At first the protests and now the coronavirus collide with the World’s Most Expensive Property Market.

By Nick Corbishley, for WOLF STREET:

The world’s most expensive housing market in terms of affordability for a median-income household is in Hong Kong, which also happens to boast the highest ratio of financial assets to GDP on the planet. That market is under huge strain as it reels from months of virtually non-stop political protest, the ongoing trade war between its two largest trading partners, China, and the U.S., and now the recent arrival of the novel coronavirus.

Values of Class A office buildings in the city fell last year by 7%. It was the first fall since 2008, according to the commercial real estate services firm JLL. Prices of offices as a whole finished the year at their lowest level since the second quarter of 2018. “There was a lot to deal with in 2019, but most importantly the market had been expanding for 11 years,” according to the report. “At a certain point, that had to change.”

The total transaction value of office and retail properties as a whole slumped 12.9% last year to HK$49.6 billion (US$8.9 billion), according to Bloomberg Intelligence. By December, Class A office buildings were registering a 6% vacancy rate, the highest level since April 2010 when the city was struggling with the aftereffects of the Global Financial Crisis. Rents for the segment also fell 3.4% for the year.

But that pales compared to the reverberations being felt across the retail sector, whose sales declined by a mind-watering 19% year-over-year in December, according to Hong Kong’s Census and Statistics Department. Sales of luxury goods — a huge part of Hong Kong’s retail industry — slumped by 37%. Many retailers have gone under or closed stores, resulting in a vacancy rate in core shopping areas of 9%, the highest in five years.

Most of the blame lies with the political crisis that broke out last spring and escalated into a crescendo of violence in the summer that decimated tourist traffic, particularly from mainland China.

Then came the outbreak of Covid-19, which compelled Hong Kong authorities to shut six of the city’s borders with the mainland. Average daily tourist arrivals plunged by 97% to 3,000 in early February from 200,000 a year earlier while many local residents have cut back on all but essential purchases, choking off retail demand.

So spooked are commercial real estate landlords by the scale of the slowdown that some have begun providing rental relief to help their tenants weather the storm. Henderson Land Development, the city’s third-largest developer, offered to slash rent by 60% to help out retailers. Hong Kong’s toy billionaire Francis Choi Chee Ming offered to lop 44% off rents at a 15,000 sq ft space at Plaza 2000 in Causeway Bay, after Prada refused to pay HK$9 million in monthly charges.

Keith Wu Shiu-kee, CEO of Sunlight Real Estate Investment Trust, a unit of Henderson Land Development, believes the impact of the virus on retail sales is likely to be far worse than during the protests, noting that in the second half of 2019 at least some tourists from the mainland were still arriving. He estimates that the plunge in total retail sales this year will be “clearly double-digits,” he said. “Whether it is 30%, 40%, or 50%, remains to be seen.”

Hong Kong’s residential real estate sector has so far weathered the storm slightly better, with home prices dropping 6.1% from a record high in June, according to the Centa-City Leading Index. The index even rebounded slightly in the four weeks through Feb 9 despite coinciding with the outbreak of COVIN-19 and the adoption of increasingly extreme measures by the Chinese and Hong Kong governments to contain its spread.

The effects of the virus are likely to take some time to feed through to property prices and transactions, just as happened with Hong Kong’s political crisis which began last March but didn’t noticeably hit the property market until the summer. Once the effects begin to be felt in the property market, it’s the luxury segment, which depends hugely on demand from mainland China, that will bear the brunt of falling prices, notes JLL.

Hong Kong real estate has been in an almost permanent boom since 2003, when the fallout from the SARS virus drove it to multi-decade lows. Since then, housing prices have risen five-fold, suffering just the briefest of dips in 2008, 2011 and 2015. Today, the prices are beyond the reach of all but the best-heeled residents and investors.

