Entire market of 3,451 stocks minus “Giant 5” is down 1% from Jan 2018. But wow, the volatility! You would have been better off with a despicable freaking savings account.

By Wolf Richter for WOLF STREET.

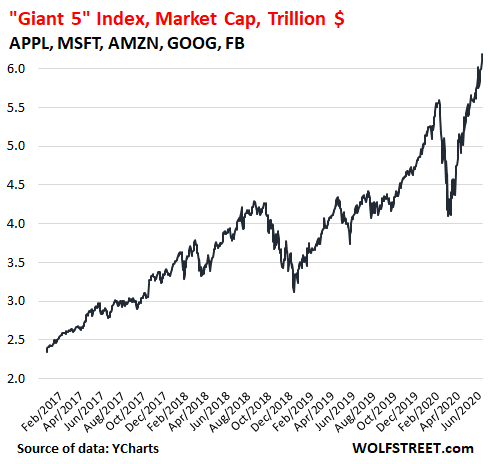

The market capitalization of the five largest stocks combined – the “Giant 5:” Apple, Microsoft, Amazon, Alphabet, and Facebook – rose to a new record today of $6.18 trillion. Since their combined low point on March 16, their market capitalization has soared by 51%. That’s an increase of $2.1 trillion in a little over three months. Since January 2017, my Giant 5 index has soared by 164% (market cap data via YCharts):

So how big did they get?

The overall stock market capitalization, as measured by the Wilshire 5000 Market Cap Index tracking 3,451 US-listed companies, ticked up to $31.8 trillion, up by 41.6% from its low on March 23.

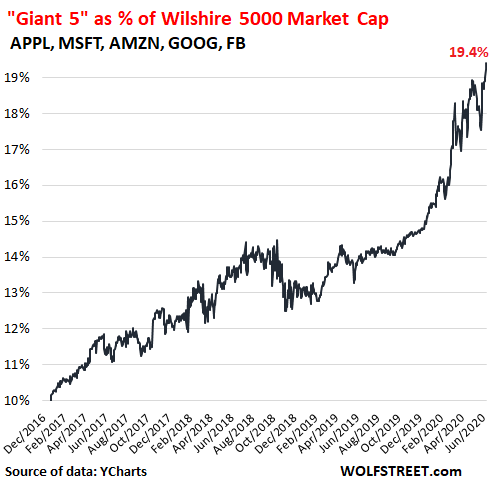

Today, the “Giant 5” accounted for 19.4% of the total US stock market capitalization, as measured by the Wilshire 5000, a new record. On January 3, 2017, the Giant 5 had accounted for 10% of the Wilshire 5000. In the three months since the crash in March, the share of the Giant 5 has soared from abound 16% to 19.4% today (Wilshire 5000 data via YCharts):

But wait… Performance of Wilshire 5000 without “Giant 5.”

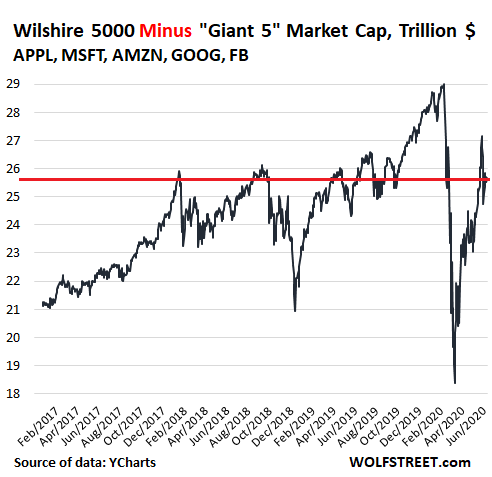

Let’s take the five largest stocks out of the largest stock market in the world, with 3,451 companies, and see what’s left over. What’s left over is now valued at $25.7 trillion. It’s up by 28.4% from the March 23 low, and while that’s till strong for a three-month rally, it’s a far cry from the 51% for the Giant 5.

And here is the thing: All these companies combined, minus the “Giant 5,” are way below their peak in February 2020, and below a whole bunch of other dates before then, and below where they’d first been in at the end of January 2018.

For the entire rest of the stock market – all its winners and losers combined – minus the “Giant 5,” the period since January 2018 was a very rough and unpleasant ride to nowhere. It declined 1%. You would have been better off putting your money in one of those despicable freaking savings accounts:

Seen the other way around: If you had shorted on January 26, 2018, the entire stock market minus the “Giant 5,” you would have had a wild unpleasant ride and made 1%. But if you had shorted the “Giant 5” over the same period, you would have lost 70%.

This is how dependent the stock market, and broad portfolios reflecting it, have become on the “Giant 5.” It’s not that there aren’t a bunch of other companies that have gained as much or more than the “Giant 5” in percentage terms – there are – but in dollar terms, and in weight in the market, they just don’t measure up to these five giants.

Apple and Microsoft both are now worth over $1.5 trillion. Amazon is at nearly $1.4 trillion, Alphabet at $1.0 trillion. These are gigantic valuations. They also speak of an immense concentration of power in a single company.

Among the losers in that rest of the market are companies that used to be the largest in the US stock market, such as Exxon-Mobile, which since January 26, 2018, has lost 48% of its value. The entire and once vast oil-and-gas sector has gotten crushed.

The market, and broad portfolios, are immensely dependent on the Giant 5. That was great on the way up – on their way to becoming giants, when their share of the overall market doubled in three-and-a-half years, from 10% in January 2017 to nearly 20% today.

But if they sell off – there are myriad reasons why giants sell off, as all prior giants have found out – the impact of these five companies is going to be proportional to their giant size.

I’m sharing this trade for your future entertainment so you can hail me as the obliterating moron that infamously shorted the greatest rally floating weightlessly ever higher above the worst economic and corporate crisis imaginable. Read... I, Who Hates Shorting, Just Shorted the Entire Stock Market. Here’s Why

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Someone described our big 5 stocks as the equivalent of our ships at Pearl Harbor sometime in the beginning of December 1941. No air cover whatsoever.

