A peek into the glass and windows shortage.

By Wolf Richter for WOLF STREET.

Shortages of windows and glazing have been reported for months. A survey of homebuilders, conducted by Burns Real Estate Consulting and released last week, found that 63% of the current construction delays of homebuilders are due to the shortage of windows. Lead times that were normally 2-3 weeks reached 4-15 weeks and for some products extending to 20-45 weeks.

Further up the pipeline, there is a glass shortage. When exploding demand that started last year hit labor shortages and material shortages at glass manufacturers, they were unable to run at full capacity and were unable to meet that demand. They started prioritizing what they make and put their customers on allocation.

This has affected all kinds of glass products, glassware, light fixtures, glass-doors, shower partitions, windows, and even WOLF STREET beer mugs, whose production has been “deprioritized” – it uses a lot of glass and is a low-margin product for the manufacturer – since the end of May, triggering the infamous WOLF STREET beer mug shortage.

Window manufacturers that buy glass and manufacture window frames and glass-doors are running into their own problems. “Window manufacturing – even in the most automated facilities – is very labor intensive, which makes the industry even more susceptible to labor shortages,” Burns Consulting said in the note, pointing at PGT Innovations [PGTI] and Cornerstone [CNR], which both blamed labor shortages in their earnings calls.

The supply of resin, which is used in the production of vinyl, which is used as cladding for some window frames, was disrupted when the Big Freeze hit Texas and the Gulf Coast. According to Burns, lead times for vinyl have expanded to 4-15 weeks, with some window manufacturers seeing 20-45 weeks. Manufacturers switched to alternate products for window frames, such as wood and aluminum, but they’re running into aluminum shortages….

Construction companies are trying to sort their way through this with alternate materials in order to avoid pausing a project because of shortages of all kinds, including some petroleum-derived insulation materials (due to the Big Freeze), steel beams, roofing materials, copper wiring, plumbing fixtures…

Builders have encountered shortages of a whole slew of appliances, making it difficult to deliver a competed house. And costs are surging across the board.

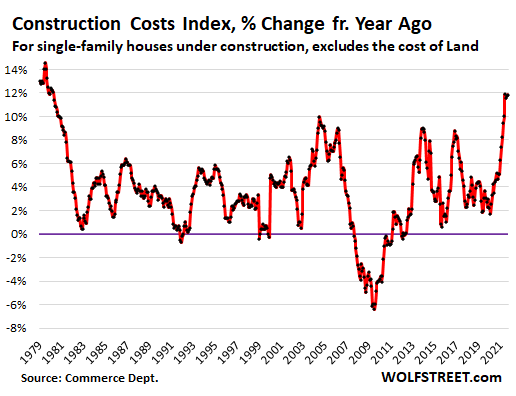

The index for construction costs of singled-family houses spiked 11.8% year-over-year in September, unrelenting in this range over the past four months, and the most since 1979, according to data by the Commerce Department today. The index is up 17.6% from September 2019. This excludes the cost of land and other non-construction costs:

The market for new houses: a mess where the lower end died.

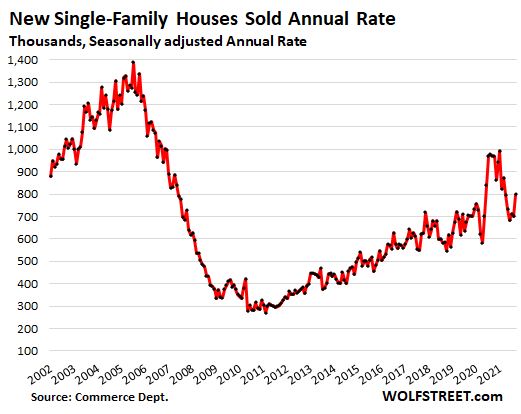

Sales of new single-family houses in September rose from August, but were down by 18% from September last year, at a seasonally adjusted annual rate of 800,000 houses, according to the Census Bureau this morning. Sales are far below their 2002-2007 heyday, as housing demand shifted to urban cores, triggering a large-scale construction boom of condo and rental apartment towers and mid-rise buildings, that are not included here. This is only single-family houses:

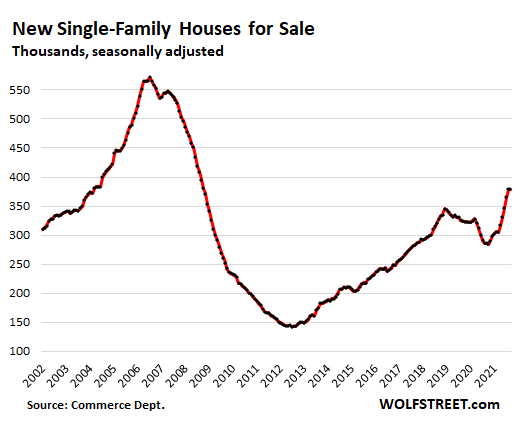

Inventory of houses for sale highest since 2008: Total inventory for sale – houses where construction has not yet started, houses under construction, and completed houses – at 379,000 houses in both August and September was the highest since October 2008:

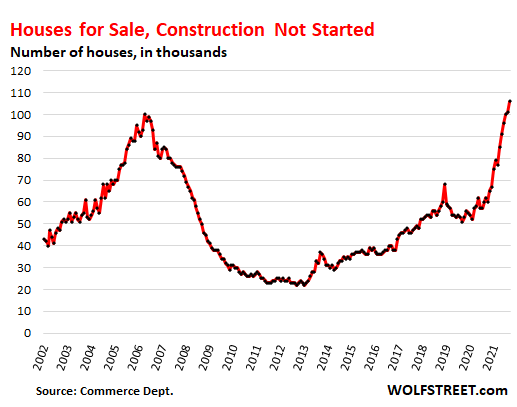

Inventory for sale by stage of construction. A record of 106,000 single-family houses for sale have not yet been started as many projects are delayed by shortages of materials and labor:

Another 237,000 houses are under construction.

