A trend we watch: As refis rose from collapsed levels, the Fed’s QT of MBS increased for the fourth month in a row.

By Wolf Richter for WOLF STREET.

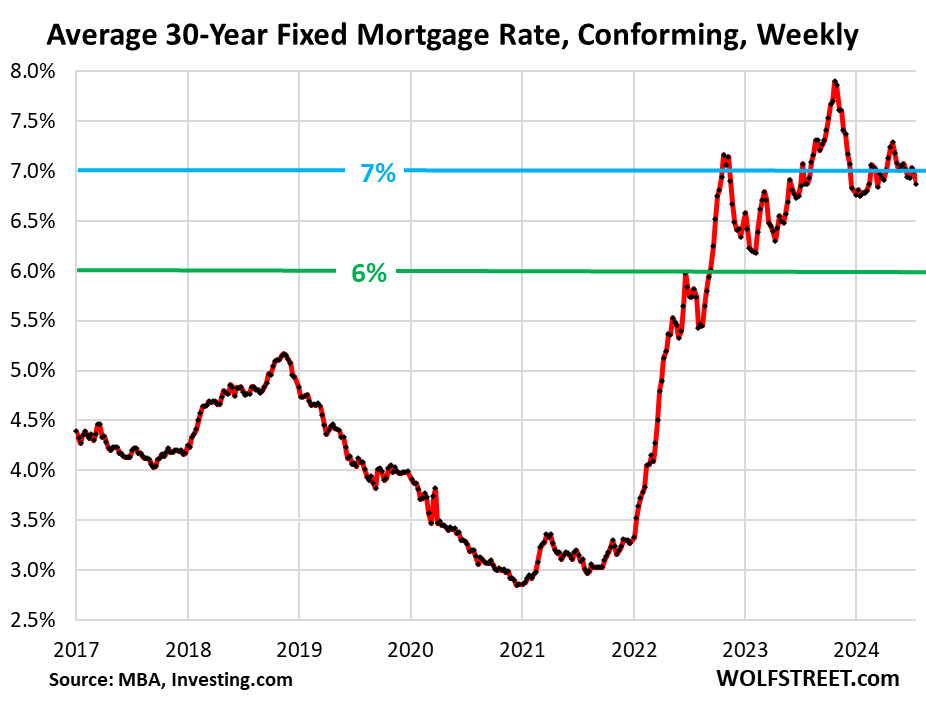

The average conforming 30-year fixed mortgage rate during the latest reporting week dropped to 6.87%, the lowest since mid-March, according to the Mortgage Bankers Association today. Not so ironically, two things happened, as the MBA also reported today:

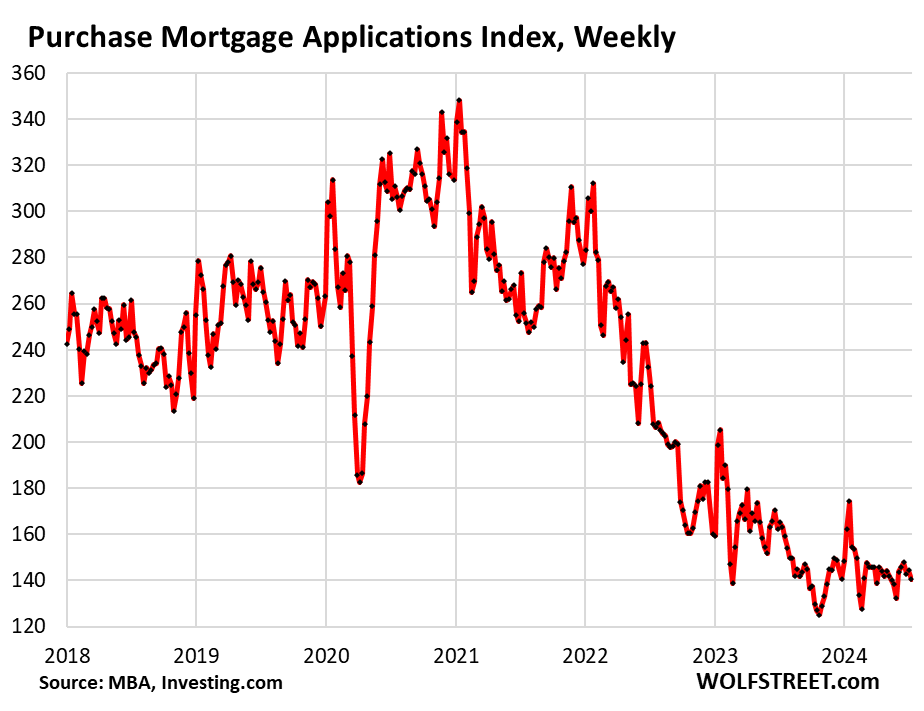

- Applications for mortgages to purchase a home fell to the lowest point since early June, as potential home buyers remained on strike, waiting for lower prices and lower rates.

