Many of these announced layoffs are in the future and won’t be in the US and won’t impact the US labor market. But we got data on actual layoffs and discharges in the US today.

By Wolf Richter for WOLF STREET.

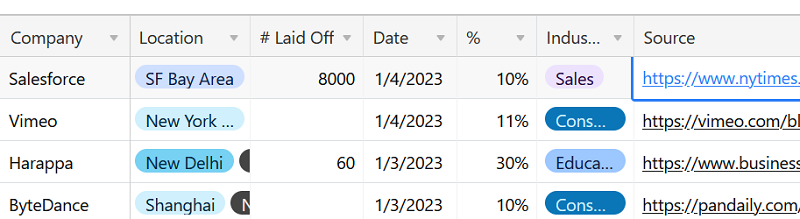

Salesforce “announced” a “plan” today. According to this plan, it may lay off 10% of its global workforce, and these layoffs, it said in the SEC filing, will be “substantially complete” by the end of “fiscal 2024,” so by January 2024, “subject to local law and consultation requirements.”

These are future layoffs that will take place “mostly over the coming weeks” and may be completed by January 2024. The layoffs may total 8,000 people, based on the number of employees the company had. They’re global: Some will be in the US and some will be in other countries, as Salesforce said specificially. Layoffs in other countries will not impact the US labor market. And some of them will be H-1B visa holders, who have 60 days to find another employer to sponsor them, and if they cannot, they’re expected to leave the US.

This is what layoff “announcements” mean. This has been the same principle with all big-company layoff announcements that get hyped in the media: they’re announcements, many of them will take time, and they’re global, and only part of them will be in the US.

So layoffs.fyi combs through media articles and company news releases, and it tracks the published number of announced future layoffs on a spreadsheet. It also links the article from which it cited the info.

This morning, layoffs.fyi added Salesforce to its list, with “# laid off 8,000” (past tense, as if those layoffs had already been done!). It said the “location” is the “SF Bay Area.” And it cited the source: a New York Times article (click on the screenshot to enlarge):

Also, it lists announcements from companies that are headquartered in other countries – such as China, India, Singapore, the UK, the Netherlands, Canada, Germany, etc. – and it totals them all up with the US-headquartered companies, as total global layoff announcements. Those announcements aren’t about US layoffs either.

That type of tracking of announcements is interesting. Another company – outplacement firm Challenger, Gray & Christmas, Inc. – has long been tracking and publishing layoff announcements by US companies of their global workforce. So this is not new. And it produces similar interesting results that are largely irrelevant for the US labor market: They’re just announcements and no one knows what portion of them will eventually even be in the US.

In other words, layoffs.fyi says zero about actual layoffs by Salesforce in the US. And it misleads its readers about when those layoffs happen – the Salesforce layoffs haven’t started yet.

We don’t know how many Salesforce employees in the US will eventually be laid off in the end. And if a company drags this out long enough, regular attrition, such as people quitting because they got a better job, will replace layoffs, and actual layoffs will be lower. Many companies announce layoffs to boost their stock price – Salesforce [CRM] jumped 3.5% on the announcement – and then the layoffs never happen to the extent announced.

A feel for actual layoffs and other discharges.

If we want to know how many people in the US actually got laid off, we cannot get this information from layoffs.fyi. It tells us nothing about actual layoffs in the US by Salesforce, but about its plans in the future to lay off 10% of its global workforce.

And yet, the financial media keep citing these figures as if they were actual US layoffs, including the Wall Street Journal today, when it said, in the past tense, as if it were an accomplished fact: “Collectively, tech employers cut more than 150,000 jobs in 2022, based on estimates from Layoffs.fyi…” No, no, no, they “announced” x number of layoffs of their global workforce, not their US workforce. And no one knows what their actual layoffs in the US were.

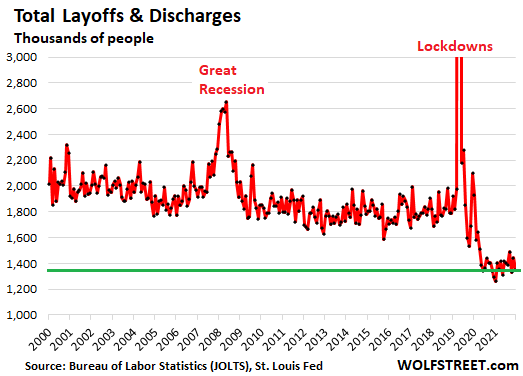

To get a feel or actual layoffs and discharges of workers in the US we can look what companies reported to the US government in a variety of huge surveys, including the data from the Job Openings and Labor Turnover Survey (JOLTS), released by the Bureau of Labor Statistics today. The companies report the actual number of people that they laid off or discharged during the survey period. Today’s data is for November, so the number of workers they laid off or discharged for other reasons in November. And it covers all US employers, not just tech and social media.

“Announced” global layoffs not moving the needle of actual layoffs and discharges in the US.

Across the US economy, there are always a lot of layoffs and discharges, even during the best of times. This is part of the normal churn in the labor market.

Employers laid off or discharged for other reasons 1.35 million people in November, down by 95,000 from October, down by 24% from November 2019, in the same historically low range since April 2022, and far below the best of times before the pandemic, going back to 2000, according to the JOLTS data, released today, based on what 21,000 employers said about the number of people they laid off and discharged.

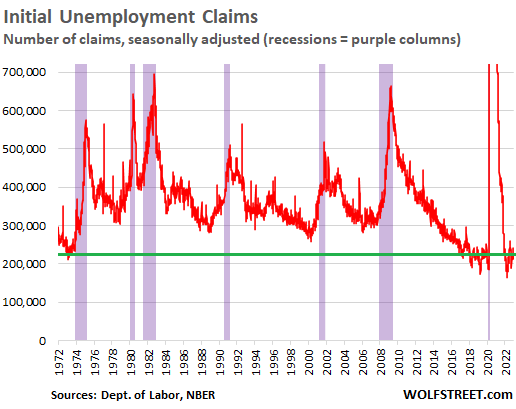

Historically low unemployment Insurance claims confirm the needle is barely moving.

Initial claims for unemployment insurance, at 225,000 in the last reporting week, have inched up from record lows, but are in the same low range as before the pandemic, according to the Labor Department last Thursday.

