Even Seattle rents are under pressure from new construction. But rents are surging in mid-tier markets.

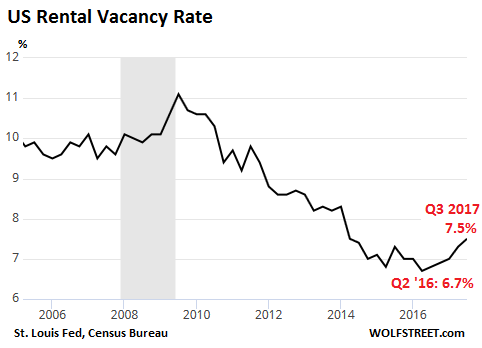

Over the past few years, commercial real estate prices have boomed, and so has multi-family construction, enticed by dropping and desperately low rental vacancy rates that have pushed up rents. But vacancy rates bottomed out in Q2 2016 and have since turned up. In Q3 2017, the rental vacancy rate rose to 7.5%, the Census Bureau reported on Tuesday. While still low, it’s the highest rate in over three years:

Rents have started to respond in the most expensive rental markets.

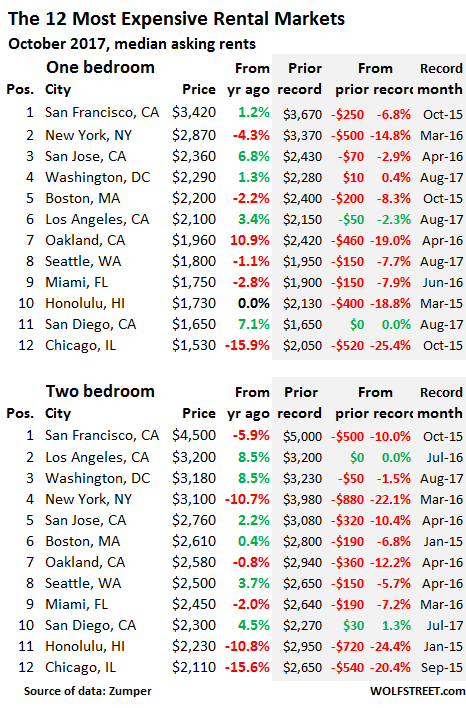

In San Francisco, the most expensive major rental market in the US, the median asking rent for a one-bedroom apartment inched up 1.2% year-over-year to $3,420 but is down 6.8% from the peak in October 2015. For a two-bedroom, the median asking rent dropped 5.9% year-over-year to $4,500 and is down 10% from the peak.

These are asking rents in multifamily apartment buildings, that Zumper aggregated in its National Rent Report. Single-family houses or condos for rent are not included. And these asking rents do not consider incentives, such as “one month free” or “two months free,” which effectively slash the rent for the first year by another 8% or 17%. The data is based on “over one million active listings,” Zumper explains in its methodology. Importantly, the data also includes asking rents from new construction.

So this is not what renters are currently paying, which in many cities includes rent-controlled units. Rather, it’s a measure of the open market, including new construction units.

And these new units have an impact. In New York City, the median asking rent for a one-bedroom dropped 4.3% year-over-year to $2,870. For two-bedrooms, it dropped 10.7% to $3,100. Measured from the peak in March 2016, asking rents – not including incentives – have plunged respectively 15% and 22%.

After this plunge, New York’s one-bedroom rents are in second place and two-bedroom rents in fourth place behind San Francisco, Los Angeles, and Washington DC – which also says a lot about how expensive DC and LA have become.

In Chicago, the median asking rent for a one-bedroom apartment dropped 15.9% year-over-year to $1,530, and 15.6% to $2,110 for a two-bedroom. Whatever the reasons – from Chicago’s declining population to its fiscal woes – median asking rents have plunged by 25% and 20% respectively from their peaks in late 2015.

