A Mississippi River of debt issuance. But the Treasury buybacks are small.

By Wolf Richter for WOLF STREET.

The Mississippi River of debt, as we’ve come to call it, that is streaming into the bond market day after day, looked like this yesterday and today: For the two days combined, the government sold $476.5 billion in debt, ranging from 6-week Treasury bills to 5-year Treasury notes, including 2-year Floating Rate Notes (FRNs).

Some of this new issuance was to replace maturing debt and would therefore not add to the US government debt; the rest is for funding the new deficits and refill the government’s checking account, the Treasury General Account (TGA) at the New York Fed, which had been drawn down substantially during the debt ceiling period. And that part of the issuance increases the US government debt.

This is what has come down the Mississippi River of debt issuance over the first two days of this week:

| Type | Auction date | Billion $ |

| Bills 6-week | Jul. 29 | 84.8 |

| FRNs 2-year | Jul. 29 | 32.0 |

| Notes 7-year | Jul. 29 | 47.0 |

| Bills 13-week | Jul. 28 | 86.9 |

| Bills 26-week | Jul. 28 | 77.4 |

| Notes 2-year | Jul. 28 | 73.7 |

| Notes 5-year | Jul. 28 | 74.8 |

| Total | 476.5 |

It shows how gigantic these Treasury auctions now are.

There are three more T-bill auctions scheduled this week for Wednesday and Thursday, with a combined offering amount of $245 billion.

All combined, this week’s total securities sales will be $722 billion (plus some SOMA purchases). Some of this is to refinance maturing debt, which will not increase the debt; the rest of the issuance will increase the debt.

The Treasury Department said yesterday that this Mississippi River of debt issuance in the current quarter through September will increase the total debt by $1.01 trillion, the additional amount of borrowing needed to fund the current deficits and to refill the TGA account to the desired level of $850 billion.

With TGA’s closing balance yesterday at $363 billion, it’s nearly $500 billion short of the desired level of $850 billion.

The $500 billion liquidity drain by the TGA.

This $500 billion needed to refill the TGA (a liability on the Fed’s balance sheet) represents liquidity that will now get drained back out of the financial markets, to reverse the process during the debt ceiling.

When the debt ceiling was in effect for the first six months of the year, the TGA balance was drawn down as the government funded deficit spending but couldn’t borrow more to keep the TGA topped off. And thereby the cash in the TGA (a Fed liability) washed into the financial markets – which was in part the fuel for the rally in stocks this year through June (discussed here at the time). Now that flow of liquidity has started to reverse from the financial markets back to the TGA (where the Fed absorbs it).

Then in the fourth quarter, the government will have to increase the total debt by another $590 billion, assuming that the TGA ends the quarter with $850 billion in it, according to estimates by the Treasury Department yesterday. If this plays out, the total debt would increase by $1.60 trillion in the calendar year 2025.

So over the second half of this year, the global markets will have to come up with $1.60 trillion to fund this increase in the debt, $500 billion of which will get mopped up again by the Fed and vanish as the TGA refills.

The recklessly ballooning debt of the Federal government.

