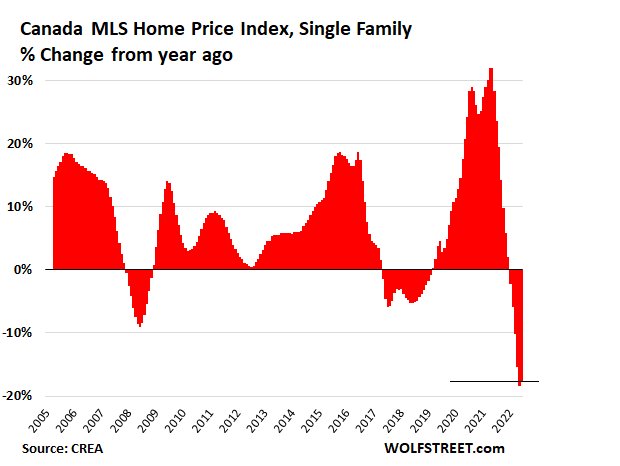

Prices rose in March, but are down 17.5% year-over-year, the second-worst in the data. Sales -34% year-over-year.

By Wolf Richter for WOLF STREET.

The spring selling season is now in full swing in Canada. So let’s see. Sales of all types of homes rose by 1.4% in March from February, after the 1.4% increase in February from January, so on a year-over-year basis, sales plunged by only 34% from a year ago, the smallest decline since September.

And the Canada Home Price Benchmark Index for single family houses jumped by 2.0% in March from February, as it should during spring selling season. For example, in March 2017, it jumped 3.7%; and in March 2016, it jumped by 2.6%. There were Marches when it rose less, but it tends to rise sharply in March, according to data from the Canadian Real Estate Association (CREA).

And so, compared to March last year, which was the peak, prices were down 17.5%, the second-worst decline in the history of the data going back to 2005, behind only February’s drop.

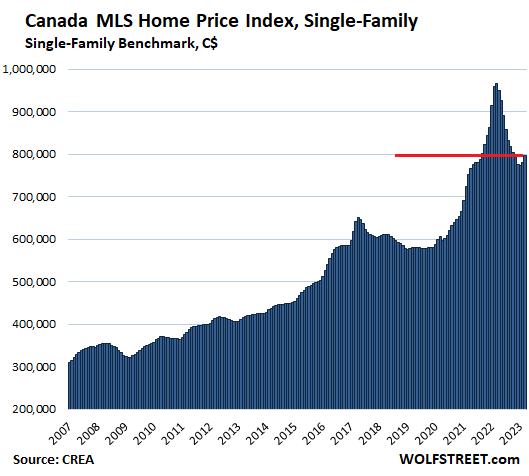

In dollar terms, the Single-Family Home Price Index for Canada rose by $15,400 in March from February, to $796,700, back where it had been in November. But year-over-year was still down by $169,500 (all prices are in Canadian dollars). Canada’s housing market didn’t reset during the Financial Crisis – unlike the US housing market – and after a small dip just kept ballooning.

These kinds of charts are just sort of funny. If money is free, prices don’t matter. And if money isn’t free anymore, well then.

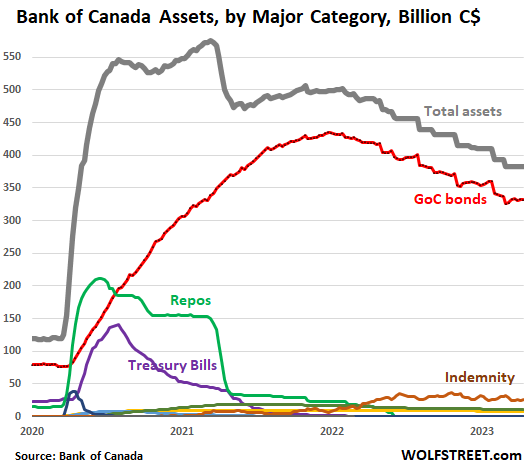

The Bank of Canada’s free-money binge is over. This most splendid housing bubble took on mega-proportions in early 2020 when the BoC began its massive money-printing program – the infamous “quantitative easing” or QE – and pushed down its policy rates to near 0%.

All this ended over a year ago. The BoC’s has hiked its overnight rate by 425 basis points to 4.50%, and has indicated that there would be no rate cuts this year. Mortgage rates have risen across the board. And QT – “quantitative tightening,” the opposite of QE – is progressing just fine. Since peak-balance-sheet, total assets have now dropped by 34% to $382 billion:

Canada’s housing market reacts very quickly to changes in interest rates. The typical US mortgage of 30 years with a fixed interest rate and a fixed payment for 30 years doesn’t really exist in Canada, where mortgages are typically variable-rate or fixed-rate for short periods, such as five years. Many current homeowners, even those who don’t want to sell or buy, are soon feeling the pressure of higher mortgage rates. For a look at the complexities of the Canadian mortgage market, see our Introduction to Canadian Mortgages and Mortgage Insurance.

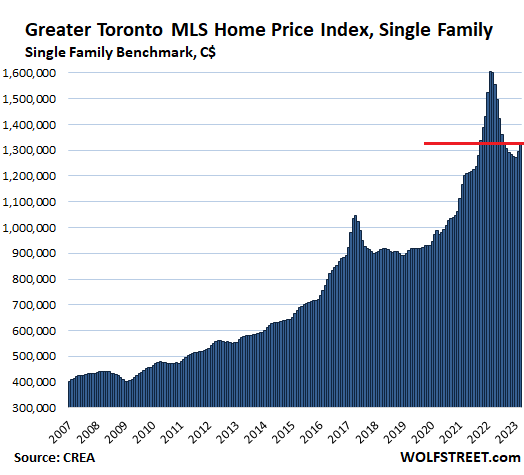

Greater Toronto Area: The MLS Home Price Index for single-family houses jumped by 2.8%, in March from February, to $1.33 million. So:

- From peak in February 2022: -17.0% or -$273,000

- Year-over-year: -16.9%

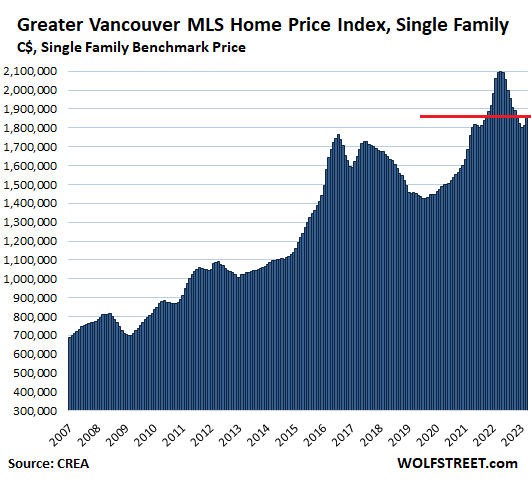

Greater Vancouver: The MLS Home Price Benchmark Price for single-family houses jumped by 2.7%, or by $48,400 in March from February, to $1.86 million. So:

