bank has that kind of concentration.

I don’t worry about them at all. If they should go bad en masse, contributing to a flood of inventory available at reasonable prices to ordinary working people, that would be a wonderful outcome. Not a likely one, mind you, but a wonderful one.

Do not keep cash. Use it or buy gold/silver if you want to save. I wrote that last years…spend it soon it is all gone papermoney or digital money nowdays

Precious metals will be hit badly when the next shoe drops. Then will be a good time to buy. For now treasuries offer a bearable way to keep up w inflation (without gains in real terms tho). Cash will have orher king moments, as will volatility.

I agree PMs will get hit hard at the start of recession, usually sold to cover failing trades. But when they tank, most dealers will either hike premiums to the moon or pull their products off the table completely.

There is no free lunch.

Right on sensible banker,@ negative interest rate, what rate? Would only a banker accept? No deal?

I tried really hard to figure out the stock market in 2005..

And never made any sense to me as the years roll on still doesn’t.

I guess I answered it a bad time to learn about something

I think there are two errors in accounting that are a little crooked.

1. Hold to maturity accounting. This allows banks to mismark risk.

2. FDIC insurance premium.

Defacto now is all deposits are insured which means deposit insurance is mispriced.

Interest rates in economy doesn’t match the risk profile. So all financial system is misprised or shouldwe say manipulated by fed put and govt put and fdic put.

This, exactly.

Brainless ZIRP for essentially 20 years (to provide political cover for DC’s 100% commitment to business/corruption as usual) has driven mis-valuation/mal-investment into every corner of the economy.

And the “decisionmakers” knew every step of the way the risks they were taking.

ZIRP wasn’t for business/corruption.

It was to permit LIMITLESS federal government borrowing and spending.

Not sure about the insurance premium, but there really needs to be some work done on whether financial institutions should be held to mark-to-market accounting. When assets are not accounted on a mark-to-market basis, it is too easy to hide losses until they have become so large they cause problems. If these banks had to worry about mark-to-market, they would have hedged their exposure.

But the real issue is that the activity of central bankers in the markets with zero percent interest rates has created a financial tsunami that has still not even hit us. Things are going to get much worse as the housing market finally relents and crashes.

Sounds like a golden opportunity. Take over valuable assets and leave the garbage for somebody else to cleanup. Good for JPM i guess.

Just wondering. The thirteen billion dollar bailout, are FDIC member banks going to have to chip in to cover this or is the fund just going to have to endure the loss?

Now that ALL deposits are effectively “insured”, I would imagine that the FDIC will have to increase the annual assessment rates for all member banks and perhaps even require a one-time “special assessment” to bring the fund’s reserves up to the level necessary to cover all deposits.

Our dear leaders are assuring us that everything is peachy. There’s never been a better time to run! They’re already looking for the bagholders to finance the next unavoidable bailouts.

At the end of the day, it’d be common people and tax payers who would need to chip in to make up for this.

As JPM gets paid to take over FRC, our

local church just raised its three reservation rates/hour due to the higher cost of maintenance and cleaning (still not charging for profit.)

Parish center, was $40, now $50/hr.

Parish Family Room, was $50, now $100/hr.

Gym for events, was $60, now $150/hr.

These increases are clearly far above the 5.5-6.0% currently being touted by the Fed.

Small sample? Yes.

An aberration? No.

The Fed employs over 23,000 people. No one there is feeling inflation pain as, with benefits, they make over $300,000/year (on average). Expect ever more tools and bailouts.

They run our economy like a hedge fund, are consistently wrong, and are never punished or “fired” for performance.

As always, the common man will suffer the most.

Yikes.

LOL $300k/year, on AVERAGE? LOL

The website for the Board of Governors of the Federal Reserve System reports that the Fed Chair’s salary in 2019 was set at $203,500. It also says that the annual pay for other Board members that year was $183,100. Everybody else is paid a whole lot less contrary to your assertions.

If you are talking about the Federal Reserve System, they only have 1,609 employees and the top salary is $259,500.

Read the Federal Reserve’s Statement of Operatiions in detail.

After reading that, check out the 2021 annual report. Keep digging. The total employee head count is well hidden.

