Gasoline & used-vehicle prices plunge, food inflation backs off for a moment, natural gas bills jump.

By Wolf Richter for WOLF STREET.

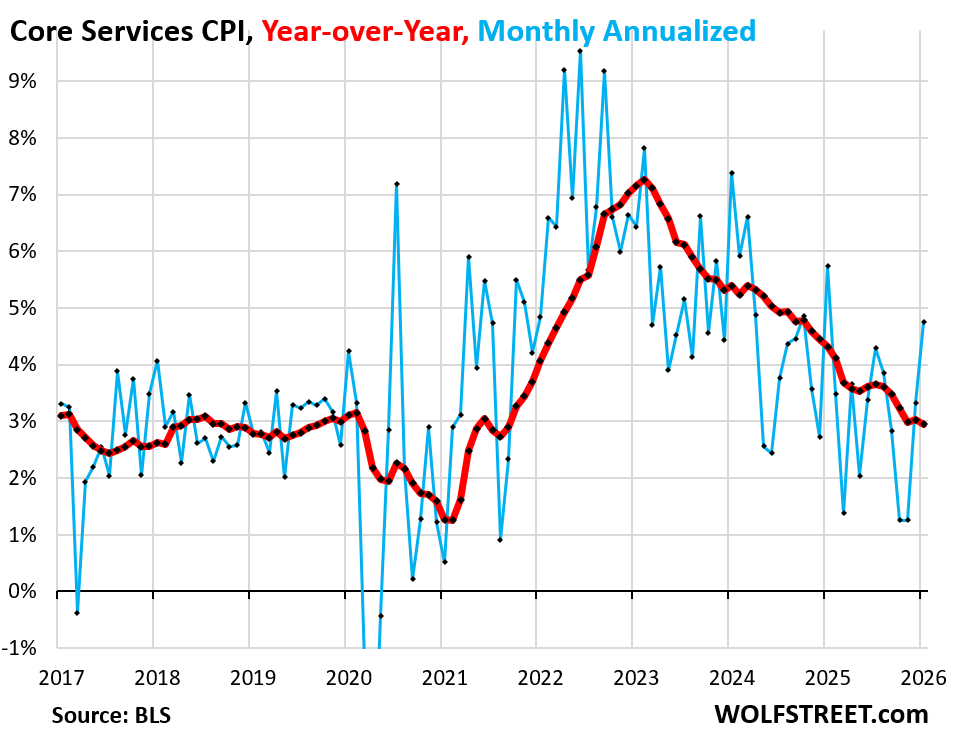

The Consumer Price index for core services jumped in January by the most in a year, seasonally adjusted. Core services dominate the Consumer Price Index and include many of the essentials that consumers cannot do without, such as housing, healthcare, and insurance.

But gasoline prices plunged, used vehicle prices plunged, new vehicle prices barely inched up, and food prices, after the surge in the prior month, ticked up modestly.

So the all-items CPI rose month-to-month by a benign looking 0.17% (+2.1% annualized) in January. But the core CPI (CPI without food and energy) rose by 0.30% (+3.6% annualized) and the core services CPI was hot.

Core services CPI jumped by 0.39% (+4.8% annualized) in January from December, the worst reading in a year (blue line in the chart). It accounts for two-thirds of the CPI basket of goods and services, and that’s where inflation ran hot.

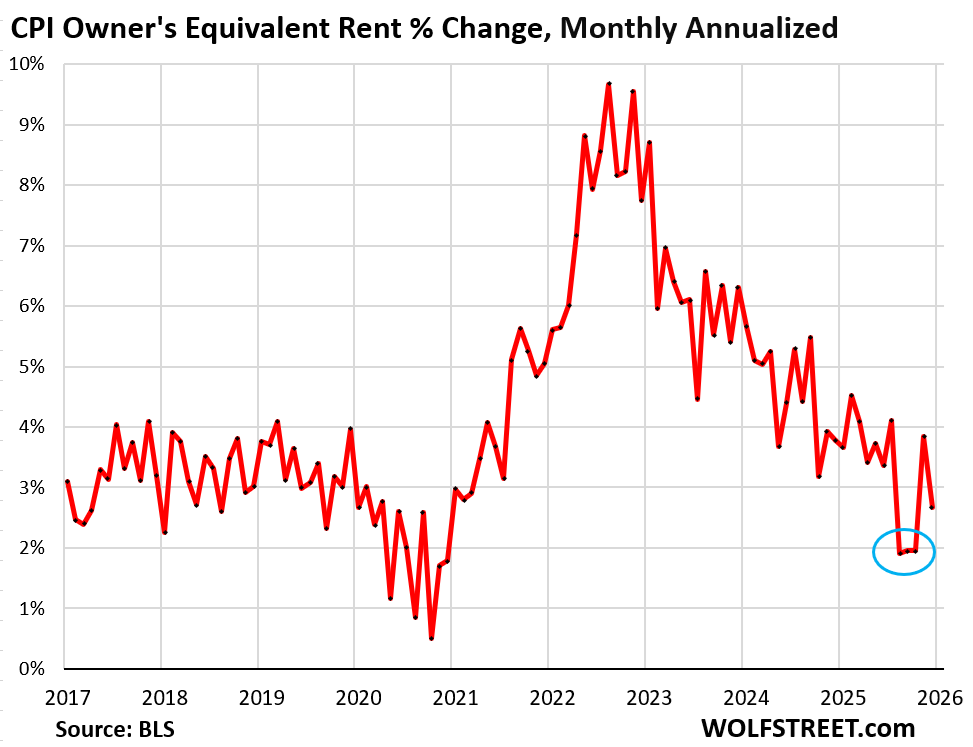

Year-over-year, the services CPI rose by 3.0% (red). It continues to be pushed down by the CPI for Owners’ Equivalent of Rent (OER), which had been doctored for the September-November period. OER is the biggest component of the CPI basket, weighing 26.2% in overall CPI and over 40% in the core services CPI, and it moves the needle. I discussed these scandalously doctored months here.

In August, the service CPI rose by 3.6% year-over-year, roughly the same pace as in the prior three months. Then came the doctored months. By November, the year-over-year reading had reset at an increase of 3.0%, and that’s where it has stayed through January. Those doctored months produced a year-over-year downshift that will stick around through October.

The services CPI includes housing costs, medical care services, health insurance (don’t get me started), auto insurance, tenant’s insurance, subscriptions; telephone, internet, and wireless services; lodging, rental cars, airline fares, education, movies, sports events, club memberships, water, sewer, trash collection, motor vehicle maintenance and repair, etc.

