This confirms what many Americans feel in their wallets.

In the data today on personal income and outlays for September was a hefty shot of reality that many Americans have been feeling in their wallets on a daily basis: On a personal level, per individual, or “per capita,” the disposable income adjusted for inflation looks lousy. In fact, it declined in September and has been declining since May.

At first glance, as per headlines, the data looked pretty good. For example:

- WSJ: “U.S. Consumer Spending Rose Robustly in September: Personal income, which includes wages and government assistance, was up 0.4% from August.”

- New York Times: “U.S. Consumer Spending Grows at Fastest Pace Since 2009, Savings Drop.” It pointed out that “the drop in savings suggests that September’s robust pace of consumer spending is probably unsustainable.”

But it’s not the drop in savings that’s the problem; it’s the drop in disposable income per capita.

First consumer spending, because that’s what grabbed the headlines. Personal Consumption Expenditures rose 2.7% from a year ago, adjusted for inflation, according to the Bureau of Economic Analysis. That’s smack dab in the middle of the range since 2010, whose low point was +1% (October 2012 and April 2013) and whose peak was +4.2% in January 2015.

Consumer spending was what the media focused on. But the report’s larger section on “real” disposable income wasn’t pretty: it rose only 1.2% compared to a year ago.

Disposable income is based on wages, receipts from assets such as interest and dividends, rents, farm income, and government benefits, such as Social Security, Medicare, VA benefits, etc. (government benefits account for about 17% of total income) minus “contributions for government social insurance,” and the like, and minus personal taxes.

So disposable income inched up 1.2% year-over-year. In other words, the total size of the pie grew 1.2%. But consumers don’t feel that. What they feel is their slice of the pie, but that pie got cut into more slices as the US population expanded. And this leaves disposable income “per capita,” which the BEA also discloses, but mercifully buried in the data.

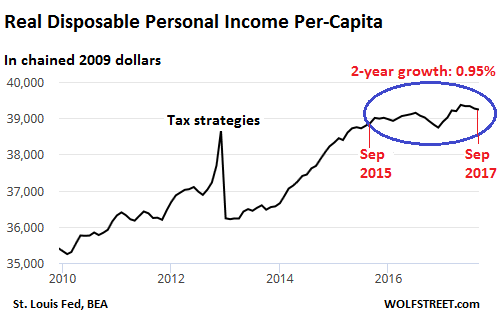

This real disposable income per capita — a function of income, taxes, inflation, and population growth — peaked in May and has been declining ever since. In September it declined -0.1% from August. Compared to September a year ago, it’s up a tiny 0.56%. Over the past two years – since September 2015 – it has inched up a total of only 0.95%:

About that oscillation in 2012/2013: That 5% spike in the second half of 2012 and subsequent 6% plunge in January 2013 was the reaction to tax changes taking effect in 2013, causing a major calendar shift in tax strategies.

That measly 0.95% gain in per-capita disposable income over the past two years could actually still be too high, if the inflation rate with which this was adjusted underestimated actual inflation over those two years just a tiny bit. Many households swear their costs of living rose much faster. If actual costs of living rose .5 percentage points faster per year than the price index used in the income calculations, the real disposable income per capita would be on a downward trajectory.

That’s across the population. At the lower 60% of the income spectrum, the equation can look outright terrible. They’re dealing with soaring housing costs, healthcare costs, and educational costs that eat up the lion’s share of disposable income. Cost-of-living increases based on these three items, depending where the people live, can be far higher.

A word about the savings rate. There’s some hand-wringing because the savings rate (disposable income minus personal consumption expenditures) declined to 3.1% of disposable income, the lowest ratio since December 2007.

But this savings rate has a bit of irony: Depending on who does the counting, about 60% of the households in the US live from paycheck to paycheck and have essentially no money left to save, and they cannot save. Savings are concentrated at high income levels.

At the lower income levels, where there are essentially no savings, the more important figure is how deep these households are going into debt to make ends meet. The answer is this: Consumer credit has been jumping to new all-time highs and (not including mortgage debt) has reached $3.77 trillion. That’s up 5.5% year-over-year, a period when total disposable income has inched up only 1.2%.

The US economy, as measured by “real” GDP, grew by 2.3% from a year ago in the third quarter. But this was the “advance estimate” based on data that is “incomplete or subject to further revision.” These revisions can be big. Read… How Much Illusion in GDP? What You See Is Not What You Get

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Great thing that most Americans get there information from Fox News and MSNBC. If they got it from Wolf Street there would be revolution in the air.

+1000%

There will be soon enough as reality bites them in the rear

Or they are boiling frogs and don’t know what’s happening to them.

