US production of crude steel edged down further. Nucor Steel moved up to #15 globally. US Steel, #24, gets acquired by #4, Nippon Steel.

By Wolf Richter for WOLF STREET.

China, which produces over half the world’s crude steel – ingots, semi-finished products (billets, blooms, slabs), and liquid steel for castings – is dealing with the more or less controlled collapse of its property development sector, which once was a big contributor to overall economic growth. Construction is a big user of steel. In addition, there has been a slowdown in manufacturing.

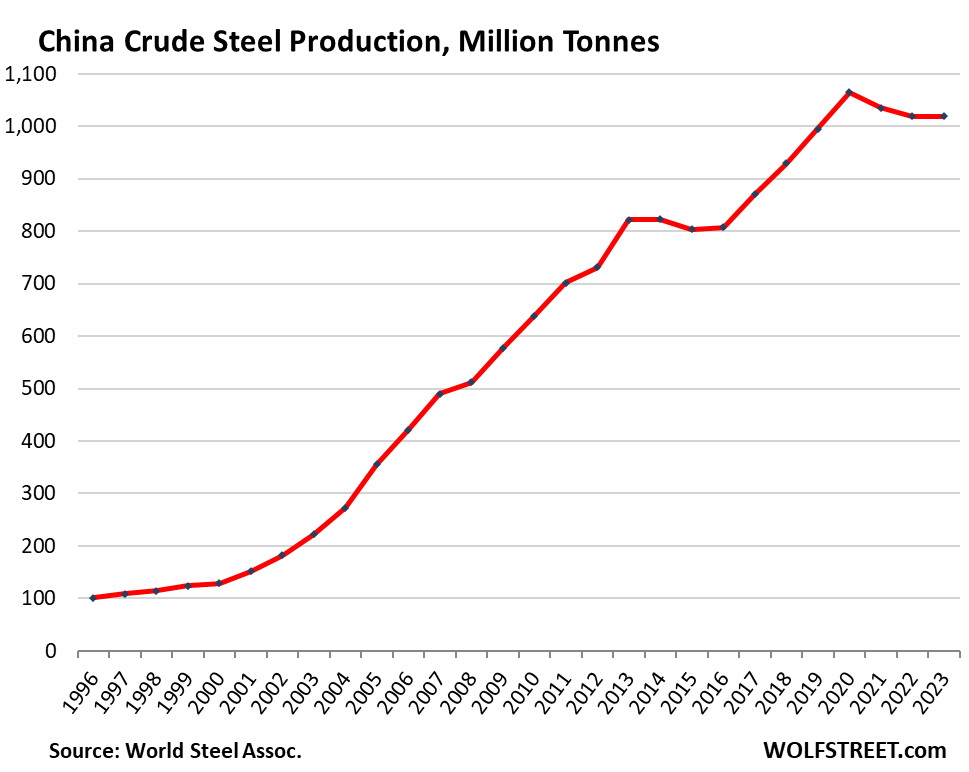

So, since the peak in 2020, China’s production of crude steel has fallen by 4.3%, to 1,019 million tonnes (Mt) in 2023, according to new data from the World Steel Association, the worst three-year drop in the data going back to 1996, which had been marked mostly by blistering growth rates:

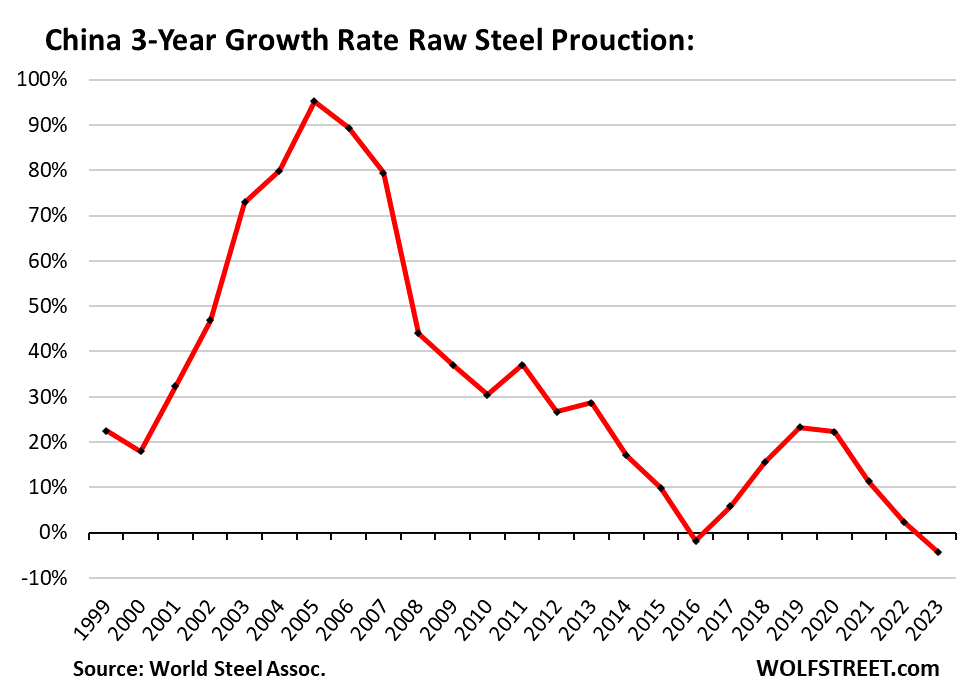

China’s production of crude steel – most of it for use by its domestic manufacturing and construction sectors, rather than exports – had seen big year-over-year growth rates in most years, even during the Global Financial Crisis, when steel production in the rest of the world dropped sharply. The exception was the period when the government tried to crack down on overproduction in 2014 through 2016. Over those three years combined, steel production fell by 1.8%, the first ever decline in the data going back to 1996.

