Introducing my new retail sales charts of three-month moving averages to iron out the big month-to-month spikes and drops that clutter up the trends.

By Wolf Richter for WOLF STREET.

OK, I’ve had it with the artificial and useless drama of the month-to-month ups and downs of seasonally adjusted retail sales that are subject to big up-or-down revisions the following month. Retailers report their sales quarterly, and GDP is reported quarterly in the US, and so I’m going to switch my charts on retail sales to a three-month-moving average, which eliminates a lot of the noise that obscures the trends. And the past six months have been particularly noisy with huge ups and big downs.

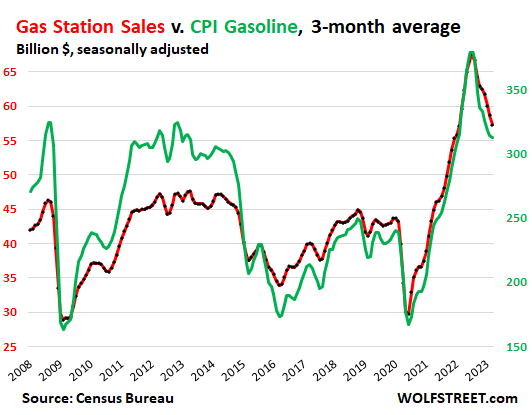

Dropping prices impact retail sales. Also note that the CPI for many categories of products that these retailers sell has dropped, with gasoline prices plunging, food prices dipping, and many goods prices falling, as inflation has shifted to services, and retailers don’t sell services; they sell goods. Dropping prices mean dropping sales, even when the retailer sells the same amount of goods. Further below you will see a chart of sales by gas stations overlaid with a chart of the CPI for gasoline, and they obviously run in near-lockstep because consumers buy about the same amount of gasoline in gallons, but when the prices change so dramatically, revenues (in dollars) change with the prices.

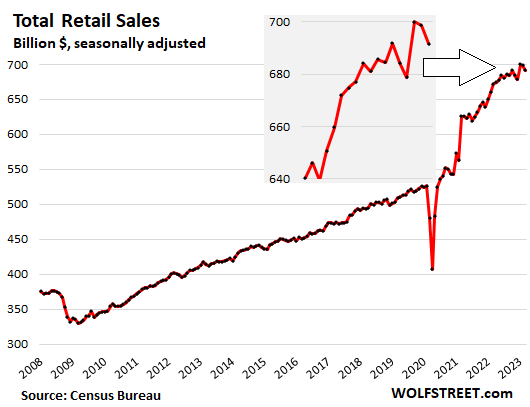

So this is my classic chart. Total retail sales, seasonally adjusted, fell 1.0% in March from February, after a dip in February, a huge 3.1% spike in January, declines in December and November, and a jump in October.

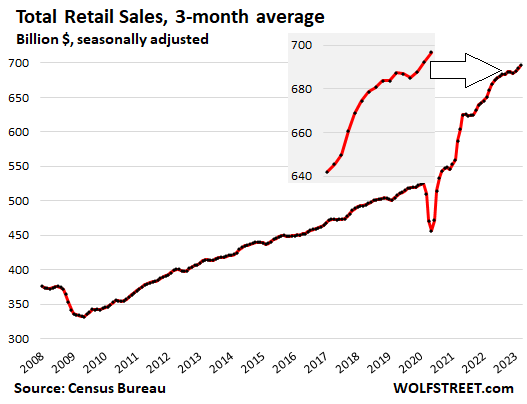

And this is my new chart of total retail sales as a three-month moving average. The March three-month moving average = the average of January, February and March, so representing Q1.

Q1 retail sales were up by 1.7% from Q4 and by 5.4% from the same period a year ago!

Reminder: Don’t apply overall CPI to retail sales because inflation has shifted to services, and retailers sell goods, and many goods prices have dropped or plunged, such as by 17% for gasoline! (My detailed discussion about inflation).

The insert shows the recent details of the trend: the slowdown late last year and a pickup so far this year:

Retail sales by category, 3-month moving average, seasonally adjusted.

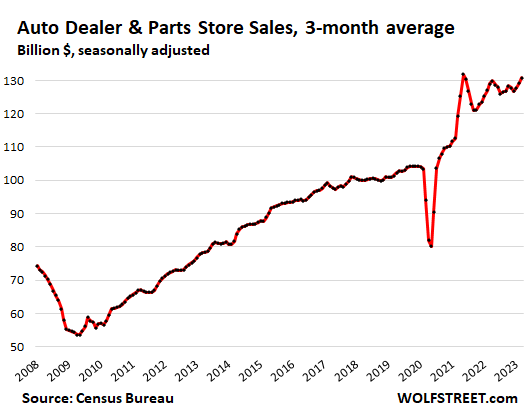

New and Used Vehicle and Parts Dealers (19% of total retail sales):

- Sales: $131 billion

- From prior month: +1.2%

- Year-over-year: +1.5%

- CPI used vehicles: -0.9% for the month, -11.2% year-over-year

- CPI new vehicles: +0.4% for the month, +6.1% year-over-year.

