Subsidizing CMBS impedes the necessary market adjustment away from commercial property and toward residential redevelopment.

By Marc Joffe, Senior Policy Analyst, Reason Foundation. For WOLF STREET.

Massive federal intervention has softened—or maybe just postponed—a feared meltdown in the market for Commercial Mortgage-Backed Securities (CMBS), bonds backed by loans on offices, hotels, retail centers and other non-residential properties. But not all of these bonds were created—or rated—equally, and some supposedly gilt-edged CMBS backed by shopping mall mortgages are unlikely to pull through the COVID-19 downturn.

When financial markets seized up last March, Congress, the Administration and the Federal Reserve took a series of aggressive measures that levitated falling securities prices. Since the beginning of the crisis, Congress passed and Presidents have signed $6 trillion in relief bills, including stimulus checks and unemployment benefit enhancements that have helped the general public to keep shopping.

Most of the federal debt issued to pay for this stimulus has been bought by the Federal Reserve with freshly printed money. If inflation obliges the Fed to rein in the money supply by shedding this debt, it will become a burden on future generations. But, for now, Fed action has helped drive down 1 year Treasury rates from about 1% before the pandemic hit to less than 0.1% today.

Low base interest rates drive demand for CMBS and other risky securities as institutional investors stretch for the greater yields they offer. Finally, the Fed has directly supported markets for CMBS and other structured instruments by lending money to investors willing to buy these securities. The Fed’s Term Asset-Backed Lending Facility has supported purchases of $1.4 billion of these CMBS since last March.

But these interventions will not save all CMBS from defaulting. Several bonds backed by mortgages on one shopping mall or a small pool of malls owned by a single borrower are unlikely to emerge from last year’s downturn unscathed. Among the bonds likely to experience payment defaults are AAA-rated securities that should have never been assigned top ratings in the first place and should have been downgraded before COVID-19 entered our vocabulary. The pandemic accelerated the trend away from brick-and-mortar retail, but that trend was already well established years ago.

Among the AAA CMBS bonds likely to take losses were two that I profiled in a previous Wolf Street article: JPMCC 2014-DSTY Class A backed by mortgages on the Destiny USA megamall in Syracuse, New York and Starwood Retail Property Trust 2014-STAR Class A backed by four shopping malls owned by Starwood Retail Partners.

On April 7, The Wall Street Journal reported that Destiny USA’s owner, Pyramid Management Group, has hired a financial advisor and law firm to look into restructuring the mall’s debt, which includes both commercial mortgages and municipal securities known as PILOTs (Payments In-Lieu of Property Taxes). The PILOT debt is senior to the larger of Destiny USA’s two collateralized mortgages.

These two debt issues represent a total of roughly $716 million in outstanding principal. But appraisers recently slashed the mall’s valuation to just $203 million.

That is not even enough to cover the $286 million in PILOT bonds, leaving little if any for CMBS investors. The Class A CMBS bond was recently offered at 70 cents on the dollar according to Empirasign, a market data provider, suggesting that traders anticipate a loss of principal.

Kroll Bond Rating Agency maintained its AAA rating on the Class A debt until June 2020 but has since lowered the rating twice to its current level of B-, well into junk bond territory. Standard and Poor’s first downgraded the bond in March 2020 and recently had the same B- rating as Kroll.

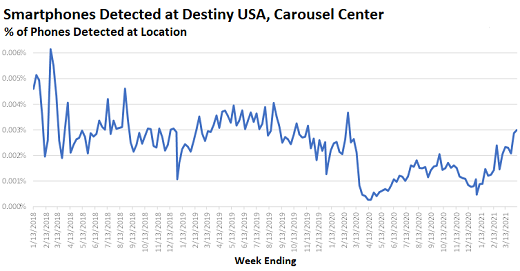

Foot traffic at Destiny USA has yet to return to 2019 levels, according to cell signal data collected by Advan Research (see accompanying chart). The recovery in customer visits will be hampered by the recent closure of Best Buy’s location at the mall.

Pyramid Management owns two other New York State malls carrying distressed debt. The Walden Galleria near Buffalo, New York backs JMPCC 2012-WLDN Class A, recently offered at 79.25 cents on the dollar according to Empirasign. This originally AAA-rated security is now rated BB- by S&P and BB by Kroll.