In 2020, the first year of Covid, China’s steel production soared by 22% year-over-year, as the rest of the world had locked down parts of the economy. But then came the drops in 2021 and 2022 in response to the crisis in China’s property development sector (construction) and a slowdown in manufacturing. And in 2023 came a repeat of 2022. From the peak in 2020, steel production in China dropped 4.3%. The chart shows the moving three-year growth rates:

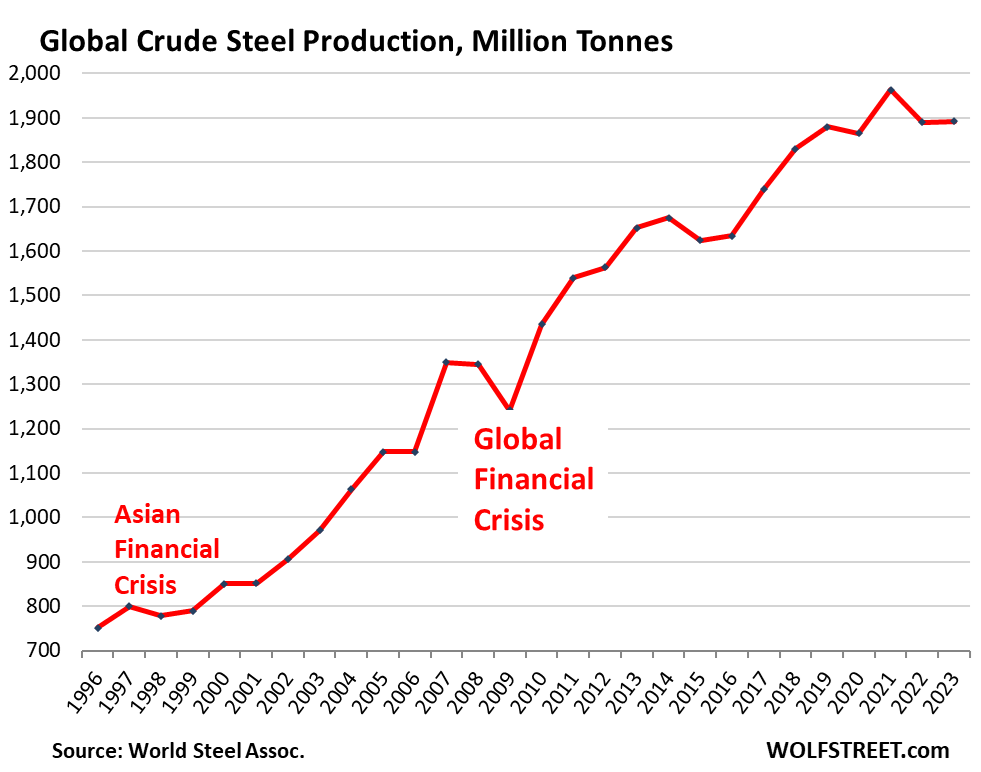

Global production of crude steel – despite the situation in China – nevertheless edged up in 2023 to 1,892 Mt.

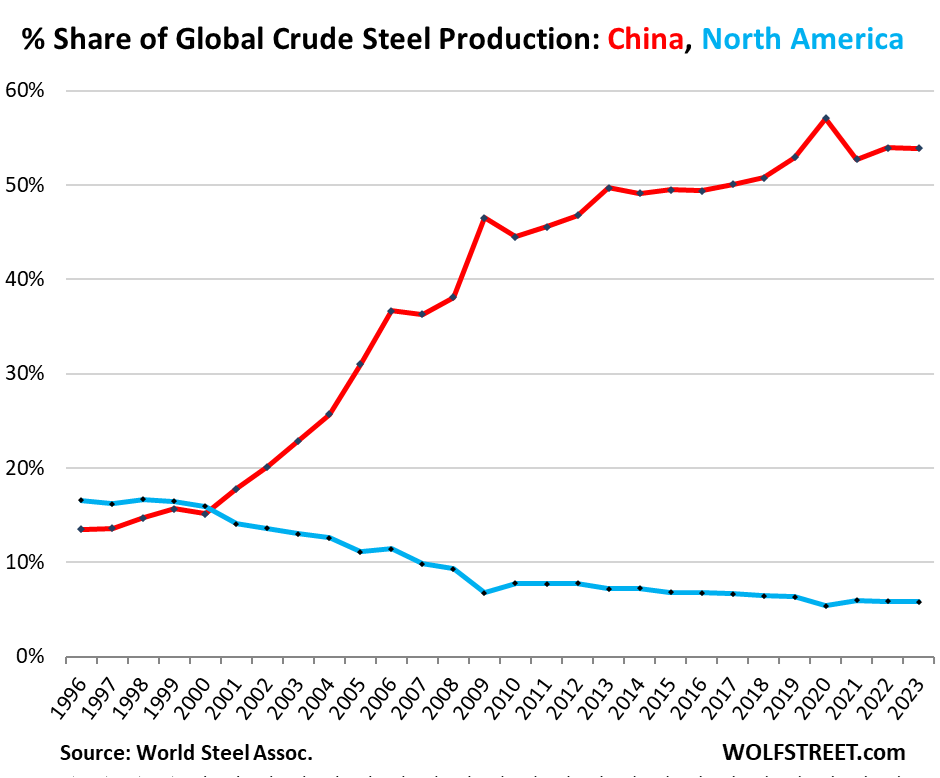

China v. the Rest of the World.

