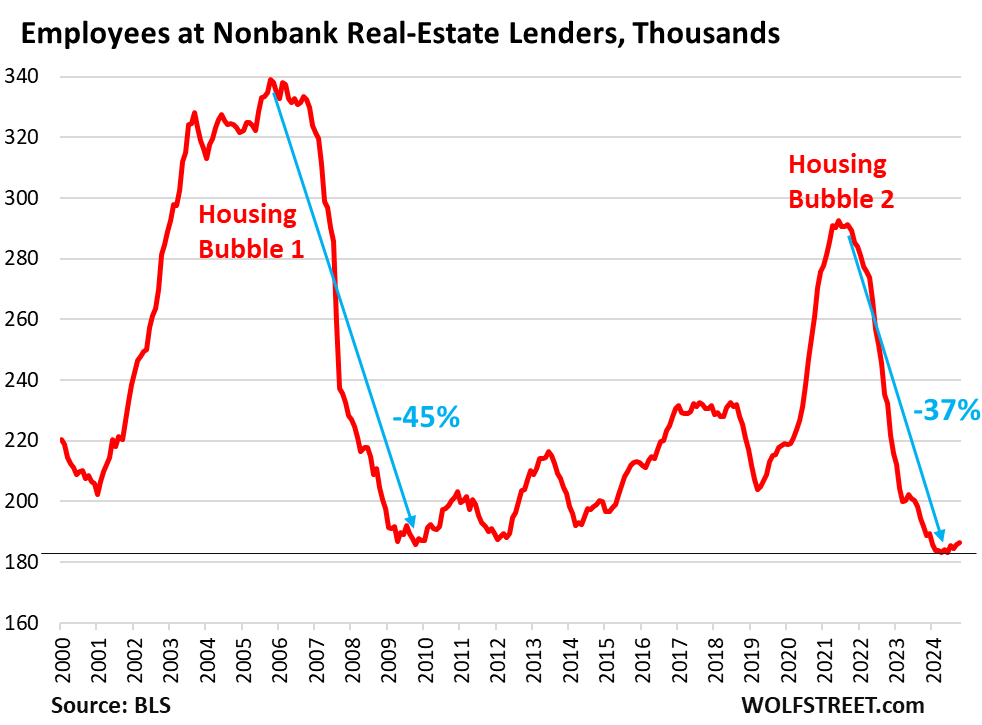

Employment at nonbank mortgage lenders collapsed by 37% this time around, to the lowest level since 1997.

By Wolf Richter for WOLF STREET.

Housing bubbles create employment bubbles at mortgage lenders, and housing busts then cause the employment bubble at mortgage lenders to implode. From June 2021 through October 2024, employment at nonbank mortgage lenders plunged 35.8%, according to the latest data from the Bureau of Labor Statistics.

At the low-point in June, employment at nonbank mortgage lenders was down by 37% from the peak, having plunged from 292,700 employees in June 2021 to 183,100 employees in June 2024, the lowest since 1997, lower even than during Housing Bust 1.

The employment bubble of Housing Bust 1 was even bigger than the employment bubble in Housing Bubble 2, largely because over those nearly two decades, a lot of tasks in mortgage lending have been automated, digitized, and moved online, requiring less human work today, and a relatively smaller workforce.

Employment at banks’ mortgage lending divisions is not included here – just nonbanks. But mortgage-related employment at banks took a similar turn.

Nonbank mortgage lenders dominate mortgage lending, while banks have pulled back. The two largest mortgage lenders – Rocket Mortgage and United Wholesale Mortgage – combined originated more mortgage volume in 2023 ($179 billion) than the next eight largest mortgage lenders (banks, nonbanks, and credit unions) combined ($171 billion), according to Experian:

| Top 10 Mortgage Lenders by Origination in 2023 | |||

| Mortgage lender | # of Mortgages | Billion $ | |

| 1 | Rocket Mortgage | 288,558 | 76.3 |

| 2 | United Wholesale Mortgage | 274,667 | 102.9 |

| 3 | Bank of America | 89,329 | 27.0 |

| 4 | Fairway Independent Mortgage | 82,985 | 26.0 |

| 5 | CrossCountry Mortgage | 77,790 | 27.9 |

| 6 | Navy Federal Credit Union | 70,371 | 14.7 |

| 7 | U.S. Bank | 69,655 | 24.4 |

| 8 | Citizens Bank | 66,687 | 15.4 |

| 9 | PNC Bank | 65,984 | 14.7 |

| 10 | LoanDepot | 62,665 | 20.7 |

| Total | 350.0 | ||

| #1 & #2 as % of total | 51% | ||

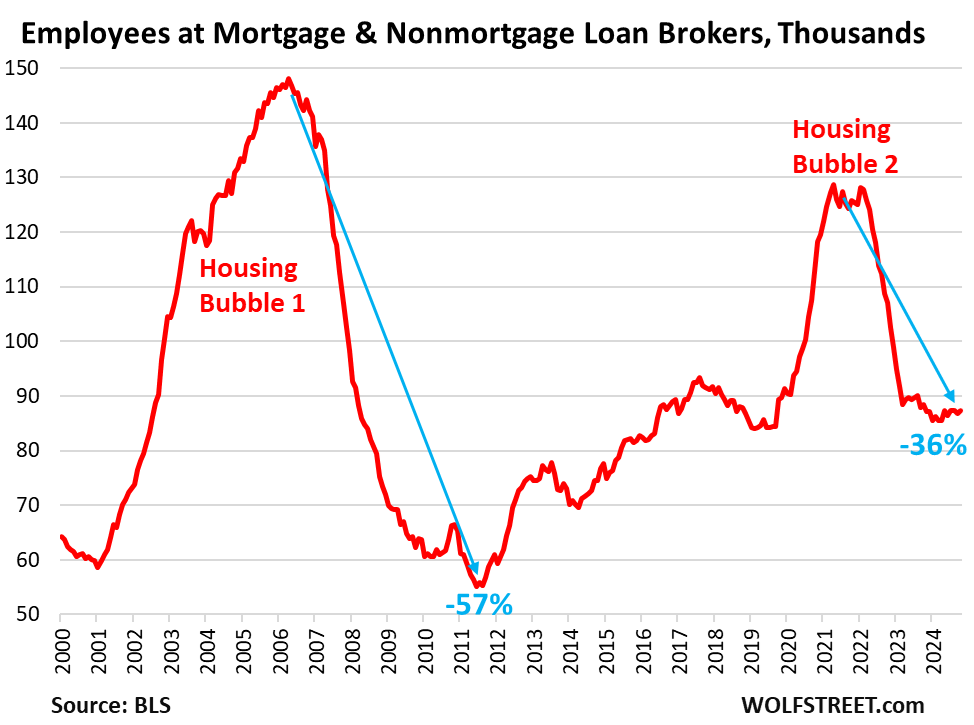

Mortgage brokers have seen similar job destruction after the housing bubbles burst. Employment at mortgage brokers and nonmortgage loan brokers plunged by 32% from June 2021 through October 2024 (and by 33.6% through the low in June 2024). During Housing Bust 1, employment in this sector collapsed by 57%:

These are different ways of depicting housing bubbles and housing busts – in terms of employment in the mortgage industry.

All combined, nonbank mortgage lenders and mortgage & nonmortgage loan brokers, lost 150,200 employees between June 2021 and June 2024, or 36% of their total staff.

Thankfully, employment in the mortgage sector is relatively small compared to the vast US labor market, and that kind of collapse in employment is barely a squiggle in the overall numbers.

