Commercial real estate (CRE) loans on office and multifamily properties got further bludgeoned in October.

By Wolf Richter for WOLF STREET.

The delinquency rate of office mortgages that have been securitized into commercial mortgage-backed securities (CMBS) spiked to 11.8% in October, the worst ever, and over a percentage point higher than at the peak of the Financial Crisis meltdown, according to data by Trepp , which tracks and analyzes CMBS.

CMBS are bonds that are sold to institutional investors around the world, such as bond funds, insurers, pension funds, REITs, etc. Banks that originated these mortgages are off the hook here, and investors eat the losses (see my discussion “Who is on the hook for CRE mortgages?” in the comments just below the article).

They were good until they suddenly weren’t. In October 2022, the office CMBS delinquency rate was still 1.8%. In the three years since then, it exploded by 10 percentage points.

Older office towers are getting crushed by a flight to quality and by corporate downsizing of office space due to continued working from home, as the much ballyhooed RTO has stalled. Even newer office towers are getting crushed by corporate downsizing and consolidation of their office footprints.

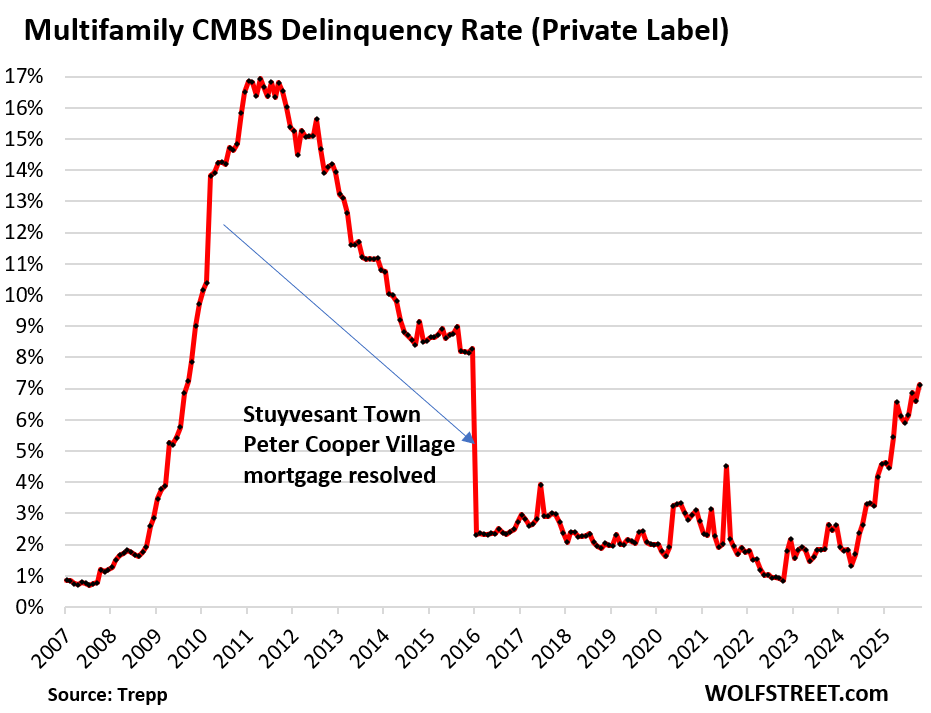

For multifamily CMBS, the delinquency rate rose to 7.1%, the worst since December 2015. Multifamily CMBS are backed by rental apartment property mortgages.

December 2015 was just before the defaulted $3-billion loan on Stuyvesant Town–Peter Cooper Village in Manhattan was “cured” through the sale of the property to Blackstone, which caused the loan to be removed from the delinquent list, and the CMBS delinquency rate plunged.

Newly delinquent office loans…

Loans become delinquent and are added to the delinquent balance when the borrower fails to make a loan payment or when the borrower fails to pay off the loan on maturity date (maturity default).

