Tapered QE-4 Further, Still Hasn’t Bought Junk Bonds or ETFs, Was Just Jawboning.

By Wolf Richter for WOLF STREET.

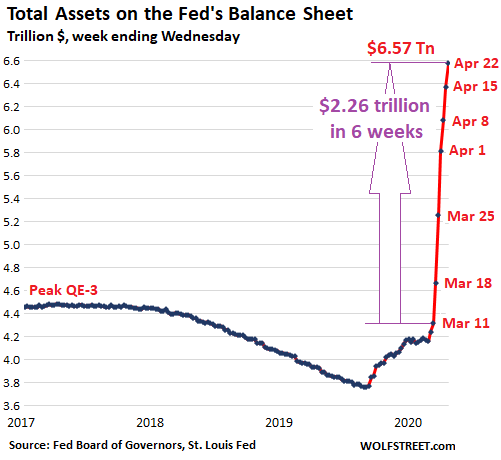

Total assets on the Fed’s balance sheet rose by $205 billion during the week ending April 22, to $6.57 trillion. Since the week ending March 11, when the bailout of the Everything Bubble and its holders began, the Fed has printed $2.26 trillion.

But the $205 billion increase was the smallest increase since the mega-bailout began with its Sunday March 15 announcement. The Fed is tapering its purchases of Treasury securities and mortgage-backed securities (MBS). Repurchase agreements (repos) are falling into disuse. Lending to Special Purposes Vehicles (SPVs) has leveled off. And foreign central bank liquidity swaps, after having spiked initially, only ticked up by a small-ish amount.

The sharply reduced increases confirm that the Fed is following its various announcements over the past two years that during the next crisis – namely now – it would front-load the bailout QE and after the initial blast would then taper it out of existence, rather than let it drag out for years.

This concept was further confirmed by Fed Chair Jerome Powell on April 10 when he said that the Fed would pack away its emergency tools when “private markets and institutions are once again able to perform their vital functions of channeling credit and supporting economic growth.”

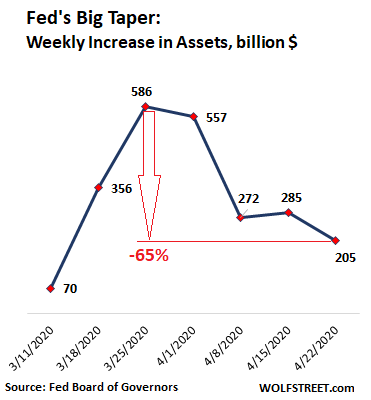

Overall, the Fed has cut the big QE purchases by 65% since the peak week (week ending April 1, $586 billion), to $205 billion:

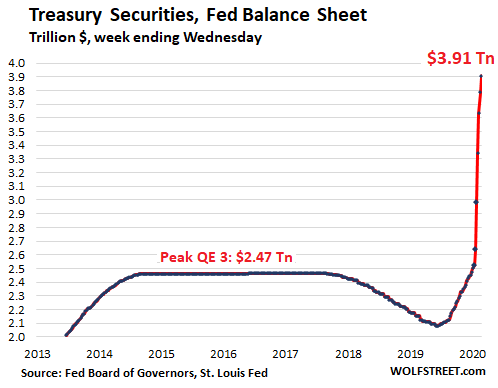

Purchases of Treasury securities get slashed.

The Fed added $120 billion of Treasury securities to its balance sheet, the smallest amount since this began, down 67% from the $362 billion it had added during the peak week:

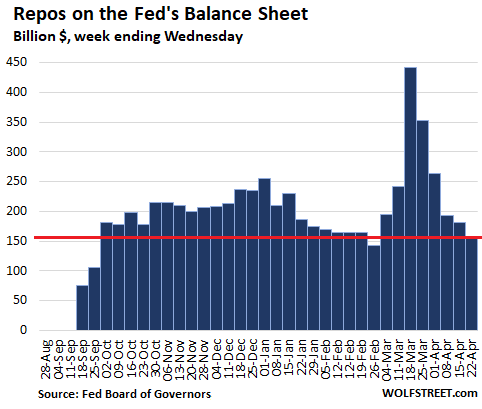

Repos balances continue to decline.

Demand for repos has abated. Recently, there have only been a few nibbles. The repos left on the balance sheet are term repos that the Fed engaged in some time ago and that will fall off the balance sheet when they mature. Total repo balances fell to $157 million, down 64% from the peak ($442 billion):

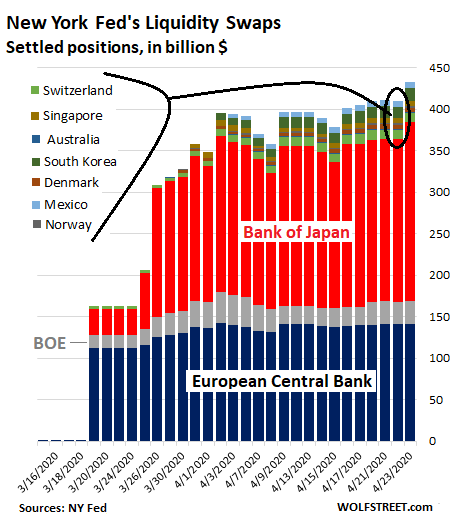

Central Bank Liquidity Swaps.

The Fed has “dollar liquidity swap lines” with the Bank of Japan, the ECB, and the central banks of England, Canada, Australia, New Zealand, Sweden, Denmark, Norway, Switzerland, Singapore, South Korea, Brazil, and Mexico. The combined amount of those swaps increased by $31 billion from the prior week to $410 billion. Some highlights:

- The Bank of Japan is the largest counterparty with $195 billion in liquidity swaps, or 48% of the total.

- The ECB, with $142 billion in swaps, accounts for 32% of the total.

- The Bank of England is in third place, with $27 billion.

- No swaps with the central banks of Canada, Brazil, New Zealand, and Sweden.

The balance sheet is for the week ended Wednesday April 22. The chart, which depicts the most current daily balances released by the New York Fed, also includes Thursday (right column):

With a swap, the Fed lends newly created dollars to a central bank, which posts newly created domestic currency at the Fed as collateral. The exchange rate is the market rate at the time of the contract. The swaps come with two types of maturities: 7 days or 84 days. When the swaps mature, the Fed collects its dollars, and the other central bank collects its own currency. The Fed books these swaps on its balance sheet in dollars, at the exchange rate in the agreement.

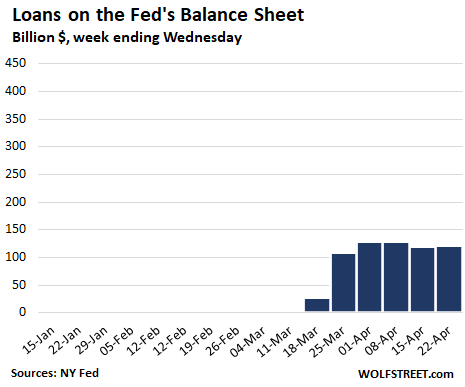

“Loans” to SPVs & Primary Dealers level off.

The line item on the balance sheet labeled “Loans” represents the Fed’s loans to Special Purpose Vehicles (SPVs) it set up, and to its Primary Dealers (the big broker-dealers and banks the Fed does business with). By using SPVs, the Fed can buy whatever it chooses to, because legally, it just lends to the SPV, a separate legal entity that then can use this money to buy whatever the Fed wants it to buy, or to re-lend the money against whatever collateral the Fed deems acceptable. Congress, which could stop these schemes, applauds them.

When the Fed first announced its alphabet soup of bailout programs, the “loans” ballooned. But over the four weeks since then, they have remained essentially unchanged, currently at $122 billion:

The Fed splits these loans into categories:

- Primary credit: $34 billion, down from $43 billion two weeks ago. Expanded to include “fallen angel” junk bonds. But since the expansion, the balance has dropped and the Fed hasn’t bought any fallen angel bonds.