Unfinished houses – the total of houses where construction hasn’t started yet and houses under construction – reached 343,000 in August and September, accounting for a record 90.5% of total inventory for sale in August and September.

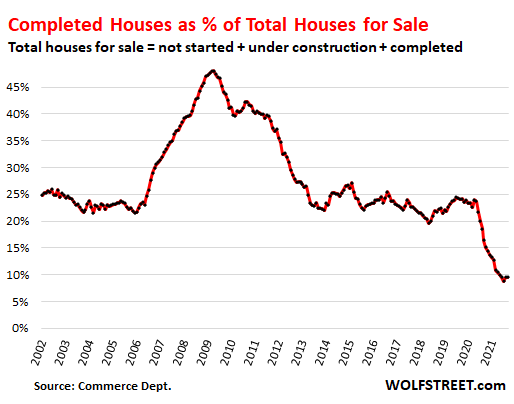

Completed houses for sale, at 36,000 in August and September, accounted for 9.5% of total houses for sale, a record low in the data going back to the 1970s – compared to the 25-year average of 28%:

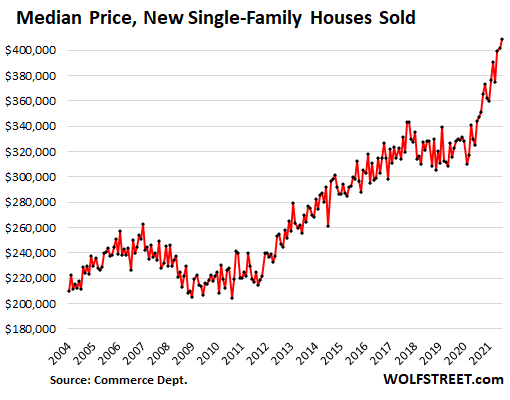

Prices continued to spike as the high end boomed and the low end died. The median price – half the homes sold for more and half sold for less – rose to a record $408,800, up 18.7% from a year ago.

- The low end died. Almost no houses were sold under $200,000. Land and construction costs have outrun this segment of the market.

- In the $200,000 to $300,000 range, only 12,000 homes were sold, 19% of total sales, lowest on record, down from a share of 29% a year ago, and from 35% in September 2019.

- The $300,000 to $400,000 range accounted for 24% of total sales.

- The $400,000 to $500,000 range also accounted for 24% of the sales.

- And the high end, over $500,000 homes, accounted for a record 31% of sales.

The median price is skewed by a shift in mix, and part of what we’re seeing here is the death of the low end, and the boom at the high end, as sales have shifted to where the money is:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

FWIW

A plywood mill close to me, has run out of warehouse space for their unsold plywood. That’s what is happening on the ground in the real world.

Things are not as they seem.

I was curious when this would start happening.

You have a huge demand side shock and people get what they want or give up looking due to massive supply constraints. Then all of a sudden you get this huge supply side shock to a market that has lost most of its steam.

We already see the supply rising so whats out there already isn’t selling like it was 12months ago. What will happen in the next 12 mo.?

Retail prices will have to come down to match demand.

You are right, but I wonder if they will come way, way down if the economy crashes as some predict. The stinking dying elephant in the room is the Chinese real estate market along with the Chinese entities that will be ultimately affected as the dominos (more real estate developers) seem to keep falling per reports.

Are entities like Blackrock structures like banks, so they become insolvent if a tiny portion of their total investments goes bad? Banks regularly have ultra-thin capital cushions, so when their investments go bad it is easy for their liabilities (e.g., owed to depositors) to become greater than the realizable, net value of their assets. If the “Fed” has not changed its prior waiver of the capital reserve requirement, that cushion would be thin for banks, at best.

Will the stink from the dead or dying Chinese, real estate elephant affect (even if indirectly, e.g., by cutting the demand for cement or steel and thereby driving producers or suppliers under) the rest of the world’s markets: e.g., crash some major, Western Wall Street entity? Given the creative abilities of accounting companies and all companies in China to fake financial records, and the amazing inability of auditors to discover any issues (e.g., with Evergrande whose auditor “missed” reporting many issues repeatedly), I predict that we do not know the half of the debts of the local governments and companies in China.

Still, that would be a better possibility than reports that the CCP may be faking the reasons for their power outages and actually are diverting the power or the coal to districts that are mass-producing weapons to intimidate or invade their neighbors. Are their leaders crazy enough to pull that trigger?

Having to bail out the ultra-rich again with trillions more dollars gifted to them as in 2008-2020 would be better than WW III admittedly. Since the Supremes are going to hold any unusual tax on the ultra-rich (such as a capital gains tax on unrealized gains) to be unconstitutional, Giving away more tens of trillions to ultra-rich persons who do not pay a significant portion of their earnings in US taxes (or as to some, any taxes) is going to be another, bitter pill we must all just swallow.

(OR more colorfully, bend over, guys, because the ultra-rich took the elevator already. You get what remains.) LOL

Or production must be cut back to match demand.

