Irrational behavior by buyers confidently betting on being able to pass on that irrationality to their customers. It works until it doesn’t.

By Wolf Richter for WOLF STREET.

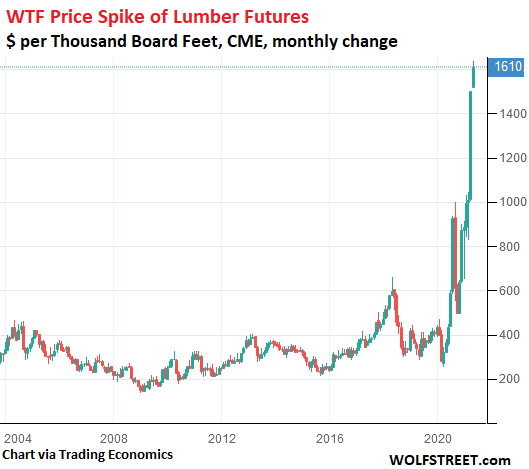

Lumber futures on Chicago Mercantile Exchange currently trade at a record high of $1,610 per thousand board feet, having quadrupled since February 2020, just before the Pandemic, a sign of scary-crazy inflation amid suddenly blistering demand from builders, insufficient supply to meet that sudden surge in demand, growing lead times, and irrational behavior by buyers betting on being able to pass on that irrationality via higher prices to their customers (chart via Trading Economics):

Here’s another boots-on-the-ground observation being passed around about this scary-crazy inflation, triggering irrational behavior by buyers betting on being able to pass on that irrational behavior to their customers.

And these are the pros, not consumers.

A local electrician with a shop in Idaho near Moscow (where the University of Idaho is) was talking with one of the house builders he does work for. And this is the story he passed on to WOLF STREET:

“Moscow Building Supply (MBS) is the big building wholesaler in Latah County – last summer, you could buy a sheet of OSB [Oriented Strand Board, a type of plywood] at about $12 a sheet (4×8). Last week, $50 a sheet.

“A couple days ago, MBS got a truck load of OSB. A big home builder in Spokane drove down to MSB and bought the entire truck load – even before it was unloaded – for $80 a sheet.

“The next load is scheduled in two weeks. MBS is now telling customers to expect to pay $105 a sheet.

“Also plastic piping, such as 3-inch PVC pipe, commonly used by electricians as conduit. Last fall, my son paid 12 cents a foot. Now it is going for $5 a foot.

“My son says he now gets updates on price sheets from his electrical parts wholesaler weekly, rather than twice yearly.

Sure, there are all the logical and rational elements.

Supply was somewhat hampered by production problems during the Pandemic and isn’t now able to ramp up fast enough to meet the suddenly blistering demand by home builders that are trying to meet the suddenly blistering demand for new houses as people are shifting from living in urban cores to the suburbs or further out.

And these builders are making hay while the sun shines, and they’re building no matter what the input costs, assuming confidently that they can pass on the additional $30,000 in lumber costs to the eventual home buyers.

And the eventual home buyers, facing suddenly blistering competition from other home buyers, are willing to pay nearly any amount to get their hands on a home.

That buyers all along the chain are willing to pay those prices shows that there is a massive shift in the mindset. What would have caused a buyers’ strike in past years is now causing a buyers’ frenzy.

But these WTF price spikes cannot persist.

Price spikes like these trigger mega-profits for producers, and they’re trying to maximize their profits by ramping up production, and thereby supply. And eventually, supply meets demand and then exceeds demand, and then supply keeps piling up everywhere because producers are still making hay while the sun shines and they’re producing more and more supply.

And that’s how these price spikes are eventually resolved: They produce a glut, and at least part of that WTF price spike collapses.

This unwinding of the price spike could start to happen soon, or the price could continue to spike, and the unwind could take months or much longer. And even if part of the price spike collapses, prices could remain high compared to prior years.

For example, if the price of lumber futures collapses by 60% from today’s $1,610 per thousand board feet, it would still be at $640 and would still be far higher than the middle of the range of the prior 10 years.

So part of this scary-crazy inflation would be “temporary,” as the Fed keeps pointing out, but part of it would not be temporary but would be baked into the economy. And even that “temporary” part could exceed the 2021 time-frame. And it increasingly looks like the Fed is going to have one heck of a Fed-created problem on its hands.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The Fed will just redefine (Using the backsolver function) how they measure inflation until it is under control.

The solution to high commodity prices is high commodity prices. If the government starts putting on price controls they will just perpetuate the shortage.

Some buyers must be saying prices are too high and I will wait until prices come down. Not everyone can do that, but some can.

Sounds Old school.

funny thing – HOME LESS DEPOT and LOWES all HAVE INVENTORY of LUMBER

not seeing 1 empty shelf and STACKS IN BACK ready to fill coffers

paid $65 for plywood yesterday

lucky I only have SMALL JOBS

but BUILDING IS GONNA come screeching to end at some point

by then OF COURSE OUR FIAT $DOLLARS will be much washed and worth LESS and LESS – 30%-50% is my guess

pretty soon 1 years wages will pay off MORTGAGE I HAVE

of course I MIGHT NOT HAVE JOB MUCH LONGER THOUGH

The new solution to high prices is stimmy checks. There is a $15,000 to $25,000 first time buyer home buyer stimmy in the works, so maybe soon more stilly can feed the inflation beast so we can hit $2,000 per 1,000 board feet…

Transitory Hyperinflation = Artificially higher long term Inflation

Like Wolf said, prices will come down “some—->someday”, but not anywhere close to where they used to be compared to the resent past. When you increase the money supply 20-30% in one year, what else would our PsychoPath Fed expect? “Transitory Hyperinflation” could become “Hyperinflation” if the Fed increases the money supply 10-20% a year, repeatedly. Hyperinflation is created in the psychology of the masses, which then affects behavior in illogical and unpredictable ways. And seeing that the latest polls show 60% approve of the upcoming $4 trillion “Infra-Stimmy-Family-super-sized-happy-meals”…the Fed will need to continue printing money to buy all those “non-transitory stimmy-me-now-for-my-vote treasuries”…which simply feeds the inflation beast indefinately.

Old School – The cure for high prices is high prices.

Foolish Fed School – The cure for high prices is “High Fed”…

The biggest WTF moment of this entire decade long Fed money printing experiment will be the moment when the masses figure out that we have reached the point of no return, which will require an epic global reset, most likely forced by events beyond anyone’s imagination and/or control…

So what REALLY is the point of no return??? That is what I would ask our foolish Fed…

These lumber price hikes would be called a short squeeze if a stock like GameStop suddenly zoomed up. Panic buying plus the lumber company cartel limiting supply seem to be at work here. There are photos of massive amounts of lumber being stockpiled in some yards. Plus there is the CV-19 blockade at the Canadian-American border, which affects Canadian lumber imports. Still, GameStop was about $4 a share a year ago and its is still $160 today, post Reddit spike.

gerry,

“There are photos of massive amounts of lumber being stockpiled in some yards.”

That article you’re referring to is brain-dead click-bait garbage, and you fell for it. Those were photos of ready-to-ship lumber waiting by a rail siding for the train to be put on. That people took this brain-dead click-bait shit seriously is astonishing.

I think you’re out of your element here, Wolf. The mills are bursting at the seams. I am a contractor and I am having no problem getting lumber. There is no shortage, only a massive increase in price. The shortages were last summer. When is the last time you priced out a lumber package?

No one said they were OUT OF LUMBER. This is just BS. A shortage means less supply than demand, longer lead times. Sure stuff sits around at rail yards, and on trains, and there are slowdowns and transportation issues. etc. A shortage doesn’t mean shelves cannot be replenished. Quit confusing a “shortage” and price spikes with being “out of.”

There is a HUGE flow of lumber all the time. The flow is just not quite enough to meet red-hot demand in a timely manner, and so prices rise.

Some of the problem is Canadian tariffs. Domestic producers are benefiting, although Idaho lumber mills have been consolidating for years. Lumber futures are ultra quirky.

