Plenty of homes for sale, at ludicrous prices for what you get. But asking prices are now getting “reduced.”

Zillow sends me a daily email with 18 “recommendations” about what kind of home to buy in San Francisco. These 18 recommendations are different each time. These emails identify the problem in the San Francisco housing market – and that it’s not easy any longer to maintain this crazy bubble.

What its emails say over and over again are three things:

- There are plenty of homes to buy.

- You have to have or earn a lot of money because most homes larger than a small 1-bedroom condo have asking prices over $1 million, and in plenty of cases multiples of $1 million. The cheapest unit on the list has an asking price just under $700,000, which is about half of the median home price in San Francisco.

- Asking prices are now being “reduced” fairly frequently because those homes haven’t sold.

As is typical in San Francisco, most of the homes on this list are condos since the majority of homes sold are condos. Practically all new construction in San Francisco in recent decades has been condo and apartment buildings, including many towers.

So let’s see what kind of homes Zillow is trying to draw my attention to today, in order of how they appeared in the email. All prices are “asking prices”:

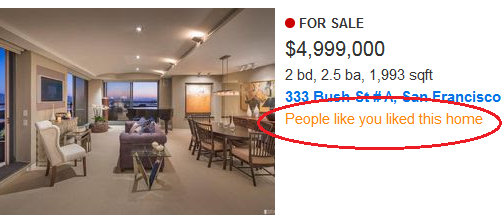

$5 million – to be precise $4,999,000: 2 bedroom, 2.5 bath 1,993-square-foot condo in a high-rise building:

The Penthouse at 333 Bush showcases iconic views spanning 270 degrees – incl. the Golden Gate Bridge, San Francisco Bay, Pacific Ocean, Twin Peaks & East Bay. Designed by Form4 Architecture to imbue striking, modernist interiors & infrastructure systems, the Living Room, Kitchen, and Bedrooms feature floor-to-ceiling sliding glass panels enabling indoor/outdoor living. HOA dues include doorman, utilities of water and refuse disposal & HOA Insurance.

Zillow estimates that a 30-year fixed-rate mortgage would run $20,282 a month, after a down payment of $1 million, plus $2,030 in home owner association fees (HOA) a month. I’d have to also figure in around $5,000 in property taxes a month, tack on insurance, and after a down payment of a million bucks, I could live there for less than $30,000 a month.

“People like you liked this home,” Zillow says. People like me?!? What does Zillow know about me that I don’t? But OK, this is a nice place and I would probably like it – the place, not the price and monthly costs:

$1.29 million: A 2-BR, 2-BA 1,116 sqft high-rise condo, this one a lot more modest, at 1701 Jackson St. The unit was last sold in April 2016 for nearly the same price, $1.28 million. In 2003, it sold for $680,000.

The mortgage is outright lowbrow, about $6,000 a month with $258,000 down, plus HOA fees of $753 a month. Throw in some insurance and over $1,000 a month in property taxes, and I could probably live there for about $8,000 a month after I make a down payment of over a quarter million bucks. Sweet deal.

$2.29 million: 2-BR, 2-BA 1,512 sqft condo on 690 Market Street, in the Ritz-Carlton Residences, where there are five units listed for sale on Zillow at the moment.

This is the same tower where YouTube co-founder Steve Chen purchased a two-level 3,030 sqft condo for $4.85 million over 10 years ago, then spend a fortune building it out, and put in on the market earlier this year. A sale is now pending [read… How Much Does it Really Cost to Buy a Luxury Condo in San Francisco, Not Live in it for 10 Years, Then Sell at a Loss?]

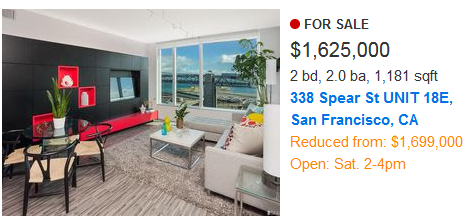

$1.625 million: 2-BR, 2-BA, 1,181 sqft condo whose asking price has been “reduced” from $1.699 million. Further checking reveals that the price had been $1.788 million when it was listed for sale in February 2017. By now, the price has been cut $163,000. Keep cutting, and at some point it’s going to sell.

This tower is a couple of blocks from the Bay Bridge, the largest and most congested bridge in the Bay Area, with ten lanes of traffic that throw off a nice amount of pollution. The condo has view of part of the Bay Bridge (see image) which seems to run about level with the condo:

$738,000: For real penny-pinchers, Zillow recommends a 1-BR, 1-BA 659-sqft tiny “Loft.” Now I know that you could buy a nice big house for that amount in Dallas, but this is not Dallas. So for $3,400 a month, plus $150,000 down, plus $259 a month HOA fees, it could be mine. Edwardian building (built in 1900), hardwood floors, redone kitchen with view of another building a few feet away, and a living room with a smallish window with city view. So a nice place, if a bit tight for us.

$1.1 million: or more precisely, $1,098,000. A true jewel, 1,515 sqft, two structures on one lot plus a rear shed. One of the units is occupied by a tenant. “This property offers tremendous potential,” it says. “Potential” in real estate means it needs a lot of work. After looking at the photos, I’d probably want to gut this thing. But if you have to worry about those details, you can’t afford it, as they say:

$1 million, rounded. Another budget deal, “Wonderful opportunity to restore this amazing Dolores Heights Victorian! Large 2-story home with high ceilings.” Nearly 3,000 sqft. On the photo, part of this place is boarded up. It’s one block from Mission Dolores Park, about which we can read this: ‘It’s Getting Worse’: Crime Plagues San Francisco’s Dolores Park Where Triple Shooting Occurred. But no problem, the area is gentrifying. I could spend a million bucks on this house and maybe another million to fix it up, including seismic retrofitting, and then I’d have a Victorian jewel (image via Zillow):

And so Zillow’s selection of “recommendations” goes on giving a great cross section of what is available in San Francisco.

$1.295 million: High-rise condo on 631 O’Farrell, 2-BR, 2-BA 1,500 sqft. Price was reduced by $200,000 from $1.495 million when it was put on the market a month ago.

$2.55 million for a building with 6 rental apartments. The building, built in 1906, is rent-controlled, so it would require some additional research to see if this is a deal.

$1.295 million for a 2-BR, 1-BA 1,525 sqft condo built in 1911. “Vintage Victorian meets contemporary and chic San Francisco living! Perfectly situated just above Mission Dolores Park… ” (see above, in terms of the tipple shooting).

