Oh dear, Vancouver, Calgary, Edmonton, and Winnipeg. But there are some warm-spots too.

June is generally a strong month for house prices in Canada, according to the Teranet-National Bank House Price Index. But this June, the index rose only 0.8% from May, compared to an average June increase of 1.2%. Once those “seasonal pressures” are removed from the index via seasonal adjustments, “the composite index would have retreated 0.4% in May and 0.5% in June,” the report said. Particular weak spots were Vancouver, Calgary, and Edmonton. But there were some warm-spots too.

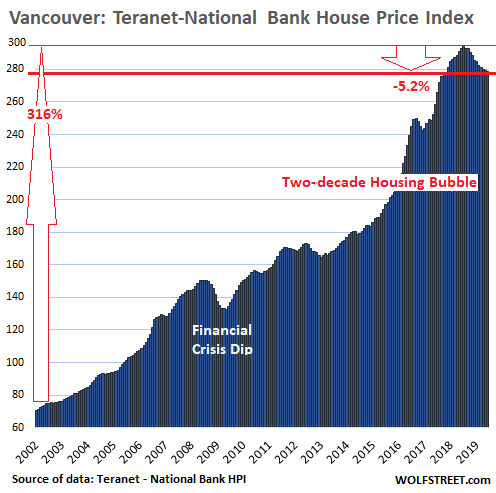

Vancouver:

Just based on seasonality, house prices should have risen in Greater Vancouver, which was until mid-2018 one of the most splendid housing bubbles in the world, where house prices had more than quadrupled in 16 years. But instead, they declined in June for the 11th month in a row, according to the June Teranet-National Bank House Price Index. The index is now down 5.2% from the peak in July 2018, the sharpest 11-month decline since Aug 2009:

The Teranet-National Bank House Price Index is a kinder-gentler version of other home price indices, moving with a delay and in smaller increments as it operates on a different principle and isn’t impacted by changes in mix or big outliers that other indices are subject to. It tracks single-family house prices, based on “sales pairs,” comparing the sales price of a house in the current month to the price when the same house sold most recently, often years earlier.

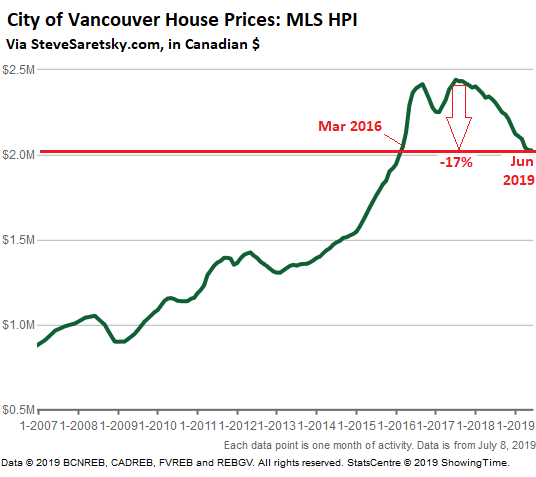

Other indices for Vancouver are not so kind and gentle. For example, for the City of Vancouver, the MLS Home Price Index for detached houses plunged 17% from the peak in March 2016:

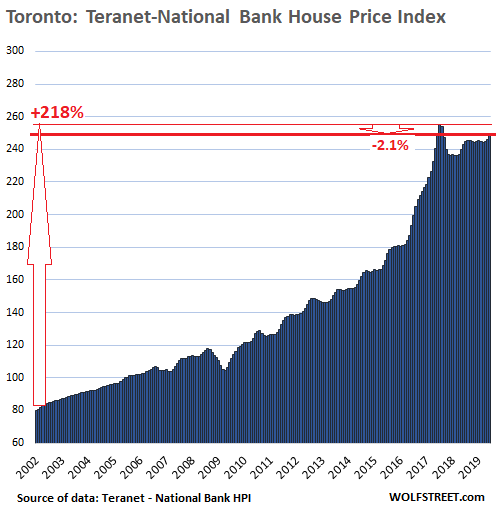

Toronto:

In the Greater Toronto Area (GTA), house prices more than tripled over the 15 years from January 2002 through the peak in July 2017, with the index soaring 218%. While this is a huge mind-blowing increase for a 15-year period, it can’t compete with Vancouver’s 316% increase.

In June, house prices in the GTA rose 1.3% from May, according to the Teranet-National Bank House Price Index. Last year in June, prices had risen 1.2%. But both increases were dwarfed by big seasonal jumps in June in prior years. The index remains down 2.1% from the peak in July 2017.