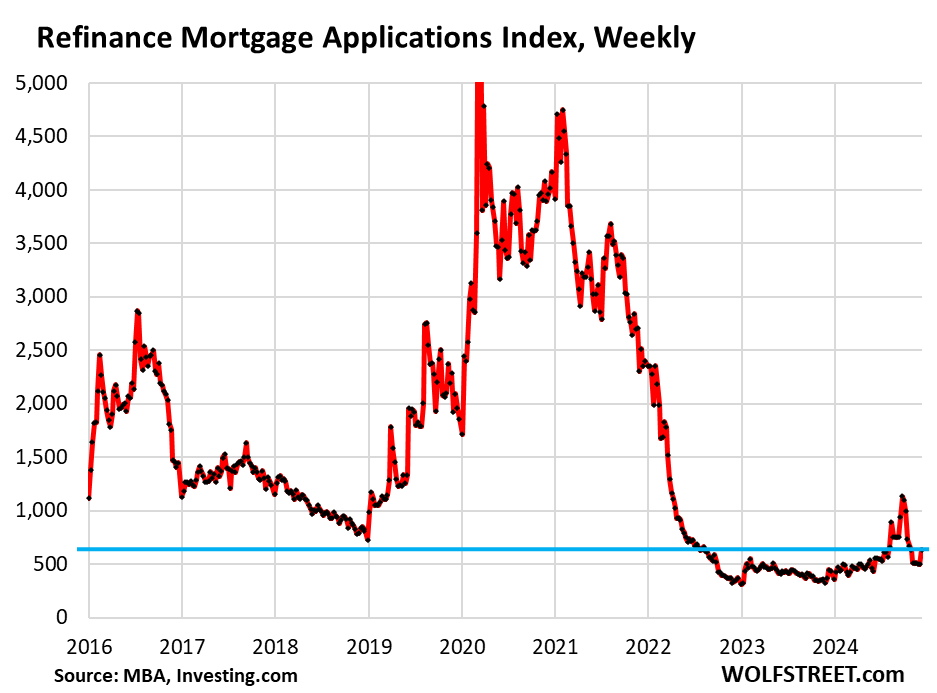

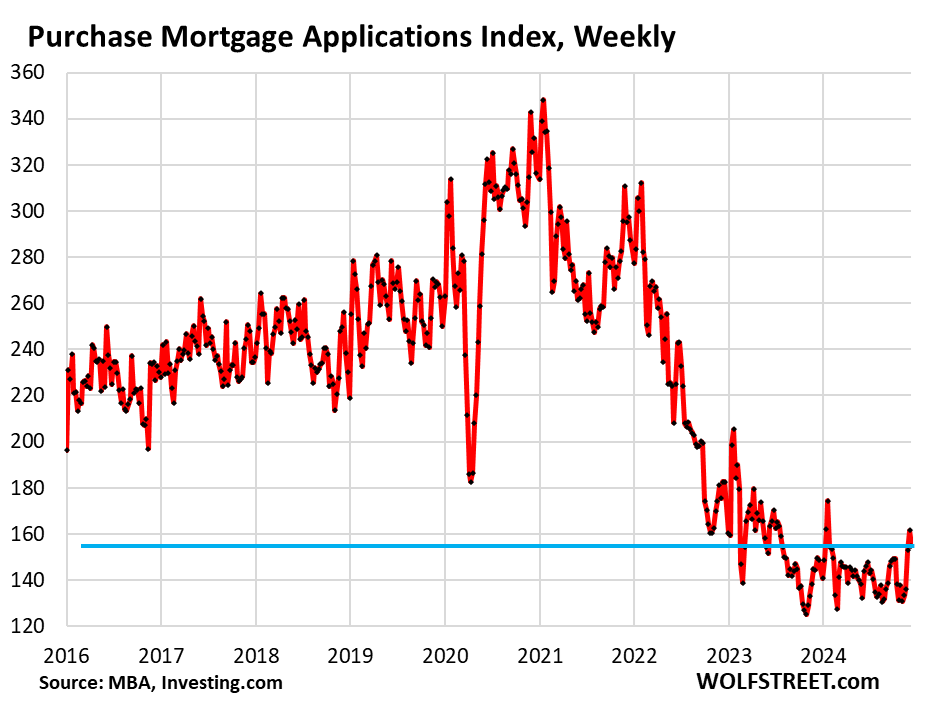

Employment plunged because mortgage originations plunged. We can see that in mortgage applications to purchase a home and applications to refinance an existing mortgage.

Refinance mortgage applications are down by 70% from the same period in 2019, and by 81% from the same period in 2022, according to the weekly Refinance Index by the Mortgage Bankers Association.

Note how in 2018, refinance activity also dropped as mortgage rates approached 5% in November 2018. And when mortgage rates started falling in 2019, refinance activity surged again.

But the historic refinance bubble occurred during the Fed’s 0% era of 2020 and 2021, when mortgage rates fell below 3%, and everyone and their dog refinanced their mortgage:

Mortgage applications to purchase a home are down by 40% from the same period in 2019, and by 48% from the same week in 2021, according to the weekly Purchase Index by the MBA. This is a stunning collapse of activity.

By comparison, sales of existing homes dropped by 35% in 2024 from 2021, to about 4 million homes, the lowest since 1995.

Housing bubbles are just so much fun, and everyone in the industry makes money, but the inevitable housing busts are a mess.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Tell that to the sellers of the two vacation houses on which we made we thought generous all cash offers over the last two months, given the houses that are sitting empty with list prices going down, down, down. They are determined I guess to wait us out. But we are seeing lots of choices. And we were and still are very conflicted about spending our money in this market anyway. So, instead, we are bumping up the money market and enjoyed visiting then leaving a nearby air bnb with no lingering responsibilities. That was really nice, actually.

Wolf, in 2023 mortgage related employment dropped to current levels. However, we are still not seeing significant home price corrections country wide. At least not as much as the declined already observed in 2009, which is when mortgages related employment first touched lows. There is a noticeable delay, prices are stubborn, they barely come down. What do you think could be the timeline for bubble deflation this time.

while I hate paying rent, at these prices, renting for summer vacay is what we’ll do

looking to add couple more home rentals to portfolio

will use one of them to pay for vacay and keep rest(income) during winter

Good for you Joididee.

I am out of this rat race as I sold all my socal rentals

Booked profits and donated a ton to my favorite charities.

Now I am thinking about bigger things and next leg of my life as I embark on my life after 50s.

Over time with age and experience I have drawn myself more inwards than outward.

Hope we all find what we really need.

@joedidee have you ever stopped to think “why” you “hate paying rent”?

I grew up being taught to “hate paying rent” (and “never buy a new car”) but as I got older I realized that paying rent (and buying a new car) is often the best decision.

