The massive and once-again extended Pandemic-era furlough programs serve their purpose, but…

By Nick Corbishley, for WOLF STREET:

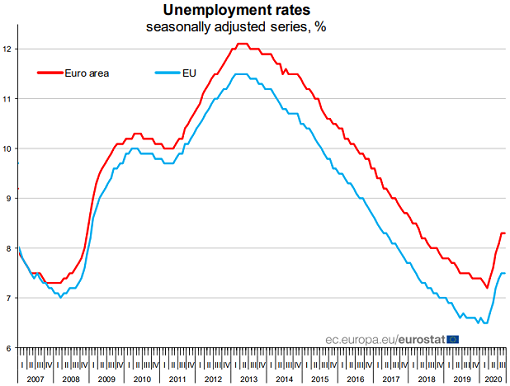

In Europe, people who are furloughed are paid under government programs via their employers. Many of these programs have been created during the Pandemic. In theory, these people still have jobs. In practice, they’re not working, or are working heavily reduced hours. But they do not count as “unemployed” and are not reflected in the “unemployment” numbers. So throughout the Pandemic, the official unemployment rates barely ticked up, compared to the last crisis, and remain low for the EU era, despite tens of millions of people who’d stopped working due to the lockdowns (chart via Eurostat):

Under these furlough programs, the government pays companies, who in turn pay employees between 60% and 84% of their monthly wage. In some cases, the workers work fewer hours for less pay; in others, they don’t work at all. The workers take a hit to their income but their jobs remain intact, at least for the duration of the program.

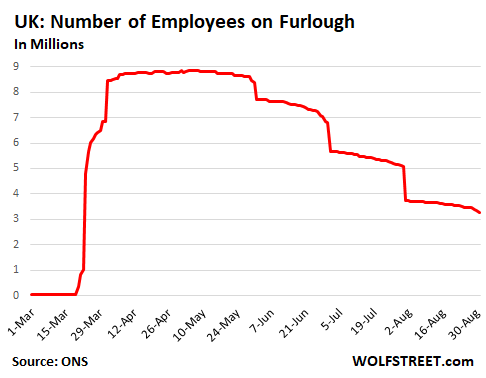

The UK adopted a sweeping furlough program at the beginning of its last lockdown. Businesses can claim 80% of a staff member’s regular monthly salary, up to a maximum of £2,500. The money must be passed on to the employee and can also be topped up by the employer.

But the unemployment rate has begun to rise as people come off furlough, and those whose jobs disappeared entered official unemployment. The unemployment rate ticked up to 4.8% in the three months to September, from 4.5% in Q2 and from 3.9% a year earlier, according to the Office for National Statistics (ONS). In London, the unemployment rate surged by 1.2 percentage points from the previous quarter, to 6%, the largest quarterly increase in unemployment since the ONS started tracking the data in 1992.

Extend and pretend. Most of Europe’s job programs were initially described as a short-term fix, providing employers affected by the lockdowns time and financial breathing space to reinvent themselves for the new economic reality that is quickly taking shape. But more and more governments extended the duration of their programs, some until 2022, in the hope that the economic outlook will change in the interim.

One country that said it wouldn’t do this was the UK. But it, too, backtracked. The furlough program was supposed to come to an end on October 31. But four days later, just after announcing a fresh lockdown, the government extended the program until March 31, 2021. It also announced a fresh round of measures to support the self-employed. On the same day, the Bank of England pledged an additional £150 billion of QE purchases, which will help ensure there is enough demand for all the new debt the government will need to issue to finance its new commitments.

In March, the number of furloughed employees exploded from zero to 8.5 million and remained near 9 million through May, after which it began to drop as the economy opened up. By the end of August, the latest available data, they’d fallen to 3.3 million:

This decline in the number of furloughed workers — some of whom then become “unemployed” — led to the irony that in the UK, as elsewhere, the official unemployment rate rose precisely when the job market was improving. Millions of people whose jobs had been put on hold during the lockdown were able to go back to those jobs once the lockdown was lifted. But many others ended up having no jobs to go back to, either because their employer had gone out of business in the interim or had decided to let them go.

Some companies announced mass layoffs in anticipation of the end of the furlough program. The problem is not just that jobs are disappearing in large numbers; it’s that very few new ones are being created.

