Lagarde frets over surging labor costs feeding into services inflation.

By Wolf Richter for WOLF STREET.

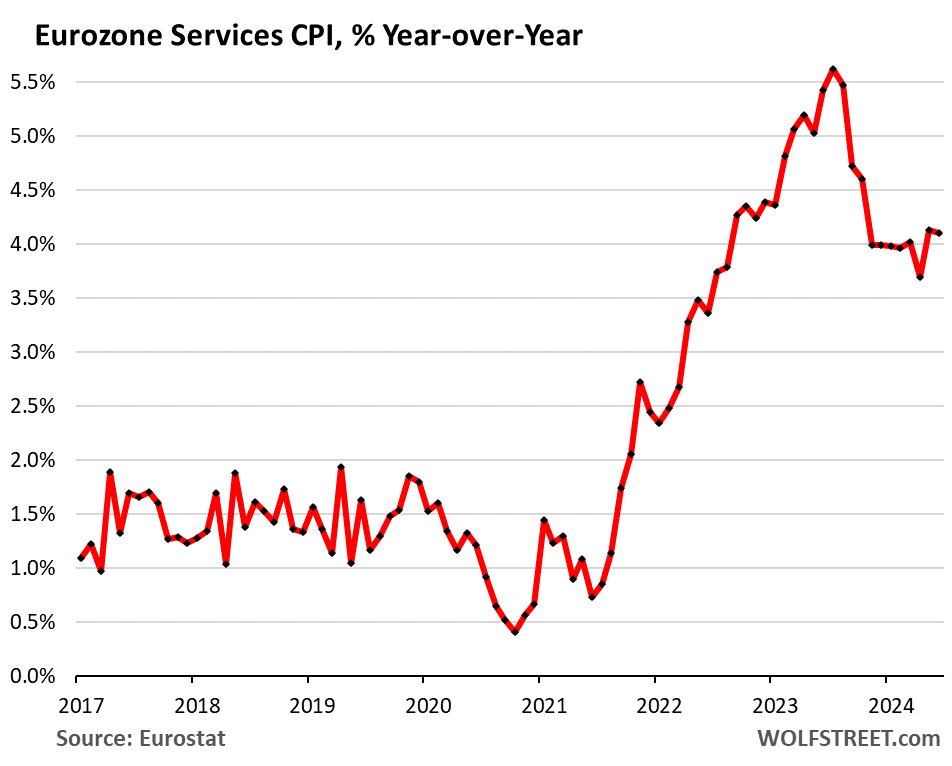

In the 20 countries that use the euro, inflation in services increased again by 4.1%, same increase as in May – and both were the highest since October. The service CPI has gotten stuck at around 4% year-over-year for the eighth month in a row, after coming down substantially to that point.

On a month-to-month basis, services CPI jumped by 7.4% annualized and has been in that range and higher over the past five months. These super-volatile and highly seasonal month-to-month readings tend to be red-hot in the first half of the year and then fall later in the year.

What we can see, however, is that these month-to-month increases have been running slightly hotter over the first half this year than a year ago, indicating that the 4%-plus range for services inflation appears to be baked into the economic cake now.