$1.8 million, rounded: 2-BR 2-BA condo in high-rise building with big views, nice place. I could live in it for just over $11,000 a month, with a Zillow-estimated mortgage payment of $8,200 a month after $360,000 down, plus HOA fees of $1,069 a month, and about $1,800 a month in property taxes.

$2.75 million: 2,055-sqft, 4-BR, 2-BA condo on 2855 Jackson St. After having been listed for $2.995 million in early April, the price was cut by $220,000.

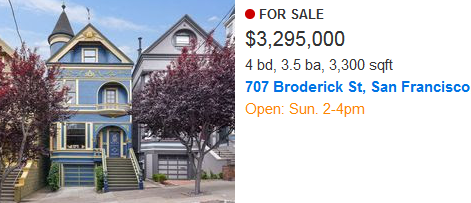

$3.3 million, rounded. This is a single-family home, 4-BR, 3.5-BA. 3,300 sqft on 707 Broderick. It’s got a turret, which is the minimum you’d expect for this price:

$895,000 for a 842-sqft, 1-BR, 1-BA condo on 1700 Gough.

$698,000: A rare find (cheap!). A few blocks from Mission Dolores Park, 2-BR 1-BA, 824-sqft condo. It listed for $739,000 a month ago. The price was cut by $41,000 to get it moving.

$798,000: 1-BR, 1-BA condo, nice views from the hill-top 136-unit building on 351 Buena Vista Ave. Square footage mercifully not indicated, but from the wide-angle photos, it looks pretty small.

$989,000: 1-BR, 1-BA, 966-sqft condo on 141 Hancock St.

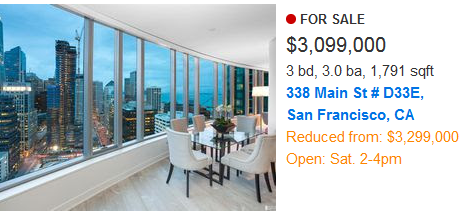

$3.1 million, something nice, to round out the list: high-rise 3-BR, 3-BA 1,791-sqft condo with views, a couple of blocks from the Bay Bridge. The price has been cut by $200,000 since it listed in March:

This list and all the lists Zillow sends me on a daily basis show in graphic detail just how far the San Francisco housing market has gone off the rails. There are plenty of homes to buy, but the prices are just ludicrous, for what you get. There are only a limited number of people who are wealthy enough to afford a $1 million home but at the same time are willing to squeeze into a tiny and not so nice place. At some point, this doesn’t make sense anymore. And the price cuts show that the market might have reached that point.

More changes in the mortgage market may be in the offing. Read… Will the New Fed Get Rid of All its Mortgage-Backed Securities? That Seems to be the Plan

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It would be interesting for you to give us an estimated Adjusted Gross Income in SF to be able to make the payments after taxes on these products. I don’t know what they are but at 5M I assume it’s the 0.1% or higher. 1% is 350k: that won’t do.

I’m in Paris (France, just sayin..) this week end and prices here are completely in the stratosphere.

Global real estate bubble.

From Census ACS released late last year: San Francisco median household income: $96,677

Household income refers to income from all sources, including from investments such as interest and dividends but not capital gains. This is before income taxes.

I don’t have AGI figures for San Francisco.

Wasn’t the old rule of thumb that bankers should only lend up to 2.5 X annual income on a mortgage? Does that rule no longer apply?

Definitely not the rule anymore. Rough guideline is that your pre-tax monthly income should be twice all monthly debt (housing, car, student, credit card debt).

Not for high earners. They have a lot more disposable income. If you make $200k a year and you pay 50% on housing, you still have $100k left over for others things. That’s better than the household only paying 35% but also only making $100k.

I find the mortgage industry very difficult to understand. Non conforming are extraordinarily difficult to obtain (more than 650K for NYC). I asked for a smallish 850k refi on a condo (income 1M, net 12M, no debt) and they wouldn’t carry on their book (non conforming are not sellable). Had to bring 200k to the table for them to budge. Guy before me was turned down for a small 1M jumbo and he had 30M cash. Makes no sense. They love the simple W2 couples without complicated investments (nothing commercial) and do not like complex balance sheets of the somewhat richer. Nobody will risk a penny not guaranteed by freddymac.

All right so if I did it right for SF.

350k income (top 1% of US)

$12900 gross/paycheck, $8000 net/paycheck (every 2 weeks).

So basically can afford your 1.29M property (6k mortgage+ 2k ccs, taxes and insurance) spending 50% of net income.

That leaves 8k net/month to live/save on.

Not too bad.

I’m just wondering who in fact is buying residential property in San Francisco when the median price is $1.6MM and the median (household!) income is only $97K. These two numbers just don’t compute. And San Francisco certainly isn’t unique in this regard; similar scenarios are playing out in other cities around the U.S., albeit not necessarily as extreme.

My suspicion is that the market is starting to exhaust the buyers who can pay such extreme prices for speculative purposes, and then the debt pyramid will start to implode on itself as sentiment turns. Like the last housing bubble, it will enter gridlock where few if any sales will happen until prices revert to a base that income from employment will support for end-user buyers (not speculators).

There are only 400-600 properties sold in a month. So it doesn’t take a lot of buyers to make a market. But you’re right, you do run out of these buyers eventually.

The guy that bought my $1.25M house made over $400,000 at Genentech. That was base pay. Smart move for him as it is probably worth $2M now. But there are enough of these people with this level of pay to make the deals work.

Also keep in mind that long time California residents are often bringing equity from other homes that they have built up over decades. In the case of my buyer, he wrote in the offer that it would be “all cash” if there were any issues with loan or appraisal, and provided a copy of an Ally Bank statement with over $2M sitting in a savings account.

So I think there are plenty of these kind of buyers that can sustain 400 – 600 transactions a month in San Francisco.

Bellinghouse,

He better try to sell now to realize those gains. Otherwise, it is only on paper.

I had to pay capital gains tax on the sale since I had owned for 30 years.

Did you know that California’s Franchise Tax Board makes escrow send them 3 1/3% of the sales price at closing, whether or not you have an actual capital gain? They will not take any chance whatsoever on getting stiffed by the seller. Seemed a bit draconian to me at the time.

I will also add that the real tragedy in all of this are the genuine end-user buyers who get caught up in the speculative frenzy, believing that it’s real and stretching financially to buy. Speculators know that they’re playing with fire, and often can absorb the losses if things go sour. Everyone else takes a ride through financial purgatory when the market turns. Greenspan, Bernanke, Yellen, et al are responsible for turning what should be managed as a utility into a casino.

https://www.immobilier-danger.com/Courbe-de-Friggit-024.html

It is not inconceivable that the market has far more to go. In Europe where interest rates are mostly negative the prices have disconnected long ago and have NOT corrected for 20 years (except for the piggs).