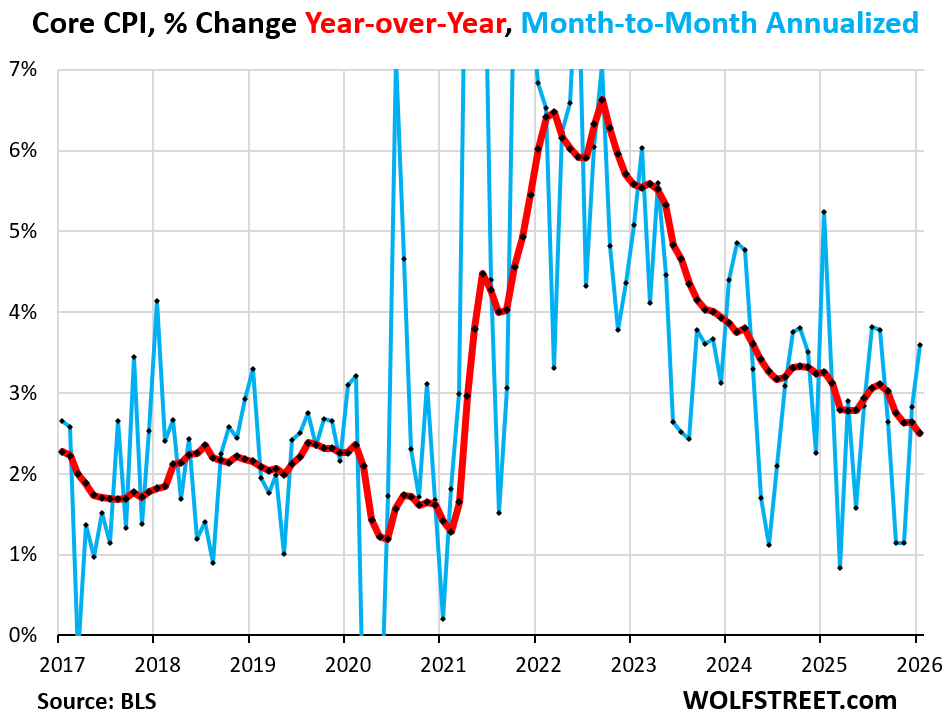

“Core” CPI, which excludes food and energy components to track underlying inflation, accelerated to 0.30% (+3.60% annualized) in January, the worst reading since August (blue in the chart below).

Year-over-year, “core” CPI decelerated to +2.5%, also pushed down by the months of doctored OER (red):

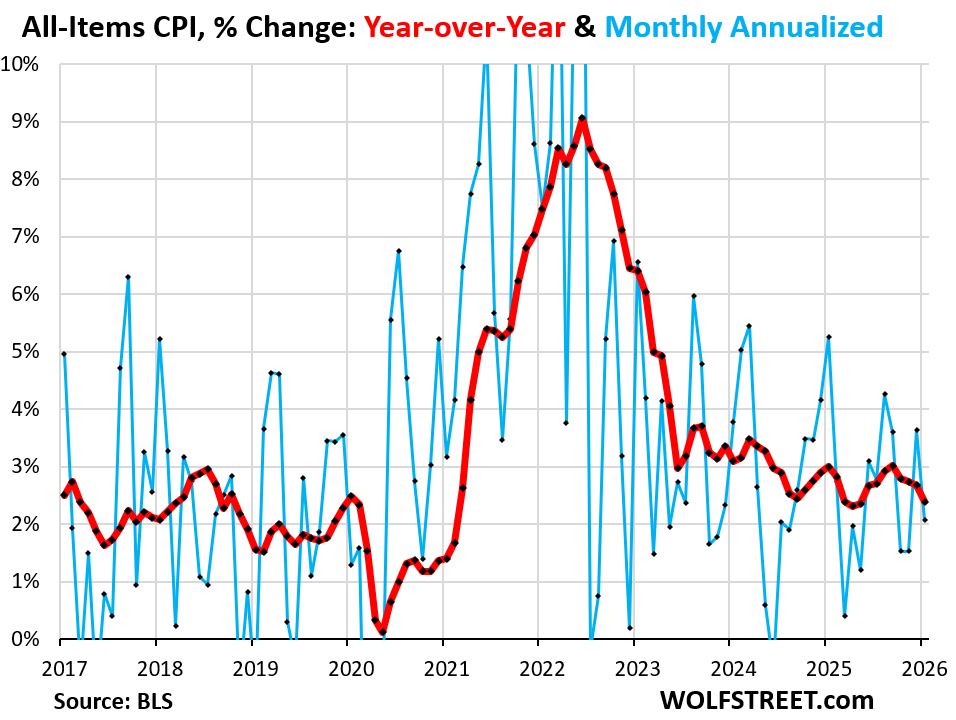

The all-items CPI, which includes food and energy, rose by 0.17% (+2.1% annualized) in January from December (blue in the chart below), as food prices barely ticked up in January after the surge in December, and gasoline prices plunged.

Year-over-year, overall CPI rose by 2.4% (red)

Some major components of CPI.

Owners’ Equivalent of Rent CPI rose by 0.22% (+2.7% annualized) in January from December. Year-over-year, the index rose by 3.3%.

OER is based on what a large group of homeowners estimates their home would rent for, with the assumption that a homeowner would try to recoup their cost increases by raising the rent. It’s not supposed to reflect rent, but the cost of homeownership as a service.

Homeowners experience a lot more inflation, but it is not reflected in CPI. The expenses of homeownership – homeowners’ insurance, HOA fees, property taxes, and maintenance – are not included in CPI, and OER takes their place. Those expenses have soared for many homeowners, and inflation is rampant in them, but obviously not reflected by OER.

OER accounts for 26.2% of overall CPI. The doctored months are circled in blue. It needs to be replaced with the indices that track the actual costs and inflation of homeownership.

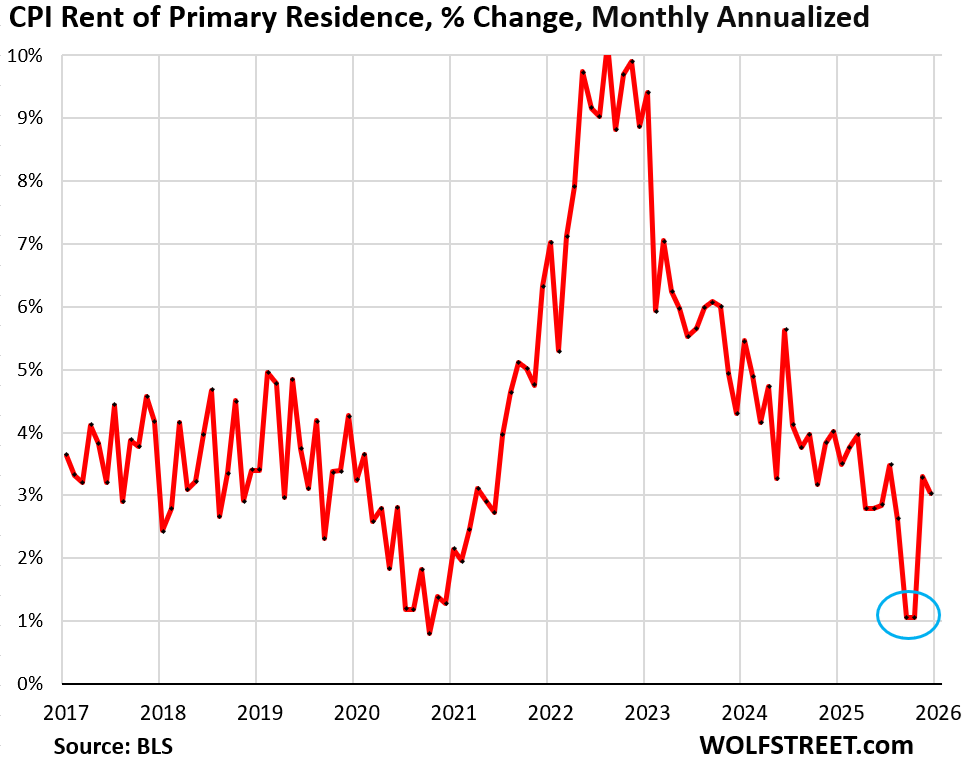

Rent of Primary Residence CPI rose by 0.25% (+3.0% annualized) in January from December. Year-over-year, the index rose by 2.6%.

It too got hit by freak figures for September that then got carried forward in the year-over-year readings.

