Everyone is talking about the AI bubble – proclaiming it or denying it – but this is what it looks like from the leverage point of view.

By Wolf Richter for WOLF STREET.

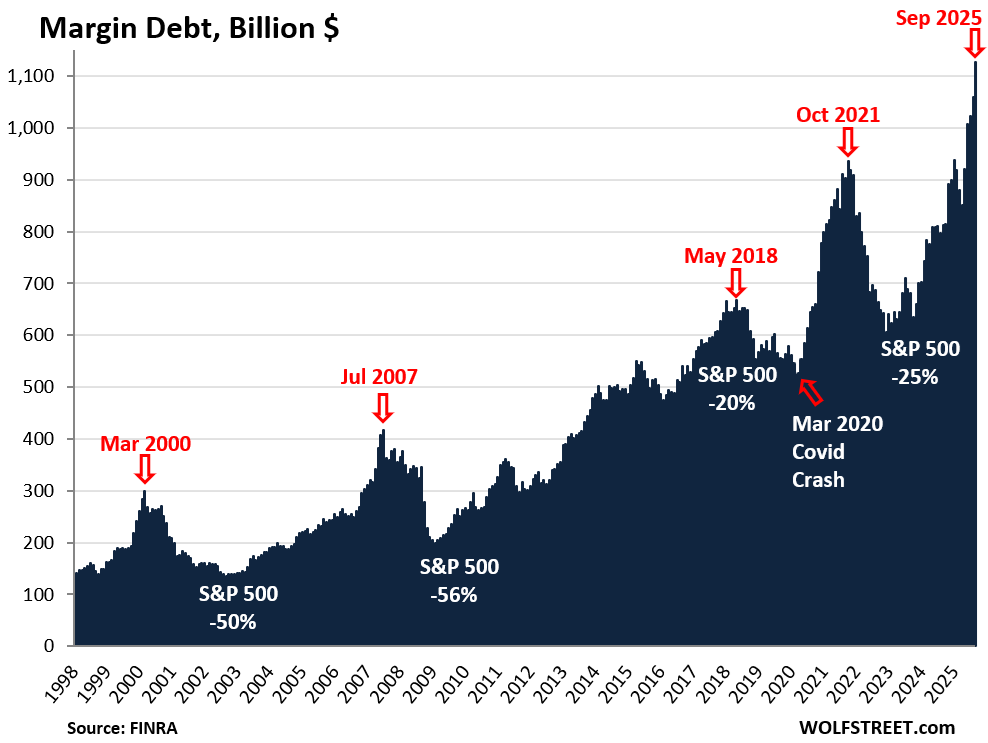

Leverage in the stock market has been spiking since April. In September, margin debt – the amount investors borrowed from their brokers – spiked by another 6.3%, or by $67 billion, from August to a record $1.13 trillion.

Since April, margin debt has spiked by 39%, the biggest five-month increase since October 2021; it was in early November 2021 that stocks began to tank, with the S&P 500 ultimately dropping by 25%.

The additional leverage – borrowed money flowing into the stock market – creates buying pressure and drives stock prices higher. Leverage is the great accelerator on the way up, but it’s also the great accelerator on the way down. Multi-month surges in margin debt, jumping from new high to new high, indicate excessive speculation and risk-taking and have invariably led to sharp selloffs:

Everyone has been talking about the AI bubble, either proclaiming it or denying it – Is it Really Different this Time? – but this is what it looks like from the leverage point of view, and it’s scary: A massive spike in risk-taking and excessive speculation in the stock market, as demonstrated by this multi-month spike in margin debt from record to record, that is creating big vulnerabilities and risks.

In the long-term view of margin debt, such as in the chart above, it’s not the absolute dollar amounts that matter, but the steep spikes in margin debt from new high to new high over a multi-month period.

The annotations in the chart:

March 2000 was the beginning of the Dotcom Bust, during which the S&P 500 fell by 50% and the Nasdaq by 78%.

July 2007 was just before the stock market started turning into the beginning of the Financial Crisis, during which the S&P 500 fell by 56%.

May 2018 was followed by a 20% decline in the S&P 500 by late 2018.

October 2021 led to a 25% decline of the S&P 500.

March 2020 was the Covid crash, caused by investors’ reaction to the pandemic. At the time, leverage was relatively low and had been declining, which was a good thing and protected the market. If leverage had been spiking for five months from record to record before the pandemic, the sell-off would likely have been much more severe.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Let’s see where this will go…all the warning signs are out there plain as day but yet plenty of people treating it like it’s another nothing burger, every single dip follow by twice the velocity of FOMO buy the dip rally, rinse and repeat….guess the lack of any real moral hazard or long term sustain consequences like that of dotcom recently, couple with just buy index funds and you’ll be just fine mentality got us to where we are at now….