If the everything bubble collapses I can envision IRs going negative in which case prices will shoot up.

The red line is Paris and refers to RE price to income. Still going up. Since 1997. I would know. Made a small fortune on riding it.

I don’t think prices would shoot up if interest rates went to zero or even slightly negative.

That would likely be the result of some type of economic slowdown or crash. I think you’d see prices crater if we had job losses + market losses.

Besides, even at 0% interest rates most people simply can’t afford a $1m house. That’s an annual mortgage of about $33k a year, before you include any other costs. Probably closer to $60k when you throw in taxes and maintenance.

DRAGI, keep printing at least 1 billion euros each day to loan to corporations! If you stop, the market crashes.

I don’t think people are purchasing houses in San Francisco (or any major urban area) with their income. Houses are merely one asset available to the wealthy (top 5% to 10%) to dump their junk currency (I include bonds in the category of junk currency) and collect ever rising rents from rent slaves.

The days when working wage earners could buy houses are dead and gone – Bernanke made sure of it.

I was looking at south Miami. Prices are dropping there. You can get a canal front decent home for under $500/ sq ft as well…

I wouldn’t get a mortgage in Miami. You will wind up underwater. Waugh Waugh.

Care to elaborate Harvey? There seem to be a wide range of prices and yes they are falling.

Harvey means literally underwater.

He’s making a pun there, referring to the writer Evelyn Waugh, who was also a seascape painter.

If Harvey does mean literally underwater…and i’m assuming the implications are “climate change” ……….. then why would a bank ever make a loan on the property?

It’s all bullshit, just like current RE prices.

Because if the banks securitize the mortgage, then someone else is stuck with it, while they’ve fattened off the various fees.

And if climate change/rising seas are such a hoax, then why does Miami suffer flooding even when it doesn’t rain, but only has high tides, and why is that a recent phenomenon?

Yet more proof that denial and self-deception are the probably the strongest forces in human behavior…

Duke De Guise,

https://www.forbes.com/sites/trevornace/2017/09/12/study-finds-the-east-coast-of-america-is-sinking-into-the-atlantic-ocean/#792d35ca33fb

“The first reason is due to post-glacial isostatic rebound. This is a fancy term for a simple process. During the last glaciation, much of the northern United States and Canada was under immense ice sheets. This ice weighed down on the continental crust, causing it to sink into the partially molten upper mantle. Imagine you’re in a swimming pool with a floating noodle and you push down on the center of the noodle (ice weighing down the continent)”

Climate change simply can not be the cause of everything as it’s be blamed for…….now even increased volcanic activity is being explain by……..you guessed it, “climate change”

And nobody isn’t saying the climate isn’t changing, it’s always changing, but i’m not a catastrophist ……and it just seems to be a money grab IMHO

https://www.youtube.com/watch?v=NjlC02NsIt0

I’m not the only one asking that question BTW

First you say, “It’s all bullshit,” then you say, “Nobody says the climate isn’t changing.”

Well, which is it?

And if your purported cause of flooding in South Florida/Miami (which seems to defy the laws of physics) is true, then why is tidal flooding a recent phenomenon there?

Then there’s your “what about”/ non sequitur/ straw man fallacy about unnamed people attributing volcanic activity to climate change.

So many fallacies, so little time…

I can’t understand lenders offering a 30 yr mortgage in a city whose fresh water aquifer is under siege by sea level rise and over consumption. In 30 years you may not be able to get fresh water from the tap.

The answer to your all-too-rational concern is an acronym that briefly became (in)famous during the financial crisis, but has unfortunately faded from people’s awareness: IBGYBG, or “I’ll Be Gone, You’ll be Gone.”

Sometimes expressed in French as, “Apres nous, le deluge.”

You’ll alawys be able to have water,the question is whether you can afford it!

There are many countries in the world were home ownership is only available to the very wealthy. This is new in America given our credit markets and housing builders ability to have fostered the belief in the American home ownership dream. In fact in many of these countries the housing price is cash!!!!!

Great point. What we have that many of those countries don’t is a combination of higher mobility paired with relatively affordable alternative destinations. The second and third tier U.S. markets are already evolving toward supporting information industries. This will help enable new generations to continue the ability to buy homes.

I knew a guy who worked in Holland or The Netherlands or something like that, and he said 90% of the population didn’t own, but rented from the 10% who were the owning class.

What he left out was probably that those countries tend to have an actual social safety net, put in place by the owning class so the working class (the 90%) don’t get out the pitchforks and the guillotines.

Anyway, he said that made him really strong on owning his own house when he returned to the States. Fine thing to say, when it’s possible. He was able to pull it off. I can’t imagine how much crack or opioids I’d have to sling to buy a house, or how many banks I’d have to rob.

Those folks you mention in ” Holland or The Netherlands or something like that ” are not ” living life ” – they’re existing. Existing sucks.

How are they just “existing?”

They’re going to school, getting their vaccinations and nutritious school lunches, there are sports, every kind of hobby group, and essentially zero school shootings.

If they get sick, they don’t lose their house.

They can get into trades or take the college route, depending on their abilities and it’s all paid for. In one of those countries I’d be a prime candidate for retraining, but here in the States I can’t afford even something like barber college, much less becoming an HVAC tech or plumber.

My understanding is that workspaces there are at least a bit less miserable than those in the US, on the whole.

You make it sound like living in this countries means you’re like the Van Gogh painting, “The Potato Farmers”.

So how are they “merely existing”?

Yeah, it really sucks to “exist” with universal health insurance (so you don’t have to be chained to a job you loathe, or otherwise have to face Obamacare), to have four weeks paid vacation every year, to look forward to a pension you can live on, and to not have mass school shootings once or twice a week…

Yeah, those poor Europeans, what saps…

My wife is Colombian and we have purchased and sold 2 homes in SA. Both times were cash and both were done in 3-4 days within accepting/closing the properties. I’ve owned 2 homes here in the states and my last one took almost 3 months from start to finish. How sad it is in a foreign country I can do business quicker than I can here.

That house with the turrent might turn out to be a wise purchase if there is unrest. I have to think emotions are running high right now. People tend to get upset when they work hard but still get driven out of town by wealthy people.