The $304 million mortgage on Bravern Office Commons in Bellevue, WA, was added to the delinquent balance in October, according to Trepp. The 750,000-square-foot complex of two towers, completed in 2010, is now vacant, but was once fully leased by Microsoft, which announced in 2023 that it would not renew the lease and has since then departed.

The property was purchased in 2020 by Invesco and Australian Retirement Trust from Principal Financial Group for about $585 million, according to Downtown Bellevue Network. In early 2020, it was appraised at $605 million. Two months ago, Morningstar valued the property at $268 million, a 56% haircut from the appraisal in 2020, and 12% below loan value.

The $300 million mortgage on The Factory in Long Island City, NY, was added to the delinquent list. The loan on the 1.1-million-square-foot office property was originated in 2020 at the very low interest rates at the time. The borrowers exercised three extensions that had pushed the maturity of the loan to October, when the loan finally went into maturity default. Occupancy dropped to 73% by the second quarter.

The property was built in 1926 as furniture warehouse for Macy’s. Atlas Capital, Invesco, and Square Mile Capital Management purchased it in 2012 at a bankruptcy sale and invested $100 million to redevelop the property into creative office space with Class A amenities. In 2018, Partners Group purchased a stake in the property that valued it at $400 million, according to The Real Deal, which added:

“While Manhattan’s trophy towers have led a recent wave of leasing activity, outer-borough landlords have struggled to land tenants. Long Island City’s availability rate hovered just below 27% in the first half of 2025, according to CBRE, compared to Manhattan’s overall availability rate of 17.5%.”

“Cured” loans…

Loans are considered “cured” and get pulled off the delinquency list when the interest gets paid; or when a deal is worked out to extend and modify a mortgage that wasn’t paid off at maturity date; or when a forbearance deal was worked out between borrower and lender; or when the loan is resolved through a foreclosure sale; or when the property is returned to the lender in lieu of foreclosure. So this process of “curing” a delinquent mortgage can mean pushing the problem into the future or taking big losses now.

For example, cured through “Extend and pretend” was the $96 million office loan backed by the 378,000-square-foot HP Plaza in Springwoods Village, a mixed-use development in Spring, in the Houston metropolitan area. The corporate campus of two buildings, completed in 2018, is 100% leased to HP Inc. through 2033. So this is a newer building, not some 1980s tower, and it’s fully leased, and not mostly vacant.

The loan became delinquent in the spring due to maturity default, when the balloon was not paid off by the maturity date. The borrower, Northridge Capital, which had acquired the property in 2019, has now negotiated a second maturity extension to November, following an additional principal curtailment, and so the loan became current through extend and pretend. “Discussions around refinancing are ongoing, with life insurance capital sources in play,” Trepp reported.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Who is on the hook for CRE mortgages?

For office mortgages: A big part is spread across investors – not banks – around the world via office CMBS – discussed above – and CLOs that are held by bond funds, insurers, private or publicly traded office REITs and mortgage REITS. PE firms, private credit firms, and other investment vehicles, are also exposed to office CRE loans.

Banks hold only a portion of office CRE loans. Many banks disclosed write-downs and losses. Many have sold bad office loans to investors at big discounts to get them off their books. And their earnings and shares were dented. And some of these banks were big foreign banks that were aggressively pursuing the US office market in prior years, such as Deutsche Bank.

For multifamily mortgages? The largest category of CRE debt, with $2.2 trillion in mortgages outstanding at the end of 2024, accounts for 45% of the $4.8 trillion in total CRE debt, according to the Mortgage Bankers Association.

Over half of multifamily debt was securitized by the US government (mostly Fannie Mae and Freddie Mac which doubled their exposure over the past 10 years) and the CMBS were sold to investors; and state and local governments hold a small portion of it.

Banks and thrifts are on the hook for 29% of multifamily debt, life insurers for 12%, and private label CMBS – discussed above – CDOs, and other Asset Backed Securities for about 3%.

