Amid renewed inflation worries and above-average economic growth.

By Wolf Richter for WOLF STREET.

The Dollar Index [DXY] which tracks the USD against a basket of six currencies (euro, yen, Canadian dollar, British pound, Swedish krona, and Swiss franc) dominated by the euro and the yen, rose to 107.6 at the moment, the highest level in two years.

Over the past two months since the Fed started to furiously backpedal on the pace of its rate cuts, it has risen by 7.3%:

The US dollar has been on a rampage against other currencies since late September when the Fed, after its monster rate cut on September 18, started talking of smaller and fewer rate cuts to end at a higher level than previously priced in, after it became clear that the US labor market was growing solidly after all, that inflation was showing early signs of re-accelerating, that economic growth continued to run well above the 15-year average, powered largely by consumers, who in recent years got big increases in incomes and saved a bunch too, while their piles of interest-earning cash have ballooned, which they could spend in the future.

And this occurred while other central banks – in our case here, the ECB, the Bank of Japan, and the Bank of Canada – have out-dove’d the Fed by far:

- The Fed has cut by 75 basis points, to 4.75% at the top of its policy rates.

- The ECB has cut by 100 basis points to 3.4% and has indicated that it will continue to cut despite stubbornly high services inflation and surging wages.

- The Bank of Canada has cut by 125 basis points to 3.75% and has indicated that it will keep cutting.

- The Bank of Japan hiked by two minuscule notches, from negative to +0.25%, despite inflation rates that are similar to those in the US, leaving real yields of government securities deeply negative. It said it may hike again after wussing out before.

The ECB’s and BOC’s cuts have widened the spread between their policy rates and the Fed’s policy rates. And the spread is now expected to widen further.

The much higher yields of USD-denominated securities, such as Treasury securities, make them a juicy target for foreign investors, and they’ve backed up their trucks and are loading up. This demand for USD-denominated securities and the higher yields expected for them in the future is very supportive of USD exchange rates.

The 10-year yields for government securities makes that clear:

- US: 4.41%

- Canada: 3.46%

- Germany: 2.25%

- Japan: 1.08%.

The euro has dropped by 7.0% against the USD since late September, trading today at $1.042, the lowest since November 2022.

The Euro Area economy is growing slowly, with growth stalling in some countries. Germany has been wobbling quarter to quarter between slight growth and slight decline for the past two years. GDP for the year of 2023 dipped a tad, and 2024 looks similar so far. Despite fears about core inflation, and especially stubbornly high services inflation, the ECB has said it will keep cutting. And the euro dives:

The Canadian dollar has been wobbling lower all year against the USD as the BOC has been focused on cutting rates. Economic growth slowed sharply in 2023. Over the past seven quarters, the economy booked two negative quarters and one near-flat quarter. The rest showed modest growth. Over the first half this year, GDP growth picked up a little. Q3 GDP has not been released yet.

By the end of last week, the CAD had dropped to 0.709 USD, the lowest since June 2020. It currently trades up a little from there, at 0.715 USD. Since late September it has dropped 3.7%. Since mid-January, it has dropped by 5.5%.

