But for yield investors: Short-term Treasury yields near 4%. Six-month CD yields at 3.5%, if you shop around.

By Wolf Richter for WOLF STREET.

What I got from the reaction in the markets today: Until this morning, they eagerly ignored my inflation discussions over the past many months, of how CPI inflation has been shifting into services – housing, health insurance, auto insurance, medical services, etc. – and those good folks focused instead on prices of gasoline and plane tickets, which are plunging, and so they expected this inflation to be well on the way out the door.

Inflation “collapse” is what Jonathan Golub, a Managing Director in Credit Suisse’s New York office, called it ridiculously on CNBC’s Fast Money just yesterday morning.

“Every one of us sees when we go to the gas station that the price of gasoline is down, and oil is down. We see it even with food. So, it really is showing up in the data already. And, that’s a really big potential positive,” he said. And stocks are going to soar because inflation is over, and the Fed will pivot or whatever. I mean, this stuff is just a hoot.

This phenomenon was all over Wall Street – this crazy notion that because gas prices were plunging, inflation would suddenly go away on its own. Obviously, these people cannot be that dumb; they had a purpose, and the purpose was to hype stocks into the stratosphere, and they did it for days. And it worked.

Then came the CPI release this morning. As I’ve been reporting for months, today’s numbers once again showed that inflation is getting increasingly entrenched in vast parts of the economy that have little or nothing to do with tangled-up supply chains and messed-up commodities, and that this inflation is getting worse, that it has been muscling into services for the 12th month in a row, and that the Fed will have one heck of a time cracking down on this raging inflation. Here’s my analysis and charts of the CPI mess today.

And markets should take Powell et al. seriously when they talk about further big rate hikes, more rate hikes, and higher rates for longer, because this inflation is tearing up the economy, and they know it, and they’re going to crack down on it, and it may be too little and way too late, but they’re now cracking down on it.

By the looks of it, markets today started to take Powell et al. a wee bit more seriously, which triggered a widespread sell-off that in the span of a few hours unwound most of the six-day-long hype-and-hoopla “inflation is over” rally.

Just about everything tanked: Industrial stocks, blue chips, giant tech stocks, SPACs, IPO stocks, even Apple bigly (-5.9%), and Meta of course (-9.4%), and Nvidia (-9.5%), and Advanced Micro Devices (-9.0%), and NXP Semiconductors (-8.1%), and Boeing (-7.2%), and Eastman Chemical (-11.3%).

The S&P 500 index dropped 4.3%, and it was a sea of red. Only five stocks in the S&P 500 index were green, including Twitter the second-best performing stock in the index today, which spiked, I mean ticked up 0.8% on the news that its shareholders approved the buyout offer from Elon Musk, who used to walk on water, but now doesn’t feel like doing the buyout anymore, and the whole thing is a mess for the court to sort out.

And there’s of course Cathie Wood, who’s been out there promoting the idea that “deflation” is the real threat here, and that the Fed is making a “mistake” by cracking down on the hype-and-hoopla stocks in her funds, I mean on inflation. Her Ark Innovation ETF [ARKK] fell 6.8% today and is down 73% from the peak in February. No wonder she’s getting a little antsy about the Fed crackdown on inflation.

Cryptos got knocked down too. Bitcoin got whacked down by about 10% from $22,500 early this morning to $20,150 at the moment. It’s down close to 70% from its high. Ethereum got knocked down about 9%. Cryptos, which had been hyped as a hedge against inflation, swoon every time inflation is shown to rage.

Gold dropped about $30/oz on the CPI news this morning. Gold, a classic and time-proven hedge against inflation over the long term, after a huge run-up during the Everything Bubble, has remained roughly flat since the Fed pivot late last year.

But “roughly flat” is great compared to the Nasdaq Composite, another hedge against inflation, which plunged 5.2% today and is down 28% from its peak in November.

Semi-good news for yield investors: Treasury yields close in on 4%.

Among bonds, prices fell and yields jumped. This is good news for yield investors wanting to buy bonds and CDs going forward, tempered by the fact that yields didn’t jump nearly enough to make up for raging inflation:

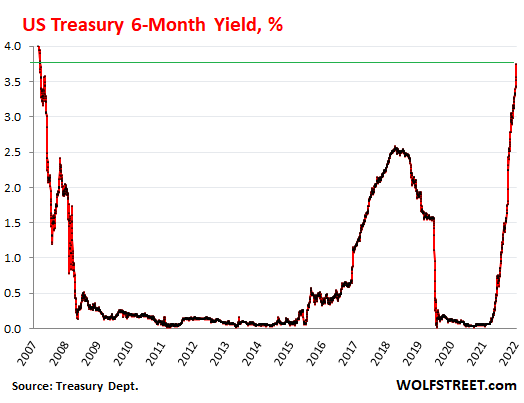

The 6-month Treasury yield jumped by 19 basis points today to 3.75%, the highest since November 2007:

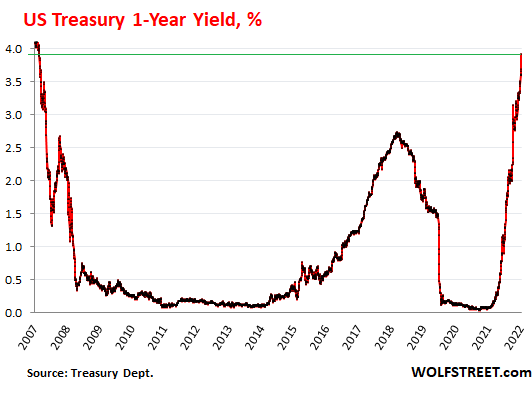

The 1-year Treasury yield jumped by 22 basis points today to 3.92%, the highest since October 2007:

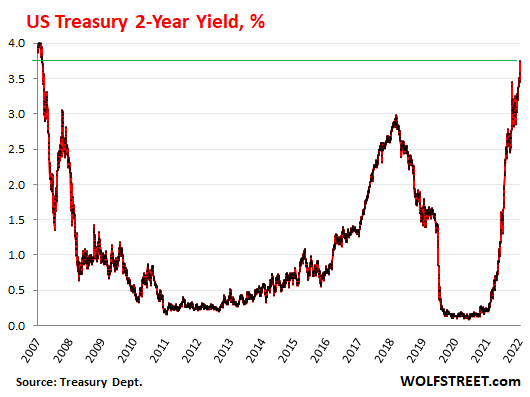

The 2-year Treasury yield jumped by 17 basis points today, to 3.75%, the highest since October 2007:

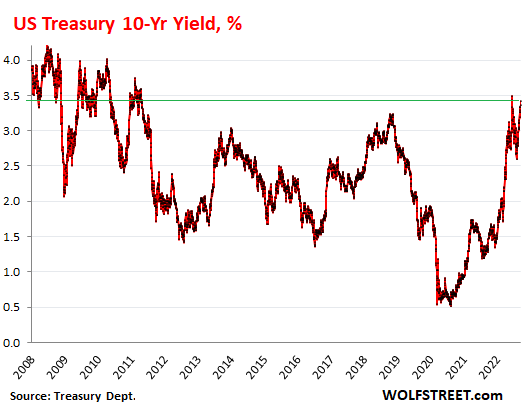

The 10-year Treasury yield rose by 5 basis points today, to 3.42%, nearly back to its mid-June multi-year high of 3.49%:

Yields on many “brokered CDs” are well over 3%.

For your amusement, I just checked at my broker this evening. It offered FDIC-insured CDs by a variety of banks with these maturities and yields:

- 3-month CDs: 3.0%

- 6-months CDs: 3.5%

- 1-year CDs: 3.7%

- 2-year CDs: 3.75%

Banks don’t want to pay their existing clients any kind of interest. But to attract new cash via deposits, they’re offering CDs through brokers – “brokered CDs” – to investors that are not already bank depositors, which for bank funding is sort of the hot money.

For your further amusement this evening, in my brokerage account, under the tab of bonds and CDs, sure enough, I found a 6-month CD from my very actual bank, offering 3.5% interest APR.

And for your maximum amusement this evening, I logged into my account with my very actual bank, and the best 6-month CD it is offering me and its other existing customers directly through its website comes with an insulting interest rate of 0.2% APR. “LOL,” the bank goes in small print at the bottom.