Who in their right mind would want to live in that place anyway Just wondering to myself You have to be a masochist To be honest I don’t understand how Doctor Savage does it

Outside of the housing costs (and a few other less crucial things), San Francisco is a great place to live. We love it here.

yes we DO love it here! and Wolf, i’ll see you at Carnaval– i’m sitting here putting the light pink pom poms on my bra top right now (it matches my light pink lipstick), and James is currently out walking up Valencia street for a place to eat dinner with his old friend in from Denver.

yes… we DO love it here, y’all.

(smile)

I hate the weather in sfo.

Don’t tell anyone about the weather in Oakland.

Kate Hykes,

What kind of toxic BS are you drowning your brains in?

I think I’d love it there.

I’ve been a street musician with my trumpet and I make about what an Uber driver does, generally from $10 to $20 an hour. I’ve recently decided to switch to drums and playing either instrument, SF’s a great place. Tons of places to play. Tons of tourists. Tons of actual gigs for a musician where you’re actually playing inside, too.

I kind of miss seeing the ocean more than once a year or so. I’ve lived in the country, but overall I like living in a city. I mean, San Jose’s pretty decent but if I could make it as a musician, street or otherwise, I’d love to live in SF.

I really only see three problems with SF. First the homelessness, and this means we need to bring back asylums and work-farms.

Secondly, the traffic; and this is because like everywhere else in the US, there are too damn many cars.

Thirdly, housing speculation and rent-seeking. The answer is high, high taxes on 2nd, 3rd, etc homes and ending foreign ownership. This is really a problem all over the US it’s just really bad in SF, and what’s really needed is Federal laws with heavy penalties and something like Hoover’s FBI hunting down and punishing any rule-breakers.

i had my James read your comment because i think you two are original PUNK and should start your own street band like Two Many Zooz, and he thinks you haven’t been in SF in awhile because it’s dead here for artists and you could be here and make LESS than you think.

a lot of the die hard hold outs here in the mission–those of us who’re late 40s to a spry 70s (that IS the bay area- where 70 year olds look HELLA healthier than these kids hunched over their phones and melting)—and the few who held on tight have reached a state of “why are we fighting to STAY here? habit?” because we’re fatigued of the sellers constantly traipsing through our homes (neighbors hunch in their cars on the street waiting til its over).

there is no secret vibe or buzz…YET… as an elder who was charged with being among the ones to help SEED an underground instead of just coming to the party in San Francisco to slot in and enjoy the end of it, i have to be a part of seeding something new.

that’s why i dance; i can slice your artery much more directly than i could when i was writing and publishing as a member of the Loyal Opposition.

but as they say, Alex… YOU ARE HIP HOP. there is no san francisco geographically/artistically of which you speak… it’s dead and conceptual and part of the tourist brochure stuff for tourists.

YOU are street art and “fxck you rebellion”. i see the most interesting bad asses in us elders. the poor kids care too damn much what OTHERS think and that’s part of why the suicidal attempts keep going way up.

they’ve hooked our kids on this shxt like crack and heroine are CUTE in comparison because the economy is tethered to the poor souls.

the only ones doing anything worth staring at in real life are the ones willing to go out on a limb, be wrong, be first, be embarrassed, terrified, made fun of.

that’s what you need for anything new real and interesting.

don’t get me started on WHY they are killing men or anything masculine and defiant.

the suburbs are like new york city of the seventies now. but as for art and edginess? it’s NOT in the cities, Alex.

it’s kinda…nowhere. the internet has killed everything and anything interesting and alive. that’s why i keep MYSELF secret now.

x

oh, and i forgot to say Alex: you are famous in our home as James has read you on Trumpet Herald i think it is!

(Wolf, i TOLD YOU i see a super cool underground speakeasy/canteen in your future)

anyhow, i was a bit flip about the real problem of an artistic community and why they’re not in cities anymore:

remember how you could choose to live cheap so you could have a life and do art? now with rampant gentrification, you have to go further and further away, and any bands i hear of, have to go to a lot of trouble to stay together from far away and working many different jobs now.

and any artists here are hustling and on their phones and it’s about making a dime now, and there isn’t as much room/time/money/COMMUNITY to experiment in private and mess up and try new things.

you go live in a second and everyone just tries to turn it into MONEY which kills anything interesting in a hurry.

that’s why i’m using rent control and James’ support of me as a form of a GIFT and in SERVICE, i must give BACK in an epic way since i’m still here. survivor’s guilt fo’ sho’ with all these senseless evictions. this “superhero” stuff can get out of hand on a bad day, but so far so good. we need more of it. not less, i figure. so if i’m wrong, i had a blast while i was here. ain’t shite on tv as they used to say. so true. in an existential way.

back to my sewing machine…

x

The Chinese will destroy San Francisco and turn it into a ghost town. San Francisco will just be another casualty thanks to the Chinese. At some point in time Trump will wake up and bar all the Chinese from buying.

My German-born great grandfather was living in San Francisco with his wife during the 1906 earthquake, after which they left and migrated down to southern California. Are there many structures in SF that survived that quake and the fires?

I lived on Duncan St. in Noe Valley, and the side of the street I lived on was wiped out in the fire, but the other side (all magnificent Victorians) survived. I lived there from 1984 to mid 1987, and never paid more than 350/month rent for splitting a house with the owner. No way would I want to live there now. It disgusts me that it has become in every meaningful way a boutique city.

What would a modern-day equivalent city/area be to the San Francisco of the past (say the 1960s)?

I’ve wanted to ask this somewhere but never remember; your comment brought it to mind again.

Debt Free,

By definition, all “Victorian” buildings that you see today survived the 1906 earthquake. The subsequent fire burned down many of them because they were made out of wood, which is good for surviving earthquakes but bad for surviving fires.

We would love to live in San Francisco too. We like the density, marine climate, the vistas, cultural events, cycling/sailing activities, and the food scene is fantastic. But we’re just a DINK doctor/nurse couple and we could never afford the housing costs of a place we’d actually want to live in. California income tax also rules out that we’d ever move to the state.

I suspect people buying those properties are very high net worth individuals who aren’t working for a living. They’re not thinking about mortgage costs; they pay cash. They want their trophy pied-a-terre in SF, and they’ve probably got others for when they’re in Manhattan or London.

Wolf: would love to see some in-depth reporting on the buyers. Where does their money come from? What titles and roles do they have in the tech scene . Or is it all hot money from China and other trading partners that run trade surprises?

Sub $5m a lot of them are max leveraged. I worked in a Private Bank…

Its probably not as easy to establish.

A lot of foreigners will send their kids up to University in the states and after a few years prob will be considered residents. Especially after graduating and getting a visa sponsored job. If they buy a home in their ex-students/yuppie name, is it considered a foreign purchase??

wouldn’t assume so.

