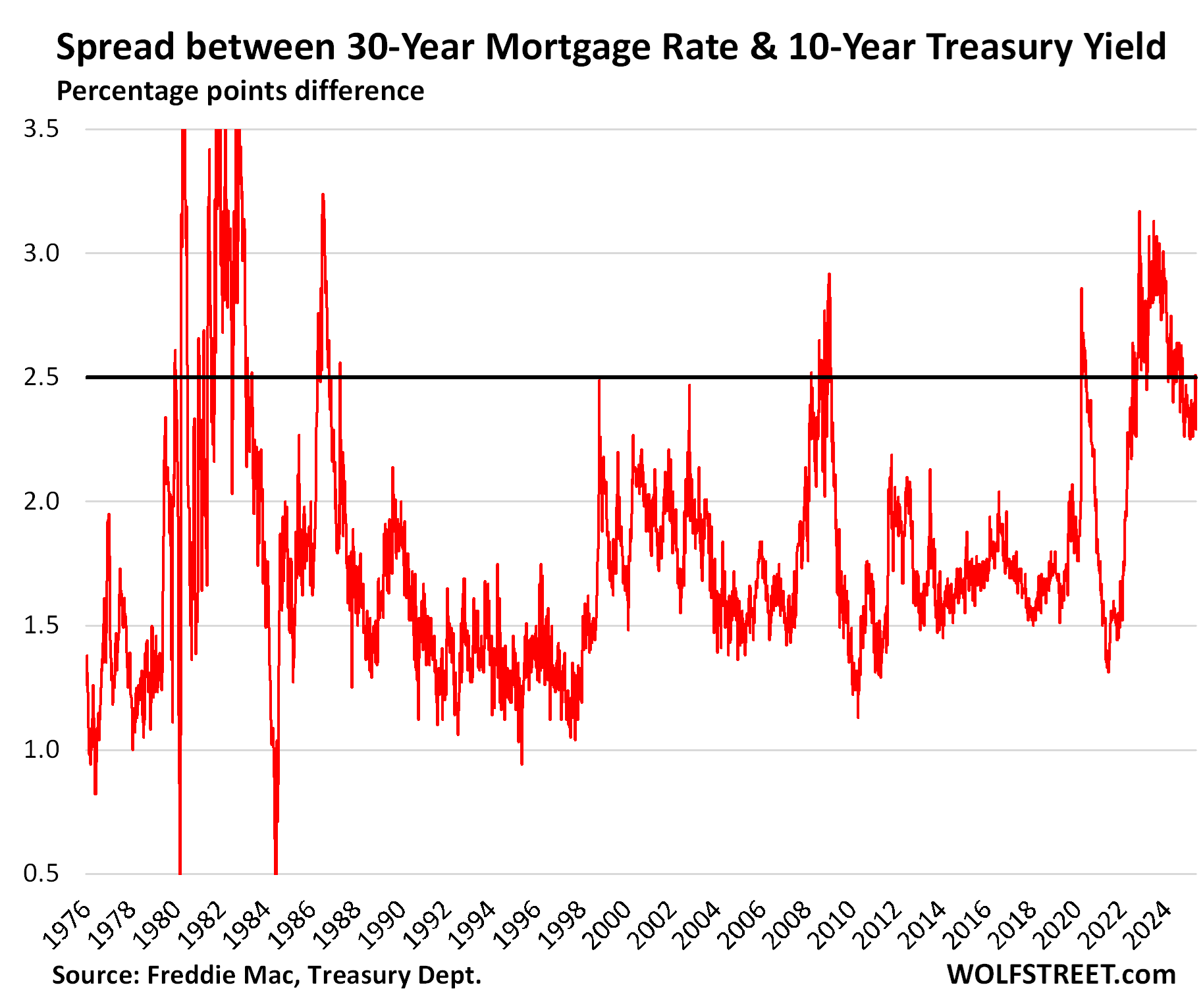

Mortgage rates are higher in relationship to the 10-year Treasury yield than they were most of the time over the past 50 years. There are reasons.

By Wolf Richter for WOLF STREET.

