One of them is wrong. Watch out for it to snap in an ugly manner.

When the economy goes into a downturn, even a plain-vanilla recession or near-recession and not a crisis, junk bonds behave badly. This is because over-indebted companies with iffy cash flows – those are the ones that are junk rated – begin to buckle.

In a downturn, they have no wiggle room; some default on their debts and file for bankruptcy, stockholders get shafted, and bondholders take big losses. Everyone knows the drill. Fear of this happening spreads throughout the junk-bond market. Junk-bond prices fall and yields surge.

Borrowing costs for some riskier companies will shoot through the roof, which will cause them to be unable to borrow new money to pay off existing creditors, and they’ll default too. And these waves of defaults will scare the market further. Investors want to be paid ever larger premiums over Treasuries securities – which are considered free from credit risk. And the difference in yield between junk bonds and Treasuries – the yield “spread” – widens brutally.

Typically, in this scenario, Treasury yields fall, as Treasury securities become more sought-after as haven, thus driving up Treasury prices. These moves are typically backed by the expectations the Fed would cut rates, if it isn’t already cutting rates.

In this downturn scenario, junk bond yields are surging while Treasury yields are falling, and the spread between the two is blowing out.

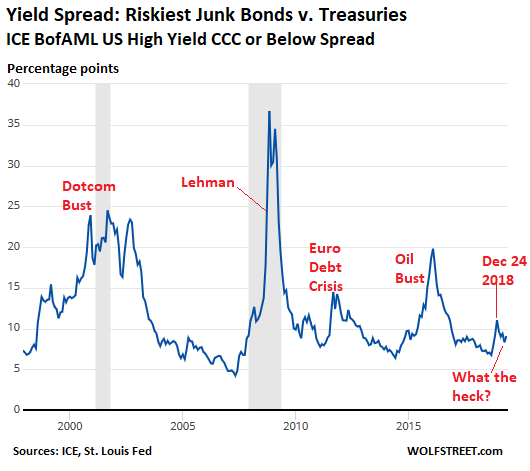

For example, take the spread between the average yield at the riskiest end of the junk-bond market, CCC-rated and below (as tracked by the ICE BofAML US High Yield CCC or Below Effective Yield index), and the equivalent Treasury yield:

- Before and into the 2001 recession, this spread doubled from around 12 percentage points to 24 percentage points.

- During the Financial Crisis, this spread more than quintupled from 7 percentage points in mid-2007 to 37 percentage points at the end of 2008, as junk bonds essentially collapsed.

- During the oil bust, from July 2014 to February 2016 – the US economy got uncomfortably close to a recession in late 2015 and early 2016 – this spread tripled from 7 percentage points to over 20 percentage points.

And in today’s scenario?

Since December 24, the 10-year Treasury yield has dropped 50 basis points (half a percentage point) and the yield curved sagged in the middle and partially inverted. In many people’s minds, this is screaming “recession” in every direction. Inverted-yield-curve-and-recession talk is now everywhere.

Wall Street pundits have been clamoring vociferously for a series of rate cuts. And they have propagated the theory that the Fed has performed a “U-Turn,” in response to the US economy heading into a recession.

And junk bond yields? CCC-and-below-rated yields should have soared in this economic-slowdown scenario, they should have doubled, at a minimum, given how much of a beating investors could expect to take during the wave of defaults associated with a downturn, and how much in yield investors would demand in return for taking that beating.

But the opposite happened. The average yield of CCC-and-below-rated bonds fell from 13.7% on December 26 to 11.2% now.

And the spread between the average CCC-and-below-rated junk bond yield and Treasury yields narrowed by two percentage points, from 11.1 percentage points on December 24 to 9.1 percentage points now.

There is no fear of an impending recession in the junk bond market. The market is sanguine. It’s leisurely sorting through company-specific risks. But the overall market has calmed down a lot from December 24. This chart shows the spread between CCC-and-below-rated bonds and Treasuries:

So now, the Treasury market with its inverted yield curve and declining yields on the long end is clamoring for rate cuts, and it’s acting as if a recession were imminent or has already started. But the junk bond market is acting as if it were a big boom party, and risks are just minor company-specific issues, rather than overall economic issues.

But they cannot both be right. So what gives?

It could be that the junk bond market ignores the problems in the economy – that it is completely oblivious to the impending downturn and the corporate default wave that this would entail.

Or it could be that the Treasury market has gone nuts – that all this clamoring for rate cuts and these proclamations of the Fed’s mythical “U-Turn” (cutting rates and re-starting QE) has polluted investors’ minds.

Or it could be that international investors are spooked by developments in China or Europe or whatever, and that they’re massively seeking US Treasuries has haven from turbulence outside the US.

Or it could be whatever.

“Why” markets are doing what they’re doing – “Dow dropped 300 points because…” – is just speculation. We rarely know with certainty “why” markets move in certain ways. And that uncertainty – market participants disagreeing over the direction – is what makes a market with buyers and sellers.

But if bond markets are seen as a predictor of the next downturn, then either the junk bond market or the Treasury market is wrong.

If the junk bond market is wrong, it would be set up for a painful reckoning.

But if the Treasury market – and the Treasury yield curve – is wrong, there could be an ugly snap-back in longer-term Treasury yields, and related interest rates, such as mortgage rates.

This sort of snap-back in Treasury yields happened in July-December 2016: as recession fears faded, the 10-year yield jumped by over 1 percentage point, from 1.37% to 2.6% — nearly doubling in less than six months.

So we can take our pick. But they can’t both be right.

Here’s the Fed introducing a new thingy about “patient” to tamp down on the rate-cut clamorers on Wall Street. Read... My Fancy-Schmancy “Fed Hawk-o-Meter.” And the Fed Says It’ll be “Patient” with Rate Cuts, Even at “Low Inflation”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The USD stays uncannily strong – exorbitant privilege, despite the shenanigans in the White House. I think trade bans and tariffs are not good for most everyone. Anyway, I think we’ll just have to ride this wild show and see what happens. By the way, I went to Walmart yesterday and it still looked fine.