All charts here are on the same scale to give a sense of perspective of how big the house price increases were in each metro. Hence, Toronto’s chart shows more white space than Vancouver’s chart:

These house price movements, based on the price of the same house as it changes hands over time, measure how many Canadian dollars it takes to buy the same house over time. When the price of a house doubles, it’s not a sign that the house got twice as big or twice as good, but that the Canadian dollar has lost its purchasing power with regards to the same house, and that it now takes twice as many of those dollars to buy the same house. And so these types of indices (including the Core Logic Case-Shiller Home Price Index in the US) are measures of house price inflation.

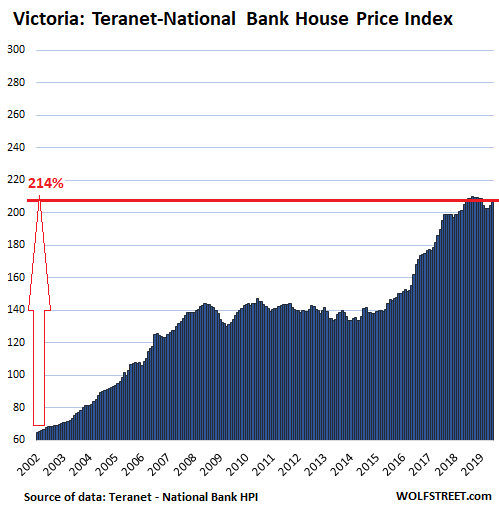

Victoria:

The Teranet-National Bank House Price Index for Victoria – which had more than tripled between January 2002 and the peak in September 2018 – jumped 2.1% in June from May but remains down 0.3% from the peak. The chart, which is on the same scale as Vancouver’s, shows the additional white space in comparison with Vancouver’s house price increases:

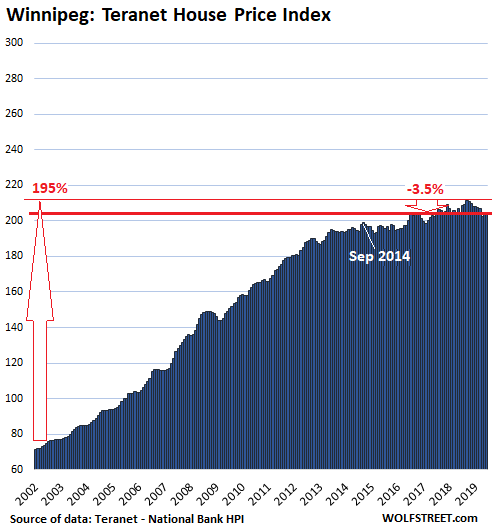

Winnipeg:

House prices in the Winnipeg metro area were essentially flat in June compared to May, according to the HPI. The index is down 3.5% from the peak in September 2018. This left the index where it had first been in October 2016.

In the Winnipeg metro – which isn’t about to run out of land to build on – house prices had almost tripled between January 2002 and the peak in September 2014. But then prices stalled and are up only 2.6% from where they’d first been in September 2014:

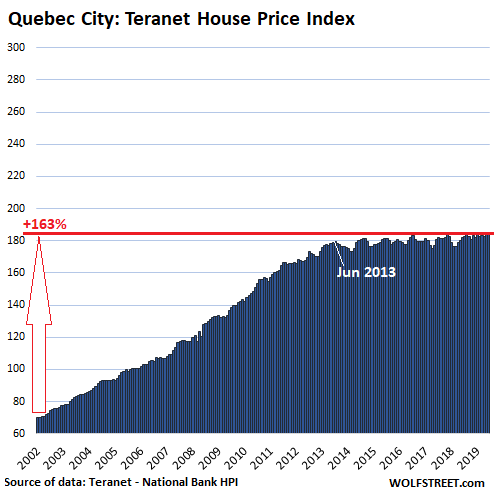

Quebec City:

The HPI for the Quebec City metro rose 0.3% in June from May, just another small move in what has been essentially a six-year flat spot since June 2013, over which the index has gained only 2.9%, following a hot 160% gain in the prior 12 years:

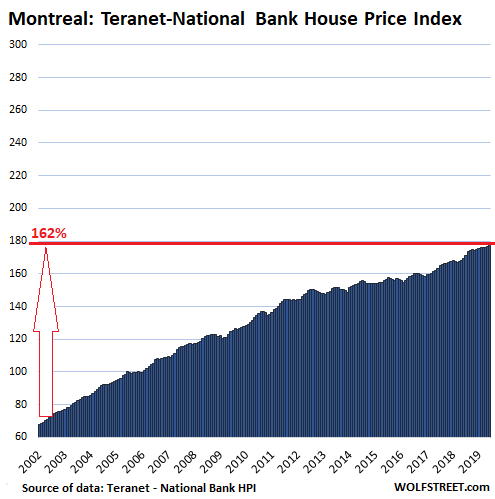

Montreal:

The HPI for the metropolitan area of Montreal rose 0.8% in June from May to a new record. The index has risen 162% over the past 16 years, ignoring the Financial Crisis without hiccup. A massive price buildup by most standards, that 16-year 162% gain was only about half of Vancouver’s 316% craziness over the same period; and so white space is beginning to fill the chart:

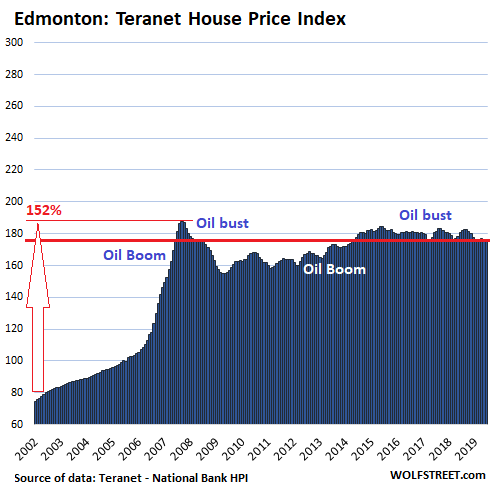

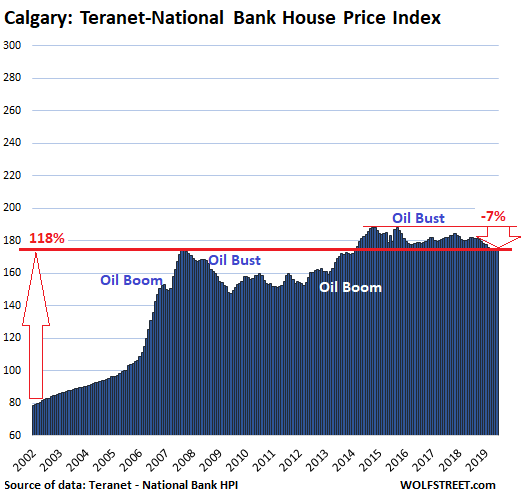

The Oil Boom-and-Bust Towns Edmonton and Calgary:

Canada’s major oil towns, Calgary and Edmonton, are dominated by regular oil booms and busts, where house prices follow oil. The oil boom before the Financial Crisis caused house prices in Edmonton to skyrocket 87% in the two years from June 2005 through October 2007; and in Calgary, it caused house prices to skyrocket 78%! But the oil boom turned to oil bust, and the house price bubbles collapsed in both cities.

In Edmonton, the HPI for June remained flat compared to May and is down 6% from the peak 12 years ago in October 2007:

In Calgary, house prices ticked down a smidgen in June from May and remain down 7% from their peak in October 2014. The index is back where it had first been 12 years ago in July 2007:

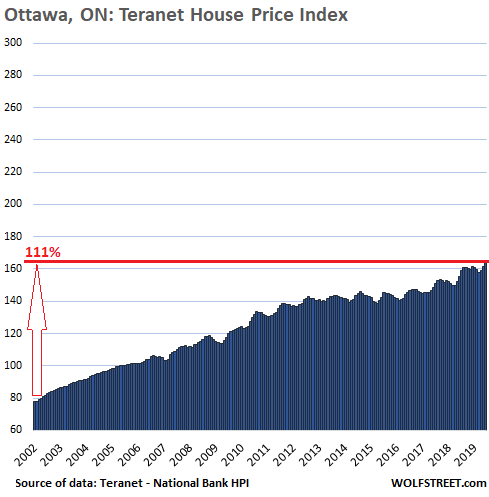

Ottawa:

House prices in Ottawa rose 2.1% in June from May to a new record, and are up 6.5% from June last year. Since January 2002, the HPI has risen 111% — in other words, it has more than doubled in 17 years, and while that is a huge price surge by most standards outside Canada, it puts Ottawa on the lowest place on this list of splendid housing bubbles:

The home price declines in Vancouver are curing a housing crisis where middle-class households are priced out of a market, inflated by rampant international speculation and large-scale money laundering, says BC’s Finance Minister. Read… Update on the Worsening Housing Bust in Vancouver, Canada: Spring Hopes Got Crushed

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Honestly, the Canadian economy is humming along. Nothing to see here. Move along citizens. ;)

Humming along on what? ZIRP, QE. Yes, your are correct there. Perhaps a couple of years behind the Aussies.