When I get people to say “I hate paying $5K/month rent to a landlord who will pay to maintain and insure the home so I will “rent” money from a bank at $8K/month so I can pay to maintain and insure the home myself” it gets people to think…

i agree with the sentiment @ApartmentInvestor

i know so many people that refinance/change homes often and end up re-amortizing to a new loan, paying mostly interest on their mortgage payments, spending 2-3 times the original principal and ultimately never paying it off. its too bad all they care about is the monthly payment. they probably would’ve been better off paying rent in the long-term.

Hard to be sure, I would say that currency debasement in this cycle is more severe, with higher inflation overall. The economy is more bifurcated with a significant pool of people who can afford these high nominal prices. Working class people are well below adequate incomes to even think about touching housing and this was still kind of true even during the 2021 peak. Back in 2005-2008, the middle class bracket was larger and the currency debasement was more subdued, with gold price to wage ratio much narrower. The building spree in 2003-2008 was much more aggressive than this time around. The lending practices back then were riskier too. In addition, we haven’t seen the widespread unemployment spike in 2024 the way it did in 2009. Home Prices may come down yet next year, but probably less severely than in 2009… again due to currency debasement factors being bad nowadays. inventories are arguably tighter this time around than in 2008.

Wolf, not to mention, though you say the drop in mortgage employment is a mere blip in the total labor market….tell that to the thousands of mortgage people who remain unemployed or have had their salaries cut in half.

Yes, true. There are some mortgage professionals commenting here from time to time. They’ve been clear about what’s going on.

Ladida it is definitely a challenging time. I happen to work for a credit union where i have a measure of job security, but mortgage loan officers everywhere have taken huge income cuts or are leaving the business entirely. I have been doing this for almost 13 years, and am considering leaving the field myself. I got into mortgage lending after 12 years managing bars and restaurants; I figured if I was going to work my butt off, why not do it in a field where i could make a decent living and feel like I was adding to society. It’s been brutal over the last 3 years and it doesn’t look like that is going to change any time soon.

I was considering trying to wait things out until after the next “boom,” whenever that is, but that feels more and more unlikely every day.

I think a lot of it has to with low inventory levels due to low interest rate mortgages (rate <=4 percent), senior citizens staying in their homes instead of downsizing and buy a smaller place a lot more money than before.

Sellers can make bad decisions. We bought in 2010 in AZ from a woman who was repeatedly too slow to lower her asking price. She ultimately sold for 1/3 her original ask.

Comparing the rest of the country to the Arizona market in 2010 isn’t really fair. Friends had peoperty there and the market went from entering a lottery to be picked to be able to buy a home to prices dropping by 60% or more in a matter of months. I think it is more than fair to say most of the markets didn’t do that or even come close

Transactions are down, but aggressive RE agents selling a few $1M houses/ year, on 2%/3% commissions, before expenses, are earning a good income during the slump.

That’s a $20k commission on a $1mm house…you’d probably want to sell more than “a few” if you want to consider it to be a good income source….

they need it given volume collapse

with mortgage rates remaining higher,

the price differential is around 30%

I’m working on heloc and they are running me thru underwriting like I’m gonna default with 849 FICO score, $1m in free and clear assets and more cash in bank than asking for

of course I write everything off and have lots depreciation

they were concerned I couldn’t make payment($2k month max)

my monthly cc bill is north $5k

California fast food workers $20/hr x 2000 = $40,000

Actually, if I were selling a +$1mm house I would make the Buyers agent commission 10%. The best salespeople can be worth more the best lawyers, physicians, engineers, most of the administrators, and virtually all of Wall Street.

than

Unless you’re in Stockton or something, that $20 wage is woefully inadequate to afford the kinds of housing prices, gas prices, taxes you see in the bigger cities or Tahoe area. Even with 2 incomes. That’s the thing here. Conservatives complain about this $20 wage like it’s a gravy train when it doesn’t even make the cut. And yet, they are correct when they argue businesses might not be able to swing those wage rates… it’s a mathematical impossibility which boils down to wealth access having dried up for all except maybe the top 10%.

@Harry whenever I have sold a piece of property (both single-family and multi-family) I paid a 6% fee with 2% going to the listing agent (one of the “top 3” who have sold the most similar property over the past 3 years) and 4% to the broker that brings the buyer (since an extra 1-2% fee on a couple million is an extra $20-$40K for the buyers broker and EVERY broker that has a buyer with any chance of buying the property will try to get them to buy it). I have been a licensed CA RE Broker for 40+ years but still always pay someone to represent me since just like a pro who sells cars all day long can get more for a car on Bring a Trailer (with pro photos) than I would get on Craigslist (with iPhone photos). A pro realtor who is “in the club” with the >20% of brokers who do 80%+ of the business will almost always sell the property for more than I can sell it for (and also act as a buffer for me from lawsuits for not disclosing something)…

A tale of two times. The housing bust in 2007-2010 resulted in a wave of foreclosures due to falling values causing an avalanche of problems that reverberated through the credit world and, eventually, made it’s way to the commercial RE sector.

