Extraordinary home price inflation in all its beauty.

The S&P CoreLogic Case-Shiller National Home Price Index for August was released today. The not-seasonally-adjusted index jumped 6.1% year-over-year. Yesterday we learned that “real” disposable income for US consumers inched up only 1.2% in September over the 12-month period, and that on an individual basis — on a “per capita” basis — it edged up only 0.56%.

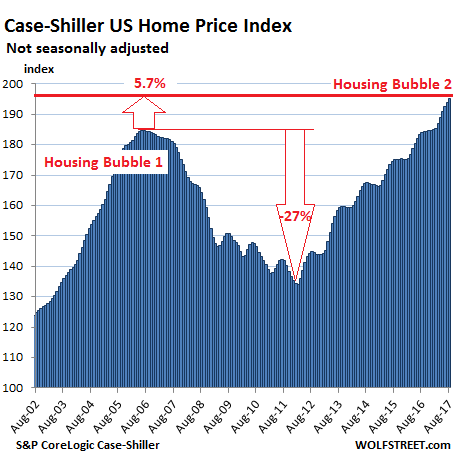

Home price increases have been outrunning disposable incomes for years. The Case-Shiller index has now surpassed by 5.7% the crazy peak in July 2006 of Housing Bubble 1:

Real estate prices are subject to local dynamics. But they’re also massively impacted by monetary policies, particularly in places where the money flows to, which creates local housing bubbles. When enough local bubbles occur simultaneously, it becomes a national housing bubble – as demonstrated in the chart above.

Below are the local housing bubbles of major metro areas in all their magnificent beauty:

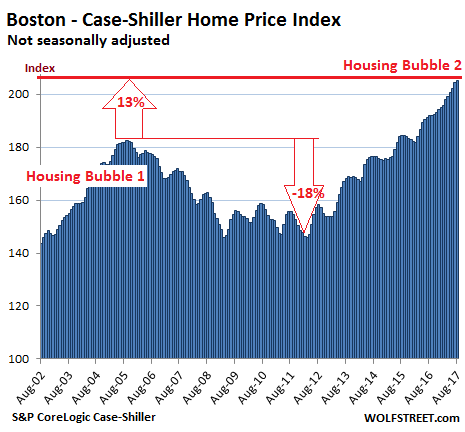

Boston:

The index for the Boston metro rose again on a monthly basis and has surged 6.9% year-over-year. During Housing Bubble 1, it soared a blistering 82% from January 2000 to October 2005, before the plunge set in. But after years of price surges, it is now 13% above the peak of Housing Bubble 1:

The Case-Shiller Index is based on a rolling-three month average; today’s release was for June, July, and August data. Instead of median prices, the index uses “home price sales pairs,” for instance, a house sold in 2011 and then again in 2017. Algorithms adjust this price movement and incorporate other factors. The index was set at 100 for January 2000. An index value of 200 means prices have jumped 100%.

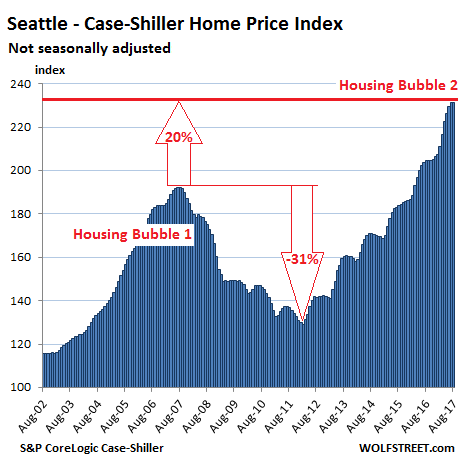

Seattle:

The index for home prices in the Seattle metro was flat on a month-to-month basis, after having spiked since the spring of 2016. First sign of a let-up? Maybe not. The index is not seasonally adjusted, and a flat spot this time of the year is not atypical. The index has spiked a breath-taking 13% year over year and is now 20.4% above the peak of Housing Bubble 1 (July 2007):

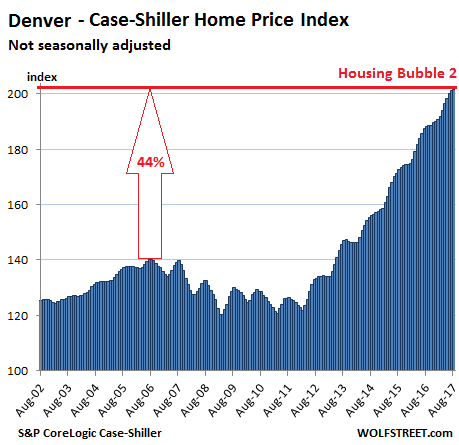

Denver:

The index for the Denver metro notched up another monthly gain and is up 7.2% year-over-year. It has now surged 44% above the prior peak in the summer of 2006. When Housing Bubble 1 was blooming in many big markets, home prices in Denver were rising but not exploding, gaining about 12% in four years, and people felt left out. But in 2012, all heck broke loose with Housing Bubble 2:

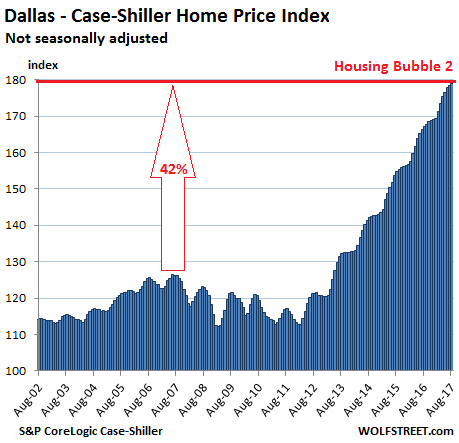

Dallas-Fort Worth:

The index for the Dallas-Fort Worth metro ticked up again on its relentless march higher. It’s up 7.1% year-over-year and 42% from the prior peak in the summer of 2007. Like the folks in Denver, homeowners in North Texas felt left out during Housing Bubble 1, when prices rose “only” 13% in five years, and a sense of unwelcome housing sanity prevailed:

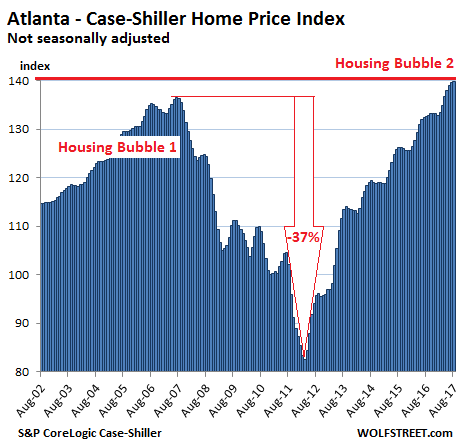

Atlanta:

Home prices rose 5.4% year-over-year and are now 2.5% above the peak of Housing Bubble 1. From that peak, the index plunged 37%. It’s now up 70% since February 2012:

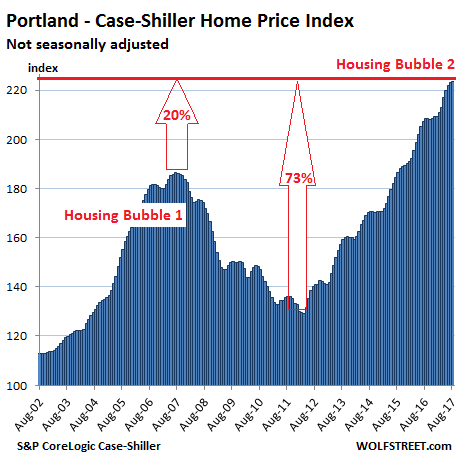

Portland:

Home prices rose again on a monthly basis and are up 7.2% year-over-year. Prices have soared 73% in five years and are 20% above the crazy peak of Housing Bubble 1, having ballooned 123% in 17 years:

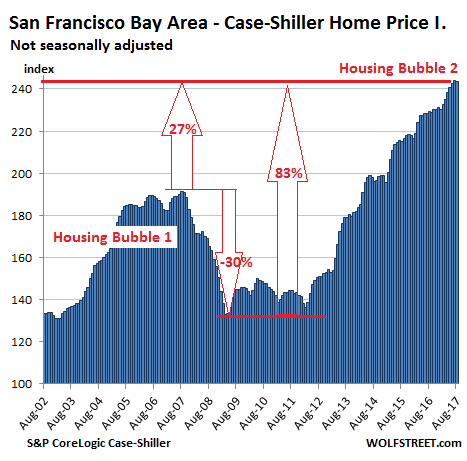

San Francisco:

The index, which covers five counties of the Bay Area and not just San Francisco, actually — I mean, wow — inched down for the month. Sign of things to come? As in Seattle, monthly declines this time of the year are not uncommon. And the index remains up 6.7% year-over-year.

Case-Shiller also offers a “High Tier” index (not pictured) for the area, which tanked 43% during the housing bust but has now surged past the prior peak. The index dropped nearly 1% from last month, but remains 11% above its peak during Housing Bubble 1.

The overall index (chart below) is now 27% above the crazy peak of Housing Bubble 1, and is up 83% from the end of the housing bust, when the liquidity from global monetary experimentation washed ashore in the Bay Area:

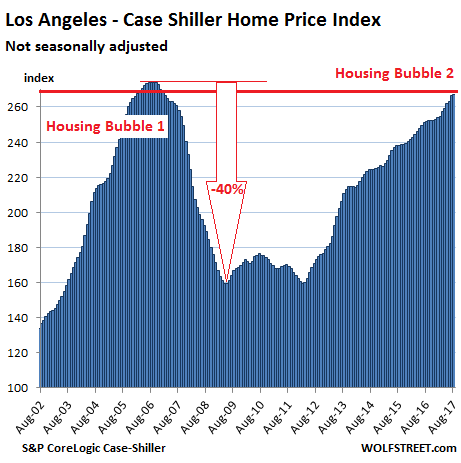

Los Angeles:

The index rose again for the month and is up 6% year-over-year. In terms of Housing Bubble 1, few cities can hold a candle to LA’s beautiful sugar loaf, where home prices skyrocketed 174% from January 2000 to July 2006, before giving up much of it. Though the index has soared at a dizzying rate since the bust, it’s still not quite back at the insane peak of July 2006, but getting closer, just 2.5% shy of taking out that record:

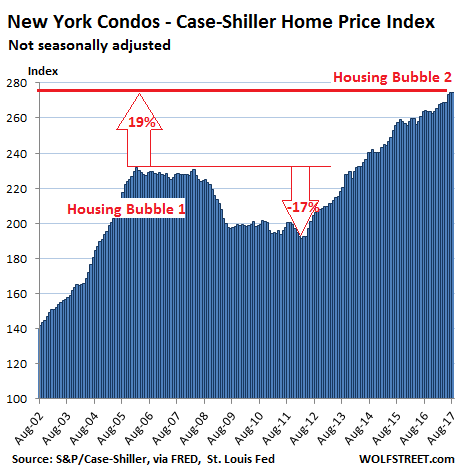

New York City Condos:

So the condo bubble in New York City is taking a breather: The index edged down for the month! But it remains up 3.9% year-over-year amid signs the condo market in Manhattan is running out of steam. Note that the index skyrocketed 131% from 2000 to February 2006. That was Housing Bubble 1. It barely deflated before the Fed’s flood of money inundated Wall Street. The index is 19% above the peak of Condo Bubble 1 and has soared 175% over the past 17 years:

This is what asset price inflation looks like. A property whose price increases by 50% in five years isn’t 50% bigger than it was before. Instead, the value of the dollar with regards to assets has gotten crushed under the Fed’s policies of QE and ZIRP. These policies produced no wage inflation, moderate consumer price inflation, and extraordinary asset price inflation.

In other words, labor has gotten shafted and now working people struggle mightily to buy or rent housing with the fruits of their labor — hence the “affordability crisis” — while asset holders have gotten the spoils. This is not a prescription for a healthy economy.

