Services are huge, 62% of total PPI. We see parallels to early 2021, when this mess started. But core goods are well-behaved.

By Wolf Richter for WOLF STREET.

The Producer Price Index, which tracks the costs of goods and services that companies buy, dished up another nasty surprise today, but it wasn’t that much of a surprise, but the continuation of a trend of nasty surprises that started in January. It was in a benign downward trend for all of 2023, and it has been in an increasingly nasty uptrend for the past six months. And it’s all driven by services. Prices of core goods are well behaved.

The PPI tracks costs that companies will try to pass on to their customers – consumers, other businesses, and governments. And the part that they’re able to pass on to consumers filters into consumer price inflation. And what it shows is that inflation is now re-gaining momentum beneath the surface of consumer prices.

Because the heat is in services, and because services are huge and account for 62% of overall CPI, we’ll start with services.

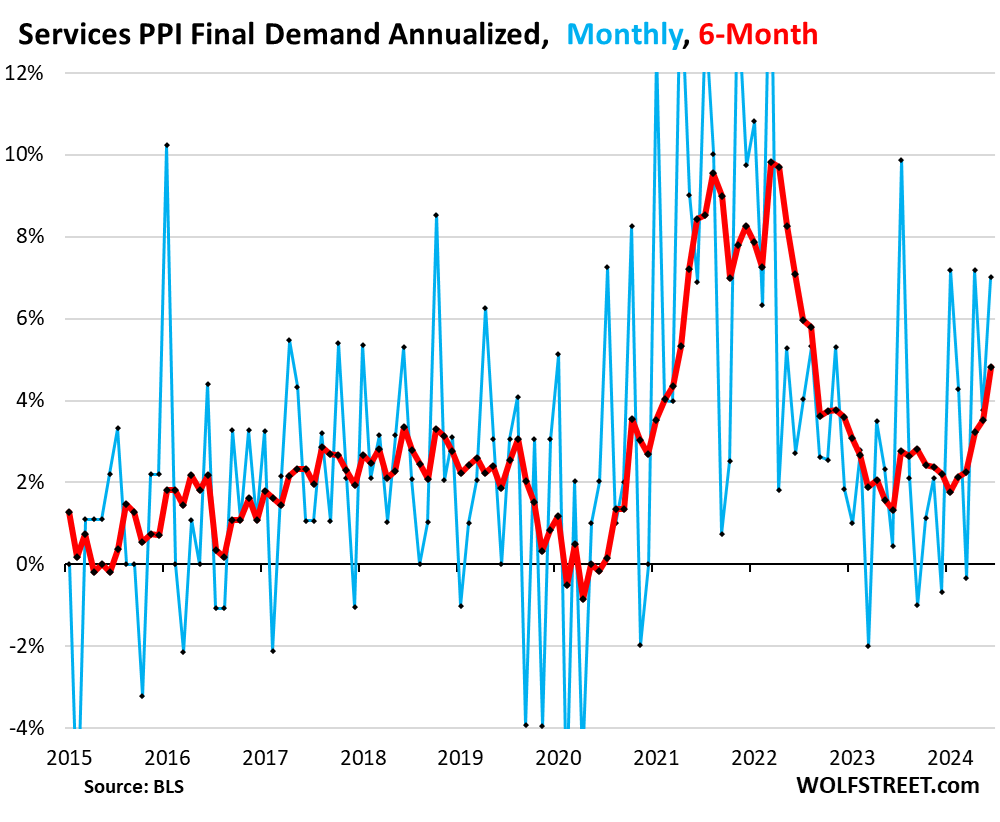

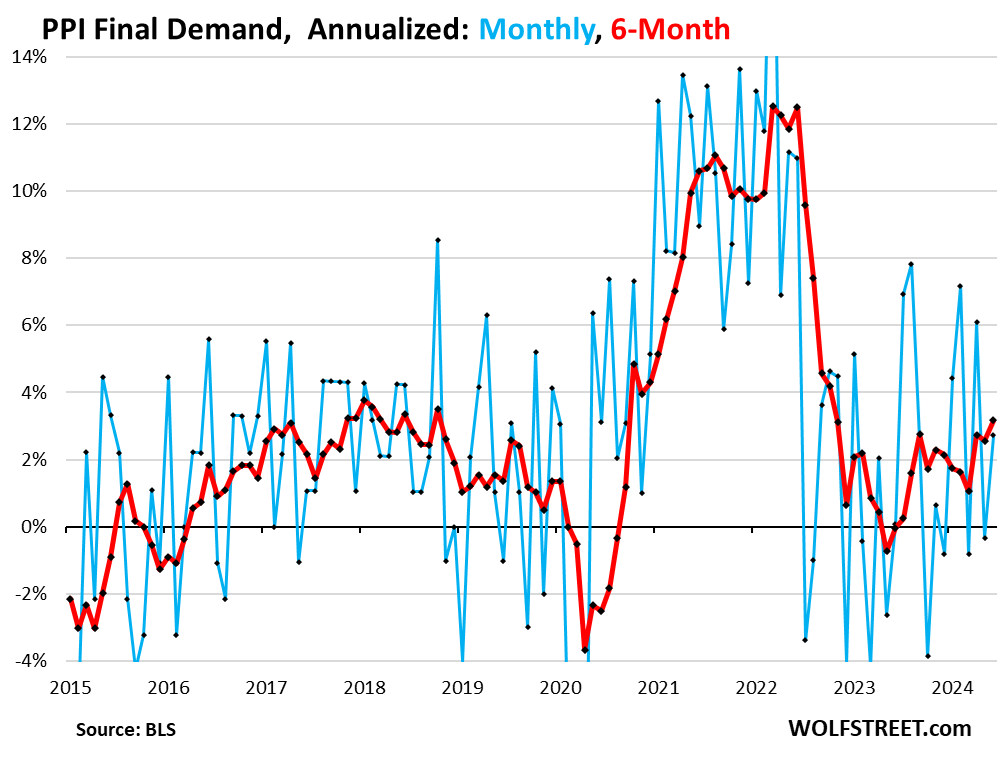

Services PPI spiked by 7.0% annualized in June from May, after the 3.8% jump in May, and the 7.2% spike in April, seasonally adjusted (blue in the chart below). These are services that producers use. And producers will try to pass those cost increases on to their customers.

The 3-month rate spiked by 6.0% annualized, the highest since May 2022 (not shown in the chart below).

The 6-month rate, which is slower in picking up the recent moves but irons out the whiplash volatility and shows the trends better, spiked by 4.8%, the highest since August 2022 (red). The 6-month rate has been increasing in a straight line since January, after hitting a low point in June 2023.

So here is a scary thought: March 2021. The six-month rate has now shot past where it had been in March 2021 (+4.3%), when consumer price inflation was still benign (CPI at +1.6% year-over-year but rising), though underlying pressures were building.

We were screaming about it in February and March 2021 because we saw the stunning price spikes in used vehicle auction prices and the big auto dealers bragging about their massive per-vehicle gross profits due to much higher selling prices, which made zero sense and shouldn’t be possible except in an environment where the inflationary mindset suddenly kicks in and inflation goes haywire. And it did. And the services PPI had warned about it months ahead of time. And now the services PPI is turning nasty again.