I do the same here in Los Angeles with Zillow and have recently noticed a lot of price reductions, I really believe we are right on the tipping point here in Calif with real estate prices, I have seen 5 of my employees pick up and relocate out of state due to the high housing cost and taxes in this state.

I tend to agree about California, but I think the market will keep rising until the overall US economy finally goes into recession. We’ve underbuilt homes for decades in cities where good jobs are, and inventory is very tight. Here in Seattle, I believe I read that there are something like 80% fewer listings as about 5 years ago. Everyone’s fighting each other over this tiny inventory, driving up prices. I think it also encourages current owners to rent out their appreciating asset rather than sell, and really dig in their heels about rezoning/development/infrastructure/NIMBY issues. It’s good for their property values, bad for everyone else…

I do think there’s a lot of inventory out there on the sidelines, currently being renting out as long as home prices keep going higher. I think the first sign of the top is going to be a big tick up of home listings as homeowners try to cash out their winnings.

I have been working in a hotel in San Francisco for the past 17 years. Lived in the city for 12 and am now out in the suburbs for several years. Worked for a few dot com’s as well as pharma before the Hotel.

I work with a nice Chinese cocktail waitress. Very smart and hard working. She is not married and no kids. Her parents and most of her family live in China with an uncle and cousin in the bay area. Her parents recently sold a one of her grand mother’s properties and are going to sell another soon. Why? So she can take the money and buy a house in San Francisco. Looking at places around 1.5 million.

She has a few Chinese friends who are all in the real estate game in San Francisco.

Just a microcosm of what is going on.

That little 1,098,000 on Collingwood would not even be sellable where I live. If it had a decent lot, say .25 acre, it might go $40,000. As an attached whatever, it simply wouldn’t sell. Period. Ever.

The turret place reminds me of older homes in Newport Oregon. For sh*ts and giggles I went to Zillow for Newport. This nails it, my friends. SF is full of crazy and deranged hopefuls; or already established lucky ones.

waterfront newport: https://www.zillow.com/homes/for_sale/Newport-OR/pmf,pf_pt/60368342_zpid/53570_rid/globalrelevanceex_sort/45.24782,-121.640625,43.810747,-125.359498_rect/7_zm/

I would have to describe that as a bijoux development opportunity

Whats the upkeep on a Victorian? Those high rise apartments remind me of office space. I know we have earthquake safety all figured out (what does CEA cost for SF, or can you even get it?)

Keeping a true Victorian house, circa 1890 or so, with all the gingerbread woodwork and funky rooflines in good shape and leak free is an absolute nightmare.

Serf’s up!

Just like stock prices, everything is over-inflated, can’t wait till 2008 part deux hits and homes get affordable again. Biding my time.

Me too and it’s coming Always does

I think the ‘People like you liked this home’ phrase is a bit more disturbing than the prices for the homes.

Be careful of a Victorian, lots of lead paint on them (inside and out).

Yep lead in all the paint. “White lead” (lead oxide?) was used in just everything. Every color from black to white, because it has really good covering capability.

Having been born and raised in SF until my early 20’s the $$ numbers make me dizzy. We lived in the “outer Mission” during ’30’s until the mid ’50’s. No crazy market there at that time. Recently visiting my granddaughter in the Mission Dolores area where she shares a “flat” cut into THREE accommodations for $1300 month each. The only reason she lives there is to be able to work at her research field in a good named hospital. It’s insane.

As soon as realtors call a property Victorian, cozy, cute, and such, you should know that there is something fundamentally wrong with it. They just want to distract you from whatever is wrong by using those cute little words.

To use a few more Realtor ™ buzz words:

If you buy a “cozy” (cramped) place “nestled” (no yard) on a “vibrant” (high traffic) block in a “hot” (over-priced) market, in due course you will wind up in the fetal position on the floor nursing a bottle of Ripple wondering what the **** you were thinking believing all the real estate propaganda.

Great addition.

Don’t worry, the possible 2019 crisis will sink prices a lot.

Is not a good idea to buy prices while they are still going down, unless you are in a hurry to get the home.

Also most condos are horribly build anyway.

Real estate industry is one of the most manipulated, and corrupted industries; it has become like a mafia run industry. According to the numbers, here in south bay, the rent has gone up something like 10% YoY for the last few years. I recently moved from a studio to a one bedroom, in a far better neighborhood, for only $200 more. If I believed the numbers, then I should have expected to pay at $500-$600 more, and not $200. On top of that, I asked the company which manages this building if they have any other apartments other than the one they showed me, and they said no this is the only one, and that they have 5 people who are interested in that one bedroom (I knew full well that was all BS); then the day I moved in, their “One Bedroom Available” went up again the day I moved in. Looking at the parking lot and also going around and scanning the windows, they have at least 4 more one bedroom (in a 20 unit building) vacant.

I’d say even small buildings have at least 4-5 units vacant, but they won’t let anyone know.

The point of the above story is that real estate industry is run by a huge number of sleazy people manipulating a very sleazy industry. Don’t believe anything they say. Also, in such a rent market, how can you justify $2 Mil shacks? If you rent that shack in such a rent market, assuming you don’t lose money on it, at best your ROI would be like 1%.

Thank the Bush 2 Presidency, when they lowered the prime to almost nothing. When interest rates went down, so did the mortgage payment for a given purchase price. This caused housing prices to skyrocket- until the new mortgage payment at 3% equaled what the payment would have been at 8%.

Meanwhile, lots of investors were looking to park money somewhere safe with a good return. Real Estate looked good, so prices in stylish markets were bid still higher.

Now, to quote Men In Black, everyone’s leaving, and the last one there will get stuck with the check. Plus, mortgage interest plus property tax at these prices far exceeds the new deduction limits.

Bloomberg reports that Chinese money is still a factor in driving up prices even with capital controls, but there’s a shift to smaller cities and cheaper houses. Apparently by going after the most acquisitive companies they have been able to stem outflow so they are easing enforcement on individuals. It’s still more costly and cumbersome than it was but people are working around it.

I was checking this out because one of the townhomes in my complex in San Mateo was listed two months ago and sold the first day for $250k over asking. The buyers are a Chinese family who will be living there, but what got my notice was the small crowds every day outside our gate peering in.

The interesting thing is the HOA on these. Some of it is just crazy. I mean in the grand scheme of things, it might not seem like much, but that cost alone and property tax could probably cover every other cost of living beyond the housing cost.

Just speculating , but if there is a true glut of overpriced homes (nothings selling) then insurance fraud (burning down your home), must be on the rise. If you bought something at the lows for 500k and now it’s supposedly worth 1.5 million by the bank, then burning it down might be a sure thing to net a cool million.