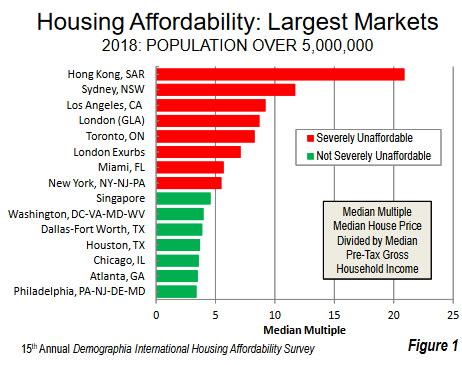

The annual Demographia International Housing Affordability Study, which ranks 92 major markets across the world based on affordability for median-income households, ranks Hong Kong at the top (with a score of 21), far ahead of Number 2, Vancouver, Canada (score of just over 12), and Number 3, Sydney, Australia (score of just under 12).

The chart below shows Hong Kong among metros with populations over 5 million, which excludes Vancouver, San Francisco, and other less-huge hot spots:

These and many other global cities have experienced insane housing bubbles, fueled largely by unprecedented central bank easing, yet over the past 10 years none of them has come even close to stripping Hong Kong of the dubious honor of being the world’s least affordable housing market.

That market is about to have its resilience tested. Prices in the luxury sector could fall by as much as 20% this year, says JLL. Not everyone agrees. According to a Bloomberg article bearing the optimistic title “Hong Kong’s Teflon Home Prices Are Virus Proof,” the fallout for the residential real estate sector is likely to be minimal, at least compared to the fallout for the commercial property sector.

The government is also desperately trying to reassure prospective home buyers and boost market demand by loosening mortgage loan-to-value (LTV) ratio rules. It is also about to unveil its biggest ever budget deficit to protect the city’s economy from “tsunami-like shocks,” according to Finance Secretary Paul Chan Mo-po. Banks are also cutting mortgage borrowers some slack.

But it may not be enough to save the the world’s most expensive property market from a very rocky 2020. As even the Bloomberg article concedes, if there’s “a drastic worsening of the economy”, Hong Kong’s “Teflon houses” may not prove to be quite so virus-proof after all. By Nick Corbishley, for WOLF STREET.

It’s not only Chinese tourists, business travelers, and property buyers who’re not showing up, but also travelers from all over the world who’ve gotten second thoughts about sitting on a plane. Read… Coronavirus Slams Airbnb, Airlines, Hotels, Casinos, San Francisco, Other Hot Spots

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

If corona virus is the “black swan” event that some are saying, then Hong Kong is simply acting as the initial “canary in the coal mine” because of its severely over-leveraged property market. The central banks have blown their load and this “perfect storm” will show how impotent and flacid their “economic theories” actually are. It’s all going to hell in a non-straight line. I can’t wait.

Fair call, but if it HK real estate does not implode then we need to accept the possibility we are wrong. I.e. all the printing/QE/bubble talk needs to be held accountable to reality. It is not good enough to be fanatic on the sidewalk with the ‘end is near – rapture in X date’ placard and keep moving the date out because ‘reasons only we understand’ when on X date nothing transpires.

The problem with Hong Kong real estate is not leveraging: it’s the prices themselves. They have gone up since 2004 with just a couple of very brief pauses in 2008 and again 2015.

Rents, especially on commercial real estate (CRE) as defined in Anglo-Saxon countries, have gone literally parabolic and have been outpacing revenue growth for years now. Hong Kong has become truly unaffordable, not just for the “small guy”, but also for multinationals and luxury brands.

Plenty of foreign companies have closed their offices in Hong Kong and moved to Shenzhen: as expensive as it is (by China standards) the rent is peanuts compared to Hong Kong and Shenzhen is an ultra-modern city. Plenty of entertainment and amenities for the yups.

This leaves the local “godfathers” (as prime movers and shakers are called) and all the big shots and upstarts from the Mainland with a ton of impossibly priced real estate to rent or to sell. It happened before during the British rule and it wasn’t pretty, albeit the rest of the world kept on soldiering on.

Hong Kong real estate has been expensive always/even since mid 80’s .

