Last time was during the Financial Crisis. Now it’s happening in a kinder and gentler way, but there is no crisis.

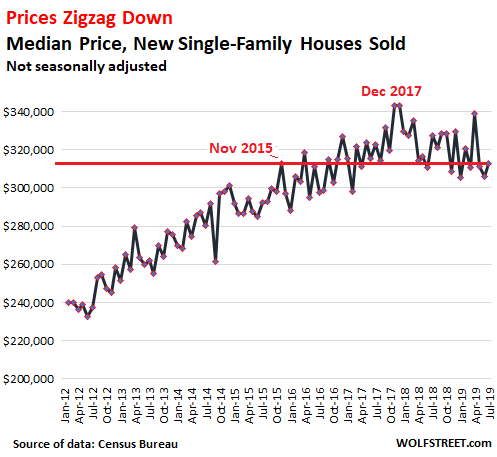

The evidence thickens: In July, the median price of new single-family houses fell 4.5% from July 2018, to $312,800, and was down 3.1% from July 2017, according to the Commerce Department this morning.

These price changes do not include the incentives – the free upgrades of finishes, counter tops, and the like – that homebuilders dangle in front of potential buyers to make deals. With incentives, buyers get a little more for the same price. The price declines in the chart are on top of that.

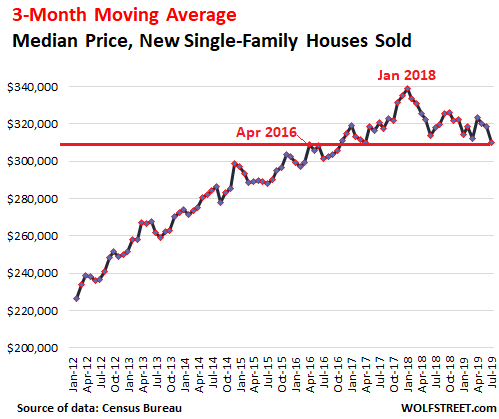

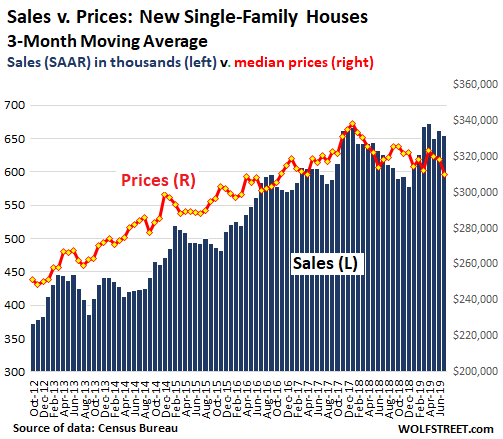

The trend via the three-month moving average.

As you can see from the chart above, this data – produced jointly by the Census Bureau and the Department of Housing and Urban Development – is, let’s say, a little “volatile” on a month-to-month basis. It also gets revised (up or down) in the following months. The three-month moving average smoothens out some of those effects and allows for longer-term trends to become clearer.

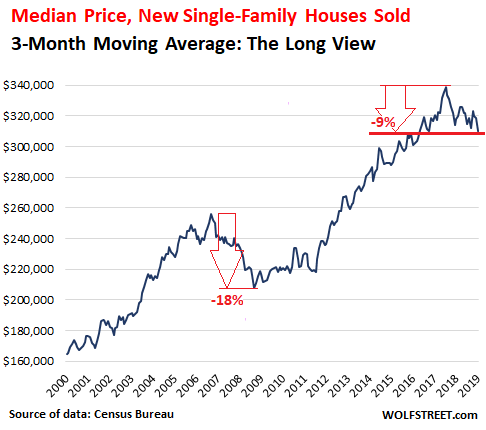

The three-month moving average through July, at $310,000, is 9% below the peak three-month average through January 2018 and is back where it had first been in April 2016:

The price trend peaked in November and December 2017 and then broke. Due to the volatility of the data, this became clear only with the benefits of substantial hindsight, but it has been clear for a while.

In July, the three-month moving average of the median price broke below the same period two years ago (through July 2017) for the second time since Housing Bust 1, the first time having been, if barely, in January this year. For much of the period since Housing Bust 1, the two-year comparisons showed increases of well into the double digits.

The long-term chart of the median price, based on the three-month moving average going back to 2000, shows the significance of the 9% decline: From peak to trough during Housing Bust 1, prices dropped 18%. So about twice as much. But back then, it happened during the middle of the Financial Crisis and the mortgage crisis and the collapse of Housing Bubble 1. Now it is happening – but in a kinder and gentler way – without crisis:

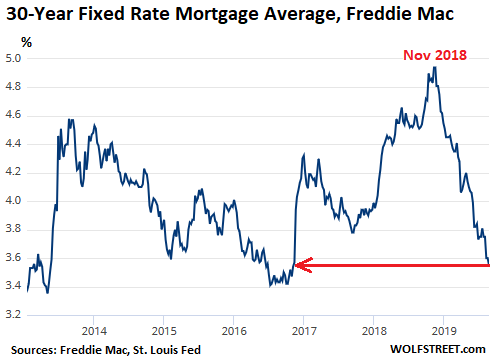

Despite near record-Low mortgage rates.

So why would prices start falling even with the labor market being in the best condition since about early 2000, with consumers spending fairly eagerly and borrowing to do so, and with mortgage rates having plunged to the lowest level since November 2016 to only a quarter percentage point above the historic low of 2012?

The plunge in mortgage rates has been touted for months as the thing that would kick the housing market into high gear, and send sales volumes soaring, and send prices chasing after volume. So why is it not happening: Because in many markets, prices have hit a ceiling, and buyers just don’t feel like paying so much for so little? Maybe.

Homebuilders are the pros in the housing market. They have to build homes and sell these homes no matter what the market does. That’s their business. They cannot sit it out. They have to go where the market is going. For them to maintain their sales volume, they have to do whatever it takes – including throwing in big incentives, lowering prices on their speculative inventory, and building houses that can be sold at lower price points, with the goal of selling the houses they built.

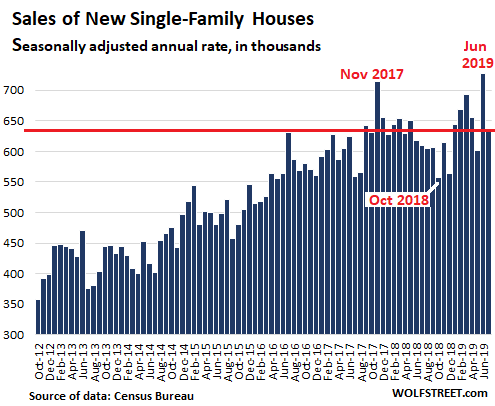

Sales of single-family houses in July rose 4.3% from July 2018 to a seasonally adjusted annual rate (SAAR) of 635,000 houses. Although this is only about half the rate of crazy 2005, by the standards of recent years going back to 2012, this is fairly high. So homebuilders are doing what they must to maintain sales volume:

The relationship between prices and sales.