Other countries too showed a surge in the official unemployment rate in the third quarter, driven by people who came off furlough programs with no job to go back to, even as the job market improved.

In France, at the height of the lockdown in April, the number of salaried workers registered for the “temporary unemployment” program exploded to 8.8 million. By September, it dropped to 1.6 million. Most of the people who left the program returned to their jobs. But not everyone.

And the jobless rate jumped to 9.0% in Q3 (from 7.1% in Q2), according to the INSEE statistics office. The increase of 628,000 unemployed people was the single biggest quarterly jump on record going back to 1975, said INSEE.

Now that France has entered another lockdown, the government expects the number of people on its temporary unemployment program to rise to around 2-2.5 million in November — roughly double the number in September but substantially less than during the first lockdown.

Much will depend on how long the lockdown lasts, how much damage it does to consumption in the lead up to Christmas, and whether or not the legions of small and medium-sized companies that already took on a huge amount of fresh debt to survive the last lockdown can weather another storm of economic inactivity.

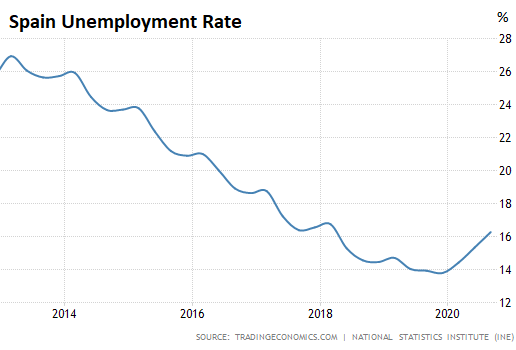

In Spain, the number of salaried workers on the government’s temporary unemployment program has fallen dramatically in the last eight months, from about 4 million in April to just under 1 million today. But the unemployment rate — which is already very high — has risen, reaching 16.3% in the third quarter. Two-thirds of the 697,000 people who were added to the official unemployment rolls between July and September were in the tourism sector, which in Spain accounts for roughly one out of every eight jobs (chart via Trading Economics).

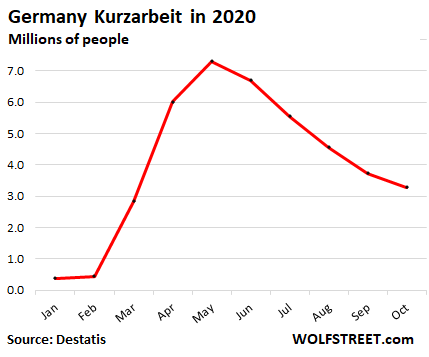

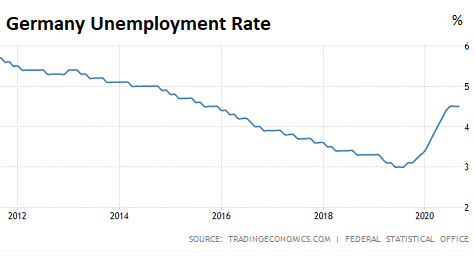

In Germany, at the peak in May, there were 7.3 million people on “Kurzarbeit” — Germany’s furlough and social insurance program. More than a third of them were in manufacturing jobs. But none of them counted in the official unemployment numbers. By October, the number of people on Kurzarbeit declined to 3.3 million.

But the unemployment rate started rising a year ago and in July reached 4.5%, the highest level since December 2015, but then remained flat (chart via Trading Economics):

But with a new lockdown in Germany — this time a “Lockdown Light,” as it’s called — in place, the number of workers on Kurzarbeit is likely to swell again.

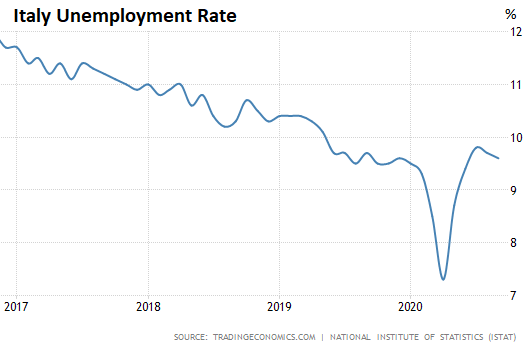

Italy had the largest number of people on furlough (12.6 million) during the last lockdown. But the unemployment rate in September was just 9.6% — exactly the same as it had been in September 2019, but it didn’t include the people on furlough.