Meanwhile, S&P has downgraded senior debt on Palisades Center Mall in New York City’s northern suburbs from AAA to BBB. Moody’s also assigned this bond its top rating—Aaa—at origination, but most recently downgraded the bond to A3 while also reporting that the mortgage loan was 60-days delinquent as of February. Palisades Center’s valuation has been reduced from $881 million to $425 million.

In addition to the Pyramid bonds, debt supported by the Starwood Retail Portfolio is also suffering. The Class A bonds were recently quoted at 74.5 on Empirasign and have been downgraded from AAA to B by both S&P and DBRS Morningstar. This deal, which involves four shopping malls under common ownership, was clearly in trouble well before the pandemic: Starwood Property Trust fully wrote down its investment in the four malls by the end of 2019.

Federal Reserve intervention and inflated bond ratings may support CMBS prices, but they do so by distorting the allocation of resources. America is over-stored and under-housed. Subsidizing CMBS impedes the necessary market adjustment away from commercial property and toward residential redevelopment. The sooner uneconomic malls are allowed to go bankrupt, the faster these properties can be converted to higher and better uses.

The disappointing performance of the Pyramid and Starwood CMBS should remind institutional investors not to rely solely on rating agencies and to perform their own due diligence. Regulatory changes in the wake of Dodd Frank did not prevent CMBS rating inflation, and they have yet to produce adequate monitoring—at least in the cases reviewed here. Non-rating agency services that provide independent commentary, market color, alternative data (such as foot traffic estimates) and customized news feeds are a welcome market response to traditional rating research. By Marc Joffe, a Senior Policy Analyst for Reason Foundation; previously, he was a Senior Director at Moody’s Analytics.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So…

Convert abandoned malls into inexpensive housing?

I hope they leave the fryer and movie theater.

How un-wok-ed of you! :-)

Convert abandoned malls into child immigrant camps. They are located closer to possible employers…gotta keep wages suppressed because inflation.

With the states ever increasing pot legalization efforts, these old malls could easily be converted into pot farms with areas for growing (retail oulets), testing quality (old food courts), packaging and shipping facilities in the big anchor stores, etc. Also many malls have high ceilings and skylights for natural light to aid in growing, ample water supply, electrical power, security, parking for many buyers, etc.

Perfect!

I’m sorry to discourage you from the marijuana craze but have you seen the taxation on marijuana? It’s ridiculous. The black market will always be around now because of it.

For the record…I don’t partake in the devil’s lettuce, but I know a lot of people in the business. They literally tell me that because of the high taxation that the majority of people still buy black market marijuana.

Tony, I don’t use it either, but it was just a thought I had for the old malls. I guess the tax is as bad (?) as on booze and cigarettes, but people pay it.

It’s actually taxed way more than gas, cigs, and alcohol. Look up the taxation. It’s pretty crazy.

Here’s California’s and it’s pretty standard nationwide:

A 15% state excise tax is placed on all retail sales of cannabis.

Cultivation taxes at $9.65 per ounce (originally proposed at $9.25).

State sales tax, which is set at 7.25% in California for all retail items including cannabis.

Local business taxes that range anywhere from 0% to 15% depending on the city.

Converting many into distribution centers and warehouses would seem desirable. They are designed to be labyrinthine, but the robots now used in warehouses should be able to navigate them.

The ones in less desirable areas could be converted to housing for the homeless or low income persons, since the mall buildings themselves are often built to very high specs. The government should stop just giving money away to the rich and business owners and demand title or lease or other rights in exchange for aid, so it can do that.

As nice as some mall buildings are, they aren’t practical for anything besides being a mall. It would cost too much and be too difficult to renovate them into anything else.

Warehouse buildings are cheap and it would be easier just to tear stuff down and build something new. Also many existing malls need repairs anyways (this can be hard to spot).

I am surprised though, that some of these malls cannot be divided in half. Half is sold off, demolished and used for something else. Half is fixed up and used as a mall with that food court, remaining stores, arcades, movie theaters and more. It largely comes down to chains wanting more control and cheaper prices as free standing stores and strip malls.

Also, only small parts of the country currently have large homeless populations and sticking such centers into the business/retail district would not be a good move.

Yup. Except the SCOTUS, being libertarian, would declare that type of government intervention as unconstitutional.