- From peak in April 2022: -11.1% or -$239,600

- Year-over-year: -11.2%

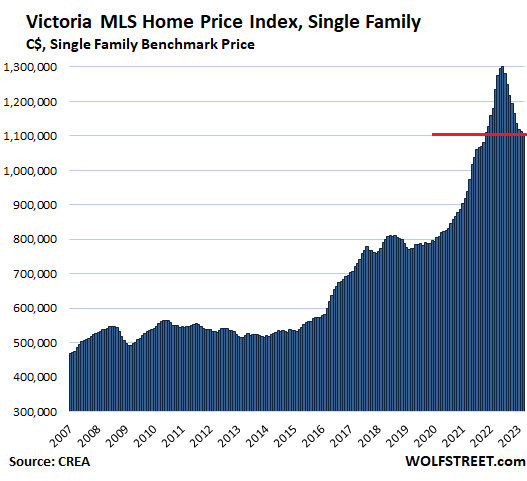

Victoria: The single-family benchmark price dropped by 0.5% for the month, despite the spring selling season, to $1.11 million. So:

- From peak in June 2022: -14.8% or -$126,700

- Year-over-year: -10.3%

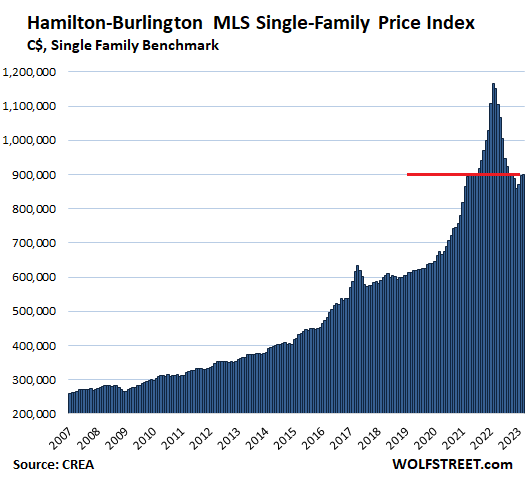

Hamilton-Burlington metro: The single-family benchmark price ticked up 0.4% for the month, to $900,900. So:

- From peak in February 2022: -22.7% or -$265,100

- Year-over-year: -21.8%

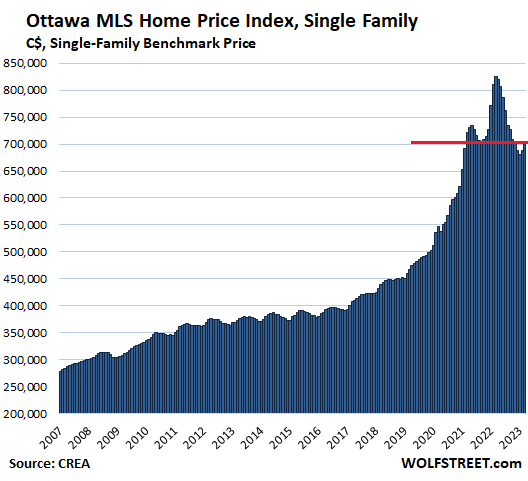

Ottawa: The benchmark price of single-family houses jumped 2.1% for the month to $702,800. So:

- From peak in March 2022: -14.9% or -$137,700

- Year-over-year: -14.9%.

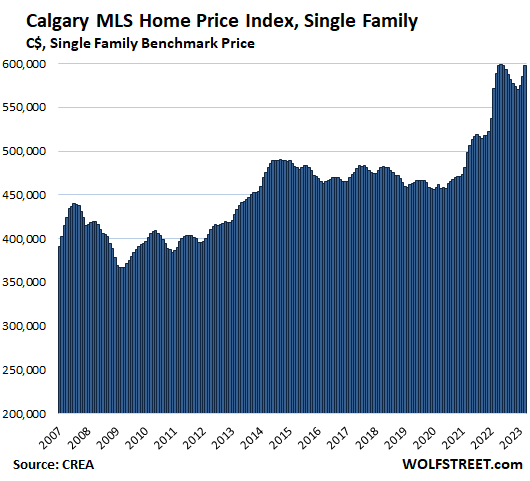

Calgary: The single-family benchmark price jumped 2.1% for the month, to $597,200. So:

- From peak in May 2022: -0.3% or -$1,600

- Year-over-year: +1.5%.

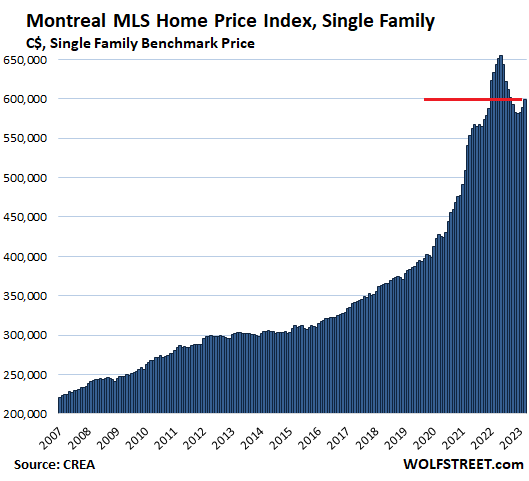

Montreal: The single-family benchmark price jumped 1.7% for the month to $599,300:

- From peak in May 2022: -8.4% or -$55,200

- Year-over-year: -6.9%

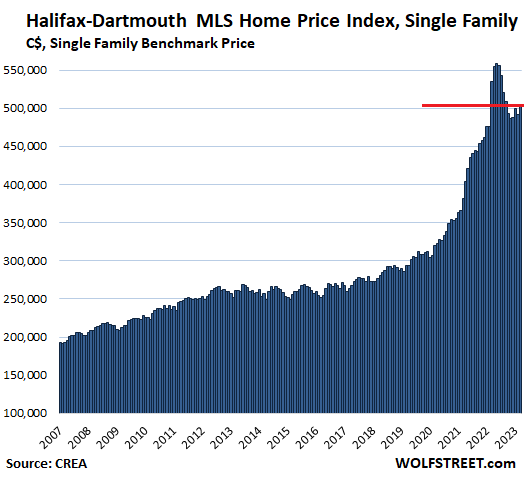

Halifax-Dartmouth: The single-family benchmark price jumped by 2.6% for the month, undoing most of the plunge in February, after the jump in January. A little noisy, eh? To $504,300. So:

- From peak in May 2022: -9.7% or -$54,200

- Year-over-year: -5.6%.

