But these are the good times. Automakers are not amused.

The auto industry depends on subprime-rated customers that make up over 21% of total auto-loan originations. Without these customers, the wheels would come off the industry. And tightening up lending standards to reduce risks would cause serious damage to the undercarriage. Subprime lending is very profitable – until the loans blow up – because interest rates can be high. But those subprime auto loans are blowing up at rates not seen since the worst days of the Financial Crisis – and these are the good times!

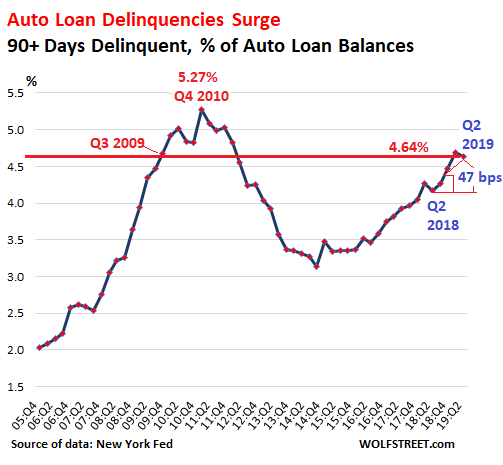

Serious auto-loan delinquencies – 90 days or more past due – in the second quarter, 2019, jumped 47 basis points year-over-year to 4.64% of all outstanding auto loans and leases, according to New York Fed data released today. This is about the same delinquency rate as in Q3 2009, just months after GM and Chrysler had filed for bankruptcy. The 47-basis-point jump in the delinquency rate was the largest year-over-year jump since Q1 2010:

But this time there is no economic crisis. The unemployment rate and unemployment claims are hovering near multi-decade lows, and employers are griping about how hard it is to hire qualified workers without having to raise wages. So, unlike during the Financial Crisis, this surge in the delinquency rate has not been caused by millions of people having lost their jobs. It’s not the economy that did it. It’s the industry.

What the lenders are sitting on.

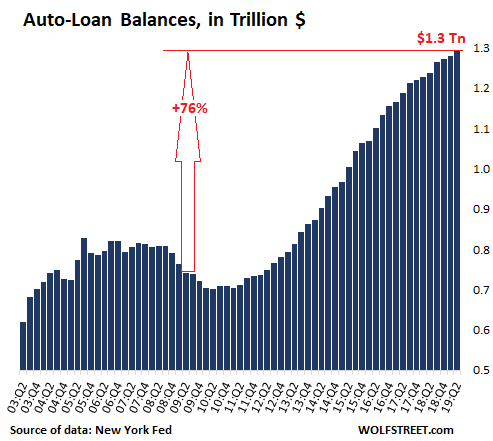

Total outstanding balances of auto loans and leases in Q2 jumped by 4.8%, or by $59 billion, from a year ago to $1.3 trillion, according to the New York Fed’s data (which is slightly higher and more inclusive than the amount reported by the Federal Reserve Board of Governors in its consumer credit data). Over the past decade, since Q2 2009, total auto loans and leases outstanding have surged by 76%:

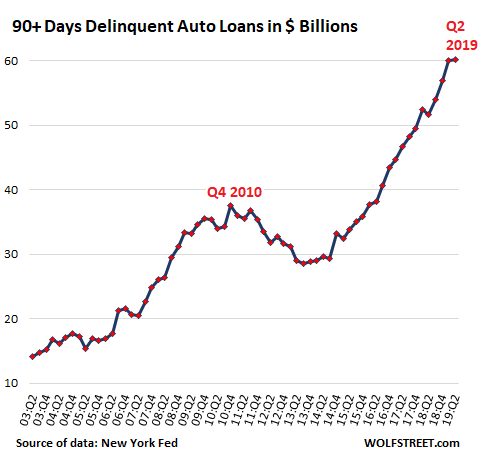

Of those $1.3 trillion in auto loans, 4.64%, or a record of $60.2 billion, are 90+ days delinquent, which gives the chart below quite an amazing trajectory. But this is not an employment crisis, when millions of people lose their jobs and cannot make the payments on their auto loans. What will this chart look like when the economy turns, and unemployment surges again, and people cannot make their car payments? No one has an appetite for making projections here.

Who ends up holding the bag?

Subprime auto loans will not cause the large banks to get in trouble. Large banks have been fairly conservative in writing subprime auto loans. Captive lenders, such as Ford Credit, are more aggressive because part of their job is to promote the company’s new vehicle sales.

The most aggressive have been specialized lenders, including small shops backed by private equity firms, and larger lenders such as Santander Consumer USA. But they’re spreading the risks to investors by packaging their loans into subprime auto-loan backed securities, of which the highest-rated tranches have AA or even AAA ratings. And these securities are everywhere, from bond funds in the US to some pension fund in a Scandinavian city.

For investors and lenders, these delinquent loans don’t represent total losses. If the default cannot be cured and the lender decides to repossess the collateral – which is easy to do with modern tracking technologies – the lender obtains a used vehicle for which there is a liquid auction market (unlike housing) with wholesale auctions around the country, and finding a buyer is generally not the problem.

The problem is the difference between the price at auction and the outstanding loan amount. The difference plus expenses is the loss that the lender and investors take. This loss might be 50% of loan value.

Automakers are not amused.

As these soured loans have been piling up over the past two years, lenders became more circumspect and tightened up lending standards. In Q2 2015, at the peak of the subprime auto-loan craziness, 25.4% of all loan originations were subprime. For GM, Ford, Fiat-Chrysler, and some import brands, 2015 was also the peak year in auto sales, driven by aggressive subprime lending.

In Q2 2019, subprime originations had fallen to 21% of total auto-loan originations, the lowest portion for any second quarter since 2011. It was down over 1.5 percentage points from Q2 2016, and down 4.4 percentage points from the reckless subprime-lending days of Q2 2015.

As lenders tighten up their lending standards, auto makers lose the sale. Subprime-rated customers, when they get rejected for a new-vehicle loan, are routinely switched to a much cheaper used vehicle that is easier to finance, and where the risks for the lender are smaller. This usually happens at the same dealer.