We live in an age of uncanny, buttressed by magical thinking. Republicans think we can magically return to the 1950s. Democrats think we can magically return to the 1990s. People of all political stripes who aught to know better are yearning for a “leader” to take them somewhere we are not. Facing the problems of today just overwhelms citizens from the smallest town to the biggest city. Which is why our popular culture is obsessed with apocalyptic visions and superheros. It’s a spooky irrational age. Our economies simply mirror that reality.

1950s were terrific, but that’s gone forever, with no hope of return; the turmoil and mess began in the ’60s when we started living off the capital.

Democrats want to return to their glory days, the 1930s, bond default, weaponizing government agencies against domestic enemies and wreckers (i.e. non-Democrats), packing Supreme Court (failed), parlance, slogans, and imagery from Soviet Union, and of course, the NRA.

https://en.wikipedia.org/wiki/National_Recovery_Administration

“1950s were terrific,…” Well, yes, if you were a white male.

Wolf runs an excellent blog based on factual analysis, and your note offers a lot of overheated rhetoric more suited to Fox “News”. Please calm down. Thanks!

Like Doc Holliday’s infamous poker game, no matter how rigged, the USD is the only game in town. Who holds Chinese Yuan? No one that doesn’t have to. You can’t buy anything of lasting value with it. No buildings, land, businesses or assets of any kind in China can be bought with it. It’s basically worthless. Everyone in the Emerging Markets has borrowed in USD. Oil, gold and all the other commodities are in USD.

Now with the trade war, there’s a flight to safety and that lies all in USD. So EM’s will now have to put up much more of their own currencies to pay back their USD borrowings . China sold off their US Treasuries mostly so now they’ll run short. It’s creating a big sucking noise as a lack of USD liquidity spirals ever faster.

The Fed is reducing liquidity which is probably a big factor in the shortage of USD supply and I wonder if this isn’t also a helpful hand to putting the squeeze on China. They can put all the currency controls on they like but it won’t increase their USD reserves that they need an ongoing balance of for trade.

So we see low commodity prices also as a result because the dollar is strong. Nice for the USA. I’m not sure where it will end up but I doubt China will come out a winner in this.

High USD (and high labor costs) only serves to make China more competitive, ergo China wins.

They are both right Wolf, your models are obsolete. You still think that the bond market is some place where efficient price discovery is supposed to happen, it is not.

Right now the market is so distorted by central bank policies that good old Soviet economy is starting to look more capitalist than what we have. Get ready for Dow 30k.

The April trade deficit widened as exports cratered 4.2%. This should only get worse as the USD gets stronger every day and is at a two year high. Trump doesn’t seem to understand that everything he has done has made the USD stronger and caused US manufacturers to suffer.

…Or nobody wins as GDPs across the world slow, and the new reality is accepted. More standard of living adjustments everywhere.

The junk bond market is much more vulnerable to severe losses than the treasury market. The universe of junk bonds is expected to expand rapidly in any down turn given the volume of investment grade paper rated slightly above junk. A decade of low rates has resulted in corporates becoming much more leveraged. This has occurred on a global basis. The central banks appear to have capitulated on normalizing rates given the risks inherent in a downturn with very little fiscal or monetary ammunition left. This avoidance of a downturn may be successful for some time hence the sanguinity in the most vulnerable portion of the bond market.

The US treasury market is the refuge when the narrative supporting the other markets becomes frayed. A decent yield plus safety is a rare commodity. Therefore treasuries aren’t screaming recession now they are broadcasting safety.

The main narrative is steady as it goes but but upside potential is limited and risks abound. Therefore no severe risk off warranted but some hedging more than justified. Isn’t this what both markets are saying?

No, Fed action is not the problem. There is no on the ground economy need for loans. Banks know this, and they are holding on to dollars,not even buying treasuries and selling them to the Fed at a GUARANTEED profit. EFF above IOER.

The economy is dead. You read it here first.

You are blinded by paradigms. USD is clearly losing ground. We are a long way from the good as gold USD that gave it its current use in the world markets. Both in international trade and as a store of value, the USD will accompany the USA in its global decline. Alternative storage of value is on the rise and will explode during the next crisis (aka bitcoin & cryptos)

The USD is at a two year high and headed higher. Clearly losing ground? Not since July 2017 – it’s been straight on up. Any bets on gold and against the dollar have been losing ones and they will continue to be losing bets for the next six years at least.

I. do. not. trust. bitcoin.

My computer dies, woops there went all my money.

Gold & silver, baby. Also skills.

alex in san jose AKA digital Detroit

with bitcoin you don’t need to trust, you verify using mathematics.

about losing it, ever heard of a computer backup?

The USD will stay strong because when people get scared of the economy and the possible devalue of their local currencies, they will opt to change their money into a reserve currency.

Nobody would want the Euro, nobody would want the GB pound with the Brexit fiasco. Few know about the Swiss Franc.

So the US Dollar is the currency they will and are opting for.

Antitodal information probably not worth a bit, contrary to anecdotal.

I’ve been in 4 different Walmart’s in the last 2 months, borderline depression zones in North East Ohio – not a solitary 26oz container of iodized salt for sale in one (never seen that in over 50 years at any grocery store in the US.) A number of sections of shelving with bulk items just stacked on empty shelves, so there would be no empty shelves, in another. Absolutely no selection of any holiday summer out-door and patio items in another, and it was right off 271 and Mayfield in suburban Cleveland. Couldn’t even find an I-Phone/clutch case in Ashtabula.

Even Aldi’s only sells apple pies now as a “seasonal” item. They had pretty decent pies from Canada all the time, up to this year too. At least Aldi’s had salt and it was cheaper than the price holder on the empty Walmart shelf. But, Eggs are pushing a price point of 1.79 a dozen, and those are NOT the range-free ones either.

Walmart inside looks like their new stock/order systems are just about at the level of Staple’s and Office Max/Getting down to the bare essentials. But, if you are in a few of the zip-codes where people still have disposable funds for anything above the bare essentials, those relatively few Walmarts are maintaining something of a standby status quo from the era of 2009-12. I think Chinese foam is the only thing that’s keeping their stock up there, too. What happens when that floats away?