The relatively limited exposure by US banks to CRE mortgages indicates that CRE is not going to pose a systemic risk for the banking sector, that most of the losses hit investors and the government, and that the Fed can let it reset on its own.

The Fed should abolish govt backing of investor mortgages for multi family housing. Mortgages to “invest” in rental income is immoral inflationary and does not make sense. I pay cash for the properties I buy to invest in renting. Worst case scenario is all my rent goes to property maintenance as it falls in value. My actual experience is some not all rent goes towards maintenance and over time property appreciates hopefully and I side step the Wall Street casino. Buying properties for rental income makes sense in purchasing with cash but not if you have to borrow to do it.

“The Fed should abolish govt backing of investor mortgages for multi family housing.”

Agreed. It also should abolish government backing of regular mortgages.

mmm… wouldn’t it take Congress to abolish Fannie and Freddie?

@Kent there have been a lot of changes recently that legally should have gone through Congress, but didn’t. Tariffs and declarations of war, for example, are the constitutional responsibility of Congress, but they passed laws to hand those powers to the president. The executive branch has been gaining power over the other two “co-equal” branches for at least 50 years, and we’re heading toward an emperor type system.

Atlantic magazine had a recent article that claimed that many of the large AI centers being build are being funded by private equity firms who are leasing the facilities back to the AI companies. The private equity firms are in turn packaging the loans into bonds which are being sold general investors. So it looks to me like unless ALL the firms who are investing in AI are successful and able to continue to pay their rent on these facilities, that we could be facing a collapse similar to the housing market collapse.

Yes, and the collateral for those loans that have been securitized is the AI equipment including chips. What’s a five-year-old AI server worth? The depreciation rate of tech equipment is very high and depreciation goes to zero. That stuff will be outdated in five years. The whole thing is nuts.

At least with housing, there is good collateral that might fall in value but then might rise again in value. Tech equipment only plunges in value to zero eventually.

@Chris B.

“an emperor type system” that takes a cut of every deal (handed to a crony/payor) with what was formerly owned by the public. So maybe a whiff of post-USSR?

I feel it’s a repeat play of the 2008 burst but only this time the lenders or banks initiating the bubble averting going under, the losers (some call them investors) buying into those CMBS, as a business an MO, will be wiped out… The entire idea of securtizing a CRE loan into shares sold to others, without those others knowing exactly whom the loans were made out to or their credit worthiness or if their business plan was viable in the first place is just obscene… While I understand this hyper innovative financial architecture and schematics has some benefits of keeping the wheel of economy spinning, it’s only for a short time before realizing you were had by the Pied Piper yet again… Who would keep doing that?!

I was walking around a Simons Property Mall in Clarksburg, MD the other day. All the stores were devoid of customers. The mall looked like it was in a death spiral. I wonder who owns the debt on this mall? There was nothing in there I would want to spend one cent on. The only few people in there looked like they couldn’t afford a cheap hot dog.

MY BEST IDEA FOR OLDER MALLS IS TO SEGWAY INTO BECOMING OUTLET STORES.

THEY HAVE TO REVISION THEIR PURPOSE AND ADAPT TO NEWER VERSIONS OF THEMSELF. THINK OUTSIDE THE BOX…

GONE ARE THE DAYS OF SEARS AND JC PENNEY…

We have outlet stores around here and they are empty most of the time and many are closing up. Let’s face it, mall retail is dying.

Bulldoze this stuff and build housing. Suburban malls are huge properties because they include so much parking, so starting over with a clean sheet of paper to develop housing on it is pretty easy to do. And it’s happening everywhere.

A problem arises when there is an old gas station on the property. In all likelihood, the soil surrounding the underground tanks is contaminated, and remediation adds to the costs.

The mall near me was demolished and is now a hotel, several large apartments, and townhomes. I basically vote in local elections by seeing which candidate is mad about that.