This is not based on surveys, but on actual applications for unemployment money by people who’ve lost their jobs. There just hasn’t been the surge of applications that I’m waiting for:

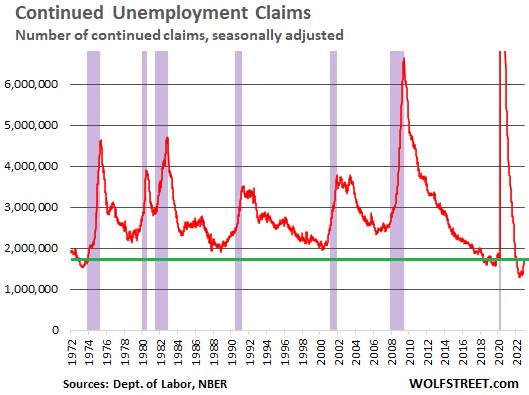

And the number of people who are still claiming unemployment insurance at least one week after the initial application for UI – people who haven’t yet found another job – rose to 1.71 million, according to the Labor Department last Thursday.

This is still historically low, in the same range as during the hot labor market in the two years just before the pandemic. But it has risen from the all-time record lows in June, indicating that the trend lower has reversed, that the labor market is getting a little less tight, and that some of the laid-off people are now having to look longer to find a new job. That 1.71 million continued UI claims is lower than any time in the decades from 2018 going back to 1974.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Great points, but is this statement a typo:

“Employers laid off or discharged for other reasons 1.35 million people in November, down by 95,000 from October, down by 24% from November 2019”

Where’s the typo?

Wolf, projections put 100 million Americans on Medicaid by March. But, most are still employed? What gives?

Folks employed at low wages, or part time, would be eligible for medicaid, especially if they have dependents.

OK, I get it. It’s gross job reductions, which doesn’t factor in new hiring.

NO, it’s not “gross jobs reductions.” It’s the number of people who were laid off or fired.

The people that were fired might have been replaced by a new hire the same day. People get fired (and replaced) for all kinds of common reasons, including performance.

“Employers laid off or discharged for other reasons 1.35 million people in November,”

Just to confirm – you are saying that the monthly JOLTs layoff figure is actually 1.35 million in November (ie, that isn’t an annualized figure).

If accurate, and a roughly equivalent number of layoffs occurred per month, that would suggest about 16 million layoffs per year (in a 145 – 155 million payroll economy per other BLS reports) – well over 10% of all US jobs.

And if JOLTs hiring exceeds layoffs by 2 to 4 million per year (typical or recent net payroll adds, per other BLS reports) that means that JOLTS hirings would be in the 18 to 22 million *per year* range.

That is a *lot* more employee churn *every year* than I think the vast majority of people perceive.

Cas127,

Wait a minute… It’s “layoffs and discharges.” Most of the 1.35 million are NOT layoffs but discharges (fires). Getting fired is a very common thing, no matter what the economy. Performance, conflicts, misconduct, ineptitude, laziness, coming back from lunch drunk, screwing up, insulting a customer… people get fired all the time for all kinds of reasons. Layoffs are just a small part of this “layoff and discharges.”

So with 153 million employees, 1.4 million get fired or laid off per month, that’s less than 1% a month. That’s historically low.

A 55 year old employee might be laid off and replaced by a recent college graduate.

More extend an pretend

Year end is the season for retirements and won’t show up in unemployment states as far as benefits go. January may show the forward trend.

stats.

The salesforce stock jumped 3.57% on the news. The lack of accountability to these announcements clearly shows that “consensual hallucination” prevails despite some QE.

In big companies most divisions have hiring freeze, however many stupid division are still hiring inf hope of picking up laid off talents at discount. These stupid divisions are the ones where the leader is new and has not seen a real slowdown and so is still adding heads to grow revenues with no regards to profitability, possibly hoping for a Fed Pivot.

But wait, US labor force is much bigger than 153M

Hype and fear sells, luckily FED doesn’t use this type of data to track unemployment so no excuse for them to slow down on QT or rate hike anytime…the road is clear Pow Pow, do your thing in 2023…we still have a long way to go in home prices and hyped up stock price to bring in back in line..

On a different note, was reading Marc’s email to effected layoff staff, apparently being part of the family means we will kick you to the curb as well..I always giggle when I see this type of empty platitude on display..

“The employees being affected aren’t just colleagues. They’re friends. They’re family. Please reach out to them. Offer the compassion and love they and their families deserve and need now more than ever. And most of all, please lean on your leadership, including me, as we work through this difficult time together”

And of course the most cynical phrase of all …

“Our employees are are most valuable assets”

so long as we cannot find someone to do your job cheaper. Should that happen, we will let you know via a layoff or termination notice.

Don’t forget Salesforce will be paying each person at least 5 months of salary. That’s very generous. They really don’t have to.

Don’t forget Salesforce purchased Slack 2 years ago for $27 billion.

Back in 2003 I was getting laid off. The deal was 5.5 months severance and my health insurance was covered during those 5.5 months. I was 39 and thought I would take 3 months off from work and enjoy it. I told that to one of my co-workers. He said are you kidding! it’s going to take you at least 3 months to find another job. He scared me and I called a recruiter… I was hired the next week by the first company that interviewed me, ha ha. So much for my 3 month vacation.

Marc’s (or any other reptilian ceo) unspoken words : Better keep my millions of dollars compensation in place.

I find this line especially interesting and echo by many of these “heartfelt” letter from CEOs…I take responsibility but you pay the price and there’s no recourse on me (i.e. like chopping up my own bonus, salary reduction…etc). If this is not empty platitude, I really don’t know what is but this is the kind of world we live in…

“I’ve been thinking a lot about how we came to this moment. As our revenue accelerated through the pandemic, we hired too many people leading into this economic downturn we’re now facing, and I take responsibility for that.”

It’s called empty virtue signaling. People pretending to care when they don’t give a cr*p.

Figures! layoffs.fyi is run by a startup founder, so it shouldn’t be a surprise that the numbers are full of hype. Somehow there’s a running tally of employees laid off at the top, yet many of the citations don’t provide numbers and the column of the chart is empty.

For layoffs only (not firings), wouldn’t using the layoff notices required by at least some states be a better source of information? I’m sure that method would have its problems, just as surveys do, but at least it should be a lot more accurate than layoffs.fyi

WOLF: “If we want to know how many people in the US actually got laid off, we cannot get this information from layoffs.fyi.”

GARBAGE IN, GARBAGE OUT.

As the article “implies”, this “Layoffs.fyi” doesn’t not appear to be a reliable, “hard data” driven, vetted technical tool or resource. To the contrary, based on this recent article in SF Gate:

Layoffs.fyi, a site that has tracked a vast majority of the tech layoffs that have taken place since 2020. That’s nearly 30% of all the layoffs listed on the site globally, Roger Lee, its creator, pointed out. Lee told SFGATE that he developed the site as a weekend project when the pandemic initially emerged.