Kent, the Bolsheviks revolted 100 years ago in the second of what they called the October Revolution, and they didn’t have any Fox News and MSNBC (or Wolf Street :-)

You are correct. The people didn’t need modern media in order to revolt in Russia in 1917. Unfortunately, they exchanged their property rights and the Czar for a military dictator and the property rights of a serf. After Lenin died it got worse. A military dictator named Stalin took over.

What property rights? Russia was still a feudal country. Peasants had neither property rights nor property.

No, the people of Russia just needed to be duped by a New York Banker:

“Jacob Schiff was head of the New York

investment firm Kuhn, Loeb and Co. He

was one of the principal backers of the

Bolshevik revolution and personally

financed Trotsky’s trip from New York

to Russia. He was a major contributor

to Woodrow Wilson’s presidential

campaign and an advocate for passage

of the Federal Reserve Act.”

I get almost all my news from podcasts but those are starting to get censored already by demonitization and channel deletion. I hope somebody makes a youtube alternative based in a country that actually has free speech or at least would allow free speech outside their borders. Maybe North Korea.

liveleak

Bitchute

Why do you think Youtube is obligated to allow people to make money off their platform without any control of what content is put out on said platform?

I don’t think you understand free speech. Youtube has nothing to do with it.

Because it is the internet, a publicy financed creation without which youtube would have had to invent it themselves

I was in a few chain stores last week having 40% off everything sales. These are the kinds of sales you would normally see when stores were closing down and they would attract a good crowd. Now you see these sales often and still no crowds. In the stores I visited, I was the only customer, and these are retailing giants. I didn’t buy anything at any of these stores.

Having done a stint or two in retail back in the day …beware of the storewide sales coming out of the blue off season or for no obvious reason . More often than not they are a bait and switch to get you into the store believing everything is on sale when in reality they’re the same ole discounted prices as ever masquerading as sales . Its a trick as old as the department store itself

As for crowds … we’re seeing the same thing . Despite all the hoopla about how good things are …. aint hardly nobody in the stores buying

Lines are forming at “Aldi’s and COSTCO continues to satisfy their members.

I use the malls as a platform to walk for exercise too, especially during the winter.

I predict a dismal Holiday shopping season. Santa ain’t comin’ down the chimney this year.

You’ll be wrong. Americans will as usual beat expectations when it comes to spending.

Rates,

I tend to agree – as long as we have access to credit.

And with this Equifax breach, won’t there be a lot of hackers with access to new credit?

Bill, I hope people got their credit freeze at the three major credit bureaus done.

Absolutely, without the grease, the wheels will stop turning and I think grease is still readily available.

Wolf – I was gonna Amazon some nice big fat packages for Xmas but …. the product I was going to make, trademark or patent etc., and have concluded I don’t have the seed money to produce, well, there will be 2 of them in the world, and they’re gonna be this year’s Xmas presents.

Santa will come but it will be for things people actually need, will not spend on themselves or have been delaying to buy.

I think they put a stop to him sliding down the chimney, especially while the husbands were away working.

well, he only comes once a year…

The U. S. is not “exceptional” in the sense that the financial/economic rules don’t apply to us. It can and will happen here if we let it.

Everywhere it has been imposed, reactionary neo-conservative [neo-liberal outside the U. S.] socioeconomic policies have been a disaster for the very large majority. It is a serious mistake to not learn from the mistakes of others. [Kansas (where I live) is a mild example of what always goes wrong.]

For the endgame, that is a barter economy for an increasing fraction of the population, mediated by Facebook, see

https://www.pagina12.com.ar/72534-de-cambiemos-la-crisis-hizo-troquemos

[If your Spanish is rusty, use Google translator] also note that the IMF is back to “review accounts” as a precursor for further cuts in the social safety net, infrastructure investment, pensions, public health and education.

Also see https://www.pagina12.com.ar/72652-la-peor-distorsion-fiscal-es-la-evasion-dixit

[“the worst fiscal distortion is evasion” (dixit) “]

FWIW: Many governments, including Argentina, rely heavily on the VAT [sales tax] for revenue. In general “barter” does not result in any VAT/sales tax revenue.

One of the bigger, yet unreported/under-reported trends, is the FI Movement. Financial Independence is tied to numerous factions and trends. Whatever the branch of FI, it typically involves less spending and certainly less consumerism. The next downturn will swell the ranks of the movement(s). I just don’t spend much money at all, have no debt, etc. GF got a gift card for Ruth Chris’ Steakhouse – I told her to take her sister – the $50 or whatever the dollar amount for the steak would be wasted on my palate. My spending habits are such that I not only don’t want to pay $50, I don’t really want to have someone else pay 50 bucks for my meal either.