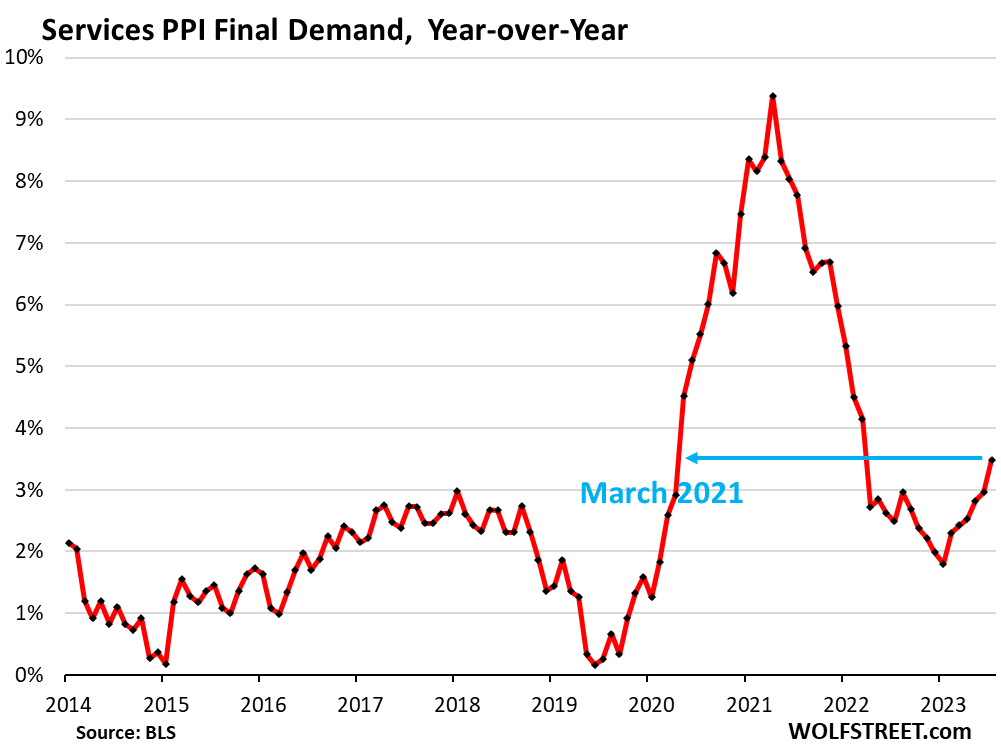

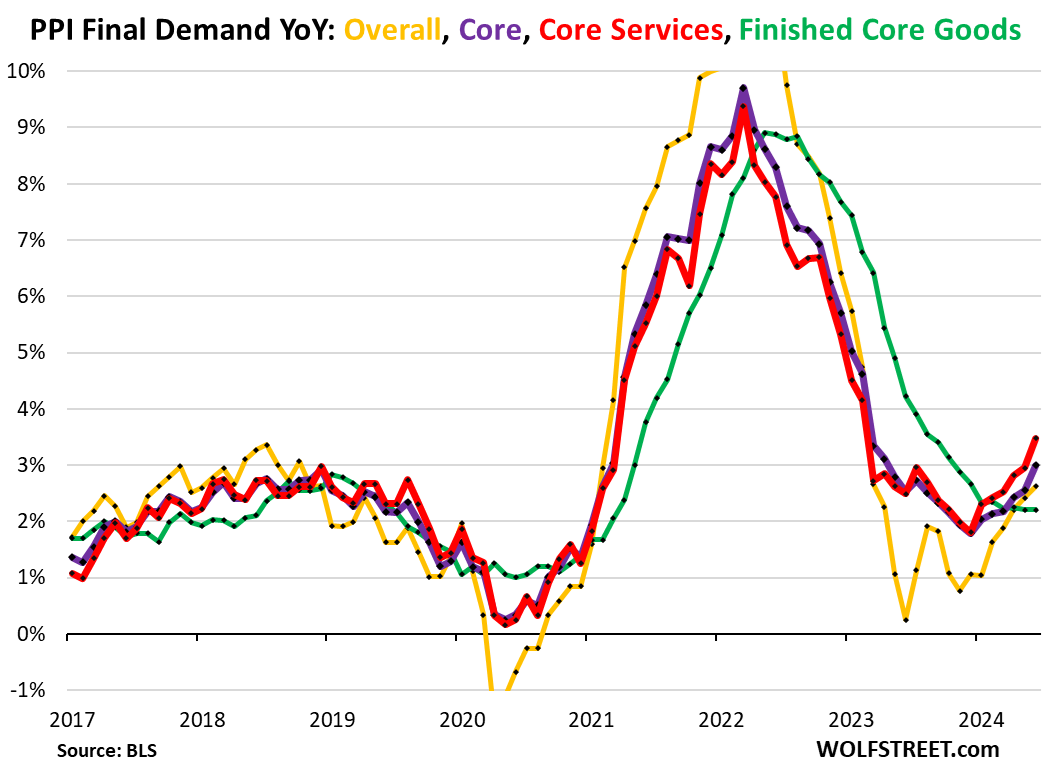

Year-over-year, the services PPI jumped by 3.5% in June, the worst since February 2023, and up from 3.0% in May. It has been heading higher every month since December, which is now visible at the bottom of the U-turn. It’s now ahead of where it had been on the way up in March 2021 when all this started.

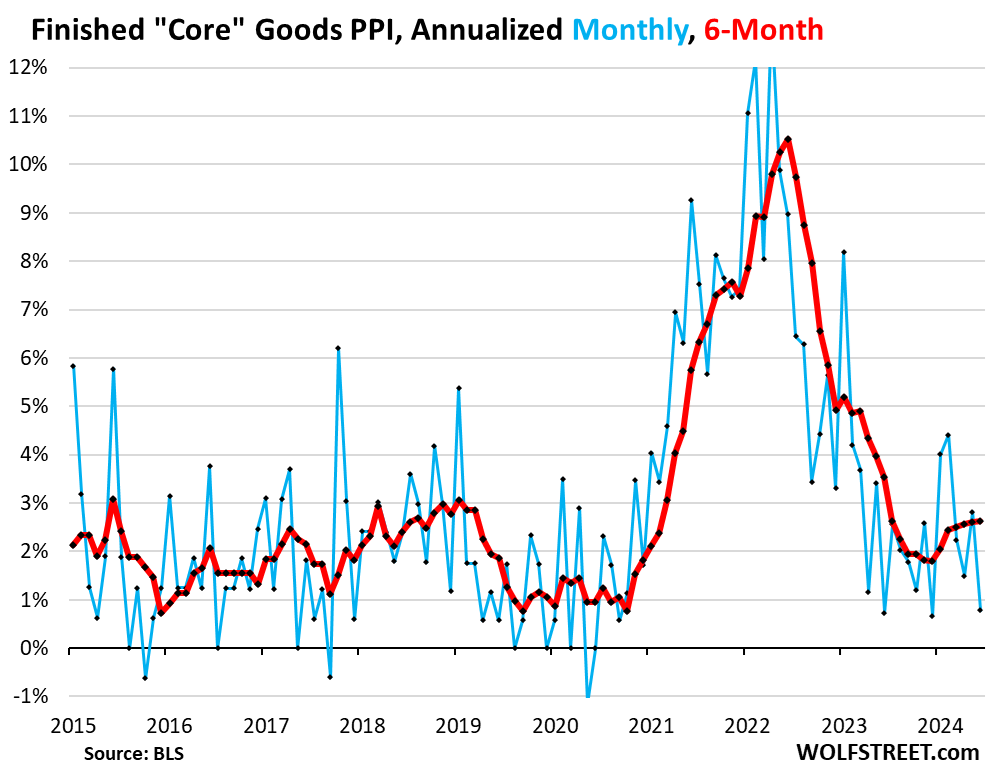

“Finished core goods” PPI is well-behaved. In the consumer price indices, many goods prices have fallen since mid-2022, and the CPI yesterday documented the steepest year-over-year drop in durable goods prices in over 20 years. Inflation is no longer in goods.

The PPI for “finished core goods” includes finished goods that companies buy except foods and energy. Prices have continued to rise, but at a slow pace.