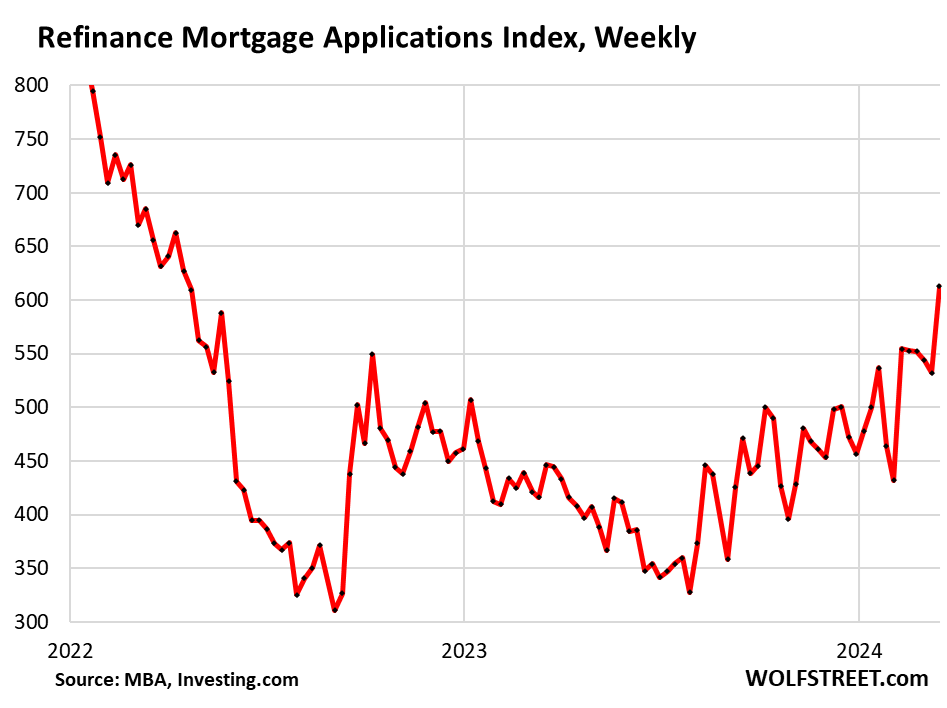

- Applications to refinance an existing mortgage jumped to the highest since August 2022 and have nearly doubled from the collapsed levels last November, with implications for the Fed’s QT.

The give-or-take 7% mortgage rate has been a fixture in the housing market since July 2023, briefly reaching 7.9% in October 2023. It has been above 6% since September 2022.

The problem isn’t mortgage rates, the problem is home prices. A 7% mortgage rate used to be a good deal. From 1970 through 2001, mortgage rates ranged from 7% to 18%. Relatively lower home prices made those higher mortgage rates work.

But when mortgage rates dropped as low as 5.5% in 2005, they fueled Housing Bubble 1, which led to the Housing Bust from 2006-2012. Mortgage rates dropped below 5% in 2010, then ranged mostly between 3.5% and 4.5% until 2020, when they plunged to 2.5%. These mortgage rates, especially the 3% mortgage rates during the pandemic, caused mindboggling home price increases, and those home prices don’t work with anything other than 3% mortgages – and not even with them.

Buyers’ strike continues, prices are too high.

Home prices are simply too high even for cash buyers, home purchases have dropped, and home purchases requiring a mortgage have collapsed by nearly half from their pre-pandemic levels in 2019.

Mortgage applications to purchase a home in the latest reporting week fell to the lowest level since early June 2024, were down 14% year-over-year and down 47% from the same week in 2019.

Mortgage applications are an early indication of home sales volume, and sales volume is dismal, even as active listings have risen to multiyear highs. In November 2023, mortgage applications hit the lowest levels in the data going back to 1995.

This is a clear indication that potential buyers are holding out for lower prices and lower mortgage rates, they’re still on buyers’ strike, even as sellers are getting more eager to sell – hence the rising inventory and price reductions.

Mortgage refi applications jump from collapsed levels.

Mortgage applications to refinance a home began to collapse in 2022 when mortgage rates surged. Non-cash-out refis have nearly vanished. Most of the refis that are taking place are cash-out refis, according to data from the AEI Housing Center.

But looking at it with a microscope, we can see that refi volume has been trending up from the collapsed levels since November 2023, and in the latest reporting week jumped to the highest level since August 2022, having nearly doubled from November 2023.