Go out and enjoy a nice meal. Life is short.

I agree.

Why not stay in and enjoy a nice meal?

In this World Series season, consider the following:

Life is short, play hard.

Life is hard, play short (stop).

The underlying message is to engage in life, find your muse, tickle your fancy, just do something to enjoy your time on this mortal coil.

We’ve been living on 35k a year for three years now. Health insurance is the only wild card. We even squeeze in one trip to Asia a year. Early retirement is good. I have time to hang out on sites like this one.

Are you kidding me? I don’t think $50 will buy you a steak at Ruth Chris’ Steakhouse. Maybe a baked potato and a side of coleslaw. Get a two for one coupon and buy 2 Whoppers for $4.00 at Burger King that includes 2 quarter pound beef patties.

I don’t know what it costs, I’m just guessing. We went one time to for some event to Ruth’s and I had a piece of my GF’s steak. I think the mash potato side dish was like $10. I didn’t even order a salad. The thing is, I can enjoy a good meal w/o paying $50 for the main course plus whatever for the sides, plus tax, plus tip, plus whatever. Its just not consistent with my values. I really like my profession and I earn good dough, but I don’t have to do it; I live frugally. Look up the root of the word frugal… not what you think.

Enjoying life is being financially independent to do what I want or go where I want, when I want.

I

Instead of living in the US and vacationing in Asia, live in Asia and visit the US. You will have at least 3X as much more cash to spend on yourself. If you don’t mind hot climates, try Thailand. Great country. They have an excellent retirement visa program for Westerners. Health care is very good and very cheap.You pay cash and it will be less than the deductible on your American health insurance.

$35k a year is big bux. I’ve recently gotten a raise and may make as much as $15k a year. No benefits. I dream of someday making $35k a year.

Huh?? I’m female and my husband and I retired in our forties.

I received a letter today informing me that my Covered California (Obamacare) premiums for my teenage son and me are going from $900/month to $1,240. That’s a 38% increase!

Another way to look at this is to calculate the percentage decrease in salary. Suppose one makes 80K/year. In order to come up with $4,080 more per year, you’d have to deduct more from salary due to taxes. Let’s assume this decreases salary by $500. So this hit to your healthcare costs is like getting a 5.7% salary reduction. I love how the media makes a big deal when average salaries rise by 1 to 2% but never point out the percentage declines in salary when costs rise.

PS: I will probably have to move from a silver to bronze plan next year and pray I don’t get sick.

You’re a textbook case of costs of living rising far faster than the official rate.

I’m not sure if you have access to them, but have you checked out Kaiser Permanente? Might be worth a look-see. They’re a healthcare provider AND insurer all in one. So their whole method is different.

We’ve been with them for years. Our rates have stayed nearly flat for the past three years — but we have very large deductibles (max allowed) along with an HSA that gives us an IRA-like tax deduction which in essence pays a big part of the already low premium. The combo of high deductible, low monthly premiums, and HSA works for us because we rarely need medical care.

But it’s not a good option for everyone, including people with regular large healthcare expenses. Also, to benefit from the HSA deduction, there needs to be enough taxable income.

If you feed your HSA at the maximum rate every year (tax deductible), and if you don’t use this money for health care expenses, after a few years you have a lot more money in the HSA than you’d need to cover even the largest deductible.

Thanks for the tip, Wolf, but with Covered California, I have found Kaiser’s rates to be pretty comparable to Blue Shield. (I was with Kaiser for one year, and it’s possible that the out-of-pocket costs are a tad lower.)

Of my $340 monthly increase, $89 is for my son’s Kaiser insurance. So the Kaiser premium is actually increasing by 43%.

Blue Shield wrote that the changes were due to:

1. Changes to certain provisions of the Affordable Care Act and the decision to not continue federal funding of cost-sharing reductions, which impact Silver plan rates.

2. General costs associated with the administration and delivery of essential health benefits.

Given explanation #1, I guess it’s possible this will change if decisions change within the government. I’ve decided to not start a business and instead look for a regular job with decent benefits.

We were with Blue Cross (Anthem). After they jacked up our premium by 120% in a two-year period back in 2010-ish, we switched to Kaiser. Anthem is the worst.

Wolf thanks for the golden advice.

When Obamacare came out, I went online and got information like, “Oh, you made $7k last year? OK then your insurance costs will be $8k”.

So I did the best thing: Nothing. Lo and behold, insurance was issued to me. I didn’t use it except for one ER visit, so it was kind of moot which insurance I had – I think it was Anthem something or other. But, it sounds like I probably want to, if I have a choice, go with Kaiser.