I just read an article that in my country of origin (Germany) lumber prices are increasing because of exports to the US. I wouldn’t believe the stockpiling theories. I watched the video on clickbait ZH and it looked like a regular transportation hub with normal supply. People underestimate what goes into transportation logisitcs. Hubs will always have many days of supply. If the US mills were really stockpiling, now that the prices are going through the sky, someone outside the country would eat their lunch. The reason for the price explosion is simply shutdowns and underestimation of demand by the mills during the early phases of the pandemic + super high demand since then (because of easy money & stimulus policies) + inflexible supply (because it’s not that easy for mills to increase production).

It appears that it’s a little more complex than “greed” and tarrifs: From an article published by Professional Remodeler Magazine:

“According to the Canadian Forest Service, mountain pine beetles in British Columbia have affected 18 million hectares of forest, attacked 50% of the total volume of commercial lodgepole pine and destroyed pine trees that could have produced an estimated 752 million cubic meters of sellable pine from the 1990s to 2017. For reference, 18 million hectares of land is roughly equal to the size of Rhode Island,18 times over.

Meanwhile, Oregon, the largest softwood producer in the United States, is also plagued by the pine beetle. The state’s Department of Forestry says that the “mountain pine beetle is the most destructive forest pest in the west and has contributed to more tree mortality than any other bark beetle in Oregon.” The bug destroys an estimated 380,000 acres of the state’s forests per year.”

“The reason for the price explosion is simply shutdowns and underestimation of demand by the mills during the early phases of the pandemic + super high demand since then (because of easy money & stimulus policies) + inflexible supply (because it’s not that easy for mills to increase production).”

BS. Name a lumberyard that is short in supply of anything. Name the product. Tell us. Tell us what you build. Put up or shut up.

I’m not sure any of you are really disagreeing with each other. Is there really a philosophical difference between a shortage and price increases? If government mandated that lumber yards sold their lumber at 2019 prices, there WOULD be a shortage.

Price increases are the market’s way of preventing a shortage. Even if there appears to be a shortage of something, you can (with rare exceptions) always get your hands on whatever you want if you’re willing to pay the price.

Yes Wolf, we know… and gas prices go through the roof every summer at vacation time because of “refinery maintenance”

and the west coast utility companies were not caught in a hotel room fixing prices. Pharmaceutical companies never get busted for knowingly marketing dangerous meds, and banks never get busted for laundering drug money, or creating fake accounts to charge service fees. None of these things ever happen because if they did, it would suggest there are conspiracies to exploit the public, and as we all know, there are no such thing as conspiracies……

@Depth Charge

Price of timber has barely moved. It’s lumer prices alone that skyrocketed. Why would mills forgo once in a lifetime profit margins? It makes no sense at all. Extraordinary claims take good evidence to support, more than a youtube video of someone seeing lumber stacked at a logistics hub.

If you know more, share it, else it’s you who should shut up

Construction on a home close to me has slowed to a crawl … they are having a hard time getting enough lumber to finish the job.

“If you know more, share it, else it’s you who should shut up.”

I build sh!t for a living and am at the lumber yard every week. I got two lumber package quotes this morning. What do you do?

@Depth Charge

So tell me your evidence for mills/suppliers being involved in price manipulation. Let me guess: There is none. Because if they would, they’d be stupid and just lose buisness to a competitor. But all the US mills are invovled in this grand scheme, and I the foreign mills too? We all love the conspiracy theories put forward by sites like ZH.

It’s the same with the silver meme crowd and the silver bullion markups. Low supply of coins does not imply physical silver shortage nor manipulation. And I say that as someone invested in silver.

I never talked about price manipulation, you just made that up. This is just yet another massive bubble care of Wall St. speculators. Once they drive those lumber futures to these levels, price go berserk on the retail level. It’s the same as the oil price spike back in 2008.

OldSchool

Yes, the cure for high prices is high prices, just as the cure for low prices is low prices. But the Fed and the rulers dont believe in “free market” forces.

The injection of TRILLIONS of dollars by the irresponsible and unaccountable Fed has made it certain that when balances are established, the price levels will be MUCH HIGHER than before.

The Fed lies to us. This is not transitory, it is systemic.

The Fed continues to buy MBS despite the fact there is a dearth of supply of houses for sale. Their policies have created imbalances, and we will pay.

The “uneducated economist” on YouTube works in retail lumber and had been tracking developments in lumber production for years. Particularly of interest here are the cascade of mill closures that have occurred over the last couple years, coupled with beetle infestation issues, and other problems in Canadian supply. The stage was already set for a price spike due to lack of supply before the pandemic demand pulled the trigger.

Off topic, but related, lumber history. In 1976 we were buying boxcar loads of Black Walnut for our expensive office widgets and wall plaques for $2.40/bd ft, with guaranteed %’s of 8 quarter and 4 quarter (2″ and 1″ thick….hardwood talk). The supplier back east told me farmers were waking up in the morning and the “big tree in the south 40”, or wherever, was GONE.

That’s a shortage!

If they do then we will soon have price stability, and perhaps in a couple months we will be near maximum employment, so the only thing left is moderate long term interest rates! Pat those banksters on the back for doing such a fine job.

Stump prices, at least in the South, are very low compared to milled lumber prices. From stump to end users, lumber is not a simple process, and lumber and timber prices often disconnect. As a kid I use to log timber, and as an adult I sell timber as a side venture. There is a great article titled “Why Stumpage Prices are Low Despite Historic High Lumber Prices”, March 17, 2021 Posted by: Adam Maggard and Daowei Zhang. Below is the last two sentences, which will help explain some of the “stranger things” happenning in the lumber industry right now:

Conclusion

“Lumber production and consumption are still behind 2019 values, as is the pace of new home builds. Therefore, the issue appears to be more a result of a restraint on the supply of lumber rather than expanding market demand. For the start of 2021, lumber prices again increased to new historic highs, rising above $1,000 per MBF at the end of February and beginning of March. This is likely a result of limited capacity of mills during the winter months as they do repairs and updates, paired with a continual strong demand for lumber.

While lumber prices could be jumpy and may remain high for the remainder of 2021, we have seen some homeowners deciding to postpone their renovation or new home activities as lumber prices are currently too high. As for timber prices, it is unlikely to see a substantial improvement in the short-run because it is a buyer’s market and sawmills do not have to pay more than they have to pay. It may take a while before an increasing sawmill capacity can absorb the oversupply of timber that has been accumulating for more than a decade. Until then, the industry may continue to see the usual decoupling of lumber and timber prices that has been seen since the spring of 2020.”

New standard for the dollar instead of measured in gold it’s worth one foot of a 2X4. Its the new wood standard.

Fed really is blowing their real job which is to protect the value of your savings.

The cure for high prices is high prices. Witness the crude oil spike in 2008.

We never got free gas back in twenty aught and twenty.

Actually, oil went negative for a few days for those who could take immediate delivery and store it.

The price of a contract to deliver oil in the future dipped negative briefly. It was not possible to take delivery of negatively priced oil as the price was bid back up before the expiration date. Futures are not puts or calls.

Right, but my sense is that $1.60 or so is the lowest gas can really be when you take into account taxes, refining costs, distribution costs, and so forth. That’s why gas never really dropped below that even with oil negative.

The Fed has no fear. Real fear has fearful consequences. If their projections go south, they migrate to a bank or hedge fund and make more money.

Get it into your head – there is no accountability. Criminals are held blameless because of using too much dope. Politicians just say or giggle whatever they want whenever they want and then forget about it. Not even accountability for being good, innocent people are persecuted for made-up reasons.

House near my sister sold for $3M cash. My wife’s friend just bought a new house – $3M cash.

The lemmings accelerate to the horizon.

Yep, ZERO accountability. That’s the number one disease in this country and it’s of course amplified by freedumb ……

In South Korea, presidents are sometimes sent to prison for their crimes. In the USA, it’s scums pardoning other scums. Nixon was an example …..

In USA they get book deals and Netflix deals.

joe2

The Fed is the well spring of all the dangerous price action in this country.

They ignore their mandates…

They are INSTRUCTED TO FIGHT inflation yet they promote inflation.