Do you mean the Federal Reserve (FR) with about 20 000 workers or the Federal Reserve Board (FRB) with about 3 000 workers (Yes those are different entities although there is a line item on the FR statement for the total funding the FRB received from the FR). Someone dropped a FOIA request in 2020 for precisely the type of information you claim to have and the FR returned only information on the FRB (and have stonewalled any other FOIA attempts about the lesser earners & the entirety of the FR stating that that is privacy sensitive information). 12%-13% of the people having a salary over $225k/year, 16 having a salary of 286k/year as highest earners. Even with 2 years worth of inflation (the statement you referred to is for 2022) you are going to have an hard time to get the average wage of the FRB to $300k/year.

For the FR itself that leaves page 7, subsection Operating Expenses, line item Salaries and Benefits. $3.943 billion.

the FR has roughly 20 000 employees, giving an average salary of roughly $197 150/year.

Even bringing in the entirety of the System Pension Service Cost line item (which for various reasons is not the correct thing to do, for example the FR only matches up to 6% of an employees salary paid by that employee into the pension fund with a minimum of 1% if the employee would pay less into it) would only get you an average salary of about $245k.

So yes you do not know what you are talking about and blindly referred to a statement you either did not read or did not understand yourself thinking it would strengthen your argument when it does no such thing (or were you hoping no one on the internet would be bored enough to go trawling for this statement).

That said I can only guess where Arnold got his numbers from. 1 600 employees makes me guess it is one of the banks making up the federal reserve. It is also easier to look up average and/or top salaries per individual bank on job hunting websites for the state they are in. But it is the wrong thing to do.

$197K/yr is still a crazy high salary from my perspective as a private-sector pleb.

@MM That is not the take home salary or even the salary listed in the employee contract. About 1/3 of that is employer only costs. But seeing that Nevada22 talked about everything including benefits it would be incorrect to not include that.

As for the high salary; The people they have working for them can earn more, sometimes a lot more, if they’d work for a bank.

That said there are other things in that line item that reduce the average salary in a contract even more. The reason I state that is a look at the following page: https://www.federalreserve.gov/careers-salary.htm , the average line (if using 197k/130k) is too high up on the scale for either pay structure.

Which is confirmed by a cursory search giving me https://www.zippia.com/federal-reserve-system-careers-57346/# ,with an average salary of 91k/year (for Washington, DC)

Or about 135k/year with employer costs included.

I am just curious if those numbers you are using include bonuses and benefits etc?

Also consultants and subcontractors?

I just would be very surprised at a government agency NOT hiding the true costs of it’s “services”.

Well at least churches don’t have to pay taxes or the increases would be probably be much worse.

Well said!!! The common man suffers and the Fed never feels the pain of inflation and is never held accountable.

Well, I had predicted that its next earnings report in July would show the bank is dead, but that was quicker than I had expected.

I am just relieved to hear Jamie Dimon state emphatically that this crisis is now over./sarcasm.

So, which banks are next to fall?

Watch KEY bank ,heard it’s next

I worked for key in retail and then investment services.

In retail they seemed fairly conservative with lending. Lower approved limits unless tier 1 credit sort of stuff.

Investment side and what I understand from other arms of the bank were much more wild west and wouldn’t be surprised if that puts the bank in a bad place eventually.

Pretty competitive deposit rates tho so that may keep the bank run limited.

I would both laugh and cry if they collapsed

You can’t regulate away stupidity…but you can socialize it!

Kramartini,these people are very intelligent,they steal from the common people =taxpayer right in front of your eyes. With no CONsequencces . But they forget we’re broke ,games almost over

Buying long-dated, low-yielding assets with short-term deposits is not a sign of genius. Lex Luthor these folks are not…

It’s surprising and refreshing to hear someone in power talk about “bailout culture” when 99% of the media & the rich & powerful constantly gaslight us into trying to believe it doesn’t exist.

JPMC would now have more than 16% of all bank deposits in the US, and a special exemption/waiver/exception had to be approved in order for JPMC to jump on this sensational deal of acquiring $90 billion of deposits at First Republic for a mega-bargain $10.5 billion after First Republic was seized in the middle of the night!!!

Deposits are a LIABILITY. JPM didn’t “acquire” the deposits. It’s a debt that is owed the depositors. JPM “assumed” the deposits, meaning it agreed to take on that debt. Assuming the $92 billion in deposits was in part how JPM paid for the assets.