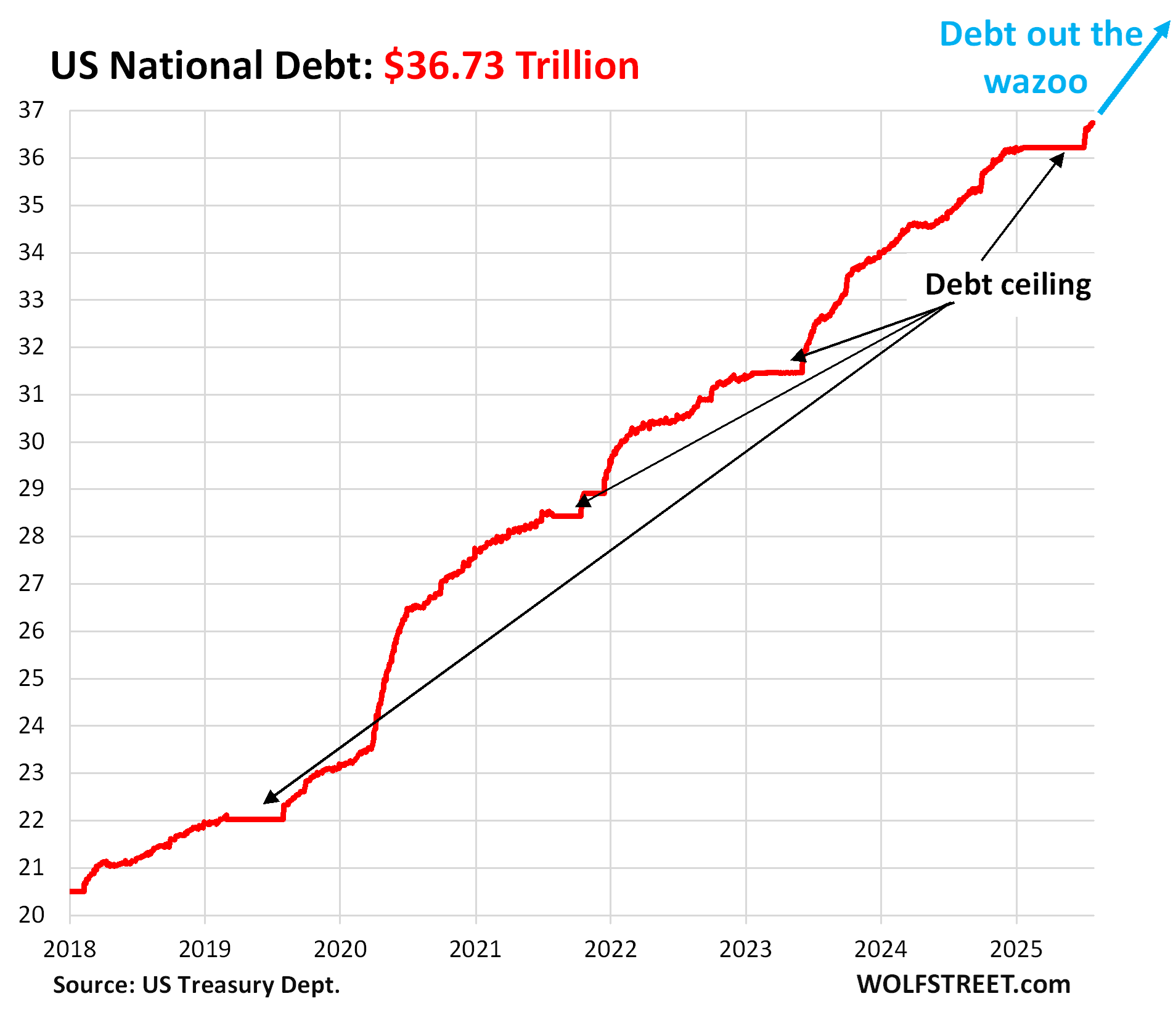

The total debt during the Debt Ceiling was $36.2 trillion. If the assumptions by the Treasury Department play out, the debt would increase by $1.6 trillion and end the year at $37.8 trillion.

Since the debt ceiling was lifted early in July, the debt has jumped by $519 billion, to $36.73 trillion as of July 28, according to Treasury Department data today. This does not yet include the recent Treasury auctions whose securities have not yet been issued.

The Treasury buybacks.

The Yellen Treasury started a program under which the Treasury Department buys back Treasury securities that had been issued some time ago (off-the-run securities). The Bessent Treasury has continued the program. The stated purpose was to improve the liquidity for off-the-run Treasury securities and push down longer-term yields.

The government has to borrow every dollar it uses to buy back Treasury securities. There is no money-creation involved. The Treasury borrows through issuance of new securities and uses a small portion of the proceeds to buy back small amounts of off-the-run securities.

This week’s buyback auction on Wednesday has a maximum purchase amount of $2 billion – compared to the $722 billion in securities that the Treasury Department sells this week.

At last week’s buyback auction (July 23), the government bought back $4 billion in Treasuries, spread over 12 issues:

- 8 issues totaling $3.65 billion at a discount to face value;

- 4 issues, totaling $353 million, at a premium to face value.

At a discount: For example, it bought at 93.4% of par value $1 billion of 7-year notes, issued in February 2022 with a coupon interest of 1.875%. These notes mature in February 2029, so they have 3 years and 7 months left to run, and trade with a 3-year-7-month yield, not a 7-year yield. By comparison, the 3-year yield last week at the time of the auction was 3.84%, a lot higher than the coupon interest of these notes. So these notes traded at a discount in the market, and the government bought them back at a discount.

At a premium: For example, it bought at 101.6% of par value $60 million of 5-year notes, issued in August 2023 with a coupon interest of 4.375%. These notes mature on August 31, 2028, so they have 3 years and 1 month left to run, and trade with something close to a 3-year yield, not a 5-year yield. Given that their coupon interest is higher than the 3-year yield, they sold at a premium.

For the Treasury department to increase its buybacks, it would have to increase the amounts it sells at auction. And those amounts are already huge – $722 billion this week alone – and are getting huger as the debt balloons, and more and more maturing securities need to be refinanced, and more new debt needs to be issued to fund the ongoing budget deficits.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Absolute disaster.

And people worry about social security getting shaved 30%. Heck, why not just sell a few trillion more of Treasury debt to refund SS? They are blowing tons of money on everything else so why not?

Don’t worry. The debt will be inflated away. Plan accordingly. Maybe buy real estate since it’s losing pace to inflation….

I already own real estate !

I remember overhearing a couple’s conversation around 2007-2008: “Honey, we can just max out all the credit cards we can get, and all the inflation that’s going to happen from these bailouts will just inflate it away. It’ll be like free money.”

