This junk-bond market is in peak-bubble mode, and Netflix is just doing what investors want it to do.

Wow, that was fast and huge. After announcing this morning that an investor call was scheduled to try sell a “drive-by” issue of $1.5 billion in 10.5-year bonds that S&P rates four notches into junk (B+) and Moody’s three notches into junk (Ba3), Netflix found insatiable investor demand and sold an additional $400 million, for a total of $1.9 billion, Netflix’s largest bond offering ever.

The investment banks running the deal were Morgan Stanley, Goldman Sachs, J.P. Morgan, Deutsche Bank, and Wells Fargo. The notes, which mature on November 15, 2028, priced at a yield of 5.875%, just 291 basis points over the equivalent US Treasury yield, according to S&P Global Market Intelligence.

This comes just six month after Netflix borrowed $1.6 billion in 4.875% bonds due in April 2028. And earlier in 2017, it had sold €1.3 billion of 10-year unsecured junk bonds in Euroland at a yield of 3.625%, bringing its total issuance in 2017 to about $3 billion. So interest rates are rising, debt is getting more expensive, and there’s a lot more debt, but it doesn’t matter to Netflix investors.

Last week, Netflix reported total long-term debt of $6.5 billion as of March 31. With the $1.9 billion just added, it now has $8.4 billion in long-term debt.

This is in addition to current and noncurrent “content liabilities” of nearly $8 billion. This company is rated deep into junk for a reason.

And it’s going to get a lot worse. In its earnings report last week, it disclosed that its negative “free cash flow” – a measure of the amount of cash it burns – of -$287 million was “less negative than we expected due to content payment timing differences.” In the prior quarter, it had booked negative free cash flow of -$524 million.

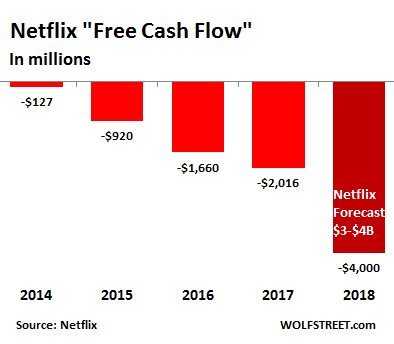

In total, it forecasts to be “free-cash-flow negative” between -$3 billion and -$4 billion in 2018. So the next quarters, when the “timing differences” are reversing, the negative free cash flow is going to be a doozie. And it also disclosed that it would be “free cash flow negative for several more years as our original content spend rapidly grows.”

This is Netflix’s negative free cash flow history and propitious forecast:

In its earnings report last week, Netflix said that it had $2.6 billion in cash (all of which is borrowed money) and that it would “continue to raise debt as needed to fund our increase in original content.” And it didn’t wait long to raise some of this debt, with $1.9 billion raised today.

In its earnings report in January, Netflix explained how this works. “Our debt levels are quite modest as a percentage of our enterprise value,” it said, adding that junk bonds have “rarely seen an equity cushion so thick.” It’s saying that its market capitalization ($142 billion currently), based on its sky-high share price, is so huge that Netflix thinks it can always sell more shares if it can’t sell enough debt to service its current creditors and fund its gigantic and growing negative cash flows. This math assumes that its share price will always remain sky-high.

At the time, it also disclosed that its “net income” as reported to investors is a mirage that likely turns into a loss when reported to the IRS. It said so indirectly when it explained with a reference to the new tax law that limits the deductibility of interest expenses: “The new limitation on deductibility of interest costs is not expected to affect us.”

In other words, that “net income” is just for show.

So here we have it: A mature company that has been publicly traded for about 16 years, and has been bleeding cash at ever larger amounts, and that has to sell ever more junk bonds or shares to fund its bleeding operations, finds enthusiastic demand for its debt, backed by nothing other than its sky-high stock price, which is premised on its being part of the FAANG stocks whose shares can never decline. Nevertheless, when word got out with the details of the bond offering today, shares declined 2.8%.

But the company is just doing what investors want it to do. These investors are hooked on the metric of “subscribers” and the sky-high share price itself, and they don’t care about much else, based on the demand for its bonds today, which shows just how bubbly the junk-bond market is, and based on its share price with a P/E ratio of an astronomical 214, which shows just how bubbly the stock market is.

That would be a first, but it might be happening: Everything in slow motion, even market declines? Read… An Orderly Unwind of Stock Market Leverage?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

In this bizarro world apparently “startup” companies like Tesla and Netflix can endlessly issue more and more debt and equity to burn cash delivering products in an unprofitable manner. I’m going to assume this is a last-ditch effort to issue debt before interest rates begin to rise. What I want to know will the company begin to peter out or can it go on forever?

It can’t go on forever, hence why I am looking at these zombie companies with interest, as the moment they do sell less junk bonds than they expected is when we will know for sure the crisis is here.

The Number One argument of Tesla and Netflix believers is: take a look at Amazon.

I don’t care enough to verify if Amazon’s cash burning rate was/is comparable.