So savers need to shop around. Your own bank does not have your best interest in mind. It just wants to borrow from you, its existing customer, as cheaply as possible while still retaining your money, hopefully at near 0%, while it is willing to pay a lot more for new money from non-customers by selling brokered CDs.

All these yields of under 4% mean that yield investors are still getting ripped off by raging inflation – currently 8.3%. But those higher yields mitigate some of the damage from inflation, and they’re out there, but folks may need to shop around to get them.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Bahahahaha!!!! I LOVE the title. I just had to say that before I dig in.

Elections are in 2 months and Fed has completely failed to control inflation with its negative 5.7% real rate (2.6% fed fund rate – 8.3% inflation rate).

Why will it have any motivation to go ahead once elections are over? They are not accountable to us 99%!

What of they Pivot and push inflation higher to please Wallstreet?

What are you talking about?

The Inflation Reduction Act of 2022 will cost $400 billion and has been very successful, according to those in power.

In 2023, they just need to expand this legislation. Maybe make it like $1.4 trillion to really tamp down on inflation.

“a great deal of fiscal stimulus on its way into the market to take some of the place of the monetary stimulus that’s being withdrawn.”

Not sure $1.4 Trillion will be enough to keep up with inflation. Lol

“What of they Pivot and push inflation higher to please Wallstreet?”

They’ve been doing it for a decade already. Wake up and smell the roses.

The motivation is that Powel and others don’t want to be fired or worse remembered in ignominy or blow up the world. No, the inflation does not benefit Wall Street. No, there is no conspiracy.

Yes, there is no conspiracy, but for some reason the rich are getting richer and the working class is getting screwed!

“What of they Pivot and push inflation higher to please Wallstreet?”

That’s no longer an option. Too many of the interest rate hike deniers, QT deniers and general Wall St. squawkers can’t see the forest for the trees, and can’t realize that the Fed is dealing with much more historically critical territory right now that they can’t afford to take into account the tender sensitivities of already over-leveraged speculators. Like Wolf is saying, high inflation is becoming dangerously entrenched in the US economy (and plenty others too), and runaway inflation like this destroys nations and brings great powers down.

Asset prices are a pale and distant priority compared to taming inflation right now–in fact, asset prices have to come down (and the housing bubble and other asset bubbles in the US have to pop) to have any hope of bringing this inflation under control, it’s the same situation that Paul Volcker faced. Whatever his shortcomings before, Powell and the Fed are acutely aware of this, and the Wall St. speculators, crypto-bros and real estate profiteers will have to deal with the fact that their bloated asset values will have to come if the US economy is to be saved–in fact, if inflation isn’t brought down and fast, then all their assets will soon be worth zero since the United States itself will dissolve into disaster as the dollar plunges and Americans’ savings and buying power deteriorate further. Again, far more great powers and major empires throughout history have been brought down by rampant inflation than by any war, and JPow knows this.

Such uncontrolled inflation is even more dangerous in the USA since we have such a massive trade deficit (compared to the trade surplus in most other countries facing high inflation), and we’re also already bitterly divided and esp since Jan. 6 2021, constantly teetering close to a second civil war (more like the ones in Syria or Bosnia than 1861 but still..). And not to mention that the US has 400 million firearms in out there and quickly rising each month. Inflation like this is NOT an option if the US is to stay a viable nation. The Fed has to crack down on it and hard.

Even after today’s inflation numbers many on CNBC including but not limited to Jeremy Siegel kept repeating the same line from prior days and weeks that the Fed is making a mistake by over tightening and inflation is already peaked and markets already bottomed and housing already crashed….. These are the people that are long the market and frustrated by their loses trying their best to manipulate the viewers in to ignoring the reality on the ground.

All of the uber wealthy beneficiaries of the FED’s largesse are crying foul because Jerome P. and company took away their free shit. Now they’re, horror of horrors, facing a new reality where they can’t pile hundreds of millions more on top of their billions. These clowns smugly stated the FED could never raise rates, for a number of reasons. Now it’s time to eat some crow, and some serious losses.

Well-said.

Might even have to get a real job, like the rest of the peasants.

DC

I’m with you. I’d also like to see some hellfire and brimstone rain down on some of these CNBC actors too.

But if today’s pre-market is any indicator, it appears as if the $SPY may bounce around the $390 mark again. Just like a week ago, before this last little run up.

If it does break thru, then some of the mid-level HF’s may take a shot on the chin but the big guys – those with access to the FED RRP – will be fine. Heck, unless my understanding is off, they will just get a bigger, daily, interest payment when the FED raises interest rates again.

I don’t think the big boys will be in serious trouble until the monster they created, through their holding companies, Evergrande, finally falls. Based on the total news blackout and the few scraps of current information available about EG, it could be possible that there is a massive amount of corporate bonds being held as collateral there, which could be why it has magically been able to avoid default or BK allowing those bonds to still be good although they are only worth pennies.

I realize there are tons of rumors out there about EG and the truth is had to come by. However, no company could hold on this long, naturally, based on what little HAS been reported. It has to be for a reason. If/once it finally timbers, then the domino effect begins and the sky, just might, turn red.

Then we’ll all be eating crow, along with the big guys. Literally.

D.C., do you keep your web browser open to Wolf’s meta-site so you can be one of first commentators? Harmless question. Good comments and I like your enthusiasm in verbally striking out at the mongrels that are ruining our country. Keep it up and vote several times in the Fall, that is the new American way!

Deflation is just around the corner – CNBC sentiment from Gundlach and Wood. They just can’t help themselves.

Wage inflation is sticky and feeds back on itself. The “talking heads” are not down in the trenches. Labor costs everywhere around me is increasing and labor finally has the upper hand. They want housing affordability back, they want food prices and energy costs stabilized. They are not taking “no” for an answer. Inflation will be persistent and FED will raise and QT.

“inflation is sticky and feeds back on itself”

spiraling in a word

And this is why the Fed has a “stable prices” mandate, and this is why there should be formula driven monetary guard rails so that reality can not be explained away as “transitory”.

Fed Funds should be tied to inflation, period. No fedspeak excuses to delay or ignore their duties.

Jack, I didn’t see the discussion you mention but it is likely we will see both deflation and inflation at the same time: deflation of asset values and inflation in the things we need to live. Deflation was very active in the stock market today. If these zombie companies start tipping over and housing really takes a dive, the carryover into the markets will be highly deflationary.

Historicus writes : “Fed Funds should be tied to inflation, period. No fedspeak excuses to delay or ignore their duties.” This is all the result of irresponsible Congresses and the 40 year decimation of taxes and ‘trickle down’ which is a hoax. A scam for the ignorant. The Fed is a one trick pony. It is the Congress which possesses the far more effective fiscal tools.

I think there is an argument to be made that the wipe out of zombie companies could end up being inflationary.

In short, zombies are suppliers. They are inefficient, but they are still competing in the market which limits the ability of more efficient companies to raise prices.

So, when the supply from the zombies is taken out of the market, it could, at least in the medium term, result in lower supply relative to demand, and hence we end up with stagflation.

Gundlach is a high IQ guy with a lot of bond market experience. I tend to listen to him realizing he has a primarily bond investment firm.

Fed did too much loose money and there is a good chance they will tighten too much on the way down as it all works with a lag.

Wouldn’t surprise me if they crash housing hard as that’s the sector most sensitive to rates.

The inflation reporting on this site is excellent. The deflation reporting on this site will also be excellent.

Gundlach is foreshadowing emerging dynamics that may play out soon and differently to the “inflation is entrenched” narrative.

One way to undermine him is to conflate his views with Cathie Wood, who has quite transparent motivations. The other way might be to compare this period to the 1970’s.

AB,

I’d LOVE to have a little bit of deflation to make up a tiny bit of the damage that decades of inflation have caused. Deflation is when your income and your assets gain in purchasing power rather than lose purchasing power. A little bit of deflation would be my dream come true, to undo just a smidgen of the damage that inflation has done. As a side effect, it would also make borrowers pay back their debts honestly, including government borrowers, which would be a good thing and maybe teach them a lesson to be more careful taking on debts. But it’s just wishful thinking. I’m not going to get any noticeable deflation ever, I’ve come to grips with that, and so I stopped looking forward to it. What I’m going to get instead is inflation and raging inflation, and that’s what I need to deal with because that’s reality.