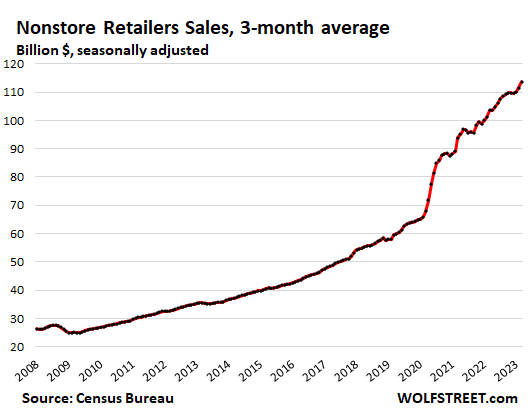

Ecommerce and other “nonstore retailers” (16% of total retail sales), ecommerce retailers, ecommerce operations of brick-and-mortar retailers, and stalls and markets:

- Sales: $114 billion

- From prior month: +2.0%

- Year-over-year: +9.8%

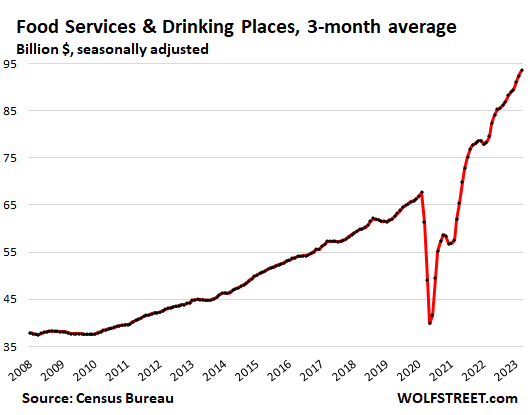

Food services and drinking places (13% of total retail), includes restaurants, cafeterias, bars, etc.

- Sales: $93 billion

- From prior month: +1.2%

- Year-over-year: +17.5%

- CPI for “food away from home”: +0.6% for the month, +8.8% year over year:

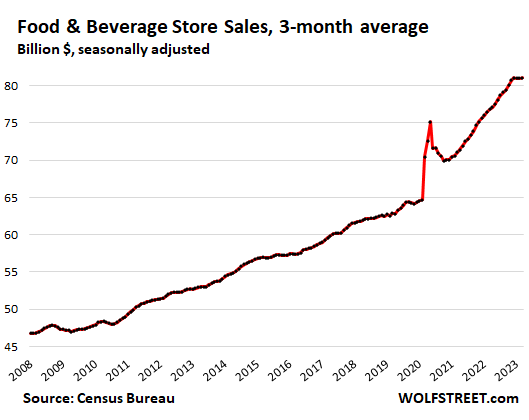

Food and Beverage Stores (12% of total retail):

- Sales: $81 billion

- From prior month: +0.1%

- Year-over-year: +5.5%

- CPI for “food at home”: -0.3% month-to-month, +8.4% year over year:

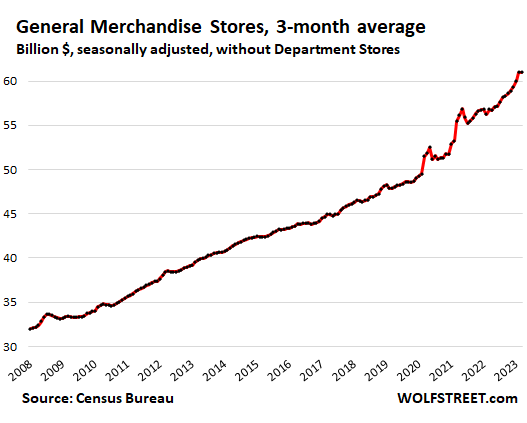

General merchandise stores, without department stores (9% of total retail):

- Sales: $61 billion

- From prior month: -0.1%

- Year-over-year: +7.4%

Gas stations (8% of total retail):

- Sales: $57 billion

- From prior month: -2.4%

- Year-over-year: -4.0%

- CPI for gasoline: -4.6% for the month, -17.4% year over year:

This chart shows the relationship between the CPI for gasoline (green, right axis) and sales in billions of dollars at gas stations, including the other merchandise gas stations sell (red, left axis):

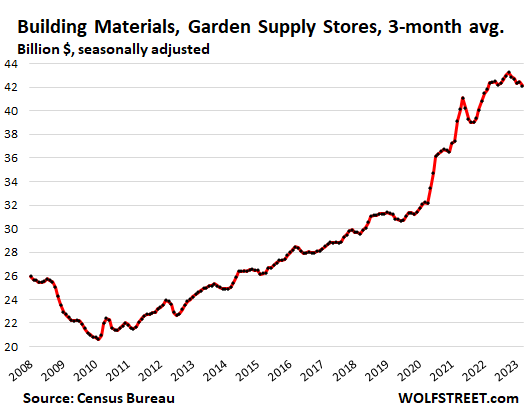

Building materials, garden supply and equipment stores (6% of total retail):

