Great news, but not for the stock. Share buybacks gutted Starbucks. The SEC should again rule them illegal market manipulation, as it had until 1982.

By Wolf Richter for WOLF STREET.

On his first day as the new old interim CEO of Starbucks, which has been in the news for a series of successful union votes by frustrated employees, Howard Schultz told employees in a letter this morning that the company would end its share buyback program. “This decision will allow us to invest more profit into our people and our stores – the only way to create long-term value for our stakeholders,” he wrote on his first day back in the job.

This follows a huge share buyback binge initiated in October by the now departed CEO Kevin Johnson, who’d had this job since 2017. In October, the company announced that it would pay $20 billion in share buybacks and dividends.

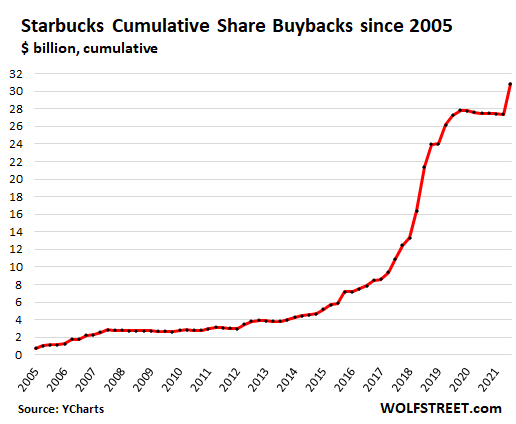

It promptly blew, wasted, and incinerated $3.5 billion in cash on buying back its own shares in Q4, according to its 10-Q filing. Since 2005, Starbucks has blown, wasted, and incinerated $30.8 billion on share buybacks, most of it ($22 billion) since 2017 under Kevin Johnson (data via YCharts).

With the buybacks, the company also hid the dilutive effects of shares issued to executives and others as part of the company’s stock-based compensation plans.

Distributing a portion of its profits to its shareholders in form of dividends is what a company is supposed to do. In Q4, Starbucks paid $576 million in dividends, and that was rich, given that it only had net income of $816 million. But ok.

But this came on top of the $3.5 billion it blew, wasted, and incinerated on share buybacks in Q4. The share buybacks were used to prop up the share price, given the lacking performance of the company’s operations. Those share buybacks were funded with borrowed money.

Over the years, these share buybacks, funded at least partially with borrowed money, left the company with more liabilities than assets: In Q4, the company’s negative shareholder equity worsened to $8.5 billion (“shareholders’ deficit,” as the company calls it). Share buybacks have gutted the company financially.

Share buybacks were considered illegal market manipulation until 1982, when the SEC issued Rule 10b-18 which provided corporations a “safe harbor” to buy back their own shares. And since then, companies have blown, wasted, and incinerated huge and ballooning amounts of cash – often borrowed cash – with the sole purpose of manipulating up the price of their shares.

Think of all the things Starbucks could have done since 2017 with the $22 billion in cash it blew, wasted, and incinerated on share buybacks. Two of the things it could have done were pointed out by the new old CEO Schultz today: take better care of its employees and stores.

“We all have a stake in our future,” Schultz wrote in the letter. “This serves as an invitation to come build it.”

Starbucks is facing a host of major issues. There is widespread employee discontent that has led to successful union votes at nine of its stores. Another 180 company-owned stores have filed petitions for union elections. This comes amid the general labor shortages that have made workers aware of their newly gained powers, and they want better compensation packages and working conditions. The company also faces large increases in costs of the products and services it buys. Dealing with these pressures is going to cost some real money.

Starbucks should have never incinerated the $30.8 billion in cash on share buybacks. And incinerating $22 billion since 2017 left it weakened, now that it is facing these operational pressures. And ending these share buybacks is a good thing for the company, and a new focus on employees and stores will also be a good thing for the company.

And it would be a good thing for the SEC to once again rule that share buybacks are illegal market manipulation.

But ending share buybacks may not be a good thing for the share price. Starbucks [SBUX] is down 4.7% at the moment, and down 31% from the high in July last year.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“And it would be a good thing for the SEC to once again rule that share buybacks are illegal market manipulation.”

~Agreed!

Too little too late and simply an action of putting lipstick on a pig. The care about our employee part is pretty laughable.

CEO Schultz today: take better care of its **employees** and stores.

Meant to say take better care of it’s top employees aka executive team. Not to be misinterpreted to mean rank and file employees

Whatever happened to Schultz’s ballyhoo’d Presidential run?

Agreed. Capitalism by definition only cares about profit. Workers are a hindrance to capital accumulation, what with their demand to be able to eat and pay exorbitant rent. Until workers own and control the means of production, there can be no justice.