- Secondary credit: $0. Designed to purchase corporate bonds, bond ETFs, and even junk-bond ETFs. None were purchased, but the Fed’s jawboning about it was enough to trigger a massive rally in junk bonds and junk bond ETFs.

- Seasonal credit: $0

- Primary Dealer Credit Facility: $32 billion, down from $36 billion last week. Amounts the Fed lent to primary dealers to buy stuff with. After the initial burst, nothing.

- Money Market Mutual Fund Liquidity Facility: $49 billion down from $53 billion two weeks ago. This is the money-market fund bailout where the Fed’s SPVs bought corporate paper and other short-term assets that money-market funds normally buy. After the initial burst, nothing.

- Paycheck Protection Program Liquidity Facility: $8 billion. Showing up for the first time. This is where the Fed lends to the SPV to buy from the banks the loans they have issued to “small businesses” under the PPP program.

So over the past four weeks, the Fed has not done any of the things with these SPVs and Primary Dealers that the markets were raving about it would do. It didn’t buy junk bonds, it didn’t buy ETFs, it didn’t buy stocks, it didn’t buy old bicycles. But Wall Street sure loved raving about it.

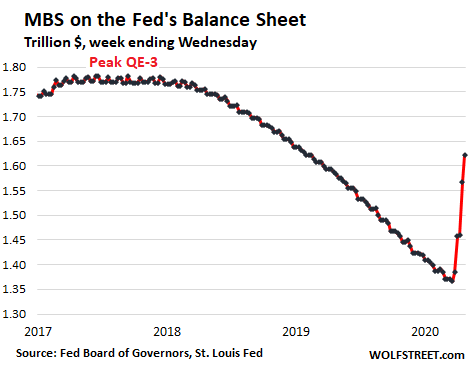

MBS purchases get tapered.

The Fed has slashed its purchases of MBS over the past three weeks, as reported by the New York Fed transaction summary (for the weeks ended):

- $157 billion (Mar 25)

- $145 billion (Apr 1)

- $109 billion (Apr 8)

- $58 billion (Apr 15)

- $56 billion (Apr 22)

MBS trades take a long time to settle. For example, all of the $56 billion in MBS the Fed bought this week will settle in May. The MBS the Fed bought last week will settle variously in April, May, and June. But the Fed books the trades only after they settle. So the Fed’s balance sheet lags by some time the actual trades.

Something else is different with MBS. Holders of MBS, including the Fed, receive pass-through principal payments as the underlying mortgages are paid down or are paid off. Due to the current boom in mortgage refinancing – 75% of all mortgage applications are now refis – these pass-through principal payments have become a torrent. Just to keep its balance of MBS level, the Fed would need to buy a significant amount of MBS.

On the Fed’s balance sheet, MBS increased by $54 billion to $1.62 trillion, down from an increase of $108 billion last week. This $54 billion increase is a mix of MBS trades that the Fed did in prior weeks and that just now settled, minus the torrent of pass-through principal payments:

The Fed has stated last year a number of times that it would like to get rid of the MBS on its balance sheet because they’re cumbersome to deal with for monetary policy purposes. And it was getting rid of them until the MBS market started blowing up in early March. That’s when the Fed held its nose and started buying them again.

If…

The Fed has printed $2.26 trillion since March 11 to inflate asset prices and bail out asset holders and Wall Street. If the Fed had spread that $2.26 trillion equally over the 130 million households in the US, each would have received $17,380. But this was helicopter money for Wall Street and the wealthy that were losing part their wealth in the sell-off. Those are the folks that matter to the Fed.

The gut-wrenching tally balloons. Gig workers and contract workers are starting to be included. Florida tries to catch up. Read... Week 5 of the Collapse of the U.S. Labor Market

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

> It didn’t buy junk bonds, it didn’t buy ETFs, it didn’t buy stocks, it didn’t buy old bicycles. But Wall Street sure loved raving about it.

Yet people everywhere but here (though I have my suspicions about a couple of folks) continue to believe it lol

~1.3% of the bonds in HYG are in default, while its down ~11% from ATH: (default OILG 7, TELE 2, N/A 1, RETL 4). One can only imagine what will happen when the default rate hits 10% (O&G makes up like 10%) lol

Don’t worry the Fed will buy the junk bonds, they are just waiting for the right time. The Fed is generous and they have the best traders working for them.

And will matter jack shit for protection leg holders of CDS who will get that check under a technical default :P

Jerome can buy all the trash he likes! lol

It would be useful if there was an internet site that tracked upcoming large bond maturities (by company) on a calendar.

I know this can be done by individual company – but it would be more useful if there was a consolidated online calendar that listed all companies’ maturities on a given day (in contrast to equities, there are tens of thousands of corporate debt issues).

That’s a great idea!

I just work backwards from the maturity date, which i can get by looping over the CUSIP against `’https://nga.finra.org/bondfacts/api/bond/%s?’ % (d[“CUSIP”])`, which i can get from any of the holdings files (between HYG and LQD, i look at about +3000 unique CUSIPs).

For April in HYG there are about 111 that will have coupons payments (everything is pretty much bi annual so a coupon payment will be near these dates +/- some days based on prospectus/terms/we for these bonds, some may be in default though like WLL), check out pastebin[dot]com/raw/9gvr3sND

119 for may: pastebin[com]com/raw/Vq3ZYdUT

19 of which are OILG, of which all are senior unsecured, a fed trading way under par (XOG, GPOR, QEP, OAS)

>>Tapered QE-4 Further<<

Yet this current situation on stock and debt valuations is surreal. IMHO, absolutely no fundamental analysis is needed except for an analysis of money inflow or outflow.

When I see closed companies like Tesla having its stock trying to rally back to new highs, I just need to walk away from even looking at this market. Companies like Tesla are going to need massive debt infusions.

All I want is for the gold price to correct heavily so that I can buy more. The government will find a way (legally, illegally, or covertly) to prop up every asset class except precious metals.

I love hearing the analysts say that balance sheets are now important. There are still some terrible balance sheets out there(CVNA, W, BA, etc) and market caps(PTON, TSLA, UBER, etc) at ridiculous levels You can’t even calculate E and PE ratios are close to historical highs. At least 26 million unemployed, over 6% of mortgages in forbearance and despite all this stocks continue to rally.

I have never seen a market this far divorced from reality.

To be fair, equity prices are supposed to reflect the net present value of many years’ worth of earnings (less a risk premium), so if you think the economic crisis will be short-lived and your company will survive, you can justify a high valuation. I personally have no confidence in that sort of math right now – the range of uncertainty is huge, so the risk premium should be as well – but that hasn’t stopped anyone in the past.

The machines calculate probabilities of jacking it higher by buying and pushing it to create a self fulfilling bet by examining delta and gamma of options.Predictions that I read say it could last until the 8th of May when it will turn the other way. They can get away with it cause the volume is so low.

could you clarify your point? Machines create a self fulfililng bet by options? I am intrigued.

Why a turn around May 8th? Won’t volume get even lower starting in May?

A collection of folks don’t seem to understand that the Fed is using BlackRock. Since the Fed is the ultimate guarantor it is reasonable to expect that there may be a lag in reporting. Further since the Feds interventions are at best opaque it is reasonable to assume that it is constantly selling vol in virtually every market.

You just have to think about the market a little differently. We always assume that the actions of the market are the input and volatility is the by product. Sort of like the large sprocket on a bike dictating how the back wheel revolves. The Fed knows this.

What if the Fed (with an unlimited balance sheet) sold vol in every market with abandon? Who would see it? How would it be booked? Does anyone have to meet a margin call?

Does anyone even notice the off balance sheet chicanery? Likely not.