Just guessing here, it looks like an increasing number of homeowners wanting to do a cash-out refi have been trying to outwait the 7% mortgage rates, thinking for months or for a year that this too shall pass, but now this too still hasn’t passed, and they cannot wait any longer, and they pulled the trigger:

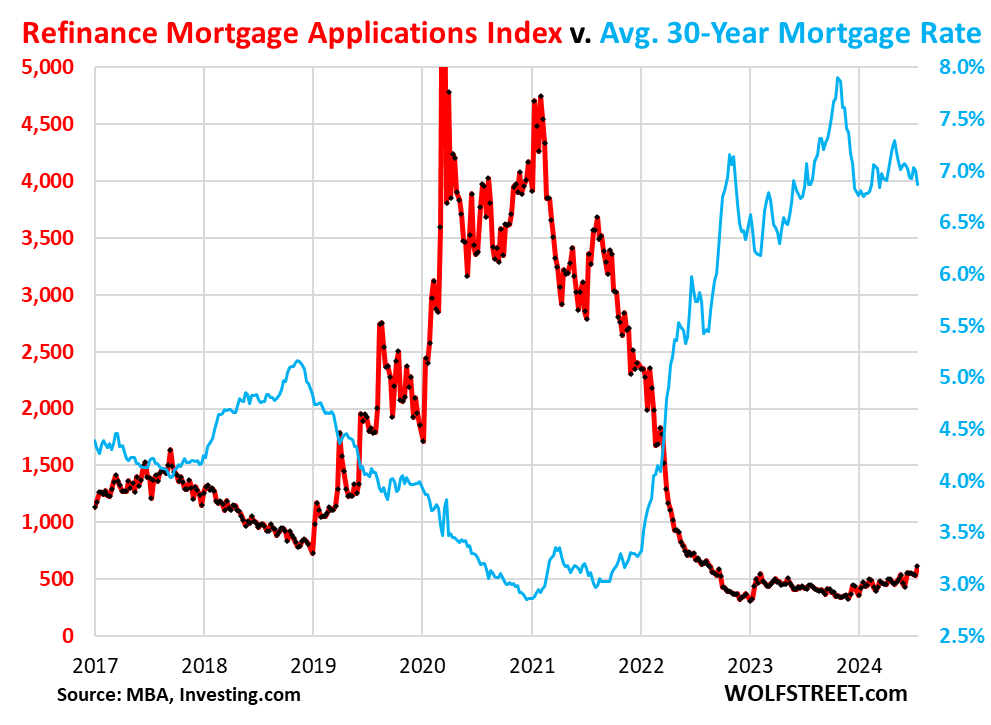

As Fed watchers here…

We keep an eye on refis because an increase in refi activity increases the pace of QT with regards to the Fed’s MBS holdings. MBS come off the balance sheet when the underlying mortgages are paid down or are paid off. In a refi, the old mortgage is paid off, and the principal is passed through to MBS holders. The pace of the MBS QT was running at about $14 billion a month in early 2024, reflecting the historic lows of refi applications in November.

But the pace of MBS QT has ticked up for the fourth month in a row to $19 billion in June, reflecting refi applications through about April. The current jump in refis won’t show up on the Fed’s balance sheet until the passthrough principal payments from the paid-off old mortgages reach the Fed.

Refis and rates, the longer view…

Refi applications are still down by 66% from the same week in 2019 and 81% from the same week in 2021. Refis are a function of mortgage rates, going dramatically in the opposite direction of mortgage rates. The chart shows this inverse relationship between refi applications (red) and mortgage rates (blue).

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I see growing inventory in northern and southern CA. In Irvine, people still wants $1M for a condo with $700 monthly HOA. Close to $7k per month in total housing cost (PTI, taxes, insurance, HOA, etc).

I’m calculating $8K+/month for that, assuming 10% downpayment and current 6.8% mortgage rate.

LOL…all so you can brag to your friends you are now living the American dream and not like those peasants that rent…and with 10% downpayment, those PMI you’ll be paying, all worth it to be the homeowner class..

In the meantime, you can rent the same kind of place for $4k-$5K and invest the difference but that would make too much sense

$4-5K a month to live in dead ass’d Irvine and all the cachet it confers.

Wow.

I was assuming 20% down but you get my point.

but but but.. SoCal particularly in Irvine, Ladera Ranch, San Diego and West LA will never go down in price or crash, that’s what I am being told every freaking day..perhaps this spike in inventory will all be absorb soon enough once rate mania is back on the table soon enough.

It amazes me how many people around here will jump over hoops and trip over themselves to buy a crapshack at astronomical cost before even factoring in property tax, insurance and HOA. I guess when you are only condition to believe housing will go up 15-20% every year, not buying at all cost is like not buying that Powerball lottery ticket with the winning numbers.

Yeah, I had a condo in Irvine years ago that I keep an eye on and I am amazed at what units in that development are going for today.

Part of the Irvine dynamic is hot Chinese money – lots of foreign nationals are getting their money out of China, and Irvine real estate is a popular place to park it since there is a huge Chinese population there, plus UCI (often jokingly called the University of Chinese Immigrants). When I was selling my condo in Irvine years ago one of the prospective buyers was a Chinese national looking for a condo for his daughter who was accepted at UCI. He was going to pay cash – at the time over half a mil – to buy a condo for his college daughter to live in for a few years (and probably keep after for investment). You don’t see that in a lot of areas, and it is even greater today.