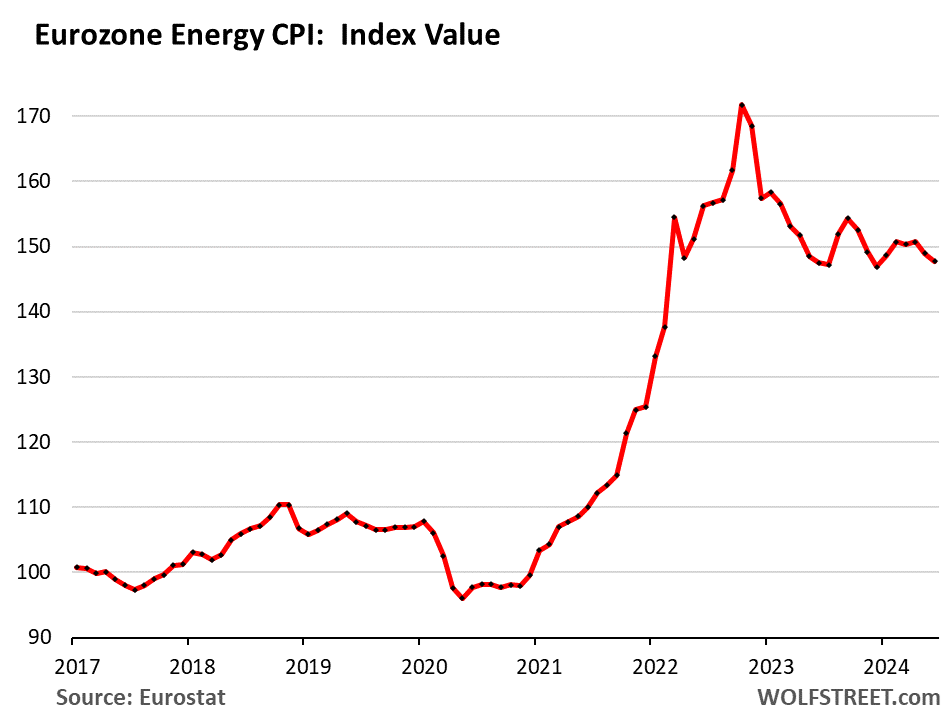

Energy prices (gasoline, diesel, natural gas, electricity, etc.) have dropped sharply from their sky-high levels in 2022 and have leveled out on a year-over-year basis. But they remain high. This chart shows the price level of the energy index, not the year-over-year change:

Prices of durable goods have also dropped from the peak. Food prices, after the spike, have not come down but have slowed their increases to less then 2% year-over-year. And these dynamics are playing out in other major economies, including in the US. The problem is still inflation in services, and that’s where consumers spend the majority of their money.

Many services are essential to modern life, such as housing and related services, healthcare, insurance, broadband and telecommunications, auto repairs, transportation, etc. Inflation is notoriously hard to eradicate from services.