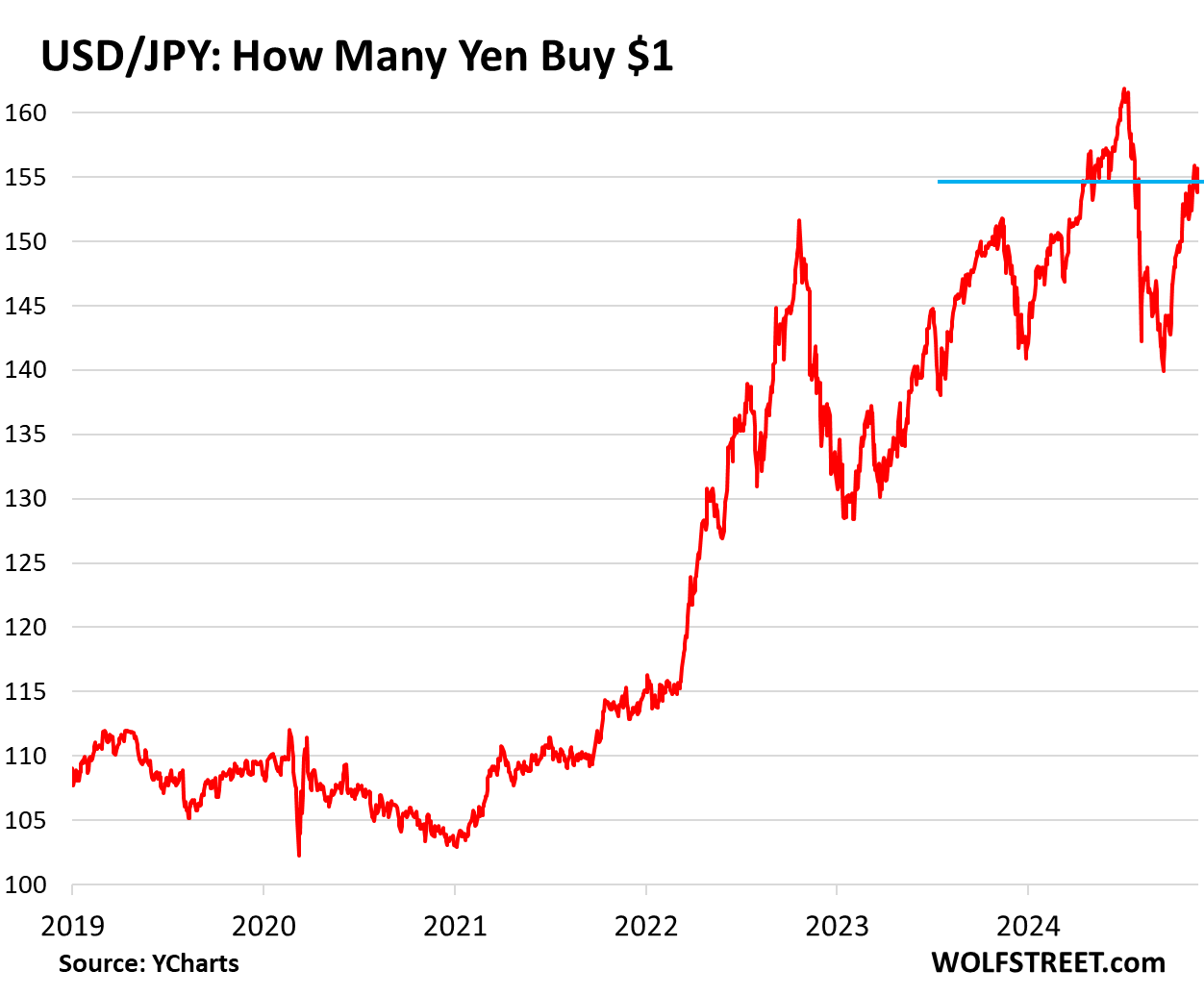

The BOJ is in a category of its own, crushing its currency. Inflation in Japan is running at similar rates as in the US. But the BOJ has vowed to do the absolute minimum as late as possible, too little too late being already too much too fast. Earlier this year it finally ended QE and a few months ago started QT, trimming its gigantic balance sheet in baby steps. This attitude of “too little too late being already too much too fast” has been going on for two years, and as a result the yen has gotten slaughtered.

The yen currently trades at 154.7 yen to the USD, on its way back to the levels of July when it had plunged to 161.5 to the USD.

Rather than changing monetary policies to prevent the wholesale slaughter of the currency, authorities have been trying to jawbone markets, and that’s essentially useless except for day-traders. And authorities have periodically been blowing tens of billions of dollars to buy yen, but those massively costly efforts to prop up the yen were only briefly effective, before the yen re-plunged, as we can see in the chart.

Since the Fed started talking about hiking rates in September 2021, the yen has plunged by 30% against the USD.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

No chart for the Swiss Franc or the Swedish Krona? ?

I don’t have a scintilla of interest in them. But I was thinking of putting up a chart of the USD/MXN since the US and Mexico are joined at the hip economically. But the Bank of Mexico never did QE and its interest rate is STILL 10.25% after four cuts. It’s doing something right!

When I look at a chart of the peso against the USD, it has still declined quite a lot over the past year in spite of those high interest rates. Why?

The Chinese Yuan is no longer hard-linked to the dollar, trades with roughly the same percent variability as the Euro, and really ought to be a separate component in the DXY now.

The CNY has also weakened noticeably vs the dollar.

