Amid constraints, shortages, and spiking diesel prices, freight volume slows, capacity opens up, freight rates may have peaked.

By Wolf Richter for WOLF STREET.

The crazy stimulus-fueled binge on goods in the US has been fading, as consumers are switching back to spending more money on discretionary services, where spending had collapsed during the pandemic, ranging from air fares to healthcare services. And there are still shortages of all kinds, preventing consumers and businesses from buying what they want, delaying construction projects, and forcing production cutbacks at manufacturing plants.

Ocean shipping is still in chaos, with container ships and containers hung up in various parts of the world. Finding containers to ship merchandise from the West Coast to Asia can be a nightmare. Portions of China, particularly Shanghai, that are critical for supplying the US with goods and components have been locked down, and shipments from there to the US have been seriously impacted. And pricing chaos reigns everywhere.

There are capacity constraints at US trucking companies and railroads. Inefficiencies due to the chaos have slowed everything down further.

Top this off with spiking prices for diesel, which this week hit a new record, and it creates a complex and very murky situation for transportation in the US.

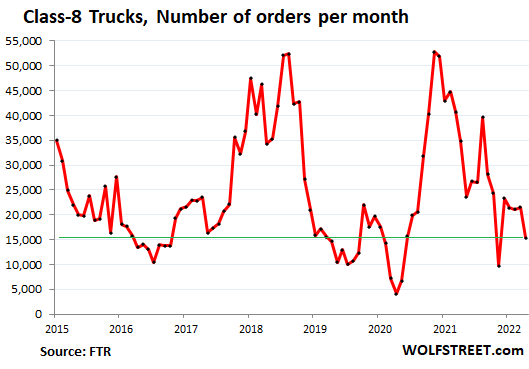

Class 8 truck orders.

Heavy truck makers are sitting on large backlogs of orders for Class 8 trucks, and order books for 2022 are largely full, but they haven’t opened their order books for 2023, according to FTR Transportation Intelligence.

Truck makers are “carefully monitoring their backlogs and continuing to evaluate monthly how far into the future they are willing to push them,” FTR said in its note.

“As production continues to be significantly impacted by supply chain disruptions, component shortages, labor shortages, and increased material costs, the hesitancy to open 2023 order boards stems from not being able to guarantee pricing given the current environment,” FTR said.

“Once supply chain issues improve, OEMs will be able to substantially increase orders. But until then, conditions remain stagnant,” FTR said.

Orders for Class 8 trucks in April, at 15,400 orders, were down 56% year-over-year, according to data from FTR. The drop in orders reflects “a market that is trying to minimize its exposure to the headwinds it could potentially face in 2023,” FTR said.

Increasing uncertainties about demand.

The situation that heavy truck makers face is symptomatic for what is going on in this economy. There is still a lot of demand and limited capacity to fill that demand as these manufacturers are having trouble getting their parts and components, and they’re hampered by labor shortages. And chaos on the cost-side makes it risky to lock in prices for orders that cannot be produced for a while.

And these constraints are showing up in shipment volume, which has dropped from prior years, as we’ll see in a moment.

In addition, there is increasing uncertainty about demand in the future. Demand from consumers for goods has started to come off the stimulus-fueled spike, though it still remains above trend. Demand from industrial customers for transportation services is constrained by the supply chain chaos and the resulting limits on production.

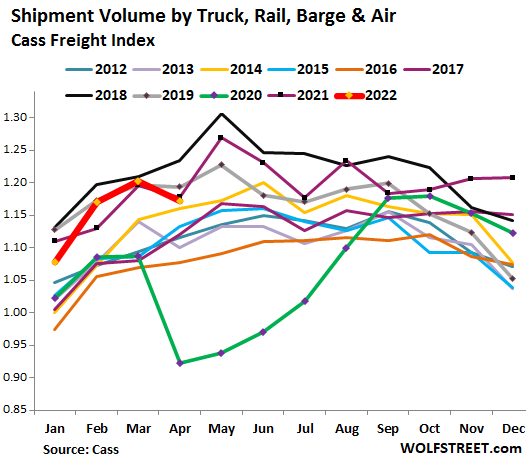

Shipment volume fell.

Shipment volume in the US by all modes of transportation fell by 0.5% in April from April 2021, by 1.8% from April 2019, and by 5.0% from April 2018, according to the Cass Freight Index today.

The index covers all modes of transportation but is concentrated on trucking, with truckload shipments representing over half of the billings, rail in second place, less-than-truckload shipments in third place, followed by parcel services and others. It does not track shipments of bulk commodities.