Once you sink those ships, it’s over.

I think that’s too dramatic a description though.

All the money it makes and Microsoft still suc-eth. For all the $$$ it makes, it’s latest Window 10 Pro update no longer allows search engine Qwant and only allows Edge – you have to go to Qwant website now (but you can use suktacular evil Google yuck!) – and when you call technical support IF you can get past the useless AI to a person, it’s someone in India who appears to have the knowledge of a relative newbie. That’s what you get with 5 companies running the world.

Real men use DuckDuckGo for their search engine.

Windows 10 does suck. The biggest issue is that many of its updates were actually deleting your files.

I switched to a Mac and if you can get a good price, it’s worth it. It’s software works as good, as I could reasonably expect.

For most people a chromebook is all they need and works well, it’s privacy is about as bad as windows 10.

If you have to use windows though, you are screwed. Don’t buy a cheap one and always keep a windows computer well backed up.

use linux

Why on earth are people using hyper-expensive mac computers or shoddy windows computers nowadays?

Years ago I switched every computer in my house over to Linux. We have spreadsheets, bookkeeping, cd quality music, video editing, web browsing, email, games, homeschooling and much more. I don’t think we’ve ever had blue screen of death. One of my linux servers only had to be reset twice in FOUR years. My kids like it enough they have started installing linux on their own computers. One thing I noticed it that our family computers hardware cycle is about 3 times longer than it was when we used windows or apple computers. We have never had a virus or any theft of information or any intrusion into our systems that we have known about.

The first major employer that switches their employees to linux will discover their IT budget has been a waste. I have recommended to every employer they switch as the typical employee spends 50% of their time on email and another 30% of their time in meetings anyway and doesn’t need anything unique that microsoft offers. Wait, what does microsoft offer that’s unique? Nothing, right?

There are so many versions of the linux operating system out there I like several of them. Typing this on a xubuntu computer. I particularly like centOS for servers.

Did use DuckDuckGo…until the crowd at another site decided Qwant was the new “IT” engine.

The Brave browser is excellent, too for privacy.

Or, if you want real security install OpenBSD, probably the best quality codes. There are also higher security systems around but they are more difficult to install.

@Happy – it’s not Window$ enslaving the corporate world, it’s Office and Outlook that only run on Window$. It’s always been the app(s), ever since Visicalc.

use linux +1

@Lisa

Every microsoft app has multiple replacements that run on other, virus resistant operating systems.

And I’ve always said I would try BSD, maybe I finally will soon.

And any CIO who let’s their employees use Microsoft products is an idiot who deserves to be fired immediately and previous lifetime of compensation clawed back.

@happy_man

“My kids … started installing linux on their own computers.”

How did you manage to make them not play Fortnight???

For the record, I am with you on Linux, used it for decades. Though – as Lisa pointed out – it’s about applications. I couldn’t get used to OpenOffice however hard I tried.

DuckDuckGo is still the one to use.

I’ve used Linux, but, most people don’t know what it is. Unfortunately, too much of the software on top and for it, including in the package managers is too buggy. It’s always making progress, but, until WINE is perfected, there just isn’t as good software for it. As most consumer devices no longer need to be connected to the computer and most corporate software moves into the web browser, it’s getting closer.

The new MacBook Air goes on sale for as low as 900 in America at least. A good windows laptop won’t be much cheaper. A Windows laptop is also what most people install Linux on. If you need a dedicated graphics card though, Macs are very overpriced.

In a corporate environment, it’s best to give your employees whatever operating system that does everything they need and that they will have the least trouble with. Saving a few hundred dollars a year on a employee costing tens of thousands could result in a productively loss, which greatly outweighs cost savings. ChromeOS is underused in this respect. A fork of ChromeOS that only adds high quality software into its package manager, would be the real windows killer. If the open source software community can start collaborating on a smaller number of projects, that would greatly help.

Thomas, took your advice (and those regarding Brave).

Just changed to Duckduckgo search engine, Brave browser. Don’t know why Edge gave me such a hard time with Qwant, it’s was probably me not knowing how to use it…

I agree about Duckduckgo, but I can buy three Windows 10 computers on sale for the price of one, equally powerful Apple. If you are willing to buy older but still powerful, used computers, you can buy five to ten Windows 10 computers for the same price as the low to mid-priced Apples.

While one of the Windows computers is busy doing something like processing your home videos, you can use the other one and get better performance than the fastest Apples. Also, if your data gets corrupted on one, you have the other one.

Windows has a feature called File history that allows you to back up files to an external drive, and it is a good idea to do your own backups anyway. If you keep your files in one place in your hard drive it is easy.

Nevertheless, I do wish antitrust legislation was enforced again and these big companies were all broken up: we have more and more monopolies, which are valuable primarily because they are monopolies. I keep moving to get away from the big banks and they have kept buying up the good banks to which I transferred my money.

Now, the same is happening with a good stock trading firm being taken over by a bad one which severely burned me with bad information years ago. I have to move again. I guess if you pay the politicians and judges enough (and the judges, by the way, are getting too much of a free ride and never, ever getting wiretapped or investigated for receiving bribes or “contributions” to their cronies/relatives, particularly in a certain large county in SoCal) you can do whatever you want.

My parents are in their 80s and have been using Linux for a decade! They even managed to install it once with help.

+1 duck duck and mac. If Microsoft made cars, they would have been sued out of business, a perfect example of failing forward because of installed base dating back to DOS.

Mac OS is essentially UNIX, dead stable across the whole platform, way easier to secure than Billy’s perpetual POS.

Brave Browser, break free!

Firefox is the best right now. I wouldn’t trust any other to not spy on me.

