The “second wave,” if prolonged, could cause bad loans to almost triple, to €1.4 trillion, says the ECB.

By Nick Corbishley, for WOLF STREET:

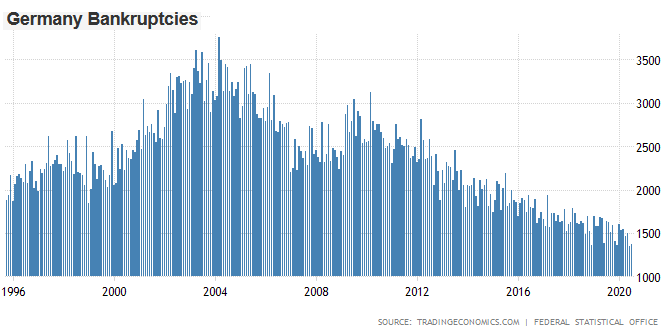

German banks need to prepare themselves for a sharp spike in corporate bankruptcies early next year, the Bundesbank warned this week in its 2020 Financial Stability Review. It anticipates around 6,000 insolvencies in the first quarter of 2021. While this would be a little lower than at the peak quarter of the Global Financial Crisis, the Bundesbank cautioned that it “cannot rule out that … a lot more companies will go bankrupt than is currently expected.”

Although Germany is in the grip of its worst economic contraction since World War 2, fewer insolvencies have been filed this year compared to 2019. This is the result of the weird bailout-and-stimulus economy, and includes these factors:

- Banks’ broad application of forbearance measures, which has given businesses extra financial leeway;

- The roll out of state-backed emergency loans and grants for struggling businesses, large and small, which forms the backbone of the country’s €1.3 trillion (so far) stimulus program;

- Germany’s “Kurzarbeit” social insurance program, which enables employers to reduce their employees’ working hours instead of laying them off, picking up government subsidies in the process.

- And most importantly, the temporary suspension of bankruptcy-declaration requirements.

Helped along by these measures, the number of firms declaring insolvency in Germany fell 6.2% to 9,006 in the first half of this year from the same period last year, trending at their lowest level in 25 years, even as the economy shrinks at its fastest rate in over 70 years.

Before the virus crisis, German companies that defaulted on their obligations and had piled up unsustainable debts had to file for insolvency. But that is no longer necessary — thanks to a new law introduced on March 1 that gave struggling companies extra breathing room. The law was supposed to expire on September 30, but, in classic extend-and-pretend fashion, its expiry date was postponed until the end of this year.

This trend has been broadly replicated across much of Europe.

In France, bankruptcies have been consistently falling on a year-by-year basis since 2015. And they’ve kept falling throughout the virus crisis. During the 12 months through July 2020, the number of insolvencies fell year on year by 28%, to 38,548, according to Banque de France. Even in sectors that bore the brunt of the crisis fallout, insolvencies have fallen sharply. Even the hard-hit travel and tourism sector saw a 28% fall in the 12 months through July.

It’s a similar story in Spain, where insolvencies hit a six-year peak of 1,979 in the last quarter of 2019 — testament to the problems the Eurozone’s fourth largest economy was already grappling with before this year began. Since then, against the backdrop of Europe’s worst contraction yet, the number of insolvencies in Spain has done nothing but plunge, first by 13% year-on-year in the first quarter, and then by 30% year-on-year in the second quarter.

For the moment, there is no official data for insolvencies in Italy, but probably much the same has happened. In all of these countries, struggling companies have hit the wall in fewer numbers than in recent years, and far fewer numbers and than would have been the case if it weren’t for all the government and central bank intervention.

That intervention has merely postponed the huge economic pain. How many of the companies benefiting from government assistance, central bank liquidity, and new bankruptcy legislation were already in deep trouble before the pandemic and are in far deeper trouble now?