“I created Layoffs.fyi as a side project to create awareness around all of these tech layoffs, in the hopes of helping laid-off employees find a home at a company still fortunate to be hiring,” Lee, also the founder of San Francisco financial startup Human Interest, said in an email.

Nathan,

[original content removed by the evil censor Wolf]

What Nathan said:

[As the article “implies”, this “Layoffs.fyi” doesn’t not appear to be a reliable, “hard data” driven, vetted technical tool or resource.]

Did you RTGDFC?

Clearly you are missing what Nathan tried to imply. He cut and pasted some nonsense from SF Gate (whatever that is) article. I read his comment twice, and it sounds more bs than the first time I read it.

“Did you RTGDFC?”

Apparently not :-]

I misread it. I’m still not sure about what it says. But it doesn’t say what I reacted to the first time. So I, evil censor Wolf, censored my own comment to nothingness. Apologies.

Slight disconnect. I was agreeing with your article that the website ” does NOT report actual layoffs.” My comment was the website is Garbage in Garbage out and does “NOT report actual layoffs.”

The quote was from the article, not my text, to reinforce that this website simply started as a hobby site, NOT vetted data of actual layoffs, and concluded it was nothing more than aggregated unvetted reports and I understand it does “NOT report actual layoffs.”

Sorry for the misunderstanding as I did not mean to undermine your article by appearing to support the website, which seems to be thrusting itself into the mainstream press lately.

Yes, I got that now, sorry. Censored my own comment.

Nice to see Wolf retracted his own comment…now if he is anything like Musk…I see him double down on the original reply instead…lol

Sorry to all. Wolf was actually correct to excoriate me, as I mis-typed a double negative, (“doesn’t not” vs. does not), which resulted in conveying exactly the opposite of what I was trying to say–albeit it very inartfully! I will be more careful (and have since turned off auto-correct) and will proof-read more closely in the future. I have experienced the pain caused by an errant “and” when you meant “or”–I have witnessed the catastrophic failure caused by an unintended “do” instead of an earnest “don’t.” Mea culpa.

Auto-correct can burn in hello.

I had no problem with your post.

FWIW.

Its amazing how much information mathematicians (and some computer science theoritists) can provide in just one page.

As for financial people, politicians, etc…

Wolf/Nathan – enjoy the civil resolution and am still laughing at what it yielded- the new ‘evil censor Wolf’ reference…

may we all find a better day.

If you type {layoffs in the usa “layoffs.fyi”} without the curly brackets but with the quotes around layoffs.fyi into google, it returns a long list of stories that say the source layoffs.fyi for their information.

If the information is inaccurate and almost every business news site on the planet is also quoting them…. I guess if everyone quotes the same data, that makes it real?

I love the news more and more every day……

Would everyone please say that I won the big PowerBall this week…..

Thanks….

JOLTS gets my vote for best acronym of the month.

Anyone else remember JOLT soda, you know a heart-attack in a can? All the sugar and twice the caffeine! I haven’t seen it for years, this was my generations monster or redbull.

Yeah… I remember it. I guess it was just ahead of its time. Otherwise, and with better graphics, it might’ve gone to the moon.

Yah, I do…. I think Monster bought JOLT cola…..

It was a great advertising campaign back when tons of sugar & caffeine was unique….

Jim Cramer issued a Buy, Buy, Buy for Salesforce. He said 2023 will be a great year for this stock. Go for it!

Always inverse Cramer!

I still do not understand what they actually do, but they built the biggest empty office building west of Sears tower.

I was down to a small position in one stock (a giant gold miner), but it ran up the last two days and I sold about half of my position. Just don’t like stocks when the earnings yield gets down to 6% when you can get 4.1% and rising in a money market. Fed is going to get the lower stock prices it wants eventually.

We know several Salesforce people who were laid off today.

Yep, I was just reading a story on HN and someone said their wife was laid off today. I definitely accept that a press release is not the same as actual layoffs, but SF backed this up with immediate action.

…And it is possible to track metro/state payroll counts every month using BLS’ own data – so we will have insights soon enough.

Not “per company” granular, but somewhat granular and from a Wolf approved source.

Yeah I would quibble with Wolf’s statement that “the Salesforce layoffs haven’t started yet” but in general his point is well taken that a layoff announcement is not a layoff and the numbers may change in either direction between the announcement and the layoff itself. Every company does it a little differently with some companies giving a lot of notice, some companies trying to be stealth but having it leak a few days ahead of time and some companies locking out access day of the layoff.

Because of high interest, it’s cheaper to announce coming layoffs for a stock surge (might, maybe, could) than buy back stock. Who says Corporations can’t roll with the times?

Can you let us know when they have new jobs? Wondering how long that process takes…

I’ve been reading job postings and articles about the American job market.

The trend is that burger flippers are being offered US$12 and up to work at fast food places in places where the State min. wage is less than US$10/hr, and in States with min. wages from $10-15/hr, they can’t even find burger flippers even if they offer a starting wage of US$18+/hr.

In Canada, warehouse agencies still have vacancies to work in warehouses starting at C$17/hr, and despite the desperation of the government to resort to indirect union busting (the 500,000 newcomers a year), these modern day peasant job agencies can’t find workers.

So, as Michael Snyder would ask, where have most of the working age gone?

A few years ago, the Toronto job agencies were telling college graduates to work for free for job experience. Even the Bank of Canada bureaucrat Poloz alluded that university graduates need to work for free for a while.

Now, you can’t even find warm bodies paying above minimum wage to work in dead-end factory and burger flipping jobs.

Those are the jobs traditionally filled by teenagers or a steady influx of immigrants. These are the jobs most Americans will not do. Whatever your politics may be on the issue of borders, the reality is cheap labor has always been done by illegal and legal immigrants and nobody in the C-suite or congress is screaming to “close the borders”, if it means the agricultural workers can’t come in to work the fields or slaughterhouses and meat packing plants. Hypocrisy has created the dearth of low income workers and it is America’s own fault– for not having a good immigration system that provides legal workers to fill those jobs.

“These are the jobs most Americans will not do.”

Why? Do most Amerikans feel that some jobs are beneath them?

Not sure. I would venture to say most Americans who will not do these, “dead-end factory and burger flipping jobs” have likely not felt enough pain to do whatever it takes to survive. They are probably just not hungry enough…not cold enough or dont have enough work ethic or sense of duty and honor to take any job that provides for their family’s immediate needs.