(Not saying this because I spent some of my childhood in Hawaii Kai, named after Kaiser, went to Henry J. Kaiser high school, or used to play on the beach in front of the Kaiser estate, nosirreee…)

I always wonder about the true value of tax deductibility. One year I worked for a small financial services company and processed 90 tax returns. The software we used allowed us to immediately see the savings of taking a writeoff vs. the standard deduction. Most people who think they are saving a lot of money because their expenses are tax deductible are shocked when they see how little, if any, it saves them.

Try running your taxes with and without taking the HSA as an expense. Any software like TurboTax will do it. Divide the annual savings by 12 and see if that number will make any significant different in your life.

An HSA is deductible on the federal return without itemizing, like an IRA. So take the standard deduction and then go down to line 25 on Form 1040 and deduct the HSA (if you’re over 55, the max was $4,350 in 2016) and then go to line 32 and deduct your IRA if you have one (max 6,000 if over 55). Very basic. And both are your money. If your marginal tax rate is 25%, the HSA deduction alone will save you about $1,100 a year. For a couple, it’s about $2,200 a year. If you’re in a higher tax bracket, it will save you more.

My tax software allows me to do a “what if” analysis, which allows me to optimize how much I want to pay into my HSA and IRA (you can do your taxes before you make the contributions).

I have the same setup at Wolf, a high deductible health plan at Kaiser, with a HSA. Just received my 2018 letter from Kaiser and my premium went from $469 to $490 — a 4% increase (I’m 57). Where as my deductible is $2,700 and the out of pocket max is $5,000 — any big costs in one year are easily covered by the ~ $30,000 in the HSA that has built up over the last 10 years (which I deducted from my taxable income).

This seems to be the model for where health insurance is headed. A number of large employers are moving toward this, where they get a lower premium cost for their employees and use the difference to put a little money in the HSA kitty.

Oh, I should add that I have a plan purchased directly from Kaiser (one of their “Individual and Family Plans”). I looked up the equivalent 2018 Kaiser plan at Covered California, and found that the monthly premium was $558 — about 14% higher than I will pay. I suppose this is because of the 10 essential benefits, or maybe the cost of government reporting on Obamacare plans.

I do not qualify for a premium subsidy, so that is why I purchase direct from Kaiser.

I used to be on Kaiser purchased through Covered California, but transitioned to a direct Kaiser account when I noticed Trump making noises about tearing down Obamacare. My premium is going up 8.6% next year. It’s now about equal to making a second rent payment.

Isn’t this amazing that you have to pay $1,240/month for health insurance of 2 people, and many are paying even more. Medical industry in this country is a racket.

I don’t even catch a cold, and yet I have to keep paying these thieves monthly. And if I did catch a cold, the doctor is of zero use in any case cause he is even dumber than me. Not to say that there are not a few good doctors, but majority are dumber than a door knob, and a complete waste of time.

Why are going to a doctor for a cold? Colds are viruses and as we all know, “There is no cure for the common cold.” It sounds like you have unreasonable expectations for something whose cure is time – it resolves on its own without any intervention.

The point is not curing my cold. The point is that most doctors have zero cure for most health problems. And also the point is that despite their total incompetence, we have to pay high prices for their services.

This all goes back to the days when everyone was illiterate, and doctors had some education; so, everyone respected them. But now medical schools teach doctor more to be a used car salesman than to be healer. I can find more answers about any potential health problem doing a short research online that I ever found by going to the doctors.

How many doctors and the same goes for dentists who are still actively learning? Doctors and dentists are not worth a fifth of what they are getting paid.

RoseN,

They keep raising the rates because people keep paying them. At some point you have to withdraw your consent to their thievery. Take the money you would have paid for insurance and bank it, pay the fine, and take the risks. If enough people do it, the rates will come down.

If you are hit by a medical emergency that requires extensive treatment use the money to get on a plane and buy the medical care elsewhere. You will be amazed at how affordable medical care is in other parts of the world.

Little hard to get on a plane after a heart attack. Yes, it is more affordable in many places including Thailand. Same with dental work. W/o catastrophic coverage, you are playing with financial fire.

Let’s assume Rose does have a heart attack without insurance. She will get a big bill from the hospital, at which point she should hire an attorney to negotiate a reduction of the bill. The hospital will settle for any amount over the amount they would have been paid by the insurance company. So I would expect that the legal bill and the hospital bill will be less then 2 years of premiums in the bank. She should always be ahead by assuming the risk, which is how insurance companies make money.

QQQ this is what I was told long ago. Get a catastrophic plan and have a savings account to cover anything under 10 grand.

Petunia,

If you have any sort of assets and some savings, I think this is an extremely risky tactic to take. Two years of premiums is equal to almost 30K. If you pay a lawyer, say, 20K, you’ll have 50K in costs. But I have read that people have received hospital bills of close to 1 million dollars. If this scenario arose, I would assume that the hospital would go after everything a person had. So your approach only works if you don’t have much to lose.