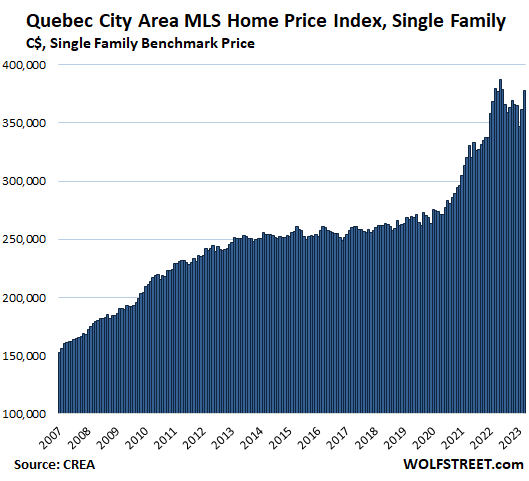

Quebec City Area: The single-family benchmark price jumped 4.6% in March, after the 4.2% jump in February, to $378,200. So:

- From peak in May 2022: -2.4% or -$9,300.

- Year-over-year: -0.4%.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Apparently, the Govt. of Canada is allowing banks to extend amortizations on the current interest to as long as 72 years! Debt slaves can continue to be so indefinitely now. Unclear about whether this resets when the Variable rate period resets (5 year max), but should slow down the selling pressure, hiding it, not removing it, but this is the reason for the March rebound.

Correct. Amortizations beyond 35 years are now 25 percent or more of all Canadian mortgages. Last year they were 0 percent. Also negative amortizations around 25 percent at all banks but RBC. Unprecedented accommodation from the big

Canadian banks did not allow any mortgage defaults. Government of Canada is backing this practice with further guidelines and putting a temporary floor under Canadian real estate.

I’m going to give it another 18 months, if they continue to prop up housing I’m taking my 8 times median wage and all my taxes and savings out the country.

In 18 months your money could be gone ,bail in

Nope because between now and then I will be in USD. BoC are going to “pause” (read: try to protect the housing market) while the Fed will hike again.

is that having a negative impact on canadian bank earnings? or does the government provide the banks with money to cover the negative amortization?

i don’t believe so, since the nominal payments do not fall. They just come down from what they would have been if the variable had renewed at new higher rate.

The bank gets to keep receiving payments and does not have to deal with forced sale and mortgage impairments.

The government intervention simply pits current homeowners against future generations. Haven’t current homeowners received enough government subsidies and stimulus? Why were 300% RE gains dropped on their lap?

This is ridiculous. Government has become extremely short-sighted and counter-productive with its interventions.

That’s true for all assets, not just housing.

Those who have theirs don’t really care about how much the younger families are screwed.

The developed first world has stopped producing and started speculating. To keep their economy strong on paper, they fuel customer spending through borrowed (printed) free money.

This same thing is killing every productive business in town and now once profitable corporations are lobbying for bailouts, Fed pivots and government contracts.

There is only one way out:

1. We have to let go of our inflated paper assets with fake valuation throgh real 10% interest rates. This will significantly correct (75%) housing, office buildings, stocks, bonds, Bitcoin, rents etc.

2. Many debt loaded businesses and enitites will go bankrupt.

3. This 75% decline will attach value to labor, to productive work, and will reduce business costs. So new profitable businesses will come up without any debt and built a strong America.

Fed tightening has proven useless buecause:

1. Corporations have more debt than ever but are not allowed to fail (TBTD BS). This prevents rates from ever getting positive.

2. This causes this old corrupt system to prevail, that keeps spreading misery and poverty.

3. US allies like Canada and Europe are bending over backwards to China, as they now fully depend on it for most goods and for propping real estate. This is weakening US globally.

By my calculations, amortizing over 72 years instead of 30 years reduces the P&I by about 15%.

How long is that going to work?

No, it’s not a real question.

That’s a 15% monthly reduction in the P&I.

> how is that going to work

Ask any Canadian, the answer is the same: increase immigration.

When it doesn’t add up, liberals say “increase immigration”, then in the same breath they’ll start saying how worried they are about the increase in right wing parties. Then they’ll HELOC to spend unearned gains.

No linkage is made at any point.

A mortgage of 72 years implies that your children will carry on the debt.

But who is having children these days?

Well, in effect the house “owner” lease the house from the bank. I do not Canadian law, but many countries it is possible to decline an inheritance.

Do you have a souce for that?

A quick check shows that with less then 20% down the longest amortisation permitted is 25 years.

You are comparing new underwriting to mortgages already underwritten – it is only the latter subject to such leniency. And yes, the amortizations are stretched WAY out.

It’s an emergency bill passed by the Trudeau Liberals. It applies to VRM’s. In Canada 5 years is the most common although it’s possible to get a 10

Year with a higher rate. People will have to re qualify after the term

ends so if rates stay the same we could see foreclosure’s. Kicking the can down the road!

The Bank of Canada’s free money binge is over.

The problem, however, is that the real estate market is the slowest changing market. It is related to psychology. And the sellers have not yet adjusted to the new conditions. They are still living with the peaks reached during the pandemic. As long as there are stupid buyers this psychology will not change. And yesterday an article came out that the government has lifted the ban on foreigners buying real estate and has introduced incentives for first time buyers. So I don’t see how this mess is going to be fixed anytime soon.

The big problem is most Canadians aren’t financially literate.

You look at rates rising, realize the cost of carry on debt is up, that people can borrow less , that available credit sets prices and therefore house prices will fall.

None of this enters the Canadian mind. Last week I had a guy tell me Montreal prices would catch up to Toronto. No mention of different median wages.

The level of ignorance has to be seen to be believed.

“Last week I had a guy tell me Montreal prices would catch up to Toronto. No mention of different median wages.”

I agree with you but assume it’s more than that. People presumably also prefer to live in Toronto, due to the culture difference, especially for foreigners.

Ignorance can be an asset during a bubble, when it burst not so much.

Nice generalization. I’m assuming you’re an all knowing citizen of the USA?

There was a time when a person’s respect derived from “What he did?”.

Now it has changed to “What he has?”.

Same with countries and corporations.

The first question is based on “Karma” that would make the world a better place.

The second one is based on “Maya” (attachment to material possessions), that only spreads misery.

Canada is busy pumping up value of its houses to satisfy the latter and create an illusion of growth with rotting houses that get marked with higher dollar tag.

Greed is good when it causes you to do productive work or invest is productive work. It’s bad when you just gamble.

Maya goes well with Karma, bit not without it.

WAAAY too simplistic use of both maya and karma L:

PLEASE study for at least another couple decades until you fully understand these concepts.

