Q1 was crappy as IPOs imploded, investment banking took a hit, mortgage activity fizzled, other stuff happened.

By Wolf Richter for WOLF STREET.

Of the big five banks and bank holding companies in the US by total assets – JP Morgan, Bank of America, Wells Fargo, Citigroup, and Goldman Sachs Group – four reported Q1 earnings so far, and BofA will do so next week. Those earnings reports were marked by a sharp decline in revenues and net income, with all kinds of complications in between. And as a group their shares continued their jagged decline that started in November last year.

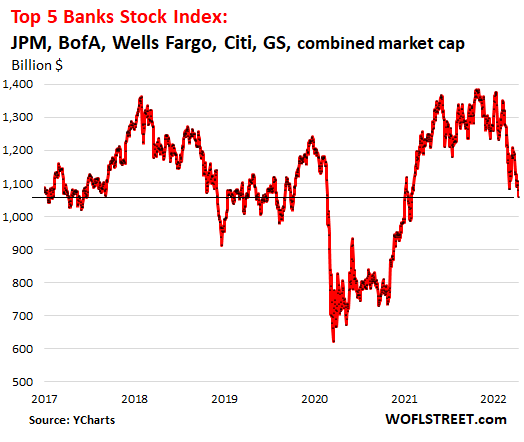

The WOLF STREET index of the big five banks’ market capitalization has plunged 23.5% since its recent peak in October 2021 (data via YCharts):

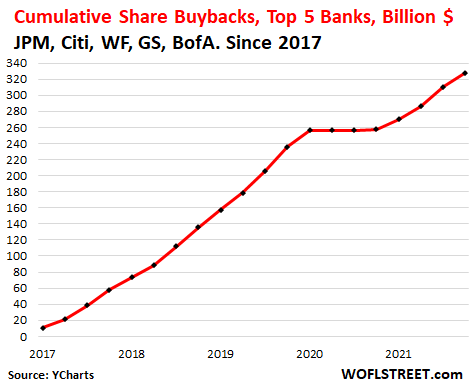

This debacle occurred amid enormous share buybacks. These banks have been regularly featured among the largest share buyback queens in the US, except during the pandemic, when they halted the practice for three quarters.

In the five years from 2017 through 2021, the five banks have incinerated, wasted, and destroyed $328 billion in cash on repurchasing their own shares to prop up their stocks, and now their stocks have nothing to show for it (data via YCharts):

Q1 was crappy as IPOs imploded, mortgage activity fizzled, other stuff happened.

JPMorgan Chase [JPM] kicked off the quarterly banking show on Wednesday morning when it reported that its net income plunged by 42% to $8.3 billion in Q1 compared to Q1 last year. Revenues fell 5% to $30.7 billion, on a 35% plunge in revenues in its investment banking division.

Over the two trading days since the earnings release on Wednesday morning, JP Morgan’s shares tanked 4.1% and are down 25% from their 52-week high in January.

In preparation for rate-hike-induced financial stress on borrowers, it set aside $902 million for loan loss reserves, compared to a $5.2-billion benefit a year ago from releasing loan loss reserves it had set up during the pandemic. And it booked $582 million in net charge-offs, bringing the total credit costs to $1.5 billion.

Its Corporate & Investment Bank profits got hit by a $524 million loss, “driven by funding spread widening as well as credit valuation adjustments relating to both increases in commodities exposures and markdowns of derivatives receivables from Russia-associated counterparties,” it said in the earnings release.

During the earnings call, CEO Jamie Dimon said that the bank sees “significant geopolitical and economic challenges ahead due to high inflation, supply chain issues, and the war in Ukraine.”

Goldman Sachs [GS] reported that revenues plunged 27% in Q1, to $12.9 billion, and net income plunged by 42% to $3.9 billion.

Goldman Sachs share were down just a tad on Thursday, and are down 24.5% from their 52-week high in early November.

Investment banking revenue plunged by 36% to $2.4 billion. It set aside $561 million for credit losses, compared to a benefit of $70 million a year earlier. Asset management revenue collapsed by 88% to $546 million, “primarily reflecting net losses in Equity investments and significantly lower net revenues in Lending and debt investments.”

But at its consumer and wealth management division, revenues grew by 21% to $2.10 billion. And its global market revenues ticked up 4% to $7.87 billion. And yes, given the turmoil in the commodities markets, currency markets, and bond markets, revenues at FICC (Fixed Income, Currency and Commodities) jumped 21% to $4.71 billion.

“The rapidly evolving market environment had a significant effect on client activity as risk intermediation came to the fore and equity issuance came to a near standstill,” the earnings release said.

IPOs were crappy all around.

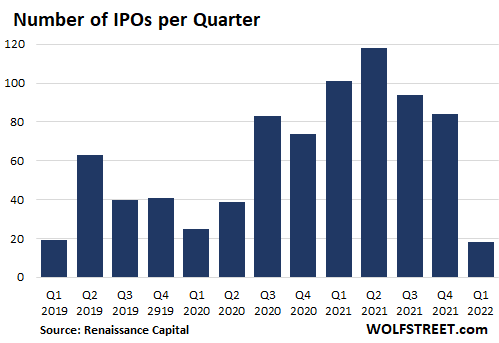

By “equity issuance came to a near standstill,” Goldman is talking about IPOs and SPACs, many of which have imploded spectacularly over the past 12 months. I’m now tracking some of them, including those where Goldman Sachs was the lead underwriter, in the WOLF STREET category of Imploded Stocks.

IPOs are massive fee generators for investment banks. But the collapse of these newly listed stocks has now essentially killed the appetite for new IPOs, which are only fun in a relentless hype-and-hoopla market. In Q1, according to Renaissance Capital, there were only 18 IPOs, including only two in March, down from 118 IPOs in Q2 last year:

Citigroup [C] reported that revenues declined 2.5% to $19.2 billion. Net income plunged 46% to $4.3 billion, on higher operating expenses (+15%) and credit losses of $755 million, compared to a benefit of $2.05 billion a year earlier.

The problem isn’t consumers in the US; they’re doing fine, Citibank said in its earnings release: “We continue to see the health and resilience of the U.S. consumer through our cost of credit and their payment rates. We had good engagement in key drivers such as cards loan growth and vigorous purchase sales growth, so we like where this business is headed.”

The big culprit was investment banking, including IPOs: “the current macro backdrop impacted Investment Banking as we saw a contraction in capital market activity. This remains a key area of investment for us,” Citigroup said.

Its shares rose 1.6% on Thursday but are down 36% from their 52-week high in June.

Wells Fargo [WFC] reported that revenues dropped 5% to $17.6 billion. Net income plunged 21% to $3.67 billion.

One of the culprits was mortgage lending activity, which plunged by 33% in the quarter on surging mortgage rates. “The Federal Reserve has made it clear that it will take actions necessary to reduce inflation and this will certainly reduce economic growth,” and “the war in Ukraine adds additional risk to the downside,” Wells Fargo said in the earnings release.

Shares tanked 4.5% on Thursday and have dropped 23% in two months from their 52-week high in early February.

Bank of America [BAC] will report earnings on Monday. In anticipation, its shares fell 3.2% on Thursday and have plunged 25% from the 52-week high in February.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Regarding Goldman, “Asset management revenue collapsed by 88%”

Can it be correct, when asset prices in general have moved relatively little? What gives?

John H.,

Ah yes, the miracles of Goldman Sachs. I linked the earnings release in the article, so you can check it out in all its details.

Here is what it says about Asset Management revenues:

“Net revenues in Asset Management were $546 million for the first quarter of 2022, 88% lower than the first quarter of 2021 and 81% lower than the fourth quarter of 2021, primarily reflecting net losses in Equity investments and significantly lower net revenues in Lending and debt investments.”

I’m just floored that if Ass. Mngt. Revenues were $546M, that they must be down FROM about $4.5 Billion last year.

Working backwards, if their revenues last year were 17.6 Billion, Asset Management was about 25% of total revs for Q12021. I’m wondering how and from what these revenues are generated.

I missed that you’d provided a link and will peak at it, but am guessing it’ll be Tower-of-Babel-ish to me.

Thanks, Wolf.

JH-losing their ‘Ass.’, in other words?

may we all find a better day.

You must be thinking of asset management revenue from charging fees to manage money.