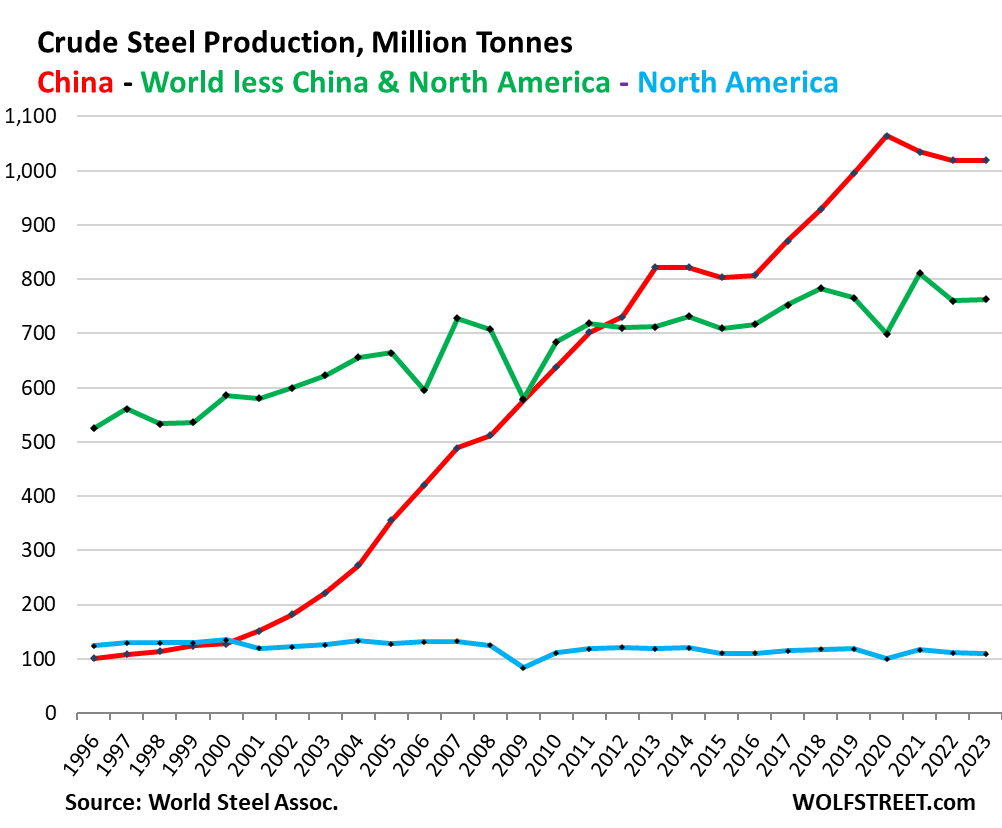

Since 2000, global crude steel production has risen by 123%, largely due to the huge production growth in China: Over the period, production in…

- China multiplied by 8! (red)

- North America (US, Canada, Mexico) fell by 19% (blue)

- The rest of the world without China and without North America rose by 30% (green).

North American crude steel production edged down to 110 Mt, flat with 2015 and 2016, wobbling along below 1996 levels.

US production, at 81 Mt, was unchanged from 2022, and accounts for 74% of North American production.

In the rest of the world without China and North America, steel production in 2023 edged up to 763 Mt, after the drop in the prior year.

The share of China’s steel production was 53.9% in 2023, same as in 2022, but down from 57.1% at the peak in 2020.

North America’s share has been on a long steady decline and in 2023 dipped to 5.8%, the second lowest ever, behind only 2020.