As a “small guy” -During 1987-1997 I was paying HK$ 18000(US$2200+) for a 950 sqft (5 staff) Import-Export office in Wanchai & HK$9000 (US$1200) for a 650 sqft 1 BHK apt in Discovery Bay (Expat coclony in Lantau island). After 1997 all the mainland hot/black money moved in to HongKong properties and pushed prices thro the roof. Foriegn tourists +Mainland visitors spend is the only thing keeping HK afloat + GOVT spending. All trading/export business business hollowed out from HK & all moved in to china. Shenzen across the border (45 mins by MTR(metro)) is half the cost . both for office + residence. Shenzen, Shanghai,Beijing are the most expensive cities in China.Most Hk based businesses keep company incorporation+banking export/import facility in HK banks ( HSBC caters to most non chinese businesses) in Honglong but operate from across the border.Most businessmen keep family in HK for schooling & maintain small accomodation in Gunanghzou/shenzen and operate business &come home during week ends.

Hong Kong is kinda like Zurich: it has always been expensive (at least as far back as people can remember), but things really kicked into high gear after 2003 and went out of control in 2010.

All these places have gone from “merely” expensive to “completely nuts”, and now they are grappling with the fact rent hikes can only outpace revenue growth for so long before high prices become their own worst enemies.

Residential is still in Nephelokokkygia (Cloud-cuckoo-land for those who don’t speak Classic Greek) all over the world, but how long the impossibly high prices can be propped up in face of shrinking sales and booming stocks is a good question: the HK residential real estate market (RRE) has been solely driven by speculation for a few years now, not unlike Greece, Italy or Spain.

Covid-19 will give Hong Kong authorities the excuse they need to bail out the real estate sector to the tune of billions HK dollars and people like Li Ka-shing will make a killing. I just hope they’ll share it with us poor ordinary CK Hutchinson shareholders like they have done so far.

“I can’t wait??” What kind of person hopes for financial destruction of others? You suck as a human.

Hahaha

Scott,

Savers — among the most prudent people out there — have been methodically destroyed and financially ruined for over a decade. And they have been ridiculed for over a decade and have been called morons. Their life savings were eaten up by inflation and their cash flows were confiscated by central bank policies. And the entire stock market and real estate community hoped for the continued financial destruction of the savers (more QE and lower rates). So yeah, people do hope for the financial destruction of others.

Bravo!

Maybe there is actually some justice in this universe.

I, for one, am willing to suffer in order to see these swine get what’s coming to them.

Exactly. Time for payback, not just for clueless “investors” but especially for central banks themselves, once the bottom falls out.

Although today it seems the banksters are still keeping a hand under the market; w’ll see after a few more days like this, maybe it gets some traction.

Wolf,

Great reply. I could not have replied as professionally as you did lol.

“What kind of person hopes for financial destruction of others”

What kind a person? The architects of extreme QE, dismantling savers’ eggs nest, feeding speculation, worsening real inflation, pumping the stock market bubble and setting up the next monumental collapse. That kinda people, stupid.

Imagine: a microscopic entity takes down the global cards castle.

Hong Kong’s real estate prices are completely divorced from reality and whatever happens to the Hong Kong property market is completely meaningless to anywhere else in the world.

Well, maybe this is going to be a good testcase to check how omnipotent the moneychangers are? RE never goes down again thanks to the modern central bank toolkit? They think they can solve any problem by printing more money and 99% of the sheeple seem to believe them.

The central bankers realize that they can’t keep printing money and raising asset prices to infinity. The Corona virus gives them a much-needed excuse for the fall.

You mean the one percent is taking an asset loss?

More please. Let it roll.

I second your sentiment Iam and I added to my stack yesterday To the moon “Alice”

Those poor souls in HK have sure taken a beating of late Havent they Things seem to be unraveling faster now A big crash/ reset seems much closer I’m hunkering down growing veggies and fruits and hoarding cash and metals Also own rental real estate outright I’m hoping to be able to survive this beer virus to be able to enjoy it And still don’t own a smart phone

And still don’t own a smart phone

The Panopticon has other methods of surveillance.

