Still lots of churn as workers arbitrage the tight labor market for their benefit. Back to “normal” a long way off.

By Wolf Richter for WOLF STREET.

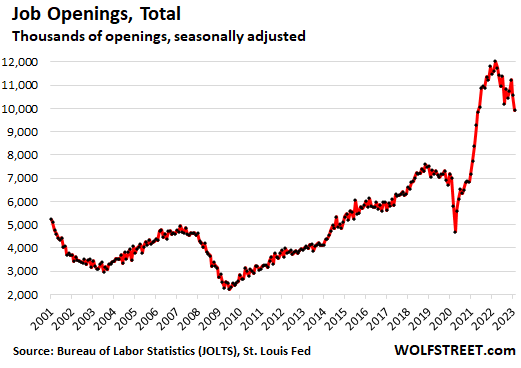

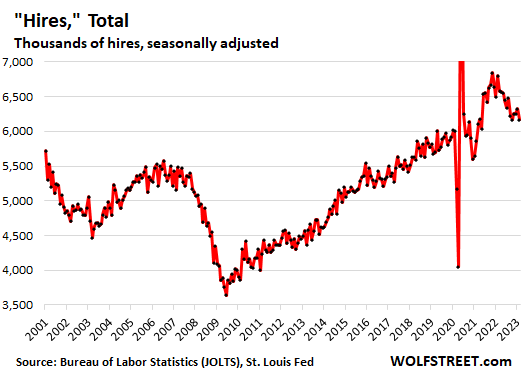

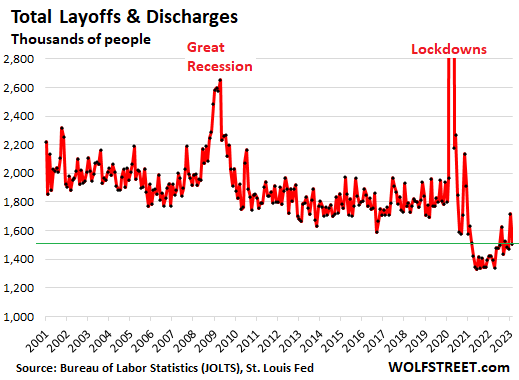

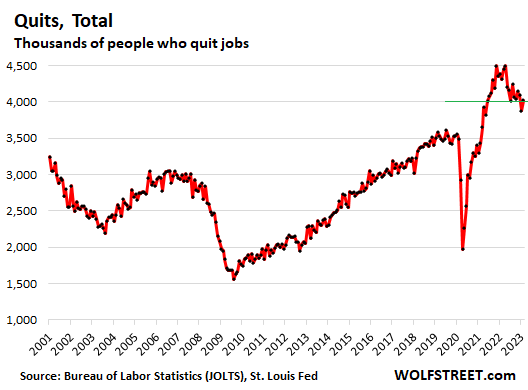

Job openings fell but remained historically high. And this is not based on wishful-thinking job postings, but on surveys sent to 21,000 businesses about their actual workforce details. Actual hiring dipped, but remained well above the pre-pandemic record. Layoffs and discharges dropped again, and were well below the pre-pandemic record low. Voluntary quits – workers going for a better job – rose again and are still in the astronomical zone.

It’s astonishing how this labor market just keeps on going like this, despite the higher interest rates, high inflation, turmoil in banking, and the sell-off in the markets since November 2021. And it explains why consumers are still not slowing down. Or vice versa.

Job openings – as reported by companies, not online job postings – fell in February, but remained historically high and was still up by 31% from the pre-pandemic peak set in November 2018. The 9.93 million job openings in February were well above the Good Times range before the pandemic of around 7.2 million openings.

Companies overall have cut back their open positions from ridiculously high levels to just very high levels – that’s what this data shows that the Bureau of Labor Statistics released today as part of its Job Openings and Labor Turnover Survey (JOLTS).

In the tech and social media segment, and to a lesser extent in some other segments, hiring freezes and layoffs have decimated job openings. CEOs of tech and social media companies have admitted that they overhired during the pandemic, and they’re now undoing a portion of it. Some companies added hundreds of thousands of people in two years, and they’re now trimming tens of thousands.