I still can’t find content I want to watch with any degree of regularity on Netflix. Most of their “originals” are duds inspite of the handful of “winners”. My partner is addicted to 90s sitcoms so we continue to pay for the monthly Netflix tax, otherwise I would’ve canceled years ago . But eventually this rerun novelty will come to an abrupt and force Netflix to deliver new and addictive content such as HBO..

I enjoy HBO Go far more than Netflix.

Netflix has to produce winners to keep subscribers from eventually fleeing. So far I’m not impressed with their originals. Wild wild country is not worth an annual subscription, just one month and you can stream their winners

I mostly agree with you. Stranger Things isn’t even that interesting. I stopped watching both Season 1 and Season 2 after a couple of episodes. If that’s the best Netflix can do, well ……

But occasionally, Netflix would pull an anime out of nowhere that’s out of this world. So I too continue to pay the Netflix tax. But if this thing goes away, I would just shrug.

Anime? People really do have to much time on their hands.

Agreed. Good original content are far and few in between (only Daredevil season 1 and Black Mirror come to mind). Netflix cannot escape the natural law of creativity — you can’t accelerate the process just by throwing more money at it. But they are betting on quantity, not necessarily quality, to attract new subscribers. Existing subscribers don’t mind keep paying because it’s still relatively cheap.

It’s a little more complicated than that. A number of the originals are targeted towards specific, niche audiences, trying to get their subscriptions. As for the winners, they don’t really need that many of them. Some cable networks base their entire strategy around getting a single hit so they can jack up the carriage fee.

The problem for Netflix isn’t that they try a lot of shows (so do the broadcast networks), it’s that they don’t cancel the bad ones quick enough. They might explain this away saying it’s needed to attract top talent, but it just seems like bad management to me.

Contrast this behavior to how a more established company reacts to mounting losses from an online division. About two years ago Scripps acquired comedy site Cracked.com, but in December 17, made major layoffs. If they were allowed to use the same logic as Netflix (treating content costs as capex), they might have continued to operate the website as is, as opposed to the major layoffs that they implemented.

https://americaclosed.com/cracked-com-layoffs-job-cuts-editorial-video-staff/

I’m paying $40 a month for basic cable (Comcast), but I’m only getting a few channels more than what I can get with an antenna (16 channels!). I may soon cut the cord altogether. Either option gives me all the 50’s, 60’s, 70’s, 80’s and 90’s sitcoms I can bear to watch. I wouldn’t even consider paying for Netflix, as a subscriber or a stock purchaser.

I looked into cutting the cord. One issue that had to be faced was Spousal Acceptance Factor (SAF). My spouse cannot reliably figure out how to use Comcast’s “On Demand” feature. Roku is totally beyond comprehension. SO we remain subscribed……

HBO > NFLX.

All of thebest shows of HBO and Netflix and lots of other TV shows (especially the old ones from the 80’s and 90’s), documentaries, PBS shows, etc., can be downloaded via tvunderground.org.ru, using the emule peer to peer software or bitorrent/utorrent. The hottest shows often appear within a day of the first TV showing (e.g., Game of Thrones, Westworld). This gives you a permanent copy of the show/movie. And, despite the .ru website address, the server is based in the Ukraine.

If that is too slow and geeky and spouse/partner unfriendly for you, there is a website called 123freemovies that will instantly stream lots and lots of movies and TV shows for free (not DMCA approved). Rule#1 on that website is do not use that website unless you are familiar enough with installing strong adblockers (Adguard is the best – make sure you add the multiple other filters that are available) and have a really good anti-virus program on your computer (I use Bitdefender). The Chrome browser seems to work best with the playback of the movies. Rule#2 is to ignore and close any popup secondary webpages that open up, and then to go back and click on the center arrow -> in the middle of the movie frame to open the movie. Rule#3 is Do Not sign up for anything or hit any download buttons on that website. Rule#4 is that the website does not stream well at certain times of day, and you just have to keep trying. Rule#5 is that the website changes its address every 6-12 months – I guess that is how long it takes for the DMCA legal work to catch up and shut it down, so you’ll have to search for it again. We used to use a similar website called niter.co, but that got shut down. Rule #6 is to get a popcorn maker and a nice reclining sofa cuz you’ll be going to the movie theaters a lot less to watch all those movies that sound kinda interesting but have no desire to pay $10+/person to see. Recent examples: Red Sparrow, 12 Strong, Jumanji (remake with The Rock), Greatest Showman (my partner liked it, I fell asleep, glad I didn’t pay money for that one), Maze Runner Death Cure…..

I should add that I don’t have Roku, although I’ve thought about getting it. I just hook up a laptop with a Wifi connection and a HDMI port to the TV. My partner has also resisted getting Sling TV or anything with a separate clicker from the TV remote control, but she at least knows how to use a laptop computer, and navigating on a laptop with a bluetooth mouse let’s you sit back on your sofa 5-10ft away and select movies. Between the free stuff available on my Android TV and the 123moviesfree site, I haven’t needed to get a Roku.

That’s stealing. If you don’t want to pay for content, don’t pay for it. But don’t steal it.