Rent CPI accounts for 7.5% of overall CPI. It is based on rents that tenants actually paid, not on asking rents of advertised vacant units for rent. The survey follows the same large group of rental houses and apartments over time and tracks the rents that the current tenants, who come and go, pay in rent for these units.

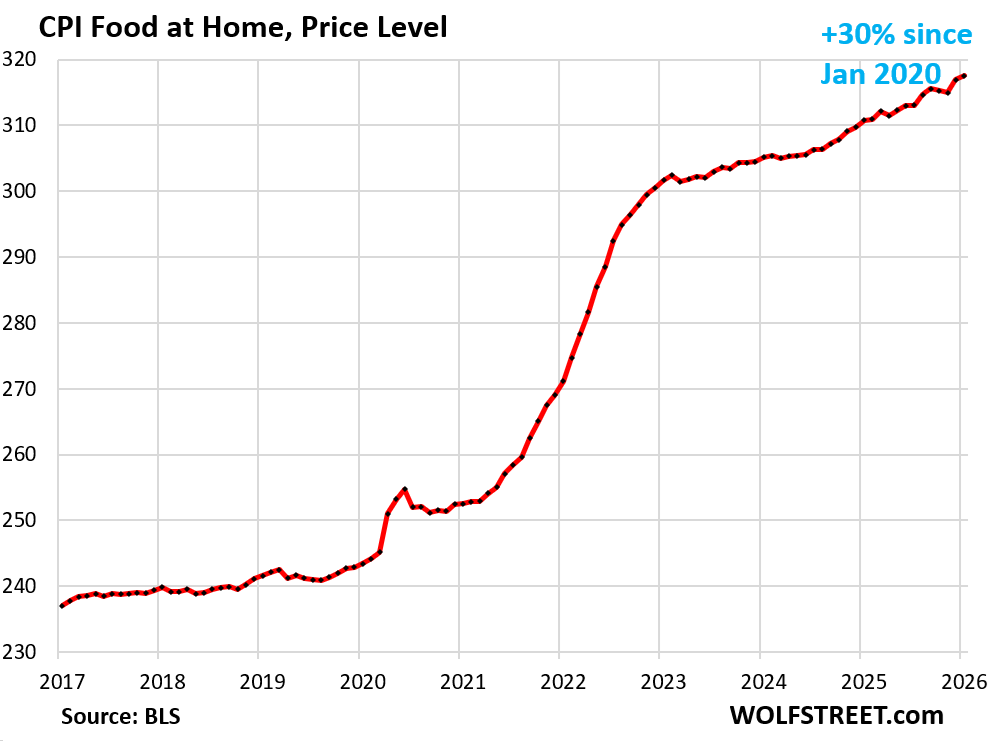

The CPI for “Food at home” rose by 0.2% in January from December, after the 0.6% jump in the prior month.

Year-over-year, prices rose 2.2%. Since January 2020, food prices have surged by 30%.

The chart shows the CPI for food at home as price level, not a percentage change:

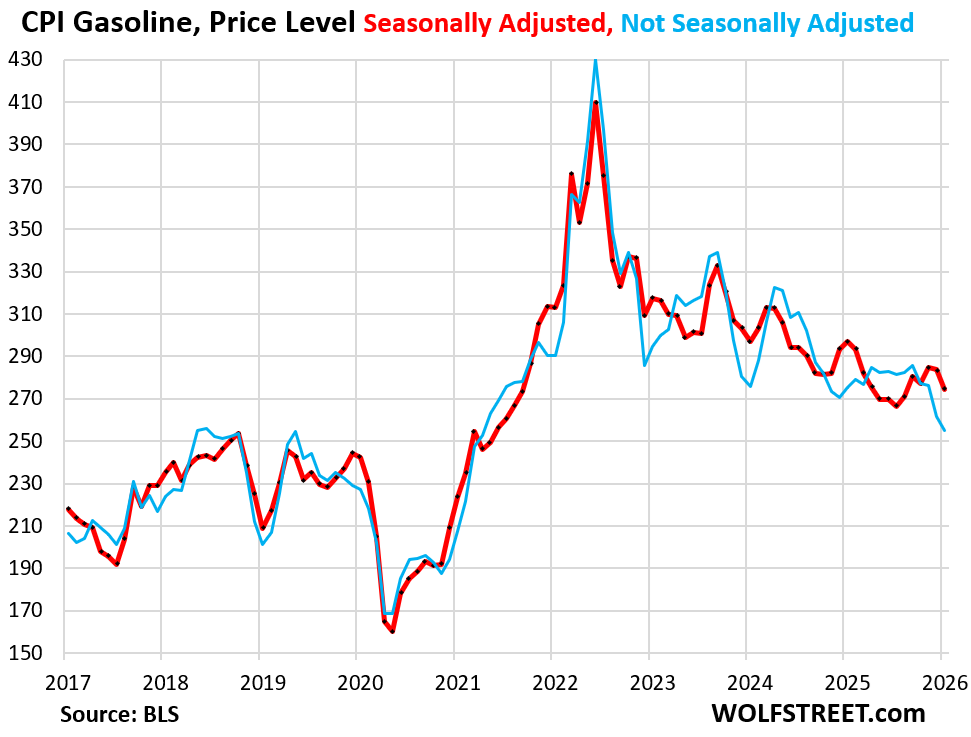

Energy prices are a mixed bag, with gasoline prices plunging, natural gas piped to the home soaring, and electricity prices slowing their spike.

| CPI for Energy, by Category | MoM | YoY |

| Overall Energy CPI | -1.5% | -0.1% |

| Gasoline | -3.2% | -7.5% |

| Electricity service | 0.2% | 7.2% |

| Utility natural gas to home | 1.0% | 9.8% |

| Heating oil, propane, kerosene, firewood | -4.7% | -6.0% |

The CPI for gasoline plunged by 3.2% month to month, seasonally adjusted (red), and by 7.5% year-over-year, on lower oil prices that have been zigzagging down from their spike-top in mid-2022. Gasoline makes up about half of the overall energy CPI.

Chart shows the price level. Not seasonally adjusted prices in blue.

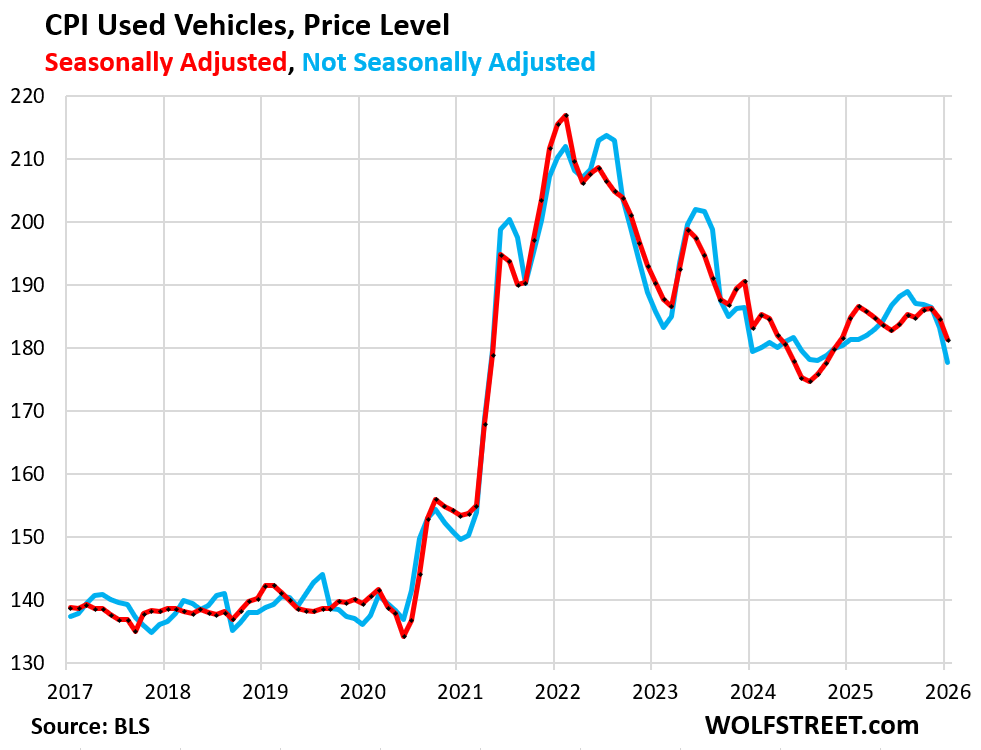

Used vehicle prices plunged by 1.8% in January from December seasonally adjusted, and were down by 2.0% year-over-year.

