Chinese RMB gains, but is inconsequential as central banks remain leery. Euro hangs on.

Those who’re eagerly awaiting the end of the “dollar hegemony,” or the end of the dollar as the top global reserve currency, well, they’ll need some patience, because it’s happening at a glacial pace – according to the IMF’s just released data on the “Currency Composition of Official Foreign Exchange Reserves” (COFER) for the second quarter 2018.

What it confirms: Global central banks are ever so slowly losing their appetite for being over-exposed to US-dollar-denominated assets, though they’re not dumping them from their foreign exchange reserves; they’re just tweaking them.

They’re not dumping euro-denominated assets either; au contraire. But they’re giving up on the Swiss franc. And they remain leery of the Chinese renminbi though they’re starting to dabble in it – it seems at the expense of the dollar.

In Q2 2018, total global foreign exchange reserves, in all currencies, rose 3.2% year-over-year, to $11.48 trillion, well within the range of the past three years. For reporting purposes, the IMF converts all currency balances into US dollars.

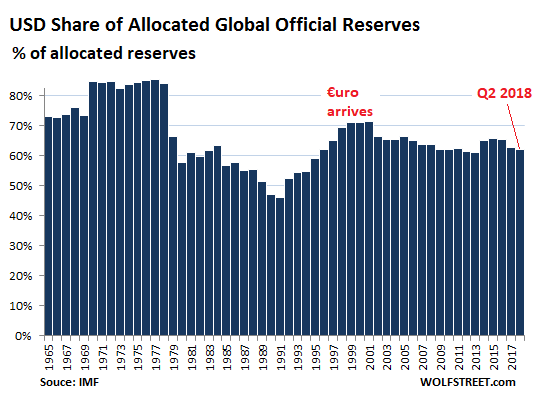

US-dollar-denominated assets among these reserves edged up to $6.55 trillion, but given the overall rise of total foreign exchange reserves, the share of dollar-denominated assets among these reserves edged down to 62.25%, the lowest since the period 2012-2013. In this chart of the dollar’s share of reserve currencies, note its low point in 1991 with a share of 46%. And note the arrival of the euro:

The euro became an accounting currency in the financial markets in 1999, thereby replacing the former European Currency Unit (ECU). Euro banknotes and coins appeared on January 1, 2002. At the end of 2001, the dollar’s share of reserve currencies was 71.5%. In 2002, it dropped to 66.5%. By Q2 2018, it was down to 62.25%.

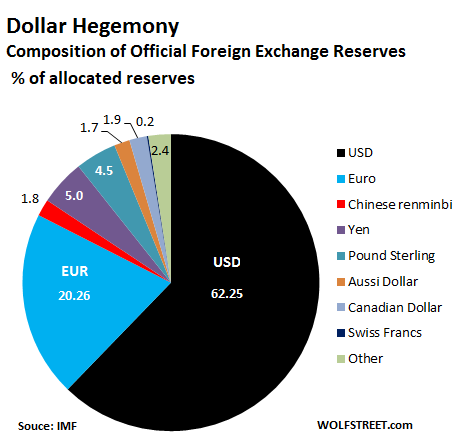

In Q2, the Euro’s share edged up to 20.26%, the highest since Q4 2014. The creation of the euro has been the most successful effort to reduce the dollar’s hegemony. Before the Financial Crisis, and the euro Debt Crisis, the theme in Europe was that the euro would reach “parity” with the dollar on the hegemony scale. But this talk fizzled out during the euro Debt Crisis.

The latest effort at whittling down the dollar’s hegemony is the elevation of the Chinese renminbi to a global reserve currency, as of October 1, 2016, when the IMF added it to its currency basket, the Special Drawing Rights (SDR).