Not sawgrass mall in sunrise Fl. Always busy.

The Sunrise Mall outside of Sacramento here is basically dead, including the department stores that up until recently said they were intending to stay. It’s right in the middle of the city so the city doesn’t want it to end up being more single family. They have this whole elaborate mixed-use plan for it. The owners were recently doing a propaganda campaign to try to get us all to vote to let them build a bunch of big box on the site, but that idea was shot down unanimously. Owners now trying to sell it, and after a few years still no takers to build the mixed use, so we’ll see where it goes. Let’s all pray that we don’t end up with another giant empty parking lot. The way it is now, about the only thing it could be repurposed as is an international airport.

The outlet store time has come and gone. They were a good idea that turned into a business model and was then subject to the usual ensh*tificiation and now there’s little to no difference between the outlet and the full price stores.

It’s really hard for big brands to hold onto the name price margin anymore. There’s resale all over the place, whereby luxury good get moved for cheap. There’s also a ton of outright fraud products, some being sold right under Amazon and Walmart’s nose.

The old malls are being converted to housing in some places, educational institutes in others.

The Clarksburg MD Simon Properties Mall noted above is a “premium Outlet” mall…..

I wonder if we are looking at the symptoms and not the cause. Anecdotally, Silicon Valley is thriving and the malls are packed, and hard to find parking. Maybe someone should study the underlying economies of areas where malls are dying. Just a thought.

Mixed used would be the best thing. Build dense housing along with room for small businesses.

Just think, someone owns all those abandoned buildings & wants to sell them to naive investors. And that is why I’m a hard-core Perma Bear & can not make friends with any Bulls.

I experienced the 2001 Dot.com crash & the 2008 great financial crash.

The experience was similar to being raised in a Russian Gulag. I never trusted Wall Street again.

I heard the same thing happened to people who experienced the Great Depression. They never trusted banks again.

I have a friend in commerial real estate in SF, he claims things are getting better. I don’t know about that. Things still seem very quiet in SF core M-F. Also the lunch spots are still hurting and that one indicator I use.

In RE most agents are clueless with market conditions! In 2007 most thought it was normal

How do I know I sold my RE business and 14 properties from 2004-2007 it was 2004 when I started seeing the collapse

Don’t known if the delinquency rate can be used to quantify the total amount of capital erased . Also question for Wolf . The math behind the delinquency rate.

As a mtg becomes delinquent how does that roll off the the delinquency rate calculation?

IE if delinquency rate was 10 percent monthly and rolled off the balance sheet then there would be 90 percent of the loans remaining to be in the pool. But I suspect that does not happen .

1. “As a mtg becomes delinquent how does that roll off the the delinquency rate calculation?”

See the section under “Cured loans…” which explains the various ways that delinquent loans come off the delinquent balance, and it gives you an example of a loan that was cured in October.

2. The delinquency rate = delinquent loan balance ($) in October divided by total loan balance ($) in October.

3. Delinquent doesn’t mean total loss for investors; it means there are problems with the loan. The losses for investors (landlord and lenders) come in different flavors over time.

I’m just a blue collar worker although I saw this coming. If we keep allowing WFH our economy will suffer and never recover.

Why would anyone stay in NY, NJ, SF, Chicago or any major area if they can work anywhere in the country or world? I’d move to the cheapest area possible and avoid expensive housing costs, property taxes, and exorbitant living expenses. These areas that are trying to do away with office buildings and replace with housing can’t shoulder the tax burden that successful businesses once did. This also eliminates small business that existed off the presence of employees being in their offices.

I’ve worked in many office buildings that have been reconfigured for housing in NYC and north Jersey. Most are struggling to find renters or buyers now.