- Sales: $42 billion

- From prior month: -0.7%

- Year-over-year: -0.6%

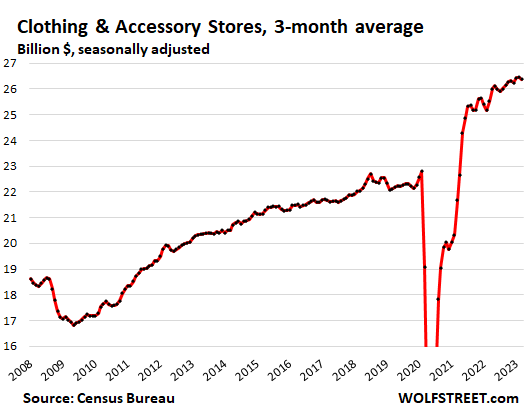

Clothing and accessory stores (4% of total retail):

- Sales: $26 billion

- From prior month: -0.3%

- Year-over-year: +3.3%

- CPI apparel: +0.3% for the month, +3.3% year-over-year.

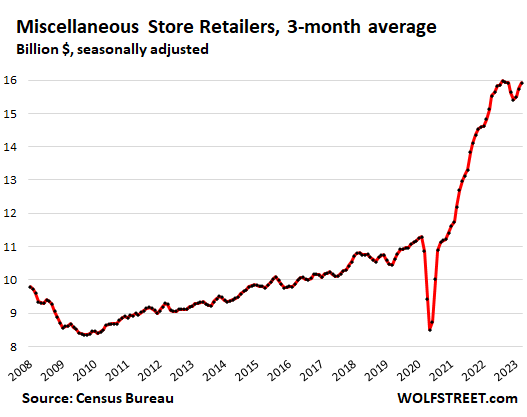

Miscellaneous store retailers, includes cannabis stores (2.3% of total retail): Specialty stores, from art-supply stores to wine-making supply stores. Cannabis stores are the growth driver in this category.

- Sales: $16 billion, seasonally adjusted

- Month over month: +1.1%.

- Year-over-year: +5.2%

- CPI Cannabis doesn’t yet exist. But per Cannabis Benchmarks U.S. Spot Index, average prices have plunged 18% year-over-year.

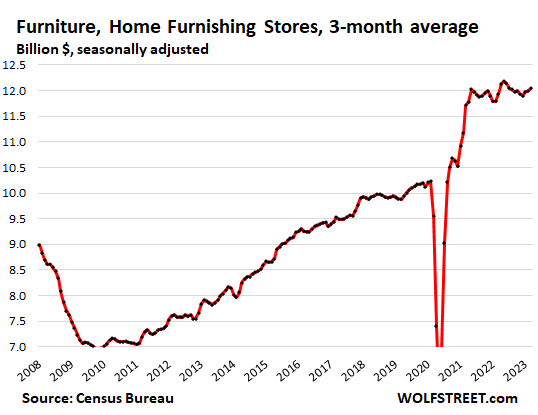

Furniture and home furnishing stores (1.7% of total retail):

- Sales: $12 billion, seasonally adjusted

- From prior month: +0.4%

- Year-over-year: +0.9%

- CPI Household furnishings: +0.8% for the month, +5.8% year-over-year.

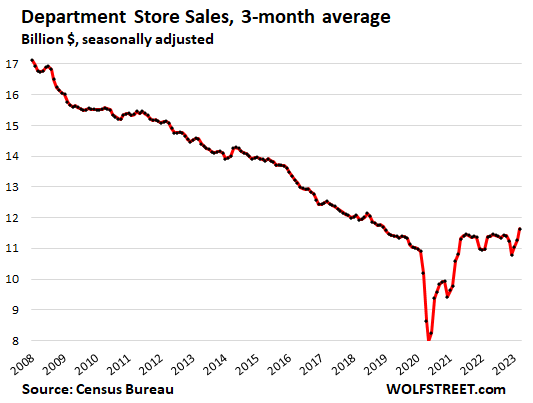

Department stores (now down to 1.7% of total retail, as consumers increasingly bought this stuff online, including at the ecommerce sites of the few surviving department store chains):

- Sales: $11.6 billion

- From prior month: +3.2%

- Year-over-year: +2.4%

- From peak in 2001: -40% despite 21 years of inflation.

