Seattle’s historic spike falters. New York condo prices back where they were last Sept. House-price bubbles in other metros get even more splendid.

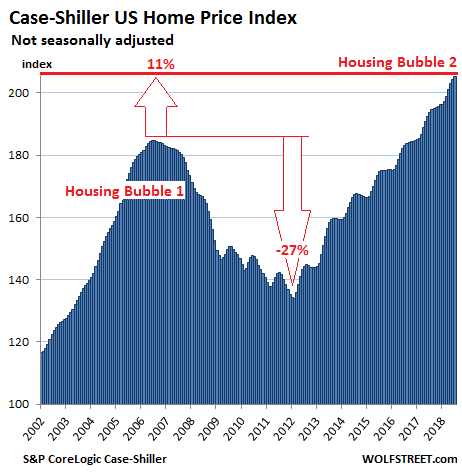

Home prices in the US surged 6.0% in July compared to a year ago (not seasonally-adjusted), and 0.4% compared to June, according to the S&P CoreLogic Case-Shiller National Home Price Index released this morning. The index is now 11.2% above the July 2006 peak of the first housing bubble in this millennium, “Housing Bubble 1,” which was called a “healthy” housing market during it, and was called “bubble” and “unsustainable” only after its collapse. However, collective memory changes, and now, this peak of the collapsed bubble has become the new-normal base of what is once again a “healthy” housing market. The index has surged 53% from the bottom of “Housing Bust 1”:

In some of the hot local housing markets, indications are starting to accumulate that fundamentals are deteriorating: declining sales, rising inventories, reduced asking prices, increasing number of days on the market, and the like — for example, in the Bay Area county of Sonoma. But there are few signs yet that any deteriorating fundamentals have impacted the bubbliest markets as depicted by the Case-Shiller Home Price index, with the exception New York’s condo situation and the suddenly halted spike in Seattle.

The Case-Shiller Index is a rolling three-month average; today’s release is for May, June, and July. The index is based on “home price sales pairs.” It compares the sales price of a home in the current month to the last transaction of the same home years earlier. The index incorporates other factors and uses algorithms to arrive at each data point. It was set at 100 for January 2000; an index value of 200 means prices as figured by the index have doubled. The index does not say anything about absolute dollar-price levels. As such, it is very different from alternative measures, such as “median” prices that are often cited.

The index is not inflation adjusted. It’s itself a measure of inflation — not consumer price inflation but asset price inflation, specifically home-price inflation. It shows to what extent the dollar is losing purchasing power with regards to buying the same home over time.

So here are the most splendid housing bubbles in major metro areas in the US:

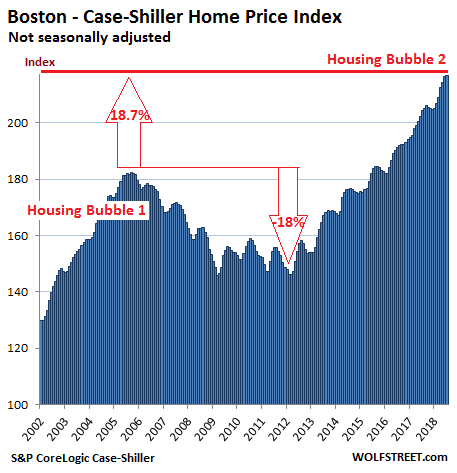

Boston:

Home prices in the Boston metro jumped 6.0% from a year ago, according to the Case-Shiller Home Price Index. During Housing Bubble 1, from January 2000 to October 2005 in Boston, the index soared 82% before dropping. It now exceeds that crazy peak by 18.7%:

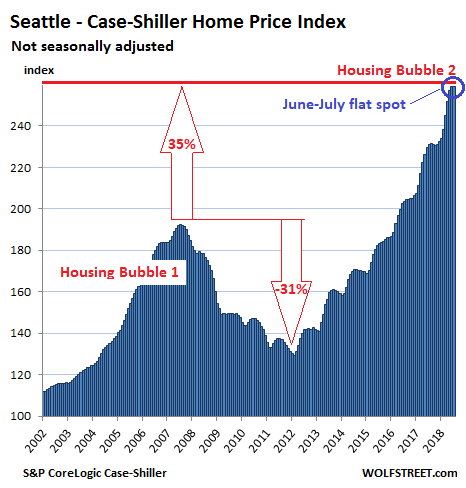

Seattle:

Home prices in the Seattle metro did the unthinkable and unspeakable, after a historic spike: They edged down a tiny bit in July from June. This is interesting not because of the size of the decline (it’s small), but because of the fact that price increases were the norm in every July through 2011. July should be a seasonally strong month. But not this year. So the wait has started for confirmation of the inflection point. Over the past 12 months, the index has jumped 12.0% and is up 35% from the peak of Seattle’s crazy Housing Bubble 1 (July 2007):

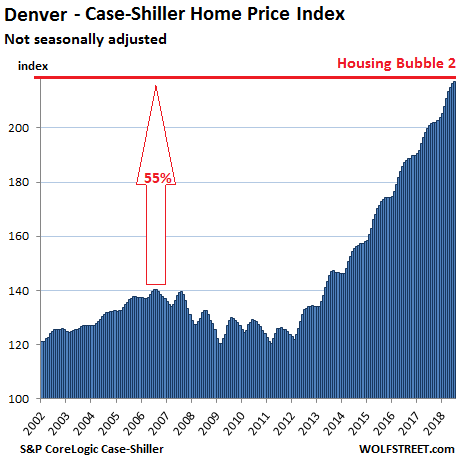

Denver:

Home prices rose 0.3% in July on a monthly basis, according to the Case-Shiller index for the Denver metro, the 33rd monthly increase in a row. The index is up 8.0% from a year ago and 55% from the peak in July 2006:

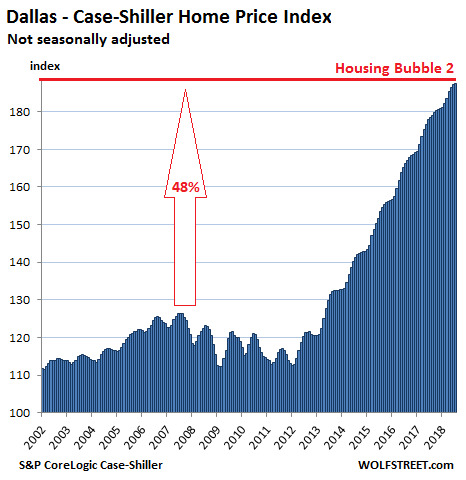

Dallas-Fort Worth:

Home prices in the Dallas-Fort Worth metro rose for the 54th month in a row in July, and are up 5.0% from a year ago, according to the Case-Shiller index. Since its peak during Housing Bubble 1 in June 2007, the index has surged 48%:

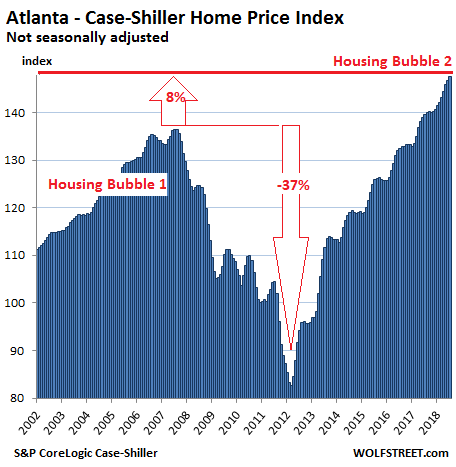

Atlanta:

Home prices in the Atlanta metro rose 0.5% in July from June, according to the Case-Shiller index, and 5.8% over the 12-month period. They now exceed the peak of Housing Bubble 1 in July 2007 by 8%:

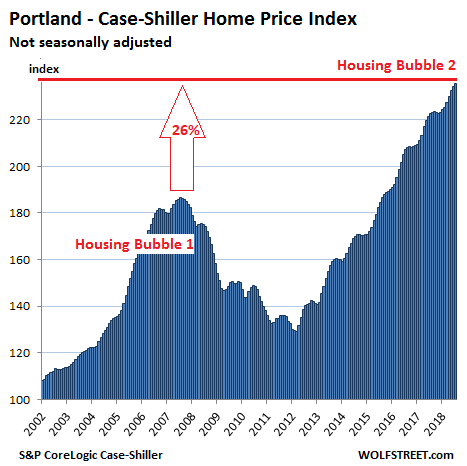

Portland:

The Case-Shiller index for the Portland metro in July rose 0.5% from a month ago, 5.6% from a year earlier, and 26% from the nutty peak of Housing Bubble 1 in July 2007. It has ballooned 135% since 2000:

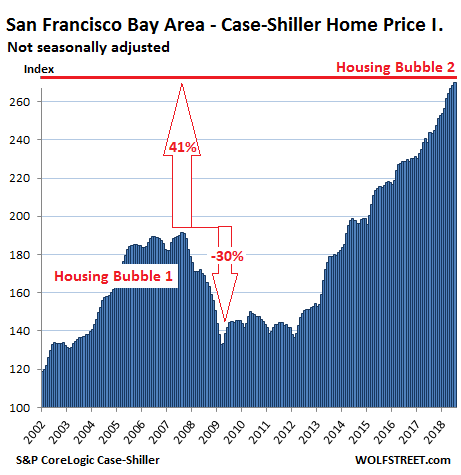

San Francisco Bay Area:

The Case-Shiller index for “San Francisco” includes five counties: The city/county of San Francisco, the northern part of Silicon Valley (San Mateo County), part of the East Bay (the counties of Alameda and Contra Costa), and part of the North Bay (Marin County). In July, the index rose 0.6% from the prior month and 10.8% from a year ago. It’s up 41% from the crazy peak of Housing Bubble 1 and up 170% since 2000:

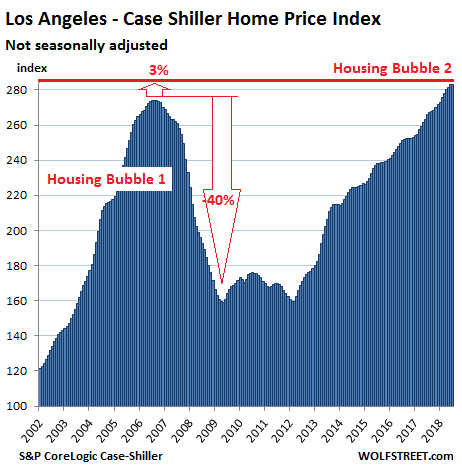

Los Angeles:

The Case-Shiller index for the Los Angeles metro edged up in July and rose 6.4% year-over-year. Between January 2000 and July 2006, the index had skyrocketed 174% before its majestic collapse. The index now exceeds the crazy sugar-loaf peak of Housing Bubble 1 by 3%:

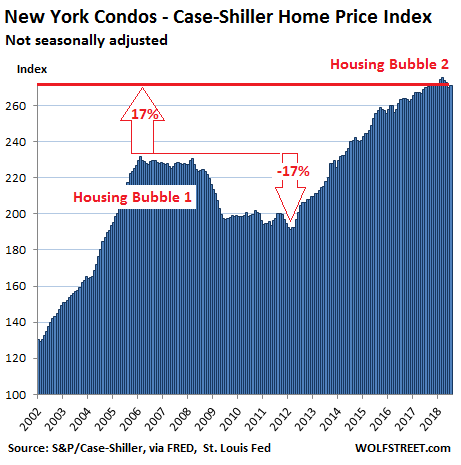

New York City Condos:

Condo prices in the New York City metro edged up 0.5% from the prior month, after three months in a row of declines, according to the Case-Shiller condo index. Prices have dropped 1.5% from the peak in March, are nearly flat year-over-year (up only 0.47%), and are at the lowest level since September 2017. For confirmation that this dip in condo prices is a visible sign of a deflating housing bubble on this list of the most splendid housing bubbles in America, we need confirmation in form of a year-over-year decline, for example, with the index value for August coming in lower than August last year. Until then, it’s too early to speak of a trend even if it’s starting to look like one:

The above charts are representations, based on Case-Shiller data, of the most splendid housing bubbles in America. The index covers other cities that have not yet reached prior bubble highs, such as Miami and Las Vegas, and so these cities don’t yet fit into the theme of this series.

But the Case-Shiller data does not cover many cities whose home prices have completely blown through the roof, so to speak, such as the Nashville metro, whose home prices, according to the Federal Housing Financing Agency’s different methodology, have skyrocketed 45% above the peak of Housing Bubble 1. By any standard, the Nashville metro, and other metros like it, should be included in this list of the most splendid housing bubbles, but the publicly available Case-Shiller data does not cover them. So don’t feel disappointed if your splendid bubble-metro is not on this list.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Rates matter. This is a good thing imo.

We’re at 7 yr high’s as of today.

