Wage growth slows to normal-ish rate.

By Wolf Richter for WOLF STREET.

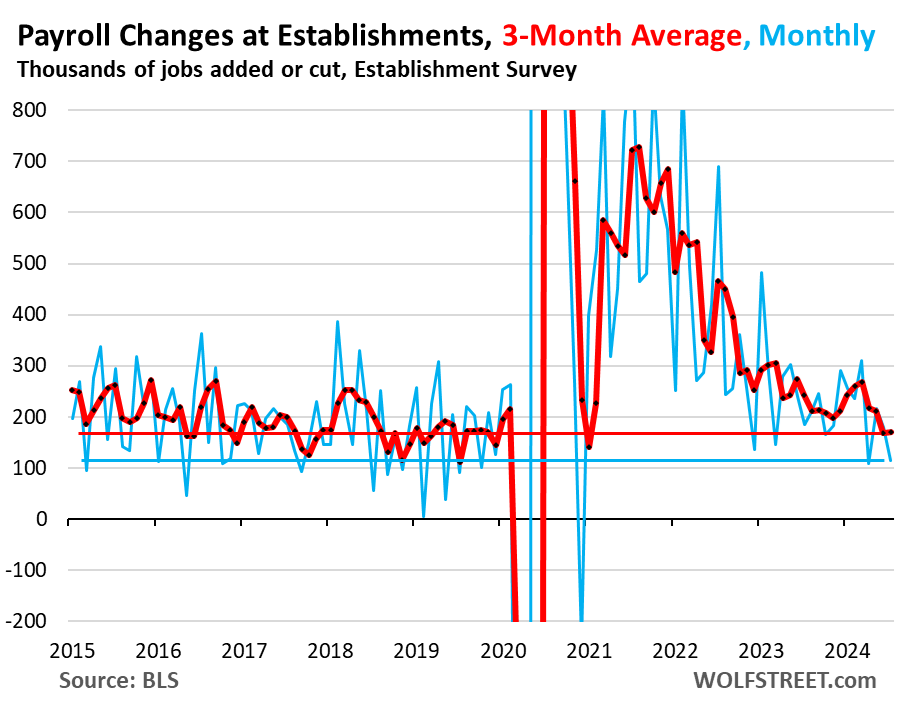

Payrolls at employers rose by 114,000 in July, below the growth in June and May. Back in April, job growth was even lower (108,000), and we went through the same handwringing. This rate of job growth remains well above the lower end of the scale during the Good Times in 2017-2019 (blue in the chart). The private-sector ADP National Employment Report showed job growth of 122,000 in July.

The three-month average — our preferred indicator because it includes all revisions and irons out the month-to-month squiggles — ticked up a hair from the prior month to 170,000 (red) and remains right in the middle of job growth during the Good Times in 2017 through 2019.

Total employment reached a record 158.7 million. Clearly, the growth in new jobs has slowed from the frenetic pace after the lockdowns and labor shortages, and has returned to the normal range with its big squiggles of the Good Times in 2017-2019.

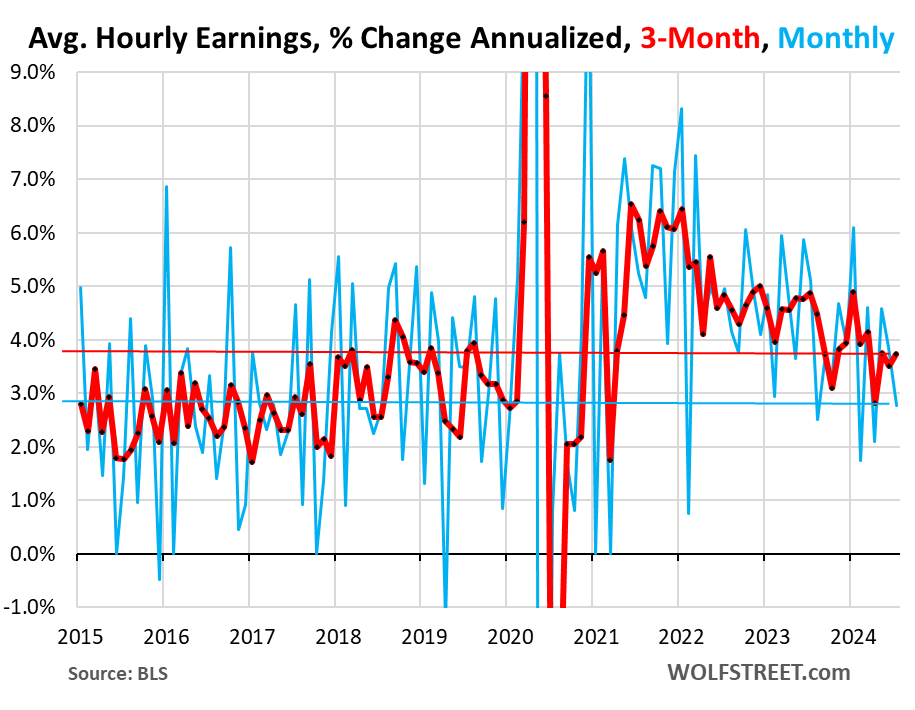

Average hourly earnings increased by 2.8% annualized (0.23% not annualized) in July from June, below the rate in June and May, but above April, and right in the middle of the range of 2017-2019.

