Last time a “plateau” was declared, the market crashed.

Legendary real-estate bottom-and-top picker Sam Zell, chairman of apartment mega-landlord Equity Residential, got on Bloomberg TV and said, “There is a high probability that we are looking at a recession in the next 12 months.”

This is not even a remote possibility in the Fed’s miserably slow-growth forecasts it issued yesterday. But Zell was once again having a will of his own. He offered a laundry list of reasons: Multinationals are announcing mass-layoffs; global trade is deteriorating; China’s economy might be spiraling down; and “the strong dollar” is hitting US production.

But he said this only after he’d unloaded a ton of commercial real estate: in total 23,262 apartments in five states. The deal was announced at the end of October. Another 4,728 apartments are to be dumped next year.

As his firm pocketed the $5.4 billion it got from Starwood Capital Group for these units, Zell said: With “pricing currently available in the commercial real estate market, it is very hard not to be a seller.”

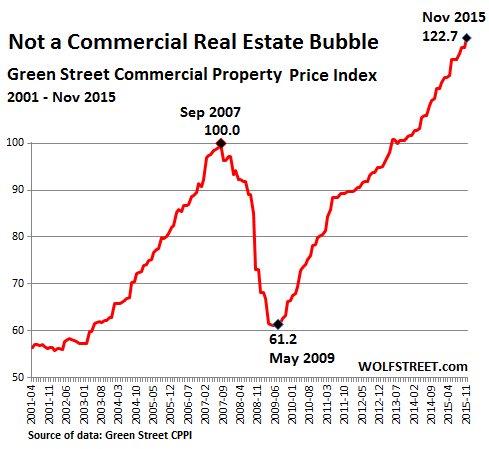

And prices for office, retail, and apartment buildings are in the most phenomenal bubble ever: up 10% this year through November, according to the Green Street Commercial Property Price Index, after having already jumped 10% in 2014. They’re up 100% from May 2009. They’re up 23% from September 2007, the peak of the insane bubble that blew up. Even on an inflation-adjusted basis, prices are now 12% higher than they’d been during that propitious peak of the bubble:

So Zell dumped about a quarter of Equity Residential’s portfolio and will unload more next year. Most of these units are low-rise and mid-rise buildings, just when a dizzying construction boom is beginning to throw a lot of new supply on the market.

The unnerving thing is that Zell has a history: in 2007, when the commercial property bubble was already teetering, he dumped Equity Office Properties Trust into Blackstone’s lap for $23 billion, not including $16 billion in debt. Then all heck broke lose, prices crashed – see above chart – and commercial property defaults ricocheted around the country. And after the Financial Crisis, he went on a shopping binge.

In one of the most exuberant property bubbles, San Francisco, rents have soared to where we now call it a “housing crisis” and read editorials like this one in the San Francisco Examiner:

When people talk about the dominant news story in The City, the housing crisis is usually the first thing mentioned. The term “crisis” is not even debated as a description — it’s accepted as fact…. It’s a crisis, possibly a state of emergency, that it’s easier for a camel to go through the eye of a needle than it is for a family to find affordable housing in The City.

But it has been good for the industry. Sky-high rents make all industry dreams possible, or at least they did. Because now, there’s suddenly talk of a “plateau.” The last time industry experts envisioned a “plateau” was in 2007 as the market was beginning to crash.

Jay Greenberg and Trigg Splenda at SF apartment brokerage Alain Pinel Investment Group see that kind of bone-chilling “plateau” in their latest report, based on two property pricing metrics, the Gross Rent Multiplier (GRM, sales price divided by gross rent) and capitalization rate (Cap Rate, Net Operating Income divided by property asset value):

GRMs and Cap Rates have reached unprecedented levels. Can prices escalate further or has pricing peaked? Of course anything is possible, and in our opinion there is little pricing appreciation left in this real estate cycle in relation to gross rent multiplier [GRM] escalation and cap rate compression.

So “if we are not at the peak pricing levels for GRM/Cap Rates then we believe we are very close.” They are echoing Green Street Advisors (source of the data for the above chart) which concluded: “If this isn’t the peak, we’re probably close.”

Greenberg and Splenda:

Currently buyers are willing to pay in excess of twenty times gross [annual rent] for quality properties. However as pricing creeps above this level we are starting to see quality properties sit on the market.

Real estate agents are privy to future closing data not yet exposed to the marketplace. Active agents have listings and escrows that are in contract and/or pending close of escrow and thus know the number of offers received, offer ranges, and final selling prices prior to the sale being published. In essence, we agents have future data available to us. As current escrows close in the 4th quarter of 2015, we will see value indicators continue to nudge forward. Yet offer activity has dropped.