I hope they didn’t act on that plan because the predictions of bailout inflation proved very wrong.

Why not sell off some Federal land and put the proceeds in the FICA trust funds? FICA tax rates don’t go up and benefits don’t get cut.

Because that federal land is a national treasure owned by all of us collectively and should not be sold because the Republicans wanted to give big tax cuts to businesses and wealthy individuals who did not need them.

Why not vote out Republican leadership who voted to increase the deficit and put some actual fiscal conservatives into power instead of allowing BLM or national forest land to be sold for cheap to wealthy people or extractive industries?

Oh my…you are so confused. You are right though, we should vote for fiscal conservatives, name one! We’ve been spending like drunken sailors since Roosevelt.

Wrong answer….Use the tariff proceeds to pay down our debt! That will reduce inflation and prove to voters we are serious about paying down our debt.

Money is fungible.

Our leaders have completely failed us.

They’re not “leaders,” they’re grifters. ALL politicians are on the take. We’re getting scammed.

but hey the billionaires got a tax cut and the molester in chief is still winning. not sure how much more winning we can take

In democracies, the leaders reflect the people’s priorities. Americans don’t care about debt. And they now have a leader who sees debt as a big, beautiful thing (to be defaulted on repeatedly).

4hens,

Thar is subjective and completely made up. The laws politicians pass seldom ever overlap with what the people who elect them want. Plenty of studies on this. The fiction is we have a democracy. 66% of eligible voters vote which is extremely low and not really hard to comprehend. The truth is it doesn’t matter which side you vote for outside of mostly political theater. Both sides will drive the US down, which from an international perspective is positive. No ability to arbitrarily sanction whoever they choose. Anyone that argues one side is better or worse than the other misses we decline under both.

The only difference between the two parties is under one we decline faster and the other slower.

Anyone disagree?

As long as voting determines elections, those who win elections reflect the will of the people who vote.

If elected officials stray too far from what’s acceptable to the electorate, they are removed from office via impeachment. The rarity of that implies that most of what politicians do is acceptable to enough American voters, even though they complain.

Except that’s not how the enormous growth in federal debt was created since 2008. The people have been scammed – no doubt. But who abrogated traditional Congressional funding processes and substituted continuing resolutions and baseline budgeting? Who made a hapless comedy of the “budget ceiling”? Who created the budget waste/fraud that DOGE has only touched upon? Who funded the enormous deficits? Who pushed QE? Who pushed for enormous stimmy give-aways? Who exported American businesses overseas killing the middle class? Who advocated loudest for a service based economy? Who funded income transfers from citizens/taxpayers to illegal immigrants to cover their medical, college tuition, rent, etc. expenses? Who exported jobs overseas in basic manufacturing industries? Who bought into MMT?

There’s a huge reservoir of residual anger over all of this.

The whole system was turned on its head for decades for political outcomes that far transcend Trump’s arrival n the scene.

Finally!! Sentiment that both parties are exactly the same. Divide and Rule. We are split right in the middle and we are manipulated to hate each other and politicians benefit from it. Two party system is a Joke!

In the Netherlands we have 23 parties and the results are the same as in the US. Government despises the people and ignores them for as long as they can.

Big difference with the US gov is that our government doesn’t have the power of sanctions meaning anything substantial internationally. So ‘we’ bark occasionally and the rest of the time we sit and wait for what the ‘biggies’ allow us to have. As a good lapdog does.

Again

Crazy. Excellent article

I remember well living in Denver in the 80’s wondering what the consequences of what I perceived as a rising tide of debt THEN would look like in 10-20 years & now it is even more frightening 45 yrs later than I can possibly. imagine!

But Wolf, I’ve been following you for a long time and I really appreciate your clear, accurate no BS explanation of “what the hell” is going on in a rather opaque process that us plebes would not normally have access to

“grok” it. Many, many thanks to you Wolf!

Another way of looking at it is you worried about something for 45 years that never happened

Another way of looking at it is you’ve been watching politicians systematically strip your wealth for 45 years and you haven’t drug them out of office yet.

Yeah, well, as late as 2000-2001 you could buy gold for $250/oz. From the perspective of hard assets, I would say you’re wrong. Of course, if you purchased real estate , stocks, etc. then you also benefited from the massive inflation which could easily cause one to have a skewed view of reality.

@ Waiono. Benefit? Some. No real gain but minimizing inflationary losses.

Robert (QSLV)

…Mississippi, or Amazon??? (ref: discharge volume, not geographic location, don’t want to run afoul of the chief sharpie…).

may we all find a better day.

Wasn’t this entirely guaranteed by the Big Bad Bill which increased the US deficit by over $4 trillion and coming at a time when the US had been using ‘extraordinary measures’ for many months to fund massive overspending at the federal level which could only be replenished by issuing a massive amount of US Treasuries starting in July? And, isn’t is now highly likely that interest rates across the board will rise with this flood of new debt?