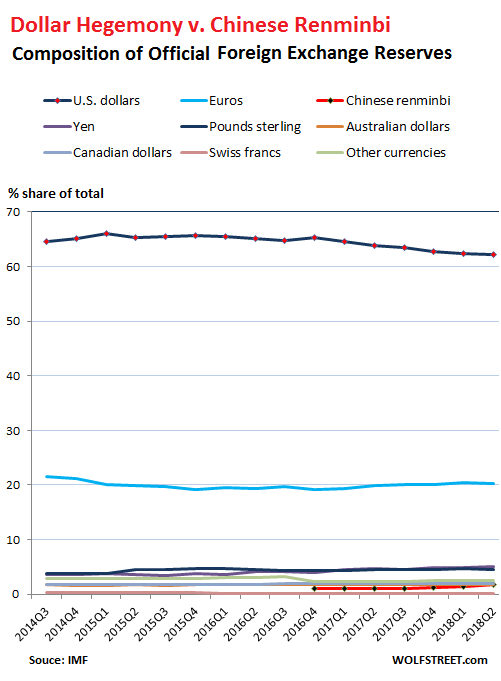

The RMB’s gains make “glacial” appear lightning fast. In the chart below, the RMB is the thin red sliver with a share of just 1.84%, but this is up from 1.39% in Q1, and up from 1.2% in Q4 2017 – minuscule, considering that China is the second largest economy in the world. It seems, central banks remain leery of holding RMB-denominated assets, but they’re beginning to dabble in it.

Note the Swiss franc, the barely visible black line in the pie chart above. It has been in the 0.16% to 0.18% range since Q1 2016, but that’s a sharp drop-off from its share in prior years.

In the chart below, the black line at the top is the hegemonic US dollar, whose share of reserve currencies has edged down. The euro (blue line), at 20.26% in Q2, has been vacillating at around 20% for years. The USD and the EUR combined accounted for 82.5% of the allocated foreign exchange reserves in Q2. The Chinese RMB is the bright red line at the bottom since its inclusion in Q4 2016. It’s just above the Swiss franc and roughly on par with the Canadian dollar and the Australian dollar:

All these percentages denote the currencies’ share of “allocated” reserves. Not all central banks disclose to the IMF how their foreign exchange reserves are “allocated” by specific currency. But over the years, disclosure to the IMF has increased. In Q4 2014, “allocated” reserves accounted for 59% of total reserves. By Q2 2018, this has risen to 91.6%. In other words, the COFER data is getting more complete.

A word about the relationship between the dollar as the top reserve currency and the huge trade deficits the US has with the rest of the world: There is a theory that says that the US, as the country with the top reserve currency, must have a huge trade deficit with the rest of the world. What pulls the rug out from under this theory is that the Eurozone, which has the second largest reserve currency, has a large trade surplus with the rest of the world.

However, the status of the dollar as the top reserve currency and top international funding currency allows those trade deficits to be financed and thus makes those trade deficits possible over the longer run (going on two decades now).

That Trump is bungling the debate on how to deal with the trade deficits became clear when he was getting bashed like a sitting duck from all sides: from Corporate America, China, the EU, other entities that would lose, and their propaganda outlets in the media. Read… What I Wrote to the White House about Trade & Tariffs

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What happens to the Euro if the EU breaks apart? That was unthinkable before 2008. Now the odds of Europe coming apart at the seams have increased.

What will happen to the renminbi if Xi Jinping turns out to rule China like Mao? That too was unthinkable a few years ago but every day it seems more plausible.

LIke Mao? Try like Stalin the way he is heading.

Couldn’t agree more, the Euro is dead man walking

….and exactly what to all these countries do if the US pull out of their countries because they won’t use dollars, or limits the use. The dollar’s power is derived primarily from the military presence in more countries than we have states. That props up their economies, and they know it. ” Lend Lease is still alive too, just that it is given now. No one will turn their back on Uncle Sam’ fiat as long as the spice flows, and it sure looks like production has increased.

As for the Swiss National Bank, they have made no secret that they have been and are pumping billions upon billions into the US stock market…and they are not alone.

Well, even if some or several countries manage to exit, I don’t believe that EU will break apart completely in the foreseable future. Euro may become the common currency of a subset of relatively homogeneous Countries that can more easily deal with EU rules.

On a longer timeframe (20yrs), EU may break completely or, on the contrary, implement some kind of fiscal union and integrate as a loose federal entity. It is not so unlikely, Germany itself is a federal entity. People’s attitudes change a lot from one generation to the next.

The German minimum wage was part of integration.

The UK was always The biggest opponent of ever closer union.