BTW with the fall in the Euro, I am also hearing that a decent (though not fancy) French sidewalk cafe meal in Paris is now actually cheaper than fast food in many parts of the US…

Food is just very expensive in the US

Thanks Wolf as a Canadian any predictions for 2025 for $CAD? Seems the resource based currencies held up better than certain other ones ie. CAD/AUD vs. EURO. I remember Soros had a trade in the old days long commodity currencies short others?

67.86 U.S.

It is wonderful to see the US Dollar doing so superbly against most all of the other currencies in the world.

Higher interest rates in the US across all rate groupings is excellent news for the strength of the US Dollar.

Yes, we are all going to be rich here in the good old USA!

Including all the immigrants – legal and illegal ?

Why don’t you take your comments to Twitter? Sounds like that’s where you belong.

MSN: ‘I have no money’: Thousands of Americans see their savings vanish in Synapse fintech crisis

The crisis started in May when a dispute between Synapse and Evolve Bank over customer balances boiled over and the fintech middleman turned off access to a key system used to process transactions. Synapse helped fintech startups like Yotta and Juno, which are not banks, offer checking accounts and debit cards by hooking them up with small lenders like Evolve.

In the immediate aftermath of Synapse’s bankruptcy, which happened after an exodus of its fintech clients, a court-appointed trustee found that up to $96 million of customer funds was missing.

Didn’t you know? That’s innovation. We can’t stand in the way of innovation

1:04 PM 11/22/2024

Dow closes at record high, S&P 500 scores weekly gain ahead of Thanksgiving

Dow 44,296.51 426.16 0.97%

S&P 500 5,969.34 20.63 0.35%

Nasdaq 19,003.65 31.23 0.16%

VIX 15.37 -1.50 -8.89%

Gold 2,707.70 32.80 1.23%

Oil 71.15 1.05 1.50%

MW: 2-year US Treasury yield (interest rate) has 8th straight week of gains on improved US outlook

Here is the thing….., the Euro Zone and UK, actually been experiencing low to slow growth for the last couple of years, and the US has Not…. (Strong Growth ), So why in the Hell would the FED Reserve want to lower Rates at the same Pace and time as the Euro Zone and UK ??????? Now as expected the Federal Reserve is learning the Hard Way…….

Even with that both Euro Zone and UK are struggling with Higher Inflation to Accelerate right now….,

Monetary policy is not via interest rates. Its transmission mechanism is bank reserves.

Monetary Policy is through Interest Rates….., that is why the Federal Reserve explicitly Targets the “Fed Funds Rate” , which is the Overnight Interest Rate that Banks lend to one another……..

Through Targeting the Overnight Interest Rate, that is used as the Mechanism to effect Bank Reserves …..

Not only that….., the Federal Reserve for more than 15 Years have used other Monetary Tools and Financial Engineering to effect Interest Rates in the Longer Term Bonds as well…….. especially in certain situations….

Last chart, ouch.

Plus Trump Tariffs.

Japan is going to have some fun inflation to deal with.

So what to buy? More BTFD of US indices?

It’s all good until the US can’t print enough money to pay 4.41% on its ever-accumulating trillion-dollar debt. If the dollar begins diving, then the other currencies will likely tank alongside. So where would you go?

The US Treasury does not and cannot print any money to pay interest on its $36+ trillion federal debt.

US Treasury absolutely can print money. constitutional prerogative. The Fed isn’t the only legal source of money, and the Fed’s privilege could for that matter be revoked by Congress.

“ the Bureau of Engraving and Printing, which is part of the Treasury, is responsible for printing paper currency.”

US will also have to soon join the rest of developed world in interest rate suppression. The Fed’s bravado of 2% target will become an embarrassment if Treasury market operations are affected.

Liquidity is trying to find a home and may likely realize that central bankers have no choice but to inflate away.

Deflation (2008) leads to money creation (2008-2022) which finally leads to inflation. Long and variable lags. Deflation is often the mother of inflation

The problem is collectively (all investors) we can’t go anywhere. So people are making best guesses on what the right hedge is from Bitcoin, to gold to equities.

But history shows that all of this is futile. If shit does hit the fan only highly indebted people benefit. Everyone else is hurt one way or the other.

But of course I am not predicting doomsday. This will resolve one way or the other in a less violent way IMO

The Fed can just let inflation run a bit higher than 2% without letting it get too high.

A bit higher than 2% *is* too high.

In a non-clown world, 2% would be too high, especially after several years of screaming inflation and asset bubbles.