Notice there is more than one possible outcome when demand, supply and price do not match. One is that a product become unavailable as prices rise and demand decreases. Decreasing demand as the price go up make production cost go up and as this wind up production is ceased altogheter.

If the manufacturers cost have risen to the point they lose money with lower prices, they quit.

Lumber, plywood and OSB mills are sitting on so much cash that they will play the “pile up the inventory” game for quite a long time.

Market distortions ? Here we are.

I work for a company that makes heaters for swimming pools. We are shipping more heaters than we ever have. We are unable to keep up with demand. On top of that we are struggling to get all of the semiconductor chips that we need for the control panels. The company has had to increase the hourly wage of the production people by more than $3/hr. And they have hired so many new people that there aren’t enough parking spaces. In the back of my mind I keep wondering how long until things reverse.

It reminds me of the late 90s/early 2000s. I was working for a fiber optics company and things were the same way. Then the dot com bust happened.

This “boom” is even more artificial than the dotcom bubble.

Every purchasing agent is telling their suppliers..

“I’ll take all you got at that price.”

Because they sense inflation is NOT transitory.

So what occurred first…the sense of inflation or the bottlenecks?

can’t wait for bust and they start laying off all those HIGH WAGE WORKERS

Cem, you just gave us a pretty good definition of one of the causes of a depression.

I hope that’s happening, and working to normalize prices. As someone who is supposed to start building a house in ridiculously expensive So Cal next summer, an 11.8% price increase is a problem. Much more and it will likely put an end to the project.

we bowed out this spring when SHTF

now we’ll just plow $$ into more rentals for income to cove said losses due to INFLATION

I think that if there are some materials that cannot be acquired, then other types of inventory will not be purchased because the house cannot be finished. Just like with cars, a shortage in one area means that other material suppliers cant move product and everything gets stacked up.

The world is a big just in time machine and all of the disruptions of materials coming in is wrecking havoc on product completion.

Everyone blames this on government intervention, but some of this is simply a natural result of COVID. Even if the government had done nothing, there would have been a big impact from COVID labor shortages.

Glass industry is mainly energy intensive.

With prices of oil and natural gas this high, those windows won’t be cheap.

Inventory seems up sharply on that chart but it’s not what I see out there, nothing decent for sale or insane prices and bidding wars if smth good comes up.

I am thinking of putting my house for sale and rent for some time.

This insanity can’t last.

It seems hardly believable that Fed will destroy the dollar and let inflation out of hand.

I wonder what are the chances of buying back my house at 30% less in three years?

I wouldn’t count on it. Despite perpetual talk about the need for “more affordable” housing, the last time housing got more affordable it was deemed a national crisis and prompted a nuclear response. It could happen again, but you’d have to be nimble to take advantage … the Fed has shown it stands ready to throw the dollar under the bus to bail out its indebted constituency.

US Government: Number of Builders Declined 50% Between 2007 and 2012

Acquisitions to obtain market concentration. Horton is the biggest acquirer of them all. Used cheap corporate funding to reduce competition and gain pricing power. The American system.

I tried to purchase a modest home in the middle of the last housing bust for $100,000 cash offer to live in. It was a preforeclosure and I was almost through the process when owner was saved by one of the Federal programs to help underwater homeowners. I checked Zillow just now and it sold in Feb, this year for $210,000 and now valued at $241,000. Fed has pumped a lot of juice in the market.

My house in Woodstock GA is up 84% in 3 years. It’s CRAZY!!!

Bunny, go for it! What could possibly go wrong?

“Houses for Sale, Construction Not Started” – what does this mean, really? If a homebuilder has 1000 vacant lots, they could advertise for sale anywhere between 0 and 1000 homes. How closely does this match real available supply?

Aside, I embraced meme investing last week. Normally I’m a conservative investor and if even I’m doing this crap (DWAC and BKKT), maybe the top is in. All I’ve learned this year is that I don’t know a damn thing about markets.

ivanislav

Go to a new development and look around. Some houses have been finished and were sold and people are living in them. Other houses are under construction, some already sold, others still for sale. Then there are some lots where construction hasn’t started yet, and the buyer gets to choose from some options in the plans.

If you buy a finished house, you don’t get to choose. If you buy an unfinished house, you might be able to choose finishes, flooring, kitchen, etc. If you buy a house that hasn’t been started yet, you get to choose a lot more.

All this is very routine.

So go walk into their sales office and say you’re interested in buying a house in that development, and see what they’ll show you. It’s kind of fun.

I just got paid off on owner financing for small 14 lot sub-division were I sold developer the land

now I got MORE CASH(useless devalued stuff) to invest in over-priced assets

likely have to buy over priced rental to keep income coming in

Yes. I was thinking the same thing. Maybe we need to have a book burning for Ben Graham’s “The Intelligent Investor”.

David Stockman said it ten years ago, as long as rates are zero Wall Street is going to leverage up and gamble.

Interesting juxtaposition: there’s a high-end gated “country estates” development down the road from me, with a fancy brick keyed-entrance, but no houses built yet because local builders are overbooked; and near it, almost in sight, is an existing newish high-end home for sale with a recently “reduced price” added to the for sale sign.

What happened to the foreclosure moratorium? It’s been lifted but seemingly there were no consequences?

Home prices surged. People can sell their home and pay off the mortgage and have some cash left over, or people can refinance the home and take cash out. Lots of options when home prices are made to explode.

Having cash “left over” ….. if it sits, it loses 5% a year…

if it stays in a house…? 18% up last year.

The Fed SKEWS every market….and real estate is no exception.