The three-month average, which includes revisions and irons out some of the month-to-month squiggles, accelerated a hair to a growth rate of 3.7% annualized (+0.31% not annualized), at the very top of the range during the 2017-2019 period. This is still relatively high wage growth, but way down from the frenetic pace in 2022 – and as Powell said at the press conference, no longer fuel for inflation.

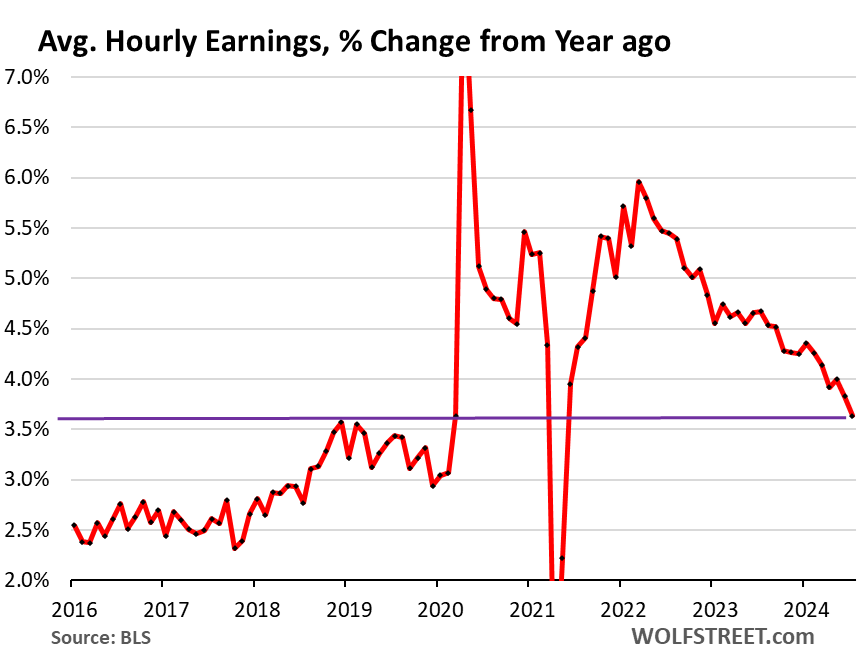

The 12-month rate dipped to 3.6%, above the peaks of the 2017-2019 period, but barely, as wage growth has roughly normalized.

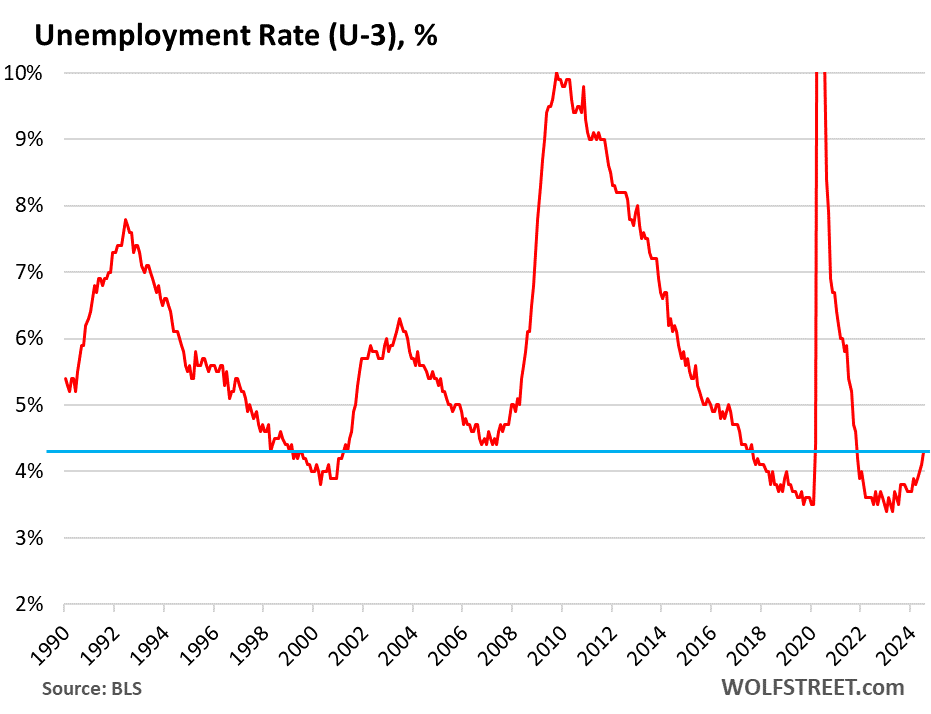

The headline unemployment rate (U-3) rose to 4.3%, which is still relatively low historically, but is up sharply from the period of the labor shortages in 2022.

This is also where the massive influx of immigrants over the past two years – estimated at 6 million by the Congressional Budget Office, using ICE data – shows up if they have not yet found a job, but are looking for a job:

The number of unemployed people looking for a job has risen to 6.87 million. At the low point during the labor shortages, the number of unemployed had dropped to 5.8 million.

The unemployment rate (above) accounts for the large-scale growth in the labor force over the decades; this metric here of the number of unemployed does not take into account the growth in the labor force.

So clearly, labor market growth has slowed. Growth in job creation by establishments has slowed from the frenetic pace of 2022 and 2023 but remains in the pre-pandemic range. Wages are growing at a normal-ish clip. And the massive influx of new workers into the labor force – from the 6 million immigrants over the past two years, as per the Congressional Budget Office – is being absorbed by the job market at a slower rate that doesn’t keep pace with the influx of these workers, and so the unemployment rate has risen, despite the increase in payrolls.