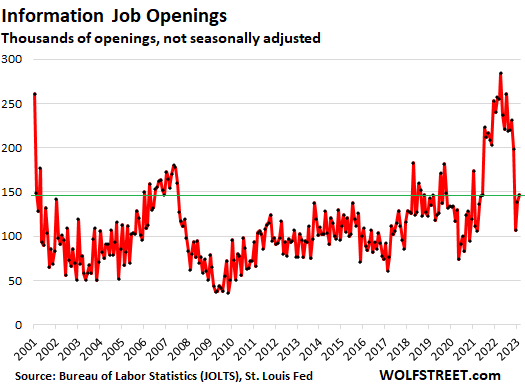

Job openings in the “Information” sector rose in February for the second month in a row, but are way down from the peak last year – yet, still in the mid-rage of the Good Times before the pandemic.

The startup bubble has imploded, funding is drying up for cash-burn machines, and in order to lengthen their runway before they get to the out-of-money date, many of these startups slashed their job openings and their actual staff. Some have filed for bankruptcy already or just shut down. So the bloom is off the bubble.

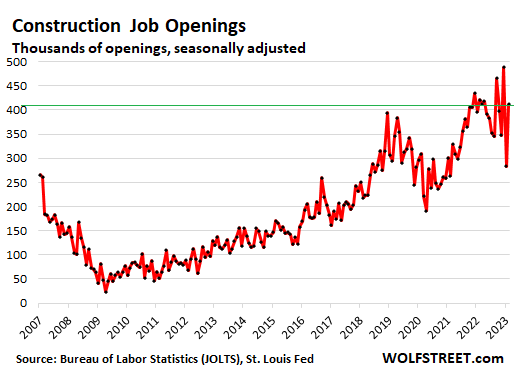

Other sectors and companies have their unique conditions. For example, in the construction sector, job openings jumped to near-record highs. At automakers, layoffs and voluntary buyouts at their internal-combustion-engine divisions contrast with massive hiring and job openings at their new EV divisions. Many companies that have been desperately trying to hire tech workers now have a slightly easier time doing so.

Actual hiring dipped in February but remained historically high, and well above pre-pandemic records, with companies reporting 6.16 million new hires in February:

Actual layoffs and discharges fell again to 1.50 million, a near-record low and well below the pre-pandemic record low. These are not announcements of layoffs by global companies that may not even take place in the US, but actual involuntary layoffs and discharges for whatever reasons.

Companies across the US always fire people for a variety of reasons; when these discharges are deemed to be for economic reasons, they’re called layoffs. During the Good Times before the pandemic, actual layoffs and discharges averaged around 1.8 million per month, with a then-record low of 1.6 million in September 2016. In February 2023, layoffs and discharges were 5% below the pre-pandemic record low:

Voluntary quits ticked up and at 4.0 million were 13% above the pre-pandemic record. This is a sign that workers are still confidently arbitraging the tight labor market to improve their income, benefits, or working conditions by jumping to new jobs, and that employers have to respond in order to retain staff and to fill the job openings that the quitters had left behind. There is still a lot of churn in the labor market.

Job openings in major sectors.

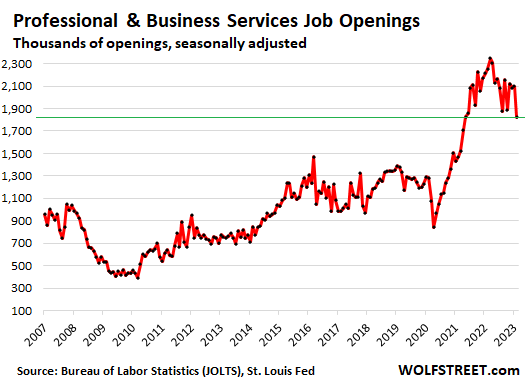

Professional and business services, a big category with 22.4 million employees in Professional, Scientific, and Technical Services; Management of Companies and Enterprises; Administrative and Support, and Waste Management and Remediation Services.

It includes some of the tech and social media companies. Others are in the “information” sector or in other categories. The job openings have tightened up from ridiculous levels, but remain very high.

- Job openings: -278,000 in February from January, to 1.82 million

- From 3 years ago: +41%

In “Information,” job openings ticked up for the second month in a row, after the worst plunge since the Dotcom Bust, and are back at the middle of the range before the pandemic. Some of the tech and social media companies are categorized in this sector.