House prices are down in Vancouver, but housing STARTS in BC overall are up almost 30% over past years; starts 30% above the money laundering right wing regime of the previous 17 years that was pretty much controlled by the RE and Property Development industries.

I sent this link last week that explained the silence:

https://thetyee.ca/Analysis/2019/07/19/BC-Housing-Starts-Blow-Past-Forecasts/

Headline: “As BC Housing Starts Blow Past Forecasts, NDP’s Critics Fall Silent

Not long ago BC Libs and friends warned of ‘plummeting’ into ‘economic winter.’ Now, crickets.”

There is pretty robust economic activity these days in western Canada. (If you have trade and engineering skills) There is a huge LNG project and a mega dam project on the go in BC. My son, who works two weeks on and off in Alberta (heads back for his shift, tomorrow), is paid extremely well and the company is rumoured to be instituting a ‘retention bonus’ of $1500 per month with their new contract. In other words, if you don’t quit and move on to another employer, we’ll pay you an additional $100 per day on top of your salary.

Housing prices have not dropped one iota outside the Bubble of Vancouver, and building activity is also very robust. I have been retired for years but could easily work full time as a carpenter. My son has an electrical contracting company on the side and pays his main apprentice $50 per hour, and a first year $25/hour. I am presently building a radio equipment building for our Regional District. I donate my labour, but was told to ‘get on it’, and that money was no object. “Just get it done”. It’s busy around here. Very busy.

Speaking of which, tea break is over and the horse flies are missing me on the job site (across the road). The bubdle deflating in YVR is a good news story, overall. Obviously, for those who bought at the height of the lemming market it is terrible news, but there were lots and lots of warning signs and perhaps even more of them on the horizon.

If one is supposed to ‘buy low and sell high’, isn’t it also the case that when times are good one should save for when it’s not? Like I said, there are lots of warning signs out there in my opinion.

regards

Lol what?

If you are a homeowner. If not? You rent.

The critical fact is, 50% of the population of Vancouver and Toronto cannot afford the rent for a one bedroom apartment.

Grossly inflated asset prices ( in this case real estate) must fall much more, to gain balance with the other half of the economy.

To say nothing of other grossly inflated asset valuations. eg: stocks.

That day of reconning draws ever nearer. Quite close now.

This is what I tell people in coastal US cities. Sure, I got in when things were more sane. But to someone now, better to pay a few years of inflated rent while things sort them out, then be on the hook for debt on an asset that will soon deflate in value.

I’m on the SE Atlantic coast, and a bunch of people are already freaking out about the new flood maps that will be updated next year.

Many of these houses will be practically uninsurable.

sc7,

I’ve been thinking that for over 10 years now…

Not sure why you would have thought that 10 years ago, values were pretty fair, IMO, until about late 2015/early 2016, then they started running away from income.

I don’t think we will ever return to the “historical norms” against income which may have been an anomaly, but there’s definitely down from here, at least in real value.

OuLookingIn, it makes me angry that these ponzi schemes are encouraged by authorities that should (and many most likely do) know better, but still help to inflate them up by supporting and encouraging the debt growth because the bubbles benefit them whilst they last.

Those who push narrative that relatively rising house prices are a good thing don’t understand, or wilfully overlook, the pernicious effect they have on society. Like other debt based growth numbers, they are a wealth transfer mechanism from fixed income earners and savers to asset owners, except that debt based price inflation in housing is worse than most, since it affects basic needs, and forces people in, whether they want to participate in the ponzi scheme or not.

If prices don’t permit some average income earner to own or rent a place to live in at a cost that also leaves them with a comfortable amount of their income to allow them to live normally, sleep easily and have some future security, then those prices are essentially antisocial.

Saltcreep,

Surely you must realize these authorities to whom you refer are well and truly “owned” by the oligarchs who profit from all this asset price inflation.

Why would expect anything else?

Free markets. hehe.

Saltcreep –

High real estate valuations =

Higher/longer mortgages – good for the finance sector

Higher property tax – good for local government

Higher goods services tax – good for federal government

Higher mortgage fees – good for agents, brokerages, and banks

More debt from “richer” homeowners 2nd mortgage/HELOC’s

Now, do you really think these entities want the gravy train to stop? Certainly not the oligarch rentier class, nor the bankers and various levels of government.