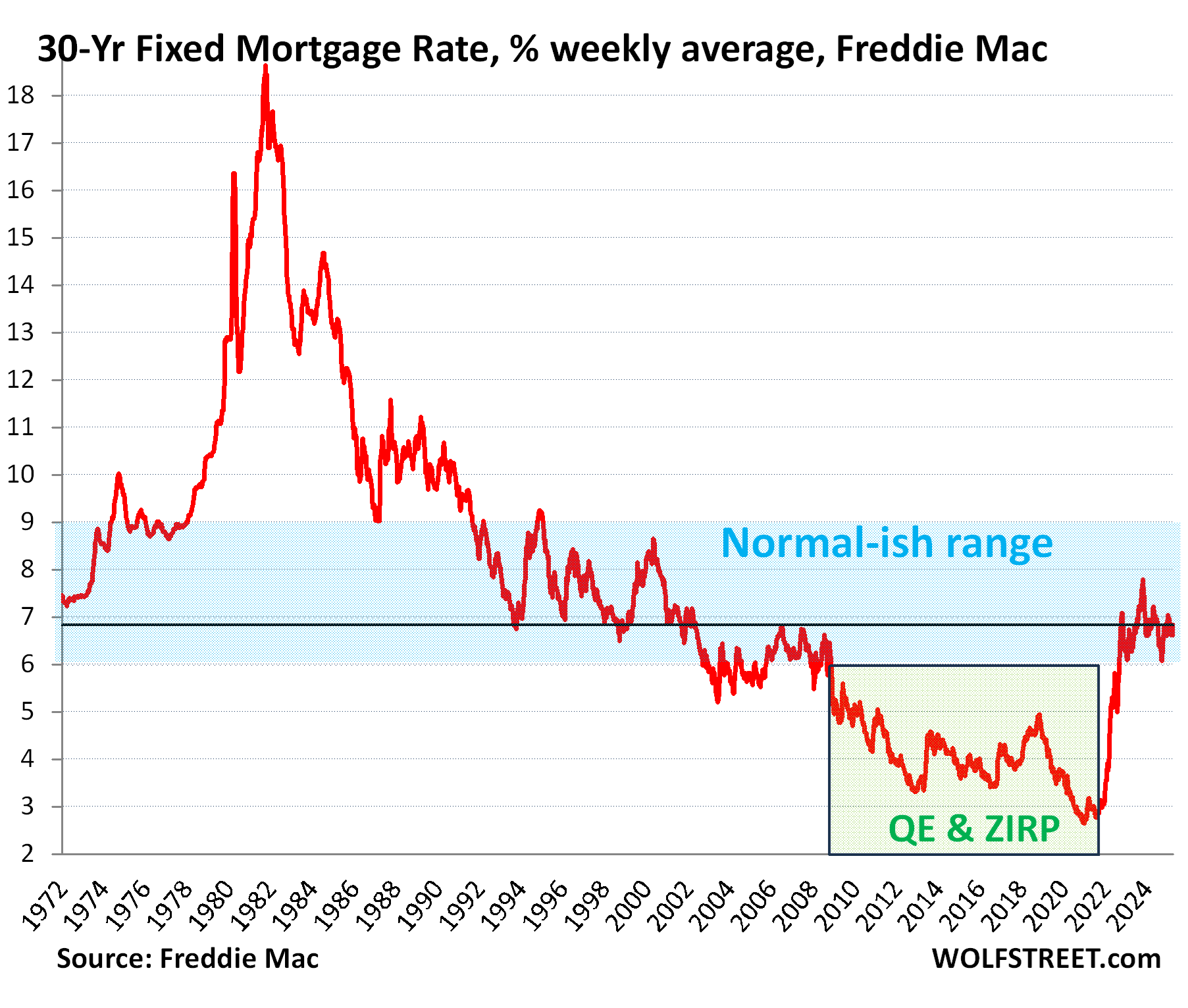

The 30-year fixed mortgage rate tracks the 10-year Treasury yield but is higher. The amount by which it is higher – the spread – varies substantially. When the Fed bought mortgage-backed securities during QE, the purpose was to narrow the spread and thereby repress mortgage rates, and eventually they fell below 3%. Then the Fed started shedding these MBS during QT in mid-2022 and stepped away from the mortgage market entirely. Mortgage rates rose faster than the 10-year Treasury yield, and the spread widened substantially, shooting past 3.0 percentage points, the widest since 1986, but then started to narrow again.