I’m kinda thinking that criminality should just be criminalized, perhaps in some cases, recriminalized, but I’m for expanding the definition, and, of course, making it retroactive – as is the current norm in criminalizing ..stuff

Criminalizing criminality is not being fair and equitable

/sarcasm off

It seems our first reaction is to say “make another law to make this illegal!” without first taking the time to prioritize the key behavioral incentives that drive this activity.

It is true that company managers are shareholder agents—and are obligated to pursue projects to the end of wealth maximization. If the managers perceive that they do not have enough net present value–positive projects to pursue, they often pay dividends or do share buybacks.

However, it is also true that the practice of share buybacks does lead to inflated earnings per share (EPS), and ultimately drives stock prices higher—to the point where many companies over the last decade issued debt on an extremely cheap basis in order to buy back shares and return capital to shareholders.

All of that said, none of this gets to the root of the problem: Why do companies have no better use for the capital than to buy back their shares?

Why buybacks have become so common is because the required rates of return to equity, essentially the minimum return percentage that an investor will accept for owning a company’s stock, and a theoretical project profitability yardstick, have become so distorted over time that managers have had no choice but to return capital to shareholders.

The required rate of return that equity holders demand is ultimately the rate of monetary expansion. The rate of monetary expansion has increased progressively over time. In 2020, however, the required rate of return in terms of this thinking accelerated to closer to 25 percent as central banks embarked on unlimited quantitative easing (QE).

The reason the rate of monetary expansion makes sense as a measure of required rate of return has to do with the fact this is essentially inflation in and of itself, devaluing the monetary units that are held by the public. The purchasing power of the money declines—while this may not be evident at first, mainly because newly “printed” money often stays within the financial system, it has consequences over time, causes the boom-bust cycle that leads to widespread economic destruction roughly every ten years, and punishes savers. It has also helped feed extreme rises in the cost of healthcare, the cost of education, the cost of housing, distorts the mechanism of prices (which are the key information signal to any functional economy), underwrites the wars that never seem to end, and is right at the root of the socioeconomic troubles facing America’s once highly prosperous middle class.

Equity holders then rationally look at the monetary inflation and seek to park their capital in places where it will keep up with or exceed the rate of monetary inflation—they do this so as to maintain or enhance the purchasing power of their capital. This capital had flowed into the equity markets in the first place due to the inability to earn sufficient yield on savings accounts and other traditional fixed-income investments. In light of inflation, a managerial team’s duty to their shareholders becomes to grow the company at a rate that exceeds the rate of monetary inflation, and help the shareholders maintain their purchasing power.

Ultimately, what this problem comes down to is that we need sound money. We need better means to transmit value not only through space but through time—purchasing power needs to be reliably transmitted into the future. When people are more confident in the money of the society—that it is a reliable, immutable store of value, medium of exchange, and unit of account—then free markets can and will work, enabling the enterprising to create products and services that serve customers and create jobs, raising the standard of living through time.

Brian “Why do companies have no better use for the capital than to buy back their shares?”

Because CEO bonuses are linked to share prices rather than customer satisfaction or reinvested profits. Change the bonus structure and I bet all of a sudden better uses will be found.

My question with inflation as it is….what percentage of their former market is going to be able to afford their products? 60-70%???

Travelling in 3rd world countries, I have found as long as people can afford a once a week treat such as a beer, pizza, etc the masses are fairly well content.

Any ideas here if inflation gets to the point where these little treats to blow off some frustration or steam become unaffordable?

IMHO all Starbucks products will remain affordable for all of their customers to buy, but will shrink in size. That would not be a bad thing for the customers – Starbuck’s “small” coffee is quite large, and their “large” is so large that one can take a bath in it. Its not good at all for customers health to consume that much coffee or sugary drinks. By keeping prices stable while reducing the servings, Starbucks will actually do good to their addicts … oops .. I meant customers.

I’ve heard Starbucks has new products in the pipeline called espresso and cappuccino.

Starbucks has always had espresso – when I went there, it was my favorite (most of their stuff is waaay to sweet); an Italian co-worker says it’s pretty good.

Pete’s Coffee is even sweeter.

Life is good at work – we have a Jura superautomatico espresso machine and a Nespresso.

I resemble that remark!

Notice how Starbucks names their sizes tall, grande, and venti without actually specifying how many ounces?

Brilliant move! Just downsize each cup by 1-2 ounces and keep the same name! Save a few trees with the smaller cups and keep the same names.

BTW, did you know that when buying an N cup coffee maker, you have to watch what size the cup is? European cups are 4.25 oz.. US cups are 8 oz. Buy an American made coffee maker to make the most coffee.

The cost of the good sold is nothing. Shaving that amount won’t save them much at all. It’s flavored water. The expense is in the real estate and the employees

Venti is 20 in Italian. They’ll have to rename that one diciotto – 18.

The old term for shaving weight from the product is ‘shrinkflation’ I presume.

With the compounding effects of inflation, Starbucks might come out with little tea light candle sized ‘sampler’ sizes in a few years.