But the price declines may not run much further, as prices at auctions, where dealers replenish their inventory, have already started to surge again in anticipation of a huge tax refund season. Tax refunds make great down payments and big profits, and dealers are stocking up for it.

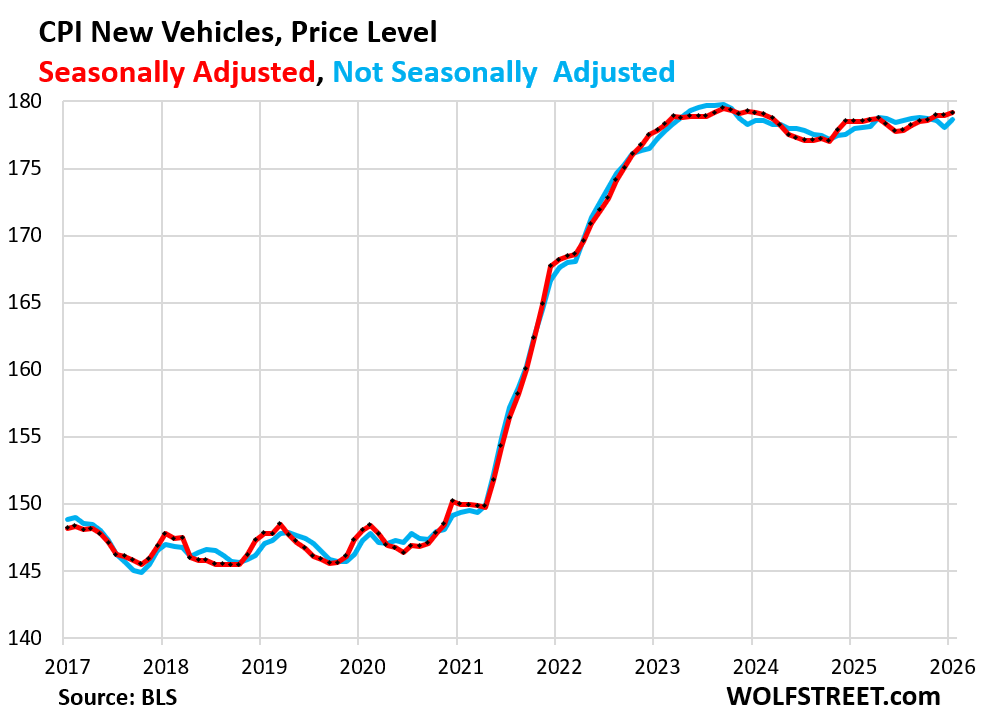

New vehicle prices ticked up by 0.15% in January and were nearly flat year-over-year. Prices exploded during the pandemic and then hit a ceiling as consumers refuse to pay even higher prices. In this environment, it’s nearly impossible to pass on any costs of the tariffs, and automakers have admitted to that when they announced their tariffs-related charges.

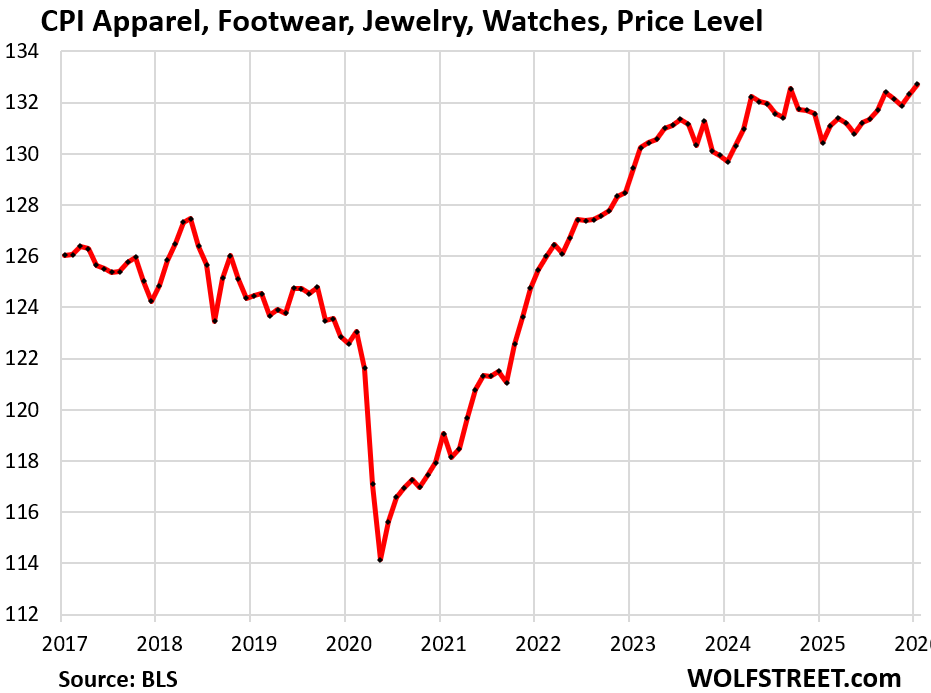

The CPI for Apparel, footwear, watches, and jewelry rose by 0.31% for the month and by 1.8% year-over-year. They are largely imported and tariffed, but the impact, if any, is minuscule.

The chart shows the price level (not the percentage change):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf,

I’ve reread this and your other article, but am still struggling to understand the impact of the doctored months of OER data. If a few months were artificially deflated with when there was no data, shouldn’t the first accurate month (December?) have a huge spike that accounts for all the inflation that was not included in previous months? I can see how this might cause some issues when these weird months eventually drop out, but don’t quite understand how we don’t have an accurate comparison to OER prices from on year ago.

No, because inflation is tracked by index values (price level), and then the percentage changes are calculated. And they doctored the price levels, and those carry forward for all times as new prices build on the old prices.

The index values (price levels) of OER are in the tables below in the column next to the dates. Then the rate of change (inflation) is calculated as percentage changes (month-over-month and year-over-year) from those price levels. And those price levels would have been higher if they hadn’t been doctored in Sep-Nov, and so the year-over-year percentage change off those higher price levels would have been higher. See the red figures.

The first table is as reported today.

The second table illustrates the principle. If OER price levels would have risen for Sep-Nov at the average of the prior 12 months (+0.33% each month) and then continued to rise at the reported amount in Dec and Jan, YOY OER would be +3.8% in January instead of 3.3%.