I switched to dual-boot Linux (w/windows available), dropped in a virtualbox to run my ancient Dreamweaver & Photoshop applications (paying no virtual, “rent!”), when Win7 was executed, and Microsoft began the Win10 process of, “OS as a service,” model that MicroS began forcing onto the market was instituted, and have never looked back or regretted it since… plus, I still have Windows available…

re: “I think that’s too dramatic a description though.”

It’s also a terrible analogy. The battleships sunk at Pearl Harbor were already anachronisms by 1941; the future of war, at that time, was airpower and, fortunately, our carriers were out to sea on Dec. 7.

Yeah, another issue is that if a ship is sunk, it’s completely gone.

If the stock markets crashes you still have something, just not crazily overpriced, assuming you didn’t only buy junk. Also assuming, you don’t buy those fractional shares nonsense.

Not if you sink that ship in a harbor, which the Japanese failed to consider. All but 3 of the ships sunk by the Japanese were raised, repaired, and went on to participate in the defeat of Japan.

not so terrible imho,,,

sure, the battleships were past their ”prime” by ’41,,, but who is to say these giants of digital world today are not already past their prime???

and, to answer to another well made point above, some of the battleships ”sunk” at PH were rebuilt and served again, similar to some of the software on these old sites cited in this article

yes, it was very fortunate that our carriers were ”out to sea” at the time of the PH attack, and it would seem to me, that many companies today are in similar position, ready to do the equivalent of those carriers in the battle of Midway, to move our world forward toward ever increasing democracy and the freedoms following, as well as ”real” capitalism, clearly not the case today…

maybe just a dream from an old guy who values/loves each and every person willing to step into my place to work as hard as they can in navy and industry, etc.

Fyi.

Battleships were in Pearl Harbor and were sunk.

The carriers were out on maneuvers and were untouched.

No one realized it at the time, but the Battleship had just become obsolete for controlling the oceans.

So your metaphor is more spot on than you think.

To be fair, some of the battleships were raised again, (obviously not Arizona or Utah), but a few participated in the battle around Leyte Gulf in 44.

From the Nifty 50 (early 70’s) to the Daft Five (now).

Pearl harbour was the beginning of the end of the Empire of Japan, though, MonkeyBusiness…

Maybe a more apt analogy might be the charge of the Swedes at the battle of Poltava? Once it failed the Swedish cause was lost, and thereby the tide of the war turned.

Were there any similar mega cap stocks carrying the load back up in 1929 – 1930s as the dead cat bounced? I’m thinking “Radio” (RCA) but I’ll have to check.

For fun I ran simple discounted cash flow on Amazon using the current earnings per share and price. You need 50% plus earnings growth forever to give you a 5% return. I will pass.

As a programmer working with australian stockmarket data, I coded up my own indicies by dividing up the market into 4 segments: top, high-mid, low-mid & bottom (in terms of market cap). I then ran the code on historical data. I observed that the different segments behaved very differently at certain times. It is no surprise to me at all that the huge mkt caps behave very differently to the rest of the market. Note also that they are far more liquid and thus attract more attention. I suspect that segmenting the market via different criteria will show markedly different performance between them. We are forever seeking the holy grail of leading indicators.

never understood “leading indicators”. Predicting future by extrapolation of the historic data. LTCM comes to mind :)

They should make a sequel to Idiocracy and instead of Brawndo, Costco and Carl’s Jr..just use these 5 as central plot of the movie of how our future will look like….

Somehow real life is turning more insidious and less funny that a supposedly wildly exaggerated version of the future…

We’ve been living in an Idiocracy since 2016

Gandalf, I’d even say 1941 when the government governmentized private industry and did whatever it wanted. At least then they asked the common folk to buy bonds. Now the government itself buys the bonds through intermediaries. Pulling on bootstraps.

On another note – do you still not have SARS-CoV-2 PCR testing available in your hospital?

That monetary relic of W2, yield curve control, is making a comeback.

Lisa,

We have that Abbott Fast test for ER and inpatients. Takes 5 minutes, but now found to be wrong (false negative) 20-50% of the time. Fast tracked by the FDA and highly touted by the Denier In Chief when it came out. NYU study showed it missed 50% of COVID infections. That’s like flipping a coin. Haha.

My last post on PCR testing for COVID was for CSF and biopsy/autopsy tissue – that’s mostly available thru a complicated process with the CDC

Re- WWII debt – that really was a different era. Politicians of both parties believed in fiscal responsibility. Taxes were sky high and all WWII debt was paid off in 1975.

Today, all countries (and Europe) practice some form of debt wazoo – that’s the only thing I can see that is keeping the USD afloat as the world reserve currency

We’ve been living in Idiocracy since 1960.

If you want a little cheap amusement pick up a used college Economics text.

The market is forward looking and investors are rational actors…

if you doubt that you can always try to take advantage of its obvious inefficiencies – good luck

Knowing investors are irrational doesn’t make it easier to invest.

Tom is not saying there are obvious inefficiencies.

if there are no obvious inefficiencies then actors are rational, given the expected actions of other agents

Re “if there are no obvious inefficiencies then actors are rational, given the expected actions of other agents”

WRONG. If there are no “obvious” inefficiencies, that just means everyone’s being inefficient in “non-obvious” ways.

The actors are known a priori to be irrational, on the basis of mountains of other evidence… implying that there are always inefficiencies. If the herd of irrational actors cannot find the inefficiencies, that doesn’t disprove their existence.

P.S. There’s no fundamental way to rationally predict the future in a fiat-currency system anyway, because events like COVID, and the central banks’ reactions to such events, are themselves not rationally predictable. No one, a year ago, predicted where we would be now. Among those who anticipated the potential for a major dip, none had an expectation of such a sharp rebound.

Using total value as an index is not correct in a time when a lot of companies where removed from the bourse by buzzard funds. This is not a problem after februari but before it was. There is also stock buybacks. It is not free money, Stock market value of companies should drop when they do a buyback

“Stock market value of companies should drop when they do a buyback”

It does. Market cap = number of shares outstanding x share price. If you reduce the number of shares outstanding via buybacks, total market cap declines (by a relatively small amount) if share price remains at the same level. But the idea of share buybacks is to drive up share prices, and if it works, rising share prices increase market cap.