The more I pay attention to the gimmicks of “stocking”, the more I am seeing an increase in really lower quality goods, and really less of everything to even consider for purchase. I travel between Ohio and PA areas, and had seriously started stopping into some of the Walmarts just to compare what is still on the shelves.

Those stores were looking pretty close to the other empties that have been sitting empty for quite a while now. The wild ride is definitely happening still in a lot of places. from what I’m seeing along I-80, groceries and box stores like Walmart are showing limited selections of bare-bones and lowest quality goods only. I really wonder if even Walmart is much of a needed shopping destination anymore. Aldi’s is so much easier to get what you need, most of the food is real food, and easy to get out of the store. But, Costco has the super apple pies.

I mean if you can’t even find a decent apple pie, at Walmart and Aldi’s what is really going on in this world? At least there’s some real hope at Costco?

calm your racism homeboy

Wow, In an Aldi in SE Wisconsin last week my wife bought decent eggs for 89 cents per dozen.

She was able to get mice berries that seem to be quite tasty and not woody.

Aldi quality is far superior to WMT in my experience.

That’s funny. I go to our house local Trader Joe’s in Silicon Valley and most of the white people there are working there.

Are you sure it’s low income people of color and not just low income people?

What conclusions do you draw from these observations- it is not clear to me what you are saying. Thank you for explaining.

And what is “Chinese foam”??

Walmart (We Always Lack Merchandise And Required Training) has a long history of supply chain issues. It’s been thoroughly covered and analyzed in the financial media. I avoid the stores at all costs.

I really like your analysis. I’m a 50+ retiree, a woman with no formal educaion in economics or finance, but I’ve done extremely wrll with market timing–sold all my AAPL in mid Sept 2018, saw the writing on the wall…current economy and market activity is wishful thinking and the Emperor’s new clothes. Sooner or later Peter will have to pay the Piper.

Anyway, I gauge a lot of my financial moves on what I see and hear from the little guy, the average Joe Blow in the street, when Grandma is in the grocery store and complaing about the high price of certain goods, what my Millenial daughter and her BA/MA/PhD peers are facing with challenges in the job market– as well as total disinterest in owning a home, which they see as a money sink (when the Dow is up) or a ball-and-chain when the economy sucks. Plus, who wants a mortgage payment hanging over their head when the threat of being let go hands over your head every morning you wake up?

Not a pretty sight for the future, no matter how you look at it.

Whenever there is a change, someone benefits and someone else loses. The tariffs, all else equal, would move production to the US and benefit workers. Corporations would suffer higher wages but corporate profit levels are way above the historical mean relative to wages, so a reduction of corporate profits would be good for the long-term health of the economy.

US consumers would pay higher costs for goods, but they also have better job opportunities and wages, so it’s a net plus for them.

China would suffer, but they’ve been benefiting from unbalanced trade for far too long.

… dream on my friend.

Junk bonds are tied more closely to overall market risk premium and S&P is up 13.5% since 12/26. Many HY traders don’t even hedge out interest rate risk.

Is there risk in retail real estate debt? One of the causes of the S&L crisis of the late 80’s early 90’s was overbuilding commercial (office buildings) real estate. Small banks were bankrupted. The Federal government took over their assets. A mild recession occurred. Some office space in the outer DC suburbs was vacant for years.

Well I don’t F’ing get it………..it’s like a popularity contest in high school.

What we have are not markets.

Market are people. Don’t reify them. They are a group of actors, like an army or a comedy troop or a football team. The number of actors is determined by who is rich enough, or has access to enough credit, to participate. These people have hopes, fears, and agendas, biases and blind spots. A market can be no more perfect than any other human institution. Some function better than others, just as some governments or sports teams or medical staffs are better or worse at doing their jobs. Don’s expect any more from markets than you do from people.

Best comment of the day. Thanks James. Well said.

Thought-provoking post. Refreshing after wading through all the race and gender baiting and political axe-grinding.

@James Levy Upvote

Yes but like high school, popularity fades as aesthetics change. The aesthetics of the market will change as well. Beauty and youth are never permanent. Eventually the punch bowl gets taken away. A lot of people with a lot of paper wealth these days are going to be unpleasantly surprised.

That’s why stawks are more or less ok, despite trade war.

Just imagine the next crise!

The Fed tops can afford to go Zirp again.

What level of NIRP ? will there be in EUssr or Japan.

-1% or maybe, just maybe -2% !!!

Look at Douchebank value, 14billions LMAO, gsib USA banks all north 300billions!

USD$ and US equities rocks!

Interesting, what we have are markets, but as was written in the 1940s or earlier (Benjamin Graham – paraphrased):

“In the short run, the market is like a voting machine–tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine–assessing the substance of a company.”

Mr. J. Powell’s comments on the “BBB bond cliff”. The US Banks exposure to CLOs, not as bad as you might think. CLOs the new CDS? If Europe or Asia cracks we’ll see if and how much global markets are connected.

https://www.federalreserve.gov/newsevents/speech/powell20190520a.htm

“The market can be irrational longer than you can remain solvent.”

John M. Keynes

This is the story of the wolf, it has been said so many times that we are on the verge of a recession and somehow it has not happened yet. Now that it is imminent, markets (people) do not believe it.

As ever, the stock market is not the economy.

You really need to qualify that statement mate!

https://www.advisorperspectives.com/images/content_image/data/c0/c017e1323d0d1b8c9b437f596b7caf23.png

If you plot a slightly different version of GDP, you see that the economy was very punk from ~2010-2014, and not that great in 2016. (see the election results for further consequences of this).

So, we barely missed recessions for ~4-5 years.

If you look at other signs of stress, such as consumer debt, it’s worse now because of the length of the expansion and recent strength of the economy.

Ned Davis uses a different definition of a bear market and says we had one a few years ago (at least one). We’ve had 2-3 drawdowns of 15-20% in the past decade, so we’ve come close to traditional bears in the stock market.

The bear market and recession are coming, but from what I watch, it’s still a bit early to make that call.