If you see something in a store you think you might like, but don’t want to pay the sticker price, do you think it’s okay to shoplift it?

This makes me furious. I work with content creators every day and I see how piracy and people’s cavalier attitude towards outright theft impacts the bottom line for working men and women.

Kgscherer,

You can call it whatever, but fundamentally, this is a problem the entertainment and information industries have long had to deal with in terms of how to monetize and maintain their copyrights in the face of a continuous deluge of new technologies.

When the MP3 was born in 1990, followed by the peer to peer sharing software of Napster (emule is a similar service, without a centralized server, which is what keeps it legal), the music industry’s response was to fight both tooth and nail.

A lot of people knew even then, including the founders of Napster, that the real answer lay in setting up legitimate pay sites where people could easily get their music at a more reasonable cost, and in the much smaller file format of an MP3 or something similar, than what the music industry was selling at the time, which was full albums on vinyl, and CDs in bulky WAV format. Popular CD’s generally sold for $15 at the time, in the 1990s, which would be close to $30-40 today, a RIDICULOUS PRICE, if you think about it. And so already, people were ripping the CD’s and copying them as MP3s, and this was followed by the peer to peer sharing networks.

It took a major collapse of the profits of the major music companies for the industry moguls to realize that they were going to have to learn to live with this new technology, or it was just going to eat them alive. And then it took the personality force that was Steve Jobs to convince large segments of the music industry to license their content to Apple so they could sell it online on iTunes for the cheap, cheap price of $1 a song.

And, now, everybody, including Amazon, is selling single songs, instead of full albums, at cheap, affordable prices.

I used to have a subscription to the DVD version of Netflix.

Blue ray was added, and streaming was added initially at no cost. Then both got separated out and became separate charges, increasing the costs. In looking around for alternatives, I discovered TVunderground and emule. I canceled my Netflix subscription.

Netflix is trying to do something similar as iTunes – deliver a legitimate service streaming in movies and TV shows. The problem is that

1. its service sucks – the availability of movies and TV shows is not anywhere close to what it should be and no where close to what 123moviesfree and tvunderground offer. This is fundamentally also because of the greed of the movie moguls – Netflix pays huge fees to the movie industry for the top movies, which gets them only a window of time that they get to show them. And so Netflix’s offerings suck by comparison to non-DMCA approved sites.

2. As Wolf’s article demonstrates, the huge costs of running the streaming service of Netflix is being paid for by massive debt, which at some point is likely to default, and so the bondholders who will be left holding the bag are essentially subsidizing the current relatively low costs of signing up for Netflix. Pensioners, and old people. Think about that, next time you want to extol the virtues of the legitimate pay streaming sites like Netflix.

This is a somewhat parallel situation between the movie/TV industry and what happened to the music industry in the 1990s.

The movie theater prices keep going up, just like the price of music. Come on, I am NEVER going to go pay $10+ to go watch Red Sparrow or Jumanji with The Rock at a first run movie theater. You have got to be kidding me.

What needs to happen is a restructuring of the movie/TV industry into what happened with the music industry – the fat and bloated music companies filled with overpaid music executives shrank, artists gained greater control of their own content, and a wide range of much, much cheaper and legitimate (including FREE!) outlets for delivery of this music through the Internet occurred.

The problem of course, is that the globalization of American movie/TV, especially into China, has massively increased profits at the moment. And so those entertainment moguls are not ready to deal with the devil of this newfangled technology called the Internet. And they won’t, until the profits start to seriously shrink

P.S.,

No need to follow up with snarky comments about depriving hard working ‘Murican workers of their livelihoods. I used to live in SoCal, and it was hard not to run into people in the entertainment industry on a daily basis. I am a bit of a film buff and so unless you are also, it’s quite likely I know more about the American film industry and film history than you do.

The U.S. movie and TV industries will not collapse. What will collapse are the enormous salaries being paid to top stars and top executives.

Remember, James Cameron made the first Terminator movie in 1984 for only $6.4 million (equiv to $15 mill today) and it was filmed in Los Angeles, with a cast of all-American citizens (Schwarzeneggar was naturalized in 1983). And it is still the best and most iconic of the Terminator movies.

Is it really necessary to pay Robert Downey Jr. $80 million to keep playing Tony Stark/Iron Man? His salary alone could have funded a multitude of smaller budget movies. I did pay $10+ to see those movies at real movie theaters, and all I see is just the bloat of an overly produced, overly budgeted movie, not creative movie making. If I wasn’t such a sci-fi/comic book geek, I would have long ago put his movies into the “watch on 123moviesfree” category, like the Maze Runner series.

The truth is, even with these films being highly profitable, the offshoring of work to Furriners is already happening.

The last Peter Parker was played by an English actor, despite Peter being such a quintessential American character. English actors do go for a LOT cheaper than American actors, and something has to give to pay RDJ his $80 mill.

More examples:

Hacksaw Ridge, a 100% ‘Murican story about a ‘Murican War Hero, was filmed in Australia, with a mostly Australian cast and crew. The film made almost as much money in China as it did in the U.S., probably because of its portrayal of the Japanese soldiers as savages.