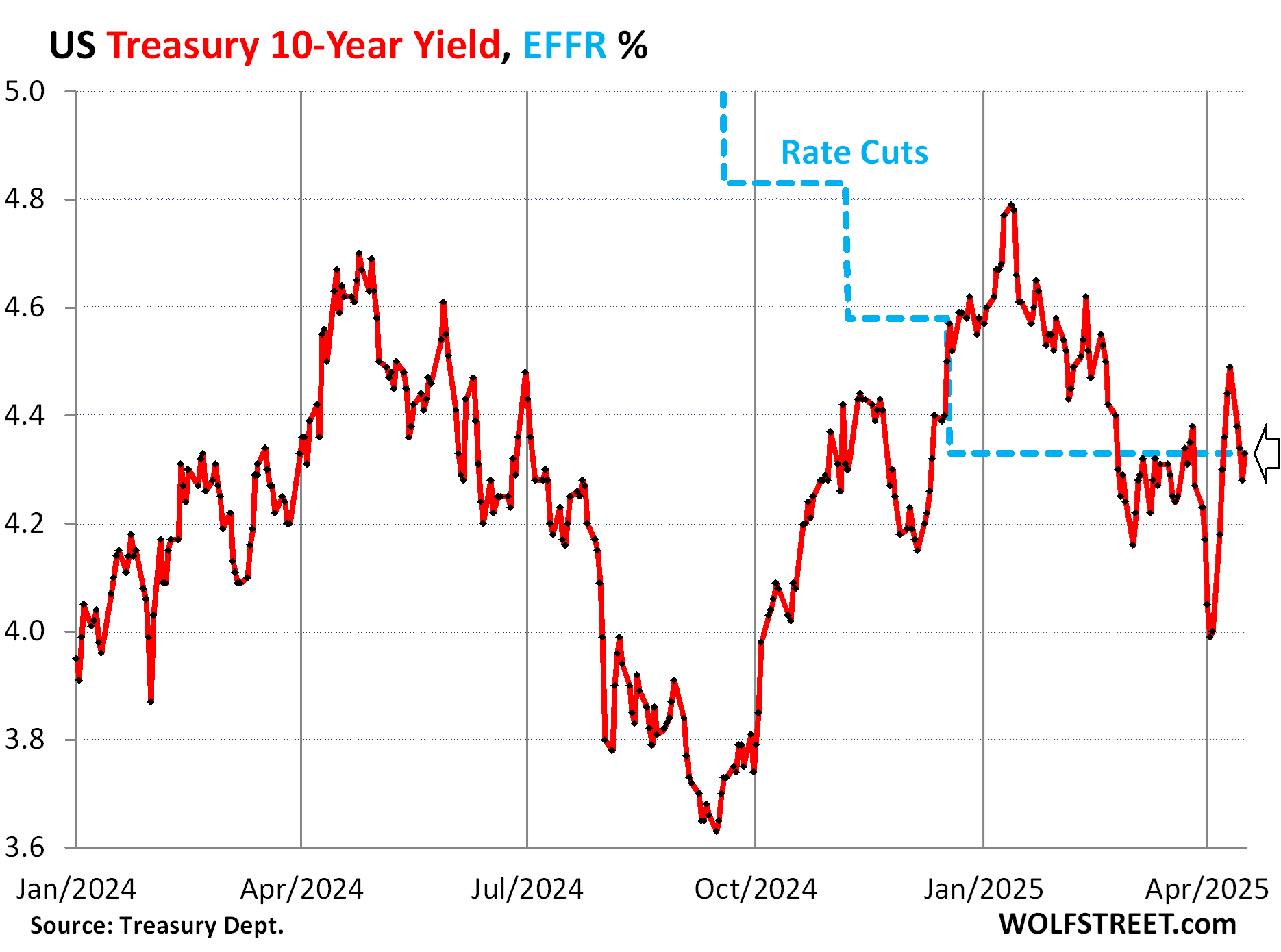

But that narrowing process hiccupped. The average 30-year fixed mortgage rate rose to 6.83% per Freddie Mac’s weekly measure on Thursday, but the 10-year Treasury yield was at 4.33%, and the spread between them widened to 2.50 percentage points, the most since September 2024. Over the past five decades, there were not many years when the spread was this wide.