This time is different right? hmm…

Pretty much. If you read the investing blogs or forums, you see people say things like “Don’t try to time the market,” “Time in the market is more important than timing the market” or “Just dollar cost average your investments in and don’t worry about valuation.”

Nobody thinks a protracted drawdown is even possible, much less likely. Any crash will be a “flash crash,” and the Fed and Congress will swoop in to fix everything, and the losses will be recovered within a year and then we’ll be back at all-time highs in no time. Anytime after 2013 or so, they’ve been right.

This is the mindset. Psychology is a powerful drug. It will all continue until something happens to break the psychology, and then, look out.

If you have a 20 year timeline, this is fine advice. Even if you bought on the night before the 1929 stock market crash, if you held stocks for 20 years, you still made 3% annually. And that’s literally the worst 20 year period in US history! If you bought at the top in 2000, you still made 7% annually if you held for 20 years.

Your end point is the currently extremely high level in the market. If there is another 50% drawdown, that calculation will look different when recalculated at the bottom of the drawdown.

There is a fifth dimension beyond that which is known to man. It is a dimension as vast as space and as timeless as infinity. It is the middle ground between light and shadow, between science and superstition, and it lies between the pit of man’s fears and the summit of his knowledge. This is the dimension of imagination. It is an area which we call “The Twilight Zone”.

haha speaking of twlight zone….current environment do feel like the episode “Eye of the beholder” where the patient wakes up and everyone have pig face and that’s the norm, her with a regular face is considered disfigured…

Feels like the entire retail investing environment are pig face norm and us looking at data, chart, tread carefully are doomers with the regular “disgured” face…new normal I guess..

PI – …redolent of the late George Carlin’s: “…it’s a big club, and you ain’t in it…”.

may we all find a better day.

Thanks Wolf. It’s charts like these which I only saw after the sell off in 2008. They made me regret not seeing the obvious warning signs of an overvalued stock market.

Not to worry. It will all be saved when Sam Altman’s OpenAI announce 50 Jiggawatt deal with next hyperscaler – Amazon, or Apple, or General Electric.

Good Chart, We need to see through the Lens of Margin Debt to Market Cap $1.1T to $63T in MCap ie. 1.7% is much lower than 2.7% in 2007-08…So the Bubble has more Legs to Run :-)

That’s not how it works. You’re abusing the chart. This is how it works, second paragraph under the chart:

“In the long-term view of margin debt, such as in the chart above, it’s not the absolute dollar amounts that matter, but the steep spikes in margin debt from new high to new high over a multi-month period.”

It’s the rate of change from new high to new high that matters.

Because the margin debt is directly causing an increase in stock prices (and thus, in market cap), your reasoning is circular.

Jose, consider though that the market cap valuations of stocks are current valuations. Those valuations fluctuate and as most readers here have pointed out, represent an extremely bloated bubble. So of course margin debt to market cap is a small fraction. Drop total market cap to $45 trillion and all of a sudden that percent changes to 2.4%.

Brilliant chart. Thanks, Wolf.

Measured as a percentage of market cap, margin loans were —

2.1% in March 2000,

2.8% in July 2007,

2.4% in May 2018,

2.0% in Oct 2021, and

1.7% in Sept 2025.

Source: gurufocus

In line with Wolf’s argument, most of these prior peaks were preceded by a sharp run-up in the margin debt / market cap ratio. The monthly figure was 1.3% in August 2024 (which was the lowest since 1998) but has since risen persistently each month (with one exception — April 2025) to reach 1.7% as of end-September.

Is that 2% line the Crack of Doom? Or should we worry more about the parabolic increase over the past year? Asking these rhetorical questions for a rhetorical friend who discloses that he/she/they is/are still up there dancing the AI lambada.

That’s not how it works. You’re abusing the chart. This is how it works, second paragraph under the chart:

“In the long-term view of margin debt, such as in the chart above, it’s not the absolute dollar amounts that matter, but the steep spikes in margin debt from new high to new high over a multi-month period.“

It’s the rate of change from new high to new high that matters.

Thanks! I was just about to ask this exact question. I’d be curious to see this in graph format. Any idea where to find it?

But that would be a nonsense figure and won’t tell you anything because total leverage of the stock market is not tracked.