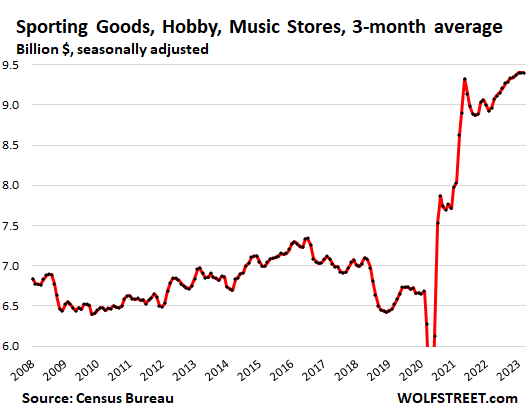

Sporting goods, hobby, book and music stores (1.3% of total retail);

- Sales: $9.4 billion

- Month over month: 0%

- Year-over-year: +4.8%.

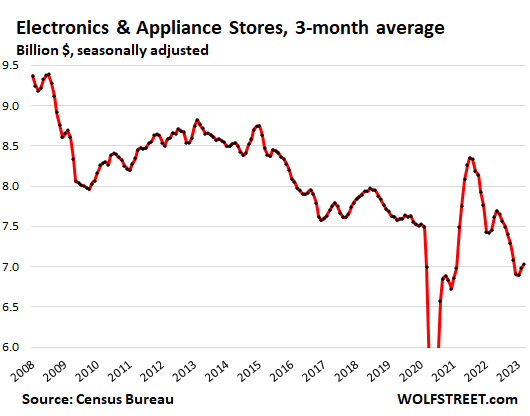

Electronics and appliance stores: Specialty electronics and appliance stores (Best Buy, Apple stores, etc.), not including electronics and appliance sales online and at other retailers.

- Sales: $7.0 billion, seasonally adjusted

- Month over month: +0.7%

- Year over year: -5.7%

- CPI consumer electronics: -0.4% for the month, -11.5% year over year.

- CPI appliances: +0.7% for the month, +1.1% year over year.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks!…….

just ordered some concrete

$197 yard +++ fuel surcharge, STATE/LOCAL/FEDERAL sales taxes

even think I saw an ENVIRONMENTAL fee

I agree with the MENTAL part of the fee

It was 40$ a yard when I started in construction,now it’s all chemical s and doesn’t last 10 years.

yep. *concrete* doesnt last anymore and its been going downhill for decades. How are we supposed to build a society when not even *concrete* can be counted on?

Interesting article and I admire your fortitude in making sense of a measurement that is destined to be irrelevant as often as it relevant.

Meanwhile, the economy functions in an animated state of economic uncertainty that I have taken to refer to as ” an unstable disequaliibrium” between monetary support of high asset prices as opposed to reasonably priced assets, which lies at least 40 % below the current asking price.

>>when the prices change so dramatically, revenues (in dollars) change with the prices

Is this a problem (in a broad sense) per se?

Forgive me if the question is too naïve, but if falling prices = problem, then prices going up = not a problem, but this is normally not the case.

Besides, if the demand for certain goods is elastic enough, falling prices without deficit and supply chain issues may well mean higher sales volume and may not necessarily mean lower revenue.

Am I missing something here?

I didn’t say it was a “problem.” What I said was that this: rising prices explain rising sales, and falling prices explain falling sales, if actual number of unit sales remain the same.

Inflation’s impact on sales matters because it’s subtracted to measure actual economic growth, and therefore it’s subtracted during the GDP calculation to get “real” GDP.

You can eliminate the rationale for and potential error in seasonal adjustments by extending it to a 12 month moving average. The tradeoff is introducing more lag.

You get more lag and smoother response, but some details may be hidden in the tradeoff.

tradeoff is introducing more lag….

So true. On the other hand, the average is more stable (ie, it’s slope is more resistant to change) and you can project it into the future farther. So it’s not as serious as the lag would suggest.

Yeah the $12 six pack of beer, what are you going to do? Just suck it up.

Stop buying !

just buy a 12 pack so it sounds as if you are getting more beer for the money!

Switch to drinking wine! In my experience wine typically costs less and is a more healthy alternative. Moderate wine drinking improves both the length and quality of a person’s life, that is if you believe most international studies. Pre-rolled joints only cost a buck at my local retail shop…another healthy alternative to beer.

Lol! You must be joking. There’s no safe amount of alcohol according to the World Health Organization and many current studies. Same thing goes for smoking.

“Same thing goes for smoking.”

Even smoking green tea leaves (Vietnam, China) is unhealthy. An green tea itself is drinking your body a favor!

I suppose it depends on the choices for wind and beer and booze,,,

Used to be the very least cost alcohol by net alcohol was the cheapest vodka,,,

Other than that,,, always keep in mind,

”In beer there is strength, In wine there is wisdom, In water there is bacteria.”

And have fun with it,,,

Doctors used to believe that moderate amounts of alcohol could provide a health benefit, especially to the heart and the brain, but recent research has called that assumption into question.