Bob,

I’ve a Walmart special made in Chyna for 13 bucks. Use old Fire King cups and usually drink about ten cups with the wife every morning.

I don’t believe it will remain affordable for a noticeable proportion or majority who’ve made it a daily habit (or near it), though have no idea how WFH has affected this habit or how much of the company’s revenue it represents.

$5 per day or whatever it is adds up. It’s over $1,000 per year.

Same idea for many other expenditures, which aren’t actually affordable to a noticeable percentage of the customer base of other companies either.

It is a habit and an addiction.

Sleep in, wake up too late to make your own coffee at home and the Starbucks drive-though is convenient on the way to work. Most need some stimulant in the AM before work. It is an addiction.

Good coffee, I agree. However, the important thing to most of my co-worker addicts is that it is VERY repeatable quality. The same taste and quality every time. Compared to some local coffee places I have visited.

I still prefer my 20 cent per cup coffee at home (amortized over the life of my more expensive US coffee maker) but while traveling, Starbucks $3-$4 coffee is always consistent. Spending $4 per cup per day is less painful than buying a new good coffeemaker at home. Less painful until you add up all of the $4 spent.

Off topic, but while traveling, I am now heavily addicted to Dutch Bros. All of the caffeine and twice the sugar.

“By keeping prices stable while reducing the servings…” That’s called INFLATION and it’s also called THEFT.

Worked a lot of retail jobs in my time, but hung in for over 4 years in my late teens/early 20s at Starbucks in the early 00’s. They paid a relatively decent wage, the benefits were far better than anything I’ve had since working in the medical field, and far more affordable. The tips covered my car payment, and I got to befriend all the locals and cops. Got out of many a ticket back then. There was always opportunities for advancement, tuition reimbursement and fringe bennies. Helped me get by in one of the most expensive areas in the country.

Knew something was up when employees were griping, quality went down and there were calls to unionize, but didn’t realize Shultz wasn’t CEO. Not sure what ended his tenure (or when) but can see him reinvesting in the labor force as priority.

Say what you will about Sbux and I’ll agree, but it was a pretty solid job for a non-professional BITD. We had a lot of moonlighters for the benefits alone.

I had a slightly different experience. I got $10/hr in 2019, when my other jobs were paying me $15/hr+. Benefits were nil as I didn’t hit the 20 hr requirement for 6 months they current have before they start. Tips were $1/hr. I got called in a lot asking me to pick up shifts and many times they scheduled me during my unavailable hours and I had to correct them. Managers were nice at my store and training was adequate. But it was no better than any of my other jobs.

I agree with Wolf, buybacks are mismanagement when you can just increase dividends, which would have the same effect, and using debt to finance them (similar to a cash advance on a credit card) leaves a company with debt with no asset to show for it.

And that’s why they are unionizing.

I made $10.50/hr in 2003. Our tips were $2.50-3.50/hr — it was a VERY high income & Old Money area, our store made the most tips regionally.

Regionally, wages were higher and I was a Shift Supervisor, but still, that’s one hell of a wage stagnation for you Jeremy.

When I started, we manually tamped espresso and hand adjusted/worked the burr grinders. Silly as it sounds there was a bit of an art to pulling an espresso shot. I had a suspicion bringing in those awful automatic press button espresso machines were gonna be an excuse to drive down wages. Place is practically a Dunkin Donuts now.

Except dividends are a form of double taxation,but these stock buybacks are true fraud

Then dont own business via corporate entity form… That will solve double taxation issue champ

Sole proprietor ship is the solution for you!

Dividends are different than buybacks. Both reward the shareholder.

Dividends pay quarterly and are taxable yearly. Good for long term investors.

Buybacks drive up share price and are taxable when you sell the shares as a capital gain.

Company executives are paid with stock so the higher the share price, the more immediate gain for them. They don’t have to wait years for dividends.

Stock options do not pay dividends until they are exercised so I can see why company executives prefer having the stock price increase vs having to pay to exercise before receiving the dividend. Plus nobody exercises their shares if the option price is higher than the market sell price. The goal is to drive the stock price higher to preserve executive options.

Am I being too simplistic?

Executive compensation levels in the US are a corporate governance problem.

I’m ok with someone making a windfall when they actually did something that contributed real value. Bob Iger buying Marvel, Pixar and Lucas Film to integrate it with the other Disney intellectual property seems to be an example.

OTOH, I don’t believe these people should make a windfall just because the stock price benefits from an asset mania which is the lopsided majority of them.

Sorry, I don’t quite grasp your comment. If a CEO is paid in stocks they get a quarterly pay out. Kind of like a bonus. However, they can also require the company to buy back stock at a financial loss to the company. In turn that allows the CEO to make even more money on quarterly returns? Almost a legal way to borrow money from the company to line their pockets? The SEC allows this? The same SEC that enforced SOX compliance allows this? Do I understand this correctly? If so, it’s like the SEC legalized an Enron tactic! My goodness. I really hope I misunderstand.