Grundlach’s annual prognostications on Barrons have been pretty mediocre or worse.

I tend to think that by the time we see some deflationary pressures the Fed will step in and open the spigots again, so Wolf is probably right… we will NEVER see purchasing power come back to the little guy in our lifetimes.

In Cathie Wood’s defence. Her Ark ETFs are particularly susceptible to deflation. Can’t argue with that.

All this talk of “deflation”…..who has ever seen it?

Price rollbacks off a SPIKE, if it happens, can not be described as deflation, but rather disinflation or intermediate price corrections.

If prices somehow, miraculously drop to the Fed’s 2% inflation trajectory from 2020 prices….is that deflation, or just less inflation, net, over the past 3 years? Hardly deflation. Less inflation is not deflation.

historicus, you’re just mincing words. When would you say it’s deflation, when you can buy a dozen eggs for 10 cents?

@ historicus –

disinflation is just a bastardized FED word that should never be used.

it just describes inflation that is slowing.

slowing inflation is still inflation. It still diminishes the value of your dollar.

Haha deflation is negative rate of change in prices, ie negative inflation. With the current financial system, that would make repayment of (positive) interest impossible. It would require negative interest rates, and negative money to neutralize all the debt. It’s easier to just default on all the debt and reset.

Nonsense. Paying interest will work just fine. It’s just that borrowers can’t cheat anymore.

cb,

I completely agree. Disinflation is a weasel word. Finance is loaded with weasel words. It’s how dishonestly gets cloaked as clever.

Ivy League Prof Jeremy Siegel seems and sounds like a buffoon with his always long view on all things. But for the last 10 years he has been right.

Again, these speculating, over-leveraged fools and tightening-deniers can’t see the forest for the trees. It’s not a choice between “let’s accept inflation and higher asset values vs. an inflation crackdown and our assets plunge”, the choice is much more raw and serious than this: if runaway inflation keeps menacing the US economy like this, soon these speculators’ assets will be worth nothing, since the United States itself will dissolve and be torn apart by social unrest. There are already spikes in crime and angry protests in much of the USA as Americans can’t afford their rent payments anymore, and their monthly budgets are running dry by just a couple trips to the grocery store. This is NOT sustainable if the US economy (and the US dollar) are to be viable.

Recessions, stock market plunges, housing crashes and speculative bubble poppings are painful, but temporary and necessary–they cleanse the US economy of asset bubbles and poorly allocated resources, and they allow for strengthening recoveries. The Everything Bubble right now is so ridiculous in its asset bubbles that a cleansing recession–likely in early 2023–is likely the only thing that will overcome it. Whereas runaway inflation wrecks nations–it is far and away the greatest fundamental threat to the US economy and US geopolitical power, far more than recessions or falling asset prices. And so it’s better to take the hard medicine and short-term pain now than to let this inflation get even more entrenched and uncontrollable. This is exactly what Paul Volcker realized in 1982, just like Powell and the Fed are realizing in 2022, and they have no other choice now than to take the hard and aggressive path that Volcker did.

Wolf,

Fed continues hiking until something breaks. How that breakage manifests? How’s about a good ol’ currency crisis.

BTW, if GDP flat-lines but unemployment remains benign who says the Fed has to stop raising rates?

Fed’s “Plan A” was to raise rates to a neutral rate of 2.5% to 3% (real rate of -5.7%).

This Plan has failed and there is no “Plan B”.

Fed and govt keep failing to acknowledge the fundamental and rigorous exponential model that is fueling inflation today and till it keeps doing that with real negative interest rates, there is no hope for controlling inflation.

Only fix : Free Markets must work again and valuation should allow real productivity to become profitable. For this to happen interest rates should be real. At current risk of default, real interest rates should be around 25%.

Not to argue WA, because your fundamental premise is sound, but let’s say real rates around 10-12%…. don’t want to over do it!

After blowing up bubble to get wealth affect, Fed has knocked 60/40 portfolio down by 15% ytd plus inflation hit of roughly 5% ytd. Keep that trend going for another 8 months and the wealth effect will be pretty much wiped out.

Wait…What???

How could this be?

“Your own bank does not have your best interest in mind.”

Nothing short of hucksters. Always have been, always will be. It’s ingrained their culture.

Such good news for my maturing CDs. Snoopy dance!!

I LOVE WOLF’S WARNINGS FOR MONTHS NOW…”DON’T FIGHT THE FED” THEN I FINALLY READ THIS IN BLOOMBERG:

“Markets had tried desperately to spin a bull case and fight the Fed, basically, and that’s a dangerous place to be,” Carol Schleif, deputy chief investment officer at BMO Family Office said on Bloomberg TV. Looking further ahead, she pointed to “a great deal of fiscal stimulus on its way into the market to take some of the place of the monetary stimulus that’s being withdrawn.”

I REALLY APPPRECIATE THE DATA DRIVEN, NO BS, LAY IT ALL OUT THERE NAKED FOR WHAT IT IS, ATTITUDE AND PRESENTATION OF WOLF’S PRESENTATIONS. THANK YOU.

In may bought deposits for 2.85 for a 1 year term.

I was early.

;s

Yeah, but knowing they could pull the rug out from under you at any second, you have to take nibbles on the way up, and take what you can lock in. At 4.5% I’ll start laying major money down, but I am nibbling on the way up.

Don’t feel bad. Last year I locked in at 1.8% for ten years! Kept nibbling on the way up though and yesterday found a 4.25% for five years. Each 1% increase I’m buying more. If they get to 10% I’ll start selling everything else to pile in.

Thanks for that info on brokered CD’s Wolf. Had no idea. Time to shop banks.

Look for them through your brokerage.

Yeah I was surprised too. My credit union does ok but the major bank I work with is offering 0.1% APY on a 6 month. Fidelity shows 3.5% from the same bank. Incredible

What’s wrong with a TreasuryDirect account. Maximum safety and better rates than from banks.

What has made me hesitant (beyond investing in I Bonds that we plan to hold for awhile), is the complexity of withdrawal rules.

– I don’t have an account with a local bank that can cash bonds

– Do I just need a Certified Signature (notarized) or

– Do I need a Medallion Signature (see above about not having a local bank) to withdraw the proceeds?

I rollover Treasury bills through a Capital One (used to be ING) account that I open online without ever visiting a branch. Everything is automatic. Auction purchases are withdrawn through ACH and interest and principle are returned through the same system. In the case of a rollover, it is just the interest obviously. I would assume notes and bonds are the same for the electronic versions, I don’t know how paper is handled. But then again it is the government and you can never underestimate its ability to add unneeded complexity.

If you have a bank account tied to your treasury direct account, the purchase and payment at maturity for bills and bonds from that account is automatic. It’s really easy and the money is available immediately on the maturity date. There’s no reason it needs to be a local bank. I don’t think they issue paper bonds anymore except maybe for tax refund IBonds.

That said, I’ve never attempted to sell a treasury bill or bond before maturity, and that may take some effort. Since you can purchase bills with maturities as short as 4 weeks, I just keep some reserves and the rest I invest at varying maturities based on my cash needs so I don’t need to deal with trying to sell a security on the secondary market.

You’re correct about better rates right now from treasuries, particularly if your state has an income tax since they aren’t subject to state income taxes. Likewise, I noticed in 2018-2019 that as the Fed increased rates Treasuries paid better than CDs. However, when the Fed reversed course and lowered rates I found better CD rates in the summer of 2019. I still have a CD from July 2019 paying 3%, which was pretty good until the last few months. Not sure it will play out this way again when the Fed does eventually lower rates, but it’s something to watch for.

Hill – make sure they are non-callable if you want to truly lock in that rate

Just stay short in your maturities because then you can progressively roll-over your hard earned moola at higher and higher rates more often. Still like Vanguard Treasury Money Market. When I was an RIA, and Fred Flintstone drove around town, that is where we gladly put a ton of our liquid funds.

At the rates he posted, might as well buy equivalent T-bills. It’s exempt from state income tax.

“Cryptos, which had been hyped as a hedge against inflation, swoon every time inflation is shown to rage.”

Sing it, brother Wolf!