Yet the term “housing bubble” to describe the housing market that peaked in 2006 and imploded afterwards with global effects is getting expunged from the national vocabulary. The idea currently being propagated is that years of asset price inflation have “healed” the housing market and that the crazy peak of Housing Bubble 1 is the new normal base for future asset price inflation or something.

This confirms what many Americans feel in their wallets. Read… The Bitter Irony about Today’s “Real Disposable Income”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I do not see how this is not breaking the back of the average individual living in the bubble cities. When will this end?

It is…I live in Boston and I’m a millennial. The difference is I’m smart enough to leave, and I will soon before buying any real estate.

It is….I live in Boston, although I’ll leave long before I buy real estate here. I know people who basically live paycheck to paycheck just to have a crap house and a 2 hour commute…not the life I want to live

I’m a lowly engineer from the Seattle area who was making little more than 90k/year. I finally threw in the towel on Seattle, after 25 years, when the rent on my modest studio apartment was raised to half my take-home pay.

No longer able to live near my employer I was put on part time status (no benefits) so my taxes have been raised by the ACA penalty. To reduce expenses for a few years I’ve moved around and stayed with relatives, now I discover Equifax gave out my personal info and destroyed my “credit” so I’m basically barred from renting an apartment (or even finding another job).

I managed to save around 900k over my career (despite the wild stock market), I can’t invest this money because, as Bernanke stated years ago, the Fed has inflated assets so people will feel wealthy. For years I hoped the central bankers would stop the insanity and the market would correct to a sane level that could be invested in, now it seems they will never let the market return to normal. I’m losing about $600/week to inflation, do I jump back into a market that has been inflated to 1.40 x GDP or keep getting crushed by inflation? (the devil or the deep blue see).

I’m planning to move to Mexico or Colombia, to save on living expenses, and return after the 900k is gone (destroyed by inflation and zero investment return). When I return broke the Fed and the government will either take care of me or I will starve/freeze. Perhaps I can shoplift, get caught and be taken care of by the prison system.

You have win my respect. Through the FED, the debtors and rent seekers would suck you dry slowly. If you resists and party like them, you will end up in an overdose. Organ damage guaranteed if NOT death.

There is NO middle road. Money decays responsible savers into oblivion.

I have been thinking how dumb those “occupy wall streeters” are back several years ago. It should have been “occupy the fed”.

The I realized it will never gain momentum since the nation is infested with debtors and they side with the FED.

Move your investments into gold or silver coins. It’s an inflation hedge. It’s universally real money. It’s transportable. Move to Mexico. See what the future brings.

Agreed. Gold and silver are inherently undervalued now.

The fact that gold is in a bear market simply means that the money printers are winning at the moment. When gold starts to move up again, it will signal they are losing control.

When / if gold resets as fully backing the dollar like it did in 1980, gold holders will finally be fully rewarded for their patience.

900k in wages saved. That must have taken some sacrifice. Well done!

Move to the southeast, take 500k, put 50k down on 10 150k rental homes. Mortgage Payment is 550 per month, rent is 1100 to 1200 per month. Minimum safe Income per unit is 300/mo, 36k/yr. Roll this back in and payoff a few properties in 5 years. Then sit back and relax/retire on 60k per year income plus part time work.

I’ve tried leaving California and invariably the income to rent ratio is much worse. I always come back. it’s always been cheapest for me to live in coastal California.

You can live forever in Colombia on 900k. The minimum salary there is 500k pesos a month. A modest 2% return on your savings gets you $18k a year, which at the current exchange rate is 54 million pesos per year or nearly 5 million per month. Buy a house down there and get an investor’s visa and live the good life. Even with 0% returns spending $20k a year and buying a house for $60k, your money will last you for 42 years.

MattP: What locations do you recco in Colombia? I’ve been to various South American countries, personally experiencing some scary stuff in my brief two week stays. And I’ve heard lots of scary stories from locals, other tourists, and from simply watching the nightly news in Brazil. Scary = life threatening.

Down that way I’ve been to Brazil, Argentina, Ecuador, Peru.

Hedge with a small amount of Bitcoin

Buy physical gold to beat inflation over the long run. Plus removing some cash from the bank won’t allow them to leverage it.

BCS, Mexico is a beautiful place to go. I’m from Seattle as well and got out before it went crazy. I have a place there and could easily live the rest of my life there with 900K while eating out for every meal, including lobster and steak 3 or 4 times a week, drinking as much as you like and spending a lot of time at the beach. Contrary to what others are going to post about Mexico under this, it is extremely safe and there are great people there both local and expat. You will have real conversations with lively people every day. You should check it out.

JD: Where in Mexico is “extremely safe”? And what makes it extremely safe?

It ends when the gov’t removes the subsidies on the bond market and lets interests rise. A very mild 1% increase in rates at this low a level has a very outsized affect on the income necessary to QUALIFY for a mortgage (using normalized risk metrics). This is why you are hearing stories about the banks and FANNIE MAE further lowering (already ridiculously poor) loan standards and possibly raising lending limits on “qualifying” loans….they are further destroying the risk metrics because there IS NO ESCAPE from massive pain at these debt levels.

And it will end quite BADLY for anyone with an adjustable rate mortgage without a limiter on the how far and fast the adjustable rate can rise….but these are the only the earliest warning consumers. The actual early warning is the slowdown in actual closings…which we are already seeing. This slowdown is due to people not being able to qualify…and sellers unwilling to lower prices (especially after being told that housing prices are increasing dramatically by the press over the past three years).

Those with fixed mortgages will be fine until they need to sell…..which is typically triggered by a life change (new or lost job, kids, medical bills) which is avoidable in some (but not other) instances.

Since government has the lever and it’s self serving, the answer is never? No doubt interest rate will increase. The answer is will it increase enough?

I live just north of Seattle.. The back of the average person was broken a long time ago with couples doubling up or moving out.. Seattle looks like a convention of cranes standing hip deep but It’s not just that city.. From Everett in the north to the far south and all of the Eastside are covered in construction cranes building high-risers, condos and apts., that few can afford.. Amazon is taking the lion’s share of the blame and that’s understandable when retail, downtowns, and malls are dying all over the country, replaced by e-commerce. The boom in Seattle is because the lifeblood of everywhere USA has had the life sucked out of it.. The working class in the next city to get the new Amazon HQ has little idea what’s in store for them..