The narrative implies something else. I don’t know the details of how they account for revenue in their reportable segments, but it appears that they booked losses on their owned assets. That’s the only way the numbers make sense.

Investment banking revenue only represents 20% of their revenue. I don’t see them as a real investment bank or even a bank at all and haven’t for years.

I consider them a hedge fund in disguise masquerading as a financial institution.

This is on p.5 of GS 2021 Annual Report (paragraph entitled “Asset Management”:

“Net revenues grew by 87 percent, fueled by significantly higher net revenues in Equity investments and Lending and debt investments. Incentive fees rose, and Management and other fees were a record, reflecting higher average AUS. Growing these durable fees is an area of strategic focus. And in August 2021, we announced that we would acquire leading European asset manager NN Investment Partners (NNIP) in early 2022. NNIP’s world-class ESG capabilities and strong footprint in Europe will help us further strengthen what is already one of the leading asset management businesses in the world.”

Describing their fees from this unit as “durable” was slightly off, I guess!

After blowing 328 million ,should have been after stealing 328 million. Hahahaha

Read it again. Billons, not millions. Millions are chump change.

You can look up securities laws and the laws of fraud, and as an attorney, I can confirm that DESPITE the later claims in the media that no crimes were committed, the banksters’ selling investors subprime, MBS bonds using fake AAA ratings, which they knew (then even bet) would never be repaid, violates numerous criminal statutes and is tortious fraud, concealment, etc.

(The banksters were just not prosecuted by the “Justice” Department or (cowardly) state AGs or DAs because as Simon Johnson explains in “The Quiet Coup” the financiers-banksters captured our government and purchased our politicians, so they are now above the law. Such AG corruption and cowardice continue as you can read about if you search for the generous Sackler Opioid Settlement, SLIGHTLY modified V2; See “A US bankruptcy judge approved Purdue Pharma and Sacklers’ $6 billion settlement agreement with states, Connecticut AG says” in CNN. I bet those AGs now have golden futures ahead of them, because the Sacklers will show their gratitude and love to them, undoubtedly, like the AGs that failed to prosecute the banksters for the subprime frauds must still be getting bankster luv.)

As to the Sackler opioid settlement, slightly modified v2, only Forbes Magazine had the big brass ones and dared to reveal the catch:

QUOTE FROM FORBES:

The billionaire Sackler family has agreed to shell out as much as $6 billion to settle litigation accusing their company Purdue Pharma—the maker of OxyContin—of contributing to the opioid crisis that has killed nearly half a million Americans, in a deal that would shield them from future civil lawsuits—but not criminal charges.

END OF QUOTE

Of course, given the corruption in our system, billionaires will be put in prison about the same time when I use a unicorn to fly each day to the moon to harvest green cheese. Hence, the wonderful (for the Sacklers not the public) part of the settlement was that they got to avoid FUTURE CIVIL LIABILITY while keeping BILLIONS of dollars DESPITE BEING SUED BY MANY PEOPLE FOR CAUSING THOUSANDS OF DEATHS!

What would you do if could do get a deal to get paid $10 billion to poison 10,000 Americans then settle by paying $6 BILLION (plus whatever bribes-contributions the politicians, AGs, judges demanded, say $100 million) and so avoid future, civil liability AND GET a federal order allowing you to KEEP approximately $5,900 MILLION (knowing that the corrupt authorities will never prosecute criminally you because of your wonderful billions of dollars that allow you to purchase hundreds of politicians) from poor people daring to sue you just because your poison killed their dads or moms or children.

I do not know about you but if it were me, I would not just want to imprison the poisoners but also the scummy judges, lawyers, AGs, and all others involved in procuring such an outrageous “settlement” to deprive victims of their right to sue for the deaths or grievous injuries to their dads, moms, children, and relatives! THIS SETTLEMENT IS EXHIBIT “A” IF YOU WANT TO PROVE THAT A CORRUPT OLIGARCHY NOW CONTROLS THE USA AND RUNS IT FOR THEIR BENEFIT, NOT THE BENEFIT OF MOST AMERICANS — certainly not for the benefit of the people that the poisoners killed or for the benefit of their families!

CORRECTION of MY math error: the right sum is not $5,900 millions, but $3,900 millions, so if maybe just being allowed to keep approximately $3.9 million would not be a good deal to you? LOL

THANKS RH!!!

Please continue posting on WOLF’S WONDER,,, as long as you can and Wolf ”let’s you”…

Thanks again for the straight poop,,,

( Appreciate your perspective too, to be sure Flea.)

Maybe those assets are empty office buildings? Just a guess.

Russian investment went to ZERO ,not hard to figure out . Jamie and his band of thieves sold out ,took cash and left government to bail them out AGAIN sickening . Where will it end

GS is not a top 5 bank.

Bob,

It is by total assets. It’s not by “banking assets” = loans. It has $1.6 trillion in total assets, which is more than any other US bank except the top four.

No other bank or bank holding company, other than those five, has even $1 trillion in total assets. They all have less.

But the Federal Reserve (as banking regulator) lists them by “banking assets” = loans and similar, which is what the Fed is worried about in terms of the stability of the banks.

I included GS as a “bank holding company” on this list because that’s what it is. They’re all in the same businesses across the whole spectrum — ranging from classic commercial banking (taking deposits and making loans) to hedge funds trading in derivative products — but to different extents.

It’s one of eight “systemically important” “financial institutions”.

In addition to the other four in the article, the other three are Morgan Stanley, BONY Mellon and State Street.

AF-

Of course the real whopper SIFI in the US is the Federal Reserve System (levered at 201:1, per James Grant. Thankfully — or not — they don’t mark to market and are backed by the treasury).

The bad parent’s dictum: “do as I say, not as I do.”

Nothing to see there, keep moving….

With most homeowners locked into 30-year mortgages at 3% interest rate or lower, I expect home sale transactions to be depressed for many years. Homeowners with lower than market interest rates aren’t about to lose that benefit by selling their home.

This is bad news for banks, which rely on a steady stream of new mortgages to keep profits flowing. Plus, these sub-3% mortgages are going to hang around for a LONG time, thereby putting strain on a bank’s ROA and risk profile.

Banks put themselves in this mess by directing the Federal Reserve to artificially repress interest rates for so long. Now, the ridiculously low mortgage rates are locked in for 30 years. The rate repression helped banks for a long time by repressing deposit interest rates, but the banks refused to retain any of the profit as capital buffer for future periods. Instead, they burned it all on stock buybacks. This is just one more example of short-sighted planning by large banks that will eventually bite the honest taxpayer.

Why wouldn’t they? They know the government will just bail out their malfeasances at some later date.

I suspect that there are more with higher rates than you think due to credit issues.

Just because someone doesn’t want to sell doesn’t mean they will not. Most people in this country are broke and most homeowners aren’t that well off either.

When the economy heads south which it will once the economic fakery can no longer keep this house of cards up, there are going to be millions who will need to sell. I still think the government will attempt to prevent the worst of it with another mortgage moratorium but with noticeably higher interest rates, believe prices will decline and maybe still noticeably.

Unless something comes out of left field, which it could, the housing market isn’t going to tank. Rather, it’s going to start a slow downward 10% trend over the next 18 months. I agree with Bobber in that we’ve moved into an enhanced period of disincentive for people to move. The housing market can’t tank if we continue to see fewer and fewer homes sold. And just like the run-up the 10% loss will be un-even throughout the country.

While I agree with you that the FED and Congress have moved towards MMT-based economics, I don’t think mortgage / rent forbearance is guaranteed unless that x-factor comes along and creates the big recession scenario.

The FED simply isn’t going to raise the funds rate fast enough or lower its balance sheet fast enough without quickly moving back towards an accommodative stance if the housing market moves past a 15-20% decline in the next 24 months.

Banks are sitting on nearly $2T that they can buy back assets from the FED before its starts to affect their liquidity. IM humble opinion is the linchpin to the entire “what’s next” scenario.

Wait until people have to start paying student loans again,after election when democrats get shown the door

“ Unless something comes out of left field, which it could, the housing market isn’t going to tank”

Sure it could…

Most of these people react to social media and think Zillow is the housing market…

If the Zillow estimates heads south, so will the the psychological state of mind that shows them losing or being stuck with negative equity…

Got to sell and sell now…

Same with cars…

Might be a tough lesson in buying CRAP… ( Covid Related Asset Purchases)

Flea, I read today they are putting together legislation to extend the student loan moratorium or to forgive $10,000 of debt as a long-term solution.