France gov is now more intrested in federalisation, it could be a lot closer than 20 years, if the biggest objectors leave.

If the Euro falls apart, then these charts will go back to what they looked like in 1995. We used to call those charts “Snow White and the Seven Dwarfs”. The USD had a share above 70%, and nobody else has a share above 10%.

I hear that foreign currency trading was a lot more fun in those days: There were a lot more horses in the race. . .

As for the rest of it, I think that Trump’s policy is correct, even if he is {ahem} an Imperfect Messenger. A $800 Billion annual trade deficit means that 8 million Americans are unemployed because of our trade policies. Multiply that number to account for the spouse, parents, and adult children, and you likely have 32 million pissed-off voters who WANT THAT TRADE DEFICIT TO END. NOW!!!

I can’t say that I blame them.

When you add in the fact that these people are concentrated in swing states like Ohio, the mystery is why this didn’t happen earlier.

One last thing: None of the NAFTA victims or WTO victims is interested in what your elitist friends think about economic policy. In fact, they pretty much oppose anything that the Establishment supports. . .

” A $800 Billion annual trade deficit means that 8 million Americans are unemployed because of our trade policies.”

Right on–the huge American INternational Co. have benefited from the ‘deficit’, by going overseas with ops that give them profits, that they keep overseas, and Americans lose those jobs.

That is what we call corporate welfare,,,,at Americans expense.

So how big a deal, in the dollar dominance scheme of things, is the news about the EU trying to figure out a payment system around US sanctions?

Obviously reserves have nothing to do with that. However, thanks for the fine portrait of what’s going on there.

Nothingburger, smoke and mirrors. All major buyers of crude (mostly traders like Vitol) have pulled away from Iran because their operations are in USD, they have US operations and are covered by the sanctions. There is already a payment system that can enable Iran to get paid in EUR, for instance (the Europayment system Target). However, any company that tries that trick can easily get sanctioned by the US (easy to check who is lifting oil from Iran). A European refinery can take delivery of Iranian crude but will never be able to buy crude again from any other source. Besides, what is Iran going to do with EUR? They import food. Priced in USD. They import other stuff. Priced in USD. And so on. The sanctions are extremely effective. There is even talk about China selling bartering products (the RMB isn’t convertible), but that is stone-age trade. What will Iran do – take delivery of excess solar panels?

NK gets crude from transferring ship to ship—bet then satellites show that up.

I think it depends on how the sanctions actually play out in real terms, if there ends up being some supply shock, further escalation with Iranian partners (Russia and China for example) , if a war results and so on. That is a very big topic, and no one I think can answer it properly at this point.

Because of the decline of Chinese yuan against the U.S. Dollar in Q2, the sequential increase in yuan reserve is somewhat larger than the sequential increment in dollar amount.

As a % the dollar was lower in the 80s and 90s per your first chart.

I don’t think this dabbling in Yuan leads to anything. For a trend need at least a decade more. This is just a blip and not unlike a modern car’s in time mpg and not over a 1000 miles.

“How did you go bankrupt?”

Two ways. Gradually, then suddenly.” ― Ernest Hemingway

Yeah, but the US cannot go bankrupt because it can print its own money and will always be able to pay its debts, even if it devalues that debt through inflation.

Before it defaults, the world monetary system will be reset. That reset will be as a result of a rising US Dollar.

The Yuan is no-go as a global reserve currency, it can’t take the weight and no one trusts it – especially the Chinese who have been using Bitcoin and any means possible to try and funnel money out of the country.

The Euro is toast and the Yen has no interest. US Dollar wins by default.

What if the US wants to go bankrupt? 45 promised to hatchet the bond market.

Friend sent me link to Sydney Morning Herald article on the same data release, the author of the SMH piece Robert Burgess gets today’s finance-journalism malpractice award for blowing up the recent minor moves into a “the dollar is in jeopardy of no longer being the world’s primary reserve currency” scare-story. Ooga booga!

Yes, the headline fits the very popular “death-of-the-dollar” narrative. But the article itself is thin, doesn’t get into the facts and numbers of reserve currencies except for the dollar’s share, and instead goes all over the place, from Italy on Friday to US sanctions.