Half of the movie Transformers: Age of Extinction was filmed in China with lots of Chinese actors, and Michael Bay and Steven Spielberg threw in some totally ingratiating suckup lines for the Chinese Defense Minister character to say, and voila, the movie was a HUGE HIT…. in China …. making far, far more money in China than the U.S.

Harley and the Davidsons, a Discovery/History Channel mini-series, another 100% ‘Murican story, was filmed in Romania, with a mostly European cast and crew. Hey, did you know Daario Naharis and the young Ned Stark from Game of Thrones built and raced American Harleys in another life?

[HBO’s Game of Thrones, btw, is almost entirely British/European, except for the two show runners, the producers and a few crew, and Peter Dinklage. Which is OK, because its a British/European story.]

The Life of Pi was hugely profitable at the box office, and yet VFX, the company that did the CGI and won an Oscar, went bankrupt shortly after finishing the movie. CGI is more and more being off-shored to cheaper Furriners.

So yeah, Kgscherer, you can re-direct the guilt trips about protecting ‘Murican jobs to the sheer greed that exists currently in this American industry despite the massive profits.

Wow. Those are two astonishingly long and agressive comments jusifying what you still haven’t denied is theft.

The thing is, I don’t disagree with much of what you have to say and certainly not with all of your analysis of the current business models whose flaws you think invite that theft.

Respectfully, I disagree that it’s likelty you know more about the business than I. I haved lived in Southern California for a deacde, but I’m not a native or even an American. I have spent decades working in every aspect of the film and TV industry, including most recently consulting in the areas of production finance, packaging and distribution. I have a pretty healthy knowledge of international co-production and non-treaty co-ventures involving the US and non-treaty territories. I get how the money for these various production models is typically raised and paid out and a large part of my business involves working with and fully understanding the business models of streamers like Netflix, Amazon and Hulu. (Though, as Wolf has pointed out, the sustainability of Netflix’s long-term plan is a head-scratcher)

I understand the frustration people feel when they see when a handful of huge celebrities make money for projects that hardly seem worth the ticket price, but actors are commodities, nothing more and nothing less. The price tags on their foreheads rise and fall based on the money their involement can raise for a project and rarely are they overpaid for long. The market is pretty pure in that regard. Not perfect, or course, and we could debate for thousands of words on how not perfect it is, but that’s for another time.

The studios are mega-media conglomerates with tentacles in a million and one different businesses. Like you, I don’t feel particularly sympathetic towards them. They have survived and will likely continue to survive, despite piracy.

But many, many filmmakers live on the margins and spend most of their time trying to raise financing for their projects. Independent filmmaking is a tough, tough road and creators typically depend on international pre-sales to finance their projects.

Piracy has effectively killed the international pre-sale market and as a result independent filmmaking is dying on the vine.

Keep pirating and soon the over-priced, over-stuffed and over-hyped studio films, featuring the over-paid actors about which you complain are all you will be left with.

Obviously they don’t plan on being around in 2028 when these bonds are due. Question is who buys this junk? Pension funds?

You’d be surprised at who buys these junk rated bonds. ;-)

While junk rated bonds have always existed and have their place in several “historical” investment strategies and portfolio compositions, these days they are the only form of investment with a discernible yield.

Yes, it was the plan all along: push investors who normally would have bought investment-grade bonds and held them to maturity into junk bonds to drive yields down and hence squeeze every drop of GDP growth no matter the future costs.

To get back on track, it’s extremely hard to find bonds with a yield as high as Neflix’s. 3.625% is the sort of yield you see from far shadier companies than Netflix, which at least has easily accessible SEC filings and something (shares, no matter how grossly overvalued) to buttress its position.

However I think well before 2028 another factor will converge on bond yields: inflation.

Let’s be honest here: official inflation figures have been so tampered with over the past three decades they are basically useless. A bit like China’s leading economic indicators. ;-)

We can debate for months on what the true rate of inflation is and for good reason (inflation for a retiree is different than from a small forestry operation) but we all agree it’s far higher than official figures. 3.5%? 4%? 5%? Junk bond yields are barely keeping up with it, if at all. Investment grade is still in Happy Land.

Fixed yield is supposed to at least preserve wealth, by offering a yield that, when all is said and done, will keep up with inflation.

Asset managers are under enormous pressure by customers demanding (and rightly so) that inflation cushion. That pressure increases as inflation heats up, like it’s presently doing.

In spite of everything Netflix had to bow to that pressure by offering a full 1% over the bonds (same duration) they sold just six months ago.

Floods always start with a few drops of rain.

I agree with your inflation theory.. I would add in another reason rates will climb and that is even bigger. Risk has not been realistically priced for a long time. So long that many have just forgotten that it exists. Minsky in his instability hypothesis describes this phenomenon. It is part of human nature and it will cycle. When Risk does return, those with capital left after the destruction will be very leery of risk and will not lend unless risk is then over priced…

Risk has never gone away and we are painfully aware of it, believe me.