The pros (the homebuilders) know that when sales start falling, it’s time to cut prices and see what happens. Sales started falling in 2017; and the price cutting started in tiny increments, and sales continued to fall through much of 2018. But in 2019, as prices continued to decline, sales perked up and are back to 2017 levels.

This becomes clearer by comparing the three-month moving average of the median price (red line) to the three-month moving average of sales volume (blue columns). It shows how the drop in sales in late 2017 was stopped a year later, and how sales have since picked up, due to a combination of lower prices and lower mortgage rates. But after the initial burst in early 2019, sales volume is now back on the decline, exerting further downward pressure on prices:

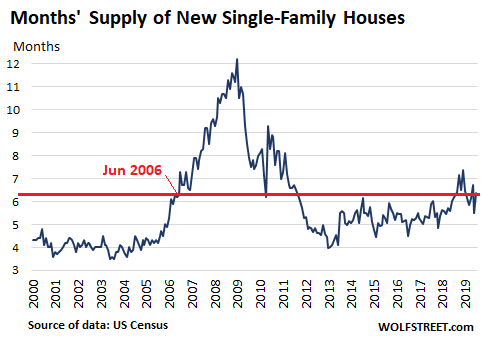

And the inventory of new houses for sale rose to 337,000 houses, providing 6.4 months of supply at the current rate of sales. This measure of supply has remained stubbornly high and is about 3% higher than the already high levels of July a year ago. Four months’ supply would be more than plenty. This 6.4 months’ supply is at the same level as in June 2006, at the beginning of Housing Bust 1:

With this quantity of inventory for sale, homebuilders will be motivated to do what they can to keep supply from rising further or worse, spiking – as seen during the housing bust. And what they can do is offer incentives, cutting prices, and making deals, which is putting more downward pressure on prices going forward.

In the San Francisco Bay Area, among the most expensive markets in the US, house prices dropped again – and ironically the most in San Francisco and Silicon Valley. Read... Housing Bubble 2 in San Francisco Bay Area & Silicon Valley Pops Despite Startup Millionaires & Low Mortgage Rates

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

To me, looking at these charts, as well as at the regional market ones Wolf has posted previously, it doesn’t look like the prices are dropping.

It’s more like “We’ve reached the cruising altitude” (from mid-2016 and on).

In other words, complete debt saturation of the retail buyers, and an uneasy balance going forward for the mid-term.

Cruising altitude is right. However, keep in mind that the disposable income of American workers is going down. As discussed by Forbes in “The Future Is Bleak For American Workers…” even when foreign (Chinese) corporations take control of our factories, they are really seeking to take advantage of our workers. This is just what the financiers and corporate class have been doing for decades.

Thus, unless you want to market solely to the elite (with mansions), there will be a smaller and smaller pool of workers in the future with the disposable income to purchase high-priced homes. Thus, there is not much chance that US house prices can climb substantially more, absent some Chinese or foreign disaster that prompts foreigners to buy up US real estate en masse.

Of course, the real rate of inflation faced by most Americans means that some price rises will occur. However, the predicted recession and other problems (e.g., the need of baby boomers to be able to pay bills as they grow old, particularly medical bills), means that the safest bet is that house prices will go down in the coming decades — if adjusted for inflation. This fall might be steep, if there is a drop of the dollar as a reserve currency, for example.

The air is coming out from the China all cash buyer. Income levels cannot sustain the inflated home prices in impacted markets even with lower interest rates. There are only so many tech millionaires to go around.

Where i live the property and other taxes + cold weather overhead are the main reasons new houses are a hard sell..

Who would buy a new home where the yearly tax bill is 10%+ of the value of the home?

Nearly all wall street analysts paint this as a bullish report … the drop in sales is coming a June figure which was the STRONGEST IN 12 YEARS. Note that the June figure was revised sharply higher. Furthermore, the drop in price is largely due to builders shifting their production to smaller less expensive homes.

The 3 month average calc hides the sharp bullish turn housing took recently with the lower mortgage rates.

Right now, there is a brokers open on a small old beach cottage priced in the low 2M. It is flooded with buyers and agents. We are looking at burst in housing activity … hopefully it lasts a while.

Mr Wolf you normally dive into the numbers a little deeper. My thought also was that home builders are finally building less expensive products for the pent-up demand of more affordable cheaper smaller homes. And the local Colorado stats show the mortgage rate decrease has added sales volume and stabilized prices… for now.

“Stock prices have reached what looks like a permanently high plateau.”

Just for fun: The “plateau” in homes prices in Miami in 2007:

“Hopefully the further bubble blowing lasts a while”, so the downturn wreaks even more havoc on the economy? Nice one, Jim.

While we are at it, how come the new home prices are down 9%, per Wolf’s chart? Sales activity is higher, but only at the same price it was 3 years ago (and with 3 years of inflation eating away at the real value).

This looks more and more like a dead cat bounce heading into a globally slowing economy. I’ll say it again, you have to be a sucker to be acquiring new real estate right now.

sc7, the prices of new homes are lower because builders are building smaller homes than they were a few years ago. That is a well document fact highlighted in sell side home builder research reports distributed on the street.

You see sc7, it’s a mix problem….

@qt

Found Thornberg’s alt.

SocalJim, is business drying up in the real estate industry to the point you need feel it necessary to post your real estate only goes up propaganda? I believe you stated you have been in the business for some time, are you ignoring all the telltale signs that are so reminiscent to 2008? You likely think “this time is different” and like most the other realtors, your right. This time we have an EVERYTHING bubble and all the headlines you speak of are courtesy of paid MSM desk jockey’s to draw out this fake wealth creation. I have made more money in the last 5 years than in my whole career but all good things come to an end. We are at the edge of the cliff, no water below to soften our landing either. Best position now is to prepare for the worst and hope for the best. The best is not going to involve real estate going up, it will involve us keeping our jobs and our country and economy allowing for its people to live within there means not paying 10x there income for a beach cottage.

Blanket. I have been in this and survived all the downturns. I always assume a downturn can happen, so I check my exposures to insure I stay alive and well.

What do they call it when you buy a McMansion on the value menu?

There is also a big battle taking shape in California over fire insurance liabilities and the insurance carriers over what are considered “high-risk” fire areas. Scores of properties covered or tied to new mortgages are getting cancelled even mid transactions. Those that get coverage under a multi layered plan including the labelled, “California Fair Plan” are being buried in multiple times billed coverages. What happens when the insurance carriers just decide to pull out or the consumers have their coverage amounts multiplied by 3 to 4 times what their “budgets” will allow?