Trump’s “Big Beautiful Bill” continues a long-established pattern by the Republicans of slashing taxes, which dries up government revenue, and spending like Democrats, which pleases the electorate. The reckoning will come due later rather than sooner, as the fiat currency system allows for some leeway of error, but it cannot be put off forever…

Have tax revenues grown?

Yes

Has spending grown more?

Yes

Real per capita spending is up 20-30% from pre pandemic days and we didn’t have a shortage of government then.

Government can’t keep spending 6% more per year forever unless inflation goes up.

Now that the 2017 tax cuts are “permanent”, including the much higher standard deductions, NOW is the time to completely eliminate the SALT deduction that goes almost exclusively to top 10% itemizing filers in expensive coastal states. I think I read that that change alone would increase revenues by $1T+ over ten years. NY and CA Republicans would not vote for it but you’d get plenty of moderate Democrats from the Midwest. Raise taxes on the rich, yes?

I always find it interesting how projections are for a 10 yr. period. I believe it is to promote one’s premise in a positive light, whereby if you only used a yearly reference the magnitude of your selling point is nil. 1 trillion over 10 years, really ,? We are looking at 1.6 trillion in one year!

The same analysis goes for SoCal trying to make the big beautiful bill look bad. The increase of debt of 3.3 to 4.2 trillion is for a DECADE. The yearly doesn’t sound so awful.

If this article doesn’t make your worry about the long-term purchasing power of the U.S. Dollar, I don’t know what will. Here’s what’s been on my mind for several years now (since The Great Inflation of 2021-2023): Which is more risky in terms of long-term purchasing power (not default risk)…

1) holding the U.S. Dollar in the form of U.S. Treasuries, or

2) holding highly diversified stock index funds, which are now trading at historically high multiples?

Looking forward to your responses.

Heck, speculating on Bitcoin, yellow rocks, or meme stocks with high short interest don’t look too bad compared to those two options.

If you think they’ll be more rate repression ahead, add overpriced RE in there too.

I believe that the extraordinary measures after the debt ceiling was reached included not contributing to pension funds for govt employees. Now those payments must be made. Is that done by issuing treasuries to the funds and if so, is that included in the figures for the auction amounts?

Thanks, Michael

Try holding land, gold, silver, etc. Anything but paper IOUs.

Try squeezing interest out of gold and silver. It’s hard. RE, if it’s rental property, pays rent. If RE is your home, it’s a roof over your head. But land that is not being used costs you money.

My experience: Timber can pay the rent while waiting for appreciation. Plus discounted property taxes possible. Farms are hard to find farmers for, then no discounted property taxes nor income. Leasing out farm land is not easily done in our area.

Yes, but timber is not “unused land.” Timber is a productive use of land.

Net worth impairment is inevitable, regardless of diversification efforts. It all surged when the tide came in, and it’ll drop just as quickly when it goes out.

In this equation, I prefer atoms over electrons.

I would recommend that you read the book “Wealth War and Wisdom” written by Barton Biggs and published in 2008. For the period 1900-1949, French equities had a total real return of minus 22% while French bonds had total real return of minus 96%. For each of the European countries listed in that table, equities outperformed bonds.

More inflation, COMING RIGHT UP.

Damn straight it is.

Depth Charge,

Who cares about inflation now?

Inflation is still higher than goal. Services where I spend most money, prices are always on rise last 3-4 years. I can switch Insurances, child care providers,. But how many times we can switch and try to get New Customer Deals? Child Care amounts been crazy as hell.

Hey.. but we continue to reach new Peak in Stock Markets. RE market prices have corrected some but compared to rise it had, this correction is nothing. 3% rate holders are able to sustain for longer because Labor market is doing good and Stock market too. Many Boomers are enjoying wealth effect. AI boom is going on. Companies are spending like anything. Our Congress is spending like drunken sailor. Foreign govts keep buying our Debt at such low rates. So why we wont have good times?

FED slowed down QT way too early by scaring us “too fast will blow up something”. Slowing down QT has only helped Treasuries stabilize long rates. Otherwise longer rates should have been 6% by now.

Based on so far comments from Trump, we know he expects a Chair who will only reduces rates. With such incoming puppet, do you have any hope inflation will be under control?

No. Think Richard Nixon and Arthur Burns in the 1970’s. By 1981, you could have purchased 30 year zero coupon non callable Treasuries with a yield of over 15%.

“Gradually, then suddenly”…….as Hemmingway said

Cry Me a River…

What’s interesting is how household debt has ballooned as well.

And how come credit card companies can charge over 20% interest on balances?

It would be dumb to pay that.

https://wolfstreet.com/2025/05/20/credit-card-delinquencies-balances-debt-to-income-ratio-and-credit-limits-in-q1-2025-our-drunken-sailors-and-their-credit-cards/

Was referring to this

https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2025Q1

Page 6

Me too, except I wasn’t being a moron and instead I considered the growth of employment and income, to show what is actually happening with consumers, and not concoct some BS conclusion, like you did. Consumer debt needs to be looked at in terms of consumer income (hence the percent of disposable income).