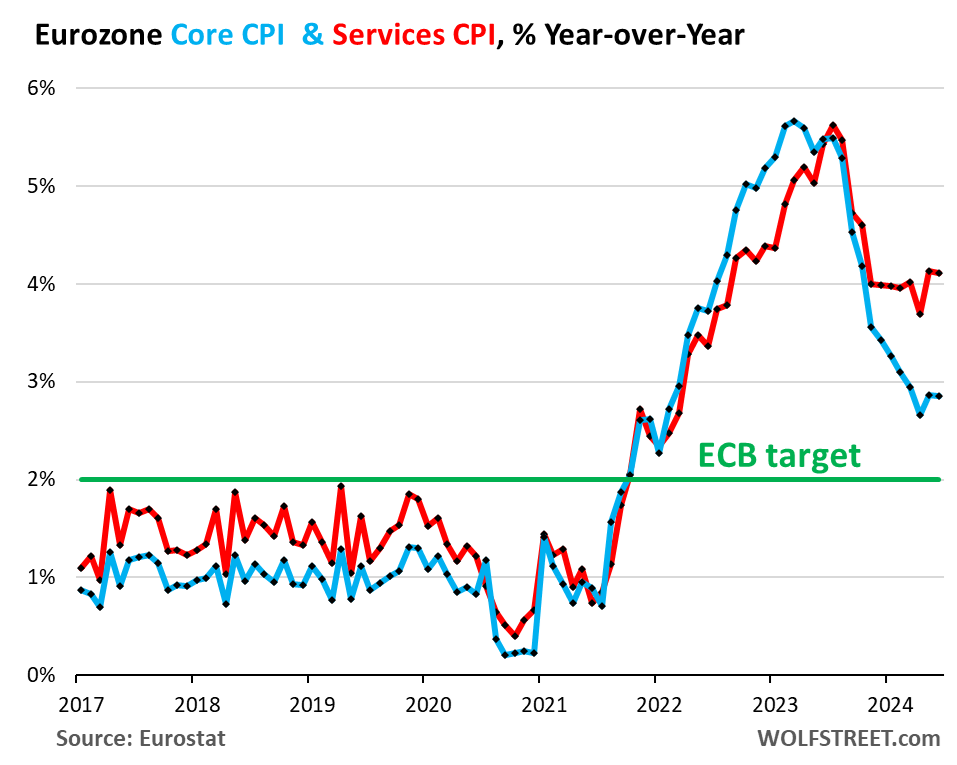

Core CPI – which excludes food, energy, and tobacco products – rose by 2.9% in June, same as in May, and up from April (2.7%). This is the measure that the ECB uses for its inflation target of 2%. The drop in goods prices pushed down core CPI while the 4.1% services CPI pushed it up.

The chart below shows both core CPI (blue) and services CPI (red), along with the ECB’s target (green) because…

There will come a time when the sharp decline in goods prices will end, and then goods prices will no longer have the same downward force in core CPI that they’re now having, which would cause the classic relationship between core CPI and services CPI to reappear, where core CPI is only slightly lower than services CPI. If services CPI is then still at around 4%, core CPI will be at 3.5%-plus.

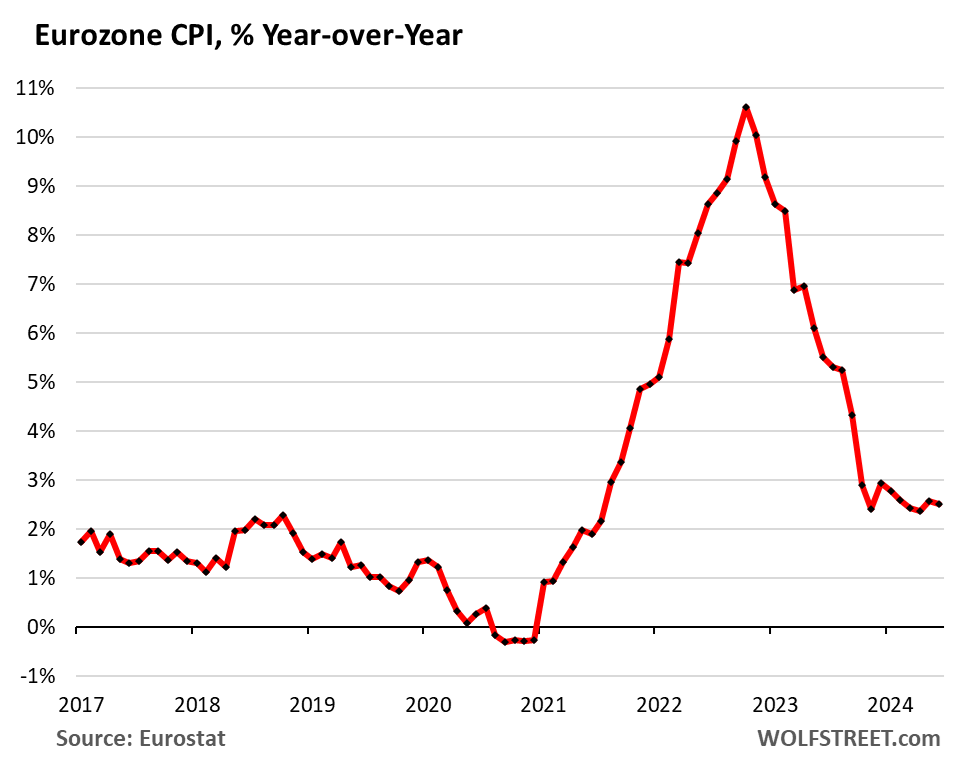

Overall CPI has been rising essentially at around 2.5% year-over-year since November, with the energy price drops having leveled off recently, with durable goods prices falling more steeply, with food prices rising below the 2% range, and with services rising at 4.1%.