In June, the finished core goods PPI rose by 0.8% annualized. The six-month rate, in June at 2.6% annualized, has been roughly unchanged for the fourth month in a row. There are no major inflation pressures building up in core goods at this point:

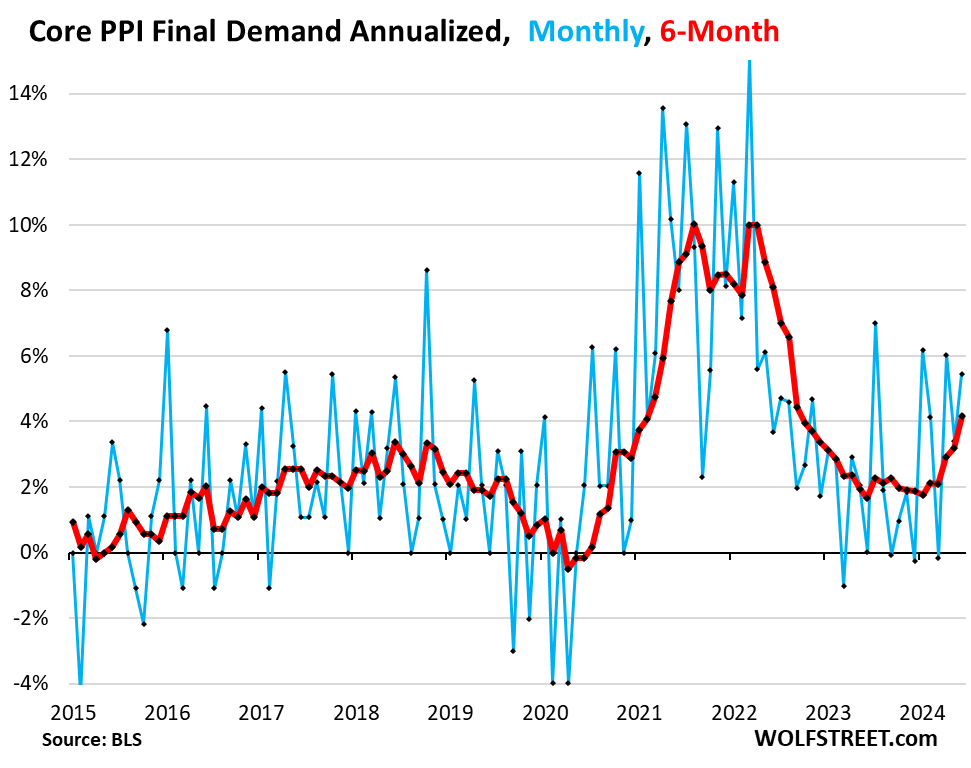

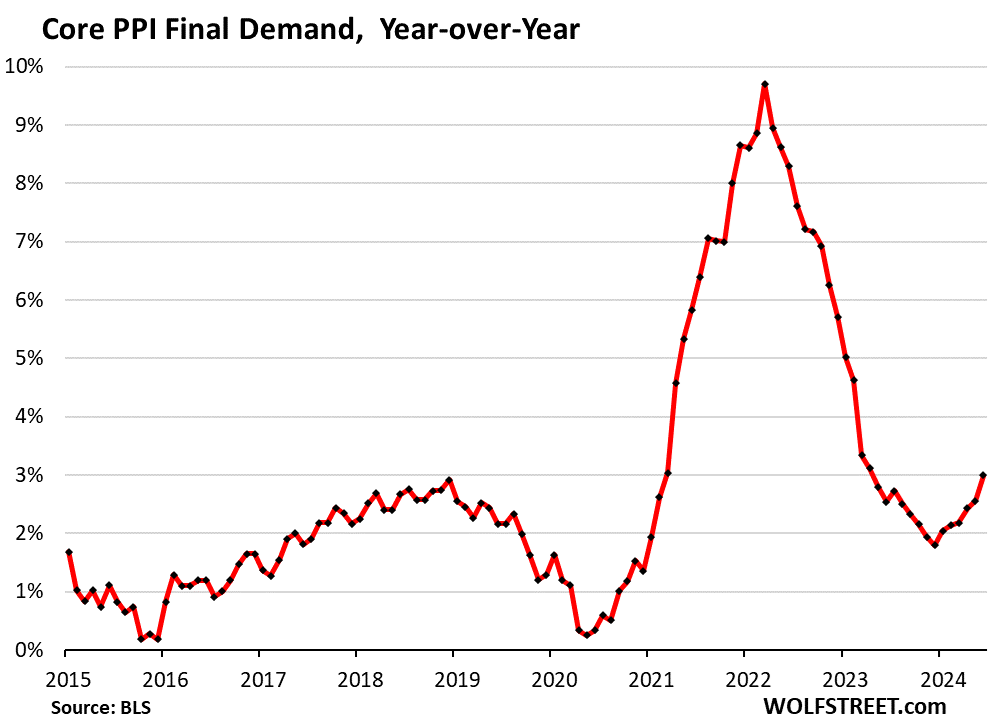

“Core” PPI spiked by 5.5% annualized in June from May, seasonally adjusted, after the 3.4% increase in May and the 6.0% increase in April, driven by the spike in services (blue in the chart below). Services dominate the core PPI, which excludes the food and energy components.

The 3-month core PPI spiked by 5.0%, the worst since June 2022 (not shown in the chart below).

The 6-month rate, which lags more but smoothens out the month-to-month squiggles and shows the trends better, spiked by 4.2%, the highest since September 2022. After spending much of 2023 super-well-behaved near the 2% line, the 6-month rate started taking off in February (red).

Year-over-year, core PPI increased by 3.0%, the worst since April 2023. It has been accelerating every month this year, with the bottom of the U-turn in December.

But the low month-to-month readings from August through December 2023 are still holding it down. As the index moves deeper into the second half of 2024, these low readings last year will fall out of the 12-month calculation.

The overall PPI jumped by 2.6% annualized in June from May, the highest since March 2023. The 6-month rate rose to 3.2%, the highest since October 2022.