The volume is low. Computer forensics would be able to determine where the trading is coming from and see who is buying and selling stocks and options. It would be interesting to see some of that data. Of Course the machines are probably trading over 80% since the volume is low. Main servers are placed close to the stock market so that the orders coming in can be front run. Whoever owns those servers like maybe BlackRock, and others does most of the trading for themselves and others. It must be harder to scramble the http address to maintain a front running ad vantage of milliseconds onds.

It is mysterious. I find it hard to believe that over the reported $200+ trillion in December 2019, derivatives gambles did not blow up in the banks’ faces. The MBS holdings purchased by the bank cartel called the Fed probably represent the most uncollectible MBS — MBS without the M. :-)

I will wait for the other shoe to drop. Could the Fed be using another mechanism to secretly give money or aid to the banks and financiers? Maybe, it is having its foreign, allied entities help them in exchange for future reciprocity?

Once more nice work by Wolf !

Just a question:how do we know what SPVs and Primary Dealers have bought

We know that they have bought nothing in four weeks.

Thanks for the reply. I reread your previous article and found this key sentence:”Those loan amounts haven’t moved in four weeks”. Market buyers are probably betting if market falls again, fed will provide more loans to support the market. With economy still in shutdown mode worldwide, if anyone buys based on fundamentals would be worried at this level. But with fed’s put there, nothing to worry! (as if)

Is this 2.2 trillion really a give-away when the Fed is buying mostly treasuries? I feel like I am missing something. How is this the same as handing out cash?

DC issues debt, hands out cash and the Fed converts the debt into new dollars which are conjured out of thin air through nothing more than accounting entries when the Fed “pays” for Treasury securities by crediting a bank with new reserves. Much like being able to pay off personal debts, meaning whatever was purchased with the proceeds, by logging onto a personal bank account and adding zeros. Of course that would be illegal because doing so would be, for all intents and purposes, stealing wealth from and damaging the wellbeing of everyone else.

Cruiser,

Right…and let’s not forget how the intl swap lines appear to compel additional Fed printing/theft in order to accommodate *foreign* printing/theft (in the name of FX rate “stability”…)

The dollar swaps peak my interest. Just print sovereign paper and exchange for dollars? This is QE, the UNIVERSE! Forex is a mystery to me, I know you can lose your ass playing it. How is this all going to unfold?

AB,

It would be helpful if Wolf would chime in, but it does seem to me that that the Fed’s intl swap agreements do chain its course of action (print!) to actions determined/initiated by *foreign* gvts (print!) – the underlying logic being that if foreign trade partners print (and the US does not proportionately), then the dollar would strengthen (presumably the presumed negative outcome for the US, that justifies at least the possible partial surrendering of us monetary sovereignty).

I know that Wolf has indicated that the intl agmts are used to facilitate the repayment of foreign issuers’ dollar denominated debt obligations (although there is a huge private FX mkt that could do the same thing…if at a higher price…) and that is likely the case. But I think the swaps can/must also operate to chain US dollar supply to monetary decisions made by swap partners.

Like so many gvt financial policies, the swap agreements seem calculated to attempt to maintain a pre-C19 status quo ante (FX rates in this case, pre bust equity valuations in other cases) regardless of the collateral harm imposed upon innocent/wiser parties.

My general recollection is that the details of such intl swap agreements had to be pried out of the Fed by legal action post-2009 – indicating that the Fed knows its actions in this area are likely to be hated by a lot of Americans.

Monetary policy: the Fed prints money on its own account which is distributed to the private sector via the primary then commercial banks to customers who spend it.

Fiscal policy: the Fed prints money on account of the US Treasury which is distributed to the private sector via the primary then commercial banks to customers who spend it.

But the Fed is an “independent agency” of the US govt. So what is the practical difference?

No difference in my book.

And yet many posters here think the Fed is run by Cabal of bankers…as opposed to a coven of politicians.

What’s the difference cas??

Both are just paid puppets of the oligarchy that actually owns and rules the world, as they should, if for no other reason than their long, very very long POV, versus the very short POV of most of the rotten CEO of modern corps, betraying the trust of both shareholders and employees.

People laughed at me a couple decades ago for trying to get them to understand how the oligarchs, whose prime SW USA properties were stolen by the upstart ”yanks” in 1848, etc., were working, slowly and carefully, and with centuries of time, to get back what they lawfully owned in accordance with the decrees of the Pope, etc., etc., going back to the 16th century CE. These folks are quite accustomed to playing the ”long game”,,, having been doing so since before the last time the millennia ”rolled over” (1,000 CE) when they had to complete the job of taking back what is now referred to as “Europe.”

C’mon folks, Una especially, ”lighten up!”,,, its gonna keep on keeping on for eva, and we the peeons can only hope they, the rulers, let us keep some more of our earnings, eh

It is run by a cabal of bankers.

That the politicians support the Fed doesn’t change the Fed’s first priority, which is to save the bankers from all dangers.

Coven is a group of witches. But I’m no an expert.

My understanding has been that the government issues new debt thru the treasury department creation of bonds. The primary dealer are issued the bonds. The federal reserve will buy the bonds with newly created electronic cash that did not exist before from the banks. Thus the banks are given free money. In addition, I believe they receive compensation for acting as a conduit for the pass thru of bonds to the federal reserve.

Correct

Look again Karen, I think you read that post to fast.

I can’t help but doubt this. If the Treasury issues Bonds, it is to get money. The money must go to the Treasury.

How it gets there, and the amount skimmed I don’t know. But I call propoganda on the primary dealers getting free bonds that they can sell to the FED and thereafter keeping the money.

Thank you, that’s the part that was missing for me. I didn’t realize that the primary dealer hadn’t paid for the bond before s/he sold it back to Jerome.

I was thinking that everyone who sold a bond to the Fed had, in fact, purchased a bond.

Yikes!

Your welcome.

It sucks but that is the most corrupt way of the world. The categorical imperative of tyranny and the unequal distribution of wealth.

Joe,

i think you are closer to actuality. The Primary dealers may be consigned the bonds, but I would bet that funds pass through them to the Treasury. Why would the Treasury issue bonds for free?

I can’t help but doubt this. If the Treasury issues Bonds, it is to get money. The money must go to the Treasury.

How it gets there, and the amount skimmed I don’t know. But I call propoganda on the primary dealers getting free bonds that they can sell to the FED and thereafter keeping the money.

The treasury is in the loop from money created by the fed. The banks purchase bonds from the treasury, and the fed buys the bonds form the banks.

The banks take the newly created money plus extra for being conduits, and buy other things like stocks, places in the Hampton’s, etc.. The fed also buys other risk assets not created by the fed, but often created by the banks themselves and large companies, like mortgage backed securities. It is a feeding loop between the treasury- banks-the fed-large companies-and the wealthy.

Derivatives, swaps, repo, etc..; their are a lot of instruments that help create inflation wealth for the rich and poverty and stagnation and repression for the masses. It is difficult to grasp the extent of it all. The awakening is mind altering.

@ Implicit –

Fair enough. Makes sense.

Junkie financial markets are rather high from the enormous hit but they will come down and be looking for an even bigger dose of their preferred central bank conjured substance soon enough.

When Bernie Sanders proposed Medicare for all they crucified him claiming it would cost $1 trillion over the next decade.

But now, printing twice that amount of money for the rich in less than 2 months – not a problem.

I think we have a clear idea of who’s important in this country.

Yup and yet any chance for real positive societal change now seems to have gone – the USA has, once again, Hobson’s choice when it comes to picking its leaders.

And dont forget MedicareForAll costs about 60% of any alternative healthcare so it would have SAVED us money, not cost us. But every question he was how will you pay for it, not what will you do with all that enormous savings?

Why do we need Medicare for All when Clorox Chewables cure everything?

Sad part of the stupidity is that there will be some out there that ACTUALLY try it out because he discussed it ???

Island,

You mean like the Dem operative in AZ who quite possibly murdered her husband in the “famed” fish tank cleaner episode…and then pre-emptively used the “Prez made me do it” defense?