At any rate, my point is Irvine and the surrounding areas have dynamics going on that are unique to that area.

Quite a few Indians and Iranians as well want to live in Irvine. And I see a lot of those multi million dollar houses in this area with like six cars parked in and around them. I think they are multigenerational. If everyone in the extended family is working they can swing the payment. The elders watch the kids. It has proved to be a successful strategy for hundreds of years. The nuclear suburban family concept might end up being seen as a temporary anomaly of the late 20th century.

Except, today’s Orange County register is reporting that OC has highest in the nation home price gains for 4 months in a row. Prices in OC are up 10.2% year over year. And, in Newport, a bidding war just took place on an old tired termite infested 3BD/1BA home in an unremarkable location listed at $3.4M. Address: 418 Pirate, Newport Beach. That is an unheard of price.

SocalJim,

An anecdote about a “bidding war,” even if true, to prove a point about the market is for the braindead. And it’s classic real estate-hype propaganda.

So let’s dig into it.

OC supply of homes in June was 2.5 months, highest supply for any June since 2020, it was up from 2.0 months in May 2024, and up from 1.9 months in June 2023 (data by C.A.R.).

And sales volume dropped another 12% year-over-year in June from the already low levels a year ago, and by 17% from May (C.A.R.). So rising supply and sharply falling sales.

So your “bidding war” story, if it wasn’t BS either by you or the brokers, is meaningless.

And then I looked it up on Zillow: it sold for asking, not over asking. Bidding war? LOL

It was listed for rent in January and then the listing was removed.

But I agree with you in terms of price: seems crazy. It’s a decent-size lot in an expensive neighborhood, so maybe a developer bought it to try to do something with the property. Regardless, it seems crazy.

418 Pirate did not close yet, so there is no reported sales price.

As an example, 406 Pirate in Newport Beach looks like it’s on a similar lot, just a few steps closer to the water, and sold for $2.65M back in 2013. It looks swankier, and Redfin’s current estimate is $6M. A developer is likely buying the land of 418 Pirate for north of $3M to build a home like 406 Pirate on it.

These lots are very, very close to the water in Newport Beach. I am not that surprised by the price.

Don’t go and look at property values that are actually on Balboa Peninsula.

The same Orange County register story shows LA county is not doing as well, with prices up 2.9% year over year. The pattern of relocating to the suburbs continues in SoCal.

SocalJim,

So here is the median price for LA. The median price has been in the same range for the fourth year in a row so far. June is always when the big seasonal jumps occur, every year:

Inventory is rising. Homes are taking off the market after several price reductions.

It appears that some RE agents are trying to get transactions started before the August 17th change in rules. The NAR mafia says nothing is going to change but I think there is a lot of uncertainty.

At this point, any disruption to the status quo is welcome.

I really don’t think you can pin the blame for Housing Bubble #1 on 5.5% rates.

He said they fueled the bubble. Which it did.

It’s not even a buyer’s strike, it’s affordability. A starter home in the Northeast is $600k best case. With 20% down you’re still looking at $4k per month. A first-time buyer has to have AGI of at least $12k/month, more like $16k per month to reasonably afford that.

Only a small percentage of first time buyers can make those numbers work, hence transactions are down.

Yes Chunky, financial trickery only works for so long. Despite the claims of unlimited foreign buyers, money on the sidelines and cash buyers acquiring rentals ,it ultimately comes down to one thing. A buyer can only afford a house that is certain multiple of his or her income.

Like the inevitability of a ski diver reaching the ground, prices will ultimately go back to that. The wreckage of many an investor, flipper and realtor will be scattered across the landscape as things return to reality. Hopefully this carnage will act as a warning to the next bunch that wants to replay the last 20 years and offend the gods.

I agree with you in principle, but the Federal Reserve seems to never allow the market to clear itself and function properly. My sense is that at the first sign of softening in house prices the Fed unleashes QE and MBS buys again, flooding the market with liquidity. To get the median home price back in line with incomes would require a 25-30% drop in prices.

The market hasn’t had true price discovery since 2009 when the Fed began its massive distortions of QE

“Buyers’ strike” is always, at best, an imperfect analogy, as “strike” implies coordinated collective action whereas a typical “buyers’ strike” is simply the result of millions of individuals noticing that the price of e.g. a can of Chuck’s Soda has gone up 10% and saying “Yeah, I’m not paying that.”

It’s even more imperfect at this moment in the housing market. That’s because compared to the soda consumers, the vast majority of whom *could* buy at least one can of Chuck’s Soda at the higher price but choose not to, many of the people who would ordinarily be buying houses today simply cannot qualify for a mortgage on any house they would actually want to live in, at current prices. In those cases, it’s not that they’re indignantly refusing to buy, it’s that they can’t buy.