In fact, still talking about apartment buildings with 10+ units…

In 2015 we’ve had escalating pricing levels with a 42% decrease in number of transactions. As we reach year end, we are currently at the highest pricing levels ever. For 2016 we are predicting pricing levels to hold and number of transactions to remain low. We’d be surprised if new market entrants (outside of the consolidated buying pool of late 2015) suddenly emerge and find a willingness to bid up GRM’s from current pricing levels.

These “new market entrants” are the rich Chinese that everyone in the industry is now praying for. But they’re tangled up in their own problems in China right now.

So the number of transactions for these types of buildings is crashing, in part because prices have shot up to levels where they no longer make financial sense for buyers, and buyers are suddenly pulling back, even at these sky-high “housing-crisis” rents:

This leads us to the conclusion that the market may have peaked (for now), and we are in a plateauing phase where buyers will pay up to a certain price, but not continue to chase properties higher.

Again that bone-chilling term, “plateauing phase.”

That would be the rosy scenario. It assumes rents don’t buckle under pressure from 59,000 units now under construction or in the planning stages that will wash over a market with a total housing stock of only 382,000 units [read… This Will Bust San Francisco’s Insane Home Price Bubble]. But when vacancies rise and rents come down, as they did during the last bust, the entire elegant math of Cap Rates and GRMs falls apart unceremoniously. Sam Zell must have had more than an inkling of that.

Alas as the chart above shows, after big booms in commercial real estate, there are no “plateaus.” Read… Industry Holds Breath for Craziest-Ever Commercial Property Boom to Implode

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

yes, prices are high, and supply is nigh.

sales will slow, supply will grow.

ho ho ho.

5% cap rate….hard to make any money.

Nice one Chris. lol

The U.S. economy is toast! 2016 is going to be tough.

+ves

– U.S. safe haven compared to most other countries therefore money will continue to flow to the U.S. (But will that money do anything useful to help the economy? No)

– One of the few countries that still have +ve intrest rates and an appreciating currency

-ves

– Dollar has appreciated significantly against all currencies. U.S. goods are too expensive (No one can buy your stuff or at best they buy will a lot less of it)

– Tourism will nosedive if it hasn’t already. Borders states with Canada are feeling it already.

– Less jobs (quality ones) in the U.S. regardless of what the Government says

– Too much debt everywhere (Government, Individuals and Corporations) – (the debtor is a slave to the lender)

– The U.S. is being hollowed out on purpose. Those that have a lot of money will be able to buy up assets for pennies on the dollar. They will get richer.

To be continued

The secret is to have a job that pays in $USD, yet is based in a country that’s suffering currency depreciation. ;)

Dave, US economy is done but because it is no longer a safe haven;dollar is going to be replaced as reserve currency (reminbi just accepted for SDR rights),dollar is not appreciating it is not dropping as fast as yen,ruble,euro, US regulation is out of control (thousands of pages of new regs on a daily basis),tourism is falling due to ICE restrictions (almost everyone needs a visa (except Saudi’s)),storing of biometric data (your eye scan belongs to .government when you enter US,our hubris has cost us any good will and is going to come back to bite us where it hurts.

The recent devaluations of the yuan (the name of the currency, the other word means ‘money’) would normally exclude it- but with permission having been given-the IMF is reluctant to further embarrass China.

However in real terms- the idea of the yuan replacing anything is now far in the future.

I don’t doubt the micro trends, but the macro trend is a much, much worse picture I think folks just gloss right over.

Young people have significantly reduced earning power and opportunity and graduate school with significant debts. They will not be homeowners in the same way their parents were … at the same time their parents are going to want to downsize as they grow older and retire. Home ownership is going to crater over the next 20 years and there are going to be a lot of landlords that don’t want to be landlords.

The system is totally borked.

I want to own NOTHING because I don’t want to pay the taxes on it and I want to be able to pack up and move if I get t-boned tax wise by a muni or state.

Regards,

Cooter

There are few secure places to park your cash these days. I’ve been switching from dividend stocks to real estate because the latter seems less likely to fall to zero.

Cooter you can RUN but You can’t Hide!

Here in UK investors have for quality propositions been paying mote than 20 times rent for some years. 2-3% yield is not unheard of

My very limited understanding of USA commercial property market is that propositions can sometimes come with a mortgage in place. In the UK that would be most unusual: buyers that need to borrow would be expected to arrange the finance for themselves. The USA inclusive approach faciliates the buying process but does away with an objective assessment of value.