There are people that prefer city living. They like not having a car because of access to transportation. They like the variety of food and entertainment. Some just like the overall atmosphere. Work isn’t the only reason why someone lives in these high cost of living cities. Economies will adapt and shift (as they have for all of history) to people working from home. Most office jobs really require no reason to go into the office. Forcing people to for the sake of keeping the economy going as we know it is a weak argument for rto.

for 1st time in 10+ years we are experiencing vacancy issue in multi-unit apartments

one factor is there are few ILLEGALS now that Trump/ICE making it difficult

another is poaching by newer large apartments offering massive concessions

2-3 months free rent, no deposit

lost 3 tenants who said they got deals they couldn’t pass up

and yet when it comes to pricing on these rentals

the FAKE ROI cap rates of 5% still flood market

gonna be interesting 2026

Another HUGE problem is people with higher paying jobs bringing higher income work from home jobs into suburban areas where the mean and median incomes are lower and pricing out the NECESSARY local workforce from buying housing.

Subjecting people to wasted time commuting in an out of major job centers is not an answer and has nothing to do with our economy. Allowing people to work from home means they can afford to move to smaller communities with more affordable housing. It means they can help restore population to areas that have been losing it. It means moving money out of urban and suburban areas an into other parts of the country where it can help grow communities. Concentrating all the wealth in big job centers and cities doesn’t help the rest of the country.

Think it through.

Not sure what world you are living in but rents are through the roof in nyc apartments are bid on. Man is a social creature so city’s are popular. Proof is in the high cost of those areas. In the future who knows but now that’s the truth.

Same in Boston. My 27 yo son lives in Brookline. Everything he needs or wants is within walking distance. Train stop is right in front of his apartment. Restaurants filled with young beautiful Harvard/MIT/UMass/Boston College grads making good money. Life is great. Rent is $3200/mo, but he drags in about $12k.

Wrong. By far the biggest growth has been in suburbs, not cities. And that has been going on for some time. City cores are declining. People are LEAVING central NYC for the ‘burbs.

As for why cost of living in NYC is so high, well… it could have something to do with the communism there.

WFH is here to stay and it’s a very good thing for most people, especially women with children, some RTO is happening in some high profile businesses like JP Morgan, but the statistics don’t lie, WFH is here to stay and most cities need to tear down 20% of their downtown offices.

Regarding the comment about the tax rolls shrinking as malls and big box stores go away… check out the YT videos from channels like NotJustBikes where they show 3d graphics of where cities generate their tax revenue versus spend it. These studies reveal that malls, strip malls, and big box stores actually pay very little in property tax per acre, and were always essentially subsidized by the denser regions of the city (i.e. the downtown). Surrounding every mall or big box store is a 4-5 lane road paved at a cost of a couple million bucks per mile, massive utilities run long distances, and emergency services established to cover the hundreds of acres consumed in this mode of development. In other words, taxpayers pay out the nose to subsidize big box retail and suburban sprawl.

When you tear down the big box model and convert the land into mixed used development, typically storefronts on the ground level and a couple of stories of apartments or condos above, then suddenly the tax revenue spikes, the traffic congestion goes down because households are close to their suppliers, and you have fewer blighted parking lots – built to the size needed for Black Friday shopping – producing no revenue.

I’m an owner and dealing with the office buildings I know all of the office market lost its value, will not be able to refinance and we all will end up in default we all lost our investment the market is down over 30% and that’s where our down payment went. It’s time for the banks to release the true numbers it’s much worse then it’s being reported. Don’t know why the fed it’s sleeping and not doing anything and ignoring it.

Banks are relatively thin into office CRE. It’s mostly global investors that are on the hook for office loans, such as the CMBS holders discussed in the article. And banks have been cleaning out their troubled office loans that they do have, often by selling the loans to specialized debt investors at a loss. This has been going on for two years and has been part of their earnings reports over those two years — we’ve seen examples of it, some of which were big news.