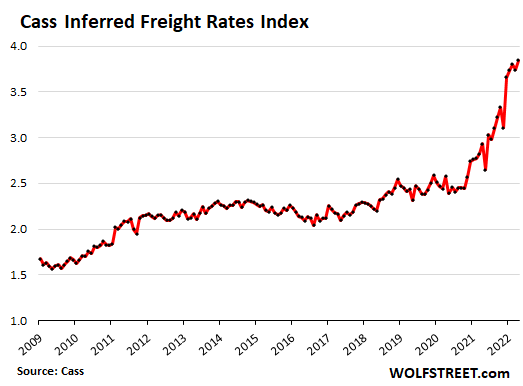

Freight rates spike.

The combination of high demand, capacity constraints at transportation companies, and spiking fuel prices shows up in the ballooning amounts that shippers in aggregate are paying to send goods to their customers.

The Cass Freight Index for Inferred Freight Rates, which includes fuel surcharges and shows the overall movement in the costs of shipping, started spiking a year ago, and in April was up by 31% year-over-year. Compared to April 2019, it was up 58%.

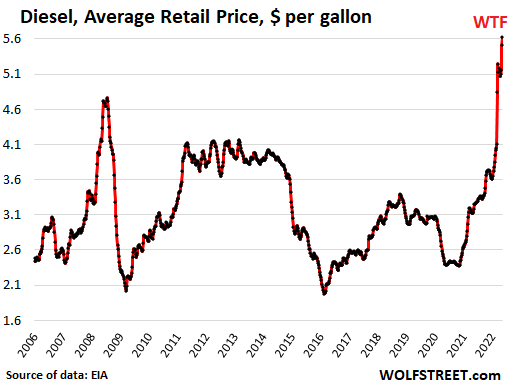

Diesel prices spike.

The average price at the pump of No. 2 highway diesel in the US spiked to a record $5.62 a gallon on Monday, according to the EIA. Year-over-year, the price of diesel has spiked by 76%!

Expectations of a downshift in the freight cycle.

In February, the DAT’s Load-to-Truck ratio, which represents the number of loads posted for every truck on the DAT Load Boards, began declining, after the dizzying heights last year and the high in January of 9.3 loads for every truck. In March, the ratio was down to 4.6, and in April it fell to 3.4 loads per truck posted on the load boards.

Similarly, the Supply-Demand Balance in ACT Research’s for-hire survey got less tight earlier this year. In April, for the first time since June 2020, capacity to ship freight exceeded demand for shipping freight.

Similarly, average US spot rates for hauling van trailers, after rising to $3.10 per mile in January 2022, have declined, and in April dropped to $2.79 per mile, according to DAT.

Getting the transportation chaos sorted out, and having plenty of capacity to ship goods in the US, and perhaps even at flat or lower freight rates, would be a good thing for shippers, such as manufactures and retailers and their customers.

But given how cyclical the transportation business is, where capacity tends to materialize finally, just when demand is starting to slow, the trends of the past few months are “a sign for fleets to batten the hatches,” the report by Cass said. And these dynamics “strongly suggest” that freight rates might be coming off their dizzying spike.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Passed onto me….

“This is how bad & ridiculous things are getting in the shipping industry now that there are less loads being shipped & more trucks available.

A month ago that ratio was 100 loads for 20 trucks.

Today, the average is reversed.

And the rate on the loads that are available have dropped 20 to 30%

Even though diesel fuel prices continue to rise.

Every week, 1 of my trucks picks up a load of bagged sugar in North Dakota that delivers to Ft Worth, TX.

The rate we’re getting is $4500, which is ok on 1150 miles.

After picking up that load an hour ago, the shipper just called me asking if I could lower my rate for next weeks load?

Shipper said he had another carrier give him a rate of $3675

So an $825 drop in 1 week.

At this pace you’re going to have more drivers quit & trucking companies go under.”

Happy Motoring.

sam,

Thanks for the “wheels on the road” report.

I’m guessing the loads are coming from the refinery just north of Hillsboro.

If so, I wonder how the land is up there. My family seed business had great relations with Nettum Seeds just east & Nelson Farms just north. Good people up there. I hope Mother Nature lets them get going soon.

Perhaps the source of your bagged sugar would be best kept confidential?

Regardless, all the best to you and your drivers sam.

Trucking has always been one of the most cutthroat industries there is, one of the problems being that many will backhaul at a slight loss just to not bob-tail at a major loss.