A number of studies have found no amount of drinking to be healthy, and the World Heart Federation recently published a policy brief saying there is “no level of alcohol consumption that is safe for health.”

sunny129,

Yes, I was shocked and appalled to learn this. I liked the prior theory better — small-ish amounts of the good stuff being good for your heart and brain. I have now switched to the belief that a small-ish amount of the good stuff is good for my soul. That’ll be much harder to disprove 😍

Wolf, et al:

Total BS from the same place(s) who gave us the very very wrong ”poop” on what was FKA ”covid”

Dont’ even believe ANYTHING ”they” say,,, because their only clear intent these days is to remove ”the great satan” and all and everyone who will not,,,

” Own nothing and be happy in your 10×10 apt, OWKA ”cell.”

BTW, my old neighbor came over the other day and told me he had ”quit drinking, quit smoking, and quit sex.”

Said it was ” the worst 15 minutes of his life.”

Just have fun all y’all,,, especially if, like me,,, you are old enough to enjoy life without the concept that you can or DO know everything as do the young folks SO similar to me when I was younger..

My heart doesn’t like having any alcohol entering the system. Quality of life is better when it’s working with all four chambers synced together and beating in a steady rhythm.

0.0 ABV beers are gaining market share, and there is a good selection of them to choose from. The brewers are making profits with them too, and their sponsorship in sporting events is growing.

The fridge is always stocked with a few different 0.0 brews. Five years and counting since I switched. Never going back. Life is good.

“Your mileage may vary.”

Yeah. That “the soul is in the pineal gland” thing was debunked a long time ago. Along with “the third eye”, for humans, anyway…..reptiles and maybe some other critters still use them, I think.

Start brewing your own beer,

There’s more old drunks, than old doctors. We’re all built differently,genetics are a big part of everyone from birth ,life is short enjoy it,as saying goes everything in moderation cheers

I know many athletes who have passed away, but everyone from our neighborhood pub is still alive and well…

Don’t listen to ANYONE that tells you to put a teaspoon of sugar in the bottle before capping to get more alcohol/better taste.

KA-BOOM!……almost put a small chunk of glass clean thru 1/2″ closet top shelf sheet rock.

Put on safety glasses, put old field jacket on backwards, and carefully took them one qt at a time out the kitchen door and opened……no fun. Real bomb squad stuff.

Quitting alcohol more than makes up for inflation on my monthly budget. Especially in Thailand where non-headache inducing alcohol is unhappily expensive.

Some moderate dosing of magic mushroom made it quite easy to quit compared to previous periods when I jumped on the wagon.

Benefits include a sharper mind (e.g., computer doesn’t kick my ass so badly in chess). The brain shrinks .4% per year, with the rate of shrinkage accelerating after age 60. Research indicates that “…two parts of the brain—the white matter and the dendrites—are most vulnerable to the shrinkage that alcohol misuse can cause.”

Also, for me, giving up alcohol results in better fitness workout energy, which is more needed to compensate for age-associated declines in muscle mass and strength.

A nice quiet evening with some albino rhino makes you pretty quickly figure out what a paupers drug alcohol really is.

Still love suds.

Well, at least you can enjoy America’s craft beer renaissance.

I can’t buy less beer. This is a crisis. We need a beer bailout. A beer subsidy would guarantee votes for the next politician. Beer should be a tax deduction. My weekly case is now $30 from $24. Maybe it’s time to return to Pabst Blue Ribbon. I think I loved it in the College days – memory is fuzzy. Did I go to College?

I am confused by the article. What is your final assessment from economy perspective? Is it a good thing or bad?

From the article near the top:

“Q1 retail sales were up by 1.7% from Q4 and by 5.4% from the same period a year ago!

“Reminder: Don’t apply overall CPI to retail sales because inflation has shifted to services, and retailers sell goods, and many goods prices have dropped or plunged, such as by 17% for gasoline!

“The insert shows the recent details of the trend: the slowdown late last year and a pickup so far this year:

It’s a rebound. Economy still seems to be hot. But how long can it last?

How long can it last? That’s the question. I get the feeling that the American consumer turns out to be a far tougher nut to crack than anticipated; there’s still way too much money floating around.

It will last until the consumer loses their job or cannot get credit.

The Fed will have to break the back of the economy to get inflation back in line.

Wolf, thanks.

You are as usual “ahead of the curve “

The important point to note is the slope. The slope is steeper post-pandemic vs pre-pandemic for every category. For instance, the slope for department store sales is now zero vs negative slope pre-pandemic. Given that services inflation is now entrenched, expect the blips in some of the slopes seen in very recent data to take off again soon:

https://wolfstreet.com/wp-content/uploads/2023/04/US-CPI-2023-04-12-core-services-MOM.png

The total retail sales graph is great. It showed a slow down leading into the end of 2022, followed by an acceleration in 2023. Prior to that the article says ” Don’t apply overall CPI to retail sales because inflation has shifted to services ” . So folks are spending more at retail on cheaper goods, and paying much more for services. Are they spending less overall on expensive services and shifting spending to goods? Confused a bit; will this result in services prices slowing/dropping and goods going back up a la inflation whac a mole?

