This whole Nikola phenomenon was only possible in a market gone willfully blind and nuts.

By Wolf Richter for WOLF STREET.

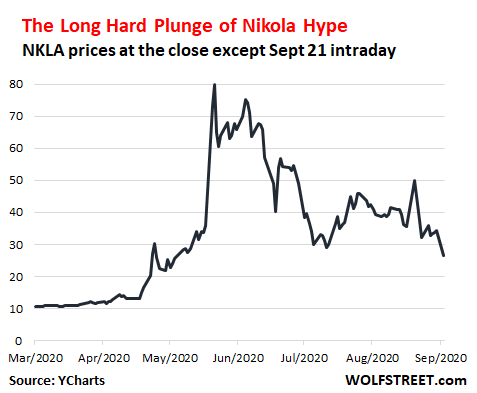

Shares of the electric truck maker Nikola that hasn’t made a single truck — not even a working prototype that uses its own technology — started trading on June 4, 2020, through a reverse merger with special-purpose acquisition company (SPAC) VectoIQ Holdings – the boom in SPACs being another phenomenon that shows how nuts this market has gotten. By June 9, Nikola’s market capitalization had vaulted to $29 billion as day-trader fans were going nuts over it, trying to get rich quick on this supernatural phenomenon.

Then the collapse began, the collapse in every aspect, including the collapse of hype.

This morning, the company announced in an astounding SEC filing that CEO and founder Trevor Milton, who is immersed in fraud allegations, was out, and the way it was done, namely effective yesterday, September 20, suggests that this was an orchestrated firing over the weekend, dressed up as “voluntary.” Some excerpts from the SEC filing:

The Executive hereby voluntarily hands over and otherwise relinquishes, and the Company accepts his relinquishment of, his position as Executive Chairman of the Company and all positions as an employee and officer of the Company and its subsidiaries (the “Company Group”), and his position as a Director on the Board and a director of any of the Company’s subsidiaries, including all committees thereof effective as of the Effective Date and without the need for any other action.

There are some minor claw-back provisions in the filing:

To help preserve capital and assist the Company in retaining world-class talent to succeed the Executive, the Executive hereby relinquishes each of the following:

(i) 100% of the 4,859,000 performance-based stock units (the “PSUs”) granted to the Executive on August 21, 2020,

(ii) any right or claim to enter into a two-year consulting agreement with an annual fee of $10,000,000 and

(iii) any other right and entitlement that the Executive may have or claim pursuant to the Employment Arrangement, except as set forth in this Agreement.

Milton was forced to announce his departure in the social media:

Following the Effective Date, the Executive will promptly revise the Executive’s employment status on social media, including LinkedIn and other social media sites so that the Executive is no longer identified as holding any position with the Company or serving on the Board.

Milton has to get approval before posting anything on the social media about the company:

Prior to using any social media site, blog or other online platform to make any statements regarding the Company Group or any of their respective employees or directors (a “Statement”), the Executive agrees to consult with the Executive’s counsel and the Company’s Chief Legal Officer as may be reasonably necessary to determine that the Statement complies with the Executive’s obligations to the Company.

And this is what Milton did this morning, when he tweeted – presumably with approval of said Chief Legal Officer: “I will be cheering from the sidelines with you. Your greatest fan.”

Nikola’s shares [NKLA] are currently down 22%, at $26.59, with plenty of true believers still thinking that this is a buy. Shares are down 65% from their closing high of $79.73, and down 70% from their intraday high of $93.99:

On September 10, Nikola got hammered by detailed allegations of short-seller Hindenburg Research that the company was “an intricate fraud built on dozens of lies over the course of its Founder and Executive Chairman Trevor Milton’s career.” In explaining its short position on the stock, Hindenburg Research summarized: “We have never seen this level of deception at a public company, especially of this size.”

Then Monday last week, Bloomberg, citing sources, reported that the SEC was examining Nikola “to assess the merits” of the fraud allegations of Hindenburg Research.

Milton had responded to the allegations with some tweets, that made things only worse. The company, still on Monday, came out with a rebuttal, that didn’t help matters either.

The deal with GM, announced on September 8 – though the media and Wall Street analysts oohed and aahed over it and caused the shares of both companies to soar briefly – raised red flags about the Nikola’s so-called industry-leading core technology upon which all the hype had been built, namely its battery and fuel cell technology that were supposed to power its trucks.

In the deal with GM, however, it was revealed that GM’s own Hydrotec fuel cell technology and Ultium battery systems would power Nikola’s Badger pickup trucks, not Nikola’s technology, which raised further doubts about the validity of Nikola’s technology breakthrough claims.

Not only would GM provide the core technology for those trucks, Nikola also disclosed that GM would “engineer, validate, homologate and build the Nikola Badger for both the battery electric vehicle and fuel cell electric vehicle variants as part of the in-kind services.”

So that leaves just the name that GM was apparently interested in and the hype surrounding Nikola. And true to form, following the announcement of the partnership, GM’s shares jumped 10%. This morning, GM’s shares are down 7%, and below where they’d been before the announcements. And it’s uncertain what remains of the value of Nikola’s tainted name. What is certain is that this whole entire Nikola phenomenon was only possible in a market gone willfully blind and nuts.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Nice to see some clawbacks. Be better to see them run all the way to investor lawsuits against directors and officers and a stay in the crowbar hotel for the proven manipulators.