The only reason to look at margin debt is the rate of change from new high to new high.

There is a lot more leverage in the stock market than margin debt, but margin debt is the only measure we have that tracks leverage, and so it’s like a thermometer of changes in leverage, which is what we’re talking about here.

Not included in margin debt, for example: Any amounts borrowed outside of brokerage accounts, such as by stock funds borrowing from whoever; Securities-based lending, such as Musk putting up his Tesla shares as collateral (many founders and executives pledge their shares as collateral for all kinds of things); borrowing at the institutional level to buy stocks; etc.

But a key element of bad reporting on stocks (or numbers in general) is a failure to contextualize or to adjust for changes in base numbers.

There are always more crimes in Texas than Vermont because Texas is 50 times larger.

If you measure stock increases or decreases in pure points on the S&P500, you’re always setting new records, because the underlying index is also increasing.

I agree with your point that data is limited, but if I want to understand this data, I want to understand how much of the change is because the economy (and population and GDP etc) is bigger, and how much of the change is on top of all that.

It is, of course, true that the increase in the number itself says something. I just want to know how to contextualize. For example, there’s a big increase from 2012-2014 in that graph that to my eye is indistinguishable from the one from 2016-2018. Why was the latter dangerous and the former not?

I have no idea whether these calculation have any relevance whatsoever, but:

Relative to closest quarter market value of all corporate equities the corresponding numbers would be:

March 1990: 1.431% [$300B vs. $20,970B]

July 2007: 1.519% [$410B vs. $26,986B]

May 2018: 1.339% [$650B vs. $48,554B]

October 2021: 1.212% [$925B vs. $75,868B]

September 2025: 1.113% [$1,130B vs. $99,797B]

Relative to prior year nominal GDP the corresponding numbers would be:

1999: 3.115% [$300B vs. $9,631B]

2006: 2.968% [$410B vs. $13,815B]

2017: 3.314% [$650B vs. $19,612B]

2020: 4.332% [$925B vs. $21,354B]

Now: 3.872% [$1,130B vs. $29,184B]

An interesting comparison is Market Value above divided by GDP above. I kind of Price-to-Sales ratio.

1999: 2.18x

2006: 1.95x

2017: 2.475x

2020: 3.55x

Now: 3.42x

Isn’t leverage considered a ‘coincidental’ indicator though? It moves with the stock market…

No, it DRIVES the stock market – up and down.

Does this include margin debt used for short selling?

Margin debt includes every dime that any investors borrowed from their brokers in their brokerage account for whatever reason.

Short selling: If you have enough cash in your account to cover the short sale, there is no borrowing of cash, and no margin debt. So if you have $10,000 in cash in your account, and you sell short $1,000 of XYZ, you just borrow the shares and pay the dividends (if any), and your cash balance goes to $11,000 (but you cannot use that $1,000 from the short sale), and there is no margin debt, and you pay no interest. But if you have $10,000 of shares in your account, and no cash, and sell $1,000 of XYZ short, you have margin debt on that short sale, and you pay interest on it.

Not included: Any amounts borrowed outside of brokerage accounts, such as by stock funds borrowing from whoever; Securities-based lending, such as Musk putting up his Tesla shares as collateral (many founders and executives pledge their shares as collateral for all kinds of things); borrowing at the institutional level; etc.

There is a lot more leverage in the stock market than margin debt, but margin debt is the only measure we have that tracks leverage, and so it’s like a thermometer of changes in leverage, which is what we’re talking about here.

Thnx for answering, if not directly.

The question then becomes, how much leverage is driven by institutional betting as opposed to retail? (which was what I was asking)

Most people on Wall Street are too young to have seen 2008 & 2000 depression.

I say Depression as both were very much an economic depression to me. I got cleaned out in both.

The lesson I learned? A fool & his money are soon parted. I was that fool who thought real estate could never go down in 2008. And that fool who invested in Nortel & Cisco in 2000. Boy, did I get that wrong.

This time I’m fully hedged for a crash.

T.I.P.S, I bonds, cash, T-bills, long bonds, ammo, guns, water, land for a garden, every Led Zepplin album & Gadstone flags.

Your jealous, I know.

You are missing gold and silver.

I had all my fillings replaced with gold. Sure, more reactive to hot and cold but when it comes a pair of pliers is all I need to get by.

Lord, lol.

A gold filling fell out. I did retrieve it and my dentist told me that people actually do exchange them for cash. Depending on the gold content it could fetch as much as $50.

Sac,am with you,some modest investments including in hand metals along with all you list except own land.