“Do most Amerikans feel that some jobs are beneath them?”

Yes, when they have wealthy parents. We have the greatest wealth concentration in history, so there are lots of wealthy parents passing down money and perks to their kids.

This includes most rural jobs as well, good luck finding a farmhand or agricultural worker that is legal.

“These are the jobs most Americans will not do.”

I did them when I was younger. So did everyone else I knew. That’s how we realized that we wanted to do something a little more remunerative, that wasn’t quite as physically demanding, and got motivated to join the military, or go to school, or something, to get ahead.

I like what Mr. Bobber replied. I am part of the 401K generation that saved for 40 years. My cohort has sizable savings that Wall street would love to tap. My kids won’t take menial jobs when the Parents are always a backstop. But we should all panic a little as we enter assisted living and PE strips our hard-won savings. Our local non profit and very nice nursing home was just acquired by PE. One of many. So that 401k will be taken by kids or PE. I’d rather my somewhat snobby kids spend it than PE. Such is life.

Yes, that is correct — todays American labor force is comprised of entitled, work-shy upstarts, unwilling to suffer like the storied stoics of stouter stuff from some other mythical period or far-off land.

It is everyone’s moral & civic duty to be underemployed and clinically depressed. Just gotta get these brats scared, hungry & cold enough!

My grandson just finished his first semester in college majoring in engineering with all ‘A’s. He is working between semesters in the kitchen at Chick Fillet because he has good parents that know that it’s good for him not because they financially need him to.

Why would they when handouts are a better option?

Why would they in major metro areas when wages do not internalize the growing risk of crime?

Why would they when the popular culture extolls the immediate rewards of gangsta lifestyle?

Why would they when the cost-of-living (including housing) outpaces service industry wages? Look at Aspen, CO for a good example.

Many parents want to keep teenagers out of entry-level jobs and into sports, arts, and other activities. They want their kids to excel in college and work life, not at Wendy’s. The parental anxiety out there is palpable. Maybe it’s always been that way, but I tend to think parents are trying to buy more success for their kids. Asset price gains have helped them do this.

Plus, I thing 529 college savings plans really have changed the game for many parents. They simply have more money to give to their college kids.

I started working resturants in 1973, prior to joining the Navy as a cook, to be discharged in ’75 back into civilian resturant work. It was good work, and paid well.

There were no foreigners working food in North Ca back then. Wages were substantially higher, compaired to dollar value.

While stationed in Long Beach (ship in shipyard) I observed Hawaiian Gardens, Bellflower, and Long Beach recently filled with illegals, many clamoring to move to NorCal to feast on the higher wages, after destroying wage levels in SoCal.

Skip forward to the early-mid 80s, and NorCal resturants were now filled with illegals working for slave-level wages, just like SoCal.

A large number of American food workers were displaced or impoverished, all as the flood of illegals was complimented by the massive movement of industrial-manufacturing jobs being offshored to China, crushing a huge % of the working American population into squalor. (except those who, “learned to code.” I became a machinest-welder as I was racing superbikes on my cook’s wages…)

Wonder where all those addicted homeless came from? The addiction comes from replacing the satisfaction of meaningful work providing decent wages with the false satisfaction of drugs. The homelessness comes from those Americans unwilling to work multi-jobs at Mexican wages to maintain any decent American quality of material life, as all pleasure and prestiege was removed from their labor life. Hope evaporating. As I said back then, this is a recipie for disaster and socal-cultural-econ-political destruction, which we are now living…but it was not like this back then…

In the meantime (early 80s NorCal) huge profits could be made from organizing the newly arrived crimigrants into small companies and small to medium businesses to displace American labor at every level: in carpentery & the trades, in basic yard and field work, and especially in food, home care, and casual labor jobs. Providing many with the “oppertunity,” to destroy their own country with ILLEGAL labor…

This multi-decadal process of de-unionization and asset-stripping American labor and the middle-class also demoralized a significant percentage of the American labor force, some into homelessness and addiction, while others sold their souls in their race to participate in the vast profits asset-stripping our middle-class that deploying illegal and offshore labor provided. A few even learned to code…

The demand those lost union and labor jobs once provided was initially, “made-up,” for by selling these huge numbers of newly-imported peasants more cheap Chinese crap than Americans could have ever manufactured for themselves at union wage levels.

This was the race to the bottom, as the rapidly shrinking wealth of the ex-middle-class tax supported social infrastructure (schools, colleges, local hospitals, and even quality of roads and bridges) began rapidly deterioriting. (and was privitized)

This social deterioriation then drew both Dems and Repugs to begin subsidizing their new peasant labor force, not to maintain American middle-class standards (which are now gone…) but to subsidize the crashed demand generated by the new peasant class vis a vi the once powerful demand of the now-broken American middle-class.

These school, food, & housing subsidies maintained a small fraction of the American middle class’ level of demand through subsidy only to the point when the supply of (“cheap”) labor far exceeded the demand, pushing food, housing, and edu costs to and through the stratosphere, and beyond the level of productive subsidy.

With the middle class destroyed, and the subsidies of the peasant class becoming insufficient to maintain their product demand and provide corporate profits anywhere near the level that the old middle-class provided, it was only a matter of time before interest rates would be required to bend towards zero and debt to ballon towards infinity (trillions? really?) to retain the levels of corporate profitability that asset-stripping the middle class provided.

Since 2007 those exhorbitant profits would be based on plunging the taxpayers into perpetual debt. To subsidize their peasant replacements…

China and Mexico should have never been, “opened,” allowing their poverty (and corruption) to be imported here. In fact, we should have spread the principals and practices of our once great middle-class manufacturing republic there, instead of their corruption, greed, poverty and squalor being imported here to destroy the Constit Republic here. Well, many will do anything, including destroying the foundations of our country, to expand their personal/class (banker) profits and power

Now we are going to pay the piper for allowing our desires (greed) to exceed and control our, “ethics” (rules). Our books (debt) will be balanced, just like a far overstreached rubber band snapping back and stinging bad, if it does not just snap and fail at this point.

That’s my point. Canada has record high population growth, yet the modern day plantation job agencies can’t find workers, even if they offer above minimum wage.

Either the newcomers are getting jobs at Google, or they are liv ing in a different dimension.

The job market is very odd.

You have to remember that jobs above the very low end in employment are also struggling to hire, that makes it all the tougher for the lowest quality/wage employers. I mean why work in a warehouse or wash dishes when you can make twice as much or more in trades which are also finding it hard to fill positions for example?