I am still long my junk bond allocation- but a sell is close to flashing.

Speaking of yield spreads, what if anything will make mortgage rates and the 10-year UST diverge from each other? The spread has been pretty much locked right around 1.75% for quite some time now.

But when you look at “agency” MBS with just a few months remaining, the spread from equivalent UST T-bills is pretty much non-existent, which means the market deems the majority USG shareholder position in Fannie and Freddie as a de-facto USG guarantee of the “agency” mortgage bonds.

NARmageddon when you think about it, there’s really nothing surprising here.

Agency MBS have been federally guaranteed since post-2008 crisis. Before that they were explicitly not guaranteed (it said so in writing on the bonds) but FedGov was forced to guarantee due to adverse consequences in the crisis. And mortgages with only a few months to go, at the tail end of a long housing boom (high collateral prices) are money good. And the bonds are federally guaranteed. So of course short-term MBS trade with tight spreads to treasuries.

As for mortgage rates, the spreads have been fairly steady with Treasuries since before most of us were born. Borrowers pay a premium over Treasury yields and investors collect a spread on the resulting MBS’s b/c there’s more risk with individual borrowers than with FedGov, and then it’s also more work to issue and track an MBS. Those costs and risks have to be covered somehow.

Can you show me an image of a FRE or FNM bond from post-2008 that says on it that it is guaranteed by the USG? Or an Edgar security registration document that says same? I would like to see that.

I had the front page from three different FNM/FRE bonds taped to the back of the machine tool that was in the way to the office door to show the dopes that they were not liable for bailing out Wall Street.

Of course the FED inhaled all of the busted junk and monetized it.

I tell my employees that have glazed over eyes that they are not legally liable for that horrendous failed debt.

Let us try it again!

From https://www.finra.org/investors/mortgage-backed-securities

MBS carry the guarantee of the issuing organization to pay interest and principal payments on their mortgage-backed securities.

While Ginnie Mae’s guarantee is backed by the “full faith and credit” of the U.S. government, those issued by GSEs are not.

Risk Profile: Credit and default risk are real for MBSs issued by GSEs: The federal government is under no legal obligation to save a GSE from default.

———————————————————————————————

Comment: So, generally speaking, Wall St is conflating Government Agencies with GSE, calling them all “agency”, and also pretending that GSE mortgage bond guarantees are backed by USG. They are not.

Irrationality in markets can outlast the liquidity of the individual investor, and this is a prime example.

We all know that junk bonds should fall, and it is easy to prognosticate, but when it comes time to place that big short bet, it aint easy, since if irrationality gets even more irrational before pricing is correct, the individual investor gets their head handed to them.

I have long ago given up on applying rationality to markets, since if markets were truly rational, we would all be loaded.

Several months ago, when junk bonds were headed down, I had questioned Wolf and the gang here as to what should be done. I was told to sell, since people were saying “you aint seen nothing yet” as far as further declines, but rebalancing of my portfolio required me to buy. How can this be, I asked? I held my nose, and then my stomach, and hit the buy button, fully expecting to be the class dunce on the trade, and to my shock, the price rebounded. It made no sense, but I was reminded of that old Wall St. saying of “would you rather be right, or make money”.

So, I enjoy the intellect, and thoughtful analysis of the data on this site, but I don’t dare trade on this information since it is logical, but the market is not.

Happy trading.

In any market, there are stocks worth buying, no matter what the general prognosis is.

I personally am an index investor, but the last few years have led me to individual stocks that are fairly priced since the indices aren’t.

I regularly buy stocks no matter what the “predictions”. I am a deep value investor, but I found something to buy even today.

Wendy and Idaho,

I am beginning to come around to your thinking. The constant negativity on this website belies the fact that life goes on and technological progress marches on, creating new value even if overall GDP and “growth” whatever that is, stagnates.

The biggest risk this time around will be the massive amount of CLOs that have accumulated. Powell doesn’t believe they will take down the banks, but I think they will take down a lot of hedge funds, annuities, insurance companies, pension funds, and other institutional investors that the guvmint is unlikely to bail out. The pain will deepen the recession

The markets go down, my dividends may stay the same or go up. I say bring it all down and let’s find some bargains.

My mentor has been investing since 1968 and he says no matter what, his dividends have been flowing in. I am good with that. Also I have been having fun this month with covered calls and secured puts. and making some money in the process.

BTI is looking good. I just put my money where my mouth is. NGG as well.

Also BLK

Not sure if it is rational or not but I am noticing a connection between the military spending and the stock values spiking, it was a subtle thing in the past, but under the current leadership groups it is screaming at the top of its lungs.

The markets seem to feel safe riding government spending with no threats of debt ceilings. Sky is the limit, until someone takes away the pie.

That’s what I said/say about land. I bought some vacant land across the road, 16 acres mixed field and trees, but zoned residential. In ten years the value has more than doubled just sitting empty. 1 year ago I built a small rental for my senior friend. I charge him my costs which are taxes on all properties, and house insurance for his cottage and house insurance for my main dwelling; divide by 12 for his rent total. He picks up his own utilities. Rural cheap.

Junk Bonds? I wouldn’t be able to sleep nights as the bond or stock owner has no control over who decides the value. It’s just paper and promises. If a company/corp goes under, who needs the hassle trying to recoup anything? I don’t care what the terms are, it’s just paper with numbers, or a screen with numbers. But arable land in a pleasing climate is something entirely different. If this entire debt-laden economy tanks the paper will be worth nothing.

Paulo I don’t know how many millions of dollars you must have to be able to do such things but they must be multitudinous.

And you found a way to get an old guy who’d be out on the street otherwise, to pay “taxes on all my properties, and house insurance for his cottage, and house insurance for my main dwelling” that’s pure Americanism right there.

Arable land of any type is just a dream for non-elite Americans. You’re livin’ the dream, man.

” I don’t care what the terms are, it’s just paper with numbers, or a screen with numbers.”

I don’t view those as numbers on a screen. I see it as being part owner of a business. Some of the things you used to build that house probably came from some of the companies I own.