Wolf,

I get the math you are presenting, but aren’t rental price levels measured in absolute dollar terms (and any index would reflect this)? They can pretend prices didn’t go up for 3 months but when they calculate the price increases in December it should show a massive increase from the artificially low price assumed from the previous month? To what previous price level are they comparing the December equivalent rents to come up with the 0.32% increase?

and yet rents in Tucson have decreased 10% or more

can’t give away some rentals right now

discounted 20% or more, biggies are no deposit

know of 100 unit with 35% vacancy and growing

many more are in same boat

rents have plateaued

my analysis is that President Trump and ICE have provided lots of empty rentals now

along with multi-generation in houses

I have several 3 gen

Wolf or others can correct me, but based on the BLS Factsheet on OER, it seems they calculate the index using 6 month interval groups. That is group 1 is Jan/Jul, group 2 Feb/Aug, etc. So, will we see the increase in April from the Mar data perhaps? Or could that group be biased?

Jared,

Surveys go out every month, and there is fresh data every month, but they rotate the addresses so that the same address gets a survey every six month, not every month. Note that this is a large panel of addresses, and they rotate through them over and over again, so that they establish the data for each address every six months, going back many years.

The base effect is going to nail them next year, and I’m sure the excuses will be awesome.

Inflation is going to go thru the roof.

Some say Tips might be smart.

I buy the 5 year, they kinda are not great but at least the bond is short term. 2-4 auctions a year.

Barely any point in 5 year TIPS, unless we get a surprise pop in reported CPI.

I like 15-20 remaining years until maturity on them, but you have to be prepared for ugly MTM along the way since it’s a long bond.

Let’s see the points

1. Inflation protection on your Cashola.

2. Out of the market because might swan dive and I need some Cashola.

3. Some interest depending on how lucky you get on the auction.

4. No basis point fees by a fund

5. It’s a treasury so you can sell it until the union ends, and if the Union ends, well we’re all fahhh….kentuckyied! Ha

6. Not leveraged junk and not crypto junk.

7. Guranteed to get what you put into them back. Minus negative inflation if that happened.

So yeah there are some points to buy them. Low low risk. Versus what every junkey is hopped up on these days, leveraging spy and hoping for losses. Morons

To justify buying TIPS right now you have to be assured that the very same government that is paying you the inflation protection is accurately reporting inflation.

Unfortunately, there are concrete examples that the government will take advantage of chaos in order to fudge the inflation number.

TIPS do not offer up much inflation protection if the government is willing to manipulate inflation data.

This is the reason I don’t buy TIPS.

looking for real assets to buy instead

needs to spend my worthless fiat $dollars somewhere

I own $0 stocks, bonds, insurance theft products

use banksters to hold worthless cash, business

unfortunately gold/silver hard to do given high prices

@JimL, this is why I said “reported CPI”. We know it’s never your actual COL, and the question is just how far off. Price that tracking error cost in. For me, it’s worth it for long maturities because if we get a bout of 20% inflation, and I get paid 15%, that’s fine.

Hi Wolf, can confirm cars that are 3-4 years old are hard to come by at good prices. Probably due to the lack of lease returns making it to the auctions. Pricing has been steady. However, cars that a year old, such as demo model 2025’s with some miles are killer deals. Big discounts on those. I don’t think a car is counted as “used” in the CPI unless its at least 2 years old?

A car is counted as “used” in CPI when it sold as “used,” no matter what the age. The BLS buys the used-vehicle data from JD Power.

if you sell a previously titled car as “new,” you go to jail.

just got rid of some worthless fiat $dollars

bought USED 2022 Tacoma with 28k miles

had to pay bluebook

Yes, your fiat was so worthless that it bought you a Tacoma.

Jeez.

Worthless fiat bought a worthless Tacoma?

“If we lose the midterms, you’ll lose so many of the things that we’re talking about, so many of the assets that we’re talking about, so many of the tax cuts that we’re talking about, and it would lead to very bad things.”

This quote speaks for itself……I have no comments, myself.

Wolf, a question about the carry forward imputation. I’ve been keeping an eye on BLS’ published CPI imputation rates recently as you’ve brought this more to my attention. It is interesting to see October 2025 is wholly missing from their charts for both commodities and services (C&S) as well as housing. This makes sense, of course, if one reads their footnotes: “The Oct 2025 data values are not available due to the 2025 lapse in appropriations.”

But of particular note, on the imputation histograms and tables, BLS shows that no data is carried forward in C&S and the housing survey data doesn’t even have that option. Housing data is either “vacant” (unit is vacant so the data is imputed from non-vacant unit rents in the area) or “non-interview” (no one responded so the data is imputed from units in the area of similar class). So BLS is carrying September forward to October and just not reporting the carry forward? Or am I misreading their imputation histograms and tables?

Look at the tables I just posted above. You can see in the bold month-to-month changes what BLS did. September was an outlier low. It carried this Sep increase forward to October and November (though it left the Oct value blank but it shows up in November so we know what it did).

Wolf, appreciate the response and the hard data. I tried to find the data on the BLS website, but could only find the FRED graphs that reference the BLS website. If you have a chance, would you let me know where you found the primary data on the BLS website? I’ll keep digging so I’ll sure I’ll find it eventually. Thanks!

Download OER data here:

http://data.bls.gov/dataViewer/view/timeseries/CUUR0000SEHC

You can search the entire BLS data base here:

https://data.bls.gov/dataQuery/search

“Core services CPI jumped by 0.39% (+4.8% annualized) in January from December, the worst reading in a year”

This is what I’ve been observing. Notice the mainstream media has downplayed this increase for some reason. Wolf Street is the only site where this is being reported.

The Fed would be irresponsible if it cut interest rates with the economy hot and inflation increasing.

I’m pretty sure the doomers and gloomers will report this.

could also be called realistic, but their predictions don’t bring down the market until times get real bad. We’re due, but who knows.

How typical is it for the annualized increase to be the largest in a year though in Jan? My experience with businesses is that many raise prices at the start of the new year.

This data is seasonally adjusted. Since price increases that happen at the beginning of every year are seasonal, these annual price increases are adjusted out of the data.

There is a question whether or not the seasonal adjustments in January are big enough. But there were also Januarys when they were too big. You can tell only a few months afterwards.

In the end, within a 12-month period, seasonal adjustments sum up to zero. So over a multi-month period, it doesn’t matter whether they’re too big or too small in one month because the following seasonal adjustments in the other direction cancel them out.

I will admit a bit confused,we had a article a week ago saying used car prices going up and now one saying going down?

I this a regional thing like homes for sale,some areas up/some down?

On the upside my latest purchase last spring of a Olds Intrigue with a hair under 50,000 miles so far a winner,am really keeping up on maintenance and will send to a body shop(know owner)has very slight rust at rockers(no rot) and want cleaned up and painted,this car is a keeper and got for 5000.

I explained it in the article today about RETAIL prices when I said:

“But the price declines may not run much further, as prices at auctions, where dealers replenish their inventory, have already started to surge again in anticipation of a huge tax refund season. Tax refunds make great down payments and big profits, and dealers are stocking up for it.”

And I explained in the article last week about AUCTION prices when I said:

“Since the used vehicle CPI reacts with a lag to wholesale prices, the impact of the jump in wholesale prices in January, and going forward through tax refund season, will start showing up in the CPI in a month or two.“

James you gotta start the sentence with

“I got out my largest magnifying glass 🔍…”

Haha

Well,I think by the time the refunds kick in from taxes times will be trying enough that used car prices will fall,not sure what I would rather have but feel costs across the board getting too high and thus cars will actually in general be lower priced if one buys from a actual owner selling….,time will tell.

What is interesting is the Food at Home.