Kabaaammmm! goes the housing in the many, many retirement communities in this coastal state. That “jingle” of keys this time will be mailings not only to banks, but the insurance carriers. This is evolving into a major real estate problem.

SocalJim,

I’m not sure you understand just how funny your comment sounds, given the data. And why would you expect anything other than a “bullish” spin from Wall Street? Bullish spin is what they do for a living. They’re very good it at.

He is in the same business. Sellers only think about selling. Forget buyers who are stuck with these frothy prices, meanwhile everyone at the bottom waiting for these smaller places he is talking about will be priced out once speculators get the rate cuts they have been screaming for over the last few months.

Good point. When was the last time you saw a home builder post negative comments, guidance? They are like most economists. The glass is always half full, even if the hull has a gaping hole which will soon sink the ship.

SoCal’s perpetual cycles of years of drought followed by several seasons of massive winter storms means those beach homes will probably get hammered again this rainy season.

Good luck with that beach home!

Funny. But, one house is a battle in the heavy rains. That one has lots of water rolling down towards the beach. Last year, I bought a trench shovel and dug a small channel down each side of the house … while it was raining … , and I kept the storm drains down the street cleared. I need gutters on that one, but of course it never happened this summer. Keeping my fingers crossed.

Cutting channels into the ground around a house without concretizing the channels or putting French drains in is a great way to increase the water flow around and under the house foundation.

Good luck with that! Really sounds like you know what you’re doing!

Have seen plenty of people’s backyards and landscaping completely slough off in rivers of mud in SoCal.

You’re gunning for a whole house slough!

Gandalf, that particular home has been there for longer than most of us have been alive, and it always had channels along the side in the dirt. That is the problem with the old beach cottages … you are talking about old stuff. Yes, I need to upgrade to concrete, as well as gutters … I think it will make 1 more season … when they built this place, they assumed mud and it works. But, it does need an upgrade.

Wait a minute, SocalJim. On comment you were digging channels, and in a later comment the channels had always been there? Sounds to me like you were digging yourself into a hole.

In general, you should know that your bubble-mongering will not work on this site. But some amount of it is useful, just so readers can see the contrast between reality and realtor-ality (realty?).

The funniest thing is how much of SoCal’s infrastructure is vintage 1930s-1950s “Oh, just stick in a pipe so the toilets flush into the sea” you see “bobbers” in the water all the time esp. after heavy rains. Every picturesque mobil home park, beach-side bungalow, etc. The rich literally think their sh!t doesn’t stink down there.

I’ve lived in that area for years off and on, and I stayed out of the water. I think the deepest I’ve ever gone was knee deep, and now I don’t even need to do that; I can just read a SoCal Jim post.

This is an astoundingly bearish report, especially in the most expensive markets. The all cash buyer in SF, NYC, Vancouver , Toronto is the reason why prices zoomed higher. These buyers , especially those from China and the Middle East have disappeared . If a further stock market correction is added to this , watch out below

Agree the Foreign Cash buyer is gone and Americans don’t have money. Does not even qualify to borrow at today’s prices.

Correction coming. The reset will happen; not just trade.

Today Jerome Powell said ““We have not seen unsustainable borrowing, financial booms, or other excesses of the sort that occurred at times during the Great Moderation, and I continue to judge overall financial stability risks to be moderate. But we remain vigilant.”

And there you have it, the big bold faced lie from the Fed, just like Bernanke in 2008 telling the world the housing collapse would not spread to the rest of the economy (S&P 500 hit a low of 666 in March of 2009). Certainly the leveraged loans and corporate debt of this cycle will not be a problem:)

It is over for asset prices this cycle, including stocks and real estate in most of the US. It is time for us to be “vigilant” and protect our wealth from heavy losses. The Fed just rang the bell.

How do I protect my wealth? Should I sell off my 401k? Serious question there. If the stock market is going to drop more than the 10% early withdrawal penalty, then the 10% early withdrawal penalty is irrelevant …

You buy gold That should be obvious by now to anyone watching

The future is plastics my son.

Gold will get pummeled from the start of May 2020 to the end of September 2020. My guess is gold will fall all the way back to $1,200 even an ounce by the end of September 2020. That will be the time to buy gold and long term bonds. May 2020 to September 2020 will be known as the counter-trend.

@ REAL JOY

Could you elaborate your basis for GLD dropping from May 2020 to Sept 2020, to1,200!

You are a predicting an event to at least 7 months in advance!

Wow! May be I should borrow your ‘crystal’ ball for a while!

@sunny129

I do not think it takes the crystal ball just to know that the speculators are now buying with gold paper that they will sell in the coming months of the next year.

People have being saying gold forever. One day they will be right. Who knows when gold will shine?

Don’t have to “sell off” 401k paper assets. Paper can be converted to hard assets, without triggering penalties.

Give you give us an example?

@Zantetsu: There’s no requirement for your 401k to be invested 100% in the stock market at all time, you know. I recently got early-called out of a 3-year 3.05% brokered CD in my 401k, Morgan Stanley called it after just 1 year due to the recent rate cuts. Like you I don’t want to be anywhere near the current everything-bubble market when the real selling starts, but would like to earn some non-zero-ish risk-free interest. Currently available brokered CDs of similar duration – don’t want to go longer because I’d like to be able to free up cash if a major correction does occur in the next 2-3 years – are yielding 2% tops … but when I looked at what the default money-market position in my Fidelity 401k account is, it’s FDRXX, the short-term-paper-invested Government Cash Reserves fund, and thanks to the recent yield-curve inversion its current 7-day-averaged yield is 1.87%, negligibly less than 2%. So I’m simply keeping the money freed up from the MS brokered-CD early call parked in that for now.

Zantetsu, you’re 401k probably has a Stable Value Fund in it. If you have an SDA then you go into SHV, VGSH or SHY. If more adventurous, then go further out in the curve to IEF, VGIT, or SCHR. Feeling even more sporty: buy TLT, SPTL, or EDV.

My opinion is that all these, on the long end at least, will have a pullback on the Steepener, when it comes. GLD, IAU, GDX & GDXJ are all good to go now as well. It’s likely they will pull back one more time when the crash comes though.

I own all of these and have done well this far; however, I await the inevitable pull back that is sure to come. It will be interesting to see if this will be an Inflationary depression, or a deflationary one.

Forgot to say that SoCal Jim might be right eventually if we end up in a inflationary depression. RE might work out pretty well for him.

I think this thing will go deflationary first and then the FED will run through their Monetary Policy Toolkit till they get to the last part MMT aka, printing.