Year-over-year, overall PPI rose by 2.6%, the highest since March 2023. Below are the year-over-year readings of overall PPI (yellow), core PPI (purple), services PPI (red), and finished core goods PPI (green). You can see the U-turn, driven by services (red), while the finished core goods PPI is well-behaved:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Let’s hope this tempers the clamor for rate reduction in September.

If they were going to cut it would happen before the fall.

I doubt the Fed wants to put itself in the election spotlight.

I think it would take a significant development to cut or raise

rates.

Treasury yields have already moved down quite a bit recently in anticipation of incoming cuts. The market is definitely anticipating some cuts relatively soon.

They are getting the effects they want by psychological manipulation. The FED gets to pump the stock market and keep asset prices high without actually returning to post great recession era and staged pandemic era ridiculously low interest rates. They also also get to keep their interest costs on the government debt (treasuries) from being what should logically be much higher without having to actually lower the interest rates and risking a faster collapse of the system due to people losing faith en mass much more rapidly and simultaneously through hyperinflation. How have people have not figured this out or why I have yet to see any comments or discussion of this painfully obvious activities is what really amazes me. I guess I should never underestimate the ability of those with brains who run this circus to be able to trick the masses. The FED is taking people for a ride and people can’t see it because they can’t deconstruct their strategies.

They are doing very well from their perspective because of the money to be made from the spread in costs and valuations.

It was the same for the pandemic. It was very profitable because there was guaranteed to be a spread in time between when the government got all the companies to increase their prices at once, in concert, compared to when those same companies had to actually start increasing the wages and salaries of their own workers. It was a minimum of two years of difference (spread). Higher prices but same wages means big profits for companies.

I say they got the companies to increase prices simultaneously as if I’m a conspiracy nutcase, but observation showed during the first portion of the pandemic that companies were hesitant to raise prices due to true basic fundamental economics that many people learn in high school which is if a company is the first to raise their prices and others haven’t yet, they will lose a lot of business and will be singled out for hate by the public. Instead, the government told all the companies through massive amounts of news articles from their state news companies that inflation is hear, before it actually was in the form of higher prices, and it prepared people psychologically to accept it because it was everywhere and it also got the message out to smaller and medium sized businesses that it will be okay for them to charge more because all the other businesses are doing it or will be doing it more. The interest thing to observe was how, even with the massive money giveaways and government spending, prices didn’t go up until the government nudged and pushed for it with their operational media affiliates due to the interesting locking effects of price comparisons and consumer aversions and company worries.

These things are being done because the US government debt is not logically justifiable. A lot of what is going on is management of this debt rather than trying to solve the problems or causes of such a debt. I believe the FED and high level bankers know that this debt is not financially sound and is a house of cards and cannot be dealt with so their real strategy to keep it from collapsing like a house of cards is to manage the debt with trickery than with logic. One way you see this is by them getting away with paying less in the treasuries, especially the longer term treasuries, than what they should be saying. They get to have their cake and it it too. The banks get their money and the federal reserve doesn’t have to pay as much money on the debt as they logically should be paying. The IRS and states gets to rake in huge and growing amounts taxes while avoiding paying higher interest on their own debts. It’s a clear and crafty strategy and people are being had. People are saying too much about how things should be and not asking about why things are actually what it is. The treasury rates is one of the best indicators of this activity, along with gold.

Cupcake:

How else do you expect the private sector folks to pay the ”campaign contributions” to the GUV MINT politicians if they are not able to raise prices to make more ”profits”???

Been going on for a long time, far damn shore.

In one form or another: ”totally ignoring obligations certified by written and sworn [[ treaties]] anyone???

IOW, the way to tell when ANY politician is lying is when their lips are moving and sounds are coming out,,, eh? LOL

Wait a minute…

The short-term yields that would be actually impacted by a rate cut in their maturity time-frame have NOT come down, not one bit. The 2-month yield is 5.52%, the 3-month is at 5.43%, the 4-month is at 5.41%. So the market that actually is impacted by rate cuts is not figuring in ANY rate cuts over the next 3-4 months.

The 6-month has come down 14 basis points, to 5.23%, showing that the market thinks that there is SOME possibility of 1 rate cut in 4-6 months from now.

The 1-year yield (4.87%) indicates that the market sees a possibility of 2-3 cuts over the next 12 months.

Longer-term yields, such as the 10-year yield, are not impacted by rate cuts but by inflation expectations and risk-seeking.

“Longer-term yields, such as the 10-year yield, are not impacted by rate cuts but by inflation expectations and risk-seeking.”

So, wolf, you don’t take in consideration at all the term premium, and you consider the fixed income market totally distacated from the overnight market??!! If the 6 month rate decreases due to rate cuts, the 10 year yield shouldn’t move, because it is impacted only by inflation expectations??!! Wolf, just check what happend with the 10 year yield after Powell mentioned back in December that they would had cut the rates this year, before doing these comments. It’s all about the promised rate cuts thats why the 10 year yield decreased and the stock market was hyped.

If the Fed cuts or raises anytime between now and November it will look political. They will stay put on rates and continue QT.

If cuts are warranted, it’s also political if they don’t.

When will it start showing in the CPI Wolf ?

It took a few months last time.

The Consumer Price Index is not an exact science, like much of economics in general.

There is a certain amount of guesstimation based on incomplete data that goes into it. Although it’s better now than it used to be.