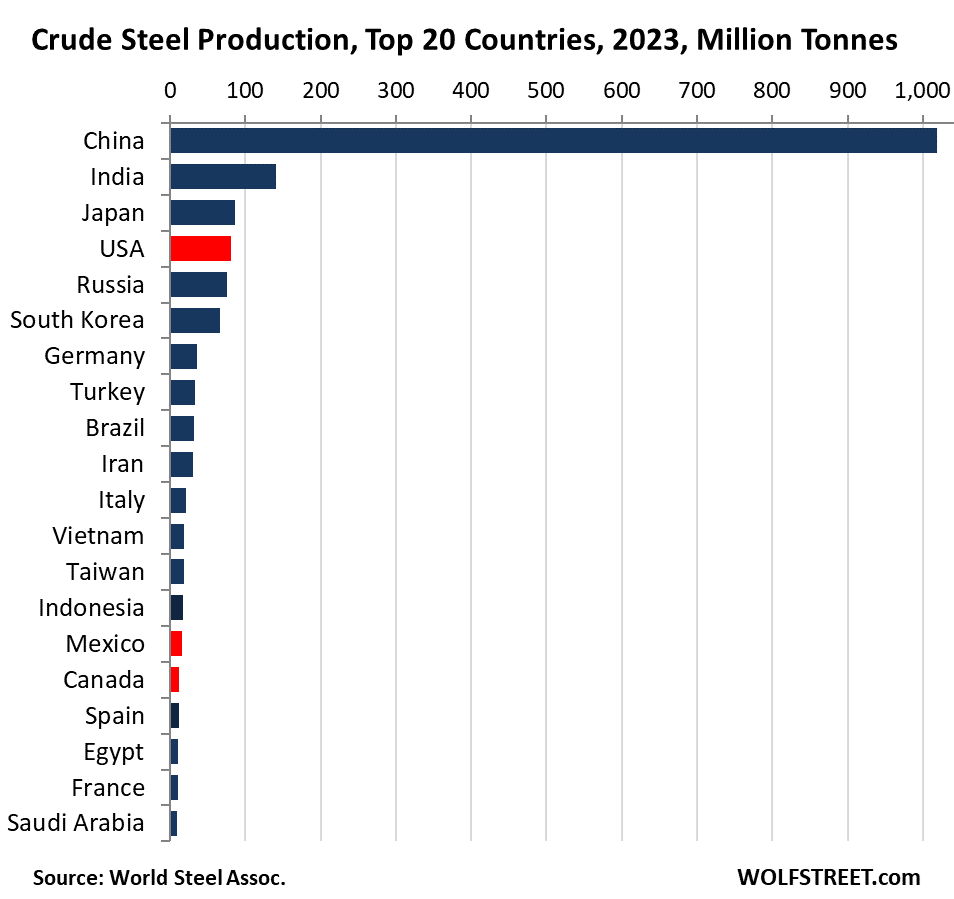

The top 20 countries in crude steel production.

China’s production (1,019 Mt, #1 in the world) was seven times the magnitude of India’s production (141 Mt, #2 in the world). India’s production has surged by 40% since 2017. The US is #4, with 1/12th the production of China (North American countries in red):

The top 20 steel-producing companies.

The largest US steel producer, Nucor, moved up to #15 globally in 2023, from #16 in 2022. The next two steel producers, Cleveland-Cliffs and US Steel, are #22 and #24 globally. US Steel is in the process of being acquired by Nippon Steel, #4 globally. The acquisition may push Nippon Steel into the #3 slot.

Eleven of the top 20 are Chinese companies. The #2 producer, ArcelorMittal, a product of India’s Mittal Steel having acquired the French company Arcelor, is registered in Luxembourg and run from India.

| Top 20 steel-producing companies | Mt | ||

| 1 | China Baowu Group | China | 130.8 |

| 2 | ArcelorMittal, includes 60% AM/NS India | Luxembourg, India | 68.5 |

| 3 | Ansteel Group, incl. Benxi | China | 55.9 |

| 4 | Nippon Steel Corporation | Japan | 43.7 |

| 5 | HBIS Group | China | 41.3 |

| 6 | Shagang Group | China | 40.5 |

| 7 | POSCO Holdings | South Korea | 38.4 |

| 8 | Jianlong Group | China | 37.0 |

| 9 | Shougang Group | China | 33.6 |

| 10 | Tata Steel | India | 29.5 |

| 11 | Delong Steel | China | 28.3 |

| 12 | JSW Steel Limited | India | 26.2 |

| 13 | JFE Steel Corporation | Japan | 25.1 |

| 14 | Hunan Steel Group | China | 24.8 |

| 15 | Nucor Corporation | USA | 21.2 |

| 16 | Fangda Steel | China | 19.6 |

| 17 | Shandong Steel Group | China | 19.5 |

| 18 | Hyundai Steel | South Korea | 19.2 |

| 19 | Steel Authority of India Limited (SAIL) | India | 19.2 |

| 20 | Rizhao Steel | China | 18.7 |

| 22 | Cleveland-Cliffs | USA | 17.3 |

| 24 | US Steel | USA | 15.8 |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Am I the only one who looks at the chart and thinks China’s steel production has reached a permanently high plateau?

Yup. And you know they are going to fold to pressure on environmental sins. Yeah, right.

Well, having been exposed, professionally, to the US steel production plans vis a vis, any upstart economy that wants too subsidize this, undeniably, importance as one of the cardinal building blocks.

It’s a sad time, At a time I was a locomotive machinist and always marveled at the size of various castings. Wow, how far we, the U.S. has fallen.

My Father-In-Law worked for Bethlehem Steel in Buffalo for 30+ years as the hot roller operator (and later Foreman) on the 11 stand tandem breakdown mill. I worked for Anaconda in heavy manufacturing early in my career. Everything in those industries is mostly gone from the U.S. now.

Air pollution moved to China too.

Have you been to China?

About 5 years ago, the government promised to clean up the air. They did. I have been living in China since 2013. We have very few bad air days now. It is not even a topic of conversation any more. Look to India for air pollution.Why are you commenting on air pollution in China? Do you know anything about the country?