It too is subject to the problem that goods prices will not continue to fall at the current rate, while services CPI is stuck at 4%. If that happens, overall CPI will reflect it by heading higher:

The ECB has cut its policy rate by 25 basis points to 4.25%, and is now arguing over how many more cuts this year. Two more cuts would bring the policy rate down to 3.75%.

The economy in the Euro Area has slowed substantially in 2023, with a near-0% growth rate, including a contraction in Q4. However, in Q1 2024, GDP growth picked up some. This lethargic economic growth and the moderation of inflation gave the ECB reasons to cut its policy rate.

But if services inflation remains at 4% and goods prices slow their descent, core CPI, now at 2.9%, will begin to edge higher and, instead of going toward the ECB’s 2% target, it would then migrate into the 3%-plus range.

And ECB president Christine Lagarde addressed this issue today – the issue being the fuel that contributes to services inflation: wage growth.

“Obviously, we don’t need to have services at 2% because manufacturing goods are below 2% and at the end of the day it’s going to be a balance between goods and services,” she said at a panel discussion today in Portugal, according to Bloomberg.

See in the chart above, before the pandemic, where service CPI ran higher than core CPI because the goods CPI was lower than core CPI. So services CPI running a little higher than core CPI is ok. But currently, services CPI is running much higher than core CPI.

“But we have to look really what is behind it,” she said. “And what’s behind it is a lot of wages. Services has a very high component of labor. Wages also suffer from the lag impact of the labor system that we have in Europe.”

Alas, wages and salaries jumped by 5.3% year-over-year in Q1, matching the record of Q4 2022. In Germany, they jumped by 6.3%, in the Netherlands, by 7.6%, in Austria by 9.8%, in Greece by 7.9%, in Portugal by 6.3%, in Spain by 4.5%. On the low side were France (+2.6%) and Italy (+3.3%).

So with this kind of wage growth, it’s unlikely that services inflation will slow down much from its 4% range and might head higher:

The forward-looking wage-growth measure that the ECB developed, based on newly negotiated collective bargaining agreements whose wage increases will be implemented in the future, jumped by 4.7% year-over-year, matching the Euro Area record of Q3 2023:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Why does Europe always seem more “dovish” than the States, going back even to NIRP? Desperation? Hope against all odds? Populist politics?

NIRP was a huge mistake, and I think most of the ECB folks are now seeing it too. NIRP was an experiment that backfired. As was the massive QE.

In terms of the current rate: the overall economic growth rate of the Euro Area has been far slower than in the US. It was near 0% in 2023, with a contraction in Q4. So they didn’t want to slow down the economy further and throw it into a recession. They cut a little, and they’re going to cut a little more, and they’ll see where this is going. They can always hike again if they need to.

Have policymakers truly learned their lesson? I haven’t heard any central bankers managing the world’s major economies definitively rule out using NIRP, ZIRP, or QE as a policy tool again.

These aren’t Christians confessing sins and doing penance. They’re face-saving bureaucrats who follow all the conversations and are part of the intellectual milieu. They know the policies were failures but they’re not going to say it loudly.

Look what it did to Japan.

If both NIRP and QE were mistakes what is the likelihood that

1) ECB (and other CBs) will not use it anyways – when push comes to shove

2) Is ECB (and other CBs) going to do its own SRF now to disassociate interest rates, bailout, and QT

A big part of the problem is that many of the economies tied into the EU are sub-par. They have excessive debt, which interest rates make harder to reduce or maintain, and huge entitlements which politics make impossible to reduce or eliminate. Italy is the worst of the major economies, but too many smaller countries are in just as bad condition.

Add to this an inability (and lack of willingness) of the EU to actually enforce their own regulations on what member states economic policies must conform to, and what you have is a nasty house of cards.