Wolf do you know/have a dataset that shows the relative strength of these two effects? presumably market cap does clearly decrease in most cases?

Theoretically, market cap should stay the same; the stock price should increase only by enough to compensate for the reduced number of shares outstanding.

In practice, I expect that share prices might increase more in price due to their reduced supply.

shouldn’t market cap decrease by the amount spent on the buyback?

“shouldn’t market cap decrease by the amount spent on the buyback?”

No, don’t think of it as an expense for the company. Think of it more as a currency conversion. The company exchanges dollars for shares, just as they would exchange dollars for yen. Total asset value would not change.

But you are not exchanging money for shares if you retire the shares (presumably required to reduce share count). You sent out money and now have nothing. If you spend $10B on a buyback, you have $10B less in cash (or $10B more in debt), which means your market cap should decrease by $10B.

I find it interesting that of the 5, only Microsoft provides what could be considered a critical service. If FB and Google disappeared tomorrow, by next week, no one outside of a few advertisers would notice, because FB’s service is superfluous, and Google’s is replaceable (though other search engines are admittedly not as optimized). There are plenty of other websites besides amazon to buy cheap junk on the internet, just with a waiting period of 2 days instead of same day. And Apple makes consumer products that 5 other companies can produce. But if every computer with a Windows OS stopped working tomorrow, 95% of the business world would be in utter chaos. I understand a critical mass of users at FB or Google creates a snowball effect, but only MSFT seems to have what Buffet could be considered a real moat.

“But if every computer with a Windows OS stopped working tomorrow, 95% of the business world would be in utter chaos.”

Not true, you could run Linux with a windows emulator (and performance would probably improve). Or, as MS is currently encouraging its customers to do, you could switch to the Windows Virtual Desktop (i.e. the cloud) which is OS agnostic. Or you could easily convert all your files to a format that is readable by Linux based software and run Linux (or ChromeOS, which is Google’s version Linux).

I use Google’s search engine a lot and there really is nothing that even comes close.

As for FB, I share your opinion.

“Not true, you could run Linux with a windows emulator…”

I think BigBird made an excellent point. What %% “of the business world” have even seen Linux, let alone capable of running a guest OS in an emulator there?

Google is way better, agreed, but I decided to only use Bing – just out of curiosity – and I noticed I can get by in 90%+ cases.

Isn’t Bing the default searchengine in Apple devices ?

Realist,

I’m sure that you already know this, but Bing is Microsoft’s search engine and is often (always?) the default on Microsoft devices.

Apple’s default is Google, but apparently does also use Bing when searching via Siri.

Maybe that’s why Siri is so poor at finding answers to questions…?

Wolf I nominate this article for your top 10. Much could be said about this topic of the 5 giants.

Apple cares so much about your privacy that it sells that default setting i.e. Google search engine to the tune of 8 billion dollars a year.

What a bunch of hypocrites.

@MonkeyBusiness

From Leader Tim: “listen to what I say, not what I do.”

Leader Tim says: “privacy is the most important thing, end to end encryption is good, Google, Facebook bad.”

Leader Tim does –> Sell your information internally so Apple can make more money on services which are crappier than competitors

Leader Tim says: “more opportunities are important for all Americans.”

Leader Time does –> outsource to India, China, Brazil, anywhere except the US. If you don’t, you’re fired.

People may not like Steve Jobs much because he was an abrasive a**hole, but you at least knew that up front, and knew he will use you and discard you. Leader Tim on the other hand wants you to love him for his words while sticking it to you when you’re not paying attention.

Many businesses rely on Google for email and other vital services, and many internet companies run on Amazon’s AWS.

Microsoft has Outlook for email, Azure for cloud and CNTK for AI. Azure may not be better than AWS, CNTK is apparently inferior to the TensorFlow, but I think the BigBird’s point is still valid: Microsoft is the most essential of the bunch.

I think your missing the big picture here. Close your eyes and imagine a future where very few people work and are on UBI. The ones that work get paid very well. AI powered by Quantum computing develop into systems that learn and replace many human positions. Now open your eyes and start to think what positions can be replaced. You will be amazed. Many can and shall be replaced. Some like construction workers etc will take several generations. Its coming. These 5 companies have all the data. That is the key. That is why they will continue to grow and imho are undervalued. This is just my opinion. I have been saying this for almost 15 years. My fathers stocks have grown but my portfolio has doubled almost every 4-5 years. He finally got onto the train about 5 years ago and now he understands at the age if 70. I think i still have another 15 year run. Hope others can catch on so the wealth and knowledge can be shared. If they crash i will just add to my longterm positions. I have held amzn, goog, msft, intc, jnj for a dogs age. Over the past few years i have added shop, ibm, amd, nvda. I also hold some banks and a few utility stocks. I will continue down this path into late retirement. Not trying to be a smarty pants here just trying to help. Cheers. Oh and virus will not stop the train but actually the opposite.

Just to add. I always hold the above positions and several others not mentioned like appl. But i do take profits off the table and trade. If i think one is over and another under valued i switch things around. I actually sold a bunch in early March when covid was hitting and lost out on some gains. I have added since and hold cash for any pull backs in these stocks. Just dont get caught up in fundamentals such as thinking goog will drop with decreased Advertising revenue. Alphabet is a beast! Forecasting the mid to longterm future is much more important then focusing on the short term. Cheers

UD,

Please see my answer above, and adjust accordingly if you want to continue to play the SM.

Not claiming any special insight on this or any other question, but, a forecaster/analyst for so long that am always living in the future, and, at this point, it appears clear that between the legitimate competition and the coming guv mint controls, the big five mentioned here will, sooner and later, be reduced similar to the battle ships of olde mentioned above.