They lay an inflation tax on the citizenry, yet only Congress has that power

to tax.

They expand the money supply permanently, not the temporary injections of liquidity which is the purpose of the Federal Reserve Act.

Who do we call.?

Call your congresspeople. They are the folks that are spending money they don’t have, and that you don’t have yet. They are spending your future earnings and those of you children.

If you get wood all the time, I don’t recommend looking at these charts.

Fools rush in where angels fear to tread, and we see them today diving head first into these distorted WTF markets. The fact is that there are plainly many such fools with more money to burn than good sense.

It has been said that a consequence of shielding people from the effects of their folly is to fill the world with fools.

Job well done, Fed central planners!

fear and greed. that is the spectrum

Now we have both

Who knew that those sharp-toothed FedRev Ferengi had the means to whittle copious wood into $$$!

many contractors are finding clients are balking at prices

I’m looking for 1/2 built home which is stopped because they ran out of $$cash

no hurry

in mean time I’m working and stashing cash as fast as I can

Joe…

Buildings that run out of money were likely short cutting proper construction techniques prior to shut down.

Janet hinted rates might increase. Market dropped. Janet and her Fed buddies immediate reversed to reassure that free money will continue to flow.

Doing that signed the Fed demand order for inflation. If you don’t raise your prices you will be eaten alive. If you do you may survive long enough to get your fiat into something of value.

My friend has three grown children in three different states. They all have major remodeling projects going. House across from my parents being remodeled. Home two doors down from my vacation spot being remodeled and another is adding an outdoor building, but work stopped after concrete pad was poured.

Too much money trying to squeeze through the door at the same time. If prices go up 25% this year and then level off, you have just had 25% of your purchasing power stolen.

“They all have major remodeling projects going.”

The next question is what lies behind this C19 triggered orgy of remodeling.

I know others have different opinions, but my guess is,

1) People think they can safeguard/multiply the value of their biggest asset by remodeling…not realizing that interest rate effects swamp any owner efforts and

2) The remodeling is a prelude to C19 triggered selling.

People understand that if they own a house, because of the price surge in materials, the replacement cost/value of their house has risen about 35% in the last 5 months!!

Remodel, dont sell …

Thank you Federal Reserve…

Last time YOY CPI was in the 2.6% range, 1999 and 2006, 30yr mortgage was 6%…now 2.9%

The Fed creates all misallocations and price incongruities in the economy….every one.

Anecdotal, but needed my soffits and vertical exposed beetle-kill planks sealed. About 350SF of exposed wood plank in all. I would have done it myself, but needed a 20ft ladder, sealant, rollers, etc.

Painter took 3 weeks to come and do the job after booked (he is as busy as a 1-armed paper hanger). Took him and his 2 helpers 3 hours and actually, the boss just held the ladder. Very professional. He said I was LUCKY because he got the last 2 gallons of sealant available and he literally did not know when they would get any more.

Charged me $2000. I did the math and presuming 3 hours represents a 1/2 day job, this Painter is making approx $420K / Year in labor only. Even if paying his laborers a healthy $75K/Year (unlikely), he’s making north of $150K / Year for residential painting.

I am actually happy that tradespeople are finally making a great living, but if you would have told me I was gonna pay $2000 for 3 hours of painting work 10 years ago, I would have laughed my A** off.

Meant to say he is making north of $250K / Yr (typo – sorry) :-(

Bear,

You probably got hosed my friend. Sorry to say that, but if you are cramped for time? And the workers did not make that money, the owner holding ladder made the windfall on your job.

My son who has 20 years high end maint experience building and maintaining computerised autonomous driving trucks and giant shovels, makes 200K plus benefits. This is a union job, and one of the highest paid on site. He does electrical work from chips, controls, to hydraulics, highly specialised. A house painter might make 40 – 50K. The contractor? Who knows? I occasionally hire a dual ticketed guy to help me (carpenter and electrician) and pay him $500 per day cash. He’s tickled pink to get it. He is pleased to make $400 per day, actually. I didn’t hire him on my latest project as he is too busy. I just do it myself rather than wait the 3-4 weeks until he is free.

I’m sure you pay him $500 per day cash, right? That’s a whole different story than $500 on the books. I don’t know about Canada, but here in the states we have to send out 1099 forms to every sub contractor we paid.

“You probably got hosed my friend. ”

Yes, professionally hosed….

One of the top fed minds in the country…….Yellen comes out and says she thinks rates need to go up…….then 3 hours later states,,,,,,,Oops…….I didn’t mean to say that………our leaders are honest servants…….bull.

Economics no longer rules……its all about having a good connection to the crooked palace of crooks. As they steal everything that is not nailed down…..and some of the nailed down stuff too.

Read about that Yellen flip flop. Very revealing.

If you can’t even state conventional wisdom bromides like “Dah, rates might need to rise a teeny tiny bit sometime in the next million trillion years or something” w/o having to back track…

I’d like to know whether she flopped voluntarily or got a call. “Jan, this is Jerry. Listen to me. I run this outfit and you talk to me before you run your mouth. I’m the one who has to auction our 10 year toilet paper. Thanks for making it harder’

Occasionally even the elite plutocrats trip over the truth in public– and a truth bomb gets released in error, only to be recanted later.

A true politician said that when things get serious you have to lie. So the authorities have been lying non-stop since ’08 at least. They have acted in emergency mode constantly since then (QE, ZIRP, etc).

As Dorothy put it, we are not in Kansas anymore.

Fred…

exactly.

Connected to the Fed is worth all the MBAs in the world.

Imagine its 2009 and you just got word the Fed will do Quantitative Easing…and will do it from that point on … to support markets. It will be “sold as temporary” but it will not be…wink wink.

Might make you invest….wouldnt it..?

Regarding:

“For example, if the price of lumber futures collapses by 60% from today’s $1,610 per thousand board feet, it would still be at $640 and would still be far higher than the middle of the range of the prior 10 years.”

I have always followed lumber prices as my lifetime employment has relied on a sound lumber market….high enough for the producer to make a buck yet affordable enough to buy. I’m used to $300 per thousand. I used to buy lumber for that price for years. I also worked 20 years flying for logging companies….to camps. I have seen the logging camps shut down for Christmas or snow and just not reopen. I have seen the price collapse in weeks and companies only working because they would lose their cutting quota. Friends of mine have been out of work for up to 18 months at a time, and these were guys with high seniority.

The forestry companies do not make money at $300. It can’t be done. Probably $800-1K is reasonable. But who knows for sure until they shut down as they always moan and whine. Always have, always will.

Today, right now, there are billboards where I live advertising for HD Techs, logging truck drivers, machine operators, foresters, and scalers. These are 150K per year jobs. Forestry is booming here on Vancouver Island….just like it was in the late 60s and early 70s.

Like I said above, it can shut down in weeks. I’ve seen it.

I’m also retired (retired carpenter, etc) but still building. I’m working on a personal project right now that will cost me twice what it should and I pay wholesale. You know what? I just pay it. Seriously, I have the time right now, inclination, and bucks. I’m not going to wait one or two years to complete this project because of high lumber prices. Builder friends are also still working; flat out. People are still buying new builds and a good builder has work lined up for years. Years. No one needs to even advertise.

I don’t see any change until the interest rates rise or some kind of huge economic shock happens. Then people will be afraid and cut back. Until then…..

Just so people understand, the cost of framing lumber to build a house is the cheapest part of a build. It’s everything else, especially high end finishing products, appliances, plumbing and electrical. A good tradesman earns at least $40 per hour, anyway. If they work full time, with two weeks holiday that is 80K per year. If a politician makes 200K + benefits a carpenter is certainly worth every penny of what they make. It’s hard work and requires skills……lots of skills that takes many years to learn.

regards

Are you saying all those years of lumber in the graph above were sold at a loss?

Log costs and milling costs for Framing Lumber are far less than $USD300/1000 board feet.

Log costs are around $250-300/1000 board feet. And milling costs, sawmill, drying and planing average around $100/1000 board feet, in all the high production (spaggetti) mills. These costs are offset by wood chip revenue at around $100/1000 board feet when counted against lumber costs per 1000 board feet.