FYI: credit cards are a universal payment method in the US, and credit card balances are not debt, but statement balances, most of which get paid off by due date. The interest-bearing debt portion is much smaller. Credit card balances are NOT a sign of borrowing, but I sign of spending.

You’d know all this and much more if you had ever read any of my credit card articles. They’re based on the same NY Fed data that you linked. So READ THE ARTICLE I LINKED. I’m tired of seeing this BS on my site.

It says DEBT wolf.

Official report

It’s statement balances. Read the definitions. The NY Fed uses Equifax data of statement balances. They call it “debt” because it is owed. But it is non-interest-bearing when paid by due-date, which is how most of the balances are paid. Only people with an agenda refuse to understand this.

Why do I have to keep wasting my time on this over and over again?

Great response! Credit Card debt as a percent of Disposable Income HAS trended down for 20 years.

But as far as “household debt” as a percent of disposable income, wouldn’t the 100 years history tell a more frightening story supporting Sucatash’s first line? Even more pointedly, the 50 year student debt craziness. Over the longer span of decades, government debt and household debt appear to have grown in parallel fashion.

“Government is a bad parent when it teaches by example that consuming beyond one’s means is good, and that thrift (collective or individual) is evil.”

-Stya Rutbier

“But as far as “household debt” as a percent of disposable income, wouldn’t the …”

All you have to do is read it instead of making up BS:

https://wolfstreet.com/2025/05/13/household-debts-debt-to-income-ratio-serious-delinquencies-collections-foreclosures-bankruptcies-our-drunken-sailors-debts-in-q1-2025/

It’s not the consumer that has a debt problem this time around, but the government and segments of the Corporate America.

I also wonder if the credit card debt is going up as everything costs more. I pay off my credit cards every month. But I noticed if I have a credit report run, it shows my current balance of 3500 even though I pay it off each month.

A few years ago I probably averaged 2500 in credit card purchases a month and now it is 3500. I did not change my buying habits and I am still buying the same stuff but it just all costs more. Food, auto repair, lawn care, restaurants, utilities, property tax, insurance, household items.

So multiply that by millions of credit card holders and credit card debt goes up.

There is a chart by the FED that shows consumers are spending more but the volume of stuff purchased has not increased be it goods or services. Most of the same stuff (goods and services) but these things just costs more with the exception of a few things like electronics and clothing.

Thanks wolf!

Consumers’ balance sheets look ok to this Dear Reader.

These numbers from McKinsey study from 2010 are what I was referring to:

Household Debt as % of GDP:

1970… 44%

1980… 49%

1990… 59%

2000… 72%

2009… 97%

[ McKinsey Global Institute, Debt and Deleveraging: The Global Credit Bubble and It’s Consequences, 2010, p. 59 chart ]

That the percentage has peaked and receded over the past 16 years (replaced by government debt bulge) does not offset a doubling over three generations. I’m not an anti-debt Luddite, but I’m failing to understand the non-recognition of this alarming trend.

John H.

But they’re bullshit and 15 years old. You dug this BS out of the landfill just because it supports your silly narrative.

1. Your list shows peak of household debt to GDP in 2009. It has been falling ever since. Now household debt to GDP (Q1 2025) is 72%. The chart looks similar to the chart I posted above.

2. Where are household assets!!!!! $180 trillion you goofball. Up from $72 trillion in 2009.

3. Household wealth:

A.) Household debt grew from $14 trillion in 2009 to $20 trillion in 2025 (+43%)

B.) Household assets grew from $72 trillion in 2009 to $180 trillion in 2025 (+150%)

C.) Household wealth (= assets minus debt) grew from $58 trillion in 2009 to $160 trillion in 2025 (+176%)

You people just put yourself on my blacklist by continuing to abuse my site to spread this stupid unadulterated bullshit about households.

Wolf, why does Treasury issue maturities other than at the “saddle” of the yield curve? (Which is currently 3yr notes, I believe.). Seems like the cheapest debt to saddle ourselves with, pun intended.

I imagine there’s some scheme to manipulate the curve by how much volume you sell into which ends…

By long-standing practice, Treasury doesn’t want to time the market to get the best deal from investors – at the expense of investors! It wants to be “regular and predictable.” So auctions are announced way in advance. Bond and note auctions are like clockwork. etc.

Bessent has indicated that he might want to deviate from the “regular and predictable” doctrine. But that could bite everyone in the butt, and it has done so before, which is why this doctrine of “regular and predictable” was established.

Yellen also cited this doctrine as reason why she didn’t increase sales of 10-year and 30-year auctions in 2020 and 2021 when yields were super-low. And that’s a good thing because the market values of those 1% 30-year bonds have imploded and have taken down a few banks. If the financial system had been full of them, it would have been a fiasco. So, “regular and predictable” did its job and minimized the damage and upheaval.