DOW down 909 as I post this.

regards

The question is how many shares are still retained.

I wouldn’t be surprised if the founder still own 10% or more of the company – so of course he is still its greatest fan…

GM’s management got snookered by Milton, that is what happened. If GM is now providing the powerplant and other engineering, then there was never a need to hook up with Nikola, not even for the name.

If it was this easy to hook GM’s management, the shareholders should demand the management be fired ASAP.

The deal was remarkably favorable to GM. See the article “GM has no reason to back out of its one-sided deal with Nikola” on Ars Technica.

What is GM getting that they didn’t already have?

Maybe GM weren’t naive dumb*asses, but rather sneaky/slimy bastards.

In brief…GM has adequate battery tech…but no “new thing” hype.

Joining with “hot” Potemkin Village “startup” Nikola at little real cost (see above) bought them that hype (ie, a couple of days worth of paint huffing over at CNBC).

Cas-perhaps accurately reading FOMO in the market is key to ‘successful’ modern management? (Certainly in old-fashioned (!) marketing…). Rebottle and pressurize.

may we all find a better day.

Shameful how they used the name of the great inventor in this scam.

Steve Girsky who takes over as chairman was an auto analyst at Morgan Stanely and then worked in strategic planning at GM and then attempted to turn GM Europe around. He is a hard driving very smart guy who knows the auto industry. He was the obvious link between GM and Nikola. I have met him a few times when he was at Morgan Stanley. He is worth a bet.

ANDREW MELNICK,

This isn’t about a guy. This is about a company and its (dubious) technology, and what that kind out outfit would be worth.

This^^^^ This ‘company’ offers nothing that does not exist already. GM jumped on a band wagon that has no band lol. Hype – the

‘Tesla’. Pathetic.

Steve Girsky whoever he might be is not Elon Musk. Also, either this company has the tech or not. If you think a bank analyst will somehow create the tech, well, you probably bought into the stock.

Elon Musk didn’t create any tech at Tesla either.

Agreed, but his vision is “compelling”. Same with Steve Jobs, he didn’t create any tech either. Look, I am the furthest thing from an Elon Musk fan, but you’ve gotta provide some hype when your tech is experimental/new.

@MonkeyBusiness

I’m not disagreeing with that last part.

Just saying that CEOs don’t have to “create tech”. So it’s not a must-have for the new CEO at Nikola to succeed. If he can sell and hype the dream, and knows the right people, it can go a long way.

Look you don’t need hype, just lie over and over, er hype, er spin,…

By-the-way they’re selling SNOW for more that 220 per share. NKLA needs to hire the people that are selling SNOW!

@Dave

So they need to bribe, eh hire, Warren Buffett. Give him a few million shares and watch your stock price fly.

He got his GM position during Obama’s government takeover of GM. He is a Ella street crony that doesn’t know crap about engineering.

he drove GM into BK.

In any case, running a semi on a battery pack is just ludicrous to begin with.

Actually, you’re running a semi on a battery pack being continuously resupplied by a hydrogen fuel cell. The power stops when you run out of hydrogen.

The big Caterpillar mine loaders are electric being powered by diesel generators. No one has ever claimed they are under-powered.

Electric power is the future

An on-board generator powering electric motors?

Shades of the 1902 Lohner-Porsche Mixte!

Everything old is new again

Somehow, it all comes down to using fossil fuel (or hydrogen?) for making electricity to run a vehicle. “Green” is really “not so green”.

That is how all of the diesel freight trains in this country are setup. Diesel engines run electric generators which power electric motors which drive the trail forward. They are very efficient when you consider the amount of freight moved per mile, per gallon of diesel.

But Hydrogen fueled, fuel cell powered semi’s are not the future. The problem with this tech ( even with a cost effective source of hydrogen) is that stored hydrogen has a very poor energy density per square foot of storage, even at high pressures. This means the fuel tank has to be very large, taking away from cargo space. In addition. hydrogen molecules are very small and creating leakproof tanks, tubing, joints and valves is technically difficult and expensive. I used to make machined parts for a fuel cell manufacturer. One of the things we made for them were cnc turned Monel gaskets, which were required for proper sealing in certain areas. This is Nasa style tech and cost. Scaling it to the economics and maintenance environment of a Semi is a questionable undertaking.

Hydrogen fuel cells typically run on methanol, ie natural gas.

You are correct that carrying H2 tanks is a failing idea. Fuel cells are not that.

Methanol is not natural gas, although it is close. Natural gas is mostly methane, which is CH4 – lots of H there to use. Methanol, aka wood alcohol, is CH3OH and has the advantage of being a liquid at room temperature and pressure.

Satya Mardelli:

Here we go again:

The railroads have been using DIESEL-ELECTRIC locomotives for a century now. (it’s the future!)

Nikola planned to run their truck on imaginary tech. At least read the short seller’s report before pretending to know anything.

Fueled with Unobtainium?