KGC – the global human condition has always been a nasty house of cards. We usually don our blinders, and continue to double-, nay, triple-down just the same, serene in our various beliefs that we, or our particular family or group, will always outrun any other force-human or otherwise…

may we all find a better day.

Is the understanding that Euro inflation is primarily caused by ECB policies or is it more likely a result of COVID supply chain/Russian invasion effects?

The understanding is: NOTHING is the fault of the policy makers!

The policy is salvation! (Yes, only for the policy makers’ makers).

It’s hard for me to imagine an efficient way to deploy capital to bring about major productivity gains in services needed to slow this inflationary trend.

Lower goods and energy costs have to be the solution. More investment in the real economy not billionaires building spaceships.

I think NASA has been happy with billionaire spaceships. Of course, comparing against Boeing is a very low bar.

It’d be the French Airbus in the EU, they make a nice plane.

“Of course, comparing against Boeing is a very low bar.”

You say, as you sit on your lazy tail typing away….

Boeing is a world class company with a healthy share of the market. Moving the HQ to Chicago was a mistake.

Boeing is a world class company? Please tell me about the other companies you think are world class so that I can short them.

Wage inflation will spike even higher during July and August, considering the impact of the Tourism sector in EU economy, especially in countries like Greece, Portugal, Spain, Italy and France. Also, considering the current unemployment rate at historical minimum and the inability of the EU to fuel immigration, as a tool to cool it’s labor market, it’s very difficult to believe C. Lagard when she talks about the cooling of wages inflation expected to materialize in the coming months. It’s like she has some kind of special abilities that gives her visibility on a future that no one else can see now, and which the data contradicts. However, she never forgets to say that ECB is data dependent. Considering, the path of the energy prices due to increasing geopolitical risk, with service CPI above 4% in next 2 months, we are going to witness a couple of funny ECB meetings with Lagard trying to justify the cut they did.

The Bank of Canada made the same mistake with wage gains running at 5.1 percent. They didn’t learn anything from the 1970’s when inflation took a second and more powerful leg up.

The BOC didn’t cut the rates because they think that inflation is cooling, they know that inflation is not cooling, but they are in a very tough spot, due to the refinancing of mortgages, which interest rates needs to be readjusted at the current level of market’s rate.

Considering that the current mortgage rate is near 7%, well that’s a big issue for households and theirs ability to keep fueling consumer demand. The risk is the discontinuation of the aggregate demand. In such situation there is nothing you can actually do, you have to choose between causing an economic depression or fueling more inflation, and it’s clear what they are choosing. However, the central banks need to improve their transparency with the market, because keep saying that inflation is cooling, while the data is showing the contrary is very risky. At some point the whole market will stop listening to them, and the consequences of that we already know, just think about Dot-Com, GFC, Black Monday, and even the 70s (as you have stated Tony).

World sitting on $91 trillion DEBT problem. ‘Hard choices’ coming…

Investors, including many commenters here, are holding this $91 trillion, and are earning interest from it, and they’re spending some of this interest, thereby plowing it back into the economy… That’s the other side of each debt: it’s someone’s else’s interest-earning asset.

They need to find something productive to invest in rather than in any way ‘investing’ in government debt.

Yes, they should have invested in office CRE, for example, to get other investors off the hook, that would have been very productive.

Investors keep buying and holding treasure notes because a part of them still belives that inflation will cool down as the centrale banks keep telling them, while the other part is just waiting for the cuts so they can get the capital gain from the appreciation. Give them a couple more months, untill it will be evident that service inflation will not cool down as a consequence of the huge imbalances in the labor market, and then we will see what happens. Let’s see how those same centrale banks that now are trying to keep the market calm by promising rate cuts, will behave in a situation of credit markets becoming more and more anxious as consequence of the inflation heading toward 4%. Then wolf let’s talk again how many investors and commenter’s will still be willing to buy and hold treasures and credit in such conditions, and how much the yields will have to increase to cool the sell-off.