The customer is happy because they drive off in a nice-looking car. The dealer is happy because they likely made more money on the used car than they could have on a new car. The lender is happy because it made a ton on the subprime loan, likely charging a double-digit interest rate. And the automaker lost a sale.

In this manner, the crisis-level delinquencies are impacting new vehicle sales, with deliveries by GM, Ford, Fiat-Chrysler, and some import brands down for the fourth year in a row, and for the industry as a whole down for the third year in a row. And yet, these are the good times.

Carmageddon for cars. But big equipment is hot and gets pricier. Read… New-Vehicle Sales Fall to 1999 Levels: How to Grow Revenues After 20 Years of Stagnation (Yup, You Guessed It)

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

And yet the indexing brigade keeps pushing total bond market funds. These are usually the primary bond options available in retirement accounts.

funny how LOW INCOME workers drive new vehicles they have no business ”’renting”’ because they will never be able to pay them off in 8 years

I find the 1 payment plan best

paid in full from day 1

which is why I never own ‘new’

This seems like a good place to maybe help put to bed another oft heard anecdotal story regarding these “stupid low income” people…albeit using another anecdote.

I often hear similar anecdotes about poorer people driving expensive cars “spotted” at Walmart.

Look to see if that Benz, BMW, or loaded big SUV came from a dealer. I walk the rows there a lot and they all are from “Trusty’s Used Cars”,etc. Which means hi miles, temporarily hidden mech probs, or other various tricks were used (or payoffs, you can look up the running “caught” list at the BAR website) to smog them, and they likely wouldn’t pass again. This means the owner has one shot at a best effort reduced price cost smog repair, and next time it either passes or no registration. 2012 rules, CA, IIRC. (I don’t know about the rules for these dealers, but I bet they vanish quick and often. I also met a Craigs list expert who knew how to game the # cars sold per year system, and all the above stuff) and did well at it in same JC auto shop.

We had one poor kid desperately trying to smog a big, Red, fully loaded, fairly new Ford Expedition, and another same deal with a BMW 500 series. The instructor teaching the BAR smog L1,L2, class told me, “Poor kid, I doubt that thing (the Ford) was legal when it was new.” Sure, they were likely unreasonably cheap, but then these folks are no match for a hustler, and they gotta have transport to get to work, and why not look cool to the girls for a few bucks a month more?

Most anecdotes usually fit the prejudice perfectly, mine too.

WR’s data, however, is another story, but likely equally sadly desperate ones. There are a lot of places when one cannot survive without reliable wheels, and many think of it as “just in case” shelter.

I have no answers.

NBay – almost all of those cars will be “salvage” titles too – can look new but have severe problems or been in a crash, few new body panels and an Earl Scheib paint job, and it looks new at least from a few paces.

Great post.

Forgot to mention using stolen, unused trailer, or exempt unused M/C “sticker trick”. Cops can’t read small #’s on road. These folks are usually caught at so called “drunk driver” checkpoints and pushed even further down into poverty by our “legal system”. Our system NEEDS the homeless as an example to rest.

“…employers are griping about how hard it is to hire qualified workers without having to raise wages.”

Yep. So many employers still dreaming of returning to the feudal years. Getting young vassals out of college, smarter than Einstein and willing to slave away for minimum wage.

If employers are so anxious to find qualified workers, how about sharing the cost of their education? How about taking 50% off the muckety-muck’s massive compensation to pay for education or re-education?

Because qualified has little to do with education and much to do with experience. Just kill 2 birds with 1 stone and bring back the timeless master / apprentice model.

Bring back? It’s been back for years. They just found a new name for it: internships.

Not just internships. In the past 30 years, it’s been common that you have to train your replacement.

Human capital is just too dang expensive to invest in these days :/ especially with people’s poor memories and generally low levels of aptitude for highly skilled work. Most of you should all be homeless for being limited in your abilities. We’re still waiting for the employee who will do it all for free and instantaneously, and we think they’ll show up any day now.

Without having to raise wages – or, indeed, having to invest any money in training.

Strangely in this world of free-market capitalism (LOL), it seems to be increasingly incumbent on the state to provide workers pre-trained and pre-skilled at no expense to the employer.

Money saved that can be invested in loan repayments to finance stock buybacks.

Aaaand? Apparently we’ll need to do a better job subsidizing transporting them to work since their jobs don’t seem to cover the car payment. Even in such GREAT times with high employment, where employers are just scratching each other’s eyes out for employees.

That training in manufacturing world used to take one or two weeks. Now the millennials take three to six months to get there.

Lol. You mean they’re coding for 100k+?

Long story short. I tried to write a more extensive reply but ended up with way too much content.

The major point is that classic industrial lines have been setup with distribution in the focus.

Capitalism has nothing to do with the liberal idea of humans providing innovation from outside company ground. The saving is the reward for participating in the reproduction of provision processes at a higher technological level.

Example for the classic/liberal idea of the triangle: Have a job in a bar in Los Angeles and watch?v=8OyRL48ADjQ ‘at home’.

The liberal triangle explained. People participate in a job just get a positive experience concerning the distribution of goods on one hand and do research/education and selling results retrieved from this process in a market economy always considering that the associations among those 3 points cross fertilize each other.

Industries don’t take care of this since they are only one point out of three.

The basic influential factor is that the point Innovation happend changed over the decades. The scientist (even in a broader sense also consultants supplying concepts) in a company today plays the role of the craftsman in classic industries.

There are many influential factors to consider. Since tools and goods from demand driven perfectly fitting consumption are retrieved using money from the redistribution the are many factors today that put supplier in a more convenient position when salaries are low or less credit is granted in order more easily set the price indicator and this way for example discounts allowing the customer/human to buy at a market place where the supplier plays the role of a monopolist (ignoring competition in this case) gains influence via manipulating other people’s (time) preferences.