I have the utmost respect for the men that both built America while saving it from the fascists.

They are all dead, and new enemies are alive.

Are you from the era of Mesta Machinery? They made the largest castings and pretty march the largest of anything for a long long time. Pittsburgh based and now gone.

and who would want to work at foundry these days?

Actually, that is exactly the disconnect from the WW2 era, fading, into the naivete of the next era of plenty.

May it continue. There is no reason, given human history, that it will do anything but.

Everybody should visit the abandoned steel mill in Bethlehem, PA. A rusting hulk that the town is trying to repurpose. It was once the biggest steel producer in the world. Also, the entire town was covered with a layer of ash and dust from the mill, and it was hard to see any distance. That’s what heavy industry looks like.

Crazy that many the met coal names I did well with in 2020/2021 continue to go higher, despite stagnant steel production in the last three years.

Just goes to show how decoupled prices are from their underlying fundamentals.

I also believe that asset prices are clinically disconnected from the likely future. AI has to be trained to achieve a goal, given a biased set of inputs.

The measure that AI has co-optid is the R2, from the mathematically correct Central Limit Theorem.

Wolf, I see that you used the word ”tonnes” rather than ”tons” in this article, and am wondering if that means all these numbers are based on 2,200 pound tonnes rather than 2,000 pound tons?

IIRC, tonnes are or were also known as ”long tons” by some folks.

Also wondering if there have been any recent developments of the challenges of QC that were formerly quite an issue with various sources of steel, especially with the stronger grades?

Thanks,

Tonnes = metric tons = 1,000 kg = 2,204.6 pounds

How expensive is it to make steel, I don’t know but making some crude steel, I’ll need to melt up some iron ore, did you know that china gets 80% of its iron ore from Australia. So, Australia sells China the rocks, china melts the rocks and makes steel.

1.6 tons of ore gets you 1 ton of steel, not hard to make this steel or get the ore to make it, the US gets most of its ore from Northern Minnesota.

Wonder what the most important take away from this article would be? For me it would be,

Chinas got better prospects than making and shipping this heavy steel any longer?

The blast furnace technology, based on the genius of the a French metallurgist, Pourbaix, who mapped the reduction of iron oxide one hundred years ago.

The problem is that the blast furnace technology is the most thermodynamicly efficient processes invented by man. The modern processes are available for a price.

Each technology becoming obsolete before it’s even built.

Alternate measure of the steal:

Thair mark on this land is still seen and still laid,

A way fur a commurce where vast farchunes wur made,

Thu supplie uv an empire where the sun nair du set,

Which is now depe in darknuss but the railway’s thair yet!

Navigatur, navigatur, roise up and be strong,

Thu mournin’ is here and thairs wurk ta be dun,

Take yur pick and yur chuvel and the boald dynamite,

Fur ta chift a fue tuns uv this urthly dulight,

Yes ta chift a fue tuns uv this urthly dulight.

Math for the multitudes of manual labor dummies who can’t yet figure out how to serve the heads of the wealthy traitors up on their own silver salvers. There’s the real 5% solution.

Amen

And long tons are 2240 pounds

When is steel not exactly steel? I’ve read so many horror stories about building with Chinese steel. Not all Chinese steel to be fair, but sometimes a few corners are taken in production.

54% of the world’s steel is from china, hats off to the Chinese, they’ve done it again. Now with India on the rise, we can get a steel from them.

In the production numbers for the top 20 companies is that all production in the country the company is based in or global production from that company? Like #4 , does Japan produce that much domestically?

Global production for each company. The listed country is where its headquarters is based.

One under appreciated thing about China’s industrial revolution is the role played by large amounts of cheap coal. In the West we started burning our coal in the early 1800’s. But Chinas unique history left most of its coal reserves untouched and in the ground until the late 1990’s.

An Abundant source of coal was key in China developing the worlds largest steel industry, ( at least for a time.) It also was a key ingredient in cheap ( compared to others) alternative energy technology like solar cells and Lithium Ion batteries. Many people have been fooled about the economics of Solar, Batteries and other things because of China’s massive burst of cheap coal energy. This is starting to wind down now, and with it will be China’s Steel Industry, Solar Cell industry and EV Battery Industry.

It is also the reason the up and coming Industrial nations like India , Vietnam and Pakistan will never become another China. They do not have the massive cheap homegrown coal the Chinese had to Power their industrial revolution.

It’s not just any coal, especially from the lowest grades the sub and bituminous coals that are burned to generate the power we require as a society. The reduction of iron oxide too iron requires a special kind of coal, anthracite with a sufficient specific gravity that it wouldn’t be blown out as the burden descended, by gravity, through the furnace.

China has massive reserves of coal waiting to be mined. The area around Ordos is a prime one. BTW, Ordos is not and has never been a “ghost city”.

Coal mining cut back when China cleaned up the air. 2023 was the biggest year for worldwide coal production and usage EVAR in the history of the planet. Humans are using more than they ever did. You can’t run blast furnaces and cement factories with sunshine and windmills. also, coal is how people heat their homes. In the northern half of the nation, massive community heating plants pipe hot water to all the homes. I have that in my condo in Qingdao. In the Southern half, they use the heat pumps which also supply A/C. These run on electricity, which is made from coal. And guess what. Every year, the air gets cleaner.