At current level of 147,000, job openings are roughly half of where they’d been at the peak in April 2022. Many of the layoff announcements and hiring freezes have occurred in this sector.

The small sector with only 3 million employees includes companies engaged in web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications.

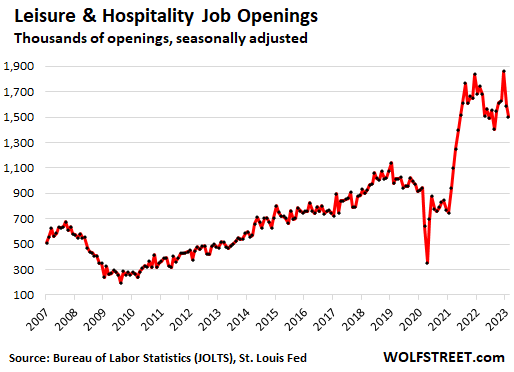

Leisure and hospitality, a big sector with 16 million employees:

- Job openings: -87,000 in February, to 1.5 million, second month in a row of declines, off the record in December, and still in the astronomical zone.

- From three years ago: +61%!

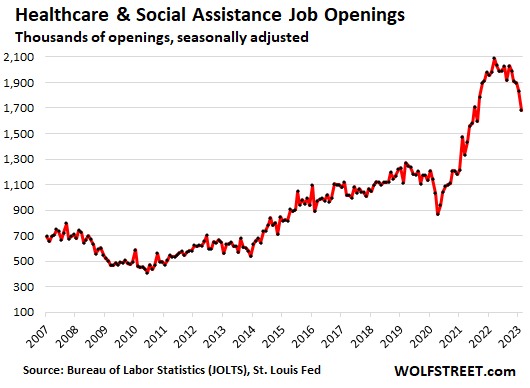

Healthcare and social assistance, one of the largest sectors about 21 million employees: job openings fell for the fifth month in a row, from the record in September, but remain in the astronomical zone.

- Job openings: -150,000 from prior month, to 1.68 million.

- From three years ago: +42%

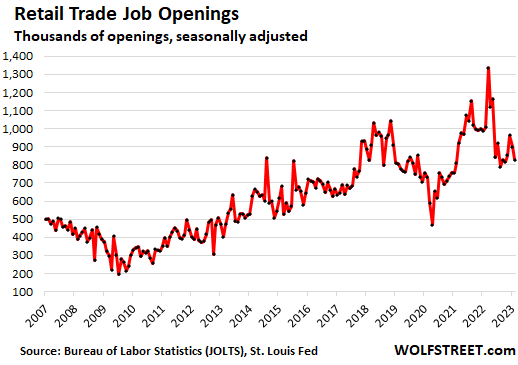

Retail trade, with about 16 million employees. This is one sector that has normalized.

- Job openings: -72,000 to 829,000 openings, back in the pre-pandemic Good Times range and well above the prior years.

- From three years ago: +10%.

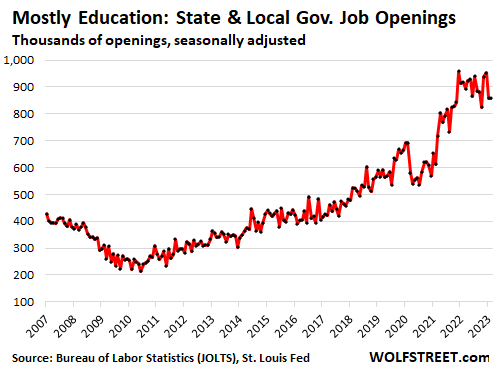

Education/state & local government job openings, most of them in education.

- Job openings: unchanged at 857,000 openings.

- From three years ago: +24%

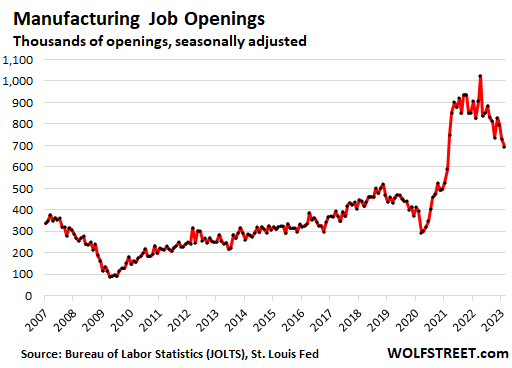

Manufacturing, with about 13 million employees:

- Job openings: -38,000 in February, to 694,000, still well above the pre-pandemic record,

- From three years ago: +72%!