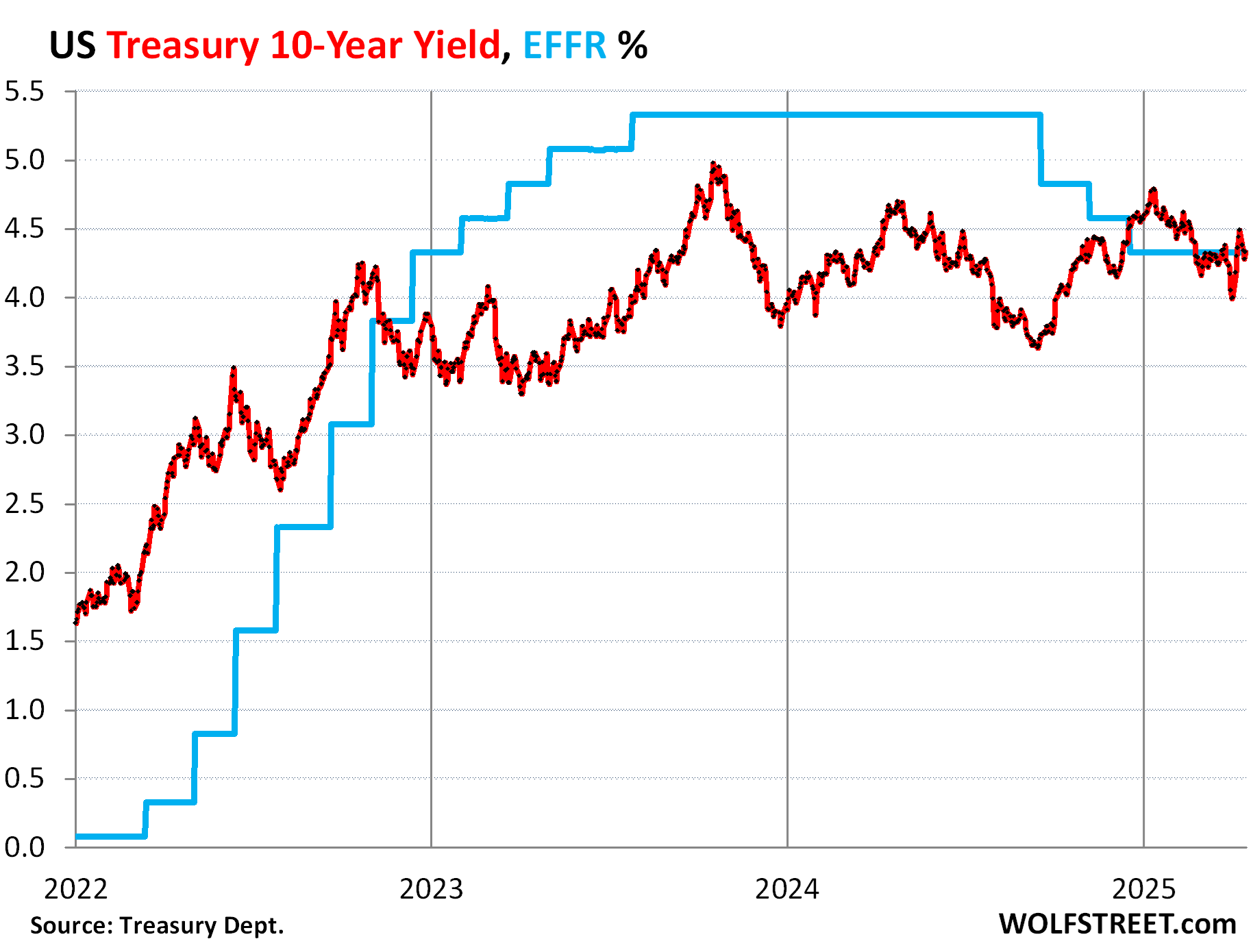

The 10-year Treasury yield has undergone some drama in recent weeks. It plunged from 4.77% on January 10 to 3.99% on April 3, including a 40-basis point plunge in the few days before April 3, and then the yield bounced back in a near-symmetrical manner, and on Thursday it settled at 4.33%, exactly where the effective federal funds rate (EFFR) is, which the Fed targets with its monetary policy rates.

The bond market got frazzled by the Fed’s 100-basis-points in rate cuts in late 2024 while inflation was re-accelerating, which triggered a bond selloff in late 2024 through early January, that had caused the 10-year yield to spike by 114 basis points from mid-September through mid-January, even as the Fed cut by 100 basis points. This taught the Fed – but not Trump – a lesson!

The Treasury market fears inflation more than anything, and it wants to be compensated for this expected future inflation by demanding higher yields. When it comes to inflation fears, the Treasury market is not to be trifled with.

Treasury Secretary Scott Bessent has been trying to manipulate down long-term Treasury yields to make funding in the economy for businesses and households less costly. His efforts have been fortified by the Fed’s more hawkish stance on inflation (the wait-and-see policy), which reduced the bond market’s inflation fears. Yields then declined in 2025 until they plunged too far and bounced back and now settled at 4.33%. But in a three-year view, the drama was just a blip:

During the 40-year bond bull-market, the 10-year Treasury yield zigzagged down from 16% in 1981 to 0.5% in mid-2021. When yields fall, bond prices rise, and a good time was had by all, but it’s over. It was followed by raging inflation in 2021 and 2022. While inflation has cooled from those levels, it continues to fester, and it started re-accelerating last fall. When bond market investors see and expect higher inflation over the term of what they’re buying, they demand higher yields to be compensated for it.

The average 30-year fixed mortgage rate rose to 6.83% (Freddie Mac). It has been above 6% since September 2022.