Governments get into real trouble with their citizens when they fail any one of three vitals – failure to feed, cloth, or house.

It’s not exactly a transfer of value, any more than rising bond prices, and falling equity prices is a wealth transfer from equity holders to bond holders. It is merely shifting returns of various asset classes. Yellen warned everyone to load up on assets early on.

really, Yellen warned everyone? Those who listen to and understand what Central bankers say get out early. Didn’t Bernake tell an exclusive insider audience before the market implosion. Information is not shared with everyone, far from it, and only the few are in position to act on it.

50 percent in Toronto much higher in Vancouver.

Nothing about Ottawa? The capital of Canada and Ottawa is not compared in the list? Nobody in Canada cares about Quebec City except Quebec City.

No problem. I just added it to the list. So check it out.

Ottawa? Really? A place where crickets go to die. It is a city that does nothing but pretends to work and produces nothing. BUT it consumes huge gobs of money from taxpayers. It will just creep along as the parasites get their annual raises and nothing changes.

Canada led housing regulation with the foreign buyers tax in Vancouver and it will spread there to other cities and here in the US too. New York City has recently passed strict rent control regulation to control rents, which will spread as well. The writing has been on the wall for years now. The real estate industry in NYC pushed too hard and it has caught up to them. The peasants are pissed.

Uh there is too much demand for NYC for any type of ‘regulation to make a difference besides the real estate industry & landlords get HUGE tax breaks (which conveniently aren’t mentioned) landlords just whine about something as meaningless as an extra measly $10 a month increase in water bills ….

even with empty store fronts other parts of the city like Hudson Yards, Long Island City and all of Northwest Brooklyn are white hot.

The rich and well off in NYC don’t rent, they own, so the new regulations won’t affect them, even when they rent out their individual units.

The investors in multi family rental buildings will be affected and that’s where most working class people live in NYC. We actually know someone who lives alone in a small multi family building and doesn’t rent out the other units because he doesn’t want to bother with all the city regulations. It’s not worth the money or the tax break he could get and the building is worth more empty.

I just hope the Chinese looking to park their money offshore don’t get into agricultural commodities.

Canada is right fooked.

Mapped: Countries With the Highest Housing Bubble Risks

https://www.visualcapitalist.com/mapped-the-countries-with-the-highest-housing-bubble-risks/

The condo market in Edmonton, Alberta Canada costs twice as much to rent than to own and that ratio will go a lot higher as mortgage rates fall.

We are at the end of a 40 year debt super cycle that has buoyed real estate and made the gullible think it was an ultimate investment. The sand in the hourglass is running out and winter is coming for the Real Estate Industrial Complex. Henry George will be laughing in his grave as the tide goes out for the RE investors. Canada and Australia are first but it will be coming to a neighborhood near you, even the beach in SoCal.

SoCal is immune to housing burst barring the last few which happened.

Why is it immune: because we are special and this time is different :-)

Everyone seems to state residential real estate will bottom out in price in 2034.

The reason real estate has risen so much in the Canada is a lack of land. The country is just constrained by not enough room to build houses for all those who demand them. Maybe they could buy part of the states.

The old “running out of land” excuse. Nonsense, plenty of open land, and Canada’s population is way lower than the US.

Think you missed the implicit [/sarc]

I read it as very explicit in-your-face kind of sarc. Maybe I misread it?

Vancouver island (Victoria) is running out of land.

Second largest land mass on earth after Russia. We are not running out of land.

Except in places like Toronto, where there is a ‘green belt’ around the city prohibiting development (and protecting ‘gentlemen farmers’, and people who don’t want anybody else moving in).

The effect is as expected.

Best comment to date. Loved the sarcasm, thanks. And don’t give the Canucks any ideas we may have to build a wall along our nothern border as well.

There would be no bubble if it wasn’t for the Chinese. The Chinese only had to push the prices in a few select cities up then the speculators drove the outskirt city prices to the moon.

this explanation is looking more true today. Vancouver, Toronto experienced the greatest run-up and also the biggest Chinese off shore money coming in. If it wasn’t for all of this foreign money, Vancouver and Toronto would look more like Ottawa, Quebec City, or Winnepeg.

I am a little bit confused here.

Instead of talking about how we can make life better for average Americans, Canadians, at the rest of the world; we are lamenting about the small increase in home prices as if houses are not too expensive already.