A big crash/ reset seems much closer

Dow futures are down 700 pts this morning. The Obama Economic Recovery might be just about over.

Ironic how with all that surveillance tech Xi was unaware of the COVAD-19 out break for over a month.

Your use of the word ‘ironic’ is itself a bit ironic, but it’s probably just a euphemism for many other words that would also work.

It may seem ironic, but even if the surveillants observe and report something, or it’s reported to them, what is to be the reaction?

They probably weren’t unaware; it’s more like ‘what the heck is it?’ and how much impact will it have, (or if you tend towards conspiracies ‘how the heck did it get out?’, which would explain better the response which followed). Was it flu? Flu virus causes millions of infections and hundreds of thousands of deaths annually and is an expected event. This virus infection, whatever it was thought to be at the time, was counted in the low hundreds, then low thousands in a country with 1.4 Billion population, but seemingly was not ‘just flu’. Whatever it is, despite the criticism, the Chinese response was exemplary, though confusing, with the draconian response to relatively few infections and a handful of deaths, still just 2,700 in two or three months. The Chinese government is not normally known to overreact, which is more a Western trait. (Y2K anyone?)

Any humongous organizations like a country the size of China will have many blindsides, not matter the political system. Also, see 9/11.

Imagine, living cheek to jowl in a rabbit warren over-priced city trying to pay insane prices for everything and always always on the hustle because there is no other way to survive.

Ain’t life grand? And to top off the years unrest with a novel virus, what other result is even possible, especially for a city already at extreme limits.

It looks like today might be the first big stair to collapse with the Dow soon to open 1,000 pts down. And just last week I was reading urges for retail investors to jump back in, that there is no finer time to invest.

Herd mentality in action. (Oh, we don’t own a smart phone either, and never will). Somehow we survive. Go figure.

Property markets become unaffordable because they’re not free markets. Prices are not determined by the dynamics of supply and demand. They’re rigged to maximise wealth extraction, as much as a given market can bear, however grudgingly. HK just happens to have been able to bear rather a lot. It’s a sellers market, and they have pushed prices to the limits of stability. Buyers have little choice but to struggle to keep up, not always successfully.

Now that adverse conditions have emerged, like the sheeple uprisings and the pandemic, the limits of that stability are exceeded. Market forces reassert themselves and the sustainability of maximal extraction becomes impaired.

Then it becomes a race to keep the dominoes from falling by reducing prices to levels where stability can be restored, supported by government and bank interventions. One gets crushed in inverse proportion to the availability of liquid resources needed to cope. The resources of those at the bottom are limited because they’ve been subject to extraction, so they get crushed, and there are a lot of those. Operations dependent on high extraction rates get crushed when those rates can no longer be maintained. And so forth.

A couple of dominoes have already fallen, and it remains to be seen what resources are available to keep more from falling. Probably not a lot, since most resources have been dedicated to wealth extraction. Avarice usually overreaches and takes on more than it can handle when things go pear-shaped. But we’ll see.

Un,

Your views echo those of the fantasy free economics blog. I hope you are wrong. We will see.

Hope can be such a cruel, cruel thing.

In the mean time, the Dutch home prices that have been surging for 30 years (except for a very minor dip after 2008) and are also extremely unaffordable (despite no-money-down and almost zero rates) are expected to rise another 6-10% this year, which is about the average (8.5-10% yoy) of the last 30 years.

I guess there are some similarities with HK like money laundering, drugs money etc. but lack of land certainly isn’t a factor over here (although almost everyone seems to think so …). The real problem is – like Unamused says – that the housing market is not free, it is completely manipulated by politics and some other big players like the banks.