How funny…WS already partying like it’s 1999 and we already got our 3 rates cuts today…gotta love the market. saw a headline that WS is riding that rate cuts wave….surfs up and cowabunga dudes…wave all the way to the moon it is..

There will be a lot of disappointing faces and hang over from hopium if Pow Pow fail to deliver by Sept..I’ll pay a dollar to see that..

There will be no change whatsoever to the Federal Funds Rate prior to the election in 2024 by the Federal Reserve for many reasons.

I think the Fed, as they’ve done in the past, is shifting towards looking more at the unemployment rate than CPI. If it ticks up to 4.3% in August going into the mid Sept FMOC meeting, then I think they cut 25-BP. Even 4.2% might do it for them. If they believe the data shows the economy is slowing, then they’ll look more at the unemployment rate as an indicator of when to cut than CPI.

Agree with you GW, for both political reasons and historical reasons — both of which might become hysterical reasons for some folks.

Several times in the last 70 or so years, it certainly appeared that the FRB was either being played, or playing along to achieve a political result…

Wolf, as usual, is certainly more able to bring that sort of history to us than I am,,, as, at this point in time, it appears my formerly chronic CRS is now approaching certifiable CRFS, the f being ”familiar”,, at least in polite company.

Well said- I think so too. Powell doesn’t want to tighten too long and have a 1982 situation all over again with unemployment of 10%+

Obviously when you add possibly 10 million + people to our labor force in a 3 year time period, Unemployment is going to start ticking up. However, at the sametime they need Food, housing, Healthcare, clothing etc, which increases supply and demand! I think we maybe looking at Stagflation in the next 12 months myself.

I’m no economist, but I have been saying “stagflation” for a couple years. We haven’t (fully?) gotten there… yet. According to the “official” numbers, everything is going great!

I am curious about the next JOLTS, coming out concurrent to the next FOMC. A recent interview I heard mentioned that the bulk of the “200k/ month job growth,” is in part-time/ second job holders.

The official numbers have an ability to hide the (perceived) bifurcation of our economy, that has been markedly growing over time and seemingly accelerated in recent years.

The consumer seems exhausted. The beast system is hungry for growth (real, artificial, whatever) at any cost/ thereby terrified by any contraction in ANYTHING.

It will be interesting to see where the extra input costs go: Inflation Or shrinking margins.

Stagflation is the wall that shrinks the margins? Then what? Unemployment, bankruptcy, foreclosure upticks? OR:

THIS TIME IS DIFFERENT! (Call it a soft landing!)

Treasury bond yields have come down quite a bit in the past few days. The market at least says there’s nothing to worry about here.

There is a wage/shelter-cost spiral that everyone continues to pretend does not exist, despite wage statistics showing a slowing.

It’s just people getting lazier, the growth of labor unions, and monopoly price practices.

NONSENSE. Even though there was growth in union membership, up by 139,000 the share of the labor force covered by unions continued its decline from 10.1% to 10.0%.

An inflationary mindset prevails because of the Fed’s helicoptering and practice of doing “whatever it takes” to avoid recession.

If the population thought financial issues were important, would government (Republicans AND Democrats) be able to run consistently high fiscal deficits? Would the savings rate be down to 3%? Would Roaring Kitty be a well-known brand? Would auto and home prices be so high?

These are indisputable consequences of Federal Reserve QE and rate repression policy, which intentionally reduced the value of savings and work, in favor of debt and speculation. Plus, whenever recession threatens, the Fed steps in with massive monetary and rate stimulus. It has zero tolerance for recession.

In my view, they’ll have a credibility problem until they do what it takes to tackle inflation. With the inflation fight dragging on unnecessarily, Wall Street sees the weakness. Stocks are exploding to new highs.

Long-term bondholders will be like sheep heading to slaughter after that final shearing.

also regardless of what they say about wealth inequality and housing unaffordability, i think the central bankers love high stock and other asset prices. they love supporting the rich worldwide.

So, if the PPI for final goods is 2.6% and the CPI for goods is negative, doesn’t that reflect a margin squeeze for the companies? Also, if the energy price keep heading upward, what does that mean for the final goods PPI, will it head above 3%? Service PPI reflects the current conditions in the labor market, that wall street and FED likes to picture as cooling and normalizing. We are entering the 70s environment, and this time there is no continent with unexploited labor market.

Re: “ So here is a scary thought: March 2021. The six-month rate has now shot past where it had been in March 2021 (+4.3%), when consumer price inflation was still benign (CPI at +1.6% year-over-year but rising), though underlying pressures were building.”

Just as additional perspective:

March 2021 unemployment rate was at 6% — 8 months later, it would be at 4.1%, where we are now.

Obviously, Fed fund rate was 0.07%, and in April, Powell said, “ while inflation has risen, Fed policymakers ascribed the increase to temporary factors”.

Meanwhile: “ Monthly GDP rose 2.6% in March, more than reversing a 1.4% decline in February. The increase in March was mostly accounted for by a sharp rise in personal consumption expenditures…”

If PPI leads towards higher CPI, then unemployment kicks higher, then lower GDP is on the other side of the Fed rate cuts and election imo

“then unemployment kicks higher,”

The opposite happened in early 2021, unemployment ticked lower, as you said just now. So if you’re going to do a parallel, do a parallel.