If and when they do that, Democrats will lose a lot of moderate voters who still value personal accountability. People who worked hard to pay their way through college, or who went to lower priced colleges to keep their costs manageable, will be VERY disappointed. The would lose my vote forever. I’m already irate over the entire PPP program debacle.

Jay:

Please be clear, very very clear, as is said, ”ALL RE is local.”

Some places will absolutely go into the tank, and remain there for longer; other places will tank, but only briefly due to the challenges of financing, and all the incredibly hidden paper wealth, etc.

THE real question IMHO after watching FL and CA RE mkts for the last 60 years is, :::

Who does what and with which and to whom…

(to paraphrase a ditty/limerick ascribed to James Joyce )

@Flea – The more they delay student loan payments the odds increase that it will eventually be permanent?

@jay

I agree “the housing market can’t tank if we continue to see fewer and fewer homes sold.” It is regional of course. Hither interest rates will hurt the higher end housing prices but low priced homes are going to have a lot of demand the next few years. This is anything that a middle class family can afford based on 3x of their salary. So anything under $350k will be in demand I think. A local relator told me there is 1 apple and 5 people trying to buy it

Overall…they are not building enough homes to keep up with population growth. Also, we are on pace of doubling last years immigration growth. Most likely 2+ million immigrants this year on top of normal birth rate growth.

Yes, immigrants do not buy $500k homes individually but they do buy $500k homes together and move in as a group. This is the new norm. Multi family members moving in together.

My metro (2.2 million) for sale inventory is 85% below normal inventory. There are only 1570 SFH for sale. Last year it was over 3k. Normally it is about 10k. It has never been this low. Well maybe when the population was only 500k about 100 hundred years ago.

That being said, a lot of homes have been bought by investors. Wall Street, small regional firms (100 to 1000 homes), etc. If they all try to exit the door at the same time, there could be a crash.

But I am thinking, we are facing high inflation the next 1 to 3 years, 5% mortgages are still below the rate of inflation, and population growth is exceeding house building.

@ru82

Immigration last year to the US was very low, way way below a million people, so even doubling that would result in far, far below 2 million people (not even half a million using a straight multiple). And there’s no indication that immigration into the United States is recovering all that much either, even if COVID travel restrictions aren’t as strict, the inflation and the housing bubble are keeping people away–skilled immigrants especially, with lots of choices, don’t have much interest in coming to a place where they’re essentially locked out of buying a home, getting a good education or affording healthcare or childcare. Our own company and lots of other tech and STEM firms are being hit by this and it’s one of the other damaging costs of high inflation (which as Wolf’s charts have shown, are hitting all kinds of critical sectors)–even offering very high salaries, we just can’t attract skilled workers like we used to (domestic migrants as well as skilled immigrants) when the rising US cost of living is wiping out their purchasing power. Now add this to the fact that so many more countries are now opening up to selective immigration (even places like Japan, China and South Korea that used to be a lot more restrictive), and the plunging birth rate even in most developing countries (like India and the Philippines, even Muslim countries in the Mideast), and you have a recipe for sharp falls in the immigration pool. Unless the US basically goes full open-borders with the remaining growing-population countries in Latin America and Africa there just isn’t even the pool of workers anymore to come here.

@ru82 And natural population growth? That was actually negative for the USA in 2021 (the half-years for first half of 2021 and last half of 2020, the way they calculate it)–more Americans died than were born, so there was actually natural decrease, resulting in the lowest amount of population growth in American history (less than 0.1 percent, due entirely to the meager migration stream that might get revised down). More than half of US states and three-quarters of US counties had a population fall. And there are even more Americans emigrating themselves, to leave to other countries, which the Census has admitted it doesn’t have an actual number for so there’s guesswork on exactly what the net migration is. Bottom line is that as far as numbers, there’s not anything like the kind of migration pressure you’re referring to on supply of homes so that’s not a valid argument as far as propping up the housing bubble. Having said that though, I would still agree overall with your point that even with current pop., supply of housing is well below demand needs–which means a lot more Americans are winding up moving back in with their parents. Or homeless. Or couch-surfing. Or going Nomadland in RV’s, or in that little attached shack in the backyard of the family home.

The GFC supposedly came out of left field in 2008.

It wasn’t a “black swan”. It was a psychological event and the psychology changed fast.

The psychological event was MBS buyers realizing that what they had bought was garbage, mortgage originators and MBS buyers realizing borrowers were garbage credits, and homeowners waking to the housing bubble.

It’s not directly contingent upon mortgage rates, though this increase is also psychological. Market rates including mortgages have risen front running FFR hikes as usually happens. Rates have been rising for slightly over two years.

Nothing moves in a straight line. Even though rates are low, bond market losses have been significant.

I can see mortgage rates being only somewhat higher than now sometime next year as the recent advance is partially retraced.

There is a lot of speculation in residential real estate right now as discussed on this blog. A declining real estate market has corresponded to a weak economy in the past but with the amount of speculation currently occurring, it’s not a requirement.

‘The GFC supposedly came out of left field in 2008. It wasn’t a “black swan”. It was a psychological event and the psychology changed fast.’

Bologna.

Deregulation allowed banks to invest customer’s money in derivatives.

Derivatives were created from subprime residential mortgages.

When the Fed raised interest rates, subprime mortgage borrowers could no longer afford their mortgages.

Borrowers defaulted on their mortgages, and the derivatives and all other investments tanked.

Lehman didn’t go belly up over ‘psychology’. They tanked because they couldn’t get a trillion to cover their asses, er, losses.

You’re wrong.

The event was psychological. It was a collective belief that caused market participants to take the actions in your post.

The idea that regulation can manage systemic moral hazard is total BS. That’s your claim. It’s the equivalent of an economic or financial religion based on belief and nothing more.

No amount of regulation can accomplish what you claim.

Collective psychological event. BS. Go re-watch The Big Short. I have no idea what the current state of Credit Default Swaps are within the current financial market, specifically as the relate to MBS, but Michael Burry predicted the entire event. So, he knew the black swan event was coming, because he and others were paying attention.

Unless an unthinkable event (i.e., Russia successfully hits us with a significant cyber attack), I see the next 18 or so month playing out in a fairly orderly fashion, meaning a mild recession. And if Russia does do something significant, we’re all likely to be less concerned about JPowell and his idiotic monetary policies as opposed to worrying about how to make it through the next week or month.

All else equal, JPowell and even the Republicans aren’t going to let the train fall off the rails just yet.

While we have our differences in thinking how this will all play out, I think we all can agree than the next 12-18 months have the potential to be a blockbuster.

We very well could see a president impeached a year from now for not securing the US border while the son of the current president and our former president may be indicted.

Augustus, you said:

“The GFC supposedly came out of left field in 2008.

It wasn’t a “black swan”. It was a psychological event and the psychology changed fast.”

—————————————————————

I have never heard anyone EVER say this EVER, – you never heard about the collapse of that Lehman, Bear Sterns, AIG, etc, etc ???????? – Geeeeeeeez!!

Get educated, – it wasn’t “psychological” – the whole monetary system froze up – this below is just a partial amount of what took place!!

This from Investopedia:

The 2007-2009 financial crisis began years earlier with cheap credit and lax lending standards that fueled a housing bubble.

When the bubble burst, financial institutions were left holding TRILLIONS of dollars worth of near-worthless investments in subprime mortgages.

Millions of American homeowners found themselves owing more on their mortgages than their homes were worth.

The Great Recession that followed cost many their jobs, their savings, or their homes.

The turnaround began in early 2009 after the passage of the infamous Wall Street bailout kept the banks operating and slowly restarted the economy.

Jay. Thoughts on Russia Credit Default Swaps

Russian Sanctions: How Will They Impact Credit Default Swaps?

Monday, April 11, 2022

Economic sanctions against Russia as a result of the invasion of Ukraine have had a broad impact on the global economy and have raised the question of whether Russia will be able to meet its obligations on foreign denominated bonds. If Russia defaults on its bonds, credit default swaps meant to protect investors from a Russian default may not work as planned because of these sanctions.