I think why the junk bond market is acting like this is the same reason institutions are buying the 10 year German Bund at -0.17%. the same reason that you bought junk bonds. You actually HAVE to, as part of a balanced portfolio.

I think that the junk bond holders are simply counting on the Fed central committee to bail them out again. They are counting on the Fed to lower interest rates to zero, do QE, buy up junk bonds, or whatever is necessary. Why wouldn’t the junk bond holders expect that? Does anyone really believe any large number of junk bond holders will be allowed to take a major hit? The only people taking any risk anymore are the bottom 70%.

I agree that this is the gamble that Wall St and the top 1% are taking: That the bottom 70% will just accept being screwed over for the 2nd time in 10 years. We shall see.

The hope of Jerome Powell having a backbone somewhat died in Jan 2019 when FOMC caved in to the Dec 2019 Wall St tantrum over Quantitative Tightening and FFR normalization. But when the crap hits the fan for real, will the pitch-forked masses prevent another taxpayer-funded bailout this time?

A question that only the masses can answer I guess.

If the tiananmen square is copied in your end of the woods, God help us all!’

No.

Corporates are the thing. Prez didn’t make a campaign promise to default on corporates. The 2T spending bill is on hold. Inflation expectations still sub 2. They are not going to give investors a real rate of return, that would kill the stock market. The stars are lined up against treasuries. Corporates are the thing because their ratings are low, and they gain implied benefit from weak treasuries, and their rates are high, and it would take a real raise in Treasury rates to change that. It’s a perfect world for corporates, and investors are not betting against corporates they’re hedging themselves against the treasury market.

Wolf,

I think the answer is pretty simple. Both markets are anticipating the Fed Put in response to a coming recession.

The long Treasuries are inverting because the market is anticipating a recession and the Fed coming to the rescue by lowering interest rates again.

The junk bond market is anticipating this also, and guessing that the lower rates will reinflate stock asset prices and save zombie high risk companies from bankruptcy and allow them to refinance their bonds.

This is the Brave New World of the Fed Put which your many savvy readers have already reached a consensus is now standard operating procedure.

@ Gand….How many times or years will the general population continue to put up with this outright theft? Bankers should be in jail, right now…thousands of them. I sense the population has had enough of the BS, from all sides.

Release the taxes and release the hounds.

Paulo, you should read up on the Gilded Age and the regular 20 year cycles of overreaching greed and financial panics in the history of the United States. Throughout, there were many violent brutal conflicts between workers and capitalists (e.g., the Mine Wars, Ford Motor strikes, Haymarket riots) that were all put down.

THAT is who we, the United States really are.

As I’ve posted before, it took the Great Depression in combination with the subsequent mass destruction of our industrial competitors as the result of WWII to bring about the simultaneous “Happy Days” 30 year postwar period of world industrial domination, strong unions, full employment and prosperity, 90% marginal tax rates, and strict financial regulation. A period that liberals and conservatives both cherry pick when they point to it as what we should return to.

So, the short answer is, I think it will continue until the next Great Depression comes along before the political willpower returns to truly return some sense of economic equality to the US

They HAD to make things good for a while, we had millions coming back from the war fronts and they knew how to fight. The powers-that-be didn’t dare piss them off.

The FED won’t do a rate cut yet, at most it won’t do another raise this year but that’s unlikely.

when you have an everything bubble, is that a situation where the fed may decide to inflate it away?

Markets are global. The “everything bubble” as you call it is tied to the global financial system. The role of the Fed has diminished over the last 20 years.

China has a larger impact now than ever before. And it is beginning to figure out the meaning of the word “limitations”. Maybe it can consult with the old dogs from Japan. The Japanese had a similar “Come To Jesus” jolt almost 30 years ago.

My take: the markets are convinced there is a FED ‘put’, that it will come running to the rescue of the junk bonds, the zombie companies and everyone else (except savers and pension funds looking for a decent but certain return)

They may be right. The Fed looks jittery, like a new pilot overreacting to every gust of wind, including those from the WH.

Over on increasingly bi-polar CNBC, they are opining about the other tools in the Fed’s tool box: these include negative rates, helicopter money and something called Modern Monetary Theory. The last apparently just means the government buying bonds instead of the market. Why it’s called ‘modern’ is questionable since at one point in John Law’s financial experiments in 18 th century France, he (as minister of everything) had the government guarantee some of its shares in his (and France’s) Mississippi Company,

The final crash of that pyramid stimulated one victim to commission a series of etchings mocking Law’s scheme to, in Law’s words, ‘turn paper into gold’

One plate has coins emerging from a human’s rear. The inscription: ‘Shit shares and trade wind’

‘Helicopter money’ refers to Ben Bernanke’s metaphor for forcing liquidity into the system even if he had to drop money from helicopters.

This would avoid the problem of loosening credit when people are so negative they won’t take it: ‘pushing on a string’

This was just a metaphor but I’ve wondered about ways of actually doing this. One suggestion: e-deposit a sum of say one thousand dollars in each FDIC personal account with less than five thousand in it. Maybe two deposits for a couple’s joint account with less than ten thousand, but only one deposit per person.

This sounds crazy but maybe no more crazy than bailing out Wall Street and the banks in the hope that loose credit will filter down to the middle class consumer.

Orderly/regulated bankruptcy is needed.

FDIC does it well for smaller banks.

GM did it.

(I’m not saying it’s perfect).

The zombies have to be hurt (and their managers fired for the idiots they are) or we continue with bubbles.

The biggest bang is a simple guaranteed income for poor people. The money goes right back into the economy.

Yes and keep them poor because if ‘poor people’ are ‘given’ money what is the incentive for them to do things to increase their employability for a higher paying job??? Most people who are poor (aka ‘low income’ aka working class’ — for caucasian men who are doing blue collar manual labor jobs that pay just a over min wage) are so because of choices they made in life. Remember that choices and actions come with consequences. sometimes those consequences (ex. a criminal record) makes it difficult to find a higher paying white collar job etc…

I’ve wondered whether, with time, the rent would just rise to eat up any increase in disposable income. people who are overstretched get an income boost and achieve stability for a while, then landlords realize that local incomes have increased and they could get more rent, and folks end up overstretched again. I guess as always it would depend on how tight the local market is.