Google it…there is a *lot* more to such stories than the one sided mythos pumped out by the MSM/DNC.

New trump hat motto “inject it to disinfect it” -the new cocktail of clorox, mr clean and fabulosa

Cas127,

Who said anything about Dems or Republicans? I am talking about nonsense blabbered from the podium daily by a narcissistic fool. Why are you so invested in pointing to red herrings?

Idaho-everyone has their shtick, that, given the consarndness of human nature, will always appeal to some percentage of the general population. P45 has his, it seemingly has a hidden (well, one I can’t detect, anyway) ‘context’ that resonates with Cas.

Strongly suggest hesitating before ingesting whatever P45’s nostrum-du-jour may be…

and-may we all find a better day.

I forgot where I saw the article, maybe it was BI originally, but the idea was bundling a form of UBI with socialized healthcare. One of the major criticisms of socialized healthcare without copays or deductibles is the disincentive to services rationing and therefore maybe there would be the dreaded massive wait-lists etc.

Well if you did a sort of inverse deductible, where healthcare services costs came out of your already covered “deductible” then with the exception of maybe a copay still, you wouldn’t pay excess costs. If you stay healthy though and don’t need medical care then at the end of the year, the inverse deductible (let’s say $5k or $10k) that’s left would get paid to you as income.

It would be like UBI as a reward to people who stay healthy and don’t eat crap all the time and keep the costs of both programs down, paying out part of cost savings as an incentive for a more efficient system and responsible behavior. I don’t know, maybe I just like the idea of southern deep fried Twinkie addicts being mad about it.

Well said.

So saith Michael Hudson

Amongst many others. Including the raw data.

Would rather have them buying junk then our treasuries! Then we could bury the FED with all the junk.

The Fed “buys” assets with fiat currency conjured out of thin air which are IOUnothings. The new currency isn’t a promise of anything hence the Fed has no liabilities in any practical sense (despite the terminology they use). The Fed can’t be buried even if it buys bad paper but the Fed can absolutely debase our currency and destroy our hard to create wealth; at least to the extent we place our wealth in dollar denominated financial paper.

So, are we ready to redefine “wealth?”

My bottom line as far as “health” goes in America:

“In America if you are healthy you are wealthy”!

Period.

Cruiser said: “The Fed “buys” assets with fiat currency conjured out of thin air which are IOUnothings. The new currency isn’t a promise of anything hence the Fed has no liabilities in any practical sense (despite the terminology they use).”

____________________________

Well put, and absolutely correct. The sad thing is, some of the smartest people I know almost willfully fail to recognize this, and it is SO DAMNED SIMPLE.

What’s new ? The Fed has been plundering the dollar for 107 years. What cost a penny in 1913 now costs over a dollar. Nobody is getting rich off this. Your home goes up in value, you sell it, buy another that costs the same. The only thing the Fed has been successful at is raising the cost of labor in the U.S. so labor cannot compete against emerging economies. They are the root cause of the labor arbitrage that is going on today.

New-reckoning you personally are overpaid? If so, you’ve explained why. If not, why not? Just asking.

And may we continue seeking that better day.

As the wealth and income gap once again accelerates away after this crisis passes, I wonder if the American populace will finally catch on to the fact that they’re being plundered?

Or will they be happy with more crumbs from the table?

The poor are always happy with crumbs they are so easy to bribe

The poor can’t afford to pay armed hessians to do their bidding.

can they afford Seven Samurai?

At this point, asset owners owe UBI to the rest. At the very least.

Wondering when will regular Americans start demanding Universal Base Income. If there’s $ to keep the wealthy happy, there’s $ to keep the rest happy as well.

Printing money does not add one single, real, utilitarian asset to existence…so in the end…nobody is going to be happy…just expropriated.

This is true. However, class warfare is already apparent and the wealthy are winning by gaming the system to their advantage. They don’t play by fair rules or want to truly have free markets anyway. Privatize the gains and socialize the losses has been the case for a long time. The majority needs to teach the wealthy they won’t put up with being trodden on. Demanding UBI is a way to punch them in the face.

The happy ones will be the beneficiaries.Read Rhodiums comment above.

Wait, you’re a critic of printing money for Main St yet approve of the trillions of dollars which The Fed has low-key printed for QE Infinity bail-outs of banks, hedge funds, real estate investors, and other wealthy risk-takers?!

As others have commented, I think Main St would be happy with getting $18,000 checks for the Trillions given so far.

That said, Utilitarianism shouldn’t always be the end goal, BTW. More often, our laws are Kantian… based on motives and right/wrong.

And BTW, a UBI is taxpayers paying themselves, whereas QE Infinity is a transfer of wealth from taxpayers (Treasury i.e. Main St) to Wall St and some risk-takers who deserve losses, as well failures which otherwise should’ve gone under

…but are instead given Fed/Our support to let them double down on losing gambles (just win it back on the next hand)!

I find your comment ironic, because the bigger picture, Moral Hazard, is in fact the OPPOSITE of Utilitarianism.

MD

Exceptionally happy, (pun intended).

Maybe you all and Unamused are completely correct about american’s being EXCEPTIONALLY… pathetic and taking more and more of this.

i watched PLANET OF THE HUMANS last night and i’m reading 1973’s GLORY AND THE DREAM by William Manchester and it starts with Hoover and his approach to the Depression, which his friends took out billboards to say it was already over in 1932, and it all sounds the SAME as right now:

“he created the Reconstruction Finance Corporation to prop up the banks, and agreed to spend twenty-five million dollars on feed for farm anmials on the condition that a bill authorizing $120,000 for hungry people be tabled.

“This sounds absurd today [1973!], but in those days sound men accepted it as the revealed word. ‘Federal feeding would set a dangerous precedent,’….it would be too much like the dole…”

i see why James and Unamused think i’m insane wrong and/or in la la land. maybe they’re right. maybe nothing will change because people are sheep who only venture out of the cages to go back in and feel safe… until billionaires are alone, flailing around loud and ineffectual like Black Knights, armless and legless on their own yachts and islands and bunkers.

KL,

Hoover is an easy target but the truth is the American financial system was flawed from the beginning. We needed a central bank, like the Bank of England, but state’s rights got in the way. The congress, then like now, exploited division for their own purposes, until the bankers finally rendered them powerless under Wilson in 1913.

The financial history of the US is a fascinating puzzle. Maybe it was obscured on purposed, or it simply fragmented naturally along the lines of private interests. There are a lot of bad guys in the story and a lot of good guys doing bad things too.

What we are seeing now are the remnants of a system which has always been broken. When someone like MadMaxine can rise to the top of the financial food chain, the system is beyond repair.

Pay more attention to James, give him a kiss from me.

oh Petunia, My Dear Older Sister, you’re making me CRY. i told James what you said as he’s just getting out of the shower. we just had a loooong morning talk about ALL THIS and now Richard Wolff is on with his take but his boring collective communistic endless meeting vision for his same-crap/productivist future bores and uninspires and even horrifies me for its lack of …JOY or new vision.

but i don’t want this to be another Standing Rock Fantasy for me./ how do i make the future i see, so???

much of this i don’t speak of the details online because they killed Jesus and MLK and other Jesues just for saying “be nice,” so forget full on insurrection, boycotts, and simply advocating a vastly stripped down entrepreneurial “fuck you” self reliance: you could be TOAST for that because it’s downright Unamerican.

i had a fantasy of getting on James’ motorcycle and riding to wherever you are whenever this is over, and sitting at your feet in a park while you tell me things because when i first read you here, i knew you’re gonna be most powerful and dangerous OFF-LINE as you’re gonna inspire real smart moves, and be The One to Know.

i came out here in 1994 because i had the same feeling about these crazy fan letters i started to get from an elder freaky cartoonist, Kris Kovick (later cancer-ridden, blue, and finally suicided), and i came out here with a one-way plane ticket and saw her make an entire scene, practically single-handed and she made grown swaggering, odd, loud women of us all on her way out.