Higher dollar vs. trade tariffs will be an interesting show. Will more valuable dollars continue to buy imported goods even with tariffs attached to them?

What most Americans don’t understand about tariffs is take for instance Toyota to get around tariffs they build manufacturing here and then no tariffs issues. But if we want to sell fords in china we have to pay 200 percent tariffs.

No, if the Chinese want to buy Fords in China, the Chinese pay 200% tariffs. Manufacturers don’t pay tariffs; consumers do.

No they don’t. They cannot buy a US-made Ford in China because of the tariffs. They have to buy a China-made joint-venture Ford. Ford had to move production and even design to China and produce in China to sell in China. Same with Tesla, GM, etc. That’s what tariffs are all about.

Can’t snap your fingers and suddenly a manufacturing plant appears. They take years to plan and build. Usually more than four years.

Looks like they are doing a great job of devaluing their currency in anticipation of tariffs.

HAHA! Clever!

I just remember all the wailing by the wall street gang last time around.

Pay attention to Mexico in the following months. They will be scrambling to replace the Chinese parts connection. USMCA

trade agreement will be enforced.

If the ratio of exchange rate gains to tariff-related increase in import cost is positive imported goods still get relatively cheaper

[1W] the DJI and BTCUSD closed at a new all time high in front of Fed

minute next Tuesday on Nov 26.

Action of gold relative to all of those currencies is quite telling.

There are rumours of a Canadian loonie worth 50 cents to the USD.

The problem is that rental investment companies tend to seek their returns in USD, while Canadians will be paid in theoretical 50 cent Loonies.

Anything to keep the housing bubble going.

If the CAD$ keeps going lower, that means I’ll just invest more USD$ back into Canada. Canadian stocks are cheap.

above avg. econ. growth = debt fueled inflationary growth

1/1/2020 1715.2

9/1/2021 4193.2

2/1/2023 3021.8

2/1/2024 3567.7

9/1/2024 3236.8

The drop in reserves since 2/1/2024 has propelled the dollar higher.

This should make imports cheaper and exports more expensive unless I got that backwards like I have in the past. Not clear what overall impact this will have on interest rates or rate cuts here. I struggle to comprehend all the real implications in these situations.

Higher dollar is crushing the farm economy. Not a complaint-just a fact. Absolutely crushing it.

Is it even possible for asset prices to decline? Or is the fix in?

It is always very possible for any and all asset prices to drop to zero or below.

Good luck with that, weirdo.

i don’t think so. enough people believe that the fed is there to save the day that the prices never drop that much before buyers rush in to btfd.

Wolf, I know you’re not an oracle, but do you think eurozone inflation will jump enough to make these morons raise rates again?

“Someday,” said my made-in-China plastic crystal ball that I bought at Walmart for $9.99 and whose price may rise to $10.59 after Trump’s tariffs, or may stay at $9.99 after I threaten to go on buyers’ strike if the price goes up.

Hahaha, 🤣

There is only one currency, USD. Anything else is Monopoly money.

Sell gold, buy dollars? LOL

I see a revaluation of the yen upwards personally. Interest rates can only go up and there is going to be yen repatriation.

Socially, the Japanese are very aware of and sick of a weak yen, one of the signs being an unusual dumping of the LDP in government for 15 years. The yen is not intrinsically weak, its deliberately weak.

For the EU and the UK, the currencies, what strength they have is through being forced unwillingly to have high base rates.

In the UK services wage inflation is 5%+, there is embedded inflation and unemployment coming through because tax rises in so far as they affect services/goods are measured as inflation(hoist on the petard of “it’s price rises not quantity of money”) and we are about to go into recession with unusually for the UK in peacetime 100% GDP debt. Barnier in France has to cut French spending by 6% of GDP, not a small sum.

For me, of course I don’t know about US domestic issues but its not impossible of Trump to fire up the domestic economy while Musk moderates the resulting inflation with public sector savings. i.e relative dollar strength is here to stay, and specifically the yen vs gbp is going to strengthen imo. The EU and the UK are very likely going to reduce interest rates as the recession becomes clearer.

You’re right about the Japanese being sick of the weak yen and of inflation too, part of which is caused by the weak yen. I hear it every day.

For the yen to strengthen, the BOJ will have to do a U-turn, hike by a lot and shed a lot of assets as part of QT to push up short and long-term yields. But I don’t think that’s going to happen. People need to focus their anger on the BOJ and get loud about it.