Unreasonable fears is what costs you all that money. If you got a $1M bill and a lawyer litigated it with the hospital, the hospital would have to disclose the amount they usually get paid for whatever they over billed you for. And since you were never refusing to pay, and in fact would pay at least $1 over their customary reimbursement, you would get the bill reduced anyway. Overall, you would pay less because the hospital only wants their usual payment for the service.

As long as you are willing to keep paying, they will keep taking more of your money.

Agreed. This is very poor advice.

Rates go up for a multitude of reasons, not because people are paying them.

I’m all the way with you Petunia; we are paying thieves. I posted in the past the kind of prices hospitals in US charge for ordinary stuff like $50 for a pair of latex gloves that they use; that’s worse than getting mugged. They are thieves, plain and simple. And as long as we keep paying them, and keep respecting them, they will take us to the cleaners.

The first step to break this is for people to stop respecting doctors and dentists as if they are some highly educated geniuses. Once you get rid of that respect, then you start questioning what they do, and how much they pay for. When I go to a new dentist these day, right away, I tell him I don’t want any procedures done, unless I have been consulted with, and I have approved the cost.

Welcome to the club. Australia has been in the same boat for a while.

Increases in GDP and the share of profits going to capital has been increasing. This is now partly as a result of the end of the huge investment in mining projects. The projects major costs such as wages have ended so any real increases in profits flow right to the bottom line bypassing workers.

Huge levels of immigration – both skilled and unskilled keep the supply of labor high and wages under control.

Unlike in the USA though our income tax brackets are not adjusted for inflation so people get hit there too.

Wage increases that push people from one lower bracket to the next higher one really hurt those people and help the government.

The last “great credit” Christmas, without real disposable income?

A fact of record to keep in mind;

Every single two term presidency election, when the incumbent changes, there is a 100% track record of a recession within the next 12 months.

It either starts just beforehand (Bush- Obama) or starts afterward, but within the first 12 months of the new presidency, there is a 100% chance of a recession.

Time is growing short.

Yup, all good things come to an end. And there can’t be any more “credit Christmases” when everyone’s cards are maxed out.

Maybe it’s time to go back to the original idea of Christmas and cut out all the expensive waste.

Hi Wolf, All this dysfunction is building to a climax.

You have been very critical when I have mentioned the Debt Jubilee option, so whether you agree or not with Porter Stansberry I think he is reading the tea leaves well enough to not be talking through his hat.

The tide is turning towards some version of it getting up in the not too distant future. Debt is past the point of being repaid. Soon even paying interest will be beyond reach. As Herman Daly writes”We have gone from ‘ruthless growth’ to ‘futureless growth'”

https://orders.stansberryresearch.com/chain?cid=MKT341373&eid=MKT341573&encryptedSnaid=&snaid=&step=start#

The proper way to deal with debts that cannot be repaid is default and bankruptcy for individuals, companies, and government entities that can’t issue their own currencies (cities and the like). This is well-established. In cases where it is not well established (US states), it should become an option. Investors take the losses. No reason to go back to Biblical times and search for answers.

Lol what is that a stab at Steve Keen? I wonder if we will initially see heavy deflation when the default wave roars through the economy and if CB’s will even be able to get to the chopper fast enough without some extraordinary supplychain disruptions in the meantime. Financial contagion and its possible effect on the corner businesses scares me.

But bankruptcy is expensive. What will it cost to process 50 million bankruptcy cases through the courts? The robo-signing and similar economies during the mortgage-default disaster were bad enough.

If anyone gets a debt Jubilee I am going to freak the fuck out I can tell you that. Living my whole life living within my means while the debt junkies get the cheese is no way to run an economy AND sure make me feel like a fool.

This is insanity.

“futureless growth”……ya, welcome to my last 20 years of zero or even negative income growth.

I wonder, who will end up holding the shittiest end of the stick, frugal people who have managed their finances or the debt junkies ?

The responsible and prudent – those who refused to buy into the Fed’s Ponzi markets and asset bubbles – are going to be vindicated at the end of the day, but only after true price discovery finally asserts itself.

The thing with the debt junkies is, they get a “get out of jail free” card but they don’t change their financial habits so they end up back in misery again.

My finances are tiny, but I like to think I manage them well. My boss makes something like 15X what I do, and he’s always sweating over money.

I don’t know about other states, but 500,000 self employed on individual plans in NC just got 100-300% increases in their NC BCBS health insurance premium.