Thanks, Petunia. / Thanks for being there and popping up when i need you most.

but funny that you say the SAME thing James just said about history being obscured.

he’s also been trying to look up Sweden and how they so casually and easily (???) changed in the 1920s from a similar elitist/raping set up as ours, to what they have NOW.

and if they’re so “paternalistic,” why is the government treating them like ADULTS now? what’s truly going on now with covid spreading over there?

Thanks for existing, Petunia. you always remind me how much i LOVE being a full on GIRL. and you’re so bad ass. you suck up to NO ONE. i trust you like i trust Kris. i need new women to luck up because honestly i’m running out of inspiration on how to continue this Girl Thing.

xxxxx

also, to any little wild freaks sitting idling, reading this and waiting for your moment, one thing i DO know is that it never takes as many people as you THINK to incite change or start trends.

people ARE followers… it’s just reality… and people will try to exploit that to sell them or convert them (new religions and cults are also destined to show up after these collective moments of Profound Questioning)…

but this monoculture has made truly odd, interesting people seem completely extinct, even to me, a freak myself.

we must remember that the beats, punk, hip hop, the hippies, civil rights activists, and the 1990s art and music scenes were all considerably TEENY TINY compared to the boring tedious mainstream.

same again. / that’s all i needed to REMIND you. i’ve got Corky and Basul and James now, and feel like i’m already TIGHT. when i got here, my main inner secret family tribe was just 2 other people, Kris and Mark, for years. off them and our energy, long walks, and secret jokes, i wrote/drew my first 4 books.

x

Where’s that blasted TALF? Have they armed it with a cloaking spell this time?

The Ancient League of Auditors has mobilized and broken out their arsenal of Pure White Light Transparency sabers…

Apparently, the FED only buys AAA-rated bonds within the CLOs under TALF rules. If Moody’s/S&P actually downgrade bonds comprising the CLO tranches to speculative, the CLOs themselves will become unbalanced and too toxic for the FED. In that case, will the FED allow them to default?

Right now, bonds with a B3 rating or worse account for around 20% of the CLO on average, but that number is likely going up. There are 155 CLO’s under review by S&P and Moody’s is reviewing CLO’s to see which bonds to downgrade and we’ll know in 90 days.

1) Since Jan 2017, for 3Y, USD is trending up.

2) In Mar 2020 USD jumped up fast, in a sling shot, on large high end bars,

above Jan 2017 high, producing an Up Thrust.

3) USD behavior is very volatile. Bubble down/ bubble up.

4) Brent-WTI became very volatile. Zero on Mar 9th, zero again on

Apr 3rd , up fast to 15 on Apr 21st, – when WTI Futures collapsed – and settled @ 8.29 yesterday.

5) US 10Y since Oct 2018(H) @ 3.25% plunged to a selling climax on

Mar 9 2020 @ 0.4%, up fast to 1.27% on Mar 18 and settle yesterday,

on Apr 23 @ 0.613.

6) TIPs went negative. From 1.1% in Oct 2018 to (-) 0.57% on Mar 6 2020

up fast to +0.62 on Mar 18 and down to the support line, to (-) 0.56%

on Apr 15.

7) On Apr 15 2020 US10Y @ 0.75% minus TIPs @ (-) 0.56 = +1.31%.

8) On Apr 15 2020 the expected inflation in the next 10 years is 1.31%. On Apr 22 : 0.613 – (-) 0.43 = 1.04%.

9) Something is going on. TIPs and WTI in Selling Climax and USD in

a Buyind Climax.

10) Covid19 created a global panic and distress and this is what we get.

11) Is TIPs and WTI in accumulation,building a cause for future inflation,

or distribution for global deflation.

12) We don’t know it yet, because building the cause have just started and we are in the most volatile part, the left side of the trading range, if

its a trading range.

I for one look forward to Michaels posts.

Wolf…

Can the lack of REPO activity be traced to the attractive use of the Discount Window.?

The Discount Window is supposed to carry a 50 basis pt penalty with public transparency. Neither seem to be in place.

The posted rate is .25%

Banks certainly don’t need to borrow in the repo market — they can borrow at the discount window. But the repo market is big, and the Fed is only a small slice of it. So the repo market itself is functioning normally at normal volumes. It didn’t die. But the Fed is simply offering terms, on purpose, that are not good enough for counterparties to accept. That’s my take.

Wolf,

To me, the interesting question is why/how the repo/short end demand has evaporated.

Pre C19, I would have guessed that borrowing-short-cheap to finance lending-long-expensive was too baked into the financial/hedge fund world (albeit idiotically) for it just to *stop* without massive dislocations (look at the massive pre C19 hoops the Fed went thru to keep repo rates ultra-low despite massive mkt pressure the other way).

But now, it looks like the borrower side of the repo mkt is doing less business than a dine-in fondue restaurant.

I suppose it is possible if they in turn have simply shut down all re-lend/lend on operations…but what are *their* borrowers doing for cash now?

It is kinda of hard to kick out just one support of America’s “Great Chain of Baloney Debt” without triggering a cascade failure somewhere down the line.

Perhaps there is so much Fed injection into the areas that were using the REPO facility that there is no longer a demand.

Just in case, like keeping a $100 bill in your shoe.

All is backwards and upsidedown in The Land Of The Fed. Instead of being proud it’s jawbone worked and junk bonds are fabu again, it should do the opposite and clear the zombie wasteland so as to set the stage for actual, real savings investment and capital formation. It should also immediately raise rates to 3% pending a determination of a normalized rate.

Couldn’t agree more.

How about allowing stocks to reach their true value instead of always always always intervening for a 20% decline.

1) Fed Total Assets jumped above the previous high to $6.57T.

2) Towards the peak Fed Assets was shortening the thrust.

3) There will be a backup, for sure.

4) This BU might be shallow, or ultra size like the Oct 1987 BU.

5) The trend is up. After the Fed will take a break, to fill its gas tank, the trend will resume.

6) Another option : the $6.67T is a Buying Climax. Assets will be in a trading range to build a cause for distribution.

7) By the end of the trading range the markdown will start. Why?

8) Inflation protection. Or :

9) The Fed will buy US treasuries, US debt, for 30-50 cents/dollar, during deflation.

It does not look like that Fed would be able to fund anything, but treasury purchases. With 4 trillion deficit projected, zero returns, major buyer like China alienated and most petro-states and beyond selling to prop up budgets and currencies, there will be few buyers out there other than Fed. And huge deficits may continue to a number of years. And those 4 trillion is going to be all new debt, but old debt may also need to be purchased to keep yields from exploding. Just add 3.5 trillion (less what already has been spent) and you will get 10 trillion balance sheet by the year end. Quite ugly for USD.

There will be of course money printing fever across the world, but China does not seem to print as it used to during the previous crisis, European also drew the lines for ECB bond buying and recovery fund, which would top 2 trillion Euro, but hardly more, and only JOB has stated that it will launched unlimited bond buying program. So the USD will only survive devaluation relative to other currencies only if the cumulative printing by other central banks would be on par with that of the Fed.

The question now is: with the production stalled across the world and all this new money created, how long it is going to be before inflation spikes in those sectors, where demand is largely preserved, such as food and telecoms.

“The sharply reduced increases confirm that the Fed is following its various announcements over the past two years that during the next crisis – namely now – it would front-load the bailout QE and after the initial blast would then taper it out of existence, rather than let it drag out for years.”

That’s a nice theory the Fed has there, that frontloading will allow it to back off later.

As the weather it is true or just theory and wishful thinking is another matter entirely.

If the Fed couldn’t back off the backloaded bailouts and QE even after 12 years when it clearly had opportunity to do so, why should we assume it will back off a very much larger frontloaded injection that by all accounts is digging us massively deeper into the very same addictive affects if the previous much smaller one it was unable to back off from?