Construction, with about 8 million employees, in all types of construction:

- Job openings: +129,000 in February, to 412,000, near record highs.

- From three years ago: +37%

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Pivot/pause dreamers are out in full force. Headlines such as “Labor Market Finally Cracks”, “Was that it for the Fed’s rate hikes?” Lolol.

Agreed, the labor market is still booming.

Damn pivot talk is causing rates to decrease and good old Lawrence Yun saying now is a good time to buy with mortgages rates decreasing.

I was able to capitalize on new worker about 2 months ago

he quit his last gig after seeing druggy die in front of him after getting 1 to head

felt his work place was unsafe

and his hourly rate is great in comparison I’ve had to pay for ‘handymen’ – no I don’t care about being PC

IT’S have no place at my work

Has he ever said now is not a good time to buy a house.

Aint it cute how Apple announces layoffs just as these numbers are coming out.

Big business would never collude against labour!

Big 4 accounting firms deff don’t share salary information with 3p provider to fix wages either

Lawrence Yun will speaking here in Rockville, Maryland April 25th. What should I ask him?

…How the readers of Wolf Street can get a great paying job that requires no skill, honesty, integrity, or sense of morality like he did.

I’m sure his response would be, “According to NAR estimates, now is a great time to buy a home.”

Perfect lol!

That is quite funny.

Haha no idea who that dude is, but isn’t MD real estate doing okay compared to west coast?

Government dollars can prop up that local market for a long time, unlike tech.

How about:

“How much are you being paid to push this bull s$it non-stop on the radio and print media?

“And, who’s paying you”?

I am observing the knee jerk reaction of thinking anyone with a different opinion is a paid troll.

As one source you can compare FRED’s “All-Transactions House Price Index for Maryland” chart with those for CA, OR and WA.

You could also compare the trends in your chosen cities on Redfin, Zillow too.

Good luck 🍀

“Can you please hold this ticking briefcase while I exit the building?”

Basically the same as Yun does for a living.

Strong labor market and low inventory. I have seen it now several times in the last week. Multiple offers over asking. One house sold 200k over asking. It’s insane. There is still too much money chasing too few homes……

Agreed 100%. 1st-time unemployment claims have to rise up to at least 225K for at least 6-8 weeks to suggest labor market softening. Then when we get to 250K for at least a month, we can say a recession is around the corner.

Mortgage rates have tanked in the last 30 days, so there’s going to be uptick sales. I agree with the 3.7% estimate of sales price increases for 2023.

If a recession happens, I think it’s in 2024.

When things turn, they turn FAST. I’m always suspicious of the openings numbers (for reasons unknown it feels to me like employers have been inflating demand polls in recent years), and I’m grateful that Wolf also put up hires, layoffs, and quits for a more well rounded picture.

What I see in those graphs are reversals and inflections from extremes… So the question is do we return to trend, or keep going? I’d argue the later.

I’ll also reiterate what I’ve offered in other comments on labor/economy articles here… I think labor will lag through this cycle due to demographics and employers that may be gun-shy after difficulty recruiting post-covid. The days of treating labor as a “disposable asset” are over or will at the least be muted through the next decade. Don’t get me wrong, layoffs WILL occur, but not before desperation has fully set in. It’s just not a viable cost control measure when its so difficult to get quality people back in the door.

Exception Clarity Again.. this explains why the Fed is so focused on the labor market.

The peak of the first significant upward rally after the top is always the best time to have the maximum short position.

Watching for the Blow Off Top… to step on the gas.

J.P. – all looks clear on Fed Mandate #2 of Max Sustainable Employment.

Price Stability…not so much.

++++

“Job openings fell but remained historically high.

Actual hiring dipped, but remained well above the pre-pandemic record.

Layoffs and discharges dropped again, and were well below the pre-pandemic record low.”