Even in Seattle, asking rents are coming under serious pressure, possibly due to new construction units piling on the market as years of crane-counting are producing results. The median asking rent for one-bedroom apartments dropped 1.1% year-over-year and is down 7.7% from the peak in August. Part of the sharp decline since the summer may be due to seasonal patterns. Rents for two-bedrooms still rose 3.7% year-over-year but are down 5.7% from their peak in April!

In this table of the 12 most expensive major rental markets, the shaded area indicates peak rents and the changes since then. Note the prodigious amounts of red ink. Double-digit declines from peak hit one-bedroom rents in four of the 12 cities and hit two-bedroom rents in six of the 12 cities:

A word about the other double-digit losers among the top 12:

- In San Jose, rents are coming under pressure compared to their peak in April 2016, with the median two-bedroom asking rent down 10% from the peak.

- In Oakland – once red-hot as it attracted San Francisco’s housing refugees – one-bedroom and two-bedroom rents have plunged 19% and 12% respectively from their peaks.

- In Honolulu, rents plunged 19% and 24% from their peak, rivaling Chicago’s rental market.

But there’s a boom in “mid-tier” rental markets.

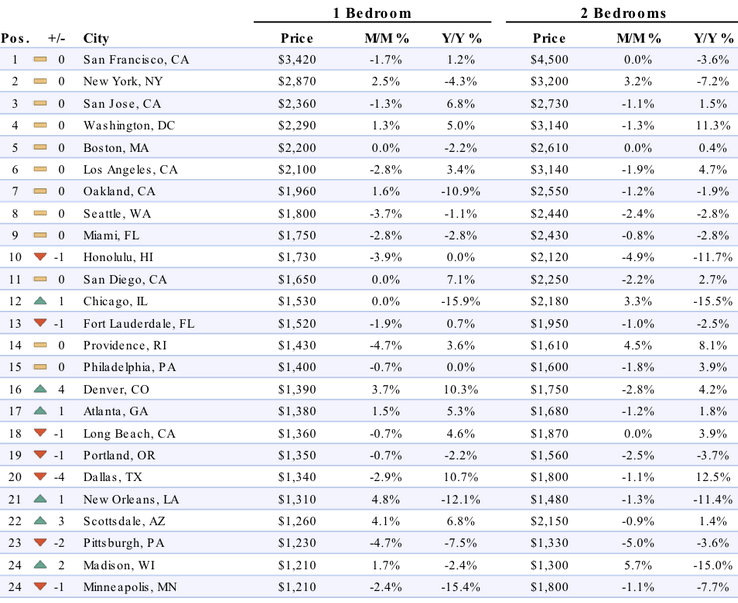

In many “mid-tier” markets – “mid-tier” in terms of the magnitude of the rent – asking rents are soaring. Here are some of the mid-tier markets with double-digit year-over-year rent increases (one-bedroom and two-bedroom apartments):

- Denver, CO (+10.3% and +4.2%)

- Dallas, TX (+10.7% and 12.5%)

- Irving, TX (+14.3% and 8.0%)

- Sacramento, CA (+15.0% and +14.4%)

- Orlando, FL (+14.7% and 7.5%)

- Houston, TX (+15.4% and 15.4%). This surge suggests that the damage Hurricane Harvey did to the housing stock is goosing the rental market.

However, asking rents in some formerly hot mid-tier markets are now declining on a year-over-year basis, including in Portland, OR (-2.2% and -3.7%) and in Austin TX (-5.2% and -6.8%). And other mid-tier markets have come under heavy pressure, including New Orleans (-12.1% and -11.4%) and Minneapolis (-15.4% and -7.7%).

Whiplash from the drama on the ground?

With rents plunging in some markets but rising or surging in many others, the picture of this vast nation shows that rents are still rising overall.

This is confirmed by recent inflation figures. In September, the Consumer Price Index for “rent of primary residence” increased by 3.8% year-over-year. And according to Zumper’s national rent index, the median asking rent for a one-bedroom rose 4.1% year-over-year and for a two-bedroom 3.8%. These overall rent increases will continue to feed inflation. It’s just that in the most expensive markets in the US, rents have hit a ceiling and have bounced off this ceiling. And some of this is now spreading to other markets.