A recession in the US (which are called out by the NBER) generally includes actual declines in payrolls, but they’re still growing, even in July, though at a normal-ish clip; and quarter-to-quarter declines in GDP, but in Q2, GDP grew 2.8%, faster than the 10-year average after the more sluggish growth in Q1.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Question: in previous recessionary cycles, is it common for the headline unemployment rate to increase, especially by this much (3.4 -> 4.3%), while monthly NFP jobs numbers remain solidly positive (100-200K+ jobs added/month?)

I remember in the 2009-2019 expansion, there were months when NFP numbers were near 0 or even negative. And yet no recession happened.

I know there are certain data quirks with the 2 surveys, the immigration-fueled increases in labor force size & participation etc.

It seemed like Wall Street wasn’t too concerned with the job market up through the previous report. But something snapped today.

The influx of 6 million immigrants looking for work and already working increases the unemployment rate (many of them are still looking) while employment is still rising. What it means is that the job market is still growing, but not fast enough to absorb the that influx of immigrants.

Canada, which has a much better handle on tracking the number of immigrants coming into the country than the US, has a big problem with that, as the job market, growing unevenly and slowly, cannot absorb them, and the unemployment rate has shot up to 6.4%.

This is the reason why limiting the rate of immigration is imperative. There is a practical limit as to how many people any society can integrate effectively during any given span of time. Exceeding that limit only fuels the backlash against immigrants. Moderation in all things…

Perhaps we could build some sort of tall, impenetrable structure along the border, and get serious enforcing whatever laws are already on the books regarding the consequences of being in the country illegally.

We have the worst immigration system imaginable right now.

1) It’s almost impossible to come to the country legally

2) It’s relatively easy to come to the country illegally

MCM – SOMEBODY’s been hiring ’em all along (…and it ain’t other illegals…). Severely/reliably-enforced card-check would dim the ‘welcome’ sign (and possibly bring that long-awaited recession from a resultant increase in labor compensation…).

may we all find a better day.

I expect that the unemployment rate will rapidly plummet come January 2005 and the implementation of a new policy on immigration and various sanctions.

Do you have a sense of the immigration numbers over time and how we have seen this interplays with periods of employment growth and contraction? Like when the US economy slows how many immigrant workers decide on their own to leave the USA to return home?(combined with the constant outflow of deportation)

6M

I get it. Using the CBO makes sense, but by the end of Biden’s first term, it’s easily going to be 12M. And even that might be a short.

I agree with your point about this mass migration causing unemployment to rise. It makes total sense.

I won’t get into the politics of it all, but 6M is low.

No worries. Still a great article, connecting many of the dots.

Howdy Folks. Bet Yall 50 cents that everywhere else, ” Ten rate cuts Incoming ” HEE HEE. Thanks for more truth Mr Lone Wolf……

The next jobs report will be interesting. If you look at the blue line of the first chart, it’s very bouncy — the month-to-month squiggles, as I call them. After a drop, it often bounces.

The reading in April was even lower than today, and people called for rate cuts back then too, and then it bounced in May. So July is above April, and there is a good chance it will bounce in August.

But if it doesn’t bounce in August, if growth slows further, then that would be one big factor, as Powell described it, for a rate cut in September.

Howdy. Thanks Teach

What if we have slow job growth and persistent inflation?

The dual mandate is sheer folly.

Yes, that’s a problem in terms of Fed policy making. We’ve had this issue in the late 1970s, which was then called stagflation.

Been saying stagflation is where we are headed for sometime now.

Eyes on the bond market, let’s watch it shoot higher on recession fears then crash again on stagflation/inflation/exploding debt fears

Meanwhile the Fed will be moving rates up and down like a yo-yo and lose the little remaining credibility they have… Bright days ahead

We are definitely into slow job growth, but like WR is pointing out, the tea leaves aren’t suggesting a final move either way just yet. The Fed isn’t going to sweat 2.5% core PCE or there abouts through the end of the year. What they’re concerned about is a continued softening of the labor market.

It’s been reported that a group of CEOs have pressed the Fed to start cutting interest rates soon, or they’re going to layoff more people. I would love to know if this is true. If it is, then one has to wonder about the independence of the Fed.

As I’ve been saying for more than a year now, $2T in deficit spending is going to be very hard to overcome and tip us into a recession. 114K jobs isn’t all that bad as WR pointed out. And, I’m not seeing a broad erosion in profits. They’re slowing down, but that’s not unexpected, IMHO.

The question is what happens to housing when we hit 5% 30YFM this fall, if the labor market is still plodding along?

Today’s jobs report was a lot more ominous than April’s though. B/c in the last couple months:

a) Weekly jobless claims have been edging up consistently

b) Continuing claims have been edging up consistently

c) Top-line forecast disappointments among major tech bellweathers

d) Deterioration in PMI data during the summer

e) Fears of escalation in the Middle East (Tuesday’s Beirut strike)

And I probably could throw in another point about a very strange Presidential election that is motoring along on nothing but vibe.

I definitely feel more squeamish than in May.

“a) Weekly jobless claims have been edging up consistently”

They’re below the highs of last summer.

In terms of feeling squeamish, sure, I always do. More than in April? Probably. You’re right about the election adding to the squeamish feeling.

The economy was bound to have this sort of slow down. We’ve been waiting for it now for 18 months. $2T in deficit spending is a lot of Pepto Bismol for a squeamish economic tummy.