Thank you… OTOH, IF you are a young person,,, young enough to still know everything,,, just do your best…

at least until the point where every year ya get older ya realize how much you don’t know and never did

Leo,

One Canadian person, Alison Jackson, has my respect for what she did seven days ago. She kicked ass, and won the Paris-Roubaix bicycle race.

“What she has? “A big, heavy cobblestone presented to her on the winner’s podium as the trophy for L’Enfer du Nord.

Alison, aller!

“As long as there are stupid buyers this psychology will not change.”

Well said. Excess money floating around in the system makes buyers stupid and is a powerful headwind for any Fed intervention. Case in point…

Super-rundown 100+-year-old Victorian down the street on the market for 235 days with a ridiculous over-market listing price (the owners decided to list after a beautifully restored house next door sold at peak in 06/2022). Lo and behold… stupid buyers appeared last week and paid full price. They will throw at least $200K and a year of time at the place to make it livable. They’re also looking for property in Europe, they said.

These are obviously people with a lot of money. But they don’t make the market, it’s the middle class people who make the market. And because the middle class has been impoverished by this inflation, now these people are taking out loans at these high interest rates and paying these insane prices. When I say stupid buyers, I mean exactly them, the people of the middle class – the masses

I respectfully disagree. Stupid is as stupid does. Class, etc., doesn’t really enter into my particular calculus. But that’s me.

There is simply still too much free money floating around.

The Chinese are the housing market. They dictate price and supply. Nothing else matters. The news and the media will tell you every excuse for housing prices being too high except the real cause. As long as you understand this you’ll see the Canadian housing market is just a duplicate of the housing market in China except in Canada you actually own a house it’s not a leasehold like in China. Both are the exact same ponzi but the government never lets the ponzi implode.

you are bery berry confused J about each and every NOUN you mention…

Please see reply above to another one similarly confused.

Even if you do NOT understand, please try your best to continue to understand on here.

thank you

I agree with you that there is still a lot of money in the system, but I think that an intelligent person with knowledge of the economy and a lot of life experience would not buy a property at these prices and interest rates, even if they had the money. He would just wait or invest in something else.

If you hab enough money ,just buy treasuries collect premium . Make house payment = free . Or just deposit money in a bank get securitized loan at 1% .

Flea

Or just deposit money in a bank get securitized loan at 1% .

You only receive 1% in the bank but if you consider that you don’t pay property taxes and that you don’t even pay maintenance, and that after twenty years you have to renovate your house because it gets old quickly, that’s a lot of money you save.

flea,

If this is irony, I’d rather have enough cash at a fire sale than make some property owner richer than he ever dreamed of being.

Juliab,

But you have to live somewhere. How much are you spending on rent each month?

This is the “carrying cost” of keeping money in the bank – what Flea is trying to say (I think).

MM

It is currently more profitable to pay rent than to pay a mortgage along with all the taxes, fees and maintenance that come with the mortgage

There is still a lot of money out there, but to me it has all changed. Inverted yield curve, M2 going from record increase to record decrease and risk free rate going from 0% to 5%. The way I see it is it’s only a matter of time before the plane hits the runway very hard.

“It is currently more profitable to pay rent than to pay a mortgage…”

It is right now, because both housing & rental markets are out of balance. Home prices are still way too high, but rents have not yet caught up to this. However it is not sustainable.

Either home prices keep coming down (lower taxes & insurance = lower carrying costs for owners/landlords), or rents will keep rising.

Eventually, rents must be higher than monthly PITI – otherwise, landlords would keep losing money and eventually exit the business.

In Canada, rising interest rates will put even more upwards pressure on rents, as landlords’ carrying costs directly go up with rising rates.

Renting = someone else making a profit on the roof over your head.

otherwise, landlords will continue to lose money and eventually go out of business.

In order to increase the rent, the tenants must be able to pay it. But if his salary is unchanged or if he loses his job, how can he pay.

And how exactly will a landlord go out of business by leaving the property empty, which is a loss, or sell it. But as we can see, prices are falling and the number of transactions is falling even more. That is, the market is not working. He can sell, but at an adequate price. And at the moment, no owner wants to lower the price to sell. Everyone is waiting for the Fed to pivot and zero interest rates and god knows what else

MM, Juliab:

Renting can be good or bad. Very situation dependent. No simple formula.

A relatively wealthy person might prefer the extra time, greater ease of moving that renting provides even if it costs this person some extra money.

Landlord and renter can both be in a losing financial situation as well. This probably only typically occurs with low end apartments, rentals.

However in a deflationary world with high unemployment it might creep up to mid range apartments as well.

My impression is a lot of younger Americans have wanted to become house flippers or investors the last decade. The more our younger generation invests time and energy in financial pursuits… to the avoidance of scientific, engineering (and perhaps certain entertainment) pursuits…

the larger the grins on our competitors will become.

Have fun flippin, US.

Juliab,

“In order to increase the rent, the tenants must be able to pay it”

In the market I used to rent in (Boston metro), there was always someone willing & able to pay the new, higher rent that came with every lease I’ve signed.

One landlord even flaunted to me that he could charge basically whatever he wanted, because wealthy BU students (and their parents) would pay whatever.

Granted, I haven’t rented since 2021, so things may be different now. But the lesson I learned is that landlords have pricing power, and if they decide to bump up the rent when you resign, you either pay the higher amount or move out.

Since moving itself is a huge expense, landlords know they can often squeeze another $100/mo or so out of tenants when it comes time to resign.

The solution is new construction (if there is any allowed in Canada). Builders are realistic and want to move inventory at any profitable price (not necessarily top dollar). This will push prices down and eventually precipitate a collapse.

Phoenix 4-10-22 to 4-10-23:

* Active Listings +144%

* Listings under Contract: -18%

* Medium Sales Price: -10%

* Closed Sales: -30%

“Look out below”

Housing everywhere is controlled by the government through zoning, etc. Typically, the housing prices are set to the maximum the jobs in the area pay; it’s all about the math to the monthly payment.

The solution to high prices is to get rid of the jobs. In the long run a recession that ruins the job outlook for the short-term is better for the average worker than a lifetime of indentured servitude to a ridiculously inflated mortgage.

“The solution to high prices is to get rid of the jobs.”

Actually, the fastest route to lower housing prices is get the government out of housing. The reason housing prices are unaffordable is because of government policy to make it “affordable”. Yes, an oxymoron.

I’m not familiar with the specifics in Canada but the most important polices inflating housing prices in both Canada and the US are first, mortgage guarantees and second, central bank “puts” through monetary policy.

Without one or both, artificial interest rates wouldn’t be enough to create such a persistent bubble because enough people wouldn’t place their own money at risk to support such an absurdity.