Here’s some extraordinary home price inflation in all its beauty. Read… The US Cities with the Biggest Housing Bubbles

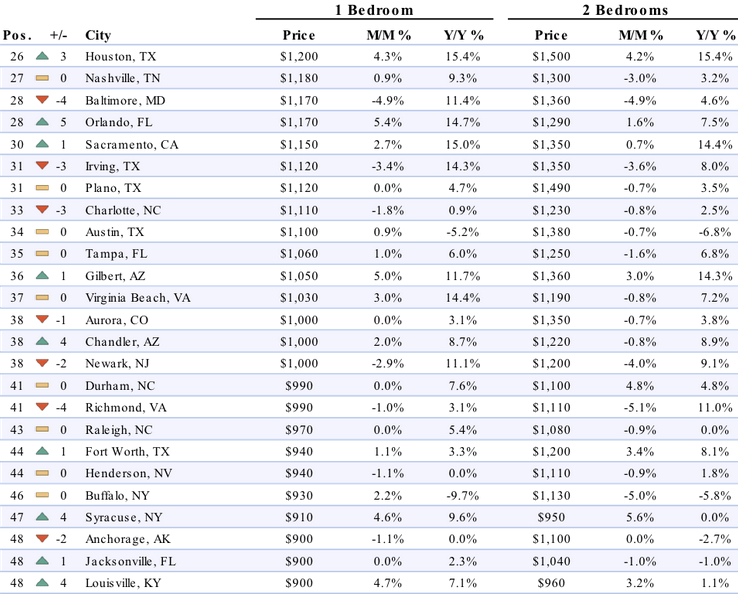

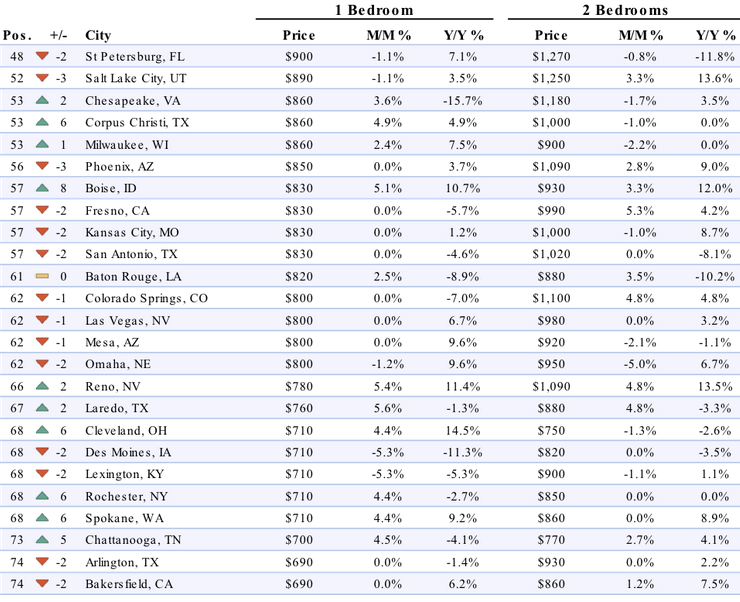

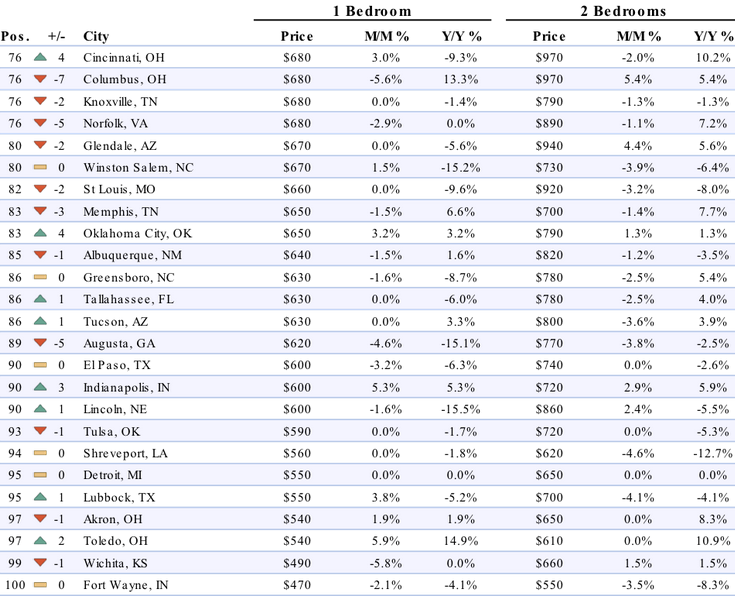

Below is Zumper’s list of the top 100 most expensive rental markets and price movements. Check out your city (click to enlarge).

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Seattle is supposedly getting more apartments in the next 2 years then the last 50 combined. That’s going to make a huge difference in rents for a while and may even spill over into housing prices.

Orlando’s jump may be attributable to Hurricane Maria which drove many Puerto Ricans to the mainland with the bulk settling in Orlando

Seattle should look at what is happening in Miami and Ft Lauderdale.

There’s no rout, at least not yet, but with all the housing coming online from here to 2022, and most of it East of the I-95, rents have already started to come down, slowly but steadily. Not even the hurricanes could stop the decline which is bound to continue for quite a while.

It remains to be seen how low landlords are prepared to go to keep vacancy rates down at manageable levels and how long they will be able to enjoy historically low interest rates on the debt incurred to finance all that ongoing building activity: there are far too many inexperienced landlords in the business right now who have incurred barely manageable debt at present conditions.

Interest rates won’t tick upward for quite a bit, at least not in appreciable fashion, but at this point it’s very likely it won’t matter anymore: most landlords are beyond stretched and a steady drop in rents will do in their ability to service even that cheap debt.

Again: no sudden burst or “the sky is falling in on me” moment, but it will be long and painful.

Was recently in Austin and took a look at 3/2 houses in town and in the south suburbs. Found ads for 1 or 2 months free rent or gift cards with signed lease. Went to one street just 4 -ish blocks from St Edward’s University and found three houses for rent sitting empty. ?!?