And the steep drop in the unemployment rate in March and April during the lockdown was caused not by a sudden miraculous burst in hiring, but by the very lockdown conditions during which people stopped looking for work and therefore no longer counted as unemployed. When they could start looking for work again, the unemployment rate returned to the pre-Pandemic level (chart via Trading Economics):

In Italy, many companies are barely holding on. Italy also has one of the biggest informal economies in Europe, and many of those who depend on it have lost their livelihoods. They qualify for little, if any, government support. Even many of those in the formal economy who lost their jobs in the first lockdown had to wait months before receiving their furlough checks, while the unpaid bills and debts kept growing. Many of those who haven’t lost their jobs yet fear they could at any moment. By Nick Corbishley, for WOLF STREET.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Eenie, meenie, miney, mo…..It’s heading toward a simple question of which nation’s cities will go up in flames first. There won’t be enough troops and cops to stop those millions when the false feast quits flowing in the Famine River Valleys.

I want so badly to disagree with you, but I know you are right.

Figures lie, and liars figure….no surprise.

Merkel called to migrants “you are welcome, there are jobs & welfare here for you” on behalf of the EU .. this included the UK.

This was a massive financial commitment on the part of the EU to begin with & in a time off economic chaos & hardship.

Add COVID-19 to this equation ..

We have not got a clue as to the true situation over there & they are never going to tell it as it is.

This is my problem with easy money. There is no apparent cost of any decision government makes including stopping the economy. Since 9/11 everything has just been put on the charge card as if there are no consequences. We must be in the final quarter of the ballgame.

@old School

‘There is no apparent cost of any decision government makes including stopping the economy.’

Until, there is no longer revenue stream/cash flow for the servicing of that mountain of debt . Choice of Social spending programs vs paying interest (even it is 0.25%!)

—

Federal budget deficit hits $3.1 trillion, more than double the previous record

It is the government’s largest annual shortfall, surpassing the previous record of $1.4 trillion set in 2009 after the financial crisis.

NBC

Stopping the economy & consequences mean people will starve to death & including in the streets of our cities.

Not that we don’t already have a shameful attitude to the homeless across the world, in the first place & they do die as a result.

Maybe the .. old school system is/was not realistic .. based on

* we could care less about lesser human life / the common man.

* the Almighty Buck is everything / the be all & end all of life itself.

* there are too many of them crawling about the earth anyway.

I would like to believe that we of this time & space on earth have evolved somewhat .. hey.

I don’t have the answers .. but a definite rethink is vital.

I’m wondering why it hasn’t started happening yet. Maybe people still trust their governments, like they trust mainstream media and big pharma to provide them with the truth about certain events.

looking bloody

One can see why the conspiracy theorists think the virus is just an EU reset to quash any nationalism and reinforce total EU government.

EU is not a government. It is a corporation. It wants a flag and anthem because people look up to that. A country has a government. How effective that is, where troops occupy most cyber security roles and field misreporting by quietly dissenting armies on the ground about personnel movements is anyones guess.

Interesting article Nick thanks. While the figures lie trends emerge.

Very good analysis again. I live in France, and most people live under the delusion that they’re making a good bargain: being paid to stay home watching tv just like a regular unemployed person without the disadvantage. There are even some shortage of labour in agriculture, like always… Very few measure the economic consequences of the lockdown, even as a victim like small businesses, hotels, restaurants…

At the risk of being tedious I would just lke to once again point out, that the BoE and ECB can carry on financing these furlough schemes until they run out of 1’s and 0’s in their computers – which is , forever.

No cities will burn, no bond markets will explode no bond vigilaties will destroy civilisation, in fact nothing will hapen except the people sitting at home may get bored.

Regards

topcat,

“At the risk of being tedious, I would just like to once again point out that” a system collapses when no one is working and all you do is print money to pay everyone, as you propose. This is an extreme, of course. The more realistic example is what Argentina has been doing for years. Its central bank, which is part of the ministry of finance, has been funding government expenditures by printing pesos. Look at the currency, and then look at how difficult it is to do business in Argentina when inflation is 40% or 50% per year.