There’s a good chance that the 30YFRM drops to 5.8% by Sept 18th just on the expectation of a rate cut. A 25 BP cut will ensure it drops towards 5% before the end of the year without another rate cut.

Granted, it’s subject to revision, but Q2 GDP just came in at 2.8% which is pretty healthy. People have been saying for 9 months now that a recession started last October. Where? How?

There’s a lot of housing money sitting on the sidelines right now. @ 5% 30YFM, sales are going to turn positive. Again, keep reminding yourself that $2T is a very big 40% jolt to the economy. June home prices were up 6.9% in June which is just stunning.

My bet is on five 1% cuts in short succession.

Howdy andy. I think a Greenspan type POW POW could easily return.

why not five 2% cuts to -5.35%, spread over the next three meetings and in-between meetings, because stocks dipped 5% in a few days, and employment doesn’t spike anymore?

Don’t give them any ideas!

Already some are howling for an emergency 50 pt rate cut, now, or certainly no later than Jackson Hole.

It’s sad to think that the savers of this country, who are finally getting a return, need to prepare for another beating.

Well, at least we can agree the next cut will be full 1%.

It’s probably being seriously considered……..who says no anymore.

@David in Texas, couldn’t agree with you more. Looks like we savers counting on a low risk return will take another one up the A$$ soon enough. It’ll be back to TINA environment again at some point and you’re force to plow back into the stock market again…this is by design at this point.

Did all 6 million immigrants who crossed illegally into the country receive a work permit? Seems like BLS is making an error if they count as unemployed a person who is seeking work as a doctor but who isn’t licensed; a person seeking work as a lawyer, but who isn’t a member of the bar; or an illegal immigrant, who can’t successfully complete an I-9 form.

I know giving illegal immigrants free housing vouchers and valid work permits will spike rents and tank wages, and place working Americans in the position of competing against new labor market entrants who have no housing costs and can easily accept a lower wage.

The unemployment rate is based on the household survey, which does not ask about work permits. And the survey is available in the language of your choice. If you looked for a job during the reference period but don’t have a job yet, you’re counted as unemployed.

I live in SoCal and know a number of folks (through a food pantry) that are undocumented and I’d be shocked if they filled out such a survey. Most are trying to keep a low profile and are naturally suspicious of anything (including receiving any type of social aid). Many of them have even been leery of giving their name and address when being asked to sign into our system. Anecdotal I know…

The survey doesn’t ask them for their address. The survey already knows the address because it is sent to the address. The whole system goes by address. It doesn’t matter who lives at the address.

The only statistical question here is if illegal immigrants are less likely than other people to answer the survey.

This is one of the reasons why actual employment would be much higher than the household survey says.

The establishment survey doesn’t have that issue, which is why there has been a massively widening gap between employment per household survey and employment per establishment survey.

Young Canadians are desperate to leave Canada for America in search of work. The numbers keep increasing due to the high cost of living in Ontario, Canada and British Columbia, Canada.

It’s funny how housing is more expensive the farther north you go.

Why is that?

DB: Almost ANYONE can “successfully fill out an I-9.” Especially with help.

I saw one written in pencil once….

The employer is not required to audit, verify or enforce any legislation, only collect the piece of paper.

I know of entire businesses that specialize in employing people with questionable immigration status.

They’re not connected with ICE or any government agencies. They generate revenue, pay taxes (most “illegal” workers do too).

When will the government decide to send the help back home?

When they themselves stop hiring them and they have an excess of tax receipts.

Maybe DB meant that you need a SSN to successfully fill out an I9.

Not true. As an employer we are required to obtain and review applicants document verifying legal ability to work. We have to attest that we have done so.

Documents are generally passports or some combination of less official support.

immigrants who enter illegally are employed only if an employer breaks the law and ignores their lack of legal documentation or the applicant manages to obtain convincing forged documents.

How many employers have been penalized for breaking the law? Very few. In fact I’ve heard numerous farm owners interviewed over the years bemoaning immigration who then turn around in the same interview saying they rely heavily on their cheap labor to survive. As if the two issues are unrelated. Hypocrites

@ Wolf –

Real D. B. Cooper said: “I know giving illegal immigrants free housing vouchers and valid work permits”

————————————————-

How is it possible to give illegal immigrants free housing and VALID work permits?

Would that very set of acts, absent fraud by the immigrants, establish those immigrants as legal immigrants?

Do you believe every line of bullshit people stick into their comments? Forget housing vouchers. But several hundred thousand of new immigrants — for example from Venezuela — can get work permits. The other 6.6 million cannot.

As a matter of fact Wolf, I don’t. I do believe most of what you say. My efforts are to keep your site a bastion of truth. Spreaders of false hoods ahould be called out. You’re welcome.

How funny, for some reason the market did not like this. Don’t we live in an insane world where bad news is good news, would this give them more ammo to pump the market up today by saying Sept rate cut will now be 1 instead of 2?

Or perhaps this is just temp pull back so BTFD crowds can come back strong next week.

As the lone bull here, I like the market thinks the Fed should’ve cut rates this week and think they’ve made *another* policy mistake. Maybe I’m wrong, who knows, and it doesn’t matter to me in terms of taking advantage of wild swings in stocks. Either way, despite the narrative here, there’s plenty of other evidence out there on the other end of the spectrum than what is constantly preached here and the truth is likely in the middle. BTFD yo! On average you only get three 5% BTFD moments each year. Bring on the 50bps cuts! Or, maybe we’ll get a 2008 kind of crash in which Depth Charge can finally buy that dip so they can stop complaining about how horrible the Fed has made his life.