Wolf,

Could you clarify…

1) JPM acquires $173B in loans and $30 billion in securities (assets theoretically valued at $203B at FR) (I know the true value may be significantly less),

2) JPM simultaneously on the hook for $92 in deposits (liabilities) that *remained* at FR at time of acquisition.

I suppose FR could have had a ton of undiscussed debt (or other liabilities) or that the mechanics/timing of depositor run-off created undiscussed debt, but I’m puzzled as to how exactly FR was insolvent at acquisition (in accounting terms) given the stated numbers. I’m guessing that FR has a ton of liabilities unmentioned in the post.

(I have no doubt it *was* insolvent, I’m just fuzzy on how exactly the depositor run (or other item) translated into insolvency given the asset valuations in #1 or the stated liabilities in #2…whose net balance is positive.)

I know that depositor runs create huge, new, cash liabilities very quickly and that the loans/securities can’t be sold fast enough or for enough to meet those cash liabilities.

But I didn’t see above the numbers that put FR into negative equity (did you just leave them out because they are going to left with the rump FR, and really aren’t JPM’s problem)?

I’m just trying to educate myself as to each step of the process (accounting and otherwise).

Here are the details:

https://wolfstreet.com/2023/05/01/heres-the-great-deal-jp-morgan-got-on-first-republic-according-to-jp-morgans-victory-lap-in-front-of-investors/

Great news corrupt bankster jamie gets dead bank for free. WTF isn’t Amerika great? I’m glad I’m so poor I don’t pay taxes.

Jamie did vastly better than that. He got the FDIC to pay JPMC $50 billion to take on this daunting and challenging endeavor!!!

You need to understand the difference between assets and liabilities. They’re not the same.

Let me give you an example: When you buy a car and pay down $2,000 and you take out a loan from the dealer/finance company for $18,000, how much did you pay for the car? $20,000.

A loan is something that you owe and have to pay in the future.

The dealer is NOT paying YOU $18,000 to take the car – that’s just silly… but that’s what you’re saying about the FDIC and JPM. No, no, no, YOU are paying the dealer $2,000 NOW and $18,000 LATER to buy the car. You will pay $20,000, plus interest.

Same with JPM. It paid the FDIC $10.6 billion now, plus it assumed the FHLB loans and the deposits, and then it also WILL PAY the FDIC the $50 billion plus interest. You have to add all of them together to get the total price that JPM is paying.

I explained it here in detail:

https://wolfstreet.com/2023/05/01/heres-the-great-deal-jp-morgan-got-on-first-republic-according-to-jp-morgans-victory-lap-in-front-of-investors/

Who the heck are you to call Jamie a ‘corrupt bankster’ ? Does it make you feel better ? Did you read it somewhere ? Or is it your take on all people who are not poor, like yourself ? Or maybe just bankers ? There’s all sorts of corruption around, but to fling accusations at someone whose career you don’t know, whose business you don’t understand…….reflects on you, badly. And, fyi, America is great…..and, whether you know it or not, you are paying taxes.

America is disgusting. A country that only cares about personal gain and property over the better interest of humanity.

With great power comes great responsibility…. America fails this with red white and blue colors

Name one thing America is great at other then military, finance, or entertainment???

Everything is corrupt, food, water, housing all in shambles.

Keep telling yourself we’re number 1… You be right every four years at the summer Olympics

Crisis only started middle of March and here we are taking out FRC w/ 200 Billions asset, the 2nd largest bank failure in the nation history.

Anyone thinks this is over is totally delusional. The zero interest rate and flush of money of the past few years are just starting to knock on the banks: a few down and many more to come. During GFC, we had a few banks every week. May be this time, we will have a few every month but the pain is just starting.

This is my response to FRC and the other zombie banks with huge losses: SUFFER B!TCHES!

Zara ,where is a safe place for money

Gold and silver.

JPMC. I am honored to be a Private Client there and am in awe of the 0.000002% interest I get on my largest account there where I earned just a little less than $8.00 on on account of around $200,000 last year. My eternal thanks go to Jamie!

Generally speaking, who are the owners of that unsecured debt? Pension funds?

So, what made their assets become worthless? Was it interest rates going up? or something else.

I should have said worth less rather than worthless.

underrated question

https://wolfstreet.com/2023/04/24/first-republic-discloses-its-a-zombie/

“Yet still a failed bank’s investors do not always bear the consequences of the bank’s poor risk management. ”

This assumes that a bank’s depositors are “investors.” Whether true or not, I can tell you that 99% of Americans don’t see it that way.