On the other hand managers know their lines and the company and fairly the company grounds and what’s required there. If you educate people inside a company you know what the result is but they are not in the position to find those who can successfully be educated.

If you looked for an inhouse consultant SAP BW guy in 2005 and didn’t get one you needed to educate someone with little experience in Excel, mainstream databases, reporting but not too specialized. What business people got ‘sold’ where experts with full stack competence in very area involved (which didn’t exist at all). Presenting people this way was a counter force to the trend to lower and lower the price indicator for consulting services.

Anything else has a lot do with shifting products from B2C to B2B. The better goods are offered in B2B (tools). Getting the real good stuff – income of a real self employed.

In order to access goods from demand driven lines you need money from the redistribution as part of your income as well (higher).

In classic industries tools were redistributed in order to find a way to reproduce the economic provision processes at an advanced technological level (since the position of the consumption in the household and the machine on the company ground were set).

Access to money from the redistribution (proxy in order to access the tools you demand) is granted only for participating in this special kind of process.

Today tool = good retrieved from demand industrial lines and classic goods are emulated (rent models for example) by the supplier modifying the price indicator (part of the real classic industrial ware which doesn’t prove savings in general).

“Long story short. I tried to write a more extensive reply but ended up with way too much content.”

—

So why didn’t you use the short version??

Saw a funny tweet that summed it up nicely:

“Job posting be like – need a virgin with two years experience in sex.”

Yyyyep. Says it all. One would think the tech world would be different, with all that desperation money flying around, but every ad is for “Junior Dev with 3-5 years experience in this framework that’s only existed for 2”. I heard that the school I went to is now CHARGING for internships.

Imagine what this subprime loan book would look like if we had a deep recession combined with a lengthy disruption to the oil market from geopolitical troubles in the middle east. People losing jobs and defaulting on loans, but gas is too scarce to encourage anyone to buy the repos.

Would gas mileage affect the resale of loaners? This seems to be a replay, only the SUVs may be a little bigger, a little less fuel hoggy but infinitely more fragile. Hich tech and all that.

Seen this one coming for a long time now and not really surprised or shocked if I’m being honest. I’m also willing to bet although it says “auto loans and leases” the majority are in fact leases.

Once upon a time leases where only available to company’s or self employed traders once they opened it up to everyone and sold as many as they could to make new car sales look good it was always going to go south at some point. As the criteria and affordability checks for these leases were/are weak to non existent.

Once again short term gains are going to result in long term pain IMHO. I’m in the UK and the same problem exists here in car loans/leases plus we are also seeing increasing defaults on credit cards and personal loans although Mortgages remain mainly unaffected as of now. But it won’t take much or long for that to go bad as well IMO.

Dear Wolf, your insight is priceless. Though In this case did you think about the strategic play of car dealers to show subprime borrowers a brand new, beautiful vehicle then let their hopes fade because of the buyers poor credit? Dealer makes more money selling a used car and also has a chance of repossessing the car and selling it again!

I call this the AUTO DOUBLE DIP

Rahim,

A franchised new-car dealer (such as a Ford dealer) is not a note lot. What you’re alluding to is done on a note lot. It’s the shadier end of the car business: selling cheap used cars for credit and a big cash down payment, and then repo-ing the vehicle when the guy is three days late, and selling it again.

Franchised dealers are not in that business. We never did this stuff. We had 250 employees and subsidiaries and were a legitimate company with a 401k and whatnot. No way that we would do note-lot stuff. (though some dealers have a separate company with a different name in another location that does that)

Customers that go to a franchised dealer, usually have at least a vague plan. If they’re a used-vehicle buyers, they head to the UV department. If they’re new vehicle buyers, they migrate toward the NV side or go straight to the showroom. Most customers have an initial preference for new or used. Many customers have done research. They think they know what they want.

Then it’s the sales person’s job to take it from there… to figure out what they really need, what they can afford, etc. But a sales person is NOT supposed to pre-qualify. F&I does the qualifying.

Dealers are under considerable pressure to sell new vehicles. They get paid that way, there are ego things (#1 Ford dealer in the City or State or whatever), and the like. If they don’t sell enough new vehicles, they lose their allocations of hot models, and the manufacturer breathes down their neck, and in the end, they might lose the Franchise.

Generally, you want to make a customer happy. If they want a new car, that’s what you will try to sell them. If the deal falls through in F&I because it gets turned down by every lender in town, you go back to the drawing board. Now you know what the credit situation is, and you start working the deal from the other end: what you CAN get the customer into. So you pick a car for them that you figure you can get financed, and it’s the sales person’s job to sell them that vehicle.

Also, franchised dealers don’t lend the money. They just arrange the loan or lease with a lender or leasing company. Usually they work with a whole bunch of lenders, including the captives (a Ford dealer will work with Ford Credit). If the customer defaults on the loan, it’s between the customer and the lender – not the dealer, and the dealer doesn’t repo the car. That’s the lender’s job.

Wolf, what do you know about some of these dealers who “approve” a loan and let the customer leave with the car. They then submit the info only to find that nobody will agree to whatever terms they promised the buyer. They then call the next day to “finish the paperwork” only to change the terms to whatever they could get approved. The payment/rate is higher or they need a bigger deposit, etc. This happened to two different people at my company, and I thought it was crazy that a dealer would do that.

RIPP

This is often a ‘spot delivery’ where customer buys car when finance company is closed for weekend or evening. Customers credit is worse than customer alleged and deal must be amended. If it is done as a sales tactic as you are saying, it is a lot of grief just to sell a car.

RIPP,

Endeavor explained it well.

This was a much bigger issue when I was in the business back in the day. Now, a lot of credit approvals are done automatically, on the spot, by computers, and many deals get done on the spot, at any time. But there are still complicated deals that require a human at the lender.

Back when I was in the business, the buyers at the banks left at 5 PM during the week. And there was no one there on Saturdays. Ford Credit buyers left at 6 PM during the week, and worked shorter hours on Saturdays.

But Saturdays and evenings were the busiest times for us. We were still making deals at 9:30 PM.