I was looking at homes in Seattle last weekend. Saw four new townhouses in the Central District/north Beacon Hill – not the nicest areas, but gentrifying quickly. A 1400-1800 sq ft box house on three floors with 1 car garage runs about ~$800k. Trendier neighborhoods just to the north, the same unit runs about ~$1M. There was no shortage of interest at the two units having open houses that afternoon – four or five other couples were there when we were.

When you do the math, a mortgage for $3000-3200/month still isn’t bad when renting something comparable costs about the same or more, and there’s no beneficial tax treatment. From what I can gather, there’s no shortage of DINK couples making $200k+ in Seattle, the shortage is in decent homes. Unfortunately, I except prices to continue to run up, supply << demand.

My young daughter is a lobbyist in Chicago with a lawyer husband, no kids yet.. I showed them Queen Anne where the cheapest tiny little bungalow was over $2mil.. The nice ones were many times over that.. My last house was in Lake Stevens with a near $3000 mortgage but that was because interest rates were much higher back then.. Rising interest rates and if the GOP tax plan of eliminating mortgage from taxable income passes (about as much chance as a snowball in July) that will kill the market in many places but with Seattle sucking what was once retail sales from everywhere USA into the Amazon maw, I’m not sure what will happen here.. By the way, the Central is a decent place to live.. I made many friends on a voter drive in that area.. Good luck to you on finding a nice home..

It is … trust me ! ( I’m in Denver )

Fact is Denver is short on teachers , nurses , tradesmen , health care etc not to mention almost every business unable to fill positions because our loverly little bubble of epic proportions is breaking the backs of the average man and woman

Denver housing prices and rents, in sheer dollar amounts, may look like a bargain when compared to say Silicon Valley or Manhattan.

However, when Denver wages are factored it certainly looks like a bubble–there is a major mismatch between wages and the cost of living–and something hasn’t been adding up for the last 4-5 years.

An average individual should live in an average city. Why would you want to live in a winner’s city? I live in Hong Kong and love the city, full of successfull, ambitious people. But it is not for everyone.

So you’re above average – a winner – is what was left unsaid in your post.

Just to stay clear, there are at least two Mary’s. This one lives in Pasadena. Gotta say Hong Kong sounds a lot more glamorous. Want to trade places?

Hi Mary, could you please add some letters or numbers to “Mary” next time you comment in order to distinguish it from the other Mary(s) here. Thank you.

Someone’s living a bubble. Perhaps you should be asking questions such as “am I a winner because other people are average?” If everyone’s a winner, how can you be one? By that definition alone there has to be average people in Hong Kong.

I know. I’ve visited Hong Kong many times, and my relatives there are just average people. The winners work at Central, party at Lan Kwai Fong and live at the Peak/Repulse Bay, but that’s probably 0.1% of the population.

“Life is hard in Hong Kong, especially if you’re making the average salary of $2,700. Renting a 1-bedroom apartment will cost you $1,400 to $2,200. With numbers that high, a person will most likely spend 50.4% of their income on rent.”

Comments / elucidation, please, HK Mary.

https://www.weetas.com/article/rent-income-ratio-17-major-cities/

While some backs are indeed being broken, low rates provide affordability, Michael.

Mortgage payments in a foot race with auto loan payments and skyrocketing health insurance premiums. One will come up gasping for air.

I already am occasionally.

I think there is a significant difference in the two “bubbles”. The runup to ’08 included many more starter houses as well as more expensive tract houses in the suburbs (at least in Charlotte where I lived). The current runup does not include this set but involves mainly in-town/desireable neighborhoods. And, because supply is constrained (no land and Boomers unwilling to sell), the prices have inflated more. We sold our house in June. A recently married couple in their early 30’s bought it. They had 200K in equity from somewhere so were able to manage the remaining 300K+ mortgage. They both work but have what I would term as fluffy jobs (jobs that could go away pretty quickly in a downturn).

Therefore, I think this run up in prices is a different animal. I think it has risks for sure; but not the same as the first one. As I’ve posted before, if we see a national recession, there will some housing pain, but I’m not sure we’ll see the crash of ’08/’09.

Don’t get me wrong on this though. I do not like this level of housing prices. It hurts the average person. But this is a result of financializing housing; something Clinton initiated while in office.

If they have fluffy jobs and are only in their early 30’s, their parent(s) most likely gave them that 200K.

Yves from NakedCapitalism also pointed out that “this rally isn’t fueled mainly by money borrowed from banks”. So looks like this bubble both real estate and stock are the safe kind. No damage to the economy if either/both pops.

It won’t end. If interest rates rise, mortgages become more expensive and home buyers pull back then foreigners will step in to fill the gap with all cash purchases.

It ended abruptly in 2008 when prices fell 45% here in the bay area. I anticipate the current decline to exceed 75% or greater.

This pertains to Bay Area.

I have heard from various commuters how the traffic is now thinning in various parts of east bay. Not a statistical observation, yet. I know a few companies that are laying off contractors/consultants in regular batches. I know people who are looking for new jobs and there’s a certain kind of desperation in job search. They are expecting more layoffs.

These people are your potential buyers, so we have to wait and see.

Yes housing prices in the bay area fell 45% the last minor correction. This time? Expect nothing less than a 75% decline.

The only money that is more jittery than that of domestic buyers is the money of foreign buyers. Don’t think foreigners will be stampeding to buy the dip. They’ll be the first ones listing and aggressively price-cutting their current holdings. Foreign money is hot on the way in, hotter on the way out.

Even at the current bubble prices, not many existing homes are being sold, and not many new homes are being built. This of course raises rents. So either way, more and more “disposable” income is being funneled into real estate, and eventually into other assets, raising other asset prices.

If this trend continues long enough, with consumers deeply in debt, the economy grinds to a halt, asset prices fall, and more QE will be required, and the cycle will repeat.

https://fred.stlouisfed.org/series/HSN1F

https://tradingeconomics.com/united-states/existing-home-sales

Click on MAX in the 2nd URL.