Yes they do. Eventually home prices will be based on income. I think in the past 10 times income is about max sustainable house price.

We have not gotten any foreclosure appraisals for over a year. Not that we mind. They are a pain in the ass.

A NAHB report released today said their members are now reporting that availability of building lots are shrinking fast.

“ In a recent NAHB survey, 76% of builders reported that the overall supply of developed lots in their areas was low to very low. This is an all-time record — by a wide margin — since NAHB began collecting the information in the 1990s. The previous record was 65%, recorded in 2018.”

So now, in addition to a shortage of building materials the nation’s home builders are grappling with, now they are facing a shortage of building lots.

New home developments require a long-lead time. My guess is the developers slowed down about two years ago with the uncertainty of Covid swirling about. Now the end result has arrived in the form of fewer developments being finished and available. If I’m right, available building lots will be climbing in price along with everything else.

I think that people who own land dont want to sell when they think prices are going higher. Supply and demand works differently in asset pricing models than in pure consumption models. You dont buy toothpaste to profit from future price increases, but you buy stocks to make future price gains. For example, Tesla’s stock surges higher as people try to jump on the momentum train. Once Tesla stock starts falling, the supply of shares for sale will probably expand, not contract. It is all about future expectations. It sometimes deviates from the notion of supply and demand where higher prices should lead to more supply and less demand.

Of course, at some point momentum loses traction and then a market might be in line for a rapid adjustment in the opposite direction.

Yes. Most people buy and sell stocks based on price appreciation instead of doing discounted earnings calculation. A whole generation trained to speculate by the Fed. What could go wrong?

I am betting margins on the low end will soon be much better than high end, which has supply overhang. The rich have choices, people who must live in their houses are chained to their jobs. Look for automation to come to home building. Robot carpenter? Just reprogram your Roomba to work a nail gun.

Too bad Roombas can’t think, do math, substitute materials, organise the job site, etc. As a carpenter for over 40 years I can attest there is a bit more to it than banging nails.

As per the article there are materials delays in Canada as well, although the shipping and port back logs are not as severe as the US west coast. Vinyl products, steel siding, and anything requiring controls are delayed due to the chip nightmare. No delays in lumber, plywood, etc. There is a trades shortage and contractors are booked up.

Today I needed some 6″ single walled stove pipe for a new wood stove in my shop. I needed one whopping 36″ piece and two 45s. I cleaned them out at the dealer and had to settle for a 30″ piece. Used an old piece of pipe to make it work. Making a point to use locally owned businesses and staying away from the Home Depots of the world as much as possible.

Inflation should it not prove transitory will manifest at the low end while China drops export of low end merchandise. HD broke the two tiered system, and sold everything at one low price. That was the start of the DIY movement. Then plumbers went to PVC. I keep thinking why hasn’t homebuilding gone tech, but maybe it has.

Residential construction these days is very diverse, especially compared with just a few decades ago AB:

More and more better ”mobilhomes” and modular homes, including ”park model” RV trailers are out there and many many more than meets the eyes, and will continue to expand in popularity.

Choices for designs have expanded from about 200 SF up to now very nice 3 bedroom 2 bath spacious homes built in a factory, installed on a prepared lot in one day, then carports with storage sheds, even swimming pools, added within another week or two.

On the other hand are the increases in true modular construction where modules are lifted off a truck and then bolted together, with no wheels on the modules, etc., etc.

Far cry from the months of construction needed when I started back in the ’50s, not to mention the ”settling” of green framing lumber needed then before the new work was stable enough to apply final finishes, etc.,

And now there are appearing beginning tokens of 3-D printing of small houses out there and improvements for that technology will be coming.

Industry has made a lot of progress from what was basically majority the same process since the middle ages 50 years ago.

I would think tilt up concrete wall construction would be a win for residential. Bring the parts from elsewhere, assemble in a day, roof it.

Panelization (not to mention prefab roof trusses) have become more and more of a thing.

That said, home construction still lags in terms of using mass production techniques…but at the end of the day, ZIRP powered exploitation accounts for much more of home construction price inflation since 2000 than any actual home component.

The real price innovation needs to come from reducing labor and building materials supplies. There is a building technique called rammed earth that uses compressed dirt to build walls. I’m curious if this type of construction will start to gain traction, or maybe some other higher-tech building types. I am somewhat amazed that the building industry continues to be so labor intensive, with homes being constructed on site, rather than merely assembled and finished at site.

Rammed earth is neat but it absolutely cannot be used in earthquake zones (so the US West Coast is entirely off-limits), and it requires a very special kind of soil that you won’t find East of the Appalachians (so the US East Coast is out).

It works well in the “intermountain West” — East of the Cascade/Sierra range, West of the Rockies.

Our new home builder in Riverview, FL has 12 month build completion clauses. Our impact is roof trusses~ 2 months and GLASS windows~6 months. YES, unfortunately this stuff is real. Projected to get the keys in June 2022.

Mark,

Neighbor building house behind me…

I’m 1.5 hours south of you…

5 weeks in, dried in… windows being delivered as I type this…

Concrete block house…trusses and interior framing in the last week…

Doesn’t seem to be any problem here getting materials…

My neighborhood has been “ discovered” with probably 20 new houses in the last year…

None sit with any delays for completion…

Ordered all my replacement windows back in February. They were finally delivered 8 weeks ago. I bought them at pre-Covid prices.

In fact I have been ahead of the game on every bit of material in my major reno job.

A few tips.

Know people in the industry who have contacts at all levels of the supply chain.