This an unexpected $10,000+ out of their pockets for 2018. There go car purchases, remodels, vacations, splurges, investments…

I got a 32% increase as self-employed with BCBS in NJ. This is the equivalent of a 2.5% pre-tax salary reduction, and my income didn’t budge, again. Crazy. How does this work year after year? Right, it doesn’t.

Of course, these premiums end up in consumer spending. No prob for the economy right? Yeah, just goes to show how GDP has no relation to standard of living after a while.

It is open enrollment time again for me. My employer (self insured, coverage administered by BCBS-TX) just raised our premiums 53%, and to add in more insult to injury, they also raised our deductibles and max out-of-pocket limit too.

But, I guess that they saved enough money to go out and buy another company today. It was all over the news. It must be great to just emerge from bankruptcy and go on a buying spree while sticking it to your employees.

Forgive me if I sound bitter. Just finished my open enrollment selections.

My disposable income peaked in 2013. I saved a lot of money up to that point, and each year since I see my savings go down a little more.

I’m Trying to cut spending, but it’s hard when retailers are having these sales. Couldn’t pass up 65% off everything at JCP. The whole family has a new wardrobe now.

I probably didn’t need that new gaming computer, or 55″ tv I bought last month either… but got a hell of a deal.

Twenty years ago I paid $8,000 for Blue Cross in New Jersey.The policy came with a $10,000 deductible

I’m uninsured right now. I makes no difference to me. I just pay out of pocket.

Either declare health insurance companies illegal and make health care like veterinary care, pay as you go and affordable, or bring on a NHS-type system already.

As Bernie Sanders just noted on Seth Meyers last night, in Canada, no one pays for cancer, car accident injuries, or any other health problem when they need care. And Canadians total spend on health care is half what Americans pay. And ALL are covered. We also live longer, so there’s that too. But of course we do not have for profit hospitals and profit hungry insurance companies either. And many Americans still try to buy drugs in Canada when they can. I know, too many ands.

The biggest problem lies in the definition of disposable income. According to mainstream textbooks it equals to income minus taxes. Yet it shoud be income minus taxes minus housing and healthcare costs. Put that into the equation and the picture gets even uglier.

By the way, 1200 $ a month for your medical insurance????? I pay 150 for me and my wife and we have the highest-end option (I am european). No wonder your products have been priced out of the market.

On top of that, if you actually use services, you still have to pay more – you have copays, co-insurance and deductibles. For example, I pay a $35 copay to see a regular doctor and a $75 copay to see a specialist. If I’m unlucky and get into a car crash, I pay the full amount of the ambulance ride from my $2500 deductible, and if I’ve hit my deductible, I pay a $250 copay. I have a $350 copay for the emergency room. (I’m not sure – this may be waived if I get admitted.) I have a 20% co-insurance payment for my hospital visit which can amount to a lot given the inflated hospital prices. Each year there is a $7,000 out-of-pocket max, and it’s safe to assume that most accidents that require a hospital visit will hit this max. Pity the person who is an accident on December 31st, requiring an out-of-pocket max of $14,000 in a short period.

The plan details sound confusing because that’s what insurance companies try to do. They try to obscure the fact that they often don’t cover a lot.

I have Irish relatives, and sometimes I think they don’t believe me about American healthcare costs, but I’m pulling these numbers straight off the Covered CA website.

On top of this, Trump is presenting a tax plan that gives major tax breaks to the uber wealthy and, in some cases, increases taxes for the middle-to-upper-income groups. Where do I sign up for a protest rally?

The obscurity makes it even worse.

My insurance plan is cristal-clear: 75€/month per person, everything included except very few things such as transplant operations. I pay 1,5 extra € for each visit (whatever the speciality) and also for each intervention or test (ambulance ride, X-RAY..). No surprises, never.

And this plan is considered to be one of the most expensives out there. Most people go on with plans that cost as low as 30€ per month or just rely on Social Security, which still functions quite well.

Just consider that the companies that offer these plans here are doing well and earning some good money, which proves that in your country, the prices you pay are not in line with the costs of the services you get. You are being robbed, and “they” will extract whatever wealth and rent the market can bear.

When I read comments about health care insurance costs in the USA it makes me happy that I am in Australia.

It costs me 2.5% of my income as a tax and if I go to a bulk bill doctor the out of pocket cost is zero.

Specialists are a different matter.

USA prices for drugs are ridiculous. The medicine I have to take costs A$500 plus a month if bought there.

Here it is $38 or so are once I retire or qualify for a partial or full pension the price will fall to around A$6…..

That is because US citizens subsidise the costs for the rest of the world. We are not allowed to re-import pills shipped out of the country.