Apart from those my mother would call “blessed souls” and the average punter with no savings to speak of nobody believes the salesmen out to shill financial products to the so-called retail market. We are all aware, too painfully aware, of the shaky foundations financial toxic waste such as Tesla are built upon and of the ticking time bomb scattered across the world.

A few of these booby traps go off now and then: Air Berlin, Areva, HSG-Nordbank… but the media quickly delivers the bankruptcy procedures (and how unsecured bondholders and junior creditors were caught in the blast) to the footnotes of history, so as to speak.

But there’s literally nothing else. Overinflated stocks are great, but you need to sell them to have money you can buy stuff with (or use them as a collateral to get credit) and valuations are so insane even a 2% dip is enough to make you swear to do away with stocks at first occasion.

That leaves junk bonds, and the idea since 2009 has been to corral everybody wanting discernible fixed yield into them to drive said yields down and hence allow zombies such as Tesla to stumble along and drive nominal GDP growth. Trickledown effect and all of that.

I am starting to be a little weary of holding my nose and dodging explosions. And wiping bits of desperate investors off my clothes.

Have you seen how much dry cleaning costs these days?

When you question the inflation fantasy number, you are opening a pandora’s box. Real GDP is also adjusted by similar fantasy number, and if your speculation is correct, there was decline rather than growth for ten years, at least.

That’s been one of the biggest lies told to support the official CPI numbers – that real GDP growth would be negative if you use some of the alternative CPI calculations out there, like shadowstats, so these alternative CPI calculations can’t be any good.

But everywhere, there is solid evidence that real GDP must have in fact been declining because in general, the average American seems to be poorer than they were in the 1970s or 1990s. The percentage of women in the labor force has been declining since 2000, the numbers of people that have dropped out of the labor market entirely has increased, the total percentage of the population on some form of disability assistance or SNAP (Food stamps) assistance has increased.

How exactly do you calculate GDP anyway, when manufacturing industries move offshore? Do Apple’s tremendous profits count towards the GDP of the U.S. when they are indirectly employing through contracted companies hundreds of thousands of low wage Chinese workers to produce their iPhones? What happens when a big cotton farm that used to employ 1500 workers to pick cotton replaces ALL of them with one worker driving a giant harvester factory combine? Revenue and profits go up for both Apple and the cotton farm, but does that count as increased GDP?

The workforce of the U.S. manufacturing industries has largely moved into the service industries – how exactly do you measure the GDP of service industries, and does this really count as growth? Service industries have largely replaced what people used to do themselves – taking care of their own yards, cooking their own dinners, making coffee for themselves, figuring out how to do their taxes themselves, or driving to the airport themselves instead of ubering. The lack of better paying jobs is what has driven these service industries first and foremost, I believe.

No doubt corporate profitability has increased, and probably that is what the GDP numbers are showing, but most of that money ends up in the hands of a few top end corporate executives and shareholders, not the average Americans.

There is no doubt that for some things, real prices have skyrocketed, while others have shown very low rates of inflation. Here’s what I’ve figured out:

1. Industries that have sent their manufacturing offshore with cheaper labor have had much lower inflation rates, and in many cases have been able to even improve the quality of their products – the electronics and computer industries would be the typical industry. Clothing and furniture manufacturing has also moved offshore, with similar low inflation rates.

2. Industries with very high levels of automation or other industrial style mass factory improvements have also had low inflation rates. This is where the farming industries have managed to keep inflation rates low. Pigs, chickens and cows are now all raised in mass industrial farms. Many farm products once picked by hand are now worked with giant machines that have replace hundreds or a thousands of workers. Factories in general that have remained in the U.S. now have large scale automation and far, far fewer workers than they did before.

3. Parts of the economy that have shown the highest inflation rates are those that have NOT been able to either offshore their labor costs or to automate, and thus have been unable to reduce their labor costs. The biggest examples would be the costs of the education and health industries, both of which have long risen much faster than the CPI, and both of which are labor intensive.

Remember, there’s GDP and there’s per-capita GDP. The US population grows at a rate of just under 1% every year. Population growth takes that economic pie and cuts it into more pieces. So if the pie doesn’t grow fast enough, the individual pieces get smaller.

Also remember that distorted wealth and income distribution makes the slices larger for a small percentage of the people, while the remainder have to make do with smaller slices.

Did you know that there are about 160 or companies listed on the First Section of the Tokyo Stock Exchange that have dividend yields of 3% or more?

If you expand that list to include all the securities markets for stock the number increases to about 265 companies.

For a yield of 2.5% the list has about 600 or so candidates.

Better value in Japan and a place where stock picking and analysis would go a long way to making a good return.

Just be aware of currency risk and the problem of the BOJ buying into certain types of shares and ignoring others.

Dunno – pensioners, widows and orphaned children, I’d guess.

DONG Energy famously issued 1000 year bonds, DONG was sold cheaply by the Danish State to Goldman Sachs, then sold off by GS for a 300% profit in “The Market” and name changed into “Oersted”; To disrupt Google searching – one assumes because one is a bad person.