I agree with your award for that piece.

– As long as the US keeps running a Current Account Deficit the USD will remain the world’s reserve currency.

In case you missed them, let me quote here the last two paragraphs of the article that deal precisely with that issue. The cause-an-effect relationship is exactly the other way around: As long as the US is the top reserve currency, it can fund the current account deficits. Here it is:

“A word about the relationship between the dollar as the top reserve currency and the huge trade deficits the US has with the rest of the world: There is a theory that says that the US, as the country with the top reserve currency, must have a huge trade deficit with the rest of the world. What pulls the rug out from under this theory is that the Eurozone, which has the second largest reserve currency, has a large trade surplus with the rest of the world.”

“However, the status of the dollar as the top reserve currency and top international funding currency allows those trade deficits to be financed and thus makes those trade deficits possible over the longer run (going on two decades now).”

That makes sense, except Euro trade balance is positive now but was mostly neutral or negative for first decade, so Euro is not a good example imo. The one that does stand out is Deutsche Mark, and I don’t know how they achieved this, but Germany ran positive balance of trade from 1950 on

https://tradingeconomics.com/germany/balance-of-trade

and achieved reserve currency during that time

http://www.country-data.com/cgi-bin/query/r-4957.html

Euro hitched onto DEM and has not really changed too much, but it is widely used as transaction currency, around as much as dollar I think. Proper older data and explanations of what was going on are harder to find, pdf at

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2505239

has some clearly presented.

Anyway, I end up with about twenty tabs open trying to piece it together and figure hmm… maybe another day.

Perhaps because stability and trust and recognition are the important factors in a reserve currency, rather than deficit?

– The reality is more complicated.

– Between say 2000 and 2014 five countries in southern Europe were running Current Account Deficits, thereby pumping Euros into a number of other countries, including countries outside the Eurozone.

– There is more “under the hood” that should worry the US. Between say 1995 and 2009 the particular combination of Current Account Deficit and the US budget deficit was benficial for the US but that combination has now turned around and is detrimental for the US.

I do recall the US current account defict in 1980 was about zero. I also recall the US being the global reserve currency at that time.

Why do people forget that?

I remember shortly after graduating high school, politicians claiming we could not continue the reckless budget deficits and trade imbalances which would lead to the destruction of the American economy, and poverty for us all.

I graduated in 1961

Yeah, but we had a huge and debilitating bout of inflation in the 1970s and early 1980s, going up to 15% in 1981. The dollar’s purchasing power plunged. Interest rates for mortgages were near 20%, etc. This also devalued the debt. Is that what it takes to solve the current problems? Is that what you want to see again, the purchasing power of your assets and income just vanishing before your eyes?

“And they remain leery of the Chinese renminbi though they’re starting to dabble in it – it seems at the expense of the dollar.”:

The CCP are forcing smaller nations to trade in CNY/RMB.

This forces more CB’S to Handel the printed use toilet paper, known as CNY/RMB. A little.

Nobody of any consequence, is holding any substantial amount of the printed chinese used toilet paper. As an investment/security(Unless they are insane).

QT effects?

Discussing whose toilet paper is the dirtiest isn’t very inspiring d…..that it should all come to this.

The dollar is the cleanest shirt in the hamper, so don’t hold your breath on the others.

Great point! The Fed is pulling in dollars by closing currency swap lines which temporarily looks good for the country doing the swap but only until the inflation bill starts biting? This is why i like Europe temporarily?

Actually, the cleanest shirt in the hamper will be a partially gold backed system/currency. This is what Putin is moving towards and when the world finally gets fed up with the flagrant inflation and abuse of the dollar by the US….well then perhaps a new order will be demanded.

And like Hemmingway’s bankruptcy wisdom, it will be very slow at first and then lightening fast.

Putin can’t even keep poor Russians fed. Gold is no use to them.

I understand at least he’s got vodka prices back where it’s cheaper than soda pop.

I assume this is why central banks of many countries around the world own gold. In the event the world returns to a gold standard, these countries will have sufficient gold to back their currency. Of course, the countries that have little gold will fight any sort of gold standard. They would simply be left out and their currencies would drop.