In Germany most companies that were experiencing cash flow problems and unsustainable debt levels back in December, 2019, have effectively been given a new lease of life. And the number of zombie firms — over-leveraged, high-risk companies with a business model that is not self-sustaining — has soared. An estimated 550,000 firms — roughly one-sixth of the total — could already be classified as “zombies”, according to research by the credit agency Creditreform.

In classic form, Berlin is thinking about further relaxing insolvency rules to forestall the wave of bankruptcies that the Bundesbank sees taking place early next year. Under the draft reform, the deadline for firms to file for insolvency would be extended to six from three weeks and authorities would apply more relaxed benchmarks when examining over-indebtedness.

In France, concerns are also rising about the prospect of hordes of companies going under at the same time. The French Economic Observatory (OFCE) is calling on the government to step up the stimulus; otherwise, it says, bankruptcies may soar by as much as 80% in the coming months. That’s more or less in line with a forecast from S&P last week that European corporate default rates would more than double over the next nine months to 8.5% from 3.8%. In the worst-case scenario, where a second wave of the virus triggers new lockdowns, it said default rates in Europe could reach 11%.

As virus infections are once again surging in Europe, restrictions on movement and activity are once again sprouting across the continent. Madrid is in a so-called “light lockdown” while Catalonia has shuttered all bars and restaurants. France has declared a six-weeknight-time curfew in 20 cities, which will hamper consumption and business activity, heaping further pressure on struggling companies.

Unlike most of their European peers, which had deleveraged somewhat since the 2008 crisis, French companies intensified their debt binge. By April, total corporate debt had reached €1.8 trillion, according to Banque de France (BdF) — the equivalent of 70% of GDP. In February, just as the virus crisis was getting going, corporate debt in France was already growing at an annualized rate of 5.8%. In March, the rate of growth jumped to 7.1%, and then 9.9 % in April. By July and August, it had surged to 12.8% and 13.2% respectively.

While debt is still relatively cheap for large French firms, despite the bleak economic panorama, the risks facing excessively leveraged companies are mounting, BdF warned in its biannual financial risk report in June. That means the risks in the banking sector are also rising. Surging impaired loans once again threaten to wreak havoc on a continent where NPLs already represent 3.2% of the total loan books of the 121 biggest Eurozone banks.

Andrea Enria, chair of the ECB’s supervisory board, told Handelsblatt this week that a prolonged second wave of the coronavirus pandemic could cause bad loans to almost triple, to €1.4 trillion.

A gradual shift in anti-crisis policy appears to be taking place at the ECB. Rather than helping lenders forestall a huge wave of corporate bankruptcies, the ECB is now urging them to put viable businesses first as well as focus on their own financial health. The challenge is in deciding which businesses are viable essentially healthy firms that have temporarily hit hard times and which are true zombies. The Bundesbank has made similar noises in recent weeks, underscoring the importance that banks continue to do their job: to distinguish good from bad risks – and also to grant loans to good borrowers. So, too, have the Fed and the Bank of England. By Nick Corbishley, for WOLF STREET.

What does it mean when Wall Street mega-landlords that bought the impaired assets after the last crash are trying to unload during the worst economic crisis on record? Read… Private-Equity Firm Blackstone, Spain’s Largest Landlord, Tries to Unload its Properties

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I get that bankruptcies and bank loan defaults are being stored up in the pipeline – that seems obvious.

I don’t get how banks in Q2 results were actually lowering provisioning against bad debt.

Wasn’t that being a bit unrealistic?

I know plenty of banks are trading as low as 50% of BV implying a lot of built in expectations of write-offs. But are they also short of capital too?

That’s just the US and they are setting aside less compared to the last two quarters, but it’s still big numbers, and their total loss reserves are still rising. It just means that their outlook is not getting incrementally worse but incrementally better.