“electric being powered by diesel generators.”

But that isn’t the “fossil fuel free”, Greenie deal millennium being hawked.

They’re hawking “plugged into the clean grid” (pay no attention to that NatGas/Coal/Nuke at the other end).

I wonder what this cost the Robinhood Traders today…

The Reddit mind hive is and has been hard, hard short on NKLA

Great post Wolf! It still amazes me, after the fraud has been uncovered, NKLA’s market cap is still over $10 billion. The more of these “pre-revenue” SPACs go to zero, the sooner some real price discovery comes back to the equity markets.

BTFD is baked into people’s genes. When reality dawns, they’ll come out of the daze they’re in and it’s going to be painful, to say the least.

The biggest red flag is the new startup was willing to partner with GM. For what? The stupid money is everywhere.

Exactly, Goverment Motors… junk since 2008… sorry permanent Baa3 lol

GM has EV pickups designed and oven ready to build and a willingness to act like an ODM and put your badge on it. That sounds like a great reason to work with GM.

this has the added bonus that you could park a lot of money with GM so no need to get money selling your stock directly which is dirty but a plan to issue new stock for a highly overvalued price, invest that money and later, when the company isn’t any longer overvalued, sell the whole company for the value of the investment you made with the money of the stock issue. This method works much better to a) stay out of jail and b) become a member of the golf club.

This is what a real scam looks like, Ponzi was an amateur compared to these guys. And to think if they had used some of the money they scanmed from investors to adquire a company that actually makes electric trucks or at least buy few electric trucks patents, they could have keep going for longer.

Learn from Bill Gates guys, how he didn’t have an operating system and bought one on the cheap, then renamed it to MS DOS. And the rest is history…

These Unicorns make the Pirates of Silicon Valley look like geniuses. Heck even Facebook looks more competent.

1) Nikola plunged. Tesla is shortening it’s thrust because of the crooked global central banks.

2) To eliminate our debt we need 8%-10% inflation.

3) To survive, for a while, with debt as chronic disease we need only 4%-5% inflation.

4) Demand for heating oil is down, because the economy is down. Peak season driving is behind us, but Oct will bring morning frost on our lawns & cars.

5) Refiners products reached it’s lowest level on Mar 23 2020.

6) March 23(L) are tested in Sept. It’s spring time on CRAK.

7) Climate change investors need CRAK. CA burning on crack. Without high WTI ==> there is no inflation.

8) Canadian Western Select minus WTI are backing up on 2019(H).

9) Tsar Nikola desperately need inflation to survive.

10) ME peace will start high inflation, after Nov election.

Demand for heating oil might be down because its not winter.

Exactly. Plus the refiners are about finished making fuel oil for the upcoming winter stocks.

At least Tesla actually makes things, Nikola is a company that never made anything but scam people.

People can drive Tesla cars, have you seen anyone drive a Nikola truck?

No, but Nikola did have a prototype that would roll downhill.

Super high tech “gravity drive”.

“2) To eliminate our debt we need 8%-10% inflation.”

That is having the GDP increase superior to minus 3% for many many years, I suppose…

Today’s share price crash, in context is nothing at all. Next you change CEOs, which gives the stock a lift. These guys appear to actually have something, as opposed to Tesla. Looking for some sort of tech stock comparison, Apple/Dell?? If we get DOW 40K by years end what does it matter?

When the Nikola hype got going I spent a bit of time looking up Milton’s bio and history. To anyone with a brain it had fraud and scamster written all over it. This guy makes Elizabeth Holmes at Theranos look like the real Nikola Tesla. He had the technical background of a small town used car salesman. I think that in a certain way Steve Jobs did a lot of damage to American industry by symbolizing the idea that a non-technical visionary could develop highly technical products. Jobs was the rare exception, in most cases we get the likes of Musk and the last chairman of Boeing pumping stock prices and running the products in to the ground.

Jobs had Woz.

Woz was brilliant as a hardware engineer. It was easy to program the Apple II, even for a HS freshman.

Totally agree!

And I am agreeing to the statement about the last chairman of Boeing. It’s a crying shame how that company has been managed the last several years.

Your comment with regards to Tesla makes no sense at all. That company may have a super overhyped stock price, but it also creates actual products which millions of people use, which have won awards for innovation, which have changed the entire dynamic of a certain market segment, and which lots of people actually love.

Zantetsu,

I think, if I read Seneca’s cliff correctly, he’s talking about “the real Nikola Tesla,” the one who died in 1943, not the car company or Musk.

Poor Mr Tesla,

A breakthrough scientist who invented alternating electric current and thus made long distance transportation of electricity possible, having his name tarnished by two sh*&£sters like this.

I think Zantetsu was responding to comment above Seneca’s cliff made by Ambrose Bierce but used wrong reply button.

I was responding to this at the end:

“in most cases we get the likes of Musk and the last chairman of Boeing pumping stock prices and running the products in to the ground.”

I don’t see Elon Musk pumping their stock price, the market is doing that through sheer exuberance. Musk appears to me to be focused on actually making product (OK so there is some showmanship too, but isn’t that part of a CEO’s job?). And I don’t see Tesla’s products being run into the ground either.