I realize that the banks books make it look like they are not heavy into this but the banks walked out of the front door, around the building and went in through the speak easy basement hatch. The banks are handing out business loans and lines of credit to businesses that front as steel industry or maybe some other construction co. Then the company has mergers, acquisitions, divisions etc. that own apartment buildings and other commercial buildings. The banks underwrite the business as a whole using everything as collateral – like machines, inventory, large equipment like track loaders etc. but I can’t figure out how they clear title on this stuff?? No idea if any of them really know which bank is line first for what or which division of the company actually owns what is being used as collateral. It is a web of chaos.

Well, not with CMBS. Banks originated the mortgages and SOLD them to investors via securitization. These investors did not borrow from banks to buy the CMBS from the banks.

You’re talking about private credit, where private credit originates the loans and securitizes them into CLOs or ABS or whatever, and sells those to investors, and borrow from banks to temporarily fund the loans until securitization (via warehouse lines of credit). I discussed this with Tricolor:

https://wolfstreet.com/2025/10/17/ai-powered-tricolor-and-its-mushroom-cloud-of-fraud-allegations-are-a-sign-greedy-lenders-closed-their-eyes-for-years-not-a-sign-consumers-are-cracking-or-whatever/

“LE CockaRoacha”!!!

Agree with your question – why this problem is not getting sufficient attention – I think it’s just too spread out in time and concentration. There has surely been greed and deserved pain for some investment in CRE, but very reasonable investors have been caught too. Commercial development cycles are longer than residential, with reliance on short -term rates and limited liquidity. While covid dynamics boosted SFH prices, policies did the opposite for most CRE. Revenues obviously suffered in offices (WFH) but also in hotels (reduced travel and corporate events) and even multi-family (restrictions on evictions and in some markets new transfer taxes (e.g. LA). Meanwhile supply constraints boosted construction costs and timelines while interest expense grew and grew. Sustained high rates are taking longer to cool the economy as the typical homeowner has a low-rate, fixed mortgage and tech companies (financed via equity rather than debt) are boosting the stock market. Using a car analogy, in trying to achieve its 2 % target, it’s like the Fed is trying to slow inflation using only a single brake (on the real estate sector). So, they’ve had to leave the rate much higher than it was when inflation was at the same place on the way up. The consequences are clearly showing on the commercial side while in residential the pain thus far has largely been limited to illiquidity – sellers content to sit on unrealized gains, financed by low rates, buyers frustrated with bubble prices and unable to afford payments at current rates. Both rates and prices will need to come down, its more a question of timing. It seems a lot of commenters would like to see 2% inflation prior to further rate cuts, but lags in the reporting of rents (both actual and OER) will likely make that unnecessarily late.

The decline in occupancies far outweighs any up tick in deals. At this rate they will have to rezone most of these properties to residential and hope they can revive their use.. Big companies are downsizing, look at the layoff numbers !!!

A question about finances of blogs. Several ads for local commercial real estate accompanied this post. Does the site receive any revenue or does the carrier of the blog get it all?

My company, Wolf Street Corp, owns this site, leases a dedicated server that I control, and gets revenues from the ads. But between Wolf Street and the advertiser (the company you see in the ad), there are thick layers of other companies (“ad tech”) that exact their pound of flesh, and by the time whatever is left over reaches Wolf Street, it is just a small portion of what the advertiser paid.

For publishers, such as WOLF STREET and all others, including all those that went out of business already, internet advertising has been the road to hell, even as the big ad tech companies get huge and fat by sucking the bejesus out of the money flow from ads. The amount that publishers get paid per 1,000 ad impressions has been going down every year, but this year has been particularly bad (AI?). I guess sometime in the future, they expect us to carry the ads for free? This is why more and more websites go behind a paywall and still carry ads.

