We’re going to be awash in huge and even absurd percentage-growth numbers.

By Wolf Richter for WOLF STREET.

The numbers are starting to crop up everywhere: For example, new vehicle sales in March jumped nearly 60% from March a year ago. But last March was the beginning of the lockdowns. Compared to two years ago, March 2019, new vehicle sales were down 1.2%. In the first quarter, new vehicle sales were up 11% year-over-year, but were down 2.9% from Q1 2019.

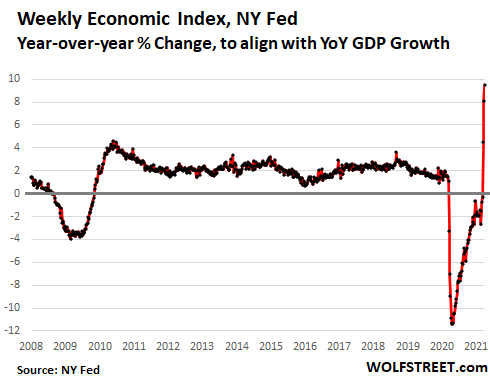

Today, the New York Fed released its latest Weekly Economic Index (WEI), one of the high-frequency measures that came out of the crisis. The index is based on ten daily and weekly indicators of real economic activity, compared to the same time last year, and is scaled to line up with year-over-year GDP growth. Last year, it fairly accurately predicted GDP growth, I mean plunge.

In Q1 2020, GDP had dropped sharply, and in Q2 2020, it plunged. The year-over-year growth rate of the upcoming GDP report compares the dollar GDP in Q1 2021 to that of Q1 2020. Given the sharply lower dollar GDP in Q1 2020, and the plunge in Q2 2020, the year-over-year growth rates for Q1 and Q2 this year will be massive, even as GDP in dollars will likely remain below where it had been in Q4 2019. But these are the kinds of year-over-year percentage spikes we’re going to see, even as dollar figures have not reached back to 2019 levels:

Another example, to dip into absurdity: The TSA reports daily checkpoint screenings, a measure of how many people entered into airports. Airlines were essentially shutting down last April and the number of passengers collapsed by over 90%, to just a trickle. Compared to 2019, the current 7-day moving average of daily checkpoint screenings is still down 37%, but compared to a year ago, it spiked by 1,168%.

All year-over-year percentage change figures of consumer spending, corporate revenues and profits, traffic, GDP, etc. will produce some truly absurd spikes, many of them without reaching the dollar levels of 2019.

This phenomenon is the “base effect.”

Fed Chair Powell brought it up when he was dismissing future inflation. Inflation dipped on a month-to-month basis for three months last spring, as energy prices collapsed and prices of some services, such as hotel and flight bookings, swooned. So year-over-year CPI growth will jump over the coming month, in part because of this base effect. And Powell is going to dismiss this jump in inflation, and he will be using the term “base effect” to do so.

But you guessed it, no one will blame the “base effect” for the approaching massive year-over-year jumps in corporate revenues and earnings.

Q1, Q2, and Q3 2020 were rough for many companies. Revenues were down or had vanished, and profits had collapsed or had turned to losses. Going forward, these companies will report their year-over-year growth rates in revenues and earnings, and some of those growth rates are going to be between huge and ginormous, but from the much lower base in the same quarter last year. This too is the base effect.

Unlike Powell who is already dismissing future inflation with a mention of the “base effect,” no one on Wall Street is going to use “base effect” to dismiss 50% year-over-year revenue growth, or 90% year-over-year earnings growth even if revenues and earnings are still far below where they had been in 2019.

We’re going to be awash in these huge percentage growth numbers. Wall Street analysts are already reveling in it.

How much would you pay for shares when the company shows 50% year-over-year revenue growth or earnings growth? This is a huge thing now being rolled out on Wall Street. Or how much would you pay for the same shares, knowing that the company’s revenues were still down 20% compared to two years ago, that it hadn’t even caught up with 2019?

But two-years-ago comparisons back to 2019, which is what should be highlighted and what the TSA is now highlighting in its checkpoint screenings, are not going to show up on the radar screen of Wall Street analysts. That would be too awkward.

Yes, this too shall pass. But it will be upon us for much of 2021, with the “base effect” being highlighted forcefully when it suits them, such as by Powell in dismissing inflation, or being silenced forcefully when it gets in the way, such as by Corporate America and Wall Street analysts.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Reporting awesome growth growth based upon a dismal baseline reminds of something my smart but somewhat underachieving son likes to tell my wife and I. “I like to keep expectations low, so no one is ever disappointed.”

Every single move from the FED is to juice asset prices. As if the disturbing bifurcation in wealth between the haves and have nots is not enough, they promise more of it. They are going to ignore asset price inflation. And if there’s even a hint of a price pull back, they will come with their printing press blazing. Nevermind the fact that regular people can no longer afford a roof over their head. No, that subject is verboten among central bankers.

I’ve given some thought to what the end game is for these guys. My conclusion is it’s not just asset price inflation, it is asset price inflation leading to justified confiscation.