This would only take place if the developed world falls into another depression, which is somewhat foreseeable given the rising government debts. Just about any alternative to the current system would look good at that point. 2027?

Beth A. Simmons wrote an interesting book about the Gold Standard. Title is “Who Adjusts?”

The Gold Standard wasn’t really a success story. All the Countries that adopted it couldn’t avoid devaluations, apart from the US that at the end dismantled it.

Moreover the value of gold is not stable. Gold has very long bull/bear markets, lasting ten years or more.

However devaluations would be possible with the Gold Standard. This would maybe the only advantage in comparison with a common currency as the EURO.

I don’t think gold can work in a growth oriented capitalist economy. That’s why it was dropped in the early parts of last century. A growing economy requires growing debt, which requires a growing money supply, otherwise the debt cannot be repaid and the economy cannot grow.

Works fine in pre-industrial economies though.

Kent:

Thank you for that comment. After reading hundreds of comments on this subject on this blog I thought I was just too “simple” to understand. But, now I know there is another who feels the same way. That gold cannot support a growing capitalist economy especially with a finite supply. These capitalist economies have to have “flexibilities” that gold cannot accommodate.

Kent and sierra,

It is my belief that we blasted through the limits for growth decades ago, hence the exponentially increasing debt required to fuel the perception of growth since around about the time we reached peak conventional oil, with debt growth mirroring the declining productivity of our energy sources.

I would contend that the future holds contraction rather than growth, and we have only been presenting growth figures based on consuming our equity. This sadly means that I also expect a pretty abrupt and disorderly correction to bring our perceptions and valuations in line with our impoverished balance sheets of declining economically viable energy/resources and exponentially expanding debts.

How about IMF paying off all debts of all countries with SDR’s. Taking rates back to 5% and the beat goes on.

Nah. The USD is backed by the US military.

SDRs are backed by hot air.

If things continue on with this administration, perhaps the reserve currency worries will lose relevance. Global Trade sure seems to be doing so south of 49. There seems to be a huge cadre of uninformed voters who believe the USA can make all their own products for themselves, and just trade stuff around internally, except for farmers of course. Then, the rest of the starving incompetents in the World need our boogerin’ soybeans and they’ll come crawling. (Zero Hedge intelligent comments /sarc)

This is not a healthy trade environment needing a US dollar reserve currency.

I was reading a synopsis of the new NAFTA agreement this morning. Then, I got to the comments. There were over 1200 of them and by the third one in I read, “Whatever, I’m still not buying anything made in the US or visiting there as long as Trump is in office”.

But this is the BIG news. LNG plant, 40 billion dollar announcement, going to be installed in Kitimat, BCs nw coast. It is 8 days closer to Asian markets compared to US Gulf plants. It’s a go and a Provincial election will result from it as the Green’s pull out support. Additionally, the Kinder Morgan Trans Mountain pipeline, delayed, will also me built. NAFTA renegotiated while new customers and markets are nurtered and developed. Maybe we’ll trade in respective currencies or a basket. This is a good time to shift the way things are done. Slowly, but surely…the World is moving on and redefining everything as US looks inward.

Canada has everything going for it at the moment. They have the space, they have the raw resources, the welcoming immigration policies, the open trade policies — and a government willing to invest in the future.

Except for resources that are land locked, nothing can move..

> Slowly, but surely…the World is moving on and redefining everything as US looks inward.

This is evidenced by the fact that the largest economies outside the US are working together to come up with standards that prop up their own industries.

These countries are making standards for electric vehicles, charging stations, solar panels, electric grids, customs and distribution, almost anything short of trading only in Euro. And even that could change with SPV by as soon as next year. All this allows German cars to work in China, Singaporean biofuels in European gas stations and if Canada joins in, Canadian and Qatar LNG standards. Notice how there’s no mention of any US company or US technology anywhere.

This is all happening way too fast. No country will stick with the dollar when their own politics and populace is at stake. And if dollar is being used as a weapon, the masses in those countries will compel their leaders to use another currency.

SPV ?

SPV- special purpose vehicle.

The EU led by U.K., France and Germany are in the process of setting this up, so that European and Chinese, Russian and Iranian entities can continue trading, after the US has imposed new illegal sanctions. The purpose is to circumvent SWIFT, US jurisdiction and supervision.