I don’t see what is to keep this from going on indefinitely. The FED has found a way to “print” (digitally generate) enormous amounts of money without causing “general” inflation by restricting the distribution to a small percentage of the population. So the people getting the money can bid up these assets ad infinitum. And since the average American doesn’t seem that unhappy about getting poorer, I don’t see why this can’t go on for quite a while.

If printing money will make a nation wealthy, Zimbabwe has already been switzerland. Money pringting destroys so much sound business that you can feel the decay around you. The time will come when people ask Amazon and Tessa and the unicorns to generate profit and then it suddenly becomes all the traditional businesses they have destroyed. This is wealth transfer and capital destruction. It will stop once enough has been destroyed. US is a rich country, it will take a while.

I agree. But Zimbabwe didn’t limit the distribution of the printed money to a small percentage of the population and suffered from the inflationary results. In the US corporations don’t need to “make” money any more. Many (most?) exist solely as a medium to bet on, kind of like race horses, and have little intrinsic value as business enterprises. I think this will go on until some black swan event that can’t be controlled occurs. Until then the money will be printed (digitally mostly as balances in computers) and absorbed by an increasingly wealthy small percentage of the population. It is financial nirvana.

Don’t know what you’re smoking, but save some for the rest of us.

Care to give us a few examples of non-.com companies that don’t have to make money to survive?

Take highly profitable Apple, Google, Microsoft,eBay, Amazon and Facebook out of the equation, and even the .com “live on OPM” pool is considerably smaller…

In order to live without making money, you have to be the hype, the new. The “new taxi” the “new hotel” the “new juice”, “new car”,”mars is the new moon”, “the new retail”, “new DVD,hollywood”, the “new ad”, the “new oil (frackers). I am a supporter of “destructive creation” as long as the disruptive company is based on sound money. This round of “new” things are based on unsound money, they pooled zero rate money from all kinds of channels and killed existing business because they are new and they can exist without making money. These are places like silicon valley, seattle and the frackers. that’s where the houses bubble are. For other industries that are NOT disrupted by these “new” ones, they do NOT attract zero rate money, so they have to make money to live.

Since companies do NOT need to make money, the product gets cheap. CPI is low and FED keeps printing.

There are ligitimate game changers, but the zero rate did cultivate lots of unsound businesses such as the the dead unicorns, the “jaw bone”, the “‘miss fit” the “juicero”. You will know the true nature of Tesla, Net flix, maybe Amazon for the years to come. By the way, the consumer espionage companies like the google and facebook will provide evidence in court when you are sued. One day, you will wish for the demises of them.

The true techs such as Aerospace, Semiconductors have the ultimate power. The Chinese has all the FANG tech, and they have yet to come up with an Intel CPU that exists for decades.

So true.

Amazon’s gross margins were -&5.2 billion, if I recall correctly. Didn’t here that in cnbc or Bloomberg

“The FED has found a way to “print” (digitally generate) enormous amounts of money without causing “general” inflation by restricting the distribution to a small percentage of the population.”

I agree with you on this. Between ZIRP and QE around the world, enormous amounts of money is going to the asset class and corporations but not working people. Assets prices are skyrocketing, because of the more money, and some here and elsewhere (like Yves at Naked Capitlism) note that many of the warning signs seen in 2008 crash are not happening…yet. So, like you, I’m wondering if I am missing something? Is it possible this really can go on and on for a very much time longer? To borrow the catch line…Is this time really different?…LOL. I wish I had the answers but fact is I feel I missing them and still looking.

“without causing “general” inflation”

WHY CAN’T I LIVE ON YOUR PLANET???? WHY AM I THE ONLY ONE BEING LEFT BEHIND IN THIS INSANITY??????

MASSIVE, MASSIVE, INFLATION IS ALL AROUND ME, FOOD, HOUSING, HEALTH CARE……EVERYTHING IS GOING UP AT A RECORD PACE AND YET I READ THE ABOVE?????????????????????

I just wish the world would blow up.

Nothing surprising about Seattle. Just look at Amazon’s stock price and Microsoft’s. Add in Chinese buyers and what’s surprising is why housing prices are not up even more.

Maybe so but Seattle has become an awful place to live. Affluent people drive everywhere (they even drive places to go for a walk) so the traffic has gotten insane, speed limits are not enforced and the noise from all the cars thundering down the wet streets is really terrible. And those expensive houses are not in good shape, you can expect 1) cheaply built poor quality houses, built for low pay mill workers, without insulation, with leaky masonry, out of control dampness and mold/mildew 2) deferred maintenance requiring 100’s of thousands in repair and remodel 3) the noise of traffic thundering past at all hours 4) rude, creepy, introverted neighbors who let their yards grow into blackberry jungles 5) Nearby tent cities for housing your local barista and grocery worker 6) ugly, ugly, ugly – you will be surrounded by lots of ugly – there are all of two trees in all of Ballard (I know because I planted them).

Ha ! Van. Brilliant. I am guessing you have not lived in Ballard long… Those Mill houses (craftsman) were built pretty darn well, for the most part. I see a lot of Seattle comments in this thread. Sad to see a city (s) die in short order due to FED policy. May we all live to see the correction and lets hope we can make it through the inevitable s**t storm..

VDBR

At the risk of appearing to kick a guy who says he is down, here’s a link to bunches (>>2) of trees on the main drag of Ballard (https://en.wikipedia.org/wiki/Ballard_Avenue_Historic_District#/media/File:Ballard_Ave_11.jpg). The Wikipedia link has several pictures with more trees.

Im also struggling with your previous statement about a studio apt exceeding 50% of your take-home. At $90k/year, I estimate taxes (inc SS) at 25%, for a take-home of $68k, or $5,700/mo; 50% of that = $2850. Ballard studios on Apartments.co (https://www.apartments.com/ballard-seattle-wa/studios/?bb=1w-y3wlquQ1-k18G) rent for $1500-1900/month.