The secondary effect of increased asset prices is higher taxes on those assets. Eventually, owner’s appreciation will lead to taxation levels they can’t afford, which leads to property sale or loss. The end game for these guys is to take everything you own.

They don’t want a crash because they will get blamed directly. They want price increases to strip you of everything. It’s already happening, but too slow for most to see. Weimar is here and the consequences will be exactly the same.

You will own nothing and be happy!

-New World Order

You will lose life, and will NOT be happy about it!

-old pleb order holding principles

Do Bill Gates and Prince Charles know that they will own nothing and be happy? Yeah, right!!!

So extend that reasoning out to include municipalities, counties, states and federal holdings. Cities go bankrupt? Fine, sell your revenue streams (property taxes for example) to corporations. They now control the administration and oversight of this revenue stream and how to divvy it up. It takes a governing body to rewrite the codes. Fine, we have the perfect candidate. Losing money? Rates go up. Can’t pay? Bye bye home. Sound absurd? We’re seeing it (and the 3rd World has been seeing it from the US over the last 100 years or so) happen in countries like Greece and other places that can’t pay their “debts”. If Chicago & Washington DC can “sell” the revenue stream from parking meters etc. who’s to say that concept can’t be extended ad infinum.

I feel like I’m crazy just writing this and there must be giant holes in the logic but this seems like the obvious coming reality as “the Corporation” becomes the World’s biggest nation state.

Agreed. For financial parasites, the ultimate prize is tax farming.

Not so crazy. The WSJ just ran an article highlighting how corporations are buying up not only single family homes, but entire neighborhoods. As if it’s not enough that you can already barely go a day without your life being impacted by any of just a handful of tech giants. The line between government and corporation is growing blurrier with each passing year.

The homes that these pension funds bought were ALL rental homes. And there were rented out. And they bought the “neighborhood” from Lennar, the developer of the “neighborhood,” not from homeowners. Pension funds also are big owners of apartment buildings. The invest to get yield. And that’s what rental property does. You need to read the WSJ article, and not just the headline. The headline was misleading click-bait.

Thanks for clarifying that, Wolf. I did actually read the article; either way it still appears anecdotally that an increasing share of the economy is being subsumed by corporations, whether it’s housing, retail, chain restaurants … even medical and dental practices. Financialization and the ultralow rate policy that encourages it have made capital artificially cheap for big corporations and given them an advantage over small businesses, and given an extra kick by the coronavirus shutdowns. If so, there should be statistics that show it.

There is no end game, just keep the lights on. Their malfeasance is backstopping banks who get ripped off. What undid them in 2009 was a giant hole in pledged collateral, similar to Archegos. Everybody was hiding money in offshore banks, equity which was holding up other equity. They couldn’t touch the hidden loot, and they probably don’t have Bill Hwang’s money either. He could have put a short on through a third party, and the losses would come back to him. Being in just a few stocks, easy to do. If you are levered 10:1, and you can capture half your losses in the amount you are leveraged, that is 5X your skin in the game. Or how do you unwind 10:1 leverage? The reason stocks went on a tear after GFC is that the Fed replaced bank losses which weren’t losses at all. Interested to know if those firms liquidating Archegos can claim FDIC? The customer lost the money but they were on the hook, so they pay themselves?

For that kind of money, people will look for it. Doesn’t matter who you are.

re:TS Do you know the results of Tiger Woods BA test? 85mph in a 45, crossed through oncoming traffic, his balls in the rough, and he gets a free drop.

It is all about stimuls… from Fed & Co … but without stimuls… economy will be in deep recession… last employment figures showed it … Armageddon is coming

Listened to an English Professor named Werner. Very bright guy. Says most of western world is doing everything wrong. His conclusion:

1. 97% of money creation is from banks and not Fed.

2. Banks lending for consumption and financial trading causes asset bubbles and inflation.

3. Small banks lending to small business is key to get growth without inflation.

4. Big banks lend to big business not small business.

5. Past Fed policies after GFC generated asset inflation. Current Fed policies post covid going to create goods and services inflation.

6. Long term agreement is central banks are regulators and stay out of customer banking. If Fed creates digital currency with customer accounts at Fed then banking is dead and things will get worse. Soviet Union only had one bank and didn’t work.

7. Bottom line is you need small community banks who do lending to small business for system to get better. We are going opposite direction.

Separating banks from repayment risk, and all the associated “garbage backed securities,” are what have brought us here, in conjunction with federally backed loans. If Frank down at the local bank had to hold the note on the local mortgage for 30 years, we never would have had a housing bubble.

Depth, yes.

And no one would have been willing to tie money up for 30 years at 2.8% unless Freddie/Fannie were buying all of these loans.

Very perceptive, Petunia.

Petunia, yes, exactly.

They have no idea what else to do. Just read the info from the Bank of England on the wealth effect. This is literally how they think the economy works – you boost asset prices, and people will take out bigger loans against those rising assets and spend more. They have no idea how to generate economic activity in lieu of this mechanism.