Taps, I think the under-reserving in the 3rd Quarter has more to do with Year-End bank executive bonuses than any sound expectation that loan default outlooks are getting better. In reality, the probability of a surge in non-performing loans, as this article points out, is only getting worse as the global economy fails to come back with any speed and a second Covid surge appears at hand. Plus, the re-classification via Extend & Pretend, under very generous “performing” terms for Zombie loans today, is only masking a tsunami of bad loans to soon hit the shores and boardrooms of these banks. Banker reserve for bonuses first, and sound banking way down the list of priorities.

Very perceptive, Dave

Because of fasb and iasb guidelines on expected credit losses which were issued in march. banks are not required to use existing models for payment holidays given because of covid-19. Expect a bang next year when this stops.

Hell, I didn’t realize commercial banks were in the business of making loans? Isn’t that how they end up with “bad debt”? Banks trade in forex & capital markets, now. The only loans being processed now (mostly) are auto and margin loans. The can kicking won’t end until Jamie Dimon is FINALLY fired–which is what should have happened 12 years ago.

US commercial banks hold $10.5 trillion (with a T) in loans and leases.

EU banks don’t have to write down NPLs anymore. So no one knows whether she / he is dealing with a zombie bank .

1st order fit is ALL EU banks are zombies … and this was true before Covid

And since GSIBs are all counterparties to each others trades, non EU GSIB’s by extension are all zombies too… though, Jeromes Open Throat Operations will try to convince one otherwise

Good borrowers = people who dont need the money.

Picking the winners and losers – wouldnt want to be enemies with the referee who decides that outcome.

A firm out of France overpaid for some weak performing construction companies throughout the US about little over 2 years ago. Pre virus crisis the companies purchased where already poorly performing. Now one of them in NYC is about to close its doors.

The Global reset is just getting started.

‘The Global reset is just getting started’

NOT until all the Extend & Pretend’ solutions are exhausted by CBers!

Going on the text being correct, then maybe instead of “viable essentially healthy…” it would be better for them to consider “Viable, Essential, and Healthy” before the rest of it all comes tumbling down. Sounds like they may have to process the failures by the batchful to keep up. One thing’s for sure, any time you toss quantities into the garbage, there’s always going to be someone who comes along and picks up value out of that trash can. Maybe they should concentrate on hiring a specialist crew of bone pickers while there’s still time to make some soup of it all.

The wait is until spring.Plenty of good people with talent to be scooped up in the “Garbage”.We just have yo wait until they’re scared and broke enough to sign the contract that pays them half of their true worth.

We get to keep the other half,cause we’re the “Makers”.

1) When central banks lower interest rates to stimulate, prices are rising.

2) When interest rates are high, prices are low.

3) In the early 1980’s when Michael Milken sold IPO’s the 10Y interest rates

was 15%.

4) The expected value of those IPO’s in the next 20 years was promising.

5) Investors could buy in 1983 an investment at :

(1.00:1.15)^20 = $0.06 ==> In 1983 six cents have an expected value of $1.00 in the early 2000. // or, for twenty five cents in 1983 u get

one dollar in 1993.

6) When US 10Y @ 0.7% and Europe @NR the expected value of one dollar today, in 2020, will be much closer to one dollar in 2030.

7) If silicon valley IPO’s expected return is 3%/Y, x4 times more than US 10Y yield, to get one dollar in 2030, investors pay 75 cents :

(1.00:1.03)^10 = 0.74.

8) CV19 is a game changer. The virus destroyed commercial RE &

major cities apartment buildings. The airlines are grounded and oil will stay in the ground for a long time.

9) The relative strength of FANG’s:value stocks will stall or drop, while

both price can fall hard.

10) The stimulus did not stimulate the economy. It kept zombie businesses

alive and put food in the mouths of the unemployed. Rent was not paid and car delinquencies are rising.

11) If the economy implode, the FANG will drop the most. The IPO’s 10Y

life expectancy will be short .

@ Michael Engel

‘CV19 is a game changer’

Yes.

But how many investors with their most of the money tied in the Equity mkts, appreciate this crucial fact? The disconnection of the Mkts to the evolving events on the ground is nothing short of shocking!