Yes. You are right. The economy will only get worse.

I almost feel sympathy for the hopeless position in which the deceptively named “Federal” Reserve, owned indirectly by the parasitic banksters, has put itself. Could we not give the world’s biggest, most harmful parasite, the “Fed,” a break? (I would like to give them all lots of breaks. :-))

I wish that they would televise every SCOTUS and banksters “Federal” Reserve’s meeting/hearing so we could all watch them as what will happen unfolds. We could all have Arabian Nights experiences while we are stuck at home.

We could watch the meetings and feel just like Ali Baba felt when he was surrounded by forty thieves. That reminds me of jokes that I heard about the LA Superior court: how is the LA Superior Court like a slaughterhouse? If you go there, they will slaughter your case if it is large enough.

How is the LA Superior Court different from medieval England? In medieval England, Robin Hood stole from the rich to give to the poor; in the LA Superior Court, the judges take from the poor to give to the rich. (That is kind of unfair to three judges: I think that three judges in that court do not need to be investigated by law enforcement.)

I will not repeat the unkind one about how it is also like the ancient Roman coliseum, because they want to make certain people martyrs there. LOL

Convert abandoned malls into cheap prisons.

Convert malls into prisons but then like George Carlin suggested have all the prisoners segregated by type ….. and then once a month open the gates within the prison and put it on pay-per-view. We would have less prisoners, no cost and real fear of prison ;)

Now you sounds like communists, convert them to NFT’s and sell them to foreign investors. /s

At least I expect that Canada will do that.

It’s amazing if you sit back and think about how many land America has locked away in useless retail and parking lots that could be better used for houses.

But in our current world of “every billionaire gets a trophy” no billionaire is allowed to lose at capitalism. So if the middle class needs to suffer homelessness so that a billionaire can keep his failing retail stores open, then the choice is obvious for the FED. No billionaire gets left behind!

Some of it is changing. There are now plans underway to redevelop the Stonestown shopping center in San Francisco. They will bulldoze part of it, and create some “main street” shopping along the street that goes through it. They will keep the big grocery store (in the former Macy’s) and some other things. And then they plan to build 3,000 housing units on this shopping center property (mostly parking lots). Now there are screams that that 3,000 isn’t enough, and they should go higher (more floors) and more units. Obviously, the property is very valuable and won’t end up in bankruptcy. But all this takes years.

That’s really awesome!

Many, if not most malls, are at crossroads. They generally were built in easily reached locations. And they usually sit on large parcels – 50 to 100 or more acres. Multifamily or some other similar alternative (seniors housing/student housing etc.) would generally be best alternative use.

Could someone explain to me the actual reasons why it matters to the Fed that such bonds should be “saved?”

Here are two possibilities I thought of:

1. The whole bond market will go crazy, nuts and stupid, and untold catastrophic damage will happen that will cause a lot of very rich people will lose a helleva lot of money.

2. The world will stop turning–it won’t be possible to even buy toilet paper anymore because all world production will cease. Inflation will go up to 50%/year.

As should now be obvious, I don’t understand these things very well.

Could someone provide more sensible reasons than those?

I’ve got the only two words you need – pension funds.

Once state pension plans were allowed to purchase “investment” grade CMBS, the government both federal and state now have a staked interest in their survival.

Thanks, Drew.

Very helpful, and much more sensible than my suggestions.

Probably option 1 due leverage on those investments.

Anyone wanna take a stab at what’s happening to the 10 yr yield? Is the Fed going to pivot to hawkish which will stop growth? Or, is are we looking at negative rates and more t-note buying than the 1+trillion already on the balance sheet?

Their bankruptcy makes it harder for new projects to get funding.

The Fed doesn’t believe in economics, but believes in infinite time and energy. We must work to save a dying system, and don’t you dare suggest we can’t still hit our quotas for all the other work that needs to be done. Like the horse in Animal Farm said, “I will work harder!”

Dieing to know who biggest owners of the debt are. IMCO, Doubleline?

And real price versus quote price discrepancy in secondary market.

” If inflation obliges the Fed to rein in the money supply by shedding this debt, it will become a burden on future generations.”

Thank you, John Maynard Keyes and his acolytes.

Nope. Thank You Milton Friedman.

You mean because Canada is not socialist enough to turn this loss into mixed market/affordable/supported housing?