I don’t know log costs in the U.S. South, but they appear to be dirt cheap.

The only exceptions are where high value old growth logs, which contain clears are located. Higher log costs, far higher value produced.

And, of course, export log prices where other countries will pay far higher prices to maintain employment. Free market, my butt.

To my eye, this all looks like an an inflationary spike before deflation arrives full-force, taking out asset and commodities prices simultaneously. My guess is that the stock market trades sideways for a few months, commodities keep going up — and then both barf out in fall.

I also don’t think 1970s stagflation is coming. Back then, America was a middle class country with some of the best infrastructure in the world. Today, it’s an oligarchy with an economy dominated by finance.

“Nailed it” jila, IMHO.

This ”spike” IS different because of folks apparently willing to buy at these crazy prices, likely due to FOMO, as stated.

Other than that, it’s really not a new thing, especially for building materials.

Seen rebar pricing good for 24 hours in 2003; similar for gypsum products, lumber, ”red iron”, etc., etc., though I don’t remember the dates; all were investigated and some were found to be manipulations by the producers, others just the ebb and flow of markets.

Judge declared the CDC ”eviction ban” illegal announced today,,, so, as many rational folks comment,,, this too shall pass.

BTW, local hood in the saintly part of tpa bay area is absolutely full steam ahead, with almost every small old house sold demolished asap, and every new home built sold before the first construction started.

“an inflationary spike before deflation arrives full-force”

I picture an exhausted marathon runner taking a big dose of adrenaline just before the finish line, only to immediately collapse on the other side.

This is not like the 1970s inflation. It is difficult to read about price increases from 12 cents to 5 dollars and not wonder, is the the big hyperinflation starting already?

I sold Caterpillar equipment when the Peoria 2 year order file in the fall of 1973 turned into 2 seconds by Spring 1974.

People walked away from deposits and the local dealer had to decide whether they wanted to bankrupt all their customers or make a different deal.

$1600/Mbf 2×4 has about $1200 of air underneath it. But what a short term rush.

“To my eye, this all looks like an an inflationary spike before deflation arrives full-force, taking out asset and commodities prices simultaneously.”

Very well said. I believe this as well…

We made things in the 70’s and we had strong unions that insured a comfortable living with retirement with dignity.

I can’t say I saw this coming, but I felt something was going to be very wrong in the future.The end for the working man started with Reagan laying off the air traffic controllers.When he did that every union member from every trade should have mobbed every international airport in the US.

They didn’t, and unions have been dying ever since.My wife and I chose to never have children because of that “feeling”.My only regret is that I will die alone, but I think things are going to get so bad in the US that people have no idea.Just stopping foodstamps would put the gated communities in great danger.

Watch…

This is what I see too.

Vast swathes of the population in the UK are being given free money.

If that carries on then gov debt rises and gov can’t sell it’s bonds as cheap, so rates rise. Pop.

If they cut the free money, the economy which was already doing badly in early 2020, and now has 18 months of disruption and debt burden, won’t support these people. Temporary supply and demand woes aside, it can only be bleak. Pop.

Since the USA election, as much money has entered markets as since 2008.

Who bought in? Institutions and retail investors? Who sold?

I think it’s fairly clear the 99% are now the currently more than willing bag holders.

Deflation will reign supreme while no one has money to buy stuff.

No jobs and no easy debt = no money.

Well,endless $$TTTs used to blow yet another RE bubble are fake but the trees lumber is made from are very much real.And they grow 60-80 years.

Why not put WWII “Operation Fortitude” lessons to good use ?

“Operation Fortitude was an elaborate, mind-boggling hoax – using decoys such as rubber tanks, canvas ships, plywood aircraft, and even dummy soldiers to fool the Germans about where we secretly planned to land on D-Day.”

4 soldiers lifting a decoy tank:

https://www.elinorflorence.com/blog/d-day-decoys/

Save the Trees !

Make inflatable $1M house decoys !

Instead of demolishing housing developments when the bubble pops just deflate them and store them until next RE Bubble appears on the horizon !!!

About Fortitude: the impetus was very much British, especially in the early stages. The crowning touch was having the Germans believe that D-Day was a feint, and the real invasion would come at the Pas D’Calais, the narrowest part of the Channel. This deception lasted a month until a million men had been landed and it became obvious there couldn’t be a second landing.

In my neighborhood, Arizona, all new construction, 3 car , 3 bdrm, 2 bath 1800 sq ft 350-390 k homes are being bought by people from California as ” investment vehicles” literally sitting empty after closing. One relator told me they have no plans to move in and are not renting it out. Builders say lumber package going up weekly, homes going up everywhere, prices going up weekly.

Gonna be one hell of a crash

Once crashed, that $390 K home is $200 K. I did about the same percentage-wise deal in 2010 when I picked one up for $64/sq. ft.

If there’s ever a person I’d get schadenfreude from watching take massive losses, it’s a speculator who buys up real estate, taking valuable housing away from someone who needs it, just to let it sit empty.

At least when someone does this with Dogecoin or shares of TSLA, it doesn’t affect normal, real people who are just looking to get by.

The Fed is buying MBSs still….and despite a lack of housing for sale.

Blackrock is partnered with the Fed, right?

And didnt Blackrock make a HUGE investment in residential real estate a few years ago? Gee, Jerome…..this is curious.

Timber!!!

Aka the China model

Reminds me very much of 1973 with the Arab Oil Embargo. Oil supported the production and distribution of so many American goods that we began an economy killing inflationary cycle. That is what is going to happen now. The Stimmy checks are largely in the rearview mirror since even the Donkey side of the aisle is getting cold hooves because the electorate is now Woke about the Dollar and Price Level destruction caused by unprecedented Government spending and money printing.

Fed Heads and Washington please take a very low bow. Although it will be akin to DUCKING in the months ahead as the Income side of the American Consumer cannot keep up with the Expense side of the ledger. Lower standard of living baked into the cake, the sugar high of something for nothing will leave one heck of a hangover for the annals of history to see. We have literally shot our wad of Dollars at the Casino.

What would stop the government from just doubling the stimulus check in 2021? Literally just putting another incentive as big or bigger than all previous stimulus paychecks. That would stimulate the economy greatly. Just use the same saying of this is not a problem to worry about today and use the guise of URGENT. The masquerade must continue until every US Citizen has been immunized. Just got my first shot yesterday.

The Fed makes money essentially free to the federal govt under the guise of “stimulating employment”.

The federal govt hands out money to an extent it keeps workers at home.

Employment numbers stay relatively high.

Fed keeps money essentially free to the federal govt.

Federal govt hands out money, workers stay home, employment numbers disappoint, Fed keeps money free to govt.

See the cul du sac of idiocy?

The Federal Reserve has your credit card.

Solar module costs have recently spiked up wards of about $.10 per watt. As this is a primary construction cost, deals that penciled out a few months ago are now losers. This reverses a significant trend that module prices were in a constant downward spiral. Bad news for solar developers.

There is no shortage of lumber whatsoever at the local mills and big box stores. This is a speculative bubble due to Weimar Boy Powell’s deranged money printing schemes. These financial terrorists have destroyed the country. Weimar Boy should be swinging on a meathook above an angry mob armed with pitchforks.

Dr Rathenau was the equivalent of Weimer boy Powell in 1922’s Weimer Germany. From “When Money Dies p 78,79

“Rathenau was driven from his home to the Foreign Office, the path of his car was blocked deliberately by another while two assassins in a third car which had been following riddled him with bullets at close range, A bomb thrown into his car thrown in for good measure, nearly cut him in half. “

I like it.

A happy ending!

Now we have cryptos gaining 100% in a DAY. Shitcoins that have absolutely zero real world utility. The end is nigh.

Even the local quarry has raised their prices on materials roughly 20% across the board from last year, give or take.

I am being very cautious right now even though I have tremendous pricing power. I think I am going to see work dry up to a trickle sometime in the next 18 months. I am saving everything.