They are still into issuing 1000 year bonds though:

Orsted, which sold its oil division earlier this year, plans to offer a hybrid note due in 3017 (it’s a 1,000-year bond) and a senior unsecured bond maturing in 2029, the company said in a statement Thursday. Both will be so-called green bonds, which means proceeds must be used to fund projects with positive environmental benefits.

…..

…..

…..

Moody’s Investors Service assigned Orsted’s new hybrids a Baa3 rating, which is the lowest investment grade, whereas S&P Global Ratings gave them a BB+, which is a step lower, the two rating firms said in separate statements.

https://www.bloomberg.com/news/articles/2017-11-16/orsted-will-sell-first-green-bonds-as-part-of-move-away-from-oil

If there is a market for bonds with a duration longer than the recorded lifetime of most European Countries, then there is a robust market for Anything with a yield :)

When Netflix decided to wade into the political arena, I canceled my subscription. Beyond that, Netflix was not worth the monthly subscription fee (nominal as it was), since most of their streams were old movies. Numerous free streaming sources will obviate the need for most to continue their subscriptions, pushing Netflix further into the red.

The way that buisness is being ran is nuts. But they have by far the best viewing interface and they capture good enoguh content regularly to make it one of a few streaming services worth keeping alive.

Hulu and Amazon are family shitty by comparison content wise in my humble opinion. But maybe that is because none of them are bleeding money to make everything like Netflix.

HBO is the only other streamer who I think generally has a high volume strong original content.

All of the above 4 are far better than being slaves to the dieing cabel companies.

It will be interesting to see how Netflix content looks after reality smacks them in face with their spending…

Speaking of the big three, Netflix, Hulu, and Amazon. I found the TV breakdown for our family is about 40% Chromecast/Youtube, 40% Hulu, 20% Netflix, and zero for Prime. Prime is gone and Netflix is close to going. Personally I don’t watch much TV as I actually find Wolf’s site more entertaining.

Once it pops no one could have it seen coming. All priced in, obviosly. They have these priceless Korean soap operas, with English close captions.

More debt, rising interest rates and an even higher junk yield. What could go wrong?

Nothing… Everything is rigged for a controlled blow… Just like 9-11.

i do have a bust-out theory i try not to think about, driven by ideology, go along get along acceptance and greed, but i try not to think about it, so i am going to stop thinking about it.

meanwhile, as long as subscriber growth …….but that’s not the real issue.

If the fed funds rate was 5% could Netflix exist? I’ve read that companies today are valued more on their distruptive potential rather than their actual ability to turn a profit. Using the aforementioned reasoning Netflix shares might triple in value.

This stock has taken short sellers out on stretchers for the last 5 years.

It reminds me so much of AOL’s stock from 1996-2000. AOL got so big that they ended up swallowing Time Warner. A total Disaster !

I would not be surprised if Netflix ends up acquiring Comcast or Disney or similar. A disaster waiting to happen.

Comcast may end up spinning Netflix off in 2022 in a $5 billion IPO.

I often ask myself why must it always be this way ?

I work in film. Netflix is supporting at least half the film/vfx industry in nyc, from looking at what projects most of my friends are working on. Of course nyc provides subsidies for tv/film so there’s that offset on production cost.

I’m considering cutting the “subscription cord” on it. Mostly because their new tittles are becoming very uninteresting personally.

If TV shows from the studio days made money on advertising during their peak popularity, and later stage from dvd sales. Considering the cost of making these projects isn’t exactly cheap, how is Netflix going to recoup the cost? My current Netflix account supports 5 separate people watching simultaneously in separate locations. How many subscribers are there out there for it to grow?

if Disney pulls most of their tittles off to start their own streaming service, that would be another blow.

I feel a little nervous for my fellow “compadres” who’s livelihood is tied to this company but on a realistic view, can it sustain?

Great insider view and insight. Thanks!

netflix is the new works progress administration. yay.

“At the time, it also disclosed that its “net income” as reported to investors is a mirage that likely turns into a loss when reported to the IRS. It said so indirectly when it explained with a reference to the new tax law that limits the deductibility of interest expenses: “The new limitation on deductibility of interest costs is not expected to affect us.”

In other words, that “net income” is just for show.”

———————————————————————————————-

What do you consider the company is manipulating in their income statement to show a growing profit over the past 3 years? Fudging the true revenue for instance?

They would need to be pulling some pretty fast accounting tricks to be showing a $559 million profit for the year to 31 Dec 2017 if in reality they are doing little better than ,say, break even or worse.

GAAP gives companies a lot of leeway when to recognize expenses. Netflix spends a lot of money on content — that’s why it has such a huge negative cash flow. So that money is getting spent. But it doesn’t account for this money as an expense. It accounts for it as an investment for now and it will become an expense in later years. There are legit reasons to do this (if you build a factory, the building and equipment are not accounted for as an expense but as an investment to be depreciated over time). But a service provider like Netflix that doesn’t build factories can take this to the extreme.

How much is a four-year-old show still worth? What kind of income does it still generate? That’s the kind of question that should drive how investment in content is accounted for.