I bought a pair of Nikes at a mall shoe store going out of business sale. I recently wore them out.

Amazon converted a mall into a fulfillment center. Another mall is being converted into an apartment complex. One is now a community college.

1) TY is up to close a gap.

2) WTI is rising to test the previous high @$68.

3) Gold is shining , but Walmart, this morning, was dying !

4) Where have all the customers gone : to the real estate agent.

5) Where have SPX gone : it went vertical, a new all time high @4,166.

6) Where have NDX gone : above 14,018. NDX in bearish divergence. PNC weekly DM13, on Fri.

8) Where have all the flowers gone : they are blooming in DC garden, on the wall.

In the 1980’s the USA economy began a transition from an industrial economy to a service and retail economy with a massive buildout of shopping centers and retail establishments of all kinds. Now we are entering the next transition from a retail and service economy to one based on government payments to the citizens, who spend most of their time in overpriced dwellings and are drip fed food and products by the new shadow government (Amazon etc.). Not sure what comes after that but I will stay firmly rooted in my small slice of the old industrial economy where I make things using real machinery.

To quote Mr. Spock, ” May you live long and prosper.”

So the Fed has bought $1.4 billion of CMBS? There’s something like $2 trillion outstanding. Irrelevant.

That’s the amount of mall CMBS in the Fed’s TALF SPV. The Fed bought a lot more residential CMBS ($10 billion). There are not that many mall CMBS outstanding.

The FED thinks they can buy everything. They are the buyer of last resort with an unlimited balance sheet. Why not just have a $50 trillion balance sheet with hundreds of millions of homeless plebs roaming the streets in bare feet? What’s the problem?

So……inflation on the PPP explodes upward

inflation on the CPI explodes upward

retail sales explode upward

the country reopens

the stock market explodes upward

the government passes a 1 trillion stimulus followed by a 1.9 trillion stimulus to be followed by a purported additional 2 trillion this summer

and…….interest rates drop dramatically

So…..we don’t have manipulated markets……right.

Can someone explain to me why the 10 year treasury is down 6% today?

Is it because people think the “amazing” retail sales numbers are organic and signs of a healthy economy, and not just massive stimulus?

I’m genuinely confused.

The FED, .gov and all big investors feel like they’ve achieved nirvana, where everything goes up forever and everything comes up roses. This is the biggest fantasy everything bubble in the history of the world, where you lose over 700,000 jobs per week for more than a year straight, and everybody becomes fantastically wealthy because of it.

It really is astounding to me, in a “We’re being gaslighted, but most of the people don’t know it” kind of way.

You give families of 4 $8,000 tax free dollars and you’re surprised that they go on a spending binge? I’m sure the April 2021 numbers will look good compared to April 2020 (when most stores were under mandatory shutdown), but how will they look compared to March 2020? There seems to be this fantasy that all of this “stimulus” is “jumpstarting” something great, so that the economy will grow organically going forward.

You and I know that is nonsense, and that the moment the stimulus ends, spending drops like a rock. Then what? What is the end game here?

Hyperinflation is the end game. The rich owning everything free and clear of debts.

Monkey, until the peons have had enough and revolt. Which they will if they aren’t fed and comfortable.

Then what?

I’ve already said this before. The peons will not revolt. Back during the Depression, there was genuine fear that Communism will take root in this country. It didn’t.

People in this country do have a social contract i.e. the ones at the top make all the rules, so all you need to do is get to the top.

America is working as expected.

Search for Barrons (free) article “Bond Yields Are Falling Despite Blowout Retail Sales Data. Here’s Why.”

Usually Treasury yields go up with a good retail numbers (economy). Barrons has some theories why that relationship broke today…

Thanks. I read this, and I’m not buying it. What difference does it make what the Fed does? Whether the Fed tapers or not, why would anyone want to hold 10 year treasuries that will lose value with inflation. Do these people really buy the Fed’s statements that there will be no long-term inflation?

Long term, our current actions are not sustainable, most of the recent growth is on paper…it takes stimulus to generate spending…10 million on the U6. Lots of deflation potential in the long run. Maybe not a bad hedge against stocks to hold some treasuries? It does seem pretty likely that we will have a short inflationary period followed by a long period of very weak growth, which is essentially what the Fed is saying.