As is often cited, ”the only constant is change”…

The big 5 mostly depends on being monopolies, total control of their online segments, and collecting personal information of everyone, to be giant. With the ability to wipe out any competition and endless capital to defend lawsuits, who can stand in their way?

Kinda like Walmart from the Nifty Fifty? :)

If FB and Google disappeared tomorrow, by next week, no one outside of a few advertisers would notice,

___

FB could go away and within a week nobody would remember it. But Google? Come on. That is so integrated in our lives it’s like electricity now. Nobody really thinks about it since it’s just there for us. But take it away and it would be pretty bad.

Just Some Random Guy,

Yes, Google’s ad servers could be replaced (there are plenty of others already).

But Google runs many corporate email and communication systems. It owns a big part of the cloud (data centers and services) and part of the communications infrastructure (undersea fiber optic cables, etc.), and a huge popular mapping service that all kinds of other corporate services have become dependent on, and a search engine that runs 90% of all searches, and on which many corporate search services depend. Google has inserted itself into myriad other things, including healthcare. Oh, and I forgot Android. So if Google and everything it has and does suddenly disappeared, we would definitely “notice.” A lot of things would just cease functioning.

That said, Google can be replaced, and it should be broken up into independent companies.

Exactly Wolf,

per my earlier comment,,,

and to extend the analogy, the battle ships were ”broken up” into a ton more destroyers that were the main new -admittedly pint sized in comparison to the battleships– war ships built for WW2, including the one i served on that was built in 1943 and still active and serviceable in 1965++ albeit with many mods in between

Well sure any company can be replaced. But to say that nobody would notice (which is what I was specifically replying to) is ludicrous.

I both love and hate Google. But they produce excellent products/services and so I use them even though they are an odious company.

Just Some Random Guy,

OK, apologies. I misread your quote from BigBird (way above) as your own statement. We’re on the same page here.

Certainly more than enough Google share holders would agree with that sentiment, especially the parts that are hardware centric, all of the special bets, and the pet projects. They should be all ejected.

Then Youtube should be spun out as its own company.

Those two act would unlock shareholder value for sure. No more drag from the moonshots, and extra stock appreciation for Youtube.

What is not to like.

Google is negligible and inept in both the Enterprise and cloud space, compared to MFST and AMZN. Also Google could not compete against AAPL in the consumer market. Google will probably be the first to get wiped out.

@Karen

I doubt that Google will be the first to go. Unless November goes horribly wrong from the Donkeys, Google, Facebook, and all of those companies will live. So much of their financial support comes from the tech industry that if they get more than a slap on the wrist, it’ll be a shock.

But regardless of November, they will still survive, every single one of them will play the China card about how they must be protected unless they are outcompeted by companies support by the Chinese government, and as such costing America an irreplaceable advantage in the tech arms race.

@JSRG – well, I haven’t used M$ Office or Outlook for 3-4 years. They’re on 2 machines, I just don’t use them, LO or OO work just fine for spreadsheet, docs and slide decks. As for Google, I only use Maps or Translate when necessary, and in a private window, scrubbing cookies and cache when done. Google is always interested in what your are doing. There are many other search engines.

Maybe you are not the market that FB & Google are targeting but the fish they sell to their market.

@BigBird:

If you took down Apple+Google: no one’s cell phones would work. Bigger impact than Microsoft.

Personally I boycott MSFT, GOOG, and FB. I minimize use of AMZN. And I tolerate AAPL as the least-bad of the “5 Evil Giants”.

All of them need to be dismantled in a renewed wave of anti-monopoly law enforcement.

@Wisdom Seeker

I would say AAPL is actually the third worst of the evil giants. MSFT is the least worst. In my ranking, they go something like this from most harmful to the least.

AMZN

FB

AAPL

GOOG

MSFT

It’s arguable which is the worst, but AMZN is the most destructive all around. The only thing that could be worse is AMZN having a large social media component.

I would also toss in TWTR because it is one of the most destructive company around in terms of the garbage that it allows to proliferate everywhere through its pipes. But then, if it’s not them, it’ll be someone else. If nothing else, social media companies needs to be banned.

The big tech companies have a lot of vulnerabilities that aren’t being priced in. Their tax rates will go up, given fiscal pressures and how profitable they are relative to the rest of the economy is having. Europe and Asia will be soaking them with local tax on digital goods.

They are having more difficulty getting B-1 visa candidates into the country.

They are facing more intense anti-trust battles.

They don’t hire a lot of women, minorities, or older workers.

Generally, they will become punching bags for politicians and the general public.

Then, you have the law of large numbers taking hold……….

“They are having more difficulty getting B-1 visa candidates into the country.”

LOL. No they’re not. Stop believing MSM lies.

Reminds me of the “Nifty Fifty” a few decades ago.

Read ancient Roman history to find out what happened to all 50 of these companies.

I checked the ticker and “Radio” was up again today. I just can’t wait until 1929 gets here. We’ll make a zillion bananas!

Reminds me of the knight in Monty Python and the Holy Grail, as his limbs are cut off, he continues to say “it’s nothing.”

First time to comment, however, an avid reader…

As humans, have we totally lost the plot, when a company like Facebook is more valuable then companies that produce medicine, companies that manufactures hospital equipment, machines, etc…These companies actually employ people…directly and indirectly.

In my naive world, the US is not a democracy, its not based on one person one vote; and to build on that, now you have the Big 5 + Tesla + Netflix; that dominates every aspect of politics, social, economic and thinking on behalf of people in all corners of the world. To add insult to this, majority of these companies P/E is through the roof, and Tesla and Netflix is permanently running a loss. Amazon’s core business of sales, is not profitable, they make money on cloud computing….

The US economy was performing poorly for sometime, hence the drop in interest rates twice in 2019. Lets not discuss the US DEBT,

Imraan Ayob:

You are correct. The United States of America is not a democracy. It’s a constitutional republic.

El Katz, you’re incorrect.