Or is it just the land that’s worth more?

In California, arson is not taken lightly. Serial arsonist in Southern California, found guilty of having set fires to homes and vehicles, was sentenced to 33 years in the hoosegow.

http://abc7.com/arsonist-sentenced-to-33-years-in-prison-for-setting-47-fires-in-la/3252830/

Key word: serial.

47 fires per the link.

That’s like 8 months per offense.

I don’t think California takes any crime too seriously — they aren’t tough on crime!

California isn’t very tough on petty crime. Break into a car, steal a case of beer, bum fights, shooting up behind a dumpster. Yeah DA doesn’t really really care.

Serious assault, arson, armed robbery, drunk driving, state of California comes down like a ton of bricks.

That isn’t how the insurance works. You get the money to rebuild the house, I don’t think they pay out to what your house is worth. If you are that hard up, why wouldn’t you just sell it.

I would be curious as to how good the plumbing and electrical is in those older houses. I would guess a fair number have cast iron or steel plumbing which eventually succumbs to rust and lime scale, and electrical systems that date to a time when the only demands on them were for lighting. Older houses may look “quaint” but can be a nightmare to fix unless you are handy or have the budget to hire out the work. They also are not very well insulated like modern construction, which may not be as important in a mild climate like SF but is a budget buster in colder or hotter climates.

> I would be curious as to how good the plumbing and electrical is in those older houses.

Depends, house I’m in was taken down to the studs 20 years ago. Friends in Berkeley are lifting their old Victorian and slipping a new foundation under it. Then they’ll take it down to the studs.

Meanwhile my old mans modern 1950’s pile of sticks has cloth and bitumen insulated wiring, galvanized plumbing, and asbestos insulated air ducts. Also not bolted to the foundation.

Real rates will rise a lot in 2019 and 20…

Having spent the last week in San Francisco on business, I can say there is much to like about the area (Pier 39, nice weather, nearby forests with redwood trees, etc.), and some things to dislike (excessive housing costs, heavy traffic, severe homelessness, etc.).

Living the Boston outer suburbs and renting a nice 800+ sq ft condo for $1400 a month, I don’t feel so bad about spending so much anymore.

Chiming in from the swamp metropolitan area, pure ancedotal, but just found a unit outrageously priced at 180k in 2005, now going a hair above 100k, and even wider margins nearby, dare I care to relay.

I’m surprised to read that San Francisco housing is undergoing price reductions because that’s definitely not happening here in North Berkeley (about 13 miles from SF). I’ve been following housing in parts of the “East Bay” for the past two years, and I’m shocked to see prices shoot up this spring. It seems like some houses in the 1.3 to 1.5 M range have increased by 100K. Supposedly, people are afraid of mortgage rates increasing further, but how do people just come up with an extra 100K? Are they getting raises? Or receiving loans or gifts from parents? Maybe they’re robbing banks?

Here’s an example of a home that recently sold for almost 1.5M.

https://www.redfin.com/CA/Albany/1034-Curtis-St-94706/home/1004704

I saw the house, and it’s not that great. You can’t even walk out directly from the main living quarters to the backyard. It’s in the city of Albany which has a reputation for good schools, but the schools are undergoing budget cuts and are overrated (IMO).

I wonder how the overall Bay Area housing market coincides with the SF market. Does San Francisco start the decline first? (I hope this is the case.)

Can you imagine spending 1.5 M on a house in Berkeley? This is not the greater fool story; this is the greatest fools in history story.

Reductions of asking prices are not always a sign of actual price declines. They may be a sign that sellers had unrealistic hopes when they were listing the property and are becoming more realistic as buyers refuse to bite. So it depends on how high the seller’s unrealistic hopes had been. Starting out high and cutting prices is a common part of price discovery. But it does show that buyers are more circumspect. And that would be a turning point from bidding wars.

I have a comparable home listed for 150k, brick ranch on half acre in the city with massive hemlocks and magnolia trees in the front yard. Taxes will run you about 2k per year. In a metro area with plenty of finance and tech jobs, great quality of life without having to be house poor.

Ppl paying 1M+ for an average home really is insane. If you need a mortgage to purchase at that price, it’s just not worth it in my opinion.

Where is this

Even fractions of interest rate increases will slowly compress prices….even in SF.

Charlotte NC

Insane if you look at what it was listed at ($895k) and what it sold at (1.5M) thats 63% over asking price. Or More than a half million over asking

Actually, that house is pretty funny. It says:

Home Sale Price: $1308679

Outstanding Mortgage: $1165000

Looks like he has put down only $135K to buy a $1.3 mil house; and that’s assuming the inflated estimate by Redfin. In actuality, the house is worth below $1 mil; seems like the guy is already under the water after only 1 month. Something pretty fishy about that sale. I smell a rat.

Have a place Inner Sunset, close to GG park and nice view of city, ocean, mt. tam, that being said, I would never pay the price our place is supposedly worth. Great neighborhood, top notch eateries, local shops and the museum all within a walk. Wife doesn’t drive and uses muni to get to work. What is strange about living in this city is how few neighbors you actually know.

Chinese have bought into this area at a very high clip, my dog walks have revealed many ghost houses where no one lives in them, hot money from China, it might be even funny money, is just outbidding any citizen here to act as a holding place or wash. The Obama Admin change of foreign home ownership laws in 2015 caused a lot of this bs.

I will rent or airbnb the place and get out of here at retirement, no way could I live here. One other thing about the City, its like Chicago in regards to the mafia like supervisors, laws, tickets, general treading on the citizens who live here. Most of the politicians that come from this place make it to the state level to carry their corruption to the next level. A cesspool of agendas exists within this place. Their sanctuary stance is hugely embarrassing.

“Embarrassing”? Interesting choice of words. I’d prefer “criminal”, “treasonous”, or “sociopathic”.

This is the kind of malgoverance the fine upstanding voters of Chicago installed by electing corrupt machine politicians. They purely and simply deserve everything bad that happens to them.

This is a great time of year to bicycle along the Mississippi river in St. Paul and Minneapolis, and when I do, I like to check out the homes for sale.

Here’s a nice one for just under 2 million bucks …

https://www.zillow.com/homes/for_sale/Minneapolis-MN/2145937_zpid/5983_rid/globalrelevanceex_sort/44.959134,-93.192183,44.945634,-93.211839_rect/15_zm/

7 bed, 7 bath and 8,000 square feet sitting on top of the river and looking at Minneapolis. Puts things in perspective from Zillow in San Fran.