Wolf – is this the same reason why the Treasury bought back a few bonds above par — because it had been planned well in advance?

I thought the whole idea was to play the game of buying back just those bonds whose yields have spiked and consequently trading at a discount to par…

The purpose of the buybacks is to create liquidity (trading) in the off-the-run securities. A 5-year note issued in 2023 is an off-the-run security. It currently trades at a premium because the 5-year yield (and the coupon interest) was higher in mid-2023 when it was issued than today. So the Treasury pays more for it, but then saves on not having to pay the higher interest for the rest of the note’s term. It all works out the same. That’s how yield works. But the idea is to create liquidity (trading) in those off-the-run bonds.

Guru Bessent has been lead to believe, that stablecoin kool-aid will save us (save the treasury from paying more and more interest on trillions of debt) if we drink until we’re blind — yes, we’re going to reengineer the wheel and make America into a Wild West casino circus (again)!

“ Before the Civil War, there were approximately 8,000 different types of money in circulation in the United States” — here we go again!

Stablecoins, essentially will be the new frontier of credit cards for this new era, or currency — apparently every entity from Amazon to Zillow will be issuing private coins, to help all us drunken sailors, transact in a better marketplace, making our exchanges and transfers faster and cheaper — and in some way, this mass hallucination of digital efficiency, is going to magically act like a vanishing act. Apparently, user adoption will explode and millions of boomers are gonna get crypto wallets and shop for eggs using stable coins, which in aggregate makes America great — I guess?

However —

“Asymmetric Effects: Research by the BIS indicates that stablecoin outflows have a significantly larger impact on Treasury yields than inflows. Outflows of $3.5 billion of Treasuries by stablecoin issuers can increase T-bill yields by 6-8 basis points, while similar-sized purchases only lead to a 3 basis point decline. This asymmetry creates a risk of sharper increases in yields during periods of market stress or stablecoin runs.“

We’re taking a chaotic irresponsible disaster — and mixing that into a bigger mess, mixed with unprecedented corruption, grifting, greed, and seems like just another day.

I am wondering if the Fed would intervene if there is an “event” in these new modes of transaction. (BTC, Stablecoin, etc.)

No. The destruction of value is part of the attraction for them. Nothing like the churn, baaby.

Morale of the story; don’t own treasuries. The dollar is melting.

The dollar is currently melting up, LOL

True. The USD is surging higher every day here in bizarro world.

When the treasury/Fed buys back bonds or just buys ’em, the word is monetization of debt.

If Trump’s policies of forcing interest rates down kick in, look out below.

Sayonara,

B

Nonsense. The Treasury cannot monetize debt, only the Fed can. The Treasury has to borrow to buy back. Read the article. Only the Fed can create money to buy bonds. And it’s now doing the opposite, it’s shedding bonds and thereby destroying money, which is what QT is.

It seems to me that the American Republic is enough of a democracy that the blame should be placed squarely on the electorate.

If a politician believed that the public would support the policies necessary to deal with the deficits and the debt mountain, then he might campaign for them. But they all know that the public wouldn’t.

In this respect even Trump’s radicalism meets an insurmountable obstacle.

Recalling an older Wolf St. slogan: the road to heck DOES seem to be in a (nearly) straight line (so vividly charted here, out the wazoo). Paved with good intentions, and along the path of least political resistance.

I have just one real question about “stablecoin”- if it is tied to an infinite issuance of UST debt, how can it truly be stable? Or is it just another bezzle with a blockchain on top?

LoL, one has to ask how long can this go on, or do we buckle down and do the awful deals necessary to buy a bit more stability?

I don’t see it happening. How will this all work out? In less than 20 years the UST will hit $100 Trillion, and soon after 1 quadrillion. Guess we will just shave three zeros off the end, or maybe just six zeros. Now, what happens when the wheels come off?

Ask the new super duper AI from Meta how well New Zealand is going to treat the rich when they no longer have any real wealth in local terms. I find it amazing how one can easily see what is coming, and yet be collectively powerless to change that future. I can just see it- Zuck sits there in his high and mighty New Zealand compound and says- I have $100 billion in New York- and the guy responds your takeout order is 10 new pence in silver buddy, not that hot air.

Now, with a limited time left on the planet, I just hope the kids can do a better job. That too is going to be rough, because they have zero stake in most of this house of cards.

Less with less, costing more coupons. Get used to it. The 70s show is back in full force.

Someday this war’s gonna end…

Re: I have just one real question about “stablecoin

I’m just starting simple research for these coins, but there are a massive amount of issues — maybe Master Wolf can eventually shine a light on this, because it’s now a Treasury concern.

In the meantime, what I find curious, is the mechanics of this tangled up framework, that looks like a Ponzi.