Gabby Cat,

The corporate board of directors authorize stock buybacks. They may decide on buybacks to stabilize the share price.

Or legally, I believe they could reward their CEO friend who will get them their next job with an over-inflated stock bonus by using buybacks to drive up share prices.

Legally, the board is liable for the health of the company so I suspect any buyback decision is run by their lawyers to at least not appear to be blatant cronyism. However, many on the boards are current or former CEOs. They are part of the 1% club by birth or success.

AFAIK, dividends require taxes to be paid first – so are less “efficient” than stock buybacks.

More importantly, stock buybacks are at the discretion of the company – i.e. can be used to drive stock prices higher during CEO compensation package measurement points whereas dividends are regularly announced quarterly events.

SBUX had $3.9B in debt in 2017, now has $23B in debt. Effectively, they borrowed $20B to buy shares

Yeah… it looks bad.

Other the other hand their stock price increased from $54 when they started (Q4 2017) to $88 two years later… and went up to $120 over the next two years before coming back down to $88 today.

Market Cap went from $77 billion then to $103 billion today (peaking at $144 billion in July of 2021).

It kind of looks like they borrowed $20 billion to buy $26 billion in market capitalization. I am not really seeing how that is a good use of shareholder funds since there are interest payments to be made on that debt.

It is unethical , immoral and obscene for corporate management to vote themselves gigantic stock bonuses while the average employee hourly wages hardly budge . We are rapidly moving towards a Marie Antoinette moment in the US

So, what is the average pay for a Starbux barrista?

Penny saved is penny gained…

It is much easier to SAVE this penny by shifting earnings from dividends (taxed as income) to share buybacks than to EARN that penny by peddling overpriced coffee.

If share price crashes once in a while – so f… what ??? If one is a properly domiciled big time investor then losses can be carried forward up to 10 years.

Countries with a ZERO capital gains tax:

Bahrain, Barbados, Belize, Cayman Islands, Isle of Man, Jamaica, New Zealand, Sri Lanka, Singapore etc.

Cue:

“List of countries by tax rates – Wiki”

Now lets conduct a thought experiment.

Suppose every individual and every corporation starts paying 100% of taxes due.Will the budget deficit disappear ? I predict that it will keep growing at a faster rate 😁

What a bag of BS. All of sudden they discovered their employees? Lack of Free money killed buy backs. $20 cup of sugar and fat disguised as coffee is on the way and the spin is straight from Wharton. “It’s for the love of our employees that you pay $20”. Kiss my fat ass. Better pack a lunch, it’s huge.

I’ve only been to Starbucks 3 times in my life…

Two were out of desperation…

It just seems so “complicated”…

The first time, when I ordered a cup of coffee, I wasn’t prepared for the 6 follow up questions from the person taking the order…

I just wanted a cup of coffee…

If Starbucks went away, it wouldn’t bother me…

I don’t use them…

Lots of places to get a cup of coffee…

I have friend who likes it and I occasionally go there for that reason. I order hot chocolate which is pretty good, and simple.

I have a cousin the same…

She can’t pass one up…

Me, apparently I’m either not sophisticated enough or too cheap…

Or both….

I have to agree with you Dr. Doom. It’s not surprising that Schultz is now trying to be “champion” of the employees right after the unions show up. I suspect that won’t keep them at bay as once the unions get in the door, they spread like Covid.

It was common for my friends and family members to get a flavored whatever once in a while at Starbux, but now that quality went down and prices went haywire that’s not even being mentioned anymore.

The Fed is still pumping this market, and despite that Starbucks stock is pulling back, and their stock is 30% off the highs. (Consumer discretionary is out of favor). The goal of buybacks is to shrink the float and then eventually take the brand private. The money ends up in the oligarchs pockets, the company gets downsized to what it really was in the first instance, a niche retailer. Or they convert their market cap to crypto.

The Starbucks drive-thru lines, that I’ve historically seen spilling out into the road and disrupting traffic, always looked like a “going to the office” crowd.

I’m sure there’s all kinds of overlap, but they always seemed to be primarily selling “white collar” coffee.

Now that many of those customers are working from home (or hybrid) I wonder if Starbucks isn’t taking a hit from that? And, assuming some decrease in traffic, won’t that make it harder for them to raise wages significantly?

What’s the hit to bottom line with unionization of all stores…

Higher pay, increased bennies, etc…

30% or so per store, maybe ?

Do they keep a lid on prices for the Arabica Paramours or do they accept much lower revenue and a falling stock price? Start cutting locations? Dividends?

That 30b would look good in the back pocket right now…

Unbelievable mismanagement to burn up $30B. And it often recycled through options into insiders’ pockets.