Insured depositors would have gotten 100% of their money back.

Uninsured depositors would have gotten a haircut on their deposits. Historically, they would have gotten between 80% and 100% of their money back. Not the end of the world. It worked before. There have been lots of bank failures under those rules. In this case, lots of wealthy depositors and 11 big banks (who’d put in $30 billion) got all their money back, LOL

Understood, and I’m not saying it’s right or wrong. I’m just saying that almost nobody considers depositing money into a bank to be “making an investment.” That is likely in large part due to 90 years of FDIC insurance, but at this point, it’s ingrained.

More raging inflation, coming right up. Economies of bail are inflationary. We need to get rid of the FED and all of CONgress. They are destroying the country right before our eyes, picking winners and losers.

Crony capitalism is socialism for the wealthy – a reverse-Robin Hood system where the government and its corporate cronies extract the wealth from the bottom 99% and give it to the already rich under the guise of “it’s what’s best for society.”

Always right in target dc.

Hi DC,

Exactly my thoughts but I can’t put them in words better than you.

I see more and more bail out of rich and elite at the expense of tax payers aka middle class.

This won’t stop unless a revolution happens but people are living a comatose life.

it(revolution) has started and will continue. Its called tax cheating for some and tax strategy for others. A big circle of scamming is what we have. Everybody is scamming where they can. Its all just a game.

You may be right, not just with taxes. When gaming the system get entrenched with all parties there is a slippery slope down. The end game is when cheating, scamming, corruption, nepotism and so on is the system.

Best buy your pitchforks now then, while they’re still affordable.

Get rid of Congress? Really? You clearly haven’t been paying attention. Voters do not pick their representatives. Thanks to gerrymandering, the representatives pick their voters. There are very few competitive districts any more and there are fewer every time redistricting happens. I used to live in a competitive district but now Chip Roy is a US House member until he dies or moves on to higher office.

Also, if you look at the QE which started after GFC, although there was no CPI inflation, but the cheap money made rich obscenely richer and poor poorer by increasing prices of all assets held by rich not by poor.

FED should be abolished and these people along with congress should be prosecuted.

but cheap money has made the rich obscenely richer and the poor poorer by driving up the prices of all assets held by the rich, not the poor.”

This wealth remains only on paper. You get rich if and when you can sell it.

Not sure about raging inflation but there will be inflation.

Luckily, we are looking at 40 year lows in Nat Gas. This is going to save billions for the bottom line for many companies and should boost earnings of many manufacturers. It will hurt profits of nat gas producers though. LOL

I must take exception to Board Member Jonathan McKernan’s comments. People must have confidence in the banking system, and cannot be expected to have to monitor their own banks financial position. The bank regulators must regulate effectively and at the same time allow the banks to function as they should in society and be of investable quality for investors. Striking this balance is not easy, but it is necessary to operate with this goal, the system will not work otherwise, and this means that from time to time there will be situations when a bailout is necessary. The cost of it is borne by the FDIC and the other banks, it is not the end of the world. I am frankly surprised a Fed board member doesn’t understand this. Not smart enough I would say. Wants to be a tough guy now that the situation is resolved. It would be interesting to see if he had the guts to make the decision to let a big bank fail, trigger a systemic failure. My bet is he wouldn’t.

If I have deposited more than 250K in a banks then I should better know that only 250K is FDIC insured.

Okay, great. So you’re a medium sized business with $50 million in cash on hand. How are you supposed to determine if a bank is healthy? I’ll wait.

Don’t waste time waiting for jon. You’re the one who wants the rules changed. You should be contacting your representatives immediately and telling them to insure all deposits. The country has never done that before, even for medium sized businesses, but you must believe it’s the only option now.

I really don’t care if Congress changes the rules for everyone, but insuring all deposits on an ad hoc basis appears corrupt. The government is once again picking winners and losers. Basic fairness dictates the same rules should apply to everyone.

Rojogrande, I agree with that.

It seems like this is an instance of regulators being asleep at the wheel. Again.

You park it in short term treasuries. Or you risk loosing everything over 250K. Your choice. Free country.

Yeah, and how do you make payroll from short term treasuries?

You can buy insurance. It’s relatively not expensive.