Historically, the average 30-year fixed mortgage rate didn’t drop to 5% until the Fed started QE in 2009, which included the purchases of massive amounts of MBS, which helped push down mortgage rates and was part of the Fed’s scheme of interest-rate repression and asset-price inflation. But then raging inflation broke out in 2021 and put an end to it.

The Fed and the spread. After shedding $2.24 trillion from its balance sheet through QT, the Fed has now slowed the pace of QT. But it has not slowed the pace of QT for MBS, only for Treasury securities. And that’s a key here.

MBS come off the balance sheet mostly through passthrough principal payments as mortgage payoffs (sales or refis) and principal portions of mortgage payments are forwarded to the holders of MBS, such as the Fed.

These passthrough principal payments have been running at about $15 billion a month for the past year. If mortgage rates drop a lot, the pace would speed up. The Fed has said many times in its official announcements that it plans to get rid of all its MBS. It stepped away from the MBS market in September 2022, and that market has been on its own ever since, unleashed from the Fed’s controlling fist.

Before QT started, the Fed held $2.74 trillion in MBS. QT has whittled that down to $2.19 trillion, and whatever comes off via passthrough principal payments comes off and goodbye.

But the Fed further slowed the pace of the Treasury securities roll-off to just $5 billion a month, starting in April. The Fed then reinvests the amounts that mature in excess of $5 billion a month by buying equivalent Treasury securities at Treasury auctions. So the Fed is again with both feet in the Treasury market, replacing a big part of its maturing securities with new securities.

And this asymmetry of leaving MBS yields, and thereby mortgage rates, entirely up to the market, while still meddling in the Treasury market has increased the spread between the 10-year Treasury yield and mortgage rates.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Informed and smart. Typical Wolf Genius.

Who is now the primary buyer of MBS? If the housing market collapses and we see more defaults, will we start seeing an even higher spread, now that the Fed is not involved? Will the Fed need to step right back in if MBS becomes junk?

why would mbs become junk? ultimately, even if the borrowers default, the government guarantees agency mbs.

NR,

Franz G is correct. This has completely changed since the financial crisis. Since then, the taxpayer is on the hook for the vast majority of the MBS and mortgages. The Fed won’t ever need to bail out banks over MBS and mortgages again, maybe for other reasons, but not MBS and mortgages.

The taxpayer (via Fannie Mae, Freddy Mac, Ginny Mae, VA, etc.) guarantees $9.3 trillion in MBS and is on the hook for them.

About $0.5 trillion in MBS are private label MBS (not government guaranteed), that investors (pension funds, insurers, bonds funds, etc.) are on the hook for. Banks don’t hold those.

Only about $4 trillion in mortgages are held directly (not securitized) by 8,000 or so banks, credit unions, and thrifts, and they’re on the hook for those.

Can you explain further? If a home owner defaults, the tax payer is on the hook (Fannie Mae & Freddie Mac guarantees) ? Are these how MBS are structured?

Thanks Wolf for this article!

Especially amid this recent bond market volatility (as you mentioned in the article).

I greatly appreciate the background/analysis/thoughts you bring to these various financial dynamics.

These “one-off” types of articles (in addition to your more regular updates on Inflation, Fed Rates/Policy, Housing Markets, Retail Sales, etc) are why I regularly & gladly donate to your excellent work & efforts…

Thank you!!

I like your charts, but the mortgage spreads usually seem to indicate finanancial stress and not Fed policy, at least for now, without rescue measures.

So it’s not a surprise the spreads widened during this tariff war.

I will watch the development closely, the stock market, the longer term rates, the USD index (DXY), the trade deficit, debt/GDP.

It’s all a big red flag.

Price of Gold is also a big red flag.

You can remove your “financial stress” theory from your worry list. There is near-zero stress in the mortgage market. Most of the mortgages are guaranteed by the government. These MBS are as good as Treasury securities (but they’re more hassle for holders because they constantly pay out these passthrough principal payments which cause your holdings to shrink, unlike Treasuries, where you get your money back only when they mature).

re: “Most of the mortgages are guaranteed by the government.”

As predicted in May 1980: “One of the principal purposes of the DIDMCA was to provide the housing industry with a reliable source of funds.

That may be achieved through various governmental and quasi-governmental corporations (according to Henry M. Paulson, eventually ½ of all residential mortgages were owned or guaranteed by the GSEs, FNMA and GNMA, or “a stunning $4.4 trillion worth at the time”).

But the role of the S&Ls in housing finance will probably diminish significantly.”

Even worse: you get bigger passthrough payments when rates are lowest, and your payments slow to a trickle when rates move up. Just the opposite of when you’d like to get money back to reinvest.

This uncertainty is one reason that mortgages yield more than treasury securities.