The original theory behind interest rate controls – that you cut interest rates and it stimulated latent business investment, which would lead to new products/services/improvements in productivity – is dead and they know it. The collapse of that growth mechanism became apparent when they drove rates to zero and the economy didn’t roar into life.

They will have a go at fiscal stimulus, but as this will be done through private contracts, my suspicion is that it will just be another mechanism to siphon off wealth, and very little real output will occur.

At a fundamental level they are trapped because most of the wealth is stuck at the top where it languishes. Investment is just at the whim of those who control this wealth, and these people have little regard for interest rates, because wealthy people do not seek maximum return on their assets anyway. If this were the case they wouldn’t buy big mansions they only use once a year, more than one car, or jumpers with ‘supreme’ printed on them for 1000x what it costs to make.

Economic growth is dead because of the high level of nonproductive debt, that’s is it.

As long as debts aren’t restructured , there won’t be any real growth, it’s not rocket science but we have no leadership with the guts to do the right thing, purge the rot out of the system.

Exactly. We used to have recessions that took care of that. Default on debt facilitated a transfer of wealth from the incompetent to the competent, eventually leading to economic growth.

Professor Werner says the dirty secret is that lower interest rates don’t cause growth and all central banks know this. The correlation is the opposite. Low growth causes low interest rates.

Re the theory of interest rate controls being dead and they know it… I disagree. They think things would be much worse had they not pushed rates to zero.

Read Fed Up… These morons live in a bubble of ignorance, so no, they don’t see what the rest of us think is blindingly obvious.

To paraphrase…it is tough to get a Fed Chair to see the truth when his job depends on him not seeing it.

Jon W,

Yes, we’re sold the idea that if people have more money, they will spend more, the economy and therefore tax base will grow, and so on.

That may be true with a large percentage of those citizens who live paycheck to paycheck, but where the real money is: the top 20%, I don’t see accumulation of assets going up = spending going up.

I take satisfaction from feeling secure in where I’m at financially. Yeah, I like having nice new toys (which comment readers are probably tired of hearing about), but even so, when I splurge, it is done buying a used car for half the price of a new one. Am I in the minority? No, I think the majority of people who have worked their lives to get to the place of security are smart in how they decide on spending versus saving/investing.

Funny thing is, if the smoke and mirror show Wolf writes about juices up the markets, my portfolio will grow. In a sort of twisted way, I say, “Bring it on.”

We’re sold a very specific idea. The wealthiest need more of our dollars to make more investments so we all can grow. The problem with the line of thinking is that the costs have been distorted. The amount of money required to invest in a new manufacturing company, for example, is somewhere in the tens of millions of dollars range. You’re probably talking the top half of the top 1% that can swing something like that. And they do all the time through private equity. And they’re greedy so they want instant returns with no risk. And banks and the federal reserve and congress all offer incentives to the royalty to keep the pawns busy for generations lest they show up at the doorstep of congress ready to take back their dollars which we so swiftly given away for the greater good. This country is so brainwashed they allowed a draft to fight a war in Vietnam. Vietnam was the third eye opener, the public saw the squeakiest richest wheels get the grease when everyone else gets WD40.

Wolf – can I change my name to “Central Bankers Swinging From Meat Hooks?”

Down in the heart of town

The Devil dresses up

He keeps his nails clean

Did you think he’d be a boogeyman?

Buffy St Marie

I’m not Wolf….but please do!

Short and sweet but highly relevant article. Perfectly demonstrates how the lie will be sold.

All your base effect are belong to us.

Ha…perfect

Why do investors fall for the cherry picking in earnings while the FED explains away a “base effect?” We are living in a world where the wealthy can have their cake and eat it, too.

This comment is only related to the world of hype, but what I just read on BBC is about the posterchild of crypto currency hype. I intrude because it’s still going on and maybe a warning will save someone. It’s about a HUGE scam (arrests and warrants) called OneCoin. The piece is on BBC Business section: ‘How one woman scammed the world and then disappeared’

It’s not even a crypto currency, no blockchain, just the result of one woman seeing all the hoopla and making up a name with the magic word ‘coin’.

Then it met the universe of multi-level marketing. The take is in the billions. Even though the founder is now on the run, the MLM’ers are still working it. like a snake writhing after its head is gone.

I don’t feel bad for anybody who loses money on cryptos.

I actually celebrate it.

Well Bitcoin is a Chinese scam according to Peter Thiel. The fact that he used to support it and is still supporting companies operating in the field should not deter you from believing him!!!

My point is: our world is a scam, so be prepared to see even scummier things.

With 70% of hashing done in China and China being the totalitarian state that it is, Xi Jinping can take over the complete bitcoin with the stroke of a pen :)

Even apart from that, Bitcoin will eventually go to zero because it is no more than a momentum trade that people will abandon once it starts dropping in value.

The fact is that Bitcoin simply sucks at its stated purpose. It is way too slow and way too expensive to serve as a currency and the idea that it is a store of value is laughable with price swings between $3k-$60k within 12 months.