Exactly. It only appears to “work” in the EU and U.S. because enough of the printed money goes out of their respective places to be held by investors, and thus doesn’t end up in the real economy, causing hyperinflation. But for how long will people be willing to buy 30 year bonds at 1.5%?

‘printed money goes out of their respective places to be held by investors’

I presume to use $ to buy assets which are already overbought and overvalued.

Value is what you get for the PRICE you pay. When you over pay above the true value of that specific asset, one is already in the hole, to be realised later. Only apparent when the secualr Bear begins. C 19 is the catalyst over which Fed has little control.

Wait and See!

“Everything You Don’t Want to Know About Covid Vaccines (Because You Can’t Be Bullish Anymore)”

oftwominds

I have to chime in too and was going to before reading these replies. A while back I pointed out on WS that the BOE does not print the world’s reserve currency. It has already had one emergency bailout from the IMF in the 70’s, at that time the largest the IMF had made. It was the run-up and impending collapse of the pound that made Soros his biggest score and title as ‘the man who broke the BOE.’

Of course, Italy and Spain, IF they were still in their own national currencies would be in far more trouble.

But whatever the flaws of the euro zone, like the US it is big. It also includes as members the Frugal Five, especially Germany with a balance sheet that puts the US to shame. Pre-covid Germany was running about a 2% surplus.

The UK isn’t big and it wasn’t frugal pre-covid.

It has the smallest economy supporting an SDR reserve currency. Add in Brexit if you like.

I’m not predicting a disaster for the UK pound like the ongoing Argentine or the incipient Turkish ones. But if it were to keep printing like the US or Euro zone, it has a lot further to fall against both of them. Then what happens to London’s fintech businesses?

Gordon Brown was the man that broke BOE giving away gold coffers so that Scotland could become independent.

Gordon Brown was (and I surmise, still is) strongly anti-Scottish independence.

It wasn’t just Gordon Brown. Thatcher destroying British industry and blowing the North Sea Oil reserves, Major and the ERM debacle, Cameron and May with the economically idiotic austerity policy, etc,etc…

Arguably the only good decision economically by a British Government was to enter the Common Market back in the seventies.

Nick Kelly,

I would think that the Euro should be worse off than the GB pound in reality with what the ECB (European Central Bank) is printing.

Topcat, (Hitchhiker’s Guide to the Galaxy warning) is that sort of like when the Golgafrinchans of Ark Fleet Ship B, after ending up on Earth as our ancestors, decided to adopt leaves as a currency to finance their consumption, and a ship’s peanut subsequently cost about three deciduous forests to purchase.

Maybe the absolute limits of inflation for digital currencies prior to a revaluation or converting to a new currency unit is when the energy costs of storage and transaction of those electronic digits surpass the exchange value of the digits used in transactions?

I would also argue that the growth/inflation imperative we impose upon ourselves is the greatest destructive force that we humans have unleashed on this poor Earth and ultimately on ourselves.

I’ll put in my two cents and argue there’s a middle ground here.

During the pandemic, demand has collapsed in a number of industries. The former employees would be hard pressed to find any work, especially during a lockdown. If they can continue to meet their basic needs of food and rent in the interim it will prevent a major catastrophe.

This can theoretically last as long as the government is able to provide essential services including food and electricity. Those paid not to work weren’t producing food and electricity before and very few people are consuming the services they once produced.

However, people are not content to live in totally dependent conditions with a minimalistic lifestyle. Resentment would also grow between those working and those being paid to do nothing. People need participation, growth, and hope in order to thrive or discontent and political instability will fester.

The economy will re-grow in a significantly different way after the pandemic. Many are trying to predict these differences and how best to position for them.

Politicians and governments tend to react more than plan. Most of them tend hold the arbitrary goals of maximizing headline GDP while minimizing headline unemployment and CPI inflation. It’s possible that some of their minor goals may be elevated, such as reducing poverty or homelessness – or that that might even add major goals like a headline number for living wage employment or a cost of living tied to a median earner’s spending patterns. That is what much of the political fight is ultimately about.

Ok, I have to ask about unemployment in Spain – you have about 65% of population in 14-65 age group, so lets say around 60% of population is working age. out of those, close to 20% are unemployed. that leaves what? 40% of all population working? how does that work? where is the moneys coming from? is Spain another Greece in the making?