Hi Wolf- Thanks for the charts. My main view is that Wall Street does not adequately recognize the likelihood and magnitude of future inflation. Nor does the Federal Reserve. So with the debt ceiling currently unresolved now, the US Treasury’s cash account has been drained. I expect when the debt ceiling is lifted, there will be a 3-4 month period where more than ONE TRILLION of new federal debt will be issued. Also, the impact of likely federal tax cut extension and other Trump tax follies will become law. So the path to 44-46 Trillion federal debt mountain will be law. Meanwhile SS is looking to run short in about 6-7 years. And tariffs will drain significant liquidity from consumers by Xmas. So I sense that the 10 year Treasury has no where to go but up, perhaps to 5% sometime within a year or two. As the twin bubbles of the equity market and the housing market deflate, and a new Treasury chairman is selected in 2026, volatility in long term rates looks likely, trending upward. Conclusion: Wall Street underestimates the upward trend in long term treasury rates. A sagging dollar has already become evident in FX reality.

The issue is how much debt the American colossus can ultimately sustain.

My guess is $100 trillion is the ultimate limit.

$100 trillion dollars would be a little worse than the current debt-to-GNP ratio Japan has, and Japan isn’t capsizing yet. For that reason, expect nothing to do be done about the debt until the year 2035. They say 2028 is the last year a Republican government can be elected due to demographic (nonwhite) changes. That means it’s up to the Democrats, who are known for their lavish spending ways, to rein themselves in…

I’m not sure I agree that Democrats are the only party that spend lavishly. Republicans have been lavishly spending for many years now.

I’ve had a few conversations with people asking why Trump hasn’t brought down mortgage rates yet. So many Americans have no clue how the economy works.

Anyone who automatically assumes that low mortgage rates are good has little clue of how our economy works,

He’s been too busy bringing down the price of eggs!

I’ve had similar discussions about all kinds of prices, including rates. Many think the president has direct influence, and the blame whoever is in office for not “fixing it”.

…many ‘Muricans, for some years now, firmly-carry the mental construct of the Presidency as an elected, non-Constitutional, possibly-supreme monarch (one might hazard including the SCOTUS and the office’s current occupant in that number. Too-many hours of preschool viewing Disney versions of government being heroically-conducted by ‘good’ (and ‘beautiful’)-royalty, perhaps? (It’s been a long time since a ‘Johnny Tremaine’ or ‘The Swamp Fox’ young folks production…)).

may we all find a better day.

As more of these pandemic mortgages at 3% fall off the books, and 7% and up become the norm, I can see the spread widening because of supply and demand..

Let’s hope they can get inflation under control! Not looking good.

Beware the Feddyguvs my son,

The rates that suck with no inflation cap,

Beware the Dogiebird and shun,

The gloomious Gingersnap!

The President wants lower rates and to hell with the data. Private money knowes this is ludicrous and will lead to inflation.

There is no certainty with the FED. I would guess he will lower rates and again buy more MBS. This could only lead to massive inflation for the US in the long run.

It seems he must want to kill the value of the dollar with all the trade and rate bs.

Oh wait – everything may change in the morning!

How are you going to get inflation under control when the deficit is 36 trillion, but in reality a lot larger if you include social security and Medicare money owed?

@Andrew — total treasury debt outstanding is $36T but the deficit is not — it’s in the single trillions, Wolf has a bunch of articles on the exact figures.

Federal debt outstanding is like a 30 year mortgage with a say $500k principal balance. You don’t pay that entire sum every year. You pay interest and part of the 500k every year for 30 years. The gov pays ONLY interest and then eventually needs to repay the principal when due. But they have a lot of time to do this AND usually just replace (think “refinance”) that principal with new debt before it’s due.

“Deficit” means revenues (eg from tax collection) minus expenditures. If that number is negative, the gov has a deficit and needs to borrow, eg sell new bonds, to plug the hole.

What matters is not the deficit itself, meaning the nominal amount, but deficit in the context of the overall economy, deficit as a % of tax revenues and/or if the deficit itself grows faster than the government’s ability to service (pay interest) on the principle outstanding among other things. Wolf has excellent detailed coverage of these subjects that really helped me grasp these data and concepts.

Hope this helps.

There is no credible plan or likelyhood that 37 Trillion in Federal debt will ever be repaid like a mortgage. The plan for many decades now is for it to be rolled forward and to grow…forever, with forever defined as “after the end of my term”.

The theory is that if the economy can grow faster than the debt and if service costs can be “controlled”, everything is fine. Maybe it’s even true.

But how is the growth in the economy measured ? By GDP and is that equivalent to a growth in my income used to service by personal debts ? No it’s not.