Most sellers are also buyers but it is awfully easy to complain about prices while listing your own doublewide at palace prices. Everyone wants a piece of that pie without giving up any crumbs.

Either way, once a few sellers who are on a time crunch list at (or rapidly drop to) more reasonable prices it’ll spread rather quick. Can’t get it if that appraisal doesn’t agree.

The problem is that there’s incentive/pressure throughout the real estate sales ecosystem (agents, lenders, inspectors, appraisers, title, etc.) to get those homes to appraise at the limits of what the FHFA conforming loan limit allows the GSEs to securitize. I believe it is no coincidence that $1.2 to $1.3 million is the current going rate for houses in Orange County, California. That puts loan value right at the conforming loan limit after downpayment.

Seen a lot of appraisal reports over the years and there is certainly some funny math and peculiar choices of comps made and seen plenty of rather pointed questions from underwriters. But I do agree there is still pressure to “make things work” as it were. Until lenders become more risk adverse it’ll certainly assist in keeping values up as well.

Problem in the area I live is mostly people moving in from out of state (from north and west) with pockets lined with cash who will pay over appraisal and have pushed values up over 50% on average over a 2 year span. It’s starting to level out due to higher rates, but the damage is done. Only thing keeping volume up now is tract builders who are dropping 10% in incentives to get people in the door.

What if the GSEs structured the MBSs into 2-3 tranches and required all of the equity tranche to go to the originators’ balance sheets?

I work in the trades in the northeast. Subtracting land, you’re going to have a hard time building anything 3br/2ba for less than $300,000 in builder costs. Add back land and your cost is in the $350,000 to $550,000 range. A $600,000 home in some places is as cheap as it gets. Good land is scarce here and many suburban towns went all in on rambling sprawl zoning, all but ensuring that land costs for buildable lots is going to stay astronomical. And those of us that work in the trades have to live in this very expensive region, so our labor rates are not coming down. The era of cheap starter homes in New England is dead unless a craftsman kit revival is coming back. Used homes or very modest homes are supposed to be starter homes. Zoning, land prices and social status all but ensures that modest homes are not coming back either, so the used market needs to buckle under the reality of current rates if anything is going to change.

A lot of people who refi’d realize it’s better to invest than to pay down the mortgage. It will take a lowering of rates and/or a dip in the stock market to change that trend

Cash-out refis are being heavily promoted on YouTube.

The pitch: Take money out of your house and apply it to your credit card debt.

Yup. That will end well. (Sarcasm off.)

I was assuming a lot of people in non-recourse states were cash-out refinancing then walking away.

Check the laws in your state before you do that. Chances are your cash-out refi mortgage is full recourse, even in a non-recourse state.

Seeing a lot of places in my area sit for 6+ months and judging by the pictures the owners have moved out. They have relisted and even tried fsbo in some cases but they need to start chopping.

The housing bubbles have been fueled by legislation changes that made homes the most attractive investment asset on the planet. The low mortgage rates were in the noise for pushing up prices. Even now, the majority of new homes built are snapped up by investors, not owner-occupants. Supply can’t fix this problem, only legislation changes surroung tax breaks for home ownership can have an impact. But since many congresspersons have a portfolio of “less than 50 rental properties”*, those legislation changes will never happen.

* 50 rental properties or more is the magic cutoff for Biden’s proposed 5% annual cap on rent increases. If it were ” real” legislation, and not a boondoggle, it would apply across the board.

Majority is the wrong word. But about one in every three home purchases by an investor feels like a majority when inventory is so low. PS 44% of all households in California are renters.

“44% of all households in California are renters”

A lot of that is multifamily, esp in the big cities. Apartment and condo towers are everywhere. And new ones are getting built all the time. Lots of condos in condo towers are rented out.

“Even now, the majority of new homes built are snapped up by investors, not owner-occupants.”

Currently the invesor class are net sellers of single family homes. They are putting downward pressure on prices.

Unlike homeowners, investors just want to find the clearing price – they’re not emotionally attached to the idea of the house being worth xyz dollars.

Recently my wife and I went looking at some condo’s in a recently created town. We wanted to spend less then $300k with a $200 or less monthly HOA. After talking to the RE agent I was told the model we were interested in started at $400k with an $800 monthly HOA.

She stated units were being snapped up by New Yorkers who found their prices to be a bargain. And these people from NY didn’t even live there (maybe for investment, maybe for retirement).

We thanked the RE agent and left the area.

LOL $800 monthly HOA…sounds like a cruel joke. It’s not difficult to imagine in a matter of couple of years, HOA will increase to $1k or more and it will also be increasing over time.

So much for the argument that once the house is paid off, I don’t have to pay anything other than property tax, insurance and maint. With HOA like this, it’s almost like a forever rent long after house paid off…

$800/mo HOA is almost as much as my mortgage payment, geez.