That said,have a large track of land with friends with home,am always welcome there as own a portion of it with a home/water source ect. that till the zombies arrive will do well.

I hope we never need preps and just keep using the old ends while supplying the new ends.

Oh,have every Tull album!

same for me but I have Sabbath albums and Pride flags. Also do you know if cocaine goes bad over time?

What, no Grateful Dead albums?

The primary lesson from those events was not to put all your eggs into the SP500. And, to be fair, VOO for life is a common enough sentiment that it is something people have forgotten about, because of the last fifteen years.

Sacramento refugee in Petaluma,

I can see having most but not all of those albums but why no Pink Floyd?

Question, if you saw and got cleaned out from 2000 “depression”, did you approach 08 thinking this time is different and 00 type event will never happen again? or did it take 2 times in less than a decade to develop your view now?

I do agree with you, youngsters and even old timers forever high in hopium land spoiled by lack of moral harzard and conditioned to think FED got your back no matter what is actively disregarding warning signs out there but it’s getting very very tiring to throw caution at the wind and over the last 5-10 years continue to get eggs throw at our face….Not saying there’s no probability being cautious will be right at the end….but do definitely take a lot of mental effort to do so…

Sac – auxiliary electric power (…those albums won’t play themselves…)? Sufficient woodlot on the land? Bridge provisions until harvest season arrives+future seed, starts, canning capability? Amenable relationships with the neighbors? (…’crashes’ are a matter of degree, I’ll admit, YMM(Wildly)V). Best!

may we all find a better day.

How much, if any, of that margin volume is generated by the banks and brokers themselves?

Margin debt includes every dime that any investors borrowed from their brokers in their brokerage account for whatever reason. It doesn’t include anything else. There is a lot more leverage in the stock market than margin debt, but margin debt is the only measure we have that tracks leverage, and so it’s like a thermometer of changes in leverage, which is what we’re talking about here.

Not included, for example: Any amounts borrowed outside of brokerage accounts, such as by stock funds borrowing from whoever; Securities-based lending, such as Musk putting up his Tesla shares as collateral (many founders and executives pledge their shares as collateral for all kinds of things); borrowing at the institutional level to buy stocks; etc.

The most high profile margin transaction of the last few month is probably Musks purchase of TSLA to the tune of 1 billion USD.

But that’s not included in margin debt because that wasn’t done through a brokerage account. That is part of the stock market leverage that is outside of margin debt. It would likely fall under Securities-Based Lending.

Not included, for example: Any amounts borrowed outside of brokerage accounts, such as by stock funds borrowing from whoever; Securities-based lending, such as Musk putting up his Tesla shares as collateral (many founders and executives pledge their shares as collateral for all kinds of things); borrowing at the institutional level to buy stocks; etc.

There is a lot more leverage in the stock market than margin debt, but margin debt is the only measure we have that tracks leverage, and so it’s like a thermometer of changes in leverage, which is what we’re talking about here.

Does this include leveraged assets like SPXL? Or options?

Margin debt includes every dime that any investors borrowed from their brokers in their brokerage account for whatever reason.

Not included: Any amounts borrowed outside of brokerage accounts, such as by stock funds borrowing from whoever; Securities-based lending, such as Musk putting up his Tesla shares as collateral (many founders and executives pledge their shares as collateral for all kinds of things); borrowing at the institutional level to buy stocks; etc.

There is a lot more leverage in the stock market than margin debt, but margin debt is the only measure we have that tracks leverage, and so it’s like a thermometer of changes in leverage, which is what we’re talking about here.

all of this happening with what Powell calls “restrictive” interest rates.

add in Gold doubling in price in a year, new car prices up 25% in 5 years, people racing to cryptos….and all the talk is of cutting.

If this is the time to cut, when is the time to raise rates?

This feels frothy and contrived.

JustAsking,

I am definitely naive in this area but would rather have people invest in companies and get a return on investment rather than taking an ownership stake. Feels like those that need money to grow are forced to give up what they built as no choice. That said, the owner typically do quite well with IPO, regardless of what happens to the company.

Glen – sounds like a ‘new normal’, and now long-passed, paradigm shift…

may we all find a better day.

Hi Wolf,

Thank you for the warning, great article. Some thoughts:

Margin Debt / GDP: currently at 3.7%, nearing all time high of 3.97 of late 2021. Compared against the peaks of 3% (2000) and 2.9% (2008).

Margin debt / Total M cap: on the rise at 1.69 after a near all-time low in 2024 as market valuation growth exceeded margin debt growth in 2022-2024.