Those are the things that I didn’t think make any sense about his comments.

Musk is a physicist.

Musk has a joint BA in econ and physics. That is the degree lots of my classmates who could not handle engineering got. If you got to your junior year in the engineering school you usually had enough credits in math, physics and other sciences to qualify for a physics BA so you would transfer to the arts school, takes some econ classes your senior year and get a joint physics/econ degree. Believe me, that does make you a physicist.

I don’t think you really have any qualifications to be judging his degrees, or any actual knowledge of the route he took to get them. If you do, please say so.

Well I think Senaca’s Cliff does have the qualifications to judge Musk’s degrees, since he had peers that did it as he states.

Musk’s problem is not that he is not a physicist, but that he is not an engineer. Engineers apply the physics to make working machines and tools. It it obvious that what is lacking in Tesla is engineering rigor.

What Musk is good at doing is getting money from the government and investors.

Good point. That is what happened to me. Ultimately you have to decide ‘Do I have the time, money, or drive to move past abstract algebra.’ That is how most STEM students end up. If we had a national focus on long term research and a reasonable career path kids like Musk or even me might have put the time and effort into the STEM side. But our economy is controlled by men like Milton, but perhaps not so blatant as he is. Selling bonds or other investment vehicles to government pension funds run by political appointees is valued a lot more than STEM which we can leave to the Chinese and Germans and Russians and Indians.

Interesting that Jobs and Milton both are accused of f*cking over a partner on the equitable distribution of profits early in their careers.

Milton came out of St George, Utah. This place should be a lot more famous as a breeding ground for scammers. There is a community of Mormon “businessmen” that come out of this place that are profoundly crooked.

I actually guessed he was from here due to the weird nature of the fraud.

Boeing’s Dennis Muilenburg, GE’s Jeff Immelt, and Intel’s Brian Krzanich are all examples of CEO’s who spent their entire lives at one company, rose steadily through the ranks, and then ran those companies into the ground after rising to the top to become CEO.

Giant companies rarely serve as incubators for true visionaries

It’s not unlike the US military, where, in between major wars, the gold plated suck ups incompetant at actually fighting wars end up getting promoted to the top – it’s not until the real shooting starts that they get found out and replaced, but in some cases, not before getting their men and themselves killed in battle.

Been a long, long time since *any* of US’ brass asshats (800+ plus US generals at any one time, with likely 10% annual turnover) came anywhere remotely near being killed in battle.

Have helped to kill quite a few economies though.

Don’t know about the chairman of Boeing, but you’re right about Milton’s bio.

It practically advertises his credentials as a scam artist.

I plan to open a startup call it Einstein, producing flying cars using human waste. It’s rechargeable just don’t ask how one goes about recharging it, let’s just say it’s green depending on the diet of course. I spoke with Masayoshi and he is willing to put 100 mil. You are welcome world.

You my friend have figured out the game.

You need to speak with Mary Berra of GM and possibly get a few $Billion in JV funds.

I read JV as junk venture. Is that incorrect?

Sold. I’m in.

Whens the IPO. AKA when can I dump all my shares?

Flying cars are so yesterday:

“VectoIQ is the premier partner for leading organizations participating in the rapid transition towards Mobility as a Service and an Autonomous Vehicle society.”

Oops – VectoIQ is not VectorIQ. Please make a note of it.

Sorry, lenert, but can’t resist:

”Flying Cars” are so yesterday when you consider that the breakthroughs in inter stellar and everywhere in between transportation is to be provided by complete dis-integration of living matter and all other matter followed by re-integration at the destination.

At the rate we are going, IMO there will be billions of volunteers to test the process,,, though most will have already pulled out ALL of their hair in frustration, eh

To add to the above:

In spite of the obvious advantages of the dis and re system, which most know all about from our fave space TV, there will also be, maybe before, maybe after, a ”Gravity Mirror” system that will be used/useful only globally, especially for materials, not needed in minutes, just because it will be a net energy producer.

While a small amount of energy will be needed to actuate the gravity mirror, ( to be called the jocular, to be sure,) after that the mirror will produce an excess of energy beyond that needed for flight, and that energy will be harvested by the receptor, so many trades will continue to occur requiring delivery just for the energy each flight will produce.

What did GM get for its money?

GM did not invest any money in Nicola.

>> It’s rechargeable just don’t ask how one goes about recharging it <<

LMAO!!!!

Your not thinking big enough, flying cars and electric trucks are so yesterday. The hot new ponzi is flying to the moon with giant robots that can mine helium 3. Then bring the helium 3 back to earth and use it to fuel fusion power plants to make the cheap energy of the future.

What a load of cr*p! ;)

“A company for carrying out an undertaking of great advantage, but nobody to know what it is”???

The SPAC motto.

Speaking of which…Wolf, an inside baseball account of the *real* motives and advantages of SPACs would be welcome.

The proffered ones seem so shallow and essentially stupid, there has to be more to the story.

Simple. An IPO needs the Goldman Sachs. They do it for money so the plays that are too smelly and will end in court with them loosing money are plays that they will not underwrite. but with a SPAC you can get those very smelling plays to the stock market.