Milton Friedman’s 1970 NT Times Magazine article heralded the arrival of the “maximize shareholder value”-as-only-responsibility-of-a-firm era. Now the broader (though still vague) stakeholder value era is very trendy especially in large public companies. Dimon came out in favor of it awhile back. Now Blackrock’s Fink too. The idea is, huge gaps in problem solving fell through the cracks. The new mantra is ESG (environmental-social-governance). SEC is on the bandwagon with new climate change accounting rules. Shareholders might not be so pleased. But as an investor, I was pretty disgusted finally with these distorted buybacks while public companies often piled on debt behind it.

Starbucks was never my style.

“Unbelievable mismanagement to burn up $30B.”

Mismanagement? It was a feature. Follow the money.

The concept of “stakeholders” is to rationalize transferring defacto partial ownership to those who don’t actually own it. It’s a backdoor form of limited private socialism by turning corporations into semi-social services organizations.

C-suite is now in favor of it presumably to avoid a PR nightmare leading to a hatchet job on their compensation, which is exactly what should have happened to most of them a long time ago.

C-suite didn’t discover “religion”. It’s a form of bribery with shareholder (someone else’s) money.

Agreed. Philosophically, there are a lot of thorny problems with trying to be a “saint,” especially with others’ resources. But it makes a splendid smokescreen. Managers can cover incompetence with all sorts of new excuses. They had the “business judgment rule” which could explain way various choices that didn’t turn up profitable. But here, they can be “saving” ________ (fill in the blank with touchy-feely emotional claims) as a reason.

If I wanted to accomplish some social goal, I (like anyone) could (arguably) more efficiently do so by donating to a non-profit. But confusing a for-profit with a non-profit (especially without clearly stated goals) invites a world of mischief from all sides.

This has been the game since 1980’s……

Issue a gazillion options to the executives on the basis of tying their performance to the well being of stockholders…..as if a salary of $10,000,000 is not enough to get you motivated.

Buy back gazillions in your own stock on the basis its undervalued. In most cases the price being paid is well above the book value of the company.

Driving the company stock up in price to crazy levels. Executives sell their optioned stock and make a killing.

Except in rare cases…….all this is revolves around stealing from the shareholders who are powerless due to the board of directors being in on the options.

The executives are long gone before any financial harm strikes the shareholders.

Just about every company is doing it…..hollowing out their balance sheets with all these newly issued shares that are issued for pennies.

A ponzi scheme put on by those great folks complaining their costs are increasing.

No mention so far of the customer, or the culture.

Coffee, in the 1960s cost 5 to 10 cents per cup, refills free (can’t find the cents key on this typomatic). Using my add-a-zero method to convert that to today’s money, that would be 50 cents to a dollar.

And tuition at the local University of Michigan was $25 per semester, just half of what it was at UC Berkeley. So that’s $250 to $500 dollars today. Chump change. The common good superseded corporate profits. Imagine!

Coffee was a draw, close to a loss leader, which brought people through the doors. If you’re too young to remember, humans were then referred to as “people citizens” before consumerization, after which we all became consumers.

A couple comments say that working at Starbucks enabled them to move into ritzy neighborhoods, enabling them to rub elbows with posher patrons.

Now, as an old fart, I’ve been a steady customer of the Duke eye clinic which used to have the nicest lady with her coffee cart, giving it out free. No more -she’s been displaced by a Starbucks – $3 and UP per cup. Want a refill? Pay up or get lost.

Personally, I wish Schultz would buy back ALL his shares and go home.

If buy backs are banned, how can float of a stock be reduced? Pros and cons?

reverse split.

Put the Lambo in reverse and split for a jurisdiction that doesn’t have an extradition treaty.

The Ferrari FS90 Stradale has no direct link through the transmission to the twin-turbo V8 to go in reverse. One of the three electric motors is dedicated to push it backwards.

A Stradale is really fast going forward, sure, but phleep’s right; take the Lambo for that job. Leave the Ferrari in the garage.

This is the way I view company share buybacks.

In a free market, the float is the outstanding shares of stock available for sale to the public.

If the float (supply) is too high, this means the demand is low for that price. The stock price should fall until demand returns. The market demand should stabilize the float at a price.

If a company has excess cash because the company is doing well financially, there are options for the company to invest this cash.

1) Employee salaries and hiring new employees.

2) Company infrastructure

3) R&D for the next product.

4) Stock buybacks to raise the price of the stock for all holders.

If a company is creating artificially strong demand with buybacks, then the stock price will artificially rise. The company is using excess cash to reward their shareholders with a high stock price instead of the other options above. The people not complaining are the shareholders, company executives, and lucky employees who may be paid partly in stock or participate in an employee stock purchase plan. The people who are complaining are the same if the stock buyback stops and the stock price drops to market levels.