The State of Oregon just announced they were canceling the special long distance travel stipend they had put in place during Covid WFH to cover the cost of long distance WFH employees to get back for occasional mandatory meetings and training. The public employee union fought this tooth and nail as they thought the stipends were some kind of guarantee, but the new governor was smart enough so see how the public would view this goody for state employees. No wonder they had so much trouble fixing the unemployment system, all the employees were ” working hard” on Maui. I think that they will start phasing out the WFH for state employees all together.

I wish it would happen to Feds. What a gravy train the Feds have. Time for them to go back to the office and do some real work, but federal unions are fighting it big time.

Looks like the IRS finally got their employees back to work. Last year they took 8 months to process my simple 1040 Tax return. They were only working a 1 1/2 day workweek according to a hot dog vendor across from the IRS building. This year I got my refund in 21 days like promised. They even gave me the extra $200 from estimated taxes that I paid but failed to report.

The dude selling hot dogs across from the IRS building on Penn Ave must doing pretty well for a change.

I don’t know if they dragged people back to work or if they hired more bodies, but I mailed off and got my refund back with five weeks. Light years better than last year.

Many agencies still “working” from home. I have plenty of friends in the federal government. Glad to hear IRS is finally doing their jobs.

What is this “refund” stuff of which you speak???? I want one of those for once!

Gattopardo

I pay $500 every 3 months estimated tax to the IRS to cover Ms Swamps business income. Last year I paid $500 one quarter, but only reported paying $300 on my 1040. My mistake. The IRS caught it and gave me the correct amount of refund including an extra $200. I have never had any problems with the IRS. Never been audited. Do my own taxes using Excel spreadsheets. I always report every nickle of income including $1.70 income from a checking account. .

I am still waiting on an amended return I filed 12 months back. I called and someone actually answered. He said wait another 4 weeks. Sounds good considering the interest rate is 7%. But overall they are doing much better. I prepare tax returns and my customers are saying 2 weeks for e-file / direct deposit.

Sigh. I’m so tired of hearing that wfh is less productive or effective. Maybe there are a few bad apples but on the whole the evidence for this hasn’t born out. Anecdotal, but my company is imploding after a year back in office. Not only are people tired and less motivated, office distractions are more difficult to navigate than at-home distractions as long as the kids are at school, and everyone who wasn’t laid off is quitting, and they can’t fill the positions. Meanwhile company is bleeding money but just signed a new fancy office lease. Just dumb.

Jerome Powell has said: “monetary policy acts with uncertain lags.” Considering that Quantitative Easing (QE) tapering has been going on for a year and a half plus interest rate rises for a year, by now in hindsight the Federal Reserve’s efforts have been ineffectual. The reduction in inflation may just be due to “transient”lower energy costs that with rise higher with OPEC+ oil production cuts.

Bottom line is Jerome Powell was successful in QE to have “inflation run a little higher than 2% for a while,” most likely a decade so the Federal Reserve can recoup the inflation they are “owed” since the Great Recession.

It is becoming apparent that the Federal Reserve wants to gather as much inflation as they can.

How can you claim the Federal Reserve’s actions have been ineffectual? Headline CPI peaked in June 2022 at 9.1% TTM and has declined for 8 months in a row (the March 2023 release was for Feb 2023 data.) It will likely be 12 months in a row by June 2023, due to base effects caused by unusually high monthly readings for March-June 2022. Core PCE, the Federal Reserve’s benchmark, peaked at 5.4% TTM in February 2022.

Remember, the Federal Reserve tried to talk away inflation for a year with the “transitory supply chains” BS, before finally taking action. Several months after the first rate increase, inflation peaked. It shows the rate increases are working as intended. The question is just how much more tightening is needed to get it down to 2%.

I can only speak for my little slice in flyover.

If bad times are coming we are the canary

in the coal mine.

Its April in the Midwest. Ours phones went quite last week,

dead this week. For my builders, proposed new builds canceled

or going on hold. Backlog they are catching up with. Some have been able to expand crew with Twin City carpenters willing to travel.

I well remember the last time this happened. Then it was in the fall of 08. This time around the rates hikes were larger and shorter time frame.

Will it be another 08 or worse? I’ll leave that to Wolf.

This time around, zero debt personal or business. I feel for the

youngsters. Some tough times ahead.