China has built and continues to build by far the largest solar-power capacity and wind power capacity of any country in the world, and it’s building nuclear power plants more than any other nation. China is building natural gas plants and is producing its own natural gas and is importing lots of natural gas to fuel them. Building coal power plants has become a sideshow. These huge efforts are in part why the air has gotten cleaner, along with other efforts, including emission controls, shutting down certain factories, planting lots of trees to keep the dust storms at bay, etc. China has invested a huge amount to clean up its air, and continues to do so.

The chart shows how the share of coal in the power generation mix has dropped from mostly coal in 2010 to about 60% coal today. And it shows how power generation from coal has now flatlined and will begin to decline over the next few years, given the massive capacity additions recently and currently of wind, solar, gass and nuclear

Chart from S&P Global. Click on the chart to enlarge:

They shut down and razed the old, dirty coal electrical generating plants. New ones use the latest technology that keep emissions low. Any industry that is a big polluter gets special attention. Cement factories, ceramics, factories, steel mills, things like that are monitored constantly. If the ambient air readings get too high, the factories shut down until the air cleans up. Electrical generating plants are now being built in remote areas and special means of transmitting the power to populated areas are used. They lead the world in Ultra High Voltage Transmission (UHV). This allows for a more efficient mix of legacy fossil fuels and renewables. They have 19 nuclear power plants under construction right now. It’s very interesting living on the cutting edge of this technology.

I think of steel as the framework for buildings. If construction on buildings is down then I would think The demand for steel would decline.

Everything in China is made with concrete, but that requires massive amounts of rebar. Steel frame buildings are not common here. Demand is down, but building of residential and general infrastructure is still continuing at a pace Westerners can’t imagine. I spent my 20’s working on construction, so it is of great interest to me.

Hi Wolf, it’s way off topic, but I’m seeing reports that the US-Saudi petrodollar pact has expired after 50 years. Can you confirm or refute this and if it is true, what is the likely impact?

This whole thing is ridiculous. There hasn’t been a petrodollar ever since the US stopped buying its oil from the Saudis. The US is now the largest oil producer in the world, and big exporter of crude oil and petroleum products, including gasoline, diesel, jet fuel etc., and a net exporter of crude and petroleum products. It’s the US frackers that can crash the global price of oil with their overproduction, as they have shown in 2016-2020.

Yes. Dr. Anas Alhajji had a great X spaces on June 13th talking about the misinformation & BRICS mania but more specifically the Petrodollar “concept”. Excellent one to watch Here:

https://x.com/anasalhajji/status/1802067122945749339

The recent “news” about the petrodollar “agreement” is an interesting case of modern mis-reporting. However, in general, the term petrodollar does not refer to how the US purchases oil from Saudi or other Arab/OPEC countries. The PD has always been about how the rest of the world buys oil. Under the PD arrangement, oil is sold in dollars alone, so any country buying oil must first obtain dollars, by selling goods to the US. The OPEC nation does not spend all those dollars on end products, but recycles some of those dollars back into US markets. More important than the financial “tribute” the US gets from this recycling is that these dollar transactions must be cleared through the US banking system. Through “sanctions” the US can restrict a nations access to the most critical global commodity. This gives the US great global political and monetary clout. Since the mid 70’s major US foreign policy action fits like a hand and glove with PD enforcement.

Of course, if you have been following the news, the sale of oil in dollars alone has been weakening for a decade or so. Any cartel like this only works with a critical commodity like oil when there exists a surplus. When the world approaches peak oil, the ability to withhold any significant oil from production without great economic pain will greatly pressure the control of the cartel. For example, the US can’t knock Russia offline without replacing it’s 4Mb/d without collapsing major countries economies.

Oil is priced in USD and paid for in any currency that the two trading partners agree on. Eurozone countries can pay with euros for oil, the UK can pay with GBP, and they do. Whatever the currency is that the two parties agree on is the PAYMENT CURRENCY, even if the price is quoted in USD. And it has been that way for a long time. The US paid in USD because that’s its currency. That’s what created the PD back in the day when the US was importing a big portion of its oil demand from OPEC. There were lots of dollars floating around because the US paid for oil. Now the US is SELLING more oil and petroleum products for USD than it’s buying, and the dollar flow reversed.

It has less to do with the USD being the “petrodollar” and more to do with the USD being the global currency (stuff being priced and paid in USD). This has the consequence that the US is exporting inflation to the rest of the world.

The Malaysian president explains why his country is trading more and more in local currencies: “inflation is low, growth is high, investment is huge, and still our currency is being attacked. It doesn’t make economic sense. Why? Because of the dominance of one currency completely alien and irrelevant to the current economic activity.”

From a layman’s view amazing their economy still hums along at c. 4.5% growth rates. Hearing everything we do out of there with their slowdown in construction, steel, increasing US tariffs and no population growth, I wonder how there isn’t a recession. I get that everyone’s still largely buying from China despite the slowdown, but how’s there still so much growth?