I expect Netflix to announce a huge “non-cash” write-off in a few years in which Netflix will finally expense the old content that people aren’t watching anymore. Analysts will tell us to ignore it since it’s “not-cash.” But that money was cash, and contributed to the negative cash flow. It will simply be an acknowledgement that Netflix lied to investors for the past years about its content expenses. This kind of thing happens all the time.

The only thing I like on Netflix are documentaries (Making a Murderer, Wild Wild Country…). Everything else, they can keep it.

I am baffled at all the FANG stocks plus TSLA. There is no yield so how do investors pay their bills while waiting for the stocks to go up? There are a lot of pretty decent stocks paying yields of 4-6% and a person has a chance of capital gains. While the key always is being able to hold an investment through the ups a bd downs. But at least you’d have spending money while you wait. On a personal note I cancelled my Netflix account when they signed Obama to a deal and put Susan Rice on the board. Baffling!!

and yet according the the braintrust at Marketwatch Netflix is growing its profits at a “stunning rate”. Perhaps they forgot the negative sign.

I read a interesting factoid the other day. Steven Speilberg’s total career gross box office was $10 billion ( presumably inflation indexed). For the, arguably, most successful movie director in history this shows that movies, even blockbuster ones, are a relatively small bore business.

Of course Speilberg’s career began in the pre internet and nascent cable days of the 1970’s when movies were the only game in town. With the proliferation of channels and content ( much of it free) I am skeptical ‘original content’ productions can generate the kind of revenue they require to turn a profit.

The head of Discovery TV pointed out on CNBC that his networks ‘Reality TV’ based content only costs $400,000 per hour to produce whereas Netflix and Hollywood movie studios ‘original content’ productions cost $ 10 million per hour.

Netflix still has the option of selling banner ads on its content to increase its cash flow. I wouldn’t mind watching one ad per movie. They increased their pricing this year by $2 a month and that was enough to make us search out other options.

We got a Roku stick and it has turned out to be a good option. We only watch the free stuff and are recouping our investment rapidly.

This year we cut back from extended cable to basic cable. If I have to choose between Netflix and basic cable, cable will go next.

In January of 2000 Time Warner bought AOL for $162 Billion almost $25 Billion more than the current market cap of Netflix.

Oh you say it can’t happen?

Other way around: AOL bought Time Warner.

Netflix has expanded into an international market, so there may be growth in subscriptions abroad. Netflix has an association with RAI of Italy, for example, for original content, and Netflix has a large number of foreign films.

I kept our Netflix streaming subscription for a long time (after the DVDs were becoming unavailable or arriving in poor shape, and the streaming movie selection seemed to deteriorate in quality) for the kids, but now I love Netflix for the language flexibility. Only on Netflix can I, in the USA, watch a foreign language movie or TV show with closed captions in that language, which is fantastic for a foreign language student. The same movie or show on Kanopy, Amazon, or MHz has only English subtitles. (Tip: create a profile in the language in which you are interested so Netflix will make that subtitle language available to you; otherwise, you might find a movie using the audio and subtitle language search, but not be shown the option you want using the subtitle icon.)

I watch mostly foreign programming too. Hollywood is another industry circling the drain.

Anyone care to list few more companies besides Netflix and Tesla, that are loading on debt while being cash flow negative? I would like to watch them as a group.

Wouldn’t be surprised if Netflix has to raise their customer rates in 2018 and/or 2019. Leveraging your companies value to issue giant sums of low quality debt, in the hopes of investing that debt into shows that nobody may ever watch (on the Netflix platform), seems like juggling lit tiki torches at a gas station with leaky pumps.

I wonder, what is the rate of return is on the average dollar spent on content licensing? With competitors like Amazon expanding into the streaming media space and content providers demanding higher licensing fees (or simply taking their content off the service), how much more revenue can you expect from your content given a static membership fee?

What is Netflix’s competitive advantage? Lots of companies have money to throw around. Netflix doesn’t have any sort of brand, platform value, or captive audience. Once people hear there’s good content somewhere, they switch without any thought.

Netflix’s only advantage seems to be it’s willingness to absorb losses, and that advantage cannot be sustained in the long-term.

I use Netflix, but I also use Hulu and Sling. I have no loyalty to any of them. Netflix’s business model makes no sense. They are trying to buy a customer base by pricing product below cost, but don’t have the financial strength to keep it up. Plus, there are no platforms or hooks to keep the customers once you start raising prices to achieve profitability.

Amazon has a “platform” with tremendous value. Microsoft, Apple, Google, etc., also have platforms. Netflix does not.

I would quibble whit this: “Netflix doesn’t have any sort of brand…” Netflix has a big brand and in many countries near universal name recognition. People know what Netflix does, know how to find the website, and get the service if they want to. Netflix has a lot of other things that are valuable. Just not THAT valuable.

I agree whit’choo Wolf. In the same way Tide is “laundry detergent”, Netflix is Netflix, er, that thingie that you use to watch movies on your puter.

There’s nothing really better about Tide, it’s good detergent but so are many others. It’s just that Tide got in first with their name.

https://en.wikipedia.org/wiki/Tide_(brand)

Disney will pull their marvel and any future tittle off of Netflix when their streaming service starts.