The money is coming from two places:

1) Catalonia and the Basque County – the rate of unemployment shows huge disparities between the wealthy North and the poorer South.

2) From abroad. Spanish and Portuguese workforce is just as popular in Europe as Mexicans in the US. Cheap and effective, they provide the backbone of Swiss, BeNeLux, British and – increasingly – Scandinavian labour market. So people with relatives working abroad often receive a 500-600 € bank transfer a month and try to make a living out of that.

Yes it was interesting to note Catalonia was the first to be locked down. Spanish Government jumped at taming independence plight.

To think people in the UK have been sitting on their arses at home getting £2500 a month is a joke in itself. Furthermore, the speed at which the government changes its mind when a z list celebrity Makes a statement on the BBC truly shows how the whole country has gone nuts.

I remember reading somewhere that once civilisations work out that they can vote for free money then this is a major step towards the destruction of that civilization. If that is true then it’s safe to say we’re totally ******!.

Why blame the citizens for the free money? This is a banker-led implosion of society.

If you add the 4 million furloughed to the unemployed then the unemployment rate doubles to 8%, where it got to after the GFC

Of course we are all pretending the GFC actually ended, and that this is something else and quite distinct.

GFC was supposed to have ended after throwing Trillions ( insane credit creation) but without fixing the underlying ‘rot’ in the global Banking system. Now C 19 has again unmasked the deteriorating financial (private/Public) all around the world.

AS Charles H Smith (oftwominds) clearly mapped out ( primary,secondary and tertiary effects of the virus) in his daily blogs since January 23rd. The attempt to rebuilt the brokem HUmpty-Dumpty’ is going no where. But pretense is every where with disconnected Stock mkts with the economy on the ground. Very few out there are challenging the V shaped recovery.

Financialization our economy by Fed favored the Wall St over the Main St, where as latter punished by financial repression affecting the savers, retirees and those depend upon fixed income and especially wage workers ( bottom 90%) with little savings on the side.

Recently an eye catching article in Time mag with the title ‘ The top 1% have stolen 50 Trilliond from the bottom 90% and hence the USA is less secure” This is an astonishing statement from a MSM mag!

Bank of Portugal recent figures tell us over 700,000 thousand mortgages and loans will be at risk of non performing there when the Bank forebearance ends. Like the other EU Greco-Romans it too has a substantial % in its informal economy.

Many well aware that their employer was on the fiddle as they were never offered a contract or formal system of pay but, spare a thought, for the many others who assumed that their deductions were actually going towards social security and pension. But wasn’t going further than their employers pockets – but none dare object.

Their now ex-employer far too important and therefore honourable for any disciplinary action to be taken against them by the authorities.

In the U.K. before COVID led to the first lockdown on March 23rd the economy was showing clear signs of slowdown,

The combination of COVID and the possibility of a disorderly BREXIT has held markets back. The outlook for 2021 for the U.K. is not looking good for employment.

The government are already looking at how taxation will recover the phenomenal overspend due to COVID. Middle and upper income households will be hit by changes to capital gains and inheritance tax allowances. The rich will shelter behind their offshore tax havens, and others will emigrate to lower tax states.

In the US, President Annointee Biden has promised to follow the sage advice of his scientific advisory panel regarding Corona-virus policy. According to the public statements emanating from members of that panel, it includes Plan Dark Winter which advocates a two month hard lockdown with mandatory home quarantine for all. If there was any doubt, that should be sufficient to drive the final nail in the depression coffin waiting to float off on the next tide.

He better get ALL the STATES to agree to this plan, which they probably won’t.

@John Seddon

‘Before Covid…economy was showing clear signs of slowdown’

For the last 25-30 yrs, more and more debt was needed to produce 1$ of GDP. Now it costs approximately $4 to produce a $. The Growth rate has come down from 5+% to 4 and then 3 under obama and now 2% and heading for below 1% probabbly for the next decade.

C -19 epidemic/pandemic is going to make all those projections worse!

I hope I am wrong!