The problem with these crypto that are backed by nothing is that there is nothing that keeps you in them when the price drops. There are thousands of crypto that do exactly the same thing as BTC, but better, faster and cheaper. So what would keep somebody in BTC when the momentum fades?

The thing that really amuses me is that the nerds who where mining BTC at home on their PCs made a bundle while many large institutions that are entering now are going to be the bagholders.

I think we’re all gullible about something at some point. Romance maybe. People want to believe and to belong. They send money for Miracle Water and Miracle Blankets. Old Mom and Pops max their credit cards for a phony real estate course. ‘Sell sheet: Don’t ask what they think, ask how they feel’

Ya I feel sorry for them. But not for the hucksters.

When a stock loses 50% and then recovers to it’s previous level, it gains 100%. They don’t want to the economy to overheat, and lose QE forever. They’ll be hoping for some tame numbers. Just don’t take the punchbowl.

There is no base effect for inflation. The numbers released in May should be the top.

o m f g why was my comment deleted?!

Hobagg,

Your comment was deleted because it was the first comment on the article and was totally off topic and was designed to rile up people, and hijack the comment thread, and it would have derailed the comment section. This is a common issue with first comments, and I’m cracking down on it now.

When you post the first comment, there is responsibility to not hijack and derail the rest of the comments. I’ve said this before.

I like this new moderating Wolf. Exciting!

Thank you! Wolf.

This is where the Wolf Street charts tell the true story that even a Stock Hawker can relate to or, at least, fess up to. 2019 is really the base year here, because 2020 was a seismic event year: Unlikely to be repeated any time soon, but, frankly, we can’t even be sure of that anymore.

Agree, the new normal is abnormal. They’re already predicting the next pandemic for 2023-2025.

Who is “they” that are doing the predicting?

Was in the DC Swamp today appraising a two unit Condo under the VA loan program. The prices are still going through the roof. People are refinancing like crazy to beat the interest rate increases that are coming. Both units were empty. One was being foreclosed on. So the figure of 14% vacancy rate is bogus just like every other piece of data the government puts out. I would estimate the vacancy rate of these VA loans to be close to 65% to 75% based on anecdotal evidence alone. That’s an abuse of the VA loan program which is backstopped by the taxpayers of this country.

An interesting thing happened today. This was an affluent neighborhood, called Brookyn, near Catholic University. Houses go for nearly a million. While I was waiting in the car a young dude who was nearly starving to death came up to my car a asked for some money to buy food. I usually don’t give money to panhandlers, but in this case I gave him $5 to go get a hot dog and drink at the gas station nearby.

I wonder if those scumbags in our government, The Executive branch, Congress, & the Fed could come down here and see what is happening to our fellow Americans, and what they are NOT doing to correct the problems.

Every few years list my basement (bedroom, living room, den, full bath) for rent on Craigslist. It’s not technically a separate apartment but priced fairly and quite nice and a good amount of space. I’m invariably flooded with requests almost pleading if an entire family could move in, no matter how many times I explain it is for 1 person only. One person I recall had a look of hunger desperation and despair in his face.

They usually do a good job keeping up a facade if being “in-touch” with the real people of the country. But sometimes they slip up and reveal they have no clue what anything costs or how anybody lives. The Speaker of the House (the real one, not the de facto bartender one) has an entire freezer filled with boutique ice creams and happily gave a virtual tour while others were suffering from depression, alcoholism, and abuse during forced lockdowns.

Some people spend their extra money on ammo. Others buy boutique ice cream.

Whenever I ask why people need either, I get the same answer.

We all need hobbies.

“… anecdotal evidence …”

The mother of all oxymorons.

I’m sure Powell intended to add he will of course be adjusting QE & ZIRP with an equally applied “base affect” as appropriate to equalize/counter inflation & soaring earnings. Probably some very rude reporter cut him off before he could go into that, no doubt.

I noticed some charts today that showed the bottom 50% are getting hit hard on food inflation. Clever for the Fed to drop out food from “Headline CPI”, as there corn was $3.07 in Aug 2020 to $4.79 today, that 88% increase in 8 months is 133% annualized…wow!

Rumor is that the three things people need to survive. Those three things are food, water, and oxygen. I’ve also heard that oxygen and water are basically free, for now…depending on where you live. So I’m guessing having food prices go up 133% per year might be an issue for people who need food to survive???

Again, just a rumor about people needing food, so this definately needs to be studied and polled over the next few years. I’d suggest the Fed hold a few more “Fed Listens” events to confirm said rumor…those worked really well in 2019…

Food is an investment in assets just like housing. Assets should not be part of inflation. The hungry homeless are investors. No need to be concerned about investors…the RIGHT ones will be cared for by the Fed.

I guess if they start including water and air in the CPI calculation, inflation will remain low for a long time.

As far as food, a pack of Ramen Noodles can still be purchased for 25 cents (in Bulk). That’s what I paid in the 1980s during college.