This time the Fed wont need the Treasury Secretary stealing the bailout, because they already looted it from us ? What a wonderful world (cascading jovial laughter)

2.55% 12 mo. CD, 2.9% 24 mo. CD as of today, 9/25. Risk-free rates are beginning to make inflated asset prices look like a really bad bet.

I wonder what a change to the Fed target rate will do to the housing market?

From WSJ through

https://www.zerohedge.com/news/2018-09-24/rethinking-feds-2-inflation-target-spotlight-absurd-debate

None. They’ve been talking about changing the target for years. Williams, as head of the SF Fed and now head of the NY Fed, has been on the forefront of this. There are legit reasons to ditch the 2% target. The question is: will whatever comes afterwards be even worse than the 2% target?

You do good work on realestate news Wolf good job. I would like to see you do stories on people opting to live and already living in Mobil homes,RVs etc refusing to be a slave to the geographically fixed home game/rip-off.

Living in a car or RV is not cheap!

My own opinion is that people who do this are desperate, deluded, or are only able to find work by chasing it across the country in classic 1930s “rubber tramp” style.

When rates were going up durin Volcker area, real estate didn’t crash, but it kept going up contrary to expectations.

I don’t think a crash is a sure thing despite higher rates.

I believe we are witnessing the acceleration of our dollar purchasing power loss and real estate might just be the only asset left still at the reach of normal people. Maybe we have reached a permanently high plateau….:-))

During the Volcker era everyone and I mean everyone had money and lots of it. Today very few have money that’s why housing will tank in the present day era.

Yes, and you can add the baby boomers getting into breeding and needing a house.

“… baby boomers getting into breeding and needing a house.”

Or more precisely,… ” baby boomers getting into breeding and needing a house, and not having the down payment tied up in student loan debt.”

Stop with inflation by demand thinking, the boomers are now building assisted living places at a rapid, next is the nursing homes 25% of the 1946 cohort is gone….peak Boomer is in ten years….

Housing is going to be hit by dropping demand. Especially if we continue to hit Chinese trade, and the fools stop parking wealth in houses.

Of course, nobody else thinks houses could go into a secular decline. Base commodity prices are back to pathetic.

But inflation!

Children of the 70s, always hoping for massive inflation again.

Inflation is a monetary phenomenon. It is alive and well, as you can see in the charts above. Sorry if that doesn’t fit your narrative. Nobody is “hoping” for 70s style inflation again. We’re dreading it.

And yes, housing will be hit by falling demand at some point. All inflationary asset bubbles ultimately collapse under their own weight. Housing Bubble II is no exception.

Thoughts on millenials and gen x’rs filling the demand void and soaking up this supply coming online over the next decade?

Student loan debt is a big issue for both cohorts.

Pretty much all student debt will be forgiven within the next 5 years. As soon as Democrats take control. There is no other option and it panders to their base just as trump tax cuts surgically hurt democratic base.

So everyone will be student debt free soon :-)

Demand will always be there. Our whole form of government / politics depends on housing demand. They will pay people to buy houses if that’s what it takes

@AS, I guess that’s what prevented the housing market from crashing 10 years ago. :)

Tom, no that’s not what I meant. The comment was talking about about a secular ie long term decrease in home prices and demand. As we all know that was not allowed to happen after the 2008 crash: we are here talking about the new highs. In Seattle we are 30% over 2007 peak.

Millennial here. I’ve said to people before, who won’t shut the F up about buying a house… pushing it.

I will not buy a house now. I’d rather live in a van or RV than buy a inflated house. I hate the rental prices…My younger people and peers are doing the Van and RV thing. Specially those who have family and acquaintances who would let them park it on their property for little to no cost.

I am a millennial. I do have a little nest egg in liquid Savings, Roth IRA, 401K, and Stocks, and no debt.

No I am NOT Buying a HOUSE.

You will when you have kids.

Yes!

We will NEVER build enough assisted living facilities and nursing homes in this country to meet the demand. Someone is going to become very, very wealthy building some kind of luxury, exclusive assisted living facility “brand” catering to Boomers entering their 70s and 80s. Staying and dying in a 4000+ sq ft McMansion is not going to be a viable option for most people.

I see empty malls as candidates for upscale housing. Self-contained gated communities with condos that have shopping, entertainment, and other facilities.

Perhaps, but empty malls are deteriorating so rapidly that they are unusable for anything.

I’ve been seeing this possibility for some time. It makes sense.

Already done years ago.

It is reasonable for tenants (relatively speaking) until something goes wrong healthwise. Then…look out and grab your wallet.

https://www.berwickretirement.com/bcr/

Totally agree. My Mom went into a nursing home last week (fell and broke her hip).

The nursing home experience is really bad. There is huge demand out there for a more civilized alternative.

‘Which Boomers’ … ??

.. aside from the ones who ALSO hold ‘student dept, lost 40% or more of their wealth due to the GFC through no fault of their own, have ALREADY incurred/incurring the ravaging astronomical medical intervention costs/fees/rents currently forced upon them ..for $$$$$ — while their ‘representitives in gov. live like royalty, out-sourced, through either ageism or ‘efficiencies’, or both, of their livelyhoods, inflation in all things necessary for basic living ….. but other then those Boomers … ?? I could go on.

“sigh”

But all of that is their own fault. They controlled the corporations that did all that and they voted for all the representatives that screwed them over.

Even if nominal prices today are same as at some point last year, the Total Cost of Ownership (TCO) is higher for most due to:

1. Increasing mortgage rates

2. Limit of $10,000 for SALT deduction in places with either high property taxes or higher cost of homes.

In SF Bay Area, I predict houses will drop at least 30% by Mar 2019 due to:

1. Elimination of H4 EADs turning dual income immigrant households to single income

2. Tighten of H1 visa issuance

3. SALT cap of 10,000

I doubt H1-Bs were buying very many houses.

Sorry, but you are wrong!

I live in Sf Bay Area and personally know lots of such couples. Mostly Indian where husband is H1B visa holder and in certain cases wife has H1B too or qualified H4 EAD.

Lots of these people have mortgages; just take a trip to East Bay and South Bay – mostly Indian; Peninsula has Asian population.

Anecdotally houses are not selling within 2 weeks or much above asking as was typical until Mar 2018

Are they cash buyers?

Or how do they finance with no credit history?