Margin debt / US10Y: I’d expect the US10Y rise since 2020 to dampen the the increase, but the opposite is true.

Meanwhile the direct & indirect stock holdings now account for a whopping all time high 45% of financial assets of US Households. Which to me seems concentrated at the top, as the relative amount of households directly holding stocks hasn’t signficantly changed.

In summary, the blow-out valuations are not slowing it, the interest rates are not slowing it, it outgrows gdp growth by far, and folks are more exposed than ever in history. Is that fair to say?

It’s the rate of change from new high to new high that matters.

From the second paragraph under the chart:

“In the long-term view of margin debt, such as in the chart above, it’s not the absolute dollar amounts that matter, but the steep spikes in margin debt from new high to new high over a multi-month period.“

Hi Wolf, thanks for the reply. Yeah I read and agree with that.

I was attempting to highlight that the rate of change has been accelerating despite some indicators pointing in a different direction, which to me makes it seem even more alarming. Folks seem to not in the least be hindered by increasing rates, and seem blind to the already incredibly high valuations.

What a great chart in pictures. And the commentary from Wolf that the key is not the absolute numbers but the parabolic shape.

Option activity is also experiencing a significant rise especially with the proliferation of leveraged etfs . Tqqq maybe one of the largest was created in 2010. Pretty much the bottom of the GFC drop and the start of QE. Impeccable timing to have created a product with leverage with the rise tech money printing era. Manage risk my recommendation .

Draw a graph using “If I had invested $20.67 in the S&P 500 index in 1933, our investment would be nominally worth approximately $465,088.97 in 2025….. Then overlay the decline in the US $ purchasing power due to inflation and money printing until 2025, that being now worth 4.013 % of a 1933 Dollar……. = $18,664

BTW, do this knowing, one oz of Gold was $29.67 in 1933.

I think there is something in that for everyone when you talk about leverage and how completely messed up the World has become when lenders lend fiat into existence

I may just be too old, but I can’t figure out how any money is being made off applications of AI (as opposed to those making out like bandits selling shovels at the gold rush). I expect it all to end in tears.

Not with ChatGPT and so forth but when agents are sold for other reasons they make money and allow companies products to continue to compete. I am a software developer a few years from retirement but already common for developers to use AI such as Claude. Not as good as a human yet but makes them much more productive. I see it like Lyft and Uber who hemorrhaged money to get market share, who unfortunately thought humans could be eliminated quickly but have had to pivot to revenue models now.

Great informative chart.

I see the problem, but what does a retired guy do about it?

This is just the leverage that is required to be reported for stocks. Don’t forget all of the leverage in terms of companies taking an equity share for this or that circular dealing that AI companies have been doing. That has also been blowing up. Not to mention a lot of equities are pledged as collateral in other arrangements.

With the risk of “abusing the chart”, it appears that the slope in each subsequent bubble is steeper than the previous. In my mind, Big Money is perfecting the art of pump-and-dump. They fund the economy to the brink and once the little guy takes out a second mortgage to join the fun, they get out leaving him holding the bag then buy his house when he can longer keep up with his extended debt.

I second the sentiments of A Guy. Wolf, do we completely ditch the market at this point? Personally, we are currently about 40% TBills, CD’s, etc.

And I suspect I speak for most of your readers when I say – thanks for all you do!

You need to be aware of the risks, and not brush them off, and figure them into your calculus. Stocks are not risk-free.

Once the little guy understands this, he no longer has to be the little guy.

<– A Former Little Guy

Be interesting to see a margin debt chart overlay with stock prices. Why? To see debt levels when prices turn. What I find interesting is the hump after the break, before it resumes dropping until hitting bottom and turning once again to begin a new climb. The duration seems to be decreasing but is nevertheless present in all the depicted breaks. Guessing next time it will decrease to about $600B (approximate trend line) before turning.

Do they break down where the margin is going anywhere?

My fear is it’s concentrated in the young for whom “investing” has been gamified and pushed so heavily it’s nearly indistinguishable from gambling at a bookmaker.

We know where margin debt is NOT: retirement accounts. 401ks, IRAs, SEP IRAs, Roth IRAs, etc. do not allow margin debt. Margin debt is only in regular brokerage accounts.

which adds to my fear.

It seems extremely easy to get margin on Robinhood, for example.

Funnily enough, if you get tagged as a “pattern daytrader”, they insist you deposit $25K instead of $2K. That seems…problematic.

Thank You for this angle. The posts tell most most do not get it. When was the last time (this time is different) yet I have heard variations of that before.