I am not sure what the priority is. Do we buy the Greenspan bs on rising home prices makes people wealthy or do we something different? I don’t want to blame anyone but this model is broken. Please don’t hate me.

Who is “lamenting?”

In one of the most notorious neighbourhoods in Toronto (Jane and Finch), bungalows are going for $700k+ and the home-owners are getting over asking within the week of listings. Maybe its the neighbourhood dynamic (i.e. the hood has gotten safer) that has changed but the housing cost has taken a toll on a lot of the people there. Makes you wonder where the poor will go.

Debt donkeys over borrowing for today’s gratification. People overpaying in bidding wars now will be kicking themselves in 3-5 years.

NASDAQ 5000 wouldn’t surprise me in the least.

I’ve got oil pegged at one US Dollar a barrel.

Natural gas prices are still negative in Texas…and Summer suddenly ended for week.

Canada will be cutting interest rates like crazy starting this Fall. The Aussie Dollar is already in free fall.

Mexico is hyperinflating…and they produce far more than … well they used to produce oil anyways.

Big lawsuit coming against BP at Whiting, Indiana so good luck seeing heavy crude processed there in volume.

Obviously Houston is swimming in product still.

Short gold.

Strong sell.

The next Hurricane to hit where I live (four in four years for me…one a direct hit) could be epic because of how warm the Gulf of Mexico has been all year.

Who is this clown that’s PM of Great Britian again?

Where are the Germans helping out in Ukraine? The 3rd Reich was nicer.

Negative rates coming to Greece.

Too funny.

Short sellers in $tsla look about ready to be Volkswagen’ed circa 2008.

Might look at $meoh methanex on any news of a massive price collapse in the US tech mania.

I see interest rates on US Treasuries plunging to at or near zero…and staying there for the next ten years.

Happy trading tomorrow!

New Zealand paying too much for a home should not cause me any great worry. Australia already realizes mistakes were made. Canada may be high on house appreciation. It is like a gold rush, until the ore is gone.

Pine bark beetles have destroyed so much Canadian timber, saw mills have closed.

The immigration rate in Canada is over 3 times higher than the US. Therefore, Canada’s economic model is more than sustainable, there will never be enough homes – hence unending building boom. For example, Toronto currently has the largest number of active construction cranes on the continent.

Prices have already fallen and are cratering fast, sorry.

Hey Nicko, is that Calgary condo of yours still rising “a few percent per month?” Because a friend of mine just unloaded his townhome in SW Calgary for $50k less than he paid in 2006.

By the way, there is no “unending” boom in Canada or anywhere on earth. Canada has not invented some new economic model that keeps the economy going forever via Quantitative Immigration. That’s a figment of your imagination. Just like the Calgary condo you were boasting about a few months back.

There is no value in many parts of Canada to live of what the money you make.My co-worker is 71 years old and lives with her 36 year old son in a one bedroom apt.They both can’t afford to live on their own.Victoria is no place to live if you make under $22 hr.I’ve never seen it so bad,the central bank and the goverment basically says it hates low income people.With my little pension at 55,I plan to leave Canada for a more affordable country.High immigration that basically that go to a few cities in Canada.Truedeau is a total train wreck,I may leave early if that clown gets re-elected.

Inflation of assets is caused by ultra-low interest rates. Japan 1990. Nikkei 40 000. Now 25 000. What happened with real estate?

Not when everyone runs out of money and they start taxing the rich instead of what used to be the middle class.

Then there are the tri-cities – Waterloo, Kitchener, and Cambridge. Individually not that big, but they have grown together so now the population of about 500,000 is up there with Hamilton, Halifax and Quebec City …. Prices there continue to increase fueled by a tech boom and an exodus from nearby Toronto where people can sell for a lot and buy more for less in the Tricities.

I think Wolf said somewhere that Canada and the US both suffer inflation beyond the cost of living indices the government claims. That inflation is housing, whether we buy or rent.

This is an old thread but I wanted to point out a Wolf Street siting on Huff Po.

https://www.huffingtonpost.ca/entry/negative-interest-rates_ca_5d3dc8dee4b0c31569eca2a8?utm_hp_ref=ca-business

Thanks. I should scream “copyright violation,” but a few years ago, I contributed a couple of articles to the Huff Po of Canada, and so I’ll let them get away with it :-]

Hopefully it gets you more traffic, and maybe get some helpful information to more eyes.

Well written and to the point. I appreciate the detail in this article!