I have seen this personally:

Super star far outlier high intellect (and skill) guy graduated from IIT (India’s MIT) comes here on an H1B visa. Works for a few years, then sends home for his wife, arranged marriage when they were both 8. Her IQ is somewhere in the 80s or 90s. She stays home all day and cooks, and has kids like a late-1800s Minnesota sodbuster’s wife.

Fast forward a few years; they have 6-7 kids who all *expect* to become engineers because that’s what Dad does and that’s how it’s “always” been done, just ask Dad. Well, there’s this thing called “reversion to the mean” and none of these kids are geniuses; they’re all painfully average. But the world owes ’em, just ask ’em and they’ll tell you at length.

This is based on real neighbors in Sunnyvale, and yes I “interviewed” the kids. It was fascinating and horrifying.

Cut H1B’s to zero would be just fine with me.

I know some Indian tech couples. None fit into the mold you described. They have 1 or 2 kids, or none “yet.” Both parents work, one on an H1-B, the other on a spouse visa. There are all kinds of people, and when we generalize we get into trouble.

Someone who was on H1B visa sometime back and who knows the system in and out and still has lot of friends on H1B, I can tell you for sure:

1) H1Bs are buying houses

2) With Trump, it is very difficult to be on H1B

3) H4EAD, one of the worst decision against Americans

4) With Trump, the quality of H1Bs have improved drastically

Let’s see how things pan out in next 2 years or so

The previous adminstration did let America be raped on multiple accounts:

1. H4 EAD

2. Lax H1B enforcement

3. Encouraging illegals to swarm the southern border.

That said, H1Bs are part of the lowest crime committing demographics. They may have displaced American workers but the workers voted (and in some cases were not asked) to get the Immigration agenda that exists.

I see a lot of pain for H1B and take no comfort in that. But no one gives 2 hoots to Americans whose jobs were taken – both H1Bs and offshoring.

Anyways, see how this plays out by Mar 2019

A 25-30% drop in the median price for the five Counties seems quite likely over 3–4 years.

That’s the usual correction, however it is unlikely to happen in one year even adding the disruption caused by Brexit to the issues you have listed.

5%-8% by late August 2019 would be my guess.

This for the Median price in the 5 County MSA.

Home prices are remarkably sticky on the way down.

How does Brexit have an impact?

H1-B visas are not being tightened. Next Monday, the Trump administration will issue another 100,000 of them.

This is why the GOP will not be doing as well in the Midterm elections as they did last time. . .

I call it betrayal. You can call it whatever you want.

Well, it’s ‘in-your-face’ out-in-the-open apparent .. for thpse with eyes wide open, certainly since the 2016 election, that BOTH legacy parties have, and will continue to, betray their base bigtime ! The’re ALL lying jackals ..

But of course.

The problem is that Trump promised to deal with this problem, and instead listened to his rich buddies at the golf club when they whine about how “hard it is to get good help”. This has already reduced Trump voters’ enthusiasm.

It may well cost him control of the House.

High housing costs only ever benefit a small segment of the population. When businesses choose to relocate from one city or state to another, real estate and other overhead costs are usually a major factor in that decision. Expensive real estate is very bad for a region’s (and nation’s) economy.

I would tend to argue the opposite.

I do not see Fortune 500 companies relocating to the center of the country where real estate is very cheap.

Heck, General Electric is moving to Boston isn’t it?

I remember Charter Communications moved from St. Louis to Connecticut a few years ago and then raised my cable bill to pay for that move. :-)

General Electric stock is circling the toilet bowl at 9 year lows (lowest since July 2009) while the S&P is at all time highs. It won’t be in the Fortune 500 much longer at this rate.

Wrong. My company, #241 on Fortune 500 announced moving to the center of the country just a few weeks ago. We are currently 600 strong in the east bay. We haven’t been able to recruit from other metropolitan areas for 2-3 years now because of how out of whack the Bay Area has become versus the rest of the country. We couldn’t even recruit from New York. Now we are cashing in our chips (6 year old west coast headquarters on 14 acres of SF Bay waterfront) and moving to Denver.

If your not in tech, the Bay Area isn’t workable. And tech has experienced a major boom due to free money looking for high return. When this current boom corrects, the Bay Area is going to get throttled. Perhaps not all, but a lot of VC money will disappear. Heck, we have (5) food delivery apps in the east bay. None of them are profitable, and all of them have engineering, marketing, office space, and prodigious burn rates.

The reason I Know it’s coming is because all the tech folks I know say ‘it’s different this time’ followed by a litany of reasons why.

Toyota recently moved it’s long time headquarters in Torrance CA to Plano TX. One of the stated reasons by the company and it’s workers for the move was the high cost of living in Southern California.

An anecdotal example for sure, but still….

And Raytheon moved one of its division headquarters, Space and Airborne Systems, to McKinney TX (just north of Plano) too.

From El Segundo CA…

I completely agree.

A fun city attractive to 20 somethings, in a pleasant climate, good mass transit options, low traffic, access to an airport, and low crime tends not have affordable housing for long – especially after a major employer paying very good wages moves in. And it’s very, very hard for an employer to convince a single, college educated plus 25 year old to move to Peoria (nothing against Peoria).

In my opinion, the bigger problem is poor city planning, zoning regulations, and NIMBYism which interact to keep home prices rising for current homeowners while making the city unaffordable or a traffic nightmare for newcomers. Investments in infrastructure and zoning early on for higher density would help developers build and keep prices stable as population grows. Here in Seattle, all I see are the nearly militant homeowners blocking development – and we are all paying the price for that.

Low interest rates have enabled 20-somethings to overpay for housing in trendy metro areas. What may have been possible at 3.5% mortgage interest rates will not be possible at 5.5% or 6%. An unprecedented misallocation of resources has taken place over the last decade, all in the name of reflating a bubble across many different asset classes.

I am generally in agreement with the expectation that housing prices will eventually plateau and then decline due to a combination of rising interest rates and/or being toward the end of this current expansionary economic cycle. But seeing that this post infers we are currently in “Housing Bubble 2” by comparing to “Housing Bubble 1”, wouldn’t a more accurate way to test this assumption be to compare the housing price trend to income trends during the same period?

The reason I bring this up is because I recently looked at a chart showing the house price trend in the Southern California city where I live, and it was very similar to the charts presented here. I thought it completely reaffirmed that we are in Housing Bubble 2, but then I decided to put together a chart utilizing the same price information but also including median income data, and the results instead showed that “Housing Bubble 2” is nowhere near “Housing Bubble 1” because of the steady rise in income over the past decade, at least where I live. Perhaps this is particular to my local market, but I wonder if such an analysis for the metros presented in this post would reaffirm Housing Bubble 2 or disprove it. Perhaps I can look into it myself when time permits, but I was just wondering if Wolf has already done some similar research from this angle.