What inflation?

yeah, but the package is smaller…

When my dad was in SE Asia for the Vietnam War in the 1960’s, he instructed my mom to give me 25 cents a week allowance. I used to buy a Hershey bar for 5 cents. A kite was 10 cents. String was 15 cents. I was at Walmart and saw the Hershey bar now costs $1.50. Blue jeans are under $20 similar to the mall price I remember from the 70’s. The price of a new home in the DC metro suburbs is way up, almost 15 times higher.

In 1867 the U.S. bought Alaska from the Russians for about $7.2 million. What a deal. If they say inflation will go away, who would believe them? Where will it wander too?

Hate to be that guy, but based on your own numbers that’s “only” a 56% increase in 8 months. I do agree with your position though. Who needs food anyway, no real impact on working families, and no discernible impact of stonks(which is what really matters /s)

I still have market exposure at this point, but really don’t like what I see and like most wolfstreeters don’t think it will last.

$5.79 is today’s price…$4.79 was my typing mistake so 88%/133% is correct for 8M/12M The actual percentage is actually slightly more as we have a positive basis for corn at the grain elevators right now. Front half Oct corn prices with current positive basis is around $5.00ish if sold from bins today. $5.79 plus about 0.05 cent positive basis is $5.84 if you have the grain in the bin today, and moved it to the market today. Not many farmers have grain in the bins as China outsmarted, once again, the USA govt by waiting until the farmers got enough stimulus last year to break even on 2020 crops, then farmers sold grain in mass so they could break even and not take a loss, then China started buying magically huge amounts of grain during and after the farmers gave away the grain at hughe discounts…which is one of the biggest reasons prices went up 88% in 8 months. China outsmarted the USA again. They are clever…

China did the same thing with other commodities. It turns out that when a country is run by college educated engineers and scientists vs ex-bartenders and billionaires with daddy issues, they somehow can make logical decisions and are a few steps ahead of less intelligently run political structures. China has been hoarding commodities for the last 12 months, yet just last week the USA put out a notice that the US should “start stockpiling” basic commodities in the future…I’m sure after we address more pressing matter such as what words in the dictionary need to be banned this year.

Day late and a dollar short…

Maslow’s hierarchy of needs. The human race and capitalism loses perspective. LIFE. Oxygen deprivation gives you a few minutes to live. Water deprivation depending on climate gives you 12 to 100 hours. Food deprivation or elimination 30-90 days? Lack of shelter in extreme climates can end the life force in hours.

The other rumor is you need an electric car to survive…or a beach front home…or a career in something exciting.

Wolf’s post:

BA (Boeing) had revenue of $94 Billion in 2017, $101B in 2018, $76.6B in 2019 and only $58B in 2020. An almost 50% drop in revenue since 2018. I bet Q1 beats last years by 40%? What a recovery!

Micheal Engle will like the BA chart, huge bubble and another bubble.

I went to Houston today. It was like a bomb went off and everybody left town. Recovery? All of the Asian Jasmine vines on the buildings were dead from the freeze in metaphor. I don’t think the numbers on the page are going to fool anybody. Nothing to see here, move along….

No one works downtown in Houston anymore. It’s all WFH or your business moved out to the suburbs already. Come out to The Woodlands and see the traffic jam and full businesses. Or take 59 South (actually West a bit) and see the same.

I’d bet there were no restaurants, coffee shops or any other businesses hurt in downtown Houston when people stopped working there…

I’m wasn’t downtown. But I hear you what you’re saying.

But what gets me is I was down there in November way into this Covid shutdown/mask nonsense and it was packed as usual. But now it’s not.

I have a view on all this similar to Harry Dent, we are in a long global deflation, we have an $18 trillion world economy and a debt pile of $285 trillion, imagine if you were to remove even half of that global debt, then you would see deflation proper, the only reason we seem to be suffering inflation is that all the central banks have painted themselves into a corner and have to print debt to service the debt, the side effect of which is we seem to see inflation, but we don’t look at the debt, or take it into account.

This is all going to end very badly with all currencies virtually worthless and the ensuing chaos will result in the biggest thug wining.

The base effect does not count for house prices. These days, the listing price is where the bidding war starts.

Stock market will rocket up again because you know it doesn’t look out 6 months or something rather it overlooks whatever that is inconvenient.

Careful of your short, Wolf. S&P might be at 10K before this thing is over.

It overstayed its welcome. I’m getting ready to boot it out, which may be the sell signal the market has been waiting for :-]

I know the feeling Wolf,,, been there and done that a couple of times before I got OUT of the SM in the 80s, LOL

Maybe let us know when you get out of your short, and I will go long, and that will REALLY crush the market… Maybe all the way back to reality??

Nah,,, not going to happen with these stim at all costs folks in charge.

It’s been hard enough sitting in cash watching all the money being sprayed out of DC. It seems too late in the game to buy any financial assets now including stocks, bonds or real estate but holding cash is a waiting game for opportunity that costs you 2% per year. I was just thinking that being short was probably the right play as assets are so stretched but I don’t have the nerve to do it.