In my opinion, stock buybacks are useful in a market crash. In an irrational sell-off, due to the high float, stocks can plummet far below the fair value of a profitable company. Before corporate raiders step in, a company can stabilize the stock price, and if all companies do this, stabilize the entire market.

They are also useful to stabilize short-term crashes in a particular company. ie one case of food poisoning at a restaurant chain location could cause panicked sellers to sell driving the stock to irrational lows before it recovers.

In a completely free market, the company board of directors should be able to use excess cash to buy back shares if it benefits the company. If the result benefits only a few in the short term, then there is a problem. ie a CEO receives $10M in inflated stock with no actual benefit to the company. The CEO can then take his money and run leaving the company to ruin. The company board should prevent this and they are legally liable to shareholders. This abuse is legal but open to shareholder lawsuits.

If a company board is borrowing money at a low interest rate for stock buybacks which drives the stock to a higher % level in the short term, this sounds like Fed interest rate induced gambling.

I remember a joke about aspiring authors would spend all day there. Any successful book came out of that? 🤔

Zark Muckerberg,

I don’t know about the joke… but people who are working at home all-day-every-day like to get a change of scenery every now and then and maybe have some people nearby, in addition to getting a caffeine fix. The newly minted working-from-home crowd is discovering that too. Except they’re not going back to the cafe downtown, but to the cafe in their neighborhood.

There is demand for cafes. People like sitting in them. Starbucks just happens to be biggest chain. But there are also lots of locally owned cafes. And they’re really a great place to hang out during the day for an hour or two every now and then. In addition, they’re great for business meetings when you work at home. The double-espresso and the lemon tart are table rent. Speaking from experience.

I completely agree with Wolf. As someone who WFH, I will gladly over pay for one cup of coffee every now and then (like, once a month or less) to drink something nice, be around people, and to rent some decent real estate for a couple of hours to work on my laptop.

When you take into consideration that many Starbucks cafes are in prime real estate areas, I don’t think the coffee is a total rip off if you factor in 10-15sf of commercial real estate rent for a couple of hours.

The real people who are getting ripped off are the people purchasing $8 high margin drinks every morning as a habit through the drive through.

I agree!

If I am traveling, with a few hour break between appointments, I head for a coffee shop with internet to get some work done.

$5 for a hot beverage while working makes it feel like home and is cheap rent.

I am not sure about book, but one travel guide was born in Starbucks. The title is: How to get all-day free internet for a price of one coffee.

It was plagiarized a few dozen times, and made it into a Hollywood movie.

No. They are all still aspiring. Posers.

Buybacks (along with mortgage backed securities) are probably the financial original sin and should have never been legalized for obvious reasons, at least if you care about financial inequalities. They have always been for the purpose of market manipulation. But, really, this is a tax system malfunction (is “malfunction” the correct word when the action is intentional?). Start taxing the buybacks as the regular income they truly are and much of the abuse in the system would dry up very quickly. And if you think calling yourself an “investor” entitles you to a lower taxation rate, well, you’re part of the problem. As for Mr. Schultz, I don’t recall him as a crusader against buybacks and investing in “our people” when he ran for President a few years back.

But I’m not a good guide as to coffee. I’ve had maybe 20 cups of coffee since my waiting-for-my-newspapers-at-Dunkin-Donut days in 1969 (Dr. Pepper was my addiction of choice then before switching to cane sugar lemonade mixed with unsweetened tea about 10 years ago during the day before settling down with my evening Dos Equis served in my chilled Wolf Street mug). But I’ve obviously seen the Starbucks around. And I’ve wondered about these coffee drinkers, with the motors of their 3-Series idling, in line to steady themselves for what the day would bring. How is a $6 cup of coffee sustainable? I’d silently ask myself, being of the belief since 2006 that most commerce has just been the government propping things up.

Of course, maybe if I’d had a bit more coffee I’d have recognized I was staring at the greatest wealth creating period of time in history. That is, if you knew the government was going to seeming randomly inject trillions into a mature economy and knew when to get in and get out. Seems to me the smart money got out the day the CEO of Microsoft liquated his holdings in his own company. I didn’t need fancy coffee to hear myself thinking, “Houston, we have a problem”. I needed a good accountant who drank more coffee than I did.

I don’t get it. If you are unhappy with your retail job, quit and go somewhere else. If you are an investor and you don’t like the way the company is run, sell your stock and invest in one you do like. Why all the angst?

Look !

Another believer in “choices” without limits!

And “choices” that are virtually identical.

Why?

Are you the assistant manager?

Oh, that’s right you nail things together, owl eyes and all.

“Why?”

Because you’re apparently unskilled? On every occasion where I’ve asked you to share your supposed superior profession after you have insulted every skilled tradesman the world over, you disappear like a cockroach when the lights are turned on. You’re a coward.

Starbuck is just one of the many, many examples of the economic malpractice that so many US corps are engaging in. People see it and hate it, hence the angst.