Today’s housing bust is in the residential sector and is reflected in the employment in the building and mortgage industry due to lack of production and sales caused by higher interest rates and higher property values that remain sticky. The flip side is some parts of the commercial RE sector have drastically collapsed and, at this point, the problems seem to not have derailed anything. One would think the extend and pretend games are going to end eventually and cause some havoc in the general economy. But who knows. Maybe AI can pay off the defaulted loans?

Expectations I hear in the RE sector are that residential (1-4 units) may have a slight correction but is likely to hold fairly stable. Definitely not expecting a nationwide crash, but of course some markets fair better or worse than others. In fact, affordability is rising slightly as wage increases are outpacing inflation.

The big pressure is going to be in commercial property, including 5+ unit apartments. This is where investors are increasingly being forced to refinance at today’s rates when their 5-year ARMs are getting called. Those with cash on hand are waiting for these to get devaluated heavily in the next year.

“Definitely not expecting a nationwide crash,”

That’s also what they said about CRE a couple of years ago, and now we have a nationwide crash, with losses ranging far and wide.

I don’t see how a 25 basis point reduction will cure this downward spiral but as reported, a lot is already priced in for tomorrow’s cut. Fed is tied to the whipping post and no matter what they do we’re all due for a flogging.

Unless you’re following the Wolfmeister (aka Wolf Richter).

The banks are adjusting by using AI and robots for many jobs. Call a bank, try to get a human, the robot will direct you to the website, and getting an actual human probably won’t be easy.

Many….I repeat…MANY lenders are sending your most confidential information overseas to India to be underwritten because it’s cheaper. When scouting for a lender…ask…will all of my documents remain in the hands of US employees or will the documents be sent to India. Me, I would not want my divorce decree, child support documents, investment statements, social security number, DOB …everything you put on that 1003 and every document you provide, to go to India. Mortgage employees in the US go thru very intrusive background screenings, fingerprinting, investments are reviewed, etc…do you think these lenders are doing the same with the India workers? I doubt it.

If the fed does not design a separate interest rate model for housing at 3 or 4 percent for housing this cycle will keep repeating forever , credit card debt are for wants , shelter is a need. At average $500000. For a home and 7% average mortgage rate the average household income needs to be around $125000 and that’s the low point , it’s not going to work

Home prices need to come down quite a bit, they’ve been blown out of all proportion, and it’ll work just fine after a while. No reason to panic. Mortgage rates between 6% and 7% are about right at the current rate of inflation. If inflation accelerates a bunch, mortgage rates should be higher, of course.

There is a whole generation out there now that has never had to deal with “cost of capital” as something to even think about because it was so cheap for so long. This has now changed. Cost of capital is real, and it enters into the math and decision process.

Wolf,

“No reason to panic.”

If only the Fed/DC adhere to that philosophy when SFH *prices* follow SFH *volumes* down (the phoney-baloney wealth effect engineered by the Fed via ZIRP lives on so long as prices *don’t* follow volumes down…once they do the phantom/theoretical wealth goes poof…*then* the Fed will likely panic).

For the last 20 years the Fed/DC has essentially spun itself up into a fairly psychotic mindset…

1) Desperately masking lack of real growth in the US real economy (see China and US de-industrialization),

2) By means of paper financial engineering (see ZIRP),

3) Treating any decline in the artificially/hopelessly inflated value of various “assets” as a catastrophe – as opposed to simple exposure of an enormous fraud,

4) Necessitating the next round of moronic paper financial engineering (see money printing).

Given that this has basically been the Fed’s modus operandi for over 20 years, it is hard to see the Fed detoxing/getting straight/using methadone rather than monetary dilution.

The fact that unZIRP lasted a bit longer than I thought and that re-ZIRP has proceeded fairly slowly gives me a tiny bit of hope.

But the accumulated cancer (manifested in the national debt and wholly deranged deficit growth) makes it very hard to have a lot of hope for the US.

When institutions have been junkies for decades, it becomes extremely difficult to have any faith in their reform or their success even if a miracle of will occurs.

Well said cas127! All good points. I have enjoyed your commentary for some time now.

“Cost of capital is real”

yes, when the FED is not manipulating it …………..

Meanwhile prices never stopped rising especially here in Delaware. It could be because money is slowly headed to zero with no gold standard. Politicians with huge appetites for frivolous spending got us here. Without a total market collapse nothing changed and even then they’ll probably turn up the printing and hyperinflate. It is a game of converting Fiat instantly and working 3 times harder to survive and only getting worse each day. Middle class is dead everyone is a serf except business owners.