I have stopped buying any new materials. Instead I am repurposing old surplus material I have laying around. So I am still building just not feeding the beast!

I wonder how long the sheeple will continue to celebrate that $3,200 which has been completely eaten up and then some by this inflation. They are paying it back in spades now. They are too stupid to understand math.

Oh, you didn’t know? math is r*****, or at the very least doesn’t promote equity. We will need to make sure no child is left behind (AKA no child gets ahead).

You, my dear DC are on the wrong side of history promoting math when education departments from coast to coast are discouraging advance math. Cause only r***** in other countries or red states would promote something like math.

You don’t want to be a r*****, do you?

?

Math is not needed for internet gaming, Fakebook, Twitter, and other important pastimes. Math was needed when one had to work and write checks to pay bills. Now all the Gov stimmies are deposited automatically and Google Pay handles the outgo. No rent money is needed and mortgages are history. Utopia!

So long as they give people a generous paycheck for not working, it will create inflation. That is a no brainer.

Many people would rather sit on their backsides than work. This lowers production, which causes shortages, which corporations see as an opportunity to engage in price gouging.

This is not rocket science. The Governor of Montana understands this and is saying he will end Federal supplemental unemployment. Too bad we do not have another 49 Governors with the moral fiber to do the same.

@James, you the Gianforte, the soon to be ex-governor of MT?

hehe…. you know, if the J team wants to give me 2x my salary in unemployment permanently, I’d take them up on the offer. But how dare some worthless Federal judge tell the CDC that they cannot impose an eviction moratorium. Totally unAmerican.

@Anthony,

That’s right, math leads to low wage low value work that should be outsourced to Asia. Let them do it, while we in the US focus our efforts on more value added endeavors like justice, equity, equality. Hey, I think we’ve been oppressing squirrels a lot, and it’s just total unfair how we’ve treated cows, let’s get equal rights going on those subjects too. I’ve heard the squirrels will pay us in nuts.

Are you reading Calif board of educ proposal to eliminate all advanced math classes. Best and brightest go f#*k yourself. In Calif we don’t want any Lake Wobegone kids.

Another important factor is that as of today, 45% of Americans have had their first jab so covid restrictions will continue to be lifted and commerce could increase substantially from here.

By the way, Yellen The Felon did a complete 180 on her raising rates comment that had apparently burped forth from her gross face before she could stop it. And now another FED stooge came out and said absolutely no taper anytime soon. This country is full of dumbed down chowderheads who allow these financial terrorists to walk all over them.

Yeah, well the other members of the J team put her in her place. Joe and JP reminded her that of the three of them, she was the only one who served at the instantaneous of one other person.

Toe the line, or they’ll fine another J to replace her… hmmm, May be Joe from WV?

I nominate Jon Corzine. He fits the bill both in name and character.

maybe you should do something about it instead of whining on an internet message board all day

The cure for high prices is NOT always high prices. There are well-documented disconnects. For example, the spike in oil prices in 2018 was sticky because the slump below $50 in 2014 discouraged upstream investment. This was compounded by geopolitical crises in the Middle East and Venezuela that hampered production. Higher prices couldn’t draw in more producers and cut prices.

We saw the same thing with palladium over the past few yearsb. An increase in demand could not induce more production due to problems at the production end, whether it was power outages in South Africa or flooding in Russian mines

No man is an island, and neither are commodities. The prices of all commodities are inter-related, both directly and indirectly.

Copper mines often yield silver as a by-product. If the price of copper goes too high, consumers may substitute aluminum for many uses. The drop in copper output also decreases silver output. Naturally, the phenomenon runs as well in reverse. So there is an element of both production and substitution causing disruption in the price of silver.

Palladium is a by-product of silver and nickel mining. Silver demand fell after VW-Gate (in 2015 VW admitted it had fudged its diesel numbers). Diesel uses silver for its catalytic converters, whereas gasoline uses palladium. The collapse in demand for silver and the increased demand for palladium as consumers shunned diesel turned everything upside down, and nobody was able to step up palladium production. As we move to EV the paradigm could easily reverse. If run a silver or palladium mine, will you commit to yet another market shift or wait and see? Even if you wanted to switch tomorrow, mines just don’t turn on a dime – whether true silver or debased copper filled junk. Mines are capital-intensive and rely heavily on oil. Ah, another connection to worry about!

Dacron and cotton are both used in drip-dry shirts; this is a consumer-driven disruption.

If a commodity goes up in price and people can’t find a substitute demand will likely fall. The cure for gas guzzling cars and few car pools was $4 gasoline.

One general factor of production, labor, can be very fluid. Where did the tanker truck drivers go? Obviously they found greener pastures during the quarantine. I have a friend who’s a former trucker and he gets calls all the time. Too late – he’s now retired, adjusted to his benefits, and will never go back. Stimulus checks aren’t even part of his equation.

As I mentioned in the discussion of the lumber shortage, there is no shortage of TIMBER. The problem is a shortage of conversion of TIMBER to LUMBER. Quite a few mills have closed. And also as mentioned before, mills could hire back workers but are reluctant to do so because they are concerned that this truly is a transient phenomenon.

So labor can be diverted, in the short run or in the long run, directly or indirectly, from one industry to another or even dry up as skilled labor can’t find a market and moves on.

If one commodity goes up in price, and consumers are unwilling or unable to substitute another, they will be forced to consume a little less of something, either the commodity or something else.

Since all products compete for consumers’ dollars, a change in any one price will affect an unpredictable number of other prices.

The cure for high prices is high prices sounds good but is actually an oversimplification since it assumes that higher prices will draw in more players.

I am not even sure we are going to EV. Dreamers dream until reality punches you in the face. Saw the dreamers now have to accept nuclear power or the green dream is dead. Might realize they have to accept natural gas as well.

Lot of problems with EV unless you have the wealth to throw out fossil fuel infrastructure and build EV infrastructure. When it comes to choosing between pensions or building EV infrastructure we will find out how important it is.

I couldn’t agree more. The irony of the Save the Planet crowd endorsement of nuclear power has not escaped me.

Whatever happened to thorium reactors? That was supposed to be the best of both worlds.

I was also reading yesterday that EV owners are going back to gasoline. Apparently there’s this “convenience” thingy that makes the Planet less valuable.

I am waiting for an electricity can that allows me to walk to a charging station and walk back with the can containing enough electricity to get my vehicle to the charging station. I anticipate a long wait.

Half the worlds palladium is mined in Eastern Russia. They have big problems, the tundra is melting, and the mines are flooded. That problem may not get any better. Palladium is the active ingredient in Cat converters but apparently you can reduce the amount. After market CCs only have about a three to five year life, while I still have the orginal OEM in my 91 Chevy. Same story, the box of cookies gets smaller, and there isn’t so much over capacity. They can keep prices down by not making as many. Even while the EV continues to take market share, the need for replacement CCs should do pretty well. (People steal them) There is also no incentive to find a better solution, for a CC in an ICE with an end date, just keep using the same material.

Agree read Gail Tverberg’s writings, analysis and followvthecreal economics. Ourfiniteworld.

Wolf,

Glad to see your WTF are marching from a monthly to a weekly feature. Should we expect a transition to a daily cadence in the near future?

Also, I am thinking that WTF may not longer be sufficient to cover the nuttiness associated with the induced impacts on our economy. In other words, is there a more appropriate acronym to describe the insanity of our current situation?

Might be useful since the current acronym is starting to wear off in terms of shock effects.

MCH,

Later today or tomorrow you’ll get another WTF chart. Then there may be a pause of several days :-]

“As I mentioned in the discussion of the lumber shortage, there is no shortage of TIMBER. The problem is a shortage of conversion of TIMBER to LUMBER. Quite a few mills have closed. And also as mentioned before, mills could hire back workers but are reluctant to do so because they are concerned that this truly is a transient phenomenon.”

BS! What do you build? Where do you get your lumber? I am sick and tired of these keyboard lumber experts. I just got quotes on a number of projects this morning. No shortage of ANYTHING, but the customer is sure gonna pay for it. $92 per sheet for 5/8″ 4×8 stainable T1-11 siding. $11.60 per for 2x4x8 doug fir. I can get any sheathing I want, pine/fir/spruce trim, redwood decking, etc. They have more available than ever. This “shortage” meme is nonsense!