Also saw several cranes working on what looked like high rise apartment buildings. Hmmm.

Austin dropped most height restrictions for builders. The city is undergoing major changes.

That’s the problem with economic growth fueled by debt and consumption (USA) rather than manufacturing and export (eg China).

Any – meager – wage rise that results from inflation produced by the easy credit are quickly gobbled up, and more, by inflation in costs of basic facilities such as housing.

Only the banks and the financial speculator win. But that should come as no surprise – they’re the people who invented the neoliberal dogma that’s dazzled our political class and is dragging us under, pulled down by the millstone of usurious lending practice.

Sure, and China’s Debt to GDP = 300%. When will people realize it’s not about consumption, etc? It’s about making a certain class called the elite winners and others losers. If you are not the elite today and your children somehow makes it there next time, they’ll do the same.

The Human Race Sucks. Full Stop.

I don’t know many people in Tampa that can find a 1 bedroom for $1k.

Jay, I live there and that’s what I pay, but it’s 650sqft in an old building that doesn’t even have laundry facilities let alone a w/d in unit. I make decent money as a junior research scientist but if I lived in one of the many $1800-3000 luxury places, I’d be resigned to never actually owning a home. Yeah, my neighbors suck, but it’s low crime and lets me divert a nice chunk of every paycheck to my house fund. The unfortunate thing is that there are a dozen REITs scooping up all of these little mom & pop operated buildings and severely raising rents while doing zero improvements, cutting pest control and landscaping, and adding new fees for things previously included in the rent like water/sewer/garbage. The one that bought my building and several others nearby is a collective of former NFL players from Cali, allegedly.