Instead of hiding WOLF STREET behind a payroll, I ask for donations. And it works; regular readers are generous (thank you!!)

https://wolfstreet.com/2025/11/02/dear-readers-please-donate-to-wolf-street-fall-2025-reminder/

As a regular reader and regular contributor, I SAY WONERFUL on WOLF,,, and plan to contribute each and every year until I am called…

OK, will only add that after many years of study, I am NOT any kind of religionista, but keep trying to understand why ANY of ANY ability think it IS or MIGHT be OK for GUVMINT to take from some without their agreement for any reason…???

Thank you for sharing your situation as a publisher with ad revenue. This is an important topic that many of us hoping to be informed need to know more about. Clearly there is no such thing as “free” internet.

LoL, probably based on your tracking cookies. I get ridgid plumbing tools (aka ridgid red) ads, were I have actually have interest in Ridgid power tools (aka ridgid orange).

Southern jewel New Orleans is reeling from deadly cocktail of soaring debts… and empty skyscrapers: ‘It’s a perfect storm’

The city’s office market is bracing for a wave of $400 million worth of unforgiving loans which financed a little more than half of the city’s class-A office buildings and are coming due. ‘It’s a perfect storm,’ said Mike Siegel, president of Corporate Realty, the city’s biggest office-leasing firm. ‘You have major tenants moving out, and concurrently you have the mortgage coming up. It’s distressed both a little bit on the real-estate side and the capital-markets side.’

One of America’s most famous cities is heading for a downtown catastrophe as its office towers hemorrhage tenants – and owners default on massive loans.

Commercial real estate in New Orleans, Louisiana, is in crisis, with falling occupancy rates colliding with a wave of debts coming due.

Two of the city’s landmark skyscrapers – the Hancock Whitney Center and 400 Poydras Street – are the latest to fall into what’s known as ‘maturity default’, meaning the borrower has reached the end of the loan term but can’t repay or refinance it.

I wonder if this could be one of the (many) reasons that the Federal Reserve is cutting interest rates even while inflation still appears to be very warm, as well as simultaneously announcing the end of QT on Dec 1.

I would like to think they keep an eye on these types of problems (or at least read Wolf Street). LOL.

Yea, add not setting off a CMBS crash to the other reasons for the Fed to prefer higher inflation rather than higher rates:

-not setting off a housing crash

-not setting off a bank crisis

-not setting off a US treasuries Minsky moment or debt spiral

-not setting off a stock market crash

It’s the Fed versus the Fed Put at this point. The Fed Put keeps running up asset prices and encouraging the taking of risk, while the Fed is supposed to be hiking rates to prevent these issues from blowing up. Defeating the business cycle is complicated.

The situation may not improve anytime soon.

The AI hype aside, specialized AI will be used to increase white collar productivity and reduce the number of workers, like word processors did in 80s.

Remote work will still play a role, especially when it allows off shoring positions.

On the consumer side, the population is not growing, and immigration is curtailed by the current administration. Since people cannot eat a lot more, or stuff their home with more products, the growth may be marginal (more entertainment and travels, possibly).

The whole thing means lower office space needs than before.

My .2cents (worth what you paid for it):

AI will benefit the top 10-15% of the business population. Using it well requires a high degree of cognitive ability, something not present in a large part of the population. Just getting a good prompt is only half the battle, the other half is having enough intelligence to ask the next three questions and apply to output to specific situations where it may or may not fit.

AI needs human creativity to be truly transformative. The bulk of the white collar workforce will use it to do the work for them and fail to edit the output or put diverse pieces together. Those are the people who will end up being replaced. If your work can be turned into copy/pasted AI output, your days in a comfortable office chair are numbered (that goes for C-Suite and leadership as well). Just moving email around and doing data entry will no longer qualify someone for a middle class gig with benefits within 3-5 years.

The question people should be asking is: once a bunch of people have been moved from middle class to working class, where does that leave the economy? Is housing going to drop enough to make up for the income loss? What happens to their health insurance and health care? What happens to all the businesses that depend on white collar workers with disposable incomes?

The benefits of the AI transition will not accrue downward.