Here are some links:

https://www.dw.com/en/eu-and-iran-create-special-vehicle-for-trade-despite-us-sanctions/a-45623867

https://www.reuters.com/article/us-iran-nuclear-mogherini/eus-mogherini-eyes-iran-spv-for-trade-before-november-idUSKCN1M62OF

Here is a quote from Federica Mogherini, it is quite telling how people in the EU, myself included, feel about the US controlled financial system.

“Asked if the United States’ pulling out of the Iran deal could be a serious challenge to the U.S. dollar as reserve currency in the context of the creation of the SPV, Mogherini said [“it is still an initial stage, but this could be a result of that. For sure, it has made us and other parts of the world wonder what kind of (financial) autonomy we have.”]”

A final quote from the Reuters article also from Fredrick Mogherini:

“Even as she said she continues to consider the United States the EU’s strongest ally, Mogherini said [“no sovereign country or organization can accept that somebody else decides with whom you are allowed to do trade with.”]”

RE: the collapse of the euro because of Italy, the more likely thing to happen is that the populist lunatics take Italy out of the euro.

The ECB is making it clear that it used its ‘big gun’ to give Italy time to reduce its deficit and time is up.

If Italy bails rather than face reality, this would strengthen the euro. Italy rapidly becomes Argentina, hopefully not Venezuela. but that would be their problem.

But suppose the euro itself is abandoned. Then if Germany goes back to the D-mark, the US dollar quickly, or instantly, becomes a second tier currency.

The $US is the cleanest dirty shirt. but what if there was a clean shirt?

Let’s not forget that around 1978 the US dollar was so weak it had to issue bonds denominated in Swiss francs. (Carter bonds) US tourists around the world were asked to pay in local currencies, even lira.

The preponderance of the US military was not seen a bulwark against dollar weakness. It was seen as overspending the US could not afford and was paying for with printed dollars.

Even if Italy, Greece, Spain were to leave the Euro, why should the others do the same? There are several Countries that don’t have so many problems with the EU rules.

The BCE can print all the money that is needed to ring-fence their banks, abandon the leaving Countries and look at the carnage from a distance.

Italy is a big, big problem, but I wonder, does it really exist a too-big-to-fail financial entity that an independent modern Central Banks cannot, under proper conditions, save?

It’s a long story, but Italy has not benefitted from Euro economically. The constant devaluatiom of the Lira was part of a structural system, including political, which maintained Italian competivity and expansion. The result of the no fx Euro and rates set at a level to suit EU as a whole did not benefit Italy. So in return for resulting falling productivity, which was part won over by Germany, Italy is being pressured into making structural reforms to fit in with pan-EU policy, which it does not like. It isn’t a question of which system is empirically right or wrong, and this is why you hear about north/south divide – the whole social economic political financial method of a country is different between the two. It is the same difference between a creditor and debtor – when it does not pay who’s to blame? Do Euro countries have obligation to make the creditor whole when they consider the method used odious, when under normal rules failed investment does not get bailed or lead to political control of a country? It is an argument, and Germany would not necessarily benefit from the outcome…at the very least it will lose some influence and have a new independent competitor in Europe.

So I hope if Italy leaves Euro its sovereign monetary policy will be used to pull it back into shape…might not but I am not pesimistic either.

Well before Draghi came to the rescue, the interest Italy had to pay on its bonds had spiked to over 7%, pretty much requiring a default or ‘haircut’

A central bank is not a fairy godmother, able to wish prosperity into existence. As the US FED, especially the new guy Powell, keeps telling us, it does not control fiscal matters. i.e., spending.

At some point the game is up.

Has anyone noticed how a US 1 Year treasury bond gives a higher rate then a 1 year Bank CD??

Chase 1y CD = 2.4-2.55%

US1Y T-Bond= 2.64%

Considering the hit with states tax too in states like CA/NY. Can someone explain the logic behind this? And if anyone has some rates hand, any updates on other bank 1y and 2y CDs??

Thanks

The relationship between the 2year Treasury and 2y Bank CD is still logical.