David-

Good thoughts. Two counter-viewpoints related to your comment:

“After all, the Fed’s ability to manage the economy mainly comes from its ability to create booms and busts in the housing market. If housing enters a post-bubble slump, what’s left?”

—Paul Krugman, Running Out of Bubbles, NYTimes, May 27, 2005

“To a less extreme extent — as I describe later in this book — this [Japanese “invasion money” issued during WWII] is sadly what happens throughout many developing countries today: people constantly save in their local fiat currencies that, every generation or so, gets dramatically debased, with their savings being siphoned off to the rulers and wealthy class.”

—Lyn Alden, Broken Money, Timestamp Press, 2023, p. 28

Managed Money (or controlled or manipulated) leads to fiscal imprudence, and ultimately to debasement or depression. Or both.

David,

“…prices never stopped rising especially here in Delaware.”

Move to Austin:

https://wolfstreet.com/2024/12/12/the-most-splendid-housing-bubbles-in-america-november-update-prices-drop-in-all-33-big-metros-most-in-austin-tampa-dallas-san-antonio/

I worked in Austin, TX in 2019, and I saw plenty houses with asking prices between 300-350K. From Wolf’s chart, housing prices in Austin are still overvalued.

Let me know once the home value index in Austin fall back to 300-350K. I consider that is a “reasonable” price for a house.

I think I just saw a headline of 400 days until the government hits $40 trillion in debt. I am not sure if that it true or not but… hmmm… we went past $20 trillion in debt just 7 years ago in 2017.

My concerns is that:

1) As more money is printed via debt by governments or Central Banks, fiat loses its value and assets go up in price due to the devalued currency. Housing, land, stocks, PMs

2) But many metrics point to a housing bubble. Commodity prices seem to be flat or still dropping (there are a few exceptions). Is this a slowdown or over production?

I own a few rentals. I was thinking about selling after the covid price appreciation. But then I think….where do I put my money. In the SP500 that has a PE of 28 when the average for the past 30 years has been 21? So 30% overvalued? Is the next 5 years going to be that prosperous and with great EPS company growth from AI? If so, that probably means lots of future layoffs. Europe is in contraction. China is a mess. Treasuries interest rates are being cut which I think will put them under the inflation rate of everyday things I need. Global debt is over $310 trillion.

How do we not have future high inflation unless we have a recession.

Time it took the government to add $5 Trillion in debt.

1980- 1996: 16 years

1996-2008: 12 years

2008-2012: 4 years

2012-2017: 5 years

2017-2020: 3 years

2020-2022: 2.5 years

2022-2024: 2.3 years

That is exponential folks. Is there anyway that GOV debt spending will slow down. Can DOGE slow it down?

It is exponential and that alone doesn’t matter. The last $5T added is worth much less than the first $5T. The thing you want to look at is the rate of increase, which IMHO should be brought down but is not super alarming.

MarMar-

The rate of increase is important, but aren’t the relative proportions of debt-to-GDP and debt service-to-federal revenue are even more so?

As these two rise, systemic sustainability comes into question.

So who is really in a mess, China or we?

Gold has no role whatsoever to play in relationship to money. It is just a metallic asset whose aggregate value is worth less than 1% of all other assets. What is so difficult to comprehend about that?

To quote JP Morgan in his Congressional Testimony back in 1912: ” Gold is money. Everything else is credit.” What has changed?

LOL, that stuff keeps getting slung around. Morgan got his money and power through providing CREDIT. He disparaged and ridiculed gold with this comment, gold just being money, not credit. What do you do with money? nothing. What do you do with credit? Get rich and run the world. He figured that out.

@ Wolf – ” Morgan got his money and power through providing CREDIT. He disparaged and ridiculed gold with this comment, gold just being money, not credit. What do you do with money? nothing. What do you do with credit? Get rich?”

—————————————

Insightful explanation. I think very few, including myself, have understood Morgan’s often quoted comment. I mostly thought it was just antiquated thinking, not realizing the full irony of what he was saying.

Read about the Hall Carbine affair if you want some more Morgan, and his ilk behaviors and character. And check out his Gilded Age participation.

Anything to make a buck, eh?……our prevailing (and soon ending) game…….?

Yeah, Toad, the turntable at Playland in SF was lotsa fun (long before Wolf’s time there)………for kids. Sliding off and hitting the PADDED wall was even fun.

Sorry to spit in anyone’s get richer soup….just another economic loser…..must be envy, yes?

How long before housing prices reflect the bubble pattern, and return to the price levels before the bubble?

Didn’t you know that “housing bubbles are so much fun”, they really are…

But to those people who don’t have a job or a house now because of the “funhouse bubble”… Give it time and as this funhouse ride goes faster and faster, watch as people get flung off, loosing everything…always a good time at the funhouse.