Sounds like a developing country.

The amounts that management companies get should be tracked and ranked. I was told that they get one month’s rent per apartment rented plus a monthly bonus fee that is between $10-$20 per unit.

This is probably why the rent increased and the other costs were segregated out.

As long as the Fed’s ultra-easy credit and debasement of the currency continue apace, Housing Bubble 2.0 will only continue to expand – until it doesn’t. The next financial crisis, once again caused by the central bankers, will make 2008 look like child’s play, only this time around the Keynesian fraudsters at the Fed and central banks have already expended all their ammunition on nine years of “emergency measures.”

That’s right, the “Emergency measures” have been going on for eight years, so that seems like the new normal, when we have really been hanging on desperately the whole time.

The TPT has worked 24/7/365 keeping up this new ETF charade called the stock market.

Ultra loose money to any bank – developer here in Seattle has given us China-level ghost cities right downtown. I go in these new buildings as part of the gig economy and NONE of these are more than 40% full. But they can always tell people legally say that they only have one more unit available. JUST one more.

I bet downtown Seattle will have 20,000 empty units this time next year.

Epic price collapse…. Oh wait all these REITs will get bailed out.

KurtZ,

Great comment about the REITs. I keep telling people that we don’t have a shortage of places to live, but rather a shortage of affordable places to buy. In other words, we don’t need all this f-ing construction gone wild.

But the REITs and developers have probably conned people into thinking we need all the construction when we don’t. People aren’t suddenly going homeless by the hundreds.

Once people realize, “Oh gee, we actually have loads of supply. It just costs too much,” the developers and REITs get bailed out.

I’m in Seattle and that’s the first I’ve heard about empty buildings. Can you say the names/locations of these empty buildings?

Seattle home prices and rents are doing well because Amazon, Microsoft, and Boeing are doing well. Employees are paid a lot in stock, and the stock prices have doubled or better in a few years. When there is a general stock market drop, local wealth will dry up and things will change – especially if there are layoffs. I know Microsoft and Boeing like to lay off first, then ask questions later. They usually begin the layoffs before there is any sign of trouble.

Empty units: They write off the cost of the empty units as a loss and the tenants from the 40% pay a little more to cover the expenses for the entire complex.

Just like in 2008, investors can lose money, including REITs. The big banks get bailed out and perhaps a small group of government insiders using special means. Where pension funds, 401k’s, and other holdings are concerned, the REITs can lose a lot of money – though the hedge fund organizers often organize it to guarantee their profit regardless (they are different legal entities so not obligated by a particular REIT investment fund going bust)

Gershon: monetarism is not Keynesianism; monetarism is the opposite of Keynesiansim. You are very “mish”-informed!

Real Keynesian (fiscal) policy properly applied impedes the power and leverage of the banksters. The banksters want you to oppose Keynesian policy. The banksters thank you Gershon, for your unwavering support of the .01%.

Trump is going to announce Powell as next fed Chair. Powell is same as Yellen policy wise so buckle up for very low/negative interest rate and more QE..

The orlando market might see additional significant rental increases due to a potential migration of Puerto Ricans leaving their hurricane impacted country. The orlando metro area and I-4 corridor currently supports large populations of Puerto Ricans. Governor Rick Scott is trying to remediate. Very similar to Houston .

Slowly but surely, every buildable square inch in Northern VA is getting built upon. I saw a Ryan Homes development west of Fredericksburg going up. Between it and I-95 is every fast food restaurant known to man (including two Taco Bells, spaced a couple of miles apart). Getting up north to Woodbridge or DC from such a remote location is going to be a daily headache. This is the problem also with Washington’s I-270 Corridor coming in from the NW. I look forward to the day when McMansions in far flung suburbs become unsellable, as predicted by futurist James Kunstler.

The commute from outside is insane, that’s for sure. It’s been my observation that once you sell inside the beltway, you’re not getting back in unless your salary increases substantially.