It has been ages since I even stepped into a warehouse but even back then employment agencies mostly offered the bottom of the barrel of employees that most places (though not all) did everything they could to avoid. Decent number of hires were through family and acquaintances of other employees. With any kind of ethnically dominated business employees are hired in that way too but also through various ethnic community organizations, these businesses are the most likely to snag newcomers and suffer less from a labour shortage provided newcomers share the same language (the biggest barrier initially), but it will be tougher for English only places of work. It was like this already over a decade ago.

In Canada it’s different from the USA. One way is that an American employer has to sponsor someone to get them hired for the job, and mainly that’s in tech.

In Canada, we treat educated newcomers with decades of experience as medical doctors or managers at Swiss banks in the same league as undocumented migrants crossing the US-Mexico border to pick strawberries in a Californian farm.

Many newcomers to Canada don’t start off working in their fields. They are told that their skills are needed for Canada, but when they arrive, they are coerced by bureaucrats to get any job they can get, which in this case is washing dishes or working in warehouses to enrich the Canadian corporations.

The would would rather hire the illegals.

“These are the jobs most Americans will not do”

at the wage being offered..

If the illegals or immigrants were not present, the employer would need to raise the wage to the level that Americans would do the job. And that is the point.

There is no such thing as a “job an American will not do”. This is narrative is usually from any employer that would rather pay substandard wages and pocket the difference and this is the excuse they usually give.

Kids in the 50s didn’t need to compete on a wage basis with illegals that are neck deep in some places (here in California, 10% of the entire population by the governor’s own admission). This depresses salaries. Massively. The h1-b program in IT too, has the same results. American’s IT pay would be higher without it (and pensions and good Healthcare might come back too). [Don’t worry, everything that can be offshore already has].

With any of these jobs. Pay more and I guarantee you can find Americans to do the work..

There also wasn’t artificial labor demand in the 50’s like there is now. That’s the other half of the equation you left out.

Take a look at reported GDP since 2009 and then take a look at the annual change in the national debt. Without this increased government spending, there would be virtually no “growth” since 2009.

Remove or reduce QE and ZIRP, it would be even worse.

Have to figure in the expansion of the welfare state. Last night at Dollar General I saw a 30-something guy whip out an EBT card at the cash register. Without the welfare state this guy would’ve been picking apples, mopping floors or whatever.

If you can’t find workers to fill the job at $12 an hour, you have to raise the rate. This is equivalent to people saying the manufacturer of a car “Doesn’t want to work anymore” if they aren’t selling a car for $10k brand new. Supply and demand exist.

AlexW – well stated. The steady societal dishonoring of work – AT ANY ECONOMIC LEVEL – leading to the hardening of class psychology (work that ‘Muricans won’t do for reasons social-i.e. ‘beneath’ them, keeping wages depressed in those fields). Hence the need to replace vanishing cheap domestic labor with cheap labor from anywhere which also yields the bonus of that demographic serving as a whipping boy for many ills of the national population as it seems to constantly forget its own immigrant past.

Severely enforced employment card-check could have been put in place long ago, but that would have impacted the cheap/malleable labor supply, and yielded no whipping boys to point at other than ourselves (government) and our captains of finance and industry…

On a more pleasant note, Alex, hope i encountered you somewhere along the way in your SB days in AFM/AMA-good racin’, then…

may we all find a better day.

Totally agree. It’s weird. I hire minimum wage staff for my quasi government employer.

Never seen anything like it. We constantly get ghosted and scrape the bottom of the barrel. Our main selling point used to be the benefits, which are really good, but after the pandemic they simply don’t draw the interest they once did.

Our best employees were the 19-22 year olds (still figuring out what they wanna be) and the others were / are all 55+ (who know what they don’t wanna be). Can’t get either age bracket to even apply, much less come onboard.

We used to get a good one for every 3 we hired that would stick for a couple years. Lately we are running about 1 out of 7. I have had constant open positions for over 2-years.

The over 55s don’t want to take health risks for minimum wage jobs that provide incremental spending money. Covid illustrated that life is too short.

And the under 21s? 50 years of stagnant real wages crushed birth rates, so the 18-21 cohorts are much smaller than historically.

These aren’t mysteries.

You pay $7.25/hr and you get little interest and get ghosted?

That’s a puzzler for sure.

“I hire minimum wage staff”

“We constantly get ghosted and scrape the bottom of the barrel”

Gee, I just can’t imagine why!

What is the old expression “You get what you pay for”.

Try offering $20 an hour to start and see what happens.

Just based on my experience as an RN I wonder how many workers we’ve lost to opioid use. Some days ALL of my patients are homeless/jobless, many days at least half. Of those, a solid 3/4 have an opioid addiction. I haven’t bothered to look lately, but I know a few years back the problem was growing exponentially, and it seems to be continuing just based on what I see around the city.

Like others have commented, there are plenty of jobs available that pay $18/hr with only the most basic requirements around here. Some are not exactly backbreaking (example – sit with a confused patient, literally do not touch them, don’t even need to speak their language, just notify trained staff if they’re doing anything unsafe). That’s $37,000 a year with the same benefits I have, AND at that income you qualify for every govt handout (which is what, 3K a year at this point?). I may have earned much more than that this year, but I lived on less. About 31K to be exact, and while I’m frugal for what I make, I’m hardly pinching pennies here. Just not blowing money like its free. So yeah, as someone who struggled to find a job (ANY job) around 07-09 when I was a 20 y.o, I’m still on the younger side and just can’t relate to a lot of what’s going on today.

There’s f***in’ room to move as a fry cook. I could manager in two years. King. God.

DanRo-but would still advise not looking in the trunk on you way to the food machine …

may we all find a better day.

I got myself a Canadian PR card back in 2003 as a backup to US green card. Got a job offer in Ottawa. Flew to Toronto, (did my landing for PR card, got a SIN card), stayed at a family friends place, rented a car and drove to Ottawa. This was in March 2003. They wanted me to be a contractor for the department of agriculture for a 3 month gig. They assured me it would extend atleast 5 years in 3 month increments, but they could only guarantee 3 months at a time. The pay was equivalent to what I was making in the US. I was expected to move from US to Canada on my own dime for this job. And it would mean abandoning the green card processing. Glad I did not move.

Modern Fed is supposed to be counter cyclical, but they were stimulating into the boom and are going to be restrictive right into recession.

Unfortunately it wrecks havoc in the interest rate sensitive sectors like housing. I expect everyone employed in residential construction to get crushed. Going to take a couple of years to play out.