“taper it out of existence” has happened because jawboning has worked. IMO, a financial system that depends on jawboning and kitchen sink measures seems to be one hell of a fragile system. So basically it is like it works till it doesn’t. Such a fragile system will prove Wolf’s theme of “nothing goes to heck in a straight line” correct (down and then up ) but then one fine day it just might go down in a straight line and not get up. When will that be? May be sooner than we imagine given the destruction coronavirus has wrought across the world. After all how long can you hang by a thread.

You can’t taper a Ponzi Scheme

“As the weather it is true or just theory and wishful thinking is another matter entirely.”

As in, can’t predict the weather?

Yes, Shirley that’s what meant…

Money printing only goes so far. Companies with no employees and no customers are in reality worth nothing. Now they are going to force people back to work to keep asset prices up. Of course the MSM will claim its all for mental health, so families can pay their bills and get on with their lives-not just to keep billionaire’s happy. By all rights, the Dow should be below 10,000. So you have to hand it to them, they have kept this charade going. Still, you can only strip out wealth from the general population and its government for so long. How long is the question?

Good comment, Augusto. I would also feel much better with a lower Dow, and would be happy enough at 15,000. It’s almost 24K this minute. It is rising. How can anyone believe these numbers are reflecting reality? Lockdown has only been what? 6 weeks? What happens when there is a resurgence of C19 cases due to premature opening of services?

There will be lawsuits aplenty.

My hunch is that policy choices around reopening are all managed around a delicate balance of political considerations vs. litigation risks — in other words, a massive CYA exercise

In fact, it’s already happening:

“White House pressing ahead with plans for a “liability shield” that would protect employers from lawsuits related to coronavirus…Biz executives told White House that liability concerns could hamstring Trump’s push to “reopen” the economy”

https://www.washingtonpost.com/

Trump won’t accept responsibility for the re-openings. He’s “leaving it up to each state’s governor” to CYA (cover his a$$).

Just watch… as we re-open, he’ll claim any credit for success, but pin any blame for problems on the States.

Yeah, it’s pretty shocking. There’s an article on MarketWatch today by Hulbert discussing expected future returns based on current valuations and the projections from the Value Line Survey. And it’s based on analysts long-term price targets. The VLMAP they call it. It’s a long[er] term 4yr forecast and historically has decent correlation with actual returns similar to CAPE or MarketCap/GDP or whatever.

The article today indicates appreciation expectation has jumped from -1.5% a few months ago to +6% now (and +13% at the low). My initial thought was that this was just based on valuations and assumes the long-range projections haven’t changed much, we’re now just at a lower starting point.

But if you actually go thru the numbers and figure what the implied 4-year stock market target was a few months ago and what it is now, you find not only do they completely disregard any effect of the Covid pandemic and shutdown but they are actually currently projecting the market will be at higher point in 4 years than they were a few months ago by around 10%. This analysts have apparently watched this pandemic and economic cliff unfold and RAISED their price targets!

The only explanation I can see is that money printing is actually more important to stocks than a functioning economy. Crazy.

There’s no evidence that interest rates matter for capital investment. As for housing, lower rates bid up house prices, neutralizing the benefit from affordability. So I think you’re exactly right; money printing is more important for stocks than a functioning economy.

They don’t make real products, just financial instruments that make them rich from nothing created.

But they do create havoc on the products that are made cause they are bought with inflationary induced liquidity that creates inflation and repression for the masses by inflating assets and repressing interest rates.

Money needs to be tied to real base elements of finite magnitude like precious metals, rare earth metals, elements that make things: like iron, steel aluminum, titanium. nickel, copper etc… and even oil.

The neural learning algorithms that are used to front run small investors, and push markets where they want should be put to use productively to keep track of the value of money by monitoring the use of these elements that have real value. Tear it down and start over.

Or just use gold and silver to to keep it simple ;>[)

Jawboning seems to be working in 2020 just like it did in 2012.

How long before people get sick of earning .7% on a 10-year?

The Fed is going to lose control of interest rates at some point.

I just don’t know. This is my favourite grouse. People just do not seem to wake up. Look at Europe – they are eating negative interest rates. And here too no nothing against the Fed even though the interest rate was pinned to the floor for a decade nearly.

When does this playing on a string collapse is anyone’s guess. But should it happen it could bring the world down in a such a heap that our present lockdown, job losses, businesses going belly up will appear like a walk in the park (as 2008 appears today). The sad part is people who had nothing to do with the nefarious activities of the Fed and its no-good cohorts will walk away probably even with accolades for having saved us from something worse.

Even today the bunch of lunatics at the Fed are banking their salary at the end of the month while ordinary, honest, hard working people are being shafted. I am not saying the Fed is responsible for the coronavirus but it is singularly responsible for the mis-allocation of capital since the Greenspan days for which no punishment will be punishment enough.

KPL:

A mis-allocation of capital likely created the virus.

So central bankers aren’t off the hook!

Fed Total Assets :

1) From Feb 2009(L) @ $1.9T up $2.6T to Jan2015(H) @ $4.5T.

2) From Sept 2019(L) @ $3.8T up $2.8T to Apr 2020(H) @ $6.6T.

WTIC :

1) From the 2014(H) to a Selling Climax on Mar 2015(L) @ 42.03. Its a support line

2) The response came fast on May 2016(H) @ 62.58. Its the resistance line.

3) Mar 2015(L) @ 42.03 was tested several times during the last 5Y.

4) From Oct 2018(H) @ 76.90 to 42.36 in Dec 2018. WTIC survived.

5) WTIC next lower high was a thud that lasted until Jan 2020(H) @ 65.65. From 65.65 it plunged in x5 waves down.

6) When WTIC breached the support line @ 42.03 it left behind a huge

gap.

7) WTIC waterfall collapse ended in Feb 21st @ 6.5. It might be tested again if the next paper contracts will be negative.

8) WTIC testing will take some time. Te first phase on the left is very volatile. WTIC canbe in accumulation for several quarters, or years.

9) Once WTIC jump, the Fed Total Assets will adjust.

10) The Fed have plenty of time to prepare. During the next phases will be over we witness the bloody transfer of oil assets from the weak to the strong hands.

11) During WTIC accumulation phases, other assets might go down.

From the Who Gives a Sh*t files:

New Castle County says wastewater analysis shows 15X’s more COVID-19 cases than confirmed tests

“At a time when unemployment is skyrocketing, we’re trying to figure out how to make basic ends meet,” said New Castle County Executive Matt Meyer. “So one of the things we’re doing is looking everywhere we can possibly look to get more information about this invisible enemy.”

One of those places, according to Meyer, ended up being poop.

Tracking coronavirus

WDEL’s got you covered: For all of WDEL’s latest novel coronavirus COVID-19 coverage, including a list of symptoms and important numbers, locations for confirmed cases, and stories relating to the pandemic, visit WDEL.com/news/coronavirus.

After New Castle County Public Works Stormwater and Environmental Program Manager Mike Harris teamed up with Massachusetts Institute of Technology’s startup Biobot Analytics, officials studied samples of waste matter at a pretreatment center for the sewer system. According to estimations provided following bacterial testing at the plant, the county appeared to have a staggering number of novel coronavirus COVID-19 cases–15,200 in a catchment area that serves about 100,000 individuals in an area of the county.

“I want to emphasize it is an imprecise estimate, but their imprecise estimate is that there are approximately 15 times the number of positive cases as there are confirmed, positive tests, Meyer said during a Zoom call with reporters Thursday. “Again, emphasize this is a new technology, it’s unconfirmed, but they have been doing it in various areas throughout the country, and our result is somewhat comparable…to the other areas around the country.”

https://www.wdel.com/news/new-castle-county-says-wastewater-analysis-shows-15xs-more-covid-19-cases-than-confirmed-tests/article_2570afb0-85a7-11ea-912f-13319352641f.html

Wolf, when you say the Fed is printing the money for Wall St. can you explain the mechanism used to get the money to Wall St.