Americans don’t understand but in Canada the Chinese are the housing market. They dictate all aspects of the housing market. In Ontario its the local Chinese and in British Columbia its the foreign Chinese. Today about 5 percent of the locals (excluding the Chinese locals) can compete with the Chinese for housing so the Chinese have basically monopolized the housing market in Canada.

Go to an open house in Montreal, everyone is Chinese.

They didn’t pay 50% marginal tax on their earnings that built the shared infra that created the neighborhood, yet they outbid those earning and paying taxes here.

The Real Tony – “In Canada, the Chinese are the housing market.” You are absolutely correct about this.

The manufacturing jobs were offshored to China. This made the Chinese wealthy. After buying up their own property market, they then turned around and starting buying up ours.

Shell corporations were set up, and money laundering was rampant. It’s been a nice money-making machine for the Chinese and the Canadian real estate, construction, and banking industries.

They forewarned us that the jobs would be leaving. They just left out the part where the country was going to be sold off to the highest bidder.

The government of Canada is solely to blame for this. They have completely destroyed what was once a great country. They should be ashamed.

Frosty, you left out mortgage and prop tax deductibility….

The Federal Reserve hasn’t dropped Assets by 34%.

I noticed that too. The BoC asset graph starts from zero and measures in billions with a B. Amateurs up north, eh?

On the BoC chart, total assets stood at $125 billion in Jan 2020 before all this started.

But remember: the Canadian economy is very roughly 1/10th of the US economy. So you need to divide everything-US by 10 to compare. So the Fed’s assets of $8.6 trillion divided by 10 = $860 billion.

The Fed’s balance sheet at the peak was still much bigger than the BoC’s at the peak, but the difference wasn’t that huge in relationship to the size of the economy.

Also the BoC loaded up early on with liquidity measures (repos and short-term Treasury bills) that are quick to mature, and that it got out of in 2021 by just not replacing them when they matured. This was relatively easy to do. The Fed also got out of repos very quickly, but loaded up on long-term securities, which was an immensely stupid move. And long-term securities are slow to roll off.

I think the chart for Victoria is missing.

Yes, thanks!

Hi Wolf!

You have the greater Toronto chart listed twice by accident, once under Toronto and again under Vancouver, and then the Vancouver chart under Victoria, and I guess the Victoria chart is like its many retired residents, somewhere else on vacation.

Thanks for the updates!

Yes, thanks.

We have a rental condo in Calgary….put the rent up 15% last year, found a happy tenant in less than two weeks. So far this year average rents have increased another 10%. There is no housing bust in Canada, and there won’t be.

Thrilled you have pricing power for your rental in Calgary. A lovely city without a doubt. Just curious if you have any data on office space vacancies downtown Calgary? Calgary based on the data provided in the article is up 50 percent 400k to 600k since 2007 for housing,

The city just above as many in Canada rose 300 percent in the same period from 300k to 900k with a peak of 1.2mm a year ago. And have fallen 20 percent or more in a year that’s a bubble popping in my opinion and wish you the best in your future rental and condo ownership .

It’s all people coming from other provinces. The locals in Calgary all lost their shirt in real estate so they can’t bid up prices just people coming there from out of province can. So far no one has gone to Edmonton and everything is still up for rent. Condo prices are still selling for about half of the 2007 peak. I checked out Country Club Estate in Edmonton and recent price sales are the same as they were back in the year 1990. All the property manager in Alberta are crooks but the laws are so lax in Canada none of them get thrown in jail. In America people would do life for the things these property managers in Alberta do. I personally had Revenue Canada shut down Rainbow Property Management in Edmonton. The owner who’s now dead had a rap sheet with more than a hundred convictions. He also owned half the properties at Country Club Estate that were willed to his heirs.

There is no housing bust in Canada, and there won’t be.

I think not only did you not read the article, but you didn’t even read the title

Prices rose in March, but are down 17.5% year-over-year, the second-worst in the data. Sales -34% year-over-year.

Using numbers doesn’t really work with Canadians, try hand puppets.

georgist,

I’m assuming you’re an citizen of the USA. Glad most Americans I’ve met aren’t as arrogant and ignorant as you.

Who need enemies when you have friends like this!

Yeah but he got 15% more in rent so the housing bust has been cancelled!

Hahahah, yes, but life has taught me not to believe everything people say. Sometimes people say things that are impossible just to comfort themselves

Ya, and the Renters were Happy to Pay more….lol

Nicko2: “sweet data set you have there, but check out this ANECDOTE that disproves it.”

RE shills gonna shill RE.

lol right? I even doubt Nicko2’s shilling here, a bunch of us were in Calgary last year and even though it’s housing isn’t at Toronto or Vancouver nosebleed prices, the home prices were still way beyond what locals could afford but without having Toronto salaries. A lot more homelessness than we ever expected for such a cold city, and so many people in miserable conditions. 5 desperate and angry roommates sharing a filthy two-bedroom apartment, working 60-hours a week that barely kept them afloat and too tired to do any longer term planning or do anything with leisure. No way that Calgary or anything in Alberta can keep up housing prices like that. The bloated housing bubble, and the healthcare bubble and education-industrial complex of the US, it’s just the short sighted drift from a productive form of capitalist economy down to useless, parasitic rentier activities that North America is now self-destructing on.

This stupid rent seeking based economy that Canada (and the US and Australia) have adopted does nothing other than making it impossible for young couples to afford families, and drives more and more overseas. Three of the young people we talked to in Canada were already on their way out, one using some kind of ancestral connection in Europe, a second going expat in France (that French connection for Canadians is apparently useful, even in Alberta) and a third getting an engineering assignment down in southern Brazil to pick up and move to the coast. That one raised eyebrows for us but then again, housing costs at least are much lower in Brazil, he’s got a pretty Brazilian girlfriend to go home to there and if he gets married and winds up in divorce, he won’t get wiped out financially in family court the way Americans and Canadians do. And the southern part of Brazil is apparently comparatively nice. Canada and much of the US right now kind of have the worst of both of these worlds, a lot of blighted and unpleasant neighborhoods yet for inflated and outrageous prices that even skilled professionals can no longer afford, we don’t even at least get the low cost of living that places like Brazil or Argentina have. That’s the harsh price of so many years of foolish ZIRP and QE policy (and the criminal action of the Fed buying MBS’s), carried on way outside the very short term emergency they were designed for.

104% inflation,be careful what you wish for, Do some homework

To be fair, we own a 2 bed condo just inside Calgary city limits….the same condo would go for double the price in Vancouver. Plus the valuation hasn’t done much in the past 5 years. What has changed are the rapid rent increases in Calgary since the end of the pandemic. Im sure things will calm down in a year or so and go back to normal. An available unit in our building went up another 10% asking rent! The law in Alberta dictates you must give 3 months written notice to a tenant of any rent increase….But hey….I’d rather have a happy tenant than a vacant unit, so we cool.