This is THE FLAW with UBI, minimum rent, quickly rises, to consume all of UBI, so the UBI recipient has the same choice as before, food or shelter.

To break the cycle, you have to break the extortive rent/land price rise.

One method is for the state to own the land and the householder the house, but as seen in ccp china this is open to crony capitalist abuse and corruption.

The old English common lands and perpetual occupation titles had this under control, hence today there are no “common lands” and the only perpetual titles, are in the new Forrest national park. Those title date back to the doomsday book 1086 ce.

Fair low/semi-skilled job markets are needed.

This requires unwanted political choices by the rich elite: no import of cheap labor or export of capital to cheap labor globally.

Also helpful is a normal interest rate structure, where interest is not so low that the only thing rationally to do is stock buy back.

The two are related. Why would executives invest in tangible plant and equipment if the average joe can’t afford to buy big things like houses, cars, etc.?

Vicious cycle for the bottom 50% or so (income and wealth).

The financialized capitalist assets (paper- and hard assets inflated by paper) need a bear market very badly- along with other developments- before this is fixed.f

Giving money away is not sustainable for various reasons.

ultimately, it’s impossible to have continued economic “growth” with decelerating population growth or in the case of Japan/Italy/Germany/Greece, actual negative growth rate.

The planet is shrinking, in technological terms which creates a reactionary psychology (populist movements) while the central bankers run expansionary economic policy. These two forces are are bound to collide

Simply stated, MMT means what Wolf has explained here – that the US because it has a sovereign currency can never go bankrupt and can spend any amount it wants or needs. Currently and for a very long time we’ve been practicing MMT to finance wars invasions super massive spending on things that don’t work like F-35. Also Wall Street bailouts and massive tax cuts for the rich and huge subsidies to rich gigantic corporations. It’s only when someone notices this and says let’s spend instead on things that benefit people like healthcare education retirement public works paying government workers decent wages & benefits that we hear we can’t pay for it because reasons – as we launch a new war or bombing campaign and new weapons and explode military spending and tax cuts for the rich and subsidies for the rich. MMT has worked since the Dawn if time. But they don’t want you know that so you think in terms eternal austerity, balanced budgets like a family sitting around a dinner table.

1) UUP @ 26.43, – rising nonstop since Jan 2018 bottom, – is testing the March 2015 Buying Climax @ 26.50, and under the upthrust of Jan 2017 @ 26.83. RSI bearish diversion indicate a potential US $ correction and higher commodities prices, for a while.

2) Switzerland CPI is 0.2%, but yesterday their 3M was @ (-)0.80 // their 2Y was @ (-)0.804 and their 10Y @ (-)0.463.

Their 10Y – 2Y is positive @ +0.341, while ours is slightly above zero.

Switzerland use to be top money center, but lately they reject savers.

3) Yesterday SPX had a hammer above dma200. The battle of the dma200 have started.

Its possible that the SPX will bounce back higher, for a while,

before turning back down.

4) NDX monthly was on “high” for 10 years thanks to a hypodermic needle. A thin channel : June 2016(L) to Dec 2016(L) as support line and a parallel line from July 2016(H) as resistance, – led the charge.

Apr high was stopped by the needle top line.

The monthly bar in May, an engulf, breached the needle support line.

Its very possible that this hypodermic needle will be used again ,

before being discarded, to the bottom of the economic pit.

If Canada can assemble Lexus and Honda, why not assemble F 35 ?

Because Lexus and Hondas actually work as advertised?:-)

I took a tour of WR archives back to Jan 31 2019. I gave each one a mental score of doom or gloom or neutral. I am a doomer and that’s my bias. Still outstanding of my bias my mental chart of the stored scores pointed toward at best a recession and maybe worse ,stag-flation. My particular form of doom if I had to choose would be deflation. A recession with only 2.25 or 2.50% headroom for the Fed to cut could be devastating enough . As for inflation , we are at 10% no matter what the politburo says , hyperinflation is a bridge to far as long we have the Larry Kudlow “King dollar” aka petro-dollar . Doom is click bait for me.

Corp profits down twice in a row. All the QE and Fedstock buying won’t turn this around. An absolute disaster.

You are warned.

We appear to have gone through the looking glass, profit is now loss and loss is profit, https://www.bbc.co.uk/news/business-48451339.

Since the U.S. yield curve first inverted in December mainstream financial media pundits shrug it off.

They’ve highlighted that the U.S. economic data is still relatively solid. And that there’s no recession in sight.

I’ve read ‘respected’ analysts say things like:

“Who care if yields invert? It means nothing these days.”

“It’s an outdated tool that doesn’t belong in a post-Quantitative Easing (QE) world.”

And even though many pundits want to disregard this yield inversion – I urge you to ignore them.

Let me explain. . .

For starters – why is the yield curve inverting to begin with?

Historically, the Fed raises short-term rates when they believe the economy is doing well – which means inflation and growth picking up – justifying higher rates of interest. (And vice versa when the economy is doing poorly).

And since December 2015 – the Fed’s been tightening via rate hikes (and Quantitative Tightening – QT) because they see the U.S. economy outperforming.

But bond investors aren’t so sure.

They don’t believe that the economy’s as strong as the Fed says it is. So they’re buying longer-term bonds – which pushes yields down – to lock in the higher yields today since they expect the Fed will begin cutting rates sooner than later (when they have to fight a deflationary recession).

Thus – instead of bond investors pricing in growth and inflation (a steeper yield curve), they’re instead pricing in deflation and a recession (an inverted yield curve).

So, what the inverted yield curve tells us is that the bond market’s expecting slower growth, deflation, and a recession.

And although many analysts and pundits want to disagree with bond investors and claim that the economy is looking good – the Fed themselves even admitted defeat.

It isn’t a coincidence that the Fed has effectively paused their tightening program since the yield curve first inverted in early December 2018.

That’s because they know if they continue hiking rates – pushing up shorter term yields – they will further invert the yield curve.