I also think Folks underestimate the likelihood of a Socialist in the WH and in Congress in 2021.

Do not sell off your 401k. Instead re-allocate your funds into the Money Market section within your 401k. The Money Market account is the equivalent of a savings account.

Falling prices + rising inventories…even with dropping mortgage rates.

####

“And the inventory of new houses for sale rose to 337,000 houses, providing 6.4 months of supply at the current rate of sales.”

The job market is much worse than the numbers reflect Lots of lower paying jobs have replaced higher paying jobs in the past Plus many of the jobs counted are part time with some people being counted as two due to having two or more part time jobs Purchasing a home isn’t inexpensive and many of these jobs will simply not support owning a home Plus other expenses such as property taxes, insurance and maintanence costs have skyrocketed since 2008

I am in the market for my first home in the USA (only owned one before, in New Zealand, and that was 10 years ago). I am buying into a very specific region, a half mile on either side of highway 85 between Cupertino and Mountain View.

I feel like the market has been following my own internal conflicts and is coming to the same conclusion I am: why overspend now when prices are likely to be lower in the coming year anyway? Puts a real damper on home prices.

Also, it appears to me that rents haven’t been going up much lately around here … when I look to rent a townhouse comparable to one I might buy, historic trends show rents for those properties haven’t increased much at all in the past two years. Which makes one feel even more comfortable in just waiting it out …

How much higher can rents go? I’m of the same mindset in Raleigh NC I’m sitting on the fence in cash and gold waiting Tic Toc

Raleigh is still dirt cheap, against incomes housing prices there are amongst the lowest. I’d expect that area to fare well next downturn.

sc7 maybe by San Francisco standards it’s cheap but it’s a lot more expensive than 5 years ago and it’s also a lot more expensive than many surrounding areas due to the research triangle Depends how bad the next downturn is how much they will be affected I’m in no hurry to buy though The market is definitely softening and inventory is rising daily

Contra Costa County here and my (big corporate) landlord is demanding an absurd 30% rent increase for month-to-month or “only” an 8% increase if I sign a 12-month lease.

Shopping around, I’m not seeing housing market weakness affecting rents in my area yet.

Strange. I guess it’s a local thing? Rents for townhouses in the Cupertino area are just completely levelled off as far as I can tell. Maybe I am not looking hard enough, but the five or six I looked at have the same or very similar rent that they had two years ago.

In Socal beach cities, small old 3/1 beach cottages that rented for 4K in 2016 have blown clear through 6K, if you can find one. I just saw a 3/2.5 rent for 7K in two weeks. Just wow.

Falling prices of new homes is one of the best indicators of recession approaching, if not the best.

“Falling prices of similar new homes in the same location is one of the best indicators of recession approaching, if not the best.”

Fixed it for you. And no, that’s not what Wolf reported.

Wolf is reporting a change in the sales mix, from larger more expensive houses that don’t sell, to smaller less expensive houses in lower-cost areas that are now in demand.

P.S. KBH homebuilder stock index hit new 52-week highs this week.

oh yes, both toll brothers and Lennar are price cutting houses in San Ramon and Dublin. I’ve been sitting patiently in the sidelines for months now

@JDoe – I agree Bay Area looks soft. Wolf has documented a rollover in existing home median prices in several metro areas too. But it takes more than a few metro areas to make a “recession”. CalculatedRisk, who tracks real estate more closely than Wolf and nailed the 2005-2009 housing fiasco, said last week he’s “not on recession watch”. Things can change, and we know there will be a recession eventually, and we know it will be a doozy. But not yet.

Wisdom Seeker

Some numbers concerning homebuilders’ last quarter:

KBH: Total revenue -7% (to $1.0 billion); net income -17% (to 47.4 million).

Toll Brothers: home sales -8% (to $1.77 billion); net income -24% (to $146 million).

Stocks do what they do, but revenue and income-wise, homebuilders are hurting.

WolfStreet … “are hurting”? Not anymore. It is “were hurting”. I am seeing a big jump in pendings on both coasts, and people are finally starting to dip their tows into the big money stuff. Keeping my fingers crossed the low mortgage rates stay, and I bet the home builders are doing the same. This concept might be out on a limb, but it is possible that individual money that invests in fixed income may be reallocated to rental real estate … once yields get about 100bps lower. Rental real estate will be the last decent yielding safe investment left. Don’t you think that is possible? Many do.

shorting (after buying puts) these high end builder Cos like KBH is not that easy.

They are down but not as much as the XHB’ looks like a support by a group who think they will come back!?

Just wondering how many readers here, trade options? thank you.

Options only work for the institutional investor looking to juice up portfolio returns a handful of bps by carefully selling a little volatility. For the retail investor, they are a death wish … too risky. On the wall street’s sell side, traders dreamed to be on the other side of retail option flow … that is all you need to know.

@socaljim

As the very data in Wolf’s OP shows, builders are still hurting. Existing homes appear to be doing better than new.

Have a link to anyone making that suggestion? Seems off the wall to me, there was an event in a little more than a decade ago that made real estate not a safe return. I see far more theories about an echo bubble and then next recession taking real estate through the mud.

Regardless, the jump in pendings I saw in Boston was short lived. I’m seeing activity start to slow in the suburbs again, rather significantly.

You can keep your fingers crossed about low mortgage rates, but if this is all they’ve been able to do, unless they drop to 2.5% next year, we’re cooked.

The trade war is eroding my confidence in real estate investing.

What is the point of that comment? We’re all here to share opinions about the topic at hand.

Amen

Mine as well Houses should be homes anyway and not a get rich quick scheme IMO

Also is it surprising that the break in the house price increase occurred right when Trump’s grandfathering in of the mortgage deduction maximum expired?

It is undeniable that Trump’s mortgage deduction changes should have reduced prices because a mortgage on 01/01/2018 has a higher long term cost than the exact same mortgage on 12/31/2018. And yet the prices didn’t reflect that at all. It is my conclusion that there was momentum left in the market leftover from the rush of people trying to get in before the deadline, and that momentum had to play out. And now it’s played out and the prices are regressing to where they “should have been” given Trump’s changes.

Uncertainty and fear are just adding on top of that to put even more downwards pressure on prices.

In northern California, a significant component of a house price is the speculation on its future value. Homes are seen as investments as much as they are places to live. When confidence in future gains erodes, it has a serious impact on how much premium beyond the ‘natural value’ of a home homebuyers are willing to spend. This is happening *right now*.

Correction: the grandfathering cutoff date was 12/14/2017, not 12/31/2017, so my dates are wrong there, but the point remains the same.