As the “lone bull,” you should be aware of history.

The beginning of a Fed cutting cycle is typically bearish for financial markets.

I doubt you’re the only person holding long. As mentioned in many places: the financialization of everything means many people buy into the market every couple weeks, up, down or sideways.

The market was up by 20% in the first 6 months. It doesn’t take much disappointment from earnings or economic data to start a sell off.

The net profit margin for the S&P 500 for Q2 2024 is about 12.1%, above the net profit margin of a year ago. What disappointment? The economy is doing just fine, despite all the BS you hear.

I have absolutely nothing of value to say and nothing insightful to contribute about this article since I have never worked and never will.

Thank you for your service.

No, thank That one guy for making sure the trains run on time, otherwise I’d have to fly to more of my vacation destinations.

In politics?

A priest?

Marketing?

Kinda, sorta, but not really I suppose you could say. I’m in philanthropy. Not wanting to work hard in life, I didn’t have many options for success until the supreme court ruling in 2015. That really opened a lot of doors for me. I learned well from my ex-wife and the divorce process.

I found me a nice rich man, and then some years later, cleaned him out in the divorce courts. Now I’m independently wealthy and the house I lost to my wife is insignificant to what I’ve got now. So these days I make it my ‘job,’ you could say, to give. I give advice, bits of wisdom, unsolicited opinions, and weak attempts at witty banter. It’s mainly for tax write-off purposes anyway. Gotta have something to put down on the IRS forms.

I don’t know if what you’re saying is true, but this has got to be the greatest post ever. Your ex-wife screwed you over in the divorce courts, so you found a wealthy gay man and married him and fleeced him in the divorce courts?

This is like something out of “I Love You Philip Morris.”

No. Just because I don’t work doesn’t mean I’m completely devoid of morals.

Must be priest then lol

I finally met my role model !

Q4 is looking like we could have net job losses as workers pile up and new immigrants realize they can’t get easy jobs anymore. Recession actually coming? Housing prices actually decreasing y/y? NVDA actually falling more than a few days? We’ll see if these things are even possible! Nothing surprises me anymore.

We’ve been in a recession for the past couple years at least, the phony govt stats only fooled those without memories and critical thinking skills. A nation of uber and doordash drivers trading crypto while government hands out gobs of welfare to invaders and any country thats vaguely interested in warfare with its neighbors does not an economy make.

Sad but true

and simps for the ruling uniparty ;)

Don’t think we have been in recession maybe some places locally but not nationally. The financials from public companies with the majority having higher revenues just don’t support that idea even jobs have been increasing and credit card purchases

The last couple of years boost to consumer spending could be helped by the government paying for the food, clothing, and shelter for the 6+ million immigrants? Government/State support has probably helped increase consumer spending at stores even though the immigrants do not show up in unemployment, jobs, and other census type reports. But businesses will see consumption transactions.

Don’t forget, alot of places are only just now running out of the money they were “gifted” during 2020. Odd isn’t it?

Yeah, I’ve been through this quite a few times. It’s always different but always the same. This time it was like riding in a car with a drunk teenager trying to impress his friends. Slam on the brakes, slam on the gas, slam on the breaks, steer, panic.. this is that moment when you’re going into the turn twice as fast as you should be and you know neither gas or brakes is going to save you. So you start looking for the softest hit point.

Most bear markets after this kind of speculative boom are pretty fast and brutal. -50% in the S&P and -70 in the NASDAQ wouldn’t surprise me this time. Rate cuts sure, the brakes will just light on fire at this point.

Send lawyers, guns, and money

The shit has hit the fan

I don’t think they will be able to call this “Black Friday”, but maybe they can go with “Light Gray Friday “?

To be followed by the usual “BTFD Monday”?

😋

It’s great when markets get “frothy” on a Friday. The stew can simmer all weekend. I hope everyone in NYC tips their bartenders well, they will deserve it.

XOM came out with sneaky fantastic earnings today.

Hi Wolf. Would you have some insights about how the FEDs are timing events? Often, FEDs are making decisions just days before new important data is arriving. Is that crazy that these events are not synchronized to avoid acting on state data? Have FEDs had idea 2 days ago about the jobs related readings? It seems that they had no clue since the keep decision was done by general agreement.

Market plunges, but bitcoin still resilient hovering above 65000. This should lose 50% of its value on a day like this. Not enough fear yet.

It’s like a scam that just won’t go away anytime soon…I bet Michael Saynor is happy even as the market is going through correct, his HODL position still paying off..

Also both the Price to Book and Price to Sales ratios of the S&P500 are at or near record highs, which strongly suggests that this IS a top for the stock market…

I think the odds of Sept cut are near certain and the odds of 2 cuts this year getting there.

Not if we get a hot CPI print for Aug and Sep. That could be the black swan event for the market and a nightmare for the Fed. They might still be forced to cut in Sep for the election, but it could be the only cut for a long time until CPI comes down.

What if they get a hot CPI print and mounting unemployment? This is the watershed moment that would tell us which of their dual mandates they really care about more. Hint: probably the one that affects the stock market more.

They haven’t been tested yet. It may be coming soon.

That would be bad.

Like crossing the streams bad.

Two more CPIs, two more PPIs, one more PCE and one more jobs report before the September FOMC.

Still a lot of data.