That is the “official” narrative of what happened in 2007/2008. Hollywood even made movies about it, which should tell you there’s a rat to smell.

Well.

Really, Bear Stearns was nixed by leveraged silver shorts that went bad. Reeeally bad. And guess who stepped up to the plate ?

” In February 2008, Bear Stearns stock traded as high as $93; by mid-March the insolvent company agreed to be taken over by JPMorgan for $2 a share (later raised to $10 after class-action lawsuits). In the annals of Wall Street, there was hardly a more sudden demise than the fall of Bear Stearns.”

Now read this paragraph of JPM’s earnings report:

“a $524 million loss, “driven by funding spread widening as well as credit valuation adjustments relating to both increases in commodities exposures”

There you go. Next one please.

How many ounces and in what form is all that counts now.

Bobber. You have no where to go, politically speaking. The PPP was rife with fraud and that fraud was committed by business. So that does away with you supporting the fraudsters. No Dems, and no Reps. for you. You could go libertarian, which is the latest illusion alongside cryptos. The first has never in human history been applied. Ever. Not once. The later is a ponzi scheme.

Unamused I believe Buffett said 20 years ago derivatives would blow up financial system

GFC was a collateral crisis. Collateral was stripped out of investment banks, and moved offshore, Cayman Islands. They had no jurisdictional recourse to recall that capital, and the banks were on the hook, so the head banker printed money and replaced the purloined loot. Ergo you have 8% inflation today. The inflationary expansion period was extended while China was exporting deflation to the US. When the trade agreement broke down (trade wars) the backup in the monetary base started to reflect. The same lack of capital controls exists today. The trade is basically, borrow against your assets, short your assets from offshore, S&P futures perhaps, when the market collapses collect your winnings, and wait for the Fed to reflate your core positions. Oh and buy a little more at the bottom.

AB: “Collateral was stripped out of investment banks, and moved offshore, Cayman Islands.”

Laundromats work so well with tax evasion on unreported earnings they decided to extend the practice to laundering missing financial assets. I like to use central London as the example because references to the Caymans are a little stale. Monaco, Andorra, Liechtenstein – there are laundromats for every taste.

The primary purpose of regulation and prosecution is to reduce risk. Near-total deregulation and nonprosecution guarantee accumulating risk and toxic assets will detonate the system. It is only a matter of when and how. The system is teetering drunkenly these days.

“ MBS, but Michael Burry predicted the entire event”…

Jay, I think you’ve got it slightly skewed…

Burry didn’t so much predict the event, he was actually on the betting side HOPING it would happen…. Thus his purchases of CDS…

However, he had to carry those CDS for what, a couple of years or more at great expense and the loss of many of his clients before the PSYCOLOGICAL event of everybody running for the exits happened and he found that he bet right…

Burry BET…. And bet right, the way it played out…

“perpetual perp”,

Libertarian is not “the latest illusion.”

It is the philosophy espoused by many people over centuries regarding the rights of individuals. John Locke is one the more influential Libertarians, and he said this in the 17th century.

“Government is morally obliged to serve people and protect life, liberty and property.”

One of Locke’s greatest achievements was working with Lord Ashley who was then granted the title of the Earl of Shaftsebury and getting the Habeas Corpus Act passed in 1679.

I would assume that most people who are educated understand the significance and meaning of this Act. Perhaps for you, “perpetual perp”, that may be a false assumption, but I would hope that it is not.

If you have any questions regarding how the United States of America began, just read the Preamble of the Declaration of Independence. Life, Liberty and the pursuit of happiness are my God-given rights according to my nation’s founders.

And on the topic of banking, Locke stated this little gem regarding the government regulation of interest rates:

“The first thing to consider is wether the price of the hire of money can be regulated by law; and to that, I think generally speaking that ’tis manifest that it cannot. For, since it is impossible to make a law that shall hinder a man from giving away his money or his estate to whom he pleases, it will be impossible by any contrivance of law to hinder men to purchase money to be lent to them.”

Three and a half centuries ago the Libertarian philosophy that shaped the USA was given to humanity by an Englishman named Locke. Nope, it ain’t the latest illusion.

It wasn’t a black swan, since it was obvious it was going to happen. Roubini predicted it about 2 years before. It wasn’t a psychological event either. It caused the current TBTF situation since governments bailed out financial organisations leading to the situation today. And now we have a much worse problem. Since there are likely to be food shortages, and food trumps everything else, I would say this sucker’s going down.

Augustus, you are correct and people simply don’t realize what you mean when you say “psychological event”.

It’s not that it wasn’t real. It’s not that the stuff in The big short isn’t fairly accurate. What the psychology is referring to is what created the bubble in the first place, which was a belief that housing cannot go down and that the market will go up forever. It’s the story of sentiment, which happens over and over again in surprisingly predictable ways.

We are now approaching the top of an even bigger sentiment wave. I believe personally the housing market will not turn for another year or two in a significant way. We may see a plateau even small declines overall, there may be some markets that start dropping fast while others are surprisingly strong.

The pointers all the underlying fundamentals that get covered here on Wall Street I really happening, But they don’t have the timing impact that many here believe they should, and that is because of sentiment. We simply aren’t at the top yet.

Bobber economy will crash mass layoffs,then foreclosure on homes ,cars, so that elites can buy back for nickels and dimes ,the bottom 90% better wise up or this country is TOAST

Oh darn, now everybody’s going to know.

Precisely this. I look at it as pulling revenue forward. X number of people will move or y number of companies will IPO in the next 3 years by default – then you create some of the best conditions in history to move or go public – you giving these people incentive to jump early. Early being the key word. And for every early jumper there is one less person in the pool for later.

“I expect home sale transactions to be depressed for many years.”

Throw into the mix increasing mortgage rates, how long before people find themselves with upside down mortgages they can’t refinance. Which, in turn, drives down prices even further.

Possibility for a vicious death spiral here.

The large IB’s printed money in 2021, as they underwrote and promoted crap SPAC’s. I wonder if they have set aside enough reserves to handle the hundreds of class action lawsuits against them that are surely coming. I am a fellow banker, so I don’t take my comment lightly, but these IB’s had to know most of these SPACs they promoted would wind up at zero.

I’m surprised it took this long for the SEC to start cracking down on SPACs. It was obvious from the beginning they were a way for lower-quality businesses to get around legal & disclosure requirements in the traditional IPO process.

Is not it fun to take screenshots of MSM financial headlines-du-jour and look at them after 5-8 years ?

All-around winner from 2018:

“DOW SKYROCKETS 1013 POINTS BECAUSE NO NEWS IS GOOD NEWS !!!”

Last week headline writers ran out of steam using the same BS explanation for both surging & plummeting:

“STOCKS GAIN AS INVESTORS MULL WAR IN UKRAINE”

“MARKETS DOWN AS INVESTORS MULL WAR IN UKRAINE”

It’s as enlightening as reporting Texas Hold’em winning hand at Las Vegas Wynn casino.

Total, utter, absolute meaningless BS.

Some of their standard keywords, “as”, “amid”, “after”, “ahead off”, “mull”, “anticipate”, “traders”,”even as”, “despite”,”jittery”,”wobble”, “in sympthy with”

They are careful not to establish causation/correlation buy they are writting to just imply this to on looker. They are just taking two disparate events and join using one of the above key words.

Sometimes the process is robotic and automated..

For example, “shares of several technology companies are trading lower AHEAD OF russia ukrain meeting as traders MULL the fed FOMC minutes”

Dem damn writing bots. ..

No respect at all for Arthur the Iconoclast and his “On the Fourfold Root of the Principle of Sufficient Reason (German: Ueber die vierfache Wurzel des Satzes vom zureichenden Grunde)” which builds on Aristotle and sheds some light on CAUSATION ☺

This is part of game theory scientific study. See the choas approach.

Chaos :)

We believe that according the name ‘investors’ to institutions that trade actively is like calling someone who repeatedly engages in one-night stands a ‘romantic.’ – Warren Buffett

Cue David Lee Roth…

“Just a gigolo”…

Seems apropos….

From a different generation, I’m thinking of the Louis Prima/Keely Smith version.

Check it out on YouTube.

Gigolo Sachs, makes perfect sense.