Rents in mid-tier markets will start to decline as well; a lot people tired of high costs in the big cities started moving to these mid-tier markets, but that stream of new comers will slow down, and thus they can’t ask for higher prices anymore.

As for Bay area, I see so many of these building managers keep spamming Craigslist on daily basis, and yet the dumbos won’t decrease the asking rent. It’s like these morons can’t get it through their thick skull that it is over; you can’t get those high rents anymore; there are no more takers.

Well here in Denver we are the very epitome of the rapidly escalating mid tier market .. but to date things have anything but slowed down when it comes to the streams of newcomers thinking we’re the new Gold Rush of the 2010’s with the gold in this case being cannabis .

And what might be the result of these escalating rental and home purchasing prices combined with an onslaught of newcomers you might ask ?

First and foremost as of today Denver now has the fastest rising homeless rate of any city in the US ( NPR CPR etc – et al ) And one day volunteering at a soup kitchen will show you that the majority of those partaking are not the typical street people you’d think .. but rather individuals who only months ago had a roof over their heads .. food on the table .. and decent cloths on their backs with reasonable jobs to pay for it all .

Secondarily is the lack of teachers , health car workers , corporate and business support staff , nurses , tradesmen etc due to the high cost of housing

Yet is any of the above effecting the housing market rental or otherwise in the slightest ? Other than the plethora of Homes for Sale that suddenly sprang up in October ( Oct – Feb being Denver’s down market for real estate ) not to mention a lot of homes coming back on the market after the contracts had fallen thru for one reason or another … not one damn bit .. with prices escalating regardless

I relocated from Colorado to rural Florida a year ago after living in Westminster for 35 years. Do I miss it? The impossible traffic on the Valley Highway, the waits at virtually any restaurant at any time of the day, the increasing rudeness of the populace? Nope. We visited friends and family there during this previous summer and honestly, I was sick of the Front Range all over again after about one week. Traffic even worse, bunches of new restaurants- all full!, and the ubiquitous bums with their cardboard signs at just about all the corners in Denver. I don’t believe most of ’em are really homeless though- more likely just out of work and just trying to pick up some extra cash.

I see the high rise apartment boom continues in lodo, Douglas County is even more of a choked mess, and quite a few more suckers have been conned into buying homes on the buffer of Rocky Flats within easy walking distance- if you don’t get bitten by a rattlesnake- of ground so radioactively contaminated that it could not be cleaned up, so it’s been covered and paved over. (don’t they realize that rates of leukemia and various cancers are significantly higher in that area?) I visited Erie and was tempted to stand on Briggs St. and issue a public apology for building several homes there and thereby contributing to the ruination of that once cute little town. Instead I just had a quick beer and beat it before I burst into tears.

One of my kids just rented a semi-rundown one bedroom apartment down on Colorado Blvd. near the old Silverado building for a cool grand a month- just about double the mortgage payment on my first house with 4 bedrooms and two baths out by Standley Lake. He earns barely more than I did at his age- and he has a college education and works a white collar job.

I would have bet (and realistically I did) that the housing boom on the Front Range was ending by last spring and being wrong on that bet cost me roughly thirty thousand dollars by selling out too soon.

Was it worth it? After living here for a year without the congestion, without the high prices for just about everything but groceries and gasoline, and without the increasingly rude people (easterners? Californians?) I’ll say unequivocally “hell yes!”. But… then again, I’m 63, retired, and with damned few expenses- I’d SURE hate to try to make a living down here.

Concerning your remark about Rocky Flats, in the 1960s and early 1970s, I had an uncle who worked at Rocky Flats. He, his wife, and daughter died in the mid 1970s of radiation poisoning. He was some sort of a lab worker (he wore a white coat) and was required to take a shower at the end of every work day.