Plus who knows what may happen in the Middle East and Russia in the coming weeks…

Not a black swan. I believe it is highly likely. With a “higher than expected” CPI print, combined with the heavy lifting this weeks fall in yields has already done for the Fed, the Fed will have good reason to delay the first cut until at least November. There is a lot of “pants on fire” media and market reaction right now, little of which has to do with the current day US economy.

PS A 4.3% unemployment rate is ungodly low. There is at least another three tenths of a percent increase needed before it’s worth getting nervous. About 300,000 people a month are reaching retirement age. There is about $6.4 Trillion resting peacefully in US money market accounts, just waiting to be spent. Paraphrasing Mark Twain, reports of the US economy’s death are greatly exagerrated.

I agree, 4.3 unemployment is ridiculously low, and they are acting like the sky is falling. Throughout my entire career, it’s always been harder to find a job during the dog days of summer. And the moronic media consistently acts like one report is a trend. Last month beat huge. Propaganda in this country is over the top. It’s gotten to the point I can’t watch much news anymore.

We had an unsustainable four year period that never should have happened and the expectation/desire is for it to continue at that frenzied pace forever. It needs to stop.

DR – can remember when the pre-Murdoch ownership of the WSJ editorialized that the ‘proper’ amount of the national unemployed population should be around 10%…

may we all find a better day.

This is why Powell should explcitly state the possibility of rate hikes when the reporters try to bait him into talking about cuts. These pivoteers and inflation deniers just won’t stop.

No one discusses what model the fed should be using to raise or lower rates.

The Fed is a micromanager and has placed itself in the economy in a way unthinkable a few decades ago. This needs to change

Agree. As Judy Shelton said today, the Fed is too powerful. Its power should be limited.

Kevin, a Judy Shelton reference, nice. This is why I like reading Wolf Street. Now try asking a hundred ramdom people on the street who Judy Shelton is……………crickets.

“… try asking a hundred ramdom people on the street who Judy Shelton is……………crickets.”

Not to be offensive, but try asking a hundred ramdom people on the street who Wolf Richter is……………crickets.

Btw, I’ve never heard of Judy Shelton.

I’ve heard of her.

Judy,

🤣 You got a fan base here in this joint!

Thanks for listening, Kevin.

Best wishes,

Judy

Two questions Wolf,

1) What does the FED prioritize? What would happen if unemployment starts to rise more in August and September along with a way lower jobs added metric, while at the same time we see inflation spiking back up? What should the Fed do in this case. Because to me, it doesn’t seem impossible given the circumstances and the immigration changes.

2) I see that dollar index has plunged today. Some headlines mention that today’s payroll data boosts rate cut bets. I also see 3-month treasuries plunged to 5.18, does this mean markets are pricing in a more than 25-point cut in September?

Thanks for your detailed articles.

In Dec 2023, the market ( the federal funds futures market) priced in 6 rate cuts for 2024. By early Jan, the market priced in 7 cuts. Then the cuts didn’t happen. Now the market is down to pricing in 2-3 cuts in 2024. The market does what it does because it does it.

Wolf,

Why did the market tank in December of 2018, why did the fed begin to cut rates in 2019, why did the fed stop QT in 2019, why did the fed restart QE in 2019 but the press didn’t point it out? Is it possible another financial crisis started then, sure as heck would explain why they’ve been running massive deficits during “peak growth” wouldn’t it?

1. Trump was keelhauling Powell on a daily basis for a year over his 2.25% rates and $50 billion a month in QT, and eventually Powell caved.

2. In fall of 2019, the repo market blew out — largely because the banks stopped lending to it. We discussed there here a lot. That could have caused some contagion. It’s a huge market with about $4 trillion repos outstanding on any one day. So the Fed stepped into the repo market to calm it down. And after it calmed down, it stepped back.

Just admit that we’re bankrupt, and don’t say we can’t. You can be liquid but the money won’t be worth jack and S(%* and jack just left town.

“And after it calmed down, it stepped back.”

Did it? I don’t think it did. Until we admit the true problem we’ll just lurch from crisis to crisis until we hit rock bottom. Can’t fix the problem until you admit it.

“The market does what it does “

Yes— if left alone. However, everyone has come to depend on the fed to help deliver the economy in their desired direction. Inflation too high after they first goose the money supply—then raise short term interest rates quickly, pleasing savers & busting banks. Then when the Big Ponzi seems to be running out of fuel, who do we pant and pine to save the day? The Fed of course—the creator of the problems to begin with!

Would it be tragic if the fed were eliminated? If markets and the economy learned “to do” without continual attempts at fed manipulation?

Inflation is bad but as long as it is nowhere near hyperinflation, employment will trump inflation. The Fed has been in a goldilocks position since they only have had to worry about inflation.

If unemployment begins to race towards 5%, they will cut and inflation be damned. If it just slowly drifts up towards 4.5%, any cuts will be well spaced.

Once again, Wolf Richter demonstrates why he is the best source of unbiased and truthful economic reporting. Wolf is the first person I read when new economic data comes out. He is an extremely valuable resource. And if you are a regular reader, please consider making a generous donation since he doesn’t charge for his valuable insights.

Is that you posting anonymously Wolf?

No, but it’s nice for him to say, after he tripped over my commenting guidelines and a few other things that I don’t allow, and I took some of his comments down.

@Wolf I read something that the increase in weekly job loss claims was impacted by hurricane season in the South, any truth to that?

Also this is probably a dumb question, but how does illegal immigration impact the unemployment numbers? If these people can’t legally work here, why would they be counted as unemployed? Is it normal to consider non-citizens in unemployment calculations?