Tom, thanks. But that requires a) that the dollar doesn’t drop and b) that the Fed doesn’t print even more to try to counteract those deflationary forces.

Now that people have had a taste of “free” money, why does anyone think it’ll end with the latest “stimulus?”

I guess it’s time to move my 401k into dogecoin, for the long haul.

Fear? Treasury prices tend to rise, and yields fall, when there is fear. They’re considered haven investments.

I read today that both team Blue and team Red are merging to create “team Purple” in order to eliminate the SALT $10,000 limits on property tax deductions, giving the top 1% another $88.7 billion per year in tax savings.

Perhaps then malls can be saved by selling $10,000 – $20,000 luxury purses to the top 1%…(sarcasm)…

Per Bloomberg:

…repealing the SALT cap would largely help relatively wealthy residents and would do little to help lower-income households that aren’t likely to have more than $10,000 to write off or even to itemize on their tax filings.

More than half of the benefits would go to households earning more than $1 million a year, according to an estimate from the Joint Committee on Taxation. It would cost $88.7 billion to repeal the cap in 2021…

“Everything is a rich man’s trick.”

Hey wolf could you update blackrock situation in Spain where they bought up properties on cheap only to be filled by squatters

Don’t commercial properties EVER get paid off? Half of Destiny USA is over 30 years old, and the same is true of Walden Galleria.

In many cases, these places just keep rolling over their debt, or even borrowing more. Sort of like a cash out refi for shopping mall operators.

No.

Perpetual deductable interest expense.

From Investopedia:

“Because of problems servicing the national debt after WW2, the 1951 Treasury-Fed Accord settled the question of who controls the Fed’s balance sheet by reversing roles: the Fed would control monetary policy by supporting debt prices without control over any debt it holds, and would buy what the public doesn’t want, while the Treasury would focus on the amount of issuance and categorical maturities.”

I’ve been reading a history of the Fed (Gods of Money) but have not got to 1951. It’s difficult to understand the above description. The “reversal” supposedly:

“…separated the Fed from fiscal policy and credit allocation, and allowed for true independence. It also freed the Fed from monetizing debt for fiscal policy purposes and prevented collusion, such as agreements to peg interest rates directly to Treasury issues.”

I have a vague suspicion that is B.S.

‘should remind institutional investors not to rely solely on rating agencies’

Maybe they shouldn’t rely on them at all, or at least auto-downgrade their ratings by two notches, which would take more than half of the bonds rated investment grade into junk.

BTW: every time malls come up we get these suggestions to convert them to housing. There have been abandoned malls in the US for 30+ years. The US has an inventive, robust industry doing conversions of APPROPRIATE former commercial and industrial space into housing: e.g. lofts etc. They don’t do malls because it would be cheaper to create even budget housing if the building wasn’t there.

Ed institution works a little better.

I would disagree with the two-notch auto-downgrade heuristic. This assumes that rating agencies equally inflate their ratings on all kinds of bonds. Academic research suggests that rating inflation varies across the spectrum. Thanks for your point about the relative unsuitability of malls for residential conversions. I need to look into that.

Thanks. The ideal conversion is on a higher floor so poop can run downhill. If on one floor, a typical main mall floor it’s all on ground level so you need to break floor or pour new floor with pipes in place. Alternate is communal living with shared plumbing and kitchen. Windows? Mall has none. Imagine yr unit in the center of the anchor space.

PS: fact: one half of investment rated bonds are BBB, just one level over junk. The raters are paid by the companies.

Ok. because I live in the Bay Area, I see multilevel malls and lots of unhoused people. If the Westfield Shopping Mall were to go vacant (admittedly not very likely), there are hundreds of people sleeping rough within a 10-block radius that would be far better off in it’s windowless and ill-suited rooms vs. where they are now. I admit that the SF-case cannot be generalized and would almost certainly not apply to a dead mall in a midwestern suburb.

BBB is a good example but also a special case. Lots of ratings are pegged at BBB to keep them in investment grade. Looking at alternative metrics (like Merton or financial ratio-based models), we’ll see some that appear justified at BBB and others that are probably well into junk territory.

I just don’t think a uniform two notch adjustment is a good heuristic for institutional investors who want to earn their pay by seriously trying to maximize risk adjusted return.

Thanks for engaging on this, Nick. I’ll leave the final word to you if you choose to take it!