Housing Bubble 1 in Southern California was incredibly vicious when it collapsed (see LA chart; the San Diego chart looks the same). You don’t ever want to get near it again, ever. You don’t ever want to get to the point where Housing Bubble 2 is on an income-adjusted basis or inflation-adjusted basis anywhere near as bad as Housing Bubble 1 was.

The best thing you can HOPE for is an immediate end to the price increases and a very soft landing over the next many years. If prices go up further in Southern California, the landing will be harder.

The peak of the bubble last time was catastrophic in its collapse. That’s NOT the status to aspire to now.

“You don’t ever want to get near it again, ever.”

As a potential buyer I’m hoping and praying for a crash in San Diego. 30% drop, and I’m there.

But…. everyone is hoping for that scenario. And with that scenario the Fed will surely cut and put instant home equity into the pockets of buyers.

The notion that a crash will occur and the FED will keep raising rates is fantasy. Likely the market will dribble 10-15% lower UNTIL, I SAY, UNTIL, the next FED rate cut.

So I claim the day’s of crashes are over and the FED can be counted on to keep real estate moving parabolic over the next ten years at least. If prices rise too high, down payments and monthly payments will be reduced.

-please pardon the caps, but I got carried away-

I though the same in 2007 2008 that says day the crashes are gone

People think san Diego is special and we are different and we all know about the previous crashes which happened many times

Everyone always ignores the fact that during the last two stock market crashes the Fed lowered rates aggressively. Stocks still fell. Housing is a different beast, of course, but if it starts to fall as quickly as 2008 I doubt lowered rates would help over the short term. Crashes will still happen, and will become bigger the more they are “prevented”.

Come on man! .001% increases as far as the eyes can see! It didnt depreciate? Scare us with negative inflation instead of hundred dollar backpacks? A spoonful of sugar makes the opiates go down?

I am a long time Southern California owner of beach properties. I made a small fortune in my beach homes. One home I bought a little more than 20 years ago went up 4 times from the late 90s to 2007. Then, that price fell 22%. Since then, it has more than doubled. Since I bought it, it is up 7 times. People are still buying them, although prices are increasing in the low single digits. The home is in Corona Del Mar. I have other homes with a similar story.

Southern California has different markets. Markets where white people are the majority went up more in the booms and fell less in the drops. Markets where minority people dominate performed poorly, with the exception of markets that gentrified. That is the story here … demographics by skin color.

Speaking as someone originally from Southern California and who has spent some time there, 99% of one’s fate is pure chance there. Chance in terms of whether your Okie ancestors were smart enough to put their war-work money into a gas station and a beach bungalow post-WWII, chance in terms of skin color because that matters a TON in the US, always has and as far as I can see always will.

If I had to come up with a visual picture of the US economy and society, it’d be some particularly dangerous roller-coaster you get strapped into, with fake controls like Maggie’s steering wheel in the opening sequence of The Simpsons.

CPI adjusted we still below the old peak. The bias-protected modeling I’ve done of the US housing market (not local markets) indicates supply is about 80% of the price trend, affordability 20%. The wider economy has almost no independent impact, at least in a stat-sig trading model.

I did open houses in Manhattan this sunday. Did 5 .

1.5 to 3M.

I was the only visitor each time not only de visu but also from the sign in sheet.

Anecdotal I know but still you don’t feel there’s a rush to buy out there.

Same in DC. Did opens both days. Only a couple visitors.

I have a house for sale that I got from the FedGoo for our loss of 90k on a “guaranteed” loan. It would be a million in Toronto or the usual suspects, but here it is 95k.

There is a huge project underway nearby (15 minutes) that is the biggest undertaking of any foreign country ever. (Foxcon 15bn)

Yet I get these people coming in that expect HGTV end product villas, and they cannot afford to put up for a house without goomint grants and guarantees. To get the goomint crap they must have everything perfect for the same price.

My house, or should I say, My wife’s house is an 1893? Frank Lloyd Wright side project as are two or four others in my close area. (Certified by U of Chicago)

Diagonal is a Prairie style house that is certifiable FLW where the new owner had to put in half a million to fix the problems inherent in those designs. The traffic flow in that house is like a rabbit warren. His older stuff is far more usable.

I thought that the influx of so much money would boost the RE prices, but there is no evidence of that at this point.

stupid anecdote

Marion – you want to hit the sweet spot; far enough into the decline that they’re putting out rather decent food at the open house, but not so far into it that they’re putting the food from one week’s showing into the fridge and putting it back out for the next …

SoCal is boom and bust, happened many time sin history..although everyone here thinks ” this time is different” as socal is such a special place to live :-)

For Suzie – there is no reply button to your comment so answering here:

1. Most H1Bs (In SF Bay Area) are NOT cash buyers.

2. They do have some credit history, I guess. I personally know of a few who bought with 5% down with no PMI.

3. Some lenders accept RSUs in lieu of assets.

4. Local Hindi language radio stations are replete with ads for financing for H1Bs.

My point is the truth does prevail, though some times it takes too long.

I haven’t seen overseas all cash Chinese at open houses for about a year and starting to see fewer

H1B Indians.

2. “No PMI” is actually lender paid PMI with a bumped rate.

Which is great, because these people are buying a forever house. They’ll own for 5-6 years and bank appreciation, while paying a higher rate.

besides these Indians will load up the house by renting rooms with bunk beds to the tune of 3-4 per room.

so the buyer makes out like bandid.

Breaks my heart that as a 40yo with kids, having rented for 16y, after couple more years of this, there is a fair chance I will never own a home, despite PhD and silicon valley job. How is that for a social contract? Enjoy your assets, retired car mechanics, school teachers, widows of tram drivers and private equity funds I’m condemned to serve. Even if I were to get there, I will have handed you for your rundown bungalow ten times what you’ve ever earned. It’s not just me: many of my generation who work and have no inheritance. Well played!

You likely would have been much better-off moving away from the madness that is Silicon Valley.

Come to Wisconsin. Relatively cheap housing and a quickly growing need for your labor skills; just don’t bring wacko politics.

Just don’t mind the cold during the winter. If you get a house along Lake Michigan you get cooler summers and warmer winters. 2500 sq ft for 250-450k with a decent yard and garage. Bring your snowblower from where you are because you’ll need it.