Depth Charge,

No one said they were OUT OF LUMBER. This is just BS. Quit confusing a shortage with being “out of.”

There is a HUGE flow of lumber all the time. The flow is just not quite enough to meet red-hot demand in a timely manner, and so prices rise. That’s what a shortage is.

Hey Wolf. I just talked to my lumber guy this morning to get pricing on 2 lumber packages. I felt a little silly asking him, but told him I’d been hearing about some lumber shortage as the cause of the price spikes and wondered if it was true. He laughed and said he had no shortage of anything but prices were sure up. If you’d like, I’ll email his contact info and you can call and see for yourself. This lumber yard is about 200 miles from you and does massive business. I’ve been doing business with them for years.

No one said they were OUT OF LUMBER. This is just BS. Quit confusing a shortage with being “out of.”

Sound like a broken record until you get it.

“In economics a shortage occurs when demand is greater than supply, causing unfulfilled demand.”

Where is the unfulfilled demand, Wolf?

Yes, “when demand is greater than supply,” exactly, that is one part of the equation.

But you forgot the other part of the equation: PRICE. If you pay more, you get the merchandise.

Even during a famine, the rich don’t starve. Only the poor. That is the function of price. If you’re willing to pay, you can get it. And as you pointed out, you were willing to pay. And as others pointed out here, they’re not willing to pay, and they’re not buying at those prices (“unfilled demand”). That is part two of the equation of a shortage.

When the economy is OUT OF something, then no one can get it, and price cannot address that issue either.

Just curious, would it be possible to run out of self serving politicians? That would be a change, right?

?

Since I used my double-sided axe to cut down a 10 meter tall red maple in my back yard last weekend, I now have lumber. Of course it has to dry for awhile and get run through a planar. Nice and straight though.

(True & couldn’t resist)

I am in the development business and seeing significant price increases in steel and other components as well as lumber.

I agree with Wolfs prediction that it will moderate but end up at a higher level overall, The risk is I make a commitment to a rent based on construction costs that are 9 months or a year out. As a result Developers and users are starting to pre buy some items so that they don’t get squeezed for cost and they are worried about delivery times. This isn’t speculation on my part and includes development companies building for the largest industrial tenant in the country. The futures market may be in crazy speculation mode but the demand for the commodities is very strong for now, it seems to me that we are going to feed the inflation beast.

I have been a deflationista for the last 12 years, starting to question my position as I see these trends.

The 30yr mortgages are 2.9% and the Fed buys MBSs.

The CPI YOY in march…2.6%.

CPI in 1999 and 2006 2.6% increase..

Then, the 30yr mortgage was 6%.

This is the crux of material shortages.

All true but even at these prices for lumber, it is not a big enough component to derail a frantic house market. The house market will have to correct first.

One of the biggest factors I’ve seen is the ever growing component of the building lot in the total cost. When I was a young realtor in the 80’s you could buy a decent serviced lot for about 20K. You would have to spend 60 to just satisfy the building scheme ( 1200 sq.ft.) So lot is 25% of total.

Today that same lot would be minimum 200K and you satisfy same scheme for AT MOST 200K.

So lot has gone from 25 to 50 %. These numbers are conservative. Note this is a never- ending trend not a one year thing.

There is a comparison to palladium, now the most precious of the metals. It is needed for pollution control, fuel cells etc. but is too small a component to ITSELF price the final product out of the market.

Having said that, in a SANE housing market, a extra 30 K or more would be a factor. But an addict, or an obsessive, is a price taker, not a price giver.

The bubble is always in the land price.

“…palladium, now the most precious of the metals.”

If you’re referring to price, have you taken a look at rhodium recently, nick?

I kind of thought as I wrote I should add context: the Comex traded precious metals. I’ll bet plutonium is way more precious.

I watched a Google Earth video report about deforestation including the Amazon rainforest in Brazil. Half of the earth’s forests are gone; quite a lot to ranchers converting forests to pasture. Other forests were taken by loggers and lumber companies faster than it can grow back.

It took a loblolly pine 40 years to grow from a seedling on a tree plantation in South Carolina to harvest size. They were used as telephone poles, pulp and cheap grade lumber.

Will need mass vaccinations to calm the panic that is disrupting supply chains. India considers stay at home orders.

How about Haiti and Nepal. Nothing left there either.

My son is in the process of buying a home from a big production builder in a housing development. The house to be built on each lot is locked in ( as the permits are done far in advance.) People put down small down payments then serious money when the house is near the starting point and the final price is locked in. The price for the same house has been going up weekly ( about $3000 a pop due to input inflation). But the problem is that these homes were already designed and priced to be just enough above the FHA loan limit ( for the area) that the average buyer had enough of a down to qualify for an FHA loan. With these price increases many of these buyers are coming up short on the houses they had planned on buying. The buyers for this development are 30 something Intel Engineers with midrange incomes and carefully saved down payments. Their incomes and Savings accounts are not increasing to keep pace with these prices. Back in February the model home village was crawling with customers on a rainy Saturday morning. This weekend we stopped in with our son to check on the progress of his future house and the place was a ghost town, except for some couples in the sales office moaning about how they could not move forward with the new more expensive house. I think this will have to correct soon.

I think I know the development site you are talking about. If it has train tracks running adjacent to the site, then I live close by.

Food for thought. If your son hasn’t done so already, and if it’s not too late:

Special order triple pane windows for the house. Those train tracks are active and that train runs day and night…all hours of the night. And every time that train comes to a rail road crossing, it blasts it’s horn, and that horn is loud!

Prospective buyers won’t have a clue until they’re already moved in. Consider it a feature of the new development site. And of course, the builder will use the cheapest materials available.

But if nothing else, next time your son visits the site, have him ask about the train.

Odd: I’ve never heard of deals where you lock in with a deposit and then relock in with a final price. Sounds like the developer should be helping out.

What’s all the excitement about? This is transitory, remember?

So I live in San Diego. Our local city council in its wisdom, just passed an ordinance that prohibits landlords from kicking out tenants for just cause, the only basis for an eviction in the county is now health and safety reasons. They also just created the most restrictive rent freeze in the state, requiring all landlords to only raise the price of rent at the rate of CPI for the county, which of course is a problem seeing as how the inflation index is imperfect to say the least. Not only that, but landlords now cannot kick tenants out even if they want to live in their own home and that is the reason for requesting the tenant move out. That part of the ordinance is “temporary” until August 2021. Meanwhile we have prices going up so fast no one can keep up. My mother is a realtor and still sells homes in quasi retirement. The other day she told me that when she looked at what was available she found the homes were selling before even appearing on formal listings and usually selling before anyone had a chance to look at the place, with multiple offers. Her conclusion: stay out the market. Its too crazy.

So what we do? Tell JP to stop buying MBS, would that make any difference? The problem is the money is already out there, and if the Fed rips up the PUT contract and raises rates where does all that money go?

The Fed could sell off its assets which would pull that amount of cash out of circulation.

The Fed can “roll off” as items on their balance sheet mature…not reload.

That drops the balance sheet and theoretically takes money out of the system.

But the Fed expanded M2 by 27% in less than a year…and the Fed’s purpose is to supply short term liquidity in special circumstances…

the Fed doesnt have the stones to do the right thing..as the country gets back to normal, drain off this excess liquidity. They wont.

Nowadays everything is a “special circumstance.”

I have been reading about lumber shortages for the last four weeks.

But then I watched this on YouTube “TRAIN LOADS OF LUMBER JUST STACKED UP !!!! Why”

What is going on?

Can’t train those damn logs to fall into slices onto the railroad cars before being shipped to market?

What you saw were pics of lumber waiting to be loaded on a train, and trains waiting to go someplace. Duh, I know. Someone created click-bait videos out of it and you fell for it. That’s what’s going on.

No one said they were OUT OF LUMBER. This is just BS.