Destroying interest rates from 2002 to last Tuesday is what threw the US housing mkt into erratic, volatile defibrillation for 20 years – not normalizing them.

3 or 4 percent mortgage rates for 20 years in a 100%+ Debt-to-GDP country isn’t natural, normal, reality reflecting – and *that* is the cause of the current chaos.

Not the normalization.

All those $450k 2021 houses were $150k in 2001 and should have never risen in value beyond $200 to $225k given the horrible labor mkts of 2001 to at least 2017.

All that is happening is that fantasyland is being repossessed.

I don’t disagree. My main point is Fed mistakes mainly get played out in housing related employment. Seems like in the housing bust employment in the housing market went from 8% to 2% of the workforce.

I think you are broadly right about housing employment (although a very, very large number of apartments are permitted/under construction – so 50%+ of the employment base is probably pretty safe).

But idiotic boom-busts are what happen in centrally-mismanaged economies (see Fed).

2 years into ZIRP (out of 20) the Fed could not possibly miss the fact that astronomical home price inflation (making builders rich) was occurring much more than some miracle of an affordable housing boom built along with new smiling armies of increasingly well-paid construction workers.

In short, 1 300k house was getting built instead of 2 150k houses – with all that meant for affordability and employment – all thanks to the cannibal magic of ZIRP.

Seeing this…the Fed sat with its weighted thumb up its *ss for the next 18 years.

And DC is “amazed” that a significant majority of Americans have essentially lost all faith in their institutions.

Cas127,

“centrally mismanaged economies”.

What would be your idyllic decentralized economy ?

Where does it exist in today’s world?

If it doesn’t exist why not ?

Your point has some merit probably.

Different parts of the country have different economies…including housing for sure.

Do mortgage rates differ much depending on the state you are in ?

Maybe they should.

By design or not, the 65% homeowner population benefitted from Fed, Trump/Biden policies, pandemic $ checks. The 20 to 30% renters who are not affluent or are outright poor, generally, did not benefit. Centralized or decentralized … dont see it would have made a difference. Either way those in power let investors buy up huge number of homes. Its just dandy.

Either way prospective buyers are apparently urged to forgo inspections.

Some poor folks benefitted if they bought early in the RE recovery. But most ended up further and further behind is my guess.

I knew things were bad here in eastern Washington state when a local free liberal newsmagazine had advertisements (2021 ?) for new homes in the 450 to 700k range if memory serves me correct. Per a survey done here in 2021 half the renters wanted to buy but felt priced out.

Exactly. Under a steady interest rate, housing prices will generally rise roughly in line with wages, which will rise roughly in line with inflation. Of course there are other factors at work, but the effect of interest rates dwarfs those. Well, after 20 years of a pretty steady downtrend in interest rates, most people are utterly convinced that houses appreciate at 7% per year or so. They don’t question how or why, they just know it to be true with all their hearts.

The company I work for layed off 8% in Dec, 3000 people. A lot of good paying jobs. Many execs let go. Remaining workers are looking forward to minimal to zero pay increases. In a prior downturn pay was reduced 10% so there is speculation about that. And bonuses and stock will likely go away. So even those not played off will tighten the belt. This is a company supplying the cloud. Growth there has halted. These effects will take time to impact the economy. And Biden wants to raise corporate taxes. SMH

And now we will find out who was actually swimming naked ;)

Hint: bloodbath for the laptop class is just around the corner

I think companies should pay more than 0%, it’s only fair.

What industry, company if you care to say?

If only there was a website that aggregated this sort of information… I’m not about to dox batboy and speculate on the company but if it is the company I think it is then Layoffs.fyi doesn’t even have it in its list.

Avalanches are usually preceded by crack propagation and noise as the weak snow layers fail.

Once corporate earnings are in obvious decline they will begin in earnest the layoffs as this is the fastest way to reduce costs. Share buybacks are now in the rearview mirror.

We had some of those early warnings in our office last year with targeted layoffs but they were almost invisible because the people that got cut had been “working from home.” The only way you could know is they showed up to clear their office after two years of missing in action.

I do not think we will need to wait more than one or two quarters to see the avalanche.

I have heard that it takes 1 to 1 1/2 years for each rate hike to impact the economy.

Wow HowNow

it takes me 1 second : My Income jumps way up with each increase after most often a few days . So Naturally that’s a life changing Huge event , Entering my several months vacation out of the country now since Nov 30th 2021 > Your talking Millions of people like me who where getting Squeezed like a Pancake now able to breathe again

As Per your statement I have heard that it takes 1 to 1 1/2 years for each rate hike to impact the economy.

Would you not agree ? thing is many live off of simple interest

WSJ just reported Amazon to layoff 17,000 corporate employees. More than the expected 10,000 number reported earlier.

Just search for “Amazon to Lay Off Over 17,000 Workers, More Than First Planned”

Wolf is going to slap you around because these are “planned” layoffs, not yet executed realities.

Back on November 15, I wrote a whole section about these rumored and being planned layoffs at Amazon:

“Amazon: After hiring 800,000 in two years, laying off 10,000”

You gotta keep perspective.

So now it’s: After hiring 800,000 in two years, Amazon is laying off 18,000.

And note, they’re corporate employees globally (recruiters, especially recruiters, devices people, corporate retail employees, etc.). Amazon has 350,000 “corporate employees” globally — as opposed to warehouse, transportation, and delivery employees.

There is no telling how many of them will be in the US. And the US labor market is the thing we’re concerned about here.

https://wolfstreet.com/2022/11/15/the-five-digit-layoffs-are-here-the-big-ones-weve-been-waiting-for-but-the-laid-off-people-are-scattered-around-the-globe/

A recession isn’t in the cards until 1st-time unemployment applications rise to ~250K and then slowly keep moving higher. Core PCE inflation is not going to drop anywhere close to 2% anytime this year without a recession.

“The St. Louis Fed said in its report that if 26 states have falling activity within their borders, that offers “reasonable confidence” that the nation as a whole will fall into a recession.”

Philadelphia Fed data tracking the performance of individual states, said 27 had declining activity in October.

Amazon just increased their layoff estimate to 17,000. Add that to CRM’s 10,000 layoff estimate.

Companies do these layoff announcements at the end of a quarter usually because they expect to miss earnings estimates. They hope a layoff announcement will mitigate investor backlash and stock price drop resulting from missed earnings.

I would not be holding AMZN or CRM stock into earnings given the timing of the layoff announcements. I’m predicting earnings misses at both companies.