I hate to say I’m not buying the story…but

Chip your assumptions are reasonable but don’t take into account my particular situation (for instance subtract 24k right off the top to languish in my 401k). Your rent figures are in the ballpark, I was paying around 22k/year (it was 795/month when I moved in and rent has been raised relentlessly ever since). Prior to leaving my full time position my take home pay was a smidge under 47k so I rounded up (but not by much). In general it’s probably wise to be skeptical of posts on the internet, but my situation, as I laid it out, is real (but I rounded up savings as well – actual about 881k with about 300k of that in 401k). I’ve pretty much stopped playing the game now (but still going part time for now), it was a project oriented job and there was always the fear of something going wrong and getting canned – I’m one of the few survivors to have lasted – the compensation of being able to just survive was no longer worth it. I’m relatively sure anything I put into savings from here will be inflated away before I get around to spending it and I don’t see a lot of good investment opportunities. So that’s check-mate for me, I lost and I will be the first to admit many others won the game – good for them – but I have to live my life (which looks like it will be in Mexico until the value of my savings is inflated away). Your response was thoughtful, I wish you well.

Your last point about “the new normal” is a powerful and insightful one. Just as Trump voters hanker for the working class purchasing power of a bygone era, Clinton voters dream of their home prices rising ad infinitum. Both are totally delusional. The modern political economy cannot sustain either. How we are going to respond as a society when neither dream is attainable is really going to be scary.

I assume these are nominal, and not real number?

Nominal, not adjusted for inflation.

The Fed’s preferred PCE inflation index rose 15% over the past 10 years. So you can take that off the top. For example, adjusted for the Fed’s preferred inflation measure, national house prices would be about 10% below the crazy peak that blew everything up. And in most cities on the list, the price surge since the peak of the last bubble far exceeds that 15% inflation measure. So yes, even on an inflation-adjusted basis, these prices are just as nuts and in many cases more nuts than they were during the peak of Housing Bubble 1.

The Fed and govt will NEVER let housing collapse. NEVER.

Of course not. It’s different this time.

No, Jon is right. The Fed and Govt won’t. But we know something WILL happen although no one knows WHEN that will be that will eventually cause the whole market to tumble. That’s the bit that’s different this time.

Unless you can think of a time in past history when central banks printed so much money that lenders had to pay borrowers to borrow the money, then I would say something is, in fact, is different this time.

In the past individual nations have printed money to default on debt but it has never happened in every nation everywhere around the globe at the same time. The world has never been awash in a flood of currency as it is today. Cash is trash – how do you even value an asset anymore.

Argentina (Argentina!!!! – the queen of defaults) issued 100 year bonds (100 years!!!!!) and the auction was 3.5 times over prescribed. Strong demand for 100 year Argentina bonds!!!!! You had better bet something is different this time. Central banks will let their currencies collapse long before they let assets collapse. Rich people don’t care because they own everything – they will be fine when central banks try to start all over again with new currencies (and why not, it seems to work for Argentina).

The currencies have already collapsed in relationship to asset prices. That’s what asset price inflation means :-]

VDBR

Another way of looking at Argentina 100 year bonds:

Best I can find is they pay around 8%…if Argentina didn’t default for 18 years, you’d have earned enough interest to recoup your initial investment + a 4% annual return. I’m not a bond-guy, so my numbers may be a little off, but that’s the basic idea of why there was so much demand.

And you are correct: it’s crazy.

It’s debt not cash. What happens to cash when all the debt implodes?

It will, once insiders finish dropping their shit to the latest fool. Then everything will crash and they will buy it at pennies on the $.

You just have to see how the hype machine is trying to lure small investors into cryptotulips, faang stocks and the like while execs sell their shares take the money and run.

Stupid money in, “smart” (insider) money out.

Like most here, I worry about what is to come when the “everything bubble” bursts. But before it does, let me offer one piece of advice: take a look around. Breath in the exuberance. Marvel at the construction and euphoria. If you were transported back to the Roaring 20’s, why not visit a speakeasy, even knowing the 30’s were coming?

You can’t stop the future. It’s already barreling towards you at a speed you barely comprehend. Better still, it’s totally self driving!!!

In a world where ‘a rolling loan gathers no loss’ and ‘mark to model’ accounting and CB financial repression rule, the crash point is political. The mark to model situation really is ‘different this time’ as it dates from March ’09.

Rates can not go up and stay up. It is that simple. Japan has shown that once the ZIRP is begun, it is like quicksand and there is no escape (a few false dawns, but no escape). The economy will plod along under ever increasing levels of debt for decades yet.

If the Fed keeps raising the rate gradually and maintains the asset sale schedule, there will be a harsh reversal at some point in stocks, bonds, and RE.

Holders of long term debt must realize that interest rates ARE going to increase, if only to alleviate risks of financial instability currently in the system.

Once they increase, and things start to go down the Fed will quickly decrease rates back down and probably even farther. Mortgage rates will hit 0 before they hit 6%. The Fed will defend AT ALL COSTS.

The Fed didn’t last time. It raised rates! It went into hyper-drive ZIRP and QE only when the banks began to topple. If the banks don’t topple, the Fed might not really care what happens to home prices. If you think the Fed has the homeowner’s back, you misunderstand whom the Fed represents.

Yes but now the Fed knows what to do, and housing is very important to the economy in many many ways esp consumer spending.

Wolf,

I’m not sure I can agree with this argument. At the end of the day, the major banks still make most of their money off of mortgage interest and fees. The traders aren’t very good at their jobs or profitable once you factor in their salaries and bonuses.

If housing collapses, that means defaults, right? And that means interest not being paid. Are you saying that because Fannie and Freddie would make them whole that they can’t ‘begin to topple’?

Wilbur58,

A big part of the mortgages are insured by the Government Sponsored Enterprises (Fannie Mae, etc.) that arranged them into mortgage backed securities. So credit risk on those mortgages is largely with taxpayers.

Another pile of mortgages is not insured by the GSEs but rolled into mortgage-backed securities that are spread around the world, so credit risk for the US banks that arranged them is relatively small on those mortgages.