Which do you think is most likely to drop in value by 50 percent or more: Bitcoin, stocks, or residential real estate? There’s your answer

I noticed in 2008, prices didn’t bottom out until 2012. But we haven’t even hit a recession yet. That’s what I’m wondering about.

However Austin has seen a decline of at least 20% since it’s peak. I think a couple other Texan cities also saw a decline in home values, but not as much as Austin.

Is this the beginning of the collapse or not? Who knows.

Manchester NH Zillow price index still up 7.3% YoY!!

Seeing 2-family homes that will gross $3600/month in rent selling for over $500k. Lots of people buying up the multi-families here because some podcast hosts say that’s the way to get rich. You only get 1 chance to buy at the right price though! Can’t refi your way to riches when the math won’t math.

Prices aren’t dropping significantly because there still isn’t enough houses (supply) for all of the buyers. The result of changes in new construction and existing homeowners not leaving their low rate mortgage. Also, as long as jobs/rents remain stable, foreclosures won’t add to housing supply as they did in the Great Recession. Investors/owners at the upper end can ride it out and/or pay cash/refi later.

“… because there still isn’t enough houses (supply) for all of the buyers.”

I get so tired of this BS propaganda by housing trolls.

Unsold inventory of completed new houses spiked by 53% year-over-year to 116,000 houses, the highest since July 2009 during the depth of the Housing Bust when homebuilders were trying to survive.

These completed “spec houses” are essentially move-in ready. But builders haven’t found buyers for them yet — and they will need to pretty quickly because they have sunk a lot of capital into these completed houses.

Unsold inventories of new single-family houses – from not yet started to completed – jumped by 9.3% year-over-year to 492,000 houses, the highest since December 2007. Supply rose to 8.2 months.

https://wolfstreet.com/2024/11/26/inventory-of-new-single-family-houses-jumps-to-highest-since-2007-unsold-spec-houses-to-highest-since-2009-as-sales-suddenly-plunge/

Supply second highest for any October in 7 years, behind only 2018.

Unsold inventory dipped to 1.37 million homes in October, from 1.39 million in September, which had been the highest in four years, and up by 19% from a year ago, according to NAR data.

Inventory of exiting single-family houses is 1.19 million, or 4.0 months’ supply (up from 3.5 months a year ago).

Inventory of condos and co-ops rose to 175,000, or 5.5 months’ supply (up from 4.0 months a year ago).

Overall supply in October at 4.2 months (red in the chart below) was the second highest for any October in the past 7 years, behind only October 2018 with 4.3 months (yellow):

https://wolfstreet.com/2024/11/21/demand-destruction-for-existing-homes-sales-in-2024-on-track-for-lowest-since-1995-amid-highest-supply-for-october-in-6-years/

This goes to show we don’t even need a recession for home prices to go down. The continued rise in housing inventory will take care of things.

Does the Competed SFH chart look the same by state? Or are there more states where there are Completed SFHs for sale?

By-state data not available.

//Prices aren’t dropping significantly because there still isn’t enough houses (supply) for all of the buyers.//

NOT TRUE. Prices aren’t dropping significantly because homeowners still have unrealistic expectations on asking prices. They still believe some buyers are willing to pay the premium for a house.

Not me. I prefer to rent rather than buy a house at this moment.

No upside on buying. Appreciation will be nil and cost of maintaining and property taxes will eat up any increase. Basically the reward/ risk ratio is very low. On top of that, you become tied down. Very Unattractive option for shelter and even worse for investing.

somewhat. but while volume was collapsed, many are still selling at top dollar. so those other potential sellers see that and figure out they’ll hold out for a stupid buyer. many of them won’t get that stupid buyer, but there are enough out there to give them hope.

People are still paying the premium in the northeast. It’s only getting worse here.

Exactly. Renting an $800k home in Naples FL for $3500/mo. The owners bought it in 2021 for $440k. We are debt free and sitting on cash for an opportunity.

Why no corresponding price graph?

Housing is stuck between that rock & a hard place. I don’t see prices rising much from here, but I do think in most markets sellers will remain more patient than not through one more season. No major change in expectations yet.

Unless ans until recession happens prices won’t fall a lot

Unless and until business cycle has been upended by fed there would be no recession

I wonder how much automation has to do with the reduction in mortgage related employment. Technology keeps getting stuff done that we used to pay people to do. Brokering and documentation is no different.

It doesn’t have anything to do with the sudden inflation and deflation of the bubbles. But long-term — over the two decades, as I mentioned in the article — it does have an impact.

NAR’s reduction in commission charges hasn’t helped much. Housing bust #1 was due to an overly restrictive money policy. Powell hasn’t reduced the price level like Bernanke did. In fact, long-term means-of-payment money hit a bottom in August and will rise during 2025.

Anything can happen. People who own houses say it will go up. People who don’t own houses say it will go down.