It is interesting that nothing is working as a hedge against inflation.

Especially the traditional hedges.

Not gold, cryptocurrencies, tobacco, real estate, CDs, foriegn currencies, etc.

Nothing is keeping up with 10%+ inflation to even maintain value.

If you were talking to yourself a year ago, what would you tell them about where to put your dollars to hedge against inflation?

The only things that come to mind (and sound crazy too):

Clean used cars

Physical groceries foodstuffs

Russian Ruble

Physical storage of propane

Firewood

Private jet services

Buying non performing student loan debt

Appliances

Rental apartments

Oil companies are still holding up. Everyone has figured out they’ll still be profitable at $50-60 oil and we’re not all switching to solar next week.

Actually working is a good hedge. If you are in the right field. I’m 65 and don’t even feel like doing much but home repair is booming. It’s hard to turn down what jobs are paying.

But hell no, I can’t find help or anyone who wants to work. This is a weird economy.

don’t forget water!

literally the dollar is the hedge as well as I-bonds. Why are people so confiscated on gold still? It has no real return at all. Historically it has returned garbage compared to the stock market in the last 100 years.

fixated*

Time takes care of everything, and everything has it’s day; inflation deflation, strong dollar weak dollar, war peace, socialism corrupt capitalism, the sun, the galaxies, and probably this universe. Therefore give your short term bets a heavy weight towards the scam going the other way.

At least on this web site you can get good un biased data.

Gold has actually outperformed the sp500 in the last 50 years, since Nixon closed the window.

I have one word for you – TIPS

Ok that’s really four words.

But it’s guaranteed to beat CPI since it has a real positive yield and is the world’s safest investment.

Race horses are right up there as the price of yearlings has soared.

”Traditionally” 2b, the only ”things” that have kept up or better with inflation are:

Waterfront, especially ocean front, dirt / properties.

Fine art.

Fine jewelry.

Maybe, repeat MAY bee some others these days, but that is definitely TBD.

Every other ”asset” has been and apparently continues to be at least ”sketchy” if not clearly less than keeping up over the last 50 or 70 years that we’ve been watching…

It’s not surprising that inflated tradeable markets perform this way. It’s totally disconnected from the productive economy in the real world.

There was never a reason to believe it’s possible to perpetually obtain 10% return on the S&P especially with such pathetic dividends even as the increase in real wealth is almost certainly less than reported changes in GDP.

Gold is worse. Crazy world.

Wolf,

With due respect, why would I buy a 6-month bank CD at 3.5% when I can hop on Treasury Direct and buy a 6-month Treasury bill at 3.75%? Same question across all maturities that I have tracked. I moved all of my cash out of banks into Treasury bills a few months ago. The rates are better on Treasuries. Plus, no state income tax. If I have made a mistake, please let me know. Thank you.

If you don’t have any Treasury I-Bonds (inflation indexed), go get some. You can only buy $10k per calendar year, but currently paying 9.62%.

A family of 4 can buy $100K worth of treasury bonds by using gifts and trust.

I have two Treasurydiret accounts, but I have other accounts that cannot access Treasurydirect. In those accounts, CDs are a good option. For example, I have an HSA account with a brokerage account attached to it, and with that account I cannot buy Treasuries at auction, only in the secondary market. There are other reasons.

Adam Taggart put out a Wealtheon video yesterday on the use of treasury direct “gift box” strategy to increase the amount you can invest annually above the $10k per person annual limit. I thought it was a good explaination.

Could you comment on this strategy, please?

Teacup – A good site, if Wolf allows me to say, is Harry Sit the Finance Buff. He explains I Bonds strategy as good as any I’ve found.

Why doesn’t the Fed an US Government support investing in IBonds beyond 10K/person?

It you want to eliminate cash from the market, provide more incentives at the 9.62% given by IBonds.

I guarantee that I will flood to them and stop driving up inflation with all of the cash being pulled from my mattress.

Otherwise, I am waiting for +9% returns on 10 Year treasuries so I can have a safe ROI on my retirement. 10 and 30 year treasuries at 10+% would be ideal. MAGA! Just like my parents had with their 15% Long term savings accounts and 6% mortgage.

I am a financial conservative and sick of losing 10% this year in the Value Stock Market. (Or 70% in Bitcoin)

You can actually purchase up to $15K I bonds for 2022, you have to use a tax refund to purchase the other $5K (paper I Series), but it can be done.

Even my Schwab money fund (SWVXX) is paying 2.4%. I have been loading up on 3 and 6 month treasuries since May and brokered CDs. This will continue as they mature.

This is the first time in several years us retirees can make some money on fixed income products.

We were doing better earning zero with 1.5% inflation it’s sad to say.

Good point. I have to agree.

But in defense of the current inflation situation, one must do all they can with any investable funds to try to earn as much as possible, specially us old timers who are long retired with a fixed income.

Since 1990.

Big boom to be followed by big bust. I just hope we don’t go into depression territory

I am running very conservative portfolio since 2016 as that is when stock prices by many long term measures got into 95th percentile and above. I keep about 10% as a max limit of stock ownership so I don’t have a big drawdown.

At 66 if the goal is to be nearly certain to have a given income you have to guard against a 50% plus market event that endures for a few years.

If we have a 2009 type event I might be a big buyer of stocks. Even Coca -Cola and JNJ got cheap enough during GFC that unless the world was going to end they would be good investments. It was pretty clear that from a historical perspective nearly all stocks were cheap.

In reality they fell just below long term mean for just a few months, so without Fed action they probably could and maybe should have fallen further to teach us capital markets purpose is not for gambling, but for real savings and real economic investment.

Now central banks have created a gambling casino where they try to control the gambling addiction. Government control of housing, education, health care, automobile design, and now semi conductor investment. US has changed a lot in my lifetime. Corporate profit margins at all time highs tells you corporate influence is too high in politics.

Well said

March 2009 was only “fair value” historically. August 1982 was cheap.

Another difference now is that corporate balance sheets are generally weak to terrible.

I expect deeper and longer dividend cuts this time around versus 2009, even as the S&P has a sub-basement yield of about 1.5% now.

How soon before corporate debt starts to fray and unwind? That will get the Wall Street powerhouses going! “We need more junk bonds”!

As they rollover debt and they have 14 years of easy money, the sums (read malinvestments) start to show real negative returns. Then decisions have to be made by stockholders.

The cold showers they must take have a way to wake up even the most dull of investors

Totally agree

It all depends if the narrative of earnings matter still holds true. Earnings never seemed to matter until last year.

Dividends to provide some return to shareholders while they get taken to the woodshed in the upcoming bear market and cash flow to service debt.

Earnings are an accounting abstraction to most shareholders, as 99%+ have no ability to monetize it.

Wolf – Any sense of where the interest rate for I Series Savings Bonds will be in November?

I follow this closely as I bought I-bonds 20 years ago when they were yielding CPI + 3.

August CPI-U: 296.171

March CPI-U: 287.504

This gives us a five-month inflation rate of 3.01%. If we assume next month’s CPI will be close to recent core rates that’s another 0.5%, so call it 3.5% for six months. That’s a huge assumption, but I believe the most reasonable one.

The Treasury simply doubles the six-month rate — it does NOT square it, not sure why — to get the inflation adjustment for the I-bonds. So that would be 7%. If you have older I-bonds with a fixed rate portion there’s an additional calculation on top of that, but recent bonds simply pay the doubled six-month CPI.

https://www.bls.gov/regions/mid-atlantic/data/consumerpriceindexhistorical_us_table.htm

https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_iratesandterms.htm

Right now they’re at ca. 9%. Interest rates change for specific bonds on specific dates, so it depends on the bonds you have. It will still be in the 7% to 9% range in November I would guess.

Except this isn’t the first time the stonk market has believed inflation is over. It’s at least the fourth time in recent months people have sounded the “all clear” signal, and you can argue in some corners it’s been a continuous display of hope.

And each time, either the data or some Fed speaker swiftly kick it in the balls again.

These have been classic bear market rallies. Still no one has fully priced this structural inflation in. Not stonks, not bonds. And it could get worse, for example with oil, or from food shortages or weather events or more war/terrorism.

At some point, the stonk market is going to Get It, but that’s not yet.