So in cases when we couldn’t get the deal (the financing) done because no one was at work at the lenders, or because Ford Credit turned it down on a Saturday, and we wanted to shop it to the banks on Monday, we would make a decision on our own (by crawling all over the credit profile) to see if there was a good chance we could get it bought and at what rate. Then we would run with it and spot the car.

Then on Monday, we hounded the lenders to get the deal bought. If it didn’t work, or if it came back with conditions, we would then have to redo parts or all of the deal, such as putting the customer into a cheaper vehicle or work the customer for more cash-down.

This is hard and time-consuming and you might lose the deal over it, and no one wants to do it, so dealers try to avoid it if possible.

But if you don’t put the customer into a car and take their trade-in (“dehorse” them), the customer might end up going to another dealership and buy there, and you lose the deal. So there is real motivation to end the customer’s car-shopping effort and make the customer happy on the spot.

However, occasionally management got too aggressive in estimating the credit quality of a customer just to roll the unit, and they assumed that the customer would actually be able to come up with $1,000 cash down or whatever, and then on Monday the deal would blow up. We had a special term for this type of obviously unworkable deal: “mind deal.”

RIPP, that “scam” is happening all over the country now. It happened to one of my neighbors lately. She thought she bought a new car, only to find out three days later that “for some reason to do with her credit” she couldn’t get the loan she was offered but instead they had a “higher interest rate” loan she could get instead. And this was done at the “most respected” franchised dealership in town!

This “scam” apparently isn’t illegal, at least in my state, but it is highly unethical. The dealer thinks you will fall in love with the car if you keep it for three days and be willing to pay the higher interest rate instead of returning the car.

Most people don’t talk about this happening to them because they think it is something they’ve done, instead of just another “scam”……

My most recent car buying experience was to help my oldest daughter buy a new Subaru Forrester. She picked out the model and color and I sent out requests for OTD pricing to 10 dealers.

The low bid was some $3,000-4,000 less than the high bid.

So, if you want to roll the dice and not know ahead of time what a competitive price for a car is, and if you love the feeling of having haggled the price down $3,000 without knowing whether the dealer you went to jacked the price up $3,000 as his starting bid to begin with….,

Why sure, go and play the Haggling Games and spend hours and hours haggling and filling out the loan paperwork and overpaying for an extended warranty (if you paid $1000 for an extended warranty – that’s a ripoff price. Honda Extended Care can be had online for a few hundred dollars – if you really wanted one)

Me I just want to buy a car without getting slimed and having to try to out trick the dealer. Life is too short

That has in fact been my experience also. The professional car dealer doesn’t only want to sell a car, he/she also wants to make a sale that “works”, leaving the customer happy (or at least content) and with no “noise & drama” coming back later.

Some car dealers offer a buy-back service / guarantee so there is a amicable way for the customers to get out of a purchase or a lease, usually on the condition that one finances the car via them.

—

I quite like salespeople, actually. I find that most are honest and will genuinely help to solve ones problem when one lets them work at it.

I’m with Faj on this one. Plus, I think this applies across products, even RE.

There are some very good salespeople out there. They are not all bandits. The trick is find one, tell them you appreciate their service, and tell others so the good ones survive in a tough business and their practices are reinforced.

An anecodote: ten years ago we wanted to buy a Toyota Yaris. My wife and I were both commuting at the time and there were some incentives in BC to trade down to better mileage vehicles. Plus, I could get $2200 for scrapping an old gas guzzler 4X4. We went to the local dealer where they tried a bait and switch, bulshi! us with delivery options, then finally directed us to one they had in stock, blah blah blah. I had researched this for months, gave them opportunity to ‘come around’ a few hours later, then walked away, driving down to Courtenay and dealt with a great salesman. In mid spiel he froze and said, “You already know what you want, don’t you? So let’s just get down to business. What you want has to be ordered in and we can have it in 3 weeks to a month. We will gladly meet your price”. The day of final purchase we drove down and there was our wee little sub compact on the showrrom floor, already to go. They opened the double glass doors and away we went. Cash sale and no BS. I later found out this salesman and his brother had stellar reputations and did very well in the business.

They were very interested in why we bought from their company as opposed to the local dealer. We told them.

I just bought a private sale vehicle from a widow. I phoned up a Dealer I knew and asked him for a market evaluation and his opinion, and that we would pay him for his time and expertise. He wouldn’t take any money and I finally had to leave $40 on his desk for the ‘beer fund’. It took him about 5 minutes on the computer and gave us both a printout. These are good honest salesmen surviving on their wits, and there is nothing bad about that.

If buyers choose to be sheep………

I would agree with you normally, but it was a car salesman who explained this “scam” to us. He told us that that salesman can access your credit score day or night and if he is any good, he knows what his finance companies will and won’t accept. If he doesn’t then surely his manager, who has to approve the sale, does. There is no good reason to promise more than can be delivered. But when it is hard to sell cars, as it is right now, the salesman just wants you to take the car home and hopes you won’t want to return it.

Recently I was rooting around for a new car. All that I heard was how I could have a better car on credit. They acted as though I peed on their foot if I wanted to pay cash.

OK, fine. To really get them I offered to pay in gold coin. Rather than cutting me off they should have taken the deal as gold is up 22% since then.

They hate cash buyers.

My standard method of buying a car is by internet. Find the EXACT car I want with any options, etc., ask for quotes online to as many dealers as possible, pick the best quote from the best rated dealer. I ask for the Out the Door Price, ie, this will be the check I will be handing over to you, no more, no less, and you will give me the car

My ex-wife used to love to go to the dealer and try to haggle with them. I HATED this part of buying cars. We would spend hours, and most dealers were smarter and better at haggling than her anyway, it was such a monumental waste of time.

I view buying cars like cameras or laptops- I find the EXACT model I want with the exact specs, and buy it, no fuss no muss.