The US is now an illusion of a constitutional republic. You know it’s not a genuine constitutional republic because the constitution and laws are routinely ignored by the ruling elite.

Those of us predicting FAANGs demise could compare their longevity to other Past Giants that have crashed. (As they all do.)

I know we’re in accelerated times, yada^3, but some of these things are still babies and have a lot of runway left.

As for resilience in the face of extreme change and volatility: look at what Microsoft’s done in the past 5 years to reinvent itself successfully.

Got dear ol Ma out of the stock market after the first roller coaster and glad I did as expenses are unpredictible at her age. I expect many of the baby boomer demographic are doing the same.

Savings accounts are boring and you are at risk on inflation but it’s a lot better than getting hammered for 30% at an inopportune moment. I keep wondering tho, just how safe they are with the banks “playing’ in the market too.

re:

But wow, the volatility! You would have been better off with a despicable freaking savings account.

Yah think? (asks the person who lived this method).

It works. Remember the movie Moneyball? Boring baseball but oh so sweet to make the finals with a scrap team. (great movie). Meanwhile, the flash and dash crowd are always looking for an angle of immediate payoff, a designated walk-on home run, nah….make that a walk-on grand slam. Meanwhile, slow and steady saving with disciplined spending leads to early retirement with a decent cash flow.

Pay an affordable house off, then either do it again with a better home (better not bigger or more wasteful), or let a tenant pay off the next one for you. It’s worked for generations and still working for everyone in my family.

Having a Plan is more involved than studying and playing in a rigged stock market. Might as well buy lottery tickets.

I was advised here the other day that the one of the only ways I could go insolvent was to not have other sources of income to offset my losses, this while “playing” the market lol.

I’ve watched this stuff a long time and been involved more directly with it earlier in my life and lo and behold, I can get _way_ better returns investing in myself so that’s what I do. And a house is good too. :)

Yes, thanks to our amazing President Trump, our savings accounts once again are down to ZIRP, and he would have them at NIRP if only he could.

And he promised us old timers interest on our savings accounts if we would just vote for HIM. Fool me once, shame on you, fool me TWICE…

shame on ME. And then his campaign has the nerve to call and ask me for money and then BRAG about “flattening the curve”. The irony is totally lost on them. They see everyone in the country as owning FANGMA stocks. I guess they think money grows on trees.

Reminds me of American Gods by Gaiman.

Ha. Good show – they should do another season. :)

The emperor has no clothes. Nobody who is not stupid reads internet advertising at all. Yet Google made $134.8 Billion out of $160.7 billion on selling ads in 2019. Ads that nobody really sees that do not lead to sales, that is what everyone is afraid to say aloud.

Or, you go looking for something yourself online, find it and buy it, then you get ads for the next two months all over the place for what just bought.

I am using AdWords and it’s really working. You are getting decent quality clicks like a clock for a reasonable price. Because Google has way more traffic.

I tried same ads with Bing Ads and it’s completely different. In some cases I could get tons of clicks dirt cheap but not converting into leads. Waste of time.

Bottom line – I see that AdWord will continue generate revenues. Just because it makes sense to pay for it. Like it or not.

Google is the toll booth to the internet. No one playing in the ecommerce space, or offering any sort of consumer-facing service, can afford to not pay them. If you aren’t in the front page of a Google search for your product, you may as well not exist.

“toll booth to the internet”

very well said. Sad but very true

These companies valued at 25% of GDP yet I managed not to spend a single dollar with any of them in at least 5 years. #fakeeconomy

You don’t have to spend any dollars with them for them to make money off you. Google doesn’t charge consumers any money. But it sells the data to marketers. You know this.

The final business model is selling ads to government. Figured that out when “your government recommends against Brexit” posters appeared on FB years ago. You really think FB revenue of $$$ per user is based on marketing slice of selling trinkets? No, its for political mindshare and gargantuan brand plays that only the top 5 can play. Winning hearts and minds, pushing narratives, mass recruitment, etc.

andy,

You might not have directly, but your favorite retailer, grocery store, doctor’s office, and insurance company used their services and you paid for them. These giants are very difficult to get around. That’s part of the problem. For example, Amazon’s AWS, Microsoft, and Google combined control the lion’s share of the cloud, which is where the businesses you do business with host their sites and data.

Professor Steve Keen is developing an economic model based on the Laws of Thermodynamics because he believes current modelling does not take into account the importance of energy and entropy. The Giant 5 consume huge amounts of energy through all of the server farms and attendant infrastructure they depend on. And yet, the stock of an energy company such as Exxon-Mobil has declined by 48%.

Energy and entropy is the limit and in the words of Herb Stein, that which cannot go on forever, will end.

The flu is coming back. I wonder what Dr. Powell will prescribe? This might test that theory that QE going down down. If it goes up up… well we shall see.

“the fed will print antibodies or something”

The market has already priced in a c19 vaccine by end of summer. V shaped recovery is priced in by end of summer.1929 post crash V shaped rally backed 50% quickly then slid painfully slow even lower into the crapper,then topped it off with a recession. Un-employment at 29 million is good for Wall Street. The dollar could only get to 103 at the height of pandemic rout and is sliding into the crapper at 97 and trending south. The Fed and the BOE tried trotting out the Bernanke Normalization Withdrawal Lie of 2009. The Lie landed this time with a thud. Dollar trending South. Gold out performed the market for over a year and everybody yawned then ran over one another to buy a Nas-Nasty Queen that never will pay you a dividend and will be a heartbreaker. The vast majority have already bought high . The only thing left to close the Great Circle of Stupidity is to wait and sell at the bottom. Oh I forgot . It’s different this time because the Jerome Money Printer going Brrrrrrrrrr…. was switched on high immediately and has printed a 120 day replacement economy which He will magically slide into hole left by the one lost. And alas ,just like Atlantis , the civilization of CHOP/CHAZ and all it’s accomplishments is slipping away .All of this for just 1% . What a bargain.