I’m a little confused about your comments on Japanese inflation. It has been essentially 0% for over 30 years straight and only recently topped out at 4%. This is unique among first world economies.

It is usually viewed as a bad thing as their GDP in US dollars has also not grown at all since then and real GDP in yen has grown at about 1% per year. It doesn’t seem that having no inflation for a generation has made their economy great, though it also seems that 3 years of modest inflation has been no different. This also spans a period in which the yen has gotten a lot stronger against the dollar (post great recession) and much weaker (part COVID)

Since you have a lot of familiarity with Japan, I’d love to hear your thoughts in more detail.

numbers,

“Japanese inflation. It has been essentially 0% for over 30 years straight and only recently topped out at 4%.”

Where do you go to pollute your brain with this BS. The New York Times?

Over the past 3 years, Japan’s Consumer Price Index shot up by 10%. See chart. Even in 2024, year-over-year, CPI increased by between 2.1% (Jan) and 3.0% (Aug). In October it was 2.24% — despite massive and costly government subsidies at the wholesale level for energy products and services in order to keep consumer price inflation down.

In the US, the Fed-favored PCE Price index in 2024 went in a range from 2.6% yoy in Jan to a high of 2.8% in March to 2.1% yoy in October. So Japan has more inflation than the US in 2024, and it also did in 2023.

Of the G7, the Japanese spent the greatest portion of their income on food. So: Inflation for food in October was still 3.5% yoy. It has been between 3% and 8% yoy in 2023 and 2024. Since 2022, the food prices soared by 18.0%, similar as in the US, with fresh veggies and seaweed +28%. So enjoy your household budget. You have no idea what you’re talking about.

Sorry if there’s a misunderstanding. I was referring to annual rates

Your graph shows that in the 30 years between 1992 and 2022, the CPI rose by 5% total, or about an average of less than 0.2% annual.

In the almost 3 years since, it’s increased another 10%, or about an average of 3% annual.

No other developed economy has inflation rates anywhere near this low. In that same time period where Japanese inflation totalled 15% over more than 30 years for an average annual rate of less than 0.5%, US inflation totalled 130% for an average annual rate of 2.8% and Euro inflation averaged 3%.

My point is not to claim there is no inflation or that inflation is not higher than it was. It was to ask for your perspective on how and why the Japanese were successful in keeping their inflation so low for so long and why that didn’t seem to make their economy better. Not trying to be antagonistic.

This is what I said: “You’re right about the Japanese being sick of the weak yen and of inflation too, part of which is caused by the weak yen. I hear it every day.”

The yen has plunged over the past three years, which is also when inflation took off. That’s what this means.

Which is what you replied to with your comment about no inflation in Japan

My apologies. I was just trying to hear your opinion. I come to your page because I learn things every time. Not sure why you insist on being aggro here but I’ll leave you be.

Traditionally, a strong US dollar has been correlated with lower gold prices.

Not so today.

Most countries have jumped on the MMT gravy train. Just because our dirty shirt is less dirty than the other dirty shirts means the dollar is strong only in a relative sense. This is reflected in the worldwide phenomena of inflation. “Dollar strength” is no balm to a single, impoverished mother buying eggs.

The MMT rubicon was crossed decades ago and we ain’t goin’ back. This will play out until the social consequences become overwhelming. At that point some an alternative currency will be proffered.

My take is a return to the gold standard. Crypto will never be accepted by most countries and isn’t today. It’s ludicrous to think that a Trump-token will have any value in China, Mexico or anywhere else.

But of course, the US operates in a vaccum (sarc)!

Gold standard cannot work and was a big drag on industrial expansion in the past. There are many uncorrelated reasons Gold is rising, one of them the dempgraphics of countries where gold has significant cultural lore. A rising Indian middle class wants gold for a marrige but that does not mean a return to a gold standart at all.

When Canadian dollar is high, invest in USA…..when USD$ is high, invest in Canada. It works out well this way. Long term, Canada will always recover. ;)

For now, USD is the cleanest shirt in the laundry hamper.

OK Wolf, can you humour a non-economist?

I can understand that if economic growth in the US is higher than in other countries, the USD will rise vs. those currencies.

But what I have trouble with is the line of reasoning that inflation is higher in the US, so rates are higher in the US, so the USD goes up vs. other currencies. Can you really inflate your currency vs. other countries by running higher inflation than those countries? Seems counter-intuitive to me.