Good point on timing and motive.

…And at the risk of getting slapped around by Wolf, if “announcing” companies don’t follow through on layoffs, it tends to show up in the following quarters’ financials…so I don’t know if companies go around willy-nilly announcing 5%-10%+ layoffs they don’t intend to make good on.

Yeah, and Shopify too. They doubled headcount during the pandemic and just instituted a policy of canceling large meetings. That tells me productivity is poor and is a prelude to layoffs.

Businesses complaining that they can’t hire

workers means they aren’t offering high enough wages. If the business model can’t survive unless

they have cheap labor, perhaps it’s time the

business model is changed ? My guess is that they will scream about increasing immigration

and raising the social security age instead of

making any sacrifice to their wallet.

I work at salesforce. We’ve had people in the US laid off as well as India counterparts. Salesforce also owns Tableau, Mulesoft, and Slack. Some of these companies had up to 25% let go based on internal rumor mill.

Employment like everything else has to be weighed in context. What is disturbing about the economy is not the employment numbers, but the productivity of workers. There is an ever widening gap in GDP and GDI and when ever there is a divergence in two indicators that historically are parallel it can only mean one of those indicators has to revert to the mean.

The workers in America are not in good shape. Along with dropping production, you have a reduction in knowledge and training, and a general crisis in mental health within the entire population. Depression and anxiety are increasing even higher than levels seen during COVID.

The term they are using is a “social recession”.

To part of your point, Jdog: There’s a documentary called, “American Factory”. Here’s Wikipedia’s overview:

“In post-industrial Ohio, a Chinese billionaire opens a factory in an abandoned General Motors plant, hiring two thousand Americans. Early days of hope and optimism give way to setbacks as high-tech China clashes with working-class America.”

If you watch this, you’ll see how the American workers compare to the Chinese who work beside them on the factory floor. Then, there’s a small contingent of Americans who are invited to the main offices in China. What the Amer. workers wear, how they look (slovenly, unkempt), it’s really a pitiful contrast. It’s no wonder that lots of jobs have gone elsewhere.

Sad….

Salesforce had 49k employees pre-covid. During 2020 through 2022 the employee count went to 74k. So they add around 25k or 50% more employees in 2 1/2 years.

Even after laying off 10k, they grew their employees by 30% from 2020. Many companies hired too many people thinking that the crazy pandemic growth would continue.

Yeah, there are ways to get official/semi-official individual company employee counts by year – but it is a major haul to do it for 500 companies.

That is why people just punt and look at metro/state/national payroll counts from the BLS.

Companies hire too many people when they see a competitor doing the same. In a basketball, for example, if you person you are guarding increases his/her energy level, you have to respond or they’ll blow by you.

Therefore, you can’t blame companies for trying to keep up with the competition. Instead, we must blame the Fed’s monetary policy. Using the basketball example again, the Fed policy mistake was to give every player a hit of meth before each game, for the last 10 seasons. More points were scored in the short-term, but all the players now have structural heart damage.

Interesting analogy.

Yes, pretty strong analogy all the way around.

I’m particularly intrigued by the basketball guard/hiring cascade part – it would explain some otherwise very hard to explain hiring booms (like this one) and busts.

Plus it is the kind of lazy algorithm (monkey see, monkey do…because other monkey must know something) that crummy corporate leaderships resort to.

Most of the companies did the same thing. We think these guys are smart but they are not.

SalesForce CEO said he takes full responsibility for this. But then I wonder how did it impact him in anyway. He still has his job and money.

Not to champion overpaid CEOs, but the average tenure of a Fortune 500 CEO is 4.5 years – justice/karma tracks them down fairly quick. Their average total annual comp is about $11 million (through 2015 or so). That includes stock options and the whole shooting match.

There may be 5%-10% of the F500 that elude karma for longer or accrue truly insane overpayment (hundreds of millions).

I’m not saying that $50 million over 5 years is “small” – but it may not yield the shareholder/worker pay spikes that are anticipated if redirected.

The money could be more carefully and better spent – but it won’t solve what ails the American economy – which has continent sized structural pathologies that will cripple it (beyond just CEO pay)

I’ve been saying this for a long time, a ceo’s job is the easiest to outsource. The reptilian does not do anything besides slither up in townhall meetings parroting other peoples work. It usually directs people to work/make choices that would maximize its share of the loot. Then off to spend company money playing golf and luxury living off of corporate card. Once the company is leeched dry, it moves on to another company to rinse and repeat. You can hire a 3rd world lackey to do the same exact thing for about 1/1000 the cost. Heck the 3rd world ceo would even pay for their own travel and entertainment.

CEOs are certainly overpaid, but from what I’ve observed, they work very hard, and have real work to do, and there are major consequences when they aren’t good at it. You can’t take any schlub and put them in that position. It is a rare skill.

The average S&P 500 CEO made $15.5 million last year, 299 times the pay of the median worker (c. 2019). And from an earlier study, U S CEOs earn an average of 6 times the total compensation of Japanese CEOs.

…so, are top management types compensated for being truly smart, or merely clever (…mind being sucked into the ‘rugged individualist’ meme…)?

may we all find a better day.

“Some of you may die, but it’s a sacrifice I am willing to make”

—Lord Farquaad

Hehehe…. Run run run as fast as you can! Such a classic from a simpler time!

Yesterday saw a huge screaming crowd (North Sheridan Rd, Chicago).

Instead of investigating myself I bought Chicago Sun Times. Howard Health Infirmary (or Hospital or Hospice or Outfit or whatever) has $12M shortfall and started laying off nurses. Union members are first to let go… 500 nurses gathered to protest…

Geez… I thought all those infirmaries are flush with Gov money…

And they are definitely going try to keep that money and not give it away to employees.

Hard to say my friend…

Maybe there is nothing to keep…

IIRC Fed health care money must be matched by Illinois State money 50/50.

In 2020 Pritzker was wailing “State Retirement Fund has $39B shortfall. Our $100K-$200K+ State Gov retirees will die !!!”

Then there was $10T gusher from Washington DC, then house prices skyrocketed, property tax collections skyrocketed too…

Last month, as Ronnie Reagan once said about Jimmy Carter, “There he goes again”

“State Retirement fund has $29B shortfall. We all gonna die !!!”

‘Round and ’round and ’round it goes 😁

The government money was a one time thing in 2020 and costs have gone up 20+% in health care because so many people retired or left.

Half of all non profit hospitals had negative earnings last year. They are cutting costs like crazy right now, lots of layoffs.

Amazon CEO says job cuts to exceed 18,000 roles.