Buy any stuff you still need and can at pre-Covid prices. Build/rent storage if necessary.

Take careful note of stocks in local suppliers. Typically stocks deplete in less than 3 weeks, so you must check weekly.

Remember that obscure/rural suppliers may still have stocks when the city suppliers run out. Don’t rely on this either, rural folks aren’t idiots.

Don’t rely on online stock reporting – everyone’s systems are increasingly inaccurate.

Dumb. Just wait until all this madness ends and everything is discounted because of massive gluts. They’re coming.

Gonna AGREE with DC on this question, like totally dudes and dudettes!!!

Been there, done that several times over the last six decades working and managing in the construction industry in several states.

Last time was the huge increases in 03-08 time span, when quotes/bids for million dollar quantities of materials from red iron to drywall were good for 24 hours is not committed to immediately.

Some stuff less than half a year and more after that…

Including RE, pick up trucks, fuels, almost all building materials…

OTOH, there were some glass products no longer made after the energy crushes of the mid to late ’70s, so not a slam dunk…

“Must-have-it-now-ism” almost always maximizes prices for panicked buyers (there will never be another foot of lumber produced, ever!! Buy now before prices go to $1 million psf!! Hurry, hurry, hurry!! My god! Little Nell is tied to the railroad tracks!!…).

The media plays into this (as with any poorly investigated or analyzed “trend”) as do politicos, who want to stampede consumers into resurrecting the economy into something greater than a 1% or 2% GDP growth rate).

That would be ideal, however my existing windows do need replacing, and assorted other bits of the property might not last another bad winter!

Anything that can be put off for the future glut has been.

The boys and girls at the Fed can explain this away in 30 words or less. This is proabaly a good sign and I am sure they got a doozy of a description for it. Can’t wait for Jerome to trot it out.

Looking at the inventory price distribution. Just wait until the interest rate cycle really turns. Not sure it’s happened yet. It’s been downhill since 1981 and every time I thought it might be over, it wasn’t.

Look at who got wealthy since 1981. Follow the money. It’s a system which benefits a select few.

“It’s a system which benefits a select few.”

Agree, DC, and it’s a wonder that they get elected!

No wonder they getelected if you look at how the system is organized (rigged).

Since ’81?

Since 2009?

Who knew that the Fed would no longer honor their mandates of “stable prices” and “moderate long term interest rates”?

For if the Fed was behaving as they existed pre 2009, Fed Funds would track/equate with inflation…..which would give investors pause. But others seem to have been tipped off the Fed would promote inflation and then let it run hot, as they are doing now.

The “cabal” has made tremendous money, and has separated themselves from most of America, and “pulled up the ladder”

If you believe what you read there is a real possibility that Fed has made a policy mistake and is going to have to yank the punch bowl all at once. You have got to game out that this a real possibility and not get caught leveraged up on assets.

There is a theory that the debt saturation will not let the interest rates rise, but drift along bouncing on the bottom with a sluggish economy from the debt overhang. This happened to Japan and then Europe and the good ol USA is next. At least according to Lacy Hunt.

Perhaps, by say Easter 2023, new living experiences in a area that’s going to be up and coming ( ya’ know) Will find it’s place again.

All that will be needed is the happy marriage of hormones and a real estate novelist.,

Wolf…

Your opinion on what Blackrock and Blackstone and other investment “raiders” of real estate are having on the real estate market…and the American dream of owning a home.

And if you so choose, a comment on Blackrock being in the Federal Reserves “tent” while the Fed keeps pumping money into a mortgage market with housing prices screaming.

It has been reported that housing sales are 16% corporate/investment purchases, rather than family.

Last time inflation was in this area, even lower, 1999 and 2006, the 30yr mortgage was 6%. Now 3%. I point to who is in the “tent” and the optics of that arrangement.

My comment….People can not save to buy a house…for to save is to lose 5% a year …at the current inflation…as housing leaps 18%.

VRBO, in concert with no fair return on savings, has made investors buy anything which they can perhaps get a fair return.

This is not good for society…it is an attack on the American Dream of owning your own home. And I suspect because it is the “American Dream”, it is under attack by people who really don’t like America. IMO.

Rip me up.

I agree with most of that. You have to buy with a small downpayment so that you can get in sooner than later. Until the value of the home appraises 20% higher, you have to pay PMI. That is all you can do. Get a small downpayment and roll the dice.

Only problem with that advice is leverage 30:1 works wonders in a price expansion, but it all goes wrong in a contraction.

Only goes wrong if you need to sell/can’t pay the payments. History has shown the dollar will keep being devalued and over time asset prices rise to and above where they crashed from.

We aren’t going back to late 1990s prices, and probably won’t even ever re-trace to 2019 prices.

re: “… Until the value of the home appraises 20% higher, you have to pay PMI. …”

When I bought my first house I assumed this was the case, but my mortgage broker got me into a second mortgage to muster a down payment, at a monthly payment that was about the same as PMI (and its interest was deductible from taxes). Dunno if this is still possible, but if I was looking to buy I’d look into it.

This is happening in Canada, Nova Scotia particularly.

The big money investors are using their free QE money to buy up apartment blocks and residential houses through multiple numbered companies.

They then use renovictions to remove existing tenants and bump up the monthly rentals, dodging the rent controls.

They are getting so nasty about evictions that many local bailiffs will no longer work for them.

Needless to say the local politicians are happy with this for the usual baksheesh.

I guess their aim is that eventually everyone will be a renter.