I was always under the impression they were simply buying assets like bonds….

Jdog,

1. The Fed creates money (electronically)

2. The Fed uses this just created money to buy assets, meaning it hands this just created money to Wall Street in exchange for securities. Now Wall Street has this new money (cash) and can buy new things with it. The securities have been withdrawn from circulation and trading via the Fed. So there is now more money chasing after fewer securities. And this means asset price inflation — which is a gift to Wall Street.

How ‘secure’ are these securities? Even if these securities are worth there weight in ink, what business is it of the FED to support speculation?

I wonder what it means for our currency if the Fed is the bag-holder.

FromKS:

It means you will be the final bag holder!

And the bag will be empty!

Got it, they are skewing the supply demand ratio…

Furthermore, the dogs’ balance sheets contain less liabilities, thus less insolvency risk. Another reason that investors are willing to bid/buy their equity values higher.

WH/Treasury/Fed can thus re-inflate the bubble.

When you say ‘ SECURITIES” does it mean Company Stocks and ETFs?

I thought they were limited to buying BONDS only!

If yes, them they are openly supporting both CREDIT & EQUITY MKTS!

If the bond market dives again and/or the Dow lows are retested Jerome will buy and print anything and everything . Those SPV’s are nuclear weapons under the power of Dodd Frank and will be used . The more the talking heads talk about them the more they become normal and cuddly like a box of kittens. See how they purrrrrrr.. It’s an old tried and true propaganda trick called jaw boning . My brother in law gets drunk and jaw bones with no way to deliver. Government has the power to deliver and with guns if necessary .We all remember in the last Great Recession that fed told the world that everything was temporary and the fed would normalize after the emergency. We have been in a never expiring emergency since then and the rest of the world knows we cannot normalize.The fed tried and failed. The end game fiat cycle hand must be played out because the political price for failure, going forward, is now less than the present price for trying to normalize .Smart people are in cash and are telling others to not miss the Post Covid Dow Recession Unemployment Rally to 40k. As for me I might take a small cowardly stab at the QQQ in a short position if I smell blood.

I see this as very good news. We do have some serious defaults ahead among very large corporation’s bonds (and not just retail and energy), so this may be a pause. Still very good news for now. The wave of corporate debt defaults and mortgage defaults is a delayed reaction. This raft of bad news coming will keep a lid on the stock market for a while, maybe until sometime in Q3, then it is off to the races.

It’s amazing to me that the stock market really isn’t a reflection of the economy or of the performance of comapnies anymore. The stock market’s price is simply what the FED wants the price of the stock market to be. We’re now in a world where a council of government beurocrats just get to decide what the value of everything is by command decision.

The stock market went down too much in March so they declared it must go up. Then they got a bit embarrassed that it was going up too fast so they ordered it to halt. It’s amazing to watch them just decide where the price should be.

Capitalism in America is dead.

Totally agree. And they do this on the premise that someday they will seek normalization- just as soon as the crisis passes. The FED’s normalization policy barely saw the light of day before it was back to printing as usual.

Kas-Check! The ‘Shock Doctrine’ is looking more and more like the new century’s actual ‘normal’. Resiliency has become a null term.

Still, may we all find a better day.

Smoke and Mirrors IN, Smoke and Mirrors OUT.

How else do you run a ponzi ? But something tells me a lot of pensioners are going to see the light unfortunatly.

Good info Wolf. Question is if the market take another nose dive, do you think FED will stick to its guns and continue the taper off or all bets will be off again and increase the purchase?

One problem is there no magic bullets left anymore.

1. Already tax breaks were given to the corporations, which failed to trickle down to the people.

2. Corporations used that tax break money for stock buybacks.

3. Fed interest rates were already low around 2.5 but even more reduced now.

4. The longest bull market and economy was ready for a recession by the end of 2019.

5. COVID19 made the situation worse. Consumers are in trouble

6. What ever the fed does or don’t, stimulus, CARES, printing money and (not) QE, promises for more are not helping the current situation.

7. The patient is taking Viagra pop1, pop2 and more but there is no result. Most likely, the bird is dead.

thanks for that / found it and i’m gonna read it.

sometimes this site is JUST what i need to keep in it.

—

watch PLANET OF THE HUMANS / it was creepy scary good.

PETUNIA if you’re here, you were RIGHT about climate change being used for new capitalistic pies.

x

$2.2T includes $2500/mo federal UE benefits for 25M people, for 4 months (probably will be extended). Then the $1200/person checks. Then the hundreds of billions of small business funding to keep people employed.

Why does everyone ignore this?

Just Some Random Guy,

Every item you listed is what the US Treasury does, and it has to raise the money via bond issuance or taxation — meaning it has to get money from someone who buys the bonds or from taxation and then it hands this money to the recipients. This is fiscal policy.

This article was about what the Fed does, which just creates the money to do its thing. This is monetary policy.

It’s an interesting read on the thin air money that is being generated. With these policies both in use to such an extent, I wonder if one will eclipse another at some point. For example, at what point will monetary policy be used to a point where fiscal policy is completely irrelevant. I am assuming we’re very far from this point.

I am curious also about how some of these policies connect to one another. The most obvious example from above, the PPP liquidty facility, is that connected in some what to the fiscal policy that was put in place, the way I read this, is that the program is put in place by Congress, banks do the lending, but the Fed buys these loans back, placing essentially no risk on the bank. And then what happens after that if the business defaults on the loan (I recall that one provision was that the loan would be forgiven), so does that mean the Feds just let the balance roll off the books, and then the debt is magically vanished?

This is a very small piece from the looks of it, but is that how this would work? Then nobody, not even the taxpayers are on hook for anything?

I think the Fed is pausing the stimulus for a while to see the effects. I don’t think of it as a taper. It could be the dentist is merely changing his drill bit, or using his suction hose to clear away the blood to get a better look.

I have no doubt the Fed will do anything and everything until there is consistent consumer price inflation of 4% or more. Only then will the Fed consider ending its interventions.

The Fed showed its cards with the policy reversal in 2019. The perpetual easing policy now has full support of politicians.

Bobber:

Great comment. The only point I would differ with you is the belief that the Fed will stop if it sees CPI > 4%.

Rather, I believe the priority is to prop up financial assets and if that means painfully higher levels of inflation, so be it. The result will be tragic on us little people.

I agree with 1st paragraph.

Front loading? Tapering? Withdrawing QE? Temporary measures?

Right-o, Daddie-o. Just like it did for 2008.

The Fed will withdraw all these “temporary measures” just as Shirley as did those used in the 2008 financial crises.

As in: NEVER.

And if it tries, it will be confronted with the same circumstances that have previously caused it to re-juice the tool box of “temporary measures.”

The Fed is trapped and the trap was laid by the Fed itself. The new normal is here, it’s now.

Fed is printing money to bail out the speculators and insane risk takers. If those corporations borrowed money like Warren Buffet did, they wouldn’t need any help from fed. These speculators will take on more risk now (which they already have with record no of debt deals done) and screw taxpayers more later on.

These policies cannot produce inflation, except on Wall Street. They are actually having the opposite effect, per my post last Friday, which Wolf was kind enough to republish. They fund the hollowing out of the economy and accumulation of debt burdens that are unpayable.

You say that with a lot of certainty, Karen. They are adding huge amounts of dollars to the existing supply. They are supporting creditors and their questionable extensions of debt. They are favoring the reckless over the prudent. Inflation is a given. How specifically that inflation transmits to various things, assets or goods, remains to be seen.

Suddenly the US is sitting on a pile of junk bonds with no revenue?

I could live for a year on 17k.

What they used to call a “follow the Fed” strategy has now been re-labeled “the moral hazard trade”. I think the new name is much more descriptive.

Reagan proved trickle down economics is a failure.