Listening to our CDC, you would think that the coronavirus will skip the Netherlands despite it being a major transport hub. Let’s see if the optimism of the official experts is proven right. Our last housing crash was in 1981 and it basically came out of nowhere, suddenly the bottom fell out and prices crashed more than 50% within 1.5 years, after a relatively minor 100% runup in preceding years. But that was in a time with high rates when QE and all the other devilish central bank voodoo didn’t exist yet. It still is very much a sellers market over here and rents outside social housing are so high that most people have basically no alternative, but who knows. It’s about time that the Netherlands starts to produce something useful again instead of “getting rich” by selling ever more expensive homes to each other and other paper shuffling activities.

Minor dip? ten years of standstill and the five before were not great either. It was mid 90’s until 2002 that the house prizes really exploded. Partly because the Guilder was undervalued when it entered the Euro.

HK has not a land problem. They have plenty of land. They don’t build enough and to small. But than the HK oligarch wouldn’t make so much money so can’t happen.

We have seen how well the Dutch government handled Q-fever.

It was a minor dip for sure given the HUGE price increase of many hundred percent before that dip. A bit like how the dip of yesterday on the stock exchange was nothing compared to the ten years of reckless speculative fever that preceded it.

Even in my remote area the price surges already started in the early nineties, caused by ever declining rates and looser mortgage conditions. The introduction of the Euro in 2002 was the icing on the cake, causing people to spend Euro’s in the housing market like they were the much cheaper Guilders.

Yes, for those who purchased a home just before the dip it felt bad, also because many of them purchased with mortgages way over 100%. But hardly anyone has been really punished by taking on too much debt then; savers and renters got most of the bill.

Maybe HK doesn’t have a land problem either; I read they are building (or planning) an island in the sea for new property development. Maybe it’s much like the Netherlands indeed, plenty of space but building area is strictly limited because it suits certain people in order to jack up the prices.

Q-fever: yes, with the CoV crisis still ongoing China is already talking about a severe clampdown on wild animal trade; they will act. Dutch authorities blatantly lied for several years about Q-fever and after the crisis instead of clamping down on risky activities the number of goats in livestock farming increased by over 10x. Clearly public health is only relevant for politicians and other authorities if you can make lots of money from it :(

Honk Kong is build between the bay and the first mountain ridge. Behind it lush forest and farm land.Look at google maps to see if i’m right.

nhz, Many years ago I had to salvage my airplane that went down from flying in -40 F weather where the oil breather froze and pumped out all of the oil from the dry sump tank. It was a real pain to disaasenble it to fit on trailers but that gave me some time in travel to see what western New York state was going through.

It seemed as though half of the people in the towns were real estate sellers to a dead market because of the de-industrialization that had been going on for years. It was relatively inexpensive but not quite enough as I don’t recall a sold sign anywhere on the journey. I suppose that the sellers held on while their properties declined because they could not come to grips with what had changed in their large area. I suspect that the wildly inflated markets such as Hong Kong will experience that on a far grander scale. The CBs are scared that their inflation for assets has peaked.

I have seen the same in some parts of Netherlands just after the Financial Crisis, when in some remote villages over half the housing stock was for sale. Of course this wasn’t because the locals were all planning to move, it was because whole villages had been bought up by speculators in the years before that because homes there were initially less overvalued than in the cities. And in some cases possibly elderly people decided they needed to move due to ever declining local services.

After 1-2 years most of the “for Sale” signs disappeared again, there were very few takers and over the years speculators were bailed out by the declining rates from the ECB. No need to sell and many of them have probably enjoyed an even better ride in the years after the crisis because almost everywhere valuations are now much higher than before the GFC.

But it doesn’t change the facts that there are not sufficient buyers there so unless there is an even bigger bailout in future, only a few housing speculators will really be able to sell at current ridiculous valuations.

I wonder if there is overlap or how they don’t double count on Pennsylvania and NJ. Plus Connecticut should be part of the NYC market.

New York – NY-NJ-PA – severely unaffordable

Philadelphia – PA-NJ-DE-MD – not severely unaffordable

Connecticut is a beautiful state in some areas anyway House prices are very attractive however taxes are outrageous and the new jobs created since the recession have been much lower paying and most cannot support the cost of single family home ownership in the state and I imagine things will get a lot worse before they get better there

The South China Morning Post reported housing prices in Hong Kong decreased 25% in 2019.