Char

So two steps are used to obscure the essential stupidity/corruption of a single step.

Maybe. It is a long dishonored technique.

But I still wonder where I-banks (with an intense recent history of f-ups) are able to continuously find armies of the well heeled, eager to be herded into dubious ventures upon little more than the I-banks’ word.

Sounds extraordinary and popular

Flying card propelled by human waste

Stock letters CACA

Is that better than having an “Einstein visa”?

Sir Pirate what will come out of the exhaust of those flying cars?

Pure beautiful methane gas my friend, that when exposed to a well oxygenated environment it can put up a show in the skies above. Imagine a world where the experience of driving …sorry i meant flying…to work creates a trail of fireballs behind, putting a smile on all the children’s faces. Which is why our company plans to use this as an opportunity to expand into a new venture where the real money is made…..the fireworks business.

Following all the positive feedback and good wishes of the people above we plan to list on Nasdaq asap ticker CACA per Bet’s advise.

I am Sir.Pirate and i approve this message.

It sounds more like a rocket than flying, but blowing things up is fun.

GM also bought into Cruise, a self driving car startup. It’s true the later at least has some real tech, but at the same time, you’ve got to see something real coming out sooner or later, otherwise it’s another billion that GM will need to cover.

With GM, its a billion here and a billion there. Sooner or later Mary will pull the right lever!

L4/L5 self driving is a stupendously hard problem. Cruise seems to have good demonstrations, but no one is remotely close to replacing meatbags on the streets, and lesser forms of autonomous driving are either niche (like driving mining equipment) or less earth shattering (like L2).

The computational muscle just isnt there yet.

But to be fair to GM, the entire auto industry fell into that trap.

It’s not about computational muscle. Human beings will always lose to computers in that aspect. The problem with computers is the later just don’t understand abstractions, and that’s the fundamental part of thinking.

Our computer scientists are a pretty arrogant bunch, thinking that intelligence is something that can be cleanly defined and coded. They can’t even come up with a coherent definition for intelligence other than “I’ll know it when I see it”.

If I actually have a receipt for improving intelligence, the first thing I would do would be to improve my own, not build a machine to replace myself. What does that say about the average intelligence of a computer scientist?

A self driving car doesn’t need to be self aware or intelligent, it just needs to be imprinted with enough information to make reliable decisions from a bunch of sensory input. Kinda like the human brain does when it unconciously reacts to things.

And that thing about machines is just not true. The human brain is a frightningly efficient piece of neural network hardware. Nothing based om current CMOS technology is going to come close to that, but we don’t need a network that big for self driving.

@MonkeyBusiness

Cruise is GM’s R&D lab for autonomous vehicles. Their Bolt AVs work great, but they require complex and sophisticated mapping data to function.

The value of the venture is in the technology they can transfer to and include in their other, less exotic vehicles at mass-market scale.

Of course, since the founders are now billionaires, none of this matters.

When this whole thing started I thought it was the electric truck company that bought the Lordstown plant.

@lenert

It was. But not this one.

Lordstown Motors bought GM/Lordstown, and Rivian bought Mistusbishi/Normal.

I have no idea where the future of Nikola should be. Selling a truck GM or someone else will build? If you strip away the lies and the hype, nothing is left.

How much in damages will Nikola have to pay?

You need revenue to pay damages. It’s a write off.

“The Executive” will debark to a country with no extradition treaty with the US (just in case), where he will live on his ill gotten gains that are currently residing in a Swiss bank account. In 20 years, when no finding has been made against him, he will return home a hero!

Actually, when paying damages, an insurance policy will substitute quite nicely for revenues…

Ah, of course, how silly of me. You’re good! You should set up your own ponzi scheme.

Interesting story Wolf. There were suggestions elsewhere that implied GM was investing or partnering with Nikola.

The way I read it, GM would receive $2B in Nikola stock and plans to make another $2B by selling parts and services (cash on delivery) while also receiving EV credits. Tesla is famous for making money off EV credits sold to others, so maybe this was a low risk way for GM to acquire some at a reasonable price. I suspect GM will manage the financial downside well in any agreement they sign.

There was a movie a couple years ago about the Ford Mustang. In it, a Ford engineer says they only develop a couple systems in their cars and the rest is purchased from third parties. Same thing here.

For $2B, GM got a mostly-engineered fuel cell/electric pickup and access to all the other fuel cell intellectual capital (which I’m assuming is not all vaporware). Unless legal/regulatory proceedings destroy the company, the investment might not necessarily be considered misguided once the dust settles.

The bigger risk is on the Class 8 side, where all of the OEM’s are now fully in the game. This risk goes for Tesla as well.

“For $2B, GM got a mostly-engineered fuel cell/electric pickup and access to all the other fuel cell intellectual capital “.

No.

They got nothing.

My understanding is that GM didn’t PAY anything either. It was an exchange in kind. GM got Nikola shares in return for a promise by GM to build Nikola’s trucks with GM tech.

It was more a promise to put a Nikola badge on a GM truck. calling it a Nikola truck sounds like more work than Nikola actually would do.