Well you know what? Oh no, market dropped 700 pts today, everything is still expensive relatively to earnings but don’t worry somebody already turned on the FED bat signal and I am sure by tomorrow, Papa Jerome will have some comforting words for the market..can’t let this wild melt up stop now. If Papa Jerome doesn’t come through, sure the carrot will provide coverage…trade deal is now moving in the right direction…etc…

COVID 19 will have a lot to say on the Economy than Mr. Powell, in the coming months!

Fed cannot create jobs.

Fed cannot make earnings grow for companies.

Supporting nearly 20% of S&P – Zombie companies at a cost to the rest

If CMBSs keeps going down, how long it can support the corp credit mkt?

Good article and comments. I’m thinking that Au and Ag might be worth a look for upside over the next few years ??

I work in tech, but IMHO, most of our tech companies are nothing more than sophisticated Peeping Tom operations. Their value to society is questionable.

My anti virus (Bit Defender) blocks constant connection attempts from:

msedge.exe

Before my MS update on 6/17, anti virus blocked constant attempted connections by:

MicrosoftEdgeCP.exe

Do you know why MS is constantly trying to establish connections that antivirus blocks?

Probably the same reason why IoT devices from one company do not work with IoT devices from others i.e. compatibility.

I am not very sure about the state of the art when it comes to anti viruses, but if Machine Learning is involved, then it could simply be a matter of incorrect classification i.e. Microsoft is doing things that a typical virus would do, but not for harmful reasons. In other words, there’s no way for an anti virus software to judge intent.

timbers

I also use BD I also use FFox and duckduck, WolfS has 21 trackers blocked… the overall rating was enhanced from D to B+ that is from the duckduck..

FFox privacy and security is set to custom…

I only get the beer mug ad which I used for a gift.

I am not having the Msedge problem and never had since edge was installed but I use those setting.. all those updates are bug fixes and worsification..

Now all those FAANG stocks are a bubble but not trading as high as 50-70x during the tech bubble..I think they will get busted for market domination when the government investigates them. Amazon ruined the book selling business and other business so they will eventually get busted for market manipulation. They all buy out their competitors. The deregulated phase will change to regulation to give the smaller competitors a chance if the government and the pendulum swings eventually.

I think it was Coke that stopped using those e- ads companies a few years back as they did not make any difference in their revenue when Coke stopped their advertising. The whole e-adds business is a monopoly that will eventually be busted by the government. I think we hit peak adds, and spyware tolerance by the public.

After 26 years online, I have never bought one thing from an ad, and occasionally click on them to grab an image.

Firefox, Custom settings, clear history and data upon frequent shutdown, Adblock Plus, and VERY important, NoScript.

Out of hundreds of webpages browsed, I see a video ad occasionally.

Startpage or DuckDuck for search.

–Allowing any kind of advertising into your home is like allowing sewage to back up onto the floor–

No TV, KDFC Classical, listener supported, is the only radio, try it, super relaxing, no politics, no whining, no sports, just the music of Western Culture.

Yes, I have a Wolf Street Mug.

Wolf

Of the companies that have performed the best, is there an available way to see how much of that performance can be attributed to buybacks? And how much debt those high flyers have relative to the laggards?

I read recently that nearly 50% of rise in S&P is attributed to buy-back shares, since ’09! Just a couple weeks ago AAPL borrowed 300 B on zrp and put into their buyback program! Who needs earnings when Buy-back are doing the job.

I use options on AAPL, FB and MSFT both calls and puts . Puts are there as hedges but calls are the ones going up, repeatedly, mindless mania but I am not complaining, as long as the strategy is working! Shorting (puts) on tourist industry during March was no brainer! Cruise lines, hotels, airlines. They went up recently but again declining.

Those who know how to trade using option tools don’t fear the BEAR. I put extra effort in time, money and commitment, in spite steep learning curve. But it is worth it! (been in the mkt since ’82)

At the micro economic level you justify using FB because it is free, which is the same logic you use to rationalize your credit card, you always pay the balance and earn rewards. Then one day you end up in ER and suddenly you have a mountain of debt. With FB other countries choose your president for you. My friends can barely make a phone call on their Apple phones, which makes it an expensive status symbol. Microsoft is the little shop of horrors and now Gates is doing public service which is working against him. Of course I use Google, but they “scrub”. I have never had a Starbucks, never watched a Star Wars movie, (tried but fell asleep). I am a regular person. I vote, I drive, I consume the essentials. A lot of this is psychology, and that can crash faster than a central bank pyramid scheme. A side effect of Covid, we learn what we can do without.

The issue for the Big 5 isn’t even that their respective businesses get worse – it is multiple contraction.

Cisco in the pre-Y2K bubble bust was to be the first trillion dollar company. Cisco today makes multiples of revenue and profit compared to then, but is a fraction of the stock price because its multiple collapsed.

The Tesla vs. the rest of the US car industry is another example, albeit one likely seasoned Enron-esquely.

Please provide LINK to that Wilshire 5000 minus the 5 Giants – I’d love to refer to that periodically.

Robert Khan,

Instructions: Download the daily market cap data for the Wilshire and the Giant 5 stocks individually. Put them into a spreadsheet. Dates = Column A; Wilshire = column B; Daily sum of Giant 5 = Column C. Then, in column D, set up basic formula: column B – column C, which gives you the result. Then build chart.

I download my data from YCharts — behind paywall

https://ycharts.com/

Thank you Sir.

Setting aside the real economy market controls of the “Giant 5” due to the tax, antitrust and rate environment that has favored them, and the extent to which traders and investors in equities have benefited from negative real interest rates, I do wonder what the prices of these “Giant 5” stocks would be absent their inclusion in passive ETFs. Aren’t ETF allocations based on the relative market caps of the stocks that comprise the ETFs?