In the Bay Area, people consider it “hella cold” when the temperature drops below 55F and “freezing” if it drops below 50F. They would gladly pay the price difference or rent in order to avoid -20F/-40F w/wind chill.

To add to my last point, I don’t think I’ve ever heard the term wind chill used in a local weather report. The closest was when they had some snow on Mt

Hamilton and a maintenance worker exclaimed that it sure felt a lot colder when the wind was blowing.

Not only are asking prices being reduced, but increasing numbers of recently sold homes are now valued below the recent sale price, including in the equally “remarkable” market around San Jose.

https://www.zillow.com/homedetails/4927-Kingston-Way-SAN-JOSE-CA-95130/19661267_zpid/

Wolf I would love to see data from Santa Clara county too…

And the so called Zestimate is already an inflated number; that means the owner can sell it at $1.5 M probably. Oops, the owner lost half a mil in one month. A fool and his money are soon apart.

Wow, so many recently sold are now have much lower zestimate; I didn’t even do a serious search and saw a dozen of them. Here’s another one in Santa Clara: https://www.zillow.com/homes/recently_sold/19553503_zpid/globalrelevanceex_sort/37.509453,-121.784821,37.042846,-122.522965_rect/10_zm/

I have seen the Zestimate considerably lower than the sales price for quite some time in the bay area – or at least in the East Bay. I don’t take from that that values are declining – if anything, it’s the opposite. The Zestimate is based on past data, and it’s it’s as though it can’t keep up with the rapidly-increasing sales prices.

No, Zestimates are always above the real price; that’s guaranteed; for properties above $1M, you can bet that Zestimate is always above by at least $100K.-$150K. These are not manually created estimates, not something that some accountant does with a calculator in hand; a billion of them can be done in less than one minute.

R2D2,

What information are you using to back up your claim that “Zestimates are always above real price”?

My conclusions are based on the following:

1. I have been following the East Bay area home prices for the past two years, and the Zestimate many times is significantly lower than the sales price.

2. The Zestimate and Redfin estimate can diverge by sometimes 300K. They can’t both be right!

3. Many articles online discuss how these type of estimates are not that accurate. Here’s one article:

https://www.investopedia.com/articles/personal-finance/111115/zillow-estimates-not-accurate-you-think.asp

RoseN,

Based on the fact that you can pick almost any property with any Zestimate, and I can get you that property with at least10% discount in comparison to Zestimate; actually 15% would be more like it. These are all inflated numbers. Zillow is part of the real estate industry; they are not gonna post the real price.

I’ve seen Zestimates that are way off on the low side, especially on houses that haven’t been sold in many years.

Has anyone noticed that certain markets are also stripping the sales price off of the property history. example: [ Corpus Christi, TX ].

None of the main RE websites, Realtor / Redfin / Zillow / Trulia posting prices next to [Sold] detail. Have not encountered that in any of the other markets I trial.

Here in Melbourne and in my little area it is becoming more difficult to find out what properties sell for.

If you wait three or four months you can find out through a free site, but certain RE Agents never seem to want to publish the prices. Why, I don’t know.

The other recent happening is that houses sell and you can’t find anything on the MLS – it is like a ghost sale….the sign goes up, a sold sticker goes on (sometimes in a couple of days), and new people move in.

Whatever………………..

Ridiculous prices for townhouses on dinky small lots seem to the be new rage here. One new one being built was listed for A$885,000 on about 230 square meters of land…………………

Gee Wolf,

I thought for sure that with the way Wolf Street is going you’d be able to fork over cash for that $5 million ‘beauty’ and still have enough money to party in SF!!!!!!!!!

But anyway, forget about SF, I have a better deal for you:

http://www.nb-home.jp/bukken/d_chiba/cb1054.html

A nice 95 square meter condo out in Chiba City. A six minute walk from the station and the monthly fees are less than US$300 a month. The price is a bargain too compared to SF – about US$146,000. A little over an hour to Tokyo Station by train…………….

That thing’s about a thousand square feet! It’s big!

Alex,

Yes, you can find some fairly large condos in Japan both in the big cities and in many secondary or regional areas.

Many people would be surprised at how ‘cheap’ RE can be once you get out of the big cities in Japan.

I wouldn’t rec a condo in Japan though for a number of reasons:

1. Unlike in many other countries the price movement of a condo in Japan is usually one way: it falls in value over time. There are exceptions such as in Tokyo, but generally that will be limited to high rise luxury places. At least if you buy a house in a reasonable city that has good transport and facilities there will be some residual value in the land.

2. The monthly fees consist of a maintenance fee and a sinking fund fee. The maintenance fee is often a source of profit for the place that built the building and as the building ages the fee as a % of the value can become quite high. The above condo is quite reasonable. Also many buildings lock out owners in their ability to change management companies and how the money is spent.

The sinking fund fee is supposedly to be used for repairs and other unforeseen repairs over time. The problem with this fee is that it is often set way too low when the condos are first sold so as to make it look ‘reasonable’ only for owners to be hit later on with a huge bill. The above condo has a very reasonable fee considering the age and number of condos in the building.

There can also be other fees such as a fixed water fee, a neighbourhood association fee, and the most surprising to many are fees for a condo that has a rooftop balcony or for parking your bike.

Another aspect of many condos in Japan is that the condo owners don’t own the parking lot in the building or the parking lot outside the building. You pay a company (most likely the one that built the place) a monthly fee for parking.

Condos in resort areas may also charge for a ‘hot spring’ fee. And the maintenance fees for these type of buildings are off the chart as they are aimed at the tourist market.

3. The problem with potential earthquakes. Yes, most buildings are more than safe, but why take a chance? Also the building may be ok, but the infrastructure such as electricity may be cut off. Just imagine going up and down 10 or 20 flights of stairs to get food and water.

4. You can’t ‘go green’ if you want to have solar panels or grow your own vegetables.

5. Finally, the problem of aging in Japan is going to impact this type of property more than others. One interesting aspect of inheriting in Japan is that you can reject the asset being inherited. So if mamma and papa have a condo that is old, has a high monthly fees, and is falling in value, why would you want the property? You wouldn’t.

Also factor in the declining population in many smaller towns and cities as well and the picture for condos, houses, and farms in those areas isn’t pretty.

The owner remains the deceased estate and the fees don’t get paid. What happens when a building has a large number of units with ‘no owners’???? Yep, the other remaining owners are going to hit hard.

Lee – Thanks for the great write-up.

Don’t worry, if all I can make is $13k a year in the US, I don’t think I’d be able to survive in Japan.