Top 4 bank. I’m sure every large business deposits at Chase.

I agree the limits need to be changed for business accounts. All in pod said there should be a vault account with higher fees ($100-200) that ensures all deposits, perhaps outsourced to the FDIC

My biggest issue is more systemic, mainly that we are privatizing profits and socializing losses. It’s not fair to do both – banks need to pick a side of the aisle and stick with it

About this: The cost of it is borne by the FDIC and the other banks==> Not true. The cost is born by common people and tax payers. You just need to think one layer below what appears to us then you’d realize this.

The is no free lunch. The cost of everything is ultimately born by someone. In a bank failure it is the stockholders and the dentureholders then perhaps depositors or the FDIC, with FDIC share falling to the banks in the banking system and the banks trying to push it out in fees and charges to customers and if to the extent they can’t it cuts into profits and is a cost to stockholders or to management bonuses, and lower profits and bonuses means lower taxes to government. If there is no bailout and the result is a contagion of multiple bank failures then much higher costs would allocate the same complex way. The only viable course of action is the one that minimizes the cost and disruption to the financial system.

gBC1,

Insured depositors would have gotten 100% of their money back.

Uninsured depositors would have gotten a haircut on their deposits. Historically, they would have gotten between 80% and 100% of their money back. Not the end of the world. It worked before. There have been lots of bank failures under those rules. In this case, lots of wealthy depositors and 11 big banks (who’d put in $30 billion) got all their money back, LOL

Of course as events unfold no depositor in an amount exceeding the insured amount can be certain of what percentage of his deposit he will ultimately recover, plus it will take time, possibly years, to recover it all, and the professional fees and court proceedings will take a big chunk of it. And the deposit is may need funds to make payroll, etc, depositors businesses may fail, there are lots of knock-on consequences possible, none of them good. The biggest mistake made in 2008 was not bailing out Lehman, the cost of that mistake was huge, far more than a bailout would have cost. The way to manage this is the way they are doing it, impose reasonable requirements

on the banks, monitor them carefully, learn from mistakes, limit the deposit insurance but do the bailouts when not to do them would lead to contagion, let the odd isolated failure run it’s course, charge costs to the banking system to the extent possible without threatening the system. And always think about it from the perspective of the authority making the decision whether or not to do the bailout. For example, in the Federal Republic situation, are you going to be the one who said no and caused a run on all the regional banks in the country?

GBC1,

1. Bank resolutions don’t go through a court. There is no bankruptcy filing or process. The FDIC handles this, and it’s very fast, compared to bankruptcy court proceeding which, as you said, can stretch out years. Under an FDIC bank resolution, you usually get a portion of the uninsured deposits within days. And as the FDIC sells the assets, you get more of your deposits. It was designed to put money back to work as fast as possible (as opposed to what a bankruptcy proceeding would do).

2. Lehman wasn’t a commercial bank but an investment bank with a hedge fund. (It only owned a small commercial bank). This wasn’t an issue of deposits. This was an issue of complex trades and funding needed to keep the trades going. The counterparties bailed out on it and it couldn’t fund its trades anymore and collapsed.

3. “The biggest mistake made in 2008 was not bailing out Lehman,…”

No, the biggest mistake was bailing out Goldman. They should have let Goldman implode. But Secretary of the Treasury Paulson, former Goldman guy, with much of his wealth still tied up in Goldman stock (through a swap arrangement), couldn’t handle that apparently.

Wolf….

Brace yourself for what might happen with FTX.

Party on Janet

I believe that uninsured depositors of Indymac lost closer to 50%. Let’s assume that the FDIC took that same position now. Deposit flight to the mega banks accelerates and the smaller banks reduce lending in the system. Are we really better off making the too big to fail banks bigger?

¨…No, the biggest mistake was bailing out Goldman. They should have let Goldman implode. But Secretary of the Treasury Paulson, former Goldman guy, with much of his wealth still tied up in Goldman stock (through a swap arrangement), couldn’t handle that apparently…¨

Wolf, I agree with you, but also remember, Mr. Warren Buffett’s insurance and investment company Berkshire Hathaway bought $5 billion of Goldman preferred shares yielding 10 percent, back in Q4 2008.

Berkshire also got warrants to buy an equal amount of common stock at $115 per share. Buffett said Goldman wanted money immediately and so Warren structured a preferred that was attractive for him.