You could put a 500 houses up for sale in my town 15 miles north of Boston and they’d be under contract within 2 weeks.

Good luck waiting on ur downturn. The fed will never raise rates again.

Did you hear that Rick Scott just came out against Powell? The Fed is going to have its hand forced soon.

They’re just making too many enemies with their reckless printing.

The enemies they make are not the powerful…

They are not the movers, shakers, owners of Congressmen.

Where is the Senate Banking Committee that allegedly oversees the Fed?

Never has there been a 5% gap between inflation and a savings rate of return.

rick scott is pretty powerful. i’m sure he’s getting tons of angry emails from his constituents, many of which are retired people with savings.

i’m not saying it’s a sure thing that anything will happen, but the american people are extremely angry.

historicus

You’re being too kind. Inflation is more like 20%. The gap between interest earned and inflation is 19.95%. Savers are getting wiped out, including myself.

If Powell had money in a savings account, then rates would rise, but he has money in Wall Street so he will decide what is good for his personal wallet, the nation be damned.

It’s hard to imagine, but the population may get so Fed up with inflation that the tide turns and people will be begging politicians and the Fed to kill it.

“the tide turns…begging politicians”

And they’ll elect the other half of the UniParty that’s just as owned by the forces that are causing the financial problems for them while, admittedly, having a less Postmodernist (i.e., neo-Marxist) flavor.

i think that’s more likely than people think. yes, the population didn’t rise up from 2008 to 2020, but the moves were much less extreme at that point. it was more of a slowly boiled frog situation. now, the fed and wall street have overplayed their hand, and their wall street and asset protection racket is obvious for everyone to see.

my point is that they’re not going to undo all of this because they think it’s the right thing, but that they were only willing to do what they were when they could pull the wool over the people’s eyes. they have lost all ability to do that.

we’ll see

Yep. A 1960s split level north of Boston will still fetch ~10% over ask the first weekend with all contingencies waived. No slowdown here.

Last year I built a screened in porch with a steel roof using only US and Canadian made materials, to help the stalled economy.

This year I have abstained from buying any construction materials. I wanted to build a second storage shed this year but elected to just use up leftover materials from previous years instead.

There are no reasonably priced metal sheds available here in Canada (nor last year). Everybody has sheds for sale but once you click on the picture, they say out of stock! Just time wasting click bait!

Since I never got around to building the shed this year, I found more interesting diversions, I will target next year to build the shed. However not everybody can be as flexible, hence shortages and higher prices. I suspect when supply finally catches up to demand, the demand won’t be there!

I thought the job requests would finally slow in October.

Wrong again. We are all hoping for a early winter.

Spend time doing maintenance & servicing work equipment,

then south for a lot of surf fishing. Counting down the days.

Altos Research says we are going to end the year around 301k homes for sale inventory which is a record low and he believes come spring time will mean inventory for sale will be lower than 300k. This is based on for sale inventory in the spring is usually less than inventory in the fall.

They need to get some of those new homes built.

I still get at least 2 to 3 calls a week and post cards form investors for my rental home. Maybe we are near the peak of short term prices as I get bombarded now more than I ever had in the past 10 years.

U.S. coal stock inventory is at a 24 year low. Nat gas storage is a little low but the U.S. produces way more nat gas than it consumes.

But other countries are seeing low coal inventory and low nat gas storage so this is pushing up oil as the former two have seen crazy price increases.

I guess one of the underlying problems is Europe had a longer and colder winter last year, a hot summer, and plus wind used to power wind turbines was 28% lower than in the past.

Hopefully there is not a cold winter.

“Nat gas storage is a little low but the U.S. produces way more nat gas than it consumes.”

Then it must be being exported or having gas pipeline and other distribution problems because my local utility said the reason they’re raising nat gas utility prices more than 30% on Nov. 1 is because their nat gas costs went up.

Yep. They are exporting all the excess. LNG prices in the U.S. is $6 and up 50% in the past year from 4ish. Why did it go up? Europe LNG price a year the past few years was around $4 too but it is now $22 or a 300% increase and Asia is even higher.

So nat gas companies would rather sell as much nat gas to Asia and europe.

I am an economy neophyte. So itt should no surprise that I always believed in the logic of supply and demand. Supply is up, demand goes down, and prices drop. Supply is down, demand goes up, and prices rise. Supply is stable, demand is stable, and prices are stable. I know there are deviations which may get scary, but they generally are resolved relatively quickly.

Now we have “The index for construction costs of singled-family houses spiked 11.8% year-over-year in September, unrelenting in this range over the past four months, and the most since 1979, according to data by the Commerce Department today. The index is up 17.6% from September 2019.” On the other hand. we also now have “Sales of new single-family houses in September rose from August, but were down by 18% from September last year”. That looks to me like the “supply is up so demand is down” meaning prices should be dropping side of the law of supply and demand.

Is this denial of Supply and Demand due to some flaw in the law, or is it due to the skewing of the statistics by the domination of the housing marked by people for whom cost is no object? I ask in part because I have seen working class towns become dominated by housing buyers who not only will buy everything (it seems) on the market, will even way over-bid, causing prices to skyrocket and become unattainable for people who actually have families and other ordinary things to deal with – you know, the formerly-middle-class. And yes, I am also alluding to the housing seized by the “systemically important financial institutions” that have been deputized by our own government as those for who cost is no object (after all, it’s only other people’s money and other people’s lives here).

Just my opinion. As more businesses become monopolies (3 or 4 competitors) they wipe out mom and pop middle income jobs and are replaced with lower income jobs.