Absolutely useless lack of analysis. I agree. I wonder if they are incompetent and believe it or they just know their editors wont let them publish the truth. I’d love to see a little gritty assessment of facts on the big financial outlets. I assume Bloomberg articles are decent but I wont pay for it.

Steve Forbes (aspiring biker from upstate NY) shows his idependent streak once in a blue moon ☺

Bloomberg is most corrupt propoganda media. Articles are condenscending and supportive of woke pump and dumper schemers and fraudulent stocks. Never a quality analysis on any value investment. Long ago I remember myself coming across a headline “Is Your Gas Stove Destroying the Planet?” on bloomberg, and that was my last visit to the website. Energy stocks are doing great since that article.

Voting with your wallet can effect change. Using cash to transact immediately reduces data input to centralised old news outlet bots manipulating perception.

Wall Street bonuses hit a record high of $257,500 per banker last year (unclear if this is mean or median), according to the New York Comptroller.

Judging from these financial results, it looks like 2022 (for bonuses payable in 2023) will be a tougher year. But they’ll still be making truckloads of money compared to average Americans.

many people have said this for over a year. that the covid stimulus and rate repression didn’t create new wealth, it just pulled it forward.

“Wells Fargo [WFC] reported that revenues dropped 5% to $17.6 billion. Net income plunged 21% to $3.67 billion.

One of the culprits was mortgage lending activity, which plunged by 33% in the quarter on surging mortgage rates.”

My co-worker’s sister in-law was a manager at Wells Fargo. Been with them for 17 years. She lost her job about a month ago. He said that they are closing the branch where she worked. It was a branch in the San Fernando Valley (So Cal).

It’s been my belief for a long-time that the large banks in particular would like to dump most of their customers, but they can’t due to politics and the regulatory requirements that go with it.

AF-you’re right, and they figured they could make them leave by greatly expanding banking fees. As things turned out, those fees became a great new profit center as most depositors seemed unable/willing to do the arithmetic then head for the exits…

may we all find a better day.

More telling is how a company (in an industry) that produces nothing nets almost $4B in a really bad quarter with an ROI of 20% (17.6 / 3.67).

Da Restofus would kill for that ROI on $$$ we have to earn.

Imagine a world where every individual had ability each day to make up the number held in the bank account against their name. What would happen? Fantastical figs swept aside as livelihoods focus on exercise smiles laughter sweat breath closeness trust honesty footprint.

That would be so cool (no sarc).

Curious as to how many Billions were sold by Insiders in the same period as the buybacks.

BBB-

Yes! In the banking community, which is periodically subsidized by taxpayer funded bailouts, especially.

Might be an interesting study for an enterprising Federal Reserve Bank research PhD…..

Indeed! The way to bring the Federal Reserve back into socially acceptable behavior is to prevent new Phds in economics and law from entering the Fed workforce.

I’m guessing these banks issued debt to execute these buybacks, and at the same time the insiders sold like crazy, right?

““Wells Fargo [WFC] reported that revenues dropped 5% to $17.6 billion. Net income plunged 21% to $3.67 billion.”

This is what happens folks when the Fed pulls demand forward for years with negative interest rates, and more so with their massive stimulus and PPP programs that allowed consumers to refinance homes and buy other things which will curtail demand for years.

There is really no way out of this now with inflation raging. I like Zoltan Pozsar’s analysis that this inflation is not caused by high demand due to high wages, but by supply chain interruptions, currency debasement, and the rising wages and material costs in producer countries. Zoltan also had a very meaningful comment that the only way for the Fed to make people go back to work and reduce wage inflation is by crashing bubble markets like cryptos and stocks.

Powell cannot print his way out of this now.

Outstanding revelation and charts.

Wolf–with your circulation this financial blunder will be seen at the highest levels at each bank.

Wolf, I am no fan of the big Wall St. banks…. But, the title of this article is misleading and incorrect.

1) The market cap of a company and the stock price are 2 different things = By conflating them you created a false narrative.

2) While the total market cap of these banks as a group is the same as it was in 2017, the number of outstanding shares has shrunk.

3) Higher stock prices times LESS shares outstanding = The same total market cap.

4) The SBUX situation is a good example of the destruction of wealth from buying back stock at record prices…. so is GE., the Airline industry, and many others.

=================================

Bottom line:

A) I agree with the general premise that most stock buybacks are simply stock manipulation that do NOT create long term sustainable shareholder value.

B) I think the stocks of these Wall St. banks will probably trade down a lot lower as a world recession causes some of their derivative books to explode with massive losses… and then it will be time to add them to the list of buyback victims.

I think you are describing dilution, to the detriment of remaining shareholders once the market effect of the buyback subsides (in the subsequent market cycle). I.e., to detriment of long-term shareholders.

The buyback is to the benefit of stock & option recipients, many of whom are employees of the bank, and also to shorter term traders in the bank’s shares.

So, if they had not spent $328B on buybacks, their stocks would be at least 50% lower. And gee, how much debt did they take out to do the buybacks that is still on their books. LOL. What a scam. Zombie companies everywhere you look. The Empire of Lies. Corrupt from top to bottom.

Zombie companies is right. Just look at today’s balance sheets. These absolutely suck. Interest expense is low compared to inflated earnings from the fake economy even with obscene leverage for one reason only, the bond mania.

The bond mania appears to be over.

Prior to 2009, I always wondered what kind of fundamentals would be associated with a 90%+ bear market in the US major averages.

Now I know. Whether it’s inflation or a deflationary crash (my prediction still for asset markets), contracting credit conditions combined with gutted balance sheets are going to wreak havoc on stock prices.

You refer to stock buybacks as “incinerated” and “wasted”, but in their terms, those billions were “returned to shareholders”. They are payouts just like dividends, but without the double taxation.

If they had paid the same billions in dividends, would you be calling that “incinerated” also?

It’s incinerated because those who still own the shares are worse off than before the buybacks ever occurred.

If the money had been paid out as dividends, well, they would have the money, wouldn’t they? They don’t.

Buybacks aren’t cash in anyone’s pocket. Those who still have the shares have nothing to show for it.

This fallacy is based upon the assumption that the price goes up due to the reduced float (assuming it even decreases) and then either never goes down or only after someone sells their shares.

As for double taxation, there is a timing difference but share buybacks don’t eliminate it. There isn’t even a difference in the rates anymore which was the previous rationalization for this practice.

The most obvious motivation for share buybacks is to enrich insiders. A disguised internal (quasi) LBO doesn’t create any long-term value. It’s financial engineering and has only worked due to the asset mania.

AF:

Thanks for the explanation. Seems like I’m learning a lot from Wolf’s commenters as I acquire fluency in financial terms and concepts.

Drifter,

Don’t take everything AF says as gospel – some of those claims are at least disputable.

1) not cash in anyone’s pocket…well they are cash in the recent shareholders pocket. And you can at least argue that the otherwise dubious “propping up” function benefits continuing shareholders (of all stripes) as well.

2) no tax benefits…I’m not 100% sure that AF’s claims here 100% accurate.

3) Quasi LBO…only if debt (versus retained earnings) is used to finance the buybacks (and lenders tend to hate that sort of thing and try to contractually limit it unless they are in for fees from a straight out LBO). Now there is usually plenty of pretty fungible debt proceeds sloshing around major corporations, so this isn’t a steel wall…but buybacks consume so much money, if debt were truly financing the buybacks, it would stand out.

Wolf hates buybacks for the manipulative, propping up aspect…and I trend to agree.

But…there are multiple reasons why buybacks have surged over 40 years and not all of them are bad.

(ie, Would the world really be better off if CEOs lavishly funded internal fiefdoms were engorged even more by supercharged retained earnings once buybacks are banned?

And…after 40 years of mainlining the “stabilizing” buyback heroin, what would the equity mkts look like if it got banned? The mkts are already 60% overvalued due to ZIRP crack…take the buyback heroin away at the same time and you might have a corpse.

I don’t like either (but only ZIRP impoverishes *everyone* due to its inflationary innards) but trying to undo both at the same time…

No, it’s not at all the same thing. With buybacks, shareholders sold and became ex-shareholders — that’s what buybacks do. They just buy shares from some sellers out there. Dividends are paid to existing shareholders. Buybacks buy shares from shareholders.

Buybacks used to be considered largely illegal market manipulation until 1982. For a very good reason.