Interesting info Lee. What is your opinion of single family homes? I noticed one in a beach area I like that would sell for >4x as much if it was in Clownifornia. I dont think I would ever buy, but the price made it interesting enough that maybe using it as a place to live where you also have an airbnb type setup for traveling surfers/others to enjoy the beauty of the area.

I found Tokyo and most of the other cities I saw to be unappealing, although I liked Kyoto.

govinda,

I prefer a single family house in Japan IF I was going to live there.

It would have to be in a nice second tier city with good transport and facilities and a steady or increasing population.

The easiest way to confirm this is just by looking at the number of passengers using the local train station and see how it has changed over the past 20 or 30 years.

Houses near the beach in Japan are now much cheaper in Japan than before because of the big earthquake and tsunami in 2011.

There are , however, many areas that are still close to the beach, but higher up (safer) and the prices will generally reflect that.

As far as buying and renting out a house for vacation rentals near a beach area, I really don’t have a clue as to if that would be good or bad. Many people do that sort of thing in Hawaii and I wonder if a person could do that in Japan to cover the holding costs and use it while they are in Japan on vacation.

Japanese seem to have a set beginning and ending date for swimming in the ocean and regardless of the weather seem to stick to it – or at least they did when I lived there.

Also with all sorts of condos/hotels at the beach areas and the often limited vacation time for many people I wonder how that would work for a house……………..

I do know that there is different tax treatment for a ‘second house (vacation house)’ in Japan and that with the new minpuku law each city or prefecture can set their own rules for renting out property on a short term basis.

(This is similar to what you would find as far as the enforcement and regulation of people buying ‘farm’ land in Japan. Some places encourage people to come in and buy the land and set up and other places will discourage it and place many obstacles in your way.)

And of course, unless you are paying cash the problem of finance for a foreigner would come up. I know that the banks are now much more relaxed about lending to foreigners who live in Japan now compared to 30 years ago, but on a vacation property to a non-resident??????

Lastly, for a foreigner, the other question of foreign exchange risk would also come up……the yen has been quite volatile recently and Abenomics whacked the value down quite a bit….

Yeah, but I can’t even do the basics there, such as reading the documentation of the sale :-]

However, there may be a time when we need to think about this, if my wife’s folks start needing some help (they’re in their 80s now and doing very well so far). The city would be Soka, less than 1 hour by semi-express from central Tokyo.

Wolf,

Never been to Soka, but it looks like a reasonable place. Property prices seem to be much higher than in Chiba.

What is special about ‘soka sembei’?

I’d still prefer a place in Chiba down by the beaches and a summer house in Hokkaido!

If there hadn’t been major changes to tax and pension rules and costs in both Australia and Japan as well as the concern about high potential medical costs in Japan, we’d probably move to Japan.

Oh, well we can visit!!

Thanks for your reply Lee, very good info. I have to agree with Wolf below, the tetrapods do make the coast look ugly. It seems they really try and control/tame nature, directing their rivers and fortifying their shores but its largely pointless and I suspect they know this but they are a “make work” society so they will keep busy doing something, even if it doesnt make sense.

Fortunately not all of the coast is covered in concrete – yet. I also think the lack of concrete is why many Japanese prefer Hawaii to coastal areas of Japan and Okinawa – Aside from Oahu, nature is still very much in charge.

Lee,

Here’s a quote from my book, in reference to your idea of wanting a house near the beach in Japan:

“Until today, tetrapod didn’t mean a heck of a lot to me. Creepy four-limbed bugs came to mind, but not much more. And today, we take a train to the Pacific coast of the Bōsō-hantō peninsula and hike along the coast. Deserted beach resorts alternate with cliffs and forgotten fishing villages where fish is drying on racks. But the vile stench of fermenting fish–some Japanese are said to appreciate it–is merely a background detail in face of the tetrapods.”

These tetrapods are huge concrete structures jammed into each other that — along with concrete seawalls — line much of the Japanese coast, and they’re very ugly. And they ruin the view.

I understand why they’re there, and we all now know that they were insufficient to stop or even slow down by much the last tsunami, but they’re why an otherwise beautiful coast is ugly.

Great time to sell! I cashed out of the Bay Area 3 years ago. I couldn’t resist the capital gains. Don’t miss it at all. I grew up there, but it’s not the same place it was. It’s now very crowded, lots of traffic, crime, homeless camps, and very costly. When I visit, the weather and the scenery are about the only things that are as I remembered.

If high-tech hits a recession, which it will…..look out below.

California real estate prices and residential rents have been affected by hot money from abroad, Proposition 13 (Jarvis-Gann) and, where it exists, rent control. I moved into my home before Prop. 13 passed, so my property taxes are quite low (a little over $2,000 per year on a home with a Zillow estimate of $1.3 million). This is probably the first year that my state and local taxes are likely to be higher than they would have been in Texas, which has much higher property taxes in its metro areas. Of course, if I do sell, I face a huge deferred capital gains tax.

My theory of the current state that the housing market is in, with high prices on a low volume of sales, is that the volume of sales coming out of the last downturn wasn’t very broad with a lot held by banks in foreclosure. Banks were hesitant to sell and confirm the losses on their books. This allowed the speculators and hedge funds to come in and corner the market, forcing prices into the stratosphere. The problem of “low inventory” commonly heard is simply that the bid/ask prices that an end-user market can clear given employment income is so far from the current market prices dictated by speculators.

A mathematical oddity, for sure.

I love the idea that if you buy a 200k house or a 5MM condo, the bank still only wants 20% down.

There is no way a bank isn’t going to make you put more down on a loan of that size… think >30% down.

Plus, a lot of these types of transactions go down all cash, as most people with incomes this high typically have windfalls. Some do 50% down. A $4MM mortgage is a very rare thing.

A lot of times, cash transactions are done to speed up the process. Later the property is financed either at the institutional level if it was an institutional buyer (bond issue, securitization, etc.), or by a mortgage if it is an individual buyer. For investors, real estate only makes sense if it’s leveraged.

Foreign buyers motivated by getting their money out of their country, however, will use their own cash as sort of a safe haven.

In the Bay Area, there are a lot of people whose wealth is tied up in shares (including startups whose shares have “valuations” instead of prices). So they borrow large amounts of money to buy expensive homes. I know a guy working for a big bank whose department is specialized in procuring big mortgages for the wealthy.

This is all correct, I’m just saying there is no way you’re getting 80% leverage on a 5MM condo.

I am probably very similar to that guy you know lol.

I am now noticing meet ups on how to flip houses. I noticed lately an increase in ads for flipping on radio. Last time the flipping began, the market tanked soon after. Let’s cross our fingers….