The loose money was a smokescreen. Maybe now some truth will be revealed. I expect dozens of accounting scandals.

I wonder if the $3.5 B loss is as bitter tasting as their coffee?

My coffee is on sale at my grocery store for $12.99 per 32 or 28 ounces pre-bagged. It’s story is a nice one.

In 1978, Janie & Jim Cameron start a little coffee business. In 1993, they expand. In 2008, they open a large roasterie in Shakopee, Minnesota.

Here’s the good part: Two and a half years ago, Cameron’s was sold to a coffee company located in Columbia, Grupo Nutresa, — for $113 million. That’s how you run a coffee shop.

I’m enjoying a cup of organic Colombian, medium roast whole bean that’s six-fifty a pound. Life is good in Minneapolis.

Schultz is widely hated in the Seattle area…even more reviled than the other local perp biz celebs, Gates and Bezos. Smarmy, a liar, and especially hated by local blacks who adored their Seattle Super Sonics. At one time, Schultz owned the Sonics. He decided to sell the team but promised Sonics fans he would sell to a local buyer only and keep the team in Seattle. Instead, he sold to a couple of oil and gas crackers from Oklahoma City who immediately moved the team to their horrible chigger belt state. Proven liar and poisoning the world with glycemic glycophosphate laced concoctions.

@nsa:

Clearly you do not understand the joy one can derive from selling a popular basketball team in a progressive city to some Oklahoma “oil and gas crackers.”

Why be rich if you can’t bite the hand that feeds you?

lol this comment made me crack up and rings totally true to every local seattleite who knows the Howard Schultz history.

nsa, you have been found out – you are from seattle

I agree! shitty coffee. They can go broke for all I care.

Wolf,

As others have noted, Schultz is too late. The underlying business is slowly rotting away. Operating margins in slow decline. Net margins in brisk decline.

$1 B in LT debt matures in the next two months. $1.75 B matures in 2023. Of course the share buybacks had to cease. The dividend looks shaky too.

Looking at a bleak future of higher labor costs, higher raw material costs and crimped consumers. This one can’t be fixed unless Sgt. Schultz wants to shrink the company materially. Over 80% of revenues derived from company-operated stores.

Never did understand the devotion. The coffee is horrid.

> Schultz is too late.

His reappearance here is a confession of this. I’m not equating these, but remember when Ken Lay got back on top at Enron?

They started in Seattle where bad coffee comes from. If they were a Minneapolis startup the coffee would have been fantastic. /s

Anthony A.,

In December 2012, Caribou Coffee of Minneapolis was acquired by Joh. A. Benckiser Group out of Germany for $340 million. (Controlled by the Reimann family.)

Carabou was founded in Edina, Minnesota by John and Kim Puckett in 1992. Edina is a western and affluent suburb of Minneapolis.

Cub Foods also sells Caribou whole bean coffee. It makes a good cup. But Cameron’s is also a good bean, with a nice selection of different types and roasts, at half the price of Carabou. Yes, I have a few types of Cameron’s in the pantry, and no Carabou.

For depth on Starbucks losing it’s way, see the recent Fast Company article about how they have strained and demoralized employees. and are working hard to automate the soul out of the company.

Share buybacks should only be undertaken when the price of the company’s shares are trading below book value and done for cash.

Simple.

That benefits the company and remaining shareholders.

Go given the ridiculous price to sales and price to book value of shares in the USA there shouldn’t be any share buybacks being undertaken.

Some of you may be old enough to remember when shares actually traded under book value, but I doubt it.

I didn’t mind hangin out at Starbucks but when homeless bums started taking over the place I stopped going there. And the Coffee there is overpriced and sucks. I prefer Duncan Donuts. I even buy Duncan Coffee and use it at home.

Have had ONE SB cup of a liquid that was alleged to be coffee when stranded, almost broke, in an airport; the coffee was atrocious, literally not drinkable, but the employees were very sweet folks, good natured at 0400.

Grew up with what I now know was ”cowboy coffee”: throw the grounds into the water and boil it; didn’t drink much and only when needed to drive all night, etc.

Best ”commercial” coffee WAS at Peet’s when Mr. Peet ran the original shop at SW corner of Walnut and Vine in Berkzerkeley in the late ’60s: Co worker and I walked up from the house we were remodeling, he with his own cup, I had to get one due to not having the habit, the line was all the way down to Shattuck,, OMG was it good!

Have used the “Chemex” system for decades since, with the unbleached paper filters and NOT boiling but hot water – ( 190 degrees F is recommended. ) This produces coffee as strong as one may choose with little or none of the noxious oil/bitterness, etc.

Coffee is healthy ONLY when consumed BLACK and not sweet is now generally accepted by most researchers on the subject.

But, ”De Gustibus Non Est Disputandum” rules, eh, and I still know a few folks who regularly drink a lot of cowboy coffee to this day…

Not everything is lost for Starbucks yet.