Amazon selection to grow with their 1 billion dollar speculated investment into the Lord of the Rings universe (tv show).

Hulu has certain old tittles like Seindfeld/South Park and a better supply to recent tv shows. Starz has Black Sails. HOB has Game of Thrones.

Where does that leave Netflix?

Everyone is trying to make their very own “Game of Thrones” hit to lure new or retain costumers. Netflix’s “Marco Polo” attempt was a fail. It was a high quality show with a price tag of 1 million per episode, higher then GoT (from what i’ve heard) but that could be a lot of vendors willing do work on GoT at a loss for exposure.

Netflix desperately needs a real HIT and the competition is only becoming harder for them from my point of view. I would rate most of the Neflix work being done from a vfx vendor perspective as B tittles. Unless they’re aim is to provide filler content while HBO’s GOT is between seasons of course.

speculative: Obama’s UN Ambassador Susan Rice recently got nominated to their board. Wonder if they’ll start pouring churning polarising politically left leaning content.. Because its working really good for Hollywood lately =)

Tough industry to get a macroview into. The conventional TV has been replaced with smaller and larger versions. Watching the Superbowl on your wristwatch is as misplaced as watching a sitcom on a home theatre system. Two trends, one is moving away from entertainment to socially relevant media, and the second is media as environment. The entire visual media industry becomes one huge mood ring, a goldfish bowl to stare at. Thirdly the notion that golden age TV always becomes classic, runs out of appeal after the sequels to the sequels, and spinoffs exhaust the original content. Sure a lot of today’s content is crap (so was Gilligans Island?). Will viewers twenty years from now rediscover these Netflix originals, when there may be hundreds more? Its really about public mindset, rarity, and not content.

Looking at Netflix’s revenue of $11.692 billion vs. their supposed number of subscribers of 125 million, the revenue per subscriber is $93.

Given that minimum streaming cost is $8/month, this seems consistent.

I’d also point out that there is potential for pricing increases: Netflix competes primarily with cable services which are multiples of Netflix cost, so it seems there might be room for pricing increases.

Overall, it doesn’t seem like their share price is utterly ridiculous given that they’re still growing, still generating revenue per user, and have significant room to grow in the market.

This is very different than Tesla, for example, which has yet to prove it can sustain volume, pricing power, or anything except strong marketing.

The enormous burn is certainly an issue, but again the question is what the burn is coming from. If Netflix is expanding a successful model into new regions – i.e. outside of the US – it is understandable and likely temporary. If, on the other hand, the cost of Netflix to service its customers is much higher than its present pricing (cough, Uber & Tesla), a very different situation.

It isn’t clear that this is the case with Netflix.

Each to their own but come 6 PM all I want to do is tune in to CNN and MSNBC for the ongoing Circus. You can’t make up stuff like this. If some thing like West Wing had tried two years ago it would have been mocked off the air.

There is some serious tripe out there in supposed docu-land.

Ancient Aliens for one and Hunting Hitler for another.

I loved both those shows, more reality than CNN and MSNBC.

Don’t worry Reid, Jeff, and Tim, and Zuck, and the Google boys are gonna make sure you stay part of FAANG, because losing that N would be just utterly unthinkable.

And lest you think that those guys are the only ones who got your back, all the wall street bankers are behind you too, not to mention all the talking TV heads. FAANG forever. You know, because the BAT was already taken, and there is no F or N or G in BAT.

Now, as for the junk bond status, you can at least claim that you’re much

better than Tesla, all NFLX is selling is bytes, not actual machines. Besides, if things go side ways, there is always guys like Apple and Amazon who are desperate for content.

The american economy meanwhile has many of those money-burning valuation Titans. Really strange that these companies continually find investors and creditors.

Netflix is still a great deal for subscribers, and I’m not even thrilled with its original content. I also subscribe to Acorn TV ($4.99/month) to get my British accent fix, and Amazon. Since even non-franchise mid-budget movies aren’t worth the hassle and cost of going to a movie theater compared to the short wait to stream them, I appreciate my home entertainment options. My millennial children do too, and use Netflix a lot, although the kids have more barely-legal streaming strategies available.

It’s too bad Netflix is going bananas with the spending. Years ago they were showing up at indie movie festivals and paying massive amounts to acquire films that no one else was even bidding on. People in the industry were blown away by how feverishly Netflix hoovered up anything deemed artistic and socially relevant–exactly the opposite reaction of the studios. Then came all the original content, including a record-breaking budget for “The Crown.” These guys want to be entertainment moguls in the worst way, but that’s not going to be enough.

Netflix will slowly raise it’s prices to $19.99 over the next decade.

It will also start having banner ads for additional revenue eventually.

It has a huge name brand, esp internationally.

It will start buying companies and movie chains.

Netflix is a debt junkie company, yet it stumbles on. It’s funny everyone is mired in fascination watching it, like a juggler balancing on a wire between two towers. Yet I wouldn’t short Netflix or Tesla.

But what in God’s name happened to 3M today? That’s today’s apocalyptic headline.