I own a house and think prices need to come down.

Same here!

I own two homes and I really need home prices to go down a lot for the betterment of society overall, I don’t want to live in dystopian society.

Jon,

I rent a small house to a young couple just starting out. We call them ‘the kids’. Last year one of their grandmothers stopped me on the street and thanked me for not being greedy. Seriously. However, this is a very small community in the middle of nowhere…with a focus on same. Neighbours are important, a key to a good life. This fall I was sick and the young man and his family offered to help me with pulling a dock out before high water, and with anything else. What comes around…..

Happy to hear these stories!

Paul,you are one of the good landlords that sees more then just the value of the rent,hope there are more out there like you!

I will buy at reasonable cost,still want a lot of acres with a modest home and will build a large workshop.

I will rent a few rooms to good people who I could trust to help me if I break a leg ect.(i.e. people I know).

Short of zombie nation this will be the lands I die on and thus am willing to buy at reasonable price,do not need to wait for total collapse.

I want some chickens/goats ect./want a on the move shooting range/good gardens ect.,thus,the need for a fair amount of land(and peace from others activities).

That said,the prices still too damn high!

Thanks for sharing your stories.

We need more people like you.

We should have the perspective that in the end, we all would die and can’t take anything with us.

MSN: Real estate battle over secretive off-market listings heats up…

When prospective home buyers come up empty-handed, seeing a “sold” sign on an ideal home that never showed up during their search rubs salt into the wound.

What’s frustrating to so many is these nonpublic sales, often known as off-market listings, shortcut the transparency that’s meant to inform the buying and selling process: Every home that’s listed by a real estate agent and marketed to the public is supposed to be visible through one of the hundreds of databases known as Multiple Listing Services (MLS).

Now, an internal battle is heating up between real estate brokerages over off-market listings — just as the dust is starting to settle on commission rule changes triggered by lawsuits against brokerages and the National Association of Realtors (NAR).

Unlike the commission overhaul, which pitted home sellers against real estate giants, this fight resembles a clash of titans more than a rematch of Harry Potter vs. Lord Voldemort. And the eventual outcome could result in more off-market sales at a time when buyers are already slammed by housing scarcity and high prices.

At stake is an NAR rule enacted in 2019, known as the “Clear Cooperation Policy” (CCP), that requires agents to list a property on their MLS within one business day after marketing it to the public.

I think the writing is on the wall — and this buyer and seller strike is entrenched and will grow deeper. Inflation and the deficit will continue to fuel this housing mkt reset, as the economy cools from the election fiscal sugar high. The mortgage industry might as well turn off the lights.

A cooling economy is clearly on the Trump radar — with pending fights with Fed — and the game of blaming the Fed for managing higher inflation. The tension is building, as inflation gets stickier and trump becomes more vocal with policy goals that are totally at odds with reality:

““Would be sooo great if the Fed would further lower interest rates,” Mr. Trump posted on social media that December. At another point, he posted that the central bank should get “rates down to ZERO, or less.”

Zero— wouldn’t be on the bingo card, unless they know the economy is stalling.

I think your giving him too much credit. He’s a theatrical genius… I’ll give him that but I wouldn’t read nearly so much into those comments.

Sadly shows how unaware many citizens are. Artificially low rates fuel inflation. Yet the Republicans and Democrats, who got ninety something percent of the vote, both support it. But more so it shows the lack of leadership in the elected officials, continuously choosing to do wrong instead of right for the stability and prosperity of the nation.

The supply of homes in the country isn’t an issue but the supply of homes for sale is another story. As inventory increases prices will adjust, as seen in spots throughout the nation.

“but the supply of homes for sale is another story”

The charts and figures I posted in my comment a little further above of new completed houses for sale (spiked to highest since housing bust), new houses in all stages of construction for sale (spiked to highest since Housing bust), and existing homes for sale (surged to the most in years) ARE “HOMES FOR SALE”.

It’s going to take a catalyst, a crack in unemployment or stocks to push people into urgency. Then it will happen.

The Wall Street Journal has a current article tilted

“The Housing Affordability Crisis Is Going Global.” Maybe they are pushing the ‘you’ll own nothing and be miserable’ theme?

Nonsense, that’s a figment of your imagination. Why spread this BS when you didn’t even read the article that you cited??? They’re “pushing the theme” that RENTS and HOME PRICES are both too high in many countries — their main example is Ireland — and that these high price levels are causing all kinds of damage socially and economically. But everyone knows that. Prices need to come down, and they have started to come down in many places.

I swear this is literally the entirety of the FOMC’s board meeting minutes.

Nobody wants to ruin a great party.

When the cops arrive Jay and his Wall Street pals are already stocking up on more booze and coke.

DOGE is fleecing corporations for tens of millions to celebrate in style.

Debasement is the only way to keep the buzz going.