I still don’t see a housing shortage….lots of available housing, but those rents are getting eyewatering.

Do you not remember a few years back Calgary home owners scrambling? They were giving 3 months free rent to get a 1 year lease signed… Wishful thinking long term, especially with the oil industry about to go stagnant…

Two dfferent markets, renters & buyers. Housing prices will continue to fall, but housing is still overvalued and therefore pulling up rents. Higher interest rates also help push up rents.

Both things can be true: home prices are coming down, yet this landlord has the pricing power to increase rent right now.

MM

The advertised prices of both homes for sale and those for rent are often not the prices at which deals are concluded. And a home without tenants loses money. Also, rents cannot rise indefinitely because they are a function of people’s wages. Also, most of the people who rented years ago are on much lower rents and don’t want to move so their rents don’t go up. In the end, the similarity between the two markets is that if you want to make a deal, you have to go down to the place where the buyer is (credit or purchase)

“…don’t want to move so their rents don’t go up. ”

Perhaps things are different up north – in the US, you sign a new lease each year (or 6 months or whatever), and the landlord can and usually does raise rent when you resign each year. If you can’t afford the increased rent you move out.

I rented for 8 years prior to purchasing, and I paid progressively more rent with each new lease I signed. No such thing as locking in rental rates beyond the term of your lease here.

What we need is a condo bust! Every empty lot, or former parking lot, there seems to be a sign for a proposed condo multiplex building

“These kinds of charts are just sort of funny. If money is free, prices don’t matter. And if money isn’t free anymore, well then.”

Very true statement. In SW FL real estate prices have soared up until this year. First time in 2 years I have seen street corners littered with open house signs. Seeing multiple price reductions and many pending homes coming back on the market. Coveted homes on and near the water are becoming too expensive to own with increasing property taxes and surging costs of flood insurance.

No state income tax is less attractive when it gets eaten up with insurance and property taxes.

Free money applies to marine related services. Due to the recent hurricane, marine trades have doubled their hourly rates because insurance companies are willing to pay it. Can’t blame the contractors but everyone will get screwed in the long run.

Insurance companies are not in the business to lose money but I certainly question their practices. Geico totaled my neighbor’s sailboat with $35K in non-structural damages. They gave him $97K for it (replacement value less deductible) and allowed him to buy it back for $25K. He got it repaired and added a bunch more bells and whistles. Many stories like this. Geez-o-flip!

Buying any real estate in Florida right now seems like a very risky proposition, certainly for at least half of the state that’s close enough to water to be in striking distance for a bad hurricane or even the heavy rains that we saw in Fort Lauderdale. One of our neighbors was looking at retiring down there, but he and his wife ultimately backed off when they saw the combination of both crazily overpriced housing and incredibly expensive homeowner’s insurance (plus the high property taxes), if it was even available at all. Florida’s population has to fall significantly by any realistic measure of its infrastructure and the capacity to safely reside there with the storms getting worse and worse every year.

And housing prices in Florida need to fall a lot to be realistically affordable and especially with all the uncertainty surrounding insuring the houses and the likelihood of the homes being wrecked in a storm. These FOMO homebuyers leveraging up to pay $1.5 million for a beachfront condo or detached family home a few miles from the Atlantic or Gulf coast (not to mention the crushing insurance)–they have to be out of their minds. It just seems to be another part of this collective insanity that Wolf has talked about for the United States and North America these past two decades, with loose monetary policies causing Americans and Canadians to get incredibly stupid with debt and take leave of their senses. The problem is that their foolishness with money makes things miserable for the rest of us by worsening inflation and allowing these crazy price rises. Americans are now the most indebted we’ve ever been in history, with record credit card debt, and now a record number of auto loans are high-interest and going delinquent. It’s like somewhere, millions of Americans got the stupid idea that debt has no consequence, that you can just buy things on margin and the debt isn’t an actual burden that has to be repaid. On the one hand I totally feel sympathy for Americans who got the shaft from things like medical debt, or outrageous divorce court orders for alimony or child support, or elder care or child care costs that are going insane–medical bills especially are just plain criminal, and these hit a lot of frugal people too. But most of the crazy American debt these days is from wasteful and just stupid spending like we see with Florida real estate, or buying an overpriced Tesla, or buyers loading up credit cards with debt for the latest useless iPhone gadget.

Miller can’t fix stupid ,my friend bought a place in Florida,remodeled. It flooded no insurance remodeling again .regrets purchase .we’re in Nebraska

Sold my FLA place 12 years ago, insurance was brutal so I cancelled it. You can always do that if you don’t have a mortgage. Otherwise the bank forces you to carry it.

The governments in the USA and Canada will not allow any price crash at all. They will prevent inventory from coming onto the market with more “free” programs, 40-50 year mortgages, 0% down, loan mods, forbearance, etc. There will not be any price crashes. Remember, prices have gone up 35-60% in 2 years. Just because dumpy high cost high crime SF has dropped 9% means nothing. Existing inventory is anemic and dropping, and homes are selling quite fast.

You mean they will try to prevent it.

I’m quite confident both countries will throw the housing market under the bus when it becomes necessary to support the currency in the FX markets. CDN isn’t the global reserve currency, but it is a “hard currency”.

That’s a lot more valuable to elites who run the country, much of whose wealth is denominated in CDN, than fake wealth housing bubble equity.

AF, I truly wish Canada would throw the housing market under the bus as it so richly deserves, so it could drop to the <50% mark where it should be, but as this would be an existential threat to all levels of govt, banks, and all the bankrupt homeowers, the gov here will do absolutely anything to prevent it.

So it's my sad expectation that instead the currency will be thrown under the bus – we'll be lucky to have it above $0.50 USD soon, as we quickly return to 0.25% int rates and QE. Really, with Canada's debt-to-gdp one of the worst in the world, it's not a hard currency at all.

And when the 72 year amorts aren't enough, we'll print money and use it to buy out underwater owners to make them whole and push up the market (I can just see the program now: "by buying these houses, we'll help hardworking Canadian families, while also increasing the availability of affordable housing" or some other such BS). That's the extreme level of stupid things have gotten here.

And that's why this sad Canadian is making a 5-year plan to leave the country of my birth.