Sure there will be losses. But after years of ZIRP and saver-pilfering, banks have a larger amount of capital than they use to and can take some big losses.

I don’t see a sudden crash in home prices (the last housing bust took four years on the way down). But if home prices decline gradually, which I think is the more likely scenario, the biggest banks that the Fed would be worried about will barely catch a cold, though they might have to cut their dividends and stop buying back their own shares for a few years, and their shares would suck, but hey, that’s part of the deal.

Interest rates will Never increase:

Exhibit A) Government deficits would explode

Exhibit B) Bank balance sheets would crater

Exhibit C) The bond market would collapse

Exhibit D) Collapsing bond market would crush other inflated assets

Exhibit E) Pension funds would get destroyed

Exhibit F) Household assets would drop and people would feel less wealthy

Central banks would never allow even one of the above catastrophes to occur much less all of them. Therefore central banks will continue to print until currencies are worthless. If they stopped printing interest rates would go up and the central bank world would implode. Buy any asset you can get your hands on, regardless of the price, and dump any and all currency – currencies are all going to zero. Owning an onion field outside Bakersfield is better than owning a bunch of worthless electronic Federal Reserve tokens (about as valuable as ski-ball tokens from an amusement park arcade).

“Interest rates will Never increase:” Well, the Fed has already raised its target range by a full percentage point and is going to raise it more. Short-term Treasury yields have risen over a full percentage point from their lows (which was near zero). Even long-term yields have come up from their lows.

BTW, you’re wrong about “Exhibit E) Pension funds would get destroyed” – pension funds hold bonds to maturity. They’re not hedge funds. They don’t benefit from dropping yields and rising bond prices because they don’t sell bonds. They let them mature. And when bonds mature, holders get paid face value. Everything else is a temporary illusion. Pension funds only benefit from higher yields. Pension funds are desperate for higher yields.

He probably meant increase to a historically normal number haha. Like fed funds rate of 4-5ish

Wolf, I appreciate your reply and your optimism. I hope you’re correct and the Fed raises rates or even allows a level not dictated but instead determined by the market – I lack your optimism and don’t see it happening. I believe the Fed will maintain a rate between 0% (or negative) and 1.5%, they will say the economy is doing just peachy but they need to wait and see what the future data shows (after all we don’t want it to be 1937 all over again!). They believe they can play that game for decades in the hope that the dollar continues its smooth glide to zero instead of a sudden panic that brings about a crash – I don’t think it will work. I’m a regular guy (I don’t believe in aliens, wear tinfoil hats, I’m not prepping for the collapse, hoarding food or water, I don’t believe conspiracies) and I’m starting to panic, I think inflationary default is the only possible outcome – how long before other regular guys start to panic as well. Fiat currency is a confidence scheme that works well as long as people have confidence but as soon as confidence is gone it’s game over. I think the confidence is starting to fray. Thank-you for the fascinating (and free) articles I have enjoyed for years – and again I hope you’re correct.

regarding exhibit E) it’s my understanding pension funds are under pressure to chase yields in their bond portfolios to achieve 4% bond returns (to achieve a long term blended return of 7%). My assumption is a fair percent of those bonds are not solid treasuries and would default (at least partially) if interest rates went up. If parts of their bond portfolio start to default they will get hit. European corporate junk bonds are yielding 2.1% to achieve 4% bond returns I’m assuming they have some junk laying around (Argentine century bonds yielding 8% anyone – I’m guessing those will default before maturity if yields start to increase). Perhaps none of my assumptions are correct, but they are my assumptions and they lead me to the conclusion rates will never rise. I’ll admit I could be wrong (maybe pensions can’t even hold junk – but then how are they achieving 4%).

How long do you have to hold on to an investment at 8% to double your money. What, eight years? Everything after that is gravy

Maybe I’m used to Canadian inflated prices over the last 15 yrs, but the average price of a house at 200-250K US in my mind is still cheap. 1/4 of the cost is the land (say 50k), then building materials, 100-150k (kitchen alone easily 20k), and labour another 50k. Most people spend more money in their lifetime on cars than their home. Maybe there are too many regional differences that skew the data.

Where in Ontario are lots 50k? The big city bubbles are getting way more than that for the land, plus tax on top.

I have a friend who builds outside of Calgary, a much smaller bubble than Toronto and for his new home he paid 200k to get the lot and permits. His material costs and labour have to go on top of that. You may find a 50k lot in a more rural location, but the dangerous housing bubbles don’t come from rural cities of 5000 people.

Btw Wolf, I thoroughly enjoying spending time everyday checking out the latest posts, and greatly appreciate all of the hard work. Yes, I’ll glad contribute a yearly donations to help the website run. (As per the donations tab) It may not be much but every little bit helps. Cheers!

THANK YOU!!!

I grew up in Seattle. Hubs a former software engineer, and I bailed on Seattle last winter. Sold the Seattle house. Made nice scratch. Moved out to the Olympic peninsula. Paid cash for the house. No mortgage. No car payment. No debt . I sleep well at night. Sad to see the state of Seattle. A traffic nightmare I miss it not

The Seattle I used to know….. sigh

The downside. Too many Californians have discovered it up here in the outback ….crap

Will someone please just wake me up if the pin ever meets the bubble? Thanks.

Yes, I know it seems stupid… but I still like cash at the present time.

It’s already happening in the rental market :-]

the zero interest rate nirvana for the housing sector seems to be a big mouse trap. Interest plus amortization for a flat or a house are only two thirds of the past – but the 30-year mortgage is now higher at 3.94% compared to 3.41% in Oct 2012. Why the mighty Fed is lowering interest rates to zero – desperate in finding new debtors. The price for money is interest and if you definite this equal zero you destroy the underlying processes – sneaky. Regarding housing you pay less a month but suddenly one morning people realize in having 200.000 bucks more on it’s back waiting for future amortization.