450k will buy a palace of 3500 sq feet or more. Two doors down is a 4500 sq ft that even has a sprung dance floor on the top floor. I know from experience that you want to buy a house that has most everything done properly as these 120 year old houses cost a lot to fix and paint.

Get one that the previous sap already did all if that.

It’s where you live and what you do for a living. My 35 year old Millenial son makes 200K per year + living expenses as an industrial electrician. He works away for 2 weeks , then off and home for 2 weeks. He has a beautiful home on a river. If he lived in SF he would live in a side-street apt., and work more hours. He plans to be mortgage free in 5 years. He’s thinking on switching to an Oil Major for an extra 10% plus flights, but the move would be to non-union and that always isn’t the best scenario in a downturn. Seniority is a definite benefit in a downturn as opposed to being a suck or bosses son to keep a position. (I’ve seen it, lots).

At 40 you are still young enough for a career reset. I went from being a pilot to high school teacher at age 40. That entailed a return to school for two years. I worked with lots of folks who did the same thing. To get off the hamster wheel you have to jump, first. School teaching in most States, and definitely CA means starving to death. I lived somewhere else so the pay was more than adequate. Working electrical in a city pays around $60,000 per year….maybe a bit more. Working away the rate increases 3.5X. It is the same for engineering. There are options. There are always options.

Silly me: there I was, thinking that it’s a parasitic/predatory Overclass and its elected enablers that are the source of our economic dilemmas, when all along it was teachers and car mechanics!

Go ahead buy a house in the Bay Area, go a million point five in debt, then kiss your Silicon Valley job good bye. How would u like them apples? To be successful in IT you have to move around. Most of the successful 40ish and 50ish IT people have to move from job to job; having a million point two debt over your head makes that awfully difficult.

Then there are the people who do assume that much mortgage debt, they are stuck in their jobs, they can’t move, by the time they reach your age they get chucked out of their big IT company like trash. But don’t worry in CA you can still walk away from your mortgage.

Silence: That’s what you get for not working for the wastewater plant, or the local post office.

College is a casino and it’s not designed to put money in *your* pocket.

“You don’t ever want to get to the point where Housing Bubble 2 is on an income-adjusted basis or inflation-adjusted basis anywhere near as bad as Housing Bubble 1 was”

it’ll probably be worse and last much longer. That is IF the banks and IF the government lets housing find a true price where it’s affordable without banks (letting people live 48 months mortgage free) and the FED dropping interest rates to zero (or this time negative for RE) and I say this because here’s what I experienced in the early 90’s (bubble #2 for me, current one is #4)

first time I looked at the house it was listed for $210K, but we kept looking, saw it again with a “price reduced” sign, it was listed for $199K. So we’re thinking smoking deal right, so we low balled and offered $175K they countered with $179 we settled at $177,500.

this was 1991, the price settle at $135K at about ’96 and I got back to “zero” in 2000. When I did the walk thru the old owner was bitching big time and every 5 minutes “you’re getting a hell of a deal” little did he know the prices were going to drop further. He claimed it’s high value was $230K.

$210 – $135 = ~33% drop but took me 9 years to get back to zero. on a side note my X never did get back to zero on here 2006 purchase.

About “it’ll probably be worse and last much longer. That is IF the banks and IF the government lets housing find a true price“.

That’s he rub: no government at least in the western world and definitely in the US will allow housing prices and demand to decrease over time frame longer than a couple of years. They will literally drop free home loans from helicopters :-) if that’s what it takes. So if there is one lesson from last crash: buy the dips!

Like it or not, that’s how our politics and now our way of governance has evolved in last 40 years. In this situation (especially in US as non-recourse loans) it just makes sense to borrow close to the maximum you can for houses. It sucks for the financially conservative, but I think large fraction of the population has accepted it.

Many people in China believe housing prices can only go up. They know perfectly well each year over 50% of apartments delivered (some say as many as 75%…) are “For investors only” and are building up on both an already massive stock, with much more to come on the market in foreseeable future and a homeownership rate of 90%, but they don’t care.

They are sure the government will step in one way or another: if necessary the People’s Bank of China will simply hand State-owned banks money to buy apartments at whatever price owners ask for them.

I really like the Chinese people. My business dealings with them so far have been overwhelmingly positive and I have met some truly amazing persons. But to call this idea delusional would be the understatement of the week.

The Chinese government has already tried propping up a deflating asset class: the so-called National Team has been diligently buying stocks for over three years now. State-owned behemoths such as ChemChina and China Mobile have announced massive share buyback programs even Wall Street would approve.

All of this activity has managed at very most to put a safety net underneath the Shanghai and Shenzhen stock markets, but the glory days of early 2015 are gone and it’s very likely the long-term trend for Chinese stocks is still negative.

In short the prospects for a massive bailout for homeowners is not exactly encouraging.

But in China at least there are still people ready to pay delusional prices for an asset class that is anything but in short supply.

Go to Italy and Spain and check house prices first and then how many listings the same real estate agency carries for the area.

It literally makes no sense, but people in both countries are convinced real estate is a “special” asset class and as such the price can only go up. And when you see construction cranes next to quickly depopulating villages you think you have just stepped into the Twilight Zone. No, not the song by Golden Earring.

If people expect them to prevent crashes, they probably will be disappointed.

But In the US (or most / all western countries) government will not allow home prices to be lower over long term (let’s say 10 years from now) than they are now. This is due to the nature of our political systems. That’s pretty much a guarantee.

Here in Portland many flippers and builders are being caught in trap between high lot prices and a declining top end price. The high end ( above $750) is dead in the water but many contractor/ flippers bought lots, or tear downs at high prices thinking we would soon see Bay Area home prices. Then they got crushed by higher than expected construction costs and fees. Many of these are languishing at above market prices, or have stalled out at 80% completion, behind chain link fences with frozen construction financing.

The Portland west side construction is still booming. What used to be hundreds of acres of farmland (Roy Rogers/Scholls Ferry) are now or soon will be wall-to-wall two story homes, town-homes apartments with “yards” 6-8 feet deep. Price of these starter homes has gone from 250k to 500k the last three years. One huge new high school just completed, another one just started 5 miles down the road (Sherwood). Same story in Wilsonville (10 miles south) or Hillsboro (10 miles west). We are talking thousands of new homes. I wonder where the jobs and people are supposed to come from to fill these homes.

Teachers!