A few months later March 2009, Goldman started to publicly communicate to the New York Times their intention to repay during 2009 the entire $10 billion it took from the government’s Troubled Asset Relief Program (TARP), despite a $2.12 billion fourth-quarter 2008 loss.

Goldman´s stock price in November 21, 2008 had fallen to ~$47 and by March 24, 2009 it had already risen to $115, the highest level since October 23, 2008 – and Buffett´s warrants became ¨in the money¨:)

Apparently this is the new formula for zombie banks. Doesn’t create much of an incentive to own mid tier banks that are rumored to be even remotely in trouble.

US banks are well on their way to following the Japanese model of the late 1990s: soon there will be only a few megabanks to choose from.

During the financial crisis of 2007–2008, the Federal Reserve bailed AIG out for $180 billion and assumed controlling ownership stake, with the Financial Crisis Inquiry Commission correlating AIG’s failure with the mass sales of unhedged insurance. Risk On environment always on Wall St. It’s backed by the Full Faith and Credit of the US Government. Let’s get student loans completely forgiven, free healthcare, and another round of PPP loans/forgiveness.

“Dip buyers who helped other investors unload this stuff should be thanked for their services.” – I literally laughed out loud when I read this.

Funny….arsonist pointing out the obvious…

“FDIC Board Member McKernan laments “our country’s bailout culture that privatizes gains while socializing losses.””

The fact that there isn’t riot on the streets for countless bailout of the rich and socializing the loss goes to show you how effective neoliberalism has gotten and how it turned the majority of the population into the best example of passive nihilism in the world.

“FDIC Board Member McKernan laments “our country’s bailout culture that privatizes gains while socializing losses.””

Never listen to what they say, always watch what they do. Actions speak louder than words. They say one thing and do the opposite, gaslighting the public, and the sheeple swallow the bait, hook, line and sinker.

JPM got around the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994.

Where’s Thomas Hoenig?

JPM must have gotten the “exception” that would be required for any bank with over 10% of the deposits in the banking system. But that exception was minor compared to the bailout of uninsured depositors.

Let me see if I have this right:

After SVB went down, even though all of the SVB ‘uninsured’ deposits over 250k got bailed out, the FDIC was unwilling to formally commit to insuring these deposits. So First Republic’s high net worth depositors got scared and pulled all of their money out, causing the bank to fail, and the FDIC again bailed out all the (remaining) deposits over 250k, contributing to a final taxpayer (eventually) cost of 13bn?

What a joke, it seems obvious that this ‘shadow insurance’ regime for amounts over 250k is not working. Either insure everything or don’t, but pretending not to and then doing it in the end seems like the worst of both worlds.

Also, Wolf, looking at the charts, I would say that ‘nothing goes to heck in a straight line’ remains valid. Sure the final leg down was straight to 0, but there were a couple of head-fake rallies between the peak and 0 on all the charts.

“Either insure everything or don’t, but pretending not to and then doing it in the end seems like the worst of both worlds.”

+1

Yellen’s move with SVB set a precedent that essentially ..going forward…all deposits are covered. How else can “equal treatment” be handled in court after this?

Where the government exercises discretionary authority, it can change its policy at any time. The only thing any depositor is currently guaranteed is $250,000, perhaps more depending on account structure under FDIC rules. Maybe these actions will be precedent to cover all deposits going forward, but I wouldn’t risk my money on that until the FDIC formally issues new deposit insurance limits.

So they wouldn’t let losses happen in 2008 except for little people, why do you people expect it to be any different this time?

Which bondholders survived? How much bond principle will be returned, if any?

First Republic had very little bond-type debt. It was totally relying on deposits for funding, which was part of its problem (part of the concentration risk).

There are only two issues of Subordinated Unsecured Bank Notes (preferred stock) outstanding. There are no other bonds.

$400 million of 4.375% – wiped out

$400 million of 4.625% – wiped out

No principal will be returned. JPM washed its hands off them.

On Feb 2, 2023, First Republic redeemed $500 million of 1.912% senior unsecured bank notes for 99.94 cents on the dollar. So those holders got their money out three months ago.

Dimon is a savage LOL

Two things stands out at both SVB and FRC before March

Both had significant unrealized losses on government securities . SVB specifically had losses totaling almost 100% of its equity . Management at both seemed to completely lack any elementary understanding of interest rate risks and refused to hedge .