This way is the best way to turn car buying into what Tesla stores already do

Also, the #1 reason to have the Out The Door Price and to make sure the dealer EXACTLY what I mean by that is that when I bought cars with my ex-wife, after struggling through the hours of haggling and agreeing on what we thought was the final car price, we would be subjected to several more hours of trying to sell us add on services, extended warranties, etc., and then discover that all sorts of fees had been tacked onto the final price. Some, like taxes and title, etc., were obvious, others seemed totally arbitrary and designed to rip us off, e.g., “dealer advertising costs”

It was like getting waterboarded.

I have NEVER bought a car with a loan, I just want the best deal possible, I don’t want to get ripped off, I hated, HATED buying new cars, until the internet cane along and made my current method possible

Erle,

Yes, they hate cash deals.

Here is what you should do next time as cash buyer: Hammer them hard on the price (pretend to walk out, and all) but tell them you want to finance. Then you don’t negotiate the interest rate or the payment. You just lie down. The price is all that matters. So they make you a wonderful deal on the price because they know they can make a killing on you in F&I financing the car. You go through with everything, take delivery, shake hands and smile. The next day, you walk in with a check and pay off the loan. Done. Happens.

That’s exactly what I did when I bought my current car. I got them to lower the price even more since I said I would get the platinum extended warranty. I didn’t even look at the interest rate they had come up with, and the finance guy thought he was the best salesman in the world. I signed the papers and drove off. A week later the car was paid off and the warranty was cancelled and fully refunded. Saved me about $1000.

Ha. Thanks for that advice wolf. I’m gonna do that

Noticed that inflation for used vehicles rose more than new per recent report. Buyers are obviously purchasing more used than despite increases in used car inventory.

Sub prime auto lending is a huge bubble, but what isn’t these days?

All industries have been fueled with massive amounts of debt, and it continues on and on today with the certainty of more QE & lower interest rates.

10 years ago, there was only one viable solution to save the country & the economy & that was to let everything reset to “true” price discovery. TARP was a joke. It’s sole intended purpose was to use taxpayer money to bail out & enrich the crooks who created the problems. Subsequent QE’s to enrich the already richer.

Now 10 years later, the debt frenzy is culminating into a catastrophe of epic proportions. Where has that left middle America? Grasping for straws, struggling & worrying what the future will be like. I sure hope folks are as well prepared as possible moving forward.

Have a look at what is happening in Hong Kong.

Part of the problem is the authoritarian government on the mainland, but the real problem is that a 198sf apartment costs USD500,000!

If you are graduating and even the shoe box is out of reach, you get frustrated as heck. Remember, you are already crammed into a shoe box apartment with your family.

And when you reach your breaking point you hit the streets.

Hong Kong is the canary only because asset inflation has hit that city the hardest.

The same pressures are squeezing the middle class and the youth in every country. Inflation is relentlessly crushing them. Taking on debt to pay expenses turns the vice tighter.

‘Every man has a breaking point. You and I have them. Walter Kurtz has reached his, and very obviously, he has gone insane.’

People may not go insane, but when they reach their breaking points, they will riot, as we are witnessing in Hong Kong.

Spot on. True in Berlin, London, Singapore, Toronto…just about every significant urban center in the developed world. A ticking bomb, and the Central Bank geniuses want even more inflation.

The protests in HK are entirely rational. This is no populist tempest in a teapot.

My understanding is that the reason for the protest is that mainland China wants to be able to snatch up anyone in HK they think might be likely to commit a crime including thoughtcrime, and disappear them into the mainland penal system. We all know what happens next: working to death, organ harvesting, etc.

Hong Kong also runs “cage houses”, similar to our Gilded age flop houses. Saw documentary of it.

Wall street arrogant elite celebrated when Trump bent on his knees and

bowed to China to save Xmas.

This temporary retrieve is an incentive : if Chinese military takeover

of HK ==> if that happens, tariff will doubled down, Xmas will not be saved and US & the global economy will hit by a hurricane.

Delinquency will rise in every sector, its just starting !

I remember (being a motorcycle nut) tales 30-odd years ago of Japanese just leaving perfectly good motorcycles, only a few years old, dumped in the street because they weren’t the ‘latest thing’, and as such were not wanted and had no resale value.

Peak decadence.

We all know what came after – I wonder if in 10 years’ time after the great unwinding of all this debt-based consumption and speculation (which surely must happen) we’ll be looking back and saying “what the hell were we thinking”?

Lessons will be learned etc. etc. I’m sure!

Those were urban legends: the motorcycles were actually sold to wholesalers (often rumored to be fronts for the yakuza) who then exported them to Europe by the container. We just loved the stuff.

There was a thriving market for “grey market bikes” or simply “grey bikes” in countries like Austria, Ireland, Sweden and especially the United Kingdom: this was due to the dwindling number of small displacement models available through official channels despite the fact these models had low insurance and ownership costs.

Japanese market models fit the bill just nicely because they were mostly 250 and 400cc (due to Japan’s tiered licensing system), modern and with high performances for the displacement. Generally speaking Honda’s commanded a big premium because they were just better: the Bros 400 was a huge favorite of London motorcycle couriers and smaller sportsbikes like the VFR400R and NSR250 had a well deserved reputation for being highly exotic and well engineered.

Of course this doesn’t mean it was just a banging deal: at least initially manufacturers just flat out refused to make spare parts available through their official dealerships, literature was not available (and given the mechanical and electrical peculiarities of many models it was a problem), tyres were mostly oddly-sized and only available as special (and expensive) orders from Bridgestone and Dunlop, suspensions were severely undersprung and atrociously damped even by late 80’s/early 90’s standards and to make matters worse most bikes not merely lacked a service history but had never been serviced, period.

The Japanese motorcycle market had its last huzza! in 1994 when the Kawasaki Zephyr/Xanthus/Balius family of bikes became fashionable. The Balius became infamous for redlining at 19,000rpm, albeit top power was about 4,000rpm earlier. Dear old Kawasaki Heavy Inudstries. ;-)

I love Japanese motorcycles. I had a 1995 Honda NightHawk 750 that was sweet. 4 cyclinder power & very comfortable to ride for a base model bike. Now I own a Kawasaki 2005 Vulcan 1600 Classic Cruiser that I like as much or better. Shaft drive & it idles smooth & quiet, unlike Harley’s. In fact some wiseguy once yelled at me at a gas station “hey buddy, I bet you wish that was a Harley?” Uh, no I don’t.