Mr. Richter, good reporting on this subject. GM received a shell corporation for an exchange of stock, although the reputation of Nikola is very questionable at this point. It is amazing that a hoax could go this far in the market.

Seems to me the only difference between snake oil and vaporware is the cost of pressurizing and bottling to scale…

may we all find a better day.

Old wine in a new bottle…

It will be a similar occurence for Elon “E. Holmes” Musk when the US Government stops giving energy credits to his Theranos Tesla.

Theranos Tesla will dry up and blow away like doggy deposits when that happens.

Frank Garbor

Please keep us informed on how your Tesla short is doing.

I think a new C Suite with Adam Neumann and Elizabeth Holmes as occupants would lend gravitas to Nikola.

Both Nikola and Tesla are fraud. Nikola Tesla was a genius and too bad, his name was used by these 2 companies.

John

Care to elaborate on why you think Tesla is a fraud, or are you content just throwing around big-boy legal terms?

1.Promised to manufacture solar panels in Western NY

2. Would be bankrupt without the largess of state and local governments giving out credits

3. Promises on self driving cars

4.Promises on batteries

5. Buying out the solar company involving his cousins . Without this buyout thus solar company would have no choice but to go chap 11

6. Implying that the trucks are back ordered , when only 100$ was required to reserve an order

7. Unable to obtain directors insurance from an insurance company because of Musks fraudulent statements

Rcohn

So you don’t like Musk…so what? Your jejune “list of frauds” massively demonstrates your understanding (or not) of “fraud”…and you’re the one accusing Musk of hyperbole.

1. Not fraud (how did Musk profit & who did he damage?)

2. Not fraud (how did Musk deceive to claim perfectly legal tax credits?)

3. Not fraud (how did Musk profit & who did he damage?)

4. Not fraud (how did Musk profit & who did he damage?)

5. Not fraud (who did Musk deceive & how did Musk profit & who did he damage?)

6. Not fraud (who did Musk deceive & who did he damage?)

7. Not fraud (who did Musk deceive & who did he damage?)

You Ould have been somewhat credible mentioning Musk’s comment about securing funding & intending to take Tesla private. But nope, you’re claiming it’s fraud to accept $100 deposits on a truck that isn’t yet being delivered (aka: IT’S BACK-ORDERED!).

Tesla haters will be Tesla haters and this place has a few of them. Makes no difference. Tesla will continue to sell every vehicle they can make with Giga Texas and Giga Berlin adding to those numbers next year. The fraud allegations noted by Rcohn are minor, settled or irrelevant in the big picture.

“Tesla will continue to sell every vehicle they can make with Giga Texas and Giga Berlin adding to…”

the Giga tax subsidies…

As long as the hurdle rate is about zero and they wealthy friends for a backstop Tesla can go for a long time.

Nobody wants EVs. Well not nobody, a few people who live in coastal California and Seattle want them to show the world they care. But nobody else.

Sales in China and Europe are ahead of the United States. China is well ahead, perhaps 2x.

I think those facts are not aligned with your post.

Everybody except oil companies and some car nuts wants that other people drive EV’s

When I hear that name, for some odd reason I think of that old commercial featuring some Swiss guys in the alps shouting out Ricoooola. I mean, technically, only one letter off.

Heheh, like the note about sticking the semi in neutral and rolling it down the hills. I can do that in my car too. Although it wouldn’t go as far, not enough momentum.

I am glad that I don’t own ANY Nikola of Tesla stocks, nor ANY FAANG stocks. My portfolio only include GLD, a few share of RDS.B and DXD.

Still waiting the DXD get back to my break-even price (I bought it too late). If Dow drops below 18000 again, then I might have a chance to break even.

You’re waiting for DOW to drop under 18,000? What, in this century or the next?

Is Nikola about autonomous, driver less trucking? I’ve seen signs of Nicola hiring engineers so there must be something real about this company or technology. I don’t own the stock.

Oh yes, because hiring engineers proves you do something. Oh, I see. So once I hire some engineers using other people’s money, it should send my ponzi scheme to the moon. Thanks for the advice!

By the way, does that include newly minted graduate engineers working on an unpaid internship? Cost cutting. You know how it is. Covid and stuff, blah blah blah….

Well, you don’t advance any technology or create new products without engineers. Ask Elon Musk. I am a retired engineer. What do you do besides chew the fat?

It is a good question, Ed C, but it probably doesn’t move the needle too much on the question of fraud, what with the CEO disgorging his shares on the way out.

Cheers

look how fast the SEC is on this guy. For those of you waiting for this to happen to Musk you’ll be waiting a long time. He’s connected. What other person could tell the SEC to perform oral sex on him and get away with it?

Connected for now…………

Good greif, the money they pay themselves for NOTHING…

And silly me thought you had to have something to trade before you could be open to trade.

Billy Durant was kicked out of GM (after founding it) for repeatedly pulling unnecessary mergers and acquisitions. But even Billy wouldn’t have acquired a company that was already being prosecuted for fraud, just to get its tainted name on a GM product.