I missed the run-up in pretty much everything, save for a little juice in my pms. But I don’t own a lot of them. I have no doubt that if I tried to short something I would be completely wiped out, then a day later the whole thing would collapse. I’m good like that.

There is no catalyst for a sell-off. No elections, trade wars or COVID panics in sight, yields are stable-ish, and there’s liquidity as far as the eye can see. Optimism is going to take hold for now. VIX will make a multi-year low before any serious dip is possible.

I like coming to Wolf Street because this type of nonsense is less prevalent. When markets (everything, housing, stocks, crypto, etc.) are this overvalued, you don’t NEED a catalyst. In fact, the big busts usually only had catalysts that anyone realized was the catalyst AFTER the fact.

I’m not saying a crash is imminent. Not at all. But low interest rates and the lack of a world war doesn’t mean that a crash won’t come.

RightNYer:

Great comment! Totally agree.

Just one example: even 9/11 was not enough as a catalyst to reverse a rising trend.

Artem

Agree. Can’t fight the Fed, and now this new market mantra of base effect with massive YOY growth will carry the craziness at least another year. It’s the best time ever to get back on the horse if you’ve been walkin.

‘Base effect’ thinking leaves open reaction the market is going to have to earnings? Some fear that the recovery will lag, (doesn’t it always?) and that could be bullish, assuming QE continues, and some targeted buying, YCcontrol. The US Fed balance sheet is way behind their global counterparts. Drunkenmiller is probably right, play growth in China. In the US gold might be the slow/no growth story. Growth sputters and the repealed corporate tax cuts loom large, and deficits should shrink.

“He who sells what isn’t his’n

Must buy it back

Or go to pris’n ”

From the book:

Reminiscences of a stock market operator

The peak P/E in 2000 was around 44. We’re almost there. I have a feeling that will be the line in the sand, but who knows?

RightNYEr,

Divide P/E by 10-year Treasury “P/E” for 2000. Repeat for modern times. Reflect.

I’ve heard this argument before, and I don’t buy it. It assumes that interest rates will stay low forever. I don’t think that is the case.

Hussman’s has some good data that shows you are double counting if you say stocks are worth more because interest rates are low. Long term rates being low are forecasting growth rates are going to be low. Sp500 prices are just better correlated to price to sales over the long term. Another pretty good correlation -0.8 is dividend yield. It’s 1.4% now which which means future returns are not going to be high especially if growth rates are low.

Old school, right.

Low interest rates justifying high stock P/Es only makes sense if you assume that those rates will be kept low IN SPITE of high growth (and high inflation), and thus, that continued multiple expansion is justifiable.

I wonder how much of the money invested in US stocks right now is money leaving Hong Kong and maybe Taiwan? Maybe some of that money is just being parked. That might account for seeming irrationality.

Allegiant Air was building a waterfront hotel/condo resort in SW Florida when the pandemic hit. They stopped construction. Their stock dropped as airline traffic almost halted. The Federal govt. bailed out the airlines. The public got the bill. There were complaints about them leaving their cranes up during hurricane season. The cranes are still there, construction halted. Allegiant stock is now priced above pre-pandemic levels.

“being silenced forcefully when it gets in the way, such as by Corporate America and Wall Street analysts.”

And that is what is so discouraging. This, people is disinformation and it makesyou winderif we’re in the middle of our own color revolution.

“Dude, where’s your mask…”

Election laws are being tightened in most battleground states. The mail in ballot party will never happen again. Be careful making investment decisions based on the outcome of the last election because it is temporary. Many Democrats understand this and are already backing away from the policies of this administratiion because that is the only way they can survive future elections. In 1.75 years, the next set of elected officials will be going after the tech companies for their part in this. I will be betting on that with my money.

Your political musings are about as accurate as your real estate ones.

On wall street, we always bet the politics. We had a bunch of political scientists on our staff to walk us through different political scenarios and market impacts. You have to do that.

Personally, tech companies that pick political sides have made a big mistake because political power swings back and forth. That will be fun to watch and perhaps some easy money.

“…political power swings back and forth.”. Yes it does, Socaljim, but you keep drawing the wrong conclusion as to WHY. It’s not because one or the other is bad…it’s because they are BOTH bad and essentially the SAME on all major issues. Voters are given the illusion of choice btwn 2 teams that support the same thing. Long ago when is wasn’t like that, one party held a majority for decades. Not any more, because both are basically the same thing.

Actually, my opinion is both sides are cheating. The dems did a good job pushing the cheating farther and got away with it. Gotta give them credit for that. But, McConnell was all bent out of shape when Trump called the cheating out … because the Republicans also cheat and McConnell did not want that out in the open. All crooks.

I’d enjoy some schadenfreude from that. It blows my mind when huge capitalistic companies publicly espouse anti-capitalist ideology. They’re making the bed, I sure hope they get to sleep in it.