And that will actually tip the U.S. into a recession.

Here’s why I say that. . .

Note that the last seven straight recessions followed an inverted yield curve. . .

(This chart shows the difference between one-year yields and ten-year yields. When it dips below negative, that means the one-year yield is higher than the ten-year bond. Which signals deep inversion).

The recession won’t happen immediately – it will take a few months (maybe even a year) to manifest. But it will happen.

Why?

Because the yield-curve isn’t some useless signal that the pundits believe it is. It’s a crucial leading-indicator for bank lending. . .

As the yield curve flattens – and later inverts – it curtails commercial bank lending.

And without any new lending – there’s no way for households or firms to borrow and refinance and spend.

This greatly reduces economic growth.

Take a look at the chart below – highlighting the yield curve and bank lending standards.

(Note that this chart is slightly outdated – as of today the 2/10 yield curve has already inverted i.e. dipped below zero).

You can see that during the last three recessions – 1991, 2001, 2008 – bank lending (blue line) tightened dramatically shortly after or right before the yield curve inverted (yellow line).

Why does this happen?

Well – the Fed’s surveyed banks on their lending practices since the early 1990’s.

And when they recently asked how their lending practices would be impacted in response to a “moderate inversion of the yield curve” – it wasn’t what they wanted to hear. . .

Many of the surveyed banks indicated they would sharply tighten lending standards.

When asked why – they gave three main reasons:

First – an inverted yield curve could cause loans to generate less profits relative to the banks cost of funding. (Remember – banks ‘borrow short, lend long’ – thus inversion would put them deep in the red).

Second – an inverted yield curve would cause banks to shy away from making risky loans.

And Third – an inverted yield curve signals a “less favorable or more uncertain” economic outlook. (Because of the historical tendency for inversion to precede a recession – banks wouldn’t want to lend money if they expect slowing growth).

It’s clear from the chart above – and from the answers the banks gave – that the more yields invert, the more banks will tighten lending standards – restricting the flow of credit (the life source of the global economy).

Why does all this matter?

Because historically – the economy tends to slow after banks tighten credit (which we’ve already seen).

And if inversion leads to further bank tightening – that means inversion would indirectly cause the economy to slow.

Therefore – the inverted yield curve isn’t some “outdated” signal to ignore regarding a coming recession.

But actually may be the cause of one.

Because of this reflexive (George Soros’ important feedback loop concept) nature of the inverted yield curve – I expect that over the next 8-14 months we will see economic activity continue declining as bank lending slows.

I may change my stance once I see the yield curve begin to steepen. Which I believe will only happen once the Fed begins cutting rates.

And that may occur sooner than many realize. . .

So – in summary – beware the pundits claiming that an inverted yield curve metric is now useless.

It’s actually more important than many care to realize.

could this just be part of the “new economy” of the 2000s that Business Week, Bloomberg & Alan Greenspan kept mentioning in 1999 & 2000?? In the “new economy” debt doesn’t matter since interest rates can be kept at or new zero in perpetuity due to the “technological revolution” (which is aimed at the top 5% and the other 95% goes into five figures of credit card debt from all that buying on Amazon & Uber rides) since inflation has been Vanquished due to said technological revolution and “globalization” and the evolution of the Service economy where 75% of GDP growth is achievable only thru consumption on credit

Wolf,

We’ve seen nothing but strange things in most all financial “markets” since the Fed opened Pandora’s Box and abandoned its dual mandate. We’ll likely witness many more in the next couple of years.

The real insanity is in investment grade credit. LQD keeps making new highs nearly every day, whether equities rise or fall. The chart for JNK at least is starting to show cracks. Has broken below its 9-week MA. Same situation with leveraged loans where BKLN also gave up its 9-week MA.

But the nuttiness with LQD pales in comparison with European 10-year paper. Fund managers still must be subscribing to the TINA mantra as this observer can not begin to fathom why Spanish and Portuguese 10-years yield less than 1%. Buyers must believe the ECB has their back. Uhm, they seem to be forgetting that Mario retires in a few months. No guarantees that his successor will follow the same failed policies.

Is there any dispute that this entire economic “boom” of the past few years has been due to the easiest credit environment in history for consumers & businesses and the lowest effective tax rates for corporations & the top 1% not to mention student debt (which allows most college kids the ability to ‘afford’ to buy several Canada Goose coats and use Uber or Lyft since the subway is too ‘declass’ for most of the children of the 1% .

Yeah, I’m continuing to load up on long dated slightly OTM puts on 60% BBB “investment grade” paper… Nov2019 strikes on $100 lqd can go for $0.06 a pop if you got an iceberg limit orders slurping up 1 at a time. Other strikes probably have some good rates.

Right now, 33% of the junk bond issues in HYG trade less than par at a value greater than 66% of the junk bond issues trading over par

August 2018 statistics:

{

“lg_stdv”: 0.08472,

“lg_kurt”: 32.15278261,

“lg_par_avg”: -0.012767146416903479,

“symbol”: “HYG”,

“lg_skew”: -4.45134246

}

May 2019 statistics

{

“lg_stdv”: 0.156371,

“lg_kurt”: 75.78919258,

“lg_par_avg”: -0.013913020016633495,

“symbol”: “HYG”,

“lg_skew”: -7.36799975

}

“If you just sell options naked, I would expect that to have a positive avg return with negative skew. Owning lower quality credits can be similar. ” – My fmr boss when I was working as quant at his firm algo trading futures.

So yeah, owning this trash is worse than selling options naked…

Many in ‘Merica seem to be doing it tough and that’s sad.

In ‘ Stralia the minimum wage has just been increased from about $790? per week by 3% (plus 9% super & holiday loading of around 17%). But that’s for wage slaves; last time I looked the average salary was somewhere around $70,000 pa. but most wouldn’t get out of bed for that.

Tradies earn $200,000 pa if they’re any good ( I recently had a painting quote: $46,000 in & out for a 3 BR house estimated work time 2 weeks) And the average net wealth pp is about $400,000 I think I read (don’t hold me to that – and I’m just too lazy to go back & check – but it was the highest in the world, about 3 times that of the US of A.)