The Boston market is apparently still pretty hot. Spoke with a realtor last week who mentioned most homes still have a dozen competing bids well over asking where buyers are waiving both the home inspection and appraisal. How the later are even possible I’m not sure…unless they’re all cash buyers. Sounds like irrational exuberance, don’t you think?

I am in socal where weather is awesome year round and beaches are good

I can understand real estate prices are high here

But I can’t fathom why in places like Boston Toronto Seattle Vancouver..

At a 38% trough to peak differential from 2012 to 2018, we may compute an annual inflation rate of 7.5%. This rate corresponds to a USD half life of only 9 years. Your dog now costs twice as much to feed and house as he did 9 years ago.

A “real life” annual inflation rate in the 4-6% range has been the norm since I started keeping track. Years like 2014 (energy burst) have lowered it somewhat but years like the present one are pretty damn tough: food inflation has been somehow even worse than energy so far, one of the worst years on record. We are fast approaching 10%… PPI has long been a far better measure of inflation than CPI, but it doesn’t measure food inflation and uses different metrics for rents.

If you want to see where the CPI growth every government on Earth will brag about at the end of the year, look no further than your bills and invoices.

PS: dog food is up 5.5% this year, but dog snacks are stable. ;-)

@Tyson

I have a Jack Russell so it doesn’t cost much. :-) analogy but true. My sister-in-law who rents by the way, has a 125lbs Burmese Mountain dog. It also eats the expensive raw food from a butcher. She drives a newer f-150 4X4, I drive a 32 year old Toyota.

The point of this inane reply is still important. If one lives below their means, rising costs pretty much do not matter beyond the irritation factor. And when the downturns hit there are deals if so inclined.

I work for big blue box store and enjoyed your post greatly and can only add to it by saying LOOK OUT BELOW! (Jamaican backbeat added)

The air is coming out of the balloon here in So Cal. Three friends had to drop their listing prices by 10% or more in order to get one qualified buyer over a 60+ days on the market. Price range starting out- $1,195,000 in escrow at $1,070,000 2nd started at $1,100,000 in escrow at $980,000 and the third started out $419,000 in escrow at $385,000. Look at realtor.com and many show price reductions. Look under the section “property history” to see what is happening. With 30 year fixed rates now hitting 5%, who is going to give up their 3.50% fixed rate loan they got in 2016?

I am in socal san Diego and I am witnessing the same thing

I own beach properties in Manhattan Beach, Redondo Beach, CdM, and Newport Beach. They are all older homes that need work, but in good locations with back yards. People are still buying these and prices are creeping up. I am not seeing the weakness … I am seeing places take a little longer to get a deal signed, but I am not seeing price cuts. Of course, my little beach world may trade differently than inland locations. I have no idea as to what is going on inland. I do not know those markets east of the 405.

It might be a bit too optimistic to say seattle has peaked:

The below link is a 360 sq foot “condo” with tasteless finishes that sold in six days listed at 245K. Prices all brought to us by citizens of china, king jeff, and the most useless factions of the tech industry. I am so sick of this. The people who are dumb to buy this sort of “housing” at a price like that deserve to lose everything. Can’t wait until this all implodes and all the CS majors who’s moms wrote their resumes and cover letters for them have to leave town broke and unemployable.

https://www.redfin.com/WA/Seattle/4020-Aurora-Ave-N-98103/unit-205/home/46212

“It might be a bit too optimistic to say seattle has peaked:”

Seattle has softened since May. No question about it. This is especially acute in the higher end and new construction.

My best guess is that the drop has been 7%-8% in Seattle and Bellevue since that time. Keep in mind that the tailwind of the seattle spring and summer selling season is behind us. It’s going to start raining soon.

Ouch! What horrible road noise they must get!

Still, it is not listed as Sold, or even Pending.

It is just listed as Contingent. . .

Out here in the suburbs, prices are flat or slightly down.

Whether this is due to the usual seasonal factors is not clear.

One clue: I have my MLS account pre-programmed to track slow moving properties, and I check to see what happened when they drop off the list. Six months ago, slow-moving houses eventually were reported as Sold, usually for around 5% off the original listing price. Today, they are reported as Withdrawn or Expired. The owners may figure that, if they wait, then prices will drift back up again.

My guess is that another 50 or 75 basis points on the mortgage rate will put the whole thing into the dumpster.

One more thing: I have a CS degree. Real Estate is better, because Bush&Clinton&Trump can’t import H1-Bs to replace Real Estate people.

WHO would even consider “buying” a house (actually, subscribing to a life mortgage) in any of these “markets” today???

All I can surmise is that these “buyers” must have iron-clad confidence in the security of their jobs…

I know right. My hope is that tech gets the rude awakening it is totally deserving of very, very soon. I also don’t think there is much hope that these salary disparities created by the tech industry are going to last. The little kid CS majors are not all equipped to deal with reality or the fact they are the most overvalued of all in this everything bubble.

Your bitterness seems defensive/frightened. Why are CS majors overvalued? Tech is destroying brick and mortar as we write this (on a tech platform). Tech appears overvalued as a segment and “feels” bubble-like, but CS majors are one of the few majors protected against the rapidly approaching automation wave. If anything, the CS majors themselves are undervalued.

Oh really? The very nature of what they supposedly do and are doing will automate them out of a job, assuming they will ever achieve their lofty goals. However I don’t have much faith in their ability to make usable AI or automate much efficiently. Shall we discuss how long programs like Microsoft Excel have been around and how date functions still have not been resolved. Let’s not even get started on how they are still completely unable to develop financial software/ERP systems with the end user in mind.

SV start-ups and bay area app economies are hardly the way the future, nor can they be sustained.

Give in a year or two and there will be several NYT bestsellers on how tech needs to be taken down a hundred notches for companies to be able to run efficiently.

You hit the nail on the head.

Automation is going to change the nature of labor in ways we haven’t really even started to come to terms with. Autonomous vehicles are 5 to at most 10 years away, and around 1/3 of all American males with a HS education or less make a living by driving something.

Just think about that for a minute or two.

That is just one innovation that’s very close to a reality today, and the tech companies and CS majors will be at the tip of the spear.

Future Bond traders will laugh like diplomats at the duration risk being currently assumed!

People outside tech really underestimate how much tech industry pays. new CS grad in major tech company starts at $120k easily. Someone with 3 years experience is probably at $150k+ easily. By then most are getting married to another CS major making $150k. So $300k households are average income in tech world. They can affor a $1 mil home, which is what’s driving the market in Seattle and Bay Area.