Funny, I heard a recent anecdote about NY money: raving about a 2-bed condo they’d bought for “ONLY” $5Million!

The HOA dues are probably insane. The property I work at is by sf. But the 5500 sf. Units pay over $8k/mo.

People must have a desperate need for the cash to refi their house up from around 4% to 7%. I know you probably can’t borrow that kind of cash anywhere else at anything approaching that rate, but still, putting your house at risk the need must be great. Or do they believe the rates will be down to around 4% again in a year or so? IDK.

It’s not like every owner refinanced when rates were low so it wouldn’t be unexpected for someone still holding a loan in a similar rate range or higher to do so. Especially if they were sitting on a variable rate mortgage.

Lots of divorces in 2020-2022. Sometimes you just have to.

If you have the equity to cash out refi, then you would just get a HELOC or a second mortgage for whatever cash you needed, so there would have to be some compelling reason to refi the entire balance.

Re: “ A 7% mortgage rate used to be a good deal. From 1970 through 2001, mortgage rates ranged from 7% to 18%. Relatively lower home prices made those higher mortgage rates work.”

Just for pushback sake — from my idiot perspective — there’s such a huge ongoing narrative about wage growth increases and cumulative resilience — basically an acceptance for Drunken Sailors to accept and normalize higher costs — for virtually everything on earth.

In this extremely weak argument, it seems like people should be accepting these delusional prices as the new reality and just party on with no qualms about reality — and homeowners should be adding higher profit margins to their windfalls.

If the economy is booming and GDP growth exploding, what’s holding back demand?

People should NOT accept too-high prices. That’s the whole point of a buyers strike. It worked with used vehicle, and prices plunged. If enough people do it with housing, for long enough, it will work as well in bringing prices down. But housing is slow-moving and price adjustments take years.

I’ve been on a buyer’s strike against Ferrari for about fifty years now and they still haven’t dropped those prices..

Seriously though, it’s exactly what you said. Don’t buy it if you can’t afford it. However, unlike beautiful Italian sports cars, people DO need a place to live. So the monthly rent has to be factored in. $24-36k a year in rent as you stay on strike, or paying $100k more than you know you should? Tough choice.

It will be interesting to see what the next spring selling season will be like. Couple of factors will come into play by then which might drive the FOMO back up again. By then, likely more rate cuts mania will be the sentiment, combine with what kind of new administration we will have. If drunken sailors still spending, who knows, rate drops to 5%, even if crapshacks still listed for $1M and over in SoCal, plenty of people with jobs will probably trip over themselves buying again…

I don’t have any faith in this buyer’s strike lasting unfortunately unless it’s force on to them like mass unemployment..etc. The moment rates will drop to a level where they can stretch to just make their mortgage, all bets are off. Also, I can see that happening before sellers wake up and realize they need to lower prices, especially in hubrislious markets like SoCal.

Housing prices are high. I have two adult children who have purchased homes in the past 12-18 months in very nice areas of Colorado and California. It is difficult to predict whether this will be a good investment, but they live in nice neighborhoods with very good schools (public and private).

You live your life, grow your careers, have children, and become a part of your community. I suspect if you stay for more than 6-8 years you have most of your investment- maybe a small percentage gain.

A house is really a home, and if you have a family with young children to raise, it’s that much more important to view a house as a home.

Even an old widower like me that lives in a small house looks at it as my home and a place to do whatever I want without hassles. My dog likes it here too!

Why are the masses so obsessed with houses as an investment? Rentals, OK, but your home?

Maybe this country has lost the family values it once had. I guess free money, and lots of it, makes that kind of thinking rise to the surface.

“Why are the masses so obsessed with houses as an investment? Rentals, OK, but your home?”

Good question, people are myopic and dare I say kind of illogical that way. My dad was the same way, constantly about bragging about how much his house is worth now compare to purchase price and how his friend’s house is a million here, a million there…such great investment.

In the meantime, all you have to do is ask them what’s your monthly cashflow or predictable ROI is, they look at you like a deer in the headlight and naturally retort but my house is so much more now in Zillow…see investment…

Very well said, Anthony. And if you scrimp and save and pay the house off you have some security and can retire without living on dollar store tuna. Even people who have decided to live in RVs pay hundreds of dollars per month for pad rentals, plus necessary utilities.

Raising a family and buying a home is a long tough slog. I have younger relatives who think the good life is an entitlement, and they are sweating right now, big time.

Wolf, your bottom diagram is missing the blue dots for the mortgage rates.

Thanks, fixed.

If the Federal Reserve cuts rates to the extent anticipated on the dot plot, Housing Bubble #3 will be ignited.

The average consumer isn’t going from being priced out to actively home shopping with a 0.25% or 0.5% drop in rates, but 1 to 2% and they’ll start flooding into the market.

Blackrock and other Wall St vulture capitalists will start scooping up homes even before that.