Sir, I rarely post to this site, but I must thank you for the 3.5% yielding brokered CD tip. It is true and it’s glorious. Real rates still well below CPI, but it’s better than nothing.

Hey somebody tell me where to find those 3.5% 6 month CD’s !

Any brokerage account will do (Schwab, Vanguard, Fidelity, etc).

I buy Treasury bills and bonds and hold them to maturity in both my non-retirement and retirement accounts at Vanguard. You must set up your brokered account before you can buy Treasury bills and bonds at Vanguard. It’s not hard to do. Again, the rates on Treasury bills are currently superior to bank CDs, plus interest earned on Treasury bills and bonds is not subject to state income tax. And if you are in the fortunate circumstance of having more than $250,000 in cash to invest, when you buy Treasury securities you are not subject to a bank’s FDIC insurance limits ($250,000 for individuals, $500,000 for married couples). Before you run out and buy bank CDs with your hard-earned savings, educate yourself on buying Treasury securities. It might be a better option for you. Good luck!

Note: Treasury bills are available in 4-week, 8-week, 12-week, 6-month maturities along with long-term bond options ranging from 1 to 30 years.

Thing is you can get 2.53% Liquid ( Bask Bank ) right now before the rate increase coming soon this month > by the time 6 Months comes will be over 3.5 % very likely > perhaps 2.75 within 60 days / Max insured is only $250,000 K however FDIC

Perhaps its about the same lets see what happens

A guy I know plans to invest in Tesla so he can buy a Tesla with his gains. There is no fix for these delusions without millions going bankrupt.

Those huge beautiful casinos are built and paid for by millions of folks losing lots of money.

“Her Ark Innovation ETF [ARKK] fell 6.8% today and is down 73% from the peak in February.”

Kind of funny how Buffet gives better long term returns while running a much more conservative portfolio, this time with 100 billion plus in tbills.

They both know what they are doing, but one is investing for benefit of long term shareholders and other is running an asset gathering business til it implodes. No clawbacks, so Kathy is still living the dream.

Cathy is a religious fundamentalist who has said (with a straight face) that God directs her in her stock picks and that she is doing “God’s work”. I wonder how many of her fans are in ARKK because of this.

Maybe she is? You know what God said about rich people.

I know several people who did this when Tesla IPOed waiting for the Model S and they did ok… But I agree that I wouldn’t do it now.

Nah, they got their Tesla S with their paper gains (i.e. they make monthly payments). They will continue to hold the stock all the way back to $50. Probably lower.

It doesn’t have to be doom and gloom for everyone. It literally depends where you bought into the market. I-bonds are giving 9.62% respectively.

I understand inflation is a problem, but inflation is also personal to different people. Historically inflation also falls off the cliff eventually.

I know lots of people over the last two decades just hoarding cash because of fear….fear in the fact that they are scared to spend/invest their money, so to be honest….I hope inflation goes up and erodes the savers. Let’s be real…the lower class had it rough and usually the comments on these forums want to watch the world burn for some odd reason. Hoarding cash is just as bad for an economy. For every $2 dollars you save is one less dollar in circulation. Not to mention all these corporations who have hoarded cash on their balance sheets. It’s not just govt to blame for the craziness. It’s both private and public sector. Thanks for letting me ramble.

Historically, inflation leads to civil unrest, revolutions, changes in government, destruction of the fabric of society and war.

And yes, even in America. America’s first currency, the Continental, imploded over mass printing and inflation and nearly took down the new republic.

“Historically inflation also falls off the cliff eventually.”

I’ve noticed that the panhandlers in Toronto are inflating their begging. They are asking passersby for C$20.00, which is about an hour’s average wage before taxes.

Toronto Police don’t do anything about them. They are very aggressive, even saw one coax an elderly couple to withdraw a $20 bill from a TD Bank ATM machine in downtown Toronto. These panhandlers are getting greedy for inflated begging.

The beggars know that inflation is best understood as an erosion of purchasing power.

narrative bias

Troll harder.

Without variety of thought here, we have nothing but a proxy cite for humble- less delusional thinking. Free the critical thinkers to think for themselves, politely. Species cease to exist without variety.

Wow, we got a deep thinker here.

Whom else to punish but savers.

It’s only their labor. And no one else has any money, by definition.

Tony,

You can always buy physical gold and employ people in the mining business and have some gold savings in case central bankers crash the plane. Don’t have to spend it all on consumption.

It will be “soft landing”. They said so. Well, they will not miss the ground.

endowment effect

“For every $2 dollars you save is one less dollar in circulation.”

Only if you saving literal currency under the mattress. If you store that money in any asset or account, it is still in circulation.

The majority of Americans are destined to become poorer or a lot poorer over the indefinite future.

Look at FRED data for household median net worth and net worth since late 90’s. It’s gone nowhere for an entire generation even with the most distorted economy and biggest asset mania in history.

What do you think is going to happen when reality reasserts itself?

It’s going to be even worse for the lower classes, as there is no possibility broke governments will be able to prevent falling living standards for the majority of the population.

Coincidentally, soon after the money market fund in my 401K started paying some interest (2%), they eliminated it as an option. However, Fidelity provides “brokerage link” for all plans, and you don’t even need to ask.

“However, Fidelity provides “brokerage link” for all plans, and you don’t even need to ask.”

What is “brokerage link”?

Since no one seems to have addressed your question: off the top of my head, “brokerage link” is Fidelity’s fancy way of saying that you’re not locked into the crappy investment products/funds that a plan sponsor chose to be available to you – and instead give access to the wider universe of products offered through Fidelity.

It’s not clear to me that it’s “[provided] for all plans” as the OP stated, obviously it would only be relevant to accounts that are constrained by the investment choices of a plan sponsor (such as a 401k or whatever), but I’m not sure if it’s “always” allowed in these cases or if the plan sponsor (ie employer) would need to consent for this option to be available…

hope this helps

Yes, that helps. Thank you!

My company’s 401K is with Fidelity and I think I have about 22 choices available. Most of them are down a lot this year. I will need to contact Fidelity and see if I would be able to use a Brokerage Link for my 401K.

Well, it turns out the “BrokerageLink” is not an option for my 401K with Fidelity.

Rats!!!

Okay, here is my last update. After a little more research and a call this morning to Fidelity I think I have an answer to my 401k’s limited investment choices. The guy at fidelity said that once you are over 59 you can move money from your 401k into your personal IRA. From you personal IRA your investment choices are many… including CDs and treasuries.

Smart money’s been in brokered CDs—and baseball cards.

The smart money has been selling NFTs of those baseball card to any Tom, Kunal, and Harry.

The smart money (for a woman) is in being one of Elons’ exes and having photos of the relationship and various things signed real and true with the actual signature of the great one in his foundational younger years. All for sale. What a privilege it would be to own a piece of true greatness.

Lego’s have outperformed the S&P over the last 10-15 years. No joke there are people who make a (very good) living from buying and selling Lego sets.

“Obviously, these people cannot be that dumb; they had a purpose, and the purpose was to hype stocks into the stratosphere, and they did it for days. And it worked.”

I was actually wondering about this very thing for a while now. The data this blog presents is not confusing even to a layman like me. I find it hard to believe anyone managing large funds is sincerely interpreting things differently. Keep up the great work!

Looks like Musk is finally going to pay a ‘Big price’ for being an ashehole on Twtr while being drunk and high! LOL!

Minus 7.2% might make a sound like “Boing!”, but might you have meant Boeing? 😹😹

Thanks!!

Wolf, you should be working on the street with recommending $$ losing investments.

Nah. I’m just fine sitting here, waiting for the total collapse of America and the dollar that you have been predicting in nearly every one of your comments :-]

You should check out Ally bank – my savings account has a 2% yield. Their CDs aren’t as good – 3% is the largest im seeing, but you can get it as an existing customer.

Not sponsored. Just love them.

Where are their branches?

They don’t have branches. It is one of the reasons their yields and loan rates are a bit better than Market. You aren’t needing to float the cost of brick and mortar facilities that I personally never really go to anyways.