This will mean more and more people will not be able to afford a house on their salary into the future. It is what it is.

Companies are trying to reduce operating costs and that means squeezing employee salaries and benefits.

Plus add into the equation as you mentioned, Wall Street financial institutions are now competing with home buyers. These institutions get many advantages a home buyer does not see. Amortization of the property, repairs can be written off (painting, roofing, etc), plus they have no risk as all their loans are backed by the GSEs. So what if they over pay? The MBS investor of the Wall Street home loans are guaranteed by the tax payers.

E:

There is no LAW is the answer to your first question, “Is this denial of Supply and Demand due to some flaw in the law, or is it due to the skewing of the statistics by the domination of the housing marked by people for whom cost is no object?”

Economics, just like every other ”social science” is a statistical amalgamation of anecdotal information and opinions, and has no or very little basis in facts as clearly demonstrated by the lack of predictable results; otherwise, we would have no crime, no poor people, little if any massive pollution, etc.,

In the case of commodities, the supply of many or likely most are now dominated by producers/extractors who manipulate their activities to maximise their personal profits at the expense of consumers and employees, both of which are now just cogs in the machines.

VVN, I appreciate your comment, and ru is spot on regarding one of the engines driving housing up higher and faster than Blue Origin.

Like any “law” in social sciences, the Law of Supply and Demand is not really a law since it doesn’t guide or control anything, it is just a verbal equation showing a natural and inherent relationship between important parts of any economy. It can be avoided by deliberate activity. Both of you alluded to deliberate activities by certain malicious kinds of actors.

The real point I’m hoping people will get is that the Law is not accurately predicting outcomes because the activities it analyses are being deliberately and maliciously manipulated in the ways you discussed. This is, of course a huge problem. Part of the problem is that some of the malicious actors, being deemed systemically important financial institutions, have been given license and protection by our supposed guardians and leaders to do massive damage to the economy in order to enhance their shareholders’ value to the detriment of 99.99% of the population.

We have an intolerable, possibly existential, economic problem rooted in the same causes as climate change, covid-19, and so many other things that are on track to exterminate humanity.

My friend is a home builder in the PNW. They have 8 houses right now completely finished except windows, and he is being told 8 weeks for those windows, at a minimum. They were ordered 6 weeks ago. They are still starting new house builds while they wait for the windows on the nearly completed houses. He is starting to build on 29 more houses even though they can’t even source windows for them.

He is just rolling the dice at this point that by the time the house is near completion, the shortage is over, because as a small to medium size home builder, you can’t just conveniently wait on the sidelines waiting for shortages to subside. Tight margins won’t allow it.

“My friend is a home builder in the PNW. They have 8 houses right now completely finished except windows,” I sincerely doubt that. I’m a builder in the PNW and my windows go in before the siding, mechanical, insulation, drywall, etc. L&I won’t even inspect the electrical if you don’t have windows.

This is very similar situation to what happened to a friend of a friend during last housing crisis. He got greedy and got too many beach houses going and then bottom fell out. Next thing you know he was all washed up including marriage.

If you can borrow a max of 600k to buy a house, and materials went up from 200k to 250k, then the land price just went down by 50k.

That’s how prices are set.

Or you borrow more to buy the house. Or you don’t buy the house and someone else buys it. That’s how prices are set. It’s a market.

Georgie to you are correct in theory. But in today’s much of the cost of the lot is made up of system development charges, utility connection charges, and other development costs such as roads, sidewalk, and street lamps. So if the cost to build plus these costs gets too high than it is more likely the lots will sit empty in a partially developed state.

Where I am raw land used to be pretty cheap $1000 per acre for 10 acre track. It’s going for about $10,000 acre but that is with access to county water. If you can find someone to sell you an acre of road frontage for $15,000 and ate able to get sewer and drive put in for $15,000 then you are at about $30,000 to get a place to build. I think if you can find one a new single wide is around $100,000 so $130,000 will put a modest roof over your head in rural NC.

Land prices in SoCa seriously lag home prices (land incl). A nice lot in a beach community, at a ridiculous price, with the following desc. “Low cost of this property reflects the high cost of development..”

Or you just build a 1 car garage instead of that 3 car garage. Housing shrinkflation.

georgist,

On a finished home the value of the land is really set by the insurance value placed on the house. Insurance companies regard 20% of the market value of the house to be the land value. On a 600K house the land value would be set at 120K and the replacement value of the house would be 480K. They always maintain this ratio regardless of where the construction money really goes.

I always wonder what happens to one of those 1950s 2 bedroom houses in So Cal that goes for $800k but would only take about $200k to rebuild.

So if their is a fire, does the insurance company only pay you $200k or will they pay you the 560k.

They don’t “pay” you anything. They replace the house as is was before,on the same lot.

You are ”generalizing on the basis of insufficient information” on this one P.

Value of land varies widely depending on location,,, very very widely!

Present home in the saintly part of TPA bay area has mostly land value, one city lot at approximately 60%…

Last home in fly over, 56 acres, had even more compared with the home made with our own hands…

Both values from county tax appraisers tasked with appraising to ”market value.”

You see it at the beaches near me. Ocean front lot about $500,000. Well you aren’t going to build a $200,000 house on it. Most people do a $500,000 and up house.

Come in land a half a mile and a lot is $30,000 and that’s where you might put a $200,000 house.

I am not exactly sure how they would value the house on 56 acres, but I know the land is not covered on a homeowners policy, only the house. The size of this lot would make it a rural setting where I expect the value placed on the house would be compared to other similar homes in the area and be low. I also would expect the “house lot” around the house would be a zoned minimum size.