H.R. 1 will ensure that Dems in office will be re-elected

Socaljim,

When D’s actually represented working folk to a reasonable degree, this happened. Voters had a choice and spoke loudly and clearly:

“Democrats controlled the House of Representatives from 1955–1995, a forty-year reign. But it should be pointed out that Democrats actually controlled the House for much longer, from 1931–1995. with the brief exceptions of the 80th Congress (1947–1949) and the 83rd Congress (1953–1955). That’s 60 out of 64 years — essentially three generations.”

1) SPX Is up from 2,200 to 4,100 – 4,200.

2) Lettuce, tomatoes, celery, Basmati rice, potatoes, cabbage, oranges apples…their prices had no change.

3) I see no inflation when I buy a bundle in MCD.

4) The only change from last year : where are the customers.

5) If the new $3T pass, our taxes will rise. US democracy will be casted in silicon molds.

6) If fail, wall street dump.

7) In Aug 2020 US 10Y reached a lower low @0.52> In Mar 2021 : 1.74.

8) Is 1.75 % inflation ?

9) Gold slumped from a new all time high @2,089 in Aug 2020 to 1,673 in Mar 2021.

9) Gold might test May 2 2011 backbone, between 1,576 and 1,471,

possibly in a bearish horn.

How about next quarter or even the following year? Wall St needs to prepare for this.

Yes and WS has prepared for it – it’s called eternal ZIRP and ever expanding QE.

I wonder what effect this “base effect” will have economic models moving forward.

Good question. We already know that the gyrations of the Pandemic economy have caused seasonal adjustments to go haywire and produce erratic results.

In 1955, at Cal/Berkeley grad business school, our beginning statistics text was “How to Lie with Statistics”.

Looks like these people wrote the book.

Funny Tom,,, they were using the same book in the undergrad statistics required for my ”easy” major approx 14 years later!!!

Prof let me take the final exam only, as I had had the hard core statistics course earlier when I was studying hard science rather than the ”social” type alleged science I went to when I got lazy and didn’t want all that studying/school work to interfer with my working and social life.

I use a ten/twenty year regression line for all things, on the basis that real physical things don’t really change from trend that much over longer timescales.

Anything that goes +/- 40% of that line at any time is officially weird in my book. Can work great for stocks I find. Tesla is off the page.

Covid and 2008 are way out weird on your chart!

Question is how long to settle back to the regression line? Anything else is BS.

So the job numbers are disappointing because those who are receiving Govt $$ are not motivated to go back to work

So the Fed uses the poor job numbers to justify their overly accommodative antics..

So they pass out too much money, people stay home and are appeased, and the Fed can print their brains out. Markets soar, housing soars…and a big chunk of the work force is paid to stay out of the work force. Everybody’s happy. See?

Round and round we go.

I wonder if the government dole is in fact intended to compete with employers and thus be a stealth minimum wage increase.

And the only way they will be able to afford that stealth minimum wage increase is to massively raise prices.

There’s the inflation they wanted!

Every investor with half a brain already understands the base effect. It is nothing new. Politicians have always abused the stats, again nothing new. The Fed sees the inflation as transitory, and once again nothing new. It will all be forgotten 6 months from now. It is a blip, buy the dip.

“The Fed sees the inflation as transitory,”

Of course.

The push for inflation, then when it shows, they deny it.

BTW, why is a Fed that is BOUND to stable prices pushing for an inflation (2-2.5%) that would rip 22 to 28% respectively off the dollar in ten years?

In the 20th century and until 2009, Fed Funds equaled inflation.

Since 2009, the Fed has forced Fed Funds beneath inflation.

How good will it be to own 5 yrs with a .5 yield when inflation is north of 2%? Or even ten years with a 1.65%?

How good will it be to own MBSs with a 3% yield when inflation is 3.5%?

If the Fed gets their way, they will create a bond market debacle.

“Transitionary” inflation is b0llocks anyway. Unless you get genuine deflation, a price rise is permanent. If you get 4% “transitionary” inflation, your savings will be worth 4% less FOREVER. Same for income etc.

This whole thing is such a con. We deserve better than this.

Interesting this Janet Yellen bill, as the Biden government wants to spend a mountain of money on renovation in the US, so the success of this operation will depend on the wolves of Wall-street and the wolves of the construction companies and associates. It is interesting to see who will win.

Basically it is interesting to see that the policies all have the same goal brought back to work in America.

Good article. Thanks, Wolf.

As long as they keep pushing free money to the american consumer they will keep buying. The only meaningful government indicator of our economy may be the trade deficit. Most Americans think that the bigger the deficit the richer we are and we are “booming”. At the present minus 70B a month we must be “booming”. We will be rocking and rolling with a GDP growth of 10% at 100B. The only trick is that the productive world hands over its production of goods for our debt which we can not pay back unless we use our worthless inflated de-based currency. The American does not know what de-basement means. To many it may sound like it could be a lot fun.Eventually the rest of the world will get tired of filling our gullet with free shit. The US government has gone dark and retreated into a garden of lies . This was the standard practice of the USSR before it disenigrated.