Think about it: If you send a driver from LA to NY with a load, then the return load that was set up got canceled or for whatever reason there’s no load ready, suddenly you have a truck across the country with a driver with nothing to haul.

In good times, you should be able to find a paying load, but once things get thin you get desperate and start cutting your price just to get your truck and driver back, even if it means hauling at a slight loss vs a huge loss if you had to drive it back empty the whole way. This starts destroying pricing for everybody, at least that’s what’s been explained to me.

you certainly mean, ”dead head” DC!

”bob tail” is the name of a truck type

otherwise, agree with you as usual

some of us driving ”Yellow Cabs” in the city of the angels back in the 1960s would try our best NOT to ”dead head” even if it meant picking up a fare in ”south central” that might be a bad one with a gun to rob us…

others, likely the old timers which I was NOT,,, would absolutely ”dead head” back to downtown or ”HOLY” wood where the big money was, and to hell with working people everywhere but especially in south central…

gotta think it is at least one reason the uberites have made a big intrusion into ”cabs” everywhere???

I always thought bobtail was no trailer attached, and deadhead was an empty trailer.

Note that among the many, many other benefits of not burning fossil fuels, electricity prices are far more stable. If we had an electrified goods transportation system by now (trucks and trains), the contagion of fossil fuel price volatility would not be affecting the rest of the economy.

Because electricity comes from outlets.

“Because electricity comes from outlets” (oversimplification is dangerous) Thank you.

I would like to see an explanation for why diesel is more expensive than gasoline, which is taken off further down the column, apart from so Mr. Koch can make more money

Diesel is more expensive right now because a lot of the diesel is being sent to Europe to support the Ukrainians in their war efforts. Fighting and transporting the weapons on this scale uses enormous amount of diesel.

Tom,

Diesel has a higher energy density than gasoline. In other words, there is more energy in a gallon of diesel (and similar fuels such as jet fuel, kerosene, etc.) than there is in a gallon of gasoline. So it should be more expensive per gallon, just on that basis.

But it’s also less work to refine, no?

A hat tip to you, 2banana

An electric 18 wheeler? Really?

Really?

We can get 18 tesla to haul the wheeler hauling the goods

Didn’t Musk say he has one (EV Semi) on the drawing board about four or five years ago? I read that the battery alone would weigh 8,000 to 10,000 pounds. That would surely take away from max payload capacity and charging time would be lengthy.

I think that was just to disrupt the headlines and distract how bad their shipments were that quarter.

Only on down hill routes.

Volvo electric trucks. Built in Va. They exist.

Any search engine can show you that.

HYZON and NIKOLA two electric trucks now being deployed in the USA

I have an even more hip idea.

Forget Gas

Forget Gasoline

Forget Diesel

Forget Electricity

Forget Nuclear

Let us go Keto All Natural: Horses.

Here is my idea. We build, out of re-cycled wood, a thing we can call a “wagon”. Hitch this to all-natural, grass fed, organic, free-range horses.

There. No more fossil fuels !!!!!

Yes but what about the greenhouse gases from all the horse gas “releases”???

MC Do you have an estimate of the amount of horse waste NYC removed in the late 1800s? This would help on the fertilizer shortage. Another question is could we resurrect a twenty mule team driver to handle the big loads?

In your days, they called it a chariot? 😅

Clydesdale Horse has An Incredible Pulling Power

A single Clydesdale can pull up to 8,000 pounds of weight for a short duration. They can even pull a cart weighing 200-400 pounds for up to 8 hours a day.

try telling that to the ”OLD Amish” folks whose horses will take them in a wagon or ”buggy” more than 50 miles in a day TRT,,, with some ”breaks” in that day during which some of their horses get water and sometimes oats in a bag.

There is a really true ”meme” that the only animal on earth that works harder and longer than an Amish horse is an Amish wife!!!

from what I read, it was NOT unusual for ”olde” ”frontier” horses to be able to travel 50 miles a day,,, but that was when a ”first nations” youngster would also be able to ”run down” a horse, etc., etc.

suggesting for our species that we have become only ”dead weight” on Gaia???

VVN…..”Amish wife”! I wish I knew about that 40+ years ago!

Electricity:

Manufacturing? NG at all time high and need generation capacity all over usa

Delivery? New distribution and upgraded distribution

EV battery capacity non existent

More trucks needed and drivers because of recharge time

More NG pipelines to deliver NG across the usa

I’m sure there is lots more but the cost would be much higher than the diesel today.