And if you don’t care to work, the government will give you almost $600 per fortnight, almost no questions asked, plenty to share a house with a few mates and party on the grog/pot 7 nights a week.

The Liberal (that’s right-ish here) govt was surprisingly re-elected last week and home sales immediately shot up. So much for The Wolf’s dire R/E predictions a while ago.. To d’ Moon Wolf! And beyond. Will never end…

The euphoria is suffocating. Good times roll like lazy waves onto Bondi Beach on a balmy summer ‘arvo.. Coffee-shops, up-market restaurants full to the brim.. 5 star hotels filled with tourists desperate to part with their hard-earned.

And the good news is that Utopia is not full! Plenty of vacancies for people across a variety of trades & professions (can you cook? take out an appendix? cut hair? saw a piece of wood more or less in half? put 2 electric wires together without much of a shock? You’re in!)

But if your skill set is not on the list, just get on a boat, chuck the passport and head for Darwin. You might spend a few months on an off-shore tropical holiday resort then get a medivac to the mainland and onto benefits. Heaven!

Australia is … Different.

Canadians are richer per capita…. Aussie dollar is only worth 65 cents eh?

My bet is on corporate bonds being wrong. There are 3 other important risks – the first and third are unique to the current credit cycle:

1. The amount of junk bonds issues with covenant light provisions is the highest in history. Over the last year for e.g. 70-80% of issues carried covenant light provisions. And this have been going on for years. When the downturn hits investors will have a lot less protection against losses than in the past.

2. Corporate bonds, especially junk bonds are very illiquid. Some don’t register a single trade for weeks. Liquidity risk will be another significant penalty these securities will take when spreads will start blowing up.

3. The $ amount of BBB issues is the highest in history. One notch downgrade will lead to forced sale by many funds who through their statues can only invest in BBB and higher.

Scott Mather at PIMCO (arguably one of the largest and reputable fixed income mamangers) issued a warning today: he’s never seen a riskier corporate bond market than what we currently have.

Not that I am particularly fond of Treasuries either: with the level of government debt we have and the inflationary risks lurking in the horizon they could be certainly at risk too. It’s just that I think corporate bonds will blow up first.

Oh, and someone else is in party mood too: Beyond Meat stock price surpassed $100 today. Crazy valuation: >65 times sales and losing $30M last year. One could argue that it’s easy to quickly scale up companies in the software business and make a case for high growth hence a high valuation. How do you do that though with fake meat? Also, with a low barrier to entry and a bunch of other bigger competitors ready to get in if this new type of food becomes popular with consumers.

And there are a bunch of other stocks at very very lofty valuations: especially Cloud software companies who went through an IPO in the last 1-2 years.

Maybe we are getting to the phase of the party where we are getting drunk and we don’t know what we are doing any longer. We then don’t want to remember what happened or we have a big hangover once the party is over.

Sandu,

Crap! The condom was broken! :)

I tried Beyond Meat. Guaranteed to piss vegans and carnivores off. Disgusting flavour and texture. No aroma. Have any of these people buying the stock actually tried eating it?

Idaho, have u tried Impossible Burger? I can’t find it right now but that sounds like a winner

In the current low interest rate environment, everyone is chasing yields. Pension funds are forced to chase yields of 7-8%. Most all of that money is pouring into the Corporate Bond market.

https://thesoundingline.com/brian-reynolds-how-unfunded-pensions-are-driving-this-credit-cycle/

Do you expect these funds to turn away business from Pension Funds, and pass on these multi-Billion dollar deals?

Good point Nick – that is why these problems become systemic. I would add to the list of investments that pension fund managers moved a lot into (begrudgingly too maybe), private equity. The rationale is that private equity funds have a very long investment horizon, /w big promised payoffs and it’s OK to let these funds be locked for a long time with them, even if the lack of mark-to-market of their investment instruments makes things less transparent.

With that said, if I was a pension fund investment manager (or trustee) I would still try to find ways to make things better – some ideas:

1. Try not to over promise and set expectations that in a very low interest rate environment it is maybe not realistic to expect the usual 7-8% return. I realize though that actuaries are figuring out that such a return is required to meet the funds obligations based on beneficiaries’ life expectancy and what is being contributed. That is a whole other story though.

2. Try to reduce the inefficiencies and be very diligent about the fees I pay to other investment managers, if I was to have external entities manage some of the funds. Listen to this podcast – the amount of conflicts of interest, mismanagement and most importantly lack of oversight in the pension funds industry is simply mind boggling. The guest of the podcast is truly an expert in the field.

3. Consider moving some of the funds into alternative investments towards the end of business cycles: maybe precious metals. More stability and less risk.

Sitting like a duck and accepting the risks in junk-bond investments and private equity funds just because everyone else does it, does not sit well with me. We are talking after all about the livelihoods of many people that really don’t have many other options when they most expect a steady and reliable income. Instead, they might be confronted with big losses and broken promises.

BTW – check-out this recent article – the Treasury, Fed and other oversight bodies are starting to really freak out about the risks in the leveraged buyout market and CLOs, where PEs play a big role.

I realize though that many of these ideas would not be in-line with pension funds investment plans objectives or the promises of the competition would kill me – hence, I am no investment fund manager:).

Luckily for us, we don’t need to get suckered in. We have options:). If one believes the junk bonds are in for a downturn and wants to profit from this, it is easy to express that view through an investment available to mere mortals like us: SJB.

I’m thinking that Trump is expanding his trade war and associated tariffs so that the economy DOES tank and he gets a rate cut at least a year before the 2020 election. I don’t know enough about Powell to know if the Fed Chair will capitulate to this pressure. Personally, I’d like a normalization of rates (maybe around 5%) and an end to all the shenanigans cheap money enables. Higher savings rates would be nice too.

Wolf

Overlap our 10-year yield with the total value of all global bonds with a negative yield. You can get that series from Bloomberg. Since 2015 (when Europe went negative), our yields fall when the negative value rises and rise when the value falls. While we have had some soft economic data of late, I believe money flow is what is really responsible for the big drop in yields.