First off, if I’m not mistaken — Joe Plumber has to buy a stablecoin from an exchange, let’s say, a stack of Walmart or Amazon coins, that have been issued by these entities, in the belief, that their customers will exchange cash for digital coins.

Right there, I’m already really skeptical — because, apparently, a retailer will dangle some incentive mechanism, like a gas discount or an inducement to create adoption by their consumers.

Hence, instead of a credit card or discount card, you get excited about a 2% discount by using the stablecoins that you need to go purchase.

Seems incredibly stupid to go through that maze as a consumer, for virtually no reason — but, on the higher level, all these companies have to go through a vast maze to issue stupid coins — and then Treasury has have its hand in there, connecting itself like a parasite to the reserves of thousands of companies, that need to be audited for stability compliance.

We already have a non functioning government that’s out of control with its balance sheet, but now we need to expand the insanity — under the guise of efficiency — which is a way to say, we end up with greater grift and corruption— and a far greater problem.

Another concern, is understanding Luna, where a company issues too many coins and hyper dilutes stability —- so, that’s crazy, but then we have UST issuing this vast tsunami of debt for our bankrupt state — so instead of one stream of government debt (issuance) — we get thousands of places issuing streams of coins — it’s utterly insane!

I’m fine using a credit card, and having credit available each month — I can’t fathom why I’d waste time with a stablecoin — but, this’ll probably be a generational thing, with Gen Z getting brain implants, so they can buy cupcakes on a smartphone — which apparently makes the Treasury Great Again????

Apologies for long stream of ranting

The main benefit for stablecoins is that the issuing company gets the interest generated on the US treasury notes and thus can pass on perhaps a generous 1/2 of that on “discounts.” Great way for Walmart to make money by using their customers’ money. Profits galore with no cost to themselves.

The other way corporations will profit is by not having to pay credit card transaction fees, which in the US are twice what they are in Europe.

All it takes is one 40% stock market drop and the world changes for the better. People would be forced to prioritize work over speculation. Unrealistic economic expectations and entitlement mindset would evaporate.

But if the Fed responds to every hiccup with money printing, it will never happen.

Wolff

What were the previous budget deficit estimate like the 4 trilllion this time and how we also borrowed lot more

Every time there is a new excuse

The big beautiful bill will add 4 trillion – which is a understatement

They always lowball – because nobody remembers few years down the road these predictions .

How did we go in 25 years from budget surplus to

37 trillion

They say it will be 50 trillion by 20250

I think becoming will come earlier

I

2001: $600 check for everyone who had filed a Federal income tax return, to go shopping

Federal income tax cut, US war against Afghanistan commences

2003: another Federal income tax cut, US war against Iraq commences

How much did these give aways and wars cost the Treasury?

Who wrote that song ‘Highway to He🏒 🏒 ?

Anyway, we’re on it, financially. One day soon, I think this school bus is going to fall off the cliff. Hold on for the ride.

The bond vigilantes are salivating, waiting for the next shoe to drop.

They’ll keep waiting because they don’t understand that the ‘70’s was a decade long debasement/devaluation of the dollar after going off the gold standard.

They’ll have to be satisfied with upper end of “normal” interest rates.

Bond vigilantes? What a joke. There are no bond vigilantes any more. Otherwise they would have pulled the plug on this circus.

“Debt Ceiling”

Seems a misnomer. How about ‘Debt Kite’ or ‘Debt Dam’?

Something readily adjustable…

New Debt Floor.

“New Debt Floor”

This is pretty good, as it’s certainly never been an actual ceiling we hit, just another floor of what the debt escalator continues to climb past.

“Floor” does capture the essence of what happens!

[Just add another story to the Jenga tower.]

Round numbers:

$40 Trillion in debt financed at a quite reasonable 4% interest rate equals $1.6 T in interest cost per year.

While the Fed’s direct mandate is employment/low inflation, the above reality would implode the ability to manage that mandate. Therefore, I believe Powell believes higher interest rates over the long term are the only thing that could possibly save this country from itself. Of course, he can’t say that directly, but I believe that is what is going on.

Are you saying we will be promised 2% inflation but we will recieve 2-4%, along with a healthy serving of excuses and rationalizations?

I suppose another approach is to print money during crisis, when people are less likely to complain about it. There are lots of Fed apologists on this comment board who expect money printing during challenging times to ward off the free market Boogieman.

Powell did his patriotic duty and led the totally planned and executed inflationary impulse during COVID. This, of course, was done to reduce the debt burden.

But I think Powell was expecting some reasonable level of federal spending control to follow as inflation like what we just experienced is very hard on most. Instead, both Biden and now Trump have blown that off and are continuing to spend.

Perhaps Powell is a bit fed up (no pun intended) and even feels “used”. Perhaps Powell has decided that as long as he remains in charge, the government needs to hold up their end of the bargain and get spending down. This interest rate policy, of course also helps to tamp down on the residual/ongoing inflation.