They’re a re-branded name from GMAC after GM went bankrupt and was forced to spin them off. GMAC didn’t have “bank branches” and so Ally never got any either. It’s strictly an “online bank” right now. Probably fine for most people, but not so great if you want a safe deposit box or really want to stare at a bank teller through a plexiglass window…

That is good. Alliant has 1.79% on savings account and less on checking. Being a totally online bank saves on huge overhead costs.

Hey Wolf, quick question about series iBonds (personal saving bonds)

If you have the info on them, currently the rate on them is over 9%. Is it worth waiting until October or after October when the new rate gets set because the federal fund rate went up? Would the fixed rate on the bond rise and the variable rate rise as well?

I been meaning to max out on it but that’s a question I haven’t been able to find an answer on

We don’t time I bond purchases. We buy them every January to the max for our entities. Been doing it for years. Some years, they yield very little — less than T-bills. But right now, they’re great.

None of our I bonds have a fixed rate that is worth anything — they’re all near 0%.

In my opinion, I bonds are a basic thing that you do mechanically every year, without thinking. They’re not designed to be used as market timing instruments. They serve a very basic function in your retirement nest egg.

Wolf just wondering what a sovereign debt blow up would do to world economy,these politicians seem to have a way of nothing being there fault

Right now, holders of sovereign debt are being blown up by inflation. It’s like a constant series of haircuts. That’s the case in the US, but it’s a much bigger case in the Eurozone, where inflation is even higher than in the US, but yields are far lower. This is clearing the sovereign-debt slate at investors expense, day after day, month after month.

Thanks once again for the clarity Wolf.

WE, in this case the family WE, have been thinking to go as long as allowed when the I-Bonds reset in the fall…

And thanks for the very clear narrative on the current sitrep…

Wolf said: “None of our I bonds have a fixed rate that is worth anything — they’re all near 0%.”

——————————–

I have no idea what you mean. Clarification please? I bonds are not fixed rate at all, but are variable with the CPI.

I-bonds come with two types of interest payments:

1. a fixed rate that doesn’t change over the life of the bond. In our case, those fixed rates are between 0% and 0.2%, depending on when the bond was issued. When you look at buying an I-bond, it will tell you what the fixed rate of that bond is (years ago, I-bonds came with fixed rates of 3% or 4% even, but back then, we didn’t buy I-bonds, so we never had any of those). You can check the current fixed rate at treasurydirect.gov

2. a variable rate that is tied to CPI, which is currently over 9%, but if CPI inflation goes to 1%, this variable rate will be very low.

I-bonds don’t pay cash interest. Any interest payment is added to the principal, and earns interest going forward, and when you cash the bond, you get the whole pile (which is when your interest income becomes taxable).

The IBonds we purchased in 2019, at the very low peak of the last rate increase cycle by the Fed, have a fixed component of .5%. So that bond is currently paying 10.14% according to treasury direct. It’s better than nothing. I’m hoping the currently large Fed rate increases lead to an even higher fixed rate component in 2023. We’ll know when the rates adjust in November.

@ Wolf –

Thanks. Got it. Due to you, I bought some I bonds a while back. I didn’t realize part of the quoted rate was fixed.

I am old enough & financially secure enough (hope I can keep some of it thru retirement) to be giving a living legacy to 2 of my relatives who inherit in my estate. It’s been fun watching what they do with the legacy.

Apparently there is a little known “gift box” Treasury Direct option to “gift” $10k/yr to anyone you choose with the I-bonds accruing interest upon purchase. If the beneficiary has purchased their own $10k in the year you gift, the I-bonds stay in the “gift box” earning interest until the beneficiary redeems them in a future year they did not purchase their own I-bonds. Of course, someone could also “gift” you.

I’d like to understand this. It might be a better way to give a living legacy & allow my beneficiaries to earn inflation protection rather than what I’m currently doing.

Troy – when you buy an I Bond the rate is good for 6 months. The 9.62% rate set in May means you can buy that rated bond through October and still get the 9.62% for 6 months. Even if you buy in mid-October the govt pays for the whole month of Oct. I would not wait until the end of Oct as processing time might kick you into the announced rate that starts Nov. I’m still learning all this from the web site The Finance Buff.

>>I would not wait until the end of Oct as processing time might kick you into the announced rate that starts Nov

If you don’t have a Treasurydirect account, I would actually start the process NOW to make it by the end of October – if you fail an automated ID verification, the manual process may drag for months. This is what ultimately turned me off from TreasuryDirect – if it’s so hard to put money in, I don’t want to check how hard it will be to get money back if something goes wrong. This whole signature guarantee requirement is a joke – Treasury makes signature guarantee mandatory for YOU, but nobody makes it mandatory for any bank to provide this service, so theoretically if all banks in your area decide tomorrow they don’t want to provide this service to anyone (and from what I’ve heard, anecdotally Wells Fargo did exactly this, at least in some markets), you’ll have some interesting problem to solve.

I set up a treasury direct account on Monday. It took me an entire fifteen minutes to walk my client through sign up, verify, link a bank account and purchase bonds. Not really difficult, no Real ID was needed, unlike the Infernal Revenue Service.

Wolf – Brokered CDs are nice in that you can move them without penalty and retain some future earnings at sale. I tend to avoid stick to the “Non-Callable” as that is something that normal CDs don’t deal with typically.

I recently compared the higher rates from 2018/2019 brokered CDs and the curve if really flat for 2022 CDs versus 2018/2019, and the rate increases for adding duration are very limited right now. I have a couple of theories but maybe banks are just as confused as everyone else…HA

That said in the last two weeks, two of the “Big 6” banks just moved my savings rate to 1.9%, as if they wisely understood that inflation was not going to magically go to 4% by EOY 2023…

In 2019ish my GS Marcus account was paying 2.5% and that was when there was very little inflation. Now only 1.9%? We still have a long way to go.

Biden will release the US services reserve and fix this, don’t worry.

That’s funny.

These whipsaw moves were predicted by Wolf himself on his podcast, two months or so back: that the markets would think we’re out of the woods, then yet another godawful inflation number and a plunging market, followed by an inadequate Fed response, then some quiet as investors go back out into the water again—then a violent repeat. And this for several years to come, because the same Fed who got us into this mess over years of lousy policy cannot be counted on to get very much right or very fast. I’ve paraphrased.

Still in the early innings, but WR has a no-hitter going.

It seems to me that holders of risk assets are assuming the Fed or Treasury will save them if we have a fat tail event. They are probably right if the event is bad enough. Putin has some ugly cards he can play.

THE Wolf for FRB president/.CEO/whatever…

And about damn time WE had someone there who might possibly actually know at least something about what IS happening and IS very very or at least very likely to happen sooner AND later…

At some point, the market pundits will stop with the Fed pivot message. Then they will decide a hawkish Fed is good news for markets. It shows promise for a stronger market in the future. Will stocks rise on that message or will the rising interest rates always be a dead weight dropping stock valuations?

I wonder how much longer yoi can stick to your “The Fud is tightening” narrative.

Must be getting pretty awkward.

Did you just accidentally microwave your brain this morning?

Don’t answer it, Franz Beckenbauer. That was a rhetorical question.

This thread has so much more mileage when I realized you had to let this comment through moderation, so you can then comment, and then comment on a comment to make it happen. Bravo! Although now I want to hear the reply.

What a R/R union strike on Fri might do to BRK & the CPI.

Thomas Hoeneg just said on Fox business that we are heading for a serious recession as a result of this continued Fed tightening in the middle of a slowdown. I have one correction. I would change the word recession to depression. ENJOY!@

A depression is the unstated goal of the Fed in order to ‘tamp down inflation.’ This is the same entity that printed gazzillions of dollars out of thin air, held rates at or near zero for years, and expected there would never be any inflation over 2% in anyones lifetime. Does anyone expect the Fed to get anything right in terms of raising interest rates ? Worse, they really have not done much at all yet in terms of QT. Let’s see what happens when they start sucking those dollars back out of the system. The stock market has a long long way to go before it reaches rock bottom. It’s not evident anyone staying in stocks is willing to consider another 50 % or more down.

I am a mom and I shop groceries multiple times a week. Live in the SE US. Canola oil was 2.63 in 2020 at Publix supermarkets. That same oil is 7.49 today, a 185% increase. Publix has dates when prices change on their stickers (if you look closely small print). Last time the price of that canoila oil went from 6.29 to 7.49 was 8/31. I don’t know much, but one thing I know is that inflation has NOT peaked. Have you seen the price of eggs lately? I am ready to pull my pitchforks, are you?