Is there a body of research out there that has studied the correlation between companies with frequent stock buyback , and companies that use extensive management stock option programs? It seems like there might be room for some particularly profitable mischief there…

If I am understanding this correctly, $300 billion cash changed hands. Exactly who sold their stock and took the cash? Management’s friends and family, and other insiders?

The whole thing smells really bad.

Augustus comment above I am in 1,000% agreement with!!

Just hedge funds trading their own shares and anything else they chose in their SEC approved Dark Pools!

——————————————————————————————————

“”You must be thinking of asset management revenue from charging fees to manage money.

The narrative implies something else. I don’t know the details of how they account for revenue in their reportable segments, but it appears that they booked losses on their owned assets. That’s the only way the numbers make sense.

Investment banking revenue only represents 20% of their revenue. I don’t see them as a real investment bank or even a bank at all and haven’t for years.

I consider them a hedge fund in disguise masquerading as a financial institution.

Insider shell-game. Now, rug-pull. With we the peasants as the juiced-in insurance policy against losses.

Some nice oligarch yachts are on sale, I hear.

Wealth management: people with dynastic wealth want caretakers for their piles. They can’t be bothered to learn family finance, when they can pay a pittance for the hand-holding. Off to the beach!

My mom’s neighbor has a fleet of collector cars, fancy houses here and there. He’s in that business.

I worked on big boats. One day, mating for a family scion captain moving his boat back to regular spot, I asked him, was it a burden being in charge of the family fortune? He grinned and replied, “No, no , we have people for that.”

Made sense to me.

I don’t believe your sentiments are completely accurate for long-term multigenerational “old money”.

Not sure who qualifies for that now, as the primary US family dynasties aren’t or do not seem to be (very) prominent anymore: DuPont, Mellon, Rockefeller.

Rockefeller seems to be the most unified, presumably through the trust structure to prevent the fortune from being splintered. But I don’t think the family leadership is what it used to be.

Recently I heard about monthly income ETFs. They pay 5% to 9%. How come they can pay this much because all the dividend stocks pay only 3%. Is it all junk bonds and other toxic stuff? If its good, then I can put DRIP investing and go on?

Gas tax holiday ends in the Maryland. Filled my gas tank today. Purchased a new bicycle cheaper from Walmart.

My therapist checked himself in to therapy last week.

Happy Easter everyone!

CP, if you don’t fully understand an investment, stay away from it. Anything paying 5 to 9% now is risky, from several standpoints.

These investments generally pay you back some of your principal investment every month. Not a long-term sustainable approach.

“CP, if you don’t fully understand an investment, stay away from it. Anything paying 5 to 9% now is risky, from several standpoints.”

This I understand. Unfortunately I missed out on a lot of returns over the last 15 years. :-(

Happy Easter to you!

Calamari is being served.

Not again.

Buybacks are a great way to jack up your upper management compensation while actually running the business into the ground! And all financed by wrecking the American dollar! Go team Fed!

The end is here. Game over, kids. Everything will crash and burn. I know. I gazed into my crystal ball and my Zestimate didn’t go up today.

Try Redfin.

With conclusions like this, you should probably get a second opinion.

Wolf, Thanks for reporting on this fraud known as the US banking system. It was a good reminder for me to pull every cent I have out of these rotten corrupt banks. I’d love to see the amount of $ these banks had on deposit in 2009 (when Hank and Ben bailed them out because they were deemed too big to fail) in comparison to how big they have been allowed to become today. I’d say Liz Warren failed terribly in her oversight, considering these banks are now 500% bigger today than in 2009, and now they truly are TBTF and a systemic risk to everyone.

Hmmmm – Set a politician (left or right wing) as overseer to the banking industry.

What could go wrong?

Liz Warren, to her credit, did her best. But the banking lobby as well as the politicians who fed at their troughs watered down the Dodd-Frank Act.

And the Golden Rule was proven once again: He who has the gold, makes the rules.

“…this fraud known as the US banking system” — Been pondering this for awhile. Near as I can figure, they store “fraud known as US money”. Lots of paper and electronic digits and not much else. Not even pens to use to fill out deposit/withdrawal slips. There’s no “there” there…just smoke and mirrors…

It looks like the fed is the real problem as it just prints money endlessly of which 50% goes into their pockets. It’s like buying a10$ item and 5$ goes to the invisible pit of endless dept.

Modern management

Get paid, get options, have the company buy stock at well above book, exercise options, take the parachute or huge pension. In the meantime enforce strict sexual harassment policy except for themselves and their selected few. Make a few decisions a monkey could make……..poorly.

Modern stockholder

Hope to fool the next guy into buying stock before the hollowed out balance sheet is exposed.

Modern Board of Directors

Too stoned to know the difference….it was all dad’s money anyway.

and they wonder why we have a trillion dollar trade deficit.

Fred…dont forget the rotating board of director game..where they all vote themselves huge compensations

Bill sits on Jim’s board, Jim sits on Ralph’s board, Ralph sits on Fred’s board, and Fred sits ……on Bill’s board. Daisy chain.

One of my clients in the recent past was CEO of a company out of Pittsburgh. He sits on a few corporate boards, though he is retired from being CEO at his former firm.

The man has integrity, and it was rewarding to be able to be his sporting event ticket broker for quite a few years both financially and from a person to person relationship.

The thing that stuck with me was how he managed to get to board meetings. A small, fast airplane at an airport close to his home in the Twin Cities with a hanger and car in it, plus the same set up in Pittsburgh (only one airplane needed) allowed him to be very efficient with his time.

Got a board meeting in Milwaukee? Just fly there first thing in the morning and get picked up in a limo to attend the meeting. Then, right back to his plane and he would fly it home in time for dinner.

I bring this very true story up to make the point that there are talented and honorable people out there. They don’t “all vote themselves huge compensations.”

There is a game out there….and not all play it…but there is a game. My point.

Do you know how he voted at these meetings? His presence must have been very important so as to provide him such efficient transportation.

historicus,

That’s a good question, and no, I do not know how he voted at the board meetings he was part of. And certainly, your point and fred’s comment do hold true in many cases and with many of those that sit on corporate boards.

But I have a good insight on the man’s character, as well as his wife’s who is from St. Paul, where they now reside.

The limos that I related in this are not something he really cares about or likes, but that’s how “the game” is set up — kind of standard routine at Fortune 500 board meeting procedures.

But the airplane is his, bought and paid for by years of working as an electrical engineer. And with those years of work, making his way up the ladder to be the CEO of a large manufacturing company.

This is called the HARVARD yacht club

1) In early Nov 2016 a trader short JPM because banks deserve his

punishment. JPM gap up, but he didn’t care. In 2017 JPM stabilized, but the trader knew that it will turn around.

In late 2017, when JPM went vertically up, the trader was wiped out. JPM Oct/ Nov 2016 gap is still open.

2) A guy is throwing tantrum in every direction. A woman told him : u are

mean and crazy. His blue collar boss : just relax. Finally, he found a

victim who enjoyed being insulted and humiliated. It start with few moments of giggling and laughing like a teenager. Suddenly his tone become loud and angry :

I told u not to buy it. U are losing money in the stock market, because u

don’t listen to me. U are stupid, a loser, good for nothing…. Day and night on his cell phone, in repetition, from tranquility to volatility.

It’s obvious they all need to go into Crypto in big way. They need an Alt Alt Asset Department going ASAP.

1) It’s puzzling why bankers have come up with these new ways to lose money when the old ways were working so well.

2) FYI, these bankster problems are self-inflicted and have nothing to do with The Plague. They were taking out big repo loans months before the first reported covid cases.

3) One can only imagine how tanked their stocks would be if they had not spent $328 bil on buybacks in the futile effort to prop them up.

4) The easiest way to rob a bank is to own one. I still like my speculation that the managing officers are laundering bank assets through central London.

5) I want either less corruption or more opportunity to participate in it.

Your #1 is an instant classic LOL

Viva yo.

Is the reason for bank revenue decline due to the short term effect we have seen the last few months?

1) Home loans and refi fees with points have dropped to nothing. Layoff benefits must be paid for the mortgage divisions.

2) The 2% fees to manage your entire net worth have dropped 20-25% with the stock market drop. Bank asset management divisions are collecting that much less on deflated customer assets.