If you look at charts of grains and softs, most have fallen back to pre-2021 prices and the entire covid inflation effect is gone. Most of the charts look just like Wolf’s CPI rent chart.

Corn is down -45%

Oats -60%

Rice -40%

Wheat -60%

Canola -45%

Cocoa -70%

Orange Juice -50%

Sugar -55%

So why has Food at Home not dropped…at least a little?

1. You’re listing commodity prices. The commodity cost of wheat in a loaf of bread is minuscule. If you make a loaf of bread that contains 1 pound of wheat, just ballparking: 1 bushel of wheat = $5.50. There are 60 pounds to a bushel = $0.09 per loaf of bread. But you pay $5 retail for that bread. So if wheat plunges by 60%, it reduces the cost of wheat in the bread by a few cents.

The rest of the cost of a loaf of bread at the store: the costs of bringing all the stuff to the bakery, making it, packing it, transporting everything everywhere, until it gets to the shelf, lots of labor all combined, covering those costs and paying profits to everyone along the way.

2. the price of wheat has not changed much over the past two years. You’re talking about the 60% plunge from the mid-2022 spike. But that plunge was over by 2023. So in terms of month-to-month and year-over-year rate of change (inflation), that plunge is no longer in the timeframe.

Trickle down economics baby, don’t like it well control the production then, daddy didn’t own a factory? Sucks to be you

Wolf, you state, ” Those doctored months produced a year-over-year downshift that will stick around through October. ”

So your saying through October 2026 , the CPI Inflation Data will be lower than what it should be , because of the of the doctored months of CPI OER , correct ?

How is the September – November 2025 CPI OER data, causing future CPI Monthly 2026 Data to be lower ? the reason i state this is because when they report Year over Year Inflation for January 2026, its comparing it to January 2025. The September – November 2025 Data would be out of the picture .

I just explained it in my comment above with the tables.

If I understand correctly, the missing data or doctored data will permanently lower the index because the index works as Wolf explained. One month indexes relative to the previous month. I guess actually they do this daily.

The remark about it will effect the data thru October is that reported year on year inflation will be wrong because of missing doctored data until October 2026. After that if there is no more doctoring the reported Year on Year inflation rates will be accurate, but the index number itself is still lowered for times more than a year previously by that doctored data.

So let us say we are looking back for year on year inflation in May of 2027. That will be accurate because none of the previous 12 months are doctored. However, if we were looking at inflation going back 2 years, the inflation for that two years is somewhat lower than reality because it would still include the doctored months from the fall of 2025.

Not suggesting any single person or group of persons have complete control, but how the economy is doing is completely secondary to having a strong stock market. That line of thinking dominates most political decision making in my opinion. Frightening to think of the short term bad decisions to prop up the short term but then again, that is the model here. Inflation is not desired but mostly baked into consumer thinking. A hit to investments such as 401 accounts and other investments, even those who own houses is not, especially with upcoming midterms.

It’s interesting how people think that this whole inflation thing is somehow short term and that we’re not just in a super cycle that will continue and spiral until the end of this country which will probably not happen in the next 50 or 100 years because our military is too strong

20 years from now gold very well might be worth a million dollars an ounce

And it won’t matter because nobody is using cash and nobody will use cash

Reading all the news headlines this morning, one might be led to believe that inflation is almost back to the target 2%, no worries, bring on the rate cuts. Having now read Wolf’s articles for about 3-4 months now (thanks so much Wolf for your analysis), I was sure the picture was not so rosy. Indeed.

But all those misleading headlines and articles! Surely others must be aware of this suspicious anomaly. Please tell me that the Fed board members are aware of this, because few others seem to be clued in. I think I have only seen one other article mentioning the suspicious OER.

Not that surprising when you look at who owns all that media and how much they spend. The media investments are minimal compared to controlling the narrative.

Just received my homeowner insurance bill for 2026 (Carlsbad, CA in north San Diego County). The insurance cost is up a whopping 31% from last year. The square foot replacement cost went from $324 per square foot (2025), to $434 per square foot. I assume this represents the greatly increased costs for both labor and materials.

Many homeowners in my area are having their insurance cancelled, so I may not be able to save much by shopping around.

I assume these types of price increases will be included in future OER figures.

“I assume these types of price increases will be included in future OER figures.”

No, and that’s part of the problem.

Because of the fear of Wildfires?

Had it increased before this?

Have not gotten mine yet , hoping it’s not bad.

The health insurance increase was a lot!

We live in an urban area just East of Seattle (Bellevue). We have never had any claims and our Credit Rating is excellent. Our home is not exposed to wildfires, flooding, or any special threats. Yet our home insurance has more than doubled in the last 3 years. Our auto insurance has doubled in the last 3 years. We have never had an accident and have no traffic tickets. And yes, I have been checking different companies without finding a notable difference.

No wonder folks don’t believe the published figures. They aren’t using metrics that truly measure what folks are experiencing.

The CPI for auto insurance totally nailed our premium increases with GEICO, up by 56% from Jan 2022 to Dec 2024. But since Jan 2025, our premium has come down a little, and the CPI for auto insurance was unchanged over the period. So if you got a premium increase over the past 12 months, you either have a problem of some sort, or you’re fabricating stuff, which is why extrapolating from anecdotal stuff (often lies) in the comments to the nationwide CPI is clueless BS.

Homeowners’ insurance isn’t in CPI, and CPI doesn’t track it.

I have posted this chart many times in my CPI articles. You just never read anything, maybe not even the headlines.

FWIW. I definitely am not lying. Here are my exact figures:

Auto Insurance: 2 Subarus (2005, 2021) in urban Seattle area for 2 seniors without tickets or claims.

Prices paid in November

2022 $1428.91

2023 $1981.25 +38.7%

2024 $2004.18 +1.1%

2025 $2874.54 +43.4% overall essentially doubled

House Insurance: with extended liability umbrella coverage

3000 sq ft, built 1999 , no claims ever made. Not exposed to flooding threats. Home values in my neighborhood for average houses in Bellevue are circa $2 million.

2022 $1305.24

2023 $1757.31 +34.5%

2024 $2382.79 +35.6%

2025 $3111.17 +30.5%

Research last November showed I could save a bit on auto insurance if I moved both packages to another company but the umbrella coverage costed more. Savings was too little to bother changing.

I am told insurance companies participate in some national pool and thus one’s policy costs can be affected by disasters in far reaching areas. Also told that our company was catching up for a period of having lower rates (Hah).

This last rise in costs definitely got our attention and we intend to monitor closely. So there may be some issue of which we are not aware, but I am giving you actual numbers.

SeaBell

You have a personal issue with your auto insurance if you got a big premium increase in 2025. Our premium went down in 2025. As did many others. The reason being that replacement values (used vehicle prices) plunged from mid-2022 through 2024.

And yes, auto insurance is included in CPI, see my chart above on the CPI for auto insurance.

Don’t ever extrapolate from your individual case to the economy overall and dismiss national economic indicators because they don’t match your individual situation.

You can post your individual circumstances or whatever, but you cannot post here that your individual circumstances are proof that the national indicators are wrong, because that’s BS.

I cannot believe anyone would insure with GEICO. We just got done with a 21 month ordeal with GEICO representing a hit & run driver who totalled our car and GEICO wouldn’t pay a dime of our medical bills, nor compensation for loss of work. Unfortunately for them I had all the time in the world and got a good lawyer and was reimbursed in full for all of our losses included one year of lost work. I also had GEICO at the time of the accident and I cancelled them on the spot after I found out they were working with the hit & run driver who also had GEICO. They were working together.