Federal debt is serviced by it’s income in the form of tax revenues. For the last 16 years, has federal income kept up with the growth of debt and debt service costs ? And ask for the supposed evils of the current tax rules, which simply must not be extended, I’m not sure that the federal take as a % of national income is significantly lower or higher than the trend line of the last many decades ( https://fred.stlouisfed.org/graph/?g=1DTZx ) – the graph seems to indicate it tracking in a pretty stable channel.

I’m not so sanguine about the sustainability of national debt especially as that sustainability rests on foreign buyers and that foreign demand rests on our Reserve Currency privilege which we increasingly abuse.

But USD is a very big ship, we can go on for years longer still before any real evidence appears that it is actually sinking. 6% or 7% per year deficits would not be sustainable even if we had an economy that was growing in ppp terms at a healthy clip.

Easy if the supply chain of goods was beyond the public ability to purchase. Inflation is caused by the lack of goods on the open public market. Those private producers of goods don’t want to sit on their product and services. Their is a lack of return that hinders the motive to produce. So, sales compared to available product and the cost to produce is a loss. Better to sell at a lower price to reduce inventory.

The Government, including the Federal Reserve do play a role, as they have since eternity, lol. As the borrower of last resort. Many claim the Federal budget and Federal Reserve should stop the supposed expansion, but every time the U.S. has a downturn of public assets, including employment and natural disaster, pandemic is a reference, the public expects the Federal Government and Federal Reserve to step in with additional services and goods, dollars to be blount.

…the winner of the race to the bottom will be the ‘just in time’ delta over systems redundancy. The headline might read: “…Who Knew?”.

may we all find a better day.

As a first time home buyer in the mid 1970s with a 10.something 30 year mortgage rate, I don’t recall that housing prices were quite as dramatic as they are now. Could be that age has made the “good old days” better than they actually were. ;-). We also walked to school in blizzards, uphill both ways.

Is there an historical chart like your mortgage rate chart that would also show the the average residential selling price over the same time frame?

Or would that be meaningless? Just an old guy thinking about “the good old days” with a smile.

it was the good all days, house priced income was in line around 3X. Now it’s over five so you are correct houses were much cheaper relative to income.

The recession of the 2006 reduced many homeowners from their homes. Some 2.5 million were repossessed and not available for resale, that’s what caused the Federal Reserve to step in, and the Federal Government to guarantee most mortgages today. It wasn’t until 2018, approximately that new housing across the U.S. attained the same total dollar sales pre-recession. That imposed a restricted inventory of available owner occupied and new homes for sale. Some areas of the U.S. have not recovered new home building to this day.

Are we safe regulatory wise from another CDO debacle? Is it possible something could happen that allows banks to issue loans it shouldn’t because it can simply transfer risk? I always assume any law can be undone and sometimes even laws can be ignored if the administration decides it won’t pursue enforcing them.

Glen – our nation has always LOVED saying, lobbying, and acting on the homily of: “…there oughta be a law…”. The constant enforcement and thoughtful review of those, and the sunsetting of obsolete/poorly-crafted ones, not so much. The sheer resultant mass may be a factor in a growing disrespect for law in general among the polity…

may we all find a better day.

I don’t understand how the housing market is still standing in a lot of places. Or the stock market for that matter.

All of the factors point towards what should be a down market. Instead, everything just keeps going up or trading sideways like the market is waiting for a black swan event to finally end the good times.

Wealth has to flow somewhere and with so much of it concentrated it isn’t like it is spent. Multimillionaires and beyond can probably live off dividends and interest and never touch wealth. Recessions, which is unlikely, tends to further concentrate wealth. Rich people obviously dont want to lose money but they are hardly the ones to suffer. They just buy in and when it goes back up they have more.

Wolf — do you know the total $ amount of MBS outstanding ?

$9.3 trillion government guaranteed (including the Fed’s holdings)

$0.5 trillion private label MBS (not government guaranteed).

About $4 trillion in mortgages are held directly (not securitized) by banks, credit unions, and thrifts.

It can’t be cheap for a US government GSE like Fannie, Freddie, FHA….. to own a mortgage. They need to hire private loan servicers to collect payments and generate monthly and yearly tax statements. They are also paying MBS holders a monthly interest payment. They also need teams of lawyers and collection people to handle the people who refuse to pay. I’m sure foreclosures processes aren’t cheap. Good thing foreclosures are currently low as Wolf pointed out since most people would just sell the house for a profit. However, if the house has burned, blown, or flooded down, can insurance companies still cover the mortgage? What if there is a foreclosure? Do the GSEs also have teams of people ready to take more taxpayer losses on an underwater asset?