In Omaha Nebraska had to go to title company,told me things were slow,because of interest rates. But houses selling were going over asking .WHO raised these fools ,no parental guidance.Or there smarter then me and the wonderful inflation balloon will expand ,until it blows up knocking everyone over

inflation came down from the peak because of the decline in the price of energy and core goods. Very little to do with Fed’s interest rate increase. Balance sheet reduction could have had a much bigger impact, but they decided to do a puny 70-80 billion (even less than the 95 billion they promised us) a month in order to protect their billionaire friends on Wall Street and keep the stock market bubble going.

We have, will have had three years of inflation with 14.5% for the first two, and likely around 6% for the third.

That is a cumulative 20.5% in three years.

The Fed target rate of 2% times 3 =6%.

So we are 14.5 higher than the Fed’s target trajectory.

Where is the discussion of price rollbacks?

Where is the WANT of price rollbacks to get back to the curious 2% target trajectory? This is a “reveal” of true Fed policy, IMO.

It seems any price rollback would be horrifically labeled “deflation”.

Bring it on, IMO. Other wise be revealed as a true promoter of high inflation.

It remains an absolutely grotesquely overheated economy due to FED money-printing and .gov fiscal stimulus. They have succeeded in turning the entire system into one giant speculative orgy, where gamblers run from one asset pump to the next, trying to buy the dip and sell the rip.

I just about choked on my late lunch when I read that the con man Musk changed his Twitter logo to a Shiba Inu dog to, no doubt, use his name to selfishly pump his own net worth, with Dogecoin ramping over 40% in a single day. This is only possible in a system of disgraceful money-printing and its associated scams.

The FED, and all politicians, are vile, corrupt failures of human beings. What they have turned the USA into is one giant financial crime scene, where white collar fraudsters run rampant and billionaires take every last morsel for themselves. The future of the young is gone. It’s in the bank accounts of these scum.

The FED, and all politicians, are vile, corrupt failures of human beings.

Amen

Rich or poor and larger Govern ment.

THE END result

So accurately put.

well-said, well-said. I couldn’t have said it better myself. All this speculation sickens me too, seeing gamblers making billions from bitcoin and meme stocks because of fed’s excess money printing.The crooked system has turned everything upside down. We don’t live in a normal world anymore. You are either a wage slave or a speculator. No Honesty or compassion, nothing else matters.

Right, don’t be a wage slave.

Kevin: “We don’t live in a normal world anymore. ”

Nobody lives in a “normal world” when the world is changing so fast. That’s what’s been happening, is happening and will go on happening for quite some time. The world is moving to a new normal, so will never be normal again for those used to the old normal. There’s nothing so constant as change. Only it’s normally so slow it’s unnoticed. It’s now so fast it cannot be ignored, although many try to hang onto and/or get back to the past normal.

Not sure who the other party to the transactions on the meme stocks are. I don’t fault the folk’s gambling on the stock market as the market has been in place for for much longer than we have been on this earth . The Fed is the issue not the folks participating in the free money era . We have plenty of laws on the books just No enforcement!

Yep, Wage slaves on steroids.

Many people who live in NYC or one of it’s buroughs have now gone from having two jobs to having three to make ends meet. This fact came out in one episode of Law $ Order which I watch regularly. This will become a reality across the USA.

Very well characterised! Thank you, sir.

PREACH!

Just some random info from our little patch of the Midwest to color the job market conversation…

In the truck equipment world, the murmurs of slowdown are getting louder despite near-record backlogs. Job market is still crazy today though. We used to enjoy very low turnover, and it is moderate at our shop now. Just did a 5% raise this month to keep up with the labor market. Still struggling to find welders, and that is the key shop bottleneck at the moment. Working too much OT including Saturdays and it’s starting to burn out the shop guys, especially as warm weather comes back. Every hire seems to be offset by a quit the next week.

The local KFC has been open for about a year. Yesterday someone I know tried to order for lunch, and the manager was the only guy there and was exasperated. Said he could only make mashed potatoes. He said his entire staff no-call-no-showed for the day, and that he too had another job lined up at the new factory down the road. He was calling the district manager in the afternoon to hand over the store keys. Every restaurant here has a help wanted sign, but that’s the first I saw have to close the doors, even temporarily because lack of help.