I suspect the high cost of diesel is due to lack of Russian oil for refining in EU and so some is shipped from usa.

Major (largest) east coast refiner burned down in 2019 and was never replaced so less USA refineries (higher margins)

On June 21, 2019, part of the Philadelphia Energy Solutions refinery, the largest oil refinery on the East Coast of the United States, blew up.

Never repaired or reopened!

Who would with the push to eliminate fossil fuels

We all know that one very special person that complains about all the congestion out there because of all those “damn trucks”.

But, if you’ve got it, it came on a truck.

I think the best measure of the economy, in general, is the intensity of these ingrates.

We just made the trip from Houston to Chicago visiting family. A trip I’ve made several times. To be honest, I can’t remember seeing as many trucks as I saw on this trip. The highway was jam packed with them.

Pro investment tip. Pick up some land along the Erie Canal, (now I think it is called the New York State Barge Canal).

Insightful article and comments. Thank you!

Meanwhile FMCSA is talking about mandating all trucks be governed at the same speed as a federal max speed limit on CMVs in conjunction with the ATA (Anti-Trucker Association).

That’ll be good for business, save fuel and ensure that there are miles of trucks all stuck drag racing trying to pass each other in increments of .1mph speed differences and thus causing more cars to drive less. The road rage will get a few people killed, thus lowering economic demand and carbon foot print. Additionally, truck drivers will be further driven from the industry which will help ease the coming recession in freight.

Actual truck speeds in the U.S. are absurdly high and I see truly dangerous driving by “professional drivers”. Sorry, there is no excuse to drive like that given how much these things weigh. Somehow the trucks can do 80 kmh (50 mph) in Europe and the world has not ended. They even, gasp, stay in the right lane!

Cry more fella.

I work in Montana and Wyoming. The routes I’m on require me to push 65 all day for 10+ hours of drive time a day. I often have to run 75 maxed out due to the inflexibility of the hours of service laws, company policy, and the fact that I run a day cab with no sleeper. And I’m not even in a demanding field like ltl, milk, or food service. I’ve hit snow squalls that slow me down for an hour and then I have to run as hard as possible to make the route work.

They should target the big companies that run shit like this. But of course the US government has corporate interests at heart. Not the drivers. But they’ll cut us all down to a universal speed where you’re stuck behind some brainless greenhorn Swift driver you can’t get away from and have to run whatever speed they say when speed limits are 80-85 for cars and people are running 100mph around you. Then the companies will expect the same performance out of drivers when they can’t deliver due to more and more regulations.

I can run 75 safely in a state almost the size of Germany with only 500k people and nothing but sagebrush and pronghorn around.

I’ve driven California where all CMVs are regulated to 55mph. It’s dangerous because cars run 90 and trying to merge or get around on the highways is impossible. I’ve also driven for companies that are governed to 58mph and it’s a stressful and miserable experience. There was a time when companies governed down to 55 and got sued for causing so many accidents the feds stepped in and forced them to raise the limit. Think it was JB hunt.

Got to give you some respect.

If you were lazy like the TikTok generation, we wouldn’t have food at the shelves at grocery stores.

It’s not easy having to reach a destination at a certain time, when this would be considered downtime in the paper pushing jobs, getting paid to do nothing.

About 50 years ago I worked as an over the road truck driver.

I used to work for Bob Crawford, a retired truck fleet owner in Omaha NE. He kept one truck after he retired and I drove it for him. It was one of the best looking trucks on the road and had a Cat engine with so much power, it was almost like driving a car.

Occasionally Bob would take a trip with me from Omaha to the west coast. On one of those trips, we were going through Wyoming on a 100 mile stretch of I-80 called “Elk Mountain”, which was well above 7,000 feet. The weather was clear, the road had been recently re-paved, and the big Cat engine was really cranking hard.

That engine would get really quiet when it was running at max load. About the only thing you could hear was the muffled whine of the turbo through the twin chrome stacks. We had been cruising along like this for a while when Bob turned to me and said, “Dave, why are we going so slow?” I said, “Bob, look at the speedometer.”

The speedometer needle on that 60′ long, 13′ 6″ high, 80,000 lb truck was sitting right on 80mph.

As Greg say, EU regulation is max governed speed at 88km/h on heavy vehicles. Heavy vehicle is then 3500kg or 7500kg, depending on vehicle class. Signs that heavy vehicles are only allowed in the right lane where more than one lane is not uncommon either.