San Diego here and exactly your point was in the paper today. The percentage of commercial buyers is alarming, far outweighing the regular folk purchases. The powers that be are looking into legislative changes to curb this, I say a little too late. We also have a horrible STR problem. San Diego county boasting 12k plus units. No amount of building can build enough. We are now in many areas facing “extreme” infill which is creating chaos all around. Not enough resources and way too many people crammed into very small areas. It is an unmitigated disaster.

JD,

Sales volume in SD has collapsed from the volume in 2021 and 2019. Last year was one of the lowest years for sales in recent memory. In June, sales were down 9% from May and 1.9% from the collapsed levels last year. So people who need mortgages have pulled back massively. Investors are also buying less — and the biggest investors have turned into sellers. But there are mom and pop buyers out there, and there are some other cash buyers out there, including a few foreign cash buyers. So their SHARE may have risen of the collapsed overall volume, but their overall purchases are DOWN.

Supply in SD rose to 2.7 months in June, up from 2.4 months in May and up from 2.0 months in June last year. Rising supply, falling sales. Go figure.

All data from the California Association of Realtors today.

I would love to hear more about sales by large investors.

Jackson Y

Nope, the Federal Reserve doesn’t cut mortgage rates. It cuts short-term rates. Mortgage rates go with the 10-year yield but is 1.5 to 3 percentage points above it, and the 10-year yield is a function of inflation and inflation expectations, and also of supply and demand for this paper. If the Fed cuts, inflation might tick up again or resurge on top of the huge supply of new longer-term Treasury securities being issued that have to be absorbed by the market, and they need higher yields to be absorbed amid higher inflation expectations and higher actual inflation, and then mortgage rates might be a 8% after the Fed cuts to 4%, in which case the yield curve might finally uninvert and be normal again halleluiah.

Technically yes, but 10-year yields & mortgage rates tend to move in the same direction as the federal funds rate. Doesn’t seem to matter if the cuts are “insurance cuts” / please-Wall-Street cuts or for fighting actual recessions.

The 10-year yield dipped a lot in the 2019 rate cut cycle despite the absence of a recession – and this was before COVID.

Similarly this cycle, the 10-year yield peaked last year at just over 5% and has been trending lower as rate cuts appear to be approaching.

There are transmission mechanisms between short-term rates directly set by Fed and the long-term rates. Traditionally banks and other financial institutions absorb the term spread by borrowing short and lending long while trying to hedge/mitigate interest rate risk. That trade transmits short-term rate policy to long-term rates.

Also, to the extent that the Fed harmonizes their short-term rate policy and their QE/QT policy, then they do directly affect long-term rates when they become net buyers or net sellers of long-term debt securities. Just because it’s quantity-setting and not price-setting doesn’t make it a fundamentally different monetary policy.

That said, it is true that the Fed does not currently directly set long-term rates and that the market has a greater influence on long-term rates than on short-term rates. It’s also true that there can be divergences for several years where short-term rates and long-term rates don’t move exactly in tandem–for example, long-term rates can often move in the direction of an anticipated Fed policy change, then reverse or stop once the Fed policy change happens.

“Just because it’s quantity-setting and not price-setting doesn’t make it a fundamentally different monetary policy.”

100% this.

Back in the ‘old days’ (pre-QE), the Fed would add or remove Fed Funds from the system in order to affect the Fed Funds rate, which then affected other market rates indirectly.

Good thing those rate cuts won’t happen.

You miss the point that the Fed will only be cutting rates fast if the economy is in deep trouble, which means skyrocketing unemployment. Which is toxic for house prices, as debt deflation sets in.

The FED kept rates way too low from the end of 2020, while the government keeps spending like a drunken sailor, thats what drove the new housing bubble. Also, all the free cash given to people and businesses which helped their liquidity.

Wolf thanks for the great article. Top notch as always. Would love to see that blue line in the last refi chart.

Thanks, fixed.

Many “new builds” in my area have price reduction, and I’m assuming incentives are added in. How far can home prices of existing homes fall before these “home builders” are out of a job.

I doubt a frenzy of home buying is going to happen even with a 5% reduction in home prices or a 6% mortgage rate. Like wolf says it takes years for the housing market to show it’s hand. But I think the hand it has now is a full house. Lots of money in the pot, and sitting across the table is Powell with a seven-two off suit and very few options, but he does have a good poker face.

Cars and houses, the 2 biggest expenses. Houses are 44% of lifetime spending while cars are 14% of total lifetime spending. People move on average every 15 years and they buy on average 10 cars in their lifetime.

You can add another 11 thousand dollars for toilet paper…total…to keep your butt clean.

Builders, especially the big players, have a lot of levers to pull to stay in the market. It’ll take a pretty hefty hit to really shake them off. It’s also very common for them to adjust prices up and down 5% on listings to push them back to the top of the pile. I would take that with a grain of salt.

Re: “ From 1970 through 2001, mortgage rates ranged from 7% to 18%. Relatively lower home prices made those higher mortgage rates work.”