3) My savings account is still paying 0.1% yet they continue to send me a paper statement.

4) Outstanding loans that they kept and didn’t send off to Fannie and Freddie are likely paying well below inflation.

5) Car loan originations have likely dropped significantly.

How many loans do banks actually make and keep these days? Are they going to benefit with increased car loans, credit card balances etc next quarter with higher interest and higher priced everythings?

1) Cumulative buyback = $340B. The banks probably bought 7B – 10B shares.

2) They show more earning per share, paying dividends for less numbers of shares o/s.

3) Primary dealers repo cost is zero. Total assets is growing, because their debt is rising.

4) Empty office spaces, zombie loans who cares, when the markets are up.

This all takes me back to 2008 when GSax and the rest of them were holding their hands out and crying “save me”.

(I know GSax said they didnt need the $13 Billion but they took it anyway)

Bailout or supports from the Fed, etc….should be conditional.

Moratorium on share buybacks, escrow holdings for “bonuses” (five years).

The game of pulling all the equity out for share buybacks, bonuses, etc. each year, then suddenly having the bad year or black swan event, after they have paid out all the monies that could have been cushioning hard times.,…has to stop ..IMO.

American is a welfare state bail out stock market,farmers ,welfare recipients.Then wonder why cash is trash,NEVER to be paid back!!!

Yeah, banks get huge subsidies and bailouts (which should put taxpayers up in line for paybacks), and meanwhile they have a public-facing function called, uh, BANKING?

If a company is a pure shareholder financial-engineering-wealth-privatization machine, it should change the sign on its door. And leave all the MASSIVE public freebies and vast insider payouts behind.

Have it basically one way or the other.

Gee,

JP Morgan should have done better……………

Didn’t they have a couple of big fines they paid last year including that one for over US$900 million for spoofing the precious metal markets?

So when will the banks throw us a bone? I missed >1% saving accounts

Last time inflation was this high Fed Funds near 9% (early 80s)

Now .5%?

Juxtapose the “standing to duties” between these two Feds…..same mandates, instructions, agreements to their existence and special powers.

Those who knew this time, the Fed would shirk their duties made all the $$$

Thankfully, we live in the US where the Central bank pays interest on the QE reserves that the criminal banks were forced to hold. Otherwise, they may starve granting all those small business and commoner home loans before they have a chance to sell the risk back to the government.

Real injustice.

1) JPM weekly backbone : Jan 29 high/ Feb 5 2018 low, 117.35/ 103.98.

2) JPM BB blew up a huge gap between Nov 2/9 2020, 102.96/ 113.16.

Few options, for entertainment only :

3) JPM might close the gap and move up.

4) JPM might close Nov 2/9 2020 gap, before closing Oct 31/ Nov 7 2016 gap.

5) If so, it will form a megaphone, a bearish pattern, centered

around Jan 29 close/ Feb 5 open 2018 BB.

6) Jan 29 close/ Feb 5 open 2018 neutral zone supported NDX in Mar 2020.

7) It might be a n early warning sign.

8) China big banks troubles might suck the air of JPM.

Wish I understood 20% of what you write. Sounds really important and is like trying to interpret a Nostradamus quatrain.

He always goes deep on post patterns, trying to get open in the end zone. It’s almost as incomprehensible as the sweet nothings a homeless person utters, to nobody in particular.

XC

Mmm in my book sweet nothings are what you whisper in your girlfriend’s ear, not the drunken gibberish of a hobo..

On May 4 1982 Exocet hit Sheffield.

Sheffield?

On Wednesday, 13 April 2022, USA cyclist from upstate New York and 19 year-old Magnus Sheffield won the Brabantse Pijl by finishing the 205 km race alone for the last 3.8 km.

How does a kid go to Belgium and kick ass against the world’s best pro bike racers? His answer, “I have a particularly good memory of remembering particular turns and also lines.” This ‘secret weapon’ to memorize turns, roads, and racing lines is taken from his time spent alpine skiing.

As I watch the Pais-Roubaix ‘Hell of the North’ tomorrow morning, I sure as hell hope this young man kicks ass again!

Late July ’41 Adolf was knocking on Kiev’s door. The Exocet’s forebears would appear soon.

My take on Mr Wolf’s article and all the comments, is that someone feels a big bank is heading towards bankruptcy.

Thanks goodness for bail-ins

Sarcasm? What USA bank is set up with bail-ins? Banks are now set up, I think, upon near-death-experience, and having mailed in their “living wills,” to be resolved by the regulators. I imagine those alpha food chain predators who finance them (their fellow banks and the Fed, right?) will be well taken care of. Shareholders would then normally eat the exhaust, and supposedly Dodd-Frank put up some barriers to outright bailouts. But guess what? It is all, I think, window-dressing how it comes out, winners and losers. here’s why: there is a giant thumb on the scale: one (unnamed) part of government does not need the people’s (Congress’s) consent to produce unlimited money and send it wherever it pleases. It has this permission by statute (section 15). Care to guess who?

Spot on is this how Ellon musk is now a Multibillionaire? and his assets

Keep changing, is he one of there plants to washing hundreds of billions out of the system? by fake acquisitions for the purposes of money shuffling he wants Twitter and is willing to pay hundreds of billions for it which he does not have. The problem is these kleptocrats value some thing at a massive amount and banks exchange papers to secure the asset which is never really payed for so they can create and hide multi billions in loses and make a fool of everybody as they are not really regulated by anybody. Do I have

the correct grasp of this or is it much more complex con than it looks!

Good one LB:

While it is very clearly very very much more complex than is apparent or ”transparent”,,, it also just simply boils down to the fundamental concept of ”hidden derivatives” etc., etc. that are played by the ”banksters, etc.” of each and every area of our global financial world.

That those incredible ”derivative” mountains have had and will have more ”earthquakes/volcanic eruptions ” that no one has or can anticipate — mostly because they are mostly hidden until they occur — is inevitable is a total scourge on WE the PEONs to be sure.

IMHO as a successful investor in the SMs for several decades until realizing, that these NEW and secret and hidden ( from at least my view ) financial paper products were controlling or at least majorly influencing SMs in the 1980s, WE, in this case the ”retail” investor community WE, will not have anything close to a level playing field until all such hidden ”stuff”,,, ( OK, properly called SHIT ) ,,, is made truly transparent to all of us.

Anthony,

None of these banks is heading for bankruptcy, and there is nothing in this data at all, zero, to suggest this. It’s idiotic clueless fearmongering for you to say that the article suggests that any of these banks are heading for bankruptcy.

In general, there is way too much braindead “bail-in” BS out there. If a bank fails in the US, the first to get “bailed in” are, in that sequence:

1. the shareholders (that’s a large amount of capital right there)

2. the preferred shareholders

3. holders of contingent convertible bonds

And after all this capital has been bailed in, and if that doesn’t cover the capital hole (the difference between assets and liabilities), the unsecured creditors are bailed in.

But in the US, deposits are insured by the US government, backed by the Fed, for up to $250,000 per entity per bank. So depositors in the US, if they stick to those rules, will never lose a dime when a bank gets resolved. To suggest otherwise is braindead clueless fearmongering.

Every year, some banks in the US get resolved. It happens quickly and routinely and follows the process, and depositors are insured.

I have been through 3 bank resolutions in my life, and never lost a dime on them. I didn’t even notice the difference, except for the name change.

i went through multiple in a several month period back during the gfc. i had a knack for opening up savings accounts with banks that were on the way out, like countrywide.

I think the complaint about the buybacks is overblown. If they had paid out the money in dividends instead then the stock would have risen because “OMG… look at how big their dividends are.”

Stock buybacks are just a tax-friendly way of distributing profits. They work better for some companies than others. But these are financial companies… not manufacturers. They aren’t going to use their profits to invent some great new product that they sell to the world.

The reason that financial companies are taking it on the chin right now is not because of the buybacks but because of the fundamentals of the finance industry. With inflation QUADRUPLE what it was a year ago, now is not a good time to have issued trillions of dollars in debt.

“They work better for some companies than others.”

Stock buybacks also appear to work better for some shareholders than others…

Insiders with options can exquisitely time the market. They can set up a plan in advance that gives them the means to strategically convert their options with no insider trading liability.

SpencerG,

Share buybacks are stock market manipulation that has been legal since 1982, and that’s all they are.