“Does away with an objective assessment of value.”

With a short phrase, you have described the root of our current predicament, and why it will end so badly.

Equity Residential is a big owner of rental apartments in my area. They require 3x the rent in gross income to qualify to rent. I know because I didn’t qualify for one of their apartments on that basis.

Incomes in my area are declining. Everyone I know that lost a job and got another is making less money, a lot less. Zell would have been in a position to see this first hand. I would bet that many of his tenants not only couldn’t pay rent increases, but wouldn’t qualify based on their now reduced income.

Petunia,

I always look for your savvy comments.

Most posts on this website are elliptical and jargon heavy, but yours connect observations about the economy to real world examples.

Wolf should hire you to write a column. (Of course, for all I know you ARE Wolf!)

No, I am not Wolf and I really do live in south Florida. I am a big fan of this site, as well as, of the commenters. Thank you for the complement.

The Wolf is Yellen and the people that put her in place.

2400 a month IS considered “workforce housing” rent here in South Florida. That means at 25% to 30% housing allowance, your income has to be above $96,000. A tourist town made of workforce bartenders, waiters, cleaners, and the City thinks 2400 IS affordable for a two bedroom apartment? This is insane, yet Key West is about to buy a 52 million dollar duplex complex where rents must be 2400 or higher to meet the proposed bond fund (and loose the tax base if a private sale took place). This city and county has gone bankrupt 9 times in 100 years, looks like number 10 is going to sneak up on those who have not done their homework but, instead, are wound up in some fantasy called Perry Court which also happened to be in a flood zone

The question is: are we the head of the dog or the tail of the dog?

Last year someone I know was looking to replace a maintenance man in a building they managed in Key West. It was impossible to hire anyone because no one could find a place to rent at any price. The man he was replacing could afford to work there because he grew up in the area and owned a house. They finally got someone who had a friend with a boat he could live on in Key West. Everyone who works a regular job there was born there or commutes from up north.

90% of Millenials will live out their life’s in apartments! Some will inherit mommies pad. Socialism here we come!

And then enter the crawlspace…

http://www.sfgate.com/realestate/article/crawl-space-500-rental-Pacific-Heights-Craigslist-6697499.php

LOL.

The trend for renting has been steadily growing for years now. Data shows boomers are growing old in their homes if they can afford it. Not down sizing. I’m betting there’s going to be a lot of long term boomer offspring never leaving home. In SF many people are sharing an apartment that make decent wages. Qualifying for a mortgage is still quite stringent.

Don’t extrapolate too far into the future (more than 5-7 years). I haven’t seen NOT 1 person that gets it right consistently. Most people can’t even predict what will happen in 12 months.

Also, whenever you extrapolate, something/someone(s) always comes along and changes things. Look how long Zero Hedge and other shave been predicting a crash. One will come at some point but who knows when. Crashes are a rarely occur.

No one would want to play in the casino (Stock Markets) if crashes occurred too often. The Casino has to pay sometimes to make sure you stay at the table (feel like you have a chance to win) or else they won’t make any money.

The problem with any bubble is that they are inherently dependent on continuous expansion. Any pause leads to loss of confidence and a popping. Consequently, “plateau’s” are not possible.

I would guess that those looking for a plateau are simply employing wishful thinking. They realize the bubble can’t expand more but refuse to believe it really is a bubble. So, they compromise with reality and declare a plateau.

Real estate is about affordability. As long as interest rates are zero and debt is growing, prices don’t matter much. But ZIRP and geometrical debt growth cannot be sustained. So in the end, you can only buy what you can afford.

I don’t know much about commercial real estate, but I stand by my belief that the median private house price will return to under 3 times median income. I leave the math to you but it’s frightening.

So what’s the big short here? Short CBG, SLG, SPG?

I agree there is a real estate bubble and that it was propped up by US Fed Helicopter stimulus much of which went to China and Asia via imports. China crashed when the fed turned off the taps. Smart Chinese have been buying real estate and anything they can get their hands on overseas to insulate them. China has tightened the ability of Chinese to offshore their money thus the plateau. THE US REAL ESTATE PLATEAU IS LIMITED TO KEY INTERNATIONAL CITIES, COMPANIES AND HIGH PRICED RESIDENTIAL. THE WEST COAST WILL CRASH. NYC WILL CRASH. I don’t believe this will be an across the board crash but the top markets will suck the speculation and investment money out of 2nd and 3rd tier development. However 2nd and 3rd tier cities close to market value wont crash. They will see a modest drop and tread water because the major markets will be overbuilt.