Where else can investors put their money. Stocks with PEs over 20? Real estate that is at historic highs? Bitcoin that is already up 60k%. Gold at ATHs. Government debt has essentially doubled every 10 years since 1970. From 483 billion to $34 trillion. In early 1980s people were freaking out when the total Gov debt went over 1 trillion and now we do that in 100 days.

A bit of a ramble but with todays Central Banks financial engineering genius tool set, debt…..does…..not…..matter.

If CRE debt starts to cause problems…the FED will take care of it with a new special debt buying program. Since 2010 they have created over 15 such programs. Some last several years and some are very short term and some we do not even know about until years later.

@ru82. Of course. The Federal Reserve’s primary responsibility is to bail out Wall Street and the billionaire class.

If CMBS ever threatens the “economy” (ie the stock market, as that’s the FOMC multimillionaire policymakers’ main barometer for the economy), a new Section 13 alphabet soup program will be created at the first nanosecond. Just like they did in the aftermath of SVB, repo blowouts, and any other crisis real & manufactured.

You guys refuse to understand how the market actually works, even though the history is full of examples of what happens when inflation gets out of control, and yields are kept at lower level artificially, spreads tight at historical minimum, and ERP negative at above -200 BPs. Just think what happens with the fixed incomes of those investors that have bought treasures at around 4% yield, when inflation keep heading toward 4%, and how they will react when finally market’s inflation expectations will be readjusted at higher level. Also, think about credit spreads, and ERP at the current valuations, also think about mortgage rate and consumer interest rate and leasing rates, and how those increased rates will impact the household’s ability to keep fueling consumer demand in such conditions, and last but not least think about those companies which have been keeping their head above water for a decade thanks to cheap credit, and low wage inflation. What will happen to their margins in such conditions?

Just think guys before you counting on central banks to restart QE in a such inflationary environment, or when someone suggest that FED should increase its inflation target. It’s not that hard when you start thinking about it.

How long will their interest earnings asset beat inflation particularly when central banks start cutting rates to reduce the interest payment on the massive government debt?

I have a suspicion that it has become central bank policy to inflate away the debt i.e. pay off its debt with devalued dollars. We are, imho, going to have to live with inflation for some time yet.

The EU needs a new government that understands the need for plentiful, reliable energy (like nuclear, geothermal and gas), common sense policies, balanced budget and genuine diplomacy. In particular, Netzero and all ensuing policies are a very expensive scam well exposed by the CO2 coalition, that the UN and co-instigators are imposing on us all to grab control they’re not suppose to have. The ill guided subdidies are making a few very rich and leaves most with less real savings and disposable income. I posit many are drunken sailors by necessity, and not enjoying it.

Correct. Our civilisation is built on cheap reliable energy, most of which comes from the burning of carbon and hydrocarbons. Take that away and civilisation will disintegrate.

BAF – or don’t deal with their environmental effects, let the spacecraft’s carbon-based life-friendly atmospheric regeneration systems continue to fail, and achieve the same result…TANSTAFFL.

may we all find a better day.

This issue of wages can be instantly resolved by employers simply cutting wages dramatically overnight. Easy. Fast. Effective.

And the next day, half of their employees — the most productive half — is WOOOSH, gone.

So what? Just get all new employees and start out fresh and much younger and at around $10 or less per person per hour.

That works ok, most of the time. It sure is funny when it doesn’t.

Not to worry! AI will replace most keyboard junkies of all levels.

My friend worked for a company in the EU that was way too slow to recognize the shortage of skilled labour, their demise not long ago spawned 3 companies (we know of) all of whom pay and treat their workforce better. “Wage slashing” is a little easier when there’s enough people looking for work and willing to accept “slashed wages”.. So not quite yet, maybe soon we’ll see.

I’m starting to think you might be one of those homeless on the beach in venice, mumbling prognostications at passerbys. Gold still going to zero?