The price of this dumb short sighted rentier policy is that the young qualified Canadians are packing up and leaving. It’s all but impossible even for very highly paid and skilled professionals in Canada now to start a family–every loonie they make immediately goes into paying overpriced rents or mortgages. It isn’t just that Canada and the US have dismally low birth rates, it’s that their professional classes especially are being hit very hard, forced to work longer and longer hours for diminishing returns as their salaries don’t keep up with inflation and housing costs. And it’s even worse for Anglo Canada which is way below the already dismal national average (well below Quebec and the territories). The Canadian authorities say they can just replace the emigrating Canadians with high immigration, but the immigrants can’t afford families either and as they too run into the suffocating cost of housing, more of them are returning home (not to mention the fundamental change in Canada’s culture as the politicians basically elect a new people there). And now it’s happening too in Australia with its own housing bubble and negative gearing. Trying to “maintain” an economy with high housing prices is historically one of the dumbest economic policies ever put together.

There is a catch with throwing the housing market under the bus to support the currency.

Once currency was gold, then a lot of currencies was gold backed. In a roundabout way a lot of currencies are today real estate backed.

That is, the currency is backed by the value of real estate in the country. Now, do you want a real estate crash?

That’s not how it works. Actually, it’s kind of the opposite.

Under a real gold standard, you could exchange a fixed amount of currency for a fixed amount of gold, whenever you want to, and the fixed amounts would not change, obviously, and gold would always be worth the same in currency.

Real estate is DENOMINATED in currency. But it doesn’t back the currency, and currency cannot be exchanged at a fixed amount for real estate whenever you want to. The crazy charts above will tell you that.

Fiat is backed by confidence in fiat.

Declining real estate prices mean that the currency becomes more valuable with regards to real estate, which supports the currency.

The roundabout way real estate back the currency is that that real estate is colateral for mortgages. And colateral is important for confidence in fiat.

But the prices are still going down if you believe what WR presented here.

Last bubble took 5 years or so to find its bottom .

So far the down trend is very orderly and this is what govt wants…

“Crazy” has been choked out of the Canadian Real Estate market. “Dumb” is still alive (barely). And “Irrational Exuberance” has had a wooden stake driven through his plastic bag heart.

One of my employees had/still has a 20 acre parcel he paid to subdivide off his 40. To achieve this he had to provide drilled water, roads, power, etc. The $800,000 the realtor assured him that it would be worth went away with the BOC free money exercise. Now he is technically bankrupt as slowly, slowly he falls off the cliff. Sad what Governments do to their citizens.

Stable prices and honest interest rates are to be found in a book of Fiction.

p,s. Calgary is a dump. 15% of what base price?

They must let prices crash if they want their quality of life to continue. If they continue to play pretend with their asset values then pretty soon all services will be priced out and hungry people have no regard for the law.

They’re already dropping in every city the Case Shiller tracks in the USA. And no, they aren’t selling “quite fast” — look at volume over the past year. Didn’t you read ANY or the articles posted on here?

Per RJ Talks Utube presentation yesterday:

He reviewed Redfin data and stated that hundreds, not just dozens, of US metros and counties are down over 10% peak to trough.

All across the country no longer just in the West.

Wolf Street has already shown many large urban areas (mostly in the US west, Canada) down considerably.

You somehow are not aware of this ?

Reverse psychology perhaps ?

Wolf, looks like the Toronto chart was posted twice and Vancouver omitted.

Where are the MBS on that asset chart??

/s

MBS (Canada Mortgage Bonds) are the yellow line at the bottom, now $8.1 billion.

Yes, thought that could be it. A relative rounding error.

Still haven’t realized $35B in MBS rolloff in a month here in the 🇺🇸 yet.

Wait- all the Realtors I know are saying the market is “hot hot hot!” (for some reason, they always say “hot” in threes). They also say supply is low, immigration is high, a bunch of other stuff about prices going up and rates going down, and then some misrepresentations about the market statistics. So, you know, solid facts from that crowd.

Anyways, what I can’t figure out from looking at the roll off of bonds on the BoC’s balance sheets, is how they are doing that without also buying at least some new bonds, i.e., the bonds bought during QE weren’t necessarily chosen with maturities that let them roll off at this specified rate when QT started. So, is the BoC still simultaneously buying some bonds to maintain orderly QT? Would this still affect bond prices here in Canada?

TEMPLE

Regarding the housing bubble in Canada and the economy, I had read an article from Wolf, if I am wrong, Wolf I apologize. In 2021, the average price of real estate in the city of Toronto was 5 percent higher than in Manhattan, and in greater Toronto four times higher than in greater New York. Canada’s gross domestic product is the size of New York State. If that’s not a bubble I don’t know what is.

I expect real estate to crash in the U.S. and in Canada, but I am not yet convinced that this is the beginning of the “big one”. We might have our recession, our Fed pause/lower interest rates, and stabilization of the housing market. Then when/if inflation takes off again, we get the big real estate crash down the road in round 2.

I think the big crash will come after sales drop 40 percent or more and stay there for a long time.

In the US, I think it will get a lot worse with the next advance in the interest rate cycle, but I’m not sure if longer term rates peaked in October for now or will do so with one more advance.

I still think the US (and some state) government(s) will implement payment forbearance and foreclosure moratoriums at least on government guaranteed debt, but that will only reduce supply. It won’t make housing more affordable. I don’t see any big tax or other subsidies at scale either, probably selectively.

i agree. Hardly anything becomes affordable once the government decides to help or get involved in a specific industry.

Example when they guarantee loans and the industry becomes unaffordable:

College

Housing

Why? Because there is no risk loaning out money. The lenders or investors know they will be paid if the borrower cannot.

However, that will cause inflation to start to skyrocket. You said it best earlier. Long term, they can protect asset prices or they can protect the currency, but they can’t do both.

If you look at what usd can buy in the last 3 decades or so you’d realize that usd has lost 70 percent of more of its purchasing power.

In essence government has already decided to protect the asset market

Don’t believe me.

Just look at the numbers yourself about purchasing power of dollar.

Jon, big difference. In the past, you could keep up with or beat inflation by buying treasury bills, so you weren’t losing purchasing power.

That’s what destroys nations, and that’s what the Fed will ultimately have to make a decision on.

1) Recession is baked in on low/mid heat. SPX must show it first.

Yelen : US treasury have no ovens to cook the poor.

2) The CPI plunged from 9% to 5%. It might retrace 50% to 7%, before moving lower. JP will raise rates.

3) The regional banks will tighten money supply. They will lend only to qualified borrowers. Tighter supply/ high demand ==> higher lending rates, above 2Y and the 10Y.

4) The regional banks might beat the primary banks : JPM, BAC, Citi, Wells Fargo, making more profit/ lower assets. The zombies will be out of the game without recession.

Seems like it might be a good time in future to buy long term treasuries

The question is, Wolf, is Canada’s spring market a continuation of irrational exuberance or a bull trap on the return to the mean?