Our car got totaled too, read-ended, had zero problems with GEICO, our insurance company that paid us, and litigated the other driver’s insurance company. Have had them for 20 years.

However, the insurance company on the other side of you, they’re going to fight you tooth and nail, that’s their job — deny, delay, defend.

What you want is that your OWN insurance company treats you well.

Wolf,

One lesson learned from this accident is that is worth increasing your PiP coverage to $10,000 from 5K. We had 5K with Geico and ran out of this in 1 month. This is where you get the money to pay your medical bills and loss of work while the case is in litigation. In Maryland, all your expenses, including medical, come out of your own pocket until the case is settled. Self employed people get screwed.

Here in the Swamp homeowners ins companies are using drones to fly over insured properties and mandating roof replacement for the slightest flaw detected. They need an excuse to raise rates to cover all the losses in high risk areas like Fla and flood and fire zones where they have had to pay out large claims. USAA wanted a personal inspection by a junkyard dog contractor of our home inside using an on-line mobile app. We told them to go pound sand and were ready to cancel their policy and go with another company. They let us renew without the inspection. Insurance companies are playing games with their clients and getting away with it.

Thank you big good wolf

Can someone convert firewood to electricity to cancel out the electricity price increases? That’d be great thanksssss

Yep,look up Stirling Engine,that said,requires labor on your part.

Wood alcohol gennies might also be worth a look,depends on location/time to work it/desire.

Solar power is a far cheaper and more efficient investment in electricity production for a personal dwelling than cutting down the forests on your property to power an inefficient external combustion engine like a Stirling engine, even if you also use the waste heat for hot water and space heating.

Solar panels are about 25% efficient at converting solar energy into electricity. Photosynthesis is about 1% efficient.

Save yourself time, money and headache and keep your trees available to harvest for firewood as needed, rather than going scorched earth on the trees on your property that have spent decades growing and provide numerous ecosystem benefits.

He asked for wood conversion,I gave reasonable answer.

I was joking. 🙃

Wouldn’t want to breathe wood fire 24/7

Wouldn’t mind a discount tho. These electric bills are crazy.

Only the most expensive solar panels are 25% efficient—those using single crystal, semiconductor-grade silicon. I don’t think those types of panels are even available to consumers. Also efficiency degrades as causes the p-n junction diffuses.

Since Aug 2023 All Item CPI y/y are slanting down in a narrow band, under a supply line, in re-accumulation, reaching/ breaching the previous box between Feb 2017 and Jan 2020. When the breakout happen inflation can jump above 9.1%. TradingView: inflation [USIRYY].

The US is the world largest oil producer. If the Gulf states cannibalized each other oil can rise to $120/ $150, or higher. Foreign countries will have to buy oil from us, using dollars. Inflation will rise along with DXY. Inflation will deflate the US gov $40T debt along with RE.

Manipulated numbers…

All so that maybe when someone stated that he achieved the lowest in inflation in 150 years……. It might cause some cheers !

The rent is Too Damn High !!

Nice charts – they make it clear why rents and insurance still hit hard and everything ain’t perfect.

But this is a massive economy and CPI’s always had its challenges—like democrats closing the government.

CPI measures prices, not:

Economic output – UP

Employment levels – UP – Just added 130k jobs in January

Wage growth – UP

Productivity – UP

Corporate earnings – UP

Business investment – UP

Inflation – DOWN

If we rank economic indicators by long-term structural importance:

Productivity & GDP growth – determine national wealth.

Employment & income growth – determine household wellbeing.

Inflation (CPI/PCE) – determines purchasing power stability.

Financial conditions & credit markets – determine expansion sustainability.

Point is: the economy’s better today than before, trending right despite what one side pushes —Joe Public reacts to spin, not raw numbers.

And the tax relief from that OBBB? —more money staying home.

Good dive, but bottom line—what’s the takeaway beyond flaws or just playing in the weeds and reports have been flawed before – so what?

Joe Public reacts to their own pocketbook, not spin. Financial news is about as dry and opaque as it gets and that’s why it’s barely mentioned in news coverage. When the public is this angry about their financial situation, the right question to ask is, what are the numbers missing?

While I agree with you most of the time people know their own pocketbook, I do think this particular time is unusual. People I know that are middle class to lower middle class are all displaying an attitude of “this bad economy”. They even complain about the bad parts, but in fact all those people are doing just fine. They are spending just fine as the numbers show. And by this I mean I see them spending like it is all good while griping it is all bad.

Price of food is up that last 3 or 4 years though actually most items are steady the past year. They are still complaining about something that currently isn’t happening. They ignore that gasoline is steady or down. They ignore lots of such things. They are all getting some sort of pay raise in the last three years. Things are not bad for them, but you wouldn’t know it to hear them talk about it. Even something like the no tax on overtime. Several people I talk to regularly each and every one complained it wasn’t as big as they thought it would be. They seem to think their refund on OT tax would equal OT pay. So in this case extra money in their pocket has them complaining.

With respect to the last part on OT, IMO, people believed the packaged slogan line “no more tax on OT”. That’s not exactly true.

From my understanding of the bill, OT is time-and-a-half (1.5)…. Well, it’s that .5 that is not being taxed! Still paying tax on the 1.0 part leading to their misunderstanding & frustration as you pointed out. That’s my understanding of that matter FWIW…. Maybe it’s BS. I’m salary so I haven’t had OT in years, and wouldn’t know personally. So I can kinda understand their frustration somewhat.

DRM- Spending like it is all good while griping it is all bad…

That was my point in reacting to the “SPIN” on what they hear and repeat not what they do or reality they live.

Sure some people are struggling but there are always some people struggling.

There are also a lot of people who just live beyond their means too.

Or those who spend $300 a week on food delivery (new report) – $8 bucks delivery fee on a $10 burger. Just saying.

Is this a joke?

If you laugh at it! 🤡

I mean the OBBB mention is kinda ridiculous

Was a giant gift to the rich and a pittance to us normal folks.

Some people want to kneel to the rich, some people worship them. That’s how we got here.

What’s an example of the gift given to a rich person. The biggest graft I recall in recent memory was the $2 billion to Stacey Abrams for environmental justice work in Biden/Harris inflation reduction bill.

Joe Public,

It is easy to look at some numbers and not all, and of course eliminate the negative aspects, that to be fair, our political institutions have created, regardless of party affiliation. Numbers like many of these are good at measuring overall health at a specific point but they do not measure beyond that to how even is the distribution of wealth or even spending, or even question whether corporate profits being at at an all time high is a good thing. I do think looking at other numbers you could easily arrive at long term structural problems exist, such as national debt, share of US dollar of reserves, moving onto a multipolar world, realigning geopolitical players. I for one am on the fence and waiting how all the private and government(tax payer) investments ultimately pay off, but construction of factories is a far cry from shipping out the door.

DP Penn

Did someone ask for your politically infused mid-term talking points?

Rick Vincent – politically infused

Truth + Positive Data = Political talking points?

Not one political statement there – Hmmm – guess depends on how you read it – Interesting…

#Popthebubble2026

DP Penn;

Yes, you have clear political bias, and it’s right off the bat in your second paragraph.

Stick to data , and keep your bias out of it and you’ll be fine.

You speak like a chat GPT prompt, Or just someone that thinks every single thing they say is extremely important. Are you a politician or just a closeted homosexual?

You could be both I’m just asking for clarification

This doctored CPI will affect the midterms because it will not be flushed out of the data until after the elections. Regardless of political affiliation, this is BS and bad for everyone who expects reliable reports. Why can’t our elected officials do the right thing for us especially with fiscal constraint?