Possibly inflation is beginning to break. Copper prices are off sharply over the past few weeks too. These trends would need to continue to confirm, but could mark the beginning of relief.

The Fed may not have done very much so far; the bond market has been doing the heavy lifting…

It would be nice but I can’t really find any examples of inflation breaking this early in an inflation cycle. Inflation has always had a time lag effect and you only learn about the time lag effect after that time has actually run, (as you look backwards….) This years big time lag may be caused by the price of fertilisers, who knows what the price of food will be by October…..

With oil and natural gas, the traditional time taken to increase world production is seven years and then only after you start the investment looking for new product…. I don’t see many new investments at the moment…so you may get more oil and natural gas somewhere around 2030 if we start today……..until then, we may run into shortages even with a recession….

It would be good if there was an investment chart showing new investments in oil today and over the last twenty years. Maybe Mr Wolf has one ???

I have seen interviews with Rosenberg that echo what Wolf mentioned in this article. I am not a big fan but he has made some pretty accurate calls, especially on how the Fed excess would lead to a bear market and a recession this year. He is calling for a range between 3,100 to 3,600 just to bring down S&P to a sane level, and then possibly further down from there.

‘We’re nowhere close to the bottom yet:’ An economist who called the latest stock market selloff back in March shares why the S&P 500 could fall another 20% — and how long a rebound may take

As the stock market selloff continues to intensify, investors may be starting to ask themselves: How much worse can it get?

If they posed that question to David Rosenberg — the top economist and strategist at Rosenberg Research, a firm he founded in January 2020 — they might not like what they hear.

“Our numbers would suggest that we probably will bottom somewhere around the 3,600 level,” Rosenberg told Insider in a recent interview — referring to the S&P 500 index, which ended last year at 4,766 and has since fallen to about 4,000. “And, of course, that’s a moving target. We have other indicators suggesting that we could go as low as 3,100.”

Rosenberg continued: “Pick your poison: You’re either talking about another 20% to 25% down from here.”

Wall Street’s biggest banks, which entered the year overwhelmingly bullish on stocks, have been slow to warm to Rosenberg’s bearish thesis. That hasn’t gone unnoticed by the economy chief — who also spent three decades on the Street — as evidenced by a tweet he sent on Monday.

“3,600 really, when you think about it, just unwinds the dramatic excess that was caused by Fed policy from the end of 2018 to the end of 2021 when the stock market doubled,” Rosenberg said. “And the stock market doubled — not with corporate earnings doing the heavy lifting.”

The economist added: “This is just about classic mean reversion. If we mean-revert those numbers — the multiple contribution and earnings — you end up with 3,600. That is just pure math.”

If not for what Rosenberg called “nonsense” from the US central bank, the economy chief said that he believes the S&P 500 would have peaked at that 3,600 level in 2020 or 2021. Instead, Fed chair Jerome Powell and company went overboard in responding to the pandemic, Rosenberg said. The Fed’s decision to cut interest rates from an already-low 1.5% to near-zero in March 2020 was widely praised, but the subsequent calls to keep rates low and continue to buy trillions of dollars in bonds as the economy rebounded will prove to be a fatal mistake, in Rosenberg’s view.

Now, Rosenberg believes that a recession is imminent as that monetary stimulus turns into a serious headwind for the economy. If such a downturn comes, he said that stocks should collapse even further to 3,100, which would be a 22.5% decline from current levels.

“3,100 probably I’d say has more credence to it because it is based on the economy,” Rosenberg said. “We’re nowhere close to the bottom yet.”

While the onset of COVID-19 was surely more concerning than today’s biggest economic issues, the situation that US stocks face now is even more perilous than in 2020, in Rosenberg’s view. That’s because the Fed is no longer supporting markets, and is actively implementing hawkish policies that tend to weigh on risk assets.

“There is no catalyst,” Rosenberg said. “Every catalyst for the bottom of the market had the Fed stopping its tightening program and beginning an easing program. That’s what puts in the lows every time back to 1982. Well, the Fed’s not about to ease policy, right? We are in the early stages of a monumental tightening of monetary policy.”

That’s one opinion, 3100 on S&P. If you believe Hussman, it’s 1500. Ultimately and sadly, nowadays it’s when the Fed decides enough is enough.

‘The Elizabeth Holmes of crypto’: TerraUSD founder Do Kwan is blamed for market-wide meltdown as it’s revealed he mocked his critics as ‘poor’ and said he found failing companies ‘ENTERTAINING’

Do Kwon, the mastermind behind failing cryptocurrencies TerraUSD and Luna, is drawing scrutiny and criticism after the collapse of his venture triggered a massive crypto meltdown.