The U.S. has to either open and finish the boomer remover

or provide basic income for about a year,

Somewhere around 2000 a month should do it.Nothing else

is required.

I wonder what kind of perverted sickness concocts the concept of “boomer remover”, could that be yet another mainstream media invention?

Mea Culpa MC:::

at 75 and now a ”PRE Boomer”,, FKA a ‘war baby’, I can’t help doing my best to twist tighter the drawers of the boomers each and any time I get the chance… and in case you are not up to speed on this ”issue” FKA as problem,,, they have been doing the same service to my generation for eva…

They have certainly tried to do so, from high school years when we war babies were predominate, to the last tired attempts of the boomers to achieve at least equality with their clear superiors/elders, which, of course, demonstrably, never happened.

What did happen was forgiveness from all of us older and wiser, and of course much better looking, etc., etc., to all of the younger, and hence, by definition sorrier boomers!

May the Great Spirits bless and guide us all!!

Forgetting $trillions of dollars in helicopter money for a second, can any of us mega-money-wise business experts spare a dime? WS gets thousands of readers of these top quality business summaries and its readers relish the articles and don’t mind the daily time to read them along with hundreds of comments. How much are those benefits worth? A dime?

If WS charged us that much each day, we would be paying $36/year and probably wouldn’t have all the ads popping up. I’d suggest WS post the first 3 or four paragraphs along with the comments, and let subscribers only read the rest and allow subscribers to comment.

I spend more time reading WS than Bloomberg, which charges 10X that much and has fewer comprehensive summaries or charts. Even the WSJ headlines are mostly stories, not analyses. So brothers, can we spare a dime?

Curious,

Thank you for your interest in how I keep my nose above water. Glad you’re enjoying the site and spending hours reading the comments ? If you don’t block the ads, you will see how the site earns money — through ads. If you block the ads, you won’t see that.

If you wish to support the site, you can always donate. That would be totally awesome. There is a little beer mug under each article. Click on it, it takes you to the donate page. Or you can go there directly:

https://wolfstreet.com/how-to-donate-to-wolf-street/

My site will remain open and free to all. And it will not block ad blockers unlike many of the big papers. I explained some of it here:

https://wolfstreet.com/2019/11/18/why-wolf-street-will-stay-free-and-wont-use-ad-blocker-blockers-but-needs-your-support/

Appreciate all the great reporting you do on your site. Certainly helped me learn about the financial system more than most mainstream site can ever come up with.

YES,,, first, and so far the only website I have ever supported freely, originally by simple cash donation, and, more recently by ordering a couple of the mugs, feeling, far shore, as mentioned on another thread on this site, those mugs would soon be ”collectors items”,,,

and I really hope that Wolf will do us, who favor larger doses of liquidity, a big favor and come up with some much much larger mugs, to hold the much much larger liquidity we are going to need to adjust to the ”new liquidity” post/after “the day when all the lines went straight to HECK” or some such…

ONE LITER mugs, at least,,, and we may need another set that will hold TWO Liters,,, just to keep even,,, eh?

Ill be honest. I read this site because I like looking at the underwear ads.

OK Wolf. This comment is the last freakin’ straw. With policies such as these I am forced to order a mug I don’t need (unused things I can ill afford, but so be it). I have decided to order the 16oz size in clear glass. PS: if you’re short on supply just send it when you’re flush.

Thank you!! People put the mug on their desk as objet d’art and as a reminder when things do appear to go to heck in straight line.

Plenty of supply still.

Fair point. So send Wolf some money.

I’ve been wondering if PM bugs are aware of this.

Unamused, if you’re here, i’m working on a cartoon for YOU because i think i’ve reached my maximum words-per-week already and can only think in grunts and images. and one’s cartoon’s been knocking in my head ever since you said Haiti.

cool… i haven’t been inspired to draw a CARTOON in YEEEEARS!!!!

i’ll send it to Wolf to post for you LATER. / wherever and whenever or how often he deems fit.

i was trying to blow off the idea, i get ink and white EVERYWHERE when i work, but it’s buzzing in my ear like a bee and it fits in with my job as an artist where i try to make a mockery of or undermine All This. sometimes you can’t SAY it.. you’ve gotta SHOW it.

later. right now i’ve got the magic nude sunspot for the next two hours. it’s all mine ’cause James rode to the Baker Beach to go nude in the water and sun again.

we lived like this BEFORE the virus y’all. you don’t need The Shit. going out on the beach without killing ruining slaughtering defiling exploiting anything and just being human in the sun nude and warm is what The Shit is supposed to make you feel like. it’s been hella twisted.

anyhow, Unamused… more art for you via Wolf later.

x

Looking forward to it.

Jerome is saying to foreign buyers, print your own money, I will give you dollars, you buy stocks, but don’t make my dollar any higher than it already is.

Of course, the “vital functions of channeling credit and supporting economic growth” leaves a lot of room for interpretation. That could mean channel credit early and often, regardless of the soundness and/or legitimacy of the enterprise.

That said, Wolf, you have helped me retain my *faint* hope that the Fed understands how hazardous is its current position, and will deploy these funds only as absolutely necessary. I think it’s far more likely that the borrowers haven’t completed the necessary bribes (er paperwork) yet…but hope springs eternal!

The one piece of information I would really like to see is the total amount of debt default in the US. Is that information available?

Relax. The Fed is just flattening the QE curve.

LOL – Nice analogy. QE is a deadly virus that is very profitable for some, so let’s avoid becoming immune and learn to live with it forever.

Forgive my possibly ignorant question, but I thought the ETF buying was being facilitated via BlackRock and the Fed directly?

They’re just managing it. They don’t own it. The funds are lent by the Fed to the SPV and the SPV does the buying. Folks from BlackRock manage it. For them, it’s another fund they manage. They get a management fee. That’s it.

These loans to SPV’s are supposed to make fed acting as a “lender of last resort to securities firms” which means the primary dealers can lend the loan out to clients to buy up eligible securities but its a voluntary act of the clients. But in reality, I’m curious if fed can ‘force’ the SPV’s and its clients to buy up the securities? I wouldn’t doubt it can. I read the autobiography of Alan Greenspan that during 1987’s crash, NY Fed would call up the banks and give them ‘hints’ to support the market or else……And given market has made a tremendous V-shape rebound after all the lending programs been announced, even when global economy is shutdown and no sight of reopening yet, fed’s invisible hand is amazing!

But what’s so different in this market ‘correction’ from 1987’s is, the market price doesn’t just get stable after fed’s intervene but it shoots up like no tomorrow! Fed’s job is not supposed to push up the securities price but merely to intervene to provide liquidity and prevent a fire sale of the securities market. In that sense, I think fed has failed in doing its job. It encouraged speculation and build up more leverage in the market each time it intervenes!

When my Springer Spainel cannot locate a ruffed grouse he comes back to me and sits trembling from excitement beside me whining and licking my hand . He knows that when the game is afoot guessing is not an option,unless I give him the nod then he will go on a “wilding” that is at times un-believable in his response . It is almost scary. Like my Springer I ain’t doing jack and will stay in cash until this economy gives me the nod. I don’t need the stock market, it needs me. My Springer does not need the afoot grouse that will not hold and in this regard He does needs me.

Dr.D-very nice analogy! Thanks.

The treasury is in the loop from money created by the fed. The banks purchase bonds from the treasury, and the fed buys the bonds form the banks.

The banks take the newly created money plus extra for being conduits, and buy other things like stocks, places in the Hampton’s, etc.. The fed also buys other risk assets not created by the fed, but often created by the banks themselves and large companies, like mortgage backed securities. It is a feeding loop between the treasury- banks-the fed-large companies-and the wealthy.

Derivatives, swaps, repo, etc..; their are a lot of instruments that help create inflation wealth for the rich and poverty and stagnation and repression for the masses. It is difficult to grasp the extent of it all. The awakening is mind altering.

The sleeper has awakened!

-Dune