What’s better, the EU approach, or ours in the USA of throwing people out of work? On the one hand, the workforce remains fairly intact for the eventual end of the cycle, and families stay together. On the other hand, the creative destruction process which leads to the formation of new businesses and the good things this brings about also means a disorderly mess and unhappiness that results in people living in cars. Plus companies unable to pick up where they left off once the cycle returns things to normal because their institutional knowledge is gone? An honest discussion, and a national policy of employment for all who want it, and an acknowledgement of the taxes to fund same since no matter what, there’s no free lunch. Unemployment compensation won’t go away, nor should it, but do we fund keeping people on their jobs even if it’s painting the rocks lining the driveway with whitewash, or put them out of work to collect unemployment from the individual states. I own a business, so I sign the front of paychecks and believe the EU approach should be investigated. maybe not exactly the same way they do it, but with American characteristics. Of course, I’m a nobody and nothing will happen . . . but these are my thoughts.

Hi John. Interesting insight. A few notes.

“What’s better, the EU approach, or ours in the USA of throwing people out of work?”

1. Free money is never, ever free. The tentacles remain. Everywhere.

2. The effect of unintended consequences is always and everywhere grossly underestimated.

3. Central command has always turned out badly. Central command only goes in one direction. Stronger and stronger “commands”.

4. No one is “thrown out of work”. The firm scales back and waits to hire people back when demand asks for it. Private people making private decisions with the best available data. Bad idea?

There is massive, permanent youth underemployment in the EU, no one thinks their unemployment schemes are something we should emulate.

The EU system: Extend and pretend until every red blooded European adopts the old Soviet motto— “We pretend to work and they pretend to pay us.”

The US system; Use Corvid to bankrupt every middle class business until the last remaining member of that class moves into a tent under a freeway overpass. When we run out of overpasses, seize all the tents and shopping carts and offer them for sale on Ebay.

New infrastructure jobs on the USA: Build more overpasses.

Back across the Pond, here in the Untied States, as Wolf and I and others have predicted, the 3rd Quarter + unemployment situation is much worse than what has been reported by the BLS.

https://www.silver-phoenix500.com/article/recent-economic-data-more-fiction-fact

Once again this is pulling back the curtain on Government stats, esp. just before a still contested Election.

Whether it is Furlough Printed Debt or Unemployment Compensation Printed Debt, the end result is the same: The global Debt Collapse coming down the pike is going to be monumental /historic on all fronts. Countries will default on their obligations in entirety or partially, currencies will swirl down the Toilet of Currency Devaluations, and hyperinflation will be had by one and all. Bah Humbug.

The old fashioned way of resolving banker debt was war. EU is composed of member states who’s last two generations witnessed massive cataclysms with widespread civilian death and suffering. It’s entertaining but also very depressing to watch how the elites in Europe try to wiggle their way out of resorting to the same old solution. Fiat money might be soluble, but that only leads to the recognition that humans can be reduced to liquid pools of blood. One remedy is to invent reasons and go on a colonial binge fit for the 21st century. Empty out the various nations of all the discontented and find new vistas for investment. But that will take some clever P. R. Maybe look to the CCP for leadership on that.

In History, the wars were motivated by many reasons.

1. Attack a violent neighbour before he attacks you.

2. Attack a rich neighbour : if successful, you’ll get the glory and the loot.

3. Channel the internal violence outside before it gives you a civil war.

I can think of no case when the debt was the reason of war.

Last century I can only think of two major countries that had to war because of debt: Germany and the United States – after their extreme spending on social programs and infrastructure left them highly indebted. Do you think Germany financed their ’30s growth by selling to the rest of Europe? The US? Honest questions, not sarcasm.

#3 channel the interval violence outside . . .

Whence comes this internal violence that could erupt into a civil war/agitation for socialism? Income inequality/Workers in debt to rentiers?

I’m not arguing, just asking questions of knowledgeable people.

By bankers I meant private owners/rich, not necessarily nations treasuries depts. or even Central Banks.

Read about WWII and why it was caused by too many demands from the victors of WWI.They essentially looted as much as they could from Germany to pay for the past war expense.

Then came Hitler…

Erdowhan bad spelling,from Turkey could be our new bad guy

Sorry, but you folks need to study WWI ( historians see WWII as the next round)

It wasn’t begun to liquidate debt, in fact all participants (except briefly the US), ended up with much more debt, mostly owed to the US. Whatever the sins of the US, no historian blames it for outbreak of WWI.