In a similar vein, looked at a few of the stocks with the largest 52-week price gains a week or so ago. Most are reporting losses, yet appear to me to be priced beyond perfection. Saying that their prices are sky high understates the effects of the momentum-based trading that has been underway. What’s that old Wall Street proverb about bulls, bears and pigs?

Bull make money, bears make money but pigs get slaughtered!

I think it refers to those sheeple gambling on bubbles.

The way these FAANG stocks and high tech stocks are valued is not by PE ratio as they have no net earnings but by a multiple of revenue which is now about 30X estimated future revenue growth which may be estimated as far out as 3 years out in the future. If they keep growing at the same rate for the next 3 years and there are more greater fools that keep buying the stock you might break even or make a paper profit.

With any bubble as the economist Keynes said the market can stay irrational longer than an investor can stay solvent. that I guess refers to those shorting and the length of a bubble.

There was Sir Issac Newton who lost a fortune in the South Sea Bubble..

“Aren’t ETF allocations based on the relative market caps of the stocks that comprise the ETFs?”

Yep, the vast majority of indices and ETFs based on them are market cap weighted…creating an amplifying feedback loop on both the upside and downside (higher mkt caps get higher percentage of new money flows, lower mkt caps, less).

So a dangerous sort of self-fulfilling momentum gets created…until people wake up, look around, and start noticing economic absurdities like 5 companies in the SP *500* being “worth” 25% of the whole index or the next 80 members combined (invented numbers…but broadly accurate).

Indexing is a huge plus for investors (due to diversification) but the specific indexing methodologies have to be understood (ie, kind of member weighting) otherwise the advantages of diversification can be unwound.

Diversification alone cannot prevent loss of capital unless accompanied with UNCORRELATED assets including some against the mkt by bear positions ( options, inverse and Bear MFunds)

Most of the mutual funds have to remain invested up to 80%! Read their prospectus and their performance during BEAR mkts ( 2000 & 2008) Been in the mkt since ’82. S&P lost nearly 60% and the Nasdaq nearly 80% in a period of 18 months!

We are amidst not just bubble but Mkt mania, in this surreal mkt of my life time.

Agreed…for diversification to work, the components of the portfolio have to be largely uncorrelated.

ZIRP has done real damage here, as almost everything is heavily correlated to artificially low interest rates created via money printing. That increases the amount of cross correlation between individual stocks.

For those who would like to escape from Microsoft Windows I recommend Linux Mint. It’s a great operating system and it is good for beginners. You can find videos on how to install it on Youtube.

Keep buying the big stocks?…it works until it doesn’t. Popular delusions stay…well popular…until they aren’t. Better hope the next delusion doesn’t start a nasty crash and depression. Best to stay away from delusions.

I don’t understand anything about the stock market but I have to do something for my retirement so I just buy these stocks because they always go up.

/s

After all we once had a president that was distressed when told half of Americans had an IQ of 100 or less.

There is a case to be made for those whom have done hard labor or have an infirmity That retirement will be a relief. Other than that,,F##k retirement . It will kill your ass.

A somewhat different statement regarding retirement:

Given reasonable health and essentially independent of income, the lower your combination of inquisitiveness and will power, the less rewarding your retirement will be.

In that predicament, retirement may well kill your ass.

Retirement has taught me that I don’t have enough time to learn all the things I want to learn.

Echoing HappyMan, Wolf – this was an excellent piece of analysis.

In the Age of ZIRP madness, focal points of true valuation weirdness are going to emerge…it is almost a necessary implication of using the discounted cash flow model. You screw with the I, the PV gets very volatile.

With multi-decade ZIRP (nuzzling NIRP), all non-fixed income invt sectors become a series of unanchored giant bathtubs on a pitching and rolling ship, dramatically sloshing tens/hundreds of billions in and out at random moments.

But hey, the pirate printing press keeps DC “in control” and that’s what really matters, right?

Note…preceding post got dropped from proper thread…looks like network hiccup can cause your comment threading software to lose track of post-reply relationships. Not sure if you can fix on your end, but wanted to give you heads up.

Any idea what people will do when the $600 weekly unemployment boost ends next month?? Are mass foreclosures/BK’s on the horizon?

Trump has agreed to more stimulus. Makes sense since he is going for reelection. I think Congress is on board. The Senate looks doubtful, but we probably need a market crash here so that they can pass more dubious bailout schemes.

Have there been any other periods when the stock market was similarly dominated by a small number of companies? That’s what the Dow Jones index was originally for, right?

Still concerned over search engine privacy? Let me set your minds free. The privacy ship sailed long ago and will never return. While you should obviously make sure your banking and other financial transactions are secure, entirely give up the thought that anything you do on the internet is private. It hasn’t been and will never be ever again.

Better to use those brain cells envision how to make Facebook, Google, Apple etc. PAY us for this infringement that earned them trillions. Retroactively if possible…

“There is no privacy. Get over it.” – 1999 Scott McNealy, president, Sun Microsystems.

GNC just filed bankruptcy.

Another bullish sign!!!

Larry Kudlow must be in ecstasy now. He is imagining thousands and thousands of small businesses taking over GNC’s stores.

Go Long Ecstasy!!!

Another business that should’ve been gone long ago before CV19. Kind of surprising they are still around, everytime you walk by it’s dead in their stores.

I’ve thought that too. There is (was) one on my way to the Safeway. GNC seemed like the deadest store in the universe to me. The lockdowns are definitely clearing out the deadwood, for sure.

Safeway/Albertson’s??!!!

You top hatted one-percenter!

Must be all that blog lucre!

Next you’ll be tossing off asides about animal protein…

The deadwood is GNC, not Safeway.

How did Private Equity with free money from the Fed let GNC slip into bankruptcy before harvesting its innards and feasting on the cash maggots that appear during the process. Hell, Jerome could have pre-packed the carcass with cash to make it vulture worthy. I guess Mit was circling too high due to virtue signaling to pick up the stench of rot.My faith in good ol’ American style capitalism has been shaken to the core.