Gold will always have some value but is headed to around $20 per pound in the days ahead.

I sure hope your right! Would love to pick up a few thousand pounds to add to my ounces. Me and a few billion friends and enemies.

EU also has some of the strongest labor laws that might cripple the companies if they attempt a layoff . Your statement needs some more research and what those unemployed people would do. Deflation is worse than stagflation. Free labor ? Goods prices falling ? Asset values? Bank failures?

Those unemployed (re: freshly quit due to greed) would likely be in the back door, shopping the company store at a 5- finger discount the next day.

Civil and social unrest is more terrifying than economic weakness or decline.

The ruling class is as small as ever and trigger men demand good pay.

It’s time for a weird, abstract take on service inflation, based on the Baumol Effect and cost diseases.

This is a story from Slate, 2016:

“why are we spending more on animal health care? First, just like humans, animals are benefiting from medical advances that increase their lifespan—so much so that canine dementia is a growing problem. But, unlike humans, we don’t need to treat ill pets. We choose to do so. A visit to the vet isn’t necessary. As economists would say, it’s a luxury good. Some of our spending is driven by desire.”

The point here is, costs rise based on preferences and as a global world, we are all making economic choices that in the aggregate, influence the increases of prices.

I recently heard my daughter’s friend talk about the cost to have her pets teeth cleaned — a technological advancement now considered important for pet parents — something that was absurd ten years ago.

However, that service is now a common preference, an economic choice that extends life for pets. That’s a new service based on technology and education. We now have pets being serviced by kids who invested their parents money into lucrative new careers — the schools charged a fortune to produce that hygienist, but pet owners demand the service and the tools, labor, etc.

And, somewhere in there is the concept of goods and services and inflation and productivity.

Here’s a bit from some economics prof in Houston describing Baumolism:

“And we’re done. Productivity growth in the goods sector raises the wage in that sector, but also raises the output of that sector. So the ratio of wage to output – a measure of the cost of a unit of output – stays constant over time. Higher wages in the goods sector put pressure on wages in the service sector, so wages rise over time there. But (taking the exteme position) productivity is not growing in services, and so output is not growing. The ratio of wages to output in services – a measure of costs – is thus rising over time. This is the “cost disease of services”.”

At least this line from your last quote is ignorant bullshit: “But (taking the exteme position) productivity is not growing in services, and so output is not growing.”

Whoever wrote this has no freaking idea what “services” are, and thinks of them as “cutting hair.” I have news for you: many services — from software development to medicine — have been partially automated and require much less human input. For example, many diagnostics in healthcare are now done by machines automatically, and the results are posted on your account automatically, and all kinds of manpower in this process has been replaced by machines, which is a huge gain in productivity.

DM: Sports goods chain that operates across seven states to shut ALL stores – but will clear stock first with 70% off bargains

Bob’s Stores to shut ALL stores – week after filing for bankruptcy. ‘Bob’s has been a stalwart of our local communities for nearly 70 years, and we know our customers remember us as having been there for major moments in their lives.

‘We remain grateful to our vendors, suppliers, customers and employees for all of their support over the years.’

Gift cards and merchandise credits will be honored through close of business on July 14.

The retailer, which sells athletic and casual clothing across six states, is shutting all its stores. It began ‘Going Out Of Business’ sales on Friday, with customers able to pick up goods with 30 to 70 percent off at the 21 stores. The website no longer works. Shoppers will find reduced prices on leading national brands like Nike across the stores. Select shop fixtures, furniture, and equipment like TVs and registers will also be on sale.

How will I go on without Bob’s. Wait – what in the hell is a Bob’s?

Dude: obviously in your eyes, they weren’t “gouging “ their customers enough!

Student Loan Borrowers Owe $1.6 Trillion. Half Aren’t Paying…

Half? No one is paying.