Just a quick regional report from the Tampa, FL area. Residential building is brisk here. The traffic is starting to become a major issue here as FL is probably growing much much faster then people think, especially the Tampa area. While the incomes around here generally stink (compared to major markets), the new home prices are a steal here compared with the stuff they are selling in the Mid-Atlantic and North-Eastern markets. Also, it helps to have no state income tax and lots of warm weather in winter. Of course, in the long run, I see this area as another Atlanta where the congestion takes a big chunk out of general quality of living (unless, maybe you are retired and can avoid the terrible commutes). We will see if the job creation and incomes can match the pace of residential building. The air can be let out of this regional tire VERY fast with a large drop in jobs and income.

I agree that Florida is getting too crowded. I follow the south Florida residential market and have noticed county club properties like Broken Sound in Boca can’t give them away. Of course it costs around $70 G to buy in and then there is the yearly amount you must spend in the club which is around $10 G. There are some very nice homes listed at give away prices.

Three things are contributing to a slowdown in sales and a decline in prices:

1. Most new home buyers do not have the necessary cash for a down payment; therefore, they cannot buy.

2. Most of the newly-minted millionaires are not “cash” millionaires — their wealth is tied up in common shares that cannot be sold (for varying reasons) — they are “paper” millionaires.

3. Actual mortgage rates are higher than reported and requirements for qualifying are so tight that financial institutions are only lending to the creme-de-la-creme of applicants.

Here’s my question: As someone who is trying to refinance, what is the prudent stance to take — jump in now or wait until the Fed’s further interest rate cuts happen (or not)? By the way, as opposed to securing a mortgage for a new home purchase, when you refinance, your rate is locked in for 90 days the moment you initiate the application process. When you apply for a new home purchase, you can have the rate adjusted down if mortgage rates go in your favor.

My friend who works in one of the biggest banks wants to know if it’s time to Refi already or will mortgage rates still drop. (Smile)

Is this supposed to be a joke? What does your friend do at the bank? Obviously, no one knows the absolute answer to this legitimate question. But, is there an educated guess out there or a consensus amongst those who should be more qualified and knowledgeable than the rest of us to offer an opinion? Please let us know.

Do it now then it is done.

My first 95% mortgage had a rate of 11.2% in the 1980s so any rate in the 4-5% range is cheap, imo, presuming you are saving at least a couple of points and the refi closing is not loaded with up-front fees nor added to balance – a 25 bps drop in fed rate will not make a huge difference in your monthly payment. I would watch the 10 year Treasury rate if you are staying on the sideline.

Well, today it looks Powell did a mid cycle correction to his mid cycle correction. Just don’t call it a U Turn.

Chinese money is leaving the building.

From everything I read, millennials owe massive student debt, have jobs that do not pay very well, and spend whatever cash them have on experiences.

They cannot afford to buy homes.

Which leaves me wondering, how does the entire housing market not fall to pieces?

Isn’t it like a conveyor belt where you have a constant supply of people in their 20’s stepping onto the belt and buying property. But now very few are getting onto the belt?

I would be interested to see figures that compare home ownership of people from 25-35 over time. Have the numbers for home ownership in that demographic fallen off a cliff – or not?

As a Millenial I can tell you that my Millenials friends and coworkers (who are generally well off) CANT and DONT WANT to own homes. I have friends that have 150k in student loan debt. Who wants to deal with all that maintenance anyway! I have coworkers that can’t really save since rent is eating up 50% of their take home pay. Also a lot of millennial feel that boomers are leaving behind a screwed up world. Awful healthcare system, fake foods, polluted environment, an economic system that has benefited the rich and now they want us to pay them $2m for the home they bought a few years back for $200k. For what so we can feed into their greed system and they can take the money and retire on a beach. Nope nope nope.

With that being said my partner and I are stashing our cash away and just waiting. People have no idea. We are already seeing in SoCal. Some people in suburbs are selling houses at the same prices they bought it for in 2005!!! The same is true for New Jersey. It’s only going to get worse when boomers wake up and realize the system has come to an end. There is not that many millenials that will jump into their conveyor belt. Asset prices will deflate. Karma is a bitch.

“Also a lot of millennial feel that boomers are leaving behind a screwed up world.”

Not just millennials. I am Gen X and i feel the same way. As a group, they are self-absorbed whiners. There are individuals who are exceptions.

Those who fought in WW2 are referred to as “the greatest generation “

I would call the baby boomers the greediest generation.

They were influential in shipping thousands of factories overseas. They were the ultimate consumers, buying huge SUVs and were behind the huge amounts of plastic pollution

The only good thing about the baby boomers is that most will die off on the next 15 years

Rcohn, you’re attributing to the general population that which should properly be ascribed to corporatists.

The general population does not make decisions about sending jobs overseas. Your corporate masters do that. The general population does what it is told.

Yours is a technique commonly used by your overlords (and overladies) to deflect blame away from themselves for the consequences of their venality, corruption, and malice: blame the victims.

Don’t lump all of us boomers in the same greed trough .. not all of us went that route. There are outliers within every generational group .. on BOTH sides of the wealth stream. In fact, I would posit that the majority of citizens .. of all groups .. are neither greedy, nor wealthy, and see with clear eyes the train wreck of demographics & geopolitical changes speeding foward throught the tunnel of Chaos, in real time !

@polecat, look at how Boomers overwhelmingly vote. They are on the wrong side of history.

To be fair, the blame is not attributable to *all* boomers. And though many boomers did benefit, so did some Gen-Xers I know.

Higher prices of housing, healthcare, and education? Every bit of that is attributable to (a) government subsidies and backstops, combined with (b) the Federal Reserve’s ‘easy money’ policies of the last 30 years. Far fewer than 1% of boomers have been the politicians and Federal Reserve policy makers that did this.

When you are sharpening your pitchforks, please remember this.

My GenX/Millenial kids are going to inherit all my worldly goods one day. But then again, they don’t need anything as they have put their shoulders to the wheel and are both doing quite well for themselves. Beats whining, I guess.

When I read all encompassing blame diatribes all I think about is how hard my parents struggled, and how hard I also struggled to get ahead. No lunches out, for sure. And, no free lunches. Just sayin’.

During this spectualar economic cycle, I paid off my student loans. Putting my small savings in stocks or real estate seems really ill advised at this time. I ain’t here to be catching other peoples falling knives, I am in ain’t no rush. I got 30 years of wage slavery ahead of me. I am sure there will be another downturn

I got 30 years of wage slavery ahead of me.

Actually, no, you do not.

The Dickensian dystopic drudgery you propose would be preferable to a Kafkaesque denouement, but you don’t get to choose. That choice has already been made for you, by persons who would dismiss your preferences as irrelevant if they bothered to notice them at all.