Lays potato chip products and Fritos are the laugh for me. Are people actually paying those ultra-inflated prices for this junk? Of course in most states, food stamps still pay for these items along with soft drinks.

The funny thing about stamps are, if you *do* buy healthy food with them, you tick off just as many people around you as the junk food buyers. The healthy food purchasers just have far, far, far less items on the belt, for reason$ quite obvious. Your best bet is to say a lil prayer to your chosen diety and hope you never end up needing to pay with stamps, and should you anyway, be glad you/your family has food access regardless of the expressions on the faces of the people in line behind you.

Completely given up on my local grocery store. $1.49 tiny tin of tomato paste that was $0.59 last year. Its only Aldi’s, TJs or Wallyworld now. Still stings, but not nearly as bad as things did in the Stamp days. Eternally grateful those days are long in the rearview while my heart breaks for anyone depending on them now with these prices.

1) July 7/8 2021 backbone gave support to SPX. SPX moved higher to Jan 4 2022, before the first slump.

2) Jan 12 high is a test.

3) Mar 29 high, a good opportunity to dump stocks.

4) Aug 16 high, possibly the last opportunity.

5) The mark down might end when SPX enter Jan/Feb 2018 trading range.

6) SPX weekly log : Jan 2018 to Feb 2020 highs / a parallel from Feb 2018 low.

7) We don’t know what will happen next in the blue zone casino…

8) For fun and entertainment only.

I don’t keep much money in the bank. They have broken my trust after 50 years with them. My canadian bank, which is a major bank that starts with an “S” is forbidding me to buy bitcoin entirely, has removed my etransfer services due to donating to truckers, and just now informed me “they care” about my security so certain purchases will be declined until I verify with my phone, which I’m sure will need upgrading to something they want me to buy… This is all going somewhere and I do not want to be where it’s going.

Sure glad I opened a new account at a credit union and possess alternative currency such as cash and metals, and firewood…

1. for any purposes only.

2. went on a vacation and now the entire comment section is different.

3. This is a dip but I am waiting for a dip-dip-dip-dip. Then i will buy some good stoc or ETF

4. The inflation in rent is going to an uncontrollable levels especially in the cities.

5. Rent control might solve some problem. not for a long.

6. As far as food, even charities are stretched thin.

7. I hope everything will be good after a while.

1) SPX weekly : From Mar 2020 low SPX took off like a rocket.

2) June 8 2020 high is a trigger.

3) There was no close < the trigger low.

4) We might get one and a lower low, a new trigger below. That will start the markup.

5) It's an option, out of many, for fun and entertainment only.

Nothing goes to heck in a straight line. The Fed knows how to cure inflation, but it will require money to be scarce again.

Real cost of funds has been dead since 2008, but now it’s here again in a very small way.

The real question is what happens when house prices adjust to meet the median wage with a real interest rate.

As Cathy Ark, well, ask how well tech can wreck again.

Oceans of borrowing are beginning to evaporate, and those higher CD rates are a very bad sign.

I prefer to buy treasury bills and notes in place of CDs. Similar interest as brokered CDs, just as safe. No CA tax on the interest.

A question for everyone, including Wolf

Is it the “wrong time” to “lock in ”

the yield of a 1 or 2 Year Treasury Bill/Note right now ?

Yields are nearing 4 %, highest since 2007..

The majority “crowd” assumption is yields are going much higher

in 2022-2023.

What gives me pause, is RSI is bearishly still diverging from price,

as yields continue to rise on 13 week Bill and 20/30 Year TNX.

If the stock market has any kind of serious meltdown

wouldn’t high yields come crashing down as well,

on the “flight to safety” by big money away from the stock market.

Any feedback here is appreciated. Thank you.

The calculus is something like this: 4% now for a year, and then roll over next September at 4.5% v. 0% for four months and then 5% for a year… Either way, you’re betting on an uncertain outcome. The idea is to start buying in small-ish quantities, different maturities, over time, and rotate through.

We’ve been building CD ladders for clients using brokered CDs for a long time. Paused in 2020 when they stopped paying any yield, but back on the horse again early this year as they climbed out of the hole. It’s been interesting to watch the online banks beginning to see the handwriting on the wall, while the local brick and mortars keep sleeping out back. We too are waiting for the big collapse, and to pick through the rubble for anything with a pulse. Maybe we’ll launch an ETF with futures on spam, bullets, and water.

@ Brendan –

Why are favoring CD ladders and not Treasury ladders?

403b holders generally lose to 401k holders. However, CREF annuity is paying 4.75% with a guarantee of 3.0% and you can withdraw at any time with no penalty!

A Retired Professor

If it’s this bad now imagine what it will be like after the election and the administration stops the SPR releases.

the september futures expire on friday, the december futures were heavily traded yesterday, rally into thurs

Great comments and many good ideas on how to deploy funds to make a few points.

Only disappointed by lack of wood shed jokes 🤪💸

Yield curve inversion. Danger, Will Robinson!

6 month – 3.75%

1 year – 3.92%

2 Year – 3.75%

10 Year – 3.42%

When will the 10 and 30 year recover?

This just means QT is too slow compared to rate hikes. Speeding up QT will quickly uninvert the yield curve

Okay, let’s starting voting on what the Fed Funds rate will be on 12/31/22. I think, my bunions are telling me so, that we get 1.00% up at the upcoming September meeting and then 0.75% times two to finish up the year. We are then in the 5% zone at that point to start 2023 as some very astute commentators on this super-site have prognosticated when the Fed starting pulling the Volcker act-alike skit on Wall Street.

But me don’t look for any pivot for several years, because the gradual effects of QT have just begun, and inflation is now forcing railroad employees, as a start, to start demanding, not asking, for higher wages and benefits. Labor cost inflation is the stickiest form there is.

Wait for other transportation unions to start making signs for the picket line. Crummy timing for the rest of us peons, but train personnel got to eat and heat their homes too! Still say we are already in recession, just ask small business owners who by a 57% majority surveyed say already there, and another 14% say it will be a fact by the time Santa squeezes down the EPA approved chimney. Mrs. Claus, due to soaring food costs, put him on a crash diet months ago, but you know Santa!

We can automate trains 100%. Time to do so.

Just fire all the rail roaders and replace with automation. Easy.

That’s probably why they caved in to the strikers. It’s just short term pain, long term those jobs will die.

Amtrak opened a new segment near Tacoma a few years ago. On the very first run the geniuses went 70 around a corner designed for half that and crashed. They didn’t run again until now while they waited to install positive train control (automation). Why do we let the dumbest people drive the largest equipment? Automate it all, trains, planes, trucks, automobiles.

I wonder how much longer before the White House blames what’s gonna happen in the November elections on Powell (they’ve already begun that in a small way). It’s very atypical for rates to do this before an election, which even further drives the point home of how bad inflation must really be.

1) TA for fun. Skip. SPX weekly, Sept 6 low is a trigger. June 13 low is the previous lower trigger. In order to dive, in stepping stones, there must be a close Aug 15 high and a higher high, a higher trigger.

6) If done, there must be a close and a trigger > the new trigger….until u reach Mar 28 high.

7) Got it ?

Yes sir !

Long Wolf Street, short Credit Suisse

I’m still in the camp that the Fed tightening is going to tamp down on inflation pretty quickly. Goods inflation has generally turned the corner and is flatlining. Many commodities (not all) have fallen back down. The very strong dollar helps us to import less inflation with our large trade imbalance. China’s weak economy also will help keep inflation down.

So all the inflation is in services. Rent or owner’s equivalent of rent is a lagging factor. Actual asking rents are falling. So we will see rent inflation remain high even though asking rents will fall more for a few months. And actually, the increase in home prices, combined with spiking interest rates means much higher mortgage payments, so some people who would have bought will now rent. But this is a short term impact and will reverse once home prices begin to really fall, it will wipe away alot of wealth and cause an inverse wealth effect. That is not inflationary.

Food prices have been hit with a number of factors. Part of the increase in food prices is related to a bad avaian flu season and increases in transportation and fertilizer, etc. Part of it was profit taking by the big packaged goods and food retailers. I think that people close to a Costco will be flocking there to save some money, since Costco is going to be really pushing hard to get prices back down.