At the end of the day people should be able to afford these prices on a sustainable basis

If not the rents would come down

If yes the rents would stay this or up

If I may … you’re thinking logically … with logic playing little or no part in todays markets … real estate .. rentals or otherwise

One aspect as to why ? You’d be shocked ****less to know how many rentals at least here in Denver are being tied up by investors etc left unoccupied … to what end is anyone’s guess

One more ? The raft of single family home rentals ( best estimates are 20-30% ) being used as illegal ‘ grow ‘ facilities

Landlords are like utility operators, they set their profit margin, based on costs, taxes, maintenance. This is why the business has become popular with institutional investors. So if rents are dropping costs are probably also dropping. You can’t afford to hold a vacancy while you wait to see if the market has moved and it might be one indication that interest rates are not going to rise.

If someone inherits a clear- title apartment building (happens all the time) and employ professional management, they charge what the market will bear, not any more or less than a similar building that has to pay a mortgage.

The first may be a cash cow while the second just gets by, or operates at a loss while hoping for a capital gain.

The huge number of rental unit bankruptcies post 2008 was precisely because their costs didn’t drop as rents dropped. Which lender, utility or tax authority (the 3 main costs) gives apartment owners a break because they’re having problems renting?

LoL- wages are stagnant, so what will happen is prime properties will go BK and be sold to owners that will rent them out for whatever the going rate is at the time. And slum properties will once again become cheap.

The housing mirage is starting to break down, and when the Chinese money parking scam finally dies, that will be the last step.

Reduced immigration, low wage growth, and an aging population don’t spell increasing demand. Nevertheless, everyone seems to think housing can’t lose- again.

Real ironies here people. The educated youth are burdened by their student debt, so they delay homeownership and children- but hey, not a real problem, eh?

Go long assisted living and nursing home operators- they are going to win big through demographics.

Meanwhile, housing bubbles froth away again.

https://en.wikipedia.org/wiki/Household_income_in_the_United_States

LoL- just back to where we were in 2006-7!!!

Winning big folks.

Not.

In short, reality bites, and if it breaks down again, so much of our financial system will once again be crunched.

And the Fed can’t lower rates enough to matter.

And quant easing does nothing for wages….

Nice box we are in, eh?

Someday this war’s gonna end…

“Go long assisted living and nursing home operators”

Just sold all my Omega Healthcare Investors stock today. Really bad results and with looming cuts to Medicare, etc., they are going to have even more problems with the top line and bottomline. Their occupancy rate is down from 92% to 89% and the future does not look good.

I think more people and going to spend their last days at home rather than in nursing homes, as they used to do 50 years ago. People can no longer afford nursing homes.

Some day this war is going to end? LOL not likely. At 38 years old at least not in my lifetime. I feel very sorry for the screwed up USA and world my kids are going to inherit. People have been raging against the Federal Reserve since 1913. 100+ years its grip has only strengthened and its reach lengthened. This is all pointing to a global economic crash that will make 2008 look like a cakewalk. “They” want to cripple the American gun owning consumer and initiate a one world economy compromised of a universal currency. It may not happen in the next decade but in the next century it will. It humanity survives that long.

North Korea has been pretty quiet lately. But major war is likely to break out before we have another bad collapse. It’s really the only thing that will really distract people from what’s going on. Trump has been a complete back peddler on just about everything he campaigned on and I voted for him. I’m only 38 but the bills and expenses of life just keep piling on. The one thing many people older than me don’t have that I do is my health and earning potential. I’m in a good field compared to many. But I pay over $1000 a month in childcare so I can work full time. That doesn’t include car payment, town home payment, what little student loans I have left after 15 years. These older boomers I’d say between 60-70 years old HAVE NO FRICKIN CLUE how hard it is nowadays. Most have tons of equity, assets, bonds, and major safety nets all the while collecting SS that most likely will not be there in its current form for my generation. $20 trillion in debt and growing………we are a country of literal brain dead and brainwashed cowards.

Nick, they don’t want to know.

I stood behind a boomer at a recycle center who requested that the millennial ‘worker-bee’ count each plastic bottle after he just weighted counted them. She thought she had been shorted. He counted each bottle. Her gain thirty cents. She did not care about the line or his efforts in the task.