As an American who moved to China almost 12 years ago, I can tell you that you don’t know much about China. In my first visit in 2009, it only took me 3 days to realize that 95% of what I “knew” about the country was propaganda. I was angry. First at the American media for its lies and constant twisting of every story to fit the American narrative. I was also mad at myself for getting conned. Unless you actually spend some time in China and live there, you won’t realize what’s going on. The country bounced back pretty nicely after COVID, and has been making progress and having a nice life. Things improve every year and the people are happy.

Senor Wolf,

Random comment with a mfg. engineer [consulted for Pacar]

on steel quality.

He noted that Pacar (mfg of Kenworth/Peterbuild trucks) was sourcing Japan for their (disc brake) rotors as US steel mfg.’s could not hold consistency/quality content due to (from his viewpoint) aging US steel mills not updating their equipment while Japan did.

No position.

Addendum – another acquaintance manages a major auto parts warehouse and notes what %’s of parts being ordered are increasing for vehicles that are <5-7 years old. Particularly [OEM] 'engine mgmt' items that are globally sourced.

In his view: "All new stuff (vehicles) is junk, and replacement parts are

crap."

Again, no position.

Thank You for all you do/provide @Wolfstreet.

Space – a sidebar to steel quality is the continued, illegal, ‘mining’ of shipwrecks, including ones classified as war graves (see the virtual vanishing of the wrecks of HMS ‘Prince of Wales’ and ‘Repulse’-very large warships sunk off Malaya by the Japanese early in WWII, for example). More than just high-quality, pre-nuke (the market for it in the technological-calibration sector, I understand) steel and armor-plate here, but that obvious demand for it makes one wonder about current ore grades and refining processes…

may we all find a better day.

Steel is such a legacy product. It is just another relic of the early 20th Century to think that it is anything other than just another product. Almost all the commodities are simply huge soaks of gambling that move the prices off the fundamentals. The reality of it is first world generates immense value production off of cheap commodities. The real gain in China will be to dynamite the old steel companies, take the employment hit, and move the people into something more productive. Their rustbelt moment is now upon them, and the newer mills are the future, and the cheap old crap is ripe for demo. But until they decide to kill the zombie production,so much will keep coming out of the old pollution belchers.

Wolf, why do so many economic zombie crackpot theories persist in the wild? I know zerobrain makes money promoting with stuff, and agora used to be the same. Ron Paul got rich off the fools, and the son became a senator. Is it just America has to always think the obvious can’t be right, because it’s all a conspiracy?

One big real estate crash and it will be the same thing over and over. One big stock market crash and the same.

Everything has a season, and now we live in the world where the West has won the right to enter senility in decadent comfort. And the rest want that comfort.

Globe is starting to “feel” like 1930s. Wonder who will be the “arsenal of democracy” this time? US seems to be out of the running.

This steel story is a precursor to what lies ahead, with china dumping its various surplus inventories onto fragile global markets.

As gdp growth declines globally and currencies become weaker, a supply glut in a commodity like steel probably will be matched by a decrease in demand — but of course, this is priced in and everything is fine.

Go Nividia

I’m not at all surprised by this. China’s government funding of everything was bound to collapse at some point and we’re finally seeing that. Combined with a falling population, China is really in trouble. It’s likely we’ll see India be the next country with explosive economic growth

So who makes steel? Everyone makes steel.

Why does China make so much more steel? One reason not noted: it uses a lot of steel. It is in the process of building out the infrastructure that the US and Europe built out over the last 150 years. 20 % of its production is rebar, a lot of it exported. It’s a low- quality low- margin product that isn’t worth making in an advanced economy.

Why does everyone make steel? It seems like a prestige thing, like having a national airline aka ‘the flag carrier.’

The UK that invented the Bessemer process, exceeded US production before WW1, still wastes time and money and angst over its remnants, that it would be fine without.

Isn’t steel strategic, could there be a sudden, overnight strategic shock requiring a WWII supply? The US could rely on Nucor, its number one miller. Nucor just melts scrap in electric furnace mini mills. The US could run on scrap for a couple of years even without a patriotic diversion and metal drives. There are still a lot of ‘clunkers’ in them hills.

Don’t get me wrong. It’s an interesting biz, partly because it has so many problems. But the abundance of stranded assets like ‘open hearth’ mills etcetera is not a symptom of a stranded national economy or of its decline.

Best news for the survival of the basic ‘from ore’ US industry: the Japanese buying US Steel.

“One reason not noted: it uses a lot of steel.”

Third paragraph starts out this way:

“China’s production of crude steel – most of it for use by its domestic manufacturing and construction sectors, rather than exports – had seen big year-over-year growth …”

Also first paragraph:

“China, which produces over half the world’s crude steel – ingots, semi-finished products (billets, blooms, slabs), and liquid steel for castings – is dealing with the more or less controlled collapse of its property development sector, which once was a big contributor to overall economic growth. Construction is a big user of steel. In addition, there has been a slowdown in manufacturing.

Sorry. My comment was provoked by the doom and gloom from the other comments, that seemed focused on the ‘take over the world’ aspect of China’s production.

Not sure why censoring is becoming more severe here. I posted a reply in response to “slowdown in manufacturing” but it was blocked.

tradingeconomics website:

“Manufacturing Production in China increased 6 percent in May of 2024 over the same month in the previous year. Manufacturing Production in China averaged 6.62 percent from 2013 until 2024, reaching an all time high of 39.50 percent in January of 2021 and a record low of -15.70 percent in January of 2020.”