US2Year=2.82

BankCD=2.95

considering a 4-5% states tax on the CD they basically even out.

Are ppl flocking to the 1y CD for convenience and dropping its value bellow financial logic?

The Dollar has all the advantages as long as it is the Reserve Cuurency. This allows the Fed to influence the rest of the world.

But if Russia, China and Iran want to trade oil for gold it removes the power of the reserve currency. This is why the CIA serves its propaganda about the three.

Gold is collateral for the central banks, as all fiat currency’s are losing value or purchasing power, and all the CB collude in the same direction to create illusion all is well.

“But if Russia, China and Iran want to trade oil for gold it removes the power of the reserve currency. ”

Nonsense. Trade is immaterial. It is the denomination of DEBT that counts. And, that, globally, is in US Dollars. Trade actually means very little…. capital flow is what matters.

“It is the denomination of DEBT that counts. And, that, globally, is in US Dollars. ” He just got done telling you that they were accepting other than dollar-denominated debt.

Russia, China and Iran could, for that matter engage in barter trade if they did not want to ship gold back and forth and were leery about each other’s currency.

It is interesting to recall before our Annus Horribilis- 1913- when the Fed and the IRS appeared, that no one in the U.S. cared what one traded in, because there was no income tax, and everything did not have to be crammed into a dollar peg. Tariffs provided the necessary national income. A very good case for abolishing the IRS, which would also lift an enormous psychological millstone from everyone’s neck.

Good points Wolf makes. USD hegemony and US power is here to stay for a very, very long time. China will never get there unless RMB becomes freely tradable which will never happen as long as the country exists like it is. EUR is not an economic power alternative because there is no “Europe”, it is still a collective of 19 sovereign countries in eurozone (and 8 in EU outside of euroland). USD is on 85% of all FX trades, and 63% of all FX reserves, and 54% of all global assets under management. All energy, food and other commodities are sold in USD. China is totally dependent on the USD as their biggest customer. Total and complete US hegemony. As John Connally said in 1971 to the G10: “the dollar is our currency but it’s your problem”.

This topic isn’t that complicated: examine the reserves of Switzerland. Lots of Euros. Trade balance just under 75 billion USD. Reserves? ~800 billion. Why so much? So the theory Wolf mentioned has to also look at the capital account. It’s easy to understand why Europe has a trade surplus, and the Euro is also held so much as a reserve currency. This topic came up before, and the references are there. Capital investment, flight, and capital movement mean that reserve amounts can’t simply be looked at as trade surplus/deficit balances.

” It seems, central banks remain leery of holding RMB-denominated assets” (the RMB being a mere 1.8% of foreign exchange reserves). Even though it happened during the time of Marco Polo, it seems people have not forgot China was the one to inflict fiat money on the world in the first place.

But Central Banks being leery about anything is a joke. The U.S. Central Bank enabled the creation of trillions of dollars, virtually interest-free to the very banks that own it, to cover their gambling losses (at U.S. taxpayer expense) during the “crisis” in 2008. So why shouldn’t every other CB do likewise? (Hint: they did. This is why debt has skyrocketed worldwide. Now Central Banks are as thick as thieves, so the question is: “How does CB A really know how many yuan, lira, rubles or pesos CB B is really cranking out in its basement?” The answer is they don’t (which explains why the gold standard- sh*t, any standard) was once the norm- to enforce a modicum of honesty.

I am not fan of their dictatorship but China’s seems to be the only major nation engaged in significant long term planning. They keep their excess cash in US dollars so it can be deployed internationally in investments in the real economy. They limit their involvement in the US stock and debt markets because they know this is unsustainable. Their Belt and Road initiative financiers charge reasonable rates as opposed to the exploitative rates charged by Western institutions. Through the Initiative they invest in the real economy. Meanwhile private industry has proven incapable of any long term planning or long term investing. As a result the capital goes to financial instruments and especially debt. Everyone and every entity has limits to how much debt they can take out. Eventually we will run into that limit. The banks will have to be bailed out again. Given the national debt we already have, this is likely to cause a devaluation in the US dollar and Euro. China would move its money to its own currency which would be catastrophic to the US dollar. Can China weather what is coming better than the rest of us?