My point is that there is tremendous overhead with owning a mortgage. Much more than a stock fund. The taxpayers are paying for this overhead. I think about this as I pay my decreasing $200/month interest payments to Freddie via my loan servicer. What is the effective interest rate Freddie is earning on my sub 3% loan? My guess is it possibly negative with all of the overhead and MBS interest payments to holders.

I can understand why the US government wants to dump the GSEs and get out of the taxpayer backed home loan business. Would this mean the taxpayers are off the hook if the housing market does crash and there are more foreclosures?

In the meantime, I’ll keep paying my $200/month interest payments to Freddie (the taxpayers) while earning $300/month in TBills (the taxpayers) and paying back $50/month for Federal Taxes(the taxpayers). I’m currently up $50 from the taxpayer. How long before the taxpayer grows tired of losing $50+/month for the next 25 years and comes after me?

My additional comment. (I always have one.)

If Fannie, Freddie, and FHA are privatized, mortgage rates/mortgage fees/mortgage insurance will likely go up raising the cost of housing.

Back in 2007/2008, mortgage rates were between 6 and 7%. Very close to where they are now. That was obviously not enough since when home prices crashed in 2008, private bank mortgage lenders failed and had to be bailed out by the taxpayers or just allowed to go bankrupt.

Any new private lenders will have to account for the risk this time so mortgage rates will likely rise.

so an investor reaching for yield might prefer MBS? ” Foreign holdings of Agency MBS declined by 3.51% from a high of $1.188 trillion in June 2021 to $1.146 trillion in June 2022. ” Just not sure if these are foreign reserves and subject to political policy. XI recently warned Chinese billionaires not to invest in US RE, (thats a dogwhistle for buy it with both hands). I assume if you already own it that its a done deal. The US is considering a ban, but any sort of policy miscue (see tariffs) could cause an airpocket under MBS and put an impairment on the Feds balance sheet. And if you are holding MBS and mortgage rates are going higher you want to dump what you have. The mystery in this equation is why are bond yields so low, not why are MBS spreads higher? A crash in MBS and a drop in RE values would set off a cash buyers land rush (sell stocks buy homes) Good for Blackrock. Mortgage rates and home prices are positively correlated, to think otherwise is HS economics. The dip in US RE would be the buying opportunity of a lifetime, for corporations, the home going the way of the family farm in the 1930s with rates higher for longer (and then trash all the GSEs for good measure, no FHA?).

“A crash in MBS and a drop in RE values would set off a cash buyers land rush (sell stocks buy homes) Good for Blackrock.”

Huh? Why do so many go to the B-word for stuff like this? BLK has never bought SF homes (giant apartment complexes like Stuy, yes), not bought up a bunch of land or whatever. Maybe you are thinking of BlackSTONE.

You might get an exogenous event like removing the SLR requirement from the bank’s Basel III’s regs. (capital against their portfolios) – in order “to improve liquidity in the Treasury market”

So the Fed is buying treasuries again. So does this mean the Fed is buying about $20B in treasuries now? Granted, it’s just started, but it will be interesting to see if there’s an measurable impact on yields. Any idea if they’re buying more on the short or long end?

Most importantly, I wonder if we’re on the verge on Sept 2019 all over again? Also, I would like to know if the Fed will ramp up MBS purchases when we hit the next recession? I’d imagine the answer to the later question will depend on the severity of the recession.

Just to make sure we’re all on the same page: The Fed has always bought Treasuries to replace maturing Treasuries. During QT, the replacements are capped and below the maturing amounts. That cap has been lowered now to $5 billion starting in April. And so the monthly replacement purchases = amount matured minus $5 billion. This causes the Treasury holdings to shrink by $5 billion a month. So what has changed is that the Fed is buying MORE Treasury securities in April than it did in March or February.

The thing to watch out for, and I will report on it when I see it: the Fed has long been talking about shifting some or all of these replacement purchases to T-bills. This would put some upward pressure on long-term yields. I’m not sure if the Fed will follow through with it, with Trump trying to fire Powell. These are soap-opera dynamics over the Fed playing out in Washington now, and it could have an impact on Fed policy decisions, such as the shift to T-bills.

LOL…are RE agents still telling everyone it’s a good time to buy cause 30 years or 15 years rate are coming down soon? So better get in and buy that house you can barely afford if the rate comes down and definitely can’t if it doesn’t and you’re locked in and can’t refinance….

” … 10-year yield to spike by 114 basis points from mid-September through mid-January, even as the Fed cut by 100 basis points. This taught the Fed – but not Trump – a lesson!”

Different criteria, IMO: Trump is going by PR messaging with an extremely short time window — until the next wall of noise and distraction are deployed. Blame can always be deflected later. Systematic accountability has never worked, against that technique.