My wife works in staffing at a local hospital which is part of a larger regional system. They are absolutely desperate for help, and still having to pay big wages and bonuses to entice workers to show up. $35/hr is the new $25 in her line of work, in just a few short years. Our business banker is also on the board of a large healthcare system. He said in passing that most hospitals nationwide are running losses because their costs (especially wages) have skyrocketed, but they lack flexible pricing power in the short term. That seems like another wave of inflation waiting to happen as those prices adjust.

I’ve heard all the crotchety people talk about “no one wants to work anymore”. I disagree. People are incentive-driven. It doesn’t MAKE SENSE to work too often. Assets like cars and houses are out of reach relative to wages. Healthcare costs are running out of control. Child care costs make working difficult. The tax donkeys are starting to kick a little.

I keep coming to the conclusion that a lot of businesses need to cease to exist for this mess to correct. Those with solid business models will survive. Those with weak ones need to go under and free up labor and capital for better use. Higher interest rates should slowly separate the wheat from the chaff.

That will be painful, but who knows when it will happen. Every day I keep being surprised at the resiliency of this economy though. Weird times.

Yep, I’ve also said it on this board multiple times before also…

Either labor supply and labor demand come into balance or it’s elevated inflation for an extended period of time. Either way there will be pain, either from job losses or from the steps the Fed will need take to flight the extended period of inflation. This situation has to resolve itself somehow… and somehow many market participants appear to be oblivious to this fact.

I remember when (late 70s) KFC, McDonald’s and all the rest had NO HELP WANTED signs in every window — because no one with a job (any job) was quitting.

Lol!!

I was 16 in 1979. I got a part time job working at the Sizzler, busing tables and washing dishes.

Would be interesting to see the owner of the KFC working the counter, guess they’re too busy at one of their homes in Aspen.

That would be stock holders ,by the wat don’t eat there anymore food sux no misspelling

“I keep coming to the conclusion that a lot of businesses need to cease to exist for this mess to correct. Those with solid business models will survive.”

I agree. I’m past fed up with this country anymore.

That wasn’t supposed to be a response to random guy 62.

“I keep coming to the conclusion that a lot of businesses need to cease to exist for this mess to correct. Those with solid business models will survive.”

*Cough* Crypto *Cough*

LOL!!

Except in a lot of America it is functionally illegal to build a small business. Many traffic, parking and building codes are set up for sprawling high-cost businesses. You may think the McDonalds is a mom-and-pop franchise, but the assets needed to start one of these are large.

There’s so little in the way of existing storefronts in core neighborhoods available – the kind of place someone with $20,000 can start a business in, than many people aren’t even trying. In the restaurant world this explains food trucks – low capital startup to make up for the lack of viable real estate.

When you let capital and big business set the rules, you get either their garbage or nothing, and you will like it.

Who thinks McDonald’s is a mom-and-pop business?

Looks like we should keep on raising rates

That might be a little too aggressive for Jerome’s Bowel. Wouldn’t want to dent the net worths of billionaires or he may suffer some loose stools and stain his ten thousand dollar suits.

His 10,000 suits are now 12,000 so that’s nice

J Powells biggest concern is the number of homeless tents he has to look at on his way to work every morning. He brought this up at one his his weekly luncheons with JB. I noticed they moved the tents away from Constitution Ave, but now with the tourists coming here for the Cherry Blossom Festival are a big concern of the DC Mayor and she wanted them removed from under the freeways in DC. So they moved them again. Typical government response to a problem. Don’t solve it, just move it somewhere else, out of sight, and out of mind.

1) Hiring minus firing minus quitting minus retiring & expiring ==> that’s the labor force.

2) The labor force participation rate got severe injuries in 2020. It plunged to 1956 high, when women were homemakers. It retraced only 62% of the move. It might test the lows, because the boomers are retiring/expiring in big numbers.

3) There are 100 million people over 55 in this country, about 1/3 of the population. The health care sector is good to go with open hands and open purse. They expanded like there is no tomorrow, opening new facilities to make people healthier, thinner, happier.

4) Their major expansion started years ago when rates were low. Rollover will come at 8% and above. The invincible doctors might charge more, if they can, with gov support an copay. If they can’t, there will be more vacant commercial real estate.

I know everyone is tired of me saying it, but people lose jobs just as the clock strikes midnight and the expansion is over. If its a 10 year expansion, the jobs are lost in years 10, 11 and maybe 12.