Also if the increase in unemployment is primarily due to illegal immigration then would it be safe to say that the economy isn’t cooling significantly, because these people were never really significantly contributing to US economic growth since they’re newer inhabitants of the US?

Non citizens? There are millions of people who are legal residents of the US with green cards who are legally allowed to work but who are not citizens. Soggy mush mush.

1. Weekly initial unemployment claims (NOT the data we got today, but yesterday):

— Not seasonally adjusted, fell this week to the lowest level since June.

— Seasonally adjusted, they rose this week, after falling last week, and they’re below the highs of last summer. They’re kind of at normal levels.

— So I don’t fret over that.

2. In terms of your topic of “illegal immigrants” and “non-citizens” — I think you just slipped here by including non-citizens into your bucket of illegal immigrants. It’s the other way around: There are lots of non-citizens in the US – and they include green-card holders, H1B visa holders, people with work permits, seasonal work visas, etc. They’re perfectly legal, and they’re working and paying taxes legally, many of them for decades. The term “Non-citizens” should not have been in your paragraph. It doesn’t belong here.

3. The 6 million strong influx of immigrants in 2022 and 2023 consists of newly arrived people who are either legally or illegally in this country. Many of them are working or looking for work.

4. The unemployment rate comes from the household survey. The survey does not ask about immigration status at all; and the survey is available in several languages. So immigration status has nothing to do with the unemployment rate.

Wait! Do I understand this correctly? If the unemployment rate is derived from the household survey, and the household survey doesn’t distinguish between legal citizens/non-citizens and illegal immigrants, doesn’t it follow that the unemployment rate is materially affected by the increased number of illegal immigrants who fill out that form. Our stated unemployment rate is higher than it should be; thus the Fed is taking important actions that affect us all by relying upon inappropriate data. Had the six million not been here and filling out these forms and our stated unemployment rate a couple of clicks less, would the press be baying at the moon for a rate cut! Would the Fed be mulling over a rate cut? Just asking.

@ Wolf –

Unemployment Rate = Number of people looking for work who can’t find work / Total Work Force

True or False?

Does Total Work Force include illegal immigrants who are working or are looking for work ?

The unemployment rate is based on the household survey, which covers all people in the US and doesn’t ask for immigration status. So it covers illegal immigrants in the labor force, working, and not working but looking for work. The rates also cover them.

But note, the household survey data is extrapolated out to the Census Bureau’s population data which as of yet has underestimated by 6.6 million the net population growth due to immigration in 2022 and 2023, according to the Congressional Budget Office, using ICE data. The Census will eventually make those adjustments, but until then, the household survey data are messed up.

Based on Wolf’s post “Eyepopping Factory Construction Boom in the US Reaches New Highs…” from August 1, shouldn’t we expect to see hiring pick up heavily again at some point as these factories go into operation? (I don’t know how long it averages from beginning factory construction to putting it in operation.) Even with automation and robots, with so many factories being built I’d think they’d create quite a few jobs.

Not necessarily.

Some of these factories support the EV transition and its supply chain (e.g. batteries). Consumer uptake of EVs has stalled and if Trump wins the Whitehouse – he isn’t likely to help their adoption.

This is also true of renewable energy such as solar. Domestic manufacturers are hitting the “pause” button fearing the impact of a hostile Trump administration. This despite the new round of tariffs that was announced in May that should kick in soon.

And we now seem to be in the early stages of a cyclical downturn.

The pause by Biden admin for LNG plant permit and construction will end and a new wave of LNG export plants will be built that is terrific for USA job creation as we fill up those plants . They usually have a 20-40 year life . Natural Gas for August delivery hit 2.00 usd NYMEX this last week . A level I have not seen since 2020 covid and the early 1990s from gas deregulation and an abundance of cheap coal. Both oil and NG drops late July and August will help keep inflation lower I suspect .

Hiring in construction is strong – there are still labor shortages including to build the chip plants. So that’s where the first wave of jobs is. In terms of manufacturing employment, it takes a goodly while to get a factory going, after you start building the walls.

6 Million? Try at least double that.

Wolf,

I saw this in a WSJ article earlier today regarding the unemployment rate “The Labor Department on Friday said that 461,000 people with jobs were unable to work because of weather in July. The average number of people missing work because of weather over the previous 10 Julys was 37,000. The August jobs figures could see a rebound as those storm effects reverse.”

They didn’t expand on it much, and you didn’t mention it so I was curious if this sort of noise is “normal” and at least a part of the cause for the squiggles? It seems something that could heavily skew the numbers, though I guess in the case of hurricanes and such that could cause more permanent changes to employment maybe it offers some benefit. I’m just wondering if they have minimum criteria to filter out somebody who couldn’t work one or two days but worked the rest of the week and will work next week? Or if situations like that are part of the reason behind corrections of past data. Thanks as always for all your insight.

Yeah, happens every hurricane season. That’s why my guiding line is the three-month average (red line in first chart) that irons out those month-to-month squiggles (blue).

As I said in a comment above, I expect the blue line to bounce in August.

Just wanted to say thank you for writing up these level headed reports, Wolf.

I’m embarrassed to say, but not afraid to admit (hehe), that I frequent ZeroHedge a lot for entertainment purposes, and they are meltdown that this is it.

The big market crash! This times is the dreaded Sahm Rule, and unemployment is the biggest red flag that everything is going to crumble down now.

After I had a quick laugh over there from all the market crash and Trump propaganda I shot over here for the real story.