And Simone with 8 years experience is almost surely making $250k and most likely married to someone else making similar amount. People marrying similar people and women earning high amounts is contributing to this too.

Nobody knows the future, but as of now that’s how it is.

You’re right, for now at least.

While I personally wish for Zuckerberg, Bezos, et. al. to be humbled (if that’s possible), a friend’s daughter who does hiring at Google just told him of some hotshot coder who turned down a $450,000. p/yr. (before stock options) offer… so the boom is still happening…

We should also keep in mind that there’s a economic floor under tech, provided by the military-industrial complex, of which it both a beneficiary and a Principal.

Consumer and commercial businesses may take a hit over an economic cycle, but the Pentagon and Department of Energy will keep those companies afloat until the tide rises again. At this point, they are systemically important institutions, just as the big banks are, and essential to the running of the ever-growing National Security/Industrial State.

In other words, it ain’t no accident that Bezos is providing Cloud services to government spy agencies.

We should never forget for a moment that the Internet was given birth by war-making, war-planning and surveillance, as journalist Yasha Levine demonstrates in his book, “Surveillance Valley, and that it will always be its foundation.

I am a CS major working in tech industry and the numbers you are quoting here are very good case scenario but they are plausible numbers

On top of this, if you are above 40 in tech industry, as a computer engineer you are too old.

In my company, which is one of the biggest company in the world, we are replacing 40 years old with 25 year old almost every month. We pay ~$90K/year base salary to 25 years old which is much cheaper than 40 year old with additional “baggage” ( children, health insurance etc etc ). 25 year old can easily work 70 hours a week which is a norm in my company and is difficult for 40 year old to work.

On top of this, a lot of H1Bs are happy to come here and work 80 hours/week as for them it takes 10+ years to get their greencard.

80% of the H1Bs are Indians and the wait list for Indians to get employment based greencard is easily 10+ years. These guys are then indentured slave for the company for 10 years or so,

On top of this, most of the programming jobs are being outsourced to India aggressively for the last few years since we have big/good India presence.

$90k for new CS grad is low compensation if it’s California or Seattle. Where are you located? It might be okay elsewhere.

Of course there is a range anywhere depending on the company, skill level needed etc. but in my mind the “major” techs are companies like Apple, FB, Google, Amazon, Microsoft etc. and many more that pay similarly.

Not to demean but I know many Nannies that makes ~$70k a year in Seattle. The caveat is that it is probably equivalent to $50k in the Midwest, if they decide to buy a house anywhere in this metro area.

About 40 year olds: yeah. I think tech industry is the new finance of 80s (minus excesses like strippers and drugs lol). It’s very performance oriented. So not an easy career in some ways. But if you are in 40s and at these major companies and doing well you are getting paid like many Wall Street traders used to.

In any case, this won’t last forever, but maybe a long time. For example the finance career “bubble” has lasted at least 30-40 years. From mid-80s to maybe even today.

AS, I was a wall street guy for many years. Now, I just sit back and collect rents. Wall Street has many guys making a lot of money … definitely way more than the money you talk about CS people pulling down. The wall street are buying multi-million dollar homes after a few bonuses.

Also, I am north of 40, and I know many people my age in the tech industry. For the most part, their pay seems to have leveled out in the 150 – 220K area. That is all they are getting for salary and bonus. So, if you really want to make the big money, like 7 figure stuff for years and years, you need to move your tail to NYC or Boston, and get a “Financial Analyst” position at a major fund firm. Spend 60 hours per week figuring out how big funds work. Add in a little bit of computer stuff … all you need is a few classes in computer programming … and you are off to the big big money.

Jimmy, of course finance has the top paid jobs.

The numbers I mentioned are somewhat below average. And I didn’t talk about the top end.

In the top tech companies (google, amazon, facebook etc) top performing engineers with 8-10 year experience (let’s say 20% of all engineers) pull in $500k range, including stock vesting. I know folks making as high as $800k per year.

People puzzle why Bay Area and Seattle real estate has been inflating. I think they underestimate the increase in tech compensation for the top bracket.

Yeah but unlike finance no one makes $2 million bonus unless you are the top 100 folks at these companies :-)

The data from salaries.com and payscale.com does not of show 120k starting salaries for software engineers. But yes top talent from top schools going to top companies will pay that much, but it’s not the norm. Tech is also in a huge bubble flush with Monopoly money.

Shawn, yep I agree the norm for all Software engineers in the country or even the state is not what I stated. I mentioned the figures were for big tech. It is the the norm at big tech companies which drive Seattle housing market a lot and also Bay Area to a lesser extent.

Salaries tied to stock options may reach half a million if the stock prices go up

I work in tech and has offers from bay area and still get offer from bay area

At this time I don’t see much upshot in stocks of big companies

Joining start up is like a lottery

The point I was making was.. as an average engineer you can’t make half a million unless you have hit a start up jackpot or joined faang st a good time .

Of course some people are making these money but it’s generally not the norm

Jon, housing demand in a number of top neighborhoods in the bay and in Seattle is very FANG + Microsoft driven. I am not implying that their employees can hold up the local housing market, but they drive the bids up with their high income. I am assuring you that even *without any* stock appreciation, mid career engineers have those kind of incomes. Stock price appreciation bumps that up. Many also have a well paid spouse. They can afford / qualify for quite a bit of mortgage.

I think the larger threat for those real estate markers is not interest rate increases, but a major tech stock meltdown.

The market seems chilled in San Diego, but few people are selling still.

What a condo in my complex go up for sale on redfin listed as hot 1 month ago. It’s still there same price and the hot label is gone.

Waiting to see a price drop or it pulled off the market.

San Diego is a cool place and we are different. The prices would never go down here!!

No worries! Your house with always go up in value faster than the cost of school supplies! Feel better?

We need to normalize these charts by the size of the Fed’s balance sheet. It was 800 b at the time of the first bubble and 4000 b today, an increase of 5 times. Clearly a portion of that created money has gone into real estate. From that perspective until the fed shrinks back to 2007 levels, nominal prices are unlike to revert completely. Inflation adjustments alone don’t quite capture the required adjustment to the numeraire because the way the money creation was done. The beneficiaries were banks and other financial institutions through increases to their loanable funds.

Exceptionally good article and comments!

One factor that appears to be omitted in the Schiller-Case index is the actual reduction in the value of houses in terms of physical depreciation, e. g. a twenty year old roof, water heater, furnace, AC, etc. is most likely at the end of its useful life and will require replacement, so the index is a “best case.”