The middle class is slowly disappearing and nearly stagnant income will have consequences in the medium term – not only for the US shopping malls [six times more space than in Germany]. Final demand for goods and services will shrink due to massive changes in the population – the strongest group will be soon people > 70 years which are spending less – not to mention the each day greater pension fund gap. It’s all at the table but only pain will force people to act in moving to other locations in avoiding e.g. taxes or lower its own property tax. These removal process has started but is actual not visible. As analyst I’m collecting all the time hints and these hints are forming unfinished mosaics – like point of pointers which are becoming every day a bit clearer: look for a good place to live – bring your income and expenditures in balance and avoid to be indebted – continued another time.

What’s happening here is that all the available “money” that Janet, etc. have printed is sloshing around looking for somewhere for its owners to invest is heading for, for lack of a better expression, the necessities of life. Ultimately, its those simple necessities of life that are the real gold mine for investors, especially when the population is not growing rapidely enough.

And as state and local governments get deeper and deeper in debt, they will come under more and more severe pressure to “privatise” anything that that governemnt owns “for the public”. For example, the drinking water system or public transportation system or, in the case of countries that have a national healthcare system, the healthcare system. I guess if “the public” isn’t “willing” to pay enough tax to fully fund the aforementioned, they don’t really deserve to own it and benefit from it.

After “investors” buy those formerly-public necessities of life for pennies on the dollar (perhaps using “money” that has been printed out of thin air by Janet and handed to those buyers), the cost of water, transportation and healthcare will of course have skyrocket, as the cost of housing has skyrocekted. After all, it is only “natural” that investors deserve to make a profit on what they now own/control right? If people can no longer afford the water that flows out of their taps, they are “free” to haul it from a nearby river or drill wells in their back yards.

And if they can’t afford the “sewer fee” that has become so popular in various cities of the world, they can do their excretory business in a container and try to find a place they can dispose of it ………….. for a fee, of course.

Don’t worry. This how capitalism works and, as we’ve been told every waking moment of our lives, capitalism is the best economic system that has ever existed. Things will turn out just fine as long as “we” stick to (crony) capitalism.

When it all happens and it will, it just comes out of nowhere. Things always go bad on a friday night so you cannot do anything till monday, by monday big brother has figured out how to freeze everything.I had a convenience store for 40 years and i can remember all kinds of things we sold that were in a bubble and overnight they just stopped and you could not give them away.I realize the whole economy is a little different but not really.Remember MARKETS ARE BORN ON PESSIMISM, GROWN ON SKEPTICISM, MATURE ON OPTIMISM AND DIE ON EUPHORIA. OR BETTER SAID WHEN THINGS GO GOOD THE DONKEY WALKS ON THE ICE.

Hot off the presses: How the Canadian Elite Keep the Canadian Economy Growing and the Canadian Housing Bubble Inflated

https://beta.theglobeandmail.com/news/politics/canada-to-admit-40000-more-immigrants-a-year-by-2020-under-liberals-new-three-year-plan/article36800775/

From the above:

===

“The Conference Board of Canada – among the groups advocating for a multi-year plan – welcomed the move.

‘Canada’s decision to increase immigration will help sustain long-term economic growth in light of its rapidly aging population and low birth rate,’ senior vice president Craig Alexander said in a statement.”

=========

If you wonder what the “Conference Board of Canada” is, here is Wikipedia’s definition:

https://en.wikipedia.org/wiki/Conference_Board_of_Canada

But the questions that everybody should be attempting to answer are as follows.

1. Just exactly WHY does the DESIGN of the Canadian economy require so many immigrants year after year, ad infinitum?

2. Is Canada’s economic DESIGN unique in this requirement, or do the other nations of the world that have the same economic DESIGN also have to do “whatever it takes” to raise their populations by an equivalent amount ad infinitum?

3. If Mother Earth cannot support the present human population, how on earth (pun intended) is Mother Earth going to support a population that is twice or, eventually, ten times the size?

In short, “Canada’s” decision to increase the immigration rate into Canada is an ultimately disasterous, short-sighted one whose sole purpose is keep a fatally-flawed economic design and all its bubbles on very temporary life support, while making it even more polticially difficult for people who haven’t even been born yet to do the right thing (or, incidentally, pay down that national debt) in the future — in other words, kick-the-can-down-the-road situation normal.

But Japan has not yet caved in to its equivalent of Canada’s “Conference Board”. How is Japan managing to survive without massive immigration; will it be able to continue to do so and, if it can’t, just exactly what will it do when push comes to shove — open the floodgates of immigration or, much more importantly IMO, adopt an economy of different design? We’ll know in the near future.

It’s not just Canada…It’s the entire western world. More debt slaves are needed to keep the ponzi going. Debts can never be paid down; debt must always expand. There was an article about the UN stating they would need immigrants to fill the void. Article was in the year 2000. One side of the NWO wants less population (Bill Gates, ” kill em with vaccines”) and on the other hand they need more people to incur more DEBT

– Housing in Canada already is tanking. I regularly visit the canadian website “Juggling Dynamite” who brought this news on the canadian housing market.

https://jugglingdynamite.com/2017/11/02/unexpected-price-declines-hitting-highly-levered-buyers/

The owner of this website (Mrs. Danielle Park) is also a regular guest on “Howestreet.com”.

– Even in Australia the sales volume of “dwellings” is falling.

https://1drv.ms/i/s!AluvxwylJSzygSlbqmr01uBWb_Lp

It’s interesting that people, primarily younger people are thinking about a housing bubble and then ignoring the Baby Boom-realted pension crisis that is less than a decade away. If we are in the early to mid-stages of a housing bubble, the outcome will be like a flu bug, whereas, the underfunded pensions and tsunami of Boomers concentrating their losses into one pool, will look far more like black plague, literally and figuratively — the financial world we know today will be vaporized. ==> “The world’s six largest pension systems will have a joint shortfall of $224 trillion by 2050, imperiling the incomes of future generations and setting the industrialized world up for the biggest pension crisis in history.

Adding in China and India, which have the world’s largest populations, the combined savings gap for the eight countries reaches a total of $400 trillion by 2050, a sum five times the size of the current global economy.

The WEF study shows that the United Kingdom presently has a $4 trillion retirement savings shortfall, which is projected to rise 4% a year and reach $33 trillion by 2050.”