So far I have blown out the budget for this year, same as last year. Buying less but higher quality/price items. My retail story is after years of austerity, lots of stuff needed replacing. Medical expenses also put a big dent in the budget.

P:

As a young carpenter apprentice, one of my mentors was VERY clear with two ”suggestions.”

1. Buy one, and only one tool every paycheck until your ”clutch” is all you can carry in your ”site tool box” with one hand, ( about 60#s in those days. )

2. Buy THE very best quality tools you can find; which, in those days meant the various and sundry TOP brands made in USA…

His rationale proved very successful, and I still have some of those tools bought 50+ years ago, though to be honest, I have given many of them to offspring, as MY ability to use them properly has gone down hill much faster than the top quality tools…

Jay Powell is scratching his head and looking for his toolbox again as he looks up the definition of “transitory”.

J Powell would be a fool to not increase the FFR by 0,25 pct at the May meeting of the Federal Reserve Board. Talk about a freebee. It is obvious to me from examining the current yield curve that it is a contrived artifact meant to simulate a free market while being just the opposite.

inflation is running at somewhere between six and seven pct while the interest rate on risk free eight week treasuries are selling like hot cakes for a yield of 4.5 pct annualized.

The alternative is the commercial bond market, the stock market, or the foreign markets, which Buffet signaled were okay to invest in. Not sure what his message is, certainly not a Dodd-Grahmn analysis that he used to claim he adhered to.

The master mid-west huckster.

Huzzah! This may help reduce some of the mania surrounding the monthly fluctuations.

Thanks, Wolf

Love the three month average! Makes it so much easier to see the greater trend…. Speaking of trend lines, I think I say this everytime, but my God drawing a trend line through these charts and seeing where demand should be versus where it’s at is laughable.

Fed official waller finally acknowledging that this is a demand issue and it’s probably been more of a demand issue the entire time.

But hey everyone used the pandemic as an excuse for something so can’t blame the Fed too much for blaming inflation on COVID supply chain problems🤷

Exactly. I keep telling my wife I’ve gained 10 pounds due to the pandemic and it has nothing to do with the IPAs I drink every weekend. She’s incredulous, but I keep insisting the presence of the beer in our refrigerator is transitory so that can’t be the problem.

Well, depending how old you are, eat, drink and be merry because tomorrow you may be physically healthy, drooling in your corn flakes.

Uh, Waller advocated that further increases in the interest rate were warranted. Far from admitting that it was a demand push inflation, which no serious person would suggest.

He recognized the nature of the current and previous inflation infections and advocated the ancient cure for this ancient economic disease, higher interest rates.

Like Volker found out and started to adhere to the Taylor search algorithm.

I like the switch to the 3-month average. Thanks, Wolf

With wages going up and sales relatively flat, doesn’t this still point to a contracting economy? Less M2 in fewer hands. M2 velocity is just barely ticking up.

This is just retail sales, not overall consumer spending, and not the overall economy. What consumers spend at retailers is just a small-ish part of the overall economy. So within these limits, retail sales point at decent, but not spectacular growth in Q1.

I think you may have mixed up the flat wages while inflationary sales were increasing. Whether either are a causal vector responsible for a contracting economy ??

I respond by saying that the contracting wages are probably related to your imagined contraction of the economy. Were such a situation to develop, I feel confident that it is not the demand for higher wages is the fault.

Crazy. You have to wonder why the stock market even dropped last year with these kind of sales numbers. LOL

Sales is through the roof still on most things. I think it was over a year ago Warren Buffet made a comment on Nebraska Furniture Mart sales. He said they keep raising prices and every time he checks the sales, people keep buying.

I just went to home depot to buy a few plumbing items. Things I could have bought 3 years ago for $6 is now $10.

It could be a continued reaction to the pandemic. People have violently voted against the pandemic times by over spending.

At some point, one would think they would look at how much they are bringing in Vs. how much they spend.

Perhaps the stamp increase will put these jolly green giant spenders in their place! Ha

Well, I think, that phenomena you just described is inflation. Almost imperceptible, an insidious economic poison for 99 pct of the people.

From your last few articles, the impression I get is, some sort of recession ahead as credit contracts. But probably there is at least one more “muddle-through” left in the fiat currency tank.

What is going on with hobby stores, holy moly. Is this the new work/life balance that everyone says has shifted after the lockdowns?

And department stores: holding on, desperately clutching the last sandwitch half after ecommerce ate the rest of their lunch.