Chill bro Absolutely you should NOT buy into the everything bubble that the FED has brought to the world Hang tough and wait You WILL get your opportunity soon enough IMO I’m a 1954 “ evil boomer” that you guys hate so much by the way Good luck to you kid

“Karma is a bitch”…. sounds like as if you wait long enough time, things will happen in circles. Let me tell you millennials, as long as the FED is there, they will print the shit out you young folks. Anything you buy, any service you use, they will make sure there is a loan on it. If you dare to save, they will print and raise prices so that you will feel like you are running on your feet chasing a running tuck. “Karma is a bitch” will become “100 year indebtedness” for you generation. No corporations will allowed to be bankrupt, no land lords will foreclose. You will borrow money ton buy their bonds, their products, pay their rents and then inflation.

Good luck to you sir! My 30 year old son is in the same boat. My stupid generation (and especially the stupid ones before mine) made zero effort to leave things for the future. For the past decade, I’ve been hoping this idiotic bubble would pop, but no. We’re all fighting the Fed.

Anyway, not all of us oldsters want to screw you guys over. we’re all along for the ride courtesy of the Federal Reserve.

“My stupid generation (and especially the stupid ones before mine) made zero effort to leave things for the future.”

I’m one of the “stupid generation” before yours and, as usual, generalizations such as yours don’t apply to everybody.

Precisely by AVOIDING the financial “system” as much as possible, our family has amassed all we need for several generations, provided we can avoid its confiscation.

If you took five minutes to do the research, you’d discover that most Boomers don’t have enough savings to retire, so whatever their personal shortcomings, the majority of them are no more responsible for our dilemmas than you or me.

But keep thinking that : the top ten percent – meaning the 1%, their professional enablers and their Praetorian Guard – are happy to have the generations and races fighting among themselves, while they extract wealth from all of us and fortify their bunkers in New Zealand.

Wake up: it’s about Class, not calendar, race, gender, sexual identity or immigration status.

Boomers lived through the greatest economic expansion and spent it all. Every godforsaken penny. Then they taught their kids to do the same. You can blame the greatest generation, you can blame the schools, but at the end of the day, if you’re broke, it’s down to your choices. And the next crop of children will either learn and make the difficult daily decisions or they will suffer, just as their parents are now suffering. I’m the child of two boomers, om the cysp of the millennial generation. My parents worked their asses off, my dad worked his way out of an abusive, impoverished upbringing full of every vice my grandfather could stick his dirty little fingers in (but he himself grew up in generational poverty and murderous abuse, so I guess he did improve on that) and now has more than they could ever need. I have less, but I’m 25 years younger. What i dont have is the necessity of work. I suggest everyone work so that, even if it requires a tight budget, you still have f**k you money, which is what I teach my 300 students a year. If 10% of them learn it, it’s a start toward a better future for all of us. You can do it too. And heres the secret bonus gift: you’ll be happier spending less. Try it. It tastes good.

One thing I’ve noticed is that when you rent an apartment, you tend to rent the cheapest you can get by with, but when it comes to buying a house, it seems financial prudence goes out the window and it becomes a matter of how much can you stretch to buy and then just hope nothing disrupts the cash flow you need to keep the house?

The crash was only 10 years ago. The kids know how easy it is to lose everything; they had a first-row seat to the sh!tshow at an age when they were just starting to learn about money and the larger world. They saw their parents go through hell.

So I think they’re going to be non-buyers or very conservative buyers.

“One thing I’ve noticed is that when you rent an apartment, you tend to rent the cheapest you can get by with, but when it comes to buying a house, it seems financial prudence goes out the window and it becomes a matter of how much can you stretch to buy and then just hope nothing disrupts the cash flow you need to keep the house?”

Excellent observation.

I wonder if expected tenure at a job is having any effect on young people’s decision to buy. I know a lot of people who have been in multiple cities/states in a relatively short timespan. It doesn’t make a lot of sense for them to buy because they are moving after 2-3 years anyway. I figure if you feel secure, then you would have more incentive to put down some roots. I guess putting off having kids exacerbates this trend because it’s less of a hassle to pull up and head elsewhere. Just a thought?

Definitely a factor Mobility is key

Everybody is in the gig economy now, the millennials and their parents.

Sargento,

Yaasssssss!!!

As an older Millenial (with none of the benefits of being on Gen X cusp), I couldn’t agree more. My younger Millenial friends feel very strongly that Baby Boomers screwed them over…my view is that Boomers were sold a scam back in the 70’s/80’s. But I only blame the ones that are still touting the “bootstraps” narrative of American success. I know people that work 70hrs a week and can’t get ahead.

If i hear one more time that Millenials just need to quit their Starbucks habit before they can afford a house…..smdh

In my humble opinion the blame should be directed at the Trillionaires that run this world- that own the governments, the politicians, the economies, the media, education, etc. These Controllers of our world are evil to the core and have literally sold their souls to Satan.. and are intentionally creating all the problems we have in the world today.

Dear Sargento,

I, a babyboomer born in 1960, cannot agree with you more. Karma is a bitch. Fortunately I have always pursued cheap rent and am not shackled to a home I fantasize selling for $1m+. I am appalled by property taxes. Know enough people forced to sell free and clear homes because fixed incomes can’t keep up with them. Alas! Keep up your attentive living. Thinking is the only way out and up!

Homeownership Rate, birth rate, marriage rate are all much lower for millenials than for GenX/Boomer at the same age.

The WSJ had a controversial article a couple of months ago about the glut of Boomer dream homes that simply can’t sell.

https://www.wsj.com/articles/a-growing-problem-in-real-estate-too-many-too-big-houses-11553181782

Wonder why, right?

answer: student debt of 1.5 T and growing! This factor is under appreciated out there! A silent epidemic creeping against housing prices/values. in years/decades to come!

I’ll still never understand how a $34k average student loan debt (a Honda Accord), financed over 15 years, is unpayable for people with a college degree (which earns on average $1mm more over lifetime).

sc7,

It’s quite understandable when you consider that averages often conceal more than they reveal (the Bill Gates-walking-into-the-room fallacy).

Young winners of the birth lottery graduating without debt bring down the averages of those with $100,000 or more.

I keep waiting for the NAR to make an issue of this, since, barring a steep decline in real estate prices, student loan debt is going to help crush their business in the coming years.

It’s a demographics nightmare indeed Look at Japan and all the vacant homes over there We have more immigration which can offset part of it but still it looks to be an issue with housing

@Envo: What you’re “reading” could easily be someone gaslighting you into false beliefs.

Instead of reading about hypothetical millennials, get out and meet some real ones. The ones I know are growing up, getting married, buying homes and having babies. They need houses and are working up the ranks to afford them. They might want smaller, less expensive housing, and they might have been slowed down by student debt and the Great Recession, but they will live longer (40 is the new 30) and they still have the American Dream.