Why it started is complicated. It’s simpler to answer why it lasted so long and with such carnage and debt: technology caught up with humans’ million year- old tendency to settle disputes with violence. The two major advances were machine guns (and rapid firing rifles) replacing muzzle loaders and high explosive replacing gunpowder.

By the time each side figured out that infantry and cavalry charges wouldn’t work, they’d each lost about 1.5 million men ( not counting Russia)

Progress in arms continues. The only one not tested in combat is one of the many thousand H- bombs, which use a small atomic explosion to initiate a fusion reaction, in effect creating a small brief star on the earth’s surface. On the plus side they will liquidate debt.

Okay, nation state might have added debt, but maybe after it having shifted from the owners who got their private debts cleared, their factories up and running again, their workers not agitating any longer? This after a long, tough depression? I’m not insisting on a point, just asking questions of more knowledgeable people.

True, a very complex mess involving industrialization, colonialsm, the rise of a more unified and successful German state caught between neighboring imperial relatives (one giant pissing contest), at the same time as growing American centralization of corporate business control which projected more pie eating. It was all headed toward a massive showdown. But you can simplify it as such….When your gunpowders factories are over flowing and people are running around trying to get attention by tossing firecrackers, something very bad is bound to happen no matter how much you want to believe it’s not possible. Murphy, plain and simple.

Less than 100 H-bombs will cause a nuclear winter (and countless dead). Some say, so what? But apparently, for now at least, moderation through biological and economic warfare are preferred. It’s civillized war.

Private equity will do very well this year.

The NYT writes that 11 million people have COVID-19, but I would say, isn’t that just the number that has tested positive in 10 months? So these headline numbers, God knows what they really mean.

WW1 didn’t solve anyone’s problems economically and led directly to WW2 due the Versailles treaty. IMO the post WW2 boom was due to the widespread use of oil…

That’s how you “manage the decline to avoid the chaos” (expression found in comments of this site).

My respect goes to the HR and accounting teams of the companies : they had to make emergency calculations of the amounts to transfer to the persons on payroll under new rules; those ruled have certainly not been embedded originally into the Information Systems.

Morlocks and Eloi.

Nomenklatura vs Precariat

Aristoi vs periokoi

SOYLENT GREEN IS PEOPLE!

Soon we may all be living “lives of quiet desperation”!

But interesting

“Millions of people whose jobs had been put on hold during the lockdown were able to go back to those jobs once the lockdown was lifted. But many others ended up having no jobs to go back to, either because their employer had gone out of business in the interim or had decided to let them go.”

The above movie will be played in USA in the following months. politically there is NO resolve to contain the virus spread during fall and winter.States with GOP governors have stated that they won’t follow the orders from DC!

Unlawful/unapproved gatherings, get together, family or otherwise are being held as a protest against Dems/Liberals, by you know, who!?

We are destined more infections, more hospitalizations leading to more deaths in the months to come!

In Germany furlough programs: up to 87% (with child), probably taxable

Totally taxable. It’s regular income as far as the taxman is concerned, if only because the subsidy is paid to the employer, not to you, and you get it as part of your (reduced) salary.

The biggest problem the Governments have is that they can’t get their largesse of printed electronically created “money” out into the economy to be spent.

However, CBDC Central Bank Digital Currency credited directly to each citizens central bank account, (wallet), together with UBI, Universal Basic Income will remedy that problem, (and cause numerous others), both of which plans have been greatly accelerated by the COVID crisis, never let a good crisis go to waste.

May I ask why my emails are constantly deleted?

I’m not aware of any of your comments being deleted.

OK forget last we crossed in the post as it were

Inflation was death bound before the pandemic. As expressed in the Fed interest rate. Governments need inflation. That’s how the system works. Governments spend new money. Debts are paid byinflation. Notably pensions. When people retire and find the money is gone, they’re better off dead. When the pandemic ends people will be happy and do extra spending so that the normal inflation cycle returns. For now, in the USA, credit card debts to China were paid off by pandemic checks. So consumers will be ready to spend again. The climate, private equity, billionaires, all having a good year. Call it serendipity. Call it quid pro quo. If you lost loved ones, you’re probably black and bad or a loser anyway.