With risk there should be reward. Where is it at these levels?

Machine trading will not help the volitility when it happens.

Here’s a little lesson. Ask AI “How overpriced was RCA stock in the 1920s?”

Sellers need to be reasonable..For example,

I monitor My neighborhood.

This home at 423 W Monterey Ave 95204 just sold,

From June 2025 to Oct 2025 they dropped it by 70k it then sold quickly.

Sellers understanding reality.

Have a fantastic day !

The notable thing in that listing is that the seller is actually taking a loss. This is important because this is how the declines go. First, the delusional sellers think “I’m going to make 50% on my investment!” Then when it doesn’t sell quickly, they move to “I’m going to make 25% on my investment. Still not bad!”

Then, when reality starts to set in, it’s “I’ll break even after fees. Could have been worse!”

Then, it finally ends at “I’m going to have to bring cash to closing, but better to get out now!”

A lot of fools are going to ride this all the way down.

Hot money burns…

Excellent chart!!

That intersects nicely with things I’m researching about stocked based compensation and stock buybacks — and also the hidden off balance sheet arrangements that hide this wall of debt.

It’s different this time — it’s insanely, systemically dangerous — the hidden leverage in this bubble is vastly underestimated!

From my Google bro:

When margin debt rapidly increases, it can form a feedback loop with stock-based compensation (SBC) and dilution. The cycle begins with increased investor confidence and risk-taking, which inflates stock prices. Higher stock prices make SBC more valuable, providing stronger incentives for employees. However, this also encourages companies to issue more equity, which can dilute shareholder value, especially in a market downturn.

In 2020 when the Fed went QE crazy around the pandemic I thought that the general price level had just jumped 30-40%, and sure enough over the next few years it did. Food, cars, goods. Housing popped almost immediately and then was further juiced by the 3% mortgages for a couple years. I know a lot of people around here think a big housing crash is coming but I truly believe prices will just flatten out until the rest of the economy catches up, including earnings. Down a bit here and there but no 30-50% drop like some are expecting.

Gold is signaling something. What if with $38T in US Federal debt and maybe ten times that globally in all forms, “they” have decided that only another 75-100% price level increase will work to keep the music playing. $38T debt in a $30T economy is much worse than $45T in a $60T economy. And you can either grow or just reprice everything except that fixed debt.

There was a time when $1 gas and $15k cars and $2 hamburgers were normal. Now it’s $3.50, $45k, and $8. What if in 2030 it’s $7.50, 80k and $14? No more value in anything really but just higher numbers. Then the stock market can levitate for a while and S&P 8000+ won’t seem so out of place.

Sometimes I ask myself if I’m just thinking about all of it in the wrong way. With gold at $4200+ and climbing maybe now is one of those times. Gold could be ten thousand an ounce in 2030 with all those other prices way up and somehow it might all make sense.

“Gold is signaling something.”

Yes, MANIA

I look at gold as something you buy and then put away and never sell. Let the beneficiaries of your will decide what to do with it after you found out that you cannot take it with you.

I also look at gold as a trading instrument, buy low sell high. And it’s great for that during a mania because it moves a lot when there is a mania. But as trader, you have to remember the “sell” part.

Gold is a legitimate long-term investment. But it is subject to periodic manias that then collapse, which makes gold very risky unless you intend to hold for a long time and don’t care about the price changes along the way, and don’t need to sell it along the way for whatever reason.

What we now have is a massive, unadulterated, all-out, balls-to-the-wall, FOMO-driven mania.

You can see that in the comments here.

The last mania of that type ended in Sep 2011, and then over the next four years, gold plunged by nearly 50%. People who bought at the peak in 2011 were underwater for nearly a decade. And they earned no interest on it. And they may have had some carrying costs.

Like I said, traders can make a lot of money when there is a mania, but they shouldn’t forget the “sell” part of trading.

Wolf, I’ve been long the yellow metal since 2004 and watch that market intently. I respectfully think you are missing the big picture on it if you think this move is FOMO. Gold is money, everything else is credit said JP Morgan back in the day. Central Banks all over the world have been adding it as reserves to the detriment of the US Treasuries for the past year or so. They aren’t sellers near term I don’t think. We could be looking at a huge global restructuring. It’s happened before.

philm

Your comment is precisely the kind of comment I get in a MANIA. In recent weeks, people have posted hundreds of these kinds of comments. It’s proof that this is a mania. If you sit where I sit, you see it every day. The comments tell me a lot about sentiment, and gold is now in a mania sentiment. All the reasons people concoct why this time it’s different from other manias is proof that this is a mania.