With mortgage rates subsiding a tiny bit it seems FOMO is taking hold in the face of massive immigration (1M in 2022, 1.2M. In 2023), and the Fed Puters are putting down bets that they’re buying the RE dip.

Is Canada going to be ‘different this time’ or is its splendid bubble heading for a more splendid pop?

My bet is on *pop*.

Thoughts?

If you hab enough money ,just buy treasuries collect premium . Make house payment = free . Or just deposit money in a bank get securitized loan at 1% .did you misspell pop= poop ,I crack myself up sometimes

All you have to do is follow the Chinese cities in Canada because they dictate what will happen in all of Canada. Take Richmond Hill that city barely fell from the January 2021 peak and from an astronomical price level. Just follow the Chinese money and remember if there’s a recession Canadian home prices will go to the moon because the Chinese don’t work and recessions don’t affect them but lower interest rates means they can buy hundreds more homes apiece.

POOP

the Canadian real estate market is showing signs of recovery. While sales are still down compared to a year ago, the year-over-year decline is the smallest it’s been in months, and prices for single-family homes are increasing as expected during the spring selling season.

However, it’s worth noting that prices are still significantly lower than they were at the peak in March of last year, with a 17.5% decline year-over-year. This decline is the second-worst in the history of the data going back to 2005, with only February’s drop being worse.

Overall, while the Canadian real estate market is improving, it still has a ways to go to fully recover to pre-pandemic levels. It will be interesting to see how the market continues to perform in the coming months as the world continues to navigate the ongoing COVID-19 pandemic.

Satire. I love it! What? Did I miss something?

1) Canada MLS prices. Bubbles might deflate to the bottom, or be in a trading range, before plunging or rising to a new all time high. Most bubbles decay, before rising again.

2) US CPI buying climax was 9%. It might drop to 3%/4%. Inflation might be in a trading range for years.

3) To measure inflation economists should use a fast moving average (X) periods and a slow one (Y) periods, with a conservative look (Y) periods backwards to the left. It’s more important than m/m or y/y which is noise.

4) Economist should be more humble. Exogenous “events” cause

inflation/deflation, not the Fed or other central banks.

‘These kinds of charts are just sort of funny. If money is free, prices don’t matter. And if money isn’t free anymore, well then.’

This is great.

My corollary: If money is free, logic doesn’t matter!

Startups unable to generate revenue soon will go the way of pets.com in the absence of free money.

The government told the banks to extend amortizations by over fifty years.

This increases speculation because the monthly interest costs will be lower than a shorter amortization period.

It’s very certain that the current leadership doesn’t care for those who don’t own their homes.

Do renters in Canada get to extend their lease amortizations to lower their monthly rent payments? No.

No, extending the amortization period reduces the portion of the payment allocated to principal, not interest. Interest always accrues on the principal balance at the agreed interest rate. Interest costs can only be lowered if the interest rate is reduced or the principal balance on which interest accrues is reduced. That’s why extending a loan term from say 30 to 50 years doesn’t reduce the amortized payments of principal and interest very much, as noted in a comment by Augustus Frost above.

It’s interesting how the price dips and price spikes happen at the same time in all markets. Why is that?

To me, this means local factors such as job opportunities have little to do with supply/demand. It’s more about national factors such as interest rate levels, foreign investment, and other factors that drive national market sentiment.

It seems as though large and small investors have taken over the housing market. That’s a problem. Housing is a staple, like medical care. People living and working in a community should have reasonable access to housing.

It’s because the central banks of the world turned the world’s economies into speculative casinos with their low rates and then QE. It was intentional. The already wealthy became obscenely wealthy. All asset holders benefited. The working class and poor not so much…

But governments could have put limitations on how many homes investors could buy in a given locality. Not a simple matter, …. well one could disallow investor puchases period.

Zip. None. Nada.

In 2021 I read investors purchased 19% of homes in US. It was 5% in 2000, 2001 per Washington Post chart I saw.

There’s various ways one could put a limit on how many homes can be purchased by investors. I do believe individuals deserve priority over investors but the last few years

the reality was quite the opposite from what I’ve read.

Politicians failed to act… much to the benefit of the 65% who own, not rent, their homes out there.

Wolf: From your article on Canadian MTG overview: “HELOC’s are always variable rate, almost always interest only”.

I have a Heloc (with TD) and have the option of a locking into a fixed part and having a float part. I can lock as much as I want into a fixed portion as I want. Not sure what the other banks offer, but locking in is not unusual for the TD Helocs.

The Real Estate Cartel continues to Pump up this Market with the help of the Canadian Government…business as usual. They are allowing those with a VRM (25%) to ammortize for over 30 years to keep things going. They are also telling them that the Bank of Canada will have no choice but to Pivot and lower interest rates in 2023. I don’t believe that the masses of Speculative buyers and the many that purchased a house or houses that they clearly could never afford can be saved, nor should they. I believe that the interest rate hikes and the 20% dip in prices that has occurred alread, haven’t taken effect yet. I have been watching this Bubble, specifically in Ontario for many years. I am in a position to buy a nice Retirement home right now, but I am waiting it out.

So the big question becomes will residential prices revert to pre-pandemic levels before this thing is over? The same holds true for the US.

No home prices will just keep on rising because every 6 weeks the Bank of Canada overestimates (forecast) the CPI/inflation rate and then at each meeting they tell you the CPI and inflation rate came in way below the estimate. When this hits the news everyone runs out to buy a home figuring interest rates are falling. The Bank of Canada pulls this every 6 weeks to save the banks from any run or run on the banks.

Seems from the chart about BOC QT that they have been a bit more aggressive then the Fed has been in taking down the balance sheet. Is that a contributing factor to Canada being ahead of the US in terms of taming inflation? Or are they just more interest rate sensitive within the housing sector due to variable rates?

The central banks of the world conspired with crooked politicians to steal shelter and turn it into a luxury good reserved only for the well-healed. There is no punishment too severe for these filthy crooks.

Interest Rates are the fulcrum upon which housing demand and prices are levered.

Watch the US dollar against other currencies and near-money.

Bitcoin at $30,000,

CDN dollar rising

European currencies and pound now rising.

Heck. Some Rube was talking about the Rouble becoming rubble.

Without U.S. dollar demand, as U.S. Foreign Policy pushes other countries to use their own currencies instead of the U.S. dollar as the medium of exchange, will make it harder and harder to sell U.S. Government Debt to outsiders, hence higher interest rates

Interesting discussions and ideas. I too, am waiting on the sidelines for a proper housing correction, but housing inflation everywhere is shocking. I really believe we can’t allow the 1% elite to exploit anymore, and we need to plan our society.