They make you take the caps off which subtracts from the weight. I cut mine open with the caps on and compress them before hand. As an old friend says, “Nothing short of right is right..”

So in fact this boomer (retired, living on social security or a meager pension?) HAD been shortchanged by thirty cents? How? What were the circumstances? Were the millennial “worker’s” efforts in error (can’t count?) or fraudulent?

I know, I know, 30 cents might seem not even worth counting to some yuppies and such but to an elderly person on a fixed and maybe substandard income that little bit could be quite substantial. Are you postulating that this older person should have been intimidated into foregoing her or his rightful return-

no matter how seemingly insignificant- by the line or this incompetent individual’s “efforts”?

I am once again reminded of why I moved from the city.

A thousand a month in childcare sounds reasonable. Do you expect society to subsidize your childcare expenses? The remainder of the expenses you cited – car payment, house payment, student loans – are nothing out of the ordinary.

As for the Federal Reserve, every major capitalist country in the world has a central bank. We can count ourselves lucky that the USD is the world’s reserve currency. That way, we have foreigners buying our bonds, subsidizing our wars and the other costs of government. If we didn’t have that, taxes would have to be considerably higher.

Which is why immigration will not be curtailed.

The need to import demand and cheap labor won’t

end soon.

Rents and housing prices are not falling enough or fast enough. Anyway, they’re not falling at all here in LA.

When I graduated from college, I was always told spend no more than 30% of your income on rent, ideally around 25%. I stuck to that in the late 2000s but it was hard, most of my friends were blowing easily 40% of income on rent. 25-30% seems impossible with today’s rents and wage stagnation. I have a lot of sympathy for Millennials younger than me, I see them working hard but with bleak financial futures.

Millennials are working hard in and for a system that has turned them into debt serfs. They don’t need to work hard they need to collaborate and come together and revolt against the current system or they will forever be enslaved by a corrupt debt based monetary system. They should revolt against all the older people in government that have stepped on them and lied to them with empty promises. McCain, Pelosi, McConnell, Obama, Bush, Clinton, Hitlery, Trump, Waters, black white left right…….the entire US government needs to be dismantled and rearranged. THAT is what millennials should be focusing on with the help of their parents generation who contributed to this mess overwhelmingly.

They don’t need to work hard they need to collaborate and come together and revolt against the current system or they will forever be enslaved by a corrupt debt based monetary system.

Millennials in 2008 had a clear choice: Ron Paul, who campaigned explicitly on a platform to end the Fed and let Wall Street reap the consequences of its greed and recklessness, or Wall Street water carriers Barak Obama (#2 campaign contributor: Goldman Sachs) or John McCain – essentially, the same candidate, with both supporting the taxpayer bailout of Wall Street banksters. Millennials overwhelmingly backed “Change Goldman Sachs can believe in,” aka Obama. So it would seem they have accepted their serfdom with bovine complacency.

Interesting blaming millennial for the outcome of any election – voting demographics clearly shows that participation rates increase with age so that the 60+ age group had double participation. Add to that the bigger size of the boomer generation and it’s clear that older people decide these things.

As for particular candidates, Obama was a vote for change, and Trump was another vote for change. It’s really that simple- often you get binary choices of same party or other party and that’s your say. Voters don’t directly decide policy – lobbyists have much more say there.

Bezos, Gates, and Buffet now own as much as the entire lower half of the nation. That is 3 Crown Princes = 180million serfs. Exactly what have they contributed to merit it? Create a debt-funded Weapon of Mass Destruction that destroys every middle class small business owner in its path? Steal a superior computer operating system and use the profits to dominate the world and absorb or beat to death all competitors? Buy insurance extortion companies and criminal lending institutions like Wells Fargo and build a financial empire from them?

If we were to seize all the Crown Princes’ assets and distribute the proceeds to the 180 million people in the serf class would the world not be better off? Give the deposed Princes a free condo in Florida and a Social Security check for life– that is more than they deserve.