Excellent comment, I also have oodles of gold and silver that will be left to my grandkids when I die to do ever they want. I am extremely ok with that.

Just got to say that that looks pretty scary. The 2000 and 2007 are dwarfed by the size of this one!!!!

Wolf –

Love this chart for, as you call it, a “thermometer” of leverage. You’ve sort of answered this question in other comments by explaining (several times) what it is, and what it is not.

But I’m curious if you know of any other metrics for leverage. This stat is mostly just retail investors taking margin loans to buy more “normal” shares.

But anecdotally, I think it’s clear other forms leverage have accelerated HUGELY and I don’t think most investors (even limiting ourselves to retail investors, to say nothing of increasing institutional leverage) are using standard margin loan leverage as much as they used to. From simply high-beta holdings (NVDA, TSLA, Bitcoin etc). To leveraged ETFs (TQQQ etc) to options (wall street bets crowd) to futures. I think retail investors are increasingly finding other ways to add leverage beyond margin loans.

A 20% decline in the S&P is going to cause a loss much higher than that for even the average investor, and a small but significant percentage are going to get completely wiped out by a mere 20% dip. And note, just a return to the low of 6 months ago would be a 25% drop.

“But I’m curious if you know of any other metrics for leverage.”

No, but I wish there were some.

Securities-based lending (SBL) is a big one. Some banks/brokers disclose it on their balance sheets, while others don’t. And no one tracks it overall since banks/brokers are not required to disclose it. This is leverage that wealthy investors use, often pledging the shares of their own companies, such as Musk pledging Tesla shares to borrow for other stuff. The amounts per investor can be very big, in the billions of dollars.

Occasionally, an SBL deal like that blows up, and then we read about it even on WOLF STREET:

“Citigroup, HSBC, Goldman Sachs, and Nomura had extended Wiese this “securities-based loan” in September 2016. His investment vehicles pledged 628 million of his Steinhoff shares as collateral, at the time worth €3.2 billion.”

https://wolfstreet.com/2017/12/19/margin-debt-backed-by-steinhoff-shares-hits-bofa-citi-hsbc-goldman-bnp/

Great chart. I wouldn’t be surprised to see the mania drive these numbers higher. It seems there is still both excess liquidity and delusion out there. If it ever does come crashing down, boy some people are going to get wiped out.

Yes, there could be another piece to the parabola. It cannot nail down the final month of the binge in advance. We’ll see it when it comes.

Yes.

Call my broker! He won’t answer the phone, dang it!

My computer sell button is not working. It’s froooooozeeeeeen!

That’s what happens when the crowd piles up at the door trying to get out and your crawling over dead bodies.

Wonder how this chart would look if we included TQQQ and other popular leveraged funds. Not sure if leveraged funds count as a “different type” of leverage and have to be treated separately.

TQQQ is not margin debt, nothing to do with it.

There is a lot more leverage in the stock market than margin debt, but margin debt is the only measure we have that tracks leverage, and so it’s like a thermometer of changes in leverage, which is what we’re talking about here.

Not included in margin debt, for example: Any amounts borrowed outside of brokerage accounts, such as by stock funds borrowing from whoever; Securities-based lending, such as Musk putting up his Tesla shares as collateral (many founders and executives pledge their shares as collateral for all kinds of things); borrowing at the institutional level to buy stocks; etc.

Curious if leverage in personal consumption compares to this at all. There’s been some coverage of the proliferation of buy-now-pay-later offerings to regular consumers, who end up leveraged up on debt.

Wonder if there is a systematic dependence on those loans getting paid back, like there was a systematic dependence on mortgages getting paid back before the financial crisis.

But maybe that leverage is too small to become a systematic problem.

Households have relatively little leverage (government and businesses are the overleveraged entities now)

BNPL is minuscule and is included in “other consumer loans,” the blue line here:

https://wolfstreet.com/2025/08/19/credit-card-delinquencies-balances-burden-credit-limits-and-collections-in-q2-2025/

And BNPL loans are included here along with credit cards:

Many thanks. I did not know that disposable income seems to have skyrocketed since 2022, to keep the debt as % of disposable income flat even as credit card balances have shot up.

This is going to end one way – badly.

Anyone who says that this isn’t a bubble is lying to themselves and others.

Protracted drawdowns in stocks and other assets are absolutely possible. The federal government can’t bail everyone out this time.

Act accordingly.