LoL they want smaller overpriced places that are sold at prices that are 3x what the prior bought them for. Yea, that’s it. They want bad deals.

Then again, instead of anyone saying “Hey that’s a horrible deal, $250/sqft for that garbage that is realistically worth $20/sqft” everyone seems to egg on the foolishness be it TV shows or parents.

they might have been slowed down by student debt and the Great Recession, but they will live longer

Life expectancy in the US is declining, for reasons which guarantee the trend will continue.

they still have the American Dream.

Hope is such a cruel, cruel thing.

Hot damn! You are on fire! I love the cynicism, you put even me to shame.

Eeyore is his role model.

‘The student debt crisis is not the burden of a single generation. It impacts Baby Boomers in their 60s and 70s; Gen Xers in their 40s and 50s; Millennials in their 20s and 30s – as well as Gen Z high school students still planning for college. Thus it’s a grave mistake to frame student loan debt as exclusively or even primarily a “Millennial problem.” At the same time, Millennials have borne the brunt of the astounding rise in college costs. They are the first generation to experience a life shaped by the near-certainty of student debt.’

see the link above – Nakedcapitalism

@sunny129–

> Millennials have borne the brunt of the astounding rise

> in college costs.

States under-funding their colleges is primarily due to their pension funding obligations. Meanwhile the federal government is struggling with out of control medicare spending and the middle-east crisis.

The bedroom communities around Indianapolis have seen home price go up, up, up to the point communities are clamoring about building lower cost housing so younger people (offspring) will be able to afford a home close by.

Home prices are going to be higher. In the San Diego area prices are as high as they have ever been and sales are increasing. I don’t see any slowdown.

Looks like 10year yield is going to zero. I wonder what 2% or below mortgage rates will do to housing prices, you ain’t seen nothing yet.

It takes some time for the drop in mortgage rates to show in the statistics but I don’t predict a housing recession. There is no place to safeguard wealth nowadays, buying a house seems the most rational decision if you are renting and plan to live in for some time, you will come out ahead.

For housing prices to continue rising, some other aspect of living is going to take a gas. Only two I can think of that will free up purchase money for a house is either college or auto purchases. I think Detroit may be in big trouble sooner than later.

Over the last 60 years, real per capita PCE spending is up 183% (dominated by healthcare, housing, and education), while real wages for 70% of Americans classified as production and nonsupervisory are up 15%.

A lot of things have been crowded out, and it’s going to get worse until we either (a) remove all government subsidies and backstops, or (b) treat certain industries like utilities (like water and electricity).

Birth rate.

Detroit was in big trouble when I left there, sixty-five years ago.

But not just Detroit – any damned (literally!) big city.

Born, raised, college in SD. Left and returned 20 years ago. Finally left 7 years ago for the desert. Still have rentals, so I think I can say I know SD. While quality of life in SD has declined too a high degree since “old days” ( abalone, fishing fleet, little Italy before I5, the rock, swami’s uncrowded surfing), quality today is still leagues above LA, OC, or nor cal. In terms of traffic, housing costs, neighborhoods, recreation, occupational job variety and so forth. So SD which includes all the beach communities is a special case which cannot be directly compared to numerous other areas. RE demand and prices will continue to be strong. Those of us that follow SD watch like hawks for any sign of weakness, slowdown for an opportunity to acquire for investment, but competition is stiff.

Not everybody prefers San Diego. I personally do not and would not live there. The further south I go in California the more I dislike it. I so much prefer to go north. But to each his own.

“I so much prefer to go north.”

Me. too. Alaska beckons.

Here is the FRED data showing how new home prices nationally are as good a leading indicator of recession that you will probably find (cut and paste url)..

https://fred.stlouisfed.org/series/MSPNHSUS

And to address Zantetsu’s question, it depends on a myriad of things each of us has to consider (age, taxes, asset allocation, etc.). Generally speaking, it is a time to get more defensive, such as sell winners and raise cash. or move out of more aggressive growth funds to a balanced fund or high quality bond funds. There are many ways to ease the pain of a bear market and position yourself for the eventual recovery. Unless you go all cash you are going to take a hit, just make it less of a hit. On real estate, that also depends on a myriad of personal things. In what have been the hottest markets recently I would not be a buyer here unless it is really special property you’ll hold on to forever.

Keep.. That FRED chart is not a good recession indicator, even if you fine tune it!

https://fred.stlouisfed.org/graph/?g=oGWy

Purchasing is such a big decision I think most of us don’t really do it well. As I have said before I like Michael Bluejay’s rent vs buy on-line calculator. At least it prompts you for all of the inputs to the financial aspect of the decision which is an incredibly complicated one. Renting is always cheaper the first month, so he gives you the number of years to breakeven

I have also seen that you should combine housing and transportation into one number and keep that to less than 50% of your income. That allows you to figure in cost of commute apples to apples.

As I have gotten older the more I appreciate liquidity. A s&p index fund is a wonderful thing in that it is very liquid. Need a $1000, hit tje sell button even in a down market. A house not so much. There is a saying that banks loan you an umbrella when the sun is shining and take it away when it rains. Don’t count on being able to get to the equity in your home. If you value liquidity renting is ok.

There are at least 42 Millions with student debts of various amounts, some worse than the others. It is a crushing their dream of owning home. Some have given up!

It is a silent deadly ‘epidemic’ with devastating effect on the housing industry, in the near future!

‘The student debt crisis is not the burden of a single generation. It impacts Baby Boomers in their 60s and 70s; Gen Xers in their 40s and 50s; Millennials in their 20s and 30s – as well as Gen Z high school students still planning for college. Thus it’s a grave mistake to frame student loan debt as exclusively or even primarily a “Millennial problem.” At the same time, Millennials have borne the brunt of the astounding rise in college costs. They are the first generation to experience a life shaped by the near-certainty of student debt.’

I have put off having children, marrying, or purchasing a home due to the high costs of student debt repayment. Regularly, I contemplate selling everything and living in my car to help free up money to pay off the debt sooner.

(Melissa – Granbury, Texas)

https://www.nakedcapitalism.com/2019/08/life-deferred-student-debt-postpones-key-milestones-for-millions-of-americans.html

Wow that’s really unfortunate. I think people need to seriously consider whether a college education is ‘worth it’ before enrolling. If the college education does not enable an income level that would allow paying off the college debt in a reasonable time frame (5 years or less), then I’d say it’s not worth it. I will not allow my children to enroll unless they have a specific goal in mind and only if that goal is economically viable.

The first person you quoted in that article is a woman who went $100,000 in student loan debt to get a Masters Degree in English, so I think my point has been made …

“You think of college debt as a Millennial’s problem – and it is – but the fastest growing group of borrowers is seniors, according to CBS News …

For seniors who fall behind, the government will garnish their social security. Many of them face a mountain of student debt they can never pay off.