Ammusing that this can even take place, 1999 all over again. Like I said many times it will all collapse & it is doing that now, only a massive collapse & a flush out of all the fraudsters like 1999 will see the market survive, it’s pathetic how regulators & politicians stand by and watch, the Fed is as close as ever to being disbanded, for this to happen, for markets to be so corrupt those taking part have to be extremely greedy & totally deluded which is the case right now, the loss of confidence & trust will take decades to restore, if ever, the history books wont be kind, I predict 1000s of best sellers about the collapse are coming, oh how they will reap what they sowed. I don’t think there will be any rebound after the collapse for decades, the psychological destruction will last a very long time.

Who wants to bet me, the S&P going to 813?? Yes that’s eight hundred & thirteen. take a note, sound crazy but just hold on to ya hats & fasten ya seat belts.

1) EV & inflation.

2) US10Y – US3M hit it’s low in Aug 2019 @(-)52. It’s is up in stepping

stone. In the last six months the 10Y – 3M is a trading range between 0.42 to 0.76.

3) The 10Y and the 3M are glued together. Wealthy investors are in cash

or UST, fearing deflation.

4) Gravity with NR is pulling UST down.

5) A thermal fusion will break this bond.

6) That will happen when oil will rise and investors will wake up.

7) USD is in a 5 year trading range, on the up, after the jump in 2015.

8) A rising USD will not affect oil and other commodities, at this stage,

because oil is so low. USD & Oil can rise together, without problems, up to a certain point.

9) There are two analogs at work

10) Analog #1 : we are in the middle of the period : 1996 to1982, in 1975/ Jan 1996 Jimmy Carter inauguration osc near the top, before the next plunge.

11) Analog #2 : the old DOW Theory : the last 3Y, during those violent lows, the strong hands accumulated stocks from the weak hands. // Sept 2 2020(H) is a Sign of Strength and Backup. // Next : a low slog up, when the public will wake up. // Then : a vertical rise when investors will shift their bonds & cash into the madness of stocks, commodities and oils.

I’m starting a company that will build the first space elevator. It will be powered by the sun and wind currents, using my proprietary “quantum yarn” technology made from sustainable cotton.

Anybody have Mary Barra’s phone number? I need a few billion.

GM has an interesting corporate history.

Bankruptcy to the side, the list of stuff they once owned and closed or sold is amazing. An elite aerospace company. Refrigerators/air conditioners. Home mortgages. A giant IT services company. The leading car brands in Europe, the UK, and Australia.

Oh, and Pontiac/Oldsmobile, Saturn, Hummer, Saab, and most of Buick except models that they sell to minor Party officials in China.

One day, a new broom will sweep away the Barra priorities and GM will once again build popular sedans.

Popular sedans? no sedan is popular in the American car market

Trevor Milton got canned, like that poor guy who got baked in an industrial tuna oven a couple of years ago.

Without him, there is no Nikola. The SPAC, by design, is a shell corporation.

Read the Hindenburg report. The remaining company officers are terrified, as they should be.

You gotta love shorts who name themselves Hindenburg Research.

General Motors desperately needs Nikola pickups to be competitive with Ford F-150!

Methinks the whole stock market concept needs to be quarantined just like Covid-19!

Then a vaccine to inoculate against selling snake oil…..then a good dose of castor oil for the violators….

Given the article and the basics I can’t for the life of me condoning a company like GM for falling for the basic vitae of Nikola……..but, but…..the, “Smartest Guys in the Room?……….

Wow! Have we come a long way baby!

Amazing, well I guess not, that a big report needed to ‘uncover’ this ‘supposed’ case of fraud.

Current ‘finance’ reporters seem to be dead from the neck up.

Another example popped up in the news here in Oz in regards to the national Age Pension as there was no top up in the semi-annual adjustment as the CPI here in Oz for the last quarter and year were both negative.

As previously stated in another comment the main reason for the fall in the CPI was the fact that the government is paying 100% of the cost of child care as a result of the pandemic. The ‘cost’ went to zero for that component and took the entire CPI down with it. Not even the huge increase in tax on tobacco could move the index up.

Of course any person with an ounce of intelligence would understand that people in the retirement age bracket probably don’t use child care and the actual CPI for them would have more than likely increased, but no, not a mention of it all in the article.

The article did mention that compared to everybody else getting a scoop or two or three of cash from the various state and federal governments in OZ that people on the Age Pension had only received a small amount so that SOME top up was needed.

So there may be an increase in the rate or more likely another cash payment to these people.

And speaking of ‘fake’, IMO this company is just a tip of the iceberg when it comes to crap data.

At the top of my list would be Chinese companies including the ones ‘listed’ on the US share makets.

As far as countries are concerned, again, China would top the list. And closely folllowed by that would be Australia when it comes to unemployment data and economic growth forecasts.

For some reason Australia seems to get a pass when it comes to people actually looking at data or the the supposed ‘data’ and getting good grades when in reality the country is in deep trouble and it is getting worse.

The Australian dollar reflects this GIGO analysis as well. First, there was the argument that interest rate differentials were the reason for the strong dollar, then it was the iron ore price, and now who knows what.