Add to this the increase in auto prices, which again is temporary.

Healthcare is an area I have not seen analyzed. 24% increase is massive. Is this due to COVID? But healthcare has been out of control for so long, this is not new.

I just really think that driving interest rates higher will quickly turn the housing market very sour and alot of spending is tied to that. So I dont deny the short term of inflation hanging around, but I think that 4 months of tightening will punch the economy and inflation in the mouth and we will start to see it turn rapidly south.

Honestly, we could use a year of deflation.

Maybe I am an inflation denier now. It all goes through cycles and right when everyone is freaking out, it is usually the peak of something.

One last thing. This is an election year and the Fed is trying to kill inflation before the election, so I expect they go at this real aggressively for the next 2 months, even if that means pain in equity markets.

Probably a good call gametv. I’m in the same camp these days. In my own life I’m noticing that product inflation is pretty much past its peak. Car lots are packed with used stock and used car prices are definitely cooling down. House price growth has been stopped in its tracks. Even at the grocery store, where price tags were changing regularly for a while, I’ve noticed a slow-down in price growth this month where my usual items seem to be stabilizing a bit. All of these things are lagging factors in CPI readings. Even services are going to be running into consumer weakness in time. Credit card debt was paid down a lot, but it’s growing with alarming speed and nobody is pulling cash out of their house anymore, so it’s clear that the American consumer’s strength has peaked.

Oil & gas prices are big wild-cards, but if those prices remain reasonably stable or continue to drop, I don’t see inflation holding as strong as it has, though I also don’t see inflation fully abating until those 11M+ job openings start to close up. The Fed will pause hikes going into 2023 to let monetary policy sink in as they have hinted numerous times. I don’t personally think that our debt-driven economy and job market can survive even a 4% FFR for long since our whole system is now too deeply reliant on dirt-cheap debt. If by this time next year, house prices have dropped and job openings have turned into unemployment claims, inflation will have cooled and the Fed will be loosening back up.

Increases petrol prices were the most egregious manifestation of inflation to Joe Sixpack. Midterms soon, so there was a great deal of arm twisting to lower them.

Don’t worry, Big Oil will be amply rewarded later for their minor sacrifice at this time.

Every one thinks that inflation related to oil/gas is under control. I think NOT. Just wait for December and the bid for them at marginal global prices.

Even ESG economy needs fossil fuel to produce, maintain and replace the solar panels, wind turbines, batteries of all kind. Have people already forgotten last winter in Texas? One needs natural gas to produce fertilizers and pesticides.

You guys seen nothing yet with inflation. They will use their social government spending, borrowing, tax policies and all other control freak policies plus global organizations, NGO’s to make sure you pay more out your pocket, bank account for many years. Just accept doubling of prices of everything within the next 5 to 6 years.

It’s been a curious thing to watch how the high yields have shifted.

Banks have always been terrible for cash, for a long time I’ve been parking my cash reserves in FDIC insured High Yield Savings Accounts. But this year I noticed that Treasury Bills have been increasing their yield faster than the savings accounts. 8 week bills last week have been returning 2.7% (as opposed to 1.7% at Capital One), and on top of that its free from state tax, which is a big deal since I live in California. So I’ve been buying and rolling over 4 or 8 week t-bills via my Vanguard brokerage account. It’s not quite as safe as an FDIC insured account, but I figured if the Treasury defaults then there will be much bigger problems.

I’m assuming you’re all over this, but if not – don’t forget your I-bonds. Sure, they’re limited to $10,000 per individual or entity per year, but if you have a spouse and a couple of kids, and a family trust, that’s $50,000 per year you can sock away into a risk-free investment whose yield is indexed to inflation. You’ll still have to pay Fed taxes on the returns, but depending on your state, you may be exempt from state taxes. I-bonds are currently returning 9.62%.

It’s just as safe, if not safer than an FDIC account I have been told.

so much for the soft landing.

We’ve had an unparalleled and immeasurable surge in the money stock. I.e., Powell eliminated deposit classifications. Powell matriculated at the wrong universities.

I don’t think the Fed nor the Gov’t would give a flying f$&k what inflation does to piss ants like me, vote or nor vote, they don’t care. The Empire cares only about selling its debt so the grift can continue to the political class and it’s benefactors such as the Security State and the MIC. However,there may be a disturbance in the force. There may be a looming bidding war for buyers to sell their non-productive debt to by Western Gov’t before the winter is over with. The collective wests central banks colluded lock step going to zero and below and putting a good old collective f$&king to savers on several continents. However, it may be “every man for himself” going the other way toward “wait for it” positive real yields. Another jeopardy in the bidding war for the central banks may be their own sinking fiat currencies that may be further exposed by other external events outside their control. Producing is hard,consuming is easy. Hard lesson to learn and may be even harder to re-learn. So, this Christmas while your nuts are getting roasted by the fire you can tip a glass of cheer and warmly reflect on this. Yes Virginia,there is a thing called positive rates.

Well done article of the current survey of the fixed income market. Nominally positive interest rates are like water in the desert to those that can’t afford to lose it.

One can’t help but wonder:

What is the equilibrium interest rate.

By equilibrium, I am referring to the interest rate at which demand equals supply. Prices become stable which, at this point is what a massive cadre of people are hoping for. Forget the 25 pct loss in value of their savings.

The faux decline in the market yesterday had the feel of a choreographed passion play. As if the speculative market was exhausted.

To me, it’s a matter of duration between stocks and bonds. The net present value of a share of stock, discounted at the cost of capital, has increased toward 100 years from the previous 20 to 30 years during the QE free cash period.

Welly, after that flabberghast,I feel compelled to finish my mystical assertions with at least saying what is my personal expectation of the equilibrium interest rate.

At this point, I agree with John Taylor, at least, 9 pct.

I realize my point of view is at odds with the most highly paid mavens in the city of dreams.

Sometimes hopium fails and a more conservative environment is forced upon us.

In opposition to the syrup being distributed by the mavens from the city of dreams, I challenge them to remember the city in 1980, murder capital of the world.

As the Fed fiddles, Rome burns.

A scene of JP being forced by his nerd companions to confront the playground bully, Jamie Dimon, dances through my mind as I sleep.

As JP enters with his knee pads on, he was given the okay for a 75 basis point increase in the FFR in time to compose himself before lying to the patriots.

Which is notable because the stock market bulls are viewed as progressive, like the buffalo jump that I am familiar with. The bulls led them over a cliff for a while and the human beings harvested the hunt for their needs.

I hope is the first words of a love song.

Just to set the record straight SPY was lower than 390 week before CPI announcement, from there it surged starting Sept 8, 2022 thursday at 3:48 PM. It was all sea of “Green” before it took a plunge on Sept 13, 2022 tuesday, while still remaining above 395.

Just for clarification each dollar SPY is worth 100 billion in market cap so the plunge is not a real plunge, its just splash for effect, it’s still sea of green for most bubble stock like apple.

In the mean time Apple behaved liked biggest pump and dump of all stocks where on Monday Sept 12, 2022 it rose by 99 billion only to fall on Tuesday Sept 13, 2022 by 154 billion, while still remaining above what it was before CPI announcement so it’s not a sea of “red”.

And tesla remain highly elevated.

“… it’s still sea of green for most bubble stock like apple.”

You people are so funny. Even Apple is down 17% from its January high and down 13% from mid-August, when the bear market rally ended. Sea of red for sure.

Down 17% after up like 100%

I dunno man. Starting to feel like more of a correction than a real bear market.

Green over June lows. So is this just more bear nonsense?

DarthTrader,

Lots of “consensual hallucination” going on here, it seems.

This is shaping up to be a perfect example of a bear market rally that suckered lots of people back in and then blew up. The bear market rally ended on Aug 16, with the S&P at 4,305 at the close, and today the S&P is at 3,901 down 9.3% from the bear market rally peak, and down 19% from the high on Jan 3.

Oh, and the Nasdaq is down 29% from the peak in Nov.

And while at it, the Wilshire 5000 total Market is down 20%

When apple falls below 160 billion market cap (per share price less than 10 dollars) I will consider it red, haha :)