They don’t “distribute profits to shareholders,” that’s just nonsense. They’re buying shares from SELLERS, and those sellers are then no longer shareholders. They’re buying shares from traders with the SOLE purpose of creating demand for those shares and drive up their stock price. That’s all they do. And they’re burning capital/cash to do so.

What you’re saying is the same old propaganda that has been spread around for four decades.

Paying dividends to existing shareholders is what a corporation is supposed to do.

I have thought about this and collusion would still be possible if corporations bought each other’s stocks, which happens all the time. Hard to ban or enforce that, especially with the SEC so corrupted, captured, toothless and defunded.

No, share buybacks are positive for shareholders under one and only one situation:

When the company buys shares at a price that is under book value.

Of course, many on this site aren’t old enough to actually have the experience of seeing shares sell for under book value on the stock exchanges.

When a company does this it increases the book value of the outstanding shares and increases the underlying value of the remaining shares.

A bullish option : JPM almost reached Feb 28 low/ Mar 3 high 2020. Apr 13 high volume indicate a potential move higher next week.

I say with a straight face: Jamie for Prez!

Best manager I’ve ever seen. Best corporate strategist. Despite the bank-bashing I join in too. Good political sense and messaging too.

But yeah, right, that’ll happen. The people prefer a DC hack, or a game show host who plays a business leader.

Or maybe this time we’ll get that Trotskyite from New England.

So Wells Fargo is buying back stock instead of giving their depositors some decent interest on their savings. I can’t wait for the day I close out my account with Wells. I’ve already closed two accounts with them and now have only one more to go. Need to get my 2021 Tax refund delivered electronically and my retirement check re-routed and then its good riddance. Wolf’s mugs are going to get a good workout as I celebrate.

Wells Fargo ruined their reputation the day they open unauthorized accounts.

I did a check deposit there as a favor for someone, I was so sure the moment I walk in, the wells fargo reps was going to held me down, frisk for any cash, and create an account with it

Awesome statement made me laugh Could you come up with some more gems? You would be a great comedy writer.

Congratulations Swamp Creature for leading by example. Banks transacting on behalf of socially unacceptable examples are dust.

Wells doesn’t care who opens an account with them. Wells has accounts of criminals, felons, drug dealers, cartels, and anyone with cash, and needs to launder money. I found this out when some checks I wrote were stolen out of the Post Office and forged to the tune of 20K. The criminals were caught and were all Wells customers. They use the ATM machine to deposit the forged checks.,

The biggest problem with buybacks is cos tend

to buy at the top not the bottom.

Didn’t used to be that way. In the past buybacks were done when the company felt their stock was underpriced. Now it’s just financial engineering for the top brass.

Yes, totally agree.

Please excuse my crocodile tears for the big banks.

Today’s word is “schadenfreude”

I read that the market sentiment now is overwhelmingly bearish, with something like only 20+% being bullish at the moment. These numbers are even lower than during Covid…and the comments on this website are certainly representative of the general public..

TYPICALLY, however, such extreme bearish sentiment occurs at relative market bottoms…and often strong rallies follow.

We’ll see…

Trying to read sentiment is a fool’s game. Sentiment is reliably gauged only through actual transactions. Thinking you might want to sell and actually selling are two very different things.

Watch the price trend and nothing else. If people are willing to sell at lower and lower prices, that’s when you know sentiment is bad.

It would be hard to believe their managers couldn’t see anything like this coming. But the incentive structure is messed up. It’s all about the next quarter. Short termism is a systematic problem.

It is a GAAP miracle!

Every time financials are made to bear no resemblance to economic reality, an accountant gets his wings!

This was supposed to go under the Goldman 88% asset mgt decline discussion.

My internet connection dropped for a minute and I guess the threading link got lost.

stk buybacks are market manipulation for the benefit of insiders ( option compensation ) and were one of two reasons cited for the 1929 stk market holiday. Trick question 1) company reports terrible earnings 2) firm announces massive stk buyback,, stk rises 5% that day,,,,,,,, which was more important to the stk price..??

Zippy,

These large buybacks have been more or less continuous for many, many years. If it is manipulation, it is grand scale manipulation…propping up *all* shareholders.

I don’t know if there has been any academic proof establishing any correlation in the timing of buybacks and the issuance/vesting/sale of insider options (and academics love ’em some correlatin’).

I’m not saying it is impossible (perhaps the public *announcement* of buybacks is uncorrelated but the proprietary *timing* of actual cash transfers for buybacks is perfidious) but the truly huge waves occur with public announcements – making them ripe for correlation analysis. Which hasn’t been screaming about widespread abuse tied to the specific reason you give.

The more likely corruption is likely more “universal”…buybacks create a very false impression of true, enduring outsider demand for a given public co’s shares.

And without *that* support, once companies stop generating enough cash to lick their own ice cream cone, share demand/price will collapse much faster than the corporate facade suggests.

Wolf, you have said in reply to several comments that none of the big banks are in trouble. I’m not arguing about bail-ins or bail-outs or whatever government picks the winners nonsense. Let’s talk about CMBS jingle mail.

Blackstone recently handed over the keys and deed to two large office buildings in NYC. Despite silly threats from CEOs who confuse managing with attendance taking…. Many employees have flat out refused to return to the office. The Covid lockdowns proved beyond a shadow of a doubt that sitting in a cubical and looking busy for the fool in the corner office is not necessary. I know some dim witted people still try to argue the point, but two years of irrefutable evidence shows they have it wrong.

Office workers are refusing to be taxed and mugged in NYC, but there are major office buildings in NJ and CT suburbs that are being abandoned too. Just yesterday, Empire State REIT turned over keys for a large building in CT suburbs. They were offering steeply discounted rents, and no one wanted it. Companies are consolidating office space, using a LOT less of it.

A lender now owns a building that doesn’t generate enough revenue to cover the loan and property taxes. Property taxes are going to get slashed, and many muni bonds will be effected. Go ahead and deny it. This won’t be the first time NYC muni bonds went into default.

Banks and insurers that lent money to office space will discover the collateral isn’t worth as much as the loans. Obviously they won’t be getting coupons either, as inflation hits 8.5% they are getting zero. Asset liability management 101 … liabilities aren’t getting covered by deprecated assets.

I don’t know if banks or insurers or bloated municipality headcounts will take the hit, but you are seriously underestimating the effect of CMBS jingle mail

Greg,

Most CMBS are owned by investors, not banks. Institutional investors are going to lose money on those office CMBS. This includes your cherished bond funds, insurance companies, pension funds, etc. The banks own very little in CMBS. They make FEES off the CMBS and sell them to the dumb money.

Same with CLOs and other structured securities. They have been sold to institutional investors. That’s the purpose of them. That’s how banks shuffled off risks to the dumb money and made a ton of money doing so.

That said, banks hold CRE loans on their books outright (not CMBS). But for the big banks, it’s a relatively small amount. And they might lose money on some of those loans, and maybe that’s why they’re now increasing their loan loss reserves, has I mentioned in the article. Just the cost of doing business.

But there are some smaller regional banks that are heavily concentrated in commercial real estate (holding the loans on their books, not CMBS), and some of them might get in trouble because of their heavy exposure to CRE. The Boston Fed has been pointing that out for years (without naming names). But these are smaller regional banks that don’t really matter.

The debacle of failing banks during the last housing crash was approximately 465 banks in 5 years from 2008 to 2012.

That a couple of the banks (that we did biz with ) that disappeared during that time are not on the list recently reviewed tells me some were ”purchased” to hide the fact they were upside down, or for other reasons including being part of the HUGE money laundering effort going on within USA banks at that time; those included SouthTrust, Wachovia, and Colonial, and I suspect a lot of folks who had participated in let’s say ”dubious” activity with those and others likely went to Wells Fargo where they continued to be a bit loose with the rules, and perhaps do so today.

We ended our relationship with WF ASAP after they had assumed a RE second or some such instrument from one of the above without, or even asking our agreement.

Not sure why that bank even continues these days with the bad PR that has apparently now become well known???

Maybe due to the old saying, ”Bribery will get you anything. eh?

Wolf, thank you for correcting me on terminology. The big banks supposedly have little CRE (as opposed to CMBS — a legal distinction with minimal practical difference).