Dan Farrand,

Yes, muddling through is probably a good term. This is the weirdest economy I have ever seen I think. There is all kinds of bad stuff happening, esp. in real estate and asset prices, and interest rates, and inflation, and yet the consumer is just blowing through it all so far.

Could it be the second roaring 20s

Well, I have asked myself that very same thing:

Is this Fed induced delusion the same kind of delusion that defined the roaring 20’s. A delusion that has often attributed to the profligacy of the Fed’s money creation a mere decade after it’s establishment in 1913.

“…every day is better than the day before it, if I see a rain cloud then I just ignore it…”

Al Stewart – ‘Lindy Comes to Town’

may we all find a better day.

What do you guess is the active ingredient behind the current consumer mindset?

Delusional

It seems like price sensitivity has been completely thrown to the wind. Gotta have it, right now, at any price.

Not enough job income to pay for it? No worries, that’s what savings are for.

Not enough savings? No worries, that’s what home equity and 401Ks are for.

Not enough equity? No worries, that’s what credit cards are for.

Not enough credit? No worries, that’s what bankruptc…

Nothing weird about it. 40% of the money supply was printed in a 2 year time frame. This is the result.

Not a contraction with GDP as more goods were sold in 2023 q1 than last year . Feds I think are expecting the 9-12 month lag in QT to start to kick in but we have not seen much contraction . Fed minutes this week says Fed expects a flat GDP for 2023 with the Q1 at 2 percent which means contraction in last half of year . More growth in sales even with the aggressive hikes by Feds . Yes there is a lot of money sloshing around in the system . QT to continue especially the balance sheet contraction . Maybe a pause if data starts to indicate contraction in Q2-3 after the next 1/4 pt hike

You have probably discussed this point before and I have missed the lesson somewhere along the way.

If inflation is 10% and sales go up 10%, isn’t that essentially flat unit sales, no real increase has occurred? If sales have dropped 1% and inflation is 5%, isn’t that roughly a 6% real decrease? All the govt reports really seem to overstate the real amount of growth if inflation is left out?

No, you NEVER APPLY THE OVERALL INFLATION RATE (whatever you might imagine it to be) TO RETAIL SALES.

I discussed this in the article, so READ THE ARTICLE.

But since you cannot force yourself to read an article, I’ll summarize it here for you:

Gasoline prices plunged 17% yoy. So are you going to apply your imaginary 10% inflation to gas station sales even though they got hit by 17% deflation in their products? You see how nuts this would be?

Used vehicles and electronics prices plunged year-over-year. So you’re going to apply your 10% imaginary inflation to them though they’re in deflation? That would be nuts.

Many goods prices are in DEFLATION, and these are THE ITEMS THAT RETAILERS SELL and that make up RETAIL SALES.

For many retailers, inflation may be negative now!

Inflation is now in SERVICES, where it rages, and services is 63% of total consumer spending, but RETAIL SALES ARE GOODS, NOT SERVICES.

Consumer spending is adjusted for inflation by each category of products and services. Later this month, when the data comes out, I will publish my analysis on “real” consumer spending, and the negative inflation in many goods categories will give a boost to “real” spending in those categories.

12Y ex bourbon Balvenie whisky vs fresh Mulveny BUD.

Of course the bally whoo that the rate of increase in the rate of inflation, the second derivative, has leveled off. The statistics about the recent report by the BLS on their measurement of inflation are not consistent with the Wall Street celebration that has ensued.

In reality, the rate of inflation, the rate of increase in the price of consumer products, is statistically, the same.

There’s a reason why the US is (more or less) the world’s richest country…

The US consumer is relentlessly optimistic, they love to spend, and they are not afraid of debt.

A +5% YoY spike in US retail sales, at a time when everyone on the planet is screaming recession, is quite remarkable.

Richest?

You must be joking. Easy credit easy spend. If you have to borrow to buy a phone you are not rich.

Perhaps we churn the most?

When one is flying an F35 economy, one must take nose dives into debt and then abruptly pull that sucker up into adding 4 more shifts of work a month!

As Jim Gafigan the comedian put it.

“Credit cards are crazy, I’m still paying off a Taco I ate in 1988.”

Americans are programmed to spend.

Everybody has the mentality that while a recession will happen it won’t impact them so why not YOLO purchase everything.

Problem is the recession will impact tons of people who won’t be prepared for it. Oh well round and round we go

Not sure of the rest of the country, but gas prices in the Chicagoland area have gone past the painful level again. And I don’t think we switched to the summer blend yet… so much for those plunging gasoline prices…

Right, barely a month ago regular gas here in Tucson was 2.99 now the same stations are 4.59 that’s a whopping 50% increase. I’m driving up to WA again next week and most prices along the way seem unchanged from early March.

Just hide the gas nozzle with lettuce, tomatoes, peppers and onions. Maybe some processed cheese? Relish?

Oh great now I need a dog at the cubs game. Ha

Gasoline, beer and cigs cheaper on Indiana side.