Unemployment will kick lower, and that’s the issue. Higher wage inflation, means higher service inflation. Basically we are at the maximum short-term supplies capacities. The gov and FED is trying to fuel further the economic growth(or avoiding that the aggregate demand breaks) through huge stimulus, but the issue is that the supply is constraint, so the stimulus ends up in fueling inflation, price increase and not increase in product volume. So, the economy is in Checkmate, nomatter what the FED does, there is no escape from this situation.

This is all great info that’s hard to find anywhere else, but does any of this matter? If the fed believes that it’s “mission accomplished” so to speak, then they’re just going to cut rates and do whatever else they want to do anyways.

Either way it’s good to see the data, but where does it get us?

Is the PPI being, or will be, influenced by the $800 million and rising federal interest payments which are forecast to approach 3.5% of GDP? These levels are awfully uncommon.

Wolf,

I believe I have read that there is a part of the PPI that goes into the PCE inflation index.

True?

And if so,how did that component do in this months report?

Yes, such as a portion of the financial services (mutual fund fees, etc.), the health insurance index, and maybe some others. These are super-volatile sub-indices whose month-to-month numbers spike and plunge by massive amounts constantly, so they might push month-over-month core PCE readings up or down, so that instead of +0.1% core PCE, we might get +0.2%, or the other way around. But they have minuscule impact on the year-over-year numbers where the month-to-month volatility cancels out. They were down this month, so it would seem they might reduce core PCE by a little, compared to core CPI. but the math doesn’t always pan out because there are other differences.

In terms of the impact on PCE, is the idea that these high services PPI numbers will eventually filter through to higher core CPI components which will then impact core PCE more directly?

The high services PPI numbers include things like repair and maintenance of production machinery or software — services for the producer that manufactures and sells some goods. So, high services PPI readings can end up both in CPI services and in CPI goods, if they get passed on.

But the issue that TrBond was asking about is a different one. It’s that some sub-indices of PPI are included in the PCE price index basket which is broader than the CPI basket and includes things that CPI does not include.

I, as well as just about everybody else, must look at the government inflation numbers and wonder how it is possible to talk about inflation and not include food and fuels in those numbers. I spend more each month on food and gasoline than I do on services, excluding rent. Milk is $3.99 a half gallon and I just saw, and didn’t buy, a pint of Häagen-Dazs ice cream at Raley’s for $8.99. If it weren’t for Grocery Outlet, Winco, and Food-Mart type stores, many people could not afford to eat. I know food and energy are said to be excluded from the CPI because they are too volatile. Hello, that’s even more reason to include them! The gaming of the CPI is so obvious. It would be nice if Congress mandated the CPI figures came from a list of items most people buy each month, and that would obviously include food and gasoline or diesel.

“how it is possible to talk about inflation and not include food and fuels in those numbers.”

What kind of @#%$&*>~!Ö¡ is this!???!

FOOD AND ENERGY ARE INCLUDED. RTGDFA.

They’re only not included in the “CORE” numbers. That’s a subsegment. Like “services” is a subsegment. And “durable goods” is a subsegment.

The yellow line in the last chart, and the numbers associated with it — “the Overall PPI” — reflect all items including foods and energy. The reason why “CORE” measures exclude them is because prices in foods and energy can move with the vast swings of commodities, up and down, and to see “underlying inflation,” we look beyond food and energy.

But I’m wasting my time since you never read anything here anyway. If you had read any of my inflation articles, you would have known this.

In my CPI article yesterday, I even highlighted food and energy separately with with their own charts and tables so you can see by how much they have jumped or not. RTGDFA

Wolf, based on the figure showing Goods and Services PPI, it appears that Services PPI YoY has a higher amplitude and is a leading indicator for Goods PPI. As Services PPI decreases, Goods PPI decreases within a couple months. Is Services PPI generally considered a leading indicator? If yes, why might that be as opposed to the other way around?

Thanks as always.

Re: “The Producer Price Index, which tracks the costs of goods and services that companies buy, dished up another nasty surprise today“

“…an increasingly nasty uptrend for the past six months”

The really strange thing about this inflation trend, is the downward trend in S&P 500 earnings yield. Maybe this is partially due to the index price spiking, but the earnings yield on the index has been headed lower and lower for a long time. This year the index yield is down 15.9%. Lows of this level are only seen in recession depths.

S&P 500 Earnings Yield : 3.427% (As of 2024-07-11)

Semi related is the average monthly yield on government debt, currently at about 3.27%, up from 3,2% in February.

So, “PPI can be a good pre-indicator of inflation, because it measures the costs to produce consumer goods.”

Thank God Wolf is here, because it’s confusing that corporate earnings are declining (in general) as PPI has been rising for 6 months — it almost seems like corporate margins are getting crushed by inflation. Furthermore, the only way to protect margin is to pass on inflation to consumers.

I can’t help but ponder the concept that a lot of companies are currently complaining about nonperformance at lots of retail stores, where consumers are not spending. That story is expanding from Walgreens to hooters to Walmart, etc.

It seems the decline in earnings problems feeds directly into sticky inflation and higher unemployment— which might just really screw up the 80% odds of a September rate cut.

Higher inflation and higher unemployment with decreasing earnings is starting to smell like stagflation and not a soft landing.