I did RTGDFA and know this would have been better on yesterday’s article, but I have been musing over a question for a bit and was hoping the Wolf chorus could help me: when does Michael Saylor (and all the rest) have to pay the piper?

With all of his margin debt, I would think a margin call is only one of his concerns. If he bought 1000 bitcoin at $50K with $40 million borrowed money, he will have to pay that back, right? If he cannot find a way to roll this debt over, he will have to sell 1025 bitcoin at $29K. Won’t this crash the market? What is the term on margin debt? Years? Months? Weeks? In a tightening credit environment who will facilitate a debt roll over? Margin call aside, when does this margin debt unwind? This month? This year? In a public company, is there a website where debt amount, price, and maturity can be seen?

I underestimated the amount of leverage present in the business of crypto. The recent blow ups of LUNA and the like are teaching me. The leverage seems to me to be similar to leverage that fractional reserve central bank lending employs. Since it is new, relatively ahead of law and regulation, and separate from many government influences, not terribly encumbered by borders or exchange rates, the crypto world has been able to employ much greater leverage of much higher nominal amounts that I’d considered.

I can now imagine that $30 billion to begin with and leveraged 50:1 (by the time the leverage is clear I believe that it will be in this range of leverage) becomes $1.5 trillion on the balance sheets of many entities.

Each considers their balance sheet entry as “money’. Each responds as one responds when they think they have “money” in their wallet.

Yet behind it all is nothing. Nothing one can eat. Nothing one can live in. Nothing that can be used for energy.

Since reading Friedman and Schwartz’s book I’ve been fascinated by the non-governmental creation of money. The crypto world is an example of non-government money creation.

Fascinating. I continue to self educate and I have a lot to learn.

Clark

I believe Saylor says he gets a margin call if/when BTC hits $21k.

But he says a lot of things.

Clark-

Leveraged positions in bitcoin remind me a little of the Hunt brothers fiasco.

Leverage is a cruel mistress. Especially when it’s money that’s being levered (government sponsored or not).

We are feeling a minor bust making truck equipment. Backlog is still pretty big but it’s spread out into next year. Seems that some people are buying things well ahead of normal to be sure they get the equipment, but doesn’t do much for today. We are now trying to keep the shop guys busy and starting with voluntary unpaid days off before more layoffs. Already did one round.

The crazy stimulus demand is now gone. Our late order list reached four pages in mid-2021. It is now blank. In dollar sales, we are well ahead of 2021, but that YTD number drops every month we ship light. Order rates Jan-May are well below average, on par with recession years.

Supplier lead times are just starting to normalize, but are still historically long.

A semi truck, tractor portion of tractor trailer, lasts 15 years. Higher maintenance costs may be expected for the second half of its service life.

In April 2022, Walmart offered up to $110,000 to its truck drivers. Looks like a truck driver shortage.

Class 8 truck manufacturers are affected by semiconductor chip shortages. They can not take many more orders.

Everybody should take the month of June off. Well, almost everybody.

But not August. I’m taking August off.

Small truck co and independent truck drivers have to pay their bills.

They might work below cost until this storm is over.

The reward : get new customers.

That makes no sense. There’s such a shortage of truckers these days the independents I know have raised their rates, have waiting lists, and are apprenticing recent STEM graduates.

It’s considered a profession. 300,000 leave it every year. Truckers get no respect.

Not according to Sam

“Not according to Sam”

Sam’s experience contradicts information freely available from the US Department of Transportation, the American Trucking Association, and the Teamsters.

Those of us who manage partners who are overpaid specialists in logistics consulting will happily concede that poorly operated trucking firms typically do rather badly under most circumstances, but they are clearly not our clients.

There’s a lot more to transporation logistics than driving a truck. One must have interpersonal, organizational, and negotiating skills.

1) SPX weekly with a cloud, for entertainment only :

2) Last week, May 2, a hooting star inside the cloud.

3) This week a hammer at the bottom of a downturn below the cloud.

4) Glue them together and u get long legged doji on average volume.

5) A short term 38% bounce might be next, to T&K, which will flatten for two weeks, before testing the low, in June.

Truckload van spot rates fall even faster – Freightwaves

just made a donation to Wolf as I promised last time. I made a little money from UVXY by shorting the market. Thanks for the insight.