There is a HUGE flow of lumber all the time. The flow is just not quite enough to meet red-hot demand in a timely manner, and so prices rise. That’s what a shortage is.

Seems like a lot of fabricated capacity shortages with different actors. We just experienced a once in a hundred year virus and all of the sudden there is a lack of capacity for computer chips, new/used cars, lumber, housing, workers. Somebody is making WTF profits as all of these WTF / all time-high

Those people made money out of your gullibility. Make sure you hit like and please make sure you subscribe to be notified about more outrageous content sure to get you commenting about stuff you know nothing about.

The Fed has grown dependent on use of fuzzy terms to further its fuzzy goals.

When they say inflation will be “transitory”, they mean prices will go up 10% next year, then inflation will resume at a “normal” 2% rate. They do not mean that prices will go up 10%, then down 10%. Thus, consumers are looking at a permanent 10% price increase, on top of the “normal” 2% inflation.

Once prices go up, they never go down, except during an economic crash.

It is not “fuzzy”.

The Fed is INSTRUCTED per their stable prices mandate…to FIGHT INFLATION, not promote inflation.

The Fed is INSTRUCTED per their promote moderate long rates mandate, not to peg rates too high OR too low, as this creates an imbalance between lender and borrower and is draconian when too high, and allows irresponsible debt creation which harms future generations, when too low.

All time lows in the long end is not “moderate” by any definition. The Fed has made the lender slave to the borrower since 2009, and allowed future wealth to be drawn forward to “fluff” today.

Why they are not held to their mandates is clear….Congress enjoys the free money for schemes and antics that are nothing but vote buying.

Cloward and Piven cheered the fiscal ruin of the country to achieve a great “reset”. Pelosi and Powell seem to be their missionaries.

Here in California there was no way to legally dispose of pressure treated wood for several months, and now a mechanism is in place to do so the cost has skyrocketed.

That is not a cost that’s going away.

If the lumber prices keep going higher then you can always go back to brick and concrete slabs for walls. There are plenty of ways to reduce the amount of wood you put into a home.

Brick homes were very common in America once upon a time. Last a long time.

Robert, California is earthquake country.

Take a look at the pics of Berkeley after the 1868 quake or those of Santa Rosa after 1906 you will see that there can be issues building with brick here.

There are 49 other states that brick or concrete can be used to build a home with.

The brick just replaces the wood siding, and costs even more $. Behind the brick are 2×6’s and 4×8 sheathing (OSB).

I would choose a house made of straw .. baled, of course. ‘;]

I am thinking that the way America is going lately it will be more like mudblock walls with a straw roof, or maybe a roof made out of scorched Tesla body panels.

Would be relatively fireproof. Might even be able to get an insurance discount on that in California.

If you have a home or apartment complex in progress, you basically have no choice but to pay the higher lumber prices. I have to think, however, that high lumber prices are putting a damper on new projects, especially in the apartment context, where rents are declining in many areas.

Take Seattle. I still see lots of apartment construction. Not as much as two years ago, but still a lot. The profit projections for these projects must be dropping quickly with the increase in lumber cost. Why would you plan a new project when costs are sky-rocketing and rents are stagnating?

I think the frenzy can’t last more than a few months as new projects are delayed or permanently terminated.

Peak lumber (prices) folks, time to sell the news.

Probably in a few more years the housing market will soften, and as a consequence so will lumber prices. The latter may precede the former.

In Sonoma County the lack of housing for workers is a serious issue, we lost @ 7K residences in the recent fires and there was a housing shortage before the Tubbs fire.

Residential building is going on at a terrific rate pretty much anywhere you can build it.

Houses, townhouses, condo’s, apartments, you name it.

I’m also seeing some mixed use, not much.

And commercial building is dead.

Watch the “Hotel Sebastopol” as an indicator, construction of the 60 room luxury Hotel with all the doodads suitable for the nearly elite.

They had a really nice square block cleared and ready to go and the fires came.

And the numbers did not work any more.

They got their permits extended and they are holding on to the land

When they break ground ( Or their successors in interest via BK do)

it will because the numbers work again.

Is this all fake news to panic people into buying? I look at an order from October 2020 from Lowes for about $1000 worth of wood delivered to my house and look at the prices currently on the website, they are the same. How can a retailer possibly eat this cost increase? Something fishy going on here.

TimTN,

Just in general — not that I believe your story — Lowes doesn’t buy the lumber today at today’s price that it is selling today. It bought that lumber some time ago. It buys lumber on long-term contracts negotiated at prices some time ago. You have no idea what Lowe’s costs are in the products that it is selling today. Price spikes like this take a while to impact retail price.

When the price of crude oil dropped below zero last year, did you get paid to get gas at the gas station?? No, of course not. Because that’s not how it works.

Yes, fair enough, that is true, but you’d expect with that lumber price chart you’d see a much more dramatic increase. I’m in the “inflation is real” camp but something appears to be off. Just noticed too a couple houses in the area (Atlanta) actually lower their asking prices. Seems like the cracks are forming at the very least.

TimTN,

Form “Depth Charge” further up here in this thread: “I just got quotes on a number of projects this morning. No shortage of ANYTHING, but the customer is sure gonna pay for it. $92 per sheet for 5/8″ 4×8 stainable T1-11 siding. $11.60 per for 2x4x8 doug fir.”

But yes, I can see all kinds of cracks anecdotally, just like you said. Yesterday I got a report from Tom, real estate broker who posts here, that the price of a new house in Sonoma County (Bay Area) by one of the best builders out there has been cut three times in five weeks. So yes, there are signs this stuff is cracking.

I see the same in San Diego, reduced asking prices but these are anecdotal evidences only.

You might want to check the YouTube ‘ uneducated economist’ he works in lumber yard getting all the materials together for construction projects. He has a lot of insights on lumber prices and shortages.

Are we now unable to make wood? We could do that thousands of years ago. Trees all over large parts of the country.

Timber is plentiful and the price hasn’t spiked. But it’s a long way from a tree to a sheet of plywood.

Most species are not good lumber.

Wolf:

I don’t know what Lowe’s or Home Depot do for framing lumber, but all their Cedar products used to be booked for volume and price, in the Fall, for shipment in the first 4 or 5 months in the Spring. Because Lowes, Home Depot, Menards, like Walmart are slow, slow pay (you have to finance them) I, and many others, went to smaller, prompt payers.

The cash market certainly is not the CME speculators market.

I have a solution. Tear down the old houses instead of remuddling them with particle board replacement upgrades and make 3 new ones out of the rubble. What a green idea!

I marvel at the building materials of old homes from circa 1900. You could slice my home’s lumber into thirds and it’d still be stronger than the CRAPPP they sell today (I literally laugh when I look at it). You could melt my claw-foot tub down and make 10 new ones out of it. The cement board withstands humidity unlike the paper stuff they sell today.

Our power bill is the same price as a modern house half its size. How ‘ya like them (green) apples?

Where did this all go so wrong? (Rhetorical question—I’d offend someone if I answered).

Wolf-

I absolutely love your site. You are my favorite financial/economic guru out there.

I’m trying to figure out if I’m missing something here. Last summer when I was building, I ran into a shortage of certain products at times – wood siding, wood trim, 3/4″ AC plywood, etc. In fact, for the first time ever I saw some 3/4″ AC from Vietnam. And fasteners as well. There were certain decking screws and things in limited supply. I had a hard time finding gas for my Paslode nail gun.

This year – NONE of that. But there’s supposedly this incredible shortage going on. Admittedly, I’m just a little guy. Is this shortage for corporate thugs like Toll Brothers or something, where they’re ordering tens of thousands of lumber packages at a time? I’m trying to wrap my mind around how last year was when I saw shortages first hand – shelves empty – but now we’re getting some hellacious price spike when I have no trouble getting everything I need and as much as I want. It does not compute for me, when I’m the one ordering and using the materials, and my supplier is full to the brim and tells me he has no difficulty getting me anything I need. The only thing that is different is my price quotes are only good for 48 hours.