Thanks again, bud. Looks like the outlook of things is still healthy.

So what are your thoughts on the relationship between PCE and unemployment? Could we have increasing PCE and increasing unemployment.

That would certainly be a hoot. It would lead to a new dance, called Fed Tango or something.

Wolf,

How would you set the odds that we get into a stagflationary scenario where unemployment rises but with still positive job growth, and inflation refuses to cooperate and stays sticky around where it is? Translation– rate cuts would have a high risk of inflation reaccelerating.

I would wager around 60% on that prospect, but would like your perspective.

By the way, the volatility stuff I talked about last time is happening now. VIX almost hit 30 (mid 29s for about 20 minutes), because people started getting margin calls on in the money calls and other people weren’t rolling their calls.

If we get some more downward movement in stocks, we could get VIX into the 30s and start the doom loop.

Problem for the market is that the Fed CANNOT cut rates enough to deal with the option market leverage without reigniting inflation (my guess is that would have to cut 200 basis points– but I would love to know what you think).

So if the doom loop hits, watch out below… maybe 1987 redux? Doubtful would be that bad, but we’ll see…

I’m thinking any job market slowdown will put the STAG in front of the ‘flation we’ve had.

It will be a long decade.

@ TulipMania

@ Wolf

Why would people get margin calls on their in the money calls?

1. You don’t have to exercise calls

2. If you are “in the money” a call should not be triggered

(I am not an option trader, so clown me severely if I am spreading falsehoods)

“Whenever unemployment is under 4%, it tends to spike afterward.”

I read this concept in about 2016… when it was continuing to historically low levels.

Ultimately it was a correct call, but nobody would have predicted it would be a global pandemic that triggered a spike.

Today the hangover may be near, the hair of the dog has been taken away. The number itself is not so worrisome, but rather the directional momentum.

Couple this all with huge companies trying to temper expectations (Amazon is not projected to double sales in the second half?!? Poorly managed Intel is laying off and still a mess?)

I have started to consider the total market cap of crypto an indicator of financial conditions.

At $3 trillion, things are loose and wild. The 2022 bottom was $750 billion. Today’s selloff only shaved off a billion, we’re still north of 2trillion.

Intel just laid off 15,000 employees. Not good sign for employment numbers in the near future. That is with all the government subsidy via the Chips Act.

“Intel just laid off 15,000 employees.”

No it didn’t. It announced that it would lay off 15,000, and this takes time, and they’re GLOBAL layoffs, and Intel has a huge presence in other countries, including chip plants, so we don’t know how many of these layoffs will eventually occur in the US.

In addition, keep in mind that many of those 15,000 are currently open positions. Actual layoffs will be less.

I was in Home Depot yesterday and it was so crowded I couldn’t get anyone to help me check out to fill my propane tank. I wound up going to the outdoor garden check out to get this task done. Looks like the home improvement business is still booming. Most of the customers in there looked like mom & pop contractors. Maybe, people are starting to work on home improvements vs trading up homes because they have 3% mortgages which they don’t want to give up.

Economy and labor market are definitely cooling here in flyover country. After working nearly three years of straight OT with two Saturdays per month, our fab shop just went back to straight 8’s this week. Our lead times and competitor’s lead times are finally back to normal.

Pricing power is back in our favor buying steel, aluminum, and copper. Metals that often take10-12 weeks to get can be on the dock in 2-3 weeks. Our two largest suppliers both said they had a slow Q2, and Q3 is shaping up to be slower.

Just picked up a few good employees laid off from other local manufacturers. The shops making agricultural equipment in the area are really hurting for work.

Hoping the bottom doesn’t fall out entirely, but we welcome this little slowdown as a breather to rework the shop.

Which companies?

I keep it halfway vague to retain some semblance of anonymity. We make truck equipment. O’Neal Steel is one of our larger suppliers of metals. Our rep stopped in yesterday and said we would be seeing a 9% drop on a fresh large purchase of extruded aluminum since it is priced at the time of mill exit, and ingot tanked this week. Two week lead time on extrusions is absolutely unheard of for us. Pre Covid lead times were 10 weeks or more, briefly exceeded six months in the worst of shortages during 2021-2022. Now two weeks.

I own a business in flyover tied to construction. Private sector projects have been drying up. Public sector projects are still stacked.

I can update any piece of construction equipment at zero percent rate.

Trucking has been in the pit for months.

Nothing close to resembling the GFC….yet.

Until wage growth remains at or below 2.6% for a six month period or longer, we are still in a high wage growth regime, despite what mainstream media is saying. The current 12 month average wage growth of 3.6% is still too high for a September rate cut if the (core services) CPI does not fall next month.

Recession calls on ZH. Goldman Sucks having a cow, calling for emergency rate cuts. So sick of this crap. I nope the entire shtshow collapses. I’ve beyond had it.

I’ve always been taught that supply = demand more or less.

Seems like if you want to reduce supply of pesky low income labor types you should go after the demand for them and they’ll stop coming here.

But then we’d probably have to cut back on our veggies among other things.

@ Wolf –

Wolf said in the last sentence of the article: “and quarter-to-quarter declines in GDP, but in Q2, GDP grew 2.8%, faster than the 10-year average after the more sluggish growth in Q1.”

————————————————-

did you not mean quarter-to-quarter declines in GDP GROWTH ?

NO, no, no. A recession means that GDP in dollars (adjusted for inflation) actually drops. Slower growth is NOT a recession. A recession is NEAGTIVE growth.