The median home price between 1970 and 2001 was $169,800 according to Fred and apparently the current total enchilada median price is $420,800.

When I sold my house, nothing seemed relative, it just seemed like generational once in a lifetime profit explosion.

I’m not arguing or criticizing — just pondering how out of whack prices are, and thus, relatively speaking, interest rates played no role in this pricing anomaly — but neither did wages or inflation — this was a bubble pricing phenomenon that has no fundamental basis in reality.

The entire pandemic economy had no basis in reality or fundamental valuations and I strongly believe the only path towards normalization will be through huge price declines.

Seems like the median home price is $100k overvalued.

Homes are hard assets rather than purely financial assets, thus closer to a safe haven like gold. Add to that the “all carrot, no stick” investor tax incentives tied to home ownership, and people couldn’t resist, especially at near zero financing. DSCR (aka liar) loans didn’t help the situation.

In my non-ceasing effort in nonsense, I was just looking again at Fred:

Median Sales Price of Houses Sold for the United States (MSPUS)

I arbitrarily took 30 years of median price milestones, looking at 10 year increments;

Between 1994 to 2004, there was about a $83,000 increase in median price.

Between 2004 to 2014, there was about a $21,000 increase in median price.

Between 2014 to 2024, there has been about an increase of $146,000 in median price.

Never giving up a chance to beat a dead horse, can’t resist looking at changes in median household income:

Between 1994 to 2004, household income increased $12,000.

Between 2004 to 2014, household income increased $10,000.

Between 2014 to 2022*, household income increased $20,000.

* Fred data mysteriously stops in 2022?

Bottom line, there’s a tsunami crapload of people whose incomes don’t compute with this housing bubble. Thank God I didn’t adjust for inflation.

You should do this in percentages and then it might make some sense.

The ‘flight to safety’ in the Dow is now in full swing!

1:04 PM 7/17/2024

Dow 41,198.08 243.60 0.59%

S&P 500 5,588.27 -78.93 -1.39%

Nasdaq 17,996.92 -512.42 -2.77%

VIX 14.48 1.29 9.78%

Gold 2,464.20 4.30 0.17%

Oil 83.19 0.34 0.41%

No flight to safety, rather an attempt to reignite the “Trump Trade.”

Phx-Ikki wondered about next Spring selling season: when Donald opens the spigots and hires a new Fed Chair, the flowers will be in full bloom!

MW: Tech selloff erases $1.1 trillion of ‘Magnificent Seven’ market cap in five days!!!

Barely a correction at these valuations.

Even after falling more than 10% today, AMD is still trading at 232 times earnings!!!

It looks like many of the homeowners doing cash out refi’s are going to be underwater once the housing bubble bursts and/or a recession hits.

It’s interesting how much home prices differ depending on where you live. In St. Louis, MO it’s still possible to buy a brand new 4 bedroom, 2.5 bath, 2779 square foot home for $342,990. Before anyone knocks St. Louis, I just want to point out that not all areas there are bad and there’s many very nice places to live in St. Louis and surrounding areas. Sure, it’s not as pretty as New England or the west coast, but there still are affordable areas to buy a home.

If you’re waiting on a correction, buckle up for a loooooong flat road ahead.

Bottom line: Nothing will change until the Sellers feel afraid.

And why would they? What’s to fear? Plenty of sellers don’t have mortgages, and the ones who do also have good income and cash on hand.

Didn’t get their asking price? Just take it down, and re-list it next month for even more!

Sellers have no fear.

Even if there was a correction, sellers believe Gov’t will bail them.

Whether rates drop doesn’t matter, so long as most homeowners believe they will drop, they will white-knuckle this ore cart right off the cliff.

The housing market seems to be correcting and in the early stages of a crash in Florida and Texas right now. Many sellers there are starting to panic and inventory is exploding. Not only that, Wolf’s charts (in other articles) show inventory going up all over the country, although not as fast as in Florida or Texas. But it won’t be long before this spreads to other areas.

We need a little fear at this point and much less irrational exuberance (lemmings).

2008-2012 was extreme fear where people were walking away from their primary homes because they were underwater. If they would have waited 6 years and enjoyed their houses, they would have been fine.

Instead, they panicked, sold at an extreme loss or just sent the keys to the bank. Lemmings.

According to Wolf’s charts, if you are buying a primary home for the long term (10-15 years) to live in and enjoy, you will do very well. If you are speculating and expect a massive yearly return. Be prepared for short term losses.

Removing speculation from the “Forever Home” market would be a great thing

Wolf, you mentioned that the potential cash out refi folks find they can’t wait longer for lower rates. I’m just a homeowner but from that part of the article, I get the sense that there is some pressure to do cash out refi even at upper 6 percent rates. You you have a comment on what that pressure might be coming from?

Always appreciate your articles and commentary, best around IMHO.