Instead of googling around until you find something you don’t understand but drag into here, you should read the articles here, including this:

https://wolfstreet.com/2024/06/27/corporate-profits-by-major-industry-q1-update-greedflation-hits-ceiling-in-some-industries-but-still-thrives-in-others/

Which includes lots of charts about business profits — all businesses not just S&P 500 companies — including these two:

Corporate profits in financial domestic Industries: Profits in the financial sector spiked by 11.7% in Q1 from Q4, to a seasonally adjusted annual rate of $758 billion, more than undoing the profit declines in the prior three quarters. Year-over-year, profits rose by 5.7%. Over the two years since Q1 2022, profits spiked by 58%!

I RTGDFA and have one observation to toss in trash can.

The spike in profits around 2022 reminds me of the SVB story, where various banks tripped over each other because they didn’t know what to do with their massive stimulus windfall — in this case, instead of betting on low yielding treasuries, we have lots of bets going into ai — where eventually, I think there’s going to be a duration mismatch ( of sorts) as those investments turn sour.

I appreciate the painful lessons today!

Redundant

The earnings yield of S&P 500 is decreasing because of the huge market hyped since November. The earnings of S&P 500 have increased but nowhere near the huge increase of the index. Q1 earning increased by 4.1% compared with the previuos quarter, while the index price has skyrocketed over the same period, that’s why the earnings yield has decreased. Also, if you consider that the treasure 10 year yield is at 4.2%, and treasure notes are by themselves overvalued if consider the current level of inflation, which is at around 3%, which implies a 1.2% real yield at maximum, when you have TIPS at 1.95%, and also consider in the overall picture the trend of PPI and as consequence of CPI and PCE after, then here you have a full picture of the current unrational state of the market. It’s just a mater of time, and we will have 10y yield at 5% again, IG yield above 6.5% (considering a 150bps spread which still very conservative level considering the situation), and then S&P 500 earnings yield will have to adjust at leveld of at least 6%(which is still a -50bps spread compared to IG yield), and considering the trend of earnings growth, well the correction will have to come from valuations. We are going full speed toward a Black Monday situation.

…in the land of pennies, the man with a dollar is king (but the non-monetized, planetary life-support problems is still the steamroller looming over all…).

may we all find a better day.

The September FOMC will be on the 17th and 18th of September.

Between now and then we get:

June PCE on 7/26

July CPI on 8/14

July PPI on 8/13

July PCE on 8/30

August CPI on 9/11

August PPI on 9/12

That’s a lot of data points coming at everyone between now and the September FOMC.

Yeah Wolfman, the producers have to streamline operations and manufacturing.

Time to revisit the 1990s business psyche of quality management such as Total Quality Management, or whatever else they called it (Total Production Management, Toyota Production System, Six Sigma, etc ?).

This may mean layoffs and forcing workers to do more with the same (not “doing more with less”).

I’ve seen more news reports of layoffs such as with Intuit, John Deere, and CNN.

I hope they don’t pass on the increase in PPI to the consumers enough to see a reversal in the downward trends with Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE).

PCE has remained at or below 3% since October 2023.

“I’ve seen more news reports of layoffs such as with Intuit, John Deere, and CNN.”

The Intuit layoffs aren’t about cost cutting: What Intuit announced is that it will lay off 1,800 people in its existing divisions and focus on AI and HIRE 1,800 people for its AI effort. So the net change in employment is zero, but there is a big shift toward employment in its AI effort, and these are likely more expensive people than those getting laid off, and in that case, Intuit’s payroll expenses would rise on net. I pay attention to this because Intuit bought Mailchimp, a service that I use for my email updates, and not long after that, Mailchimp started urging me to have its AI write the headlines, etc., for an additional fee. I hate it when big companies buy the smaller companies that I do business with.

Intuit is not holding back on price increases for their software. My QuickBooks renewal coming up will be $100 more that last year after last year doubling from the year before.

Correct! And Mailchimp raised its prices too, by a lot. Inflation is in services!

Great article. I like the point that inflation in services is a big part of the PPI, it is good to know the current state of what makes up PPI. Was it after WWII or after the Vietnam War that America moved to a more service based economy? Less industrial. Too much coddling of the kids and college degrees and mom Dad told their kids they didn’t have to have mundane factory jobs.

Hopefully Fed chief Powell will take the rise in inflation of services and future rise in services into account in his September FOMC meeting. I’m not sure if he looks at PPI though as much as CPI because the main stream media doesn’t print about PPI as much.

What it seems like to me is insurance rates are catching up to inflation, and that in turn is showing up in the PPI. The other thing that is possible is as debt comes due and these producers have to refinance debt they are pushing off the higher rates as long as the market seems able to handle it. I don’t think we’re going to see the CPI show any meaningful increases as everything finally settles out here.

Mailchimp started urging me to have its AI write the headlines, etc., for an additional fee.

Heck Wolf your headlines are amazing. These chimps ought to pay you to write some of their stuff.

Cheeze

Inflation is being sustained at the current rate structure, controlled by a Federal Reserve that has gone far beyond it’s mandate.

Come November, we will find out.

” Because the heat is in services, and because services are huge and account for 62% of overall CPI, we’ll start with services.

Services PPI spiked by 7.0% annualized in June from May, after the 3.8% jump in May, and the 7.2% spike in April, seasonally adjusted (blue in the chart below). These are services that producers use. And producers will try to pass those cost increases on to their customers.”

Which is consistent with my fuzzy POV that inflation is the monetary po0licy.

Calamity is always the precursor of innovation.

As I grow old I am aware of the hazards of the environment into which I have been thrung, unwillingily.

Finally realizing that it’s only love can make you whole. There’s nothing else.