Pharmaceutical companies do what they do to make a profit. When they are not bilking the taxpayers for research money, they do have to invest considerable capital. If we paid the prices you pay, those drugs probably would not have been made in the first place.

For those who say they live in Europe or elsewhere and pay less for income, what are your income and sales (and any other) tax rates

I meant pay for health care.

Yes, defend the system that’s draining your blood, that’s the way to go.

You are not subsidising anybody apart from wall street. The point is that in europe drug prices are fixed by the government while in the USA big pharma is allowed to extract whatever the market can bear.

When it comes to insurance cost. In most of europe this cost is way lower because we have a far cheaper alternative: free universal healthcare, which keeps the prices down.

About our taxes, you pay a lot more than us… It is just that you call them tution fees, insurance premiums etc…

Going back to the healthcare topic. The point is that your system is by far the most expensive and the one which delivers worst results. You might not want to hear that but your system is broken, and it will break you too soon.

It is a misconception that “free universal healthcare” is free in Europe, it is paid for by taxes that in most European countries are deducted straight from your wages, the same applies to education in most European countries.

The big thing is that there is a big gorilla in the room preventing drug manufacturers and healthcare businesses from lining their pockets too much, thus keeping costs at a manageable level. The gorilla is named government ….

This means that it usually isn’t a total economic calamity for an invidual or family when disease strikes hard. A certain ( usually high ) level of care is provided in most countries without bankrupting the unfortunate ones. For those who wish, there’re private alternatives that they pay for themselves, the choice is there if your pocketbook allows for it, but the thing is that most people are more than satisified with the care they recieve.

There are countries in Europe where the healthcare and educational systems seem to be breaking down, for example Sweden, where the system seems to be coming apart at the seams due to the huge influx of migrants and inadequate resources and financing to handle the load. Greece for example is another, quite different case…

It will be interesting to see developements in Britain, since the Tories aren’t too friendly against the NHS, will the Tories open Britan for US style health care after leaving the EU ?

“(The U.S.) system is by far the most expensive and the one which delivers worst results.” – HiHo

U.S. research pays for developing the drugs Europe enjoys and price controls.

The U.S. continues to take most of the Nobel prizes for the research underlying clinical advances.

So, a case can be made for the proposition that the U.S. subsidizes European health care, which is cleverly exploited by European politicians.

If “our” system breaks, so does “yours”.

Repeat the same lie as many times as you wish, it will still be a lie.

The high price you pay for your drugs does not derive from Research costs but from pharma companies taking advantatge of their monopoly privileges: patents. The sooner you understand that, the better.

Big fat bonuses and stock buybacks, that’s what you are subsidizing, my friend.

@realist

I do know that free healthcare is not free at all. Yet at the end of the day a single payer-public system seems to be (and is) far more efficient.

If you want proofs just compare healthcare costs relative to gdp of some european countries vs USA.

Full cost of that medicine is shown as $A89 something. The difference is the subsidy the government pays. So in effect it is like getting a refund on the Medicare tax that I paid.

“In fact, it declined in September and has been declining since May”

I’m sorry, I had to laugh out load at that. It’s been declining for decades for me. And there is no hope of every regaining any footing, it’s just a slow grind down to zero. Welcome to the USA.

Question for wiser heads: to what extent is the recent stagnation of the low earning 60% a function of demographics vs ‘erosion’ as described above.

E.g. more retirees whose savings accumulation has tailed off, and who are living comfortably if not elegantly in paid off homes, etc? Also young graduates (many of whom will in turn enter the top third of earners) coming in with far more debt (negative savings)… but are also starting families later, so don’t really need a down payment saved by age 30. And so on.

I think you get my drift here… Longtime/first time: I love this site because it’s realistic but not generally prone to doom p&rn.

Hey lots of people work for all these big insurance companies. I know 10 people that work for United Healthcare. Their corporate buildings are like 5 star hotels with security that rivals Ft. Knox. Healthcare is booming lol. You should see the multi-million dollar medical buildings going up literally on every corner. Orthopedic buildings are huge right now! I’m in Healthcare and its crazy, who is really paying for all this fake growth? Are banks and creditors that stupid? Doctors are no different than greedy CEOs

HiHo,

Assuming everything you say in your last post is true (except the first sentence), fact remains that the cost of developing most drugs used worldwide is borne by U.S. users

Big Pharma does indeed spend massive amounts of money on drug research, but not on the kind of scientific research that actually leads to improved health care.

Drug research is based on the same principle as playing the lottery–keep throwing money at various number combinations until there’s a huge payoff. That payoff could be a new cancer treatment that will add a few months to a lung cancer patient’s life. At a cost of, say, a thousand dollars a dose. The optimum result being to keep you alive exactly as long as it takes to confiscate every dime you and your family can scrape together.