>Are you saying we will be promised 2% inflation but we will recieve 2-4%, along with a healthy serving of excuses and rationalizations?

Why are you using future tense?

It seems that right after announcing a Treasury auction that did not go well at all, the very next auction is reported to be “stellar”. Why is this? Do you believe that the US is now a non-reported buyer of its own Treasuries (i.e. stealth QE)?

All auctions are going reasonably well and are oversubscribed. And all securities sell with ease. Sometimes at a higher yield, sometimes at a lower yield. Headlines are trying to get you to click on what a very technical articles.

The meme of “stealth QE” has been polluting brains for three years. There is no such thing. If you imagine there is, and if you want to spread this BS, go somewhere else.

On the bright side, the Treasury is getting an absolute steal on 3-year notes and the dollar will regain some value.

I know the dollar is going up slightly in the last few weeks, but for how long and why will it continue to go up when The Superrich plan to diversify out of the US, along with foreigners over time?

Howdy Folks. Same old same old. Guess that electric car guys chain saw had no gas in it. I had hoped for a couple of months things would be different. History seems to repeat, again and again.

I kinda remember bessent bitching about Yellen being overly political:

“While outlining his debt plans, Scott also took time to call out the Federal Reserve. Speaking at a Breitbart News event in Washington on Wednesday”

There’s absolutely zero credibility created by aligning himself with a trash news outlet — might as well use zerohedge. Amazing

Recklessly Ballooning US Government Debt

Just like with U.S. consumer credit card debt, it’s good to put the U.S. federal deficits and debt in context and perspective of “in relation to what?”

U.S. dept-to-GDP ratio is now 123.1%. This doesn’t include unfunded liabilities.

The U.S. federal budget deficit as a percentage of GDP is somewhere in the 6-7% range. A “normal,” or sane, or rational range for the U.S. in peace-time would be 2-3%.

Of the OECD countries, the U.S. is now only behind Israel in budget deficits. Recall that Israel is currently at war, and the U.S. is technically not. The U.S. is now ahead of Greece, France, Italy, UK, and Japan on this metric. I don’t have data for China.

Debts and deficits of this magnitude are a huge drag on the economy. The first red flag level is 90% debt-to-GDP reduces growth significantly. It gets worse and non-linear from there. What’s taken from the private sector by the public sector isn’t spent on productive investment.

The interest payments on the debt are now greater than defense spending. This is, according to history, the beginning of the end for the empire.

So, there’s no officially declared war, no pandemic, and the economy by most measures is doing fine. Why the need for fiscal dominance?

Finally, with few exceptions, Congress – feckless and reckless spendthrifts – no longer represents its constituents. Perhaps it’s now too late for a federal balanced budget amendment. Self-enrichment (e.g. stonk trading) seems to be the (market) order of the day. It’s taxation without representation (deja vu) all over again. Time to clean out the stables.

“good to put the U.S. federal deficits and debt in context and perspective of “in relation to what?”

Yes, and I do that a lot:

https://wolfstreet.com/2025/05/29/us-government-interest-payments-to-tax-receipts-average-interest-rate-on-the-debt-and-debt-to-gdp-ratio-in-q1-2025/

Thank you! It can be fixed, but need political will to do so. Elon and DOGE tried. Javier Milei is otherwise occupied.

but hey the billionaires got a tax cut and the molester in chief is still winning. doge was a joke no real money there to save not sure how much more winning we can take

[Wolf]>> It’s not the consumer that has a debt problem this time around, but the government and segments of the Corporate America.

When you reported earlier this week on margin debt taking off (again), I don’t believe you mentioned *whose* margin debt that is being reported by FINRA. Is it retail investors, institutional investors, both?

It’s total margin debt. But institutional investors often can borrow at the institutional level without putting up securities as collateral, so that wouldn’t be part of margin debt. In addition, securities-backed lending is also not part of margin debt. There are other forms of leverage that institutional investors and wealthy investors have access to that are not part of margin debt. Margin debt is just a window into financial market leverage.

>> securities-backed lending is also not part of margin debt

That’s interesting. I wonder how increasingly commonplace these things are. For example, it’s trivial to set up a pledged-asset line (PAL) at Schwab, and even to negotiate down the advertised rates. Seems pretty popular, with the melt-up in people’s brokerage accounts, the popularization of “Buy, Borrow, Die”, and the ease at which the banks can make a percent above SOFR with little liquidation risk (vs., say, having to foreclose on a house).

The crazy thing for these security-backed credit lines is you can draw up to 70-80% of the collateral value before getting hit with a margin call. Which with today’s rollercoaster market swings…eek.

It would be really interesting to have one’s thumb on the pulse of margin calls, for everything, including these things.

Yes, EEK!!! Consider that in 1929 the margin rate was only 5%, and how well that worked out.

Ironic how we see government as separate from people. If we called government debt, US tax payer debt we might think about it differently. Not suggesting anything would change as a result but mental shifts are the start of larger changes.