Federal Government borrows near zero because of the Fed

Federal Government pays out so much for “stimulus” and other employment adjustments that people stay out of the work force

The Fed points to the employment numbers, skewed by government payouts, and keeps interest rates artificially low

The Federal Govt borrows at these artificially low rates, spews money out to those who choose to remain unemployed

People choose to remain “unemployed”, unemployed numbers up, Fed points to the numbers, pounds rates, govt borrows, sends money out,….

round and round we go…

1) TY will die, but not today.

2) UST 10Y Note Futures TY, monthly log :

3) Take Oct 1987 low to Jan 2000 low, the dotcom crap.

4) Take a support line L1 from the big red on Dec 1999 open.

5) Take a higher support line L2 from Sept 2008 open, BernardSki picnic.

6) TY popup from Oct 2018 low @117.42 , crosses L1, but failed to reach

L2.

7) Within a year TY made a bearish horn.

8) TY weekly : When TY crossed the long legged doji, an inside day, a Harami (a pregnant woman in Japanese), from Mar 16 2020 it was all over.

9) Currently TY got support from L1.

10) TY might bounce up to form another lower high and drop below L1, between L1 and the support line, to proceed the downdraft.

11) If in the next few years TY osc between L1 and L2 and reach L2 ==> NR.

12) The inflation will start when TY will drop and enter the channel,

forming an Adam & Eve.

The rush out of dollars will continue unabated – if anything it’s accelerating – I have a modest vacation home in a South Florida development with 1650 homes – right now there is one home for sale (listed yesterday) – one listed Sunday was pending Monday.

The market is white hot – not sure how/when this will end.

The geniuses at the Fed think they have figured out how to generate profits/wealth without producing. Maybe they can show us that perpetual motion does exist!

1) Put a dot between BernanSki trail in Sept 1998 and June 2003 high.

2) Put a second dot above June 2006 low.

3) Put a third dot under the 2Y fused area between 2014 and 2015 lows.

4) IF TY will form and Adam & Eve, a spitz and a curving female,

put the forth dot under Eve.

5) The inflation will start if the next dot will drop under the channel.

As we heard discussed previously numerous times, one way the government intends to pay for all these boondogles and spending is by inflating away everyone’s income and savings. Its working quite well. Just noticed another subtle trick that they have done which they hoped no one would notice, but I did. In the 2020 1040 tax instructions they suddenly deleted the tax tables which showed the marginal tax rates based on taxable income, which was on the previous years’ 1040 instructions. So if your income is between 75K and 100K you will no longer be able to see when your income pushes you into the next tax bracket which doubles the rate from 12% to 22%. It will be invisible as you have to go to the general tax tables, which DON’T show this demarcation. They kept the tax tables for incomes over 100K, tricking you into thinking that below that you were in the 12% bracket. If fact, at about 79K the bracket changes to 22% Fed tax rate. This little change has an enormous effect on people’s behavior. As was pointed out, the natural inclination in to keep your reported taxable income low so as to avoid paying higher % of that income to taxes. This can be done by re-structuring your investment portfolio, making Cap expenditures etc. which I have dome many times in the past. In a deep Blue state which I live, 22% Fed + 7 1/2%% MD + 15.3% Self employment tax adds up to 43.8% of our income above that 12% to 22% cuttoff going to taxes. That’s the thanks we get for working 12 to 18 hours/day. Somebody sitting on their sorry a$ses collecting state and Federal unemployment will come out ahead under this corrupt system. And to add insult to injury they use gimmicks and tricks so you don’t even know that you are getting screwed.

Corporate management is usually able to issue itself stock options whose exercise price is the price at time of issue. This is why they prefer buybacks to dividends; if they can boost the price they get an immediate profit, with no risk of loss if unsuccessfull (if the price doesn’t rise they just don’t exercise the option).

It would be interesting to know details about how many companies issued options to management last spring when prices were so low.

1) SPX crossed the 4,100 line.

2) A ski trip for two cost $1,000/day. It’s worth it, because u can call your friends from the lift.

3) US 10Y weekly.

4) The most important bar is the inside bar, a Harami, on Mar 16 2020.

5) After forming a five weeks triangle, between Nov 30 and Dec 28,

US 10Y jumped on Jan 4 2021.

6) UST 10Y was pumping muscles for nine months.

7) After the jump, 10Y reached 1.74 and closed Jan 21/27 gap.

8) The horizontal distance from the jump, to the big red bar on Mar 2 2020, is about equal to the diagonal distance from the bottom. If u take it from the jump, US 10Y can move higher.

9) If the 10Y reach the Harami, hopefully it bounce back and move up.

10) If the 10Y cross it ==> we might see NR.

There’s a few places where skiing is cheaper. You’re not going to get the huge resort experience and heated lift seats, but if the skiing is what you actually care about, it’s worth it. I went to a place this year in the middle of the Adirondacks that charged $25 for a weekday ticket. Small mountain, but great terrain, and hardly any lines for the lift (or T-bar).

Apropos of nothing, a quote from a guy I talked to on a lift in Vermont pre-pandemic; “Don’t ski the trees, ski the space between the trees.”

I feel like that means something profound, but I’m not sure what.