Some of the biggest and best Pharma companies are European. Roche, Sanofi, Novartis, Novo Nordisk. The NIH is a “barely veiled subsidy to the U.S Pharma industry”.

http://thehill.com/blogs/congress-blog/healthcare/140355-new-federal-research-subsidizing-pharma

“Assuming everything you say in your last post is true (except the first sentence), fact remains that the cost of developing most drugs used worldwide is borne by U.S. users”

This is not even remotely true. As a talking point it has been so thoroughly debunked it’s basically an outright lie.

We do spend the most on R&D. That makes sense, since we are the largest wealthy nation in the world, and we also use the most drugs in the world.

But, roughly 60% of global R&D research invested in the US produced approximately 40% of the latest important drugs… this means the rest of the world is actually producing more of the most important drugs (60% vs. 40%), and at cheaper cost (40% vs. 60%).

Why? Because the US pharmaceutical industry spends a significant portion of its R&D on “new” drugs that don’t actually constitute a new and innovative drug, while only 1 in 10 are considered breakthroughs. New drugs are approved assuming they are better than placebo, but don’t have to actually be better than existing drugs on the market. This means a massive amount of money is spent on researching derivative drugs that, again, offer little improvement over already existing drugs.

Ok, I assume it is possible and likely. However, my point is that prices are not in line with costs of production (and research) but instead are the result of monopoly power and unchecked predatory behaviour.

People who believe in Porter Stansfield, Doug Nolan, The Daily Reckoning etc are the same people who go to chiropractors. Both are scams. Read up on Palmer the inventor of chiropractic. Snake oil salesmen.

Jack, isn’t that Palmer guy one of the original members of ZZ Top?

Sorry Jack, but chiropractic itself is not a scam. Restoring joint movement and it’s neurological function is not snake oil. I’m not sure what your understanding of the human structure is but perhaps it’s not complete. The fact that Palmer was less than perfec does not make what he did “fake”. Do some chiropractors suck? Yes. But the same you could apply to any profession. Medicine used to give people mercury and other poisons, and keeps Killing people with their many pills and unproven procedures, yet nobody questions it’s present usefulness, even though it is not clearly the answer to every ill. It seems to me that you have never heard of Wilk vs. AMA. Sure what happened then happens no more…

Yet, somehow chiropractic, acupuncture, etc are a total a scam.

Wait…Let me ask my doctor for some Norco first… (sarc). :)

George, ah I don’t know if I’d want to trust a guy that looks like Billy Gibbons (https://en.wikipedia.org/wiki/Billy_Gibbons) to manipulate my back, but good point re: the usage of mercury, etc.

Now on a serious note, what you should’ve said was that they (M.D.s) used to do lobotomies and electric shock therapy up until the early 1960s I believe. Some Portuguese neurologist actually received a Nobel Prize for the Lobotomy procedure!

Who are these consumers brimming with such confidence in the economy? Nobody I know. Or is this more fake data to fit the MSM’s “Everything is Awesome!” narrative?

https://www.marketwatch.com/story/consumer-confidence-climbs-to-a-nearly-17-year-high-in-october-2017-10-31

Consumer confidence at record high. Who needs disposable income? Both Thanksgiving and XMas will be strong for sure.

Another great day at school, thank you!

Thank the USA!

Mandated healthcare doesn’t work. It incentivizes neglect, and makes MDs claims adjusters for self insured policy holders, so there is no reason to defend the patients health. There is no one to make a claim against unless you want to count Medicaid. It does keep the labor market full of people who take jobs based on the HC plan and not the extra disposable income they might earn

Just got a letter from my insurance company telling me my premium will rise 30% next year. This is happening across the board and may very well be the straw that breaks the camel’s back for the American consumer.

Certainly I will have to cut back on spending. I’m sure Wolf will cover this in future ‘episodes’.

I wonder how many Americans will simply cancel their plans (I’ve considered it).

The “Bitter Irony” about today’s real disposable income is that the majority of the comments involve outrageous and unaffordable INSURANCE COSTS for high deductible (and dubious) health care.

Exactly as our Overlords intend.

After 40 years as a member of one of the Duopoly’s, I switched to Independent. Time for a real People’s Party.

In fact it is not even a duopoly, both parties essentially have the same vision of how the econonomy should work. They just disagree in some innocuous subjects (identity politics) and things which do not go against the status quo.

Even our local business school director thinks that Disposable Income Gains for the majority are few and far between compared to the rentier class appropriation of all gains for the one per cent. Furthermore, I, for one, have never attained ‘disposable income gains’ in my entire working life. Suffice to say that resentment of the monied classes increases exponentially over time.

MOU

MOU