Both had very large amounts of uninsured deposits. SVB had 96% of its total deposits uninsured while FRC had 68% uninsured . The obvious question comes up is why the heck would rich people and corporations ever keep large sums in a bank . I can understand why corporations would keep monies over 250,000 for payroll and similar requirements , but many companies kept far more these needs on deposit . Individuals had no incentives to keep deposits at a bank UNLESS there was some sweetheart deal to do so . I have read that SVB lent money on the equity of very illiquid private equity holdings and that FRC made very low rare interest rate loans to rich borrowers , but thus seems to be only the top of the iceberg

“The FDIC receives no Congressional appropriations – it is funded by premiums that banks and savings associations pay for deposit insurance coverage.” – FDIC

Banks will raise customer fees and keep savings rates near zero to pay for the increase in premiums caused by these bank failures. As bank failures increase, these premiums will increase. Get out of banks. Keep only the bare minimum in banks to cover paying bills. Reasonably safe alternatives are money market funds and Treasuries.

What happens with Certificates of Deposits (CDs) when these banks fail? I’ve been buying CDs of smaller banks but now I’m wondering if that’s dangerous.

You are fine if under 250K at any bank. FDIC insurance up to 250K. Risk free money.

And in fact, lately you are fine if you have a gazillion in the bank, but that is not the law as I understand it.

@paiute, same here. It’s already happened to me with Silvergate Bank — I got my principal returned in full with no interest paid. It was surprisingly fast, and the best I could have hoped for.

I have two CDs at now-failed Signature Bank. They were purchased thru my brokerage account, and have continued sit and accure interest as if nothing happened.

One matures in a couple weeks, I’m curious to see what happens with it.

///

Speech by Aladeen Haffaz a fictional character from the movie “Dictator”

“…

You could let 1% of the people have all the nations wealth.

You could get your rich friends get richer, by cutting their taxes,

and bailing them out when they gamble and lose

…”

When watching a comedy, one laughs and is entertained. But when one takes part in the comedy, the tragedy is inevitable.

///

I am curious how the DB AG will react to this, and the European financial sector to this situation.

///

All depositors, including uninsured depositors, including $30B by the

11 big banks will be paid by JPM. JPM will bail in itself and 10 other banks.

“Another bailout of uninsured depositors, including the big banks:”

The rules were clear….above 250K, uninsured.

Then Yellen and others declared different, and erased the rules….again.

(Now all $17 Trillion insured) de facto

How can the decision to insure all deposits FOR EVER, the actually effect of these moves, be done without Congress…..in such a cavalier fashion…by the unelected bureaucrats???

Uninsured deposits was a form of market discipline. But just like 2008, the gunslingers, the rule ignorers, those pushing the envelope when others are stopped by caution…….get bailed.

Any bailouts should have AUTOMATIC clawbacks of salaries and bonuses for a specified period prior to the emergency action.

Who gave Yellen the authority to put the taxpayers on the hook for 17 trillion in bank deposits? I thought Congress was in charge of the purse strings? What is this? A dictatorship or third world country. Screw these SOBs.

Aren’t banks supposed to have a regulatory “stress test” done every so often?

Well, yeah, mid-sized banks used to until regulations were loosened in 2018, and then they didn’t anymore.

In addition to protesting the bailout of uninsured depositors, McKernan uses his bully pulpit to complain about burdensome regulations. I agree with his abhorrence of the bailout of uninsured depositors, but not his complaints about regulation. Is he implying (or cleverly suggesting) that difficult regulations caused the collapse of SVB or First Republic? I haven’t seen or heard that cited as a cause for either implosion. Just bad practices. I believe his comments are part of the politics of these two wind-downs. Both banks are from the very blue SF Bay Area, and SVB was entwined with the Tech Sector from the day it opened. Would the FDIC have been as lenient if the banks were in Houston, and tied to the petroleum industry? Conversely, would McKernan, whose history and credentials are very red, have taken the same near-vehement stance if the banks and clientele were from a red state/area?

Some day, there may be a bank wind-down that doesn’t indemnify uninsured deposits. And on that day, the not-made-whole uninsured depositors will have good cause to sue the FDIC to cover their losses, and to sue for damages, citing the recent bailouts.