How long can this madness last, well it appears forever……….

Which also means that it is very close to collapse

How close?

We may have to wait forever to find out.

Now where is my copy of ….They are going to take you Away…. from the 1960s

I think it may take me forever to find it, as it’s stored in the loft, oh well…

I think things in finance tend to be cyclical. High prices followed by low prices. Euphoria filled by panic. Over leveraged followed by austerity. Stocks in favor, out of favor. Gold in favor, out of favor. Bonds in favor, out of favor. People still dancing at the party right now. Signs of being careless with money everywhere.

The questions are backwards..

It is not “what things are worth”…

It is “What is money worth?”

what is something in perpetual decline worth….?

and why the perpetual decline? Ask J Powell and L Fink.

Wolf, what will happen when the demand inevitably starts to slow down? Will there be a crash?

Once the “free money” is gone and people starts to cut their expending and demand for house continues to shrink down because at least some people will continue to do remote work, then what?

Yes, excellent question. Lots of factors here. But real estate moves slowly. The last bust took 5 years before it bottomed out. And for the first year or two, everyone was brushing it off.

The lack of components won’t matter much when the bulkheads start caving in on capitalism and we head into deep waters none dare call it even a depression though, need to soften the language.

Nobody builds new homes when the existing ones are worth a fraction of old once upon a time prices, which is what happens when the roof caves in on the housing bubble and values plummet.

Not many new homes built during the Great Depression from 1930 to 1945, thus the pent up demand of baby boomers parents after ww2.

Don’t think you can call what we have capitalism when the most basic price of capitalism which is cost of money is administered and not discovered.

Apparently, mortgages are related to the 10 year bond yield.

I have noticed that the 10 year bond yield is “allowed” to rise as long as the stock market is going up. But if the stock market is falling, the 10 year bond yield drops. I attribute this to blatant market manipulation that may disappear after the Fed stops buying bonds, but perhaps there is another explanation.

Bond markets are manipulated by FED. Short term bond prices by FED fixing the interest rates and long term rates by FED buying $120B treasuries per month ( 80B for bonds + 40B for MBS ).

In essence there is no price discovery. FED working only for rich people as FED can’t see inflation. They wont hike the rates or do tapering in a meaningful way

We built a lake house in Northern Michigan (Petoskey) two years ago, and finished in the summer of 2019.

Just talked to our builder recently…. If we built the same house now, it would cost 40-50% more and take twice as long to build, due to parts and labor shortages.

Your timing was impeccable.

Do not believe the Bank of Canada’s trying to fight highest inflation in 19 years. It is all BS. It is already too late. If they were really serious about this, they would of raised interest rates already and a big increase is needed. Something like Chile or Russia or even Czech Republic.

The 0.25% Bank of Canada rate is a joke and never should of happened. The Bank of Canada rate should be minimum at 2007 levels, 4.5%.

Central bankers are the enemy of common folk. I pray that in my remaining years I will watch public hangings of these parasites.

Simple fix, stop buying things that are not essential. Come out when the dust clears.

EXACTLY del:

Even with the degradation of the dollar,,, STOP ALL the ”want buying” and keep the cash/powder dry and ready!

Savings are trash, yeah, inevitable/very clear,,, but that cash will do wonders at the time of the crash,,, that crash too is inevitable ONLY WHEN is not at all clear, as always.

Only real hard core question at this point is IF ”they” are going to ”revalue”, as in completely reset the USD again.

Probably not,,, but that is certainly not certain, eh

We still have clients who expect “fixed price contracts” and who ignore the reality of changing prices, changing supplies and changing labour availability and price.

Makes life difficult for us poor contract administrators.

These issues can be accommodated but at the additional cost of additional attention to the project and additional costs to contractors in line with general inflation, which no modern customers seem to be able to comprehend.

So, flawed contracts go to carry projects forward and then hey ho a year or so down the line, it is that old pool of tears again.

Where are all of these supposed undeveloped/under-construction lots for sale? Not seeing much listed with the major realtors. Undeveloped lots appear to be as expensive as they ever were. Where are you getting your data from?

1. You misunderstood. Read it again. These are not lots that are not for sale. These are houses for sale by homebuilders that haven’t yet started construction on those houses. They’re not going to sell you the lot in these developments. They’re going to sell you the house, and then they’ll build it for you.

2. This data comes from where all this data comes from — the Census Bureau.

If there are no takers, then they would at least be paying an opportunity cost to hold. Like in any other supply chain, shouldn’t some of the excess inventory then show up on the market? The only other factor would be speculation that the land value will offset the opportunity cost and any tax/financing costs.

The homebuilder bought them to build houses. They’re generally in big developments that the homebuilder is developing and marketing. The home builder is going to sell individual houses, not individual lots. It can take years to sell the last house, and that’s fine.

If the homebuilder goes bankrupt, someone else might end up with their assets, including land, and then who knows what’s going to happen. But they’re not going bankrupt now.

This data doesn’t track empty lots for sale. It tracks houses for sale at various stages of construction.

If I understood correctly this time, then this is a more or less useless figure. I can go on the market tomorrow and sell the promise to build 1 million cars at $1 million per car. Of course my “inventory” would be 1 million un-built cars.

You need to go to a development and find out how houses are sold. Houses are NOT cars.

For you, the data may be useless. If you’re not interested in the housing market, this data is useless to you. That’s just how it is.