Kawasaki & Honda’s are the best in my opinion.

Japan is, or at least was, full of small-displacement bike gold because if their tiered licensing and insurance systems. The result was gobs of high-performance tiddlers.

Meanwhile here in the US a 750 is a beginner’s bike?

Cycle World said Honda made a 50cc GP prototype with 4 cyls! special plugs, etc.

Volumetric efficiency and high rpm stuff. Even F-1 finally put an end to that game, too expensive for smaller teams. But did get to hear V-10’s limited to 19,000 in 2007….banshee wail through the Ardennes.

When I was a kid we heard the stories of getting a one year old Corvette for 200 dollars. It went that some guy shot himself and the car sat for long enough to make it stink really badly so no one would want it. It usually was a 283 or 327 fuelie.

Yeah. Heard that urban myth, too.

$1,300B x 0.21 subprime sector x 0.12 subprime % =

$33B/Y, each year, plus other fees, plus repo ==> is a good cushion

to absorb some losses on $60B.

A local insurance agency in the Bronx can hit a $5K car,

owned by an illegal immigrant worker, a new driver with a family,

parking at street level, with a $5K car insurance per year.

Sounds like the comprehensive insurance, which is probably at about the right level because Asset Forfeiture and Shitty Neighbourhood!

“Here”, if one is a new driver, one will first buy an older car and only buy the mandatory minimum of 3’rd party liability and accident insurance. If the car is wrecked, it’s just bad luck, but a 100% write-off is still cheaper than the insurance would be for an inexperienced driver in a brand new car.

Anyone looking for a new car? Thanks Wolf.

Wolf,

Insurance run hand in hand as they have convinced governments that we need insurance and it is made into laws…

Must have had fantastic incentives for our politicians to put insurance into laws..l

Now that the numbers are in; thanks to Wolf, do we know WHY this is happening?

Is it because car prices are high? Or interest is high? Or lack of income? Or food and rent displacing other needs? Any idea?

Reckless subprime lending in 2014-2018. Probably still too reckless, but less reckless than it was. There were a lot of small specialized lenders (PE backed) that drove this, and larger subprime lenders such as Santander too.

It’s not reckless if you know you can pass on the loans to someone else before they go bad, right!

And heck, it’s just another way to issue negative-yielding bonds, isn’t it?

/snark

My thoughts exactly. What has been happening to underpaid (subprime) workers since 2014 to create that graph? Housing prices come to mind. Wages. Moral decline? Is it Obama’s fault?

Not one big player went to jail, and after all that campaign rhetoric about inequality. I think someone took him aside and made him an offer he couldn’t refuse.

Newest scam now is venders (Mom and Pop) will need 3 million dollars liability insurance if they want to sell anything in a public place. Barrie, Ontario has started this.

I dropped my commercial plates years ago because of this. ( I had them on my personal car, as parking at my shop in Boston is mainly commercial parking) If I transported anything, say a wrench from Home Depot, that I was to use in my shop, got in an accident, the insurance company needed to cover me as a business. Huge costs if there was any physical injury. Lawyers come after the business. So, dropped the commercial plates. Now I pay a huge parking garage fee, but save the business.

I can see the prescribed remedy this debt problem thing-y. I’m sure folks at the Fed will eventually join the dozens of central bank throughout the world who have also seen the solution are as we speak intensifying to policy:

QE and Negative Interest Rates.

No, not mid term correction…NIRP and QE.

Who would have thought that with the average auto loan approaching $600/mo that some people would default hmmmmm! With loads of negative equity to boot.

So Wolf, genuine question, am I sitting pretty with 86% of my wealth in cash and short term bonds? Why don’t I just hold this position until we’re much further into the cycle and the panic really sets in?

I have constructed a “super model” based on the work of Martin Zweig, and the model has a combination of sentiment and hard economic indicators (similar to Market Edge if you’ve ever seen his website). Anyway, this model very clearly shows that on both a short-term and medium term basis we’re likely to experience a sizable correction in asset prices. I would argue, as you suggest in other posts, that it is already now under-way.

On the balance of probabilities aren’t I sitting pretty to simply ride out the storm, until the metrics in this model are so bad, that they indicate it is time to buy-in again?

In case anybody was interested here’s a few:

Yield curve, US housing starts, Auto loans delinquency rate, 10 day short seller activity, % stocks above 50 day MA for S&P 500, VIX (looking for extreme readings), Shiller CAPE ratio of stocks, Q-ratio, US ISM PMI index, S&P 500 earnings, S&P 500 200 day MA, and the Value Line Geometric Composite (if it falls 4%, triggers sell), and Martin Zweig’s monetary model, i.e. what the Fed is doing.

Conventional wisdom (and the Buffet fans out there) would suggest that you cannot time the market. However, that’s the problem: Buffet himself is sitting on $129bn+ in cash and although he doesnt time the market, in effect he is, because there is recognition that pretty much nothing out there is cheap anymore. I find it hard to commit my family’s life savings to an 80% equity plan just because I am 33 years old and it is expected of me. If anything, I’d rather take a chance that it all blows up and I get to purchase assets at knock-down prices. And if they go down further, I’ll go to 100% equities. And if they continue to drop like they did in the 70’s I’ll take on a bit of leverage and re-mortgage part of the house (which is nearly paid off).

Anyone could time the U.S. stock market for all the years before 1994 when it was more or less honest. Today with it 100 percent rigged its like in the past trying to pick winners at the racetrack in the days before slot machines at the racetrack when most races were fixed.

Thanks for your comment – I agree it is sort of rigged now, the biggest contributors probably being share buybacks and easy money pooling in the S&P 500 and driving the prices up beyond sustainable levels.