I like to have a martini,

Two at the very most.

After three I’m under the table,

after four I’m under my host.

(Dorothy Parker The Greenwich Village Poetess)

Starbucks can be a place to go to even for people who hate coffee and just want to get quietly drunk in splendid solitude w/o participating in bar fight.

Around 2018 Starbucks started serving alcohol and introduced “Evening” menue and “Roasteries”.

Idea did not quite catch up yet SOME people who are totally not me STILL manage to make cocktails at Starbucks from lemony drinks spiked with 50ml Absolut vodka mini-bottle when sharp-eyed Barista is not looking.

Gotta love the negative equity for shareholders that keeps increasing year after year. Buy stock and get? Less than nothing! LOL

Wouldn’t stopping share buybacks exacerbate the inflation problem? If the money spent is redistributed more broadly to the rank-and-file workers, lower-level improvements, and whatnot, wouldn’t the common worker spend more on everyday goods and services further troubling the supply/demand imbalances?

When lots of money is sent to wealthy shareholders, there are fewer families to service with everyday goods and services in that case,

Note that I am *not* favoring buybacks, but I do think ending them should have occurred in a lower inflation environment some years ago rather than today.

Ending buybacks now might have a perverse inflationary effect nobody wants.

I’d almost go so far as to suggest holding off ending share buybacks and/or regulations towards that aim until the inflation problem is under control once more and THEN press forward with the buyback issue.

It’s not rank and file workers causing the inflation. It’s stock and RE owners that are spending, courtesy of the wealth effect.

Stock value down.

The value of the share rests on the ability to extort their workers. The higher the surplus value and the lower the wages, the more capitalists keep.

So why is the USA stock market so high? Because your workers are so low.

Does it fee like every single thing you were told growing up wasn’t true?

“But ending share buybacks may not be a good thing for the share price.”

May be in the short term yes. But if the money used for share buyback is put to good use, in the longer term it will be a good thing for the share price.

“And it would be a good thing for the SEC to once again rule that share buybacks are illegal market manipulation.”

But then who expects the SEC to do what is a good thing. Another arsonist in the guise of a firefighter.

Per Jon Stewart’s interview with Gary Gensler, the SEC is so underfunded by Congress there’s a coffee donation collection in the break room.

Sbux has the upper hand still.

Perhaps if the SEC employees didn’t spend all their time viewing porn or angling to get a job with the companies they oversee, they would be able to enforce the law.

Perhaps if the SEC employees would stop using their work time to view pornography, the SEC could do their job.

During the past 5 years, the quality and appeal of Starbucks has been dramatic. The once clean, well-regulated shops I used to visit are now threadbare, disorganized, filthy relics, manned by sad, fatigued employees. The scumbags who hollowed out this once great enterprise enriched themselves at the expense of shareholders and employees. Sadly, the immorality of their behavior is not limited to Starbucks, it is ubiquitous, and had transformed our country into a shadow of its former self.

Good summary of ”Corporate USA” RA.

What I forgot to say earlier, above, was that I could not and still cannot understand why any rational person would pay ANY money at all to buy the coffee I had at SBs.

And to support your 5 years comment, my experience was several years before then, and the employees were good.

Companies with unions always fail in competitive markets. Retail coffee is very competitive. It’s relatively easy to set up a coffee shop. Between higher costs and efficiency killing work rules, SB’s union stores will fail. On the other hand, SB’s woke policies towards their employees probably didn’t help SB.

Investing in or proclaiming that “Our people are our single most important asset” is a sure sign that cuts and grief for those people are now on the way. 40 years in corporate life teaches you what those proclamations portend.

I love going into Starbucks, plopping the kids down in a comfy seat, plugging in my power tools to recharge ’em, use their bathroom, breaking out our lunch and drinks from home always making sure to mention to all the employees how important a union ism and if they want to learn about the economy, give them slips of paper with Wolfstreet.com written on them.

Oh, and we never spend one cent in there, except for few bucks in the tip jar.

Is there even ONE truthful sentence in your post?

Humor, to lighten up our sour mood — that’s how I read it. And it lightened up my sour mood :-]

Yeah, that makes sense 😀

It would be interesting to know the number of stock options exercised by executives…shares pumped to enrich those executives.

This feels like what venture capitalists do to the businesses they rape

I’ve got bad news for you about the new old Starbucks CEO who “gets it”: he’s announced that Starbucks is getting into the NFT business. I wish I were joking.

That’s what he’ll be doing instead of stock buybacks.

They’re trying to create and SELL NFTs, and make money doing it (or for marketing purposes), rather than buying them. No one wants to buy NFTs. Everyone wants to create and sell them LOL

I lost respect for Kevin Johnson in 2020. He wanted reduced store rent due to covid. My first thoughts were the wasted money on stock buybacks.