Looking at the actual data, the government is supporting over 3 million workers with some kind of salary supplement, another 1 million or so are unemployed (that includes those people getting paid on some program or another but working zero hours that are counted as ’employed’), the budget deficit is going to be between 15 and 20% of GDP, the international education sector has been decimated, and immigration has basically fallen to zero. Even the number of babies being born is falling.

Australia is going to have the biggest fallen in population since WWI when it sent a huge number of troops overseas. This reduction in population is reversing one the main components of growth in the country.

The RE industry in Victoria is dead and the rental markets in the Melbourne and Sydney CBD’s are bad and getting worse with vacancy rates soaring.

In terms of exports, coal prices have been slammed as have LNG prices. LNG cargoes are down and going to fall even more over the near future. The ‘export’ of education is dead well with universities here looking to get rid of another 30,000 people by the end of the year as the international students are not here (estimates are between 200,000 – 400,000 students didn’t show up for the school year), and iron ore prices are starting to fall……………….

And yet people have piled inot the Australia dollar driving it higher than when the year started.

And don’t get me started on the various economic forecasts put out by banks and international rating agencies that read like a science fiction novel.

New technologies tend to get over hyped and can be good technology, but poor investments. The best businesses don’t need any debt to have a decent return, but all debt and no earnings is not a business I want to be a stock holder in. The stock holders usually at risk of a total wipeout.

Nikola….what’s joke. A true clown act with nothing to show for that had Min boggling valuation in the billions. Just mind boggling. Wolf is exactly right. Just goes to show how messed up and desperate the whole market is at this point.

I just read about Nikola founder Trevor Milton. From what I understand he quit the company after allegations of fraud. That is baaad news for GM. They just invested $2 Billion with the company.

Any comments on the action in the gold and silver markets yesterday?

Over 900 million ounces of silver were traded and dropped the price like a rock………………………….

Lee,

Same thing happened in 1980 IIRC, when the TX bros tried to corner the silver market, or at least tried to make it appear they were doing so.

My understanding is they did not know RU was sitting on 12MM oz, which they promptly sold some of when the price went to $50/oz, or thereabouts.

I was in London at the time for the great Boxing Day sales, as I had figured the savings at those sales would more than pay for my plane fare, which did happen.

(Bought a few hundred oz, and made about 200%.)

Bought a couple dozen oz for the grands last year around $15, wish I had bought some more, but suspect it will be down around there before the current situation resolves — if it ever does.

Well I wish I knew where to buy physical silver as cheap as that price when the price got hit earlier this year.

There was nothing for sale at anywhere that price here in Australia and most places were sold out of silver for months anyway even at the higher prices.

There is a hugh disconnect between the physical price and the futures price.

Lee, you must understand that large selloffs like that are the only way to make “institutional” kind of money in this market. Wave the red cloth at the bull and wait for the bull to charge. When the bull gets close, whoosh! Sell, sell, sell. Bulk trade = bulk cash. The only way to deal with such risk is to eliminate the risk entirely by selling only when the price is high. Just what any successful matador will tell you.

Just for Wolf:

“Carvana lets customers choose from more than 19,000 cars and complete purchases in as little as 10 minutes, according to its website. Buyers have the option of picking up their car at more than a dozen vending machines located around the country, using a coin. Its revenue doubled to $US3.9 billion last year as it sold about 200,000 cars. It now sees a path to 2 million sales a year.

Garcia II is worth $US15.2 billion and his son $US6.4 billion, according to Bloomberg’s Index, which tracks the daily fortunes of the world’s richest 500 people.

Carvana has been the target of sceptics and short sellers in the past, and its shares have been volatile since it went public. It has rallied more than 680 per cent since a March low and has a $US36.6 billion market valuation.

The company said Tuesday it will sell $US1 billion of new debt, seizing on the boom in demand for its vehicles and low yields in the corporate bond market. Around $US600 million of the proceeds will be used to refinance existing debt, with the rest held as cash on the balance sheet.”

Never heard of them and never heard of people ‘getting a car out of a vending machine” before !!!!!!!!!!!!!!

Any comments on the company?

The more they lose, the higher the stock price, it seems. And they’re losing a ton of money. How the heck can you lose money selling used cars??? I just don’t get it.

Here is my discussion about another online used vehicle retailer, Vroom, same problems, losing a ton of money selling used cars:

https://wolfstreet.com/2020/08/12/used-car-truck-supply-and-demand-shocks-wreak-havoc-on-vroom-freshly-ipo-ed-online-used-vehicle-dealer-shares-20-afterhours/

There will always be snake oil sellers. In to-day context it comes in the pitch of high tech. And there will be not so savy folks or those who sense an opportunity to make quick bucks on the foolishness of others. Yes it continues to ‘ tic-tok tic-tok’ louder and louder by the media. When you pitch snake oil you hit the gong very hard eachtime.

And you know the rest.

Talking about frauds, check out Nano-X Imaging (Nasdaq: NNOX) and their futuristic xray machine. They have a rendering and have been called out by Citron and a few others who say this is a stock promotion masquerading as a company. I asked a radiation oncologist about the design of the machine and he said there was no way this could exist based on current technology. The lawyers are all lined up to sue this junk of a company. Crazy.

Who would have thought that an artist’s rendering of a truck would be worth more than the Mona Lisa.