If rates keep rising many of the 20% of businesses losing money will have no employees.

Other factors not discussed above that could contribute to the labor shortage:

—a lot of 50-60 year olds calling it quits during the pandemic. They had an epiphany and then left the work force for good. (Although they might have to come back when/if their home values and stock portfolios tank.)

—a lot of people (maybe 1 million?) with various degrees of disability from long Covid and cannot work at their previous functional level

—a lot of 20-35 year olds living again at home with their parents who take care of them. Especially a whole generation of lost young men.

All of these add up.

These are accurate drivers. Labor force participation is key and the fact it is finally starting to tick up is very relevant to policy. Also, worker productivity doesn’t seem related to WFH but rather level and degree of illnesses (which have been rampant). Most likely due to immune systems that were compromised by one or more bouts from COVID (which has been found to impair immune system response for months after infection).

As we work through the health issues and discouraged workers (who largely never re-entered for obvious reasons) we should continue to get supply relief. Of course this is coming just as demand has edged down in many sectors.

There is no price-wage spiral and that has been clear from the softer earnings growth metrics in latest employment data reports. Check back in 12 months and we’ll be sub 3.5% YoY and in 18 months sub 3%.

This is great information. As a humble comment, if you can also add the 3-month averages, it may remove some fluctuations and help to see the trend better.

Somebody told me that the federal government has spent something like 25 trillion over the past three years. Add about 11 trillion for state and local governments and you have 36 trillion. Adjust the 36 for the velocity of money at 1.3 and you have 48 trillion.

So my back of hand calculation means the government is responsible for roughly 2 out of 3 dollars of GDP the past three years.

So if the fed steps on the brakes and 2/3 of the economy could care less…….jobs galore…….and this ignores the parts of the economy like Doctors, Lawyers etc that seem to exist and spend no matter what.

My goodness what a mess this is…..

fred—

You’re correct about doctors spending. Huge doctor shortage in most fields—a lot retired during Covid—so big starting salaries for new docs, and the rest are swamped. Every doc I know spends like crazy, partly because they can (job security) and partly to reward themselves like a drug to offset burnout/depression.

Wolf,

Thank you for providing more history coverage on the charts…it really helps with understanding the Fed’s ZIRP motivations, failures, and derangements.

You found it! The jobs report was a silver lining, but sure enough, you found the dark cloud. Never fail. Sometimes though the silver lining is the cloud.

When demand for a commodity increases at the same time supply decreases, the price of the commodity goes up and/or demand goes down via substitution. Pay labor more in the short term and allow COVID-based social benefits to expire; automate more in the medium term; and in the longer term a large number of WFH-type jobs will be eliminated by AI at the same time most retail and restaurant jobs will be automated. This recent stretch may be labor’s last gasp of pricing power.

I went back through my working career, I changed jobs 11 times from 1976 to 2003, and have no regrets. For those working now, this is a great opportunity to improve your condition in life and it is probably ending soon as Wolf’s charts show. Search the job market now and find a way to improve your situation before the opportunity is gone.

More than 106,000 persons in the U.S. died from drug-involved overdose in 2021, including illicit drugs and prescription opioids. Mid West states will continue to see KFC and other businesses fail or run short on labor. Thank God for high school part time students at Chick Filet. I’m seeing more abled bodied 20 plus year olds asking for money at the gas pump these days in Denver. It must that time of year for the back pack tour of America, the weather is warming up. Job market better than it’s ever been, many employers are running on the edge everyday…front line supervisors middle management have the worst seat at the musical chairs circus and it will never end.

It looks like we are still way off proper recession and housing correction with employment numbers like these. No mass unemployment, no panic.

The news coming from that most american of companies, McDonalds suggests that “flipping Burgers” might not be a viable choice of career in the US of A for very much longer.

McDonalds was never supposed to be a career. It is a place teens learn about the world of work. It’s a summer, after school job. High schoolers used to get credit for working a few hours a day, during the school day.

A few moms and older people picked up the hours the kids couldn’t work.

Each store was a franchise owned by a local businessperson. People didn’t own 100 stores in different States.

Times changed, not for the better in this case.

McDonald’s really is a REIT. What you talk about is just the franchise.

And as we all know, commercial real estate in the US of A is doing just fine.