The mkt is addicted continually to ‘easy-peasy’ money infusion stimulus from the Congress or more QEs from the Fed. With less than 3 weeks to election, the mkts are remarkably calm! But how long? Volatile weeks ahead!

The Central Bankers dont seem to know that the private sector can create debt and float new stock faster than they can buy them up….and to encourage this dead end central banking strategy can only lead to collapse.

Long torches and pitchforks.

Price to sales ratio on big tech indicates a 80% thumping is likely. Wonder if Twitter screw up this week is the bell at the top.

– “CV19 is a game changer. The virus destroyed…”

… the predictability of the world’s economic, political and social development – and the associated comfort and peace of mind.

Acceleration of the big fish taking out the small. A few government-supported too-big-to-fail faceless corporations monopolizing every aspect of our life. Meaning dropping average labor income for years to come topped with inflation icing. The standards of living in Europe and North America will be more in line with Mexico. Hasta la vista!!

Last quarter, Buffett slashed his JPMorgan stake by more than 60% and its Wells Fargo position by more than 25%. Buffett also sold some shares of BNY Mellon, PNC Financial, US Bancorp. Buffett is obviously worried about certain banks.

Guten Tag from Germany,

love reading your stuff.

As far as the german “economy” (or what’s left of it) is concerned, it’s basically dead men walking all over the place. Problem is, zombie companies that aren’t allowed by “the gubment” to just get over with it, file their insolvency and start new with less baggage have suppliers they can’t pay, customers they can’t service any more (i just called my lawyer to get some money back from a cancelled flight that the travel agency obviously isn’t able to pay me any more) and real estate they occupy without paying their rent which drags down the landlords with them into the abyss.

In my town, on Main Street stores are closing basically on a daily basis. They just announced that Karstadt Kaufhof (one of the biggest german brick-and-mortar retailers) will be closing down, this is by far the largest commercial retail building in town. If that one’s empty, it will be ghost town pretty soon. There’s already talk of rebranding some of the office and retail buildings so that people can live in central places in their town again !

But we have elections coming up next year. But by now it’s clear to basically everybody that things will get very ugly very soon.

Franz,

Germany surely cannot have any problems?

Merkel brought in all those immigrants to “help” the German economy and the economy of the EC.

And from what the MSM was showing us; you German people welcomed and hugged them when they arrived.

I gather the only reason that the Germans don’t seem to be hugging them anymore is because of the corona virus distancing?

Now the UK has left the EU, the EU are shorter by 9 Bn Euros. Looks like Germany might have to “invest” (throw away) some more money into the EU.

That shouldn’t be a problem with Christine Largarde at the helm of the ECB “stabilising” the EU and with her friends at her old employer, the IMF.

Some of us have been predicting the demise of the EU for a few years, mainly English and hence wanted to get out even though the UK elected government tried to prevent it.

The only reason these people were brought to Germany is – as far as i’m concerned – first, to do the jobs Germans just won’t do any more because of our brilliant, bankrupt social security system that pays people more for being dependent on “the state” than to work.

And secondly, one might wonder what young, strong, testosterone-pumped men that come from societies where violence and conflict are commonplace might be useful for in the not too distant future.

Like the fossil fuel industries, I think the sun is also slowly setting on the conventional banking industry.

With zero interest rates forever and a flat yield curve, what money is there to be made from maturity transformation, which used to be the main business?

There is clearly a trend of central banks more and more financing government and even corporations (the ECB has been buying corporate debt for 5 years now). Now this stuff is still bought via the secondary market, but I expect that commercial banks will gradually be cut out of the loop. The ECB will introduce their digital currency in 2021. Not much is known yet, but I expect that to be (or eventually become) sovereign money (base money, debt free), which opens the door to direct financing of governments by the central bank. (But of course they will start small to test the waters).