According to a Forbes analysis of Federal Reserve data, student loan debt among consumers in this age group has increased 71.5% over the last five years. This means that, as of the last number-crunching session, seniors ages 60 to 69 owe $85.4 billion in student debt altogether.

… Like other generations, seniors and baby boomers often choose to go back to school to increase their job prospects or learn new skills. And when they do, they take the path nearly everyone does when they go to college — they take out loans.

Of course, sometimes seniors are left holding the bag when their child or grandchild decides to go to school. This may mean they co-signed on a private student loan for a loved one they wanted to help with college, but it can also mean they took out parent PLUS loans, which come with a fixed interest rate of 7.6%.”

https://www.forbes.com/sites/robertfarrington/2019/05/22/the-growing-trend-of-retiree-student-loan-debt/

In a failing system, the elderly are increasingly subsidising the young.

Isn’t it a Golden Rule: Never, ever, become indebted on behalf of someone else?

Yup it effected me I had to shell out almost 200k hard earned smackers for my sons 4 years at Georgetown But at least I could do it and he has no student debt

University is highly overrated, imho. Making a measurable life plan with achievable stair step goals is far more crucial. Ivy league isn’t about the education available at the institution, it’s about networking and connections. It’s a class place holder. Real learning, is for the most part, free. No tuition required.

regards

Paulo, your forest folk wisdom shtick is entertaining…but graduates of Georgetown become global leaders. It’s a whole different ball game than plucking around in the forests of BC.

If you are drowning in debt, find Dave Ramsey on the radio and follow his plan. No matter how bad your situation is you will hear people call in with bigger problems.

Basically his idea is to sacrifice now good and hard and get the debt gone as quick as possible. You can start living after the debt is gone.

On the contrary, soon we will all get paid to take on debt.

So what you want to be doing is loading up on debt!!!

I know this sounds really, really crazy.

But I am told that it’s not. It’s just the new normal.

oh shoot, they used to have a word for this..wait

This is what the stock market is going to do when rates go to zero…

The dual death knell will be rates for savers zero and stocks falling (everybody long).

Then the Central Bankers will have finally shot themselves in both feet, and us in the wallet.

Curious about the rates for HELOC’s which appear to be a hot item. The rates of mortgages are going down but the rates on HELOC’s are not…in fact some of them have increased month over month…can anyone shed light on this?

Heloc’s are second liens on the property, under the first mortgage, therefore more risky for the lender. In a default the first mortgage will get most if not all the money. Expect helocs to be terminated if any hint of a financial crisis appears on the horizon.

As they say all real estate is local. And my local real estate market is showing zero signs of a slowdown.

This summer there have been 4 houses for sale on my street. One sold almost instantly, like within 24 hours it went pending. Two went pending after about 2-3 weeks. The 4th is still sitting. The owners made a cardinal sin in real estate, they bought the most expensive house on the block. It was a former model home with all the extras. That’s always the toughest house to sell. It’s a $500K house in a ‘hood of $400K houses. But buyers looking for $500K houses want to be surrounded by $500K houses not $400K houses. Unless they reduce the price significantly, that thing will sit forever.

Rates are low heading lower, investors rush into safe or hard assets. Is it a housing crisis, an asset crisis or a mortgage crisis? Too much supply? Probably. Massive devaluations after a Treasury bond reset? Low probability. Subprime or sharp rise in interest rates? Maybe, don’t know if this generation of fixed rate buyers has a big enough firewall to avoid a call on their paper? With retired mortgage holders putting their hopes on shadow bank refi lenders how many homes that are mostly equity will be foreclosed?? Like a lot of things when SHTF this will unfold case by case. There was no omnibus solution in 08, (other than QE) and more shadow banks. Will government ride to the rescue? Case by case.

US politicians and banksters should study the Netherlands where the housing market has been booming for more than 25 years now, with only a small dip in 2009-2013. The average new home costs around 400.000 euro (with WAY lower average income than in the US) and prices are still rising 7% yoy (a little less than previous years though …). Even in the most remote corners of the country prices are totally ridiculous and often 10-15x higher than in the nineties (for the same home, not some national average number), despite less than 100% income gains in the same period. In the last few years foreign speculators have started to enter the market but I don’t think they have a significant influence except in a few spots like Amsterdam.

Rates close to zero, no down payment for almost everyone, a free government-guaranteed put option for the home price for all homes up to the average home price, full mortgage cost deduction from income taxes, no tax on equity gains from selling a home, lots of extra subsidies and incentives for “disadvantaged” groups etc. etc. And the Dutch government does everything they can to jack up rents in the free market (= for those who make more than the minimum income) and push conversion of homes to Airbnb or speculation properties. As a result, renting is 2-5x more expensive than the mortgage cost for a similar home.

BTW, the cost of a new Dutch home today is around 60% higher than the cost of the same home built 3 years ago. But according to ECB and the government there is “too little inflation” in Europe… Of course the ECB wants more inflation, the mortgage debt of tiny Netherlands alone is sufficient to crash the whole EU-con-omy, so rates must continue going down and homeprices must continue climbing.

Coming soon to other countries I guess, because a huge chunk of the population profits along as long as this super-Ponzi play is running. So lots of voter support for continuing this con game, it’s even better than tulip bulbs!!

Netherlands is a beautiful country, would love to have one of those cute little bungalow houses along a canal. I have a friend down the rail line outside Antwerp, a great area. Although…sad to say, plenty of ghetto-like places in between the idealistic medieval towns like Bruges (so it hasn’t all been gentrified).

Clearly markets are topping out in developed economies, the wise will get out of debt, sell at the top, and keep their powder dry.

One of the reasons for the fall in price on new homes can simply be that they are building smaller sized houses and the overall price has reached a plateau.

As this crash unfolds you will see RE sitting for 150-200 days with multiple price reductions and open houses every weekend. It’s the new normal. Sales will pick up when you see 20-30% reductions in price. It’s the boom and bust cycle we have seen multiple times before in California

The government has had , and has used it’s ability to fudge numbers since the (first) criminal post 911 administration

backed up it’s books all the way to 1929.

They have the ability to lie about employment, to lie about

retail closers, to lie about home sales… they can do this now…

so why is nobody shooting off the flare gun here? it is my contention that the system would fail without any help from

the puppet masters… but a surprise crash would not allow the opportunity for “timed full spectrum shorts” to be placed on a Friday , one second before market close…

The economy is being guided… the gold market is being allowed to rise… am I really they only one who sees this?

like spraying wheat with roundup to deliver the first harvest

to the silo, the date of the crash has already been carved in stone.