Doesn’t that mean we are agreeing though: don’t invest in a rigged game yet, however, when there is a serious correction of like 15-20% perhaps reconsider things? Surely there is a point where you’d go back in, which may be different for everybody?

For me if Brexit ruins the U.K. stock market – if the FTSE100 hits a yield of 4.8-5.0% (which it is close to) id be 100% invested in my sterling accounts.

For the US market I’d like to see a recession and correction of 20%, then come out the back of it with some sustained recovery – that’s when I’d invest heavily in equities again.

Models are just exactly that – models. Nothing predicts the future with certainty, it can’t be P=1. I guess you can create your own models to convince yourself.

Most of us do not have $129B or even $1B, so our “problems” are unlike that of Buffett’s. But yes, most assets are very “expensive” and there is a risk of a draw down or correction that you (33 yrs old) will have to live with. The real question is can you handle that? At what risk/reward?

I have 100% of my money (excluding my ESOP) in Treasuries that yield a little bit more than 2%. But I am Retired and of Medicare age. Because of my past stroke, I do not care to risk anymore. I cannot afford to wait for another cycle. As of today, I can live very comfortably with that 2%. I have zero debt, own my house and cars. So, the allure of owning stocks and “getting rich” means nothing to me since I don’t have FOMO. My goal is KEEPING IT rather than EARNING IT.

But for a 33 year old; that’s a different story. You still have lots of games to play. It’s hard not to be tempted in making money from assets instead of earning money from a job or business now. Just make sure you can handle the RISKS. I hope you have a large inheritance. Good luck.

Iamafan……good comment. It’s always age dependent. I have my money in term deposits because we have a decent pension and everything paid for, on top of universal health care, etc. age 64. If another property comes up (neighbours) I will probably buy it and my kids will inherit. My 35 year old son is socking away 50K per year into med risk options and is paying off his house/land. He is turning into a saver (like his old man).

Paulo,

Before my stroke, I already planned my kids’ retirement funds and they are only in their 20’s. Life is short. Oh, and I manage these funds in Vanguard invested in Treasuries.

All of them have Treasury Direct accounts also.

If they want to gamble, they can use their 401k for that.

Safety first. I learned to keep all my fingers around power tools. Same with money, too.

To be fair everything I’ve got is my inheritance, so if I was 80% invested and encountered a 40-50% bear market I’d be forced to work longer and sort of claw my way back. I am risk adverse at the moment and would rather get 2-3% for the next year or two and not really go heavily into equities until I believe the risk is more advantageous. I just genuinely don’t see it being worth the risk now and it sounds like we are seeing the same thing!

I am 60% cash right now. I was 80% cash, but after waiting for a long while, started buying again in Dec 2018. I have eased into dividend growth stocks. There are some reasonably priced companies out there with low/no debt. They have just become harder to find.

I am also making some decent money selling puts on stocks on my buy list.

As auto lenders get more repo inventory instead of loan payments, they might not be able to pay their creditors. It is like dominoes falling.

I woke up this morning and saw a message on my phone; the 2yr – 10yr spread inverted. It is the first inversion of this part of the yield curve since 2007.

Germany’s economy is sinking again. The negative interest rates are not increasing worker productivity.

Too many people are trying to earn a living by flipping houses. The type of renovations they do may not make the new homeowner any more productive. It is too much vanity. A counter top is a counter top.

Re: your comment “note lots”. What makes them so lucrative, at least in my area, is that the seller or a subsidiary/brother/sister operation almost always has a small loan license and is thus able to finance the sale at incredible high interest rates –around 36 %.

This is a non-event. Way back in 2009, the chatter on ABS trading desks was how people were willing to walk away from a house, even if they had a good job, while they were UNWILLING to walk away from a car, even if they did not have a job. The 90 day late number on subprime should be considered an unremarkable data point since the 2009 subprime default experience was insignificant.

It’s not “insignificant” to automakers whose sales have been dropping because subprime lending got tightened up and will likely get tightened up further.

Yeah, and it wasn’t “insignificant” either in 2009 as auto sales collapsed, in part because deals couldn’t get financed anymore, and GM and Chrysler went bankrupt, and Ford almost did, and many component makers went bankrupt. From your ABS swivel chair and rumor mill, it might have looked “insignificant.” For the actual industry, the world was ending.

I guess he doesn’t care because foreigners buy most AAA tranches anyway.

If the Asians don’t buy our ABS, who will finance their car exports?

Iamfan,

Are AAA tranches really AAA now? If I recall correctly, “All The Devils Are Here” made the case that if one AAA tranche “touched” a pie-full of junk-rated tranches, the whole pie was then AAA rated, and investment grade. The raters, Moody’s, Standard and Poors said- after the bomb went off, that if one rating house did not give the AAA rating, the others would, and they would have lost that business.

So the institutional investors bought into this, and got hammered. Many foreign institutional investors included.

Are things different now?

Yes, people will do anything to keep their wheels. I predict that in the next recession people will stop making payments on their Newport Beach rental house so they can keep the Tesla or Range Rover. You can live in your car but you can’t drive your house.

oh man, I can’t tell you how often I got eye-balled by 50yr old men in their Lambo’s or Bentley’s or whatever in NB back in 2007….(and insert Shania Twain’s “that don’t impress me much”). I don’t know if they gave up their houses or their cars after the crash because they just disappeared completely.

ha, I’ll never forget the time I got in a fight with a d-bag giving me a ride home after drinks because he claimed it was “trashy” that I lived in proximity to a Norm’s restaurant.

GirlinOC – Norms on Harbor? Could be worse, you could live near the Ana-Mesa Motel lol.

Those cars were all leases or even weekend rentals.

alex,

hahahaha Norms on Harbor!!! Man, I wanted to punch that guy in the face so bad. (and I am a pretty woo-woo hippy-dippy peace lovin’ girl.)

This is really an income crisis not only an auto industry crisis. In flyover country a $15 HR job is considered a good job, but that good job requires a car to get to, and that car cannot be supported on $15 HR.