I have argued before that the central bank could finance the government to the tune of 3-4% of GDP annually (1-2% productivity growth + 2% inflation), which would be their entire deficit in normal times. Also, as a one-off the central bank could deal with a lot the legacy government debt by replacing reserves that banks hold against current accounts with this new digital currency (you can do this only once, but it can massively reduce government debt, depending how much money is currently parked on current accounts).

This would be inflation neutral, PROVIDED that you take away the money creation powers of commercial banks, i.e. abolish fractional reserve banking with a full reserve system.

Btw: A transition to a full reserve system would not be such a radical change as it seems. The trillions of QE have created trillions of excess reserves in the banking system, so we are already a long way there.

Of course this would take away a big chuck of the profitability of commercial banks. Commercial banks will still be the interface to clients, but fin-tech can do that too (and perhaps better) from a much lower cost base.

So conventional banks are really going to struggle with their profitability in the future. But then again, they don’t matter much, since the money on current accounts is not a bank liability anymore. So who cares if a bank fails? It is not a systemic risk anymore. Time deposits still are a bank liability. They will be a bit like bonds, risk bearing, with rates depending on how strong the bank is.

There are many advantages. Banks failures don’t pose a systemic risk anymore. Rising interest rates would be less trouble for governments because to a large extend they can be financed debt-free by the central bank (If they need more they would have to borrow out of the limited money supply at market rates). So you can allow interest rates in capital markets to rise and get a better functioning economy again. Bubbles are less likely to form because rising interest rates would smother them. Also, where QE/ buying assets “stimulus” is trickle down economics, the thing I described above is trickle up and will be very popular in current day and age.

Btw: this is not my proposal, but seeing current trends, this where I think where we are heading in the coming years. Of course I could be wrong and completely misread the masterplan behind the central banks digital currency plans. But if I think about the least destructive way out of this mess, this idea would appeal to many. It also fits perfectly in the MMT agenda.

The trouble with the Fed ‘helping out’ is that it enables politicians to overspend. Imagine in USA that three people are negotiating how to spend an additional $2 trillion dollars. It’s definitely not going to be dispersed on merit.

Wolf any comments on the Fed H8 Loans and Leases in Bank credit contracting back to March levels? I guess the Fed deficit is propping up final demand.

Just unwinding the huge spike in March and April when companies maxed out their credit lines at banks to make sure banks can’t turn off the spigot.This is a normal crisis reaction by companies, but this time it was huge. So now, with things settling down, that spike is getting unwound as companies are paying down their credit lines again.

Who said that the Central Banksters can’t let interest rates go higher in this environment when the global corporate bond market will eventually have its say! As these companies fail to make interest and/or principal payments on all of the Zombie Debt out there, throw out a number, it is huge, the bonds will crater and the effective yields on this Junk will soar. It doesn’t matter whether these companies have filed for Chapter 7 or 11, they ain’t got the dough to service their debts that still trade in the open market.

Investors in the global bond market are currently blind to the rising risk of default in both corporate and Government debt, so yield chasers will buy this sinking debt at the higher rates, thinking that their central bank will be buying this junk to hope to suppress yields or be the Buyer of First Resort. But every central bank in the world, without exception, is pumping out endless currency with their bond buying, sovereign issuance or not, and currency devaluations versus goods and services is going to bring hyperinflation back to the world stage. Not good for any bond market.

Extend and pretend will work until it does not and that day of reckoning is coming quickly to a venue near you and me. This central banking failure is a massive failure of government intervention in the formerly free markets. Junk is junk from a credit evaluation standpoint, and low rates will not prevail because the ballooning supply of bonds is not sustainable.

Agreed. The debt market fall will make the stock market look like kindergarten.

One thing I see is that it is impossible to price a lot of commercial real estate because it’s too early to know what the return to normal is going to be. Are discounted cash flows going to be impaired 10%, 20% or 50%. I am wondering if government will socialize apartment losses to prevent disruption in housing.