What about the new student loan debt or is this money just handed out as well? Probably why some private instiutions have closed or maybe their degree was not worth the time for the students regardless of free money .

No one is paying? Then why do I have nearly $300 a month debited by EdFinancial Services (the “Official Servicer of Federal Student Aid”)? Did I forget to cancel a subscription?

Have go call B.S. on that one Wolf. I, for example, just paid off all my grandkids student loans so can say at least some are getting paid.

What do you mean no one is paying? I’m paying. I can’t stop paying. Student loans for a lot of us started back up a year ago.

MSN: Greece plan for 6-DAY workweek to boost sagging productivity may not work…

Grexit’s looking good now…

This is the opposite of other recent (past 2-4 years) “studies” that a 4-day work week increases productivity.

I for one see that I have about 2.5 “prime” work days per week.

The rest can turn to fluff.

Inflation has left people’s buying power behind without subsequent pay rises.

We need pay rises to bring back buying power, but doing so creates inflation.

Trying to avoid the contraction necessary to stop this will only make it more likely and deeper.

The ECBs hubris is their undoing.

They’re not in control. They can only guide the ship through choppy waters, not avoid them entirely.

The EU could run a multi-year (and with no end in sight) 7% budget deficit. Then we could pretend everything is ok and carry on while remaining calm.

For an n=1 example:

I live in The Netherlands. And although energy prices have come down substantially, energy taxes have come up. Especially for natural gas, because ‘they’ want us to transition from gas to electricity.

At the moment a m3 of methane costs 63 cents. The gov ads 70 cents tax on top. Then the provider charges 15 cents for transport to the home. And on top of the total the gov adds another 21% VAT. So we pay 179 cents.

The same MO applies to petrol and electricity.

This month rents have gone up 5%. But incomes didn’t.

Minimum wages have gone up 5% last year, but a further raise is not in vision. Most people are lucky to have gotten 2.5%. As was in our case. And that is going one for several years now.

Expandable income is diminishing and that feels like inflation. Even if prices didn’t go up, the income covers less time.

For the last month the official annualized price-inflation was 3.6%. Mainly due to a rise in services costs, according to the officials.

How can catching up with inflation cause inflation? It only makes the previous inflation permanent.

Wages are costs to service providers, and with many services, wages are the biggest cost factor, and so service providers hike their prices to cover the higher costs of labor, which is why services inflation rises when wages rise — that’s the point Lagarde was making (and others have made the same point about the US services inflation).

Viva Socialism Viva! The two very left wing Cougars Ursula and Christine are attempting to continue their claw-like hold on the EU, but the voters have finally realised that the utopia they were promised is slipping further away than ever. Command and control management style over a very diverse group of 350 million people is having an unhappy result as usual and who knows how it could be turned around. Capitalism and free enterprise? Not unless the two old ladies get sent off on their broomsticks.

What’s odd is that Europe, despite having enacted rate cuts, isn’t getting the same kind of crazy stock market exuberance like the U.S.

“But that’s because of AI mania!” All of the U.S. indices are positive for the year, including Dow, Dow equal weight, S&P 500 equal weight, and Russell 2000. It’s not just Big Tech alone pushing markets up every day.

As of June 20th per the WSJ, 40% of the gains in the S & P 500 index since 2022 are from Nvidia. So yes, it IS because of AI mania.

Thanks, Wolf.

The ECB rate cut was misguided. Further cuts will pour more gasoline on the fire so those are probably dead ahead.

At least QT made some progress this past week. Nice chunk of TLTRO loans matured. Assets dropped more than €60 B.

Have a delightful Independence Day!

Inflation in Europe is above targets, ECB rate is what 4.5% and home mortgages here in Spain are 3%, I just don’t understand it. Why aren’t rates closer to USA rates ?

EU countries need to compete with exports. Stronger Euro puts their producers at a disadvantage; especially vs much cheaper Japanese imports for engineering products. Throw in Korea and China – that’s some stuff competition for durable production goods.