It was predictable: I invested few money on it, just to make sure this ‘bad bank’ will shut down! 😅😂🤣

I don’t know the answer to this question, but say that the FDIC runs out of insurance money, does that mean that even those depositors with 250K and below will get bailed in?

There will be money for the deposits. At the worst, the Fed will temporarily bail out the FDIC. If that happens, then the system is so screwed that it really won’t matter. Essentially, at that point, we will have fully nationalized the banking system.

So don’t worry about the end of the world.

It is like worrying we will allow everything to fail like 1933. We have already established we won’t do it. So, in the land of fiat currency, we can always have a functioning system.

It may suck to contemplate, but the system will work, period. So stop with anybody running out of money that matters.

Get it? Shareholders, bondholders, pffffft. Deposits are now good, period. But those others are on teh block.

Stop complaining about the systemic backstops. and watch what you invest in. Banking is returning to a utility, and needs regulation as such, not freewheeling dealmakers.

Wall street’s chop is coming as well, as bonds turn to turds that only lose value.

Commercial real estate, and so much else that has been levered up to the max is essentially dead.

Easy money has killed the markets for quite a while. And inflation is pushing relentlessly through the economy. The only question is if there are more waves of it, or will it settle down.

But real interest rates are back, and nothing is really ready for it.

Someday this war;s gonna end…

SocalJimObjects,

I know the answer: No.

The FDIC is a US government agency and is backed by the full faith and credit of the US government. It has a credit line with the Treasury Dept. During the Financial Crisis, it had to draw on the credit line; and over the years, as the fees it collects from banks kept coming it, in paid off what it had drawn and rebuilt the fund.

Obviously reqd to raise the level of fed insurance for deposits from present 250k, and should be done immy. Whether insurance level is raised to a million, two million……but must be higher to slow down movement of deposits from smaller to giant institutions. If I’m not insured, I’m out of there…..that’s the way it is.

As to mark to mkt, presents as many distortions as present system….there is not ‘ideal under all circumstances’ system.

America has the most highly fragmented banking system on the planet, by a country mile. There are advantages, it’s dynamic and flexible, and, interestingly, local and personal….and there are disadvantages.

Wrong solution. How many people in America have more than 250K in their accounts? Very very few. One possible solution is the creation of postal banks.

Spare me the return to the 19th century. We have banks that need managed like utilities. You really want to wait in line at the effing post office?

I don’t.

Businesses and a lot of private individuals have more than $250k. That level hasn’t changed in forever, and it is stupid in the modern world.

You want to wait in line to get your deposits out, like what happened with some banks during 2008? And please, this is 2023, a Postal Bank does not have to mean that people will have to wait in line just to withdraw some money.

The problem I am seeing is that people want conaame time banks are allowed to take big risks to earn returns. The people complaining about moral hazards are often the ones advocating for bailouts. Seen this movie too often.

Lots of businesses do. If you have a payroll of 100 people, you need more than $250K in the bank. If these are highly paid workers, paid once a month, you need over $1 million in the bank.

Yeah, but if a bank does not take risks and simply hews to the most basic banking operations, why would it need to be insured?

SocalJimObjects

“…why would it need to be insured?”

Because borrowing short and lending long is inherently risky. It’s structurally risky.

Question:

If the rapid interest rate rise is the cause of this banking problem, why couldn’t new “small and medium sized” banks be created which are not stuck with the long duration, low-interest rate treasuries. The new banks can just offer the depositors a rate closer to the money market fund rate. This will engineer a capital flight from the distressed small banks and perhaps even the mega-banks to a whole lot of new small banks. The established banks might lose, but the general public might benefit.

So, how do we start a new small bank?

You start with lots of capital. You cannot start a bank without capital. Then you have to figure out your business model, and how you’re going to make a living as a bank, and then, once you have all this together, you have to apply and get approved… banking regulations are pretty strict. Not any Tom, Dick, and Harry can start a bank — to then run off with the money. That idea has been had, LOL

Remember, “The best way to rob a bank is to own one”.

So you also need good character standing.

Does “Jamie Dimon” have that?

Perhaps we might interest Mr. Cassandra who can improve on past performance, place the BSAT (biggest short of all time) by creating an array of NSB’s (new small banks) and invite America to the party. It will be like 3D chess and some righteous poetic justice for 08.

Anyone twitter user who can tag Cassandra?