Now Hong Kong is on partial lockdown. There is ban on travel from the mainland.

Rumors of epidemic have caused sell offs around the globe. People avoid cruise ships, flights to certain areas are stopped, borders closed. Wuhan is still on lockdown.

This certainly blows the idea of a ‘orderly’ market failure. This is unprecedented. It’s both scary and exciting to watch this play out. I think we are in epic times and those of us who live for the next 50 years are going to have some stories to tell. Kind of like the few Marines left who were on Iwo Jima. I hope I am wrong, but I don’t think so. Everything is way too leveraged to think that all just turns out peachy keen with all the market and supply chain disruptions going on globally.

Youre spot on Stephen and I’m going to do everything I can to survive to enjoy the spoils with my much younger wife

today looks pretty orderly to me, for now, given the circumstances … in the old days (before QE etc.) such declines were fairly normal. Only the recent surge in gold is pretty unusual. Current “investors” have no idea what a normal stock market looks like.

The surge in gold is long overdue If you look at a ten year chart of gold you can clearly see that without manipulation gold by all rights should be well north of 2500 USD by now It’s just trying to fight its way back up to the long term trend line Silver is even more absurd given the amount of monetization( money creation) that has transpired in the last decade Hold onto your hat kid

My friend Riekus from Holland who I met in Izmir Turkey actually educated me about precious metals in 2005

I think the whole market is manipulated, not just gold; so difficult to say what is normal action ;(

I agree that looking back over the last ten years or so the surge in gold isn’t strange. On the other side, the +/- 6x price increase in the last 20 years compared to euro currency, and especially over 50% gain in a little more than one year doesn’t reflect the cost increase for the average EU citizen. So in that respect gold might be getting ahead of itself, if you assume that “gold is money”.

Markets don’t always fall quickly;

Japan’s markets have been -slowly- dropping,

last 30 years — including house prices.

I chose a conservative lifestyle and am quite pleased with it. I cannot for the life of me, understand those who desire to tear down success, and successful people, and who want to tax and regulate success into submission. Who’s going to pay the bills?

My hope is that more and more people find success and become as wildly wealthy as they can or desire. They buy extra homes, take huge vacations, buy yachts and planes, and a lot of cars and SUVs. It takes a lot more people to produce and sell those things and services to them. It takes a lot of on going maintenance too, again requiring more people to accomplish.

Success begets success at every level possible. If people will not take the opportunity a healthy economy brings, then they should at least shut the hell up and enjoy their little pity party all alone, and quit trying to drag everyone else into their depressing little world.

This Rant ends here.

If only the rich truly spent like that and didn’t horde their money.

Bloomberg has over 50 billion and hasn’t even spent 1% of his money running for President.

I wonder if he has worn out soles on his shoes and drives a beat up old station wagon like some of the wealthy people I’ve met over the years

Rest assured, he most certainly does not.

The Uber wealthy are employers of hundreds of thousands of people through their business enterprises, which is where most of their wealth comes from. I doubt it would be better for the average Joe or Jane if they hosed that money on yachts and watches and fancy clothes.

Despite Bill Gates’ desire to spend his money,

via his many charities,

he’s still getting richer,

thanks to his “Beyond Meat” venture.

CreditGB:

Depends on your definition of “success”!

What you describe in my opinion is a “junk” society; not for me.

1) The DOW & IWM daily inside the cloud. The DOW close x3 Feb gaps.

2) SPX, IWM and QQQ closed only x2. Both SPX & QQQ above the cloud, not inside.

3) Feb 19 was a Buying climax. Today/ tomorrow the response.

4) SPX might cont in a trading range, or plunge in a waterfall collapse.

5) The market will tell us what is coming next. At this point

its too early to know. Nobody know.

6) The DOW is down > 1000 pt today.