Data that impacts cola adjustments and payments on tips might be manipulated but at least….

Dow is over 50000 dollars 😂🥳🤦

And no one thought it could be done in four years, and “he” got in done in one. And the NASDAQ is smashing records.

That whole exchange made me laugh.

Yeah I just wish sometime would’ve said… You do know the NASDAQ topped in October

The only thing that matters is winning at least that’s what being American is about right? Even if it’s not you directly winning as long as someone near you is I think that’s all that matters.

I completely agree.

I assume it could also mean smaller COLAs for Social Security recipients next year as well

Yes, and it already did that for the 2026 COLA because the Sep CPI was one of the three months that determined the COLA.

Many gas utilities’ prices are regulated and it seems to take the public utility regulators several months to approve a rate change. In the four Midwest states that I had lived in, the gas utilities all offered balanced billing with payments being the same every month. The monthly payment only changed after the winter season ended. I guess fixed monthly billing doesn’t happen in other parts of the country.

Bob,

Here in the UK, 70% of households pay their gas and electricity utilities by ‘Direct Debit’ (fixed monthly payments).

Overcharging / overestimating is very common. After the utilities have taken too much of your money, it can take some time to get it back..

Bob,while not balanced in northeast the utilities give you say a 30-40 dollar break during winter to help a little keep the bill down but play catch up early spring/summer.

“Year-over-year, prices rose 2.2%. Since January 2020, food prices have surged by 30%.”

I really wish they would segregate groceries from prepared food sold at grocery stores given how prevalent “ready to heat” meals and their higher margins have become in the grocery space. This section now has a larger footprint than produce at my market.

They DO separate them into thousands of categories, and I have reported on a few of major ones individually: beef, chicken, eggs, dairy products, fresh fruit and vegetables, roasted coffee, and “other foods” which include “prepared meals.” All of them each with a chart of course. All you have to do is read it:

https://wolfstreet.com/2026/01/15/food-inflation-gets-hot-but-not-every-item-a-look-at-beef-chicken-coffee-eggs-dairy-fresh-fruit-vegetables-other-foods/

Excellent work Wolf.

I often wait until your analysis before formulating thoughts on markets.

I don’t see this work on the CPI anywhere else, yet it’s important

In 1929 Shiller PE ratio, adjusted to inflation, was 32.56. In Dec 1999 it peaked at 44.19. Since 2018 it osc above and below the 1929 peak. It reached 40.18 in Jan 2026. The spread between Jan 2026 and Nov 2021 at 38.58 is small. It started turning down to a healthier level. We are not in the 90’s. Rolling hills up since Mar 2009. Rotation from the few elite co to small, medium and large innovative co., to the whole economy. The economy will grow for at least a decade. In a dynamic economy both Prices and Earnings can rise, but E will rise faster ==> therefore Shiller PE will be lower.

Shiller PE will take even this economy down.

Everytime!

Can you make historical comparisons with Shiller’s PE analysis?

Accounting for earnings has changed dramatically over the years. For examples: Pension expenses used to be recognized when paid, Option grants were never recognized as expenses, R&D spending used to be capitalized not expensed, Software spending was always capitalized, Revenue could be recognized when product shipped to a distributor or prior to end-customer acceptance, Tax expenses could be reduced due to payment timing differences.

It is tough to imagine grain prices staying this low or dropping….

and same with energy…

if true there will be no help from these sectors going forward in creating lower inflation numbers.

“Deep Fission”, a small innovative co, uses vertical and horizontal boreholes, a mile/two underwater, to build SMRs, saving time and 70%/80% of the cost.

One interesting characteristic of the core services data is how the monthly variability of the data points increased after 2020 and has not yet calmed down. Prior to 2020, the monthly data points landed in a tight band. Now they swing all over the place.

One function of money is as a unit of account. The monthly data points are volatile, which translates into risk for businesses. If they see prices rising 9 percent one month, then 1 percent the next, they aren’t going to be very likely to lower prices. Inflation stays sticky.

In its function as a unit of account, the monthly data shows that the dollar is like a ruler whose graduations slide around as you tilt it to get the measurement.

perhaps you will mock this, but i have been a r/e investor since the 1980s. quite successful i might add. the only way to gauge the prices for me is 2 fold. caprates whether i bought single families or multi families or commercial……….the other gauge i like is the price of houses in ounces of gold. as an aside i use the dow/gold ratio in my long term outlook for trend. i have been a very successful stock and fx and bond and commodity trader since the 1970s. i’m a trend follower with concentrated small number of positions………with trailing stops. i won’t buy anything if the trend is shit.

Wow you’ve been investing in real estate and you’re successful oh my God tell me more? You started investing almost 50 years ago wow You’re probably so smart. And probably was so hard for you to buy houses when they were $10,000 each. I wish I was as smart as you.

I wonder if folks did not pay the “going rate” for some non-essential items and services whose prices have risen significantly, would make a difference.

I am thinking if more than a few people do not spend $20.00/breakfast (eggs and toast), if the prices eventually decrease?

Just a thought.

Yes, I’m pretty sure prices would decrease, but Republican and Democrat deficit spending, adding to the high debt, is keeping people flush with cash, and Americans like to eat out and aren’t very frugal. But the high deficit spending seems unsustainable to me.

Seems like the bond market doesn’t care or doesn’t see the OER issue. Very strong 30-year bond auction the other day and 10-year is flirting with a 3 handle again. Odd times…..

Bond market appears to be sensing the near term possibility of an economic downturn and associated lower bond yields. We are way way overdue for such a correction by any historical measure.

yes, the bond market is like the stock market: it wants higher prices. And higher bond prices = lower yields. Higher prices allow bond traders who are often very leveraged to make lots of money.

On the other hand, when yields are rising, then bond prices are falling, and existing bond holders lose money, and lots of money if they’re leveraged.

There’s been a huge shift into liquid demand deposits and currency the last 2 months. The demand for money remains high, velocity low.

I’ve been hearing anecdotal reports of gas and electric bills higher than $1,000 a month in parts of the country. Is this really happening to many people? If so, that is a much bigger expenditure/inflation issue than a mere 2%-3% increase in many other items and services.

I turned mine down and controlled it pretty well.

Still was high because it has been so cold.

50% more when it is really cold or really hot.

QVC on brink of bankruptcy as grim sign hints at death knell for beloved shopping channel

The once-dominant shopping giant – which helped shape purchasing habits in millions of American households through its infomercials – has faced mounting challenges in recent years.

Bloomberg reported that the company is weighing bankruptcy after years of declining viewership and big debts, worsened by weak sales and tariffs.

A final decision has not been made, but talks between QVC Group and its creditors are ongoing.

But the reaction of investors was a clear signal things are bad. QVC Group’s stock plunged 66 percent on Tuesday to $3.74 – its steepest one-day drop on record.

“QVC on brink of bankruptcy as grim sign hints at death knell for beloved shopping channel”

Who the hell comes up with these stupid-ass headlines? “Beloved shopping channel”???? If it were so beloved, it wouldn’t have to file for bankruptcy. It’s the most un-beloved way of shopping now and has fallen out of use. People discovered the internet 🤣

As the silent generation passes away so does the captive QVC viewer base. Once upon a time QVC has a call center in Chesapeake VA and I heard they treated employees pretty ok.

QVC created shopaholics who fill their homes with junk they do not need.

I guess without qvc, these people would drive somewhere and buy the crap.

Now with Amazon they can do the same.

That stock had already been wiped out with a huge loss a couple of years ago when I think it was QRTEA, and it has been an OTC stock since then.