Thanks, Sandy, for the sobering comments. Read Suleyman’s book, “The Coming Wave” for the risks AI will bring in addition to job losses.

We have an economy made of straw on a foundation of sand, with storm clouds on the horizon.

Yes, might turn into a kinda, sorta, maybe a Japan situation. Zero interest rates and deflation.

Should we lock in some long term rates now?

What happened to the whole “end of remote work” / “return to office”? There was a lot of blaming telework and remote work for killing downtown offices (both on the private but especially the federal government). What happened to that narrative?

The narrative is that at the end of the day office space is costly and so is moving offices. Folks got used to WFH and they like it. No more commute, time for daily chores while taking a break, for some it’s even much more productive (and for those that it’s not, there’s still an office)

RTO failed, big time. It was announced with a lot of fists on tables in a job market that was too tight, people just moved over to the next company in line that wasn’t being uptight about it. And so everyone adopted hybrid. Of course, most jobs done remotely might as well be done from India, so expect to see a fresh wave of geniuses that invent outsourcing.

We will find out whether WFH is truly here to stay when the next recession finally arrives with a sufficiently high unemployment rate giving businesses the leverage they need to force people back to the office (if they really want to) while retaining the high-performers. Such a recession would iron out many of the economic conditions (distortions?) discussed on this site. Until then, the status quo shall play on…

Please define Delinquency. Is that 30 days, 60 days, or 90 days late ?

Miss one payment, and after the 30-day grace period expires, and they miss the second payment, they’re considered delinquent.

Fannie and Freddie should not be involved in cre loans. This is obscene.

A significant portion of all new debt is from nonbanks looking for higher rates with less conern for duration or risk because it is being fractionalized.

Huh?

“They were good until they suddenly weren’t. In October 2022, the office CMBS delinquency rate was still 1.8%. In the three years since then, it exploded by 10 percentage points.”

The wages of extend and pretend.

And the chart makes it look like it was additional months before the Good Rocketship Delinquency really started taking off (look at that upward slope!).

Once the Fed started ending ZIRP in March of 2022, the writing was on the wall – many years of ZIRP distortion (including Pandemic bottoming) on NPV calculations of asset worth were going to unravel and the lower the interest rates were once, the worse the asset value collapses later…common-sense and simple math.

The intriguing/unfortunate thing is the long delay in asset value correction – how many naive bag-holders got suckered in by CRE sales-creatures saying, “This time is different…just look at the extremely low delinquency rates…” for maybe 12-24 months after the writing was on the wall.

A lesson for all asset valuation booms and busts…the madness can gone on for much longer and the correction can take much longer than common sense would seem to suggest.

An especially valuable lesson for those tempted to “catch a falling knife” – delinquency/valuation rot can be much, much, much worse than the superficial, contemporary numbers suggest.

It looks like the Multifamily Delinquency chart is for Private Label loans. Elsewhere you say that more than half of multifamily loans are securitized by GSEs. Are the delinquency rates similar for GSE-securitized loans as Private Label loans?

Let me guess. These CMBS were rated AAA, right?

:)

7:27 AM 11/3/2025

Dow 47,208.72 -354.15 .-0.74%

S&P 500 6,828.33 -11.87 -0.17%

Nasdaq 23,792.50 +67.54 0.28%

VIX 18.16 +0.72 4.13%

Gold 4,036.90 +40.40 1.01%

Oil 60.78 -0.20 -0.33%

There is no appetite for another bailout, this time it will be a “bail-in”…

There simply are NOT enough taxpayers to cover this fraud this time around. Having said that, the “mark to fantasy” accounting will continue right up until there is a serious failure to deliver on some important assets like food, energy, or rare earths/precious metals….

Nothing new under the sun.

Interesting times.

Investors and lenders have been getting “bailed in” for two years in CRE. There’s blood all over the place. I’m working on a story right now that gives the specifics on one office REIT, will have it ready later today.