Your prior comment was automatically sent to moderation because it included a link. When I saw the comment a little while ago, I released it.

And replied to it, encouraging you to actually look at the chart you linked, to look at the 10-year frame not the one-year default frame, and you will recognize the BS nature of your prior comment, and of this comment.

This is what I said in my reply to your prior comment:

“Yes, click on the 10-year tab in the chart you linked to see the last 10 years. In May, production was BELOW 10 years ago.”

And if you look at the 10-year frame of the chart, you will see why the “average” was screwed up. It sticks out like a sore thumb, “literally.”

And ta for not saying: RTGDFA

Hah!

Nostradamus was spot on with his prediction for China in 2023 referring to bad luck as the term ponzi didn’t exist in the 15th century. Like I said all along on all the blogs and forums all America had to do was raise interest rates and that spelt the end of China as their real estate ponzi was all that kept that country going. At the 1:47 minute mark of this video on youtube we learn how good Nostradamus was at predicting things.

China Collapse Predictions

1990. China’s economy has come to a halt. The Economist

1996. China’s economy will face a hard landing. The Economist

1998. China’s economy’s dangerous period of sluggish growth. The Economist

1999. Likelihood of a hard landing for the Chinese economy. Bank of Canada

2000. China currency move nails hard landing risk coffin. Chicago Tribune

2001. A hard landing in China. Wilbanks, Smith & Thomas

2002. China Seeks a Soft Economic Landing. Westchester University

2003. Banking crisis imperils China. New York Times

2004. The great fall of China? The Economist

2005. The Risk of a Hard Landing in China. Nouriel Roubini

2006. Can China Achieve a Soft Landing? International Economy

2007. Can China avoid a hard landing? TIME

2008. Hard Landing In China? Forbes

2009. China’s hard landing. China must find a way to recover. Fortune

2010: Hard landing coming in China. Nouriel Roubini

2011: Chinese Hard Landing Closer Than You Think. Business Insider

2012: Economic News from China: Hard Landing. American Interest

2013: A Hard Landing In China. Zero Hedge

2014. A hard landing in China. CNBC

2015. Congratulations, You Got Yourself A Chinese Hard Landing. Forbes

2016. Hard landing looms for China. The Economist

2017. Is China’s Economy Going To Crash? National Interest

2018. China’s Coming Financial Meltdown. The Daily Reckoning.

2019. China’s Economic Slowdown: How worried should we be? BBC2020. Coronavirus Could End China’s Decades-Long Economic Growth Streak. NY Times

2021. Chinese economy risks deeper slowdown than markets realize. Bloomberg

2022. China Surprise Data Could Spell R-e-c-e-s-s-i-o-n. Bloomberg.

2023 yada yada yada…

2024 “All America had to do was raise interest rates and that spelt the end of China”. The Real Tony.

Meanwhile:

“China to account for 21% of world GDP growth through 2029

China will be the top contributor to global growth over the next five years, with its share bigger than all Group of Seven countries combined, according to Bloomberg calculations using International Monetary Fund forecasts.”

Doom porn sells. Good news is boring.

Wonder what would be the ranking in terms of value. Raw steel is not a valid indicator industrial strength. Well, maybe in the nineteenth century.

“Manufacturing slowdown”

Not really: https://tradingeconomics.com/china/manufacturing-production

Yes, click on the 10-year tab in the chart you linked to see the last 10 years. In May, production was BELOW 10 years ago.

Go to ceicdata’s website and look at the graph of electricity production for the last 40 years by China and by the US. It’s quite telling.

China’s production has been steadily increasing, even in 2023-2024, during the so-called “economic collapse”. In fact, the only uncharacteristic dips were in 2008-09 due to the US great recession and in 2020 due to the pandemic.

If electricity production is indicator of manufacturing activity (some economists believe it is), then China is doing just fine (doesn’t mean there are no issues).

Electricity production is an indication of the surging use of air conditioning in China, from very low when I was there to universal now. It’s an indication of the electricity used by the surge of its passenger rail systems (subways and highspeed rail). It’s an indication of the surge in data centers (energy hogs). It’s an indication of the surge of computers everywhere. It’s an indication more recently of the surge in EVs in the national fleet. Etc. etc. The one thing that hasn’t grown in China in 10 years is manufacturing production. See the same chart you linked earlier but refused to look at.

There’s big trend in Chinese manufacturing that runs under the radar. An example is my Chinese relative’s garment business.6 or 7 years ago they moved their manufacturing from Guangdong to Vietnam, Cambodia, and Bangladesh. Now the goods arrive in American retail stores with non-Chinese Country Of Origin tags and are not subject to onerous tariffs. However, at the end of the day, the profits end up in Bank of China. Chinese business people and engineers are building factories in Southeast Asia countries because of the lower labor costs. Chinese money, Chinese technical knowledge, Chinese machinery, Chinese contracts with worldwide markets, and Chinese profits. On the surface, it looks like a simple case of Chinese factories being closed. The country is moving up the evolutionary chain that all nations go through. Agriculture->heavy manufacturing->more spophisticated manufacturing-> high tech and electronic. One laborer sweating in a steel mill does not add as much to the GDP as a technician building robots for a car factory.