I see the $15 HR pay rate quoted often as being a sustainable wage but it really isn’t if a person is self supporting. Maybe it is a sustainable wage for someone living in an extended family or as a second income, but for a single person it is not a livable wage. That wage earner pays taxes, medical insurance, rent, utilities, food, and then a car payment and mandatory car insurance. Please keep in mind that many people make less than this aspirational wage.

The auto industry is in the subprime business without understanding the subprime customer. This customer wants to pay, but sometimes can’t keep up with the schedule. If the subprime business were better managed, there would be less losses. They cannot lend to people with unstable finances and get paid back in a stable manner, it’s a fundamental misunderstanding of their business.

Wolf, are you writing a book called “These are the good times” or something like that? Because the more you say it the more sarcastic it sounds.

Now you’re giving me more book ideas. That would be one heck of a title, to be published at the height of the next crisis :-]

But yes, my usual mix of serious and sarcasm. I took out a line that read like this, “… the best of times, according to the Administration.” I wasn’t sure if I could pull that off with a straight face.

This is the Fed’s problem …..

(snark)

Why don’t they just forgive the subprime auto loans, then they won’t have the discomfort of dealing with the delinquencies? Problem solved.

I see the wheels coming off everything.

\\\

Wolf a question for you…if we were to bundle all of these loans into one giant security, and if we assume that 4% of the securities are defaulting (later then 90 days on payment), at what point can we call this security junk rated? Is it when the default ratio reaches the average car loan interest rate?

\\\

LouisDeLaSmart,

The percentage doesn’t work that way. This is a “flow.” So currently, 4.6% of $1.3 trillion are 90+ days past due. But there are also loans that are 1-30 days past due, and there are loans that are 30-60 days past due, and loans that are 60-90 days past due.

Loans that don’t get cured the next month get moved to the next basket, for example from the 30-day basket to the 60-day basket, etc., all the way up. So there is a constant flow.

Then when the vehicle is repossessed and the loan is written off, the loan disappears from the 90+ days past due list. And other past-due loans move into it.

Rough numbers here: The 4.6% is figured as $60 billion in 90+ days past due loans, as a percent of total auto loans of $1.3 trillion. But look at just subprime:

There are about $260 billion in subprime loans outstanding. Of them, $60 billion are 90+ days past due AT THAT POINT IN TIME. That’s 23% of all subprime loans are 90+ days past due at that moment. This is huge!

Then there is a considerable percentage that are past due but less than 90 days past due. They’re “transitioning” to serious delinquency.

So if you have a fixed basket of $1 billion of subprime loan balances packaged together that you sell to an investor, the percentage of defaults and repossessions over the years in that basket will be much higher than 4.6%. Maybe 20% and the way this is looking today, much higher. (23% are already seriously delinquent at this moment).

But there is good collateral, so if the recovery is on average 50%, and if 20% of that basket of loans default, the loss on the basket would be 10% or $100 million.

If 40% of this loan basket default, and the recovery is 30%, then the loss is $280 million, or 28%.

The equity tranche and lower-rated tranches take the first loss. So if you have an AA-rated tranche, and 20% of the loans default, with a 50% recovery, you’re OK. If you have a B-rated tranche you may be eating part of the loss.

With an unemployment crisis, you may have 50% defaults leading to repos in that basket over the years, and if recovery is only 30%, the losses go way up in the hierarchy, and higher-rated tranches will take a hit.

\\\

Thanks for the great explanation.

\\\

How much of this spike is loose lending and how much economic stress? I seem to recall that people in 2008-9 would rather make their car payments than their mortgage payments – probably because cars get snatched back overnight.

BenX,

Reckless lending, as I called it, included an element of reckless greed: interest rate too high, payments too high, too much profit for the lender, too much profit for the dealer. Subprime customers often don’t think they have choice. They just take what they can get. And they get nailed. This practically guarantees that the customer will run into trouble making payments.

If you put a subprime customer into a 4%, 60-month, loan for a 3-year-old Ford 4-door car, and you stick to the average profit range, you might never have a problem with that customer. It’s when you get greedy and try to make too much money on a customer with limited resources and bad credit that it doesn’t work out.

autos are a mandatory tool for ride share and other ‘contractors’.

when they lose gig/tool they are not counted as ‘unemployed’,

just hungry. id think the causes of situations this pervasive and recurring

could be identified.. instead of just another opportunity to practice

our ‘surprised look’.

tommy runner,

“…when they lose gig/tool they are not counted as ‘unemployed’,..”

No, that’s not how unemployment data works.

If a gig worker, such as a driver, is counted as working in the household survey data (which establishes the unemployment rate), and then he loses his car and can’t work but he says in the survey that he wants to work and is looking for work of whatever sort, including figuring out how to get a car and drive again, he is counted as “unemployed” and shows up in the unemployment rate.

In addition, there are rental programs for Uber/Lyft drivers who don’t have their own car. So if you lose your car, you can temporarily rent a car under these programs and drive and make money (though less money), until you get your feet on the ground and can buy a car.

I own a nice German car. 2006. Has been paid off for 10 years. This winter had a few issues as I don’t maintain it.

I shopped for a car this spring and was SHOCKED at the price of cars (and the poor service: I’m a professional making loads of money and nobody was interested in my business).

So I decided to bring the car to the dealer. They fixed everything, cost $1500. Runs like new. 105k miles.

Will keep it until it dies.

So places like Ally Financial who hold huge amounts of Auto loan debt are in for a bad time (They used to be GMAC), this will then affect ALLY bank which is very popular. Since ALLy is a Systemically important Financial Institution this opens up the depositors to finance the bank from collapsing. People will lose all their money, no wonder it’s offering 2% interest rate

1. Prime auto loans are doing very well. Subprime is in trouble. The question is: how much subprime is Ally holding in relation to its prime loans, and how aggressive were they in underwriting these subprime loans?

2. Ally’s deposits are insured by the FDIC. So even if the bank were to collapse — I doubt it — depositors who stay withing the limits of deposit insurance would be insured by the FDIC and would not lose any of their money.