Yes, finally, you are linking the two parts of the equation of a shortage. See my last comment in reply to your “Where is the unfulfilled demand, Wolf?” (time stamped 8:33 pm). It addresses your issue – price — which you addressed here. It’s the other part of the equation of a shortage, and how a shortage gets worked out in an economy.

From reading your comment now, I get the impression that we have a definition problem of some sort, not a difference in understanding of the current situation.

Something is happening in China. Financial media has no clue. PBOC talks about tightening credit, although the numbers don’t always jive. Then the problem with AU over steel. Copper prices started higher a long while ago. No reason for that at the time. China is simply not pushing down commodity prices any longer, they are allowing them to rise. They are also outsourcing? labor, Vietnam, Iran? This might explain their new concern with reunifying Taiwan. Brazil, is in deep covid trouble because of their loose containment policies, (they kept pushing their economy). Belt and Road may be a labor initiative, but it’s really hard to get anything other than the usual “numbers” on credit. They showed up at the climate change conference with a serious face. Things are changing and we aren’t getting the whole story

Wolf,

When you can borrow money at such absurdly-low rates or there is a ridiculous amount of money sloshing around among institutions and the very-wealthy – demand tends to remain quite inelastic (in the short-term) in the face of rising prices.

Lots of people are pocketing gains right now for various reasons (e.g. potential for changes in the tax code0 and using the gains to make hard-asset purchases.

At the same time, there is nothing so self-catalyzing as inflation – i.e. buy now or pay more later.

Timber prices haven’t budged.

But lumber prices have obviously spiked.

Futures contracts for timber don’t exist. Hence, no speculators.

Futures contracts for lumber do exist, and hence, massive speculation.

And as for the prices of building materials, in general, rising in concert with lumber: Price gouging.

Riding on the coattails of lumber.

$11.60 per 2×4 ?????!!!!!! Where do you live?

Monopoly money ugly picture when it ends

Great article! A big part of these prices spikes has to do not with the supply of lumber, but with the supply of dollars. All that’s needed for lumber prices – in dollars – to rise is for the supply of dollars to rise faster than the supply of lumber.

That so much of this is a dollar issue is made clear by the rise in prices of other commodities, such as copper. The price increases need not be exactly the same in magnitude or timing, but when you see them across disparate goods, you know it’s not just the goods themselves.

All price incongruities are a function of an irresponsible Fed following MMT…and not understanding that..

For every action, there is an equal and opposite reaction.

Suddenly no houses for sale….was that the goal?

What of the Fed’s close working relationship with Blackrock…who made a giant residential housing play about 6 years ago?

Coincidence that 30yr mortgages are 2.9% with a CPI ranging around 3%?

Unbelieveable.

Last time CPI was in that range, 1999 and 2006, 30yr mortgages were 6%.

The Fed SKEWS everything they touch.

Hit up lowes over the weekend to look at 2×4 to make a stand for a 35mm projector I’m fooling with. $7.37 a board! Ouch! But the product was stacked literally to the ceiling. I didn’t look in the parking lot but supposedly a lot of locations have a bunch sitting in the parking lot or side storage also.

A bummer. I had hoped to be buying a house around now. Now I feel like I need to find a new job with a huge pay bump to keep up.

Hedonic adjustments will get rid of the inflation measurements due to lumber. The lumber you are getting today is 2-3 times as good in quality as the lumber you got in prehistoric times like 2019.

This is obviously correct. The lumber you get today is woke and culturally sensitive which makes it much more valuable and the rise in costs is therefore not inflationary. Are we not fortunate to live in such a wonderful time?

Get the sarc. but seriously the quality of plywood is WAY down from 20 years ago. As for OSB, I can’t believe it is in the Code for roof sheathing.

Time to short lumber futures?

Price at $1630 per 1000 board feet.

1 contract = 111,000 bf = 1 rail car.

Futures contract size = $180,930

Margin = $15,800

Leverage = 11.5 to 1.

If price drops to what was 10 days ago. Profit = $36,630

If price increases in next 10 days as in past 10d. Loss = $36,630.

Too much risk for me.

If $15k is 1% of your risk capital, probably worth it.

Let me know how it turns out.

If memory serves me correctly, the Fed remedy for runaway inflation is higher interest rates. Mortgage rates at 12% and higher were prescribed, as I recall. And that type of medication cures all that ails you. And it will “cure” things you didn’t want “cured” too… But there is a bright side… certificates of deposit may suddenly become attractive.

If 80% of bank lending is for property, one can only wonder how much debt is behind this spike in prices. Once the bubble bursts, are we facing another bank bailout?

I can confirm this same dynamic is happening in San Diego. Just went to get lumber for a job yesterday for a repair we’re doing for a customer and barley any wood costs over $600. I confirmed with the lumber yard that their sales volume has actually gone up over the last several months and that they never experienced any dip through the pandemic.

What I would like to add, though, is that the homeowner, unlike the developer, is getting cold feet about personal projects. There’s building going on everywhere in San Diego but it’s more and more the speculator than the homeowner. As the mills ramp up production this will definitely correct but, in my opinion based off of the spike in demand, the correction will not go back to feb 2020 levels again. I would also say that it can’t return in large part due to the horrible monetary policy we’re currently embarking in.

Just bought a $63 sheet of plywood, and plenty in stock. Nobody parked under the awning, guys buying onesies and twosies.

All the wood pulp is being used to create dollars. lol

There is a bit of ignorance in the comments regarding “the cure for high prices is high prices” free-market dogma.

That is less true than you think….or at least much slower to be realized.

Lumber supply is not particularly elastic any more.

a) It takes not-much-less than 2 years to build a new saw mill and staff it.

b) Prior to the current boom – the lumber industry has been through a net-zero growth period of about 12 years.

c) Right now the margins for lumber are the best producers have seen in many, may years. Increasing supply would depress prices – and, thus, margins.

This is playing out in the Steel Industry (and other industries) as well.

You will need a very long period of sustained/increasing utilization to grow supply.

If the Fed has a role here – it would be to try to clamp down on asset prices to cool the demand side. But since they view the protection of asset prices as their most important role – they will not do so.

The Federal Government has already accomplished its goal. By paying people to sit on their backsides, they have created the labor shortage, that has translated into the goods shortage, which has translated into price gouging.

When ever you hear the words, we are the government and we are going to help, you know disaster is on the horizon….

It scary that this seems as if its planned to fail.

There is no lumber shortage, its a transportation shortage we are going through. Ship, rail and truck is where the bottleneck is right now. I have seen lumber loads go three weeks before getting a truck under it at rates we use to dream of getting. Lots of reasons why but the transportation sector always corrects itself, in time.

@Lee martin

Lumber production is at a 13 year-high.

But it is not able to keep up with demand – which is just about unprecedented.

We are starting to see housing projects get canceled in New England as a result of the prices. This might drive demand down, yes, but it will also make producers very wary about making any investments to increase the supply.

CBC Radio reports that New Brunswick builders are already cancelling projects left, right, and center. Regarding price increases other than lumber, the developer interviewed by CBC confirms my speculation that everybody is jumping on the price-increase bandwagon because they can:

“Nobody is going to sit next to a guy eating a steak and be happy with a ham sandwich.”

Anything ‘financial’ that quadruples in a short time is not ‘rational’ it must be driven by ’emotive’ factors.

The guy who bought $12 sheets for $80 is going to have to pass them on to somebody else, probably after adding on his inflated margin, given his mindset. This is yet another example of looking for a greater fool to turn up, and hoping not to be the last one in the chain, left holding a truckload of weather-stained surplus board. The fact that the greater fools keep turning up everywhere is because there is way too much money around and unless the Fed bumps up rates soon, this is going to go on and on, ad infinitum. OK so Covid has magnified the volatility but it’s fundamental money supply.

The fed board members should all be hanging from a tree or eating lead. They have stolen 20% of savers’ money in just 1 year. They should be storming the fed, not the capitol.

There are mainly 3 big USA lumber firms. Oligopoly anybody ?

3 big lumber firms? There are at least a dozen that supply the U.S. Market. Canada alone has 3 big firms that ship billions of board feet into the U.S.