Good charts, thank you.

Same situation here in Australia.

Yes gasoline prices nationwide are probably more than 50 percent higher due to the tax component that’s constant per gallon. Summer time always brings on higher fuel prices due to higher demand.

Wait until OPEC cuts production starting May 1st. Prices will go up more than the summer time normal.

Gas prices are 50 pct higher because the industries that are producing and selling that commodity, a cartel, are attempting to establish a price that is far greater than the cost of production in accordance with the profit maximization model of a monopolistic market dynamic.

There are at least two ways to approach a problem such as this where a specific industry is manipulating the market price.

The gentle way is for consumers to cut back, forcing the increase in inventory to solve the problem.

The second way is legislative, a desperate strategy. A last resort when all else fails.

Once the student loan fiasco is over with and payments resume, I suspect a lot of this relentless consumer spending will begin to slow. Not sure how sharp the spending inflection point will be, but I suspect the party will be over by years end.

Next year is election, there is a good chance the moratorium is going to be extended.

I think a lot of people aren’t jarred by inflation because their houses have doubled or tripled in price. The continued inflation is not surprising to me. I don’t see it getting to 2% without some serious asset price pounding.

Look at how high asset prices are relative to prepandemic period.

My Email and phone are still being overwhelmed with HELOC offers. The home equity must be still out there.

I have mistakenly answered the phone a few times. I always start with: “Have rates dropped below 3% again?”. That usually causes a chuckle or laugh. I try to keep their morale up.

The stock market still has so much froth and speculation. CXAI went up 1000% in two days without any news. The amount of excess money floating around is insane. The fed really screwed this up and made gamblers win. I reluctantly joined this dirty game of speculation and made out with some gain. Still thanks to Wolf’s articles for keeping us sane every day.

Note that spending on food home over years is giving up to eating out. We all are living better but it feels like stagflation. Initially all happy, but slowly are getting poor.

When I go to grocery store they’re really empty,but it means nothing because my kids order online and pick up . I’m old school only buy sale items ,inflation not affecting me much,except property tax ,insurance. Already dumped soda,beer.

My “Gas Station from Hell” has not increased their price yet. Still at $4.69/gallon. All the others have gone up .50/gallon.

Wolf wrote above that the consumer is a tough nut to crack and that too much money is still floating around.

But where’s it coming from? Credit card balances aren’t rising much.

Surely all the pandemic stimulus money has been spent, right?

Right?

Are the retail sales being driven by the common consumer who has less than $,000 in their savings account?

If it’s not coming from savings or credit card debt, is it coming from higher salaries gained from the pandemic-era job hopping? The personal saving rate is still less than five percent and as low as it has been in ten years.

Are the US consumers with higher-paying jobs now spending their “surplus” income that came with their 10-15 percent raises?

The was $700 billion of PPP money that largely went to “businesses” that didn’t need the money. That largely went to the top 1% and will take time to work off.

In addition, there continues to be $1.5T of deficit spending that gets spread all over the place – infrastructure, medical, welfare, etc. That’s an inflation gusher that keeps spewing.

The wealth effect is contributing to inflation as well.

Some PPP scandal in Crook County, Illinois being uncovered by an inspector general (who knew?!!!), dozens of workers implicated.

Sun Times and Tribune have stories.

There’s more where that came from!

record tight labor market, biggest pay raises in 40 years, big gains in asset prices (though part of it has now vanished), and much higher yields (income) for holders of Treasuries, CDs, savings, etc., and they’re spending it too.

So how can spending remain so vigorous? Earnings are a part of it. Credit does not seem to have a huge role. Those home equity loans are slowing down. There is another component. The baby boomers have/had a lot of money in IRAs. Unlike defined benefit, people can withdraw the RMD or more, then distribute the remainder to heirs. The Roths have no tax to avoid. As they pass that money along, much of it is spent. And Grandparents do spend on the grandkids ie: College tuition. So I bet no one ever thought that tax-deferred retirement savings could end up contributing to inflation. I saw this on many of the tax returns I prepared this season.

Wolf observes: “Don’t apply overall CPI to retail sales because inflation has shifted to service…..”

In referring to “services” are you talking about the rise of natural gas, water/sewage/garbage collection, loan and food costs; veterinary bills and others?

If so, we are seeing huge increases in our natural gas bills, water/sewage, garbage collection, vet and food costs. Most of those have been privatized. We relate that to the mark down of “asset prices” when the FED upped the interest rates.

“Services” here is “Core services” without energy services:

https://wolfstreet.com/2023/04/12/services-inflation-rages-durable-goods-prices-rise-again-after-6-months-of-declines-food-inflation-backs-off-energy-plunges/

I have been singing from roof tops…”this does not end until the fed fund rate goes comfortably over the rate of inflation..”..We are being dragged there kicking and screaming, each hike.. ” being the last one”..