The expected job reduction numbers are not significant, however, the announced jobs cuts have nearly doubled within the last several months.

Yes. Back on November 15, I wrote a whole section about these rumored and being planned layoffs at Amazon:

“Amazon: After hiring 800,000 in two years, laying off 10,000”

You gotta keep perspective.

So now it’s: After hiring 800,000 in two years, Amazon is laying off 18,000.

And note, they’re corporate employees globally (recruiters, especially recruiters, devices people, corporate retail employees, etc.). Amazon has 350,000 “corporate employees” globally — as opposed to warehouse, transportation, and delivery employees.

There is no telling how many of them will be in the US. And the US labor market is the only thing we’re concerned about here.

https://wolfstreet.com/2022/11/15/the-five-digit-layoffs-are-here-the-big-ones-weve-been-waiting-for-but-the-laid-off-people-are-scattered-around-the-globe/

Just wait till AI grows up enough to write code, and it’s getting there. It’s gonna go META TSLA!

They certainly don’t call compilers AI but they are pretty clever software. They translate the C, C++, Java, etc code into machine language (or close to it). Java gets interpreted i think as opposed to compiled, a notable distinction (though Java compilers probably exist ?).

First ones written in the 1950s, 1960s.

And then some smart guy decided to write YACC.

Humble him…Yet Another Compiler Compiler.

Yea, I’m just writing another one…hey he was at Bell Labs.

You provided the specs for your language and it would generate the compiler for the language.

Unix world, 1980s. AI was already being heavily researched by this time.

I’m not in the AI world but I get the impression that in recent years AI has been equated to machine learning and analytics. It should not be seen as so narrowly confined.

1) Claudia Sahm indicator : when unemployment rise 0.5% above the

lowest point in the last 12 months the risk of recession is growing.

2) The Sahm indicator stretch all the way to Jan 1960, covering 9 recessions.

3) In Sept 2021 Sahm indicator fell to the deepest point ever, to (-) 0.37.

It was underwater for a year and a half, between Apr 2021 and Aug 2022.

4) The lowest point in the last 12 month was 0.33%, in Nov 2021. It’s up

0.4% to 0.07%, below Sahm threshold.

5) Today our economy is different than the one in the 60’s and 70’s. US

labor force stretch all over the globe. We have R&D centers, cheaper

engineers pyramids, workers, partners, contractors, tens of millions

employees beyond our borders, unaccounted in the 158M labor force, besides a huge black marker, possibly between 40M – 50M.. The real labor force might be between 200M and 230M, who knows. We keep the world running, humming.

6) The Sahm indicator might be outdated.

7) Our labor force isn’t tight. It’s flexible.

8) Until it collectively Snaps!

Wolf, I’ve mentioned layoffs.fyi in my comments in the past. I never meant it as an authoritative source of all layoffs. In the past you’ve shown charts and tell your readers to ignore the numbers and just look at the trends (I forget which data this is). I look at layoffs.fyi in the same vein to get a sense of the momentum. The JOLTS data is great but it appears that they don’t break out the data by firings (which is the overwhelming number) and layoffs so it is hard to see a trend there. The unemployment claims is good too but misses H1B workers that can’t file for unemployment and is for all industries. Challenger, Gray & Christmas, Inc. may have been collecting similar data in the past but no one knew about it. I guarantee that people in tech know about layoffs.fyi just like during the dot.com bust everyone knew about fuckedcompany.com. If you are narrowly interested in trends in the tech industry, I think these announcement numbers as a trend still make sense. The data from the “layoffs chart” tab on that site clearly show a spike of layoffs when Covid first happened in Q2 2020 and it went away until Q1 2022 at which point the numbers increased for 4 quarters in a row. The numbers may not be complete but the trend seems valid.

I don’t see layoffs expanding much until the large vacuum from the pandemic early retired/passed gets filled. If you think though of most of this huge group as layoffs, you would not be wrong. They were people removed from GDP who were not replaced. Many small businesses still have an empty mom n pop building shell standing. But I’ll ask, if they were all still here, how many layoffs do you think you’d be seeing? My point is currently layoffs are not a good indicator of the health of the economy. I’d look more at house price direction, homeless and welfare growth, and Wolf’s list of imploded stocks among others. I don’t even see defaults happening much until this void get filled. Then open the floodgates. Guess how much houses cost last time interest rates were 7%. Best guess wins.

Pre Recession ( if we are not already started ) ” Rate Hikes ” are what has brought My Financial Life back to life . It’s a Depressing Fact to see the country gone to the Dogs of Financial War of a totally miss managed Financial economy. It’s like a Clock with a Winding spring installed backwards and now a Rich Banker trying to learn how to become a Clockmaker rather than a Banker.I can’t help but think of the appointments and reappointments of a non Economist to the Fed ? they may as well have a Clockmaker Yes ?

One question no ones answered? what is going to happen to the 25000 jobs Amazon promised Northern Virginia in exchange for corporate welfare err..tax incentives? Also, were not the high tech jobs the jobs that would replace the blue collar jobs? It seems like it was a sham . Calling Michael Moore to do another Roger and me ; This time in Silicon Valley.

Agree with your premise regarding announcement versus actual layoffs.

However, can confirm based upon my LinkedIn feed Salesforces employees in the US are being let go as of yesterday. The actual # agree is not transparent and will come out in official figures.

Private payroll is up more than expected this morning. Futures are down. We are back to good news is bad news again.

God bless the Fed!

OMG, DIA Renko 2Pts daily close vol is going crazy.

Three million baby boomers retiring each year is a fierce headwind for creating higher official unemployment. If you have an education and get laid off, apply to the government for a job. The government is always hiring and never lays off people. Hardly ever fire anyone.

I see many posters speaking about the need to pay more to attract workers.

What about the cases where that wage is not feasible? Sometimes paying someone $15/Hour is all an employer can afford given the level of output-production of an employee.

If said employee produces $20 of product/service per hour and their labor cost is nearly $20/Hour given wages and government mandated taxes – employer’s SS share, unemployment insurance … the math does not compute beyond $15/hour.

The same careful analysis should be carried out with job openings. The IMF freaked out about the past 400k number. Now remove the low quality jobs included in that bloated number that pay too badly in order to cover for housing costs in that area – unless they are fully remote – and then see what’s left.

I’d be surprised if 50% of those job openings that aren’t fully remote cover local housing costs, the jobs that don’t aren’t Jones, they are jokes. One should laugh and discard :-)

Great analysis WS! Keep it up cleaning murky data.