Does the Oct 2021 drop have a relationship to the Russian war on Ukraine in Feb 2022? And the subsequent increase in oil prices, which lead to drop in market and tumbling of the margin?

Should we be expecting a “trigger event” before popping of the bubble and a run on market?

Zero relationship. It was a stock market peak after a crazy run-up. The stock market peak was in mid-November 2021, thereafter stocks tanked for a year.

Looks like the master trading Algo just got new marching orders to change direction. Unless the buy the dippers can come thru today and tomorrow. Technically is the basis, input creates output!

From a conspiracy perspective maybe the recent big down day was front running the hot inflation data leaked to insiders and the china tariff news was just a cover story. We will see this month what the inflation data is. Hot? Or Very Hot?

As a graphic designer and occasional stock picker, these lines look pretty well defined. A correction is due soon.

“…this is what it looks like from the leverage point of view, and it’s scary: A massive spike in risk-taking and excessive speculation in the stock market, as demonstrated by this multi-month spike in margin debt from record to record, that is creating big vulnerabilities and risks.”

When the FED prematurely paused on their rate hikes, I said that the stock market would be making new all time highs. I wish I could find the thread, but you disagreed with me, Wolf. Yet here we are. This bubble is grotesquely insane.

Wolf,

Can you shed your brilliant insight on the current revaluation of gold?

Everyone is mesmerized by possible ‘gains’ and what have you casino speculation

More interesting is the side effect that the USD M0, is starting to be sufficiently backed by the US gold reserves again. With current price of $4200, we are at 20% , the minimum as is deemed good enough for a gold back currency.

Give it a little more and a declaration by shiny-gold-on-display-everywhere-loving bragging Trump that the USD is again backed by gold might very well become a possibility. All it takes is Treasury to revaluate the reserves to current prices.

Your thoughts and what this could mean?

I already said what I think about the current gold situation further up. So I’ll just repeat it:

I look at gold as something you buy and then put away and never sell. Let the beneficiaries of your will decide what to do with it after you found out that you cannot take it with you.

I also look at gold as a trading instrument, buy low sell high. And it’s great for that during a mania because it moves a lot when there is a mania. But as trader, you have to remember the “sell” part.

Gold is a legitimate long-term investment. But it is subject to periodic manias that then collapse, which makes gold very risky unless you intend to hold for a long time and don’t care about the price changes along the way, and don’t need to sell it along the way for whatever reason.

What we now have is a massive, unadulterated, all-out, balls-to-the-wall, FOMO-driven mania.

You can see that in the comments here.

The last mania of that type ended in Sep 2011, and then over the next four years, gold plunged by nearly 50%. People who bought at the peak in 2011 were underwater for nearly a decade. And they earned no interest on it. And they may have had some carrying costs.

Like I said, traders can make a lot of money when there is a mania, but they shouldn’t forget the “sell” part of trading.

Wolf,

Many thanks. Timely. Especially since there may be a bank in trouble. Fed’s Standing Repo Facility in use the past two days. $6.5 B Wed and $8.35 B today.

Maybe a blip is all this is, maybe not. If there’s no more usage tomorrow, will go with the former.

That “bank in trouble” is stupid-ass clickbait ZH bullshit.

The new SRF is designed to encourage banks to borrow at the Fed and lend to the repo market when repo market rates are higher than the Fed rates. That’s its purpose. The SRF’s job is to keep the repo market rates under control. The Fed has improved the SRF with two auctions a day. The amounts are small, $6 billion, $8 billion a day, the biggest since Covid was on June 30, $11 billion (quarter-end), as repo rates have risen because QT has tightened liquidity, and so banks are making money on the spread, and in the process keep a lid on repo rates. That’s exactly how it is supposed to work, and it’s working. Liquidity is normalizing after 3 years of QT.

I have discussed this here endlessly, starting over a year ago in my Fed articles. And now you drag this stupid-ass clickbait ZH bullshit into here?

Stocks get expensive and the cash pile gets tight, time to borrow. Time to leverage.

“ The additional leverage – borrowed money flowing into the stock market – creates buying pressure and drives stock prices higher”

So I have to borrow more? To afford a few shares?

I can see why this might not end up very well.

And if my stocks drop, I have to put up more cash I don’t have.

Sell,sell,sell!

Climbing the paperwallofworry must be exhausting. 401’s and IRA’s in for a religious experience. Your Index Fund will not save you.

The most experienced and notable investors have gone to cash. Took their massive profits. Most, I’d posit, traded cash for gold.

Cash, metal, property working out quite well for some