The DOW is up 54% in 5 years down today currently at 1.70%. A big yawn in reality.

yes, wake me up when it is more than 54% down; that would be a good first start to achieve realistic valuations. I agree with writers like Hussman that a decline of over 50% in the major stock indices is required to make prices even slightly attractive again for real investors (instead of speculators who only bet on the greater fool). I guess that long before we get there the whole market will be locked up or closed though, with everything “marked to fantasy”.

You will get to sleep for a few more weeks I suppose and meanwhile I will be buying more gold and silver lol certainly NOT buying any freaking dip

Time to take another look at the Dow, now -3.5%. But yes, still a big yawn so far, given where it still is and where it could end up as this plays out.

WOLF – I don’t recall if COVID-19 played into your “short?” I seem to recall it was just market irrationality (meaning way more than the normal irrationality of the past 3 years).

Actually, COVID-19 messed up my short, I think. When it showed up on the scene, stocks rose because everyone was expecting more stimulus due to COVID-19, and got it from China, huge amounts of it. So the whole calculus of mine is being scrambled. That said, when a market is so irrationally high, something is going to deflate it.

Very good article. Some of the commentary is interesting as well.

Hong Kong’s construction industry grinds to halt

Some 50,000 construction workers in Hong Kong have lost their jobs since the coronavirus epidemic hit, and more than 80,000 have had their hours slashed, a union said on Monday.

The Hong Kong Construction Industry Employees General Union said half of its 57,000 members were now unemployed, a situation it attributed to supply chain issues that had arisen since the outbreak began.

Some 250,000 people work in the industry in Hong Kong, and the union said a fifth had been laid off while a third of those fortunate enough to still have jobs had been reduced to working one or two days a week.

Wong Ping, the union’s chairman, said the coronavirus had forced many factories in mainland China to stay shut until a week ago, affecting the amount of building materials that could be brought into the city.

“The construction chain intertwines with one another. If we do not have some of the materials, we cannot proceed to the next step,” Wong said.

“For example, some workers can nail boards first [for shuttering], but without cement pouring in as the next step, you cannot proceed to nail boarding for the other floors.”

https://www.scmp.com/news/hong-kong/hong-kong-economy/article/3052113/hong-kongs-construction-industry-grinds-halt-and

HK is on the border of China. Construction materials can be trucked from the factory to the site within hours. If the factories were up and running Hong Kong would not be running out of construction materials.

Europe, the US, Australia, etc… are weeks away by ship. If something as innocuous as nails do not arrive soon…..

‘And if disruptions drag out, I expect troublesome supply chain issues that will eventually get worked out. Broadly speaking, inventories are high in the US. And there is a buffer for many products.’

So beyond some limited sectors, I don’t expect a huge impact in the overall US economy. I don’t think this is the black-swan event that people have been predicting for years. I expect that the reaction to the coronavirus will eventually settle down. This may happen over the next few weeks, or it may take longer, but it will settle down.

https://wolfstreet.com/2020/02/06/what-will-the-coronavirus-do-to-the-us-chinese-economy/

Change your mind?

“Change your mind?” About what? Ever since you showed up on this site last year, your contention has been — initially due to the price of oil, or now due to the coronavirus, and in a few months due to something else — that everything collapses and everyone dies. And you’re having a blast trying to spread this nonsense on my website (though you’d be busy doing other things if you really believed it), and I have fun blocking this nonsense. I haven’t changed my mind about it at all.

And as to this: “So beyond some limited sectors, I don’t expect a huge impact in the overall US economy. I don’t think this is the black-swan event that people have been predicting for years.”

This article above talked about HK not the US, and they’re not the same thing. And I have said from the beginning that this would be very tough for China’s economy.

It looks like Dow 30,000 predicted since 2000 still has to wait. It maybe another year or two until there is that real possibility.

As for interest rates, this is clearly the most longest manipulated, artificially, controlled market probably in history. Governments and corporations are so scared of 5%+ interest rates that were normal just before 2007 to 2008 financial meltdown.